Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 PRESS RELEASE DATED JULY 30, 2014 - SUN COMMUNITIES INC | exhibit991-pressrelease73014.htm |

| 8-K - FORM 8-K DATED JULY 30, 2014 - SUN COMMUNITIES INC | suiform8-k_73014.htm |

1 Blue Heron Pines – Punta Gorda, FL Lost Dutchman – Apache Junction, AZ Royal Palm Village – Haines City, FL July 30, 2014 Sun Communities, Inc. Acquisition of the American Land Lease Portfolio from Green Courte Partners

1 This presentation has been prepared for informational purposes only from information supplied by Sun Communities, Inc. (the "Company") and from third-party sources indicated herein. Such third- party information has not been independently verified. The Company makes no representation or warranty, expressed or implied, as to the accuracy or completeness of such information. This presentation contains various “forward-looking statements” within the meaning of the United States Securities Act of 1933, as amended, and the United States Securities Exchange Act of 1934, as amended, and we intend that such forward-looking statements will be subject to the safe harbors created thereby. For this purpose, any statements contained in this presentation that relate to expectations, beliefs, projections, future plans and strategies, trends or prospective events or developments and similar expressions concerning matters that are not historical facts are deemed to be forward-looking statements. Words such as “forecasts,” “intends,” “intend,” “intended,” “goal,” “estimate,” “estimates,” “expects,” “expect,” “expected,” “project,” “projected,” “projections,” “plans,” “predicts,” “potential,” “seeks,” “anticipates,” “anticipated,” “should,” “could,” “may,” “will,” “designed to,” “foreseeable future,” “believe,” “believes,” “scheduled,” “guidance” and similar expressions are intended to identify forward-looking statements, although not all forward looking statements contain these words. These forward-looking statements reflect our current views with respect to future events and financial performance, but involve known and unknown risks and uncertainties, both general and specific to the matters discussed in this presentation. These risks and uncertainties may cause our actual results to be materially different from any future results expressed or implied by such forward-looking statements. In addition to the risks disclosed under “Risk Factors” contained in our Annual Report on Form 10-K for the year ended December 31, 2013, and our other filings with the Securities and Exchange Commission from time to time, such risks and uncertainties include: changes in general economic conditions, the real estate industry and the markets in which we operate; difficulties in our ability to evaluate, finance, complete and integrate acquisitions, developments and expansions successfully; our liquidity and refinancing demands; our ability to obtain or refinance maturing debt; our ability to maintain compliance with covenants contained in our debt facilities; availability of capital; difficulties in completing acquisitions; our failure to maintain effective internal control over financial reporting and disclosure controls and procedures; increases in interest rates and operating costs, including insurance premiums and real property taxes; risks related to natural disasters; general volatility of the capital markets and the market price of shares of our capital stock; our failure to maintain our status as a REIT; changes in real estate and zoning laws and regulations; legislative or regulatory changes, including changes to laws governing the taxation of REITs; litigation, judgments or settlements; our ability to maintain rental rates and occupancy levels; competitive market forces; and the ability of manufactured home buyers to obtain financing and the level of repossessions by manufactured home lenders Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made. We undertake no obligation to publicly update or revise any forward-looking statements included in this presentation, whether as a result of new information, future events, changes in our expectations or otherwise, except as required by law. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. All written and oral forward-looking statements attributable to us or persons acting on our behalf are qualified in their entirety by these cautionary statements. Forward Looking Statements La Casa Blanca Kings Pointe

2 Transaction Overview Transaction Acquisition of an irreplaceable portfolio (the American Land Lease or “ALL” portfolio)(1) of primarily age-restricted manufactured home communities from Green Courte Partners (“GCP”) sponsored funds 59 pure-play manufactured home communities 19,504 manufactured home sites ‒ 14,245 (73%) age-restricted sites ‒ 5,259 (27%) all-age sites Contract to purchase an additional age-restricted community comprising 198 sites for $15.8 million Consideration $1.32 billion purchase price, funded through a combination of: ‒ Approximately $560 million in assumed debt; ‒ Approximately $262 million of SUI Common Stock / Operating Partnership (“OP”) Units; ‒ $175 million of SUI Convertible Perpetual Preferred Stock / Convertible Perpetual Preferred OP Units; ‒ Combination of asset sales, cash on hand and SUI’s line of credit / new term loan ‒ Approximately $13 million in SUI equity purchased by GCP (2) Board of Directors Transaction has been unanimously approved by SUI’s Board of Directors Randall K. Rowe and James R. Goldman, principals at GCP, to join SUI’s Board of Directors Staged Closing Closings in late 2014 and early 2015, subject to customary closing conditions Lake Shore Landings The Reserve at Fox Creek Lost Dutchman Northridge Place 1) Portfolio of 59 communities includes those acquired from American Land Lease by GCP in 2009. 2) GCP has committed to purchase a minimum of $12.5 million and has the right to purchase up to a total $50 million of SUI equity.

3 A Compelling Investment Opportunity for SUI Riverside Club Gulfstream Harbor Desert Harbor Desert Harb r Unique opportunity to acquire one of the highest quality portfolios in the MH sector Increased scale and diversification Irreplaceable portfolio focused on attractive age-restricted segment Strong operating metrics and attractive growth Expected to be immediately accretive to 2015 FFO per share Cost synergies and upside from integration into SUI platform

A Compelling Portfolio Opportunity Irreplaceable portfolio in high-barrier, sought after markets Large, well-located high-quality communities with attractive amenities Portfolio with potential for occupancy and rent growth Significant age-restricted nature of portfolio allows SUI to capture growth potential from very favorable demographic trends Immediately Accretive to SUI’s Earnings Transaction expected to be accretive to 2015 FFO per share Acquisition funded in part through Common Stock / OP Units and Convertible Perpetual Preferred Stock / Convertible Perpetual Preferred OP Units ‒ Additional SUI equity to be purchased by GCP ‒ Vote of confidence from seller on the SUI platform Opportunity to lower SUI’s cost of capital Increases Scale and Improves Portfolio Quality Provides significant operating and management efficiencies Increases overall geographic diversification, exposure to attractive Florida market and size of SUI’s age-restricted portfolio Ability to apply SUI’s demonstrated operational and integration capabilities Complementary SUI and ALL portfolios provide for simplified integration Larger asset base and increased scale 4 Transaction Rationale Plantation Landings Rancho Mirage Pelican Bay Serendipity Sunlake Estates

Age- Restricted 73% All-Age 27% 5 Irreplaceable Portfolio with High-Quality Assets Source: Company as of 7/23/2014. 1) Excludes one additional property comprising 198 sites, which SUI has a contract to purchase for $15.8 million. Age-Restricted Properties 41 communities 14,245 sites All-Age Properties 18 communities 5,259 sites Aggregate Portfolio (1) 59 communities 19,504 sites Expansion Sites Potential to add 558 additional sites Avg. Monthly Rent per Site $454 Occupancy 90% Number of States 11 Summary Statistics Geographic Exposur (by sites) Age-Restricted Concentration Avg. Monthly Rent per Site $471 Occupancy 91% Number of FL Sites 10,409 Expansion Sites 325 FL 56% AZ 11% MI 8% IL 7% NY 6% Other 12%

6 Representative Properties of High-Quality Acquired Portfolio Savanna Club La Costa Village Property Highlights Irreplaceable property located approximately 5 miles northeast of Port St. Lucie, FL 5+ star, age-restricted community with resort- quality amenities including 18-hole golf course Property Highlights Attractive location approximately 5 miles south of Daytona Beach, FL 5+ star, age-restricted community with resort- quality amenities Amenities include: clubhouse, pool, spa, shuffleboard, and a ballroom Location Florida Age-Restricted? Number of Sites 1,069 Avg. Monthly Rent Per Site $348 Occupancy 97% Acres 272 Location Florida Age-Restricted? Number of Sites 658 Avg. Monthly Rent Per Site $565 Occupancy 100% Acres 136 Source: Company as of 7/23/2014.

7 Representative Properties of High-Quality Acquired Portfolio Property Highlights Located in downtown Mesa, AZ, approximately 15 miles east of Phoenix, AZ Gated age-restricted community with mountain views and high-quality amenities Recent $1.7M clubhouse, entrance and park renovation Location Arizona Age-Restricted? Number of Sites 350 Avg. Monthly Rent Per Site $589 Occupancy 95% Acres 58 Location Florida Age-Restricted? Number of Sites 389 Avg. Monthly Rent Per Site $485 Occupancy 94% Acres 136 Property Highlights Located on Florida’s Gulf Coast, approximately 20 miles north of Fort Myers, FL 5 star, age-restricted community with resort- quality amenities, including an 18-hole golf course Opportunity for expansion of up to 20 additional sites Blue Heron Pines Brentwood West Source: Company as of 7/23/2014.

8 Reserve at Fox Creek Bullhead City, AZ Gulfstream Harbor Orlando, FL Park Place Sebastian, FL Sunlake Estates Grand Island, FL Riverside Club Ruskin, FL Pure-Play Portfolio of High-Quality Communities Source: Company as of 7/23/2014.

9 Acquisition Increases SUI’s Scale and Diversification Total Enterprise Value (1) $3.8 billion $1.3 billion $5.1 billion Number of Communities 186 (2) 59 (3) 245 Occupancy 92% (2) 90% (3) 91% Number of Sites 70,397 (2) 19,504 (3) 89,901 Avg. Monthly Rent / Site $444 (2) $454 (3) $446 Geographic Diversification MI (34%) FL (18%) TX (9%) IN (9%) AZ (3%) Other (27%) FL (56%) AZ (11%) MI (8%) IL (7%) NY (6%) Other (12%) MI (28%) FL (27%) TX (7%) IN (7%) AZ (5%) Other (26%) ALL Portfolio from Post-Acquisition Source: Company filings as of 6/30/2014. 1) As of 7/29/2014, based on $52.70 SUI stock price ; calculated based on fully diluted shares outstanding. 2) As of 6/30/2014, adjusted for four community dispositions subsequent to quarter end. 3) As of 7/23/2014.

10 Source: Company filings as of 6/30/2014, adjusted for four community dispositions subsequent to quarter end. Strong Geographic Footprint and Overlap in Key Markets SUI will strengthen its presence in key, high-barrier markets with this acquisition ALL Portfolio from Post-Acquisition ALL Properties SUI Properties MI 24,018 1,519 25,537 28.4% FL 12,988 10,873 23,861 26.5 TX 6,511 -- 6,511 7.2 IN 6,212 -- 6,212 6.9 AZ 2,021 2,220 4,241 4.7 OH 3,668 -- 3,668 4.1 NJ 2,627 -- 2,627 2.9 CO 1,470 755 2,225 2.5 NY 579 1,147 1,726 1.9 IL 309 1,345 1,654 1.8 ME 1,038 483 1,521 1.7 PA 974 304 1,278 1.4 GA 1,150 -- 1,150 1.3 MO 976 -- 976 1.1 DE 920 -- 920 1.0 VA 684 -- 684 0.8 Other 4,252 858 5,110 5.7 Total Sites 70,397 19,504 89,901 100.0%

11 Total Purchase Price: $1.32 billion Issuance by Sun Communities to GCP shareholders of: – 5.2 million SUI Common Stock / OP Units for approximately $262 million – $175 million Convertible Perpetual Preferred Stock / Convertible Perpetual Preferred OP Units with a dividend rate of 6.50% and a conversion premium of 12.5% – The balance to be funded through a combination of SUI’s cash on hand, cash from seller’s purchase of SUI equity, proceeds from planned asset sales, and SUI lines of credit and new term loan Seller has the ability to further invest in SUI equity beyond their approximate initial $13 million investment Sources & Uses Sources Uses Thoughtfully structured transaction to meet the needs and objectives of both SUI and GCP stakeholders Sun Communities is committed to maintaining a flexible balance sheet and conservative leverage level over time ($ in millions) Sources Assumed Debt $560 SUI Common Stock / OP Units 262 SUI Conv. Perp. Pref. Stock / Conv. Perp. Pref. OP Units 175 Cash from GCP Equity Investment 13 Other Sources 311 Total $1,321 Uses Purchase of MH Communities $1,291 Purchase of Homes 23 Purchase of Notes 7 Total $1,321 Source: Company filings as of 6/30/2014.

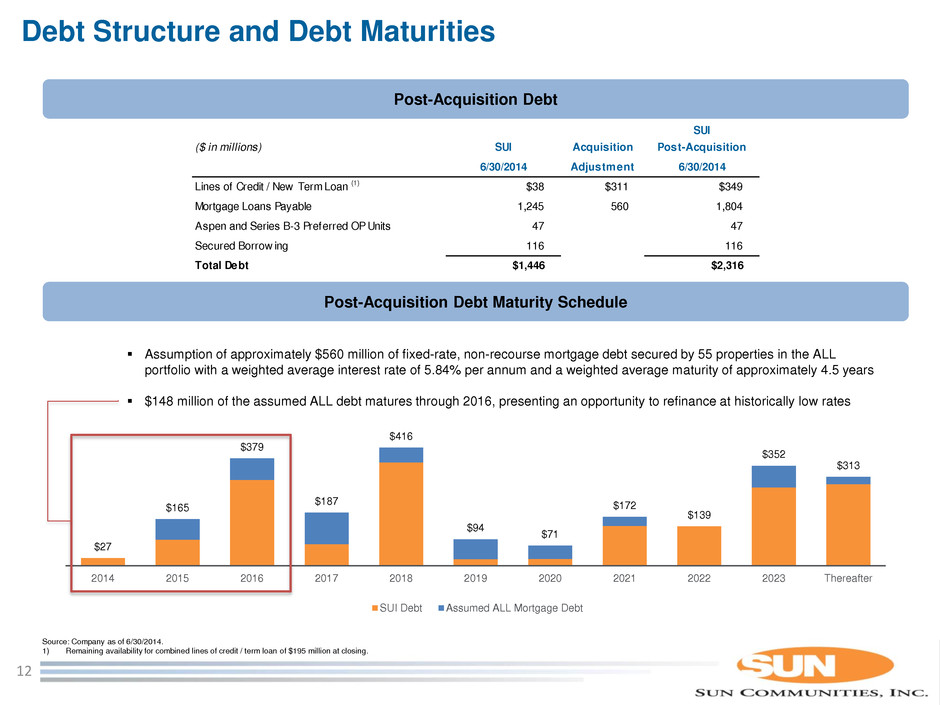

$27 $165 $379 $187 $416 $94 $71 $172 $139 $352 $313 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Thereafter SUI Debt Assumed ALL Mortgage Debt 12 Debt Structure and Debt Maturities Post-Acquisition Debt Maturity Schedule Assumption of approximately $560 million of fixed-rate, non-recourse mortgage debt secured by 55 properties in the ALL portfolio with a weighted average interest rate of 5.84% per annum and a weighted average maturity of approximately 4.5 years $148 million of the assumed ALL debt matures through 2016, presenting an opportunity to refinance at historically low rates Post-Acquisition Debt Source: Company as of 6/30/2014. 1) Remaining availability for combined lines of credit / term loan of $195 million at closing. SUI ($ in millions) SUI Acquisition Post-Acquisition 6/30/2014 Adjustment 6/30/2014 Lines of Credit / New Term Loan (1) $38 $311 $349 Mortgage Loans Payable 1,245 560 1,804 Aspen and Series B-3 Preferred OP Units 47 47 Secured Borrow ing 116 116 Total Debt $1,446 $2,316

13 Earnings Accretion and Integration Looking forward to the first year under SUI ownership and operation, SUI has underwritten the transaction at an estimated 6.0% cap rate based on projected Year 1 NOI and expects the acquisition to be approximately 5.0% - 8.0% accretive to 2015 FFO per share Synergies – Limited incremental G&A to operate and grow acquired portfolio – Grows SUI by approximately one third of current Total Enterprise Value (1) – Strong projected same-site NOI growth • Occupancy growth • Rent growth • Below-market leases • Expansion of existing communities Opportunity to lower SUI’s cost of capital SUI has successfully integrated acquired properties historically Since 1Q 2011, SUI has acquired 58 communities comprising over 24,000 sites – During the period, total portfolio occupancy has increased from 85% as of 3/31/2011 to 91% as of 6/30/2014 – Same-site NOI growth over that period has averaged over 5% per year Earnings Accretion Proven Success in Delivering Value through Acquisitions SUI is the right platform to integrate and operate the ALL portfolio, and maximize the embedded growth of the combined portfolio Source: Company filings as of 6/30/2014. 1) As of 7/29/2014, based on $52.70 SUI stock price; calculated based on fully diluted shares outstanding.

14 Conclusion: A Compelling Investment Opportunity for SUI Desert Harbor Desert Har r Cypress Greens Fiesta Village Lamplighter Vizcaya Lakes Sun Valley Estates Unique opportunity to acquire one of the highest quality portfolios in the MH sector Increased scale and diversification Irreplaceable portfolio focused on attractive age-restricted segment Strong operating metrics and attractive growth Expected to be immediately accretive to 2015 FFO per share Cost synergies and upside from integration into SUI platform West ide Rid