Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION - DEEP WELL OIL & GAS INC | f10k2013a1ex31i_deepwelloil.htm |

| EX-32.2 - CERTIFICATION - DEEP WELL OIL & GAS INC | f10k2013a1ex32ii_deepwelloil.htm |

| EX-32.1 - CERTIFICATION - DEEP WELL OIL & GAS INC | f10k2013a1ex32i_deepwelloil.htm |

| EX-31.2 - CERTIFICATION - DEEP WELL OIL & GAS INC | f10k2013a1ex31ii_deepwelloil.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

(Mark One)

þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2013

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______ to ______

Commission File Number: 0-24012

DEEP WELL OIL & GAS, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

98-0501168

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

Suite 700, 10150 – 100 Street, Edmonton, Alberta, Canada

|

T5J 0P6

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Registrant’s telephone number, including area code: (780) 409-8144

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

|

None

|

None

|

Securities registered pursuant to Section 12(g) of the Act:

|

Common Stock, $0.001 par value per share

|

|

(Title of class)

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

Accelerated filer o

|

|

Non-accelerated filer o (Do not check if a smaller reporting company)

|

Smaller reporting company þ

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

The aggregate market value of the registrant’s common stock held by non-affiliates computed by reference to the price at which the common equity was sold on or about March 31, 2013 was approximately $4.5 million.

As of December 31, 2013, the Issuer had outstanding approximately 229,326,287 shares of common stock, $0.001 par value per share.

EXPLANATORY NOTE

We are filing this amendment to our Annual Report on Form 10-K for the fiscal year ended September 30, 2013 (the “Original Form 10-K”), which was filed with the Securities and Exchange Commission on January 14, 2014, solely in order to amend Item 2 (Properties) of the Original Form 10-K. In addition, this amendment contains new certifications pursuant to Rules 13a-14 and 15d-14 under the Exchange Act and Section 906 of the Sarbanes-Oxley Act of 2002.

Except as described above, this amendment does not amend the Original Form 10-K in any way and does not modify or update any disclosure contained in the Original Form 10-K, which continues to speak as of January 14, 2014 and does not reflect events occurring after such date. Accordingly, except as described above, all other information contained in the Original Form 10-K remains unchanged and this amendment should be read in conjunction with the Original Form 10-K.

PART I

ITEM 2. PROPERTIES

Office Leases

We lease and maintain office space in Edmonton, Alberta for corporate and administrative operations; this lease expired on December 31, 2013. We are currently negotiating the terms of entering into a new lease for our Edmonton office space. We previously leased and maintained an office space in Calgary, Alberta; this lease expired on November 30, 2012 and was not renewed.

Oil and Gas Properties

Acreage

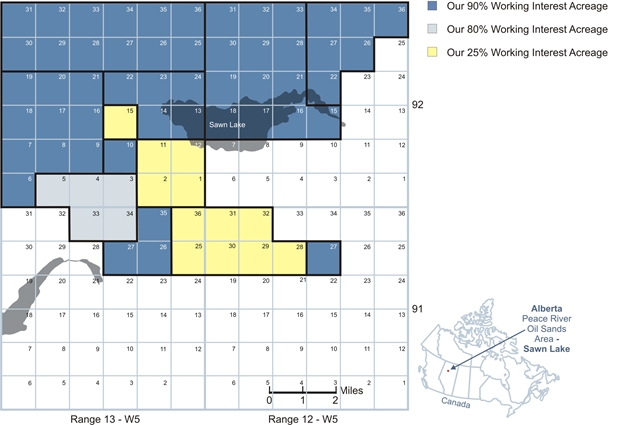

Currently, we have a 90% working interest in 51 sections on six oil sands leases, an 80% working interest in 5 sections on one oil sands lease, and a 25% working interest (after the Farmout Agreement dated July 31, 2013) in an additional 12 sections on two oil sands leases in the Peace River oil sands area of Alberta, all of these sections are contiguous. These nine oil sands leases cover 43,015 gross acres (17,408 gross hectares). Of the 68 contiguous sections on nine oil sands leases, one of our joint venture partners is the operator of 12 sections on two oil sands leases where we have a 25% working interest (after the Farmout Agreement dated July 31, 2013), and we are the operator on 56 sections on seven oil sands leases where we have working interests of either 80% or 90%. For further information, see Oil and Gas Properties on our Balance Sheet and Note 3 and 4 of the notes to the consolidated financial statements included in this annual report on Form 10-K.

3

The following table summarizes our gross and net developed and undeveloped oil and natural gas rights under lease as of December 31, 2013.

|

OIL SANDS RIGHTS as of December 31, 2013

|

||||||||||||||||

|

Gross Hectares

|

Net

Hectares

|

Gross Acres

|

Net

Acres

|

|||||||||||||

|

Oil Sands Developed Acreage

|

||||||||||||||||

|

Sawn Lake – Peace River oil sands area, Alberta, Canada

|

None

|

None

|

None

|

None

|

||||||||||||

|

Total

|

None

|

None

|

None

|

None

|

||||||||||||

|

Oil Sands Undeveloped Acreage

|

||||||||||||||||

|

Sawn Lake – Peace River oil sands area, Alberta, Canada

|

||||||||||||||||

|

51 sections (1)

|

13,056 | 11,750 | 32,261 | 29,035 | ||||||||||||

|

5 sections (2)

|

1,280 | 1,024 | 3,163 | 2,530 | ||||||||||||

|

12 sections (3)

|

3,072 | 768 | 7,591 | 1,898 | ||||||||||||

|

Total

|

17,408 | 13,542 | 43,015 | 33,463 | ||||||||||||

|

TOTAL HECTARES/ACRES

|

17,408 | 13,542 | 43,015 | 33,463 | ||||||||||||

|

(1) 90% working interest.

|

||||||||||||||||

|

(2) 80% working interest.

|

||||||||||||||||

|

(3) 25% working interest after the Farmout Agreement dated July 31, 2013.

|

||||||||||||||||

A developed acre is considered to mean those acres spaced or assignable to productive wells; a gross acre is an acre in which a working interest is owned, and a net acre is the result that is obtained when the fractional ownership working interest of a lease is multiplied by gross acres of that lease. The number of net acres is the sum of the fractional working interests owned in gross acres expressed as whole numbers and fractions thereof.

Undeveloped acreage is considered to be those lease acres on which wells have not been drilled or completed to a point that would permit the production of commercial quantities of oil or natural gas, regardless of whether or not that acreage contains proven reserves, but does not include undrilled acreage held by production under the terms of a lease. As is customary in the oil and gas industry, we can generally retain our interest in undeveloped acreage by drilling activity that establishes commercial production sufficient to maintain the leases, or by paying delay rentals during the remaining primary term of such a lease. The oil sands leases in which we have an interest are for a primary term of 15 years, and if we meet the Minimum Level of Evaluation (“MLE”) as set out by the Alberta Government oil sands tenure guidelines we can continue these leases beyond their primary term for an indefinite period.

The Government of Alberta owns the land and we have acquired the rights to perform oil and gas activities on these lands. If we meet the conditions of the 15-year leases we will be permitted to drill on and produce oil from the land into perpetuity. These conditions give us until the expiration of the leases to meet the following requirements on our primary oil sands leases:

a) drill 68 wells throughout the 68 sections; or

b) drill 44 wells within the 68 sections and having acquired and processed 2 miles of seismic on each other undrilled section.

We plan to meet the second of these conditions. As at December 31, 2013, we have an interest in ten wells, which can be counted toward these requirements.

We have also identified two other wells drilled on these leases, which may be included in the satisfaction of the MLE requirements. We have also acquired and processed 25 miles of seismic on the leases, which can be counted toward the MLE requirements.

We have undeveloped oil sands acreage as of September 30, 2014, covering 43,015 gross acres (33,463 net acres) on 68 sections of land under nine oil sands leases. Until the Company extends the leases “into perpetuity” based on the Alberta governmental regulations, the lease expiration dates of the Company’s nine oil sands leases are as follows:

|

|

1)

|

32 sections of land under 5 oil sands leases are set to expire on July 10, 2018;

|

|

|

2)

|

31 sections of land under 3 oil sands leases are set to expire on August 19, 2019; and

|

|

|

3)

|

5 sections of land under 1 oil sands lease are set expire on April 9, 2024. It is the Company’s opinion that the Company has already met the governmental requirements for this lease and it will be applying to continue this lease into perpetuity.

|

4

Reserves, Production and Delivery Commitments

We did not engage in any sustained production activities during the years ending September 30, 2013, 2012 and 2011 nor did we have any proven reserves at the end of such periods. We do not have any obligations under existing delivery commitment contracts or agreements calling for the provision of fixed and determinable quantities of oil and gas over the next three years, and have therefore not filed any information or reports with any federal authority or agency containing estimates of total proven developed or undeveloped net oil or gas reserves.

Drilling Activity

We had no drilling activity during the years ended September 30, 2012, 2011 and 2010. See Present Activities below.

Present Activities

Effective December 3, 2012, we entered into and closed upon a Purchase and Sale agreement with 113, one of our former joint venture partners, pursuant to which we acquired 113’s 10% working interest in most of the Sawn Lake oil sands properties where we already own working interests in the Peace River oil sands area of Alberta.

On July 30, 2013, we entered into a joint SAGD Project agreement with a joint venture partner to participate in a recently AER approved SAGD Project on our 25% (post Farmout Agreement dated July 31, 2013) owned oil sands properties located in North Central Alberta, Canada (also known as the Sawn Lake heavy oil reservoir). On August 15, 2013, and in accordance with the SAGD Project Agreement and the Amendment, we served notice (“Notice of Election”) to our joint venture partner of our election to participate in the SAGD Project. Upon signing the Notice of Election we were required to pay in full the cash calls for our initial share of the costs of the SAGD Project and we have since paid all the cash calls in full as per the Farmout Agreement dated July 31, 2013.

On July 31, 2013, we entered into Farmout Agreement dated July 31, 2013” with a new joint venture partner (the “Farmee”) to fund our share of the recently AER approved SAGD Project at our Sawn Lake heavy oil reservoir in North Central Alberta, Canada. In accordance with the agreement the Farmee has agreed to provide up to $40,000,000 in funding for our portion of the costs for the SAGD Project, in return for a net 25% working interest in 12 sections where we have a working interest of 50% (before the Farmout Agreement dated July 31, 2013). As required by the agreement, the Farmee has since paid in full the cash calls in the amount of $11,014,946 Cdn to the operator of the SAGD Project for the Farmee’s share and our share of the initial costs of the SAGD Project. The Farmee will also provide funding to cover monthly operating expenses of our Company, of which the first such payment shall be in respect of the month of August 2013 and not to exceed $30,000 per month. In addition, by December 31, 2014, the Farmee has the option to elect to obtain an additional working interest of 40% to 45% in the remaining 56 sections of land where we have working interests ranging from 80% to 90%, by committing $110,000,000 of financing to our Company’s Sawn Lake oil sands project.

In August of 2013, we received approval from the AER for our HCSS Project application. It is anticipated that we will develop a thermal demonstration project on our properties followed by a commercial expansion project on one half section of land located on section 10-92-13W5 of the joint Sawn Lake properties. This application, submitted in early 2012, was an application to modify our previously approved in-situ demonstration project for a well to test thermal production on our Sawn Lake oil sands leases. This modification changed the vertical CSS well earlier approved, into a thermal recovery project to test 2 wells that use a horizontal application of CSS. Our proposed HCSS Project will be located on the north half of section 10-92-13W5, which has good road access on hard packed roads recently built by a third party owning P&NG rights in the area. This proposed thermal recovery project location is approximately 1.4 kilometers away from the nearest hard packed road.

On October 9, 2013, and in connection to the SAGD Project agreement dated July 30, 2013, we entered into a Water Rights Conveyance Agreement whereby we acquired a 25% working interest in one water source well and one water disposal well for a cost of $425,000 Cdn, which in turn was reimbursed to our Company by the Farmee. In conjunction with this acquisition our Company was issued a cash call from the operator in the amount of $1,058,568 Cdn for the expenditures relating to the water source well, water disposal well and pipelines to connect them to the SAGD Project surface facility. The Farmee has since paid us this cash call in the amount of $1,058,568 Cdn pursuant to the Farmout Agreement dated July 31, 2013 and we have in turn paid the joint venture operator.

5

On October 18, 2013, the operator spudded the first SAGD Project well pair for our joint venture project and both wells were successfully drilled and completed in mid-November of 2013. Prior to the spud of the SAGD Project well pair, our last drilling activity was in the 2009 year end, during which we drilled 6 wells used to delineate our reservoir and plan for our HCSS Project.

Currently we have in place joint operating agreements with one joint venture partner to manage our joint oil sands leases, which are all based on the 1990 Canadian Association of Petroleum Landmen (hereinafter referred to as “CAPL”) Operating Procedure. Under these agreements our joint oil sands leases were evaluated seismically, geologically and by drilling to establish the continuity and the distribution of the crude bituminous-bearing Bluesky reservoir zone across our joint lands. The development progress of our properties is governed by several factors such as federal and provincial governmental regulations. Long lead times in getting regulatory approval for thermal recovery projects are commonplace in our industry. Road bans, winter access only roads and environmental regulations can and often do delay development of similar projects. Because of these and other factors, our oil sands project can take significantly longer to complete than regular conventional drilling programs for lighter oil. To date; our geological, engineering and economic studies lead us to believe that our working interest can support full profitable commercial production.

Past Activities

On April 26, 2004, Northern (now a 100% owned subsidiary of Deep Well) signed a Joint Operating Agreement with Pan Orient to provide for the manner of conducting operations on three Peace River oil sands leases for a total of 32 sections covering 20,243 gross acres (8,192 gross hectares). These 32 sections were acquired jointly on April 23, 2004, with Northern having an 80% working interest and Pan Orient having a 20% working interest in the joint lands.

On August 18, 2004, Deep Well and Pan Orient jointly participated in a public offering of Crown Oil Sands Rights held by the Alberta Department of Energy, in which the joint parties successfully bid on three Peace River oil sands leases for a total of 31 sections covering 19,610 gross acres (7,936 gross hectares). Deep Well acquired an undivided 80% working interest and Pan Orient acquired an undivided 20% working interest in the joint property.

On December 9, 2004, Deep Well signed Joint Operating Agreements with 113 under which 113 acknowledged the terms under which their 10% working interest acquired from Pan Orient in the joint lands acquired on August 18, 2004, would be governed.

On February 25, 2005, as previously disclosed in this annual report on Form 10-K, Deep Well and Northern entered into a Farmout Agreement dated February 25, 2005 with Surge. This Farmout Agreement dated February 25, 2005 allowed Surge (previously known as Signet and now known as Andora) to earn up to a 40% working interest in the farmout lands (50% of our share). And on November 26, 2007, pursuant to the Minutes of Settlement between us, Andora and Signet, Signet acquired 40% of our working interest in 12 sections on two of our oil sands leases. As part of the 40% working interest transfer to Signet, two of the original oil sands leases previously acquired by Northern on April 26, 2004, were split into four oil sands leases.

On March 3, 2005, Deep Well, Northern and Surge mutually agreed by an amending agreement to extend the payment date of the prospect fee under Article 13 of the Farmout Agreement dated February 25, 2005, whereby Surge was granted an extension for payment of the prospect fee to the closing date of March 18, 2005.

On March 10, 2005, Deep Well, Northern and Surge mutually agreed by an amending agreement that Surge US is only a party to the Farmout Agreement dated February 25, 2005 for the purposes of Article 14 of the agreement. In addition, all three parties mutually agreed by an amending agreement to establish a procedure whereby Signet is to be appointed as the operator under the existing Joint Operating Agreements in respect of all Farmout Lands in which Signet earns an interest pursuant to Article 7 of the Farmout Agreement dated February 25, 2005.

On July 14, 2005, our Company and Surge mutually agreed to amend the Farmout Agreement dated February 25, 2005 in order to extend the date to spud the first well until September 25, 2005.

6

On September 21, 2005, Signet was granted a permit by the AER for a test well, and on September 28, 2005, Signet began drilling our first well on section 1-36-091-13W5 (hereinafter referred to as “1-36”) on our joint Sawn Lake property located in the Peace River oil sands of Alberta, Canada. Signet did not spud the first joint well by the 25th of September 2005 and we noted them in default of the Farmout Agreement dated February 25, 2005.

On November 15, 2005, as part of a settlement agreement, we agreed to amend the Farmout Agreement signed on February 25, 2005 between our Company and Surge that had previously been terminated by Deep Well (as previously disclosed on Form 8-K on September 29, 2005). The amendments to the agreement provided that: 1.) all current conditions of the Farmout Agreement dated February 25, 2005 will be deemed to have been satisfied as at September 25, 2005; 2.) the earning period (the period during which Signet has to drill 10 wells) under the agreement will be extended until February 25, 2008; 3.) Signet will have until September 25, 2006 to drill an option well (the second well); 4.) an additional 6.5 sections of land will be added to the land subject to the agreement; 5.) Signet will pay Deep Well $1,000,000 on November 15, 2005 in satisfaction of the prospect fee outstanding instead of after drilling the second well as stated in the agreement; and 6.) no shares of Surge US would be issued to Deep Well or Northern, but rather we would receive 7,550,000 common shares of Signet (now known as Andora), a private subsidiary company of Surge US.

On July 17, 2006, Signet had received the required licenses by the Government of Alberta to drill the next three horizontal wells in the Bluesky Formation on our joint Sawn Lake oil sands property. The next 3 wells drilled were within less than one mile (1.6 km) of the first test well that was already drilled. These surface locations were 4-32-091-12W5 (hereinafter referred to as “4-32”), 7-30-091-12W5 (hereinafter referred to as “7-30”) and 13-29-091-12W5 (hereinafter referred to as “13-29”). Seismic and reservoir mapping were undertaken to be used to support and progress work on near and long-term plans of development on our joint Sawn Lake oil sands property.

In October 2006, the 4-32 and 7-30 wells along with the 1-36 well were suspended. Signet (now known as Andora) had undertaken a mapping of the reservoir to assist in its delineation for any future development of our joint Sawn Lake property. The first three wells were drilled in the most heavily documented portion of the Sawn Lake lands. Although, as determined by Signet, the preliminary results from the last two wells indicated a lack of cold flow production from wells 4-32 and 7-30, the compartmentalized nature of the reservoir and varying characteristics of these compartments may show different results with further evaluation. Our Company felt that the level of testing on these wells to determine their complete potential was incomplete.

In late 2006, our joint venture partner acquired over 200 km of reprocessed seismic and aeromagnetic studies on our joint properties.

On November 26, 2007, we entered into mediation with our Former Farmout Partner and resolved our differences and certain collateral matters. The settlement included but is not limited to:

|

|

·

|

the Farmout Agreement dated February 25, 2005, being effectively terminated concurrently with the execution of the settlement agreement; and

|

|

|

·

|

our Former Farmout Partner being regarded as having earned the two sections on which the option wells were drilled and 4 additional sections as set out in the Settlement; and

|

|

|

·

|

our Former Farmout Partner being required to reconvey registered title to 57.5 unearned sections of the Farmout Lands, as defined in the Farmout Agreement dated February 25, 2005, back to us; and

|

|

|

·

|

our Company having the right to retest the option wells previously drilled.

|

|

|

·

|

Andora has acknowledged that Deep Well is not responsible for any potential royalty assumed by Deep Well on behalf of our Former Farmout Partner in the Farmout Agreement dated February 25, 2005.

|

On March 18, 2008, the 6.5 section oil sands permit, which was originally scheduled to expire on April 9, 2008, was extended for one year pursuant to an application submitted by Northern to the Alberta Department of Energy.

On September 10, 2008, the AER granted us well licenses to drill 6 wells on our Sawn Lake oil sands properties.

On December 1, 2008, in conjunction with our 2008/2009 winter drilling program, we acquired two vertical wells they previously drilled along with existing road infrastructure. Of the two wells we acquired, one was drilled to a vertical depth of 737 meters on our existing oil sands lease and was cased for Bluesky heavy oil production. The casing of this well was perforated at intervals from 681.5m to 684.5m and 684.5m to 685.0m. This well’s status is drilled and cased for future bitumen production. The existing roads we acquired totalled 12 km of access on our Sawn Lake properties.

7

On December 4, 2008, we successfully spudded the first well of six wells to be drilled in our 2008/2009 Sawn Lake winter drilling program in the Peace River oil sands area of Alberta. By early February of 2009, we successfully drilled all planned six wells on our joint Sawn Lake oil sands property. All of our exploratory wells were logged, cored and analyzed by independent service providers and are currently being evaluated for in-situ recovery methods.

On February 1, 2009, we acquired additional existing access roads on our Sawn Lake properties from Penn West Petroleum Ltd., adding 8.7 km of roads to our Sawn Lake road infrastructure.

On April 30, 2009, the Alberta Department of Energy approved our application to convert 5 sections of our oil sands permit to a 15-year primary lease. By drilling on these lands where the permits were set to expire, we have preserved title to 5 sections and now have a primary lease, which is valid for an additional 15 years.

In September 2009, we submitted an application to the AER for a commercial bitumen recovery scheme to evaluate the 12-14-092-13W5 well for potential development using CSS and later we added the 6-22-092-13W5 well to the application, and in late 2010 this application was approved by the AER to test one of the wells using steam injection on a vertical well.

In July 2010, a third party performed an independent technical evaluation of the heavy oil properties on some of our Sawn Lake properties. The report confirmed the suitability of the properties for employing thermal recovery methods on them. In addition, this third party identified a new hydrocarbon bearing zone up-hole from the Bluesky zone presently being concentrated on by our Company. This secondary heavy oil zone is in the Peace River formation. It is a clastic unit of lower cretaceous age found at a shallower depth than the Bluesky zone. It is approximately 35 meters thick and is a massive, very fine to medium grain sandstone conformably deposited on the Harmon Shale. We intend to continue the development of the Bluesky reservoir and at the same time we intend to evaluate this newly discovered reservoir by coring future wells within this zone.

In December 2010 and January 2011, two separate independent reservoir engineering firms prepared National Instrument 51-101 (a Canadian evaluation engineering standard) compliant resource appraisal reports for one of our joint venture partners. These reports evaluated the resource of some of our Sawn Lake joint properties and included an economic evaluation of the oil sands leases in the Sawn Lake area based on using thermal recovery to exploit the resource.

8

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

DEEP WELL OIL & GAS, INC.

|

||

|

By

|

/s/ Horst A. Schmid

|

|

|

Dr. Horst A. Schmid

|

||

|

Chairman of the Board

|

||

|

Date

|

July 24, 2014

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

By

|

/s/ Horst A. Schmid

|

|

|

Dr. Horst A. Schmid

|

||

|

Chief Executive Officer and President

|

||

|

(Principal Executive Officer)

|

||

|

Date

|

July 24, 2014

|

|

|

By

|

/s/ C. J. Sparrow

|

|

|

Mr. Curtis James Sparrow

|

||

|

Chief Financial Officer

|

||

|

(Principal Financial and Accounting Officer)

|

||

|

Date

|

July 24, 2014

|

9