Attached files

| file | filename |

|---|---|

| 8-K - ADK 8-K 072414 - REGIONAL HEALTH PROPERTIES, INC | adk8kconferencepresentatio.htm |

July 24, 2014 NYSE MKT: ADK AdCare Health Systems, Inc. "THE NEW ADCARE" “Maximizing Cash Flow and Shareholder Value” ® EXHIBIT 99.1

Maximizing Cash Flow and Shareholder Value NYSE MKT: ADK Forward-Looking Statements Any forward-looking statements made in this presentation are based on management's current expectations, assumptions and beliefs about the Company’s business and the environment in which AdCare operates. These statements are subject to risks and uncertainties that could cause the Company’s actual results to materially differ from those expressed or implied on the call. Readers should not place undue reliance on forward-looking statements and are encouraged to review the Company’s SEC filings for more complete discussion of factors that could impact the Company’s results. Except as required by Federal securities laws, AdCare does not undertake to publicly update or revise any forward-looking statements, where changes arise as a result of new information, future events, changing circumstances or for any other reason. In addition, any AdCare facility or business the Company may mention today is operated by a separate independent operating subsidiary that has its own management, employees and assets. References to the consolidated company and its assets and activities, as well as the use of terms like “we,” “us,” “our” and similar verbiage are not meant to imply that AdCare Health Systems, Inc. has direct operating assets, employees or revenue or that any of the operations are operated by the same entity. Also, the Company supplements its GAAP reporting with non-GAAP metrics, such as Adjusted EBITDA from continuing operations and EBITDAR from continuing operations. When viewed together with the Company’s GAAP results, these measures can provide a more complete understanding of its business. They should not be relied upon to the exclusion of GAAP financial measures. A reconciliation of these measures to GAAP is available in the Company’s latest earning release. This presentation is copyright 2014 by AdCare Health Systems, Inc. 2

Maximizing Cash Flow and Shareholder Value NYSE MKT: ADK Important Additional Information to be Filed With the Securities & Exchange Commission This presentation may be deemed to be solicitation material in respect of the proposed shareholder vote to be held at the Company’s special meeting of shareholders scheduled for October 14, 2014. In connection with the special meeting, the Company intends to file with the Securities and Exchange Commission a proxy statement and other relevant materials. BEFORE MAKING ANY VOTING DECISION, SHAREHOLDERS OF THE COMPANY ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION, INCLUDING, WHEN AVAILABLE, THE DEFINITIVE PROXY STATEMENT, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSALS PRESENTED AT THE SPECIAL MEETING. The definitive proxy statement (when available) will be mailed to shareholders of the Company. Shareholders will be able to obtain, without charge, a copy of the definitive proxy statement (when available) and other documents that the Company files with the Securities and Exchange Commission from the Securities and Exchange Commission’s website at www.sec.gov. The definitive proxy statement (when available) and other relevant documents will also be available, without charge, by directing a request by mail or telephone to AdCare Health Systems, Inc., Attn: Corporate Secretary, at 1145 Hembree Road Roswell, Georgia 30076 or (678) 869-5116, or from the Company’s website, www.adcarehealth.com. The Company and its directors and executive officers and certain other members of its management and employees may be deemed to be participants in the solicitation of proxies in connection with the special meeting. Additional information regarding the interests of such potential participants will be included or incorporated by reference in the definitive proxy statement (when available). 3

Maximizing Cash Flow and Shareholder Value NYSE MKT: ADK 4 Why We are Here Introduce new business model that maximizes CASH FLOW and SHAREHOLDER VALUE

Maximizing Cash Flow and Shareholder Value NYSE MKT: ADK New Business Model: “Cash Flow” Current Business Model Primarily through a successful M&A strategy the Company has built a portfolio of high quality properties at attractive valuations Owner and operator of SNFs High G&A expenses High variability in earnings and cash flow Shareholder value has not been realized 5 New Business Model MAXIMIZE CASH FLOW by leasing properties to third party operators SIGNIFICANTLY REDUCE G&A LOWER COST OF CAPITAL by refinancing and reducing debt HIGHER VISIBILITY in cash flow and earnings SHOULD DRIVE SHAREHOLDER VALUE ATTRACTIVE DIVIDEND YIELD OPPORTUNITIES TO GROW THROUGH FURTHER ACQUISIIONS MORE ATTRACTIVE TO REIT ACQUIRERS

Maximizing Cash Flow and Shareholder Value NYSE MKT: ADK Strategy Rationale 6 ADK has spent several months analyzing strategic options and putting together an actionable plan to maximize shareholder value Leasing/sub-leasing properties mitigates operational underperformance Predictable revenue and income stream permits ATTRACTIVE DIVIDEND YIELD Maximizes value of real estate Plan allows AdCare to benefit from significant tax NOLs More attractive to potential acquirers REITs are in a position to place the highest value on the Company and/or its assets New model fits into a REIT and avoids REITs having to find third party operators ADK shareholders achieve the significant synergies from reducing G&A expenses

Maximizing Cash Flow and Shareholder Value NYSE MKT: ADK Selected Financial Information 7

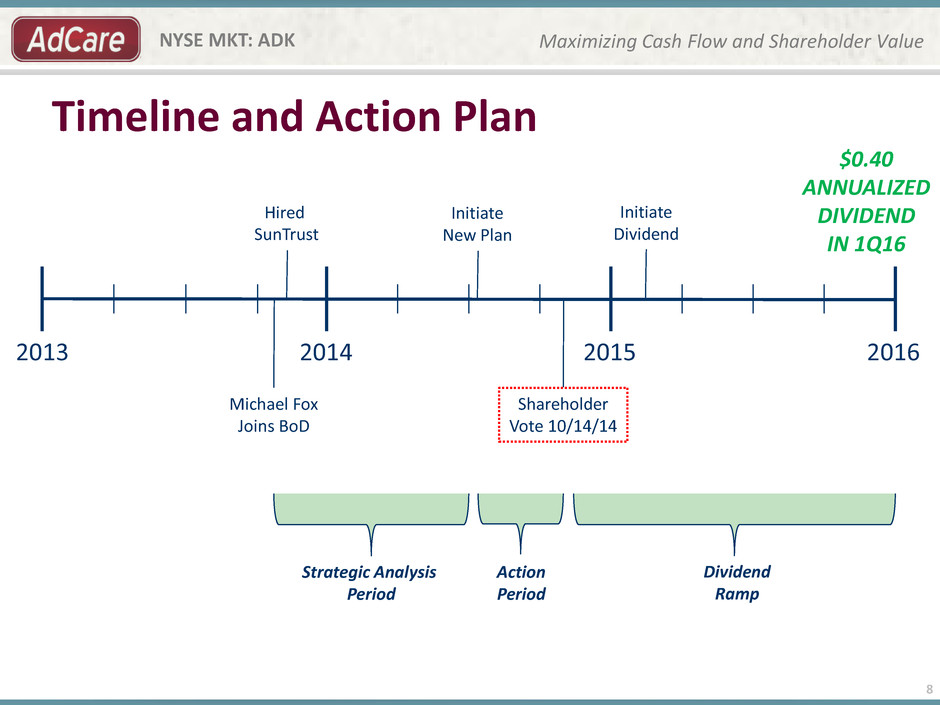

Maximizing Cash Flow and Shareholder Value NYSE MKT: ADK Timeline and Action Plan 8 2013 2016 2015 2014 Hired SunTrust Shareholder Vote 10/14/14 Initiate Dividend Initiate New Plan Michael Fox Joins BoD Strategic Analysis Period Action Period Dividend Ramp $0.40 ANNUALIZED DIVIDEND IN 1Q16

Maximizing Cash Flow and Shareholder Value NYSE MKT: ADK Dividend Ramp 9 *1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 Run- Rate $0.05 $0.06 $0.07 $0.08 $0.09 $0.10 $0.40 *The Board plans to declare a $0.05 dividend in 4Q14, payable in 1Q15

Maximizing Cash Flow and Shareholder Value NYSE MKT: ADK Summary 10 New operating strategy emphasizing cash flow not revenue growth De-lever balance sheet to reduce interest expense and unlock cash collateral Clear path to initiate a dividend in Q4 2014 and ramp each subsequent quarter Explore additional strategic options including growth of lease base or sale of company

Maximizing Cash Flow and Shareholder Value NYSE MKT: ADK For More Information Company Contacts Dave Tenwick, Interim CEO Ron Fleming, CFO AdCare Health Systems, Inc., Atlanta, Georgia Tel 678.869.5116 • www.adcarehealth.com Investor Relations Brett Maas, Managing Partner Hayden IR • www.haydenir.com • Tel 646.536.7331 11