Attached files

| file | filename |

|---|---|

| 8-K - 8-K - COUSINS PROPERTIES INC | cuz-northpark8k.htm |

| EX-99.2 - EXHIBIT 99.2 - COUSINS PROPERTIES INC | cuznpacquisitionpressrelea.htm |

STRATEGIC PORTFOLIO REPOSITIONING UPDATE AUGUST 2014

DISCLAIMER 2 Certain matters discussed in this presentation are “forward-looking statements” within the meaning of the federal securities laws and are subject to uncertainties and risk. These include, but are not limited to, the availability and terms of capital and financing; the ability to refinance indebtedness as it matures; the failure of purchase, sale, or other contracts to ultimately close; the failure to achieve anticipated benefits from acquisitions and investments or from dispositions; the potential dilutive effect of common stock offerings; the availability of buyers and adequate pricing with respect to the disposition of assets; risks related to the geographic concentration of our portfolio; risks and uncertainties related to national and local economic conditions, the real estate industry in general, and the commercial real estate markets in particular; changes to the Company's strategy with regard to land and other non-core holdings that require impairment losses to be recognized; leasing risks, including the ability to obtain new tenants or renew expiring tenants, and the ability to lease newly developed and/or recently acquired space; the financial condition of existing tenants; volatility in interest rates and insurance rates; the availability of sufficient investment opportunities; competition from other developers or investors; the risks associated with real estate developments (such as zoning approval, receipt of required permits, construction delays, cost overruns, and leasing risk); the loss of key personnel; the potential liability for uninsured losses, condemnation, or environmental issues; the potential liability for a failure to meet regulatory requirements; the financial condition and liquidity of, or disputes with, joint venture partners; any failure to comply with debt covenants under credit agreements; any failure to continue to qualify for taxation as a real estate investment trust; and other risks detailed from time to time in the Company’s filings with the Securities and Exchange Commission, including those described in Part I, Item 1A of the Company’s Annual Report on Form 10-K for the year ended December 31, 2013. The words “believes,” “expects,” “anticipates,” “estimates,” ”plans,” “may,” “intend,” “will,” or similar expressions are intended to identify forward-looking statements. Although the Company believes that its plans, intentions and expectations reflected in any forward-looking statement are reasonable, the Company can give no assurance that such plans, intentions or expectations will be achieved. Such forward-looking statements are based on current expectations and speak as of the date of such statements. The Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of future events, new information or otherwise, except as required under U.S. federal securities laws. Unless otherwise noted, all information in this presentation is as of 6/30/14.

Execute Attractive Funding StrategySource Compelling Investments CONTINUED PROGRESS WITH STRATEGIC PORTFOLIO REPOSITIONING 777 Main (Fort Worth) • Limited platform growth opportunities in Fort Worth • Non-core market • Anticipate marketing after Labor Day Publix Portfolio (TN and FL) • Five Publix anchored shopping centers • Capitalize on strong investor demand • Non-core product type • Currently marketing Lakeshore Park Plaza (Birmingham) • Last remaining Birmingham asset • Non-core market • Under contract to sell Issued common equity • 18MM shares • $224MM gross proceeds • Settled Aug 4, 2014 Pursue strategic joint venture of 191 Peachtree • Harvest value created since purchase in 2006 at $127 PSF • Increased occupancy from less than 20% to 86% • Cousins will retain an ownership interest and exclusive leasing and management duties • Anticipate marketing after Labor Day 3Focused Sunbelt strategy with a fortress balance sheet Capital MarketsAsset Sales Northpark Town Center (Atlanta) • Central Perimeter submarket • 1,527,720 SF • Investment of $348MM / $228 PSF(1) • 87% leased • Status – Under contract • Anticipated closing – Oct 1, 2014 Fifth Third Center (Charlotte) • Uptown Charlotte submarket • 697,817 SF • Investment of $215MM / $308 PSF(1) • 82% leased • Status – Under contract • Anticipated closing – Aug 8, 2014 Property Acquisitions 1. Based on gross purchase price.

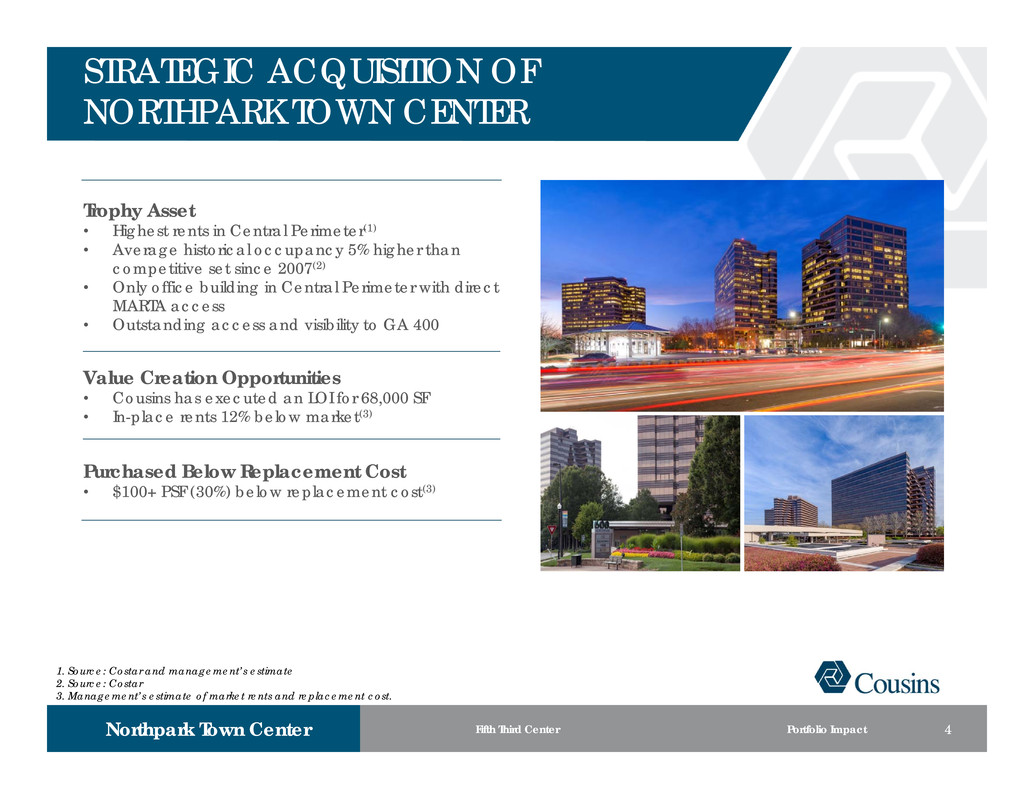

STRATEGIC ACQUISITION OF NORTHPARK TOWN CENTER Trophy Asset • Highest rents in Central Perimeter(1) • Average historical occupancy 5% higher than competitive set since 2007(2) • Only office building in Central Perimeter with direct MARTA access • Outstanding access and visibility to GA 400 Value Creation Opportunities • Cousins has executed an LOI for 68,000 SF • In-place rents 12% below market(3) Purchased Below Replacement Cost • $100+ PSF (30%) below replacement cost(3) 1. Source: Costar and management’s estimate 2. Source: Costar 3. Management’s estimate of market rents and replacement cost. 4Northpark Town Center Fifth Third Center Portfolio Impact

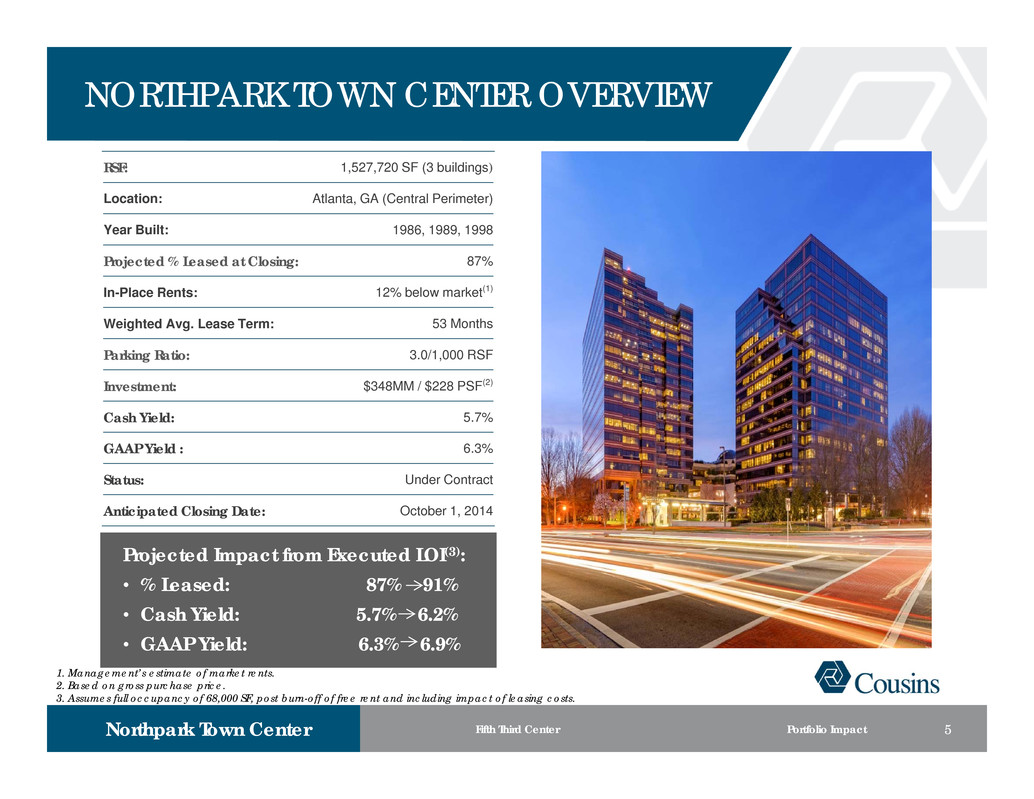

NORTHPARK TOWN CENTER OVERVIEW RSF: 1,527,720 SF (3 buildings) Location: Atlanta, GA (Central Perimeter) Year Built: 1986, 1989, 1998 Projected % Leased at Closing: 87% In-Place Rents: 12% below market(1) Weighted Avg. Lease Term: 53 Months Parking Ratio: 3.0/1,000 RSF Investment: $348MM / $228 PSF(2) Cash Yield: 5.7% GAAP Yield : 6.3% Status: Under Contract Anticipated Closing Date: October 1, 2014 Projected Impact from Executed LOI(3): • % Leased: 87% 91% • Cash Yield: 5.7% 6.2% • GAAP Yield: 6.3% 6.9% 1. Management’s estimate of market rents. 2. Based on gross purchase price. 3. Assumes full occupancy of 68,000 SF, post burn-off of free rent and including impact of leasing costs. 5Northpark Town Center Fifth Third Center Portfolio Impact

Strongest Office Demand Among Atlanta Submarkets • 2.7 MM SF of net absorption 2012-2013(1) • 48% of Atlanta’s total net absorption 2012-2013(1) Stage Set for Rent Growth • Competitive set 91% leased(1) • Limited blocks of contiguous space • No speculative construction underway • Minimum of 14% rent growth needed to justify new development(2) Preferred Location for Atlanta’s Fortune 500 • Most centrally located submarket with outstanding highway and mass transit access • 18 Fortune 500 customers at Northpark alone • Rapidly urbanizing submarket with approximately 2,500 multi-family units planned or under construction(3) CENTRAL PERIMETER SUBMARKET 1. Source: Costar 2. Source: Wells Fargo Research 3. Axiometrics 6Northpark Town Center Fifth Third Center Portfolio Impact

CENTRAL PERIMETER SUBMARKET Northpark Town Center 1,527,720 SF 87%(1) $31.00 psf(2) Perimeter Summit 1,353,692 SF 98%(1) $30.50 psf(1) Three Ravinia 813,145 SF 94%(1) $28.00 psf(1) Concourse V 687,107 SF 91%(1) $28.75 psf(1) Concourse VI 697,400 SF 87%(1) $28.75 psf(1) Class-A Competitive Set 1 Percent represents occupancy as of August 5, 2014. Dollars represent highest gross asking rents for asset as of August 5, 2014. Source: CoStar 2. Cousins’ projected gross asking rent. 7Northpark Town Center Fifth Third Center Portfolio Impact

STRATEGIC ACQUISITION OF FIFTH THIRD CENTER Trophy Asset • Tryon Street address, across from Bank of America Corporate Center • Highest parking ratio in Uptown Charlotte • Home of The Capital Grille • 9-year weighted average remaining lease term Value Creation Opportunities • 82% leased with immediate lease up potential • Attractive contiguous high floor vacancy • Building in excellent physical condition with limited near-term capital expenditures projected Purchased Below Replacement Cost • $50+PSF (15%) below replacement cost(1) 1. Management’s estimate of replacement cost. 8Northpark Town Center Fifth Third Center Portfolio Impact

FIFTH THIRD CENTER OVERVIEW RSF: 697,817 SF Location: Charlotte, NC (Uptown) Year Built: 1997 Projected % Leased at Closing: 82% In-Place Rents: 5% below market(1) Weighted Avg. Lease Term: 9 Years Parking Ratio: 1.5/1,000 RSF Investment: $215MM / $308 PSF(2) Cash Yield: 6.0% GAAP Yield : 7.1%(3) Status: Under Contract Anticipated Closing Date: August 8, 2014 1. Management’s estimate of market rents. 2. Based on gross purchase price. 3. Note that the projected GAAP yield of 7.1% is an update from previously disclosed projection and reflects updated market rent information. 9Northpark Town Center Fifth Third Center Portfolio Impact

UPTOWN CHARLOTTE SUBMARKET Leading Charlotte Submarket • Largest submarket in Charlotte at 23 MM SF(1) • Since 2000, Uptown Class-A occupancy of 93% compared to 89% for Charlotte MSA(1) • Uptown employment has jumped 23% since 2010(2) Stage Set for Rent Growth • Class-A 90% leased, competitive set 98% leased(1) • Only two blocks of multi-floor contiguous space available in competitive set(3) Charlotte Recovery Well Underway • Current Bank of America and Wells Fargo head count in Charlotte greater than pre- recession levels in 2007(4) • Continues to attract jobs from corporate relocations • No. 4 fastest growing city in the country since the recession according to Forbes.com 1. Source: Costar 2. Source: CBRE 3. Source: Cassidy Turley 4.Source: Charlotte Business Journal 10Northpark Town Center Fifth Third Center Portfolio Impact

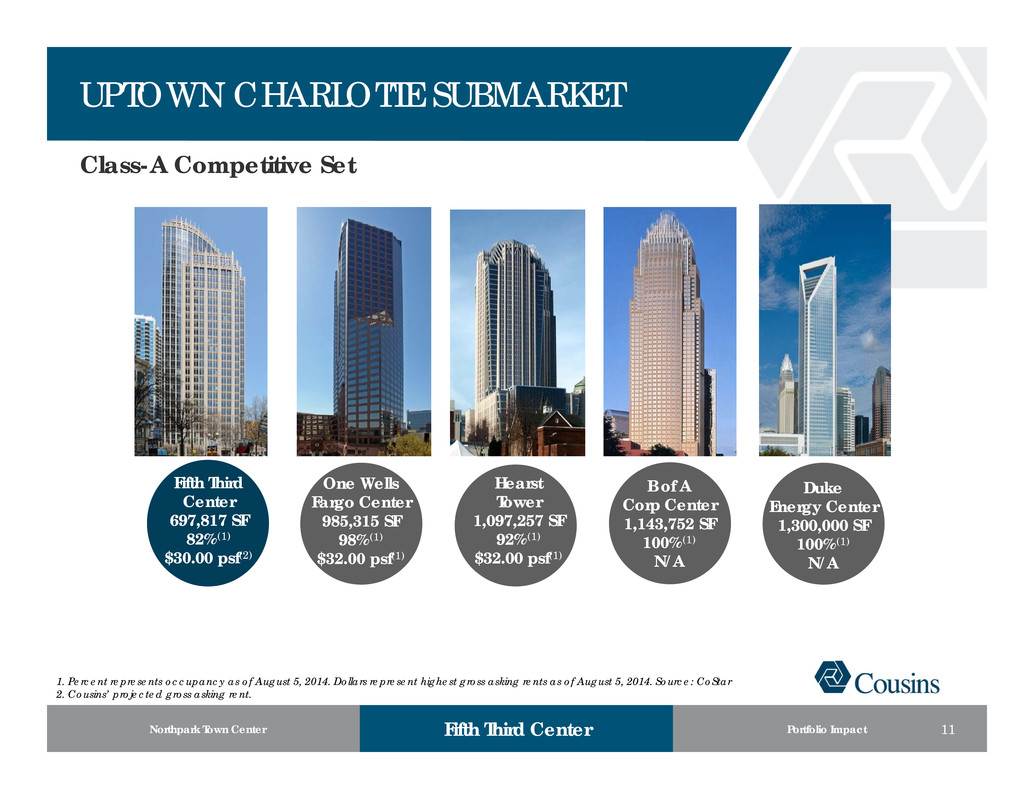

UPTOWN CHARLOTTE SUBMARKET Fifth Third Center 697,817 SF 82%(1) $30.00 psf(2) One Wells Fargo Center 985,315 SF 98%(1) $32.00 psf(1) Duke Energy Center 1,300,000 SF 100%(1) N/A Hearst Tower 1,097,257 SF 92%(1) $32.00 psf(1) B of A Corp Center 1,143,752 SF 100%(1) N/A Class-A Competitive Set 1. Percent represents occupancy as of August 5, 2014. Dollars represent highest gross asking rents as of August 5, 2014. Source: CoStar 2. Cousins’ projected gross asking rent. 11Northpark Town Center Fifth Third Center Portfolio Impact

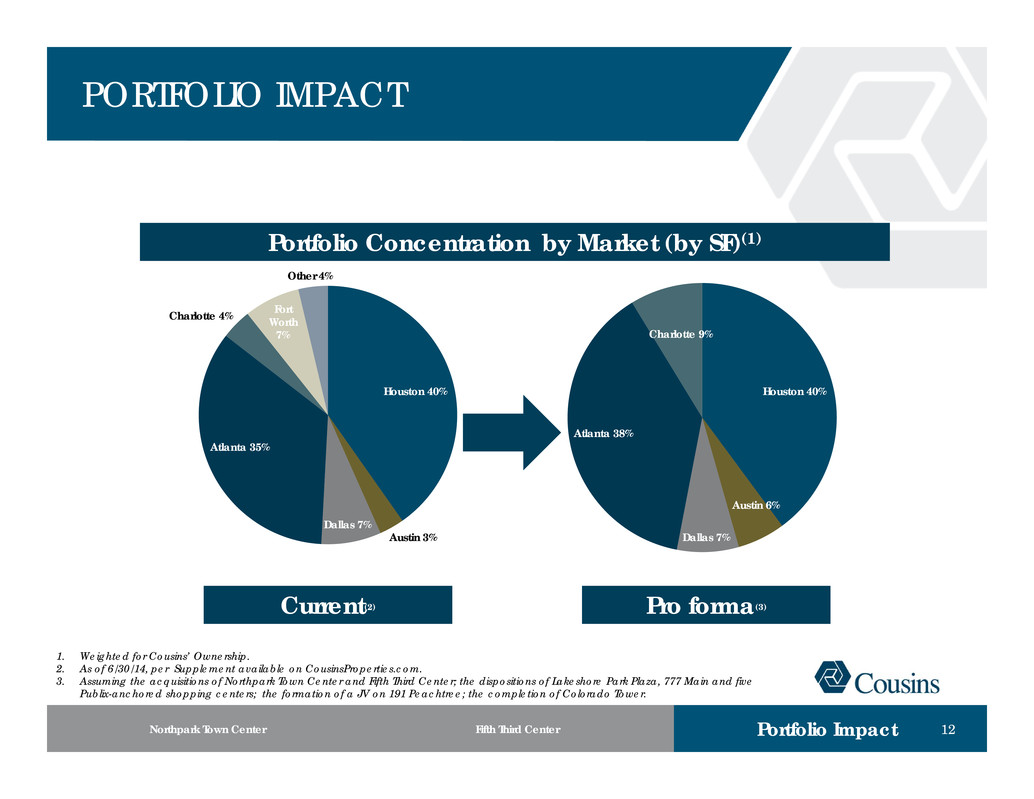

PORTFOLIO IMPACT Houston 40% Austin 6% Dallas 7% Atlanta 38% Charlotte 9% Houston 40% Austin 3% Dallas 7% Atlanta 35% Charlotte 4% Fort Worth 7% Other 4% Pro forma(3) Current(2) 1. Weighted for Cousins’ Ownership. 2. As of 6/30/14, per Supplement available on CousinsProperties.com. 3. Assuming the acquisitions of Northpark Town Center and Fifth Third Center; the dispositions of Lakeshore Park Plaza, 777 Main and five Publix-anchored shopping centers; the formation of a JV on 191 Peachtree; the completion of Colorado Tower. Portfolio Concentration by Market (by SF)(1) 12Northpark Town Center Fifth Third Center Portfolio Impact

REIT WORLD PROPERTY TOUR AND COCKTAIL PROPERTY TOUR November 4, 2014 Atlanta, GA Hosted with Highwoods Properties Highwoods in the Morning (10:00 am – 1:30 pm) Cousins in the Afternoon (1:30 pm – 4:30 pm) Northpark Town Center, Terminus, Promenade Formal Invitation to Follow COCKTAILS November 4, 2014 Atlanta, GA Hosted with Post Properties Immediately after Property Tour (4:30 pm – 6:00 pm) Center for Civil and Human Rights Formal Invitation to Follow 13