Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - URS CORP /NEW/ | form8-k.htm |

| EX-23.1 - EXHIBIT 23.1 - URS CORP /NEW/ | ex23-1.htm |

EXPLANATORY NOTE

Effective with the beginning of our 2014 fiscal year, we realigned our Global Management and Operations Services Group, which was a component of our Energy & Construction Division in fiscal year 2013, under the operations and management of our Federal Services Division. The realignment of this group consolidates the majority of our business with U.S. federal government agencies and national governments outside the U.S. in our Federal Services Division. We also realigned a portion of our facility construction, process engineering, and operations and maintenance services to the oil and gas industry among our Oil & Gas, Infrastructure & Environment, and Energy & Construction Divisions. These changes, which restructured elements of our oil and gas business from an organization based on legacy acquisitions to one based on service, are designed to improve our ability to provide integrated services to our oil and gas clients. These changes are collectively referred to as the “Realignments.”

On July 11, 2014, we entered into a merger agreement with AECOM Technology Corporation (“AECOM”) under which AECOM has agreed to acquire URS (the “merger”), subject to the terms and conditions of the merger agreement. As part of that agreement, AECOM is filing a registration statement on Form S-4, which will include a joint proxy statement of AECOM and URS and a prospectus of AECOM. The Form S-4 will incorporate by reference the attached unaudited pro forma consolidated financial information based on the combination of URS and AECOM's historical financial statements. We are required under Securities and Exchange Commission guidance to recast or reclassify our Form 10-K for the fiscal year ended January 3, 2014 to reflect the retrospective impact of the Realignments as if they had occurred for all periods presented in the financial statements. As a result, we are filing as Exhibit 99.1 revised sections of our Form 10-K for the fiscal year ended January 3, 2014, which recasts the following sections to reflect the Realignments for all periods presented in the financial statements: Item 1. Business; Item 1A. Risk Factors; Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations; Item 8. Consolidated Financial Statements and Supplementary Data, Note 9, “Goodwill and Intangible Assets,” and Note 16, “Segment and Related Information.” In addition, we have included Note 21, “Subsequent Events,” to discuss the merger. Note 18, “Condensed Consolidating Financial Information,” included within Item 8 of the original filing, has been omitted as the information included in this disclosure is provided to comply with Rule 3-10 of Regulation S-X but is not required by U.S. generally accepted accounting principles (“GAAP”). We have also made additional disclosures within the recast sections noted above related to the pending merger. We have not otherwise revised our disclosures to reflect events that have occurred since the date of the Annual Report. Accordingly, except for the items identified above, the revised sections of our Form 10-K speak as of January 3, 2014, the date of the original filing and any forward-looking statements represent management’s views as of the date of the original filing and should not be assumed to be correct as of any date thereafter. The revised sections of our Form 10-K should be read in conjunction with our other filings made with the Securities and Exchange Commission subsequent to the date of the original filing.

ii

Summary

We are a leading international provider of engineering, construction and technical services. We offer a broad range of program management, planning, design, engineering, construction and construction management, operations and maintenance, and decommissioning and closure services to public agencies and private sector clients around the world. We also are a United States (“U.S.”) federal government contractor in the areas of systems engineering and technical assistance, operations and maintenance, management and operations, and information technology (“IT”) services. As of January 31, 2014, we had more than 50,000 employees in a global network of offices in nearly 50 countries.

On May 14, 2012, we acquired the outstanding common shares of Flint Energy Services Ltd. (“Flint”) for C$25.00 per share in cash, or C$1.24 billion (US$1.24 billion based on the exchange rate on the date of acquisition) and paid $110.3 million of Flint’s debt prior to the closing of the transaction in exchange for a promissory note from Flint. At the close of the transaction, Flint’s operations became the Oil & Gas Division, with the exception of the facility construction component that was included in the Energy & Construction Division.

Pending Merger

On July 11, 2014, we entered into an Agreement and Plan of Merger (the “merger agreement”) with AECOM Technology Corporation (“AECOM”), ACM Mountain I, LLC, a direct wholly-owned subsidiary of AECOM (“Merger Sub”), and ACM Mountain II, LLC, a direct wholly-owned subsidiary of AECOM (“Merger Sub I”). The merger agreement provides for the merger of Merger Sub with and into our company, with our company continuing as the surviving company and a direct wholly-owned subsidiary of AECOM (the “Merger”). Immediately thereafter, as part of a single integrated transaction with the Merger, pursuant to the merger agreement, we will merge with and into Merger Sub I, with Merger Sub I continuing as the surviving company and a direct wholly-owned subsidiary of AECOM. Subject to the terms and conditions of the merger agreement, holders of URS common stock will receive consideration at $58.79 per share (based on the closing price of AECOM common stock on July 25, 2014). Each outstanding share of URS common stock will be exchanged for per share consideration consisting of 0.734 shares of AECOM common stock and $33.00 in cash. URS stockholders may elect to receive cash or stock consideration, subject to proration in the event of oversubscription for cash consideration. The actual value of the merger consideration to be paid at the closing of the merger will depend on the average closing price of AECOM common stock in the five business days prior to closing.

Completion of the merger is subject to certain customary conditions, including approval by both the AECOM and URS stockholders, listing of the shares of AECOM common stock to be issued in the merger on the New York Stock Exchange, receipt of required regulatory approvals, effectiveness of AECOM’s registration statement on Form S-4 and receipt of customary opinions related to certain tax matters from the parties’ respective counsels. The financial statements included in this revised Form 10-K do not reflect any adjustments or otherwise give effect to the proposed merger.

iii

Reporting Segments

We provide our services through four reporting segments, which we refer to as our Infrastructure & Environment, Federal Services, Energy & Construction, and Oil & Gas Divisions. Our Infrastructure & Environment Division provides a wide range of program management, planning, design, engineering, construction and construction management, operations and maintenance and decommissioning and closure services to the U.S. federal government, state and local government agencies, and private sector clients in the U.S. and internationally. Our Federal Services Division provides program management, planning, design, engineering, systems engineering and technical assistance, construction and construction management, operations and maintenance, management and operations, IT, and decommissioning and closure services to U.S. federal government agencies, as well as to national governments in other countries. Our Energy & Construction Division provides program management, planning, design, engineering, construction and construction management, operations and maintenance, and decommissioning and closure services to public and private sector clients. Our Oil & Gas Division provides oilfield services, such as rig transportation and fluid hauling; oil and gas production services, including mechanical, electrical and instrumentation services; pipeline and facility construction; module fabrication; and maintenance services for oil and gas industry clients throughout the U.S. and Canada.

Effective with the beginning of our 2014 fiscal year, we realigned our Global Management and Operations Services Group, which was previously a component of our Energy & Construction Division, under the operations and management of our Federal Services Division. The realignment of this group consolidates the majority of our business with U.S. federal government agencies and national governments outside the U.S in our Federal Services Division. We also realigned a portion of our facility construction, process engineering, and operations and maintenance services to the oil and gas industry among our Oil & Gas, Infrastructure & Environment, and Energy & Construction Divisions. These changes, which restructured elements of our oil and gas business from an organization based on legacy acquisitions to one based on service, were designed to improve our ability to provide integrated services to our oil and gas clients. These changes are collectively referred to as the “Realignments.” As described in the “Explanatory Note” above, certain sections of this revised Form 10-K have been recast to reflect the retrospective impact of the Realignments as if they had occurred for all periods presented in the financial statements.

For information on our business by segment and geographic region, please refer to Note 16, “Segment and Related Information” to our “Consolidated Financial Statements and Supplementary Data,” which is included under Item 8 of this report and incorporated into this Item by reference. For information on risks related to our business, segments and geographic regions, including risks related to foreign operations, please refer to Item 1A, “Risk Factors” of this report.

Clients, Market Sectors and Services

We serve public agencies and private sector companies worldwide through our global network of offices including locations in the Americas, the United Kingdom (“U.K.”), continental Europe, the Middle East, India, China, Australia and New Zealand. Our clients include U.S. federal government agencies, national governments of other countries, state and local government agencies both in the U.S. and in other countries, and private sector clients representing a broad range of industries. See Note 16, “Segment and Related Information,” to our “Consolidated Financial Statements and Supplementary Data” included under Item 8 of this report for financial information regarding geographic areas.

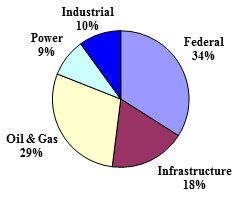

Our expertise is focused in five market sectors: federal, infrastructure, oil and gas, power, and industrial. Within these markets, we offer a broad range of services, including program management; planning, design and engineering; systems engineering and technical assistance; IT services; construction and construction management; operations and maintenance; and decommissioning and closure.

iv

The following chart and table illustrate the percentage of our revenues by market sector for the year ended January 3, 2014, and representative services we provide in each of these markets.

2013 Revenues by Market Sector

|

Market Sector

|

|||||||||||||||

|

Representative Services

|

Federal

|

Infrastructure

|

Oil & Gas

|

Power

|

Industrial

|

||||||||||

|

Program Management

|

ü

|

ü

|

ü

|

ü

|

ü

|

||||||||||

|

Planning, Design and Engineering

|

ü

|

ü

|

ü

|

ü

|

ü

|

||||||||||

|

Systems Engineering and Technical Assistance

|

ü

|

— | — | — | — | ||||||||||

|

Information Technology Services

|

ü

|

— | — | — | — | ||||||||||

|

Construction and Construction Management

|

ü

|

ü

|

ü

|

ü

|

ü

|

||||||||||

|

Operations and Maintenance

|

ü

|

ü

|

ü

|

ü

|

ü

|

||||||||||

|

Management and Operations

|

ü

|

— | — | — | — | ||||||||||

|

Decommissioning and Closure

|

ü

|

— |

ü

|

ü

|

ü

|

||||||||||

ü the service is provided in the market sector.

— the service is not provided in the market sector.

Market Sectors

The following table summarizes the primary market sectors served by our four divisions for the year ended January 3, 2014.

|

Divisions

|

||||||||||||

|

Market Sectors

|

Infrastructure &

Environment

|

Federal Services

|

Energy &

Construction

|

Oil & Gas

|

||||||||

|

Federal

|

ü

|

ü

|

— | — | ||||||||

|

Infrastructure

|

ü

|

— |

ü

|

— | ||||||||

|

Oil & Gas

|

ü

|

— |

ü

|

ü

|

||||||||

|

Power

|

ü

|

— |

ü

|

— | ||||||||

|

Industrial

|

ü

|

— |

ü

|

— | ||||||||

ü a primary market sector for the division.

— not a primary market sector for the division.

v

Federal

As a major contractor to the U.S. federal government and national governments of other countries, we serve a wide variety of government departments and agencies, including the DOD, DHS, Department of Energy (“DOE”), as well as the General Services Administration, the Environmental Protection Agency, NASA and other federal agencies. We also serve departments and agencies of other national governments, such as the U.K. Nuclear Decommissioning Authority (“NDA”). Our services range from program management; planning, design and engineering; systems engineering and technical assistance; and IT services to construction and construction management; operations and maintenance; management and operations; and decommissioning and closure.

We modernize weapons systems, refurbish military vehicles and aircraft, train pilots and manage military and other government installations. We provide logistics support for military operations and help decommission former military bases for redevelopment. In the area of global threat reduction, we support programs to eliminate nuclear, chemical and biological weapons, and we assist the DOE and other nuclear regulatory agencies outside the U.S. in the management of complex programs and facilities. We also provide a wide range of IT services to both defense and civilian agencies to improve the efficiency and productivity of their IT networks and systems, and to combat cyber security threats.

Our project expertise in our federal market sector encompasses the following:

|

·

|

Operation and maintenance of complex government installations, including military bases and test ranges;

|

|

·

|

Logistics support for government supply and distribution networks, including warehousing, packaging, delivery and traffic management;

|

|

·

|

Weapons system design, maintenance and modernization, including acquisition support for new defense systems, and engineering and technical assistance for the modernization of existing systems;

|

|

·

|

Maintenance planning to extend the service life of weapons systems and other military equipment;

|

|

·

|

Maintenance, modification and overhaul of military aircraft and ground vehicles;

|

|

·

|

Training military pilots;

|

|

·

|

Management and operations and maintenance services for complex DOE and NDA programs and facilities;

|

|

·

|

Deactivation, decommissioning and disposal of nuclear weapons stockpiles and other nuclear waste;

|

|

·

|

Safety analyses for high-hazard facilities and licensing for DOE sites;

|

|

·

|

Threat assessments of public facilities and the development of force protection and security systems;

|

|

·

|

Planning and conducting emergency preparedness exercises;

|

|

·

|

First responder training for the military and other government agencies;

|

|

·

|

Management and operations and maintenance of chemical agent and chemical weapon disposal facilities;

|

|

·

|

Installation of monitoring technology to detect the movement of nuclear and radiological materials across national borders;

|

|

·

|

Planning, design and construction of aircraft hangars, barracks, military hospitals and other government buildings;

|

|

·

|

Environmental remediation and restoration for the redevelopment of military bases and other government installations; and

|

|

·

|

Network and communications engineering, software engineering, IT infrastructure design and implementation, cyber defense and cloud computing technologies.

|

vi

Infrastructure

We provide a broad range of the services required to build, expand and modernize infrastructure, including surface, air and rail transportation networks; ports and harbors; water supply, treatment and conveyance systems; and many types of facilities. We serve as the program manager, planner, architect, engineer, general contractor, constructor and/or construction manager for a wide variety of infrastructure projects, and we also provide operations and maintenance services when a project has been completed.

Our clients in our infrastructure market sector include local municipalities, community planning boards, state and municipal departments of transportation and public works, transit authorities, water and wastewater authorities, environmental protection agencies, school boards and authorities, colleges and universities, judiciary agencies, hospitals, ports and harbors authorities and owners, airport authorities and owners, and airline carriers.

Our project expertise in our infrastructure market sector encompasses services related to the following:

|

·

|

Highways, interchanges, bridges, tunnels and toll road facilities;

|

|

·

|

Intelligent transportation systems, such as traffic management centers;

|

|

·

|

Airport terminals, hangars, cargo facilities and people movers;

|

|

·

|

Air traffic control towers, runways, taxiways and aircraft fueling systems;

|

|

·

|

Baggage handling, baggage screening and other airport security systems;

|

|

·

|

Light rail, subways, bus rapid transit systems, commuter/intercity railroads, heavy rail and high-speed rail systems;

|

|

·

|

Rail transportation structures, including terminals, stations, multimodal facilities, parking facilities, bridges and tunnels;

|

|

·

|

Piers, wharves, seawalls, recreational marinas and small craft harbors;

|

|

·

|

Container terminals, liquid and dry bulk terminals and storage facilities;

|

|

·

|

Water supply, storage, distribution and treatment systems;

|

|

·

|

Municipal wastewater treatment and sewer systems;

|

|

·

|

Dams, levees, watershed and stormwater management, flood control systems and coastal restoration;

|

|

·

|

Education, judicial, correctional, healthcare, retail, sports and recreational facilities; and

|

|

·

|

Industrial, manufacturing, research and office facilities.

|

vii

Oil and Gas

In the oil and gas market sector, we provide a wide range of planning, design, engineering, construction, production, and operations and maintenance services across the upstream, midstream and downstream supply chain. Our expertise supports the development of both conventional and unconventional oil and gas resources. While our work in this sector is focused primarily in the North American oil and gas market, we also support the worldwide operations of global oil and gas clients.

For oil and gas exploration and production, we provide transportation, engineering, construction, fabrication and installation, commissioning and maintenance services for drilling and well site facilities, equipment and process modules, site infrastructure and off-site support facilities. We also perform environmental and technology assessments for exploration and production projects to optimize recovery and minimize environmental impacts. For downstream refining and processing operations, we design and construct gas treatment and processing, refining and petrochemical facilities, and provide maintenance services. Our capabilities also include due diligence, permitting, compliance, environmental management, pollution control, health and safety, waste management and hazardous waste remediation.

Our project expertise in our oil and gas market sector encompasses services related to the following:

|

·

|

Environmental assessments, permitting, compliance, air quality services, waste management and hazardous waste remediation;

|

|

·

|

Planning, design, construction and construction management for gas treatment and processing, refining and petrochemical facilities;

|

|

·

|

Construction of access roads and well pads, and field production facilities, such as wellhead gas processing equipment, gas compression stations, and oil storage tanks and related facilities;

|

|

·

|

Pipeline planning, design, construction, installation, maintenance and repair;

|

|

·

|

Energy-related transportation, including rig moving and oilfield equipment hauling services, mobile pressure and vacuum services, and fluid hauling;

|

|

·

|

Electrical, mechanical and instrumentation services;

|

|

·

|

Equipment and process module fabrication, installation and maintenance;

|

|

·

|

Asset management and maintenance services, including routine plant maintenance, coordination of third-party services, sustaining capital projects, and shutdown turnaround services for oil sands production facilities, oil refineries and related chemical, energy, power and processing plants; and

|

|

·

|

Demolition, asset recovery and property redevelopment and reuse of former oilfield sites, refineries and other oil and gas facilities.

|

viii

Power

We plan, design, engineer, construct, retrofit and maintain a wide range of power-generating facilities, as well as the systems that transmit and distribute electricity. Our services include planning, siting and licensing, permitting, engineering, procurement, construction and construction management, facility start-up, operations and maintenance, upgrades and modifications, and decommissioning and closure. We provide these services to utilities, industrial co-generators, independent power producers, original equipment manufacturers and government utilities. We also specialize in the development and installation of clean air technologies that reduce emissions at both new and existing fossil fuel power plants. These technologies help power-generating facilities comply with air quality regulations.

Our project expertise in our power market sector encompasses services related to the following:

|

·

|

Fossil fuel power generating facilities;

|

|

·

|

Nuclear power generating facilities;

|

|

·

|

Hydroelectric power generating facilities;

|

|

·

|

Alternative and renewable energy sources, including biomass, geothermal, solar energy and wind systems;

|

|

·

|

Transmission and distribution systems; and

|

|

·

|

Emissions control systems.

|

Industrial

We provide a wide range of engineering, procurement and construction services for new industrial and process facilities and the expansion, modification and upgrade of existing facilities. These services include front-end studies, engineering and process design, procurement, construction and construction management, facility management, and operations and maintenance. Our expertise also includes due diligence, permitting, compliance, environmental management, pollution control, health and safety, waste management and hazardous waste remediation. For facilities that are no longer in use, we provide site decommissioning and closure services.

Our industrial clients represent a broad range of industries, including automotive, chemical, consumer products, pharmaceutical, manufacturing, and mining. Over the past several years, many of these companies have reduced the number of service providers they use, selecting larger, global multi-service contractors, like URS, in order to control costs.

Our project expertise in our industrial and commercial market sector encompasses services related to the following:

|

·

|

Biotechnology and pharmaceutical research laboratories, pilot plants and production facilities;

|

|

·

|

Petrochemical, specialty chemical and polymer facilities;

|

|

·

|

Consumer products and food and beverage production facilities;

|

|

·

|

Automotive and other manufacturing facilities;

|

|

·

|

Pulp and paper production facilities; and

|

|

·

|

Mines and mining facilities for base and precious metals, industrial minerals and energy fuels.

|

ix

Representative Services

We provide program management; planning, design and engineering; systems engineering and technical assistance; information technology services; construction and construction management; operations and maintenance; management and operations; and decommissioning and closure services to U.S. federal government agencies, national governments of other countries, state and local government agencies both in the U.S. and overseas, and private sector clients representing a broad range of industries. Although we are typically the prime contractor, in some cases, we provide services as a subcontractor or through joint ventures or partnership agreements with other service providers.

The following table summarizes the services provided by our divisions for the year ended January 3, 2014.

|

Divisions

|

||||||||||||

|

Services

|

Infrastructure & Environment

|

Federal Services

|

Energy &

Construction

|

Oil & Gas

|

||||||||

|

Program Management

|

ü

|

ü

|

ü

|

— | ||||||||

|

Planning, Design and Engineering

|

ü

|

ü

|

ü

|

ü

|

||||||||

|

Systems Engineering and Technical Assistance

|

— |

ü

|

— | — | ||||||||

|

Information Technology Services

|

— |

ü

|

— | — | ||||||||

|

Construction and Construction Management

|

ü

|

ü

|

ü

|

ü

|

||||||||

|

Operations and Maintenance

|

ü

|

ü

|

ü

|

ü

|

||||||||

|

Management and Operations

|

— |

ü

|

— | — | ||||||||

|

Decommissioning and Closure

|

ü

|

ü

|

ü

|

— | ||||||||

ü the division provides the listed service.

— the division does not provide the listed service.

Program Management. We provide the technical and administrative services required to manage, coordinate and integrate the multiple and concurrent assignments that comprise a large program – from conception through completion. For large military programs, which typically involve naval, ground, vessel and airborne platforms, our program management services include logistics planning, acquisition management, risk management of weapons systems, safety management and subcontractor management. We also provide program management services for large capital improvement programs, which typically involve the oversight of a wide variety of activities ranging from planning, coordination, scheduling and cost control to design, construction and commissioning.

x

Planning, Design and Engineering. The planning process is typically used to develop a blueprint or overall scheme for a project. Based on the project requirements identified during the planning process, detailed engineering drawings and calculations are developed, which may include material specifications, construction cost estimates and schedules. Our planning, design and engineering services include the following:

|

·

|

Master planning;

|

|

·

|

Land-use planning;

|

|

·

|

Transportation planning;

|

|

·

|

Technical and economic feasibility studies;

|

|

·

|

Environmental impact assessments;

|

|

·

|

Project development/design;

|

|

·

|

Permitting;

|

|

·

|

Quality assurance and validation;

|

|

·

|

Integrated safety management and analysis;

|

|

·

|

Alternative design analysis;

|

|

·

|

Conceptual and final design documents;

|

|

·

|

Technical specifications; and

|

|

·

|

Process engineering and design.

|

We provide planning, design and engineering services for the construction of new transportation projects and for the renovation and expansion of existing transportation infrastructure, including bridges, highways, roads, airports, mass transit systems and railroads, and ports and harbors. We also plan and design many types of facilities, such as schools, courthouses and hospitals; power generation, industrial and commercial facilities; waste treatment and disposal facilities; water supply and conveyance systems and wastewater treatment plants; and corporate offices and retail outlets. Our planning, design and engineering capabilities also support homeland security and global threat reduction programs; hazardous and radioactive waste clean-up activities at government sites and facilities; and environmental assessment, due diligence and permitting at government, commercial and industrial facilities. We also provide planning, design and engineering support to U.S. federal government clients for major research and development projects, as well as for technology development and deployment.

Systems Engineering and Technical Assistance. We provide a broad range of systems engineering and technical assistance to all branches of the U.S. military for the design and development of new weapons systems and the modernization of aging weapons systems. We have the expertise to support a wide range of platforms including aircraft and helicopters, tracked and wheeled vehicles, ships and submarines, shelters and ground support equipment. Representative systems engineering and technical assistance services include the following:

|

·

|

Defining operational requirements and developing specifications for new weapons systems;

|

|

·

|

Reviewing hardware and software design data; and

|

|

·

|

Developing engineering documentation for these systems.

|

We support a number of activities including technology insertion, system modification, installation of new systems/equipment, design of critical data packages, and configuration management.

xi

Information Technology Services. We provide a broad range of IT services to U.S. federal government clients, including both civilian and defense agencies. Our expertise covers network and communications engineering, software engineering, IT infrastructure design and implementation, cyber defense and cloud computing technologies. Our services typically include:

|

·

|

Assisting government agencies in developing, implementing and managing secure, federally compliant cloud computing technologies;

|

|

·

|

Cyber defense services, including vulnerability assessments, policy development and management, compliance, incident response, disaster recovery and continuity of operations;

|

|

·

|

Engineering, procuring, installing, certifying and operating IT networks; and

|

|

·

|

Developing software applications for complex, multi-user, multi-platform systems.

|

Construction and Construction Management Services. We provide construction contracting and construction management services for projects involving transportation infrastructure; environmental and waste management; power generation and transmission; oil and gas, industrial, manufacturing, and water resources and wastewater treatment facilities; government buildings and other facilities; and mining projects. As a contractor, we are responsible for the construction and completion of a project in accordance with its specifications and contracting terms. In this capacity, we often manage the procurement and/or fabrication of materials, equipment and supplies; directly supervise craft labor; and manage and coordinate subcontractors. Our services typically include the following:

|

·

|

Procuring specified materials and equipment;

|

|

·

|

Work force planning and mobilization;

|

|

·

|

Supervising and completing physical construction;

|

|

·

|

Facility commissioning;

|

|

·

|

Managing project milestone and completion schedules;

|

|

·

|

Managing project cost controls and accounting;

|

|

·

|

Negotiating and expediting change orders;

|

|

·

|

Administering job site safety, security and quality control programs; and

|

|

·

|

Preparing and delivering construction documentation, including as-built drawings.

|

As a construction manager, we serve as the client’s representative to ensure compliance with design specifications and contract terms. In performing these services, we may purchase equipment and materials on behalf of the client; monitor the progress, cost and quality of construction projects in process and oversee and coordinate the activities of construction contractors. Our services typically include the following:

|

·

|

Contract administration;

|

|

·

|

Change order management;

|

|

·

|

Cost and schedule management;

|

|

·

|

Safety program and performance monitoring;

|

|

·

|

Inspection;

|

|

·

|

Quality control and quality assurance;

|

|

·

|

Document control; and

|

|

·

|

Claims and dispute resolution.

|

xii

Operations and Maintenance. We provide operations and maintenance services in support of large military installations and operations, and hazardous facilities, as well as for transportation systems, oil and gas, industrial and manufacturing facilities, and mining operations. Our services include the following:

|

·

|

Management of military base logistics, including overseeing the operation of government warehousing and distribution centers, as well as government property and asset management;

|

|

·

|

Maintenance, modification, overhaul and life service extension services for military vehicles, vessels and aircraft;

|

|

·

|

Management, maintenance and operation of chemical agent and chemical weapons disposal systems;

|

|

·

|

Comprehensive military flight training services;

|

|

·

|

Development and maintenance of high-security systems;

|

|

·

|

Integrated facilities and logistics management for industrial and manufacturing facilities;

|

|

·

|

Toll road, light rail and airport operations;

|

|

·

|

Operating mine and metal and mineral processing facilities;

|

|

·

|

Other miscellaneous services such as staffing, repair, renovation, predictive and preventive maintenance, and health and safety services;

|

|

·

|

Oil rig moving, setup, and removal services;

|

|

·

|

Pressure and vacuum services, and fluid hauling; and

|

|

·

|

Asset management and maintenance services for oil sands production facilities, refineries and related chemical, energy, power and processing plants.

|

Management and Operations. As a contractor to the U.S. DOE and the U.K. NDA, we manage and operate programs involving the cleanup of former uranium enrichment, plutonium production, nuclear research, fuel disassembly, and reprocessing sites in the U.S. and U.K. In addition, we are part of the management and operations teams at several DOE national laboratories. Our management and operations services include the following:

|

·

|

Project and facility management;

|

|

·

|

Design and engineering for nuclear applications;

|

|

·

|

Nuclear facility construction;

|

|

·

|

Nuclear decontamination and decommissioning;

|

|

·

|

Nuclear and hazardous waste management and disposal services;

|

|

·

|

Safety management;

|

|

·

|

High-level radioactive waste-tank closure; and

|

|

·

|

Waste repository management.

|

xiii

Decommissioning and Closure. We provide decommissioning and closure services to government agencies and to clients in the industrial, oil and gas, power, and mining industries. Our work involves the provision of environmental, engineering, remediation, demolition and reclamation services for military bases, chemical weapons depots, and other government installations, as well as for oil and gas, power generating, industrial and mining facilities that are no longer operational. Our decommissioning and closure services include:

· Site assessments;

· Planning, engineering, scoping surveys and cost estimating;

· Due diligence and permitting;

· Environmental remediation;

· Hazardous chemical and waste stabilization, treatment and disposal;

· Asset recovery and evaluation;

· Pipeline removal;

· Structure and facility demolition; and

· Reclamation, redevelopment and reuse.

Major Customers

Our largest clients are from our federal market sector. Within this sector, we have multiple contracts with our two major customers: the U.S. Army and the DOE. For the purpose of analyzing revenues from major customers, we do not consider the combination of all federal departments and agencies as one customer because the different federal agencies we serve manage separate budgets. As such, reductions in spending by one federal agency do not affect the revenues we could earn from another federal agency. In addition, the procurement processes for federal agencies are not centralized, and procurement decisions are made separately by each agency. The loss of large federal government clients, such as the U.S. Army or the DOE, would have a material adverse effect on our business; however, we are not dependent on any single contract on an ongoing basis. We believe that the loss of any single contract would not have a material adverse effect on our business.

Our revenues from the U.S. Army and the DOE by division for the years ended January 3, 2014, December 28, 2012, and December 30, 2011 are presented below:

|

Year Ended

|

||||||||||||

|

January 3,

|

December 28,

|

December 30,

|

||||||||||

|

(In millions, except percentages)

|

2014

|

2012

|

2011

|

|||||||||

|

The U.S. Army (1)

|

||||||||||||

|

Infrastructure & Environment

|

$ | 125.2 | $ | 128.4 | $ | 141.7 | ||||||

|

Federal Services

|

1,100.3 | 1,497.8 | 1,352.4 | |||||||||

|

Energy & Construction

|

149.5 | 128.8 | 198.2 | |||||||||

|

Total U.S. Army

|

$ | 1,375.0 | $ | 1,755.0 | $ | 1,692.3 | ||||||

|

Revenues from the U.S. Army as a percentage of our consolidated revenues

|

13 | % | 16 | % | 18 | % | ||||||

|

DOE

|

||||||||||||

|

Infrastructure & Environment

|

$ | 4.7 | $ | 5.6 | $ | 5.9 | ||||||

|

Federal Services

|

821.9 | 984.0 | 1,260.5 | |||||||||

|

Energy & Construction

|

4.6 | 0.1 | 2.6 | |||||||||

|

Total DOE

|

$ | 831.2 | $ | 989.7 | $ | 1,269.0 | ||||||

|

Revenues from DOE as a percentage of our consolidated revenues

|

8 | % | 9 | % | 13 | % | ||||||

|

Revenues from the federal market sector as a percentage of our consolidated revenues

|

34 | % | 40 | % | 49 | % | ||||||

|

(1)

|

The U.S. Army includes U.S. Army Corps of Engineers.

|

xiv

Competition

Our industry is highly fragmented and intensely competitive. We have numerous competitors, ranging from small private firms to multi-billion dollar companies. The technical and professional aspects of our services generally do not require large upfront capital expenditures and, therefore, provide limited barriers against new competitors. Some of our competitors have achieved greater market penetration in some of the markets in which we compete and have substantially more financial resources and/or financial flexibility than we do. To our knowledge, no individual company currently dominates any significant portion of our markets.

We believe that we are well positioned to compete in our markets because of our reputation, our cost effectiveness, our long-term client relationships, our extensive network of offices, our employee expertise, and our broad range of services. In addition, as a result of our national and international network in nearly 50 countries, we are able to offer our clients localized knowledge and expertise, as well as the support of our worldwide professional staff.

Our Infrastructure & Environment, Federal Services, Energy & Construction, and Oil & Gas Divisions operate in similar competitive environments. The divisions compete based on performance, reputation, expertise, price, technology, customer relationships and a range of service offerings. The following is a list of primary competitors for each of our divisions:

|

·

|

The primary competitors of our Infrastructure & Environment Division include AECOM Technology Corporation, CH2M Hill Companies, Ltd., Chicago Bridge & Iron Company, Fluor Corporation, Jacobs Engineering Group Inc., and Tetra Tech, Inc.

|

|

·

|

The primary competitors of our Federal Services Division include AECOM Technology Corporation, BAE Systems, Booz Allen Hamilton, CACI International Inc., CH2M Hill Companies, Computer Sciences Corporation, Dyncorp International, Fluor Corporation, Jacobs Engineering Group Inc., L-3 Communications Holdings Inc., ManTech International Corporation, Parsons Corporation, SAIC, Inc., and Serco Group plc.

|

|

·

|

The primary competitors of our Energy & Construction Division include AMEC, Bechtel Corporation, Black & Veatch Corporation, CH2M Hill Companies, Ltd., Chicago Bridge & Iron Company, Fluor Corporation, Granite Construction Company, Jacobs Engineering Group Inc., KBR, Inc., Kiewit Corporation, Quanta Services, Inc., Skanska Group, The Babcock & Wilcox Company, and WorleyParsons, Ltd.

|

|

·

|

The primary competitors of our Oil & Gas Division include Aecon Group Inc., Big Country Energy Services LP, EnerMAX Services, J.V. Driver, Jacobs Engineering Group Inc., Ledcor Construction, Matrix Services, Mullen Group Ltd., Kiewit Corporation, TransForce Inc., and Willbros Group, Inc.

|

For the purpose of calculating our book of business, we determine the amounts of all contract awards that may potentially be recognized as revenues. We also include an estimate of the equity in income of unconsolidated joint ventures over the life of the contracts in our book of business. We categorize the amount of our book of business into backlog, option years and indefinite delivery contracts (“IDCs”), based on the nature of the award and its current status.

Backlog. Our contract backlog represents the monetary value of signed contracts, including task orders that have been issued and funded under IDCs and, where applicable, a notice to proceed has been received from the client that is expected to be recognized as revenues or equity in income of unconsolidated joint ventures as services are performed.

The performance periods of our contracts vary widely from a few months to many years. In addition, contract durations often differ significantly among our divisions. As a result, the amount of revenues that will be realized beyond one year also varies from segment to segment. As of January 3, 2014, we estimated that approximately 60% of our total backlog would not be realized within one year, based upon the timing of awards and the long-term nature of many of our contracts; however, no assurance can be given that backlog will be realized at this rate.

xv

Option Years. Our option years represent the monetary value of option periods under existing contracts in backlog, which are exercisable at the option of our clients without requiring us to go through an additional competitive bidding process and would be canceled only if a client decided to end the project (a termination for convenience) or through a termination for default. Option years are in addition to the “base periods” of these contracts. Base periods for these contracts can vary from one to five years.

Indefinite Delivery Contracts. IDCs represent the expected monetary value to us of signed contracts under which we perform work only when the client awards specific task orders or projects to us. When agreements for such task orders or projects are signed and funded, we transfer their value into backlog. Generally, the terms of these contracts exceed one year and often include a maximum term and potential value. IDCs generally range from one to twenty years in length.

While the value of our book of business is a predictor of future revenues and equity in income of unconsolidated joint ventures, we have no assurance, nor can we provide assurance, that we will ultimately realize the maximum potential values for backlog, option years or IDCs. Based on our historical experience, our backlog has the highest likelihood of converting into revenues or equity in income of unconsolidated joint ventures because it is based upon signed and executable contracts with our clients. Option years are not as certain as backlog because our clients may decide not to exercise one or more option years. Because we do not perform work under IDCs until specific task orders are issued by our clients, the value of our IDCs is not as likely to convert into revenues or equity in income of unconsolidated joint ventures as other categories of our book of business.

As of January 3, 2014 and December 28, 2012, our total book of business was $22.8 billion and $24.9 billion, respectively. Our backlog and option years decreased primarily due to a combination of reduced funding, continuing delays in contract awards, particularly in the federal market sector, revisions to estimates of anticipated work, and de-bookings due to project cancellations. Our IDCs increased mainly due to the continuing shift towards the use of IDCs by both private and public sector clients.

The following tables summarize our book of business:

|

Infrastructure

|

Energy

|

|||||||||||||||||||

|

&

|

Federal

|

&

|

||||||||||||||||||

|

(In millions)

|

Environment

|

Services

|

Construction

|

Oil & Gas

|

Total

|

|||||||||||||||

|

As of January 3, 2014

|

||||||||||||||||||||

|

Backlog

|

$ | 2,851.0 | $ | 4,284.4 | $ | 3,705.0 | $ | 462.3 | $ | 11,302.7 | ||||||||||

|

Option years

|

146.2 | 3,733.6 | 76.5 | — | 3,956.3 | |||||||||||||||

|

Indefinite delivery contracts

|

3,081.8 | 3,150.2 | 131.0 | 1,186.5 | 7,549.5 | |||||||||||||||

|

Total book of business

|

$ | 6,079.0 | $ | 11,168.2 | $ | 3,912.5 | $ | 1,648.8 | $ | 22,808.5 | ||||||||||

|

As of December 28, 2012

|

||||||||||||||||||||

|

Backlog

|

$ | 2,974.7 | $ | 5,877.2 | $ | 3,835.9 | $ | 588.4 | $ | 13,276.2 | ||||||||||

|

Option years

|

197.3 | 4,711.7 | 73.2 | — | 4,982.2 | |||||||||||||||

|

Indefinite delivery contracts

|

2,561.0 | 3,238.7 | 236.0 | 623.1 | 6,658.8 | |||||||||||||||

|

Total book of business

|

$ | 5,733.0 | $ | 13,827.6 | $ | 4,145.1 | $ | 1,211.5 | $ | 24,917.2 | ||||||||||

|

January 3,

|

December 28,

|

|||||||

|

(In millions)

|

2014

|

2012

|

||||||

|

Backlog by market sector:

|

||||||||

|

Federal

|

$ | 4,891.6 | $ | 6,546.5 | ||||

|

Infrastructure

|

2,683.2 | 2,957.6 | ||||||

|

Oil and Gas

|

1,102.9 | 1,461.3 | ||||||

|

Power

|

1,338.7 | 1,416.1 | ||||||

|

Industrial

|

1,286.3 | 894.7 | ||||||

|

Total backlog

|

$ | 11,302.7 | $ | 13,276.2 | ||||

xvi

History

We were originally incorporated in California on May 1, 1957, under the former name of Broadview Research Corporation. On May 18, 1976, we re-incorporated in Delaware under the name URS Corporation. After several additional name changes, we re-adopted the name “URS Corporation” on February 21, 1990.

Regulations

Our business is impacted by environmental, health and safety, government procurement, transportation, employment, anti-bribery and many other government regulations and requirements. Below is a summary of some of the regulations that impact our business. For more information on risks associated with our government regulations, please refer to Item 1A, “Risk Factors,” of this report.

Environmental, Health and Safety. Our business involves the planning, design, program management, construction and construction management, and operations and maintenance at various sites, including but not limited to pollution control systems, nuclear facilities, hazardous waste and Superfund sites, contract mining sites, hydrocarbon production, distribution and transport sites, military bases and other infrastructure-related facilities. We also regularly perform work, including oil field and pipeline construction services in and around sensitive environmental areas, such as rivers, lakes and wetlands. In addition, we have contracts with U.S. federal government entities to destroy hazardous materials, including chemical agents and weapons stockpiles, as well as to decontaminate and decommission nuclear facilities. These activities may require us to manage, handle, remove, treat, transport and dispose of toxic or hazardous substances. We also own several properties in the U.S. and Canada that have been used for the storage and maintenance of equipment and upon which hydrocarbons or other wastes may have been disposed or released.

Significant fines, penalties and other sanctions may be imposed for non-compliance with environmental and health and safety laws and regulations, and some laws provide for joint and several strict liabilities for remediation of releases of hazardous substances, rendering a person liable for environmental damage, without regard to negligence or fault on the part of such person. These laws and regulations may expose us to liability arising out of the conduct of operations or conditions caused by others, or for our acts that were in compliance with all applicable laws at the time these acts were performed. For example, there are a number of governmental laws that strictly regulate the handling, removal, treatment, transportation and disposal of toxic and hazardous substances, such as the Comprehensive Environmental Response Compensation and Liability Act of 1980 (“CERCLA”), and comparable national and state laws, that impose strict, joint and several liabilities for the entire cost of cleanup, without regard to whether a company knew of or caused the release of hazardous substances. In addition, some environmental regulations can impose liability for the entire clean-up upon owners, operators, generators, transporters and other persons arranging for the treatment or disposal of such hazardous substances costs related to contaminated facilities or project sites. Other federal environmental, health and safety laws affecting us include, but are not limited to, the Resource Conservation and Recovery Act, the National Environmental Policy Act, the Clean Air Act, the Clean Air Mercury Rule, the Occupational Safety and Health Act, the Toxic Substances Control Act and the Superfund Amendments and Reauthorization Act, as well as other comparable national and state laws. Liabilities related to environmental contamination or human exposure to hazardous substances, comparable national and state laws or a failure to comply with applicable regulations could result in substantial costs to us, including cleanup costs, fines and civil or criminal sanctions, third-party claims for property damage or personal injury or cessation of remediation activities.

Some of our business operations are covered by Public Law 85-804, which provides for indemnification by the U.S federal government against claims and damages arising out of unusually hazardous or nuclear activities performed at the request of the U.S. federal government. Should public policies and laws be changed, however, U.S. federal government indemnification may not be available in the case of any future claims or liabilities relating to hazardous activities that we undertake to perform.

xvii

Government Procurement. The services we provide to the U.S. federal government are subject to Federal Acquisition Regulation (“FAR”), the Truth in Negotiations Act, Cost Accounting Standards (“CAS”), the Services Contract Act, export controls rules and DOD security regulations, as well as many other laws and regulations. These laws and regulations affect how we transact business with our clients and in some instances, impose additional costs on our business operations. A violation of specific laws and regulations could lead to fines, contract termination or suspension of future contracts. Our government clients can also terminate, renegotiate, or modify any of their contracts with us at their convenience, and many of our government contracts are subject to renewal or extension annually.

Transportation. We own a large fleet of trucks and other heavy vehicles to transport drilling rigs and provide fluid hauling and other oil and gas services in North America. We are subject to national, state and Canadian provincial regulations including the permit requirements of highway and safety authorities. These regulatory authorities exercise broad powers over our transport operations, generally governing such matters as the authorization to engage in transportation operations, safety, equipment testing and specifications and insurance requirements. The transportation industry is also subject to regulatory and legislative changes that may impact our operations, such as by requiring changes in fuel emissions limits, vehicle air emissions, the hours of service regulations that govern the amount of time a driver may drive or work in any specific period, limits on vehicle weight and size and other matters.

Other regulations and requirements. We provide services to the DOD and other defense-related entities that often require specialized professional qualifications and security clearances. We are also subject to the U.S. Foreign Corrupt Practices Act and similar anti-bribery laws, which generally prohibit companies and their intermediaries from making improper payments to foreign government officials for the purpose of obtaining or retaining business. The U.K. Bribery Act of 2010 prohibits both domestic and international bribery, as well as bribery across both private and public sectors. In addition, an organization that “fails to prevent bribery” committed by anyone associated with the organization can be charged under the U.K. Bribery Act unless the organization can establish the defense of having implemented “adequate procedures” to prevent bribery. To the extent we export technical services, data and products outside of the U.S., we are subject to U.S. and international laws and regulations governing international trade and exports, including but not limited to the International Traffic in Arms Regulations, the Export Administration Regulations and trade sanctions against embargoed countries. In addition, as engineering design services professionals, we are subject to a variety of local, state, federal and foreign licensing and permit requirements and ethics rules.

Sales and Marketing

Our Infrastructure & Environment Division performs business development, sales and marketing activities primarily through our network of local offices around the world. For large, market-specific projects requiring diverse technical capabilities, we utilize the company-wide resources of specific disciplines. This often involves coordinating marketing efforts on a regional, national or global level. Our Federal Services Division performs business development, sales and marketing activities primarily through its management groups, which address specific markets, such as homeland security and defense systems. In addition, our Federal Services Division coordinates national marketing efforts on large projects, which often involve a multi-segment or multi-market scope. Our Energy & Construction Division conducts business development, sales and marketing activities at a market sector level. Our Oil & Gas Division operates in regional markets across Canada and the U.S. to help stimulate and focus on increased sales opportunities for multiple service lines. Personnel from these regions work collaboratively with the Oil & Gas Division’s business development group and service line specialists. For large complex projects, markets or clients that require broad-based capabilities, business development efforts are coordinated across our divisions. Over the past year, our divisions, including the Oil & Gas Division, have been successful in marketing their combined capabilities to win new work with clients in the various markets we serve.

xviii

Seasonality

We experience seasonal trends in our business in connection with federal holidays. Our revenues typically are lower during these times of the year because many of our clients’ employees, as well as our own employees, do not work during these holidays, resulting in fewer billable hours charged to projects and thus, lower revenues recognized. In addition to holidays, our business also is affected by seasonal bad weather conditions, such as hurricanes, floods, snowstorms or other inclement weather, which may cause some of our offices and projects to close or reduce activities temporarily. For example, in the first quarter of the year, winter weather sometimes results in intermittent office closures and work interruptions. In our Oil & Gas Division, winter weather enables increased access to remote work areas in Northern Canada, while spring road bans may limit access to work areas in Canada and the Northern U.S.

Raw Materials

We purchase most of the raw materials and components necessary to operate our business from numerous sources. However, the price and availability of raw materials and components may vary from year to year due to customer demand, production capacity, market conditions and material shortages. While we do not currently foresee the lack of availability of any particular raw materials in the near term, prolonged unavailability of raw materials necessary to our projects and services or significant price increases for those raw materials could have a material adverse effect on our business in the near term.

Government Contracts

Generally, our government contracts are subject to renegotiation or termination of contracts or subcontracts at the discretion of the U.S. federal, state or local governments, and national governments of other countries.

Trade Secrets and Other Intellectual Property

We rely principally on trade secrets, confidentiality policies and other contractual arrangements to protect much of our intellectual property where we do not believe that patent or copyright protection is appropriate or obtainable.

Research and Development

We have not incurred material costs for company-sponsored research and development activities.

Insurance

Generally, our insurance program covers workers’ compensation and employer’s liability, general liability, automobile liability, professional errors and omissions liability, property, marine property and liability, and contractor’s pollution liability (in addition to other policies for specific projects). Our insurance program includes deductibles or self-insured retentions for each covered claim. In addition, our insurance policies contain exclusions and sublimits that insurance providers may use to deny or restrict coverage. Excess liability, contractor’s pollution liability, and professional liability insurance policies provide for coverages on a “claims-made” basis, covering only claims actually made and reported during the policy period currently in effect. Thus, if we do not continue to maintain these policies, we will have no coverage for claims made after the termination date even for claims based on events that occurred during the term of coverage. While we intend to maintain these policies, we may be unable to maintain existing coverage levels.

Employees

The number of our employees varies with the volume, type and scope of our operations at any given time. As of January 31, 2014, we had more than 50,000 employees, including part-time workers. The Infrastructure & Environment, Federal Services, Energy & Construction, and Oil & Gas Divisions employed approximately 20,000, 10,000, 12,000, and 11,000 persons (including part-time workers), respectively. At various times, we have employed up to several thousand workers on a part-time basis to meet our contractual obligations. Approximately 28.5% of our employees are covered by collective bargaining agreements or by specific labor agreements, which expire upon completion of the relevant project.

xix

Executive Officers of the Registrant

|

Name

|

Position Held

|

Age

|

||||

|

Martin M. Koffel

|

Chief Executive Officer (“CEO”) and Director since May 1989; President from May 1989 to October 2013; Chairman of the Board since June 1989.

|

74 | ||||

|

Thomas W. Bishop

|

Executive Chairman, Infrastructure & Environment, U.K., Europe & India since January 2013; Senior Vice President of the Infrastructure & Environment Division since January 2011; Vice President, Strategy since July 2003; Senior Vice President, Construction Services since March 2002.

|

67 | ||||

|

Reed N. Brimhall

|

Chief Accounting Officer since May 2005; Vice President since May 2003; Corporate Controller from May 2003 to January 2012.

|

60 | ||||

|

H. Thomas Hicks

|

Executive Vice President and Chief Financial Officer (“CFO”) since May 2013; Vice President and CFO from March 2006 to May 2013.

|

63 | ||||

|

Gary V. Jandegian

|

President of the Infrastructure & Environment Division and Vice President since July 2003.

|

61 | ||||

|

Susan B. Kilgannon

|

Vice President, Communications since October 1999.

|

55 | ||||

|

Joseph Masters

|

Secretary since March 2006; General Counsel since July 1997; Vice President since July 1994.

|

57 | ||||

|

George L. Nash

|

President of the Energy & Construction Division and Vice President since January 2014; Chief Operating Officer of the Energy & Construction Division from July 2011 to December 2013; General Manager of the Energy & Construction Division Power Business Group from September 2008 to July 2011.

|

53 | ||||

|

Randall A. Wotring

|

President of the Federal Services Division and Vice President since November 2004.

|

57 | ||||

Available Information

Our Annual Reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, (“Exchange Act”) are available free of charge on our web site at www.urs.com. These reports, and any amendments to these reports, are made available on our web site as soon as reasonably practicable after we electronically file or furnish the reports with the Securities and Exchange Commission (“SEC”). In addition, our Corporate Governance Guidelines, the charters for our Audit, Board Affairs and Compensation Committees, and our Code of Business Conduct and Ethics are available on our web site at www.urs.com under the “Corporate Governance” section. Any waivers or amendments to our Code of Business Conduct and Ethics will be posted on our web site. A printed copy of this information is also available without charge by sending a written request to: Corporate Secretary, URS Corporation, 600 Montgomery Street, 26th Floor, San Francisco, CA 94111-2728.

xx

Please refer to Item 1A – Risk Factors in our Annual Report on Form 10-K for the fiscal year ended January 3, 2014 for a discussion of some of the factors that have affected our business, financial condition, and results of operations in the past and which could affect the future. We have updated the following risk factors since our Form 10-K for the fiscal year ended January 3, 2014. In addition to our other disclosures set forth or incorporated by reference in the Annual Report on Form 10-K for the fiscal year ended January 3, 2014, the following risk factors could also affect our financial condition and results of operations:

Because the market price of AECOM common stock will fluctuate, URS stockholders cannot be sure of the value of the merger consideration they will receive at the time of the URS special meeting or at any time prior to the closing of the merger.

Upon completion of the merger, each share of the URS common stock will be converted into the right to receive a merger consideration consisting of shares of AECOM common stock and/or cash pursuant to the terms of the merger agreement. The value of the merger consideration to be received by URS stockholders will be based on the average five-day AECOM closing price at the time of completion of the merger. This average price may vary from the closing price of AECOM common stock on the date we announced the merger, on the date that the joint proxy statement/prospectus was mailed to AECOM stockholders and URS stockholders and on the date of the special meetings of the AECOM and URS stockholders. Any change in the market price of AECOM common stock prior to completion of the merger will affect the value of the merger consideration that URS stockholders will receive upon completion of the merger. Accordingly, at the time of the URS special meeting and prior to the election deadline, URS stockholders will not necessarily know or be able to calculate the amount of the cash consideration they would receive or the exchange ratio used to determine the number of any shares of AECOM common stock they would receive upon completion of the merger. Neither company is permitted to terminate the merger agreement or resolicit the vote of either company’s stockholders solely because of changes in the market prices of either company’s stock. Stock price changes may result from a variety of factors, including general market and economic conditions, changes in our respective businesses, operations and prospects, and regulatory considerations. Many of these factors are beyond our control.

The pending merger with AECOM is subject to a number of conditions, including governmental and regulatory conditions that may not be satisfied, and the merger may not be completed on a timely basis, or at all. Failure to complete the merger could have material and adverse effects on URS.

Completion of the merger is conditioned upon, among other matters, the receipt of governmental authorizations, consents, orders or other approvals, including the expiration or termination of the waiting period under domestic and foreign antitrust regulations, and the receipt of any other consents or approvals of any governmental entity required to be obtained in connection with the merger. In deciding whether to grant antitrust or other regulatory clearances, the relevant governmental entities will consider the effect of the merger within their relevant jurisdictions. The governmental agencies from which we and AECOM will seek the approvals have broad discretion in administering the governing regulations. The terms and conditions of the approvals that are granted may impose requirements, limitations, costs, or place restrictions on the conduct of the combined company after the merger. There can be no assurance that regulators will not impose conditions, terms, obligations or restrictions and that those conditions, terms, obligations or restrictions will not have the effect of delaying the completion of the merger or imposing additional material costs on, or materially limiting the revenues of, the combined company following the merger. In addition, we cannot provide assurances that any such conditions, terms, obligations or restrictions will not result in the delay or abandonment of the merger.

If the merger is not completed on a timely basis, or at all, our ongoing businesses may be adversely affected. Additionally, in the event the merger is not completed, we will be subject to a number of risks without realizing any of the benefits of having completed the merger, including (i) the payment of certain fees and costs relating to the merger, such as legal, accounting, financial advisor and printing fees, (ii) the potential decline in the market price of our shares of common stock, (iii) the risk that we may not find a party willing to enter into a merger agreement on terms equivalent to or more attractive than the terms set forth in the merger agreement and (iv) the loss of time and resources.

xxi

Uncertainties associated with the merger may cause a loss of management personnel and other key employees that could adversely affect our future business, operations and financial results following the merger.

Whether or not the merger is completed, the announcement and pendency of the merger could disrupt our business. We are dependent on the experience and industry knowledge of our senior management and other key employees. In addition, the combined company’s success after the merger will depend in part upon the ability of AECOM and URS to retain key management personnel and other key employees. Current and prospective employees of AECOM and URS may experience uncertainty about their roles within the combined company following the merger, which may have an adverse effect on our ability to attract or retain key management and other key personnel.

Accordingly, no assurance can be given that we will be able to attract or retain key management personnel and other key employees. In addition, following the merger, the combined company might not be able to locate suitable replacements for any such key employees who leave URS or offer employment to potential replacements on reasonable terms.

Lawsuits have been filed against URS challenging the merger, and an adverse ruling may prevent the merger from being completed.

URS, as well as the members of the URS Board of Directors, have been named as defendants in lawsuits brought by purported stockholders of URS challenging the URS Board of Directors’ actions in connection with the merger agreement and seeking, among other things, injunctive relief to enjoin the defendants from completing the merger on the agreed-upon terms. One of the conditions to the closing of the merger is that no temporary restraining order, preliminary or permanent injunction or other judgment, order or decree issued by any court of competent jurisdiction or other legal restraint or prohibition shall be in effect, and no law shall have been enacted, entered, promulgated, enforced or deemed applicable by any governmental entity that, in any such case, prohibits or makes illegal the consummation of the merger. Consequently, if a settlement or other resolution is not reached in the lawsuits referenced above and the plaintiffs secure injunctive or other relief prohibiting, delaying or otherwise adversely affecting our ability to complete the merger, then such injunctive or other relief may prevent the merger from becoming effective within the expected timeframe or at all.

The merger agreement contains provisions that could discourage a potential competing acquiror of URS.

The merger agreement contains “no shop” provisions that, subject to limited exceptions, restrict our ability to solicit, initiate or endorse, encourage or facilitate competing third-party proposals for the acquisition of our company’s shares or assets. Further, even if our Board of Directors withdraws or changes its recommendation with respect to the merger, we will still be required to submit each of our merger-related proposals to a vote at our stockholder meeting. In addition, AECOM generally has an opportunity to offer to modify the terms of the merger in response to any competing acquisition proposals before our Board of Directors may withdraw or change its recommendation with respect to the merger. In certain circumstances in connection with the termination of the merger agreement, AECOM must pay to URS a termination fee equal to $140 million, or $240 million if the merger agreement is terminated by URS under circumstances where all closing conditions have been satisfied but AECOM’s debt financing is not available to complete the merger and AECOM fails to close the merger. In certain circumstances in connection with the termination of the merger agreement, URS must pay to AECOM a termination fee equal to $140 million. If the merger agreement is terminated by a party because of certain breaches by the other party, then the non-terminating party will be required to reimburse the terminating party for its reasonable out-of-pocket fees and expenses up to $40 million.

These provisions could discourage a potential third-party acquirer that might have an interest in acquiring all or a significant portion of URS from considering or proposing that acquisition, at a higher per share cash or market value than the market value proposed to be received or realized in the merger, or might result in a potential third-party acquirer proposing to pay a lower price to the stockholders than it might otherwise have proposed to pay because of the added expense of the termination fee and/or expense reimbursement that may become payable in certain circumstances.

xxii

The following discussion contains, in addition to historical information, forward-looking statements that involve risks and uncertainties. Our actual results and the timing of events could differ materially from those described herein. See “URS Corporation and Subsidiaries” regarding forward-looking statements on page 1. You should read this discussion in conjunction with Item 1A, “Risk Factors,” beginning on page H23; the consolidated financial statements and notes thereto contained in Item 8, “Consolidated Financial Statements and Supplementary Data,” of this report.

BUSINESS SUMMARY