Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MULTIMEDIA GAMES HOLDING COMPANY, INC. | q32014earningsrelease.htm |

| EX-99.1 - EXHIBIT - MULTIMEDIA GAMES HOLDING COMPANY, INC. | exhibit991q32014earningsre.htm |

MGAM INVESTOR PRESENTATION 2014 Fiscal 3rd Quarter

SAFE HARBOR STATEMENT In addition to historical facts or statements of current conditions, this presentation contains forward-looking statements that are intended to qualify for the “safe harbor” from liability established by the Private Securities Litigation Reform Act of 1995. The words or phrases “believe”, “will”, “expect”, “continue”, "are confident that", "intend", "plan", "seek", "estimate", “project", "may", or the negative or other variations thereof, or comparable terminology, signify such forward-looking statements. All forward-looking statements reflect the current expectations and views of the Company. The preparation of this presentation and the forward-looking statements contained herein also require that the Company make estimates and assumptions regarding, among other items, target dates, operations, valuations, financial outlook, regulatory enforcement, technical compliance, and amounts of assets, liabilities, revenues, sales and expenses. Actual results in the Company’s performance may differ materially from the possible results expressed in or implied by such forward-looking statements, or from the current expectations, views, estimates, and assumptions. The Company’s ability to perform as contemplated in this presentation, including without limitation, its ability to enter into or remain in any new or existing jurisdictions or to sell new or existing products, or complete and successfully transition any acquisition, is subject to numerous risks, such as, without limitation, customer concentration, competition from other suppliers, regulatory approvals, licensing requirements, intellectual property considerations, and other known and unknown circumstances. Those and other risks are described in the Company’s filings with the Securities and Exchange Commission, including without limitation, under “Risk Factors” in the Company’s reports on Form 10-K and Form 10-Q. Many of such risks cannot be predicted or quantified, or may be beyond the Company’s control. If any of these or other risks were to occur, the Company’s business and financial condition, including the trading price of its common stock, could be materially harmed. All forward-looking statements contained herein speak only to the facts and circumstances existing as of the date of this presentation. Except as required by applicable law, the Company does not undertake and expressly disclaims any obligation to update or revise any forward-looking statements, estimates, projections, dates, or risks, whether as a result of new information, future events, changed circumstances, or otherwise. This presentation may include non-GAAP financial measures to describe our operating performance, which we believe are useful in measuring and assessing the performance of our operations. These measures are intended to supplement, not substitute for, GAAP comparable measures. Investors are urged to consider carefully the comparable GAAP measures and reconciliations. Reconciliations of these non-GAAP measures to comparable GAAP measures and other related information can be found in our recent SEC filings available in the Investor Relations section of our website at www.multimediagames.com. 2

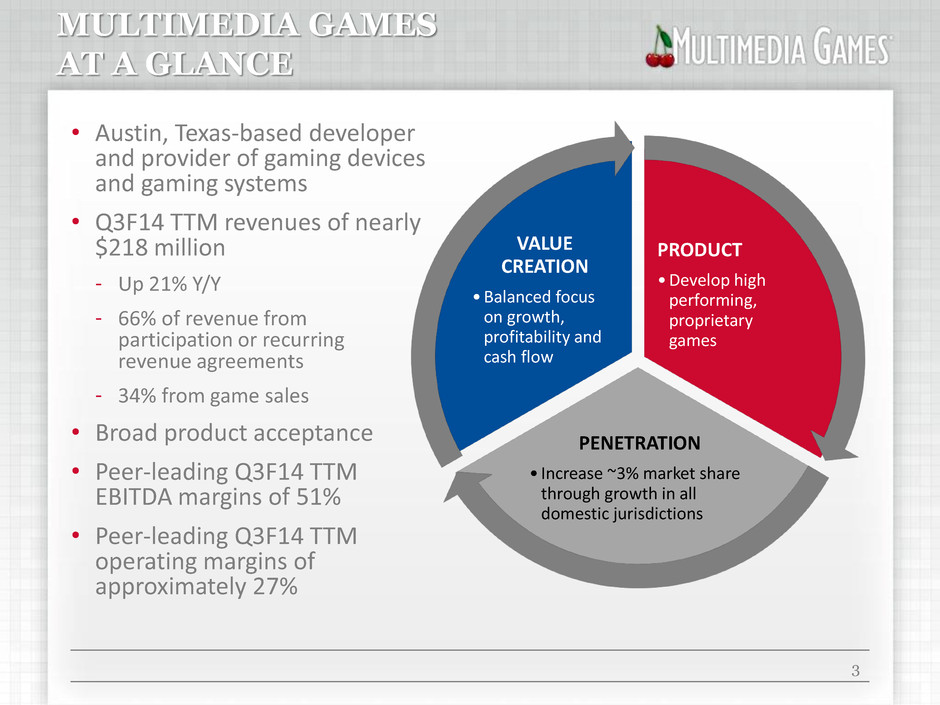

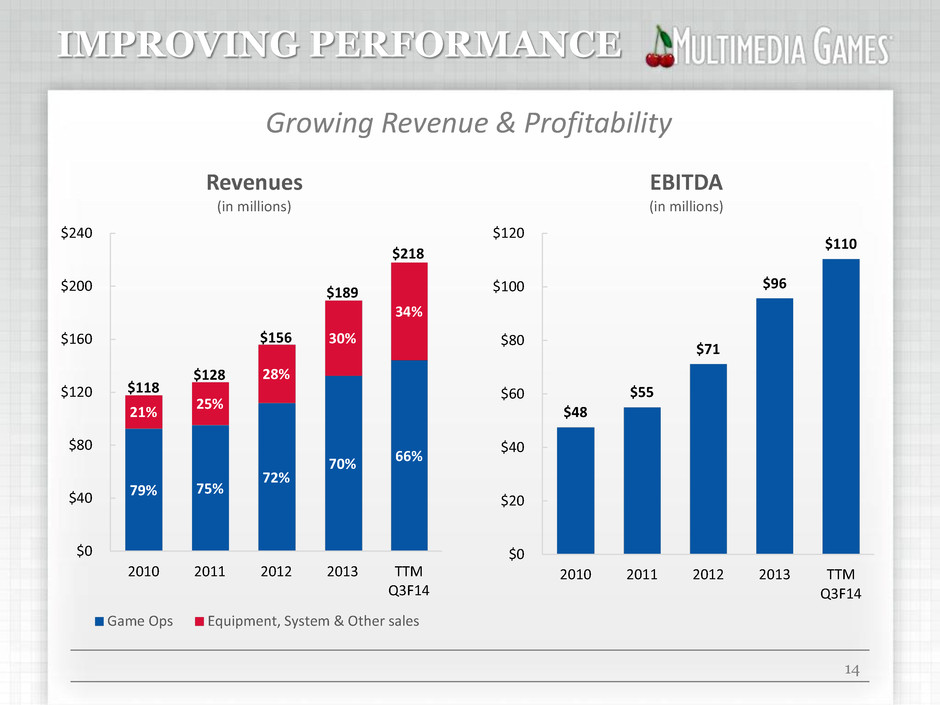

MULTIMEDIA GAMES AT A GLANCE • Austin, Texas-based developer and provider of gaming devices and gaming systems • Q3F14 TTM revenues of nearly $218 million - Up 21% Y/Y - 66% of revenue from participation or recurring revenue agreements - 34% from game sales • Broad product acceptance • Peer-leading Q3F14 TTM EBITDA margins of 51% • Peer-leading Q3F14 TTM operating margins of approximately 27% 3 PRODUCT •Develop high performing, proprietary games PENETRATION • Increase ~3% market share through growth in all domestic jurisdictions VALUE CREATION • Balanced focus on growth, profitability and cash flow

MGAM Product 4

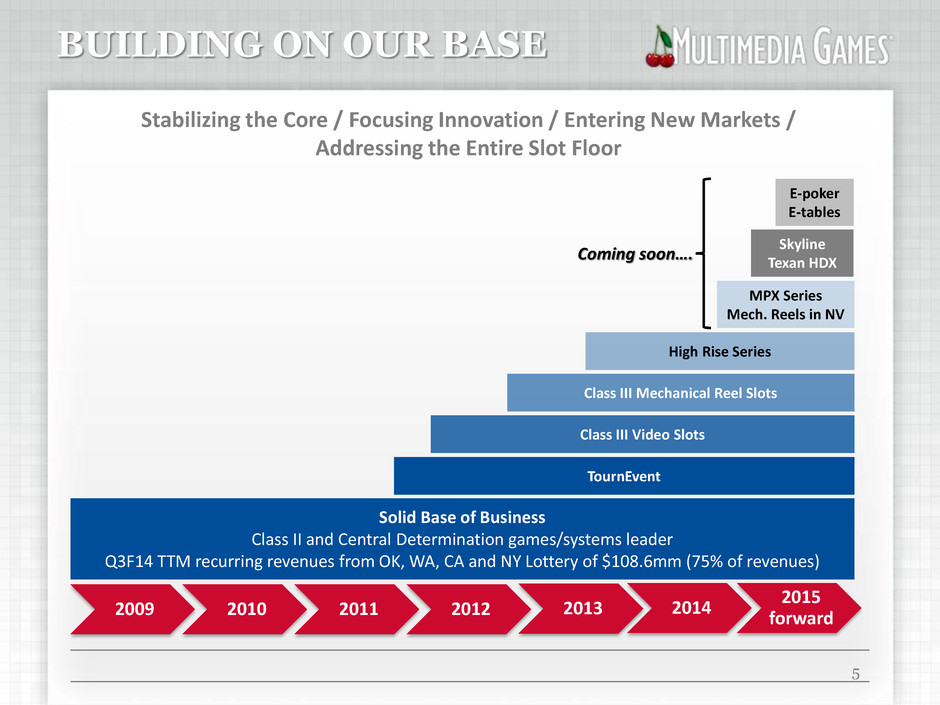

5 BUILDING ON OUR BASE Solid Base of Business Class II and Central Determination games/systems leader Q3F14 TTM recurring revenues from OK, WA, CA and NY Lottery of $108.6mm (75% of revenues) Class III Video Slots Class III Mechanical Reel Slots TournEvent High Rise Series Stabilizing the Core / Focusing Innovation / Entering New Markets / Addressing the Entire Slot Floor 2009 2010 2011 2012 2013 2014 2015 forward MPX Series Mech. Reels in NV Skyline Texan HDX E-poker E-tables Coming soon….

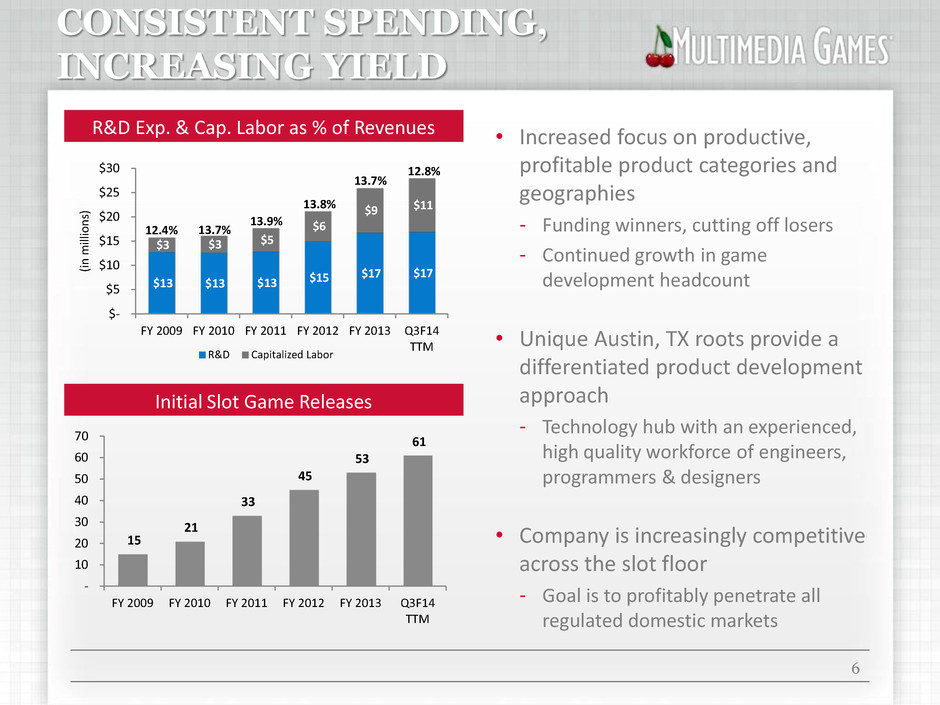

CONSISTENT SPENDING, INCREASING YIELD • Increased focus on productive, profitable product categories and geographies - Funding winners, cutting off losers - Continued growth in game development headcount • Unique Austin, TX roots provide a differentiated product development approach - Technology hub with an experienced, high quality workforce of engineers, programmers & designers • Company is increasingly competitive across the slot floor - Goal is to profitably penetrate all regulated domestic markets 6 $13 $13 $13 $15 $17 $17 $3 $3 $5 $6 $9 $11 $- $5 $10 $15 $20 $25 $30 FY 2009 FY 2010 FY 2011 FY 2012 FY 2013 Q3F14 TTM (in m ill io n s) R&D Capitalized Labor R&D Exp. & Cap. Labor as % of Revenues 15 21 33 45 53 61 - 10 20 30 40 50 60 70 FY 2009 FY 2010 FY 2011 FY 2012 FY 2013 Q3F14 TTM Initial Slot Game Releases 12.4% 13.7% 13.9% 13.8% 13.7% 12.8%

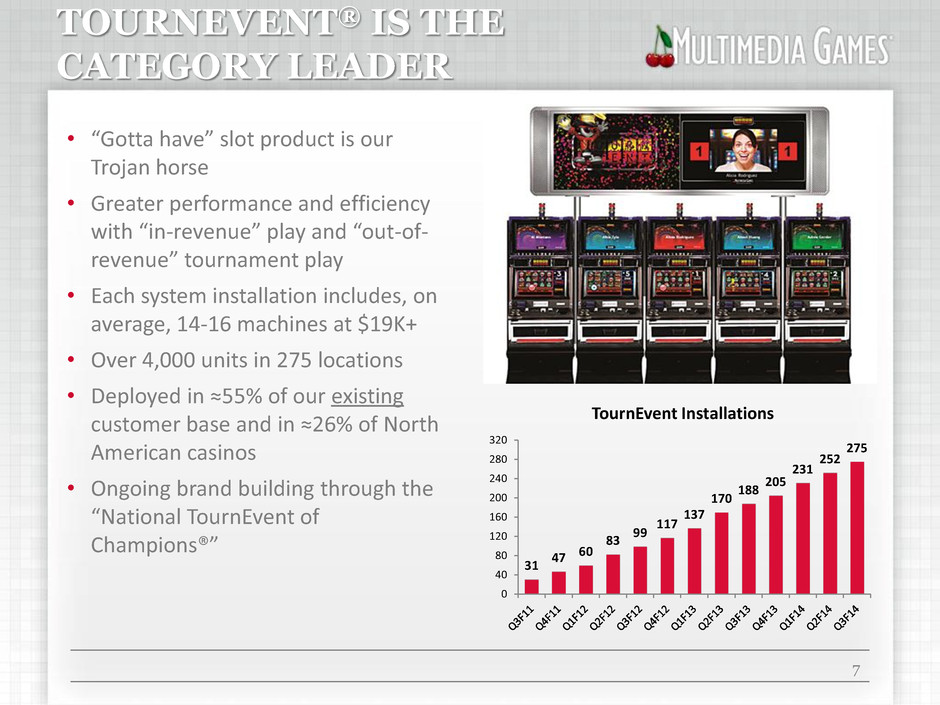

TOURNEVENT® IS THE CATEGORY LEADER 7 31 47 60 83 99 117 137 170 188 205 231 252 275 0 40 80 120 160 200 240 280 320 TournEvent Installations • “Gotta have” slot product is our Trojan horse • Greater performance and efficiency with “in-revenue” play and “out-of- revenue” tournament play • Each system installation includes, on average, 14-16 machines at $19K+ • Over 4,000 units in 275 locations • Deployed in ≈55% of our existing customer base and in ≈26% of North American casinos • Ongoing brand building through the “National TournEvent of Champions®”

HIGH RISE GAME® SERIES 8 • MGAM’s first premium participation / daily fee product line featuring a customizable vertical 37” LCD screen • Multiple titles - Include MoneyBall®, Jackpot Factory®, One Red Cent Deluxe®, High Rollin’® and Chamillion® Deluxe - Combines video and traditional mechanical reel games in the bonus • 1,168 units in 227 casinos as of 6/30/14 • Prominent physical and visual presence drives competitive performance • Quarterly game releases ensure fresh content

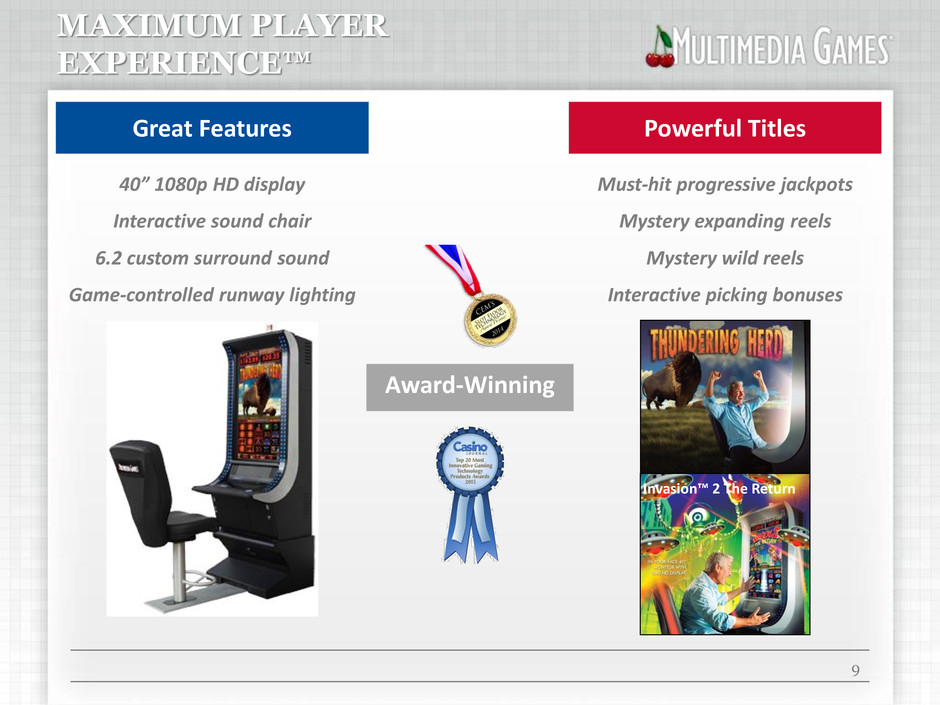

MAXIMUM PLAYER EXPERIENCE™ 9 Must-hit progressive jackpots Mystery expanding reels Mystery wild reels Interactive picking bonuses Great Features 40” 1080p HD display Interactive sound chair 6.2 custom surround sound Game-controlled runway lighting Powerful Titles Invasion™ 2 The Return Award-Winning

POKERTEK ACQUISITION • Total acquisition price of $13 million or $1.35 per share • We expect the acquisition neutral to F2015 EPS and accretive in F2016 • Transaction expected to close in calendar 2014 • PokerTek generated $5.5 million of revenue in calendar 2013 - 85% of total revenue from recurring revenue placements • 2,294 gaming positions deployed at March 31, 2014 10

MGAM Distribution 11

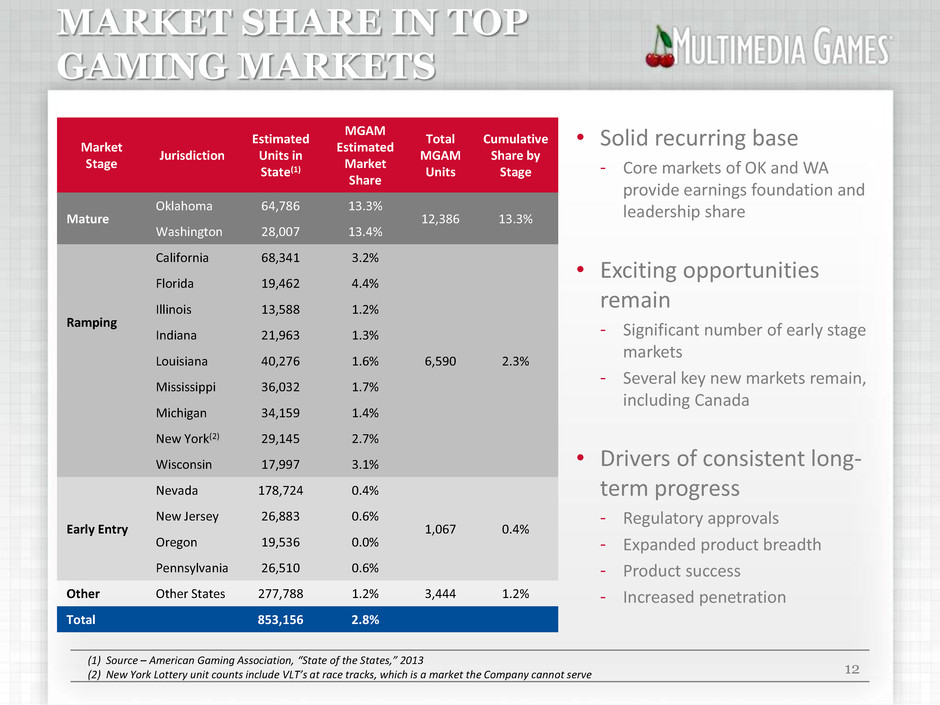

MARKET SHARE IN TOP GAMING MARKETS 12 (1) Source – American Gaming Association, “State of the States,” 2013 (2) New York Lottery unit counts include VLT’s at race tracks, which is a market the Company cannot serve • Solid recurring base - Core markets of OK and WA provide earnings foundation and leadership share • Exciting opportunities remain - Significant number of early stage markets - Several key new markets remain, including Canada • Drivers of consistent long- term progress - Regulatory approvals - Expanded product breadth - Product success - Increased penetration Market Stage Jurisdiction Estimated Units in State(1) MGAM Estimated Market Share Total MGAM Units Cumulative Share by Stage Mature Oklahoma 64,786 13.3% 12,386 13.3% Washington 28,007 13.4% Ramping California 68,341 3.2% 6,590 2.3% Florida 19,462 4.4% Illinois 13,588 1.2% Indiana 21,963 1.3% Louisiana 40,276 1.6% Mississippi 36,032 1.7% Michigan 34,159 1.4% New York(2) 29,145 2.7% Wisconsin 17,997 3.1% Early Entry Nevada 178,724 0.4% 1,067 0.4% New Jersey 26,883 0.6% Oregon 19,536 0.0% Pennsylvania 26,510 0.6% Other Other States 277,788 1.2% 3,444 1.2% Total 853,156 2.8%

MGAM Financial Performance 13

IMPROVING PERFORMANCE 14 79% 75% 72% 70% 66% 21% 25% 28% 30% 34% $0 $40 $80 $120 $160 $200 $240 2010 2011 2012 2013 TTM Q3F14 Revenues (in millions) Game Ops Equipment, System & Other sales $48 $55 $71 $96 $110 $0 $20 $40 $60 $80 $100 $120 2010 2011 2012 2013 TTM Q3F14 EBITDA (in millions) Growing Revenue & Profitability $118 $128 $156 $189 $218

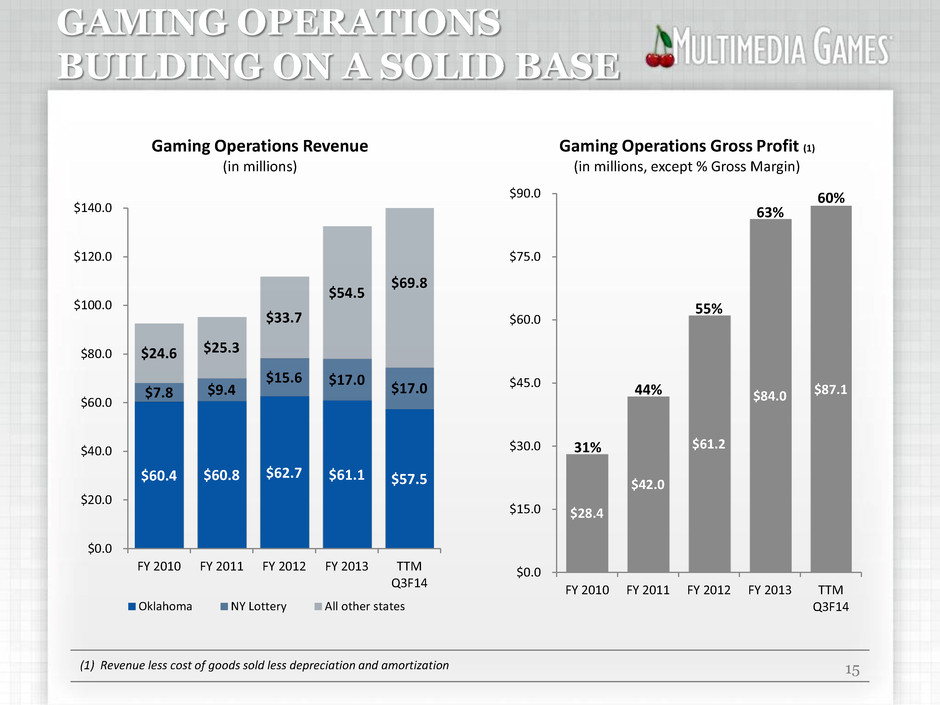

GAMING OPERATIONS BUILDING ON A SOLID BASE 15 $60.4 $60.8 $62.7 $61.1 $57.5 $7.8 $9.4 $15.6 $17.0 $17.0 $24.6 $25.3 $33.7 $54.5 $69.8 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 FY 2010 FY 2011 FY 2012 FY 2013 TTM Q3F14 Gaming Operations Revenue (in millions) Oklahoma NY Lottery All other states $28.4 $42.0 $61.2 $84.0 $87.1 $0.0 $15.0 $30.0 $45.0 $60.0 $75.0 $90.0 FY 2010 FY 2011 FY 2012 FY 2013 TTM Q3F14 Gaming Operations Gross Profit (1) (in millions, except % Gross Margin) (1) Revenue less cost of goods sold less depreciation and amortization 31% 44% 55% 63% 60%

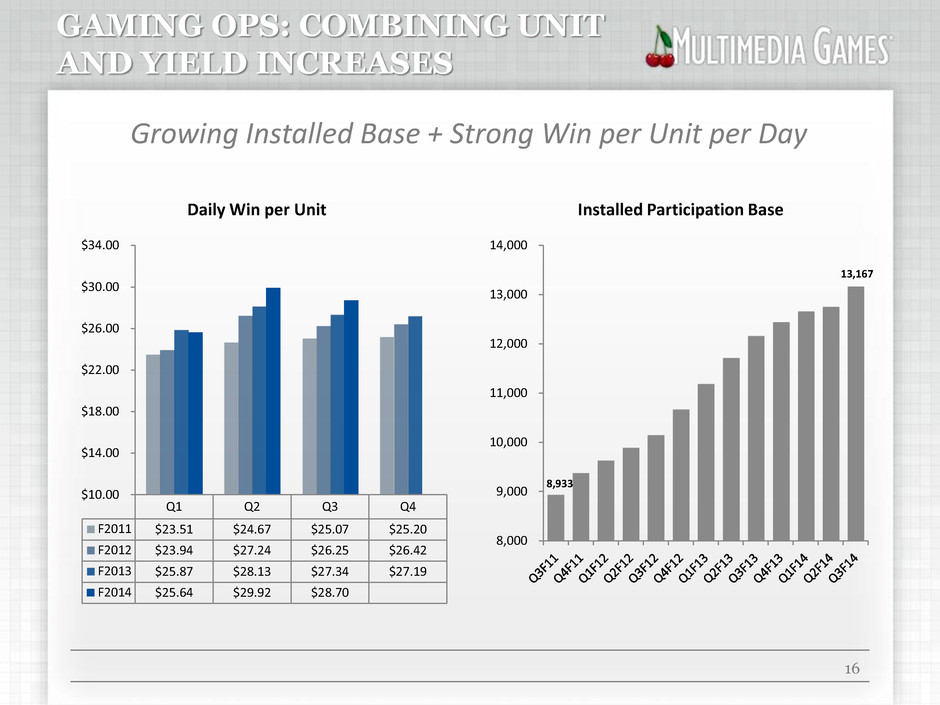

GAMING OPS: COMBINING UNIT AND YIELD INCREASES Q1 Q2 Q3 Q4 F2011 $23.51 $24.67 $25.07 $25.20 F2012 $23.94 $27.24 $26.25 $26.42 F2013 $25.87 $28.13 $27.34 $27.19 F2014 $25.64 $29.92 $28.70 $10.00 $14.00 $18.00 $22.00 $26.00 $30.00 $34.00 Daily Win per Unit 8,933 13,167 8,000 9,000 10,000 11,000 12,000 13,000 14,000 Installed Participation Base 16 Growing Installed Base + Strong Win per Unit per Day

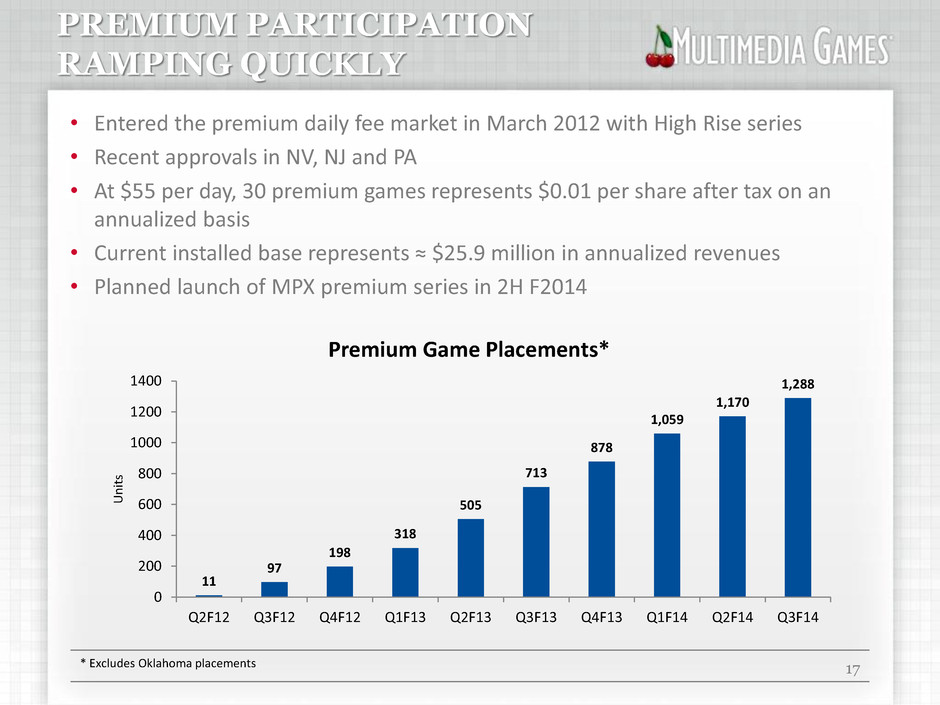

PREMIUM PARTICIPATION RAMPING QUICKLY • Entered the premium daily fee market in March 2012 with High Rise series • Recent approvals in NV, NJ and PA • At $55 per day, 30 premium games represents $0.01 per share after tax on an annualized basis • Current installed base represents ≈ $25.9 million in annualized revenues • Planned launch of MPX premium series in 2H F2014 17 * Excludes Oklahoma placements 11 97 198 318 505 713 878 1,059 1,170 1,288 0 200 400 600 800 1000 1200 1400 Q2F12 Q3F12 Q4F12 Q1F13 Q2F13 Q3F13 Q4F13 Q1F14 Q2F14 Q3F14 U n it s Premium Game Placements*

GROWING EQUIPMENT & SYSTEM SALES 18 $23.4 $30.9 $42.8 $54.5 $71.1 $0 $20 $40 $60 $80 FY 2010 FY 2011 FY 2012 FY 2013 TTM Q3F14 Equipment & Systems Revenue (in millions) $12.3 $16.3 $24.2 $31.4 $38.5 $0 $5 $10 $15 $20 $25 $30 $35 $40 $45 FY 2010 FY 2011 FY 2012 FY 2013 TTM Q3F14 Equipment & Systems Gross Profit (in millions) Consistent Growth & Strong Markets 53% 53% 57% 58% 54%

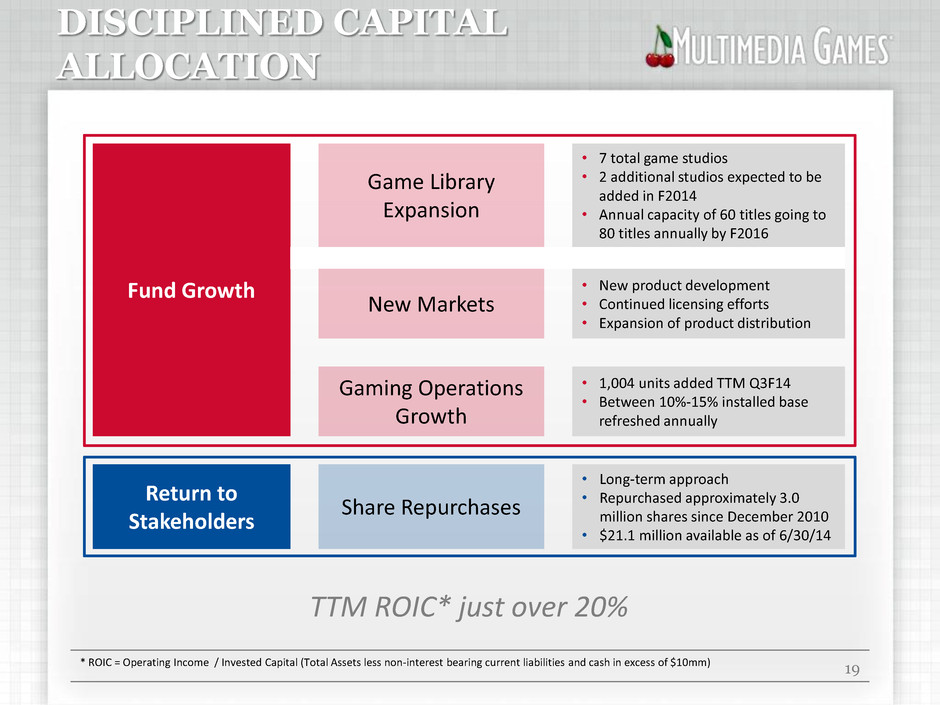

Fund Growth Game Library Expansion • 7 total game studios • 2 additional studios expected to be added in F2014 • Annual capacity of 60 titles going to 80 titles annually by F2016 New Markets • New product development • Continued licensing efforts • Expansion of product distribution Gaming Operations Growth • 1,004 units added TTM Q3F14 • Between 10%-15% installed base refreshed annually Return to Stakeholders Share Repurchases • Long-term approach • Repurchased approximately 3.0 million shares since December 2010 • $21.1 million available as of 6/30/14 DISCIPLINED CAPITAL ALLOCATION 19 TTM ROIC* just over 20% * ROIC = Operating Income / Invested Capital (Total Assets less non-interest bearing current liabilities and cash in excess of $10mm)

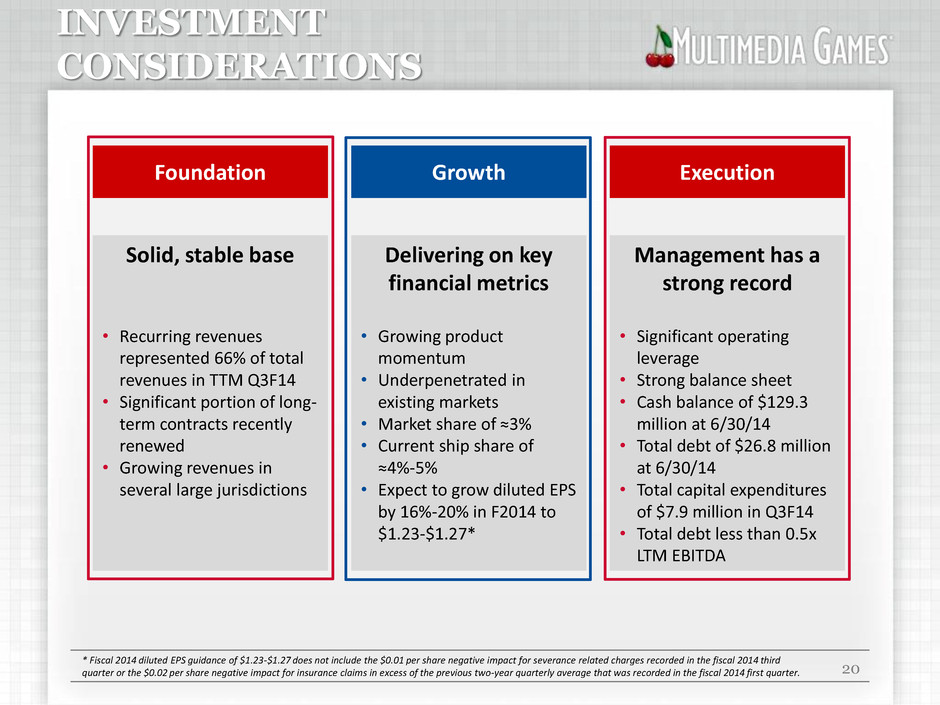

Foundation Growth Execution Solid, stable base • Recurring revenues represented 66% of total revenues in TTM Q3F14 • Significant portion of long- term contracts recently renewed • Growing revenues in several large jurisdictions Delivering on key financial metrics • Growing product momentum • Underpenetrated in existing markets • Market share of ≈3% • Current ship share of ≈4%-5% • Expect to grow diluted EPS by 16%-20% in F2014 to $1.23-$1.27* Management has a strong record • Significant operating leverage • Strong balance sheet • Cash balance of $129.3 million at 6/30/14 • Total debt of $26.8 million at 6/30/14 • Total capital expenditures of $7.9 million in Q3F14 • Total debt less than 0.5x LTM EBITDA INVESTMENT CONSIDERATIONS 20 * Fiscal 2014 diluted EPS guidance of $1.23-$1.27 does not include the $0.01 per share negative impact for severance related charges recorded in the fiscal 2014 third quarter or the $0.02 per share negative impact for insurance claims in excess of the previous two-year quarterly average that was recorded in the fiscal 2014 first quarter.