Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Armada Hoffler Properties, Inc. | d768437d8k.htm |

| EX-99.1 - EX-99.1 - Armada Hoffler Properties, Inc. | d768437dex991.htm |

Armada

Hoffler Properties, Inc. Second Quarter 2014 Supplemental Information

Exhibit 99.2 |

Table of

Contents 2

Forward Looking Statements

3

Corporate Profile

4

Second Quarter Results and Financial Summary

5

Highlights

6

2014 Outlook

7

Summary Information

8

Summary Balance Sheet

9

Summary Income Statement

10

Core FFO & AFFO

11

Summary of Outstanding Debt

12

Debt to Core EBITDA

13

Debt Information

14

Portfolio Summary & Business Segment Overview

15

Stabilized Portfolio Summary

16

Stabilized Portfolio Summary Footnotes

17

Development Pipeline

18

Construction Business Summary

19

Operating Results & Property-Type Segment Analysis

20

Same Store NOI by Segment

21

Top 10 Tenants by Annual Base Rent

22

Office Lease Summary

23

Retail Lease Summary

25

Historical Occupancy

27

Appendix - Understanding AHH

29

Corporate Overview

30

Differentiation Provides Value Creation

31

Business Segmentation Overview

32

Components of NAV

33

Stabilized Portfolio

34

Identified & Next Generation Pipeline

35

3rd Party Construction

36

Net Asset Value Component Data

37

Appendix - Definitions & Reconciliations

38

Definitions

39

Reconciliations

43 |

Forward

Looking Statement 3

This Supplemental Information should be read in conjunction with

our Quarterly Report on Form 10-Q for the

quarter ended June 30, 2014, and the unaudited consolidated financial statements

appearing in our press release dated August 5, 2014, which has been furnished as

Exhibit 99.1 to our Form 8-K filed on August 5, 2014. The Company

makes statements in this Supplemental Information that are forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995 (set forth in

Section 27A of the Securities Act of 1933, as amended (the “Securities

Act”), and Section 21E of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”)). In particular, statements pertaining to our

capital resources, portfolio performance and results of operations contain

forward-looking statements. Likewise, all of our statements regarding anticipated

growth in our funds from operations, core funds from operations,

adjusted funds from operations, funds

available for distribution and net operating income are forward-looking

statements. You can identify forward- looking statements by the use of

forward-looking terminology such as “believes,”

“expects,”

“may,”

“will,”

“should,”

“seeks,”

“approximately,”

“intends,”

“plans,”

“estimates”

or “anticipates”

or the negative of these

words and phrases or similar words or phrases which are predictions of or indicate

future events or trends and which do not relate solely to historical matters.

You can also identify forward-looking statements by discussions of strategy,

plans or intentions. Forward-looking statements involve numerous risks and

uncertainties and you should not rely on them as predictions of future events.

Forward-looking statements depend on assumptions, data or methods which may be

incorrect or imprecise and the Company may not be able to realize them. The Company

does not guarantee that the transactions and events described will happen as

described (or that they will happen at all). For further discussion of

risk factors and other events that could impact our future results, please refer to the section

entitled “Risk Factors”

in our most recent Annual Report on Form 10-K filed with the Securities and

Exchange Commission (the “SEC), and the documents subsequently filed by us

from time to time with the SEC. |

4

Corporate Information

Management & Board

Board of Directors

Corporate Officers

Daniel A. Hoffler

Executive Chairman of the Board

Louis S. Haddad

President and Chief Executive Officer

A. Russell Kirk

Vice Chairman of the Board

Anthony P. Nero

President of Development

Louis S. Haddad

Director

Shelly R. Hampton

President of Asset Management

John W. Snow

Lead Independent Director

Eric E. Apperson

President of Construction

George F. Allen

Independent Director

Michael P. O’Hara

Chief Financial Officer and Treasurer

James A. Carroll

Independent Director

Eric L. Smith

Vice President of Operations and Secretary

James C. Cherry

Independent Director

Joseph W. Prueher

Independent Director

Analyst Coverage

Janney, Montgomery, & Scott LLC

Raymond James & Associates

Robert W. Baird & Co.

Stifel, Nicolaus & Company, Inc.

Wunderlich Securities

Michael Gorman

Richard Mulligan

David Rodgers

John Guinee

Craig Kucera

(215) 665-6224

(727) 567-2660

(216) 737-7341

(443) 224-1307

(540) 277-3366

Investor Relations Contact

Julie Loftus Trudell

(757) 366-6692

Armada Hoffler Properties, Inc. (NYSE: AHH)

grade

office,

retail

and

multifamily

properties

in

the

Mid-Atlantic

U.S.

The

Company

also

provides

general

construction

and

development

services

to

third-

party clients throughout the Mid-Atlantic and Southeastern regions of the U.S. Armada

Hoffler Properties was founded in 1979 and is headquartered in Virginia Beach,

VA. is

a

full

service

real

estate

investment

trust

company

that

develops,

builds,

owns

and

manages

institutional

mgorman@janney.com

rj.milligan@raymondjames.com

drodgers@rwbaird.com

jwguinee@stifel.com

ckucera@wundernet.com

Jtrudell@armadahoffler.com

Vice President of Investor Relations

Corporate Profile |

Second

Quarter Results and Financial Summary |

Highlights

6

Funds From Operations (“FFO”) of $6.3 million, or $0.19 per diluted share for

the quarter ended June 30, 2014. Core FFO of $6.8 million, or $0.21 per diluted

share for the quarter ended June 30, 2014. Occupancy increased

slightly to 94.6%, compared to 94.5% as of March 31, 2014. Initial occupancy at

the new 4525 Main Street office tower in the Town Center of Virginia Beach commenced in June

2014.

Construction contract backlog of $179.0 million as of June 30, 2014, which includes the

Harbor Point project in Baltimore, Maryland.

Cash dividend of $0.16 per share payable on October 9, 2014 to stockholders of record

on October 1, 2014. Today, the company announced that West Elm, Free People,

lululemon, francesca’s and Tupelo Honey Cafe have signed leases for retail

space at the Town Center of Virginia Beach. This completes the co-tenancy requirement for

the anchor tenant, Anthropologie, and rounds out the Company’s strategy to

position Town Center as a premium upscale destination.

On August 4, 2014, the Company announced that it has entered into an agreement to

acquire Dimmock Square, a retail power center located in Colonial Heights,

Virginia. The Dimmock Square acquisition will add over 100,000 square feet

of 100% occupied retail space to the Company’s operating property

portfolio. The agreement provides that the Company will acquire a 100%

interest in Dimmock Square in exchange for approximately 990,000 OP units of limited

partnership interest in the Company’s operating partnership and approximately $10

million of cash. The acquisition is expected to be accretive to annual FFO

per diluted share and is expected to close in the third quarter of 2014. The

Company is continuing its long-standing strategy to sell single tenant assets from time-to-time. The Company has

recently entered into an agreement to sell the Virginia Natural Gas office building,

located near Town Center, for approximately $8.9 million, representing

approximately 6.25 percent cap rate. |

2014

Outlook 7

Current Parameters

Previous Parameters

As of June 30, 2014

As of May 13, 2014

Core FFO

(excluding the impact from non-stabilized projects)

Approximately $27.5 million

In-line with full-year 2013 Core FFO

Non-stabilized projects - negative impact to FFO

(excluded from Core FFO)

Approximately $1.0 million

Approximately $1.5 million

General & administrative expense

Approximately $7.6 million

Approximately $7.8 million

Third party construction company annual segment

gross profit

Approximately $4.3 million

Approximately $4.0 million |

Summary

Information 8

$ in thousands, except per share

Market Capitalization

Key Financials

6/30/2014

Financial Information:

6/30/2014

% of Total

Equity

Total Market

Capitalization

Rental revenues

$15,319

Market Data

20,495

Total Common Shares Outstanding

58%

19,265,919

10,071

42%

13,785,017

1,141

Common shares and OP units outstanding

100%

33,050,936

Net income

2,273

Market price per common share

$9.68

Funds From Operations (FFO)

6,330

Equity market capitalization

$319,933

FFO per diluted share

$0.19

Total debt

349,840

Core FFO

6,824

Total market capitalization

$669,773

Core FFO per diluted share

$0.21

Less: cash

(19,495)

Total enterprise value

$650,278

Weighted Average Shares/Units Outstanding

33,035,198

Stable Portfolio Metrics

Debt Metrics

6/30/2014

6/30/2014

Rentable square feet or number of units:

Key Metrics

Office

950,246

Core debt/enterprise value

42.4%

Retail

1,092,311

Multifamily

(1)

626

Fixed charge coverage ratio:

Core EBITDA

$9,793

Occupancy:

Interest

2,678

Office

(2)

95.3%

Principal

864

Retail

(2)

93.5%

Total Fixed Charges

3,542

Multifamily

(1)(3)

94.9%

Fixed charge coverage ratio

2.76x

Weighted Average

(4)

94.6%

Core Debt/Annualized Core EBITDA

7.0x

Three months ended

Three months ended

General contracting and real estate services revenues

Rental properties Net Operating Income (NOI)

General contracting and real estate services gross profit

(1) Excludes Liberty Apartments

(2) Office and retail occupancy based on leased square feet as a % of respective total

(3) Multifamily occupancy based on occupied units as a % of respective total

(4) Total occupancy weighted by annualized base rent

Operating Partnership ("OP") Units Outstanding |

Summary

Balance Sheet 9

$ in thousands

6/30/2014

12/31/2013

Assets

(Unaudited)

Real estate investments:

Income producing property

$436,450

$406,239

Held for development

8,592

-

Construction in progress

105,253

56,737

Accumulated depreciation

(112,024)

(105,228)

Net real estate investments

438,271

357,748

Cash and cash equivalents

16,271

18,882

Restricted cash

3,224

2,160

Accounts receivable, net

19,517

18,272

Construction receivables, including retentions

12,730

12,633

Costs and estimated earnings in excess of billings

1,287

1,178

Other assets

24,815

24,409

Total Assets

$516,115

$435,282

Liabilities and Equity

Indebtedness

$349,840

$277,745

Accounts payable and accrued liabilities

6,743

6,463

Construction payables, including retentions

34,631

28,139

Billings in excess of costs and estimated earnings

1,227

1,541

Other liabilities

16,474

15,873

Total Liabilities

408,915

329,761

Total Equity

107,200

105,521

Total Liabilities and Equity

$516,115

$435,282

As of |

Summary

Income Statement 10

$ in thousands

Three months ended

Six months ended

6/30/2014

6/30/2013

6/30/2014

6/30/2013

Revenues

(Unaudited)

(Unaudited)

Rental revenues

$15,319

$14,231

$30,512

$27,629

General contracting and real estate services

20,495

23,291

39,729

41,247

Total Revenues

35,814

37,522

70,241

68,876

Expenses

Rental expenses

3,840

3,399

7,816

6,628

Real estate taxes

1,408

1,248

2,751

2,460

General contracting and real estate services

19,354

22,503

37,339

39,961

Depreciation and amortization

4,057

4,020

8,026

7,179

General and administrative

1,981

2,857

4,027

3,574

Impairment charges

-

533

-

533

Total Expenses

30,640

34,560

59,959

60,335

Operating Income

5,174

2,962

10,282

8,541

Interest expense

(2,678)

(3,289)

(5,243)

(7,204)

Loss on extinguishment of debt

-

(1,125)

-

(1,125)

Gain on acquisitions

-

9,460

-

9,460

Other income

(194)

185

(82)

452

Income before taxes

2,302

8,193

4,957

10,124

Income tax (provision) benefit

(29)

211

(178)

211

Net Income

$2,273

$8,404

$4,779

$10,335 |

Core

FFO & AFFO 11

Three months ended

Six months ended

6/30/2014

6/30/2014

(Unaudited)

Net income

$2,273

$4,779

Depreciation and amortization

4,057

8,026

FFO

6,330

12,805

FFO per weighted

average share $0.19

$0.39

Core FFO

Adjustments

Loss on extinguishment of debt

-

-

Non-cash stock compensation

193

522

Impairment charges

-

-

Loan modifications

-

-

Non-Stabilized development pipeline adjustments

301

562

Core FFO

6,824

13,889

Core FFO per

weighted average share $0.21

$0.42

AFFO

Adjustments

Non-Stabilized development pipeline adjustments

(301)

(562)

Tenant improvements, leasing commissions

(1)

(1,007)

(1,216)

Leasing

incentives (63)

(63)

Property related capital expenditures

(322)

(541)

Non cash interest expense

160

293

GAAP Adjustments

Net effect of straight-line rents

(301)

(690)

Amortization of lease incentives and above (below) market rents

157

317

Derivative (income) losses

262

169

AFFO

5,409

11,596

AFFO per weighted

average share $0.16

$0.35

$ in thousands, except per share

(1) Excludes tenant improvements and leasing commissions on first generation rental

space. |

Summary

of Outstanding Debt 12

$ in thousands

(1) LIBOR rate is determined by individual lenders.

(2) Subject to an interest rate swap lock.

(3) Principal balance excluding any fair value adjustment recognized upon acquisition.

Weighted Average Fixed Interest Rate

5.3%

Weighted Average Variable Interest Rate

2.2%

Total Weighted Average Interest Rate

3.5%

Variable Interest Rate as a % of Total (excluding interest rate caps)

57.8%

Weighted Average Maturity (years)

8.9

2Q 2014

Year to Date

Capitalized Interest

$644

$1,260

Debt

Amount

Outstanding

Interest Rate

(1)

Effective Rate as of

June 30, 2014

Maturity Date

Balance at

Maturity

Virginia Beach Town Center

249 Central Park Retail

$15,701

5.99%

September 8, 2016

$15,084

South Retail

6,927

5.99%

September 8, 2016

6,655

Studio 56 Retail

2,654

3.75%

May 7, 2015

2,592

Commerce Street Retail

5,581

LIBOR +2.25%

2.40%

October 31, 2018

5,264

Fountain Plaza Retail

7,850

5.99%

September 8, 2016

7,542

Dick's at Town Center

8,267

LIBOR+2.75%

2.90%

October 31, 2017

7,889

The Cosmopolitan

47,430

3.75%

July 1, 2051

-

Diversified Portfolio

Oyster Point

6,371

5.41%

December 1, 2015

6,089

Broad Creek Shopping Center

Note 1

4,478

LIBOR +2.25%

2.40%

October 31, 2018

4,223

Note 2

8,220

LIBOR +2.25%

2.40%

October 31, 2018

7,752

Note 3

3,442

LIBOR +2.25%

2.40%

October 31, 2018

3,246

Hanbury Village

-

Note 1

21,333

6.67%

October 11, 2017

20,499

Note 2

4,125

LIBOR +2.25%

2.40%

October 31, 2018

3,777

Harrisonburg Regal

3,751

6.06%

June 8, 2017

3,165

North Point Center

-

Note 1

10,235

6.45%

February 5, 2019

9,333

Note 2

2,796

7.25%

September 15, 2025

1,344

Note 4

1,018

5.59%

December 1, 2014

1,007

Note 5

695

LIBOR+2.00%

3.57%

(2)

February 1, 2017

641

Tyre Neck Harris Teeter

2,460

LIBOR +2.25%

2.40%

October 31, 2018

2,235

Smith's Landing

24,633

LIBOR+2.15%

2.30%

January 31, 2017

23,793

187,967

132,130

Credit Facility

88,000

LIBOR + 1.60% -

2.20%

2.10%

May 13, 2016

88,000

Total including Credit Facility

$275,967

$220,130

Development Pipeline

4525 Main Street

25,251

LIBOR+1.95%

2.10%

January 30, 2017

25,251

Encore Apartments

14,342

LIBOR+1.95%

2.10%

January 30, 2017

14,342

Whetstone Apartments

7,219

LIBOR+1.90%

2.05%

October 8, 2016

7,219

Sandbridge Commons

4,409

LIBOR+1.85%

2.00%

January 17, 2018

4,409

Liberty Apartments

20,743

(3)

5.66%

November 1, 2043

-

Oceaneering

3,376

LIBOR+1.75%

1.90%

February 28, 2018

3,376

Total

Notes

Payable

-

Development

Pipeline

75,340

54,597

Unamortized fair value adjustments

(1,467)

Total Notes Payable

$349,840

$274,726 |

Core

Debt to Core EBITDA 13

Three months

ended 6/30/2014

6/30/2014

(Unaudited)

(Unaudited)

Net Income

$2,273

Total Debt

$349,840

Excluding:

Excluding:

Interest Expense

2,678

Development Pipeline Unstabilized Debt

(73,873)

Income Tax

29

Depreciation

and amortization 4,057

Core Debt

$275,967

EBITDA

9,037

Additional Adjustments:

Non-recurring or extraordinary (gains) losses

-

Early extinguishment of

debt -

Core Debt/Annualized Core

EBITDA 7.0x

Derivative (income) losses

262

Non-cash stock

compensation 193

Development Pipeline

301

Total Other Adjustments

756

Core EBITDA

9,793

Annualized Core EBITDA

$39,171

$ in thousands |

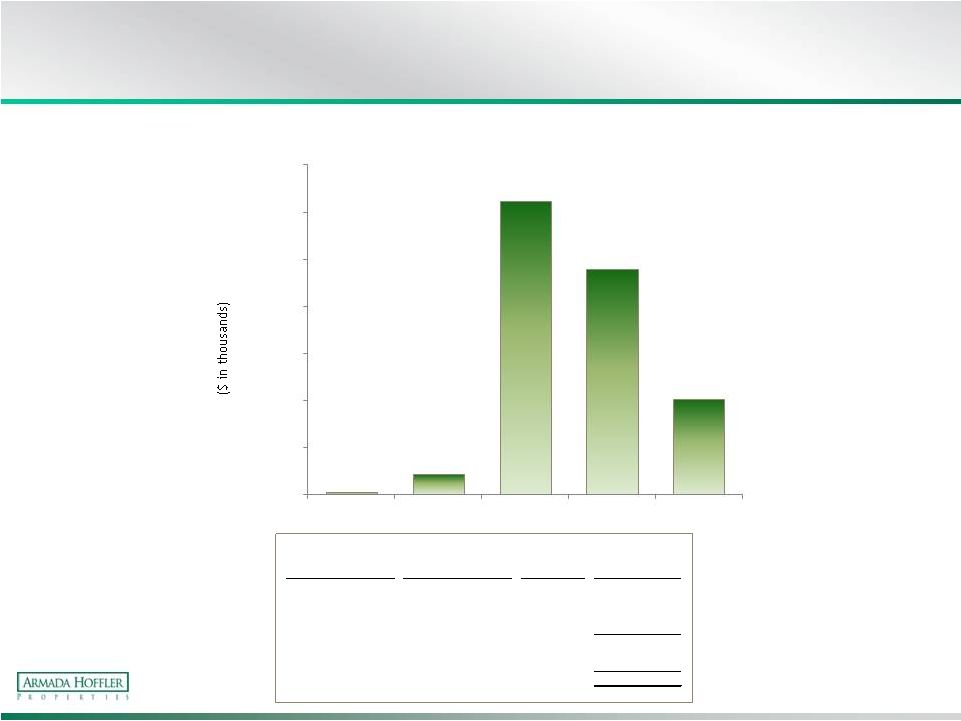

Debt

Information 14

$ in thousands

$0

$20,000

$40,000

$60,000

$80,000

$100,000

$120,000

$140,000

2014

2015

2016

2017

2018 and

thereafter

Debt Maturity as of 6/30/2014

Interest Rate Cap Agreements At or Below 1.50%

Effective Date

Maturity Date

Strike Rate

Notional Amount

May 31, 2012

May 29, 2015

1.09%

$9,008

September 1, 2013

March 1, 2016

1.50%

40,000

October 4, 2013

April 1, 2016

1.50%

18,500

March 14, 2014

March 1, 2017

1.25%

50,000

Total Interest Rate Caps at or Below 1.50%

$117,508

Fixed Debt Outstanding

147,505

Total Fixed Interest Rate Debt (including caps)

$265,013

Fixed Interest Rate Debt as a % of Total

75% |

Portfolio Summary & Business

Segmentation Overview |

Stabilized Portfolio Summary

16

As of 6/30/2014

Property

Location

Year Built

Net Rentable

Square Feet

(1)

% Leased

(2)

Annualized

Base Rent

(3)

Annualized

Base Rent per

Leased Sq. Ft.

(3)

Average Net

Effective

Annual Base

Rent per

Leased Sq. Ft.

(4)

Armada Hoffler Tower

(5)

Virginia Beach, VA

2002

324,348

97.1%

$8,123,253

$25.79

$26.55

One Columbus

Virginia Beach, VA

1984

129,424

100.0%

2,996,509

23.15

22.80

Two Columbus

Virginia Beach, VA

2009

109,091

90.7%

2,527,529

25.55

25.50

Virginia Natural Gas

(6)

Virginia Beach, VA

2010

31,000

100.0%

568,230

18.33

20.17

Richmond Tower

Richmond, VA

2010

206,969

98.0%

7,393,070

36.45

41.88

Oyster Point

Newport News, VA

1989

100,214

79.1%

1,730,856

21.83

21.45

Sentara Williamsburg

(6)

Williamsburg, VA

2008

49,200

100.0%

1,006,140

20.45

20.50

Subtotal / Weighted Average Office Portfolio

(7)

950,246

95.3%

$24,345,587

$26.88

$28.34

Retail Properties Not Subject to Ground Lease

Bermuda Crossroads

Chester, VA

2001

111,566

94.0%

1,394,953

13.30

13.82

Broad Creek Shopping Center

Norfolk, VA

1997-2001

227,691

96.8%

3,080,678

13.98

12.77

Courthouse 7-Eleven

Virginia Beach, VA

2011

3,177

100.0%

125,000

39.35

43.81

Gainsborough Square

Chesapeake, VA

1999

88,862

96.5%

1,353,202

15.77

15.39

Hanbury Village

Chesapeake, VA

2006-2009

61,049

86.4%

1,299,135

24.64

24.19

North Point Center

Durham, NC

1998-2009

215,690

92.1%

2,348,731

11.82

11.75

Parkway Marketplace

Virginia Beach, VA

1998

37,804

100.0%

729,644

19.30

20.61

Harrisonburg Regal

Harrisonburg, VA

1999

49,000

100.0%

683,550

13.95

13.95

Dick's at Town Center

Virginia Beach, VA

2002

100,804

83.3%

798,000

9.50

7.79

249 Central Park Retail

Virginia Beach, VA

(8)

2004

91,171

96.2%

2,458,145

28.04

26.50

Studio 56 Retail

Virginia Beach, VA

2007

11,600

84.8%

371,200

37.75

36.92

Commerce Street Retail

(9)

Virginia Beach, VA

2008

19,173

100.0%

781,588

40.77

41.63

Fountain Plaza Retail

Virginia Beach, VA

2004

35,961

100.0%

970,230

26.98

26.47

South Retail

(24)

Virginia Beach, VA

2002

38,763

83.6%

621,240

19.17

19.03

Subtotal / Weighted Avg Retail Portfolio not Subject to Ground Leases

(10)

1,092,311

93.5%

$17,015,294

$16.66

$16.16

Retail Properties Subject to Ground Lease

Bermuda Crossroads

(11)

Chester, VA

2001

(13)

100.0%

163,350

Broad Creek Shopping Center

(12)

Norfolk, VA

1997-2001

(14)

100.0%

579,188

Hanbury Village

(11)

Chesapeake, VA

2006-2009

(15)

100.0%

1,067,598

North Point Center

(11)

Durham, NC

1998-2009

(16)

100.0%

1,062,784

Tyre Neck Harris Teeter

(12)

Portsmouth, VA

2011

(17)

100.0%

508,134

Subtotal / Weighted Avg Retail Portfolio Subject to Ground Leases

100.0%

$3,381,055

Total / Weighted Avg Retail Portfolio

1,092,311

(18)

93.5%

$20,396,349

$16.66

$16.16

Total / Weighted Average Retail and Office Portfolio

2,042,557

94.4%

$44,741,936

$21.46

$21.88

Property

Location

Year Built

Units

(19)

% Leased

(2)

Annualized

Base Rent

(20)

Average

Monthly Base

Rent per

Leased Unit

(21)

Multifamily

Smith's Landing

(22)

Blacksburg, VA

2009

284

96.1%

$3,321,096

$1,013.77

The Cosmopolitan

Virginia Beach, VA

2006

342

93.9%

6,940,140

1,568.57

Total / Weighted Avg Multifamily Portfolio

626

94.9%

$10,261,236

$1,313.58

Office Properties |

Stabilized Portfolio Summary Footnotes

17

1)

The net rentable square footage for each of our office properties is the sum of (a) the square

footages of existing leases, plus (b) for available space, management’s estimate of net rentable square footage

based, in part, on past leases. The net rentable square footage included in office leases is

generally determined consistently with the Building Owners and Managers Association, or BOMA, 1996

measurement guidelines. The net rentable square footage for each of our retail properties is

the sum of (a) the square footages of existing leases, plus (b) for available space, the field verified square footage.

2)

Percentage leased for each of our office and retail properties is calculated as (a) square

footage under executed leases as of June 30, 2014, divided by (b) net rentable square feet, expressed as a percentage.

Percentage leased for our multifamily properties is calculated as (a) total units occupied as

of June 30, 2014, divided by (b) total units available, expressed as a percentage.

3)

For the properties in our office and retail portfolios, annualized base rent is calculated by

multiplying (a) base rental payments for executed leases as of June 30, 2014 (defined as cash base rents (before

abatements) excluding tenant reimbursements for expenses paid by the landlord), by (b) 12.

Annualized base rent per leased square foot is calculated by dividing (a) annualized base rent, by (b) square

footage under commenced leases as of June 30, 2014. In the case of triple net or modified

gross leases, annualized base rent does not include tenant reimbursements for real estate taxes, insurance,

common area or other operating expenses. 4)

Average net effective annual base rent per leased square foot represents (a) the

contractual base rent for leases in place as of June 30, 2014, calculated on a straight-line basis to amortize free rent periods

and abatements, but without regard to tenant improvement allowances and leasing commissions,

divided by (b) square footage under commenced leases as of June 30, 2014.

5)

As of June 30, 2014, the Company occupied 16,151 square feet at this property at an annualized

base rent of $446,172, or $29.40 per leased square foot, which amounts are reflected in the % leased,

annualized base rent and annualized base rent per square foot columns in the table above. The

rent paid by us is eliminated from our revenues in consolidation. In addition, effective March 1, 2013, the

Company sublease approximately 5,000 square feet of space from a tenant at this property. 6)

This property is subject to a triple net lease pursuant to which the tenant pays

operating expenses, insurance and real estate taxes.

7)

Includes square footage and annualized base rent pursuant to leases for space occupied by us. 8)

As of June 30, 2014, the Company occupied 8,995 square feet at this property at

an annualized base rent of $287,658, or $31.01 per leased square foot, which amounts are reflected in the % leased,

annualized base rent and annualized base rent per square foot columns in the table above. The

rent paid by us is eliminated from our revenues in consolidation.

9)

Includes $31,200 of annualized base rent pursuant to a rooftop lease. 10)

Reflects square footage and annualized base rent pursuant to leases for space

occupied by AHH.

11)

For this ground lease, the Company own the land and the tenant owns the improvements

thereto. The Company will succeed to the ownership of the improvements to the land upon the termination of the

ground lease.

12)

The Company lease the land underlying this property from the owner of the land pursuant to a

ground lease. The Company re-lease the land to our tenant under a separate ground lease pursuant to which

our tenant owns the improvements on the land. 13)

Tenants collectively lease approximately 139,356 square feet of land from us

pursuant to ground leases.

14)

Tenants collectively lease approximately 299,170 square feet of land from us pursuant to

ground leases. 15) Tenants collectively lease approximately 105,988 square feet of

land from us pursuant to ground leases.

16)

Tenants collectively lease approximately 1,443,985 square feet of land from us pursuant to

ground leases. 17) Tenant leases approximately 200,073 square feet of land from us

pursuant to a ground lease.

18)

The total square footage of our retail portfolio excludes the square footage of land subject

to ground leases.

19)

Units represent the total number of apartment units available for rent at June 30, 2014. 20)

For the properties in our multifamily portfolio, annualized base rent is

calculated by multiplying (a) base rental payments for the month ended June 30, 2014 by (b) 12.

21)

Average monthly base rent per leased unit represents the average monthly rent for all leased

units for the month ended June 30, 2014.

22)

The Company lease the land underlying this property from the owner of the land pursuant to a

ground lease. 23) The annualized base rent for The Cosmopolitan includes $936,143 of

annualized rent from 15 retail leases at the property.

24)

As of June 30, 2014, The Company occupied 2,908 square feet at this property at an annualized

base rent of $12,000, or $4.13 per leased square foot, which amounts are reflected in the % leased,

annualized base rent and annualized base rent per square foot columns in the table above. The

rent paid by us and is eliminated from our revenues in consolidation. |

Development Pipeline

18

$ in thousands

Identified Development Pipeline

Schedule

Office/Retail

Location

Estimated

Square

Footage

(1)

Estimated

Cost

(1)

Cost Incurred

through

6/30/2014

Start

Anchor Tenant

Occupancy

Stabilized

Operation

AHH

Ownership %

(1)

Property Type

%leased

Anchor Tenants

4525 Main Street

(2)

Virginia Beach, VA

239,000

(3)

$50,000

$38,000

1Q13

3Q14

1Q16

100%

Office

56%

Clark Nexsen, Development Authority

of Virginia Beach

(3)

, Anthropologie

(8)

Sandbridge Commons

Virginia Beach, VA

70,000

13,000

8,000

4Q13

1Q15

2Q16

100%

Retail

66%

Harris Teeter

Brooks Crossing

Newport News, VA

36,000

8,000

1,200

4Q14

3Q15

3Q15

65%

Office

0%

Huntington Ingalls

(4)

Greentree Shopping Center

(5)

Chesapeake, VA

18,000

6,000

4,000

4Q13

4Q14

3Q16

100%

Retail

40%

Wawa

363,000

77,000

51,200

Schedule

Multifamily

Location

Estimated

Apartment

Units

(1)

Estimated

Cost

(1)

Cost Incurred

through

6/30/2014

Start

Initial

Occupancy

Complete

(1)

Stabilized

Operation

AHH

Ownership %

Encore Apartments

(2)

Virginia Beach, VA

286

$34,000

$22,000

1Q13

3Q14

4Q15

1Q16

100%

Whetstone Apartments

Durham, NC

203

28,000

20,000

2Q13

3Q14

3Q15

1Q16

100%

Liberty Apartments

(6)

Newport News, VA

197

30,700

30,700

-

-

1Q14

3Q15

100%

686

92,700

72,700

Next Generation Pipeline

Schedule

Office/Retail

Location

Estimated

Square

Footage

(1)

Estimated

Cost

(1)

Cost Incurred

through

6/30/2014

Start

Anchor Tenant

Occupancy

Stabilized

Operation

AHH

Ownership %

(1)

Property Type

%leased

Anchor Tenants

Oceaneering

Chesapeake, VA

155,000

$26,000

$10,000

4Q13

1Q15

1Q15

100%

Office

100%

Oceaneering

Commonwealth of Virginia - Chesapeake

Chesapeake, VA

36,000

7,000

2,000

2Q14

1Q15

1Q15

100%

Office

100%

Commonwealth of Virginia

Commonwealth of Virginia - Virginia Beach

Virginia Beach, VA

11,000

3,000

1,000

2Q14

1Q15

1Q15

100%

Office

100%

Commonwealth of Virginia

Lightfoot Marketplace

Williamsburg, VA

88,000

24,000

9,000

3Q14

1Q16

2Q17

70%

(7)

Retail

60%

Harris Teeter

290,000

60,000

22,000

Total

$229,700

$145,900

(1) Represents estimates that may change as the development process proceeds

(2) This property is located within the Virginia Beach Town Center

(4) The principal tenant lease has not been signed as of the date of this supplemental

information (5) AHH has completed the sale of a pad ready site to Wal-Mart adjacent

to Greentree Shopping Center (6) Reflects purchase price of the acquisition, which

occurred in 1Q14 (7) AHH earns a preferred return on equity prior to any distributions

to JV partners (8) Executed lease with retail anchor

(3) Approximately 83,000 square feet is leased to Clark Nexsen, an architectural firm

and approximately 23,000 square feet

is leased to the Development Authority of Virginia Beach |

Construction Business Summary

19

$ in thousands

(1) Related party contracts

Location

Total Contract

Value

Work in Place as

of 6/30/2014

Backlog

Estimated Date

of Completion

Projects Greater than $5.0M

Exelon

Baltimore, MD

$164,709

$6,307

$158,402

1Q 2016

Hyatt Place Baltimore / Inner Harbor Hotel

Baltimore, MD

25,366

16,351

9,015

4Q 2014

City of Suffolk Municipal Center

Suffolk, VA

24,933

21,314

3,618

2Q 2015

Main Street Parking Garage

(1)

Virginia Beach, VA

18,035

16,887

1,148

3Q 2014

Sub Total

233,043

60,859

172,184

Projects Less than $5.0M

86,494

79,691

6,803

Total

$319,537

$140,550

$178,987

Gross Profit Summary

Q2 2014

YTD 2014

(Unaudited)

Revenue

$20,495

$39,729

Expense

(19,354)

(37,339)

Gross Profit

$1,141

$2,390 |

Operating Results & Property-

Type Segment Analysis |

Same

Store NOI by Segment 21

(1) Excludes Main Street Office

(2) Bermuda Crossroads and Greentree excluded

(3) Smith's Landing and Liberty Apartments excluded

(Reconciliation to GAAP located in appendix pg. 43)

$ in thousands

Three months ended 6/30

Six months ended 6/30

2014

2013

$ Change

% Change

2014

2013

$ Change

% Change

Office

(1)

(Unaudited)

(Unaudited)

Revenue

$6,473

$6,420

$53

1%

$13,022

$12,906

$116

1%

Expenses

1,971

1,940

31

2%

4,102

3,886

216

6%

Net Operating Income

4,502

4,480

22

0%

8,920

9,020

(100)

-1%

Retail

(2)

Revenue

5,163

5,131

32

1%

10,391

10,137

254

3%

Expenses

1,588

1,574

14

1%

3,275

3,255

20

1%

Net Operating Income

3,575

3,557

18

1%

7,116

6,882

234

3%

Multi Family

(3)

Revenue

1,920

1,903

17

1%

3,736

3,810

(74)

-2%

Expenses

870

875

(5)

-1%

1,701

1,690

11

1%

Net Operating Income

1,050

1,028

22

2%

2,035

2,120

(85)

-4%

Same Store Net Operating Income (NOI), GAAP basis

$9,127

$9,065

$62

1%

$18,071

$18,022

$49

0%

Net effect of straight-line rents

(251)

(143)

(108)

76%

(638)

(358)

(280)

78%

Amortization of lease incentives and above (below) market rents

183

180

3

2%

369

376

(7)

-2%

Same store portfolio NOI, cash basis

$9,059

$9,102

($43)

0%

$17,802

$18,040

($238)

-1%

Cash Basis:

Office

4,143

4,237

(94)

-2%

8,068

8,446

(378)

-4%

Retail

3,863

3,831

32

1%

7,693

7,462

231

3%

Multifamily

1,053

1,034

19

2%

2,041

2,132

(91)

-4%

$9,059

$9,102

($43)

0%

$17,802

$18,040

($238)

-1%

GAAP Basis:

Office

4,502

4,480

22

0%

8,920

9,020

(100)

-1%

Retail

3,575

3,557

18

1%

7,116

6,882

234

3%

Multifamily

1,050

1,028

22

2%

2,035

2,120

(85)

-4%

$9,127

$9,065

$62

1%

$18,071

$18,022

$49

0% |

Top 10

Tenants by Annual Base Rent 22

As of June 30, 2014

(1) Virginia Beach Development Authority would be included in the Office Portfolio top

ten tenants based on ABR once 4525 Main Street Office Stabalizes

Office Portfolio

Tenant

Number

of Leases

Number

of

Properties

Property(ies)

Lease

Expiration

Annualized

Base Rent

% of Office

Portfolio

Annualized

Base Rent

% of Total

Portfolio

Annualized

Base Rent

Williams Mullen

3

2

Armada Hoffler Tower, Richmond Tower

3/8/2026

$7,808,034

32.1%

14.2%

Sentara Medical Group

1

1

Sentara Williamsburg

3/31/2023

1,006,140

4.1%

1.8%

Cherry Bekaert & Holland

3

3

Armada Hoffler Tower, Richmond Tower, Oyster Point

1/31/2025

949,713

3.9%

1.7%

GSA

1

1

Oyster Point

9/21/2022

870,047

3.6%

1.6%

Troutman Sanders LLP

1

1

Armada Hoffler Tower

4/26/2017

865,370

3.6%

1.6%

The Art Institute

1

1

Two Columbus

12/31/2019

787,226

3.2%

1.4%

Pender & Coward

2

1

Armada Hoffler Tower

12/31/2019

781,536

3.2%

1.4%

Kimley-

Horn

1

1

Two Columbus

12/31/2018

682,162

2.8%

1.2%

Hampton University

2

1

Armada Hoffler Tower

5/7/2023

681,304

2.8%

1.2%

Hankins & Anderson

1

1

Armada Hoffler Tower

4/30/2022

572,601

2.4%

1.0%

Top 10 Total

$15,004,132

61.6%

27.3%

Retail Portfolio

Tenant

Number

of Leases

Number

of

Properties

Property(ies)

Lease

Expiration

Annualized

Base Rent

% of Retail

Portfolio

Annualized

Base Rent

% of Total

Portfolio

Annualized

Base Rent

Home Depot

2

2

Broad Creek Shopping Center, North Point Center

12/3/2019

$2,189,900

10.7%

4.0%

Harris Teeter

2

2

Tyre Neck Harris Teeter, Hanbury Village

10/16/2028

1,430,532

7.0%

2.6%

Food Lion

3

3

Broad Creek Shopping Center, Bermuda Crossroads,

Gainsborough Square

3/19/2020

1,282,568

6.3%

2.3%

Dick's Sporting Goods

1

1

Dick's at Town Center

1/31/2020

798,000

3.9%

1.5%

Regal Cinemas

1

1

Harrisonburg Regal

4/23/2019

683,550

3.4%

1.2%

PetsMart

2

2

Broad Creek Shopping Center, North Point Center

7/21/2018

618,704

3.0%

1.1%

Kroger

1

1

North Point Center

8/31/2018

552,864

2.7%

1.0%

Yard House

1

1

Commerce Street Retail

11/30/2023

538,000

2.6%

1.0%

Rite Aid

2

2

Gainsborough Square, Parkway Marketplace

5/29/2019

484,193

2.4%

0.9%

Walgreens

1

1

Hanbury Village

12/31/2083

447,564

2.2%

0.8%

Top 10 Total

$8,868,044

44.3%

16.4%

(1) |

Office

Lease Summary 23

Renewal Lease Summary

(1)

GAAP

Cash

Quarter

Number of

Leases

Signed

Net rentable

SF Signed

Leases

Expiring

Net rentable

SF Expiring

Contractual

Rent per SF

Prior Rent

per SF

Annual

Change in

Rent per SF

Contractual

Rent per SF

Prior Rent

per SF

Annual Change

in Rent per SF

Weighted

Average Lease

Term

TI, LC, &

Incentives

TI, LC, &

Incentives

per SF

2nd Quarter 2014

2

18,824

1

8,452

$25.12

$24.33

$0.79

$25.37

$27.55

($2.18)

7.75

$204,718

$10.88

1st Quarter 2014

1

25,506

2

5,430

32.28

26.66

5.63

29.95

29.25

0.70

10.00

1,315,127

51.56

4th Quarter 2013

5

45,677

4

5,112

26.74

25.27

1.47

23.58

27.97

(4.39)

11.34

1,927,309

42.19

3rd Quarter 2013

5

16,289

4

30,038

29.18

26.76

2.42

28.26

27.92

0.33

6.79

60,809

3.73

New Lease Summary

(1)

Quarter

Number of

Leases

Signed

Net rentable

SF Signed

Contractual

Rent per SF

Weighted

Average

Lease Term

TI, LC, &

Incentives

TI, LC, &

Incentives

per SF

2nd Quarter 2014

4

6,948

$20.18

4.28

$190,255

$27.38

1st Quarter 2014

2

5,430

24.12

1.00

5,239

0.96

4th Quarter 2013

4

18,381

23.56

10.34

577,382

31.41

3rd Quarter 2013

1

1,142

29.50

5.00

3,577

3.13

(1) Excludes leases for space occupied by AHH. |

Office

Lease Expirations 24

Year of Lease Expiration

Number of

Leases

Expiring

Square

Footage of

Leases

Expiring

% Portfolio

Net Rentable

Square Feet

Annualized

Base Rent

% of Portfolio

Annualized

Base Rent

Annualized Base Rent

per Leased Square

Foot

Available

-

44,593

4.7%

$0

-

$0.00

2014

8

18,631

2.0%

282,451

1.2%

15.16

2015

11

35,957

3.8%

793,596

3.3%

22.07

2016

10

33,481

3.5%

802,954

3.3%

23.98

2017

5

64,492

6.8%

1,564,421

6.4%

24.26

2018

17

157,665

16.6%

4,274,352

17.6%

27.11

2019

9

92,048

9.7%

2,160,096

8.9%

23.47

2020

3

25,283

2.7%

783,034

3.2%

30.97

2021

4

41,363

4.4%

973,852

4.0%

23.54

2022

3

48,117

5.1%

1,280,663

5.3%

26.62

2023

4

115,889

12.2%

2,368,413

9.7%

20.44

Thereafter

9

272,727

28.7%

9,061,755

37.2%

33.23

Total / Weighted Average

83

950,246

100.0%

24,345,587

$

100.0%

$26.88

1.2%

3.3%

3.3%

6.4%

17.6%

8.9%

3.2%

4.0%

5.3%

9.7%

37.2%

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

35.0%

40.0% |

Retail

Lease Summary 25

(1) Excludes leases from space occupied by AHH

Renewal Lease Summary

(1)

GAAP

Cash

Quarter

Number of

Leases

Signed

Net rentable

SF Signed

Leases

Expiring

Net

rentable SF

Expiring

Contractual

Rent per SF

Prior Rent

per SF

Annual Change

in Rent per SF

Contractual

Rent per SF

Prior Rent

per SF

Annual Change

in Rent per SF

Weighted

Average Lease

Term

TI, LC, &

Incentives

TI, LC, &

Incentives

per SF

2nd Quarter 2014

6

12,916

2

3,842

$20.47

$19.66

$0.81

$20.20

$20.65

($0.46)

1.87

$5,730

$0.44

1st Quarter 2014

5

23,857

3

6,540

20.84

20.41

0.43

21.18

21.82

(0.64)

4.55

63,339

2.65

4th Quarter 2013

7

37,733

6

7,928

13.82

13.49

0.33

13.79

14.12

(0.33)

4.70

40,540

1.07

3rd Quarter 2013

6

24,506

3

3,648

24.26

25.11

(0.85)

23.55

28.34

(4.79)

5.67

227,766

9.29

New Lease Summary

(1)

Quarter

Number of

Leases

Signed

Net rentable

SF Signed

Contractual

Rent per SF

Weighted

Average

Lease Term

TI, LC, &

Incentives

TI, LC, &

Incentives

per SF

2nd Quarter 2014

4

10,574

$25.73

$7.78

$1,071,485

$101.33

1st Quarter 2014

1

3,160

16.25

10.50

126,558

40.05

4th Quarter 2013

2

3,270

18.67

5.06

75,884

23.21

3rd Quarter 2013

-

-

-

-

-

-

|

Retail

Lease Expiration 26

Year of Lease Expiration

Number of

Leases

Expiring

Square

Footage of

Leases

Expiring

% Portfolio

Net Rentable

Square Feet

Annualized

Base Rent

% of Portfolio

Annualized

Base Rent

Annualized Base Rent

per Leased Square

Foot

Available

-

64,471

5.9%

$0

-

$0.00

Signed Leases not Commenced

2

6,332

0.6%

0

-

0.00

2014

10

17,869

1.6%

291,572

1.7%

16.32

2015

18

60,233

5.5%

1,293,171

7.6%

21.47

2016

20

59,949

5.5%

1,413,379

8.3%

23.58

2017

23

146,050

13.4%

2,045,639

12.0%

14.01

2018

20

122,737

11.2%

1,772,513

10.4%

14.44

2019

18

301,341

27.6%

4,331,948

25.5%

14.38

2020

7

133,586

12.2%

1,677,169

9.9%

12.55

2021

5

25,204

2.3%

740,832

4.4%

29.39

2022

5

79,588

7.3%

1,151,218

6.8%

14.46

2023

5

27,625

2.5%

869,930

5.1%

31.49

Thereafter

8

47,326

4.3%

1,427,923

8.4%

30.17

Total / Weighted Average

141

1,092,311

100.0%

17,015,294

$

100.0%

$16.55

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

1.7%

7.6%

8.3%

12.0%

10.4%

25.5%

9.9%

4.4%

6.8%

5.1%

8.4% |

Historical

Occupancy 27

(1) Office and retail occupancy based on occupied square feet as a % of respective

total (2) Multifamily occupancy based on occupied units as a % of respective total

(3) Total occupancy weighted by annualized base rent

Occupancy -

All Properties

as of

Sector

6/30/2014

3/31/2014

12/31/2013

9/30/2013

6/30/2013

Office

(1)

95.3%

95.4%

95.2%

93.4%

93.4%

Retail

(1)

93.5%

93.4%

93.4%

93.6%

94.6%

Multifamily

(2)

94.9%

94.2%

94.2%

92.7%

91.2%

Weighted Average

(3)

94.6%

94.5%

94.4%

93.3%

93.5% |

Multifamily Occupancy

28

Occupancy Summary - Smiths Landing (284 available units)

Quarter Ended

Number of Units

Occupied

Percentage

Occupied

(1)

Annualized Base

Rent

(2)

Average Monthly Rent

per Occupied Unit

6/30/2014

273

96.1%

$3,321,096

$1,014

3/31/2014

283

99.6%

3,430,260

1,010

12/31/2013

282

99.3%

3,382,380

1,000

9/30/2013

284

100.0%

3,427,980

1,006

6/30/2013

264

93.0%

3,163,164

998

Occupancy Summary - The Cosmopolitan (342 available units)

Quarter Ended

Number of Units

Occupied

Percentage

Occupied

(1)

Annualized Base

Rent

(2)(4)

Average Monthly Rent

per Occupied Unit

(3)

6/30/2014

321

93.9%

$6,042,132

$1,569

3/31/2014

307

89.8%

5,799,564

1,574

12/31/2013

308

90.1%

5,721,144

1,548

9/30/2013

296

86.5%

5,506,764

1,550

6/30/2013

307

89.9%

5,818,908

1,580

(1) Total

units occupied as of each respective date (2) Annualized base rent is calculated

by multiplying (a) contractual rent due from our tenants for the last month of the respective quarter by (b) 12

(3)

Average

Monthly

Rent

per

Occupied

Unit

is

calculated

as

(a)

annualized

base

rent

divided

by

(b)

the

number

of

occupied

units

as

of

the

end

of

the

respective

date.

(4) Excludes annualized base rent from retail leases |

Appendix -

Understanding AHH |

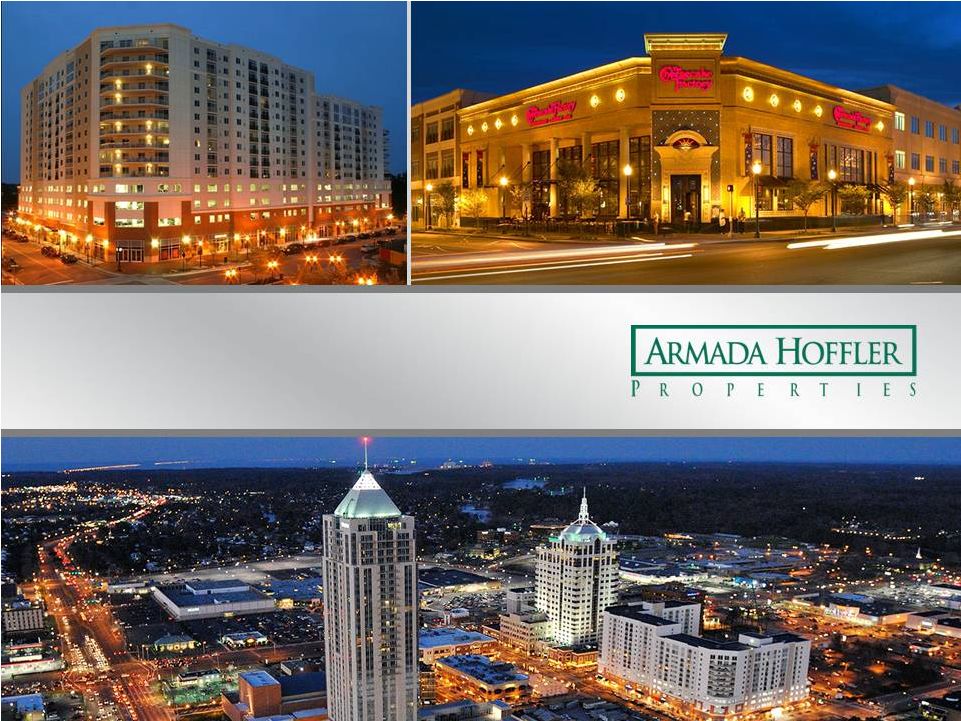

Current Portfolio & Development Pipeline

Previous Construction or Development Projects

Armada Hoffler Properties, Inc. is a full-service real estate investment trust

(REIT) and property company that

develops, builds, owns and manages institutional grade office, retail and multifamily

properties in the Mid- Atlantic U.S. The Company also provides general

construction and development services to third-party clients

throughout the Mid-Atlantic and Southeastern regions of the U.S. Armada Hoffler

Properties was founded in 1979 and is headquartered in Virginia Beach, VA.

30

Diversified portfolio consisting of Office, Retail

and Multifamily properties

Institutional grade portfolio focused on the Mid-

Atlantic region

35 year corporate track record with senior

leadership team averaging more than 20 years

with the company

Market Cap of ~$320 million as of 6/30/14

Management and previous partners own in

excess of 40% of the company through limited

partnership units in the operating partnership

Understanding AHH –

Corporate Overview |

1.

Advantages of Core Stabilized Portfolio:

Consistent cash flow

High occupancy

Stable same store metrics

2.

Advantages of Wholesale Development Pipeline Engine:

Equity creation

Asset base growth

3.

Advantages of Construction Company:

Stable earnings and value creation

Reduces risk in selecting/executing development opportunities

Brand recognition in new markets

31

Sum of the Parts Leads to Valuation

Understanding AHH –

Differentiation Provides Value Creation

Development Engine

Construction

Business

Stable

Portfolio |

32

Definition

Characteristics

Valuation

Stabilized

Portfolio

•

Consistent cash flow

•

High occupancy

•

Stable same store

metrics

•

Traditional real estate

valuation, NAV/Cap

Rates

Development

Pipeline

•

Real estate assets in

development or ramping

towards stabilization

•

Value creation

•

Asset base growth

•

Equity Creation

Construction

Business

•

3 party construction

business

•

Stable earnings and

value creation

•

Reduces risk in

selecting/executing

development

opportunities

•

Brand

recognition

in

new markets

•

Multiples analysis

Business Segmentation Overview

rd

th

•

Includes stabilized

office, retail, and

multifamily real estate

(defined as the earlier of

80% occupancy or the

13

full

quarter

after

CO) |

33

See Pages 34-37 for Further Information Regarding the Components of NAV

Components of NAV |

1)

Understanding AHH –Stabilized Portfolio 34

(Reconciliation to GAAP located in appendix pg. 44)

$ in thousands

(1) Excludes Greentree Shopping Center

(2) Excludes Liberty Apartments

(3) Includes leases for space occupied by Armada Hoffler which are eliminated for GAAP

purposes totaling ~$211K per quarter (4) Excludes Main Street Office

Cash NOI

Three months

ended 6/30/2014

Annualized

(Unaudited)

Office

$2,141

$8,564

Retail

(1)

3,047

12,188

Multifamily

(2)

589

2,356

Total Diversified Portfolio NOI

$5,777

$23,108

Virginia Beach Town Center

Office

(3)(4)

$2,142

$8,568

Retail

(3)

1,240

4,960

Multifamily

1,053

4,212

Total Virginia Beach Town Center NOI

$4,435

$17,740

Total Stabilized Portfolio NOI

$10,212

$40,848

Diversified

Portfolio |

Note:

The data below reflects the Company’s current estimates and projections, which may change as a result of various

factors. The Company can make no assurances that the estimates and projections

below will actually be realized. 35

$ in thousands, unaudited

Estimated Cost

Estimated

Stabilized NOI

Estimated

Return on

Cost

Projected

Value Spread

The Company's

Estimated Equity

Creation

The Company's Est.

Equity Creation

Excluding JV

Ownership

Identified Pipeline

$139,000

$11,400

8.20%

125bp

$24,995

$23,903

Next Generation Pipeline

150,000

12,400

8.27%

150bp

33,251

33,251

Liberty Apartments

30,700

(1)

2,000

6.51%

-

Estimated Stabilized Value/Weighted

Average $319,700

$25,800

8.24%

$58,246

$57,154

(1) Purchase price

2) Understanding AHH –Identified &

Next Generation Pipeline

Greater

than

$57M

in

Equity

Creation

-

3

to

4

Years |

Gross Profit

Summary Q2 2014

YTD 2014

(Unaudited)

Revenue

$20,495

$39,729

Expense

(19,354)

(37,339)

Gross Profit

$1,141

$2,390

3) Understanding AHH –

3

rd

Party Construction

Gross Profit -

metric to use when evaluating the profitability and valuation of the general

contracting & real estate services segment

36

$ in thousands

Construction Company -

Ongoing Profitable Business with Intrinsic Value |

4) NAV

Component Data 37

$ in thousands

(1) Includes leases for space occupied by Armada Hoffler which are eliminated for GAAP

purposes totaling ~$211K per quarter Stabilized Portfolio NOI (Cash)

Development Pipeline

Annualized three

months ended

6/30/2014

Development Investment as of 6/30/2014

$113,845

58,246

Office

$8,564

$172,091

Retail

12,188

Multifamily

2,356

Total Diversified Portfolio NOI (pg. 34)

$23,108

Operating Companies

Outlook

Office

(1)

$8,568

6/30/2014

Retail

(1)

4,960

Multifamily

4,212

$4,300

Total Virginia Beach Town Center NOI (pg. 34)

$17,740

Stabilized Portfolio NOI (Cash)

$40,848

Other Assets

Liabilities & Share Count

As of 6/30/2014

As of 6/30/2014

Other Assets

Liabilities

Cash and Cash Equivalents

$16,271

Mortgages and notes payable

$349,840

Restricted Cash

3,224

Accounts payable and accrued liabilities

6,743

Accounts Receivable

19,517

Construction payables, including retentions

34,631

Construction receivables, including retentions

12,730

Other Liabilities

17,701

Other Assets

26,102

Total Liabilities

$408,915

Total Other Assets

$77,844

Share Count

Weighted Average Common Shares Outstanding

19,250

13,785

33,035

General Contracting and Real Estate Services per

Company June 30, 2014 parameters (pg. 7)

Virginia Beach Town Center

Weighted Average Operating Partnership ("OP") Units Outstanding Total Weighted Average

Common shares and OP units outstanding

Diversified Portfolio

The Company's Estimated Equity Creation - 3-4 years (pg. 35) |

Appendix –

Definitions & Reconciliations |

Definitions

Net Operating Income:

We calculate Net Operating Income (“NOI”) as property revenues (base rent,

expense reimbursements and other revenue)

less

property

expenses

(rental

expenses

and

real

estate

taxes).

For

our

office,

retail

and

multifamily

segments, NOI excludes general contracting and real estate services expenses,

depreciation and amortization, general and

administrative

expenses,

and

impairment

charges.

Other

REITs

may

use

different

methodologies

for

calculating

NOI,

and

accordingly,

our

NOI

may

not

be

comparable

to

such

other

REITs’

NOI.

NOI

is

not

a

measure

of

operating

income or cash flows from operating activities as measured by GAAP and is not

indicative of cash available to fund cash needs. As a result, net operating

income should not be considered an alternative to cash flows as a measure of

liquidity. We consider NOI to be an appropriate supplemental measure to net

income because it assists both investors and management in understanding the

core operations of our real estate business. (Reconciliation to GAAP located in

appendix pg. 45)

Funds From Operations:

We calculate Funds From Operations (“FFO”) in accordance with the standards

established by the National Association of Real Estate Investment Trusts

(“NAREIT”). NAREIT defines FFO as net income (loss) (calculated in accordance with

accounting principles generally accepted in the United States (“GAAP”)),

excluding gains (or losses) from sales of depreciable

operating

property,

real

estate

related

depreciation

and

amortization

(excluding

amortization

of

deferred

financing costs) and after adjustments for unconsolidated partnerships and joint

ventures. FFO is a supplemental non-GAAP financial measure. Management uses

FFO as a supplemental performance measure because it believes that FFO is

beneficial to investors as a starting point in measuring our operational performance.

Specifically, in excluding real estate related depreciation and amortization and gains

and losses from property dispositions, which do not relate to or are not

indicative of operating performance, FFO provides a performance measure that,

when compared year over year, captures trends in occupancy rates, rental rates and operating costs.

Other equity REITs may not calculate FFO in accordance with the NAREIT definition as we

do, and, accordingly, our FFO may not be comparable to such other

REITs’ FFO.

39 |

Definitions

Core Funds From Operations:

Adjusted Funds From Operations:

40

We calculate Core Funds From Operations ("Core FFO") as FFO calculated in

accordance with the standards established by NAREIT, adjusted for losses on debt

extinguishments, non-cash stock compensation and impairment charges. Such

items are non-recurring or non-cash in nature. Our calculation of Core

FFO also excludes acquisition costs and the impact of development pipeline

projects that are still in lease-up. We generally consider a property to be in lease-up

until the earlier of (i) the quarter after which the property reaches 80% occupancy or

(ii) the thirteenth quarter after the property receives its certificate of

occupancy. Management believes that AFFO provides useful supplemental information

to investors regarding our operating performance as it provides a consistent

comparison of our operating performance across time periods and allows investors

to more easily compare our operating results with other REITs. However, other REITs may use different

methodologies for calculating AFFO or similarly entitled FFO measures and, accordingly,

our AFFO may not always be comparable to AFFO or other similarly entitled FFO

measures of other REITs. Management believes that the computation of FFO in

accordance to NAREIT’s definition includes certain items that are not

indicative of the results provided by the Company’s operating portfolio and affect the comparability

of the Company’s period-over-period performance. Our calculation of Core

FFO differs from NAREIT's definition of FFO. Other equity REITs may not

calculate Core FFO in the same manner as us, and, accordingly, our Core FFO may

not be comparable to other REITs' Core FFO. We calculate Adjusted Funds

From Operations (“AFFO”) as Core FFO, (i) excluding the impact of tenant improvement

and leasing commission costs, capital expenditures, the amortization of deferred

financing fees, derivative (income) loss, the net effect of straight-line

rents and the amortization of lease incentives and net above (below) market rents

and (ii) adding back the impact of development pipeline projects that are still in

lease-up and government development grants that are not included in FFO. |

Definitions

EBITDA:

We calculate EBITDA as net income (loss) (calculated in accordance with GAAP),

excluding interest expense, income taxes and depreciation and amortization.

Management believes EBITDA is useful to investors in evaluating and facilitating

comparisons of our operating performance between periods and between REITs by removing the impact of

our capital structure (primarily interest expense) and asset base (primarily

depreciation and amortization) from our operating results.

Core EBITDA:

We calculate Core EBITDA as EBITDA, excluding certain items, including, but not limited

to, non-recurring or extraordinary gains (losses), early extinguishment of

debt, derivative (income) losses, acquisition costs and the impact of

development pipeline projects that are still in lease-up. We generally consider a property to be in lease-up until the

earlier of (i) the quarter after which the property reaches 80% occupancy or (ii) the

thirteenth quarter after the property receives its certificate of occupancy.

Management believes that Core EBITDA provides useful supplemental information to

investors regarding our ongoing operating performance as it provides a consistent comparison of our

operating performance across time periods and allows investors to more easily compare

our operating results with other REITs. However, other REITs may use different

methodologies for calculating Core EBITDA or similarly entitled measures and,

accordingly, our Core EBITDA may not always be comparable to Core EBITDA or other similarly entitled measures

of other REITs.

Core Debt:

We calculate Core Debt as our total debt, excluding any construction loans associated

with our development pipeline. Same Store Portfolio:

We define same store properties as including those properties that were owned and

operated for the entirety of the period being presented and excluding properties

that were in lease-up during the period present. We generally

consider

a

property

to

be

in

lease-up

until

the

earlier

of

(i)

the

quarter

after

which

the

property

reaches

80%

occupancy

or (ii) the thirteenth quarter after the property receives its certificate of

occupancy. The following table shows the properties included in the same

store and non-same store portfolio for the comparative periods presented.

41 |

Same

Store vs. Non-Same Store Properties 42

Same Store

Non-Same Store

Same Store

Non-Same Store

Office Properties

Armada Hoffler Tower

X

X

One Columbus

X

X

Two Columbus

X

X

Virginia Natural Gas

X

X

Richmond Tower

X

X

Oyster Point

X

X

Sentara Williamsburg

X

X

4525 Main Street

X

X

Retail Properties

Bermuda Crossroads

X

X

Broad Creek Shopping Center

X

X

Courthouse 7-Eleven

X

X

Gainsborough Square

X

X

Hanbury Village

X

X

North Point Center

X

X

Parkway Marketplace

X

X

Harrisonburg Regal

X

X

Dick’s at Town Center

X

X

249 Central Park Retail

X

X

Studio 56 Retail

X

X

Commerce Street Retail

X

X

Fountain Plaza Retail

X

X

South Retail

X

X

Tyre Neck Harris Teeter

X

X

Greentree Shopping Center

X

X

Multifamily

Smith’s Landing

X

X

The Cosmopolitan

X

X

Liberty Apartments

X

X

Comparison of Six Months Ended

June 30, 2014 to 2013

Comparison of Three Months Ended

June 30, 2014 to 2013 |

Reconciliation to GAAP -

Segment Portfolio NOI

43

$ in thousands

(1) Main Street Office excluded

(2) Bermuda Crossroads and Greentree Shopping Center excluded

(3) Smith's Landing and Liberty Apartments excluded

Three months ended 6/30

Six months ended 6/30

2014

2013

2014

2013

Office Same Store

Rental revenues

(1)

$6,473

$6,420

$13,022

$12,906

Property expenses

1,971

1,940

4,102

3,886

NOI

4,502

4,480

8,920

9,020

Non-Same Store NOI

46

-

46

-

Segment NOI

$4,548

$4,480

$8,966

$9,020

Retail Same Store

(2)

Rental revenues

$5,163

$5,131

$10,391

$10,137

Property expenses

1,588

1,574

3,275

3,255

NOI

3,575

3,557

7,116

6,882

Non-Same Store NOI

438

197

842

197

Segment NOI

$4,013

$3,754

$7,958

$7,079

Multifamily Same Store

(3)

Rental revenues

$1,920

$1,903

$3,736

$3,810

Property expenses

870

875

1,701

1,690

NOI

1,050

1,028

2,035

2,120

Non-Same Store NOI

460

322

986

322

Segment NOI

1,510

1,350

$3,021

$2,442

Total Segment Portfolio NOI

$10,071

$9,584

$19,945

$18,541 |

Reconciliation to GAAP -

Segment Portfolio NOI

44

$ in thousands

Three months ended 6/30/2014

Office

Retail

Multifamily

Total

Cash NOI

$2,141

$3,047

$589

$5,777

Net effect of straight-line rents

237

(115)

(12)

110

Amortization of lease incentives and (above) below market rents

(16)

39

(13)

10

GAAP NOI

$2,362

$2,971

$564

$5,897

Office

Retail

Multifamily

Total

Cash NOI

$2,142

$1,240

$1,053

$4,435

Net effect of straight-line rents

164

(18)

(3)

143

Amortization of lease incentives and (above) below market rents

(26)

(141)

-

(167)

Elimination of AHH rent

(140)

(70)

-

(210)

GAAP NOI

$2,140

$1,011

$1,050

$4,201

GAAP NOI

Office

Retail

Multifamily

Total

Diversified Portfolio

$2,362

$2,971

$564

$5,897

Town Center of Virginia Beach

2,140

1,011

1,050

4,201

Unstabilized Properties

46

31

(104)

(27)

Total Segment Portfolio GAAP NOI

$4,548

$4,013

$1,510

$10,071

Diversified Portfolio

Town Center of Virginia Beach |

Reconciliation to GAAP -

Segment Portfolio NOI

$ in thousands

45

Office

Retail

Multifamily

Total Rental

Properties

General Contracting &

Real Estate Services

Total

Segment revenues

6,519

$

5,703

$

3,097

$

15,319

$

20,495

$

35,814

$

Segment expenses

1,971

1,690

1,587

5,248

19,354

24,602

Net operating income

4,548

$

4,013

$

1,510

$

10,071

$

1,141

$

11,212

$

Depreciation and amortization

(4,057)

General and administrative expenses

(1,981)

Interest expense

(2,678)

Other income (expense)

(194)

Income tax provision

(29)

Net income

2,273

$

Office

Retail

Multifamily

Total Rental

Properties

General Contracting &

Real Estate Services

Total

Segment revenues

13,068

$

11,473

$

5,971

$

30,512

$

39,729

$

70,241

$

Segment expenses

4,102

3,515

2,950

10,567

37,339

47,906

Net operating income

8,966

$

7,958

$

3,021

$

19,945

$

2,390

$

22,335

$

Depreciation and amortization

(8,026)

General and administrative expenses

(4,027)

Interest expense

(5,243)

Other income (expense)

(82)

Income tax provision

(178)

Net income

4,779

$

Three months ended 6/30/2014

Six months ended 6/30/2014 |