Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CommunityOne Bancorp | a8kforinvestorpresentation.htm |

CommunityOne Bancorp July 29, 2014 Investor Presentation

Forward Looking Statements & Other Information Forward Looking Statements This presentation contains certain forward-looking statements within the safe harbor rules of the federal securities laws. These statements generally relate to COB’s financial condition, results of operations, plans, objectives, future performance or business. They usually can be identified by the use of forward-looking terminology, such as “believes,” “expects,” or “are expected to,” “plans,” “projects,” “goals,” “estimates,” “may,” “should,” “could,” “would,” “intends to,” “outlook” or “anticipates,” or variations of these and similar words, or by discussions of strategies that involve risks and uncertainties. Forward looking statements are subject to risks and uncertainties, including but not limited to, those risks described in COB’s Annual Report on Form 10-K for the year ended December 31, 2013 under the section entitled “Item 1A, Risk Factors,” and in the Quarterly Reports of Form 10-Q and other reports that are filed by COB with the Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward-looking statements, which are subject to numerous assumptions, risks and uncertainties, and which change over time. These forward-looking statements speak only as of the date of this presentation. Actual results may differ materially from those expressed in or implied by any forward looking statements contained in this presentation. We assume no duty to revise or update any forward-looking statements, except as required by applicable law. Non-GAAP Financial Measures In addition to the results of operations presented in accordance with Generally Accepted Accounting Principles (GAAP), COB management uses and this presentation contains or references, certain non-GAAP financial measures, such as core earnings and core noninterest expense to average assets and tangible book value. COB believes these non- GAAP financial measures provide information useful to investors in understanding our underlying operational performance and our business and performance trends as they facilitate comparisons with the performance of others in the financial services industry; however, these non-GAAP financial measures should not be considered an alternative to GAAP. The non-GAAP financial measures contained within this presentation should be read in conjunction with the audited financial statements and analysis as presented in COB’s Annual Report on Form 10-K as well as the unaudited financial statements and analyses as presented in COB’s Quarterly Reports on Form 10-Q. A reconciliation of non- GAAP measures to the most directly comparable GAAP measure is included within tables in the presentation or with the appendix to this presentation. 2

3 – Contributed $310 million in new capital – Merged CommunityOne Bancorp and Bank of Granite Corp – Installed new experienced management team and Board – Reorganized into lines of business around customer needs – Implemented revised credit policies and processes – Preserved DTA Recapitalization and merger in 2011 – Returned to profitability in 2nd half of 2013 - $6.3 million in net income – Executed Bank merger and achieved targeted synergies – Resolved all legacy enforcement actions – Exceeded asset quality goals with minimal credit cost Achieved or exceeded turnaround goals for 2013 – CommunityOne Bank founded in 1907 as First National Bank of Asheboro – Bank of Granite founded in 1906 – High quality, low cost deposit franchises – Multi-generational customer relationships Long history of performance CommunityOne at a Glance 3

4 – Strategic initiatives drive loans to deposits ratio from 69% to 75% – Grow loans 8%+ through share gains and expansion into new markets – 3% deposit growth aided by investments in Treasury Management and online/mobile banking infrastructure – 4% core expense savings invested in Strategic Initiatives – Continued improvements in asset quality and reduced credit costs – Pursue growth through acquisitions Key objectives for 2014 Driving Financial Performance 4 – Grow net interest income at above peer rates Generate above peer loan growth by adding banking talent and expanding into new geographic markets via LPOs Rotate asset mix from overweight securities Grow earning assets – Reduce expenses through branch consolidation, automation and staffing, regulatory cost reduction, and vendor contract renegotiation – Fee income growth from existing investments in Wealth, Mortgage and Treasury Management platforms Path to Enhanced Profitability – Stock trades at a discount to DTA and AFS Mark adjusted TBV (82% at 7/25/14), a significant discount to peer valuation metrics – Acquisition platform Investment Thesis

Attractive Franchise Attractive community banking franchise in North Carolina High quality, low cost core deposit base Experienced origination teams in key lending markets – Metro Charlotte – Piedmont Triad – Legacy markets of Hickory and Asheboro – Commercial Real Estate – Raleigh Loan Production Office Full range of capabilities – Commercial banking, small business banking, treasury services, consumer banking, auto finance, mortgage banking, wealth management, and trust 5

Experienced Leadership and Board 6 Executive Officers Experience Brian Simpson Chief Executive Officer Bob Reid President Dave Nielsen Chief Financial Officer Beth DeSimone General Counsel and Chief Risk Officer Neil Machovec Chief Credit Officer Non-Management Directors Experience Chan Martin Chairman John Bresnan1 Director Scott Kauffman Director Jerry Licari Audit Committee Chair Gray McCaskill Director Ray McKenney Compensation and Nominating Committee Chair Boyd Wilson Risk Management Committee Chair 20 years of banking experience as senior executive and Operating Committee member at First Union, including Head of Structured Products, Real Estate Capital Markets and Leasing and Head of Balance Sheet Management. 33 years of banking experience as senior executive at First Union/Wachovia/Wells Fargo including President of TN, PA/DE and NY/NJ/CT regions, President of Retirement & Investment Products and Head of Real Estate. 25 years of banking and financial services experience at KPMG, First Union/Wachovia/Wells Fargo including Wholesale Integration Manager for the Wells Fargo/Wachovia Merger, and COO of Corporate and Investment Banking. 25 years at Arnold & Porter in the Corporate and Financial Institution area. DeSimone's practice concentrated on regulatory matters, mergers and acquisitions and consumer banking issues. President of MBM Auto Management, a multi-franchise automobile and powersports management company which he founded in 1981. 1 John Redett, a managing director of The Carlyle Group, LP, w as elected to serve as a director of CommunityOne at the 2014 Annual Meeting of Shareholders in place of John Bresnan as the Carlyle-designated director. His qualif ication to serve is subject to regulatory non-objection, w hich is pending. Mr. Redett has almost 15 years experience in the investment services business, focusing on opportunities in the f inancial services sector. 34 years of banking experience, including Small Business Risk Management Executive and Commercial Card Risk Executive at Bank of America and Director of Credit Policy and Risk Management at HSBC Mortgage Services. Retired banking and financial services executive at Bank of America including Treasurer, Enterprise Market and Operational Risk Executive and Global and Corporate Banking Risk Executive. Board member at CNL Healthcare. Retired banking and financial services executive, including CRO for Corporate and Investment Banking at First Union/Wachovia and Managing Director of Credit at Lehman Brothers. 18 years of banking and financial services experience, including Principal in the Business and Financial Services Group at Oak Hill Capital and Co-COO for the America's Financial Institutions Group at Goldman Sachs. Retired Engagement Partner and SEC Reviewing Partner for insurance and bank clients and Partner in Charge of the US Banking Practice and the Financial Risk Management Practice. CEO of Senn Dunn Insurance, the largest privately-owned insurance agency in NC, specializing in business insurance, employee benefits and personal insurance. EVP of Broyhill Investments, a family office, and CFO of BMC Fund, a registered investment company.

Sustained Profitability Four consecutive profitable quarters NIBT of $3.0 million in 2Q – Increase of 133% from 1Q 2014, $6.0 million better than prior year – Core earnings grew 55% in 2Q 2014 to $2.6 million Loan growth was strong and broad based across all lines of business – Portfolio grew $50.1 million in 2Q, 16% annualized growth rate Positive credit performance – NPA’s fell to 2.7% of assets – Provision recovery of $1.7 million – 7 bps YTD annualized net charge-offs Net interest income grew 2% in 2Q – Net of non-cash accretion, net interest income grew 9% year over year and at an 11% annualized rate in 2Q 2014 – NIM of 3.40% $5.4 million (22%) reduction in year over year NIE – Core NIE fell 2% from 1Q 2014 – NIE to average assets at 3.47% – $0.4 million US Treasury sale expenses in 2Q 7 Quarterly Performance Metrics Dollars in thousands except per share data 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 Net income (loss) before taxes (2,947)$ 4,292$ 1,241$ 1,300$ 3,028 Net income (loss) (3,183) 4,006 2,290 1,277 2,792 Net income (loss) per share (0.15) 0.18 0.11 0.06 0.13 Return on average assets (0.62%) 0.79% 0.45% 0.26% 0.56% Return on average equity (14.5%) 21.0% 11.0% 6.2% 12.7% Net interest margin 3.27% 3.76% 3.52% 3.43% 3.40% Core noninterest expense to average assets 1 3.59% 3.42% 3.34% 3.59% 3.47% Loans held for investment 1,189,413 1,195,142 1,212,248 1,219,785 1,269,865 Deposits 1,811,485 1,790,608 1,748,705 1,767,930 1,763,765 NPA's to total assets 4.7% 4.1% 3.2% 2.9% 2.7% 1 Non-GAAP measure. See page 9 for reconciliation to GAAP presentation. Quart rly Results Results of Operatio Dollars in thousands 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 N t interest income 5 14$ 17 382$ 16 464$ 15 479$ 15 18$ Recovery f Provision (Provision) for loan losses 1,057 350 (1,8 0) 684 1,685 Noninterest income 5,247 4,487 4,147 3,943 4,893 Noninterest expense (24,665) (17,927) (17,550) (18,806) (19,268) Net income (loss) before tax (2,947) 4,292 1,241 1,300 3,028 Income tax benefit (expense) (236) (286) 1,049 (23) (236) Net income (loss) (3,183) 4,006 2,290 1,277 2,792 Core Earnings 1 1,821$ 4,698$ 3,808$ 1,642$ 2,551$ 1 Non-GAAP measure. See Appendix for reconciliation to GAAP presentation.

8 Almost 5% loan growth year to date – Loans held for investment grew $50.1 million (4%) in 2Q; Annualized growth of over 16% – Organic loan growth of $34.8 million; annualized growth of 14% – Growth rate and loan to deposit ratio of 72% both ahead of plan – Growth across all business lines, especially commercial, and does not reflect impact of recent LPO and staff additions – Asset resolution is less a headwind Grow loans Deposits up $15.1 million, or 1%, since year end, 2% annualized growth rate – Deposits were lower in 2Q by $4.2 million – Core deposits fell 2.1% in the quarter on seasonal declines in interest bearing DDA accounts and declines in money market accounts – Treasury Management product and mobile banking infrastructure investments on track – Noninterest bearing deposits up $6.3 million in 2Q Grow core deposits Credit resolution activities are ahead of schedule – Reduced NPAs by 9% in 2Q; NPA ratio of 2.7% vs year end goal of 2.3% – Reduced classified assets by $22 million YTD; 2014 goal of $40 million – Bank classified asset ratio at 56%, down from 67% last quarter Resolve remaining credit issues Year over year reduction in core noninterest expenses of 6% – YTD expenses are lower than our internal plans. Significant vendor contract related savings beginning in the second half of 2014 – 11% year over year reduction in FTEs – Expect annual run rate decline of over $1.0 million in regulatory costs based on improvements in capital, earnings and asset quality – Core NIE to average assets ratio of 3.47% better than goal Invest in new businesses while maintaining focus on expenses Key Objectives for 2014 and Progress To Date 8

9 Hired 2 experienced commercial and real estate bankers to start a Raleigh Loan Production Office in June – Raleigh is NC’s 2nd largest and fastest growing economic hub – Expect to hire 1-2 additional commercial bankers Hired team of 4 experienced commercial and real estate bankers in Greensboro in July – New Regional Banking President and new Greensboro Market President – Greensboro is the largest city in the Piedmont Triad, the 3rd largest market in NC Hired team of 2 commercial and real estate bankers to start a Winston-Salem Loan Production Office – Winston-Salem is the 2nd largest city in the Triad Distinctive lending model driving success – Experienced and focused C&I and CRE bankers provide more insightful advice and better solutions than generalists – Deal team approach ensures responsiveness Accelerate loan growth by expanding commercial and real estate resources and geographic reach Loan Growth Initiatives 9 Hired experienced mortgage executive to lead new non-branch origination channel – Charlotte, Raleigh and Piedmont Triad – Focused on realtors and builders Expanding existing indirect auto finance business with platform investments Accelerate loan growth in consumer and mortgage lending

Growing Net Interest Income Net interest income grew 2% in 2Q – Net of non-cash accretion, net interest income grew 9% year over year and at an 11% annualized rate in 2Q 2014 Net interest margin improved 13 bps year over year from 2Q 2013; 3 bps decline from 1Q to 3.40% Average earning assets grew $24.3 million during 2Q 2014 on strong loan growth – Average loans grew $29.1 million Earning asset yield fell 3 bps in 2Q on reduced loan accretion – Loan yield excluding accretion was flat at 4.39% – Loan accretion on purchased impaired loans was $0.7 million in 2Q 2014 , $0.9 million in 1Q 2014 and $1.7 million in 2Q 2013 2Q cost of interest bearing deposits was flat at 48 bps Liability costs rose 2 bps as a result of 1Q actions to hedge and extend duration 10 Quarterly Loan and Securities Yields Quarterly Margin and Cost of Deposits 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 Yield on Loans Yield on Investment Securities 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 Cost of Interest Bearing Deposits N t Interest Margin Quarterly Results Average Balances, Yields and Net Interest Margin Dollars in thousands 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 Average loans (includes loans held for sale) 1,114,841$ 1,188,357$ 1,199,309$ 1,209,714$ 1,238,847$ Average yield 5.21% 5.35% 4.97% 4.73% 4.66% Average loans and securities 1,692,304 1,784,130 1,785,541 1,770,270 1,788,879 Average earning assets 1,895,137 1,839,359 1,859,379 1,830,822 1,855,092 Average yield 3.85% 4.29% 4.05% 3.98% 3.95% Average interest bearing liabilities 1,675,133 1,606,302 1,611,915 1,585,272 1,581,777 Average rate 0.65% 0.61% 0.61% 0.63% 0.65% Average cost of interest bearing deposits 0.54% 0.51% 0.50% 0.48% 0.48% Net interest margin 3.27% 3.76% 3.52% 3.43% 3.40% Net interest rate spread 3.20% 3.68% 3.44% 3.35% 3.31% Net interest income 15,414$ 17,382$ 16,464$ 15,479$ 15,718$

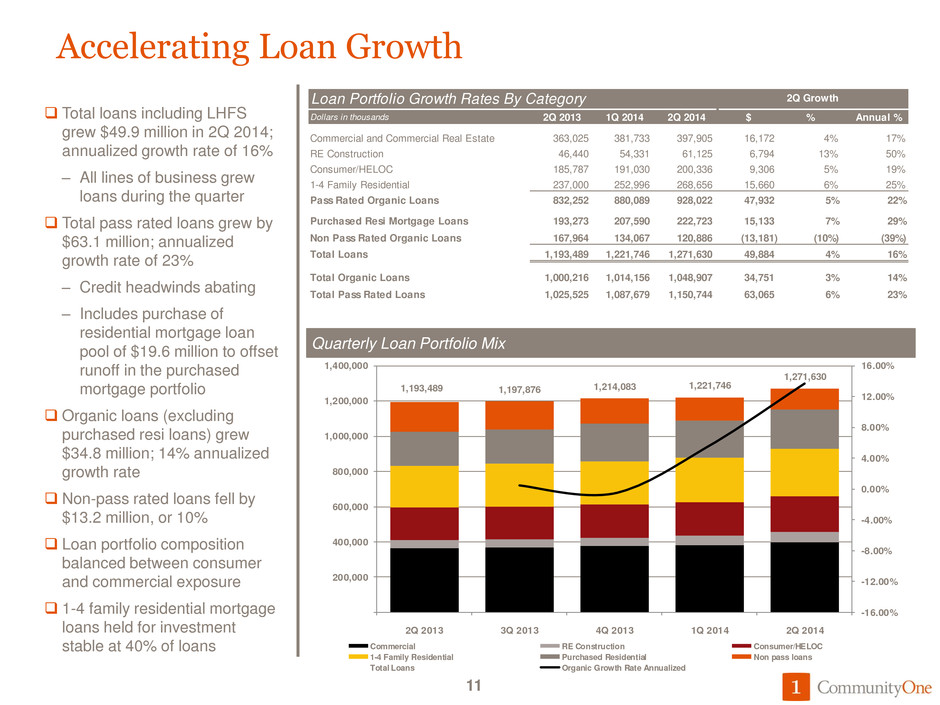

1,197,876 1,214,083 1,221,746 1,271,630 -16.00% -12.00% -8.00% -4.00% 0.00% 4.00% 8.00% 12.00% 16.00% 200,000 400,000 600,000 800,000 1,000,000 1,200,000 1,400,000 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 Commercial RE Construction Consumer/HELOC 1-4 Family Residential Purchased Residential Non pass loans Total Loans Organic Growth Rate Annualized 1,193,489 Accelerating Loan Growth Total loans including LHFS grew $49.9 million in 2Q 2014; annualized growth rate of 16% – All lines of business grew loans during the quarter Total pass rated loans grew by $63.1 million; annualized growth rate of 23% – Credit headwinds abating – Includes purchase of residential mortgage loan pool of $19.6 million to offset runoff in the purchased mortgage portfolio Organic loans (excluding purchased resi loans) grew $34.8 million; 14% annualized growth rate Non-pass rated loans fell by $13.2 million, or 10% Loan portfolio composition balanced between consumer and commercial exposure 1-4 family residential mortgage loans held for investment stable at 40% of loans 11 Quarterly Loan Portfolio Mix Loan Portfolio Growth Rates By Category Dollars in thousands 2Q 2013 1Q 2014 2Q 2014 $ % Annual % Commercial and Commercial Real Estate 363,025 381,733 397,905 16,172 4% 17% RE Construction 46,440 54,331 61,125 6,794 13% 50% Consumer/HELOC 185,787 191,030 200,336 9,306 5% 19% 1-4 Family Residential 237,000 252,996 268,656 15,660 6% 25% Pass Rated Organic Loans 832,252 880,089 928,022 47,932 5% 22% Purchased Resi Mortgage Loans 193,273 207,590 222,723 15,133 7% 29% Non Pass Rated Organic Loans 167,964 134,067 120,886 (13,181) (10%) (39%) Total Loans 1,193,489 1,221,746 1,271,630 49,884 4% 16% Total Organic Loans 1,000,216 1,014,156 1,048,907 34,751 3% 14% Total Pass Rated Loans 1,025,525 1,087,679 1,150,744 63,065 6% 23% 2Q Growth

$59 $51 $35 $34 $32 $36 $33 $28 $25 $22 $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 M ill io ns o f D ol la rs Nonperforming loans OREO and foreclosed assets $47 $44 $46 $43 $41 $121 $115 $96 $91 $80 $0 $25 $50 $75 $100 $125 $150 $175 $200 $225 $250 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 M ill io ns o f D ol la rs Special Menti n Loans Classified Loans Aggressive Credit Resolution Asset quality improvements continue to be ahead of plan – Classified loans decreased by $11.1 million (12%) – Nonperforming loans reduced to 2.5% of total loans, from 5% a year ago – NPA’s reduced to 2.7% of assets, from 6.6% at the end of 2012 The ALL has been reduced to $24.0 million from $26.0 million at end of Q1, reflecting the improved asset quality and lower annualized charge-off rates ALL is 1.89% of loans held for investment $0.4 million of 2Q net charge- offs; annualized net charge-off rate of 12 bps for the quarter and 7 bps 2014 year to date 12 Quarterly Asset Quality Trends 28% decline 44% decline Quarterly Asset Quality Dollars in thousands 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 Allowance for loan losses (ALL) 25,085$ 25,387$ 26,785$ 26,039$ 23,975$ Nonperforming loans to Total loans 5.0% 4.3% 2.9% 2.8% 2.5% N nperforming assets to Total assets 4.7% 4.1% 3.2% 2.9% 2.7% Annualized net charge-offs to Average loans 1.26% (0.22%) 0.14% 0.02% 0.12% Allowance for loan loss to Total loans 2.11% 2.12% 2.21% 2.13% 1.89% Bank Classified Assets to Tier 1 Capital + ALL 93% 86% 70% 65% 56%

Valuable Deferred Tax Asset Consolidated net deferred tax asset of $150.4 million at 2Q 2014 – $5.2 million currently reflected on balance sheet and in equity – $145.2 million remaining DTA valuation allowance The Company evaluates each quarter the continued need for the valuation allowance on the deferred tax assets 13 Deferred Tax Asset Rollforward Dollars in Millions Net DTA DTA Valuation Allowance Unreserved Net DTA Beginning Balance, March 31, 2014 156.2$ 148.0$ 8.2$ Net income, tax strategies and other adjustments (5.8) (2.8) (3.0) Ending Balance, June 30, 2014 150.4$ 145.2$ 5.2$

Questions 14

Appendix 15

Non-GAAP Measures Reconciliation of non- GAAP measures to the most directly comparable GAAP measure 16 Reconciliation of Non-GAAP Measures Dollars in thousands 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 Total shareholders' equity 76,046$ 80,802$ 80,361$ 85,331$ 92,697$ Less: Goodwill (4,205) (4,205) (4,205) (4,205) (4,205) Core deposit and other intangibles (7,403) (7,196) (6,914) (6,597) (6,296) Tangible shareholders' equity 64,438$ 69,401$ 69,242$ 74,529$ 82,196$ Reconciliation of Non-GAAP Measures Dollars in thousands 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 Net income (loss) (3,183)$ 4,006$ 2,290$ 1,277$ 2,792$ Less taxes, credit costs and nonrecurring items: Income tax benefit (expense) (236) (286) 1,049 (23) (236) Gain on sales of securities 345 50 - - 720 Other real estate owned expense (3,332) 98 (21) (261) (954) Recovery of (Provision for) loan losses 1,057 350 (1,820) 684 1,685 Mortgage and litigation accruals 370 117 - 75 (7) Loan collection expense (1,146) (1,120) (548) (657) (551) Branch closure and restructuring expenses (15) 105 (178) (183) (7) US Treasury sale expenses - - - - (409) Rebranding expense (58) (6) - - - Merger-related expense (1,989) - - - - Core Earnings 1,821$ 4,698$ 3,808$ 1,642$ 2,551$

17 Investor Contacts Brian Simpson Chief Executive Officer Bob Reid President Dave Nielsen Chief Financial Officer Neil Machovec Chief Credit Officer 1017 East Morehead Street Suite 200 Charlotte, NC 28204 800-873-1172 www.community1.com