Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PANTRY INC | a06262014-form8xk.htm |

| EX-99.1 - EXHIBIT 99.1 - PRESS RELEASE - PANTRY INC | a06262014-pressrelease.htm |

The Pantry, Inc. Fiscal Year 2014 Third Quarter Earnings Call Wednesday, July 30, 2014 Exhibit 99.2

Slide 2 Safe Harbor Statement Some of the statements in this presentation constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than those of historical facts included herein, including those related to the company’s financial outlook, goals, business strategy, projected plans and objectives of management for future operations and liquidity, are forward-looking statements. These forward-looking statements are based on the company’s plans and expectations and involve a number of risks and uncertainties that could cause actual results to vary materially from the results and events anticipated or implied by such forward-looking statements. Please refer to the company’s Annual Report on Form 10-K and its other filings with the SEC for a discussion of significant risk factors applicable to the company. In addition, the forward-looking statements included in this presentation are based on the company’s estimates and plans as of the date of this presentation. While the company may elect to update these forward-looking statements at some point in the future, it specifically disclaims any obligation to do so. In this presentation, we will refer to certain non-GAAP financial measures that we believe are helpful in understanding our financial performance. A reconciliation of each non-GAAP financial measure to the most directly comparable GAAP measure is included in the appendix of this presentation.

Third Quarter Business Overview and FY14 Outlook Performance summary Merchandise trends Merchandising and brand awareness Fuel trends Focus on managing costs and improving productivity Store upgrades/quick service restaurants (“QSRs”)/new stores FY14 priorities Slide 3

FY2014 Q3 Summary Income per share of $0.61 versus income per share of $0.26 in 2013 Adjusted EBITDA(1) of $71.2 million versus $65.3 million in Q3 FY2013 Comparable store merchandise revenue increased 2.3% Merchandise sales per customer improved 3.9% over last year Comparable store retail fuel gallons sold declined 2.3% Retail fuel margins improved to $0.129 per gallon from $0.123 in 2013 (1) See Appendix for a description of each non-GAAP financial measure as well as a reconciliation of each non-GAAP financial measure to the most directly comparable GAAP measure. Slide 4

Merchandise Trends Slide 5 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Cigarettes -2.8% -6.4% -3.3% -2.0% -0.7% -2.9% -1.5% Other Packaged Goods 4.3% 0.2% 3.0% 3.8% 5.5% 4.2% 4.0% Packaged Goods 1.6% -2.3% 0.7% 1.8% 3.3% 1.6% 2.1% Proprietary Foodservice 8.6% 3.3% 6.9% 3.3% 6.5% 7.8% 3.2% QSR -1.9% -5.9% -2.4% -0.7% 4.1% 5.8% 7.7% Foodservice 4.2% -0.7% 3.0% 1.7% 5.6% 7.0% 5.0% Services 12.0% 0.7% 9.2% 9.7% 2.1% 3.2% -2.3% Total Comparable Store Merchandise Revenue 2.2% -2.0% 1.3% 2.0% 3.5% 2.3% 2.3% Total Excluding Cigarettes 4.6% 0.1% 3.3% 3.7% 5.4% 4.5% 3.9% Sales Comps FY14FY13

Merchandising and Brand Awareness Continue to realize benefits from improved price position on cigarettes ̶ Increase traffic ̶ Attachment sales New programs introduced – Frozen non-carb beverages – Frozen and iced coffee Expanded categories – Immediate consumption beverage coolers – Grill and condiment program – Hot food and fresh food programs Assortment enhancements – Other tobacco category – Flavored malt beverages – Reintroduction of the Hostess® brand – “Ready-to-eat” segments of grocery – Ethnic and limited time offers in bakery Promotional activity – “Buy more, save more” beverage promotions – Summer $1 Roo Deal programs Slide 6

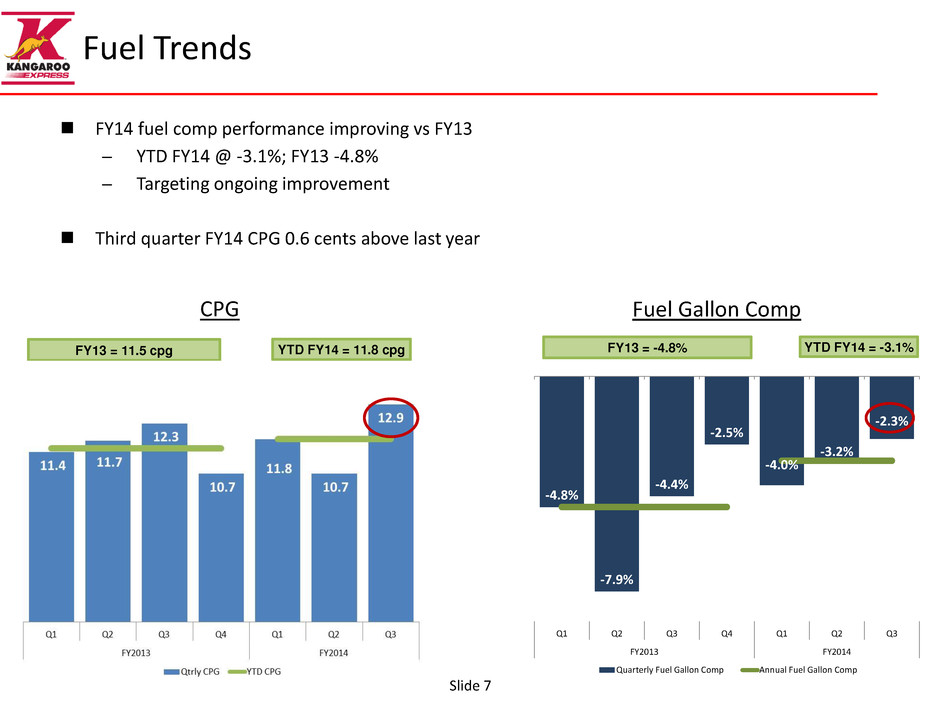

-4.8% -7.9% -4.4% -2.5% -4.0% -3.2% -2.3% Q1 Q2 Q3 Q4 Q1 Q2 Q3 FY2013 FY2014 Quarterly Fuel Gallon Comp Annual Fuel Gallon Comp Fuel Trends Slide 7 FY14 fuel comp performance improving vs FY13 ̶ YTD FY14 @ -3.1%; FY13 -4.8% ̶ Targeting ongoing improvement Third quarter FY14 CPG 0.6 cents above last year FY13 = 11.5 cpg CPG Fuel Gallon Comp FY13 = -4.8% YTD FY14 = 11.8 cpg YTD FY14 = -3.1%

Focus On Managing Costs And Improving Productivity Slide 8 Store level productivity initiatives Improved employee training and development – Customer service – Sales growth (e.g. foodservice, in-stock performance, etc.) G&A cost control Evaluate remodeled stores ̶ Optimize performance of completed remodels ̶ Minimize disruption during high-traffic period ̶ Refine approach to future investments (capital and expense)

Other Third Quarter Key Activities Facilities: – Opened four QSR’s (2 Little Caesars, 1 Dairy Queen and 1 Subway) On track to add 20 QSRs in FY2014 Continued focus on strengthening store portfolio on a market-by-market basis Slide 9

Store Development Activity Slide 10 Recently constructed rebuild store near Fort Bragg, NC complete with military theme to enhance local marketing Developing pipeline of high quality sites to support accelerated new store growth in high potential markets

FY14 Priorities Slide 11 Hire, train and develop the best and most energized people Implementation of merchandising programs and increasing store traffic Increasing the traffic to our stores Optimize remodel and QSR programs as we look to resume remodels in fiscal 2015 Balance fuel profitability while stabilizing market share Improve productivity and control costs Continue market-by-market analysis and new store site identification to support future growth

Third Quarter Financial Review Slide 12 Financial summary Financial details Capital expenditures Store count Capital structure and liquidity Fiscal 2014 outlook

Third Quarter Financial Summary ($ millions except per share data) Slide 13 (1) Includes impairment charges of $0.8 million and $1.1 million in 2013 and 2014, respectively. (2) See Appendix for a description of each non-GAAP financial measure as well as a reconciliation of each non-GAAP financial measure to the most directly comparable GAAP measure. 2013 2014 Percent Change Total revenues $ 1,992.7 $ 2,019.1 1.3% Total costs and operating expenses (1) 1,957.6 1,976.2 1.0% Income from operations $ 35.1 $ 42.9 22.2% Interest expense 22.0 21.4 -2.7% Loss before income taxes $ 13.2 $ 21.5 62.9% Income tax expense 7.2 7.5 4.2% Net Loss $ 5.9 $ 14.0 137.3% Earnings per share $ 0.26 $ 0.61 134.6% Adjusted EBITDA(2) $ 65.3 71.2$ 9.0% Third Quarter

Third Quarter Financial Details ($ millions) Slide 14 2013 2014 Percent Change Merchandise revenue $ 476.6 $ 484.5 1.7% Fuel revenue 1,516.1 1,534.6 1.2% Total revenues $ 1,992.7 $ 2,019.1 1.3% Merchandise cost of goods sold $ 315.7 $ 320.2 1.4% Fuel cost of goods sold 1,462.2 1,479.7 1.2% Store operating 123.3 123.4 0.1% General and administrative 26.1 24.6 -5.7% Impairment charges 0.8 1.1 37.5% Depreciation and amortization 29.4 27.3 -7.1% Income from operations $ 35.1 $ 42.9 22.2% Selected financial data: Comparable store merchandise sales % 1.3% 2.3% Weighted-average store count 1,567 1,532 Merchandise margin 33.8% 33.9% Comparable store retail fuel gallons % -4.4% -2.3% Retail fuel margin per gallon $ 0.123 $ 0.129 Third Quarter

FY2014 Capital Expenditures ($ millions) Slide 15 Q3 YTD Q3 YTD Q3 YTD Capital expenditures 21.1$ 58.7$ 21.3$ 76.1$ 0.2$ 17.4$ Proceeds from asset dispositions (1.4) (3.7) (1.0) (3.6) 0.4$ 0.1$ Capital expenditures, net 19.7$ 55.0$ 20.3$ 72.5$ 0.6$ 17.5$ 2013 2014 Change

Store Count Summary Slide 16 Ending Stores - FY2013 1,548 New 1 Closed (11) Ending Stores - Q1 FY2014 1,538 Closed (4) Ending Stores - Q2 FY2014 1,534 Closed (7) Ending Stores - Q3 FY2014 1,527

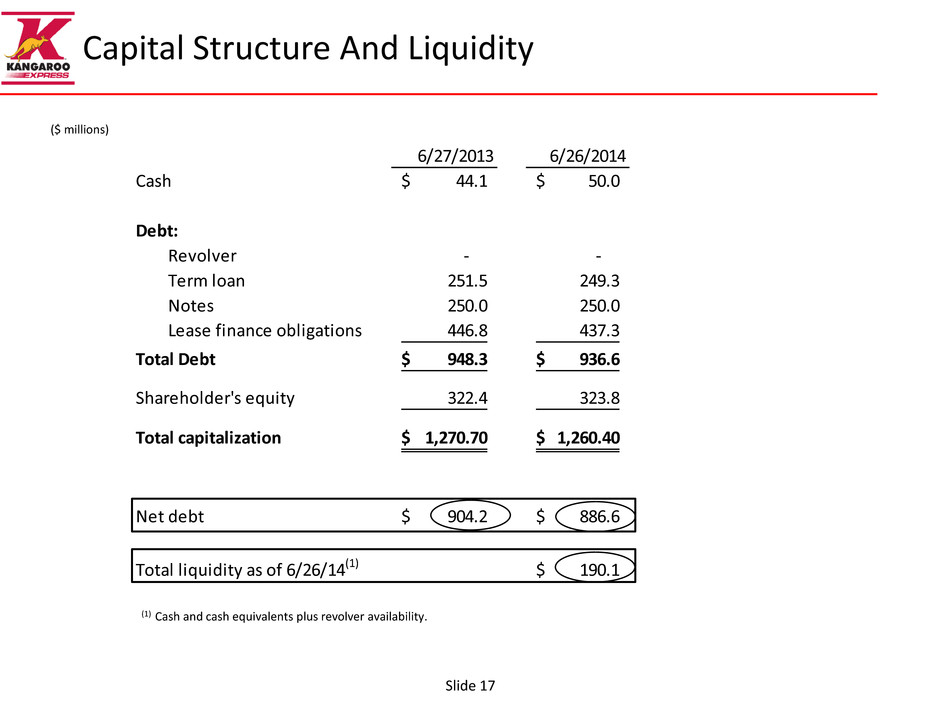

6/27/2013 6/26/2014 Cash 44.1$ 50.0$ Debt: Revolver - - Term loan 251.5 249.3 Notes 250.0 250.0 Lease finance obligations 446.8 437.3 Total Debt 948.3$ 936.6$ Shareholder's equity 322.4 323.8 Total capitalization 1,270.70$ 1,260.40$ Net debt 904.2$ 886.6$ Total liquidity as of 6/26/14(1) 190.1$ Capital Structure And Liquidity ($ millions) Slide 17 (1) Cash and cash equivalents plus revolver availability.

Fiscal 2014 Outlook Slide 18 (1) Fiscal 2014 guidance assumes closure of approximately 30 stores. Q4 FY13 FY13 Actual Low High Actual Low High Merchandise sa les ($B) $0.476 $0.479 $0.489 $1.80 $1.83 $1.84 Merchandise gross margin 34.3% 33.7% 34.2% 34.0% 33.8% 33.9% Retai l fuel ga l lons (B) 0.441 0.417 0.427 1.71 1.64 1.65 Retai l fuel margin per ga l lon $0.107 $0.110 $0.140 $0.115 $0.116 $0.124 Store operating and general and adminis trative expenses ($M) Depreciation & amortization ($M) $30 $27 $29 $118 $112 $114 Effective corporate tax rate 128.4% 30.0% 32.0% 65.8% 30.0% 32.0% Interest expense ($M) $22 $21 $22 $89 $85 $86 Capita l expenditures , net ($M) $29 $17 $27 $85 $90 $100 Q4 FY14 Guidance(1) FY14 Guidance(1) $162 $156 $159 $609 $609 $612

Slide 19

Appendix Slide 20 Selected financial data Use of Non-GAAP measures

Selected Financial Data Slide 21 ($ thousands, except per share amounts) Revenues: Merchandise $ 476,596 $ 484,522 $ 1,324,393 $ 1,351,384 Fuel Total revenues Costs and operating expenses: Merchandise cost of goods sold Fuel cost of goods sold Store operating General and administrative Impairment charges Depreciation and amortization Total costs and operating expenses Income from operations Interest expense Income (loss) before income taxes Income tax expense (benefit) Net income (loss) $ 5,938 $ 14,021 $ (3,984) $ (1,431) Income (loss) per diluted share: Income (loss) per diluted share $ 0.26 $ 0.61 $ (0.18) $ (0.06) Diluted shares outstanding Three Months Ended Nine Months Ended June 26, 2013 2014 2013 2014 June 27, June 26, June 27, 1,992,651 2,019,125 5,800,075 5,590,405 1,516,055 1,534,603 4,475,682 4,239,021 123,275 123,385 371,808 376,917 26,078 24,623 75,179 76,278 315,741 320,202 875,499 894,526 1,462,222 1,479,682 4,324,242 4,092,868 1,957,538 1,976,233 5,738,253 5,528,301 35,113 42,892 61,822 62,104 776 1,082 3,955 2,818 29,446 27,259 87,570 84,894 13,154 21,494 (5,396) (1,977) 21,959 21,398 67,218 64,081 22,896 23,011 22,673 22,853 7,216 7,473 (1,412) (546)

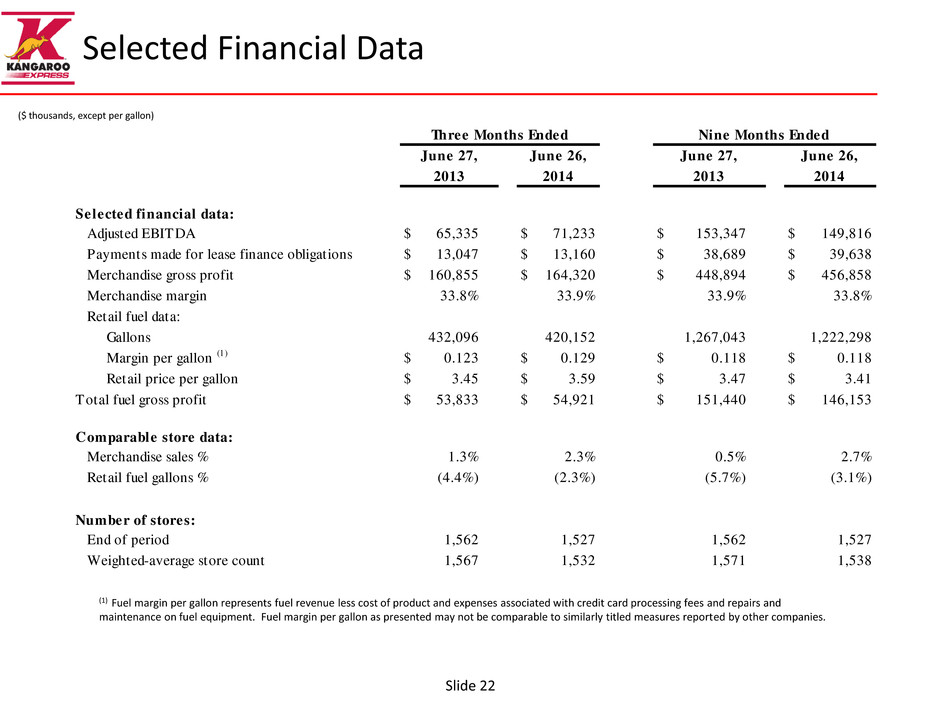

Selected Financial Data Slide 22 (1) Fuel margin per gallon represents fuel revenue less cost of product and expenses associated with credit card processing fees and repairs and maintenance on fuel equipment. Fuel margin per gallon as presented may not be comparable to similarly titled measures reported by other companies. ($ thousands, except per gallon) Selected financial data: Adjusted EBITDA $ 65,335 $ 71,233 $ 153,347 $ 149,816 Payments made for lease finance obligations $ 13,047 $ 13,160 $ 38,689 $ 39,638 Merchandise gross profit $ 160,855 $ 164,320 $ 448,894 $ 456,858 Merchandise margin Retail fuel data: Gallons Margin per gallon (1) $ 0.123 $ 0.129 $ 0.118 $ 0.118 Retail price per gallon $ 3.45 $ 3.59 $ 3.47 $ 3.41 Total fuel gross profit $ 53,833 $ 54,921 $ 151,440 $ 146,153 Comparable store data: Merchandise sales % Retail fuel gallons % Number of stores: End of period Weighted-average store count 1,567 1,532 1,571 1,538 1,562 1,527 1,562 1,527 (4.4%) (2.3%) (5.7%) (3.1%) 1.3% 2.3% 0.5% 2.7% 432,096 420,152 1,267,043 1,222,298 33.8% 33.9% 33.9% 33.8% June 26, 2013 2014 2013 2014 June 27, June 26, June 27, Three Months Ended Nine Months Ended

Use of Non-GAAP Measures Adjusted EBITDA Adjusted EBITDA is defined by the Company as net income (loss) before interest expense, gain/loss on extinguishment of debt, income taxes, impairment charges and depreciation and amortization. Adjusted EBITDA is not a measure of operating performance or liquidity under generally accepted accounting principles in the United States of America (“GAAP”) and should not be considered as a substitute for net income, cash flows from operating activities or other income or cash flow statement data. The Company has included information concerning Adjusted EBITDA because it believes investors find this information useful as a reflection of the resources available for strategic opportunities including, among others, to invest in the Company’s business, make strategic acquisitions and to service debt. Management also uses Adjusted EBITDA to review the performance of the Company's business directly resulting from its retail operations and for budgeting and compensation targets. Adjusted EBITDA does not include impairment of long-lived assets and other charges. The Company excluded the effect of impairment losses because it believes that including them in Adjusted EBITDA is not consistent with reflecting the ongoing performance of its remaining assets. Adjusted EBITDA does not include gain/loss on extinguishment of debt because it represents financing activities and is not indicative of the ongoing performance of the Company’s remaining stores. Slide 23

Additional Information Regarding Non-GAAP Measures Any measure that excludes interest expense, gain/loss on extinguishment of debt, depreciation and amortization, impairment charges, or income taxes has material limitations because the Company uses debt and lease financing in order to finance its operations and acquisitions, uses capital and intangible assets in its business and must pay income taxes as a necessary element of its operations. Due to these limitations, the Company uses non-GAAP measures in addition to and in conjunction with results and cash flows presented in accordance with GAAP. The Company strongly encourages investors to review its consolidated financial statements and publicly filed reports in their entirety and not to rely on any single financial measure. Because non-GAAP financial measures are not standardized, the measures referenced above, each as defined by the Company, may not be comparable to similarly titled measures reported by other companies. It therefore may not be possible to compare the Company's use of these measures with non-GAAP financial measures having the same or similar names used by other companies. Slide 24

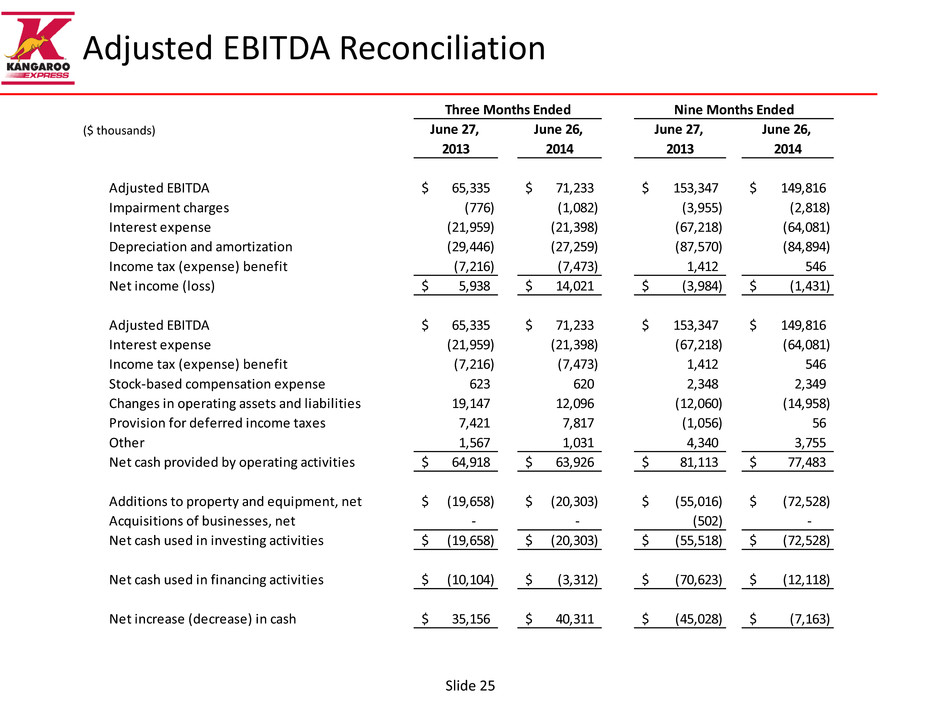

Adjusted EBITDA Reconciliation Slide 25 ($ thousands) June 27, June 26, June 27, June 26, 2013 2014 2013 2014 Adjusted EBITDA 65,335$ 71,233$ 153,347$ 149,816$ Impairment charges (776) (1,082) (3,955) (2,818) Interest expense (21,959) (21,398) (67,218) (64,081) Depreciation and amortization (29,446) (27,259) (87,570) (84,894) Income tax (expense) benefit (7,216) (7,473) 1,412 546 Net income (loss) 5,938$ 14,021$ (3,984)$ (1,431)$ Adjusted EBITDA 65,335$ 71,233$ 153,347$ 149,816$ Interest expense (21,959) (21,398) (67,218) (64,081) Income tax (expense) benefit (7,216) (7,473) 1,412 546 Stock-based compensation expense 623 620 2,348 2,349 Changes in operating assets and liabilities 19,147 12,096 (12,060) (14,958) Provision for deferred income taxes 7,421 7,817 (1,056) 56 Other 1,567 1,031 4,340 3,755 Net cash provided by operating activities 64,918$ 63,926$ 81,113$ 77,483$ Additions to property and equipment, net (19,658)$ (20,303)$ (55,016)$ (72,528)$ Acquisitions of businesses, net - - (502) - Net cash used in investing activities (19,658)$ (20,303)$ (55,518)$ (72,528)$ Net cash used in financing activities (10,104)$ (3,312)$ (70,623)$ (12,118)$ Net increase (decrease) in cash 35,156$ 40,311$ (45,028)$ (7,163)$ Three Months Ended Nine Months Ended