Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Wesco Aircraft Holdings, Inc | a14-18304_18k.htm |

| EX-99.1 - EX-99.1 - Wesco Aircraft Holdings, Inc | a14-18304_1ex99d1.htm |

Exhibit 99.2

|

|

Third Quarter FY 2014 Earnings Conference Call August 4, 2014 |

|

|

Wesco Aircraft Private & Proprietary Visit www.wescoair.com Agenda Company Overview Business Highlights &Integration Update FinancialOverview Questions &AnswersMark DavidsonHead of Investor RelationsRandy SnyderChief Executive Officer and Chairman Thad FortinExecutive Vice President, Chief Strategy OfficerGreg HannExecutive Vice President, Chief Financial Officer 2 Wesco Aircraft-Investor Relations |

|

|

Wesco Aircraft Private & Proprietary Visit www.wescoair.com Disclaimer This presentation contains forward-looking statements (including within the meaning of the Private Securities Litigation Reform Act of 1995) concerning Wesco Aircraft Holdings, Inc. (“Wesco Aircraft “ or the “Company”) and other matters. These statements may discuss goals, intentions and expectations as to future plans, trends, events, results of operations or financial condition, or otherwise, based on current beliefs of management, as well as assumptions made by, and information currently available to, such management. Forward-looking statements may be accompanied by words such as “aim,” “anticipate,” “believe,” “plan,” “could,” “would,” “should,” “estimate,” “expect,” “forecast,” “future,” “guidance,” “intend,” “may,” “will,” “possible,” “potential,” “predict,” “project” or similar words, phrases or expressions. These forward-looking statements are subject to various risks and uncertainties, many of which are outside the Company’s control. Therefore, you should not place undue reliance on such statements. Factors that could cause actual results to differ materially from those in the forward-looking statements include: general economic and industry conditions; conditions in the credit markets; changes in military spending; risks unique to suppliers of equipment and services to the U.S. government; risks associated with the Company’s long-term, fixed-price agreements that have no guarantee of future sales volumes; risks associated with the loss of significant customers, a material reduction in purchase orders by significant customers or the delay, scaling back or elimination of significant programs on which the Company relies; the Company’s ability to effectively manage its inventory; the Company’s ability to successfully integrate the acquired business of Haas Group Inc. in a timely fashion; failure to realize anticipated benefits of the combined operations; risks relating to unanticipated costs of integration; risks associated with the Company’s rapid expansion; the Company’s suppliers’ ability to provide it with the products the Company sells in a timely manner, in adequate quantities and/or at a reasonable cost; the Company’s ability to maintain effective information technology systems; the Company’s ability to retain key personnel; risks associated with the Company’s international operations; fluctuations in the Company’s financial results from period-to-period; risks associated with assumptions the Company makes in connection with its critical accounting estimates and legal proceedings; the Company’s ability to effectively compete in its industry; environmental risks; risks related to the handling, transportation and storage of chemical products; the Company’s dependence on third-party package delivery companies; risks related to the aerospace industry and the regulation thereof; risks related to the Company’s indebtedness; and other risks and uncertainties. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties that affect the Company’s business, including those described in the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other documents filed from time to time with the Securities and Exchange Commission. All forward-looking statements included in this presentation (including information included or incorporated by reference herein) are based upon information available to the Company as of the date hereof, and the Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. The Company utilizes and discusses Adjusted Net Income, Adjusted Basic EPS, Adjusted Diluted EPS and Adjusted EBITDA, which are non-GAAP measures its management uses to evaluate its business, because the Company believes they assist investors and analysts in comparing its performance across reporting periods on a consistent basis by excluding items that the Company does not believe are indicative of its core operating performance. The Company believes these metrics are used in the financial community, and the Company presents these metrics to enhance investors’ understanding of its operating performance. You should not consider Adjusted EBITDA and Adjusted Net Income as an alternative to Net Income, determined in accordance with GAAP, as an indicator of operating performance. Adjusted Net Income, Adjusted Basic EPS, Adjusted Diluted EPS and Adjusted EBITDA are not measurements of financial performance under GAAP, and these metrics may not be comparable to similarly titled measures of other companies. See the Appendix for a reconciliation of Adjusted Net Income, Adjusted Basic EPS, Adjusted Diluted EPS and Adjusted EBITDA to the most directly comparable financial measures calculated and presented in accordance with GAAP. 3 Wesco Aircraft - Investor Relations |

|

|

Third quarter revenues of $395.6 million compared to $230.2 million in the prior year period, an increase of 72% Organic growth of approximately 11% for year to date Third quarter Adjusted EBITDA of $63.2 million, compared to $49.7 million for the same period last year Adjusted Net Income for the third quarter of $33.0 million compared to $29.5 million for the same period last year Adjusted Diluted EPS of $0.34 Revising full year fiscal 2014 guidance Revenue expected to be in the range of $1.350 billion to $1.380 billion Diluted EPS expected to be in the range of $1.12 to $1.15 per share Adjusted Diluted EPS expected to be in the range of $1.30 to $1.33 per share Wesco Aircraft Private & Proprietary Visit www.wescoair.com Third Quarter FY 2014 Highlights 4 Wesco Aircraft - Investor Relations |

|

|

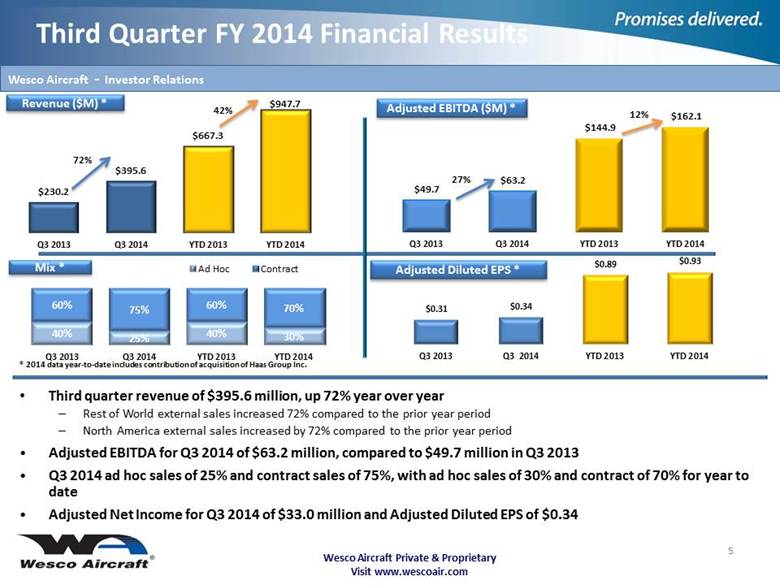

* 2014 data year-to-date includes contribution of acquisition of Haas Group Inc. Third quarter revenue of $395.6 million, up 72% year over year Rest of World external sales increased 72% compared to the prior year period North America external sales increased by 72% compared to the prior year period Adjusted EBITDA for Q3 2014 of $63.2 million, compared to $49.7 million in Q3 2013 Q3 2014 ad hoc sales of 25% and contract sales of 75%, with ad hoc sales of 30% and contract of 70% for year to date Adjusted Net Income for Q3 2014 of $33.0 million and Adjusted Diluted EPS of $0.34 Wesco Aircraft Private & Proprietary Visit www.wescoair.com Third Quarter FY 2014 Financial Results Revenue ($M) * Adjusted EBITDA ($M) * 5 Mix * Adjusted Diluted EPS * Wesco Aircraft - Investor Relations 72% 12% |

|

|

Wesco Aircraft Private & Proprietary Visit www.wescoair.com Full Year FY 2014 Outlook Full Year FY 2014 Outlook Previous Guidance 6 Revised Guidance Wesco Aircraft - Investor Relations Revenue forecast: $1.330 billion - $1.380 billion $1.350 billion - $1.380 billion Diluted EPS forecast (per share): $1.25 - $1.31 $1.12 - $1.15 Adjusted Diluted EPS forecast (per share): $1.33 - $1.38 $1.30 - $1.33 |

|

|

Wesco Aircraft Private & Proprietary Visit www.wescoair.com APPENDIX 7 |

|

|

Wesco Aircraft Private & Proprietary Visit www.wescoair.com Non-GAAP Financial Information ‘‘Adjusted Net Income’’ represents Net Income before: (i) amortization of intangible assets, (ii) amortization or write-off of deferred financing costs and original issue discount, (iii) unusual or non-recurring items and (iv) the tax effect of items (i) through (iii) above calculated using an assumed effective tax rate. “Adjusted Basic EPS” represents Basic EPS calculated using Adjusted Net Income as opposed to Net Income. “Adjusted Diluted EPS” represents Diluted EPS calculated using Adjusted Net Income as opposed to Net Income. ‘‘Adjusted EBITDA’’ represents Net Income before: (i) income tax provision, (ii) net interest expense, (iii) depreciation and amortization, and (iv) unusual or non-recurring items. Wesco Aircraft utilizes and discusses Adjusted Net Income, Adjusted Basic EPS, Adjusted Diluted EPS and Adjusted EBITDA, which are non-GAAP measures our management uses to evaluate our business, because we believe they assist investors and analysts in comparing our performance across reporting periods on a consistent basis by excluding items that we do not believe are indicative of our core operating performance. We believe these metrics are used in the financial community, and we present these metrics to enhance investors’ understanding of our operating performance. You should not consider Adjusted EBITDA and Adjusted Net Income as an alternative to Net Income, determined in accordance with GAAP, as an indicator of operating performance. Adjusted Net Income, Adjusted Basic EPS, Adjusted Diluted EPS and Adjusted EBITDA are not measurements of financial performance under GAAP, and these metrics may not be comparable to similarly titled measures of other companies. See below for a reconciliation of Adjusted Net Income, Adjusted Basic EPS, Adjusted Diluted EPS and Adjusted EBITDA to the most directly comparable financial measures calculated and presented in accordance with GAAP. 8 Wesco Aircraft - Investor Relations |

|

|

Wesco Aircraft Private & Proprietary Visit www.wescoair.com Non-GAAP Financial Information 9 Wesco Aircraft - Investor Relations June 30, 2014 June 30, 2013 June 30, 2014 June 30, 2013 EBITDA & Adjusted EBITDA Net income $28,772 $27,026 $77,454 $74,840 Provision for income taxes 16,128 13,866 41,300 37,504 Interest and other, net 9,354 4,680 19,409 20,748 Depreciation and amortization 6,913 2,775 14,192 8,495 EBITDA 61,167 48,347 152,355 141,587 Unusual or non-recurring items 2,003 1,373 9,783 3,284 Adjusted EBITDA $63,170 $49,720 $162,138 $144,871 Adjusted Net Income Net income $28,772 $27,026 $77,454 $74,840 Amortization of intangible assets 4,011 1,643 8,099 4,952 Amortization of deferred financing costs 887 791 2,056 7,158 Unusual or non-recurring items 2,003 1,373 9,783 3,284 Adjustments for tax effect (2,647) (1,336) (6,459) (5,403) Adjusted Net Income $33,026 $29,497 $90,933 $84,831 Adjusted Basic Earnings Per Share Weighted-average number of basic shares outstanding 96,580 93,556 95,675 92,985 Adjusted Net Income Per Basic Shares $0.34 $0.32 $0.95 $0.91 Adjusted Diluted Earnings Per Share Weighted-average number of diluted shares outstanding 97,938 95,924 97,511 95,579 Adjusted Net Income Per Diluted Shares $0.34 $0.31 $0.93 $0.89 Wesco Aircraft Holdings, Inc. Non-GAAP Financial Information (UNAUDITED) (In thousands, except for per share data) Three Months Ended Nine Months Ended |