Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - TEGNA INC | d767952dex991.htm |

| EX-2.1 - EX-2.1 - TEGNA INC | d767952dex21.htm |

| 8-K - FORM 8-K - TEGNA INC | d767952d8k.htm |

Unlocking Shareholder Value Through

Two Transformative Transactions

August 5, 2014

Exhibit 99.2 |

1

Forward-Looking Statements

Certain

statements

in

this

presentation

may

be

forward

looking

in

nature

or

“forward-looking

statements”

as

defined

in

the

Private

Securities

Litigation

Reform

Act

of

1995.

The

forward-looking

statements

contained

in

this

presentation

are

subject

to

a

number

of

risks,

trends

and

uncertainties

that

could

cause

actual

performance

to

differ

materially

from

these

forward-looking

statements.

A

number

of

those

risks,

trends

and

uncertainties

are

discussed

in

the

company’s

SEC

reports,

including

the

company’s

annual

report

on

Form

10-K

and

quarterly

reports

on

Form

10-Q.

Any

forward-looking

statements

in

this

presentation

should

be

evaluated

in

light

of

these

important

risk

factors.

Gannett

is

not

responsible

for

updating

or

revising

any

forward-looking

statements,

whether

as

a

result

of

new

information,

future

events

or

otherwise,

except

as

required

by

law.

This

presentation

also

contains

a

discussion

of

certain

non-GAAP

financial

measures

that

Gannett

presents

in

order

to

allow

investors

and

analysts

to

measure,

analyze

and

compare

its

financial

condition

and

results

of

operations

in

a

meaningful

and

consistent

manner.

A

reconciliation

of

these

non-GAAP

financial

measures

to

the

most

directly

comparable

GAAP

measures

can

be

found

in

Gannett’s

publicly

available

reports

filed

with

the

SEC,

all

of

which

are

available

through

the

investor

relations

portion

of

our

website. |

2

Two Transformative, Highly Strategic Transactions

•

Tax-free separation into two focused public

companies

•

Creates two industry leaders with

significant scale

•

Increases organic growth opportunities

•

Enhances flexibility to pursue strategic priorities

and acquisitions

•

Fuels growth and innovation through tailored

capital structures

•

Acquisition of remaining 73% interest in

Cars.com for $1.8 billion in cash

•

Doubles size of Digital business

•

Adds #2 auto-related site with highly

recognizable brand in business we know well

•

Expected to be highly accretive to free cash

flow, neutral to EPS in 2015, growing thereafter

•

Strong economic benefits from contractual

changes to new affiliation agreements |

3

Right Next Steps in Ongoing Transformation

•

Bold next steps following 2-1/2 year strategic realignment to meet evolving

audience needs and compete successfully in digital age

•

Successful execution of strategy paved way for today’s announcements:

•

Revitalized Publishing business:

•

Content subscription model and USA TODAY local editions have

attracted new subscribers and increased profitability

•

Developed/delivering compelling content across multiple platforms

•

Rebranded USA TODAY, now #1 in combined print and digital

circulation

•

Enhanced digital usability, USA TODAY app now a top news app

in U.S. with 20+ million downloads

•

Newsquest in the UK marked its fifth straight quarter of circulation

revenue growth in Q2

•

Dramatically expanded scale in higher-growth, higher-margin Broadcasting

and Digital businesses through acquisitions:

•

Broadcasting:

Belo/London Broadcasting acquisitions doubled portfolio; now

reaching nearly one-third of U.S. television households

•

Digital:

Cars.com

doubles

Digital

business |

4

Value-Creating Spin-Off

Summary

•

Tax-free

spin-off

of

Gannett

publishing

business

to

shareholders

•

Initial

aggregate

dividends

at

least

equal

to

current

$0.20

quarterly

dividend

•

Expected

to

be

completed

in

mid-2015

RemainCo:

Broadcast and

Digital

•

Leading

TV

broadcaster

and

emerging

digital

powerhouse

with

46

broadcast

stations

Gannett

owns

or

services

and

digital

leaders

CareerBuilder

and

Cars.com

•

Will

retain

all

of

Gannett’s

existing

debt

while

maintaining

strong

balance

sheet

•

Strong

cash

flow

enables

debt

repayment

and

return

of

capital

to

shareholders

SpinCo: Gannett

(Publishing)

•

Largest

U.S.

newspaper

publisher

with

81

U.S.

daily

publications

and

more

than

400

non-daily

local

publications

•

Includes

iconic

USA

TODAY

brand

and

UK

regional

leader

Newsquest

•

Expected

to

be

virtually

debt-free

following

close

•

Flexibility

to

complete

strong

accretive

acquisitions

in

a

consolidating

industry |

5

Compelling Strategic Benefits of Spin-Off

•

Tailored

capital

structures

based

on

profitability,

cash

flow

and

growth

opportunities

at

each

company

•

Greater

opportunity

to

grow

organically

and

pursue

value-enhancing

acquisitions

with

fewer

regulatory

obstacles

in

two

consolidating

industries

•

Enhanced

financial

flexibility

to

drive

innovation

and

further

our

mission

of

delivering

award-winning

journalism

•

Greater

organic

growth

potential

through

enhanced

ability

to

target

resources

in

high

growth/in-demand

areas

that

better

serve

our

communities

•

More

targeted

investment

opportunities

•

Valuations

more

accurately

reflect

distinctive

business

characteristics |

6

Leading Broadcasting/Digital Company

•

Attractive TV station portfolio with 46 stations covering 30+% or

nearly 35 million households

•

#4 owner of “Big 4”

network affiliates

•

#1 household coverage for NBC and CBS, #4 for ABC

•

Diversified affiliate revenue and earnings

•

Successful integration of former Belo stations

•

Leading digital positions in two major verticals:

•

Recruitment/job seekers through majority-owned CareerBuilder.com

•

Auto through full ownership of Cars.com

•

Continued strong cash flow generation with robust balance sheet

supports debt repayment

•

Committed to disciplined capital allocation policy

•

Led by Gracia Martore and will be headquartered in McLean, Virginia

|

7

Leading Publishing Company

•

Largest

and

most

diversified

newspaper

company

will

retain

Gannett

name

•

Best-in-class

operator

with

enhanced

strategic

and

financial

flexibility

to

grow

organically

as

well

as

participate

in

industry

consolidation

•

Opportunities

to

further

capitalize

on

USA

TODAY

brand

–

already

#1

in

combined

print

and

digital

circulation

•

Enhanced

ability

to

innovate,

grow

and

better

serve

local

communities

through

81

daily

U.S.

Community

Papers

•

Portfolio

includes

Newsquest,

a

leading

U.K.

news

provider

and

other

related

businesses

in

the

Publishing

segment

•

Well-advanced

digital

strategy

with

established

portfolio

of

local

marketing

solutions

•

Ongoing

market

affiliations

with

Cars.com

and

CareerBuilder.com

and

permissible

shared

service

agreements

with

Broadcasting/Digital

Company

enable

continued

cross-platform

advertising

and

content-sharing

opportunities

•

Virtually

debt-free;

expected

strong

cash

flow

generation

to

be

used

for

accretive

acquisitions

and

return

of

capital

to

shareholders

•

Led

by

Bob

Dickey

and

will

maintain

headquarters

in

McLean,

Virginia |

8

Doubling Digital Business with Cars.com

Terms

•

$1.8 billion cash consideration for remaining 73% interest

•

New 5-year affiliation arrangements, going to direct sales model

thereafter •

Expected to close in the fourth quarter of 2014

Financially

Compelling

•

Expected to be accretive to free cash flow in 2015, growing thereafter:

•

Approximately $0.43 to free cash flow per share

•

Expected to be neutral to EPS in 2015, growing thereafter

•

High-growth, high-margin business with strong cash flow and revenue

enhancing opportunities

•

Expected to contribute ~$155 million in annual incremental 2014 pro-forma

EBITDA

to

Gannett

(1)

•

Implies 11.7x 2014E EBITDA multiple and 9.2x 2015E EBITDA multiple

•

Better economics to Cars.com with new affiliation agreements

Strategically

Compelling

•

Growing digital business of substantial scale doubles digital business

•

Adds important auto vertical with #2 site

•

Opportunities for new products and expansion through full ownership in a well

understood business

(1) Assumes Cars.com was 100% owned by Gannett for all of 2014 and new affiliation

agreements were in place for all of 2014 |

9

Transforming Digital Business with Cars.com

•

Secures

long-term

digital

leadership

with

one

of

few

proven

and

established

digital

solutions

of

scale

in

most

important

advertising

category

•

Doubles

Gannett’s

digital

portfolio

and

is

consistent

with

focus

on

local

media

and

marketing

services

•

Full

ownership

provides

greater

control

over

operations

and

product

roadmap

in

business

we

know

very

well

•

Plan

to

reinvest

to

drive

further

growth

through

new

product

launches

and

expansion

into

new

or

adjacent

areas

•

New

opportunities

created

by

leveraging

Gannett’s

broad footprint

•

Will

expand

advertising

to

increase

brand

awareness

•

Potential

for

revenue

uplift

due

to

favorable

economics

of

new

affiliate

agreements

and

cost

reductions

from

more

efficient

and

focused

operations

•

New

affiliation

agreements

entered

into

with

Classified

Ventures

partners

for

five

years,

after

which

business

will

transition

to

direct

sales

model |

10

Proven Digital Solution of Scale in Automotive Market

•

#2

auto-related

site

with

approximately

10

million

unique

visitors

per

month

•

Provides

online

ad

solution

for

dealers

and

original,

unbiased

content

for

consumers

•

Leader

in

the

fastest

growing

component

of

the

automotive

ad

market

•

Displays

4.3

million

new

and

used

cars

from

nearly

20,000

dealers

•

Strong

growth

in

annual

visits

with

17%

CAGR

from

2008-2013

Leading destination for online car shoppers providing credible,

easy-to- understand information from customers and experts that

affords consumers greater control of the car buying process

Strong

Market Position |

11

Cars.com: High-Growth Business

Pro forma assumes Cars.com was 100% owned by Gannett for all of 2014 and new

affiliation agreements were in place for all of 2014

Revenue |

12

Cars.com: High-Margin Business

EBITDA

Pro forma assumes Cars.com was 100% owned by Gannett for all of 2014 and new

affiliation agreements were in place for all of 2014

|

13

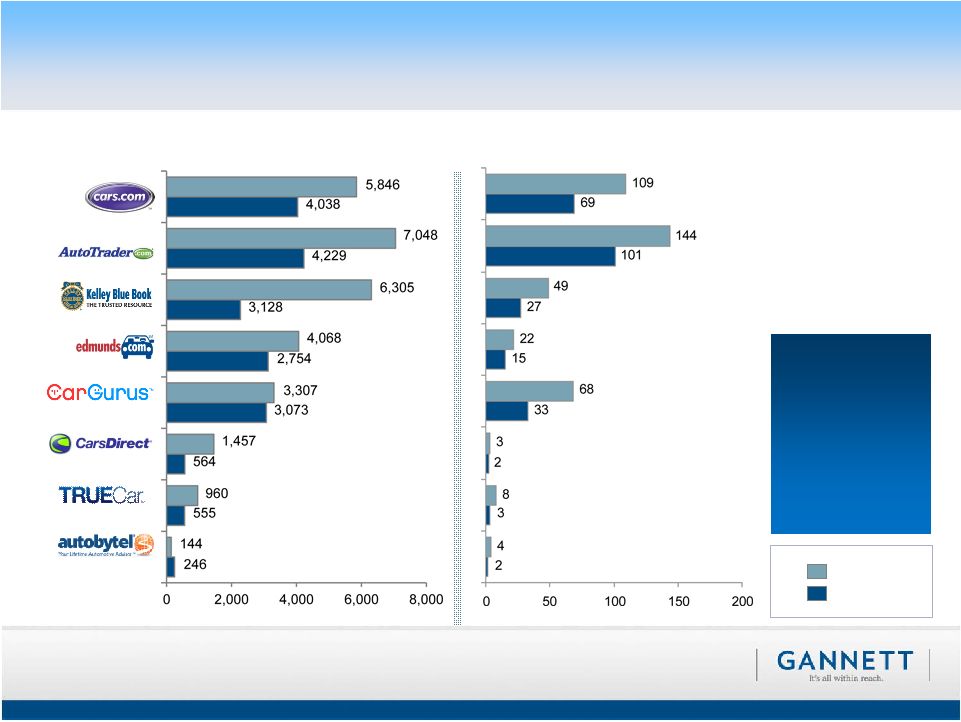

Proven Leader in Driving Consumer Engagement

Source: comScore (June 2014)

Mobile

Desktop

#2 Site for

Combined

Unique Visitors

and Time on

Site for Mobile

and Desktop

Unique Visitors

2014 YTD Monthly Average

Time on Site

2014 YTD Monthly Average

Monthly UVs (000's)

Minutes (MM) |

14

Strong Growth in Automotive Online Ad Spending

(1)

Per the 2013 NADA Report

Source: Forrester

2018F

2017F

2016F

2015F

2014F

2013E

2012

2011

2010

2009

2008

U.S. Automotive Digital Marketing Spend

(1)

($ in billions)

Automotive Online Ad Spend is Expected to Double in Next Five Years

1.4

1.8

2.3

2.8

3.4

4.1

4.9

5.8

6.7

7.8

1.3

0.0

2.0

4.0

6.0

8.0 |

15

Key Direct and Affiliate Agreements

•

Sells products through two primary channels:

•

Direct

sales

to

advertisers

with

revenue

recognized

at

retail

rates,

currently

accounts

for

78%

of

total

revenue

•

Sales

to

advertisers

by

affiliates’

sales

force

(e.g.,

Tribune

Media,

McClatchy,

A.H.

Belo,

and

Graham

Holdings),

with

revenue

recognized

at

wholesale

rates

Cars.com

Advertiser (e.g., Car Dealer)

Advertiser (e.g., Car Dealer)

Cars.com

Direct Business Model

Affiliate Business Model

Affiliate (e.g., Democrat and Chronicle)

New affiliate agreements following acquisition will increase Revenue and

EBITDA Cars.com products in

specific markets

Monthly subscription rate

Cars.com products

Wholesale rate

Cars.com products

Monthly subscription rate |

16

Compelling Financial Impact of Cars.com

•

Gannett

expects

Cars.com

to

be

accretive

to

free

cash

flow

per

share

by

approximately

$0.43

and

EPS

neutral

in

2015,

growing

thereafter

•

Cars.com

is

expected

to

contribute

approximately

$155

million

in

incremental

annual

pro

forma

2014

estimated

EBITDA

to

Gannett,

and

implies

a

multiple

of

11.7x

pro

forma

estimated

EBITDA

•

Will

generate

increased

contractual

revenue

from

new

affiliate

agreements

and

laser

focus

on

operations

•

As

a

result,

expect

multiple

to

be

even

lower

at

9.2x,

based

on

2015

estimated

incremental

EBITDA

Approximately $155mm of annual incremental EBITDA, based on economics of new

affiliate agreements Incremental EBITDA is equal to Cars.com pro forma total

EBITDA less Gannett’s existing Cars.com EBITDA |

17

Transaction Financing

•

Current debt paydown is ahead of schedule and EBITDA is stronger, resulting in

better leverage ratio position prior to transaction financing

•

Anticipate issuance of approximately $650-$675 million in new senior notes

•

7

and

10

year

tranches

•

Will use $575-$600 million in cash on balance sheet

•

Maintain minimum cash balance of $175 million

•

$600-$625 million draw on existing revolver

•

Currently undrawn

•

Plan to calibrate current capital return program with business results

•

Maintain

and

monitor

quarterly

$0.20

per

share

dividend |

18

Key Takeaways

•

Key next steps in successful ongoing transformation of Gannett

•

Spin-off creates two industry-leading companies of scale

•

Both companies will have strong, flexible balance sheets and capital

structures tailored to their individual businesses

•

Cars.com doubles rapidly growing digital business

•

Financially and strategically compelling transactions that unlock

significant shareholder value

Publishing

Broadcasting

Digital |