Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Inventergy Global, Inc. | v384256_8k.htm |

EXHIBIT 99.1

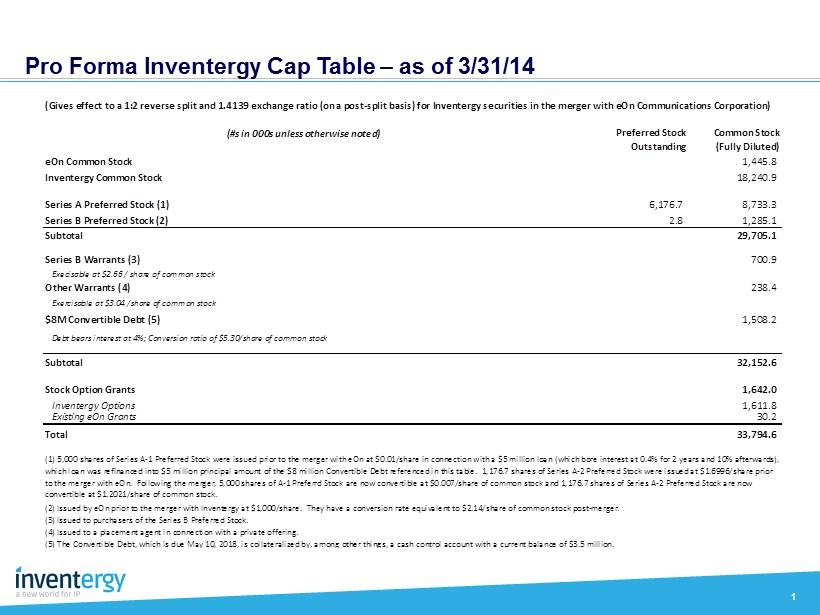

Pro Forma Inventergy Cap Table – as of 3/31/14 1 (#s in 000s unless otherwise noted) Common Stock (Fully Diluted) eOn Common Stock 1,445.8 Inventergy Common Stock 18,240.9 Series A Preferred Stock (1) 6,176.7 8,733.3 Series B Preferred Stock (2) 2.8 1,285.1 Subtotal 29,705.1 Series B Warrants (3) 700.9 Execisable at $2.66 / share of common stock Other Warrants (4) 238.4 Exercisable at $3.04 /share of common stock $8M Convertible Debt (5) 1,508.2 Subtotal 32,152.6 Stock Option Grants 1,642.0 Inventergy Options 1,611.8 Existing eOn Grants 30.2 Total 33,794.6 (4) Issued to a placement agent in connection with a private offering. (5) The Convertible Debt, which is due May 10, 2018, is collateralized by, among other things, a cash control account with a current balance of $3.5 million. Debt bears interest at 4%; Conversion ratio of $5.30/share of common stock (Gives effect to a 1:2 reverse split and 1.4139 exchange ratio (on a post-split basis) for Inventergy securities in the merger with eOn Communications Corporation) (1) 5,000 shares of Series A-1 Preferred Stock were issued prior to the merger with eOn at $0.01/share in connection with a $5 million loan (which bore interest at 0.4% for 2 years and 10% afterwards), which loan was refinanced into $5 million principal amount of the $8 million Convertible Debt referenced in this table. 1,176.7 shares of Series A-2 Preferred Stock were issued at $1.6996/share prior to the merger with eOn. Following the merger, 5,000 shares of A-1 Preferrd Stock are now convertible at $0.007/share of common stock and 1,176.7 shares of Series A-2 Preferred Stock are now convertible at $1.2021/share of common stock. (2) Issued by eOn prior to the merger with Inventergy at $1000/share. They have a conversion rate equivalent to $2.14/share of common stock post-merger. Preferred Stock Outstanding (3) Issued to purchasers of the Series B Preferred Stock.

Inventergy Cap Table – as of 6/30/14 2 (#s in 000s unless otherwise noted) Common Stock (Fully Diluted) Common Stock (1) 23,484.8 Pending requests to convert Preferred Stock (2) 111.8 Series A Preferred Stock 4,058.2 5,737.9 Series B Preferred Stock 1.1 528.8 Subtotal 29,863.4 Series B Warrants 586.2 Exercisable at $2.66/share of common stock Other Warrants (3) 238.4 Exercisable at $3.04/share of common stock $8M Convertible Debt 1,508.2 Debt bears interest at 4%; Conversion ratio of $5.30/share of common stock Subtotal 32,196.2 Stock Option Grants 2,226.2 Exercisable at $2.27/share of common stock 1,293.7 Exercisable at $3.04/share of common stock 742.3 Exercisable at $3.85/share of common stock 160.0 Existing eOn Grants (with a weighted average price of $23.56/share of common stock) 30.2 Total 34,422.4 Preferred Stock Outstanding (1) Includes 11,827,275 restricted shares of common stock held by the directors and officers of the Company. (2) Represents pending requests to convert shares of Series A Preferred Stock and Series B Preferred Stock into shares of Common Stock. (3) Warrants issued to placement agent in connection with a private placement of 2,398,109 shares of Common Stock at $3.04 per share in January 2014 (on a post-split and post-merger basis).

Conversion Information as of 6/30/2014 (Common Stock presented on a Fully Diluted Basis) Original Security Number of Shares of Common Stock Underlying Unconverted Preferred Stock Number of Shares of Common Stock Outstanding and Issued upon Conversion of Preferred Stock Common Stock 19,775,703 Series A - 1 Preferred Stock 5,240,046 1,829,456 Series A - 2 Preferred Stock 497,899 1,165,915 Series B Preferred Stock 528,838 756,213 Series B Warrants 586,237 69,288 Other Warrants 238,412 0 Convertible Debt 1,508,162 0 (111,792) TOTAL 8,599,594 23,484,783 3 23,484,783 shares of common stock were issued and outstanding on 6/30/2014 (not including 111,792 shares of common stock issuable upon pending conversion requests); 32,196,169 shares of Common Stock outstanding on a fully diluted basis as of 6/30/2014.

Stock Conversion and Lock - up Analysis as of 6/30/2014 (Common Stock presented on a Fully Diluted Basis) 4 Merger Lockup Structure* (Preferred A, Preferred B & Series B Warrants): • If common stock is < $4.00/share: No sales allowed in June, July & August 2014 • If common stock > $4.00/share: 495,000 of otherwise locked shares/month can be sold in July - August 2014 and amounts not sold can accumulate forward to subsequent months • Regardless of price of common stock: 495,000 shares of otherwise locked shares/month can be sold in September through November 2014 • If common stock > $6.00/share: Unlimited sales of otherwise locked shares Founders Lockup Structure* (Founder/Insider Common Shares): • Of 14,032,958 restricted shares of common stock granted to founders, employees and other insiders and consultants: • 13,714,831 shares (97.7%) are subject to 90% lockups through May 10, 2015 • Founders lockups can decrease to 80% upon certain events defined by the $8M Convertible Debt, including either full payoff of principal or full collateralization against remaining principal. • 13,644,136 shares (97.2%) are subject to same Merger Lockup Structure * Summary of Merger and Founders lockups previously disclosed UnconvertedConvertedUnconvertedConvertedUnconverted % Converted % Locked % Unlocked % Series A-1 Preferred Stock 7,069,502 4,645,438 1,719,455 594,608 110,001 5,240,04674% 1,829,45626%6,364,893 90% 704,609 10% Series A-2 Preferred Stock 1,663,814 437,245 245,763 60,654 920,152 497,89930% 1,165,91570% 683,008 41% 980,806 59% Series B Preferred Stock 1,285,051 404,205 116,823 124,633 639,390 528,83841% 756,21359% 521,028 41% 764,023 59% Totals* 10,018,367 5,486,888 2,082,041 779,895 1,669,543 6,266,78363% 3,751,58437%7,568,929 76%2,449,438 24% * An additional 63,722 shares of common stock issuable upon exercise of the Series B Warrants are also subject to lock-up. Totals Security Total Original Locked Unlocked Totals