Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Andatee China Marine Fuel Services Corp | v384267_8-k.htm |

Andatee China Marine Fuel Services Corporation —— A leader in the Chinese marine fuel services industry NASDAQ: AMCF July 2014

Statements contained in this presentation not relating to historical facts are forward - looking statements that are intended to fall within the safe harbor rule under the Private Securities Litigation Reform Act of 1995 . All forward - looking statements included herein are based upon information available to the Company as of the date hereof, and the Company assumes no obligation to update any such forward - looking statements . As a result, investors should not place undue reliance on these forward - looking statements . To the extent that any statements made here are not historical, these statements are essentially forward - looking . Forward - looking statements can be identified by the use of words such as “expects,” “plans,” “will,” “may,” “anticipates,” “believes,” “should,” “intends,” “estimates” and other words of similar meaning . These statements are subject to risks and uncertainties that can not be predicted or quantified and, consequently, actual results may differ materially from those expressed or implied by these forward - looking statements . Such risk factors include, without limitation, our ability to properly execute our business model, to attract and retain management and operational personnel, potential volatility in future earnings, fluctuations in the Company’s operating results, governmental decisions and regulation, and existing and future competition that the Company is facing . These forward - looking statements are subject to known and unknown risks and uncertainties that could cause actual events to differ from the forward - looking statements . More information about some of these risks and uncertainties maybe found in the Company’s filings with the Securities and Exchange Commission under the caption "Risk Factors“ in such filings . Information regarding market and industry statistics contained in this presentation is included based on information available to us that we believe is accurate . It is generally based on industry and other publications that are not produced for purposes of securities offerings or economic analysis . We have not reviewed or included data from all sources and can not assure investors of the accuracy or completeness of any such data included in this presentation . Forecasts and other forward - looking information obtained from these sources are subject to the same qualifications and the additional uncertainties accompanying any estimates of future market size, revenues and market acceptance of products and services . Forward - Looking Statements 2

• Leading producer, distributor, and retailer of quality marine fuel for small cargo and fishing vessels in China • Largest non - state - owned company engaging in marine fuel production and distribution in northern China Company At - A - Glance Ticker NASDAQ:AMCF Shares Outstanding 10,255,813 Stock Price (7/18/14) $1.77 Book value per share $ 5.29 52wk range $0.51 - $2.75 Avg Vol (3M) 54,315 2013 Year End Revenue $41,956,461 2013 Year End Gross Profit $2,864,249 Corporate Overview 3

Investment Highlights 4 Strong Position in China’s Growing Marine Fuel Market • Company is focused on underserved fishing and small cargo vessels • Long - term supplier and customer relationships provide distinct competitive advantage • Recognized brand and only non - state - owned, U . S . - listed company operating in China’s marine fuel industry Unique Business Model Sets it Apart from Commodity Sales • Offers superior blended and energy - efficient marine fuels with competitive pricing due to long - term relationships and geographical locations • Building distribution infrastructure to attain the goal of becoming a “one - stop shop” for marine port services — providing petroleum products, maintenance, payment services, and marine supplies for boat operators • Company intends to seek to increase the number of distributors carrying the products, specifically new distributors that will provide it with greater access to a wider range of end - user customers

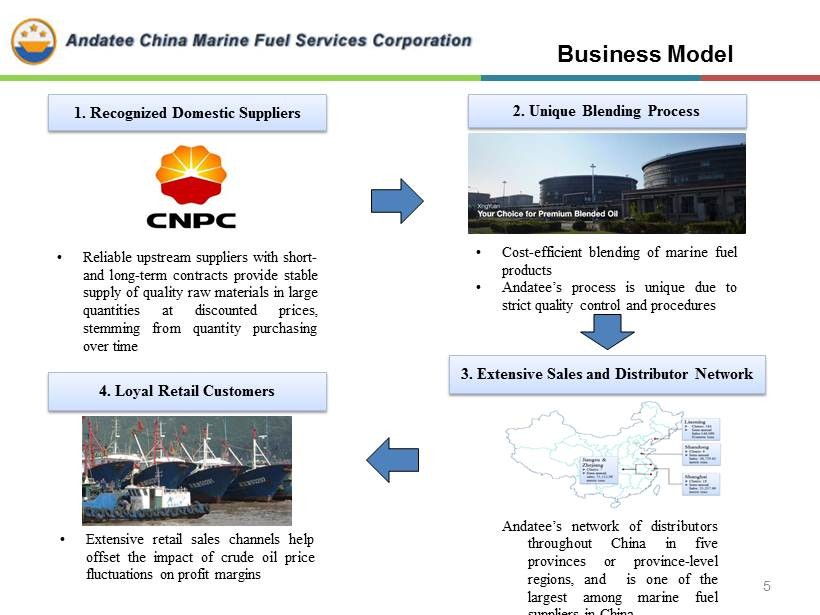

Business Model 1. Recognized Domestic Suppliers • Reliable upstream suppliers with short - and long - term contracts provide stable supply of quality raw materials in large quantities at discounted prices, stemming from quantity purchasing over time 2. Unique Blending Process • Cost - efficient blending of marine fuel products • Andatee’s process is unique due to strict quality control and procedures 3. Extensive Sales and Distributor Network Andatee’s network of distributors throughout China in five provinces or province - level regions, and is one of the largest among marine fuel suppliers in China 4. Loyal Retail Customers • Extensive retail sales channels help offset the impact of crude oil price fluctuations on profit margins 5

Wide Distribution Network Liaoning Shandong Jiangsu & Zhejiang Shanghai Andatee’s sales network currently covers provinces or province - level regions of Liaoning, Shandong, Shanghai, Jiangsu, and Zhejiang (shown in map below) 6 6

Strategic Goal: “One - stop Shop for Marine Port Services” Strategic Rationale • Diversify revenue base and expand profit margin • Leverage existing brand awareness • Take advantage of extensive distribution network • Leverage infrastructure to provide value - added services, including maintenance, payment services, and marine supplies 7

Growth Strategy » Targeted expansions: • Building new facilities • Joint ventures • Pursue selective strategic acquisitions • Expanding into clean energy segment » Explore international suppliers and trading opportunities » Product innovation for large vessels and other industries 8

AMCF 25 branches throughout mainland China Storage capacity: 300,000 cubic meters Business covering 5 provinces or province - level regions 6 self - owned wharfs Various marine fuel oil products Qingdao Grand New Energy Co., LTD . May 19 , 2014 , the company signed a definitive agreement to acquire Qingdao Grand New Energy Co . , Ltd . (Qingdao Grand), a high - tech company providing clean energy solution . New Business Development 9

Helping customer to save RMB0.0687 per 1KWH in energy saving through Clean Development Mechanism(CDM) for carbon emission credit Contract energy management (EPC) business model requires “zero investment” from potential customers who wish to use clean energy. Improve the stability of alternative energy (wind, solar and etc.) utilization, while broaden the application of these clean energies. 10 Patents Zero Investment Carbon Credit Water pumping 5 Applications Oil pumping Power generation Air separation Seawater desalination About Qingdao Grand 10

ENERGY RESERVES RESEVE E NERGY MAIN ENERGY WIND ENERGY SOLAR ENERYGY TIDAL ENERGY A IR E NERGY S TORAGE OFF - P EAK E LECTRICITY P OWER HIGH PRESSURE AIR STATION AIR TRANSMISSI O N PIPELINE PNEUMATIC WATER - PUMP SYSTEM PNEUMATIC OIL - PUMP AIR ENERGY STORAGE GENERATION About Qingdao Grand 11

Air Compression Application System Distributed Electricity Power Generation System High - Rise Fire Control Water Supply System S e wage Treatment Central Heating System Air - Tank Air - Tank 12 About Qingdao Grand

Desertification Control Farmland Irrigation System Petrochemical Supply & Eimission System Salt Chemical Industry Air Separation & Purification Air - Tank Air - Tank Air Compression Application System 13 About Qingdao Grand

About Qingdao Grand 14 The Air Compressor is one of the Qingdao Grand’s core products, which can be applied in various areas and creates tremendous economical benefits: Changing the utilizing methods of various alternative energies (i.e. wind, solar and tidal) and increase the utilization rate of these clean energy resources Maximize the utilization of off - peak electricity as the compressed air technology can ensure the continuity of factory production Helps to reduce or may even eliminate the building cost of power grids Various applicable areas, including city - based areas, industrial and agricultural areas

About Qingdao Grand 15 • Water pump is another important Qingdao Grand’s product which is supported by multiple proprietary technologies • Widely used in pneumatic irrigation system, halide - seawater desalination, sewage treatment and other city - based , industrial or agricultural areas Water Pump

Traditional pump Qingdao Grand pump Drive Motor - driven impeller Compressed gas Maintenance 2 or 3 times per year 1 time per 2 to 5 years Working Life 5 years 50 years Energy efficiency 35% 85% Anti - corrosion Rust corrosion under acid environment 316 stainless steel, corrosion - resistant Explosion - prove Electric mode security risks Gas medium, safety and environmental protection Temperature resistance <50 ℃ - 20 ℃ - 200 ℃ 16 About Qingdao Grand Water Pumps Comparison: pumps sectors Advantages Higher - lift Maintenance cost reduces by 3/4 10 times longer life Energy efficiency increases by 2 times Enhanced corrosion resistance No safety hazards Super high temperature resistance

Summary • Andatee – the only U . S . listed Chinese company in the marine fuel industry – is the leader in a fragmented market, manufacturing, distributing, distributing and selling blended marine oil fuel alternatives in China • Recognized for its superior product quality, energy - efficient marine fuels, and competitive pricing • Experienced and committed management team • Simple yet efficient business model with various expansion opportunities at major Chinese ports • Business expansion into clean energy segment which will benefit the shareholders in the long run 17

—— A leader in the Chinese marine fuel industry Thank You