Attached files

| file | filename |

|---|---|

| EX-99.1 - EIX PRESS RELEASE DATED 7/31/14 - SOUTHERN CALIFORNIA EDISON Co | ex991-2q2014earningspressr.htm |

| 8-K - 8-K - SOUTHERN CALIFORNIA EDISON Co | eix-sceform8xkre2q2014er.htm |

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM July 31, 2014 1 Second Quarter 2014 Financial Results

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM July 31, 2014 2 Statements contained in this presentation about future performance, including, without limitation, operating results, asset and rate base growth, capital expenditures, San Onofre Nuclear Generating Station (SONGS), and other statements that are not purely historical, are forward-looking statements. These forward-looking statements reflect our current expectations; however, such statements involve risks and uncertainties. Actual results could differ materially from current expectations. These forward-looking statements represent our expectations only as of the date of this presentation, and Edison International assumes no duty to update them to reflect new information, events or circumstances. Important factors that could cause different results are discussed under the headings “Risk Factors” and “Management’s Discussion and Analysis” in Edison International’s Form 10-K, most recent form 10-Q, and other reports filed with the Securities and Exchange Commission, which are available on our website: www.edisoninvestor.com. These filings also provide additional information on historical and other factual data contained in this presentation. Forward-Looking Statements

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM July 31, 2014 3 Second Quarter Earnings Summary Q2 2014 Q2 2013 Variance Core EPS1 SCE $1.11 $0.84 $0.27 EIX Parent & Other (0.03) (0.05) 0.02 Core EPS1 $1.08 $0.79 $0.29 Non-Core Items SCE $– $(1.12) $1.12 EIX Parent & Other – – – Discontinued Operations 0.56 0.04 0.52 Total Non-Core $0.56 $(1.08) $1.64 Basic EPS $1.64 $(0.29) $1.93 Diluted EPS $1.63 $(0.29) $1.92 SCE Key Core Earnings Drivers Higher revenue $0.17 SONGS impact 0.03 Higher O&M2 (0.02) Higher depreciation (0.05) Higher net financing costs (0.02) Income taxes and other 0.16 - Changes in uncertain tax positions 0.09 - Other tax benefits 0.04 - Generator settlements 0.03 Total $0.27 EIX Key Core Earnings Drivers Higher tax benefits $0.03 Costs of new businesses (0.01) Total $0.02 1 See Earnings Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix 2 Includes non-SONGS severance of $0.01 and $0.02 for the three months ended June 30 of 2014 and 2013, respectively

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM July 31, 2014 4 Year-to-Date Earnings Summary YTD 2014 YTD 2013 Variance Core EPS1 SCE $2.04 $1.63 $0.41 EIX Parent & Other (0.06) (0.06) 0.00 Core EPS1 $1.98 $1.57 $0.41 Non-Core Items SCE $(0.29) $(1.12) $0.83 EIX Parent & Other – 0.02 (0.02) Discontinued Operations 0.49 0.07 0.42 Total Non-Core $0.20 $(1.03) $1.23 Basic EPS $2.18 $0.54 $1.64 Diluted EPS $2.17 $0.54 $1.63 EIX Key Core Earnings Drivers Higher tax benefits $0.01 Costs of new businesses (0.01) Total $0.00 SCE Key Core Earnings Drivers Higher revenue $0.31 SONGS impact 0.02 Lower O&M2 0.05 Higher depreciation (0.12) Higher net financing costs (0.05) Income taxes and other 0.20 - Changes in uncertain tax positions 0.09 - Other tax benefits 0.08 - Generator settlements 0.03 Total $0.41 1 See Earnings Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix 2 Includes non-SONGS severance of $0.01 and $0.05 for the six months ended June 30, 2014 and 2013, respectively

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM July 31, 2014 5 SCE Capital Expenditures Forecast ($ billions) 2014-17 Total Requested $4.1 $4.5 $4.4 $4.2 $17.2 Range $3.6 $3.9 $3.9 $3.7 $15.1 • Capital expenditures forecast reaffirmed • CPUC GRC focused on infrastructure replacement • Includes Tehachapi scope changes for FAA requirements and $360 million estimate for Chino Hills undergrounding $15.1 – $17.2 billion forecasted capital program 2014 – 2017 $4.1 $4.5 $4.4 $4.2 2014 2015 2016 2017 Distribution Transmission Generation Note: forecasted capital spending subject to timely receipt of permitting, licensing, and regulatory approvals. Forecast range reflects an average variability of 12%.

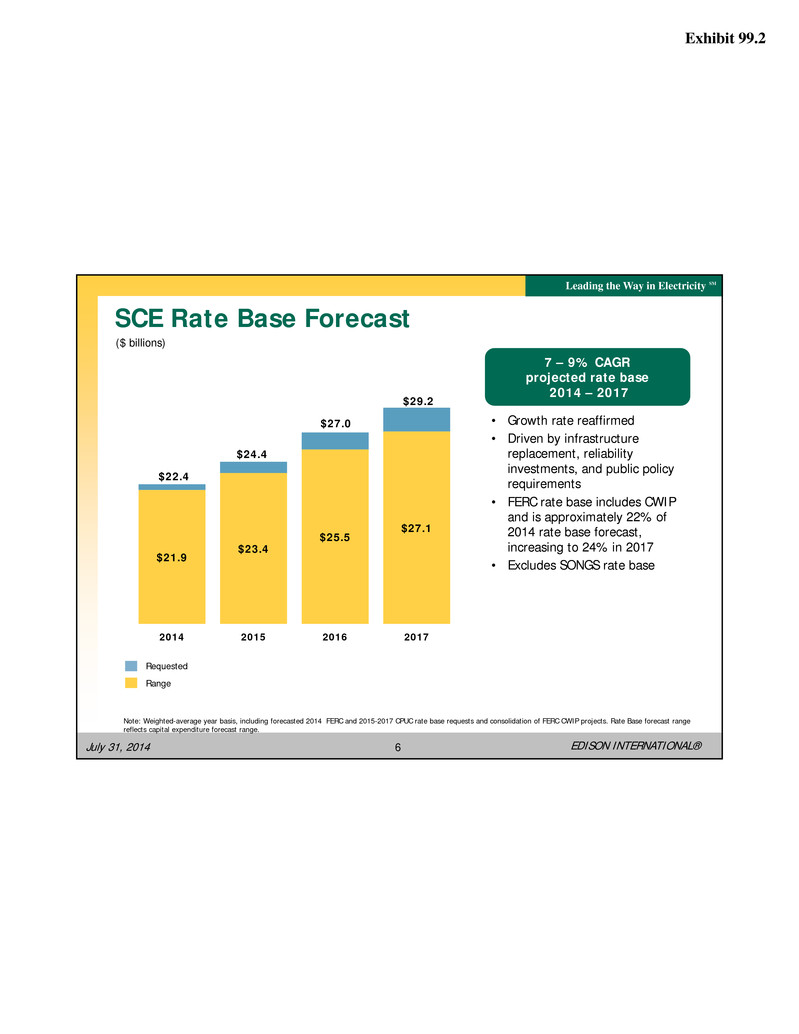

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM July 31, 2014 6 ($ billions) SCE Rate Base Forecast • Growth rate reaffirmed • Driven by infrastructure replacement, reliability investments, and public policy requirements • FERC rate base includes CWIP and is approximately 22% of 2014 rate base forecast, increasing to 24% in 2017 • Excludes SONGS rate base 7 – 9% CAGR projected rate base 2014 – 2017 Requested Range $21.9 $23.4 $25.5 $27.1 $22.4 $24.4 $27.0 $29.2 2014 2015 2016 2017 Note: Weighted-average year basis, including forecasted 2014 FERC and 2015-2017 CPUC rate base requests and consolidation of FERC CWIP projects. Rate Base forecast range reflects capital expenditure forecast range.

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM July 31, 2014 7 SCE Growth Drivers Beyond 2017 Infrastructure Reliability Investment • Sustained level of infrastructure investment required until equilibrium replacement rates are achieved - includes underground cable, poles, switches, and transformers1 Grid Readiness • Accelerate automation and control technology at optimal locations to manage two-way power flows with more dynamic voltage control • Distribution Resource Plan required under AB 327 to identify optimal locations, additional spending, and barriers to deploying distributed energy resources – due to CPUC Q3 2015 Transmission • California ISO 2013-2014 Transmission Plan2 - approved Mesa Loop-in Project (system reliability post-SONGS and renewables integration) with target in-service date of December 31, 2020 • Two existing projects incorporated from prior Transmission Plans in service beyond 2017 include Coolwater-Lugo (2018) and West of Devers (2019-2020) Energy Storage • 290 MW utility owned investment opportunity 2015-2024 Future Potential California Public Policy Requirements and Enabling Projects • Transportation electrification • Renewables mandates beyond 33% 1 Source: A.13-11-0032015 GRC – SCE-01 Policy testimony; equilibrium replacement rate defined as equipment population divided by mean time to failure for type of equipment 2 Approved by the California ISO Board of Governors March 20, 2014

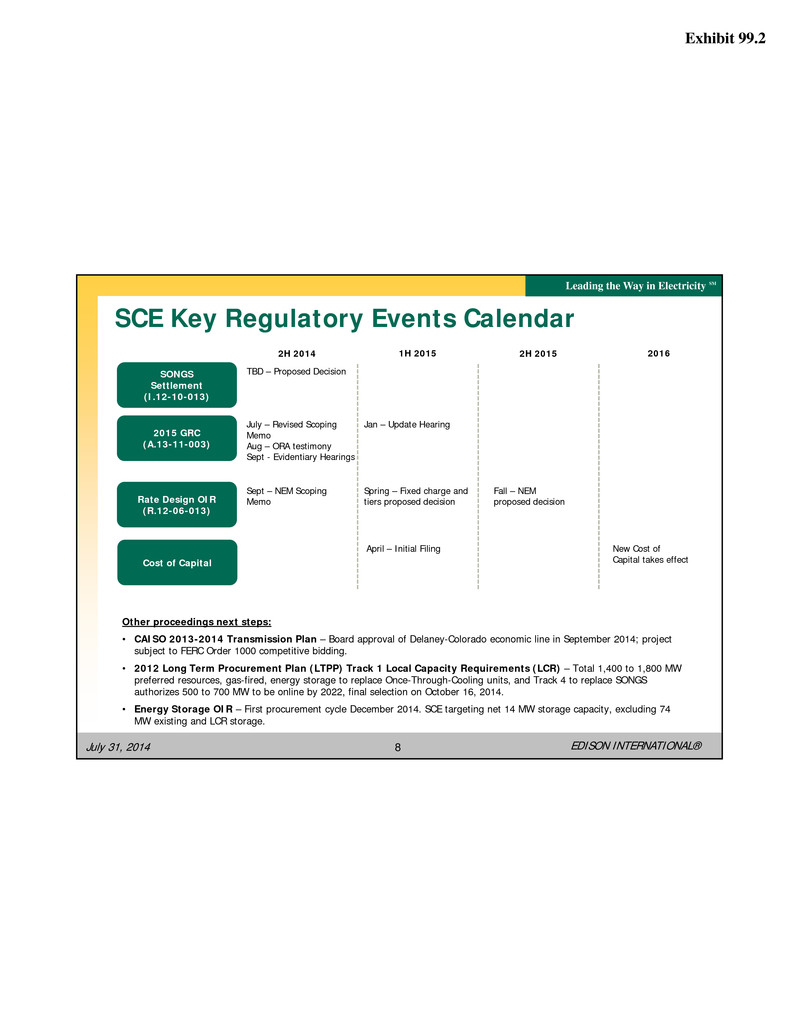

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM July 31, 2014 8 SCE Key Regulatory Events Calendar Rate Design OIR (R.12-06-013) 2015 GRC (A.13-11-003) 2H 2014 1H 2015 2H 2015 2016 SONGS Settlement (I.12-10-013) Other proceedings next steps: • CAISO 2013-2014 Transmission Plan – Board approval of Delaney-Colorado economic line in September 2014; project subject to FERC Order 1000 competitive bidding. • 2012 Long Term Procurement Plan (LTPP) Track 1 Local Capacity Requirements (LCR) – Total 1,400 to 1,800 MW preferred resources, gas-fired, energy storage to replace Once-Through-Cooling units, and Track 4 to replace SONGS authorizes 500 to 700 MW to be online by 2022, final selection on October 16, 2014. • Energy Storage OIR – First procurement cycle December 2014. SCE targeting net 14 MW storage capacity, excluding 74 MW existing and LCR storage. July – Revised Scoping Memo Aug – ORA testimony Sept - Evidentiary Hearings Sept – NEM Scoping Memo Fall – NEM proposed decision TBD – Proposed Decision Cost of Capital April – Initial Filing New Cost of Capital takes effect Spring – Fixed charge and tiers proposed decision Jan – Update Hearing

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM July 31, 2014 9 2014 Core and Basic Earnings Guidance Key Assumptions: • Midpoint rate base of $22.1 billion • Approved capital structure – 48% equity, 10.45% CPUC & FERC ROE • 325.8 million common shares outstanding (no change) • No significant transmission project delays Other Assumptions: • No change in tax policy • O&M cost savings flow through to ratepayers in 2015 GRC • Excludes $0.56 per share non-core item recorded in Q2 2014 but not in guidance • Excludes $0.23 per share core items (uncertain tax position and other tax benefits, additional FERC revenue and FERC energy settlements) included in YTD 2014 results but not in guidance 2014 Earnings Guidance as of 4/29/14 Low Mid High SCE $3.85 EIX Parent & Other (0.15) EIX Core EPS 1 $3.60 $3.70 $3.80 Non-core Items 2 (0.36) EIX Basic EPS $3.24 $3.34 $3.44 $3.40 $(0.07) $0.52 $(0.15) $3.70 SCE 2014 EPS from Rate Base Forecast SONGS Shutdown SCE 2014 Positive Variances EIX Parent & Other 2014 Midpoint Guidance • Cost savings / other - $0.35 • Income taxes - $0.14 • Energy efficiency earnings - $0.03 • SONGS LT Debt & Pf dividends Year to date earnings are trending above the high end of the guidance range and guidance may be adjusted when third quarter earnings are reported 1 See Use of Non-GAAP Financial Measures in Appendix 2 Represents non-core items recorded for the three months ended March 31, 2014

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM July 31, 2014 10 Creating Shareholder Value Resolve Uncertainties Create Sustainable Earnings and Dividend Growth Position for Transformative Sector Change • SCE 2013 cost of capital • SCE 2012 FERC formula rate settlement • EME restructuring • SONGS OII settlement reached • 10% 5-year SCE rate base CAGR (2008 – 2013) • 12% Core SCE EPS growth (2008 – 2013) • 10 consecutive years of EIX dividend increases • Acquired SoCore Energy (commercial solar) • Minority investments (energy efficiency, residential solar markets, transportation electrification) • SONGS OII settlement approval • SONGS third-party cost recovery • Monetize EME tax benefits • SCE 2015 GRC • Execute wires-focused investment program • 7 – 9% projected rate base growth (2014 – 2017) • Optimize cost structure through operational excellence • Return to target dividend range over time • Rate reform – AB 327 implementation • Evaluate new power sector business opportunities W ha t W e’v e Do ne W ha t Re ma ins Note: See use of Non-GAAP Financial Measures in Appendix

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM July 31, 2014 11 Appendix

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM July 31, 2014 12 Changes Since Our Last Presentation • Quarterly updates • SCE Growth Drivers Beyond 2017 (p. 7) – new slide • SCE Key Regulatory Events Calendar (p. 8) – new slide • 2014 Core and Basic Earnings Guidance (p. 9) • EIX is Responding to Industry Change (p. 13) – new slide

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM July 31, 2014 13 EIX is Responding to Industry Change • Public policy prioritizing environmental sustainability • Innovation facilitating conservation and self- generation • Regulation supporting new forms of competition • Flattening domestic demand for electricity • Grid of the future will be more complex and sophisticated to support increasing use of distributed resources and transportation electrification • SCE Strategy Invest in, build, and operate the next generation electric grid Operational and service excellence Enable California public policies • EIX Competitive Strategy – small, targeted investments in emerging technologies and markets to follow changes in the industry and better exploit opportunities as they arise Commercial and industrial distributed generation Energy optimization Energy efficiency and software Residential solar industry financial services and software Electric transportation Long-Term Industry Trends Strategy

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM July 31, 2014 14 Earnings Non-GAAP Reconciliations ($ millions) Reconciliation of EIX Core Earnings to EIX GAAP Earnings Earnings Attributable to Edison International Core Earnings SCE EIX Parent & Other Core Earnings Non-Core Items SCE EIX Parent & Other Discontinued operations Total Non-Core Basic Earnings Q22013 $274 (15) $259 $(365) – 12 (353) $(94) Q22014 $362 (10) $352 $– – 184 184 $536 YTD2013 $530 (20) $510 $(365) 7 24 (334) $176 YTD2014 $666 (20) $646 $(96) – 162 66 $712 Note: See Use of Non-GAAP Financial Measures in Appendix

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM July 31, 2014 15 $6,682 — 2,518 1,562 296 32 4,408 2,274 94 (494) 1,874 214 1,660 91 $1,569 $5,169 4,139 1,026 — (1) — 5,164 5 — (5) — — — — $— $6,602 — 2,348 1,622 307 575 4,852 1,750 48 (519) 1,279 279 1,000 100 $900 $5,960 4,891 1,068 — — — 5,959 1 — (1) — — — — $— $12,562 4,891 3,416 1,622 307 575 10,811 1,751 48 (520) 1,279 279 1,000 100 $900 $1,265 (365) $900 SCE Results of Operations ($ millions) Utility Earning Activities Utility Cost- Recovery Activities Total Consolidated 2013 Utility Earning Activities Utility Cost- Recovery Activities Total Consolidated 2012 Operating revenue Fuel and purchased power Operation and maintenance Depreciation, decommissioning and amortization Property and other taxes Asset impairment and disallowances Total operating expenses Operating income Interest income and other Interest expense Income before income taxes Income tax expense Net income Preferred and preference stock requirements Net income available for common stock Core earnings Non-core earnings Total SCE GAAP earnings $11,851 4,139 3,544 1,562 295 32 9,572 2,279 94 (499) 1,874 214 1,660 91 $1,569 $1,338 231 $1,569 • Utility earning activities – revenue authorized by CPUC and FERC to provide reasonable cost recovery and return on investment • Utility cost-recovery activities – CPUC- and FERC-authorized balancing accounts to recover specific project or program costs, subject to reasonableness review or compliance with upfront standards Note: See Use of Non-GAAP Financial Measures in Appendix

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM July 31, 2014 16 Earnings Per Share Attributable to SCE Core EPS Non-Core Items Tax settlement Health care legislation Regulatory and tax items Asset impairment Total Non-Core Items Basic EPS SCE Core EPS Non-GAAP Reconciliations Reconciliation of SCE Core Earnings Per Share to SCE Basic Earnings Per Share 2008 $2.25 — — (0.15) — (0.15) $2.10 2009 $2.68 0.94 — 0.14 — 1.08 $3.76 2010 $3.01 0.30 (0.12) — — 0.18 $3.19 CAGR 12% 6% 2011 $3.33 — — — — — $3.33 2012 $4.10 — — 0.71 — 0.71 $4.81 2013 $3.88 — — — (1.12) (1.12) $2.76 Note: See Use of Non-GAAP Financial Measures in Appendix

Exhibit 99.2 EDISON INTERNATIONAL® Leading the Way in Electricity SM July 31, 2014 17 Edison International's earnings are prepared in accordance with generally accepted accounting principles used in the United States. Management uses core earnings internally for financial planning and for analysis of performance. Core earnings are also used when communicating with investors and analysts regarding Edison International's earnings results to facilitate comparisons of the Company's performance from period to period. Core earnings are a non-GAAP financial measure and may not be comparable to those of other companies. Core earnings (or losses) are defined as earnings or losses attributable to Edison International shareholders less income or loss from discontinued operations and income or loss from significant discrete items that management does not consider representative of ongoing earnings, such as: exit activities, including sale of certain assets, and other activities that are no longer continuing; asset impairments and certain tax, regulatory or legal settlements or proceedings. A reconciliation of Non-GAAP information to GAAP information is included either on the slide where the information appears or on another slide referenced in this presentation. Use of Non-GAAP Financial Measures EIX Investor Relations Contacts Scott Cunningham, Vice President (626) 302-2540 scott.cunningham@edisonintl.com Felicia Williams, Senior Manager (626) 302-5493 felicia.williams@edisonintl.com