Attached files

| file | filename |

|---|---|

| EX-23.4 - EX-23.4 - RSP Permian, Inc. | a2220696zex-23_4.htm |

| EX-23.2 - EX-23.2 - RSP Permian, Inc. | a2220696zex-23_2.htm |

| EX-23.3 - EX-23.3 - RSP Permian, Inc. | a2220696zex-23_3.htm |

| EX-5.1 - EX-5.1 - RSP Permian, Inc. | a2220696zex-5_1.htm |

| EX-10.6 - EX-10.6 - RSP Permian, Inc. | a2220696zex-10_6.htm |

| EX-23.1 - EX-23.1 - RSP Permian, Inc. | a2220696zex-23_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on July 25, 2014

Registration No. 333-196388

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

RSP Permian, Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

1311 (Primary Standard Industrial Classification Code Number) |

90-1022997 (IRS Employer Identification Number) |

3141 Hood Street, Suite 500

Dallas, Texas 75219

(214) 252-2700

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices)

Scott McNeill

Chief Financial Officer

3141 Hood Street, Suite 500

Dallas, Texas 75219

(214) 252-2700

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||

| Douglas E. McWilliams Christopher G. Schmitt Vinson & Elkins L.L.P. 1001 Fannin Street, Suite 2500 Houston, Texas 77002 |

J. Michael Chambers David J. Miller Latham & Watkins LLP 811 Main Street, Suite 3700 Houston, Texas 77002 |

|

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered1 |

Proposed Maximum Offering Price per Share2 |

Proposed Maximum Aggregate Offering Price1,2 |

Amount of Registration Fee3 |

||||

|---|---|---|---|---|---|---|---|---|

Common Stock, par value $0.01 per share |

17,250,000 | $31.93 | $550,792,500.00 | $70,942.08 | ||||

|

||||||||

- 1

- Includes shares of common stock that may be sold to cover the exercise of an option to purchase

additional shares granted to the underwriters.

- 2

- Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under

the Securities Act of 1933, as amended, and based on a price of $31.93, which is the average of the high and low trading prices per share as reported by the New York Stock Exchange on July 22,

2014.

- 3

- The Registrant previously paid $32,136.12 of this amount on May 30, 2014 upon the initial filing of this Registration Statement and an additional $14,240.26 of this amount on June 26, 2014 upon filing Amendment No. 1 to this Registration Statement. The balance is being paid herewith.

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The securities described herein may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell such securities, and it is not soliciting an offer to buy such securities, in any state or jurisdiction where such offer or sale is not permitted.

Subject to Completion, dated July 25, 2014

PROSPECTUS

15,000,000 Shares

RSP Permian, Inc.

Common Stock

We are offering 6,000,000 shares of our common stock, and the selling stockholders identified in this prospectus are offering 9,000,000 shares of our common stock. We will not receive any proceeds from the sale of any shares by the selling stockholders.

Our common stock is listed on the New York Stock Exchange under the symbol "RSPP." On July 23, 2014, the last sale price of our common stock as reported on the New York Stock Exchange was $32.20 per share.

We are an emerging growth company as that term is used in the Jumpstart Our Business Startups Act of 2012 and have elected to take advantage of certain reduced public company reporting requirements. Please see "Prospectus Summary—Emerging Growth Company."

Investing in our common stock involves risks. See "Risk Factors" beginning on page 26.

| |

Per share | Total | |||||

|---|---|---|---|---|---|---|---|

Price to the public |

$ | $ | |||||

Underwriting discounts and commissions1 |

$ | $ | |||||

Proceeds to us (before expenses) |

$ | $ | |||||

Proceeds to the selling stockholders (before expenses) |

$ | $ | |||||

- 1

- We refer you to "Underwriting" beginning on page 165 of this prospectus for additional information regarding underwriting compensation.

We and certain selling stockholders have granted the underwriters the option to purchase up to an additional 900,000 and 1,350,000 shares of common stock, respectively, on the same terms and conditions set forth below if the underwriters sell more than 15,000,000 shares of common stock in this offering.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

underwriters expect to deliver the shares on or about , 2014 through the book-entry

facilities of The Depository Trust Company.

Barclays

Prospectus dated , 2014

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by or on behalf of us or to which we have referred you. Neither we, the selling stockholders nor the underwriters have authorized anyone to provide you with information different from that contained in this prospectus and any free writing prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We, the selling stockholders and the underwriters are offering to sell shares of common stock and seeking offers to buy shares of common stock only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

This prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. See "Risk Factors" and "Cautionary Statement Regarding Forward-Looking Statements."

The market data and certain other statistical information used throughout this prospectus are based on independent industry publications, government publications and other published independent sources. Although we believe these third-party sources are reliable as of their respective dates, neither we, the selling stockholders nor the underwriters have independently verified the accuracy or

i

completeness of this information. Some data is also based on our good faith estimates. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section entitled "Risk Factors." These and other factors could cause results to differ materially from those expressed in these publications.

We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. This prospectus may also contain trademarks, service marks and trade names of third parties, which are the property of their respective owners. Our use or display of third parties' trademarks, service marks, trade names or products in this prospectus is not intended to, and does not imply, a relationship with, or endorsement or sponsorship by us. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks, service marks and trade names.

ii

This summary highlights information contained elsewhere in this prospectus. You should read the entire prospectus carefully before making an investment decision, including the information included under the headings "Risk Factors," "Cautionary Statement Regarding Forward-Looking Statements" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the historical and pro forma combined financial statements and the notes to those financial statements appearing elsewhere in this prospectus. The information presented in this prospectus, unless otherwise indicated, assumes that the underwriters do not exercise their option to purchase additional shares of common stock.

In connection with RSP Permian, Inc.'s initial public offering (our "IPO"), which was completed in January 2014, and pursuant to the terms of a corporate reorganization, all of the interests in RSP Permian, L.L.C. were exchanged for shares of common stock of RSP Permian, Inc. Additionally, in connection with our IPO, certain owners of working interests and net profits interests in RSP Permian, L.L.C.'s oil and natural gas properties contributed all or substantially all of such interests to RSP Permian, Inc. in exchange for, among other things, shares of common stock of RSP Permian, Inc. See "—Our IPO and Related Transactions" for more information regarding these contributions. These contributions, our IPO and the other transactions described in "—Our IPO and Related Transactions" are collectively referred to in this prospectus as the "Transactions." Except as expressly stated or the context otherwise requires, references to our operations and assets give effect to the Transactions, and the terms "we," "us," "our" and "RSP" refer, prior to the Transactions, to RSP Permian, L.L.C. and, after the Transactions, to RSP Permian, Inc. and its subsidiary, RSP Permian, L.L.C.

This prospectus includes certain terms commonly used in the oil and natural gas industry, which are defined elsewhere in Annex A to this prospectus.

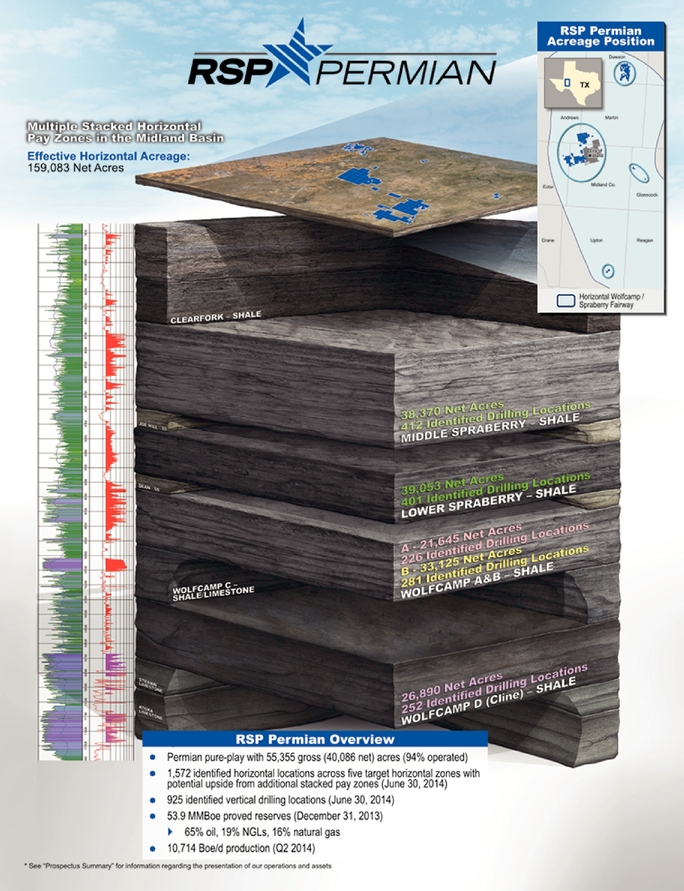

Our Company

We are an independent oil and natural gas company focused on the acquisition, exploration, development and production of unconventional oil and associated liquids-rich natural gas reserves in the Permian Basin of West Texas. The vast majority of our acreage is located on large, contiguous acreage blocks in the core of the Midland Basin, a sub-basin of the Permian Basin, primarily in the adjacent counties of Midland, Martin, Andrews, Dawson and Ector.

Since our inception in 2010, we have participated in the drilling of over 330 vertical Wolfberry wells and served as the operator of over 190 of those wells. In late 2012, our primary focus shifted to drilling horizontal wells. We believe horizontal drilling provides more attractive returns on a majority of our acreage. We target the multiple oil and natural gas producing stratigraphic horizons, or stacked pay zones, on our properties. Beginning in 2012, we were among the first operators to successfully drill and complete a horizontal well in the core of the Midland Basin targeting the Wolfcamp B formation. In addition, we are the operator of what we believe is the first horizontal well completed in the Middle Spraberry shale in the Midland Basin, which came on production in the fourth quarter of 2013. We also believe we were the first operator to successfully drill and complete a horizontal well targeting the Lower Spraberry shale in the Permian Basin. We recently drilled our first successful horizontal well targeting the Wolfcamp A formation on a dual-well pad with a second completion into the Wolfcamp B formation, without any communication between the zones.

Since initiating our horizontal drilling program, we have participated in the drilling and completion of 75 horizontal wells (36 of which we operate), which have targeted the Middle Spraberry, Lower Spraberry, Wolfcamp A, Wolfcamp B, Wolfcamp D (Cline) and Clearfork formations on our properties. In addition, we believe that our properties provide horizontal opportunities in several other intervals, such as the Jo Mill, Dean, Strawn, Atoka, Mississippian and Devonian formations. We have 11 horizontal wells we operate in various stages of drilling or completion that target five different

1

horizontal zones on our properties, primarily from multi-well, multi-zone pads to increase our capital efficiency. We expect the remainder of our horizontal wells to be drilled in 2014 on multi-well pads that target multiple horizons on our properties. Currently, all four of our horizontal rigs are drilling from multi-well, multi-zone pads.

We believe our vertical drilling program is a strong complement to our horizontal drilling program, and we plan to continue to drill vertical Wolfberry wells. In areas where we drill horizontal wells, vertical drilling, in concert with horizontal drilling, allows us to optimize total hydrocarbon recovery on our acreage, while continuing to provide attractive returns on a standalone basis. In addition, on certain sections of our acreage, vertical drilling provides the most attractive returns. Further, the combination of horizontal and vertical drilling enables us to hold our acreage through our continuous development program.

We are currently operating four horizontal rigs and two vertical rigs. We expect to add a fifth horizontal rig during the fourth quarter of 2014 and a sixth horizontal rig during the first quarter of 2015. We expect that approximately 75% of our 2014 drilling and completion budget will be devoted to the drilling of horizontal wells.

The Permian Basin is an attractive operating area due to its multiple horizontal and vertical target horizons, favorable operating environment, high oil and liquids-rich natural gas content, substantial existing infrastructure, well-developed network of oilfield service providers, long-lived reserves with consistent reservoir quality and historically high drilling success rates. Operators in the Permian Basin have produced more than 29 billion barrels of oil and 75 trillion cubic feet of natural gas over the past 90 years, and the Permian Basin is estimated to contain recoverable oil and natural gas reserves exceeding that which has already been produced. With oil production of over 960 MBbls/d from over 80,000 wells during 2013, production from the Permian Basin represented 50% of the crude oil produced in Texas and approximately 17% of the crude oil produced onshore in the continental United States during such period. According to the Energy Information Administration of the U.S. Department of Energy, the Spraberry Trend Area, which encompasses the Midland Basin, ranks as the largest onshore oilfield in the continental United States by proved reserves and oil production.

We were formed in October 2010 by our management team and an affiliate of Natural Gas Partners ("NGP"), a family of energy-focused private equity investment funds. Prior to our formation, the founding members of our management team successfully built and sold multiple NGP-sponsored oil and natural gas companies. In December 2010, we acquired 15,800 net acres in the Permian Basin with production at the time of acquisition of approximately 1,500 net Boe/d from 107 wells. See "—Our IPO and Related Transactions" for information regarding our acquisitions and other transactions since December 2010.

We have assembled a multi-year inventory of horizontal and vertical drilling projects. As of June 30, 2014, we had identified 1,572 horizontal drilling locations on our acreage based on approximately 750 to 1,050 foot spacing between wells in the same horizontal zone. Additionally, based on our evaluation of applicable geologic and engineering data, as of June 30, 2014, we had 280 identified vertical drilling locations on 40-acre spacing and an additional 645 identified vertical drilling locations based on 20-acre downspacing. We intend to grow our reserves and production through development drilling, exploitation and exploration activities on our properties and through acquisitions that meet our strategic and financial objectives, targeting oil-weighted reserves.

The following table provides a summary of our target horizontal zones and vertical drilling inventory as of June 30, 2014. While our near term drilling program will be focused primarily on the Middle Spraberry, Lower Spraberry, Wolfcamp A and Wolfcamp B intervals underlying our properties, based on our and other operators' well results and our analysis of geologic and engineering data, we believe the Wolfcamp D (Cline) interval is prospective and expect it will be integrated into our future drilling program. We also believe we have the potential to increase our multi-year drilling inventory

2

through horizontal downspacing and with additional horizontal locations in zones not included in our target horizontal zones, such as the Clearfork, Jo Mill, Dean, Strawn, Atoka, Mississippian and Devonian formations. We believe our large, contiguous acreage position allows us to optimize our horizontal and vertical development programs to maximize our resource recovery on a per 640-acre section basis and thus our returns.

| |

Identified Drilling Locations1 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

Target Horizontal Locations2 | |||||||||

| |

Short Laterals3 | Long Laterals3 | Total | |||||||

Target Horizontal Zones4: |

||||||||||

Middle Spraberry |

117 | 295 | 412 | |||||||

Lower Spraberry |

112 | 289 | 401 | |||||||

Wolfcamp A |

77 | 149 | 226 | |||||||

Wolfcamp B |

82 | 199 | 281 | |||||||

Wolfcamp D (Cline) |

77 | 175 | 252 | |||||||

| | | | | | | | | | | |

Total Target Horizontal Locations |

465 | 1,107 | 1,572 | |||||||

| | | | | | | | | | | |

| | | | | | | | | | | |

| |

Vertical Locations | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

40-acre | 20-acre | Total | |||||||

Vertical Locations |

280 | 645 | 925 | |||||||

| | | | | | | | | | | |

Total Target Horizontal and Vertical Locations |

2,497 | 5 | ||||||||

| | | | | | | | | | | |

| | | | | | | | | | | |

- 1

- Our

total identified drilling locations include 313 locations associated with proved undeveloped reserves as of December 31, 2013.

We have estimated our drilling locations based on well spacing assumptions for the areas in which we operate and other criteria. The drilling locations on which we actually drill will depend on the

availability of capital, regulatory approvals, commodity prices, costs, actual drilling results and other factors. Any drilling activities we are able to conduct on these identified locations may not

be successful and may not result in our ability to add additional proved reserves to our existing proved reserves. See "Risk Factors—Our identified drilling locations are scheduled out

over many years, making them susceptible to uncertainties that could materially alter the occurrence or timing of their drilling. In addition, we may not be able to raise the substantial amount of

capital that would be necessary to drill such locations."

- 2

- Our

target horizontal location count implies approximately 750 to 1,050 foot spacing between wells in the same horizontal zone.

- 3

- We

define short laterals as horizontal lateral lengths ranging from approximately 4,500 to 5,500 feet and long laterals as horizontal

lateral lengths ranging from approximately 6,500 to 10,000 feet. The average lateral length of our target horizontal locations is approximately 6,700 feet.

- 4

- In

addition to these target horizontal zones, we believe we have the potential to increase our multi-year drilling inventory through horizontal

downspacing and with additional horizontal locations in the Clearfork, Jo Mill, Dean, Strawn, Atoka, Mississippian and Devonian formations.

- 5

- As of June 30, 2014, seven and 103 of our 2,497 total target horizontal and vertical locations are associated with acreage that will expire in 2014 and 2015, respectively, unless either production is established within the spacing units covering such acreage or the lease is renewed or extended under continuous drilling provisions prior to such dates.

3

Based on our current drilling schedule, we do not expect the acreage associated with any of our target locations to expire. In the event leases for such acreage expire, however, we would lose our right to develop the related locations. See "Risk Factors—Our identified drilling locations are scheduled out over many years, making them susceptible to uncertainties that could materially alter the occurrence or timing of their drilling. In addition, we may not be able to raise the substantial amount of capital that would be necessary to drill such locations."

As of December 31, 2013, none of our 313 locations associated with proved undeveloped reserves is associated with acreage that will expire prior to scheduled drilling.

During 2013, we spent approximately $216 million of capital, which included $170 million to drill and complete operated wells, $37 million for our participation in the drilling and completion of non-operated wells and $9 million on infrastructure. Our 2014 capital budget for drilling, completion, recompletion and infrastructure is approximately $425 million. Our capital budget excludes acquisitions. We intend to allocate our 2014 capital budget approximately as follows:

- •

- $360 million, or 85%, for the drilling and completion of operated wells;

- •

- $40 million, or 9%, for our participation in the drilling and completion of non-operated wells; and

- •

- $25 million, or 6%, for infrastructure.

As of March 31, 2014, we have spent approximately $57 million to drill and complete operated wells, $7 million for our participation in the drilling and completion of non-operated wells and $2 million on infrastructure.

Because we are the operator of a high percentage of our acreage, the amount and timing of these capital expenditures are largely discretionary. We could choose to defer a portion of these planned 2014 capital expenditures depending on a variety of factors, including the success of our drilling activities; prevailing and anticipated prices for oil, NGLs and natural gas; the availability of necessary equipment, infrastructure and capital; the receipt and timing of required regulatory permits and approvals; drilling, completion and acquisition costs; and the level of participation by other working interest owners.

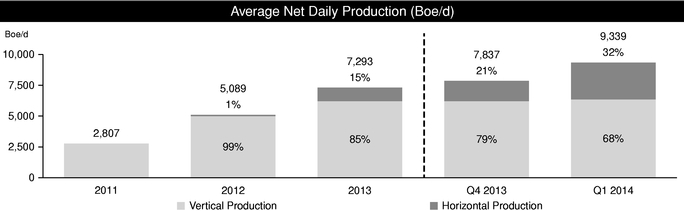

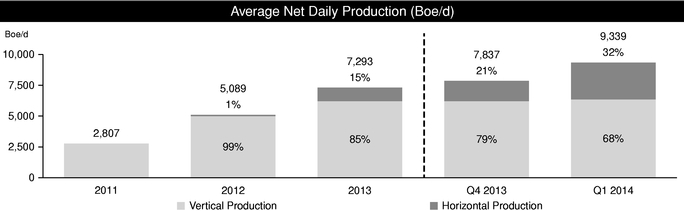

For the three months ended March 31, 2014, our average net daily production was 9,339 Boe/d (approximately 71% oil, 17% NGLs and 12% natural gas), of which 32% was from horizontal well production and 68% was from vertical well production. As of March 31, 2014, we produced from 35 horizontal and 501 vertical wells and were the operator of approximately 94% of our net acreage.

4

The following chart provides information regarding our production growth and the increasing proportion of our horizontal well production since the beginning of 2011 on a pro forma basis, giving effect to the Transactions as if they had taken place at the beginning of 2011.

The following table provides a summary of what we believe to be our combined horizontal acreage position that is prospective for hydrocarbon production across our target horizontal zones underneath our total surface acreage of 55,355 gross (40,086 net) acres. Our belief is based upon our evaluation of our initial horizontal drilling results and those of other operators in our area to date, combined with our interpretation of available geologic and engineering data. In particular, we have analyzed and interpreted well results and other data acquired through our participation in the drilling of vertical wells that have penetrated our target horizontal zones. We have also analyzed data from various industry studies detailing the geology and geochemistry of our target horizontal zones, both within and beyond the boundaries of our leases in order to evaluate and compare the drilling results of other operators' known productive wells and areas to our expected results. In addition, to evaluate the prospectivity of our combined horizontal acreage, we have used 3-D seismic data and performed open-hole and mud log evaluations, core analysis and drill cuttings analysis. We refer to the summation of our horizontal acreage across the multiple target zones as our "Effective Horizontal Acreage." We believe this acreage metric more accurately conveys our horizontal drilling opportunities in our target zones than our total surface acreage, and we believe our analysis of engineering, geological, geochemical and seismic data is based on industry standards.

| |

Effective Horizontal Acreage1 |

||||||

|---|---|---|---|---|---|---|---|

| |

Gross | Net | |||||

Target Horizontal Zones: |

|||||||

Middle Spraberry |

53,306 | 38,370 | |||||

Lower Spraberry |

54,064 | 39,053 | |||||

Wolfcamp A |

34,255 | 21,645 | |||||

Wolfcamp B |

47,644 | 33,125 | |||||

Wolfcamp D (Cline) |

39,917 | 26,890 | |||||

| | | | | | | | |

Total Effective Horizontal Acreage |

229,186 | 159,083 | |||||

| | | | | | | | |

| | | | | | | | |

- 1

- Our calculation of our Effective Horizontal Acreage is an inexact estimate. We cannot assure you that any amount of our Effective Horizontal Acreage listed above in each of our target horizontal zones is prospective for that zone. Additionally, we cannot ascertain what portion of our Effective Horizontal Acreage will ever be drilled. See "Risk Factors—Our Effective Horizontal Acreage is based on our and other operators' current

5

drilling results and our interpretation of available geologic and engineering data and therefore is an inexact estimate subject to various uncertainties."

Additionally, based on data we have collected from our horizontal and vertical drilling programs, we believe our acreage could also be prospective for horizontal drilling opportunities in the Clearfork, Jo Mill, Dean, Strawn, Atoka, Mississippian and Devonian formations.

As of December 31, 2013, our estimated proved oil and natural gas reserves were 53,883 MBoe based on a reserve report prepared by Ryder Scott Company, L.P. ("Ryder Scott"), our independent reserve engineer. Of these reserves, approximately 40% were classified as proved developed producing ("PDP"). Proved undeveloped reserves ("PUDs") included in this estimate are from 290 vertical well locations and 23 horizontal well locations. As of December 31, 2013, these proved reserves were approximately 65% oil, 19% NGLs and 16% natural gas.

The following table provides summary information regarding our proved reserves as of December 31, 2013, and production for the three months ended March 31, 2014. As estimated by Ryder Scott, our estimated ultimate recoveries ("EURs") from our PUD horizontal drilling locations as of December 31, 2013 average 524 MBoe (approximately 70% oil, 16% NGLs and 14% natural gas) for our Wolfcamp B wells, which have an average assumed lateral length of approximately 6,000 feet, 652 MBoe (approximately 65% oil, 19% NGLs and 16% natural gas) for our Lower Spraberry wells, which have an average assumed lateral length of approximately 6,400 feet, and 428 MBoe (approximately 65% oil, 18% NGLs and 17% natural gas) for our Middle Spraberry wells, which have an average assumed lateral length of approximately 5,000 feet.

| |

Estimated Total Proved Reserves | |

|

|||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Oil (MMBbls) |

Natural Gas (Bcf) |

NGLs (MMBbls) |

Total (MMBoe) |

% Oil |

% Liquids1 |

% Developed |

Average Net Production (Boe/d) |

R/P Ratio (Years)2 |

|||||||||||||||||||

Midland Basin |

34.9 | 52.7 | 10.2 | 53.9 | 65 | 84 | 40 | 9,3393 | 15.8 | |||||||||||||||||||

- 1

- Includes

both oil and NGLs.

- 2

- Represents

the number of years proved reserves would last assuming production continued at the average rate for the three months ended

March 31, 2014. Because production rates naturally decline over time, the R/P Ratio is not a useful estimate of how long properties should economically produce.

- 3

- Consisted of approximately 71% oil, 17% NGLs and 12% natural gas.

Our Business Strategy

Our business strategy is to increase stockholder value through the following:

- •

- Grow reserves, production and cash flow by developing our oil-rich

resource base in the core of the Midland Basin. We intend to actively drill and develop our acreage in an effort to maximize its value

and resource potential. Through the conversion of our undeveloped reserves to developed reserves, we will seek to increase our production, reserves and cash flow while generating favorable returns on

invested capital. Currently, we are operating four horizontal drilling rigs focused on the Wolfcamp B and Lower Spraberry target zones and two vertical rigs targeting the Wolfberry play. We

expect to add a fifth horizontal rig during the fourth quarter of 2014 and a sixth horizontal rig during the first quarter of 2015.

- •

- Apply horizontal drilling technology in multiple pay zones to increase production. In 2014, we plan to spend approximately 75% of our drilling and completion budget on horizontal drilling to develop multiple target zones. Our recent well results and the results of other operators demonstrate that the Midland Basin contains multiple pay zones for the drilling of horizontal wells. As of

6

- •

- Strengthen hydrocarbon recovery from vertical drilling and increased

well density drilling. We believe our vertical drilling program complements our horizontal drilling program and generates attractive

returns on invested capital. We also believe increased well density drilling opportunities exist across our acreage base for both our horizontal and vertical drilling programs. We closely monitor

industry trends with respect to higher well density drilling, which could increase the recovery factor per section and provide additional attractive opportunities for capital deployment.

- •

- Pursue strategic acquisition opportunities with oil-weighted resource

potential. We have made, and intend to continue to make, opportunistic acquisitions of acreage in the Permian Basin that have

substantial oil-weighted resource potential from which we believe we can achieve attractive returns on invested capital. We evaluate acquisition opportunities on a variety of criteria, including

expected rate of return, location, resource potential and the presence of multiple pay zones where we can utilize our horizontal drilling experience. We intend to grow our position around and within

our concentrated acreage position in the Midland Basin through leasing activity and acquisitions.

- •

- Maintain a high degree of operational control in order to continuously improve operating and cost

efficiencies. We seek operational control of our properties in order to better execute on our strategies of enhancing returns through operational and cost efficiencies and

increasing ultimate hydrocarbon recovery by continuous improvement of our drilling techniques, completion methodologies and reservoir evaluation processes. We expect the remainder of our 2014

horizontal development program to be drilled from multi-well, multi-zone pads to increase our capital efficiency. Additionally, operatorship allows us to more efficiently manage the pace of

development activities, including our horizontal development program, and the gathering and marketing of our production. Further, to support our operations, we have built infrastructure that allows us

to significantly reduce our operating costs. For example, we have laid approximately 87 miles of oil, natural gas and water transport lines to support gathering and transportation activities on

our properties, operate ten water source wells drilled into the Santa Rosa formation in West Texas, operate four saltwater disposal wells on our properties, and have an additional saltwater disposal

well in the completion process.

- •

- Leverage our experience operating in the Permian Basin to maximize

returns for stockholders. Our executive and core technical team has an average of approximately 25 years of energy industry

experience per person, most of which has been in the Permian Basin. Our team regularly evaluates our operating results against those of other operators in our area in order to improve our performance

and identify opportunities to optimize our drilling and completion techniques and make informed decisions about our capital program and drilling activity levels. Additionally, our experienced

management team focuses on creating stockholder value by identifying, evaluating and completing acquisitions that we believe will generate attractive rates of return. We intend to leverage our

management's and technical team's experience in applying unconventional drilling and completion techniques in an effort to optimize operating results.

- •

- Maintain financial flexibility and apply a disciplined approach to capital allocation. We carefully manage our liquidity through internal cash flow modeling that includes forecasts for each well we are scheduled to drill. We conservatively use debt financing and intend to maintain what we consider modest leverage levels. Further, as a complement to our disciplined approach to financial management, we have an active commodity hedging program to reduce our exposure to oil price variability.

June 30, 2014, we had drilled or were currently drilling 36 horizontal wells as the operator and had participated in 39 additional horizontal wells as a non-operator. Of these 75 total horizontal wells, 49 are Wolfcamp B wells, three are Wolfcamp A wells, two are Wolfcamp D (Cline) wells, six are Middle Spraberry wells, 14 are Lower Spraberry wells and one is a Clearfork well.

7

Our Competitive Strengths

We believe that the following strengths will help us achieve our business goals:

- •

- Attractively positioned in the oil-rich core of the Midland

Basin. All of our leasehold acreage is located in the Permian Basin in West Texas, and substantially all of our current properties are

well-positioned in what we believe to be the core of the Midland Basin where horizontal drilling activity has increased by more than 800% since January 2012. Based on industry data, we believe the

Permian Basin offers some of the most attractive returns among our nation's producing oil and natural gas plays. As of December 31, 2013, our estimated net proved reserves were comprised of

approximately 65% oil, 19% NGLs and 16% natural gas. In the current commodity price environment, our oil and liquids-rich asset base provides attractive rates of return.

- •

- Contiguous acreage position with high degree of operational

control. The vast majority of our acreage is located on contiguous blocks in what we believe to be the core of the Midland Basin. We

believe this large, contiguous acreage position allows us to optimize our horizontal and vertical development programs to maximize our resource recovery on a per 640-acre section basis and thus our

returns. In particular, our contiguous acreage blocks allow us the flexibility to adjust our drilling and completion techniques, primarily the length of our horizontal laterals and use of multi-well,

multi-zone pads, in order to optimize our well results, drilling costs and returns. As the operator of approximately 94% of our net acreage, we retain the ability to adjust our development program,

including the selection of specific drilling locations, the timing of the development and the drilling and completion techniques used to efficiently develop our significant resource base. This

operating control also enables us to exchange data with other offset operators, which we believe contributes to reducing the risks associated with drilling the multiple horizontal zones of our

acreage.

- •

- Significant horizontal drilling experience in multiple pay zones in the

Midland Basin. We believe our horizontal drilling experience targeting multiple pay zones in the Midland Basin provides us a competitive

advantage in these areas. Our initial horizontal focus was on the Wolfcamp B formation in Midland County. We were among the first operators in the core of the Midland Basin to successfully

drill and complete a horizontal well in the Wolfcamp B formation. In addition, we believe we were the first operator to successfully drill and complete a horizontal well targeting the Middle

Spraberry shale in the Midland Basin. We also believe we were the first operator to successfully drill and complete a horizontal well targeting the Lower Spraberry shale in the Permian Basin.

Additionally, our technical team has been drilling horizontal wells in North America since the early 1990s and applies this decades-long experience when drilling our target zones in the Midland Basin.

- •

- Multi-year horizontal drilling

inventory. We have identified a multi-year inventory of horizontal drilling locations that we believe provides attractive growth and

return opportunities. Based on our initial horizontal drilling results and those of other operators in our area to date, combined with our interpretation of various geologic and engineering data, as

of June 30, 2014, we had identified 1,572 horizontal drilling locations on our acreage based on approximately 750 to 1,050 foot spacing between wells in the same horizontal zone. These

locations exist across most of our acreage blocks and in multiple target zones. We also believe that as we execute our horizontal drilling program, we will identify additional horizontal drilling

locations. Of the 1,572 identified horizontal drilling locations, 412 are in the Middle Spraberry horizon, 401 are in the Lower Spraberry horizon, 226 are in the Wolfcamp A horizon, 281 are in

the Wolfcamp B horizon and 252 are in the Wolfcamp D (Cline) horizon. Additionally, we believe our acreage could be prospective for horizontal drilling of the Clearfork, Jo Mill,

Dean, Strawn, Atoka, Mississippian and Devonian horizons.

- •

- Low-risk vertical development program. The Permian Basin is historically a conventional play with substantial de-risking around our mostly contiguous acreage position with over 11,500 active and producing vertical wells drilled in the Midland Basin from 2010 to date. Since the beginning of

8

- •

- Experienced, incentivized and proven management

team. We believe that the experience of our management and technical teams in horizontal drilling and completions will help reduce the

execution risk associated with unconventional drilling. We believe the significant collective experience of our management and technical teams has enabled us to recognize the potential in the core of

the Midland Basin and to assemble a portfolio of assets that has been, and we believe will continue to be, highly productive. Further, our executive team has extensive experience in identifying

acquisition targets and evaluating resource potential through its involvement in successfully building and selling several companies that executed acquisitions and divestitures as part of their growth

strategy. We believe this significant experience identifying and closing acquisitions and divestitures will help us identify additional attractive acquisition opportunities in the future. Our

management team has a meaningful economic interest in us, which we believe will provide significant incentives to grow the value of our business for the benefit of all stockholders. None of the

members of our senior management are selling any shares in this offering.

- •

- Financial flexibility to fund expansion. We have a conservative balance sheet, which allows us to actively develop our drilling, exploitation and exploration activities in the Midland Basin and maximize the present value of our oil-weighted resource potential. As of July 23, 2014, we had $170.0 million of borrowings and $0.6 million of letters of credit outstanding under our revolving credit facility, providing $204.4 million of available borrowing capacity. After giving effect to this offering and the use of proceeds therefrom, we expect to have no borrowings and $0.6 million of letters of credit outstanding, and $374.4 million of borrowing capacity, under our revolving credit facility. We believe this borrowing capacity, along with our cash flow from operations, will provide us with sufficient liquidity to execute on our current capital program.

our development program in 2010, we have participated in the drilling of over 330 vertical Wolfberry wells across our concentrated leasehold position. As of June 30, 2014, our vertical Wolfberry play drilling plan included 280 identified drilling locations based on 40-acre spacing and an additional 645 identified drilling locations based on 20-acre downspacing.

Our IPO and Related Transactions

Acquisitions and Dispositions

Resolute Disposition. Pursuant to a transaction that closed in part in December 2012 and in part in March 2013, we sold all of our working interests in approximately 2,600 net acres and 80 producing wells in the Permian Basin to Resolute Natural Resources Southwest, L.L.C. ("Resolute") for approximately $214 million (the "Resolute Disposition").

Spanish Trail Acquisition. On September 10, 2013, we acquired additional working interests in certain of our existing properties in the Permian Basin (the "Spanish Trail Acquisition") from Summit Petroleum, LLC ("Summit") and EGL Resources, Inc. ("EGL"). Together with the working interests acquired pursuant to the preferential purchase rights and subsequently contributed to us in connection with our IPO, as described in "—Corporate Formation Transactions," the Spanish Trail Acquisition increased our working interests in approximately 5,400 gross acres and 70 gross producing wells (the "Spanish Trail Assets").

The aggregate purchase price for the Spanish Trail Assets agreed to by us and the sellers was $155 million. Subsequent to the signing of the purchase agreement and prior to the closing of the Spanish Trail Acquisition, Ted Collins, Jr. ("Collins") and Wallace Family Partnership, LP ("Wallace LP"), non-operating working interest owners in the Spanish Trail Assets, exercised preferential purchase rights granted under a joint operating agreement among the working interest owners in the Spanish Trail Assets. The preferential purchase rights gave Collins and Wallace LP the right to purchase a portion of the working interests sold by Summit and EGL. Collins and Wallace LP completed this acquisition through Collins & Wallace Holdings, LLC, a newly-formed entity that contributed these acquired assets for shares of RSP Permian, Inc.'s common stock, as described in

9

"—Corporate Formation Transactions—The Collins and Wallace Contributions." The exercise of the preferential purchase rights reduced our effective purchase price from $155 million to $121 million. The Spanish Trail Acquisition was funded with a $70 million term loan, borrowings under our revolving credit facility and the issuance of a net profits interest ("NPI") as further described below.

Simultaneously with the closing of the Spanish Trail Acquisition, we conveyed a 25% NPI in the Spanish Trail Assets taken as a whole, excluding the portion acquired by Collins & Wallace Holdings, LLC, to ACTOIL, LLC ("ACTOIL") in exchange for cash equal to 25% of our $121 million purchase price, pursuant to ACTOIL's exercise of a right of first refusal granted by us in the agreement that governs the NPI investment. ACTOIL contributed this NPI, along with the other NPI in our assets, for shares of RSP Permian, Inc.'s common stock, as described in "—Corporate Formation Transactions—The ACTOIL NPI Repurchase."

Verde Acquisition. On October 10, 2013, we acquired leasehold interests in 9,464 gross (8,092 net) acres in the Midland Basin located just to the north of the Dawson and Martin county line toward the eastern half of Dawson County (the "Verde Acquisition"). We are the operator on 100% of this acreage. We believe that this leasehold is prospective for the target horizontal zones of Middle Spraberry, Lower Spraberry, Wolfcamp A and Wolfcamp B. This belief is based on detailed log analysis of four key well penetrations located within the acreage block as well as drill cuttings analysis from two of these wells to verify porosity, permeability and total organic carbon content. We believe the prospectivity of this acreage is further corroborated by the data provided from an additional 50 wells drilled by third parties on or within one mile of the acreage block that have penetrated sufficient depth to provide data on the Wolfcamp B zone. No 3-D seismic data has been acquired on this acreage as of this time.

This acreage currently contains no producing wells. However, we have identified a total of approximately 276 gross horizontal drilling locations on this acreage and additional contiguous acreage acquired in Dawson County during 2014 (see "—Recent Events—Acquisitions"), of which 92 are located in the Wolfcamp B zone, 92 are located in the Middle Spraberry zone and 92 are located in the Lower Spraberry zone. We expect the lateral lengths of the horizontal wells we drill in this area to range from approximately 4,500 feet to 7,500 feet. As a result of our detailed technical analysis of the area, we believe its geology and petrochemical attributes to be similar to our other leaseholds in the core of the Midland Basin.

Our IPO

On January 23, 2014, we completed our IPO, selling 23 million shares of our common stock at $19.50 per share to the public. Of the 23 million shares sold to the public, 9.2 million shares were issued and sold by the Company and 13.8 million shares were sold by selling stockholders. Immediately following the closing of our IPO, common stock held by public holders represented approximately 32% of our outstanding common stock.

The net proceeds to us from our IPO were approximately $163 million. These proceeds were used to fully repay our $70 million term loan, reduce outstanding borrowings under our revolving credit facility, make cash payments as partial consideration for certain working interests in oil and natural gas properties contributed to us in conjunction with our IPO (which contributions are discussed below under "—Corporate Formation Transactions"), pay cash bonuses to certain of our employees, and fund a portion of our capital expenditure plan. We did not receive any proceeds from the sale of shares by the selling stockholders in our IPO.

In connection with our IPO, we entered into several transactions that changed the structure and scope of the Company. See "—Corporate Formation Transactions."

10

Corporate Formation Transactions

Corporate Reorganization. RSP Permian, L.L.C. was formed as a Delaware limited liability company in October 2010 by our management team and an affiliate of NGP to engage in the acquisition, development, exploration and exploitation of unconventional, onshore oil and natural gas reserves in the Permian Basin in West Texas. NGP, which was founded in 1988, is a family of energy-focused private equity investment funds with aggregate committed capital under management since inception of over $10 billion. Prior to the Transactions, RSP Permian, L.L.C. had approximately 13,900 net acres and working interests in approximately 324 gross producing wells in the Permian Basin.

Pursuant to the terms of a corporate reorganization that was completed in connection with our IPO (i) the members of RSP Permian, L.L.C. contributed all of their interests in RSP Permian, L.L.C. to RSP Permian Holdco, L.L.C., a newly-formed entity wholly owned by such members, and (ii) RSP Permian Holdco, L.L.C. contributed all of its interests in RSP Permian, L.L.C. to RSP Permian, Inc. in exchange for approximately 28.5 million shares of common stock of RSP Permian, Inc., an assignment of RSP Permian, L.L.C.'s pro rata share of an escrow related to the Resolute Disposition and the right to receive approximately $27.7 million in cash. As a result of the reorganization, RSP Permian, L.L.C. became a wholly owned subsidiary of RSP Permian, Inc.

The Rising Star Acquisition. In connection with our IPO, we acquired from Rising Star Energy Development Co., L.L.C. ("Rising Star") working interests (the "Rising Star Assets") in certain acreage and wells in the Permian Basin in which RSP Permian, L.L.C. already had working interests (the "Rising Star Acquisition"). In exchange, Rising Star received approximately 1.8 million shares of RSP Permian, Inc.'s common stock and the right to receive approximately $1.7 million in cash. The Rising Star Acquisition increased our average working interest in approximately 3,250 gross acres and 36 gross producing wells in the Permian Basin. The Rising Star Assets represented substantially all of Rising Star's production and revenues for the year ended December 31, 2013.

The Collins and Wallace Contributions. Collins, Wallace LP and Collins & Wallace Holdings, LLC, a newly-formed entity that is owned equally by Collins and Wallace LP, contributed to us certain working interests (collectively, the "Collins and Wallace Contributions") in certain of RSP Permian, L.L.C.'s existing properties in the Permian Basin. In exchange, (i) Collins received approximately 9.9 million shares of RSP Permian, Inc.'s common stock and the right to receive approximately $1.6 million in cash, (ii) Wallace LP received approximately 10.0 million shares of RSP Permian, Inc.'s common stock and the right to receive approximately $0.6 million in cash, and (iii) Collins & Wallace Holdings, LLC received approximately 2.2 million shares of RSP Permian, Inc.'s common stock. The Collins and Wallace Contributions occurred in connection with our IPO.

These contributed working interests consisted of the following: (i) Collins' non-operated working interest in substantially all of the oil and natural gas properties that RSP Permian, L.L.C. owned prior to the Spanish Trail Acquisition; (ii) Wallace LP's non-operated working interest in substantially all of the oil and natural gas properties that RSP Permian, L.L.C. owned prior to the Spanish Trail Acquisition; and (iii) Collins & Wallace Holdings, LLC's non-operated working interest in the Spanish Trail Assets.

The Pecos Contribution. In connection with our IPO, Pecos Energy Partners, L.P. ("Pecos"), an entity owned by certain members of our management team, contributed to us certain working interests (the "Pecos Assets") in certain acreage and wells in the Permian Basin in which RSP Permian, L.L.C. already had working interests (the "Pecos Contribution"). In exchange, Pecos received approximately 0.1 million shares of RSP Permian, Inc.'s common stock.

The ACTOIL NPI Repurchase. In July 2011, we sold to ACTOIL a 25% NPI in substantially all of our oil and natural gas properties taken as a whole. In addition, as discussed above under "—Acquisitions and Dispositions—Spanish Trail Acquisition," we sold to ACTOIL a 25% NPI in the oil and natural gas properties acquired by RSP Permian, L.L.C. in the Spanish Trail Acquisition.

11

Subsequent to our sale to ACTOIL of the NPIs, the oil and natural gas properties that underpinned ACTOIL's NPIs remained owned and controlled by us. The NPIs entitled ACTOIL to 25% of the relevant properties' cumulative revenues in excess of their cumulative direct operating expenses and capital expenditures. Because the cumulative revenues did not yet exceed the cumulative direct operating expenses and capital expenditures, we included the resultant net cash flow and the reserves associated with ACTOIL's NPIs in our historical proved reserves estimates.

In connection with our IPO, ACTOIL contributed both 25% NPIs to us (the "ACTOIL NPI Repurchase") in exchange for approximately 10.8 million shares of RSP Permian, Inc.'s common stock.

Recent Events

Acquisitions

During the first quarter of 2014, we acquired additional acreage that we believe is prospective for horizontal development located in Martin, Glasscock and Dawson counties in Texas for an aggregate purchase price of approximately $79 million in three separate transactions, with approximately $69 million recorded as proved oil and natural gas properties. These transactions were financed with borrowings under our revolving credit facility. These transactions are described in further detail below:

- •

- In Martin County, we acquired a 17.5% non-operated working interest in producing properties located between our operated

leasehold positions. The properties include 6,451 gross (1,125 net) acres, and net production, on a two-stream basis, averaged approximately 500 Boe/d (76% oil) for the month of March 2014 from

147 vertical wells. The operator of these properties has indicated it has identified 196 horizontal drilling locations in six target intervals, including the Middle Spraberry, Lower Spraberry,

Wolfcamp A, Wolfcamp B, Wolfcamp D (Cline) and Clearfork formations.

- •

- In Glasscock County, we acquired a 100% operated working interest in 961 acres of undeveloped leasehold. We have

identified 28 horizontal locations on these properties in the Middle Spraberry, Lower Spraberry, Wolfcamp A, Wolfcamp B and Wolfcamp D (Cline) formations.

- •

- In Dawson County, we acquired 3,766 gross (3,230 net) undeveloped acres in the same area as the assets acquired in the Verde Acquisition, bringing our total acreage in Dawson County to 13,389 gross (11,481 net) acres. We have identified approximately 61 additional net horizontal locations in the Middle Spraberry, Lower Spraberry and Wolfcamp A/B formations.

On July 25, 2014 we announced our entry into definitive agreements in separate transactions with multiple sellers to acquire certain undeveloped acreage and oil and natural gas producing properties located in Glasscock County (the "Pending Glasscock Acquisitions") for an approximate aggregate price of $259 million in cash, the substantial majority of which was to acquire undeveloped acreage. We will operate 100% of, and have approximately an 87% average working interest in, the properties to be acquired. The Pending Glasscock Acquisitions are expected to close in late August 2014 and are subject to the completion of customary due diligence, closing conditions and purchase price adjustments. We intend to use the net proceeds from this offering to fully repay amounts drawn under our revolving credit facility and expect to reborrow amounts under our revolving credit facility to fund a portion of the Pending Glasscock Acquisition. Please read "Use of Proceeds." In addition, following the closing of the Pending Glasscock Acquisition, we will evaluate the potential issuance of senior notes.

The properties to be acquired consist of 7,680 gross (6,652 net) surface acres or 21,440 gross (19,367 net) Effective Horizontal Acres in Glasscock County, adding another primary operating area in the core of the Northern Midland Basin. We have identified 188 gross (156 net) horizontal drilling locations, 158 gross (132 net) vertical locations on 40-acre spacing and an additional 158 gross (132 net) vertical drilling locations on 20-acre spacing. The aggregate current net production associated with the developed portion of the properties to be acquired is approximately 1,106 Boe/d (approximately 47% oil, 27% NGLs and 26% natural gas), with 13 vertical wells drilled to date. Based

12

on our internal reserve estimates, the properties contain net proved reserves of approximately 22 MBoe (approximately 9% developed). The foregoing information regarding the assets to be acquired in the Pending Glasscock Acquisitions is based solely on our internal evaluation and interpretation of reserve and other information provided to us by the sellers of those assets in the course of our due diligence with respect to the Pending Glasscock Acquisitions and has not been independently verified or estimated by our independent petroleum engineers or any other party.

The properties to be acquired are currently being developed with one vertical rig. We plan to keep operating this vertical rig on the acquired properties during the remainder of 2014 and 2015 and intend to initiate a horizontal drilling program in 2015 on the acquired properties. We believe the properties are prospective for horizontal drilling in the Company's target horizons, including the Lower Spraberry, Wolfcamp A, Wolfcamp B and Wolfcamp D (Cline) formations. In addition, we believe that additional horizontal drilling opportunities in several other stacked pay zones may be present on the properties.

RSP Permian Holdco, L.L.C.'s Distribution of RSP Permian, Inc. Common Stock

In connection with and immediately prior to this offering, RSP Permian Holdco, L.L.C. will distribute 10,235,712 shares of our common stock to its members (assuming a public offering price per common share of $32.20, which is the last sale price of our common stock as reported on the New York Stock Exchange (the "NYSE") on July 23, 2014). In the event the underwriters exercise their option to purchase additional shares in full, RSP Permian Holdco, L.L.C. will make an additional distribution of 1,697,594 shares of our common stock to its members (assuming a public offering price per common share of $32.20). The number of shares to be distributed is based, in part, on the public offering price of the common stock offered in this offering. A $1.00 increase or decrease in the assumed public offering price of $32.20 per share would cause the number of shares of our common stock to be distributed by RSP Permian Holdco, L.L.C. to increase or decrease, respectively, by less than 1%. Certain of those members, Michael G. Cook, Erik B. Daugbjerg, David Groves, William Huck, William Christopher Krusz, Robert Lemmon, Steve Smith and Leslyn Wallace, will sell all or a portion of the shares of our common stock distributed to them to the underwriters in this offering. One of RSP Permian Holdco, L.L.C.'s members, Production Opportunities II, L.P. ("Production Opportunities"), will immediately distribute the shares of our common stock distributed to it by RSP Permian Holdco, L.L.C. to its partners, including Natural Gas Partners IX, L.P., which will sell all such shares to the underwriters in this offering. None of the members of our senior management are selling any shares in this offering. See "Principal and Selling Stockholders" for more information. Prior to such distribution, RSP Permian Holdco, L.L.C. holds 16,285,481 shares, or 22.3%, of our common stock, and after such distribution and immediately following completion of this offering, RSP Permian Holdco, L.L.C. will hold 6,049,769 shares, or 7.7%, of our common stock, assuming no exercise of the underwriters' option to purchase additional shares of our common stock and 4,352,175 shares, or 5.5%, of our common stock, assuming full exercise of the underwriters' option to purchase additional shares of our common stock.

Summary Preliminary Financial Results and Production Data for the Second Quarter of 2014

Summary Preliminary Financial Results for the Three Months Ended June 30, 2014

Our management has prepared the summary preliminary financial results below based on the most current information available to management. Our normal closing and financial reporting processes with respect to the summary preliminary financial results for the three months ended June 30, 2014 have not been fully completed. As a result, our actual financial results could be different from these summary preliminary financial results, and any differences could be material. Our independent certified public accountants have not performed review procedures with respect to the summary preliminary financial results provided below, nor have they expressed any opinion or provided any other form of assurance on the these summary preliminary financial results. The summary preliminary financial results below have been prepared on a basis consistent with our unaudited consolidated financial statements for the three months ended March 31, 2014. This summary is not intended to be a comprehensive

13

statement of our unaudited financial results for the three months ended June 30, 2014. The results of operations for an interim period, including the summary preliminary financial results provided below, may not give a true indication of the results to be expected for a full year or any future period.

For the three months ended June 30, 2014, we expect that our net income will be in the range of $7.8 million to $8.3 million and Adjusted EBITDAX will be in the range of $51.0 million to $53.7 million. As set out in the following table, for the three months ended June 30, 2014, we expect that our pro forma net income will be in the range of $8.6 million to $9.1 million and pro forma Adjusted EBITDAX will be in the range of $51.0 million to $53.7 million. For a definition of Adjusted EBITDAX, see "—Non-GAAP Financial Measure" below. The following table shows the reconciliation of net income to Adjusted EBITDAX on an actual basis and a pro forma basis for the three months ended June 30, 2014.

| |

RSP Permian, Inc. | RSP Permian, Inc. Pro Forma |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Low Estimate |

High Estimate |

Low Estimate |

High Estimate |

|||||||||

| |

(In thousands) |

||||||||||||

Adjusted EBITDAX reconciliation to net income: |

|||||||||||||

Net income |

7,815 | 8,226 | 8,621 | 9,075 | |||||||||

Interest expense |

1,085 | 1,142 | 1,085 | 1,142 | |||||||||

Income tax expense (benefit)(1) |

4,701 | 4,948 | 4,852 | 5,106 | |||||||||

Depreciation, depletion and amortization |

20,647 | 21,734 | 20,647 | 21,734 | |||||||||

Exploration expense |

1,171 | 1,233 | 1,171 | 1,233 | |||||||||

Non-cash loss on derivatives |

15,160 | 15,958 | 15,160 | 15,958 | |||||||||

Net cash payments on settled derivatives |

(1,441 | ) | (1,517 | ) | (1,441 | ) | (1,517 | ) | |||||

Non-cash equity based compensation(2) |

1,582 | 1,665 | 625 | 658 | |||||||||

Other (income)/expense |

323 | 340 | 323 | 340 | |||||||||

| | | | | | | | | | | | | | |

Adjusted EBITDAX(3) |

51,043 | 53,729 | 51,043 | 53,729 | |||||||||

- (1)

- Pro

forma income tax expense (benefit) is adjusted for a normalized effective tax rate.

- (2)

- Pro

forma non-cash equity based compensation excludes non-cash equity compensation associated with IPO bonuses and incentive units owned by certain

management members.

- (3)

- For a definition of Adjusted EBITDAX, see "—Non-GAAP Financial Measure" below.

Summary Production Results for the Three Months Ended June 30, 2014

On July 17, 2014, we reported that our average net daily production for the second quarter of 2014 was 10,714 Boe/d, representing a 15% increase over pro forma average net daily production for the three months ended March 31, 2014, which was 9,339 Boe/d.

| |

Three Months Ended June 30, 2014 |

Pro Forma(1) Three Months Ended March 31, 2014 |

|||||

|---|---|---|---|---|---|---|---|

Production Data: |

|||||||

Oil (MBbls) |

687 | 594 | |||||

NGLs (MBbls) |

169 | 143 | |||||

Natural gas (MMcf) |

712 | 621 | |||||

| | | | | | | | |

Total (Mboe) |

975 | 841 | |||||

| | | | | | | | |

Average net daily production (Boe/d) |

10,714 | 9,339 | |||||

| | | | | | | | |

| | | | | | | | |

- (1)

- Represents our predecessor's production volumes for the first 22 days of the three months ended March 31, 2014 plus RSP Permian, Inc.'s volumes for the remainder of the period and does not

14

include the production volumes related to the Verde Acquisition or Pecos Contribution for periods prior to the consummation of such transactions due to their lack of significance to our combined results.

- •

- Our business is difficult to evaluate because of our limited operating history.

- •

- The volatility of oil and natural gas prices due to factors beyond our control may adversely affect our business,

financial condition or results of operations and our ability to meet our capital expenditure obligations and financial commitments.

- •

- Our exploitation, development and exploration projects require substantial capital that we may be unable to obtain, which

could lead to a loss of properties and a decline in our reserves.

- •

- Our estimated reserves are based on many assumptions that may turn out to be inaccurate. Any material inaccuracies in

these reserve estimates or underlying assumptions will materially affect the quantities and present values of our reserves.

- •

- Our producing properties are located in the Permian Basin of West Texas, making us vulnerable to risks associated with a

concentration of operations in a single geographic area.

- •

- Development of our PUDs may take longer than expected and may require higher levels of capital expenditures than we

currently anticipate. Therefore, our estimated PUDs may not be ultimately developed or produced.

- •

- Our future cash flows and results of operations are highly dependent on our ability to find, develop or acquire additional

oil and natural gas reserves.

- •

- We depend upon several significant purchasers for the sale of most of our oil and natural gas production. The loss of one

or more of these purchasers could adversely affect our revenues in the short-term.

- •

- Our operations are subject to operational hazards for which we may not be adequately insured.

- •

- Our failure to successfully identify, complete and integrate future acquisitions of properties or businesses could disrupt

our business and hinder our ability to grow.

- •

- Our operations are subject to various governmental regulations that require compliance that can be burdensome and

expensive and adversely affect the feasibility of conducting our operations.

- •

- Any failure by us to comply with applicable environmental laws and regulations, including those relating to hydraulic

fracturing, could result in governmental authorities taking actions that adversely affect our operations and financial condition.

- •

- Our business is susceptible to the potential difficulties associated with managing rapid growth and expansion.

- •

- Our four largest stockholders, RSP Permian Holdco, L.L.C., Collins, Wallace LP and ACTOIL (collectively, our "Principal Investors"), collectively hold approximately 66% of our common stock prior to this offering, and their interests may conflict with yours. After this offering, assuming no exercise of the underwriters' option to purchase additional shares of our common stock, our Principal Investors will collectively hold approximately 47.6% of our common stock.

Risk Factors

Investing in our common stock involves risks that include the speculative nature of oil and natural gas exploration, competition, volatile oil and natural gas prices and other material factors. You should read carefully the section of this prospectus entitled "Risk Factors" beginning on page 26 for an explanation of these risks before investing in our common stock. In particular, the following considerations may offset our competitive strengths or have a negative effect on our strategy or operating activities, which could cause a decrease in the price of our common stock and a loss of all or part of your investment:

15

For a discussion of these risks and other considerations that could negatively affect us, including risks related to this offering and our common stock, see "Risk Factors" and "Cautionary Statement Regarding Forward-Looking Statements."

Emerging Growth Company

We are an "emerging growth company" as defined in the Jumpstart Our Business Startups Act (the "JOBS Act"). For as long as we are an emerging growth company, we are not required to comply with certain requirements that are applicable to other public companies that are not emerging growth companies. For example, as an emerging growth company, we are not required to:

- •

- provide an auditor's attestation report on management's assessment of the effectiveness of our system of internal control

over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002;

- •

- comply with any new requirements adopted by the Public Company Accounting Oversight Board (the "PCAOB") requiring

mandatory audit firm rotation or a supplement to the auditor's report in which the auditor would be required to provide additional information about the audit and the financial statements of the

issuer;

- •

- provide certain disclosures regarding executive compensation required of larger public companies or hold shareholder

advisory votes on executive compensation required by the Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act"); or

- •

- obtain shareholder approval of any golden parachute payments not previously approved.

We intend to take advantage of these reporting exemptions until we are no longer an emerging growth company. We will cease to be an "emerging growth company" upon the earliest of:

- •

- the last day of the fiscal year in which we have $1.0 billion or more in annual revenues;

- •

- the date on which we become a "large accelerated filer" under the rules promulgated under the Securities Exchange Act of

1934, as amended (the "Exchange Act");

- •

- the date on which we issue more than $1.0 billion of non-convertible debt over a three-year period; or

- •

- the last day of the fiscal year following the fifth anniversary of our IPO.

In addition, Section 107 of the JOBS Act provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the "Securities Act"), for complying with new or revised accounting standards, but we hereby irrevocably opt out of the extended transition period and, as a result, we will adopt new or revised accounting standards on the relevant dates in which adoption of such standards is required for other public companies.

Principal Executive Offices and Internet Address

Our principal executive offices are located at 3141 Hood Street, Suite 500, Dallas, Texas 75219, and our telephone number at that address is (214) 252-2700. Our website address is www.rsppermian.com. Our periodic reports and other information filed with or furnished to the Securities and Exchange Commission (the "SEC") are available free of charge through our website as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC. The information on, or otherwise accessible through, our website or any other website does not constitute a part of this prospectus.

16

| Issuer | RSP Permian, Inc. | |

Shares of common stock offered by us |

6,000,000 shares (or 6,900,000 shares, if the underwriters exercise in full their option to purchase additional shares). |

|

Shares of common stock offered by the selling stockholders |

9,000,000 shares (or 10,350,000 shares, if the underwriters exercise in full their option to purchase additional shares). |

|

Option to purchase additional shares |

We and certain selling stockholders have granted the underwriters an option to purchase up to an additional 900,000 or 1,350,000 shares of our common stock, respectively, to the extent the underwriters sell more than 15,000,000 shares of common stock in this offering. |

|

Shares of common stock to be outstanding after this offering1 |

78,963,951 shares or 79,863,951 shares (if the underwriters' option to purchase additional shares is exercised in full). |

|

Use of proceeds |

We estimate that, after deducting underwriting discounts and commissions and estimated offering expenses payable by us, we will receive approximately $185.6 million of net proceeds from this offering, or $213.6 million if the underwriters exercise their option to purchase additional shares in full, based on an assumed public offering price of $32.20 (which is the last reported sale price of our common stock on the NYSE on July 23, 2014). We intend to use the net proceeds from this offering to fully repay amounts drawn under our revolving credit facility and for general corporate purposes. We may at any time reborrow amounts repaid under our revolving credit facility, and we expect to do so to fund a portion of the Pending Glasscock Acquisitions. We will not receive any of the proceeds from the sale of the shares of common stock by the selling stockholders. Please read "Use of Proceeds." |

|

Dividend policy |

We do not currently pay, and do not anticipate paying in the future, any cash dividends on our common stock. In addition, our revolving credit facility places restrictions on our ability to pay cash dividends. Please read "Dividend Policy." |

|

Risk factors |

You should carefully read and consider the information set forth under the heading "Risk Factors" beginning on page 26 and all other information set forth in this prospectus before deciding to invest in our common stock. |

|

Listing and trading symbol |

"RSPP." |

- 1

- Includes 463,951 shares of restricted stock that have been awarded to our directors and certain of our employees and consultants, which are deemed non-dilutive under the two-class method associated with participating equity securities and therefore do not increase the diluted share count for financial reporting purposes.

17

The information above does not include shares of common stock reserved for issuance pursuant to our equity incentive plan.

Unless we indicate otherwise or the context otherwise requires, all information in this prospectus assumes no exercise of the underwriters' option to purchase additional shares of our common stock.

18

Summary Historical and Pro Forma Combined Financial Data