Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BNC BANCORP | form8-kforpresentation.htm |

INVESTOR PRESENTATION KBW COMMUNITY BANK INVESTOR CONFERENCE JULY 29-30, 2014

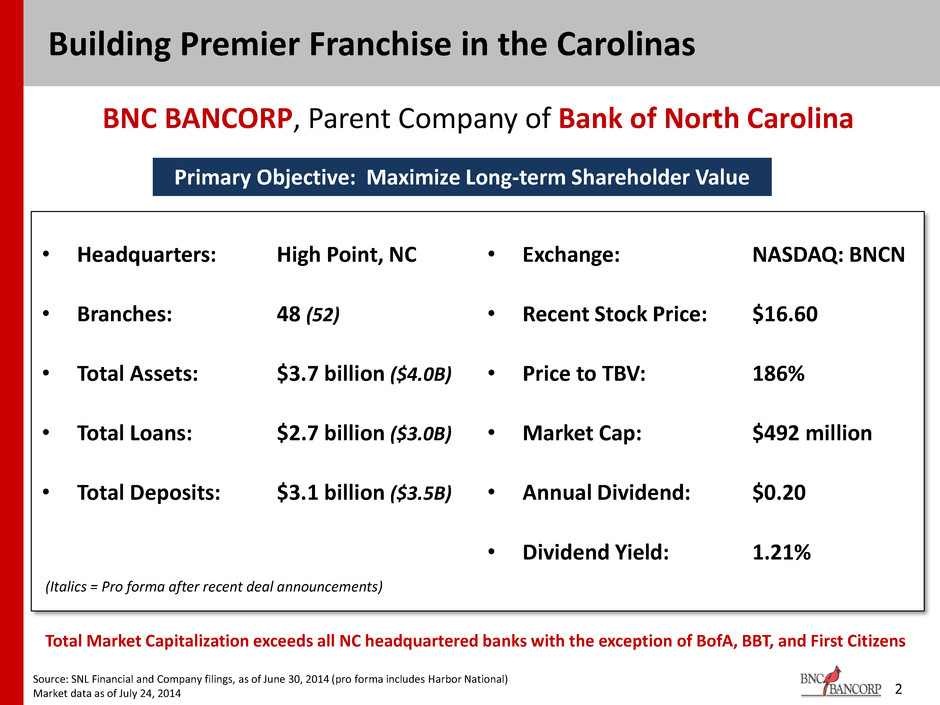

• Headquarters: • Branches: • Total Assets: • Total Loans: • Total Deposits: High Point, NC 48 (52) $3.7 billion ($4.0B) $2.7 billion ($3.0B) $3.1 billion ($3.5B) Building Premier Franchise in the Carolinas • Exchange: • Recent Stock Price: • Price to TBV: • Market Cap: • Annual Dividend: • Dividend Yield: NASDAQ: BNCN $16.60 186% $492 million $0.20 1.21% BNC BANCORP, Parent Company of Bank of North Carolina 2 Total Market Capitalization exceeds all NC headquartered banks with the exception of BofA, BBT, and First Citizens Primary Objective: Maximize Long-term Shareholder Value Source: SNL Financial and Company filings, as of June 30, 2014 (pro forma includes Harbor National) Market data as of July 24, 2014 (Italics = Pro forma after recent deal announcements)

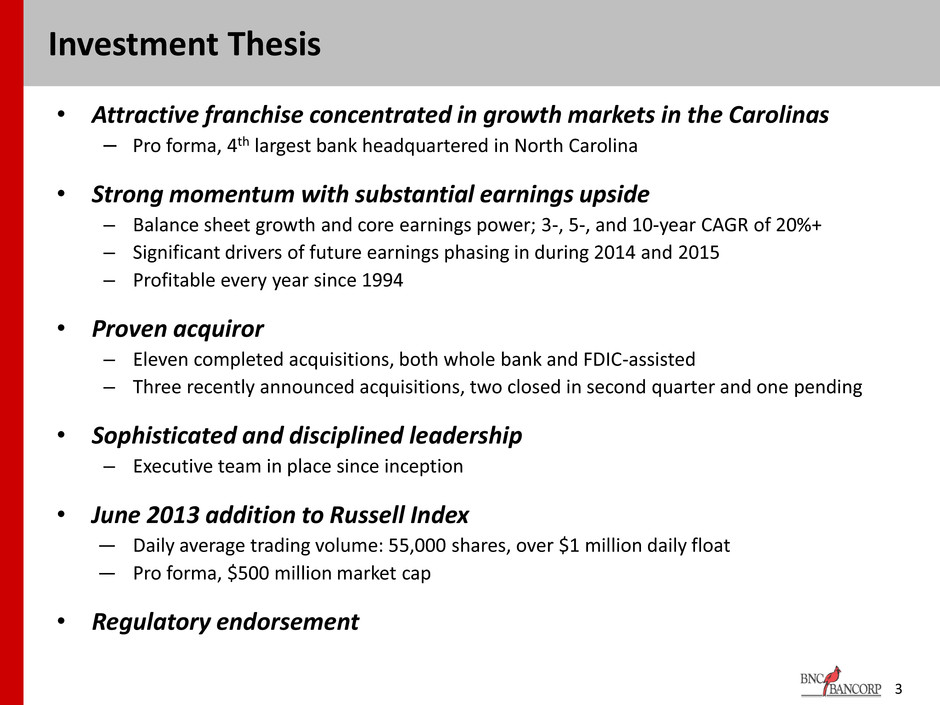

• Attractive franchise concentrated in growth markets in the Carolinas – Pro forma, 4th largest bank headquartered in North Carolina • Strong momentum with substantial earnings upside – Balance sheet growth and core earnings power; 3-, 5-, and 10-year CAGR of 20%+ – Significant drivers of future earnings phasing in during 2014 and 2015 – Profitable every year since 1994 • Proven acquiror – Eleven completed acquisitions, both whole bank and FDIC-assisted – Three recently announced acquisitions, two closed in second quarter and one pending • Sophisticated and disciplined leadership – Executive team in place since inception • June 2013 addition to Russell Index ― Daily average trading volume: 55,000 shares, over $1 million daily float ― Pro forma, $500 million market cap • Regulatory endorsement 3 Investment Thesis

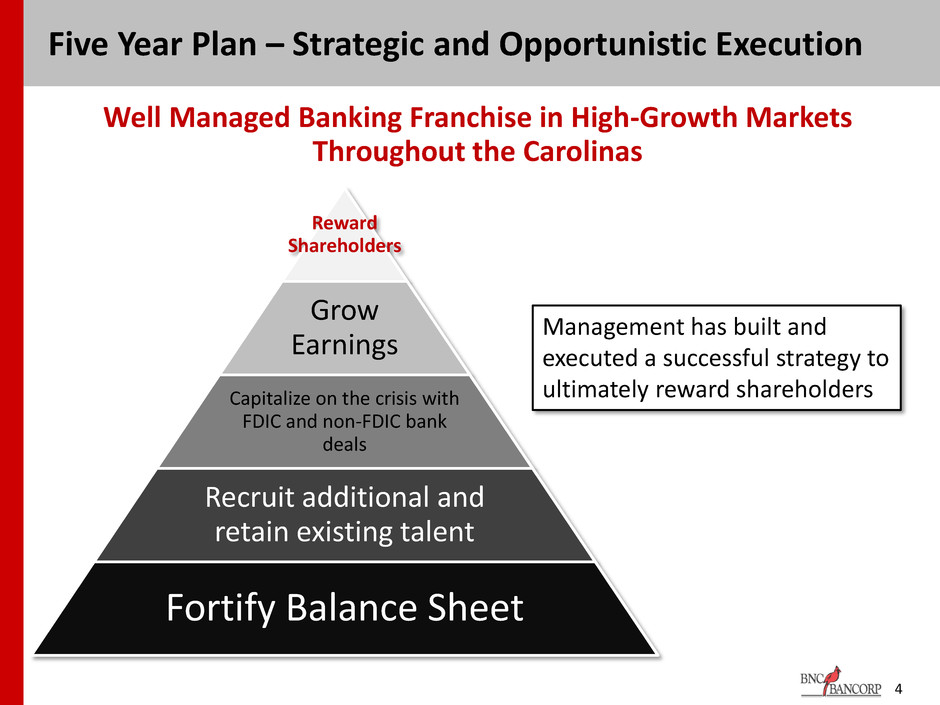

Well Managed Banking Franchise in High-Growth Markets Throughout the Carolinas Five Year Plan – Strategic and Opportunistic Execution 4 Reward Shareholders Grow Earnings Capitalize on the crisis with FDIC and non-FDIC bank deals Recruit additional and retain existing talent Fortify Balance Sheet Management has built and executed a successful strategy to ultimately reward shareholders

Attractive Franchise Concentrated in Growth Markets throughout the Carolinas

$102 $134 $154 $181 $210 $307 $372 $498 $595 $952 $1,130 $1,573 $1,634 $2,150 $2,455 $3,084 $3,230 $4,005 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Pro forma* Loans Deposits Assets Source: SNL Financial and Company filings *Pro forma includes estimated metrics for acquisition of Harbor National Bank 6 Consistent Record of Growth 1997+ 5 Year 3 Year CAGR CAGR CAGR Loans 24.7% 24.8% 26.5% Deposits 24.6% 24.3% 23.0% Assets 24.1% 20.6% 23.0%

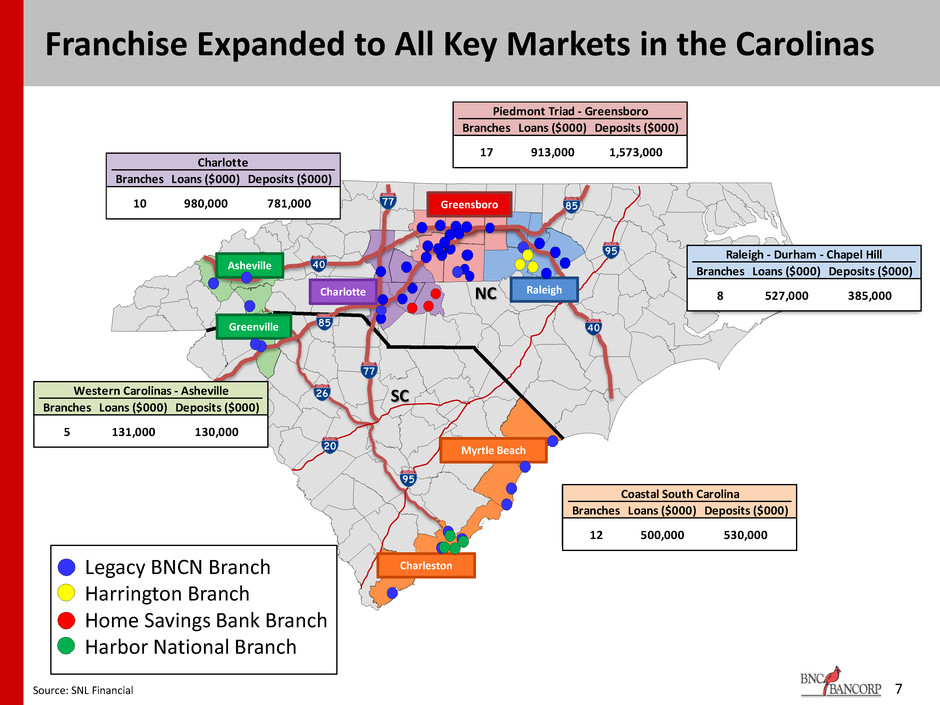

7 NC SC Greensboro Raleigh Myrtle Beach Charleston Greenville Asheville Legacy BNCN Branch Harrington Branch Home Savings Bank Branch Harbor National Branch Source: SNL Financial Charlotte Branches Loans ($000) Deposits ($000) 10 980,000 781,000 Piedmont Triad - Greensboro Branches Loans ($000) Deposits ($000) 17 913,000 1,573,000 Raleigh - Durham - Chapel Hill Branches Loans ($000) Deposits ($000) 8 527,000 385,000 Coastal South Carolina Branches Loans ($000) Deposits ($000) 12 500,000 530,000 Charlotte Western Carolinas - Asheville Branches Loans ($000) Deposits ($000) 5 131,000 130,000 Franchise Expanded to All Key Markets in the Carolinas

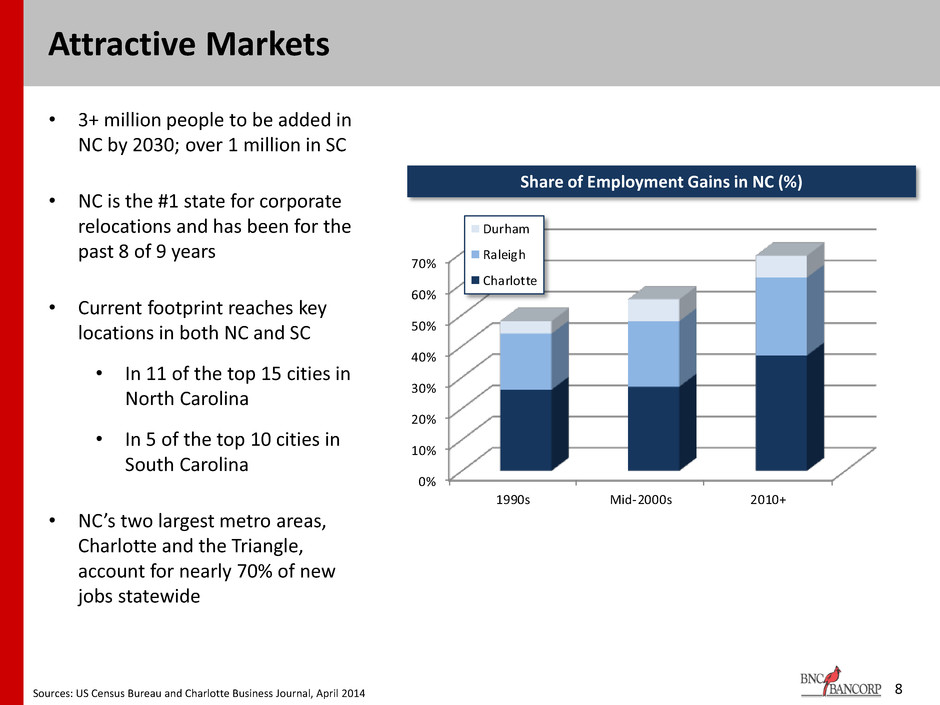

8 Attractive Markets • 3+ million people to be added in NC by 2030; over 1 million in SC • NC is the #1 state for corporate relocations and has been for the past 8 of 9 years • Current footprint reaches key locations in both NC and SC • In 11 of the top 15 cities in North Carolina • In 5 of the top 10 cities in South Carolina • NC’s two largest metro areas, Charlotte and the Triangle, account for nearly 70% of new jobs statewide Sources: US Census Bureau and Charlotte Business Journal, April 2014 0% 10% 20% 30% 40% 50% 60% 70% 1990s Mid-2000s 2010+ Durham Raleigh Charlotte Share of Employment Gains in NC (%)

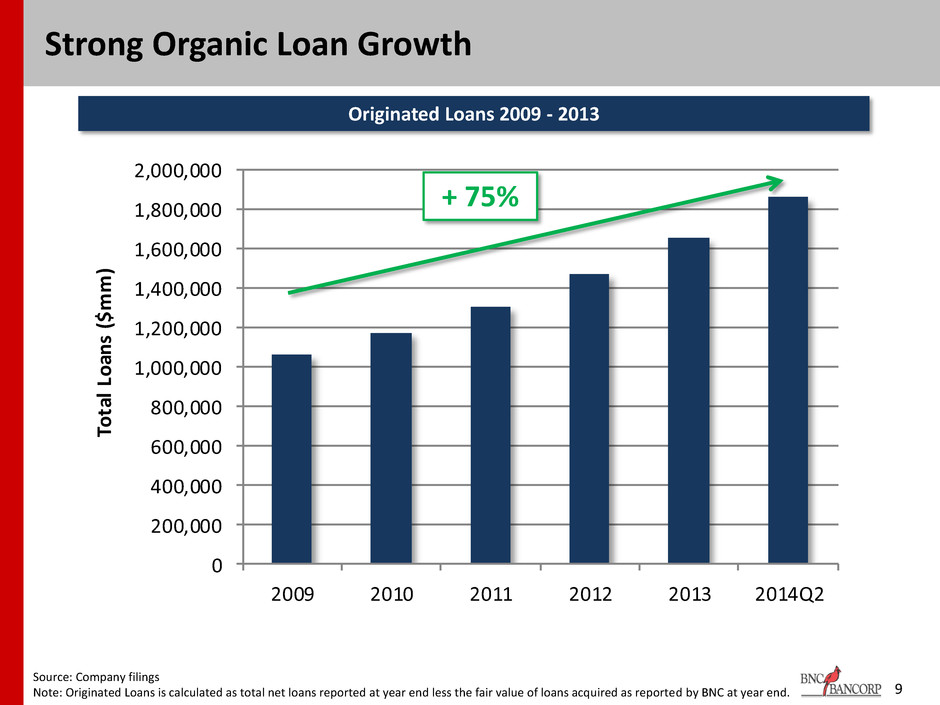

0 200,000 400,000 600,000 800,000 1,000,000 1,200,000 1,400,000 1,600,000 1,800,000 2,000,000 2009 2010 2011 2012 2013 2014Q2 To tal Lo an s ( $m m) 9 Strong Organic Loan Growth Source: Company filings Note: Originated Loans is calculated as total net loans reported at year end less the fair value of loans acquired as reported by BNC at year end. + 75% Originated Loans 2009 - 2013

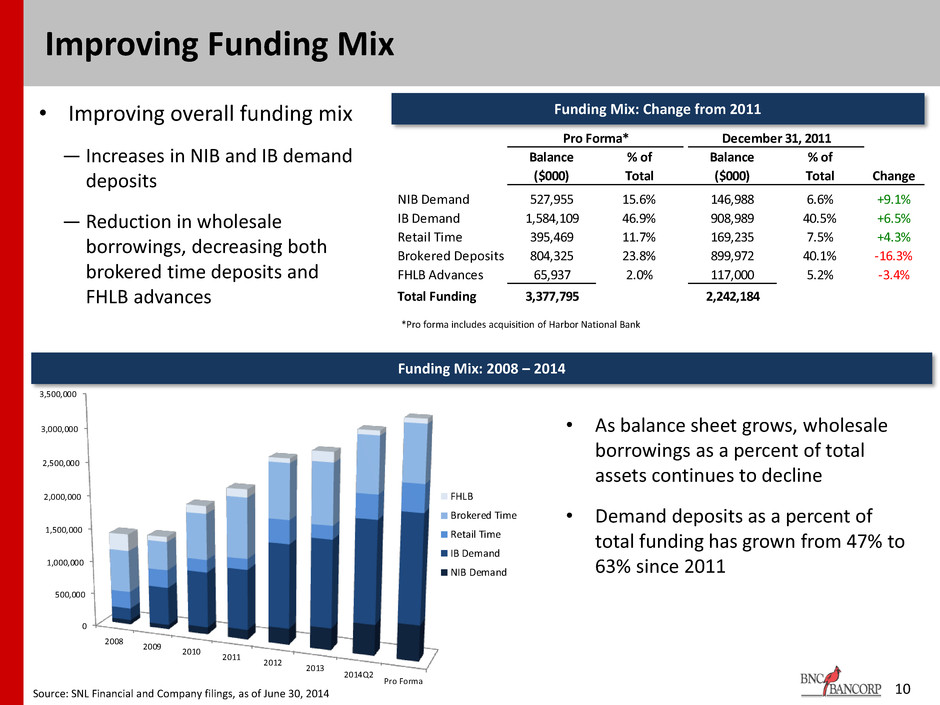

10 Improving Funding Mix Funding Mix: 2008 – 2014 Funding Mix: Change from 2011 • Improving overall funding mix ― Increases in NIB and IB demand deposits ― Reduction in wholesale borrowings, decreasing both brokered time deposits and FHLB advances • As balance sheet grows, wholesale borrowings as a percent of total assets continues to decline • Demand deposits as a percent of total funding has grown from 47% to 63% since 2011 Source: SNL Financial and Company filings, as of June 30, 2014 *Pro forma includes acquisition of Harbor National Bank Noninterest Bearing Demand Interest Bearing Demand Brokered Deposits Retail Time Deposits FHLB Advances Retail Time Deposits total dep 0 500,000 1,000,000 1,500,000 2,000,000 2,500,000 3,000,000 3,500,000 2008 2009 2010 2011 2012 2013 2014Q2 Pro Forma FHLB Brokered Time Retail Time IB Demand NIB Demand Pro Forma* December 31, 2011 Balance % of Balance % of ($000) Total ($000) Total Change NIB Demand 527,955 15.6% 146,988 6.6% +9.1% IB Demand 1,584,109 46.9% 908,989 40.5% +6.5% Retail Time 395,469 11.7% 169,235 7.5% +4.3% Brokered Deposits 804,325 23.8% 899,972 40.1% -16.3% FHLB Advances 65,937 2.0% 117,000 5.2% -3.4% Total Funding 3,377,795 2,242,184

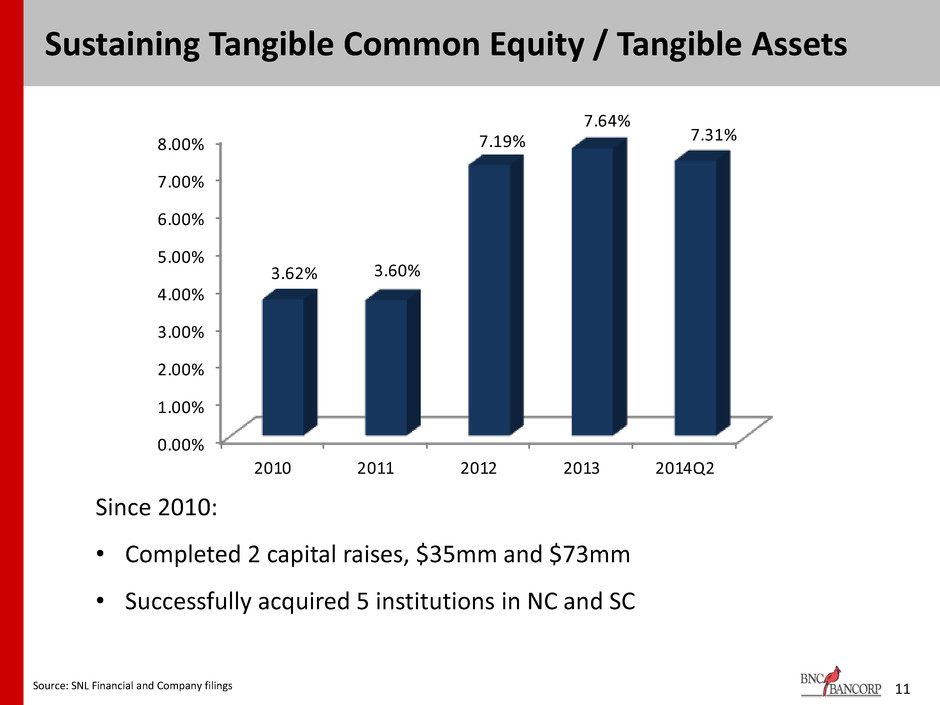

11 Sustaining Tangible Common Equity / Tangible Assets Since 2010: • Completed 2 capital raises, $35mm and $73mm • Successfully acquired 5 institutions in NC and SC Source: SNL Financial and Company filings 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 2010 2011 2012 2013 2014Q2 3.62% 3.60% 7.19% 7.64% 7.31%

Strong Earnings Momentum

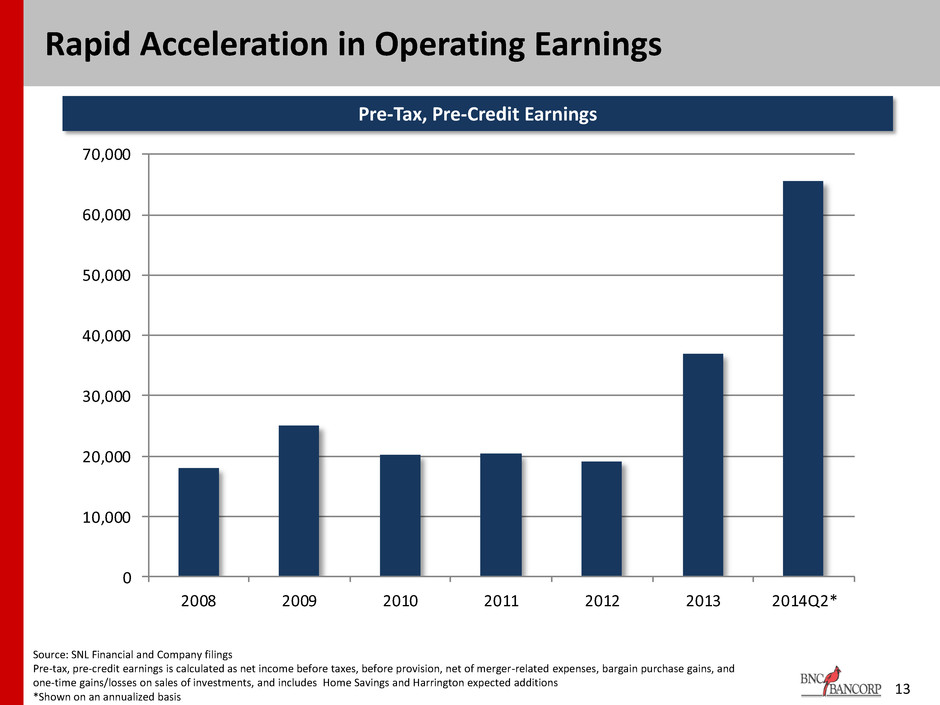

13 Rapid Acceleration in Operating Earnings Pre-Tax, Pre-Credit Earnings Source: SNL Financial and Company filings Pre-tax, pre-credit earnings is calculated as net income before taxes, before provision, net of merger-related expenses, bargain purchase gains, and one-time gains/losses on sales of investments, and includes Home Savings and Harrington expected additions *Shown on an annualized basis 0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 2008 2009 2010 2011 2012 2013 2014Q2*

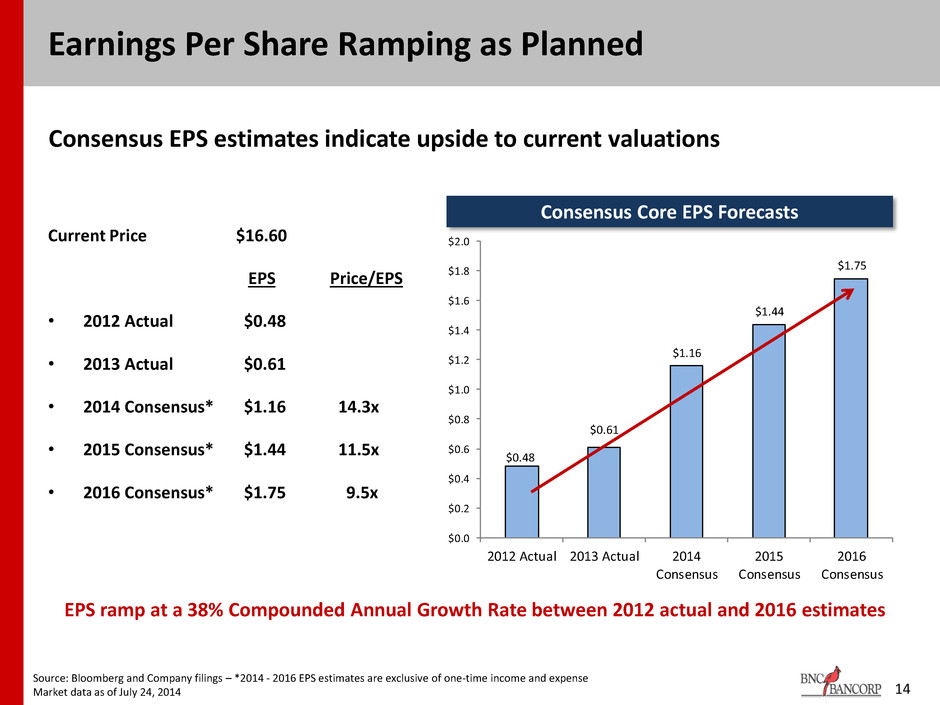

Earnings Per Share Ramping as Planned Current Price $16.60 EPS Price/EPS • 2012 Actual $0.48 • 2013 Actual $0.61 • 2014 Consensus* $1.16 14.3x • 2015 Consensus* $1.44 11.5x • 2016 Consensus* $1.75 9.5x Consensus EPS estimates indicate upside to current valuations Source: Bloomberg and Company filings – *2014 - 2016 EPS estimates are exclusive of one-time income and expense Market data as of July 24, 2014 14 EPS ramp at a 38% Compounded Annual Growth Rate between 2012 actual and 2016 estimates Consensus Core EPS Forecasts $0.48 $0.61 $1.16 $1.44 $1.75 $0.0 $0.2 $0.4 $0.6 $0.8 $1.0 $1.2 $1.4 $1.6 $1.8 $2.0 2012 Actual 2013 Actual 2014 Consensus 2015 Consensus 2016 Consensus

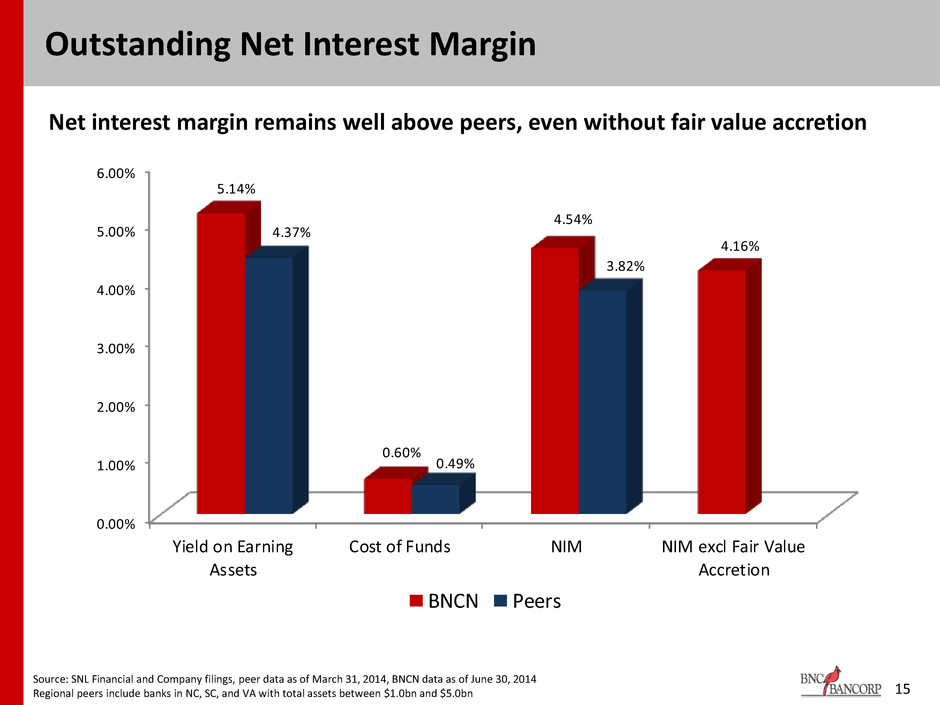

15 Outstanding Net Interest Margin 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% Yield on Earning Assets Cost of Funds NIM NIM excl Fair Value Accretion 5.14% 0.60% 4.54% 4.16% 4.37% 0.49% 3.82% BNCN Peers Net interest margin remains well above peers, even without fair value accretion Source: SNL Financial and Company filings, peer data as of March 31, 2014, BNCN data as of June 30, 2014 Regional peers include banks in NC, SC, and VA with total assets between $1.0bn and $5.0bn

“Acquiror of Choice”

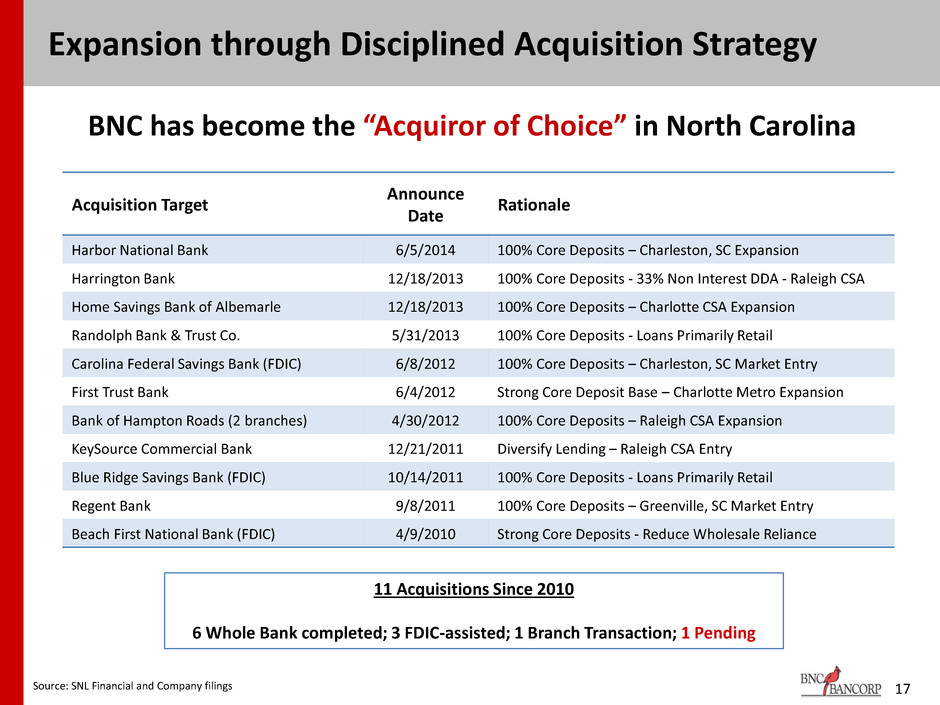

Expansion through Disciplined Acquisition Strategy Source: SNL Financial and Company filings 11 Acquisitions Since 2010 6 Whole Bank completed; 3 FDIC-assisted; 1 Branch Transaction; 1 Pending 17 Acquisition Target Announce Date Rationale Harbor National Bank 6/5/2014 100% Core Deposits – Charleston, SC Expansion Harrington Bank 12/18/2013 100% Core Deposits - 33% Non Interest DDA - Raleigh CSA Home Savings Bank of Albemarle 12/18/2013 100% Core Deposits – Charlotte CSA Expansion Randolph Bank & Trust Co. 5/31/2013 100% Core Deposits - Loans Primarily Retail Carolina Federal Savings Bank (FDIC) 6/8/2012 100% Core Deposits – Charleston, SC Market Entry First Trust Bank 6/4/2012 Strong Core Deposit Base – Charlotte Metro Expansion Bank of Hampton Roads (2 branches) 4/30/2012 100% Core Deposits – Raleigh CSA Expansion KeySource Commercial Bank 12/21/2011 Diversify Lending – Raleigh CSA Entry Blue Ridge Savings Bank (FDIC) 10/14/2011 100% Core Deposits - Loans Primarily Retail Regent Bank 9/8/2011 100% Core Deposits – Greenville, SC Market Entry Beach First National Bank (FDIC) 4/9/2010 Strong Core Deposits - Reduce Wholesale Reliance BNC has become the “Acquiror of Choice” in North Carolina

18 Efficient Integration of Acquired Franchises CURRENT NETWORK Legacy BNC 16 Acquired 40 Closed 13 Opened New 9 Net Branches 52 FULLY PHASED IN Legacy BNC 16 Acquired 40 Closed 18 Opened New 9 Net Branches 47

19 Investment in Talent to Support Growth • Chief Information and Operations Officer • Chief Enterprise Risk Officer • Director of Human Resources • Director of Marketing • Chief Accounting Officer • Director of Mortgage Banking • Four Regional Presidents • Director of Wealth, Private Banking, and Business Services • Director of Retail Banking • Director of Enterprise Compliance Conversion and Integration • Director of Internal Audit • Seasoned Director of Special Assets • CRE, Single Family, and C&I Credit Specialists • Controller of Mortgage Division • Accounting Policy and SEC Reporting Manager • ALCO Monitoring and Balance Sheet Strategist Risk and Reporting • Conversion and Merger Integration Project Coordinator • Internal Performance Manager • Loss Share/ Fair Value Loan Reporting Specialist •Merger, Conversion, and Integration Team Leadership and Management

Recent Acquisitions

21 Four branches in dynamic Charleston, South Carolina market Highly experienced leadership and lending team with local roots Local knowledge allowed Harbor National to grow and still maintain excellent asset quality throughout economic downturn Additional $250 million of core deposits in Charleston area, bringing BNC total to $300 million Transaction expected to be 4.5%+ accretive to 2015 EPS* Tangible Book Value expected earn-back inside 1.5 years* *Does not include fair value accretion or revenue synergies Recently Announced Transaction Benefits

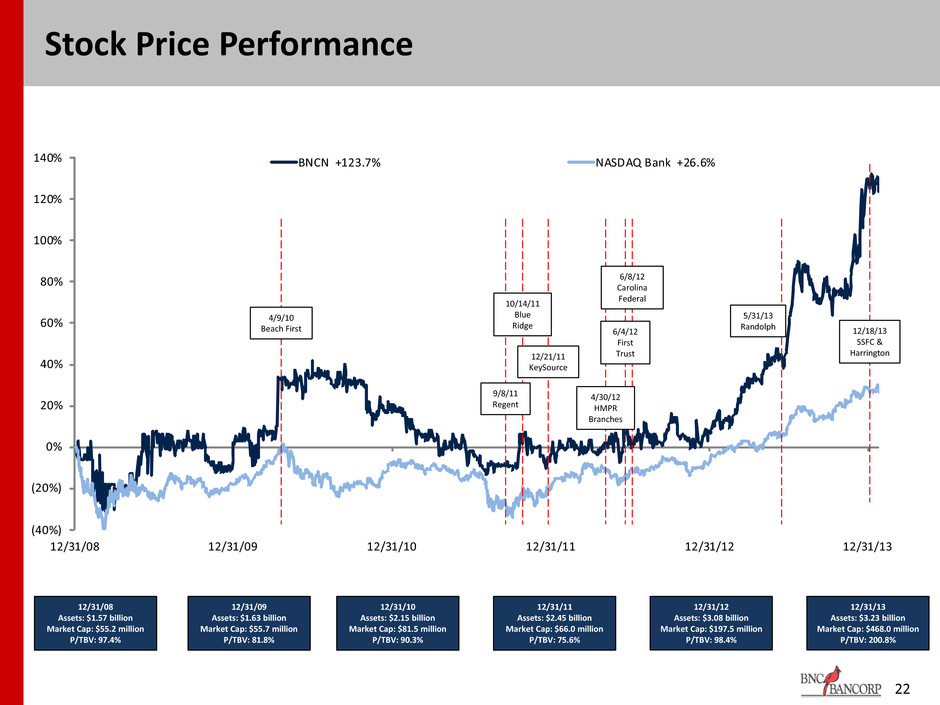

22 Stock Price Performance 12/31/08 Assets: $1.57 billion Market Cap: $55.2 million P/TBV: 97.4% 12/31/09 Assets: $1.63 billion Market Cap: $55.7 million P/TBV: 81.8% 12/31/10 Assets: $2.15 billion Market Cap: $81.5 million P/TBV: 90.3% 12/31/11 Assets: $2.45 billion Market Cap: $66.0 million P/TBV: 75.6% 12/31/12 Assets: $3.08 billion Market Cap: $197.5 million P/TBV: 98.4% 12/31/13 Assets: $3.23 billion Market Cap: $468.0 million P/TBV: 200.8% (40%) (20%) 0% 20% 40% 60% 80% 100% 120% 140% 12/31/08 12/31/09 12/31/10 12/31/11 12/31/12 12/31/13 BNCN +123.7% NASDAQ Bank +26.6% 9/8/11 Regent 12/21/11 KeySource 6/4/12 First Trust 5/31/13 Randolph 12/18/13 SSFC & Harrington 4/30/12 HMPR Branches 6/8/12 Carolina Federal 10/14/11 Blue Ridge 4/9/10 Beach First

$6.74 $7.43 $16.31 $6.86 $7.56 $16.60 0.00 2.00 4.00 6.00 8.00 10.00 12.00 14.00 16.00 18.00 Announce Date Completion Date Today $7.53 $8.62 $16.89 $7.40 $8.47 $16.60 0.00 2.00 4.00 6.00 8.00 10.00 12.00 14.00 16.00 18.00 Announce Date Completion Date Today + 124% $10.00 $12.33 $15.36 $10.81 $13.33 $16.60 0.00 2.00 4.00 6.00 8.00 10.00 12.00 14.00 16.00 18.00 Announce Date Completion Date Today + 54% + 142% 12/21/11 9/14/12 6/4/12 11/30/12 5/31/13 10/1/13 BNC Bancorp’s Acquisition of Randolph Bank & Trust 23 Recent Acquisitions: Deal Value Per Share BNC Bancorp’s Acquisition of KeySource BNC Bancorp’s Acquisition of First Trust Source: SNL Financial, data as of July 24, 2014 Deal Value per Share Closing Stock Price

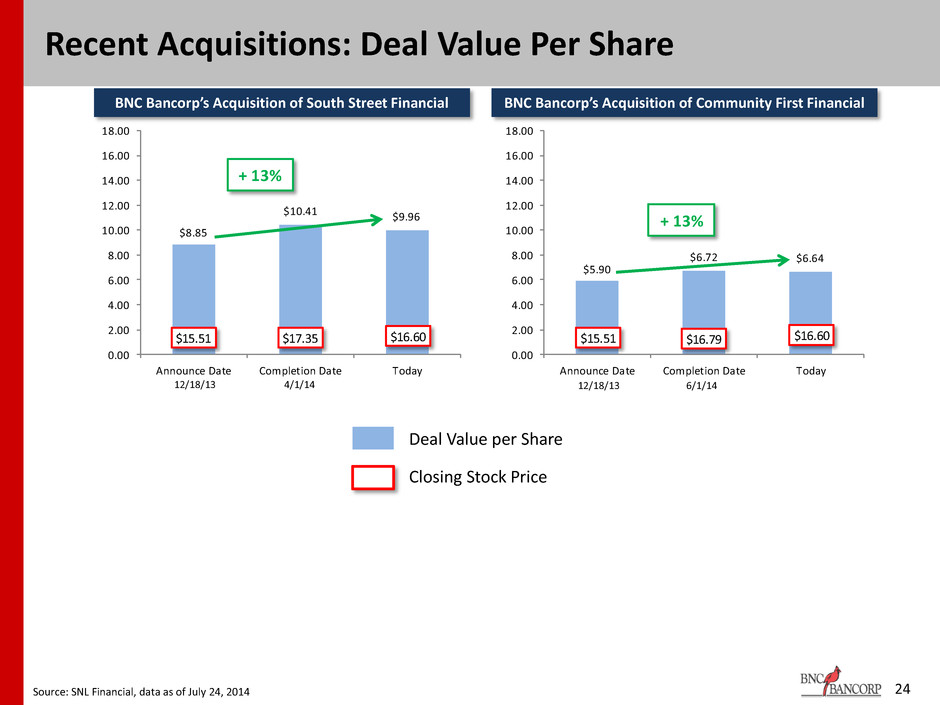

24 Recent Acquisitions: Deal Value Per Share BNC Bancorp’s Acquisition of South Street Financial BNC Bancorp’s Acquisition of Community First Financial Source: SNL Financial, data as of July 24, 2014 Deal Value per Share Closing Stock Price $8.85 $10.41 $9.96 $15.51 $17.35 $16.60 0.00 2.00 4.00 6.00 8.00 10.00 12.00 14.00 16.00 18.00 Announce Date Completion Date Today $5.90 $6.72 $6.64 $15.51 $16.79 $16.60 0.00 2.00 4.00 6.00 8.00 10.00 12.00 14.00 16.00 18.00 Announce Date Completion Date Today + 13% + 13% 12/18/13 4/1/14 12/18/13 6/1/14

Financial Appendix

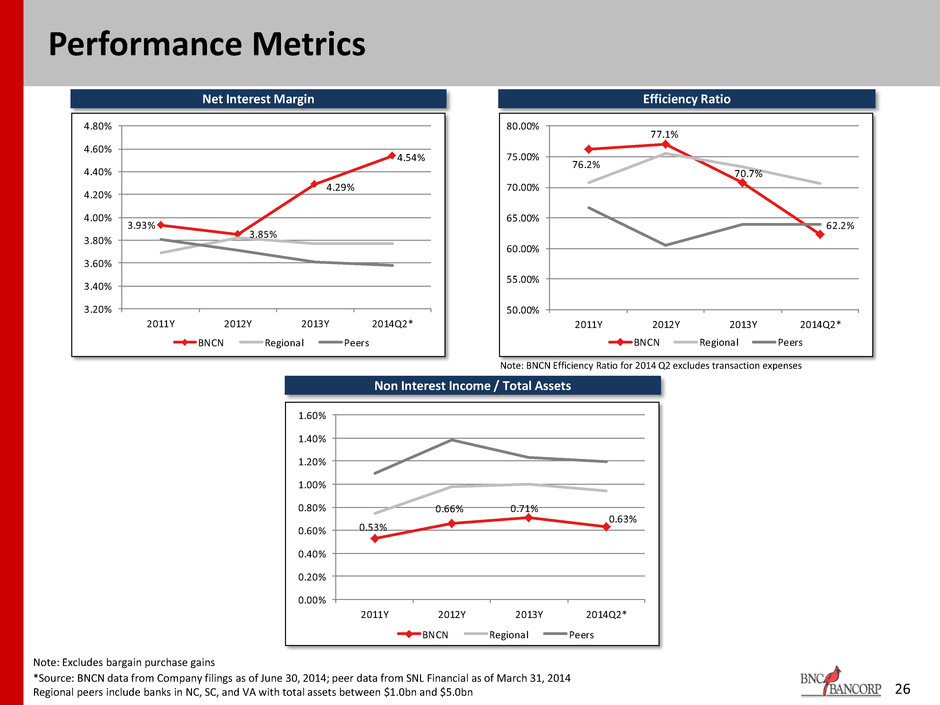

3.93% 3.85% 4.29% 4.54% 3.20% 3.40% 3.60% 3.80% 4.00% 4.20% 4.40% 4.60% 4.80% 2011Y 2012Y 2013Y 2014Q2* BNCN Regional Peers 76.2% 77.1% 70.7% 62.2% 50.00% 55.00% 60.00% 65.00% 70.00% 75.00% 80.00% 2011Y 2012Y 2013Y 2014Q2* BNCN Regional Peers 0.53% 0.66% 0.71% 0.63% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 2011Y 2012Y 2013Y 2014Q2* BNCN Regional Peers Note: Excludes bargain purchase gains 26 *Source: BNCN data from Company filings as of June 30, 2014; peer data from SNL Financial as of March 31, 2014 Regional peers include banks in NC, SC, and VA with total assets between $1.0bn and $5.0bn Performance Metrics Net Interest Margin Efficiency Ratio Non Interest Income / Total Assets Note: BNCN Efficiency Ratio for 2014 Q2 excludes transaction expenses

Pro Forma Loans and Deposits Loan Composition 27 (1) Pro forma loan and deposit composition is preliminary and based on estimates as of June 30, 2014. Presented for illustrative purposes only and does not indicate actual results of the combined company Source: Regulatory and company filings Constr & Land Dev 10.7% 1-4 Family 18.9% HE Lines 9.2% Multifamily 2.9% Comm RE & Farm 50.8% C&I 6.3% Consumer 0.6% Other Non- RE 0.7% Constr & Land Dev 10.7% 1-4 Family 20.4% HE Lines 9.0% Multifamily 2.8% Comm RE & Farm 49.9% C&I 6.1% Consumer 0.5% Other Non- RE 0.6% Constr & Land Dev 10.3% 1-4 Family 35.4% HE Lines 6.6% Multifamily 2.4% Comm RE & Farm 40.9% Consumer 0.2% BNCN Harbor Pro Forma1 Deposit Composition BNCN Harbor Pro Forma1 NIB Demand 16.8% IB De and - NOW 8.6% Promontory MMA 13.8% MMA and Savings 24.4% Time<100 9.6% Time>100 14.4% Brokered Time 12.4% NIB Demand 16.6% IB Demand - NOW 8.0% Promontory MMA 15.1% MMA and Savings 23.3% Time<100 9.2% Ti e>100 14.3% Brokered Time 13.4% NIB Demand 18.4% IB Demand - NOW 14.3%MMA and Savings 35.3% Time<100 13.8% Time>100 15.3% Brokered Time 2.9%

28 Forward Looking Statements This presentation contains certain forward-looking information about BNC Bancorp and subsidiaries (collectively, “BNCN”) that is intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact, are forward-looking statements. In some cases, you can identify forward-looking statements by words such as “may,” “hope,” “will,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential,” “continue,” “could,” “future” or the negative of those terms or other words of similar meaning. You should carefully read forward-looking statements, including statements that contain these words, because they discuss the future expectations or state other “forward-looking” information about BNCN. Such statements involve inherent risks and uncertainties, many of which are difficult to predict and are generally beyond the control of BNCN. Forward-looking statements speak only as of the date they are made and BNCN assumes no duty to update such statements. In addition to factors previously disclosed in reports filed by BNCN with the Securities and Exchange Commission (“SEC”), additional risks and uncertainties may include, but are not limited to: the possibility that any of the anticipated benefits of the proposed mergers will not be realized or will not be realized within the expected time period; the risk that integration of operations with those of BNCN will be materially delayed or will be more costly or difficult than expected; the inability to complete the mergers due to the failure of shareholder approval to adopt the respective merger agreements; the failure to satisfy other conditions to completion of the mergers, including receipt of required regulatory and other approvals; the failure of the proposed mergers to close for any other reason; the effect of the announcement of the mergers on customer relationships and operating results; the possibility that the mergers may be more expensive to complete than anticipated, including as a result of unexpected factors or events; and general competitive, economic, political and market conditions and fluctuations. As stated previously, additional factors affecting BNCN are discussed in BNCN’s Annual Report on Form 10-K, its Quarterly Reports on Form 10-Q and its Current Reports on Form 8-K, filed with the SEC. Please refer to the SEC’s website at www.sec.gov where you can review those documents.