Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HOME BANCSHARES INC | d766539d8k.htm |

| EX-2.1 - EX-2.1 - HOME BANCSHARES INC | d766539dex21.htm |

| EX-99.1 - EX-99.1 - HOME BANCSHARES INC | d766539dex991.htm |

Exhibit

99.2 |

2

This presentation contains forward-looking statements which include, but are not

limited to, statements about the benefits of the business combination

transaction involving Home and Broward, including future financial and operating

results, the combined company’s plans, objectives, expectations, goals and

outlook for the future. Statements in this presentation that are not historical

facts should be considered forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995. Forward-looking

statements of this type speak only as of the date of this news release. By

nature, forward-looking statements involve inherent risk and uncertainties. Various

factors could cause actual results to differ materially from those contemplated

by the forward- looking statements, including, but not limited to, (i) the

possibility that the acquisition does not close when expected or at all because

required regulatory, shareholder or other approvals and other conditions to

closing are not received or satisfied on a timely basis or at all; (ii) changes

in Home’s stock price before closing, (iii) the risk that the benefits from

the transaction may not be fully realized or may take longer to realize than

expected, including as a result of changes in general economic and market conditions,

interest and exchange rates, monetary policy, laws and regulations and their

enforcement, and the degree of competition in the geographic and business areas

in which Home and Broward operate; (iv) the ability to promptly and effectively

integrate the businesses of Home and Broward; (v) the reaction to the

transaction of the companies’ customers, employees and counterparties; and

(vi) diversion of management time on acquisition-related issues.

Additional information on factors that might affect Home BancShares, Inc.'s

financial results is included in its Annual Report on Form 10-K for the year

ended December 31, 2013, filed with the Securities and Exchange Commission.

|

•

Purchase all of the issued and outstanding shares of

common stock of Broward Financial Holdings, Inc., a Florida

state-chartered holding company with $168.5 million in total

assets

•

No additional capital required to complete the transaction

•

Acquired branches will operate as Centennial Bank, a

wholly-owned subsidiary of Home BancShares, Inc.

•

Proceeds from transaction between $33.06 million and

$33.96 million

–

90% HOMB Common Stock

–

10% Cash

•

Purchase price includes conversion of Broward stock

warrants into $3.0 million of Broward common equity

–

Priced between 1.645 and 1.649 of pro forma tangible common

equity as of June 30, 2014

3 |

•

Additive to current South Florida footprint

–

Expands into the southeast coast of Florida

•

Financially attractive transaction –

immediately accretive to:

–

Net income

–

Earnings per share

–

Book value

–

Tangible book value

•

Addition of experienced Southeast Florida

bankers to the Centennial Bank team

4 |

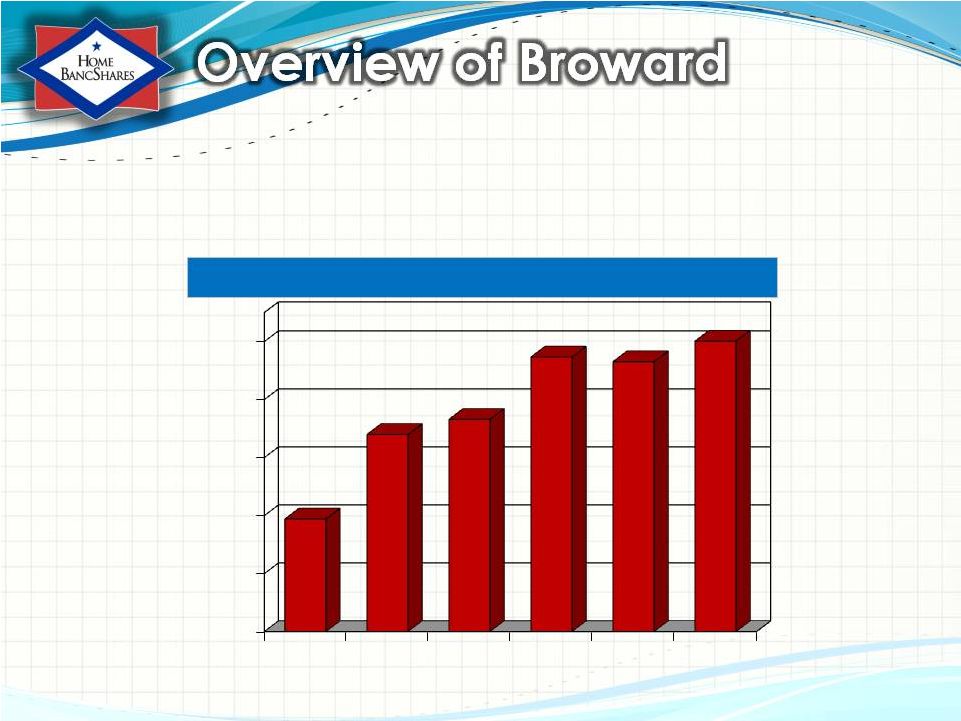

•

2 full service locations in Fort Lauderdale, Florida

•

Broward Bank has recently been ranked 12

th

in the “DepositAccounts.com

Top 200 Healthiest Banks 2014”.

Note: Core deposits defined as total deposits less time deposits greater than

$100K; Shown as Broward Bank of Commerce. (’09YE-’14MRQ)

5

Core Deposits ($mm)

$0

$20

$40

$60

$80

$100

'09YE

'10YE

'11YE

'12YE

'13YE

'14MRQ

$39

$68

$73

$95

$93

$100 |

Rank

Institution

Branches

Deposits

($mm)

Dep/Branch

($mm)

Market

Share

1

BANK OF AMERICA CORPORATION

73

10,305,955

$

141,177

$

24.7%

2

WELLS FARGO & COMPANY

74

7,979,329

107,829

19.1%

3

JPMORGAN CHASE & CO.

49

2,877,219

58,719

6.9%

4

CITIGROUP INC.

15

2,837,281

189,152

6.8%

5

SUNTRUST BANKS, INC.

36

2,607,879

72,441

6.2%

6

BB&T CORPORATION

41

2,303,376

56,180

5.5%

7

BANKUNITED, INC.

22

1,645,838

74,811

3.9%

8

HSBC HOLDINGS PLC

4

1,176,432

294,108

2.8%

9

NEW YORK COMMUNITY BANCORP, INC.

8

1,155,598

144,450

2.8%

10

FIRST BANCORP

4

1,142,091

285,523

2.7%

HOME BANCSHARES, INC. - PRO-FORMA

2

126,170

63,085

0.3%

30

BROWARD FINANCIAL HOLDINGS, INC.

2

126,170

63,085

0.3%

•

Broward is ranked 30

th

with aggregate market share of 0.30% in Broward County

(1) Deposit market share as of 6/30/13

6

Deposit Market Share of Top 10 Holding Companies in Broward County

(1) |

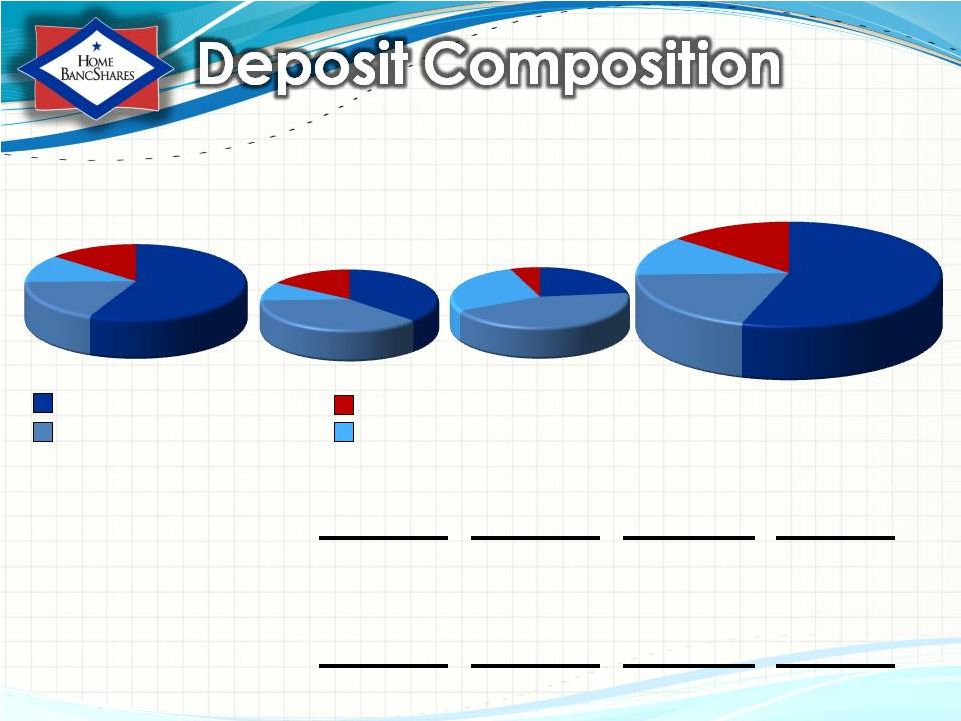

Note:

Dollars in Millions 7

HOMB

Florida

Traditions

HOMB –

Pro-Forma

Transaction Accounts

Money Market & Savings

Jumbo Time Deposits

Retail Time Deposits

12%

13%

18%

57%

16%

37%

10%

37%

12%

13%

20%

55%

6%

23%

27%

44%

Broward

Bank

HOMB

6/30/2014

Acquired

FL Traditions

Deposits

6/30/2014

Acquired

Broward

Deposits

6/30/2014

HOMB

Pro-Forma

Transaction Accounts

$

2,947

$ 102

$

$ 3,082

Money

Market & Savings

932

101

64

1,097

Retail Time Deposits

616

27

39

682

Jumbo Time Deposits

697

43

8

748

$ 5,192

$ 273

$

$ 5,609

33

144 |

Note:

Dollars in Millions (1)

Includes Agriculture

(2)

Before loan discounts

8

Loan Type

HOMB

(6/30/14)

Acquired

Traditions

Loans

(2)

(6/30/14)

Acquired

Broward

Loans

(2)

(6/30/14)

HOMB

Pro-forma

Total

% of

Pro-forma

Total

Loans

Commercial RE

(Non-farm/non-residential & agriculture)

$ 1,906

$ 149

$ 55

$

Construction/Land

Development

648

25

10

683

14.4%

Residential Real Estate

1,207

31

26

1,264

26.5%

Commercial & Industrial

(1)

512

49

19

580

12.2%

Consumer

56

2

1

59

1.2%

Other

67

-

-

67

1.4%

Total

$ 4,396 $ 256

$ 111

4,763 $

100.0%

44.3%

2,110 |

9

Note: Dollars in Millions

Year

Acquired Bank

Acquisition Type

Location

Assets

2003

Community Bank

Market

Cabot, AR

$326

2005

Twin City Bank

Market

North Little Rock, AR

$633

2005

Marine Bank

Market

Marathon, FL

$258

2005

Bank of Mountain View

Market

Mountain View, AR

$203

2008

Centennial Bank

Market

Little Rock, AR

$234

2010

Old Southern Bank

FDIC-assisted

Orlando, FL

$335

2010

Key West Bank

FDIC-assisted

Key West, FL

$97

2010

Coastal Community Bank

FDIC-assisted

Panama City, FL

$362

2010

Bayside Savings Bank

FDIC-assisted

Port Saint Joe, FL

$63

2010

Wakulla Bank

FDIC-assisted

Crawfordville, FL

$353

2010

Gulf State Community Bank

FDIC-assisted

Carrabelle, FL

$112

2012

Vision Bank

Market

Panama City, FL

$530

2012

Heritage Bank of Florida

FDIC-assisted

Lutz, FL

$225

2012

Premier Bank

§363 Bankruptcy

Tallahassee, FL

$265

2013

Liberty Bancshares, Inc.

Market

Jonesboro, AR

$2,853

2014

Florida Traditions Bank

Market

Dade City, FL

$307

2014

Broward Financial Holdings, Inc.

Market

Ft. Lauderdale, FL

$169 |

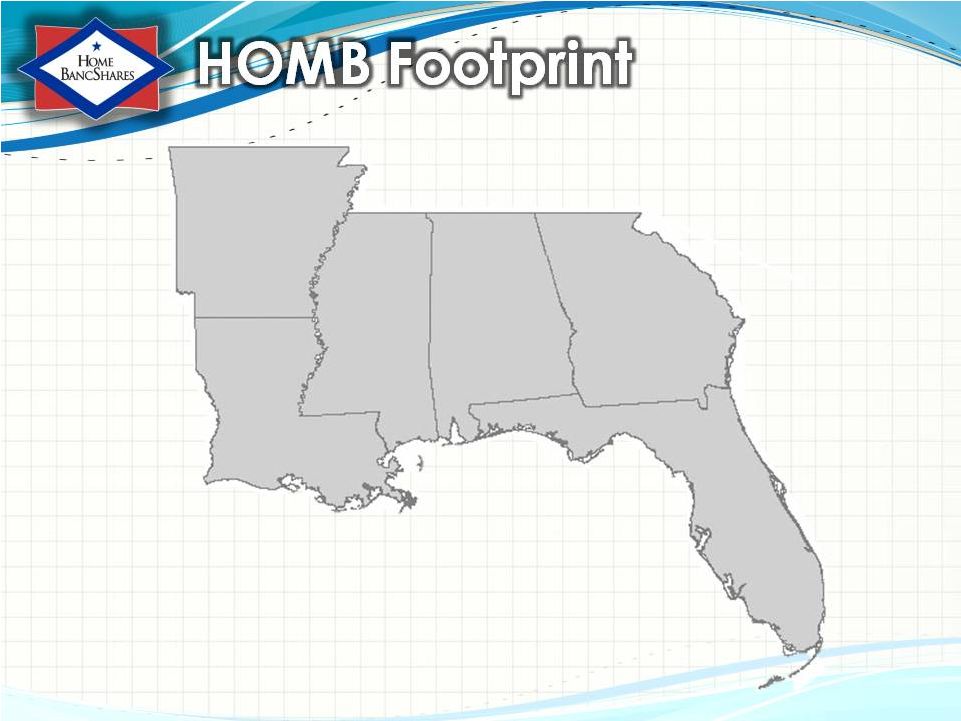

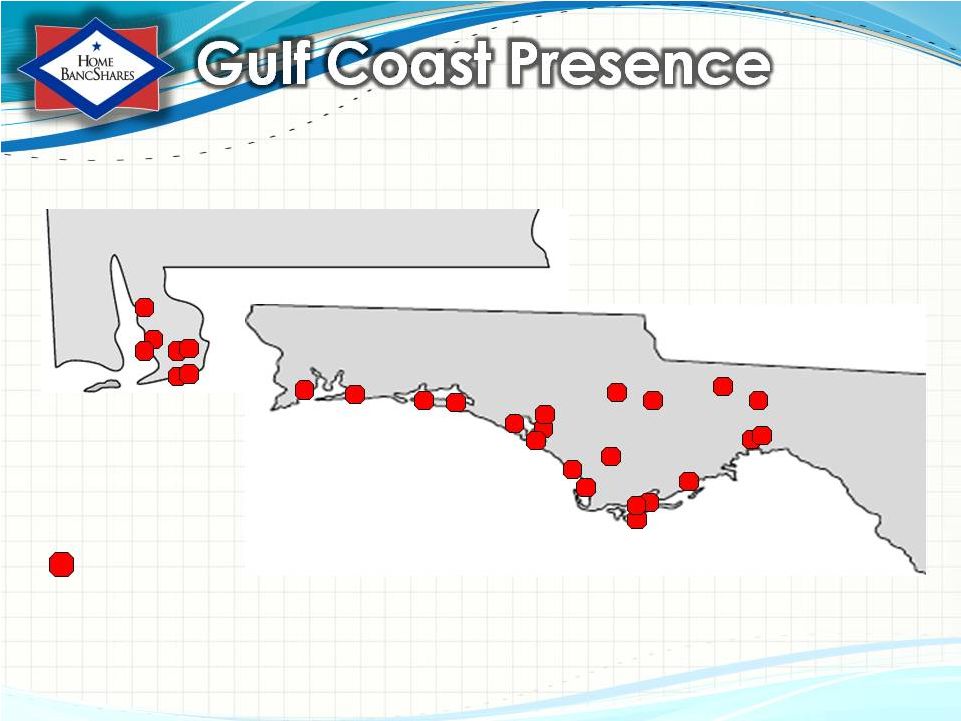

10

Note: Pro-forma map as of July 2014

ARKANSAS

83 Branches

ALABAMA

7 Branches

Panhandle

29 Branches

FLORIDA

17 Branches

FLORIDA

4 Branches

FLORIDA

9 Branches

South

Central

Southwest

Keys

FLORIDA

Branch Locations (151)

FLORIDA

2 Branches

Southeast |

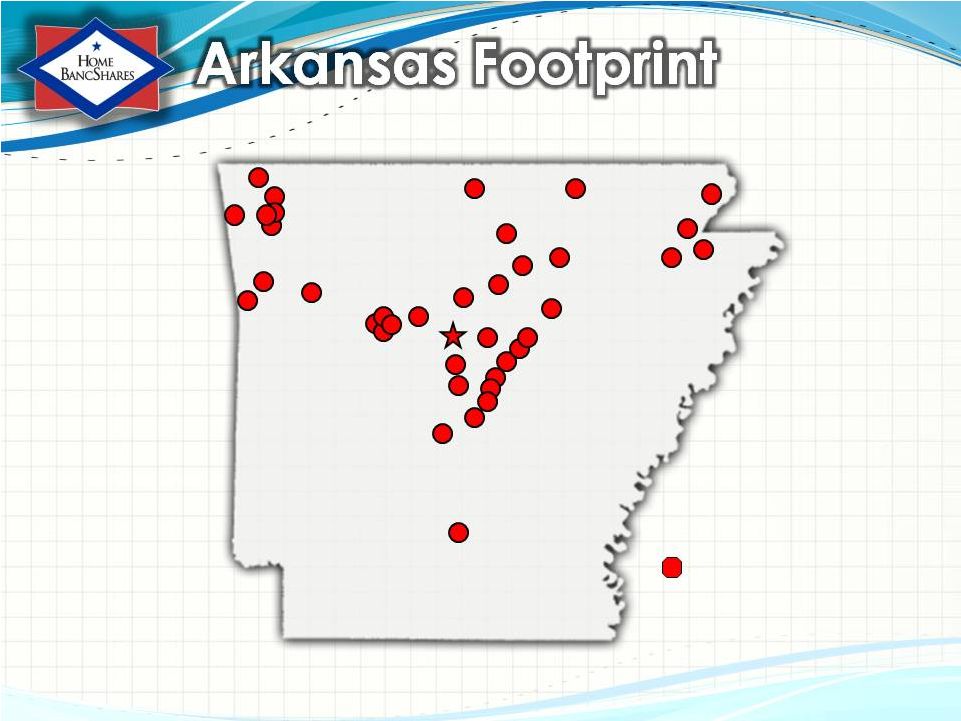

Note:

Map as of July 2014 11

Branch Locations

Mountain View (2)

Searcy (3)

Beebe (2)

Ward

Cabot (5)

Jacksonville (3)

Sherwood

Greenbrier

Vilonia

Conway (7)

Mayflower

Maumelle

Little Rock (8)

Bryant

Quitman

Fordyce

North Little Rock (5)

Morrilton

Heber Springs

ARKANSAS

Jonesboro (7)

Batesville (2)

Highland

Monette

Mountain Home (2)

Paragould (3)

Rector

Bentonville

Fayetteville (2)

Fort Smith (3)

Rogers

Siloam Springs (2)

Springdale

Tontitown

Atkins

Clarksville

Dardanelle (2)

Russellville (3)

Pottsville

Van Buren

Branch Locations (83) |

Note:

Map as of July 2014 12

Eastpoint

Apalachicola

Carrabelle

Port St. Joe

Lynn Haven

Panama City

St. George Island

Panama City Beach (2)

Mexico Beach

Southport

Blountstown

Bristol

Tallahassee (6)

Crawfordville

Daphne

Fairhope

Point Clear

Elberta

Foley

Orange Beach

Gulf Shores

Navarre

Destin

Wewahitchka

ALABAMA

FLORIDA

Quincy

St. Marks

Pensacola (2)

Santa Rosa

Beach (2)

Branch Locations (36) |

Note:

Map as of July 2014 13

Clermont

Lake Mary

Longwood

Winder Park

Orlando (2)

Kissimmee

St. Cloud

Winter Haven

Lakeland

Zephyrhills

Plant City

Tampa

Lutz

Wesley Chapel

Dade City

Spring Hill

Branch Locations (17) |

Note:

Pro-forma map as of July 2014 14

FLORIDA

Port Charlotte

Punta Gorda

Marco Island

Key Largo

Islamorada

Marathon (2)

Big Pine

Key West (3)

Summerland

Eastpoint

Apalachicola

Carrabelle

Port St. Joe

Lynn Haven

Panama City

St. George Island

Panama City Beach (2)

Mexico Beach

Southport

Blountstown

Bristol

Tallahassee (6)

Navarre

Wewahitchka

Destin

Quincy

Crawfordville

Existing Branch Locations (59)

St. Marks

Pensacola (2)

Santa Rosa

Beach (2)

Orlando (2)

Winter Park

Clermont

Lutz

Wesley Chapel

Tampa

Lake Mary

Longwood

Kissimmee

St. Cloud

Zephyrhills

Dade City

Plant City

Lakeland

Winter Haven

Spring Hill

Ft. Lauderdale (2)

Broward Branch Locations (2)

Naples |

15

Corporate Headquarters

Home BancShares, Inc.

719 Harkrider Street, Suite 100

P.O. Box 966

Conway, AR 72033

Financial Information

Brian Davis

Investor Relations Officer

(501) 328-4770

Website

www.homebancshares.com |

|