Attached files

| file | filename |

|---|---|

| EX-5.1 - LEGAL OPINION - Royal Bakery Holdings, Inc. | fs12014a3ex5i_royalbakery.htm |

| EX-23.1 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - Royal Bakery Holdings, Inc. | fs12014a3ex23i_royalbakery.htm |

As filed with the Securities and Exchange Commission on July 28, 2014

Registration No. 333-193143

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT No. 3

TO

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

ROYAL BAKERY HOLDINGS, INC.

(Name of Issuer in Its Charter)

|

Delaware

|

||

|

(State or other jurisdiction

of incorporation)

|

||

|

5812

|

45-2509555

|

|

|

(Primary Standard Industrial

Classification Code Number)

|

(IRS Employer

Identification No.)

|

|

|

Royal Bakery Holdings, Inc.

405 Old County Rd.

Belmont, CA 94002

(650) 530-0368

|

(Address including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Paracorp Inc.

2804 Gateway Oaks Drive Suite 200

Sacramento, CA 95833

(800) 533-7272

(Name, Address, Including Zip Code, and Telephone Number,

Including Area Code, of Agent for Service)

Copies to:

William S. Rosenstadt

Sanders Ortoli Vaughn-Flam Rosenstadt LLP

501 Madison Avenue – 14th Floor

New York, NY 10022

Telephone: 212-588-0022

Fax: 212-826-9307

As soon as practicable after this registration statement becomes effective.

Approximate date of commencement of proposed sale to the public

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer o

|

|

|

Non-accelerated filer o (Do not check if a smaller reporting company)

|

Smaller reporting company x

|

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to Be Registered

|

Amount to Be

Registered (1)

|

Proposed

Maximum

Offering

Price

Per

Security (2)

|

Proposed

Maximum

Aggregate

Offering

Price (2)

|

Amount of

Registration

Fee (3)

|

||||||||||

|

Common stock, par value $0.0001

|

1,366,333 shares

|

$

|

1.00

|

$

|

1,366,333

|

$

|

186.37

|

|||||||

|

Total

|

1,366,333 shares

|

$

|

1.00

|

$

|

1,366,333

|

$

|

186.37

|

|||||||

|

(1)

|

Pursuant to Rule 416, there are also being registered such additional securities as may be issued to prevent dilution resulting from stock splits, stock dividends or similar transactions.

|

|

(2)

|

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457 under the Securities Act of 1933, as amended.

|

|

(3)

|

The registration fee of $186.37 was paid on or prior to the date of the filing on the registration statement on Form S-1 through this Form S-1/A amendment.

|

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

The information in this Prospectus is not complete and may be changed. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This Prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS

|

SUBJECT TO COMPLETION DATED JULY 28, 2014

|

ROYAL BAKERY HOLDINGS, INC.

1,366,333 shares of common stock

This Prospectus relates to an offering of 1,366,333 shares of common stock that is being made by certain of our shareholders. Throughout this Prospectus, we refer to the shares of common stock as the Shares or the Securities.

Our common stock is not traded on any public market and, although we intend to apply to have our common stock quoted on the Over-the-Counter Bulletin Board (through a broker/dealer), we may not be successful in such efforts, and our common stock may never trade in any public market.

The offering price for these securities has been set at $1.00 per common share until our securities are quoted on the OTC Bulletin Board, if they are ever listed. Subsequent to the quotation of our securities, the shares may be sold at prevailing market prices or at privately negotiated prices pursuant to the Plan of Distribution. There is no guarantee that we will secure a quotation symbol or that there will be a liquid market for our shares.

The selling security holders will receive all proceeds from the sale of the shares of our common stock in this offering. We will not receive any proceeds from the sale of the common stock offered through this Prospectus by the selling security holders. We have agreed to bear all expenses, other than transfer taxes of registration, incurred in connection with this offering, but all commission, selling and other expenses incurred by the selling security holders to underwriters, agents, brokers and dealers will be borne by them. There is no minimum amount of securities that may be sold. There are no underwriting commissions involved in this offering. Selling security holders will pay no offering expenses.

We are an “emerging growth company” under applicable Securities and Exchange Commission rules and will be subject to reduced public company reporting requirements.

Investing in the Securities involves a high degree of risk. See "Risk Factors" beginning on page 4 of this Prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the Securities or determined whether this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus is [__________], 2014.

| 1 | |

| 4 | |

| 10 | |

| 10 | |

| 10 | |

| 10 | |

| 10 | |

| 10 | |

| 11 | |

| 12 | |

| 14 | |

| 20 | |

| 27 | |

| 30 | |

| 31 | |

| 31 | |

| 32 | |

| 33 | |

| 34 | |

| 34 | |

| 34 |

Offers to sell, and offers to buy, the Shares are being made only in jurisdictions where offers and sales are permitted.

In making a decision whether or not to buy any of the Shares offered by this Prospectus, you should rely only on the information contained in the Prospectus. We have not authorized anyone to provide you with information different from that which is contained in the Prospectus. While the prospectus will be updated to the extent required by law, you should assume that the information contained in this prospectus and the accompanying prospectus supplement is accurate only on the date set forth on the front of the document.

In this Prospectus, unless the context indicates otherwise, the terms "Royal Bakery", "we", "us" and "our" refer to Royal Bakery Holdings, Inc.

For investors outside the United States: Neither we nor, to our knowledge, any other person has done anything that would permit this offering or possession or distribution of this Prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this Prospectus.

The following summary highlights selected information contained in this Prospectus. This summary does not contain all the information you should consider before investing in the Shares. Before making any investment decision, you should read the entire Prospectus carefully, including the “Risk Factors” section, the financial statements and the notes to the financial statements.

Royal Bakery and its Business

Royal Bakery Holdings, Inc. (“we”, “us”, “Royal Bakery”, or the “Company”) is a bakery and café franchisor and wholesaler of bakery and bistro products. We were incorporated in the State of Delaware on June 7, 2011. We incorporated a wholly owned California subsidiary corporation, Royal Bakery Sourcing and Trading Corp. (“RBSTC”), on August 20, 2013, as the operating company. Both Royal Bakery and RBSTC are currently located and operated at 405 Old County Road, Belmont, California. We earned $21,811 and $-0- revenues for the years ended December 31, 2013 and 2012, respectively, incurred net losses of $120,433 and $85,006 for the years ended December 31, 2013 and 2012, respectively, and had a cumulative deficit during the development stage of $220,493 at December 31, 2013. We earned $84,705 revenues, incurred net losses of $53,591 for the three months ended March 31, 2014, and had a cumulative deficit during the development stage of $274,444 at March 31, 2014. There are uncertain conditions we face relative to our ability to obtain capital, generate revenue, and generate profits and cash flows from operations. As a result of these conditions, our independent registered public accountants have raised substantial doubt about our ability to continue as a going concern. As of May 31, 2014, we had approximately, $142,873 of cash on hand. As we currently use approximately $20,000 more to operate our business than we derive in revenue monthly, this means that we will use all of our cash on hand in approximately seven months unless we are able to decrease our expenses, increase our revenue or obtain additional debt or equity investments.

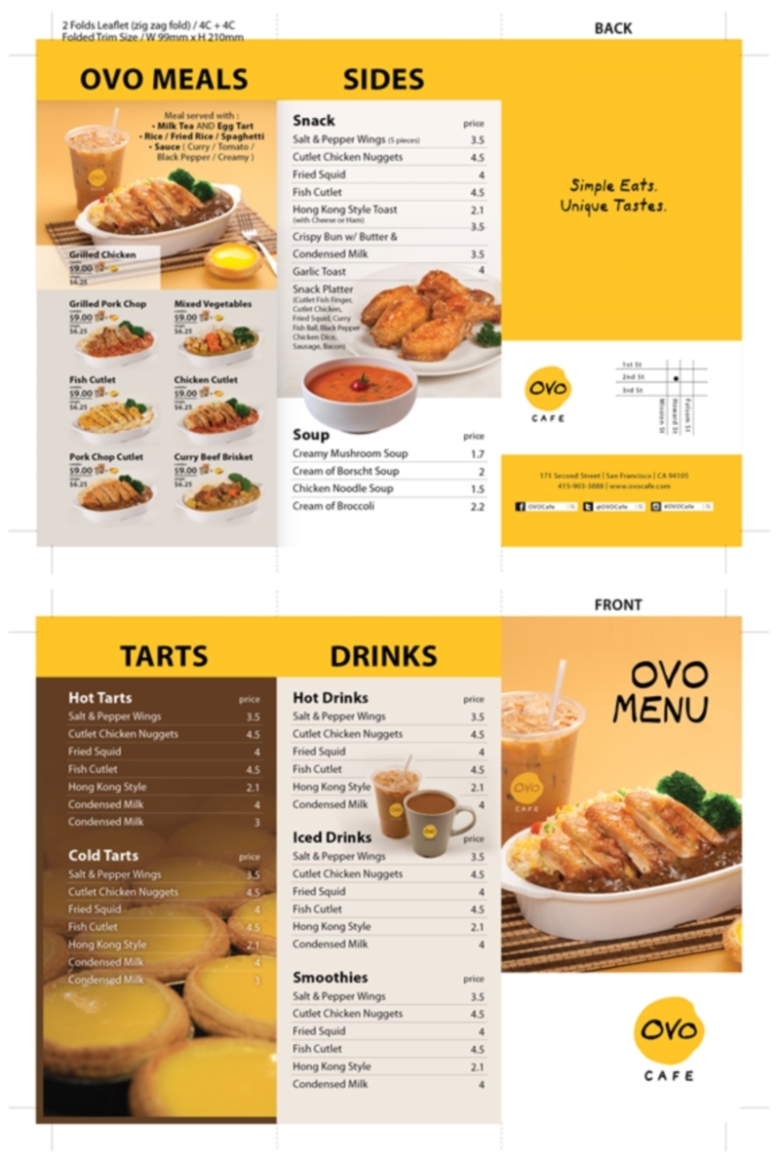

Our franchisor business focuses on franchising bakeries and cafes serving Hong Kong style cuisine under the OVO brand. Since Royal Bakery was incorporated in 2011, we have spent $32,325 on applying for and obtaining a franchise registration in California. On October 3, 2012, we signed a sub-franchisor agreement with Egg Tart Café United Holdings, LLC (“Egg Tart Café”), a Delaware limited liability company that beneficially owns about 18% of our common stock. The Sub-Franchisor Agreement, which has a term of ten years, grants Egg Tart Café an exclusive license to franchise bakeries and cafes under the OVO brand in North America and South America in exchange for payments totaling $50,000, a monthly royalty equal to thirty percent of all royalty proceeds Sub-franchisor receives from its unit franchises and one-time sub-franchise sign up fees ranging from $5,000 to $14,500, depending on the type of OVO brand business sub-franchised. We do not receive any sub-franchisee sign up fees until the aggregate of such fees exceeds the $50,000 sub-franchisor fee received from Egg Tart Café. In January 2014, the first OVO branded food truck was opened as an Egg Tart Café’s sub-franchisee. In February 2014, the first OVO branded restaurant was opened as the Egg Tart Café’s sub-franchisee. As a result of these two openings, the $20,000 franchise fee that had been received from Egg Tart Café in connection with the sub-franchise agreement and that we had previously deemed to be “unearned income” is now deemed to be earned income as well as the $30,000 which is to be received over the next two years, for a total of $50,000 to be recorded as income in January 2014.

We have spent $55,333 to bring experienced Hong Kong Style cuisine chefs from Hong Kong to advise and share their recipes with Egg Tart Café, our sub-franchisor and the parent company of our food supplier, so that Egg Tart Cafe can develop and provide Hong Kong style cuisine food to our brand specifications.

We also generate revenues through the resale of the bakery and bistro products through RBSTC. We buy these products from Majestic Productions of Peninsula LLC, (“Majestic Production”), a food producer located in Belmont, California. Majestic Production is wholly-owned by Egg Tart Café. Majestic Production produces the food products under the direct supervision of Egg Tart Café. On September 1, 2013, we entered into a non-binding agreement with Majestic Production under which we agree to buy and Majestic Production agrees to sell us products at a 5% discount off the regular sales price at which Majestic Production would sell to other third parties. In the year ended December 31, 2013, we generated $21,811 of revenue through the resale of the bakery and bistro products, the cost of which was $23,229, of which $20,786 was purchased from Majestic Production. During the three months ended March 31, 2014, we generated $33,377 of revenue through the resale of the bakery and bistro products. We purchased these products from our affiliate Majestic Production at a cost $31,959.

1

Potential Conflicts of Interest

We have entered into agreements with different affiliates. We have no agreements or arrangements under which any conflict of interest arising between us and our affiliates will be resolved in the favor of one party or the other. Nevertheless, those members of management and shareholders who influence our affiliates could resolve any such conflicts or influence the terms of our arrangements and contracts in a way that favors their other interests at our expense. The agreements where conflicts of interest could arise involve:

|

●

|

Egg Tart Café. We entered into a sub-franchisor agreement with Egg Tart Café, which owns about 18% of our common stock. As of May 31, 2014, there were 16 members of Egg Tart Café. George Ma and Alvin Li are two of the four (4) managing members of Egg Tart Cafe. Alvin Li is the husband of Winnie Sze Wing Cheung. Winnie Sze Wing Cheung is one of the three members of the Board of our Company and is also the Chief Financial Officer of the Company. Alvin Li owns an 11.3% interest of Egg Tart Café. At this time, George Ma has directly invested in our Company. George Ma owns 1% of our Company.

|

|

●

|

Majestic Production. Majestic Production is a wholly-owned subsidiary of Egg Tart Café. We have entered into a contract with Majestic Production, to produce and provide the foods, beverages and pastries to Egg Tart Café’s sub-franchisees and affiliates and for resale to third parties. The above mentioned members of management and shareholders could influence the terms of our arrangements and contracts with Egg Tart Café and Majestic Production in a way that favors their interests at our expense.

|

|

●

|

Hongry Kong. In the year ended December 31, 2013 and as of December 31, 2013, we had sales of food products of $21,811 at a 6.1% markdown to the cost of such food products to, and a receivable of $532 for, Aw2gether LLC (d/b/a Hongry Kong), which is majority-owned by Nikki Ma, our Secretary, COO and a Director. In the three months ended March 31, 2014 and as of March 31, 2014, we had sales of food products of $13,040 at a 4.4% markup to the cost of such food products, and a receivable of $3,079 for, Hongry Kong. We intend to continue selling food products to Hongry Kong.

|

|

●

|

Eunik Investment. We engaged Eunik Investment, an entity that is majority-owned by Nikki Ma, our Secretary, COO and a Director, to provide consultant services of $30,000 during the year ended December 31, 2012 and had a payable of $9,000 to this entity as of December 31, 2012. The Company does not currently have a consultancy arrangement with Eunik Investment.

|

|

●

|

Ovo Café, Inc. entered into an agreement with our sub-franchisor, Egg Tart Café, to open its own Ovo food truck which was subsequently opened in mid January 2014. Ovo Café, Inc. entered into another agreement with our sub-franchisor to open an OVO restaurant which was subsequently opened in February 2014. Both agreements were signed by Ms. Winnie Sze Wing Cheung on behalf of Ovo Café, Inc. Ovo Café, Inc. is 9.4% owned by Winnie Sze Wing Cheung, one of our directors and our Chief Financial Officer, 9.4% by Tommy Cheung, one of our directors and our Chief Executive Officer, and 18.8% owned by Yam Ming Chong and Yue Kwan Chong, two individual major shareholders of the Company. In the three months ended March 31, 2014 and as of March 31, 2014, we had sales of food products of $20,338 at a 4.4% markup to the cost of such food products, and a receivable of $8,321 for, Ovo Café, Inc.

|

|

●

|

1186 Limited. We entered a consulting agreement with 1186 Limited, a Hong Kong entity that is owned by Yam Ming Chong and Yue Kwan Chong, on March 18, 2014. 1186 Limited will advise the Company on operating a Hong Kong style food and beverage business whenever the Company requests such services in exchange for a fee of $100 per hour (with a minimum of 8 hours per training session). This agreement terminates on December 31, 2015. Yam Ming Chong and Yue Kwan Chong together own 36.7% of the Company’s common stock. Yam Ming Chong and Yue Kwan Chong are father and son.

|

Management

We have three officers. Tommy Yu Yan Cheung, is our Chief Executive Officer and the Chairman of our Board of Directors. Mr. Cheung has been in the food and beverage industry for over 30 years and is currently a member of the Legislative Council of Hong Kong representing the catering industry in functional constituencies seats. Mr. Cheung currently intends to dedicate approximately 10 hours a week to our business. Ms. Winnie Sze Wing Cheung is our Chief Financial Officer. Ms. Cheung graduated at the University of South Australia majoring in Business Computing. Ms. Cheung holds several directorships in several private companies in the United States, Hong Kong, and China engaged primarily in production and marketing. Ms. Cheung currently intends to dedicate approximately 15 hours a week to our business. Ms. Nikki Ma is our Secretary. Ms. Ma holds a Bachelor's Degree in Marketing from San Francisco State University. In January 2012, Ms. Ma started Aw2gether LLC, specializing in the mobile food catering industry. Ms. Ma currently intends to dedicate approximately 35 hours a week to our business. Both Mr. Tommy Yu Yan Cheung and Ms. Winnie Sze Wing Cheung currently reside in Hong Kong. They telecommunicate with Ms. Nikki Ma on a weekly basis.

2

Risk Factors

There are numerous risks and uncertainties involved with our Company and an investment in our Company. See "Risk Factors" beginning on page 4 of this Prospectus.

The Offering

|

Shares offered:

|

1,366,333

|

|

Common stock:

|

There are 14,383,000 shares of common stock outstanding at the time of this offering

|

|

Risk factors:

|

The Common Stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See “Risk Factors” below.

|

|

Use of proceeds:

|

We are not selling any shares of the common stock covered by this prospectus, and, as a result, will not receive any proceeds from this offering.

|

Summary of Financial Data

The summarized consolidated financial data presented below is derived from and should be read in conjunction with:

|

●

|

our unaudited consolidated financial statements for the three-month periods ended March 31, 2014 and 2013,

|

|

●

|

our audited consolidated financial statements for the years ended December 31, 2013 and 2012, and

|

|

●

|

the notes to those consolidated financial statements which are included elsewhere in this prospectus along with the section entitled “Management's Discussion and Analysis of Financial Condition and Results of Operations”.

|

|

For the

three-month

period ended

March 31, 2014

(Unaudited)

|

For the

three-month

period ended

March 31, 2013

(Unaudited)

|

For the

year ended

December 31,

2013

|

For the

year ended

December 31,

2012

|

|||||||||||||

|

Revenues, related parties

|

$

|

84,705

|

$

|

-

|

$

|

21,811

|

$

|

-

|

||||||||

|

Net loss

|

$

|

(53,951

|

)

|

$

|

(6,356

|

)

|

$

|

(120,433

|

)

|

$

|

(85,006

|

)

|

||||

|

Net loss per share – basic and diluted

|

$

|

(0.00

|

)

|

$

|

(0.00

|

)

|

$

|

(0.01

|

)

|

$

|

(0.01

|

)

|

||||

|

As at

March 31,

2014

(Unaudited)

|

As at

December 31,

2013

|

As at

December 31,

2012

|

||||||||||

|

Working Capital

|

$

|

194,446

|

$

|

265,986

|

$

|

72,440

|

||||||

|

Total Assets

|

$

|

340,984

|

$

|

346,515

|

$

|

95,886

|

||||||

|

Total Shareholders’ Equity

|

$

|

223,656

|

$

|

277,607

|

$

|

72,440

|

||||||

|

Deficit Accumulated During Development Stage

|

$

|

(274,444

|

)

|

$

|

(220,493

|

)

|

$

|

(100,060

|

)

|

|||

Our consolidated financial statements have been prepared assuming that we will continue as a going concern which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. As of May 31, 2014, we had approximately, $142,873 of cash on hand. As we currently use approximately $20,000 more to operate our business than we derive in revenue monthly, this means that we will use all of our cash on hand in approximately seven months unless we are able to decrease our expenses, increase our revenue or obtain additional debt or equity investments.

3

An investment in the Shares offered by this Prospectus involves a substantial risk of loss. Before you invest, you should carefully consider the risks and uncertainties described below and the other information in this Prospectus. If any of the following risks materialize, our business, operating results and financial condition could be harmed and the value of our common stock could decline. This means that you could lose all or part of your investment.

Risks Relating to Our Business

We and our sub-franchisor have limited operating histories, which makes it difficult to predict future prospects and financial performance.

Although members of management of the Company have experience in the food industry, our Company has no track record upon which to rely in the establishment of the franchises. Our business plan is speculative and mostly unimplemented. We may never succeed in implementing our business plan. Part of our business plan involves signing up sub-franchising restaurants by Egg Tart Café, our sub-franchisor, an entity that is also lacking in institutional experience. We entered into a sub-franchisor agreement with Egg Tart Café on October 3, 2012 after being approved by the California Department of Corporations on September 12, 2012 to operate as a franchisor. Egg Tart Café has submitted its application to be a sub-franchisor to the California Department of Business Oversight (previously known as Department of Corporations) on August 5, 2013 and was approved on December 4, 2013. We are relying on Egg Tart Café to open its own restaurant and/or sign up sub-franchisees to open the restaurants to generate franchise revenue for the Company from our franchise business. If Egg Tart Café is not able to sign up enough sub-franchisees or open its own restaurants, it will significantly alter our plan of operations. Our and Egg Tart Café’s lack of experience increases the likelihood that we could commit errors in selling and opening franchises and sub-franchises and makes your ability to predict our future success more difficult.

The auditor’s report accompanying our consolidated financial statements for the years ended December 31, 2013 and December 31, 2012, contains an explanatory paragraph expressing substantial doubt about our ability to continue as a going concern.

The consolidated financial statements have been prepared on the basis of a going concern which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. As of March 31, 2014, we had working capital of $194,446. Additionally, we have incurred losses of $274,444 since inception. Further losses are anticipated in the development stage raising substantial doubt as to our ability to continue as a going concern. As of May 31, 2014, we had approximately $142,873 of cash on hand. As we currently use approximately $20,000 more to operate our business than we derive in revenue on a monthly basis, this means that we will use all of our cash on hand in approximately seven months unless we are able to decrease our expenses, increase our revenue or obtain additional debt or equity investments.

Our ability to continue as a going concern depends on raising additional capital and generating adequate revenue through franchise fees, royalty fees collected and products sold to our sub-franchisor and sub-franchisees by our subsidiary Royal Bakery Sourcing and Trading Corp. (“RBSTC”) to fund ongoing marketing and support Egg Tart Café, our sub-franchisor, to sign up sub-franchisees. If we cannot raise additional capital or generate adequate revenue, our business will fail.

If our products and services and our branding and marketing efforts are not successful, we will have failed to establish a sustainable business and we may be forced to cease operations.

Our plan of operations depends on developing products and services that are desirable and a brand that attracts and retains customers. In turn, these efforts depend, to a large degree, on our marketing efforts. If we are not successful in these endeavors, potential customers may not purchase our products and our customers may not return for further purchases. Without sufficient customers, we will not generate enough revenues to continue operations.

We may face difficulty complying properly with the reporting requirements of U.S. securities laws as none of our officers and directors has public company experience.

Our officers and directors do not have public company experience, and this lack of experience could impair our ability to comply with legal and regulatory requirements such as those imposed by the Sarbanes-Oxley Act of 2002. None of our management has had sole responsibility for managing a publicly traded company. Such responsibilities include complying with federal securities laws and making required disclosures on a timely basis. Our management may not be able to implement programs and policies in an effective and timely manner that adequately respond to such increased legal, regulatory compliance and reporting requirements, including establishing and maintaining internal controls over financial reporting. Any such deficiencies, weaknesses or lack of compliance could have a materially adverse effect on our ability to comply with the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which is necessary to maintain our public company status. If we were to fail to fulfill those obligations, our ability to continue as a U.S. public company would be in jeopardy in which event you could lose your entire investment in our company.

4

The effective management of our business may be hindered as our CEO and CFO reside in Hong Kong but are managing a business in the United States.

Our CEO and CFO currently reside in Hong Kong, while our head office is located in California. Although our CEO and CFO work closely with Nikki Ma, our Secretary, who resides in California, to manage the Company, we believe our CEO and CFO might face difficulties running our daily operation efficiently as they are remotely managing the Company. There is risk of ineffective communication because of the geographical difference and the time zone difference between Hong Kong and California.

Our CEO and CFO are in their positions temporarily until we are able to locate qualified persons who reside in the United States to take over their positions. No such persons have been identified, we have not begun a search for persons and we will not begin such a search until the Company’s operations have been more established.

Current credit markets may adversely impact the ability of proposed sub-franchisor and its sub-franchisees to obtain financing, which may hinder our ability to achieve our planned growth in restaurant openings.

Our franchise fee and royalty fee revenue business depends on the ability of our sub-franchisor, Egg Tart Café, along with prospective sub-franchisees to open new restaurants and to operate those restaurants on a profitable basis. Delays or failures in opening restaurants could materially and adversely affect our planned growth. While the credit markets have improved over the last year, our sub-franchisor and sub-franchisees will depend on the availability of financing to construct and open new restaurants. If our sub-franchisor and sub-franchisees experience difficulty in obtaining adequate financing for these purposes, our growth strategy and franchise revenues may be adversely affected.

We intend to rely on Majestic Production to act as our only food and production supplier, and any disruption to this arrangement could jeopardize our ability to produce revenue.

We intend to use Majestic Production of Peninsula LLC (“Majestic Production”) as our only food and production supplier for our resale business. Majestic Production is a wholly owned subsidiary of Egg Tart Café United Holdings, LLC. We will purchase bakery and bistro products from Majestic Production and resell them to Egg Tart Café’s sub-franchisees and other retailers. Although we have a written agreement securing Majestic Production’s producer services, this agreement is non-binding. Furthermore, if Majestic Production or Egg Tart Café were to close, choose to no longer cooperate with us or was to increase the cost of their prices beyond what we consider acceptable, we would need to find another producer of bakery and bistro products. Likewise, if Majestic Production was to cease or decrease operations we would need to find another producer of bakery and bistro products. If we were unable to find another producer of such products in a timely manner and on acceptable terms, we may not generate resale revenues. We do not currently have arrangements with any other such producers.

The current economic and financial crisis may limit our ability to find new clients or to expand our business.

The crisis of the financial markets and ensuing credit crunch since the second half of 2008 has led to a severe economic recession worldwide, and the outlook for 2014 is uncertain. A continuation or worsening of unfavorable economic conditions, including the ongoing credit and capital markets disruptions, could have an adverse impact on our business, operating results or financial condition in a number of ways. For example, we may fail to obtain profitability (or even revenues) as a result of our sub-franchisor or its potential sub-franchisees opting not to open its restaurants or customers deciding to eat at home or at cheaper alternatives. We may also experience supply chain delays, disruptions or other problems associated with financial constraints faced by our suppliers and subcontractors.

An inability to obtain additional financing could adversely impact our ability to expand, or even continue, operations in the long term.

We estimate that we will need approximately $315,000 over the next 12 months to fully implement our business expanding plan. As of March 31, 2014, we had $252,839 of cash on hand, and as of May 31, 2014, we had $142,873 of cash on hand. Our monthly burn rate is currently $20,000 more than revenue on a monthly basis. If our projected costs and revenues are accurate, we will be forced to reduce the scope of or abandon our business plan. We have no commitments for any future funding, and may not be able to obtain additional financing or grants on terms acceptable to us, if at all, in the future. If we are unable to obtain additional capital, this would restrict our ability to grow and may require us to curtail or discontinue our business operations. Additionally, while a reduction in our business operations may prolong our ability to operate, that reduction could harm our ability to implement our business strategy. If we can obtain any equity financing, it may involve substantial dilution to our then existing shareholders.

5

As the majority of our outstanding common shares are held by a few shareholders, we could fail to take important business decisions if they disagree with those decisions.

Yam Ming Chong, Yue Kwan Chong, Winnie Sze Wing Cheung, Tommy Yu Yan Cheung and Egg Tart Café currently own a combined 84.7% of our outstanding voting common stock. As a result, they possess, and will continue to possess, combined majority control over our business. For instance, they may elect our Board of Directors, authorize significant corporate transactions or prevent a future change in control of our Company.

Our officers and directors may be subject to conflicts of interest.

Each of our officers and directors serve only part time and is subject to conflicts of interest with their other positions. Each devotes part of his working time to other business endeavors, including consulting relationships with other corporate entities, and has responsibilities to these other entities. Such conflicts include deciding how much time to devote to our affairs, as well as what business opportunities should be presented to the Company. Because of these relationships, our officers and directors will be subject to conflicts of interest. Under Delaware law, our articles of incorporation and our Bylaws permit us broad indemnification powers to all persons against all damages incurred in connection with our business to the fullest extent provided or allowed by law. The exculpation provisions may have the effect of preventing stockholders from recovering damages against our officers and directors caused by their negligence, poor judgment or other circumstances. The indemnification provisions may require us to use our limited assets to defend our officers and directors against claims, including claims arising out of their negligence, poor judgment, or other circumstances.

Two of our directors and officers are outside the United States, with the result that it may be difficult for investors to enforce within the United States any judgments obtained against them.

Two of our directors and officers, Tommy Cheung and Winnie Sze Wing Cheung, are nationals and/or residents of countries other than the United States, and all or a substantial portion of such persons' assets are located outside the United States. As a result, it may be difficult for investors to enforce within the United States any judgments obtained against those officers or directors, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof. You may have difficulty obtaining service of process against these officers and directors. Additionally, it may be difficult to obtain judgments against our directors and officers in foreign courts and it may be difficult to have foreign courts honor the judgments of U.S. courts. Consequently, you may be effectively prevented from pursuing remedies under U.S. federal securities laws against them

The requirements of being a public company may strain our resources and divert management’s attention.

As a public company, we will be subject to the reporting requirements of the Securities Exchange Act of 1934, as amended, and other applicable securities rules and regulations. Compliance with these rules and regulations will increase our legal and financial compliance costs, make some activities more difficult, time-consuming, or costly, and increase demand on our resources. The Exchange Act requires, among other things, that we file annual, quarterly, and current reports with respect to our business and operating results. As a public company, we estimate that our annual legal fees will be approximately $50,000 and our annual auditing fees will be $80,000.

Certain of our majority shareholders and members of our management may have a conflict of interest with our business.

Egg Tart Café is the sub-franchisor of the Company and owns about 18% of our common stock. As of May 31, 2014, there are 16 members of Egg Tart Café. George Ma and Alvin Li are two of the five (5) managing members of Egg Tart Cafe. Alvin Li is the husband of Winnie Sze Wing Cheung. Winnie Sze Wing Cheung is one of the three members of the Board of our Company and is also the Chief Financial Officer of the Company. Alvin Li owns 11.3% of Egg Tart Café. At this time, George Ma has directly invested in our Company. George Ma owns 1% of our Company. No other managing members or members of Egg Tart Café have a direct interest in our Company.

Ovo Café, Inc. entered into agreements with our sub-franchisor to open an OVO food truck, which was opened in January 2014, and an OVO restaurant which was opened on February 18, 2014. Ovo Café, Inc. is 9.4% owned by Winnie Sze Wing Cheung, one of our directors and our Chief Financial Officer, 9.4% owned by Tommy Cheung, one of our directors and our Chief Executive Officer, and 9.4% owned by Yam Ming Chong and 9.4% owned by Yue Kwan Chong, two individual major shareholders of the Company.

6

Majestic Production of Peninsula LLC (“Majestic Production”) is the central food producer to supply products and beverages. Egg Tart Café owns 100% of Majestic Production. We have entered into a contract with Majestic Production, to produce and provide the foods, beverages and pastries to Egg Tart Café’s sub-franchisees and affiliates. The above mentioned members of management and shareholders could influence the terms of our arrangements and contracts with Egg Tart Café and Majestic Production in a way that favors their interests at our expense.

The Company does not expect to be able to pay dividends in the near future, and if it does not, you must rely on a positive valuation of the Company’s common stock to recoup your investment.

To date, we have not paid, nor do we plan to pay in the foreseeable future, dividends on our common stock, even if we become profitable. Earnings, if any, are expected to be used to advance our activities and for general corporate purposes, rather than to make distributions to stockholders. Investors will likely need to rely on an increase in the price of the Shares to profit from their investment. There are no guarantees that any market for our common stock will ever develop or that the price of our stock will ever increase.

The Company may not be prepared to face the existing and future competition.

The Company will face competition from other restaurants. We are vulnerable to competitors that act irrationally or are able to operate at zero or negative margins, have longer operating histories, more market experience and contacts and greater financial resources than the Company. The Company may not be able to compete effectively.

The restaurant business is intensely competitive with respect to food quality, price-value relationships, ambiance, service and location, with many existing restaurants competing with us in different regions, and if we fail to provide an appropriately priced level of service or otherwise fail to compete effectively it could have a material adverse effect on our revenues and profitability. Our competitors may consist of a number of well-established entities with greater financial, marketing, personnel and other resources than ours. In addition, many of our competitors are well established in the markets where our operations are planning to open, while other companies may develop restaurants that operate with similar concepts. We also face growing competition as retail outlets improve the quality and convenience of their meal offerings potentially resulting in fewer occasions for consumers to dine out.

Your recourse against our Directors liability may be limited by our charter documents.

Pursuant to the Company’s Articles of Incorporation, the Directors will not be liable to the Company or any stockholders for monetary damages for any breach of fiduciary duty, except (i) acts that breach his or her duty of loyalty to the Company or its stockholders, (ii) acts or omissions without good faith, (iii) acts involving intentional misconduct or knowing violation of the law, (iv) pursuant to Section 174 of the Delaware Corporate Law or (v) for any transaction from which the director derived an improper personal benefit. Thus, shareholders will have limited recourse against those parties.

We depend on our executive management and other personnel, and we may not be able to replace such persons if they were no longer with the Company.

We believe that the continuing availability and dedication of our limited scientific and management staff is vital to our operations. Our success depends to a significant extent upon our key management. We may not be successful in attracting and retaining the personnel we require to develop and market our product candidates and to conduct our operations successfully. Failure to retain management and find suitable replacements would have a material adverse effect upon our business. Additionally, we do not have “key-person” life insurance covering any of our directors and officers.

We may enter into employment agreements with our executive officers and compensation payable thereunder may not be based on arms-length negotiations.

Our current executive officers also serve as our directors, and we do not have an independent compensation committee to determine compensation and to approve employment agreements. Therefore, compensation which may be paid by us to our management may not be determined based on arms-length negotiations. We may grant stock options and other equity incentives to our executive officers and directors. The consideration which may be payable to management might not reflect the true market value of services provided to us.

7

A lack of independent directors could result in a Board of Directors that does not thoroughly represent the interests of minority shareholders.

We currently have no independent directors and our Board of Directors may never have a majority of independent directors in the future. In the absence of a majority of independent directors, our Chairman and CEO, who are also directors, could establish policies and enter into transactions without independent review and approval thereof. This could present the potential for a conflict of interest between us and our shareholders generally and the controlling officers, shareholders or directors. This risk is increased by our sole customer being a related party.

As an “emerging growth company” under the JOBS Act, we are permitted to rely on exemptions from certain disclosure requirements that will result in you receiving less information about us than companies filing with the SEC that are not “emerging growth companies”.

We qualify as an “emerging growth company” under the JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements. For so long as we are an emerging growth company, we will not be required to:

|

●

|

have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act;

|

|

|

●

|

comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis);

|

|

|

●

|

submit certain executive compensation matters to shareholder advisory votes, such as “say-on-pay” and “say-on-frequency”;

|

|

|

●

|

hold a nonbinding advisory stockholder vote on any golden parachute payments that were not previously approved, pursuant to Section 14A(b) of the Exchange Act; and

|

|

|

●

|

disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the Chief Executive’s compensation to median employee compensation.

|

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We will remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our total annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, which would occur if the market value of our ordinary shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

Until such time, however, we cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

8

RISKS RELATING TO THE OFFERING AND THE SHARES

As there is no market for the Shares your ability to liquidate your investment in a public market does not exist, and it may never exist.

The Shares are not registered under the Securities Act of 1933, as amended. Additionally, the Shares have not been listed, and do not trade, on any trading market or platform, including FINRA’s Over-the-Counter Bulletin Board, the Pink Sheets or the Grey Markets. Even if the Shares were to be listed on an exchange or quoted on a market, a mature market in the Shares may never develop and there could be low to no volume. As a result, the Shares are highly illiquid and you may encounter significant delay, trouble and/or expense in any resale of the Shares, if such a resale is even possible. Investors must be prepared to be unable to liquidate their investment or even lose their entire investment.

If a market develops for our shares, our share price may be volatile, and you may not be able to sell your shares of common stock at or above the cost per Share.

The stock market in general, and the market for restaurant stocks in particular, has experienced extreme price and volume fluctuations. These broad market and industry fluctuations may adversely affect the market price of our common stock, irrespective of our actual operating performance. Additional factors which could influence the market price of our common stock include statements and claims made by us and other participants in our industry and public officials. The offering price for the common stock contained in the Shares may not be above that which will subsequently prevail in the market.

The Board of Directors could issue stock to prevent a takeover by an acquirer or shareholder group.

The Company’s authorized capital stock consists of 25,000,000 shares of our common stock and there are 14,383,000 shares of common stock outstanding. One effect of the existence of authorized but unissued capital stock may be to enable the Board of Directors to make it more difficult or to discourage an attempt to obtain control of the Company by means of a merger, tender offer, proxy contest, or otherwise, and thereby to protect the continuity of the Company’s management. If, in the due exercise of its fiduciary obligations, for example, the Board of Directors were to determine that a takeover proposal was not in the Company’s best interest, such shares could be issued by the Board of Directors without stockholder approval in one or more private placements or other transactions that might prevent, or make it more difficult or costly, completion of the takeover transaction by diluting the voting or other rights of the proposed acquirer or insurgent stockholder or stockholder group, by creating a substantial voting bloc in institutional or other hands that might undertake to support the position of the incumbent Board of Directors, by effecting an acquisition that might complicate or preclude the takeover, or otherwise. The Company does not contemplate any additional issuances of common stock for this purpose at this time.

If large amounts of our shares held by existing shareholders are sold in the future, the market price of our common stock could decline.

At the time that this registration statement is declared effective by the SEC, a significant number of shares of our Common Stock will be eligible to be immediately sold in the market. The market price of our shares could fall substantially if our existing shareholders sell large amounts of our common stock in the public market following this offering. Even a perception by the market that Selling Stockholders may sell in large amounts after the registration statement is declared effective could place significant downward pressure on our stock price. These sales, or the possibility that these sales may occur, could also make it more difficult for us to sell equity or equity-related securities if we need to do so in the future to address then-existing financing needs.

9

We have made statements under the captions “Risk Factors”, “Use of Proceeds”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, “Business” and elsewhere in this Prospectus that are forward-looking statements. You can identify these statements by forward-looking words such as “may”, “will”, “expect”, “anticipate”, “believe,” “estimate” and similar terminology.

We believe it is important to communicate our expectations to our investors. However, there may be events in the future that we are not able to accurately predict or which we do not fully control that will cause actual results to differ materially from those expressed or implied by our forward-looking statements. These include the factors listed under “Risk Factors” and elsewhere in this Prospectus.

Although we believe that our expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. Our forward looking statements are made as of the date of this Prospectus, and we assume we are under no duty to update them or to explain why actual results may differ.

We are not party to any material pending legal proceedings, and to the best of our knowledge, no such proceedings by or against us have been initiated.

As the Shares being offered hereby are owned by current shareholders, we will not receive any proceeds from this offering.

We do not anticipate paying any dividends on our common stock in the foreseeable future. We expect to retain future earnings, if any, for use in our development activities and the operation of our business. The payment of any future dividends will be subject to the discretion of our board of directors and will depend, among other things, upon our results of operations, financial condition, cash requirements, prospects and other factors that our Board of Directors may deem relevant.

The offering price for these securities has been set at $1.00 per common share until our securities are quoted on the OTC Bulletin Board, if they are ever listed. Subsequent to the quotation of our securities, the shares may be sold at prevailing market prices or at privately negotiated prices pursuant to the Plan of Distribution. There is no guarantee that we will secure a quotation symbol or that there will be a liquid market for our shares.

Our common stock is not traded on any public market and, although we intend to apply to have our common stock quoted on the OTC Bulletin Board (through a broker/dealer), we may not be successful in such efforts, and our common stock may never trade in any public market.

The Shares of common stock being registered pursuant to this registration statement are currently issued and outstanding. Their resale will not result in a reduction in their ownership interest in our company.

10

We are registering the Shares of common stock in order to permit the selling stockholders to offer the Shares for resale from time to time.

The table below lists the selling stockholders and other information regarding the beneficial ownership (as determined under Section 13(d) of the Securities Exchange Act of 1934, as amended, and the rules and regulations thereunder) of the Shares of common stock held by each of the selling stockholders. The second column lists the number of shares of common stock beneficially owned by the selling stockholders, based on their respective ownership of shares of common stock, as of July 28, 2014.

The third column lists the Shares of common stock being offered by this Prospectus by the selling stockholders.

The fourth column lists the Shares of common stock such selling stockholder would own if that stockholder sold all of its shares being offered hereby. The selling stockholders may sell all, some or none of their shares in this offering. See “Plan of Distribution”.

|

Name of Selling

Stockholder

|

Number of Shares

of Common Stock

Owned Prior to

Offering

|

Maximum Number of

Shares of Common

Stock to be Sold

Pursuant to this

Prospectus (1)

|

Number of Shares

of Common Stock

Owned After Offering

and Percentage (2)

|

|||||||||

|

Eunik Investment (3)

|

275,000

|

275,000

|

0

|

|||||||||

|

Regina Kit Lan Lee

|

100,000

|

100,000

|

0

|

|||||||||

|

Kin Kwan Hui

|

90,000

|

90,000

|

0

|

|||||||||

|

Chum Ming Chu

|

50,000

|

50,000

|

0

|

|||||||||

|

Chuen Sun Leung

|

50,000

|

50,000

|

0

|

|||||||||

|

Chi Ming Ng

|

56,000

|

56,000

|

0

|

|||||||||

|

Fuk Keung Lee

|

72,000

|

72,000

|

0

|

|||||||||

|

Yum Leung Chong

|

50,000

|

50,000

|

0

|

|||||||||

|

Suk Lai Yeung

|

20,000

|

20,000

|

0

|

|||||||||

|

Chi Chung Tang

|

20,000

|

20,000

|

0

|

|||||||||

|

Wai Pan Wong

|

20,000

|

20,000

|

0

|

|||||||||

|

Yuk Chun Wong

|

20,000

|

20,000

|

0

|

|||||||||

|

Hak Man Lam

|

10,000

|

10,000

|

0

|

|||||||||

|

Wai Yin So

|

10,000

|

10,000

|

0

|

|||||||||

|

Chun Wah Leung

|

2,000

|

2,000

|

0

|

|||||||||

|

Man Yuen Gary Lai

|

12,000

|

12,000

|

0

|

|||||||||

|

Yuk Lin Ho

|

12,000

|

12,000

|

0

|

|||||||||

|

Lai Yung Yau

|

2,000

|

2,000

|

0

|

|||||||||

|

Chin Pang Hui

|

4,000

|

4,000

|

0

|

|||||||||

|

Wai Oi Kwong

|

4,000

|

4,000

|

0

|

|||||||||

|

Wai Hung Chu

|

80,000

|

80,000

|

0

|

|||||||||

|

Man Ho Gavin Lai

|

42,000

|

42,000

|

0

|

|||||||||

|

Tuen Chung Wong

|

10,000

|

10,000

|

0

|

|||||||||

|

Cheung Yue Tsang

|

4,000

|

4,000

|

0

|

|||||||||

|

Wing Kwong Chiu

|

20,000

|

20,000

|

0

|

|||||||||

|

Fong Lai Wong

|

4,000

|

4,000

|

0

|

|||||||||

|

Bik Chun Chiu

|

10,000

|

10,000

|

0

|

|||||||||

|

Mau Wong Chan

|

4,000

|

4,000

|

0

|

|||||||||

|

Chi Yung Fung

|

2,000

|

2,000

|

0

|

|||||||||

|

Ka Wai Wan

|

2,000

|

2,000

|

0

|

|||||||||

|

Kin Pong Tang

|

2,000

|

2,000

|

0

|

|||||||||

|

Pui Ling Chow

|

2,000

|

2,000

|

0

|

|||||||||

|

Yuan Hui Fan

|

2,000

|

2,000

|

0

|

|||||||||

|

Wei Zhang

|

16,667

|

16,667

|

0

|

|||||||||

|

Hui Juan Zhuang

|

2,000

|

2,000

|

0

|

|||||||||

|

Tokuaki Dennis Wu

|

10,000

|

10,000

|

0

|

|||||||||

|

Ngai Chau

|

2,000

|

2,000

|

0

|

|||||||||

|

Fong Yin Chan

|

6,000

|

6,000

|

0

|

|||||||||

|

Hoi Ching Chan

|

4,000

|

4,000

|

0

|

|||||||||

|

Kam Fai Tang

|

6,000

|

6,000

|

0

|

|||||||||

|

Siu Sing Tam

|

4,000

|

4,000

|

0

|

|||||||||

|

Ip Chun Ho

|

6,000

|

6,000

|

0

|

|||||||||

|

Tsan Man Siu

|

10,000

|

10,000

|

0

|

|||||||||

|

Lun Woo

|

6,000

|

6,000

|

0

|

|||||||||

|

Chu Woo

|

6,000

|

6,000

|

0

|

|||||||||

|

Sui Chi Cheung

|

83,333

|

83,333

|

0

|

|||||||||

|

Shu Wing Cheung

|

83,333

|

83,333

|

0

|

|||||||||

|

Shu Ming Quinn Wong

|

4,000

|

4,000

|

0

|

|||||||||

|

Lai Fun Li

|

10,000

|

10,000

|

0

|

|||||||||

|

Cheung Pak Chi Cecilia

|

20,000

|

20,000

|

0

|

|||||||||

|

Tai, Ka Lap

|

2,000

|

2,000

|

0

|

|||||||||

|

ZhiZhong Zhou

|

2,000

|

2,000

|

0

|

|||||||||

|

Qian Wang

|

2,000

|

2,000

|

0

|

|||||||||

|

Yuchen Rao

|

2,000

|

2,000

|

0

|

|||||||||

|

Chi Man Wu

|

6,000

|

6,000

|

0

|

|||||||||

|

Kah Yee Joni Kan

|

10,000

|

10,000

|

0

|

|||||||||

11

|

(1)

|

The number of shares of common stock listed as beneficially owned by such selling stockholder represents the number of shares of common stock currently owned and potentially issuable to such selling stockholder. For these purposes, any contractual or other restriction on the number of securities the selling stockholder may own at any point have been disregarded.

|

|

(2)

|

Based on 1,366,333 shares of common stock. In determining this amount, we assumed that all 1,366,333 shares included in this prospectus will be sold. If this assumption is incorrect, the number of shares and percentages included in this column will differ from what we have provided.

|

|

(3)

|

Nikki Ma owns 50% of Eunik Investment and has the voting and dispositive power over the shares owned by Eunik Investment. Nikki Ma is the Secretary of the Board of the Company. The other 50% of Eunik Investment is owned by Eugene Ma, Nikki Ma’s brother.

|

We are registering shares of common stock held by the selling stockholders. We will not receive any of the proceeds from the sale by the selling stockholders of the Shares of common stock. We will bear all fees and expenses incident to our obligation to register the Shares of common stock.

The selling stockholders may sell all or a portion of the Shares of common stock held by them and offered hereby from time-to-time directly or through one or more underwriters, broker-dealers or agents. If the Shares of common stock are sold through underwriters or broker-dealers, the selling stockholders will be responsible for underwriting discounts or commissions or agent’s commissions. The Shares of common stock may be sold in one or more transactions at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined at the time of sale or at negotiated prices. These sales may be made in transactions, which may involve crosses or block transactions, pursuant to one or more of the following methods:

|

●

|

on any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale;

|

|

|

●

|

in the over-the-counter market;

|

12

|

●

|

in transactions otherwise than on these exchanges or systems or in the over-the-counter market;

|

|

|

●

|

through the writing or settlement of options, whether such options are listed on an options exchange or otherwise;

|

|

|

●

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

●

|

block trades in which the broker-dealer will attempt to sell the Shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

●

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

●

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

●

|

privately negotiated transactions;

|

|

|

●

|

short sales made after the date the Registration Statement is declared effective by the SEC;

|

|

|

●

|

agreements between broker-dealers and any selling stockholders to sell a specified number of such shares at a stipulated price per share;

|

|

|

●

|

a combination of any such methods of sale; and

|

|

|

●

|

any other method permitted pursuant to applicable law.

|

The selling stockholders may also sell shares of common stock under Rule 144 promulgated under the Securities Act of 1933, as amended, if available, rather than under this Prospectus. In addition, the selling stockholders may transfer the Shares of common stock by other means not described in this Prospectus. If the selling stockholders effect such transactions by selling shares of common stock to or through underwriters, broker-dealers or agents, such underwriters, broker-dealers or agents may receive commissions in the form of discounts, concessions or commissions from the selling stockholders or commissions from purchasers of the Shares of common stock for whom they may act as agent or to whom they may sell as principal (which discounts, concessions or commissions as to particular underwriters, broker-dealers or agents may be in excess of those customary in the types of transactions involved). In connection with sales of the Shares of common stock or otherwise, the selling stockholders may enter into hedging transactions with broker-dealers, which may in turn engage in short sales of the Shares of common stock in the course of hedging in positions they assume. The selling stockholders may also sell shares of common stock short and deliver shares of common stock covered by this Prospectus to close out short positions and to return borrowed shares in connection with such short sales. The selling stockholders may also loan or pledge shares of common stock to broker-dealers that in turn may sell such shares.

The selling stockholders may pledge or grant a security interest in some or all of the common stock owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the Shares of common stock from time to time pursuant to this Prospectus or any amendment to this Prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending, if necessary, the list of selling stockholders to include the pledgee, transferee or other successors in interest as selling stockholders under this Prospectus. The selling stockholders also may transfer and donate the Shares of common stock in other circumstances in which case the transferees, donees, pledges or other successors in interest will be the selling beneficial owners for purposes of this Prospectus.

To the extent required by the Securities Act and the rules and regulations thereunder, the selling stockholders and any broker-dealer participating in the distribution of the Shares of common stock may be deemed to be “underwriters” within the meaning of the Securities Act, and any commission paid, or any discounts or concessions allowed to, any such broker-dealer may be deemed to be underwriting commissions or discounts under the Securities Act. At the time a particular offering of the Shares of common stock is made, a Prospectus supplement, if required, will be distributed, which will set forth the aggregate amount of shares of common stock being offered and the terms of the offering, including the name or names of any broker-dealers or agents, any discounts, commissions and other terms constituting compensation from the selling stockholders and any discounts, commissions or concessions allowed or re-allowed or paid to broker-dealers.

13

Under the securities laws of some states, the Shares of common stock may be sold in such states only through registered or licensed brokers or dealers. In addition, in some states the Shares of common stock may not be sold unless such shares have been registered or qualified for sale in such state or an exemption from registration or qualification is available and is complied with.

There can be no assurance that any selling stockholder will sell any or all of the Shares of common stock registered pursuant to the registration statement, of which this Prospectus forms a part.

The selling stockholders and any other person participating in such distribution will be subject to applicable provisions of the Securities Exchange Act of 1934, as amended, and the rules and regulations thereunder, including, without limitation, to the extent applicable, Regulation M of the Exchange Act, which may limit the timing of purchases and sales of any of the Shares of common stock by the selling stockholders and any other participating person. To the extent applicable, Regulation M may also restrict the ability of any person engaged in the distribution of the Shares of common stock to engage in market-making activities with respect to the Shares of common stock. All of the foregoing may affect the marketability of the Shares of common stock and the ability of any person or entity to engage in market-making activities with respect to the Shares of common stock.

We will pay all expenses of the registration of the Shares of common stock, estimated to be $145,300 in total, including, without limitation, Securities and Exchange Commission filing fees and expenses of compliance with state securities or “blue sky” laws; provided, however, a selling stockholder will pay all underwriting discounts and selling commissions, if any.

Once sold under the registration statement, of which this Prospectus forms a part, the Shares of common stock will be freely tradable in the hands of persons other than our affiliates.

Each reference in this prospectus is to the fiscal years ended on December 31, 2013 and December 31, 2012, and the three months ended March 31, 2014.

We qualify as an “emerging growth company” under the JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements. For so long as we are an emerging growth company, we will not be required to:

|

●

|

have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act;

|

|

|

●

|

comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis);

|

|

|

●

|

submit certain executive compensation matters to shareholder advisory votes, such as “say-on-pay” and “say-on-frequency”;

|

|

|

●

|

hold a nonbinding advisory stockholder vote on any golden parachute payments that were not previously approved, pursuant to Section 14A(b) of the Exchange Act; and

|

|

|

●

|

disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the CEO’s compensation to median employee compensation.

|

14

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We will remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our total annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, which would occur if the market value of our ordinary shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

Plan of Operation

Our plan of operation consists of continuing to focus on our business of promoting OVO branded restaurants, cafes, kiosk and food trucks and reselling bakery and food products to these and other businesses.

In connection with promoting the OVO brand, we have engaged a product designer So Wing Po Design to assist in developing staff uniforms, utensils and containers, and a designer firm, Affinity Design Consultants Ltd from Hong Kong, to do the interior design to ensure the design layout meets our entire marketing concept. We intend to assist Egg Tart Café’s first sub-franchisee running the restaurant under the brand OVO Café in San Francisco. The staff training will be intensive during this time, particularly in training the staff to understand the menu and the philosophy of our Company. We will continue to have consultants from Hong Kong visit California to advise the sub-franchisees, on cooking techniques, logistics and customer interactions. We believe that a good marketing strategy is important and intend to dedicate at least one senior staff member to focus exclusively on marketing our products.

In connection with our business of reselling bakery and food products, we will monitor the quality of the products we purchase, a substantial portion of which are produced by Majestic Production, which is owned by Egg Tart Café. If necessary, we will assist Majestic Production in refining the menu and providing technical assistance to improve its productivity. Although we are not required to do so, we believe that it is in our best interest to coordinate closely with Majestic Production and share our expertise if it can improve the quality of the food offered at the OVO branded restaurants and reduce the cost of such food either to us in the resale business or to the customers of the OVO branded restaurants. We believe the centrally located Majestic Production site is able to support up to 30 sub-franchisees’ restaurants and 3 sub-franchisees’ food trucks around the greater San Francisco Bay Area.

On a timing level, we anticipate that we will take the following actions over the following periods:

|

●

|

We are currently continuing to assist the sub-franchisor Egg Tart Café to develop Egg Tart Café’s first sub-franchisee restaurant and the first food truck from Ovo Café, Inc. Egg Tart Café signed up its first sub-franchise as a food truck from Ovo Café, Inc. and the first sub-franchisee restaurant Ovo Café in January 2014. The food truck was opened in mid January 2014. The first sub-franchisee restaurant Ovo Café was opened on February 18, 2014 at 171 2nd Street, San Francisco, California. We believe that it is important for the first OVO restaurant to demonstrate the OVO model to future potential independently owned and operated sub-franchisees. As several of the investors in the first OVO restaurant are also members of management, we also believe that it shows their commitment to promote the OVO brand name and the franchise operation business as a viable one.

|

15

|

●

|