Attached files

| file | filename |

|---|---|

| EX-1 - EX-1 - C1 Financial, Inc. | d761213dex1.htm |

| EX-5 - EX-5 - C1 Financial, Inc. | d761213dex5.htm |

| EX-23.1 - EX-23.1 - C1 Financial, Inc. | d761213dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on July 31, 2014

Registration No. 333-197360

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

C1 Financial, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Florida | 6022 | 46-4241720 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

100 5th Street South

St. Petersburg, Florida 33701

(877) 266-2265

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Trevor R. Burgess

Chief Executive Officer

C1 Financial, Inc.

100 5th Street South

St. Petersburg, Florida 33701

(877) 266-2265

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

| Manuel Garciadiaz Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 (212) 450-4000 |

Mark Kanaly Lesley H. Solomon Alston & Bird LLP One Atlantic Center 1201 West Peachtree Street Atlanta, GA 30309 (404) 881-7000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title Of Each Class Of Securities To Be Registered |

Proposed Maximum Aggregate Offering Price(1) |

Amount Of Registration Fee(2) | ||

| Common Stock, par value $1.00 per share |

$ 61,000,000 | $ 7,856.80 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457 under the Securities Act of 1933. |

| (2) | $6,440 was previously paid in connection with the initial filing of this Registration Statement. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

SUBJECT TO COMPLETION, DATED JULY 31, 2014

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

IPO PRELIMINARY PROSPECTUS

2,631,579 Shares

C1 Financial, Inc.

Common Stock

C1 Financial, Inc. is offering 2,631,579 shares of its common stock.

Prior to this offering, there has been no established public market for our common stock. It is currently estimated that the initial public offering price per share of our common stock will be between $18.00 and $20.00 per share. Our common stock has been approved for listing on the New York Stock Exchange under the symbol “BNK.”

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act and will therefore be subject to reduced reporting requirements.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 14.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions |

$ | $ | ||||||

| Proceeds to C1 Financial, Inc., before expenses |

$ | $ | ||||||

C1 Financial, Inc. has granted the underwriters the right to purchase an additional 394,737 shares of common stock to cover over-allotments at the initial public offering price less the underwriting discount.

These securities are not deposits, savings accounts, or other obligations of any bank or savings association and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares to purchasers on or about , 2014, subject to customary closing conditions.

| Keefe, Bruyette & Woods | Raymond James | |||||||

| A Stifel Company | ||||||||

| Sandler O’Neill + Partners, L.P. | ||||||||||

| Wunderlich Securities | ||||||||||

| Hovde Group | ||||||||||

| Monroe Financial Partners, Inc. | ||||||||||

The date of this prospectus is , 2014

Table of Contents

Table of Contents

Table of Contents

| Page | ||||

| ii | ||||

| ii | ||||

| ii | ||||

| 1 | ||||

| 8 | ||||

| 10 | ||||

| 14 | ||||

| 35 | ||||

| 36 | ||||

| 37 | ||||

| 38 | ||||

| 39 | ||||

| 41 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

45 | |||

| 78 | ||||

| 107 | ||||

| 114 | ||||

| 125 | ||||

| 126 | ||||

| 128 | ||||

| Material U.S. Federal Income and Estate Tax Considerations for Non-U.S. Holders |

132 | |||

| 135 | ||||

| 137 | ||||

| 142 | ||||

| 142 | ||||

| 142 | ||||

| F-1 | ||||

Table of Contents

In this prospectus, unless the context suggests otherwise, references to “C1 Financial,” “C1 Financial, Inc.,” the “Company,” “we,” “us” and “our” refer to C1 Financial, Inc., its subsidiaries, including its wholly owned subsidiary, C1 Bank, and its predecessor CBM Florida Holding Company, and the “Bank” refers to C1 Bank, formerly known as the Community Bank of Manatee through February 2011 and Community Bank & Co. through April 2012.

You should rely only on the information contained in this prospectus. We and the underwriters have not authorized anyone to provide you with information different from that contained in this prospectus. We are offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the common stock.

This prospectus describes the specific details regarding this offering and the terms and conditions of the common stock being offered hereby and the risks of investing in our common stock. You should read this prospectus, any free writing prospectus and the additional information about us described in the section entitled “Where You Can Find More Information” before making your investment decision.

Neither we, nor any of our officers, directors, agents or representatives or underwriters, make any representation to you about the legality of an investment in our common stock. You should not interpret the contents of this prospectus or any free writing prospectus to be legal, business, investment or tax advice. You should consult with your own advisors for that type of advice and consult with them about the legal, tax, business, financial and other issues that you should consider before investing in our common stock.

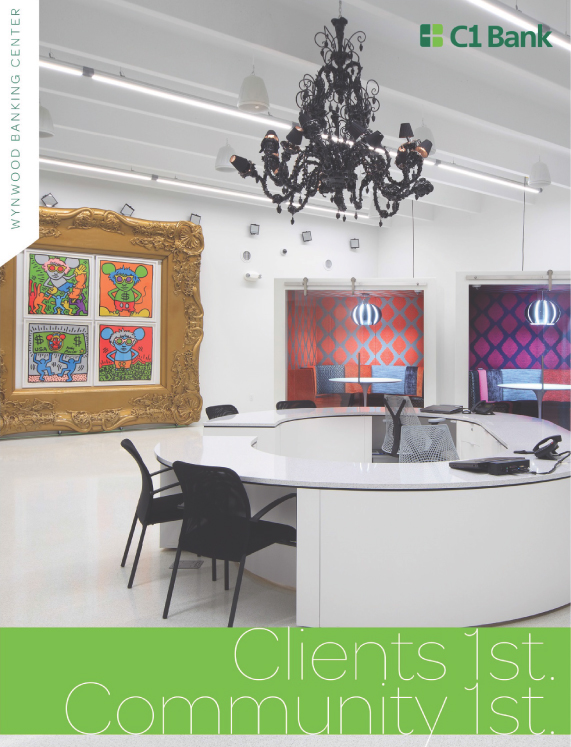

“C1 Bank” and its logos and other trademarks referred to in this prospectus including, A Bank by Entrepreneurs for Entrepreneurs™, Clients 1st™ and Clients 1st. Community 1st™ belong to us. Solely for convenience, we refer to our trademarks in this prospectus without the ™ symbol, but such references are not intended to indicate that we will not assert, to the fullest extent under applicable law, our rights to our trademarks. Other service marks, trademarks and trade names referred to in this prospectus are the property of their respective owners.

This prospectus includes industry and market data that we obtained from periodic industry publications, third-party studies and surveys, filings of public companies in our industry and internal company surveys. These sources include government and industry sources. Industry publications and surveys generally state that the information contained therein has been obtained from sources believed to be reliable. Although we believe the industry and market data to be reliable as of the date of this prospectus, this information could prove to be inaccurate. Industry and market data could be wrong because of the method by which sources obtained their data and because information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. In addition, we do not know all of the assumptions regarding general economic conditions or growth that were used in preparing the forecasts from the sources relied upon or cited herein.

IMPLICATIONS OF BEING AN EMERGING GROWTH COMPANY

As a company with less than $1.0 billion in gross revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of reduced regulatory and reporting requirements that are otherwise generally applicable to public companies. As an emerging growth company:

| • | we may present only two years of audited financial statements and only two years of related “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this prospectus; |

ii

Table of Contents

| • | we are exempt from the requirement to obtain an attestation and report from our auditors on the assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act; |

| • | we are permitted to provide less extensive disclosure about our executive compensation arrangements; and |

| • | we are not required to hold non-binding advisory votes on executive compensation or golden parachute arrangements. |

We may take advantage of these provisions for up to five years unless we earlier cease to be an emerging growth company. We will cease to be an emerging growth company if we have more than $1.0 billion in annual gross revenues, have more than $700.0 million in market value of our common stock held by non-affiliates, or issue more than $1.0 billion of non-convertible debt in a three-year period. We may choose to take advantage of some but not all of these reduced regulatory and reporting requirements. We have elected to adopt the reduced disclosure requirements described above for purposes of the registration statement of which this prospectus is a part.

Following this offering, we may continue to take advantage of some or all of the reduced regulatory, accounting and reporting requirements that will be available to us as long as we continue to qualify as an emerging growth company. Under the JOBS Act, emerging growth companies can delay adopting new or revised accounting standards until such time as those standards apply to private companies. While we have elected to retain the ability to delay adopting new or revised accounting standards in the future, at June 30, 2014, December 31, 2013 and December 31, 2012, we had adopted all new accounting standards that could affect the comparability of our financial statements to those of other public entities.

iii

Table of Contents

This summary highlights information contained elsewhere in this prospectus. This summary may not contain all of the information that you should consider before deciding to invest in our common stock. You should read this entire prospectus carefully, including the “Risk Factors” section and the consolidated financial statements and the notes to those statements.

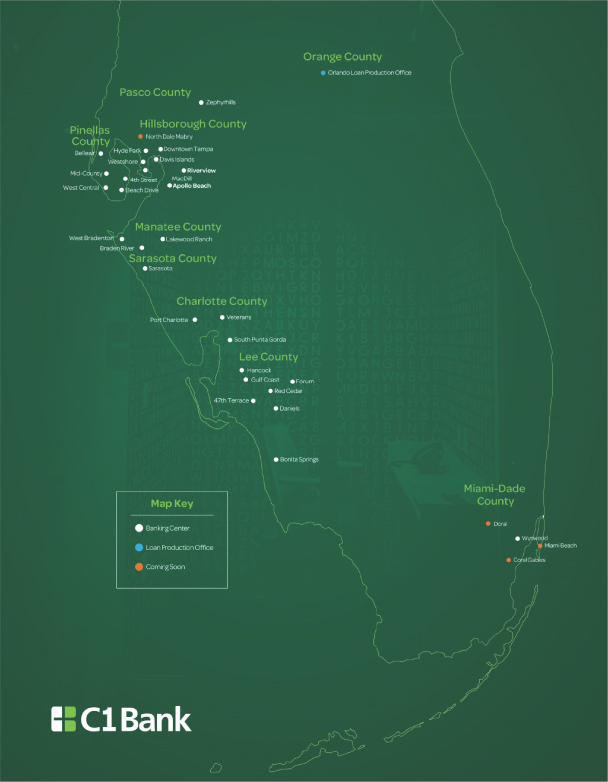

C1 Bank

Our name expresses our ideals to put our Clients 1st and our Community 1st. We are focused on serving the needs of entrepreneurs, tailoring a wide range of relationship banking services to entrepreneurs and their families, including commercial loans and a full line of depository products. We are based in St. Petersburg, Florida and operate from 28 banking centers and one loan production office on the West Coast of Florida and in Miami-Dade and Orange Counties. Now the 20th largest bank in the state of Florida by assets and the 19th largest by equity, having grown both organically and through acquisitions, we are near the top 1% of the fastest growing banks in the country as measured by asset growth, increasing assets from $260 million at December 31, 2009 to $1.4 billion at June 30, 2014.

Why Do Our Clients Bank with Us?

| 1. | We are a Bank by Entrepreneurs for Entrepreneurs. We believe our team is comprised of people with deep relationships in the communities we serve, with fundamental market and product knowledge and people who can provide sophisticated business advice to Florida’s entrepreneurs. We believe that we care more and that we try harder and that’s why businesses across the state of Florida are switching to C1 Bank. We invest in technology, developing applications to enhance our relationships with our clients and to make us more productive. |

| 2. | We believe we are great at making loans that satisfy the unique needs of our clients. In 2013, we made $418 million in new loan commitments with a focus on businesses and entrepreneurs across the state of Florida. From a $250,000 SBA loan to a $30 million commercial loan—we have the knowledge, sophistication and desire to get deals done quickly and tailored to meet the specific needs of businesses and entrepreneurs. |

| 3. | We believe our deposit accounts are simple and fair. We offer two types of checking accounts for businesses, depending on their needs. Same for families—two easy choices (plus special accounts for seniors and for students). We have 28 banking centers in eight counties as well as online and mobile banking. We believe our fees are fair when we charge them. We even pay clients $5 per month for the first year they bank with us as opposed to our regional and money-center competitors who often charge $5 per month for checking accounts. |

| 4. | We are committed to the communities we serve. We are the Bank of the Tampa Bay Buccaneers, the Bank of the Outback Bowl, the Bank of the Tampa Bay Rowdies and a corporate partner of the Miami HEAT. We volunteer, we give back, and we are committed to being a good corporate citizen. The design of our banking centers is deliberate—saying something about who we are—modern, technology forward and relevant to the communities we serve. |

| 5. | We believe we treat our people right. Our culture is based on passion—for our clients, for technology, for productivity and for being the best at what we do. Recently, we announced an industry leading initiative to pay a living wage and full benefits to all of our employees. We believe that we do the right thing by our employees and that this allows us to attract and retain who we believe to be the very best banking employees. |

1

Table of Contents

Our History

While the Bank’s charter dates back to 1995, the modern history of the Bank began in December 2009, in the midst of the recession, when four investors, including our CEO, Trevor Burgess, made a significant recapitalizing investment in Community Bank of Manatee, a small five-branch traditional community bank based in Bradenton, Florida. These investors led the turnaround and transformation of the Bank by instituting the entrepreneurial and service-based culture the Bank enjoys today, changing the name to C1 Bank, and making the following successful strategic acquisitions of challenged Florida banks:

| • | First Community Bank of America. On May 31, 2011, we acquired First Community Bank of America, or FCBA, for $10 million in cash, adding approximately $434 million in assets and 11 banking centers, raising our total assets to approximately $750 million and expanding our footprint to 17 locations covering the entire Tampa Bay region. |

| • | The Palm Bank. On May 31, 2012, we acquired The Palm Bank for $5.5 million in cash, adding approximately $119 million in assets and three banking centers taking us to 21 total locations and expanding our footprint in Tampa. |

| • | First Community Bank of Southwest Florida. On August 2, 2013, we assumed approximately $241 million in assets and all of the approximately $237 million in deposits of the failed First Community Bank of Southwest Florida from the Federal Deposit Insurance Corporation, or FDIC, as receiver. This transaction raised our total assets to approximately $1.3 billion, total deposits to approximately $1 billion, and total loans to approximately $900 million. Additionally, we acquired all seven of First Community Bank of Southwest Florida’s banking centers to expand our footprint further south on the West Coast of Florida into Fort Myers, Cape Coral and Bonita Springs. |

These acquisitions immediately increased our scale and geographic footprint. We have realized significant synergies as a result of our initiatives to rapidly manage and reduce levels of problem assets, consolidate and improve systems and technology, hire and train key personnel, institute improved uniform lending practices and import our entrepreneurial and service-based culture to drive growth and customer satisfaction. We believe all of these actions, along with material organic growth, have successfully driven stockholder value.

Making It Happen at C1 Bank

We have achieved a number of exciting milestones since December 2009, including:

| • | growing our total assets from $260 million at December 31, 2009 to $1.4 billion at June 30, 2014, a compound annual growth rate of 46%; |

| • | growing non-interest-bearing deposits from $17 million at December 31, 2009 to $253 million at June 30, 2014, a compound annual growth rate of 81%, while growing overall deposits from $219 million to $1.1 billion during the same timeframe, with a compound annual growth rate of 44%; |

| • | growing new loan origination from $84 million in 2010 to $142 million in 2011 to $202 million in 2012 to $418 million in 2013, which, combined with acquisitions, allowed us to grow our loans by 12%, 162%, 21% and 59%, respectively, during these periods; |

| • | capitalizing on the investment of our four lead investors who have personally invested nearly $70 million and have attracted approximately $35 million of additional capital to support the growth of the Bank since December 2009; |

| • | ranking number one among local banks by number of SBA loans in the Tampa Bay region in 2013 by maximizing our use of the SBA program as a way to boost return on equity for as many owner-occupied loans as possible; |

2

Table of Contents

| • | hiring a differentiated management team with diverse knowledge and prior experience not typically seen at a community bank; |

| • | expanding into Miami beginning in January 2013 with a loan production office and then, in January 2014, opening our highly publicized first flagship banking center in Miami’s Wynwood Arts District. As of June 30, 2014, after approximately six months of operation, our Wynwood location had $74 million in deposits and a cost of funds of just 17 basis points, the lowest cost of funds of any banking center in our network; |

| • | attracting and retaining the best talent by initiatives such as the community-focused introduction of a living-wage rate of pay for all full-time employees; |

| • | highlighting the recognition of our CEO, Trevor Burgess, who was named the 2013 Ernst & Young Florida Entrepreneur of the Year in the Financial Services Category; |

| • | establishing C1 Labs, a technology innovation group within the Bank and filing seven patent applications for financial technology products, which help increase productivity and improve our relationships with our clients; |

| • | winning the Coolest Office Space in Tampa Bay by the Tampa Bay Business Journal in recognition of our open plan, productivity and technology focused headquarters; and |

| • | opening on Main Street in Sarasota by taking a foreclosed property and making it into a flagship, design relevant, banking center. |

C1 Market Areas

Our banking operations are concentrated in three of the top six MSAs in the Southeast by population and the three largest business markets in Florida: Tampa Bay, Miami-Dade and Orlando. Our Florida market includes our headquarters in St. Petersburg and 28 banking centers and one loan production office which are located in Pinellas, Hillsborough, Lee, Manatee, Charlotte, Miami-Dade, Pasco, Sarasota and Orange counties. We have chosen to operate in these markets because we believe they will continue to exhibit higher growth rates than other markets across the state.

We have successfully executed our growth initiative through strategic acquisitions and organic growth. Our acquisitions of FCBA, The Palm Bank and First Community Bank of Southwest Florida strengthened our presence in our existing markets, while growing our franchise in surrounding counties. Our recent entry into the Miami-Dade market provides us a platform to further expand into this highly populated market, which is home to many small businesses and entrepreneurs. We entered the Miami-Dade market with a loan production office in January 2013 and were able to originate $154 million in loans in our first year. In January 2014, we closed the loan production office and opened our first Miami banking center with a highly differentiated look and feel in Miami’s Wynwood Arts District. We opened a loan production office in Orlando in June 2014 and hired our first full-time commercial lender focused on that market, aiming to replicate our successful Miami strategy.

3

Table of Contents

The following table shows demographic information for our market areas and highlights Florida’s rapid growth compared to the United States as a whole.

| Metropolitan Statistical Area |

Total Population 2014 (Actual) |

Population Change 2010-2014 (%) |

Projected Population Change 2014-2019 (%) |

Median Household Income 2014 ($) |

Projected Household Income Change 2014-2019 (%) |

|||||||||||||||

| Tampa-St Petersburg-Clearwater |

2,886,350 | 3.70 | 5.05 | 43,838 | 5.22 | |||||||||||||||

| Cape Coral-Fort Myers |

664,763 | 7.44 | 8.09 | 45,237 | 5.10 | |||||||||||||||

| North Port-Sarasota-Bradenton |

735,292 | 4.70 | 5.92 | 44,770 | 3.22 | |||||||||||||||

| Punta Gorda |

167,264 | 4.55 | 5.82 | 40,945 | 2.79 | |||||||||||||||

| Miami-Fort Lauderdale-West Palm Beach |

5,860,668 | 5.32 | 6.44 | 44,967 | 4.10 | |||||||||||||||

| Orlando-Kissimmee-Sanford |

2,277,414 | 6.70 | 7.48 | 45,240 | 2.81 | |||||||||||||||

| Florida |

19,654,457 | 4.54 | 5.74 | 44,318 | 3.82 | |||||||||||||||

| United States |

317,199,353 | 2.74 | 3.50 | 51,579 | 4.05 | |||||||||||||||

Sources: SNL Financial; Bureau of Labor Statistics.

Our Competitive Strengths

Entrepreneurial approach to banking. Entrepreneurial spirit is paramount to our culture. We focus on hiring and training sophisticated bankers who can be trusted advisors to our business clients in stark contrast to what we believe to be the impersonal, transactional approach of many of our competitors. We seek to establish long-term relationships with our clients so that we can customize loans to meet the needs of these entrepreneurs. Fast, local decision making and certainty of execution further differentiate our approach and give us the ability to charge a competitive, yet premium yield on our new loans. By focusing on entrepreneurial clients, we further refine our ability to provide sophisticated and tailored services, which many of our competitors are unable to match. We focus on growing core deposits from businesses and individuals through our extensive banking center network and via our new proprietary technologies, such as our iPad account opening software. At our headquarters we have no individual offices and no secretaries in order to emphasize the importance of productivity, collaboration, speed, the use of technology, and client focus. We have also developed a Management Associate Program in partnership with the University of South Florida to attract and develop the future leaders of the Bank.

Well positioned in a growing and attractive market. The state of Florida is the fourth fastest growing state in the United States. In 2013 alone, Florida’s population increased by over 230,000 people. Its population has grown from 12.9 million in 1990 to 19.2 million in 2013 and is expected to approach 21 million by 2020. This growth generates job creation, commercial development and housing starts. Our operations are focused in the Tampa Bay area with 27 banking centers in seven contiguous counties along the West Coast of Florida. In addition, we recently opened our first banking center in Miami-Dade, one of the fastest growing market in the state, and have three more banking centers planned to open in Miami-Dade by the end of 2015. We believe our demonstrated ability to successfully grow and our focus on entrepreneurs will give us a competitive advantage in these growing markets.

Differentiated brand positioning. We actively work to position our brand to attract entrepreneurs in four ways. First, we have been able to capture the press and the public’s attention through an aggressive public relations strategy. Second, we are deeply involved in the communities in which we serve, which increases our local market knowledge, grows our relationships with members of the local business community and increases awareness of our brand. Third, we use sports marketing to entertain thousands of existing and potential clients each year and to increase brand awareness and strengthen relationships with existing and potential clients. Fourth, we are focused on a highly differentiated modern and technology-forward design for our banking centers and our headquarters, which makes us stand out from our more traditional, mahogany-laden competitors.

4

Table of Contents

Long-term risk mitigation focus. Our directors and management have invested a material portion of their net worth in the Bank and as a result are acutely focused on risk mitigation and cost discipline. Our experience of turning around four troubled banks was extremely valuable in developing broad risk-mitigation policies and procedures. Having foreclosed on hundreds of loans, we learned a lot about the mistakes made by banks in Florida. We make many decisions to benefit long-term risk reduction, even at the expense of short-term gain, such as:

| • | we seek a lower risk profile by actively managing our assets and liabilities. We focus on limiting fixed-rate loans to five years or less and more than 60% of our loans have some variable rate component. We continue to grow core deposits and use Certificates of Deposit and Federal Home Loan Bank, or FHLB, borrowings to extend fixed-rate liabilities. For example, our FHLB borrowings have an average weighted maturity of 36 months as of June 30, 2014; |

| • | we primarily require properly margined real estate to secure our business loans; |

| • | we have a complete separation between the lending and credit departments with no individual lending authority at the Bank. All loans over $1 million require consensus of all members of our loan committee; and |

| • | we liquidated our securities portfolio in 2013 to eliminate mark-to-market interest rate risk in a rising rate environment. Our liquidity therefore largely consists of cash, greatly reducing risk while increasing flexibility to fund loan demand. |

Innovative approach to technology. We established C1 Labs as a group of bank employees focused on developing proprietary technology to improve our productivity and enhance our client relationships. For example, our iPad account opening software allows our bankers to open accounts more quickly and accurately than the traditional branch-based method. This software and technology also enables us to open accounts at a client’s office or place of business, or at our banking centers, in under three minutes. In addition, we have an internal tool that empowers our client managers to price loans in real time, in field with a pre-approved, risk-adjusted return-on-equity calculator. With over 3,000 simulations run to date by lenders, this tool allows us to measure incremental risk-adjusted return on equity as well as more closely tie compensation to performance. We believe our technology offers our clients a unique and convenient banking experience that is not available at traditional community banks, which will help drive future loan and deposit growth in the markets we serve. Furthermore, we believe our investments in our technology infrastructure will enable us to support our future growth and reduce long-term operational costs.

We have filed seven non-provisional patent applications in the United States and intend to file additional patent applications on these technologies and others we have in development. We are also exploring the opportunity of licensing these technologies to third parties.

Our Business Strategy

Our strategy is to “care more and try harder.” We strive to enhance stockholder value by:

Growing organically to leverage our brand awareness and expand our loan and deposit market share in Florida, particularly in the high-growth Tampa Bay and Miami-Dade markets by:

| • | growing relationships with new clients and enhancing existing relationships by hiring and retaining client managers with deep community ties, deep subject matter expertise and the sophistication to offer valuable business advice and creative solutions to meet the needs of our clients; |

| • | opening new banking centers including three in Miami-Dade and one on the West Coast of Florida by the end of 2015; |

5

Table of Contents

| • | opening a loan production office in Orlando in June 2014, expanding into one of the fastest growing markets in Florida and the third largest business market after Miami-Dade and Tampa; and |

| • | hiring, training, and equipping best-in-class client managers to serve the needs of Florida’s entrepreneurs. |

Increasing profitability and improving efficiency to increase our return on equity and return on assets by:

| • | capitalizing on our established infrastructure to realize economies of scale. Our average assets per employee, for example, have grown from $4.6 million in 2012 to $6.6 million in the first half of 2014 (a metric we intend to continue to increase); |

| • | continuing to invest in technology to drive productivity; and |

| • | resolving problem loans and selling foreclosed-upon property from acquired banks to reduce costs and to allow those assets to be redeployed into profitable new loans. We work to maximize the outcome of these classified assets by focusing on the recovery of all amounts due under the law including through the collection of deficiency judgments. |

Completing strategic acquisitions by building on our track record of successfully acquiring and integrating community banks as follows:

| • | analyzing opportunities for acquisition, especially among the 141 Florida banks with less than $750 million in assets at June 30, 2014, 120 of which are located in our target markets outside of the panhandle. We believe these banks are good targets either because of scale or operational challenges, regulatory pressure, management succession issues or stockholder liquidity needs; |

| • | targeting community banks in our existing markets or in adjacent growth regions of Florida such as the I-4 corridor, Orlando and south Florida; and |

| • | using the Wall Street experience and background of our CEO and fellow investors in negotiating and structuring acquisitions to increase the overall value of our franchise. |

Risks to Consider

Before investing in our common stock, you should carefully consider all the information in this prospectus, including matters set forth under the heading “Risk Factors.” These risks include, among others, the following:

| • | the geographic concentration of our markets makes our business highly susceptible to downturns in the local economies and depressed banking markets, which could be detrimental to our financial condition; |

| • | we are a community bank and our ability to maintain our reputation is critical to the success of our business and the failure to do so may materially adversely affect our performance; |

| • | a return of recessionary conditions could result in increases in our level of nonperforming loans and/or reduce demand for our products and services, which could have an adverse effect on our results of operations; |

| • | we are currently exempt from certain corporate governance requirements since we are a “controlled company” within the meaning of NYSE rules and, as a result, you will not have the protections afforded by these corporate governance requirements; |

| • | we are subject to extensive state and federal financial regulation, and compliance with changing requirements may restrict our activities or have an adverse effect on our results of operations; |

| • | our financial performance will be negatively impacted if we are unable to execute our growth strategy; and |

| • | the loss of any member of our management team and our inability to make up for such loss with a qualified replacement could harm our business. |

6

Table of Contents

Corporate Information

We were incorporated in the state of Florida on July 2, 2013. On December 19, 2013, the Bank’s primary stockholder, CBM Florida Holding Company, or CBM, merged with the Company. Our operations are conducted through C1 Bank which was founded in 1995 under the name Community Bank of Manatee. Our principal executive offices are located at 100 5th Street South, St. Petersburg, Florida, 33701 and our telephone number is (877) 266-2265. We also maintain an Internet site at www.c1bank.com. Our website and the information contained therein or connected thereto is not incorporated into this prospectus or the registration statement of which it forms a part.

7

Table of Contents

| Common stock offered |

2,631,579 shares |

| Common stock to be outstanding after this offering |

15,970,436 shares |

| Over-allotment option |

394,737 shares |

| Voting rights |

One vote per share |

| Use of proceeds |

We estimate that the net proceeds to us from this offering will be approximately $45.4 million, or approximately $52.3 million if the underwriters exercise their over-allotment option in full, assuming an initial public offering price of $19.00 per share (the midpoint of the range set forth on the cover page of this prospectus), after deducting estimated underwriting discounts and commissions and estimated offering expenses. Each $1 increase (decrease) in the initial public offering price per share would increase (decrease) our net proceeds, after deducting estimated underwriting discounts and commissions, by $2.4 million (assuming no exercise of the underwriters’ over-allotment option). |

| We intend to use the net proceeds of this offering for working capital and other general corporate purposes, including to finance our expected growth, fund capital expenditures, or expand our existing business through investments in or acquisitions of other business, although at present we do not have any current plans, arrangements or understandings to make any material capital investments or make any material acquisitions. |

| Dividend policy |

We currently do not intend to pay dividends on our common stock. We plan to retain any earnings for use in the operation of our business and to fund future growth. See “Dividend Policy.” |

| Directed share program |

The underwriters have reserved for sale at the initial public offering price up to 5% of the common stock being offered by this prospectus for sale to certain of our employees, executive officers, directors, business associates and related persons who have expressed an interest in purchasing our common stock in the offering. Except as described under “Executive Compensation—IPO Bonuses”, we do not know if these persons will choose to purchase all or any portion of these reserved shares, but any purchases they do make will reduce the number of shares available to the general public. See “Underwriting.” |

| NYSE listing |

Our common stock has been approved for listing on the New York Stock Exchange under the trading symbol “BNK.” |

| Risk factors |

Investing in our common stock involves risks. Please see the section entitled “Risk Factors” as well as other cautionary statements throughout this prospectus, before investing in shares of our common stock. |

8

Table of Contents

Unless we specifically state otherwise, the information in this prospectus does not take into account (i) the 7 for 1 reverse stock split that we intend to effectuate simultaneously upon the execution of an underwriting agreement in connection with this offering and (ii) the issuance of up to 394,737 shares of common stock that the underwriters have the option to purchase from C1 Financial solely to cover over-allotments. If the underwriters exercise their over-allotment option in full, 16,365,173 shares of common stock will be outstanding after this offering.

9

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL AND OTHER DATA

The following table sets forth our summary consolidated financial data (i) as of and for the six-month period ended June 30, 2014 and 2013 and (ii) as of and for the years ended December 31, 2013 and 2012. The summary consolidated financial data as of and for the years ended December 31, 2013 and 2012 has been derived from our audited consolidated financial statements included elsewhere in this prospectus. The summary consolidated financial data as of and for the six-month period ended June 30, 2014 and 2013 have been derived from our unaudited consolidated financial statements included elsewhere in this prospectus. The summary consolidated financial and other data does not reflect the 7 for 1 reverse stock split that we intend to effectuate simultaneously upon the execution of an underwriting agreement in connection with this offering. The unaudited consolidated financial statements include all of our accounts, including the accounts of the Bank, and, in the opinion of management, include all recurring adjustments and normal accruals necessary for a fair presentation of our financial position, results of operations and cash flows for the dates and periods presented.

The Bank acquired FCBA, The Palm Bank and First Community Bank of Southwest Florida on May 31, 2011, May 31, 2012 and August 2, 2013, respectively. Our consolidated financial statements include the financial position, results of operations and cash flows of these acquired banks as of June 1, 2011, June 1, 2012 and August 3, 2013, respectively. Consequently, our results of operations for these periods are not fully comparable.

You should read the information set forth below in conjunction with “Use of Proceeds,” “Capitalization,” “Management’s Discuss and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and notes thereto included elsewhere in this prospectus. Our historical consolidated financial data may not be indicative of our future performance.

| As of and for Six- Month Period Ended June 30, |

As of and for Years Ended December 31, |

|||||||||||||||

| 2014 | 2013 | 2013 | 2012 | |||||||||||||

| (in thousands, except per share data and ratios) | ||||||||||||||||

| Statement of Income Data |

||||||||||||||||

| Interest income |

$ | 30,907 | $ | 19,857 | $ | 48,499 | $ | 38,201 | ||||||||

| Interest expense |

4,164 | 2,857 | 6,650 | 6,127 | ||||||||||||

| Net interest income |

26,743 | 17,000 | 41,849 | 32,074 | ||||||||||||

| Provision for loan losses |

4,608 | 15 | 1,218 | 2,358 | ||||||||||||

| Bargain purchase gain |

11 | — | 13,462 | 6,235 | ||||||||||||

| Gain (loss) on sale of securities |

241 | 576 | 305 | 3,035 | ||||||||||||

| Total noninterest income |

4,387 | 3,063 | 21,648 | 15,051 | ||||||||||||

| Total noninterest expense |

21,947 | 18,555 | 42,637 | 33,963 | ||||||||||||

| Income before income taxes |

4,575 | 1,493 | 19,642 | 10,804 | ||||||||||||

| Income tax expense (benefit) |

1,819 | 567 | 7,652 | (2,304 | ) | |||||||||||

| Net income |

2,756 | 926 | 11,990 | 13,108 | ||||||||||||

| Per Share Outstanding Data |

||||||||||||||||

| Net earnings (loss) per share |

$ | 0.03 | $ | 0.01 | $ | 0.15 | $ | 0.18 | ||||||||

| Diluted net earnings (loss) per share |

0.03 | 0.01 | 0.15 | 0.18 | ||||||||||||

| Common shares outstanding at year or period end (000s) |

93,379 | 78,299 | 85,519 | 74,541 | ||||||||||||

| Diluted shares outstanding (000s) |

93,379 | 78,520 | 85,629 | 74,806 | ||||||||||||

| Book value per share |

$ | 1.50 | $ | 1.29 | $ | 1.42 | $ | 1.29 | ||||||||

| Tangible book value per share |

1.49 | 1.28 | 1.40 | 1.29 | ||||||||||||

| Balance Sheet Data |

||||||||||||||||

| Cash and due from banks |

$ | 258,944 | $ | 208,753 | $ | 143,452 | $ | 77,038 | ||||||||

| Securities available for sale |

— | — | — | 109,423 | ||||||||||||

| Loans receivable, gross |

1,062,701 | 724,811 | 1,053,029 | 663,634 | ||||||||||||

| Loans originated by C1 Bank (Nonacquired) |

665,615 | 400,365 | 614,613 | 301,858 | ||||||||||||

| Loans acquired(1) |

397,086 | 324,446 | 438,416 | 361,776 | ||||||||||||

| Total assets |

1,449,214 | 1,031,699 | 1,323,371 | 938,066 | ||||||||||||

| Total deposits |

1,135,451 | 789,345 | 1,041,043 | 760,041 | ||||||||||||

| Borrowings |

168,500 | 136,500 | 153,500 | 78,300 | ||||||||||||

| Total liabilities |

1,309,023 | 930,502 | 1,201,557 | 841,619 | ||||||||||||

| Total stockholders’ equity |

140,191 | 101,197 | 121,814 | 96,447 | ||||||||||||

| Tangible stockholders’ equity |

138,752 | 100,743 | 120,080 | 95,828 | ||||||||||||

10

Table of Contents

| As of and for Six- Month Period Ended June 30, |

As of and for Years Ended December 31, |

|||||||||||||||

| 2014 | 2013 | 2013 | 2012 | |||||||||||||

| (in thousands, except per share data and ratios) | ||||||||||||||||

| Capital Ratios |

||||||||||||||||

| Total capital to risk-weighted assets |

12.42 | % | 12.99 | % | 10.97 | % | 12.54 | % | ||||||||

| Tier 1 capital to risk-weighted assets |

11.98 | % | 12.48 | % | 10.62 | % | 12.03 | % | ||||||||

| Tier 1 capital to average assets |

9.72 | % | 9.92 | % | 9.36 | % | 10.18 | % | ||||||||

| Tier 1 leverage ratio |

9.73 | % | 9.94 | % | 9.36 | % | 10.21 | % | ||||||||

| Tangible Common Equity / Tangible Assets |

9.58 | % | 9.77 | % | 9.09 | % | 10.22 | % | ||||||||

| Equity / Assets |

9.67 | % | 9.81 | % | 9.20 | % | 10.28 | % | ||||||||

| Asset Quality Ratios |

||||||||||||||||

| Total non-performing loans to loans receivable |

2.02 | % | 2.33 | % | 2.26 | % | 3.51 | % | ||||||||

| Total non-performing assets to total assets |

3.98 | % | 3.58 | % | 4.90 | % | 4.51 | % | ||||||||

| Total allowance for loan losses to non-performing loans |

21.41 | % | 16.54 | % | 14.35 | % | 12.07 | % | ||||||||

| Net charge-offs (recoveries) to total loans |

0.65 | % | 0.01 | % | 0.08 | % | 0.88 | % | ||||||||

| Nonacquired net charge-offs (recoveries) to total nonacquired loans |

1.27 | % | 0.00 | % | 0.00 | % | 0.02 | % | ||||||||

| Allowance for loan losses to total loans |

0.43 | % | 0.39 | % | 0.32 | % | 0.42 | % | ||||||||

| Allowance for loan losses to nonacquired loans |

0.69 | % | 0.70 | % | 0.56 | % | 0.93 | % | ||||||||

| Nonperforming Assets |

||||||||||||||||

| Nonacquired non-performing assets |

$ | 507 | $ | 710 | $ | 737 | $ | 47 | ||||||||

| Nonaccrual loans |

463 | 663 | 693 | — | ||||||||||||

| OREO(2) |

44 | 47 | 44 | 47 | ||||||||||||

| Nonacquired restructured loans |

— | — | 64 | — | ||||||||||||

| Nonacquired non-performing assets to nonacquired loans plus OREO |

0.08 | % | 0.18 | % | 0.12 | % | 0.02 | % | ||||||||

| Acquired non-performing assets |

$ | 57,225 | $ | 36,228 | $ | 64,094 | $ | 42,296 | ||||||||

| Nonaccrual loans |

20,990 | 16,231 | 23,089 | 23,315 | ||||||||||||

| OREO |

36,234 | 19,997 | 41,005 | 18,980 | ||||||||||||

| Acquired restructured loans(3) |

921 | 948 | 916 | 2,124 | ||||||||||||

| Acquired non-performing assets to acquired loans plus OREO |

13.21 | % | 10.52 | % | 13.37 | % | 11.11 | % | ||||||||

| Loan Composition |

||||||||||||||||

| Acquired loans by type:(1) |

||||||||||||||||

| Owner occupied CRE |

$ | 118,854 | $ | 102,662 | $ | 132,834 | $ | 108,971 | ||||||||

| Non owner occupied CRE |

98,705 | 55,926 | 104,130 | 60,151 | ||||||||||||

| C&I |

26,840 | 23,774 | 29,707 | 29,719 | ||||||||||||

| C&D |

21,092 | 14,704 | 24,049 | 22,097 | ||||||||||||

| 1-4 family |

110,548 | 101,022 | 119,846 | 108,058 | ||||||||||||

| Multifamily |

6,437 | 9,662 | 9,212 | 12,326 | ||||||||||||

| Secured by farmland |

5,584 | 5,483 | 7,859 | 7,492 | ||||||||||||

| Consumer and other |

9,026 | 11,213 | 10,779 | 12,962 | ||||||||||||

| Nonacquired Loans by Type |

||||||||||||||||

| Owner occupied CRE |

97,458 | 63,478 | 71,662 | 47,109 | ||||||||||||

| Non owner occupied CRE |

240,886 | 130,167 | 201,225 | 112,987 | ||||||||||||

| C&I |

55,031 | 72,313 | 55,804 | 37,109 | ||||||||||||

| C&D |

52,238 | 28,089 | 66,925 | 37,322 | ||||||||||||

| 1-4 family |

94,675 | 42,026 | 76,392 | 43,592 | ||||||||||||

| Multifamily |

26,295 | 20,516 | 46,829 | 3,219 | ||||||||||||

| Secured by farmland |

60,179 | 18,910 | 62,487 | 14,176 | ||||||||||||

| Consumer and other |

38,853 | 24,866 | 33,289 | 6,344 | ||||||||||||

| New loan origination(4) |

208,222 | 133,965 | 417,567 | 202,189 | ||||||||||||

| Yield on loans |

5.80 | % | 5.67 | % | 5.83 | % | 5.78 | % | ||||||||

| Adjusted yield on loans(5) |

5.60 | % | 5.50 | % | 5.59 | % | 5.44 | % | ||||||||

| Deposit Composition |

||||||||||||||||

| Demand |

$ | 253,148 | $ | 145,265 | $ | 194,383 | $ | 108,862 | ||||||||

| NOW |

140,939 | 124,469 | 138,765 | 131,562 | ||||||||||||

| Money market and savings |

383,259 | 306,404 | 362,591 | 277,775 | ||||||||||||

| Retail time |

330,832 | 195,793 | 319,780 | 218,108 | ||||||||||||

| Jumbo time(6) |

27,273 | 17,414 | 25,524 | 23,734 | ||||||||||||

| Cost of deposits |

0.55 | % | 0.56 | % | 0.55 | % | 0.70 | % | ||||||||

| Adjusted cost of deposits(7) |

0.56 | % | 0.63 | % | 0.59 | % | 0.80 | % | ||||||||

| Selected Performance Metrics |

||||||||||||||||

| ROAA |

0.40 | % | 0.19 | % | 1.08 | % | 1.50 | % | ||||||||

| ROAE |

4.14 | % | 1.90 | % | 11.43 | % | 15.63 | % | ||||||||

| Net interest margin (NIM) |

4.31 | % | 4.06 | % | 4.31 | % | 4.03 | % | ||||||||

| Adjusted NIM(8) |

4.10 | % | 3.79 | % | 4.02 | % | 3.60 | % | ||||||||

| Efficiency ratio |

71.1 | % | 95.2 | % | 67.5 | % | 76.9 | % | ||||||||

| Yield on loans |

5.80 | % | 5.67 | % | 5.83 | % | 5.78 | % | ||||||||

| Cost of deposits |

0.55 | % | 0.56 | % | 0.55 | % | 0.70 | % | ||||||||

11

Table of Contents

| (1) | Loans not originated under C1 Bank (including loans originated by Community Bank of Manatee before the recapitalization by the four investors in December 2009 and those acquired from First Community Bank of America, The Palm Bank and First Community Bank of Southwest Florida). |

| (2) | OREO means other real estate owned. |

| (3) | Restructured loans include accruing and nonaccrual troubled debt restructurings. Nonaccrual restructured loans are included in Nonaccrual loans. Acquired restructured loans include restructurings from Community Bank of Manatee only. Restructured loans acquired from First Community Bank of America, The Palm Bank and First Community Bank of Southwest Florida were considered Purchased Credit Impaired loans. |

| (4) | Represents new loan commitments during the periods presented. |

| (5) | Excludes loan accretion from the acquired loan portfolio. |

| (6) | Jumbo time deposits include deposits over $250 thousand. |

| (7) | Excludes amortization of premium for acquired time deposits. |

| (8) | Excludes loan accretion from the acquired loan portfolio and amortization of premiums for acquired time deposits and Federal Home Loan Bank advances. |

GAAP Reconciliation and Management Explanation of Non-GAAP Financial Measures

Some of the financial measures included in our selected consolidated financial and other data are not measures of financial performance recognized by GAAP. These non-GAAP financial measures include “adjusted yield on loans,” “adjusted cost of deposits,” “adjusted net interest margin,” “tangible stockholders’ equity,” “tangible book value per share,” “tangible common equity to tangible assets,” and “efficiency ratio.” Our management uses these non-GAAP financial measures in its analysis of our performance:

| • | “Adjusted yield on loans” is our yield on loans after excluding loan accretion from our acquired loan portfolio. Our management uses this metric to better assess the impact on purchase accounting over yield on loans, as the effect of loan discounts accretion is expected to decrease as the acquired loans roll off of our balance sheet. |

| • | “Adjusted cost of deposits” is our cost of deposits after excluding amortization of premium for acquired time deposits. Our management uses this metric to better assess the impact on purchase accounting over cost of deposits, as the effect of amortization of premium related to deposits is expected to decrease as the deposits mature or roll off of our balance sheet. |

| • | “Adjusted net interest margin” is net interest margin after excluding loan accretion from the acquired loan portfolio and amortization of premiums for acquired time deposits and Federal Home Loan Bank advances. Our management uses this metric to better assess the impact on purchase accounting over net interest margin, as the effect of loan discounts accretion and amortization of premium related to deposits or borrowing is expected to decrease as the acquired loans and deposits mature or roll off of our balance sheet. |

| • | “Tangible stockholders’ equity” is stockholders’ equity less goodwill and other intangible assets. We have not considered loan servicing rights as an intangible asset for purposes of this calculation. |

| • | “Tangible book value per share” is defined as total equity reduced by goodwill and other intangible assets divided by total common shares outstanding. This measure is important to investors interested in changes from period-to-period in book value per share exclusive of changes in intangible assets. We have not considered loan servicing rights as an intangible asset for purposes of this calculation. |

| • | “Tangible average equity to tangible average assets” is defined as the ratio of average stockholders’ equity less average goodwill and average other intangible assets, divided by average total assets less average goodwill and average other intangible assets. This measure is important to investors interested in relative changes from period to period in equity and total assets, each exclusive of changes in intangible assets. We have not considered average loan servicing rights as an intangible asset for purposes of this calculation. |

| • | “Efficiency ratio” is defined as total noninterest expense divided by the sum of net interest income and noninterest income. This measure is important to investors looking for a measure of efficiency in the Company’s productivity measured by the amount of revenue generated for each dollar spent. |

12

Table of Contents

We believe these non-GAAP financial measures provide useful information to management and investors that is supplementary to our financial condition, results of operations and cash flows computed in accordance with GAAP; however, we acknowledge that our non-GAAP financial measures have a number of limitations. As such, you should not view these disclosures as a substitute for results determined in accordance with GAAP, and they are not necessarily comparable to non-GAAP financial measures that other companies use. The following reconciliation table provides a more detailed analysis of these non-GAAP financial measures:

| As of and for Six-Month Period Ended June 30, |

As of and for Years Ended December 31, |

|||||||||||||||

| 2014 | 2013 | 2013 | 2012 | |||||||||||||

| (in thousands, except per share data and ratios) | ||||||||||||||||

| Reported yield on loans |

5.80 | % | 5.67 | % | 5.83 | % | 5.78 | % | ||||||||

| Effect of accretion income on acquired loans |

0.20 | % | 0.17 | % | 0.24 | % | 0.34 | % | ||||||||

| Adjusted yield on loans |

5.60 | % | 5.50 | % | 5.59 | % | 5.44 | % | ||||||||

| Reported cost of deposits |

0.55 | % | 0.56 | % | 0.55 | % | 0.70 | % | ||||||||

| Effect of premium amortization on acquired time deposits |

(0.01 | %) | (0.07 | %) | (0.04 | %) | (0.10 | %) | ||||||||

| Adjusted cost of deposits |

0.56 | % | 0.63 | % | 0.59 | % | 0.80 | % | ||||||||

| Reported net interest margin |

4.31 | % | 4.06 | % | 4.31 | % | 4.03 | % | ||||||||

| Effect of accretion income on acquired loans |

0.16 | % | 0.14 | % | 0.19 | % | 0.26 | % | ||||||||

| Effect of premium amortization on acquired time deposits and borrowings |

0.05 | % | 0.13 | % | 0.10 | % | 0.17 | % | ||||||||

| Adjusted net interest margin |

4.10 | % | 3.79 | % | 4.02 | % | 3.60 | % | ||||||||

| Total stockholders’ equity |

$ | 140,191 | $ | 101,197 | $ | 121,814 | $ | 96,447 | ||||||||

| Less: |

||||||||||||||||

| Goodwill |

249 | 249 | 249 | 249 | ||||||||||||

| Other intangible assets |

1,190 | 205 | 1,485 | 370 | ||||||||||||

| Tangible stockholders’ equity |

138,752 | 100,743 | 120,080 | 95,828 | ||||||||||||

| Shares outstanding (000s) |

93,379 | 78,299 | 85,519 | 74,541 | ||||||||||||

| Tangible book value per share |

1.49 | 1.28 | 1.40 | 1.29 | ||||||||||||

| Average assets |

1,403,018 | 969,586 | 1,107,798 | 870,202 | ||||||||||||

| Average equity |

134,127 | 98,293 | 104,919 | 83,624 | ||||||||||||

| Average equity to average assets |

9.56 | % | 10.14 | % | 9.47 | % | 9.61 | % | ||||||||

| Average goodwill and other intangible assets |

1,595 | 538 | 972 | 459 | ||||||||||||

| Tangible average equity to tangible average assets |

9.46 | % | 10.09 | % | 9.38 | % | 9.56 | % | ||||||||

| Efficiency ratio |

||||||||||||||||

| Noninterest expense |

21,947 | 18,555 | 42,637 | 33,963 | ||||||||||||

| Net interest taxable equivalent income |

26,743 | 17,000 | 41,849 | 32,164 | ||||||||||||

| Noninterest taxable equivalent income (loss) |

4,387 | 3,063 | 21,648 | 15,051 | ||||||||||||

| Less gain (loss) on sale of securities |

241 | 576 | 305 | 3,035 | ||||||||||||

| Adjusted operating revenue |

30,889 | 19,487 | 63,192 | 44,180 | ||||||||||||

| Efficiency ratio |

71.1 | % | 95.2 | % | 67.5 | % | 76.9 | % | ||||||||

13

Table of Contents

You should carefully consider the following risks and all of the other information set forth in this prospectus before deciding to invest in shares of our common stock. If any of the following risks actually occurs, our business, financial condition or results of operations would likely suffer. In such case, the trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

Risks Relating to Our Business

The geographic concentration of our markets makes our business highly susceptible to downturns in the local economies and depressed banking markets, which could be detrimental to our financial condition.

Unlike larger financial institutions that are more geographically diversified, we are a banking franchise concentrated in the state of Florida. As of June 30, 2014, approximately 91% of the loans in our loan portfolio were made to borrowers who live and/or conduct business in Florida. Deterioration in local economic conditions in the loan market or in the commercial or industrial real estate market could have a material adverse effect on the quality of our portfolio by eroding the loan-to-value ratio of our portfolio, the demand for our products and services, the ability of borrowers to timely repay loans, the value of the collateral securing loans and our financial condition, results of operations and future prospects. In addition, if the population or income growth in the region is slower than projected, income levels, deposits and real estate development could be adversely affected and could result in the curtailment of our expansion, growth and profitability. If any of these developments were to result in losses that materially and adversely affected the Bank’s capital, we might be subject to regulatory restrictions on operations and growth and to a requirement to raise additional capital.

We are a community bank and our ability to maintain our reputation is critical to the success of our business and the failure to do so may materially adversely affect our performance.

We are a community bank, and our reputation is one of the most valuable components of our business. As such, we strive to conduct our business in a manner that enhances our reputation. This is done, in part, by recruiting, hiring and retaining employees who share our core values of being an integral part of the communities we serve, delivering superior service to our customers and caring about our customers and associates. If our reputation is negatively affected, by the actions of our employees or otherwise, our business and, therefore, our operating results may be materially adversely affected.

A return of recessionary conditions could result in increases in our level of nonperforming loans and/or reduced demand for our products and services, which could have an adverse effect on our results of operations.

Economic growth has been slow and uneven, and unemployment levels remain high. Recovery by many businesses has been impaired by lower consumer spending. A return to prolonged deteriorating economic conditions and/or continued negative developments in the domestic and international credit markets could significantly affect the ability of our customers to operate, the markets in which we do business, the value of our loans and investments, and our ongoing operations, costs and profitability. These events may cause us to incur losses and may adversely affect our financial condition and results of operations.

Our allowance for loan losses and fair value adjustments may prove to be insufficient to absorb losses for our loans that we originated or acquired.

Lending money is a substantial part of our business and each loan carries a certain risk that it will not be repaid in accordance with its terms or that any underlying collateral will not be sufficient to assure repayment. This risk is affected by, among other things:

| • | cash flow of the borrower and/or the project being financed; |

| • | the changes and uncertainties as to the future value of the collateral, in the case of a collateralized loan; |

14

Table of Contents

| • | the duration of the loan; |

| • | the discount on the loan at the time of acquisition, if acquired; |

| • | the credit history of a particular borrower; and |

| • | changes in economic and industry conditions. |

As of June 30, 2014, December 31, 2013 and December 31, 2012 the allowance for loan losses was $4.6 million, $3.4 million and $2.8 million, respectively. Non-performing loans totaled $21.5 million, $23.8 million and $23.3 million as of June 30, 2014, December 31, 2013 and December 31, 2012, respectively. This total is large for a bank of our size and is primarily the result of our acquisition of several troubled banks. The amount of our allowance for loan losses for these non-performing loans is determined by our management team through periodic reviews. As most non-performing loans are related to acquired banks, they were marked to market and recorded at fair value at acquisition with no carryover of the allowance for loan losses. Therefore, our allowance for loan losses mainly reflects the general component allowance for performing loans.

Like all banks, we have developed and applied a methodology for determining, based upon a number of factors—including, for example, historical loss rates and assumptions regarding future losses—the appropriate level of allowance to maintain in respect of possible loan losses. In applying this methodology and determining the appropriate level of the allowance, we inherently face a high degree of subjectivity and are required to make significant estimates of current credit risks and future trends, all of which may undergo material changes. Changes in economic conditions affecting borrowers, new information regarding existing loans that we originate, identification of additional problem loans originated by us and other factors, both within and outside of our control, may require an increase in the allowance for loan losses. In addition, bank regulatory agencies periodically review our allowance for loan losses and may require an increase in the provision for probable loan losses or the recognition of further loan charge-offs, based on judgments different than those of management. In addition, if charge-offs in future periods exceed the allowance for loan losses, we will need additional provisions to increase the allowance for loan losses. Any increases in the allowance for loan losses will result in a decrease in net income and capital and may have a material adverse effect on our financial condition and results of operations. Furthermore, if our methodology or assumptions in determining our allowance for loan losses are not sound, then our allowance for loan losses will not be sufficient to cover our loan losses. See Note 1. Summary of Significant Accounting Policies and Note 5. Loans to our Consolidated Financial Statements for further information about this estimate and our methodology.

Given our limited history and significant portfolio growth, many of the loans originated by C1 Bank may be unseasoned, meaning that many of the loans were originated relatively recently. In particular, as of June 30, 2014, we had $1,063 million in loans outstanding. Approximately 63% of these loans, or $666 million, had been originated by C1 Bank since 2010. Our limited experience with these loans does not provide us with a significant payment history pattern with which to judge future collectability. As a result, it may be difficult to predict the future performance of our loan portfolio. These loans may have delinquency or charge-off levels above our expectations, which could negatively affect our performance.

Our financial performance will be negatively impacted if we are unable to execute our growth strategy.

Our current growth strategy is to grow organically and supplement that growth with select acquisitions. Our ability to grow organically depends primarily on generating loans and deposits of acceptable risk and expense, and we may not be successful in continuing this organic growth. Our ability to identify appropriate markets for expansion, recruit and retain qualified personnel, and fund growth at a reasonable cost, depends upon prevailing economic conditions, maintenance of sufficient capital, competitive factors and changes in banking laws, among other factors. Conversely, if we grow too quickly and are unable to control costs and maintain asset quality, such growth, whether organic or through select acquisitions, could materially and adversely affect our financial condition and results of operations.

15

Table of Contents

The institutions we have acquired, and may acquire in the future, have high levels of distressed assets and we may not be able to realize the value we predict from these assets or accurately estimate the future write-downs taken in respect of these assets.

Delinquencies and losses in the loan portfolios and other assets of financial institutions that we have acquired, and may acquire in the future, may exceed our initial forecasts developed during the due diligence investigation prior to acquiring those institutions. Even if we conduct extensive due diligence on an entity we decide to acquire, this diligence may not reveal all material issues that may affect that particular entity. The diligence process in FDIC-assisted transactions is also expedited due to the short acquisition timeline that is typical for these depository institutions. If, during the diligence process, we fail to identify issues specific to an entity or the environment in which the entity operates, we may be forced to later write down or write off assets, restructure our operations, or incur impairment or other charges that could result in other reporting losses. Moreover, the process of resolving the problem assets that we have acquired takes a significant amount of time. Throughout this process, such problem assets are subject to regular reappraisals, which could lead to write-offs or require us to establish additional allowance for loan losses. Any of these events could adversely affect the financial condition, liquidity, capital position and value of institutions we acquire and of the Company as a whole.

Changes in interest rates could have significant adverse effects on our financial condition and results of operations.

Fluctuations in interest rates could have significant adverse effects on our financial condition and results of operations. We are unable to predict changes in market interest rates, which are affected by many factors beyond our control, including inflation, recession, unemployment, money supply, domestic and international events and changes in financial markets in the United States and in other countries. Our net interest income is affected not only by the level and direction of interest rates, but also by the shape of the yield curve and relationships between interest-sensitive instruments and key driver rates, as well as balance sheet growth, client loan and deposit preferences and the timing of changes in these variables. In an environment in which interest rates are increasing, our interest costs on liabilities may increase more rapidly than our income on interest-earning assets. This could result in a deterioration of our net interest margin.

Liquidity risk could impair our ability to fund operations and jeopardize our financial condition.

Liquidity is essential to our business. Our loan-to-deposit ratio, calculated by dividing our total loans by our total deposits, exceeds 90% at June 30, 2014. A higher loan-to-deposit ratio generally means that a financial institution might not have enough liquidity to cover any unforeseen requirements or that the institution is more reliant on borrowings that may no longer be available.

An inability to raise funds through deposits, borrowings, and other sources could have a substantial negative effect on our liquidity. Our access to funding sources in amounts adequate to finance our activities on terms that are acceptable to us could be impaired by factors that affect us specifically, the financial services industry, or economy in general. Factors that could negatively impact our access to liquidity sources include a decrease of our business activity as a result of a downturn in the markets in which our loans are concentrated, adverse regulatory action against us, or our inability to attract and retain deposits. Our ability to borrow could be impaired by factors that are not specific to us, such as a disruption in the financial markets and diminished expectations or growth in the financial services industry.

Our funding sources may prove insufficient to replace deposits and support our future growth.

We rely on customer deposits, advances from the FHLB, nationally marketed CDs, brokered CDs and lines of credit at other financial institutions to fund our operations. Although we have historically been able to replace maturing deposits and advances if desired, we may not be able to replace such funds in the future if our financial condition, the financial condition of the FHLB or market conditions were to change. Our financial flexibility will be severely constrained if we are unable to maintain our access to funding or if adequate financing is not

16

Table of Contents

available to accommodate future growth at acceptable interest rates. Finally, if we are required to rely more heavily on more expensive funding sources to support future growth, our revenues may not increase proportionately to cover our costs. In this case, our profitability would be adversely affected.

FHLB borrowings and other current sources of liquidity may not be available or, if available, sufficient to provide adequate funding for operations. Furthermore, our own actions could result in a loss of adequate funding. For example, our availability at the FHLB could be reduced if we are deemed to have poor documentation or processes. Accordingly, we may seek additional higher-cost debt in the future to achieve our long-term business objectives. Additional borrowings, if sought, may not be available to us or, if available, may not be available on favorable terms. If additional financing sources are unavailable or are not available on reasonable terms, our growth and future prospects could be adversely affected.

Our loan portfolio includes unsecured, commercial, real estate, consumer and other loans that may have higher risks, and we currently exceed the regulatory guidelines for commercial real estate loans.

Our commercial real estate, residential real estate, construction, commercial, and consumer and other loans at June 30, 2014, were $654.4 million, $205.2 million, $73.3 million, $81.9 million, and $47.9 million, respectively, or 61.6%, 19.3%, 6.9%, 7.7%, and 4.5%, respectively, of our total loans. We have a high concentration of commercial real estate loans that exceeds guidance by the bank regulators. At June 30, 2014, December 31, 2013 and December 31, 2012 our ratio for construction, development and other land loans to total capital was 51%, 73%, and 61% respectively, compared to the FDIC guideline of 100%, while the ratio for commercial real estate loans (including construction, development and other land loans and loans secured by multi-family and non-owner occupied nonfarm nonresidential property) to total capital was 310%, 365% and 254% respectively, compared to the FDIC guideline of 300%.

The increase at December 31, 2013 resulted from the acquisition of First Community Bank of Southwest Florida that was completed in August 2013. In 2013, our board of directors authorized us to operate at up to 400% of total risk-based capital for commercial real estate loans until December 2014, at which time we will analyze market conditions and likely extend this authorization.

Commercial loans and commercial real estate loans generally carry larger balances and can involve a greater degree of financial and credit risk than other loans. As a result, banking regulators continue to give greater scrutiny to lenders with a high concentration of commercial real estate loans in their portfolios, such as us, and such lenders are expected to implement stricter underwriting standards, internal controls, risk management policies, and portfolio stress testing, as well as higher capital levels and loss allowances. The increased financial and credit risk associated with these types of loans are a result of several factors, including the concentration of principal in a limited number of loans and borrowers, the size of loan balances, the effects of general economic conditions on income-producing properties, and the increased difficulty of evaluating and monitoring these types of loans. During the recent economic downturn, financial institutions with high commercial real estate loan concentrations were more susceptible to failure. If we cannot effectively manage the risk associated with our high concentration of commercial real estate loans, our financial condition and results of operations may be adversely affected.

The nature of our commercial loan portfolio may expose us to increased lending risks.

We make both secured and unsecured commercial loans. Secured commercial loans are generally collateralized by real estate, accounts receivable, inventory, equipment or other assets owned by the borrower and include a personal guaranty of the business owner. Unsecured loans generally involve a higher degree of risk of loss than do secure loans because, without collateral, repayment is wholly dependent upon the success of the borrowers’ businesses. Because of this lack of collateral, we are limited in our ability to collect on defaulted unsecured loans.

17

Table of Contents

We are subject to risks associated with loans to Brazilian companies.

We currently have four loans to three Brazilian borrowers, with aggregate outstanding balances at June 30, 2014, December 31, 2013 and 2012 of $46.5 million, $46.4 million and $22.7 million, respectively. The collateral for these loans is held in Brazil and consists primarily of real estate. Two of the loans are secured by a first lien on farmland appraised at $80.8 million, another loan is secured by a first lien on farmland appraised at $79.5 million and the last loan is secured by closely held stock. There is inherent country risk associated with this international business. International trade laws, U.S. relations with Brazil, foreign exchange volatility, the foreign nature of the Brazilian legal system and regulatory changes may inhibit our ability to collect payment, or claim collateral (if any) located in Brazil. Furthermore, we may experience loss due to unforeseen economic or social conditions that affect Brazilian markets and in particular the market for Brazilian agriculture products. The expense of collecting on defaulted loans may be higher than in the United States, which may reduce the size of any recovery. We are also subject to the risk that the value of any real estate collateral could decline, further harming our ability to fully collect on any defaulted loan. The substantial size of each of these individual relationships could, if unpaid, materially adversely affect our earnings and capital.

Our largest loan relationships currently make up a material percentage of our total loan portfolio.