Attached files

| file | filename |

|---|---|

| S-1/A - FORM S-1 AMENDMENT NO. 2 - Upholstery International, Inc. | upholstery_s1a2.htm |

| EX-23.1 - EXHIBIT 23.1 - Upholstery International, Inc. | upholstery_s1a2ex23z1.htm |

| EX-99.2 - EXHIBIT 99.2 - Upholstery International, Inc. | upholstery_s1a2ex99z2.htm |

| EX-10.4 - EXHIBIT 10.4 - Upholstery International, Inc. | upholstery_s1a2ex10z4.htm |

PRIVATE EQUITY LOAN AGREEMENT

THIS PRIVATE EQUITY LOAN AGREEMENT (“Agreement) is made as of the 15th day of November 2013, by and between Ken’s Custom Upholstery, Inc., an Illinois corporation (“Borrower”), and Georgia Peaches, LLC, an Illinois limited liability company (“Lender”). Either Borrower or Lender may be individually referred to as a “party” or collectively as the “parties.”

RECITALS

A. The Borrower has requested from the Lender a private equity loan (the “Loan”), the proceeds of which are to be used to provide financing for the preparation and execution of the Borrower’s initial public offering.

B. The Lender is willing to agree to provide the Loan to the Borrower on the terms and conditions hereinafter contained:

AGREEMENT

NOW THEREFORE, in consideration of the foregoing recitals and of the mutual promises and covenants herein contained, the parties hereto agree as follows:

ARTICLE ONE

COMMITMENT OF LENDER; ISSUANCE OF SHARES

1.1 Advancing Loan. So long as there exists no Event of Default hereunder and no event has occurred which would be an Event of Default with the giving of notice or lapse of time or both, and subject to all other terms and conditions hereof, the Lender shall lend to the Borrower and Borrower may borrow from Lender the aggregate amount of Seventy Thousand and 00/100 Dollars ($70,000) (the “Loan Amount”). The Borrower and Lender acknowledge and agree that the Term Note shall be a single draw loan, and that any payments by Borrower applied to the principal balance of the Term Note may not be re-drawn by Borrower.

1.2 Fees.

| 1.2.1 | Origination Fee. None |

1.2.2 Legal Fees. Of the aggregate Loan Amount, Ten Thousand and 00/100 Dollars ($10,000) shall be immediately payable at the time of closing to Lender’s legal counsel to cover the fees incurred in documenting the loan transaction contemplated herein and included in the Loan.

1.3 Interest and Payments.

1.3.1 Interest. Interest will accrue on the Term Note as stated therein. Interest accrued on the Term Note shall be payable monthly on or before the fifteenth calendar day of each month and on the same day of each month thereafter, and shall automatically be

deducted from an account held by Borrower. Borrower shall ensure sufficient funds are in such account in order to allow the Lender to deduct the payments when due.

1.3.2 Maturity. All unpaid principal, if any, of the Note, all interest accrued thereon and all fees and costs shall be due and payable on November 15, 2014 or upon the occurrence of seven (7) calendar days after Borrower has been first listed on a stock exchange in connection with Borrower’s initial public offering, whichever occurs earlier.

1.3.3 Computations. Interest on the Term Note shall be computed on a 365/360 basis; that is, by applying the ratio of the annual interest rate over a year of 360 days, multiplied by the outstanding principal balance, multiplied by the actual number of days the principal balance is outstanding.

1.3.4 Prepayments. No prepayment premium shall be applicable to any payment of principal pursuant to the Term Note.

1.4 Additional Consideration. In further consideration of Lender’s commitment to make the requested Loan, Borrower shall issue to Lender, at the time of closing, a Warrant Agreement for the purchase of Three Hundred Fifty Thousand (350,000) shares of common stock.

ARTICLE TWO

CONDITIONS OF CLOSING

2.1 Closing. The closing of this transaction (the “Closing”) shall occur at a location and time mutually agreeable to the Parties no later than November 15, 2013.

2.2 Documents Delivered by Borrower. To induce the Lender to commit to make the requested Loan, and as a condition to the advancement of the Loan Amount to the Borrower, the Borrower shall, on the date hereof, deliver to Lender the following, all of which shall be in form and substance acceptable to the Lender:

2.2.1 Term Note. The Borrower’s Promissory Note dated November 30, 2013, in the amount of Seventy Thousand and 00/100 Dollars ($70,000), payable to the Lender (the “Term Note”) over a period of twelve (12) months at a rate of eleven percent (11%) per annum, which is attached as Exhibit A to this Agreement;

2.2.2 Guaranty. A Continuing Guaranty Agreement (the “Guaranty”) of Borrower’s obligations hereunder and relating to the indebtedness evidence by the Term Note executed and delivered by Kenneth Kovie (the “Guarantor”), which is attached as Exhibit B to this Agreement;

2.2.3 Security Agreement. A Security Agreement (the “Security Agreement”) in favor of the Lender covering and guarantying Lender a first priority security interest in the personal property described therein, which is attached as Exhibit C to this Agreement.

2.2.4 Financing Statement. UCC-1 Financing Statements executed by Borrower for filing in such offices as the Lender may deem necessary or desirable (individually, a “Financing Statement” and collectively “Financing Statements”) relating to the Security Agreement.

2.2.5 Warrant Agreement. A Warrant Agreement representing the Lender’s right to purchase shares of Borrower pursuant to Section 1.4 above, which is attached as Exhibit D to this Agreement.

2.2.6 Secretary’s Certificate and Resolutions of Borrower. A Secretary’s Certificate of Borrower and Resolutions executed by the Borrower and relating to Borrower’s organizational documents and resolutions authorizing the Loan.

2.2.7 Financial Statements. Current financial statements of Borrower and Guarantor and in a form and prepared in a manner acceptable to the Lender.

ARTICLE THREE

REPRESENTATIONS AND WARRANTIES

3.1 Borrower’s Representations and Warranties. The Borrower represents and warrants that:

3.1.1 Organization, Qualification and Authorization. Borrower is a corporation duly organized, validly existing and in good standing under the laws of the State of Illinois; has the power and authority to own its property and to carry on its business as now being conducted; and is duly qualified and licensed to do business, and is in good standing, in every jurisdiction in which the nature of the business in which it is engaged makes such qualification or licensing necessary.

3.1.2 Validity of Obligations. Borrower and Guarantor have full power, right and authority to execute and deliver this Agreement, the Term Note and all other documents an agreements required to be delivered by Borrower hereunder, as applicable, (“Loan Documents”), to obtain the credit herein provided for, and to perform and observe each and all of the matters and things provided for in the Loan Documents. The execution and delivery of the Loan Document and the performance or observance of the terms thereof have been duly authorized by all necessary corporate and shareholder action and do not contravene or violate any provision of law or any provision of Borrower’s organizational documents or any covenant, indenture or agreement of or binding upon Borrower, nor require the consent or approval of any governmental entity or agency.

3.1.3 Title to Assets. The Borrower has good and marketable title to all of its property and assets reflected in its most recent balance sheet delivered to the Lender, subject to the encumbrances as therein detailed.

3.1.4 Litigation. No actions, suits or proceedings are pending or, to Borrower’s knowledge, threatened, against or affecting it before any court, governmental or

administrative body or agency which might result in any material adverse change in the operations, business property, assets or condition (financial or otherwise) of Borrower, or which would question the validity of this Agreement or of any action taken or to be taken by Borrower pursuant to or in connection with this Agreement.

3.1.5 No Events of Default. No Event of Default or hereinafter defined has occurred and is continuing as of the date hereof and no event has occurred and is continuing which would be an Event of Default hereunder where it not for any grace period specified herein or which would become an Event of Default if notice thereof were given to Borrower.

3.1.6 Financial Condition. The financial statements of the Borrower heretofore furnished to the Lender, if any, are complete and correct in all material aspects and fairly present the respective financial condition of the Borrower at the date of such statements, and have been prepared in accordance with generally accepted accounting principles, consistently applied. Since the most recent set of financial statements delivered by the Borrower to the Lender, if any, there have been no material adverse changes in the financial condition of the Borrower.

3.1.7 Licenses. The Borrower possesses adequate licenses, permits, franchises, patents, copyrights, trademarks and trade names, or rights thereto, to conduct its business substantially as now conducted and as presently to be conducted.

3.1.8 Taxes. The Borrower has filed all tax returns required to be filed and either paid all taxes shown thereon to be due, including interest and penalties, which are not being contested in good faith and by appropriate proceedings, or provided adequate reserves for payment thereof, and the Borrower has no information or knowledge of any objections to or claims for additional taxes in respect of federal income or excise profit tax returns for prior years.

ARTICLE FOUR

AFFIRMATIVE COVENANTS

4.1 Affirmation Covenants. The Borrower covenants and agrees with Lender that so long as any amount remains unpaid on the Term Note, Borrower shall:

4.1.1 Maintain Assets. Maintain and keep its assets, properties and equipment in good repair, working order and condition and from time to time make or cause to be made all needed renewals, replacements and repairs so that at all times Borrower’s business can be operated efficiently.

4.1.2 Insurance. Insure and keep insured all of its property of an insurable value under all risk policies in an amount reasonably acceptable to the Lender and carry such other property insurance as it usually carried by persons engaged in the same or similar business (and as required by the Security Agreement), all such insurance to name the Lender as loss payee and additional insured with a standard mortgagee clause, and from

time to time furnished to Lender upon request appropriate evidence of the carrying of such insurance.

4.1.3 Financial Information. Furnish to the Lender:

4.1.3.1 Within ten (10) business days after the end of each month and within ninety (90) days after the end of each of Borrower’s fiscal years a set of, respectively, interim and annual financial statements, including a balance sheet, statement of cash flow, profit and loss statement and related statements, prepared by Borrower (and reviewed for annual statement only) by a public accounting firm reasonably acceptable to Lender, in accordance with generally accepted accounting principles;

4.1.3.2 As soon as available and in any event within thirty (30) days after such returns are filed (and no later than October 15th of any year) a copy of the federal and state income tax return of the Borrower and Guarantor (including all schedules and exhibits) or amendments thereto filed for the immediately preceding year;

4.1.3.3 Within ten (10) business days after the end of each month, an accounts receivable aging report inform and substance reasonably acceptable to Lender;

4.1.3.4 Within ten (10) business days after the end of each month, a 3-month forward budget projection of revenue, expenses, capital expenditures and other budgetary matters and together with an explanation as to any year to date variations from previously prepared budgets which had been delivered to Lender, all in reasonable detail and acceptable to Lender.

4.1.3.5 Such other information as the Lender may reasonably request form time to time.

4.1.4 Access to Records. Permit any person designated by Lender, at Lender’s expense upon reasonable prior notice, to visit and inspect any of its properties, corporate books and financial records and to discuss its affairs, finances and accounts with the principal officers of Borrower, all at such reasonable times and as often as Lender may reasonably request, and unfettered electronic access to all deposit accounts maintained by Borrower with Bank and/or any other deposit institutions.

4.1.5 Taxes, Assessment and Charges. Promptly pay over to the appropriate authorities all sums for taxes deducted and withheld from wages as well as the employer’s contributions and other governmental charges imposed upon or asserted against Borrower’s income, profits, properties and rental charges or otherwise which are or might become a lien charged upon Borrower’s properties, unless the same are being contested in good faith by appropriate proceedings and adequate reserves shall have been established on Borrower’s books with respect thereto.

4.1.6 Notification of Changes. Promptly notify the Lender of:

4.1.6.1 Any litigation actually known to Borrower which might materially and adversely affect Borrower and Guarantor or any of their respective properties;

4.1.6.2 The occurrence of any Event of Default under this Agreement or any event of which Borrower has knowledge and which, with the passage of time or giving of notice or both, would constitute an Event or Default under this Agreement;

4.1.6.3 Any material adverse change in the operations, business, properties, assets or conditions, financial or otherwise, of the Borrower.

4.2 Corporate Existence. Maintain its corporate existence in compliance with all applicable statutes, laws, rules and regulations.

4.3 Books and Records. Keep true and accurate books, records and accounts in accordance with sound accounting and bookkeeping practices.

4.4 Expenses and Attorneys' Fees. Upon demand, the Borrower shall immediately reimburse the Lender and any participant for all attorneys' fees and all other costs, fees and out-of-pocket disbursements incurred by the Lender or any participant in connection with the preparation, execution, delivery, administration, defense and enforcement of this agreement or any of the other Loan Documents, including attorneys' fees and all other costs and fees (a) incurred before or after commencement of litigation or at trial, on appeal or in any other proceeding, (b) incurred in any bankruptcy proceeding and (c) related to any waivers or amendments with resect thereto (examples of costs and fees included but are not limited to fees and costs for: filing, perfecting or confirming the priority of the Lender's lien, title searches or insurance, appraisals, environmental audits and other reviews related to the Borrower, any collateral or the Loan, if requested by the Lender). The Borrower will also reimburse the Lender and any participant for all costs of collection, including all attorneys' fees, before and after judgment, and the costs of preservation and/or liquidation of any collateral.

ARTICLE FIVE

NEGATIVE COVENANTS

5.1 Negative Covenants. The Borrower hereby covenants and agrees with the Lender that so long as any amount shall remain unpaid on the Term Note, Borrower will not:

5.1.1 Merge, Consolidate or Sell. Merge or consolidate with or into another entity, or lease or sell all or substantially all of its property and business to any other entity or entities. Guarantor shall not sell, dispose or transfer any ownership interest in the borrower in a single or series of transactions without the express consent of the Lender, which consent may be withheld or granted in Lender’s sole and absolute discretion.

5.1.2 Default on Other Obligations. Default upon or fail to pay, beyond any applicable periods of grace, any of its other debts or obligations as the same mature, unless the same

are being contested in good faith by appropriate proceedings and adequate reserves shall have been established on Borrower’s books with respect thereto.

5.1.3 Limitation on Liens and Encumbrances. Except for the interests of Lender, the Borrower will not at any time create, assume, incur or permit to exist, any mortgage, lien, pledge, charge, security interest or other encumbrance of any kind in respect of the Personal Property (except such purchase money security interests granted by Borrower prior hereto as disclosed to and approved by Lender prior hereto), or any other assets, income or revenues of any character, whether heretofore or hereafter acquired by it.

5.1.4 Limitation on Distributions. The Borrower may not make any distributions of cash or property of any kind whatsoever to its Shareholders without the prior written consent of the Lender which shall also include salaries, bonuses or other compensation payable to any manager or key employee of the Borrower in amounts in excess of those set forth in Budgets approved by Lender.

5.1.5 Subordination. Any liability, indebtedness or obligations of the Corporation, to its Shareholders, managers, officers, or directors or the affiliates of each of the foregoing now existing or hereafter arising (other than Borrower and employee compensation), shall be subordinated to all of the borrower’s obligations to Lender.

5.1.6 Negative Pledge. The Borrower shall not, without Lender’s prior written consent, which consent may be withheld or granted in Lender’s sole and absolute discretion, sell (except inventory in the ordinary course of business), purchase and/or lease any real or personal property, or other assets or equipment.

ARTICLE SIX

EVENTS OF DEFAULT

6.1 Event of Default. Any one or more of the following events shall constitute an Event of Default:

6.1.1 Payment. Borrower shall fail to pay when due, any payments due under the Term Note; or

6.1.2 Other Covenants or Agreements Herein. Borrower shall default in the due performance or observance of any term, covenant or agreement contained in this Agreement or any of the other Loan Documents (other than payments under the Term Note) and such default shall continue for a period of thirty (30) days after written notice thereof shall have been given by Lender to Borrower, or, if such default does not consist of the non-payment of money and cannot reasonably be cured within thirty (30) days, for such longer period of time not exceeding ninety (90) days as may be necessary to cure such default with the exercise of due diligence so long as Borrower is diligently proceeding to cure such default; or

6.1.3 Insolvency. Borrower or Guarantor shall (i) become insolvent, (ii) suspend business, (iii) make a general assignment for the benefit of its creditors, (iv) admit in writing its or his inability to pay its or his debts generally as they mature, (v) file a petition in bankruptcy or a petition or answer seeking a reorganization, arrangement with creditors or other similar relief under the Federal bankruptcy laws or under any other applicable law of the United State of America or any State thereof, (vi) consent to the appointment of a trustee or receiver for Borrower or for a substantial part of its or his property, (vii) be adjudicated a bankrupt or fail to cause an involuntary petition in bankruptcy to be dismissed within sixty (60) days after the filing thereof, (viii) take any action for the purpose of effecting or consenting to any of the foregoing, or (ix) have an order, judgment or decree entered appointing a trustee, conservator or receiver for Borrower or for a substantial part of its property, or approving a petition filed against Borrower seeking a reorganization, arrangement with creditors or other similar relief under the Federal bankruptcy laws or under any other applicable law of the United States of America or any State hereof, which order, judgment or decree shall not be vacated or set aside or stayed within sixty (60) days from the date of entry; or

6.1.4 Representations and Warranties. If any material representation or warranty contained in this Agreement or any of the other loan Documents or any letter or certificate furnished or to be furnished to the Lender by Borrower or Guarantor pursuant to this Agreement proves to be false in any material respect as of the date executed or delivered to Lender; or

6.1.5 Judgments. Judgments against Borrower for the payment of money totaling in excess of Ten Thousand Dollars ($10,000) shall be outstanding for a period of thirty (30) days without a stay of execution; or

6.1.6 Material Adverse Change. Any material adverse change shall occur in the condition (financial or otherwise) of the Borrower and Guarantor which, in the reasonable opinion of the Lender, materially increases its risk with respect to the Term Note; or

6.1.7 Other Agreements. Borrower and Guarantor, individually or collectively, default under the terms and conditions of any other agreements with or indebtedness to the Lender.

6.2 Lender’s Right on Default. Upon the occurrence of an Event of Default, Lender may, at its option and without notice: (a) refuse to advance against the Term Note; (b) accelerate amounts outstanding on the Term Note and demand their immediate payment in full without presentment or other demand, protest, notice of dishonor any other notice of any kind, all of which are expressly waived; (c) foreclose its lien on the assets pursuant to the Security Agreement or take such other actions available under the terms of this Agreement and other Loan Documents; and (d) take such other actions as may otherwise be available in equity or at law. All remedies of the Lender shall be cumulative.

ARTICLE SEVEN

MISCELLANEOUS

7.1 Binding Effect. The parties hereto agree that this Agreement shall be binding upon and inure to the benefit of their respective successors in interest and assigns including any holder of the Term Note, provided, however, that Borrower may not assign or transfer its interest hereunder without the prior written consent of the Lender.

7.2 Governing Law. This Agreement and the rights and obligations of the parties hereunder and under the Term Note and any other Loan Documents, shall be construed in accordance with and governed by the laws of the State of Illinois. Borrower and Guarantor hereby consent to the jurisdiction of the courts of the State of Illinois for any actions brought hereon or on the Term Note.

7.3 Notices. Any notices required or contemplated hereunder shall be effective upon the placing thereof in the United States mails, certified mail and with return receipt requested, postage prepaid and addressed as follows:

If to Borrower: Ken’s Custom Upholstery, Inc.

19533 Forestdale Court

Mokena, IL 60448

Attn: Kenneth Kovie

If to Lender: Georgia Peaches, LLC

c/o Foley & Mansfield, PLLP

55 W. Monroe Street #3430

Chicago, IL 60603

Attn: Benjamin R. Skjold, Esq.

7.4 No Waivers. No failure or delay on the part of Lender in exercising any right, power or privilege hereunder and no course of dealing between Borrower and Lender shall operate as a waiver thereof; nor shall any single or partial exercise of any right, power, or privilege hereunder preclude any other or further exercise thereof or the exercise of any other right, power or privilege.

7.5 Headings. The headings of various sections of this Agreement have been inserted for reference only and shall not be deemed to be a part of this Agreement.

7.6 Amendment and Waiver. Neither this Agreement nor any provision hereof may be modified, waived, discharged or terminated orally, but only by an instrument in writing signed by the party against whom enforcement of the change, waiver, discharge or termination is sought.

7.7 OFAC Lists. Borrower represents and warrants to Lender that (i) no Related Entity is (and to Borrower’s knowledge after diligent inquiry, no other person holding any legal or beneficial interest whatsoever in Borrower, directly or indirectly, is) included in, owned by,

controlled by, acting for or on behalf of, providing assistance, support, sponsorship, or services of any kind to, or otherwise associated with any of the persons referred to or described in any list of persons, entities, and governments, issued by the Office of Foreign assets control of the United State Department of the Treasury (“OFAC”) pursuant to Executive order 13224 – blocking Property and prohibiting Transactions with Persons Who commit, Threaten to Commit, or Support Terrorism, as amended (“Executive Order 13224”), or any similar list issued by OFAC or any other department or agency of the United States of America (collectively, the “OFAC Lists”), and (ii) none of the Related Entities are controlled by, acting for or on behalf of, providing assistance, support, sponsorship, or services of any kind to, or otherwise associated with any of the persons referred to or described in any list of persons, entities, and governments issued by OFAC pursuant to Executive Order13224, or any other OFAC Lists. “Related Entity” shall mean Borrower, Guarantor, or any member of Borrower or Guarantor and any other affiliate of Borrower and guarantor which directly or indirectly owns any legal or beneficial interest in Borrower.

7.8 Compliance with Anti-Terrorism Regulations.

7.8.1 Borrower hereby covenants and agrees with (i) no Related Entity will be included in, owned by, controlled by, act for or on behalf of, provide assistance, support, sponsorship, or services of any kind to, or otherwise associated with any of the persons referred to or described in any list of persons, entities, and governments issued by OFAC pursuant to Executive Order 13224 or any other OFAC Lists, and (ii) none of the Related Entities will be controlled by, act for or on behalf of, provide assistance, support, sponsorship, or services of any kind to, or otherwise associate with any of the persons referred to or described in any list of persons, entities and governments issued by OFAC pursuant to Executive Order 13224, or any other OFAC lists.

7.8.2 Borrower hereby covenants and agrees that it will comply at all times with the requirements of Executive Order 13224; the International Emergency Economic Powers Act, 50 U.S.C. Section 1701-06; the United and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001, Pub.L. 107-56; the Iraqi Sanctions Act, Pub.L. 101-513, 104 Stat. 2047-55; the United Nations Participation Act, 22 U.S.C. Section 287c; the Antiterrorism and Effective Death Penalty Act, (enacting 8 U.S.C. Section 219, 18 U.S.C. Section 2332d, and 18 U.S.C. Section 2339b); the International Security and Development Cooperation Act, 22 U.S.C. Section 2349 aa-9; the Terrorism Sanctions Regulations, 31 C.F.R. Part 595; the Terrorism List Government Sanctions Regulations, 31 C.F.R. Part 596; and the Foreign Terrorist Organizations Sanctions Regulations, 31 C.F.R. Part 596; and the Foreign Terrorist Organizations Sanctions Regulations, 31 C.F.R Part 597 and any similar laws or regulation currently in force or hereafter enacted (collectively, the “Anti-Terrorism Regulations”).

7.8.3 Borrower herby covenants and agrees that if it becomes aware or receives any notice that any Related Entity is named on any of the FAC Lists (such occurrence, an “OFAC Violation”), Borrower will immediately (i) give notice to Lender of such OFAC Violation, and (ii) comply with all laws applicable to such OFAC Violation (regardless of

whether the party included on any of the OFAC Lists is located within the jurisdiction of the United States of America), including without limitation, the Anti-Terrorism Regulations, Mortgagor hereby authorizes and consents to Lender’s taking any and all steps Lender deems necessary, in its sole discretion, to comply with all Laws applicable to any such OFAC Violation, including, without limitation, the requirements of the Anti-Terrorism Regulations (including the “freezing” and/or “blocking” of assets).

7.8.4 Upon Lender’s request from time to time during the term of the Loan, Borrower agrees to deliver a certification confirming that the representations and warranties set forth in Section 7.7 above remain true and correct as of the date of such certificate and confirming Borrower’s compliance with this Section 7.8.

7.9 Release.

7.9.1 In consideration of the agreements of Lender contained herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Borrower and Guarantor, on behalf of itself and its successors, assigns, and other legal representatives, hereby absolutely, unconditionally and irrevocably release, remise and forever discharge Lender, and its successors and assigns, and its present and former owners, shareholders, affiliates, subsidiaries, divisions, predecessors, directors, officers, attorneys, employees, agents and other representatives (Lender and all such other Persons being hereinafter referred to collectively as the “Releases” and individually as a “Releasee”), of and from all demands, actions, causes of action, suits, covenants, contracts, controversies, agreements, promises, sums of money, accounts, bills, reckonings, damages ad any and all other claims, counterclaims, defenses, rights of set-off, demands and liabilities whatsoever (individually a “Claim” and collectively, “Claims”) of every name and nature, known or unknown, suspected or unsuspected, both at law and in equity, which Borrower and Guarantor or any of its respective successors, assigns, or other legal representatives may now or hereafter own, hold, have or claim to have against the Releasees or any of them for, upon, or by reason of any circumstance, action, cause or thing whatsoever which arises at any time on or prior to the day and date of this Amendment, including, without limitation, for or on account of, or in relation to, or in any way in connection with the Loan Agreement, or any of the other Loan Documents or transactions thereunder or related thereto.

7.9.2 Borrower and Guarantor understand, acknowledge and agree that the release set forth above may be pleaded as full and complete defense and may be used as a basis for an injunction against any action, suit or other proceeding which may be instituted, prosecuted or attempted in breach of the provision of such release.

7.9.3 Borrower and Guarantor agree that no fact, event, circumstance, evidence or transaction which could now be asserted or which may hereafter be discovered shall affect in any manner the final, absolute and unconditional nature of the release set forth above.

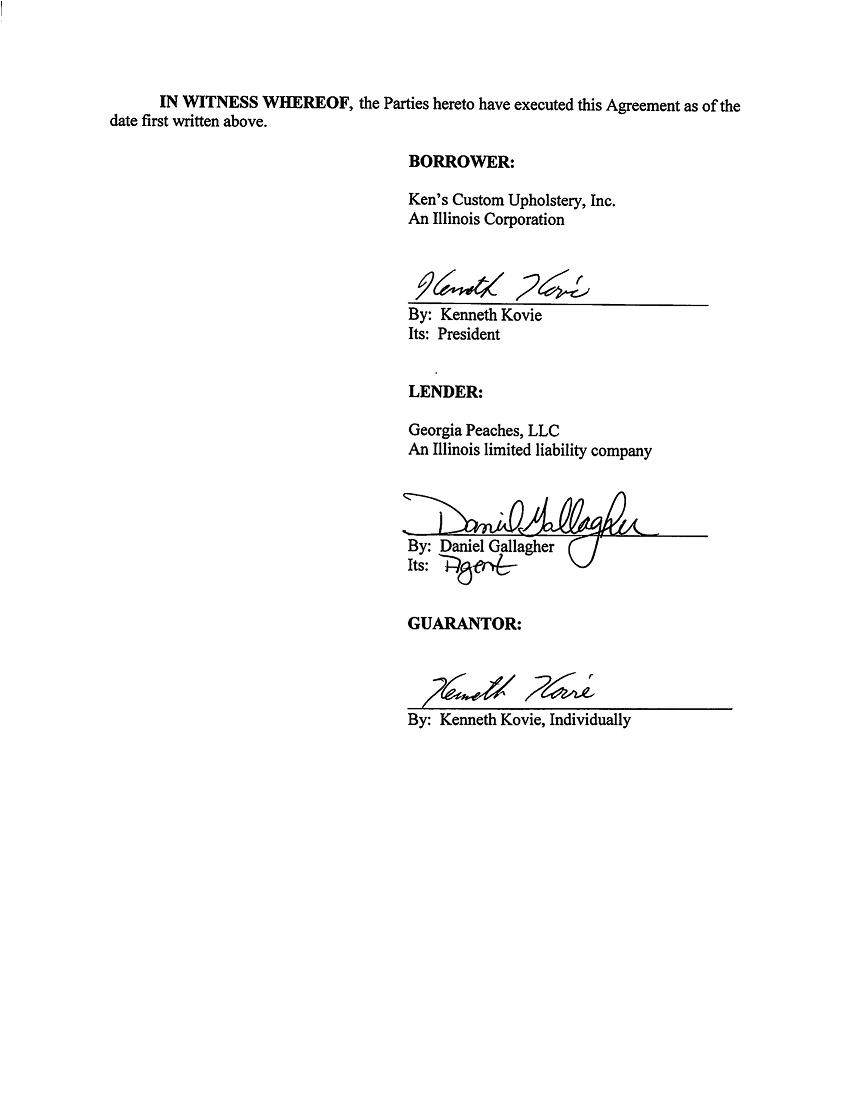

IN WITNESS WHEREOF, the Parties hereto have executed this Agreement as of the date first written above.

BORROWER:

Ken’s Custom Upholstery, Inc.

An Illinois Corporation

____________________________________

By: Kenneth Kovie Its: President

LENDER:

Georgia Peaches, LLC

An Illinois limited liability company

____________________________________

By: Daniel Gallagher

Its:

GUARANTOR:

_______________________________________

By: Kenneth Kovie, Individually

EXHIBIT LIST

| Exhibit | Title |

| A | Term Promissory Note |

| B | Guaranty Agreement |

| C | Security Agreement |

| D | Warrant Agreement |

EXHIBIT A

TERM PROMISSORY NOTE

TERM PROMISSORY NOTE

$70,000.00 Frankfort, Illinois

November 15, 2013

1. FOR VALUE RECEIVED, Ken’s Custom Upholstery, Inc., an Illinois corporation (the “Borrower”) promises to pay to the order of Georgia Peaches, LLC, an Illinois limited liability company, its heirs, successors and assigns (the “Holder”), the principal sum of Seventy Thousand and 00/100 Dollars ($70,000.00), in lawful money of the United States and immediately available funds, together with interest on the unpaid balance accruing at the rate of eleven percent (11%) per annum. In all cases interest on this Note shall be calculated on the basis of a 365 day year but charged for actual days principal is unpaid.

2. The interest accrued on this Note will be due and payable in equal monthly installments of Six Hundred Forty-One and 67/100 Dollars ($641.67) on the fifteenth day of each calendar month commencing on December 15, 2013, and continuing for a period of twelve (12) months or within seven (7) days of Borrower’s listing on a national stock exchange, whichever occurs earlier, at which time the remaining balance of all principal and unpaid accrued interest shall be due and payable in full. Together with each payment of principal, the undersigned shall additionally pay to the Holder an amount equal to all interest accrued on this Note through the date of payment.

3. The entire outstanding principal balance of this Note may be prepaid at any time at the option of the Borrower, in whole or in part, without premium or penalty, however any partial prepayment shall not reduce the amount of any monthly installment due.

4. All payments and prepayments shall, at the option of the Holder, be applied first to any costs of collection, second to accrued interest on this Note, and lastly to principal.

5. Notwithstanding anything to the contrary contained herein, if the rate of interest, late payment fee or any other charges or fees due hereunder are determined by a court of competent jurisdiction to be usurious, then said interest rate, fees and/or charges shall be reduced to the maximum amount permissible under applicable Illinois law.

6. As used herein, the term “Event of Default” shall mean and include any one or more of the following events:

(a) The Borrower shall fail to pay any amounts required to be paid by the Borrower under this Note or any other indebtedness of the Borrower to the Holder, whether any such indebtedness is now existing or hereafter arises and whether direct or indirect, due or to become due, absolute or contingent, primary or secondary or joint or joint and several;

(b) The Borrower shall fail to observe or perform any covenant, condition or agreement to be observed or performed by Borrower under this Note or any other document related hereto or thereto, for a period of ten (10) days after written notice given

to the Borrower by the Holder specifying such default and requesting that it be remedied;

(c) The Borrower shall file or have filed against Borrower a petition in bankruptcy or for reorganization or for an arrangement pursuant to any present or future state or federal bankruptcy act or under any similar federal or state law (unless such petition is discharged within thirty (30) days); or shall be adjudicated a bankrupt or insolvent, or shall make a general assignment for the benefit of Borrower creditors, or shall be unable to pay Borrower’s debts generally as they become due; or if an order for relief under any present or future federal bankruptcy act or similar state or federal law shall be entered against the Borrower; or if a petition or answer requesting or proposing the entry of such order for relief or the adjudication of the Borrower as a debtor or bankrupt or reorganization under any present or future state or federal bankruptcy act or any similar federal or state law shall be filed in any court and such petition or answer shall not be discharged or denied within thirty (30) days after the filing thereof; or if a receiver, trustee or liquidator of the Borrower or of all or substantially all of the assets of the Borrower shall be appointed in any proceeding brought against the Borrower and shall not be discharged within thirty (30) days of such appointment; or if the Borrower shall consent to or acquiesce in such appointment; or if any property of the Borrower shall be levied upon or attached in any proceeding;

(d) Final judgment(s) for the payment of money shall be rendered against the Borrower and shall remain undischarged for a period of ninety (90) days during which execution shall not be effectively stayed;

(e) The Borrower shall be or become insolvent (whether in the equity or bankruptcy sense);

(f) Any representation or warranty made by the Borrower herein or in the documents related hereto shall prove to be untrue or misleading in any material respect, or any statement, certificate or report furnished hereunder or under any of the foregoing documents by or on behalf of the Borrower shall prove to be untrue or misleading in any material respect on the date when the facts set forth and recited therein are stated or certified;

7. Upon the occurrence of an Event of Default or at any time thereafter, the outstanding principal balance hereof and accrued interest and all other amounts due hereon shall, at the option of the Holder, accelerate and become immediately due and payable, without notice or demand.

8. Upon the occurrence of an Event of Default or any time thereafter, the Holder shall have the right to set off any and all amounts due hereunder by the Borrower to the Holder against any indebtedness or obligation of the Holder to the Borrower.

9. Upon the occurrence at any time of an Event of Default or at any time thereafter, the Borrower promises to pay all costs of collection of this Note, including but not limited to

attorneys’ fees, paid or incurred by the Holder on account of such collection, whether or not suit is filed with respect thereto and whether such cost or expense is paid or incurred, or to be paid or incurred, prior to or after the entry of judgment.

10. Demand, presentment, protest and notice of nonpayment and dishonor of this Note are hereby waived.

11. This Note shall be governed by and construed in accordance with the laws of the State of Illinois, without giving effect to the choice of law provisions thereof.

12. The Borrower hereby irrevocably submits to the jurisdiction of the District Court of Cook County, State of Illinois, over any action or proceeding arising out of or relating to this Note and any instrument, agreement or document related thereto, and the Borrower hereby irrevocably agrees that all claims in respect of such action or proceeding may be heard and determined in such court. The Borrower hereby irrevocably waives, to the fullest extent it may effectively do so, the right to trial by jury and the defense of an inconvenient forum to the maintenance of such action or proceeding. The Borrower irrevocably consents to the service of copies of the summons and complaint and any other process which may be served in any such action or proceeding by the mailing by United States certified mail, return receipt requested, of copies of such process to the Borrower’s last known address. The Borrower agrees that judgment final by appeal, or expiration of time to appeal without an appeal being taken, in any such action or proceeding shall be conclusive and may be enforced in any other jurisdictions by suit on the judgment or in any other manner provided by law. Nothing in this Paragraph shall affect the right of the Holder to serve legal process in any other manner permitted by law or affect the right of the Holder to bring any action or proceeding against the Borrower or its property in the courts of any other jurisdiction to the extent permitted by law.

KEN’S CUSTOM UPHOLSTERY, INC.

(“BORROWER”)

By: Kenneth Kovie

Its: President

EXHIBIT B

GUARANTY AGREEMENT

CONTINUING GUARANTY AGREEMENT (UNLIMITED)

THIS CONTINUING GUARANTY AGREEMENT (UNLIMITED) (this "Guaranty") is entered into and effective as of November 15, 2013, by KENNETH KOVIE, an individual resident of the State of Illinois ("Guarantor") in favor of Georgia Peaches, LLC, an Illinois limited liability company ("Lender"). Guarantor requests that Lender extend credit by means of a loan in the aggregate amount of Seventy Thousand and 00/100 Dollars ($70,000.00) (the "Loan") to KEN’S CUSTOM UPHOLSTERY, INC., an Illinois corporation ("Borrower"), and in consideration of the granting of the Loan by Lender to Borrower and at the insistence and request of Borrower, the Guarantor agrees with Lender as follows:

1. Continuing Guaranty. The Loan shall be granted by Lender to Borrower under the terms and conditions of that certain Private Equity Loan Agreement of even date herewith. Each loan now or hereafter granted to Borrower shall be deemed to have been granted at the instance and request of Guarantor and in consideration of and in reliance upon this Guaranty.

2. Guaranty of Payment. This is a guaranty of payment and not of collection. Guarantor hereby guarantees unconditionally the prompt, punctual, and timely payment of any and all Indebtedness, as hereinafter defined, of Borrower to Lender. Borrower is obligated to the Lender for the payment and performance of all duties and obligations of Borrower under the terms of that certain Private Equity Loan Agreement (the "Loan Agreement"), a Term Promissory Note in the face amount of Seventy Thousand and 00/100 Dollars ($70,000.00) (the "Note"), and interest at the rate then provided in the Note and costs, attorneys' fees and other expenses provided for in paragraph 7 hereof. The Loan Agreement, Note, and any other document given to evidence or secure the Loan are hereinafter collectively called the "Loan Documents". The indebtedness evidenced by the Note together with all other indebtedness specified above, and together with any and all indebtedness arising under any provision of the Loan Agreement, is hereinafter collectively called the "Indebtedness." Undefined capitalized terms used herein shall have the meanings ascribed to them in the Loan Agreement.

3. Waiver by Guarantor. Guarantor hereby waives and agrees not to assert or take advantage of (a) any right to require Lender to proceed against Borrower or any other person or to proceed against or exhaust any security held by it at any time or to pursue any other remedy in its power before proceeding against Guarantors; (b) the defense of the statute of limitations in any action hereunder or for the collection of the Indebtedness; (c) any defense that may arise by reason of the incapacity, lack of authority, death or disability of, or revocation hereof, by Guarantor or others, or the failure of Lender to file or enforce a claim against the estate (either in administration, bankruptcy, or any other proceeding) of Guarantor or others; (d) demand, protest and notice of any other kind, including, without limiting the generality of the foregoing, notice of the existence, creation or incurring of any new or additional indebtedness or obligation or of any action or non-action on the part of Borrower, Lender, or Guarantor under this or any other instrument, or creditor of Borrower, or any other person whomsoever, in connection with any Indebtedness hereby guaranteed; (e) any defense based upon an election of remedies by Lender, including, without limitation, an election to proceed by non-judicial rather than judicial foreclosure, which destroys or otherwise impairs the subrogation rights of Guarantor or the right of Guarantor to proceed against Borrower for reimbursement, or both; and (f) any duty on the part of Lender to disclose to Guarantor any facts it may now or hereafter how about Borrower, regardless of whether Lender has reason to believe that any such facts materially increase the risk beyond which Guarantor is obligated or whether Lender has a reasonable opportunity to communicate such facts to Guarantor, it being understood and agreed that Guarantor is fully responsible for being and keeping informed of the financial condition of Borrower and of all circumstances bearing on the risk of non-

payment of any Indebtedness hereby guaranteed. Guarantor’s liability hereunder shall not be impaired or diminished by any change in Guarantor’s interests in Borrower.

4. Independent Obligations. The obligations of Guarantor hereunder are independent of the obligations of Borrower, and Guarantor’s obligations are independent of the obligations of any other guarantor(s) who have executed and delivered this or similar guarantees. Release of one or more guarantors shall not impair or diminish the liability of any remaining guarantors, except to the extent of monies actually received by Lender from the released guarantor as a consequence of such release. In the event of any default hereunder, a separate action or actions may be brought and prosecuted against Guarantor, or any guarantor, whether or not Borrower is joined therein or a separate action or actions are brought against Borrower. Lender may maintain successive actions for other defaults. Lender's rights hereunder shall not be exhausted by its exercise of any of its rights or remedies or by any such action or by any number of successive actions until and unless the Indebtedness has been paid and fully performed.

5. Authorization of Lender. Guarantor authorizes Lender, without notice to Guarantor and without impairing the liability of Guarantor hereunder, from time to time to renew, extend, accelerate, modify, or otherwise change the times for or terms of payment for the Indebtedness or any portion thereof, including but not limited to any increase or decrease in the rates of interest provided in the Note, to make other amendments, changes or modifications to the Loan Documents, to waive any other terms, covenants, or conditions thereof, to compromise or settle any amount or claim due or owing or claimed to be due or owing under the Loan Documents, or to surrender, release or subordinate all or any portion of the property or assets defined in the Security Agreement. The provisions of this Guaranty shall extend and be applicable to all such renewals, extensions and modifications.

6. Preferential Payment. Guarantor agrees that to the extent Borrower or Guarantor makes any payment to Lender in connection with the Indebtedness, and all or any part of such payment is subsequently invalidated, declared to be fraudulent or preferential; set aside or required to be repaid by Lender or paid over to a trustee, receiver or any other entity, whether under any bankruptcy act or otherwise (any such payment is hereinafter referred to as a "Preferential Payment"), then this Guaranty shall continue to be effective or shall be reinstated, as the case may be, and, to the extent of such payment or repayment by Lender, the Indebtedness or part thereof intended to be satisfied by such Preferential Payment shall be revived and continued in full force and effect as if said Preferential Payment had not been made.

7. Fees and Costs. Guarantor agrees to pay to Lender, without demand, reasonable attorneys' fees and all costs and other expenses which it expends or incurs in collecting or compromising the Indebtedness or in enforcing this Guaranty against Guarantor whether or not suit is filed.

8. Savings Clause. Should any one or more provisions of this Guaranty be determined to be illegal or unenforceable, all other provisions nevertheless shall be effective.

9. Assignment. This Guaranty shall inure to the benefit of Lender, its successors and assigns, including the assignees of any indebtedness hereby guaranteed, and bind the heirs, executors, administrators, successors and assigns of Guarantor. This Guaranty is assignable by Lender with respect to all or any portion of the Indebtedness, and when so assigned, Guarantor shall be liable to the assignees under this Guaranty without in any manner affecting the liability of Guarantor hereunder with respect to any Indebtedness retained by Lender.

10. Subordination. Guarantor hereby postpones and subordinates to the claims of Lender against Borrower and any other guarantors any indebtedness or other claim which the subject Guarantor may have against Borrower and any other guarantors. Guarantor shall have no right of subrogation and waives any right to enforce any remedy which Lender now has or may hereafter have against Borrower and any other guarantors, and waives any benefit of, and any right to participate in, any security now or hereafter held by Lender.

11. Joint and Several Indebtedness. The obligations of Guarantor hereunder are joint and several if Guarantor is more than one person or entity, are separate and independent of the obligations of Borrower and of any other guarantor who has executed and delivered this or similar guarantees; and a separate action or actions may be brought and prosecuted against Guarantor whether action is brought against Borrower or any other guarantor or whether Borrower or any other guarantor is joined in any action or actions. Release of one or more of the guarantors shall not impair or diminish the liability of any remaining guarantor, except to the extent of monies actually received by Lender from the released guarantor as a consequence of such release. Guarantor waives any rights Guarantor might otherwise have under applicable law, including but not limited to attorneys’ fees and costs of collection, by reason of any release of fewer than all of the guarantors of the Indebtedness, all in such manner and upon such terms as Lender may deem proper, and without notice to or further assent from the guarantors, and all without affecting this Guaranty or the obligations of Guarantor hereunder. Subject to the termination provisions contained in Section 17 below, the obligations of Guarantor hereunder shall survive and continue in full force and effect until payment in full of the Indebtedness is actually received by Lender and the period of time has expired during which any payment made by Borrower or Guarantor to Lender may be determined to be a Preferential Payment (defined below), notwithstanding any release or termination of Borrower's or any other guarantor's liability by express or implied agreement with Lender or by operation of law and notwithstanding that the Indebtedness or any part thereof is deemed to have been paid or discharged by operation of law or by some act or agreement of Lender. For purposes of this Guaranty, the Indebtedness shall be deemed to be paid only to the extent that Lender actually receives immediately available funds and to the extent of any credit bid by Lender at any foreclosure or trustee's sale of any security for the Indebtedness.

12. Right of Setoff. In addition to all liens upon, and rights of setoff against, the monies, securities or other property of Guarantor given to Lender by law, Lender shall have a lien and a right of setoff against, and Guarantor hereby grants to Lender a security interest in, all monies, securities and other property of Guarantors now and hereafter in the possession of or on deposit with Lender, whether held in a general or special account or deposit, or for safekeeping or otherwise; every such lien and right of setoff may be exercised without demand upon or notice to Guarantor. No lien or right of setoff shall be deemed to have been waived by any act or conduct on the part of Lender, by any neglect to exercise such right of setoff or to enforce such lien, or by any delay in so doing.

13. Release. No provision of this Guaranty or right of Lender hereunder can be waived nor can Guarantor be released from the obligations hereunder except in writing, duly executed and authorized by an officer of Lender.

14. Financial Statements.

a. Borrower shall prepare or cause to be prepared at its own expense and deliver to the Lender (in such number as may reasonably be requested) each of the following:

(i) As soon as practicable after the end of each calendar month, and in no event later than thirty (30) days thereafter, unaudited consolidated financial statements of Borrower,

prepared by the officers of Borrower and certified thereto by such one or more members of the board of directors of Borrower.

(ii) Not later than thirty (30) days after the filing deadline or extended filing deadline, Borrower shall deliver to the lender copies of filed federal tax returns of the Borrower, and statements if applicable, including all supporting schedules.

b. Guarantor shall prepare or cause to be prepared at his own expense and deliver to the Lender (in such number as may reasonably be requested) each of the following:

(i) Not later than thirty (30) days after the filing deadline or extended filing deadline, Guarantor shall deliver to the Lender copies of his respective filed federal tax returns, and statements if applicable, including all supporting schedules.

c. Guarantor acknowledges and agrees that Lender is relying upon this Guaranty and the financial creditworthiness of Guarantor as material inducements to Lender to make the Loan and that failure by Guarantor to deliver the financial statements and tax returns as provided herein shall cause damage to Lender, the extent of which is difficult to quantify. Accordingly, in the event Guarantor shall fail to deliver the financial statements and tax returns to Lender, as provided herein, and such failure shall continue after thirty (30) days' written notice from Lender, such failure shall be an Event of Default under the Loan Documents.

15. Governing Law; Venue. This Guaranty shall be governed by and construed in accordance with the laws of Illinois, without giving effect to Illinois’s principles of conflicts of law. This Guaranty shall constitute the entire agreement of Guarantor with Lender with respect to the subject matter hereof and no representation, understanding, promise or condition concerning the subject matter hereof shall be binding upon Lender unless expressed herein. This Agreement shall be enforced in the district court located in Cook County, Illinois or any federal court seated in the State of Illinois. Guarantor consents to the jurisdiction and venue of any such court and waives any argument that venue in such forums is not convenient. In the event Guarantor commences any action in another jurisdiction or venue under any tort or contract theory arising directly or indirectly from the relationship created by this Agreement, Lender at its option shall be entitled to have the case transferred to the district court located in Cook County, Illinois or any federal court seated in the State of Illinois, or if such transfer cannot be accomplished under applicable law, to have such case dismissed without prejudice.

16. Jury Trial. Guarantor hereby irrevocably waives, to the fullest extent permitted by law, any and all right to trial by jury in any legal proceeding arising out of or relating to this Guaranty, the Loan Documents or the transactions contemplated thereby.

IN WITNESS WHEREOF, Guarantor has caused this Guaranty to be duly executed as of the day and year first above written.

GUARANTOR:

|

|

Address: | |

| KENNETH KOVIE, individually |

|

EXHIBIT C

SECURITY AGREEMENT

SECURITY AGREEMENT

November 15, 2013

|

DEBTOR:

Ken’s Custom Upholstery, Inc.

|

SECURED PARTY:

Georgia Peaches, LLC |

1. Obligations Secured. This Agreement secures the following (called the “Obligations”):

All debts, liabilities and obligations of the Debtor, Ken’s Custom Upholstery, an Illinois corporation, to the Secured Party, Georgia Peaches, LLC, an Illinois limited liability company, pursuant to that certain Promissory Note in the principal aggregate amount of Seventy Thousand and 00/100 Dollars ($70,000.00) dated November 15, 2013 (the “Note”), in favor of Secured Party, and each and every other debt, liability and obligation of every type and description which the Debtor may now or at any time hereafter owe to the Secured Party (whether such debt, liability or obligation now exists or is hereafter created or incurred, whether it arises under or is evidenced by this Agreement, that certain Revolving Credit Agreement of even date herewith, the Note or any other present or future instrument or agreement or by operation of law, and whether it is direct or indirect, due or to become due, absolute or contingent, primary or secondary, liquidated or unliquidated, or sole, joint or joint and several).

2. Security Interest. To secure the payment and performance of the Obligations, Debtor grants Secured Party a security interest (the “Security Interest”) in, and assigns to Secured Party, the following property (called the “Collateral”):

All equipment of Debtor, together with all accessions, accessories, attachments, fittings, increases, parts, repairs, returns, renewals and substitutions of all or any part thereof, and all warehouse receipts, bills of lading and other documents covering such equipment, whether now existing or hereafter arising, whether now owned or hereafter acquired;

All accounts, including without limitation, all instruments, chattel paper, investment property, letter-of-credit rights, letters of credits, other rights to payment, documents, deposit accounts, money, payment intangibles, and other general rights, liens, security interests and other interests which Debtor may at any time have by law or agreement against any account debtor, issuer or obligor obligated to make any such payment or against any of the property of such account debtor, issuer, or obligor, and all other supporting obligations relating to the foregoing, whether now existing or hereafter arising, whether now owned or hereafter acquired; and

All products and proceeds of the foregoing property, including without limitation all accounts, instruments, chattel paper, investment property, letter-of-credit rights, letters of credit, other rights to payment, documents, deposit accounts, money, insurance proceeds and general intangibles related to the foregoing property, and all refunds of insurance premiums due or to become due under all insurance policies covering the foregoing property.

3. Representations, Warranties and Agreements. Debtor represents and warrants to Secured Party and agrees as follows:

| (a) | Debtor is an Illinois corporation. |

(b) Except as set forth in any existing or future agreement executed by Secured Party, Debtor is the owner of the Collateral, or will be the owner of the Collateral hereafter acquired, free of all security interests, liens and encumbrances other than the Security Interest and any other security interest of Secured Party; Debtor shall not permit any security interest, lien or encumbrance, other than the Security Interest and any other security interest of Secured Party, to attach to any Collateral without the prior written consent of Secured Party; Debtor shall defend the Collateral against the claims and demands of all persons and entities other than Secured Party, and shall promptly pay all taxes, assessments and other government charges upon or against Debtor, any Collateral and the Security Interest; and no financing statement covering any Collateral is on file in any public office. If any Collateral is or will become a fixture, Debtor, at the request of Secured Party, shall furnish Secured Party with a statement or statements executed by all persons and entities who have or claim an interest in the real estate, in form acceptable to Secured Party, which statement or statements shall provide that such persons and entities consent to the Security Interest;

(c) Debtor shall not sell or otherwise dispose of any Collateral or any interest therein without the prior written consent of Secured Party;

(d) The Debtor Shall: (i) keep all tangible Collateral in good condition and repair, normal depreciation expected; (ii) from time to time replace any worn, broken, or defective parts thereof; (iii) promptly notify the Secured Party of any loss of or material damage to any Collateral or of any adverse change in the prospect of payment of any account, instrument, chattel paper, other right to payment or general intangible constituting Collateral; (iv) not permit any Collateral to be used or kept for any unlawful purpose or in violation of any federal, state, or local law; (v) keep all tangible Collateral insured in such amounts, against such risks and in such companies as shall be acceptable to the Secured Party to the extent of its interests in form acceptable to the Secured Party (including without limitation a provision for at least 30 days’ prior written notice to the Secured Party of any cancellation or modification of such insurance), and deliver policies or certificates of such insurance to the Secured Party; (vi) at the Debtor’s chief executive office, keep accurate and complete records pertaining to the Collateral and the Debtor’s financial condition, business and property, and provide the Secured Party such periodic reports concerning the Collateral and the Debtor’s financial condition, business and property as the Secured Party may from time to time request; and (vii) at all reasonable times permit the Secured Party and its representatives to examine and inspect any Collateral, and to examine, inspect and copy the Debtor’s records pertaining to the Collateral and the Debtor’s financial condition, business and property.

(e) Each account, instrument, investment property, chattel paper, letter-of-credit right, letter of credit, other right to payment, document, and general intangible

constituting Collateral is, or will be when acquired, the valid, genuine and legally enforceable obligation of the account debtor or other issuer or obligor named therein or in Debtor’s records pertaining thereto as being obligated to pay such obligation, subject to no defense, setoff or counterclaim. Debtor shall not, without the prior written consent of Secured Party, agree to any material modification or amendment of any such obligation or agree to any subordination or cancellation of any such obligation;

(f) Debtor authorizes Secured Party to file all of Secured Party’s financing statements and amendments to financing statements, and all terminations of the filings of other secured parties, all with respect to the Collateral, in such form and substance as Secured Party, in its sole discretion, may determine.

4. Collection Rights. At any time after an Event of Default, the Secured Party may, and at the request of the Secured Party the Debtor shall, promptly notify any account debtor, issuer or obligor of any account, instrument, investment property, chattel paper, letter-of-credit right, letter-of-credit, other right to payment or general intangible constituting Collateral that the same has been assigned to the Secured Party and direct such account debtor, issuer or obligor to make all future payments to the Secured Party. In addition, at the request of the Secured Party, the Debtor shall deposit in a collateral account designated by the Secured Party all proceeds constituting Collateral, in their original form received (with any necessary endorsement), within one business day after receipt of such proceeds by the Debtor. Until the Debtor makes each such deposit, the Debtor will hold all such proceeds separately in trust for the Secured Party for deposit in such collateral account, and will not commingle any such proceeds with any other property. The Debtor shall have no right to withdraw any funds from such collateral account, and the Debtor shall have no control over such collateral account. Such collateral account and all funds at any time therein shall constitute Collateral under this Agreement. Before or upon final collection of any funds in such collateral account, the Secured Party, at its discretion, may release any such funds to the Debtor or any account of the Debtor or apply any such funds to the Obligations whether or not then due. Any release of funds to the Debtor or any account of the Debtor shall not prevent the Secured Party from subsequently applying any funds to the Obligations. All items credited to such collateral account and subsequently returned and all other costs, fees and charges of the Secured Party in connection with such collateral account may be charged by the Secured Party to any account of the Debtor, and the Debtor shall pay the Secured Party all such amounts on demand.

5. Limited Power of Attorney. If the Debtor at any time fails to perform or observe any agreement herein and such failure continues has not been cured in accordance with this Agreement or any agreement related hereto, the Secured Party, in the name and on behalf of the Debtor or, as its option, in its own name, may perform or observe such agreement and take any action which the Secured Party may deem necessary or desirable to cure or correct such failure. The Debtor irrevocably authorizes Secured Party and grants the Secured Party a limited power of attorney in the name and on behalf of the Debtor or, at its option, in its own name, to collect, receive, receipt for, create, prepare, complete, execute, endorse, deliver and file any and all financing statements, control agreements, insurance applications, remittances, instruments, documents, chattel paper and other writings, to grant any extension to, compromise, settle, waive, notify, amend, adjust, change and release any obligation of any account debtor, issuer, obligor, insurer or other person or entity pertaining to any Collateral, to demand terminations of

other security interests in any of the Collateral, and to take any other action deemed by the Secured Party to be necessary or desirable to establish, perfect, protect or enforce the Security Interest. All of the Secured Party’s advances, fees, charges, costs and expenses, including but not limited to audit fees and expenses and reasonable attorneys’ fees and legal expenses, in connection with the Obligations and in the protection and exercise of any rights or remedies hereunder, together with interest thereon at the highest rate then applicable to any of the Obligations, shall be secured hereunder and shall be paid by the Debtor to the Secured Party on demand.

6. Event of Default. The occurrence of any of the following events shall constitute an “Event of Default”: (i) any breach or default in the payment or performance of any of the Obligations; or (ii) any breach or default under the terms of this Agreement or any other note, obligation, mortgage, deed of trust, assignment, guaranty, other agreement, or other writing heretofore, herewith or hereafter existing to which the Debtor or any maker, endorser, guarantor or surety of any of the Obligations or any other person or entity providing security for any of the Obligations or for any guaranty of any of the Obligations is a party; or (iii) the insolvency, dissolution, liquidation, merger or consolidation of the Debtor or any such maker, endorser, guarantor, surety or other person or entity; or (iv) any appointment of a receiver, trustee or similar officer of any property of the Debtor or any such maker, endorser, guarantor, surety or other person or entity; or (v) any assignment for the benefit of creditors of the Debtor or any such maker, endorser, guarantor, surety or other person or entity; or (vi) any commencement of any proceeding under any bankruptcy, insolvency, receivership, dissolution, liquidation or similar law by or against the Debtor or any such maker, endorser, guarantor, surety or other person or entity; or (vii) the sale, lease or other disposition (whether in one or more transactions) to one or more persons or entities of all or a substantial part of the assets of the Debtor or any such maker, endorser, guarantor, surety or other person or entity except in the ordinary course of business; or (viii) the Debtor or any such maker, endorser, guarantor, surety or other person or entity takes any action to go out of business, or to revoke or terminate any agreement, liability or security in favor of the Secured Party; or (ix) the entry of any judgment or other order for the payment of money in the amount of $10,000.00 or more against the Debtor or any such maker, endorser, guarantor, surety or any other person or entity; or (x) the issuance or levy of any writ, warrant, attachment, garnishment, execution or other process against any property of the Debtor or any such maker, endorser, guarantor, surety or any other person or entity; or (xi) the attachment of any tax lien to any property of the Debtor or any such maker, endorser, guarantor, surety or other person or entity; or (xii) any statement, representation or warranty made by the Debtor or any such maker, endorser, guarantor, surety or other person or entity (or any representative of the Debtor or any such maker, endorser, guarantor, surety or other person or entity) to the Secured Party at any time shall be incorrect or misleading in any material respect when made; or (xiii) there is a material adverse change in the condition (financial or otherwise), business or property of the Debtor or any such maker, endorser, guarantor, surety or other person or entity.

7. Remedies. Upon the occurrence of an Event of Default, all Obligations automatically shall become immediately due and payable in full. In addition, upon the occurrence of any Event of Default and at any time thereafter, Secured Party may exercise any one or more of the following rights and remedies: (a) declare all Obligations to be immediately due and payable in full, and the same shall thereupon be immediately due and payable in full; (b) require Debtor to execute an Assignment of Contract for Deed assigning Debtor’s interest in the Contract for Deed

to Secured Party; or (c) exercise and enforce any and all rights and remedies available upon default under this Agreement, the Uniform Commercial Code, and any other applicable agreements and laws. Debtor consents to the personal jurisdiction of the state courts of the State of Illinois in connection with any controversy related to this Agreement, the Collateral, the Security Interest or any of the Obligations, waives any argument that venue in such forum is not convenient, and agrees that any litigation initiated by Debtor against Secured Party in connection with this Agreement, the Collateral, the Security Interest or any of the Obligations shall be venued in the District Court seated in Cook County, Illinois.

8. Termination. This Agreement shall terminate as follows:

(a) Upon the payment in full of any and all amounts due under the Credit Agreement including, without limitation all amounts due under the Note; or

(b) Upon termination or discharge of the Debtor’s obligations under this Agreement and/or any modifications or amendments thereto.

9. Miscellaneous. All terms in this Agreement that are defined in the Illinois Uniform Commercial Code, as amended from time to time (the “UCC”) shall have the meanings set forth in the UCC, and such meanings shall automatically change at the time that any amendment to the UCC, which changes such meanings, shall become effective. A carbon, photographic or other reproduction of this Agreement is sufficient as a financing statement. No provision of this Agreement can be waived, modified, amended, abridged, supplemented, terminated or discharged and the Security Interest cannot be released or terminated, except by a writing duly executed by Secured Party. A waiver shall be effective only in the specific instance and for the specific purpose given. No delay or failure to act shall preclude the exercise or enforcement of any of Secured Party’s rights or remedies. This Agreement shall bind and benefit Debtor and Secured Party and their respective heirs, representatives, successors and assigns and shall take effect when executed by Debtor and delivered to Secured Party. If any provision or application of this Agreement is held unlawful or unenforceable in any respect, such illegality or unenforceability shall not affect other provisions or applications which can be given effect, and this Agreement shall be construed as if the unlawful or unenforceable provision or application had never been contained herein or prescribed hereby. All representations and warranties contained in this Agreement shall survive the execution, delivery and performance of this Agreement and the creation, payment and performance of the Obligations. This Agreement and the rights and duties of the parties shall be governed by and construed in accordance with the internal laws of the State of Illinois (excluding conflict of law rules).

|

GEORGIA PEACHES, LLC (“SECURED PARTY”)

______________________________________ By: Daniel Gallagher Its: Authorized Agent |

KEN’S CUSTOM UPHOLSTERY, INC. (“DEBTOR”)

______________________________________ By: Kenneth Kovie Its: President |

EXHIBIT D

WARRANT AGREEMENT

THIS WARRANT AND THE UNDERLYING SECURITIES HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”). THEY MAY NOT BE SOLD, OFFERED FOR SALE, PLEDGED OR HYPOTHECATED IN THE ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT AS TO SUCH SECURITIES UNDER THE ACT OR AN OPINION OF COUNSEL SATISFACTORY TO THE COMPANY THAT SUCH REGISTRATION IS NOT REQUIRED.

KEN’S CUSTOM UPHOLSTERY, INC.

WARRANT TO PURCHASE COMMON STOCK

Warrant No. 1

Date of Issuance: November 15, 2013

THIS CERTIFIES THAT, for value received, Georgia Peaches, LLC, an Illinois corporation (the “Holder”), subject to the terms and conditions set forth herein is entitled to subscribe for and purchase from Ken’s Custom Upholstery, Inc., an Illinois corporation (the “Corporation”), Exercise Shares in the total amount of Three Hundred Fifty Thousand of the issued and outstanding common stock of the Corporation, at the Exercise Price, the Total Purchase Price of which shall not ________________________ 00/100 Dollars ($_____________.00).

1. DEFINITIONS. As used herein, the following terms shall have the following respective meanings:

(a) “Exercise Period” shall mean the right of Holder to purchase Three Hundred Fifty Thousand (350,000) Exercise Shares immediately upon the execution of this Agreement.

(b) “Exercise Price” shall mean $0.25 per share, subject to adjustment pursuant to Section 6 below. The Exercise Price represents the stipulated fair market value as agreed upon by the Corporation.

(c) “Total Purchase Price” shall mean Eighty-Seven Thousand Five Hundred and 00/100 Dollars ($87,500.00).

(d) “Exercise Shares” shall mean the Corporation’s common stock issuable upon exercise of this Warrant, subject to adjustment pursuant to the terms herein, including but not limited to adjustment pursuant to Section 6 below.

(e) “Maturity Date” shall mean November 15, 2013, the date upon which the option to purchase Exercise Shares may no longer be exercised.

2. EXERCISE OF WARRANT. The rights represented by this Warrant may be exercised at any time during the Exercise Period, by delivery of the following to the Corporation at its address set forth above (or at such other address as it may designate by notice in writing to the Holder):

(a) An executed Notice of Exercise in the form attached hereto; and

(b) Payment of the Exercise Price either (i) by cancellation of indebtedness; (ii) by surrender to the Corporation of its securities having an aggregate fair market value (as determined in accordance with Section 2.1 below) equal to the aggregate Exercise Price; or (iii) cashless exercise (“Cashless Exercise”), wherein the Holder, at its option, may exercise this Warrant in a cashless exercise transaction as defined below.

In order to effect a Cashless Exercise, the Holder shall surrender this Warrant at the principal office of the Corporation together with an Exercise Form, completed and executed, indicating Holder’s election to effect a Cashless Exercise, in which event the Corporation shall issue Holder a number of shares of Common Stock computed using the following formula:

X = Y (A – B) / A

Where: X = the number of Shares to be issued to Holder.

Y = the number of Shares for which this Warrant is being Exercised.

A = the fair market value of one share of the Corporation’s common stock at the date of calculation, as will be determined by the Company’s Board of Directors in good faith upon the exercise of the Warrant.

B = the Exercise Price.

Upon the exercise of the rights represented by this Warrant, a certificate or certificates for the Exercise Shares so purchased, registered in the name of the Holder or persons affiliated with the Holder, if the Holder so designates, shall be issued and delivered to the Holder within a reasonable time after the rights represented by this Warrant shall have been so exercised.

The person in whose name any certificate or certificates for shares of common stock are to be issued upon exercise of this Warrant shall be deemed to have become the holder of record of such shares on the date on which this Warrant was surrendered and payment of the Exercise Price was made, irrespective of the date of delivery of such certificate or certificates, except that, if the date of such surrender and payment is a date when the stock transfer books of the Corporation are closed, such person shall be deemed to have become the holder of such shares at the close of business on the next succeeding date on which the stock transfer books are open.

2.1 No Partial Exercise; Effective Date of Exercise. There shall be no right to the partial exercise of the rights arising under this Warrant. This Warrant shall be deemed to have been exercised immediately prior to the close of business on the date of its surrender for exercise as provided above. The person entitled to receive the Exercise Shares issuable upon exercise of this Warrant shall be treated for all purposes as the holder of record of such shares as of the close of business on the date the Holder is deemed to have exercised this Warrant.

3. COVENANTS OF THE COMPANY.

3.1 Covenants as to Exercise Shares. The Corporation covenants and agrees that all Exercise Shares that may be issued upon the exercise of the rights represented by this Warrant will, upon issuance, be validly issued and outstanding, fully paid and non-assessable, and free