Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - NN INC | d759459dex992.htm |

| EX-99.1 - EX-99.1 - NN INC | d759459dex991.htm |

| EX-2.1 - EX-2.1 - NN INC | d759459dex21.htm |

| 8-K - FORM 8-K - NN INC | d759459d8k.htm |

Exhibit 99.3

NN, Inc. Acquisition of Autocam Corporation

Cautionary Note Regarding Forward-Looking Statements

All statements in these slides, other than statements of historical fact, are “forward-looking statements” that are made pursuant to the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. These forward-looking statements, which are based on current expectations, estimates and projections about the industry and markets in which NN and Autocam operate and beliefs of and assumptions made

by NN management, involve uncertainties that could significantly affect the financial results of NN or the combined company. Such forward-looking statements include, but are not limited to, statements about the benefits of the transaction involving

NN and Autocam, including future financial and operating results and the combined company’s plans, objectives, expectations and intentions. All statements that address operating performance, events or developments that we expect or anticipate

will occur in the future - including statements relating to creating value for stockholders, benefits of the transaction to customers and employees of the combined company, integrating our companies, cost savings, synergies, earnings per share, and

the expected timetable for completing the proposed transaction - are forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict.

Although we believe the expectations reflected in any forward-looking statements are based on reasonable assumptions, we can give no assurance that our expectations will be attained and therefore, actual outcomes and results may differ materially

from what is expressed or forecasted in such forward-looking statements. For example, these forward-looking statements could be affected by factors including, without limitation:

risks associated with the ability to consummate the merger and the timing of the closing of the merger;

the failure to obtain the necessary debt financing arrangements set forth in the commitment letter received in connection with the merger;

the interest rate on any borrowings incurred in connection with the transaction;

the impact of

the indebtedness incurred to finance the transaction;

the ability to successfully integrate our operations and employees;

the ability to realize anticipated benefits and synergies of the transaction;

the potential

impact of announcement of the transaction or consummation of the transaction on relationships, including with employees, customers and competitors;

the outcome of

any legal proceedings that have been or may be instituted against NN following announcement of the transaction;

the ability to retain key personnel;

the amount of the costs, fees, expenses and charges related to the merger and the actual terms of the financings that will be obtained for the merger; and

changes in financial markets, interest rates and foreign currency exchange rates.

Additional

factors that could cause actual results to differ materially from the forward-looking statements included in this presentation include those additional risks and factors discussed in NN’s periodic reports filed with the SEC. NN does not intend,

and undertakes no obligation, to update any forward-looking statement.

2

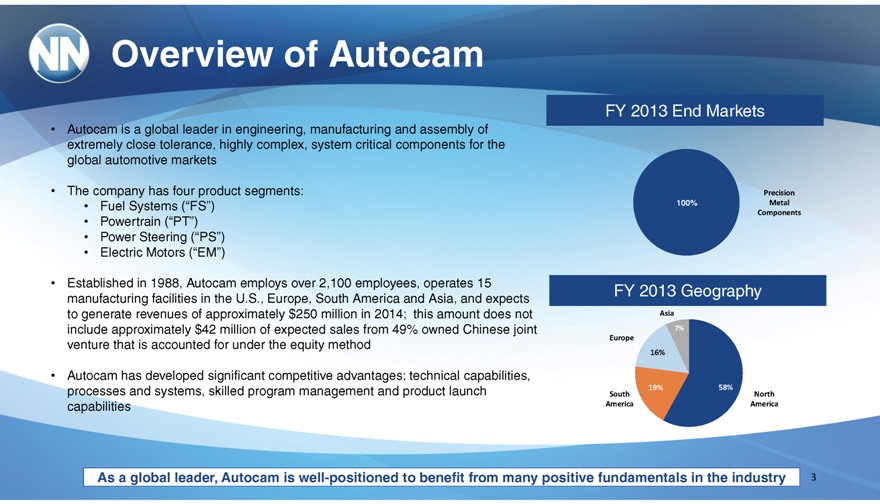

Overview of Autocam

Autocam is a global leader in engineering, manufacturing and assembly of extremely close tolerance, highly complex, system critical components for the global

automotive markets

The company has four product segments:

Fuel Systems

(“FS”)

Powertrain (“PT”)

Power Steering (“PS”)

Electric Motors (“EM”)

Established in 1988, Autocam employs over

2,100 employees, operates 15 manufacturing facilities in the U.S., Europe, South America and Asia, and expects to generate revenues of approximately $250 million in 2014; this amount does not include approximately $42 million of expected sales from

49% owned Chinese joint venture that is accounted for under the equity method

Autocam has developed significant competitive advantages; technical capabilities,

processes and systems, skilled program management and product launch capabilities

FY 2013 End Markets

100% Precision Metal Components

FY 2013 Geography

Asia 7%

Europe 16%

South America 19%

North America 58%

As a global leader, Autocam is well-positioned to benefit from many positive fundamentals in the industry

3

Strategic Rationale

Builds out NN’s Precision Metal Components (PMC) platform to one of the top 3 companies in the world

Establishes global presence in PMC with well established, profitable operations in Europe, Brazil and China; Avoids high start-up greenfield costs and start-up losses

Adds high-growth product platforms (gasoline direct injection, variable valve timing, electric power steering, multi-speed transmissions)

Strong book of business in China

Proven, profitable company – no turnaround

Significant synergy opportunities

Immediately Accretive

Significantly increases NN’s size and market presence

Deepens NN’s management talent

pool and workforce

4

Combined Global Footprint

Marshall Plant 1

Marshall Plant 2

Kentwood Plant 1

Kentwood Plant 2

V-S Products Division

Whirlaway Products Division

NN Precision Plastic Products Division

V-S Products Division

Dowagiac Plant

NN Advanced Rubber Products Division

NN, Inc.

US Ball & Roller Division

US Ball & Roller Division

NN Netherlands

Autocam France

Autocam Poland

NN Slovakia

NN Bosnia

NN Italy

Autocam (China) Automotive Components Co., Ltd.

NN Asia

Wuxi Weifu Autocam Precision

Sao Joao Boa Vista Plants 1 and 2

Campinas Local Corporate Office

Boituva Plant

Acquisition establishes global presence in Precision Metal Components with well

established, profitable operations in North America, Europe, Brazil and China that complement NN’s global bearing business

5

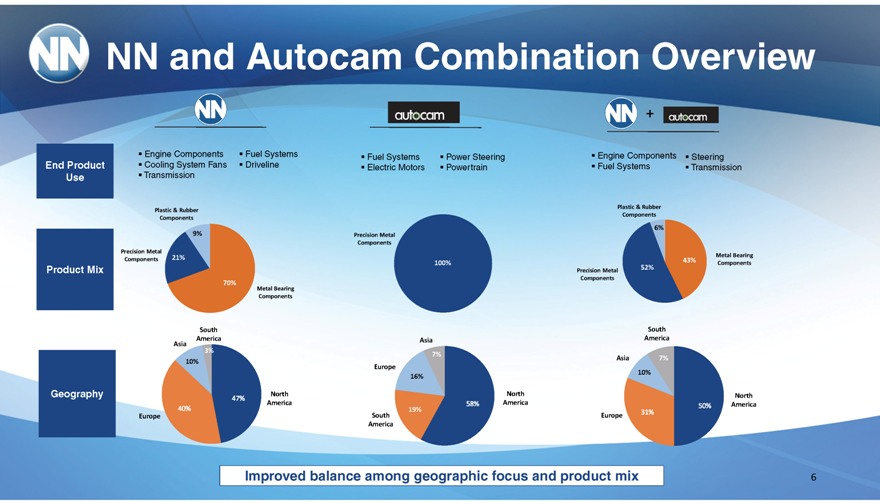

NN and Autocam Combination Overview

End Product Use

Engine Components

Cooling System Fans

Transmission

Fuel Systems

Driveline

Fuel Systems

Electric Motors

Power Steering

Powertrain

Engine Components

Fuel Systems

Steering

Transmission

Product Mix

Plastic & Rubber Components 9%

Precision Metal Components 21%

Metal Bearing Components 70%

Precision Metal Components 100%

Plastic & Rubber Components 6%

Precision Metal Components 52%

Metal Bearing Components 43%

Geography

South America 3%

Asia 10%

Europe 40%

North America 47%

Asia 7%

Europe 16%

South America 19%

North America 58%

South America 7%

Asia 10%

Europe 31%

North America 50%

Improved balance among geographic focus and product mix

6

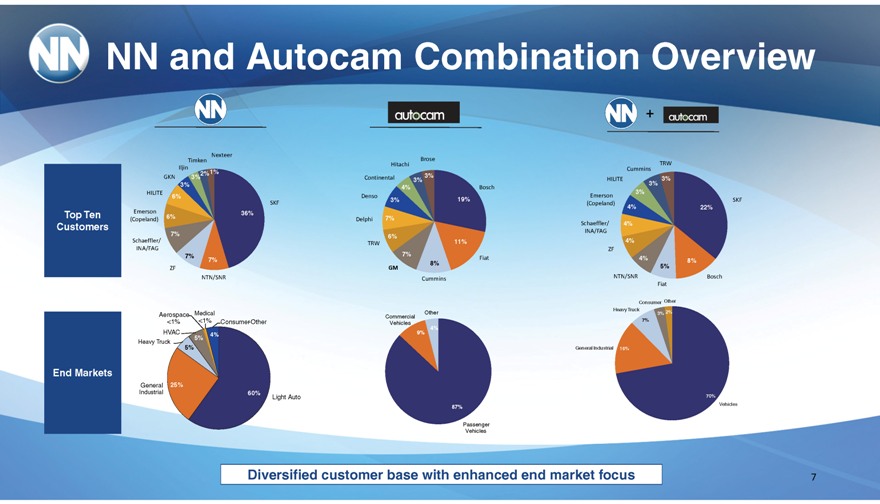

NN and Autocam Combination Overview

Top Ten Customers

Nexteer 1%

Timken 2%

Iljin 3%

GKN 3%

HILITE 6%

SKF 36%

Emerson (Copeland) 6%

Schaeffler/INA/FAG 7%

ZF 7%

NTN/SNR 7%

Brose 3%

Hitachi 3%

Continental 4%

Bosch 19%

Denso 3%

Delphi 7%

TRW 6%

Fiat 11%

GM 7%

Cummins 8%

TRW 3%

Cummins 3%

HILITE 3%

Emerson (Copeland) 4%

SKF 22%

Schaeffler/INA/FAG 4%

ZF 4%

NTN/SNR 4%

Bosch 8%

Fiat 5%

End Markets

Aerospace <1%

Medical <1%

Consumer-Other 4%

HVAC 5%

Heavy Truck 5%

General Industrial 25%

Light Auto 60%

Other 4%

Commercial Vehicles 9%

Passenger Vehicles 87%

Other 2%

Consumer 3%

Heavy Truck 7%

General Industrial 15%

Vehicles 70%

Diversified customer base with enhanced end market focus

7

Synergies and Post-Transaction

Creates a powerful global leader in Precision Metal Components and improves NN’s business mix

Post-Transaction, NN will be a top 3 global manufacturer of Metal Bearing and Precision Metal Components

$15 - $20 million of identified synergies

Establishes a global presence in Precision Metal

Components with healthy, well established operations in Brazil,

China and Europe in addition to U.S. operations

Enhances high-growth product platforms

Common goal to provide exceptional products, solutions

and service to customers more efficiently across multiple regions

Leverage procurement spend of combined company

8

Transaction Overview

Combined Company

2015 Revenue of approximately $725 million*

2015 EBITDA (adjusted) of approximately $120 million

2015 Positive Free Cash Flow of $35

million

Consideration

$300 million purchase price

$275 million in cash and assumed debt; the remainder in NN Common shares to majority owner, John Kennedy

Financing

$350 million Term Loan B underwritten by BofAML

$100 million ABL Revolver underwritten by Keybank

Financial Benefits

Immediately accretive

Over $15-$20 million in identified synergies

Timing

Merger Agreement to be signed July 18, 2014

Closing expected post HSR by end of third quarter 2014

* Includes all completed acquisitions,

estimated continued European recovery, organic growth and adjacent market growth per NN’s long-range strategic plan.

9