Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - SIERRA BANCORP | v384087_ex99-1.htm |

| 8-K - FORM 8-K - SIERRA BANCORP | v384087_8k.htm |

| EX-2.1 - EXHIBIT 2.1 - SIERRA BANCORP | v384087_ex2-1.htm |

SIERRA BANCORP Acquisition of Santa Clara Valley Bank, N.A. July 17, 2014

Forward - Looking Statement This press release contains forward - looking statements concerning Sierra Bancorp and Bank of the Sierra and their operations, performance, financial conditions and likelihood of success. All statements other than statements of historical fact are “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. In particular, statements about the timing and likelihood of the consummation of the acquisitions, shareholder approvals, regulatory approvals and the successful integration of their employees and customers, as well as statements that anticipate these events, are forward looking in nature. Forward - looking statements are based on many beliefs, assumptions, estimates and expectations of our future performance, taking into account information currently available to us, and include statements about the competitiveness of the banking industry. Such statements involve inherent risks and uncertainties, many of which are difficult to predict and are generally beyond Sierra Bancorp’s control. Forward - looking statements speak only as of the date made, and we don’t undertake to update them to reflect changes or events that occur after that date. We caution readers that a number of factors could cause actual results to differ materially from those expressed in, implied or projected by, such forward - looking statements. Among other things, our ability to obtain regulatory approval and our ability to retain the assets and customers related to these acquisitions, and our ability to realize the benefits expected from these transactions, may be limited due to future risks and uncertainties including, but not limited to, changes in general economic conditions that impact our markets and our business, actions by the Federal Reserve affecting monetary and fiscal policy, regulatory and legislative actions that may constrain our ability to do business, and the competitive environment. A discussion of the factors that we recognize to pose risk to the achievement of our business goals and our operational and financial objectives more generally is contained in Sierra Bancorp’s Annual Report on Form 10 - K for the period ended December 31, 2013. These factors are updated from time to time in our filings with the Securities and Exchange Commission, and readers of this release are cautioned to review these disclosures in conjunction with the discussions herein. 2

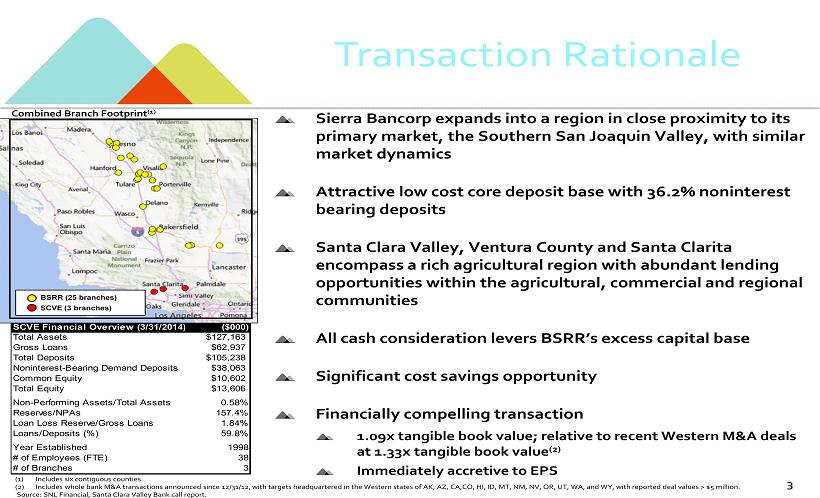

SCVE Financial Overview (3/31/2014) ($000) Total Assets $127,163 Gross Loans $62,937 Total Deposits $105,238 Noninterest-Bearing Demand Deposits $38,063 Common Equity $10,602 Total Equity $13,606 Non-Performing Assets/Total Assets 0.58% Reserves/NPAs 157.4% Loan Loss Reserve/Gross Loans 1.84% Loans/Deposits (%) 59.8% Year Established 1998 # of Employees (FTE) 38 # of Branches 3 Sierra Bancorp expands into a region in close proximity to its primary market, the Southern San Joaquin Valley, with similar market dynamics Attractive low cost core deposit base with 36.2% noninterest bearing deposits Santa Clara Valley, Ventura County and Santa Clarita encompass a rich agricultural region with abundant lending opportunities within the agricultural, commercial and regional communities All cash consideration levers BSRR’s excess capital base Significant cost savings opportunity Financially compelling transaction 1.09x tangible book value; relative to recent Western M&A deals at 1.33x tangible book value (2) Immediately accretive to EPS Transaction Rationale Combined Branch Footprint (1) BSRR (25 branches) SCVE (3 branches) 3 (1) Includes six c ontiguous c ounties. (2) Includes whole bank M&A transactions announced since 12/31/12, with targets headquartered in the Western states of AK, AZ, CA ,CO , HI, ID, MT, NM, NV, OR, UT, WA, and WY, with reported deal values > $5 million. Source: SNL Financial, Santa Clara Valley Bank call report.

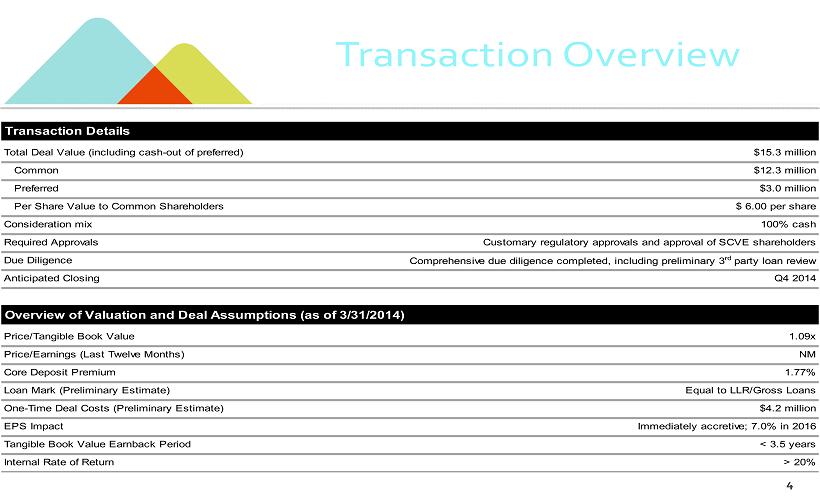

Transaction Details Total Deal Value (including cash-out of preferred) $15.3 million Common $12.3 million Preferred $3.0 million Per Share Value to Common Shareholders $ 6.00 per share Consideration mix 100% cash Required Approvals Customary regulatory approvals and approval of SCVE shareholders Due Diligence Comprehensive due diligence completed, including preliminary 3 rd party loan review Anticipated Closing Q4 2014 Overview of Valuation and Deal Assumptions (as of 3/31/2014) Price/Tangible Book Value 1.09x Price/Earnings (Last Twelve Months) NM Core Deposit Premium 1.77% Loan Mark (Preliminary Estimate) Equal to LLR/Gross Loans One-Time Deal Costs (Preliminary Estimate) $4.2 million EPS Impact Immediately accretive; 7.0% in 2016 Tangible Book Value Earnback Period < 3.5 years Internal Rate of Return > 20% Transaction Overview 4

Type Balance ($000s) % of Total Deposits Noninterest-bearing Demand 392,518 29.6% MMDA, Savings & Int. Bearing Demand 481,693 36.3% NOW + Other Trans 136,455 10.3% CDs < $100k 91,458 6.9% CDs ≥ $100k 223,292 16.8% Total Deposits 1,325,416 100.0% Type Balance ($000s) % of Total Deposits Noninterest-bearing Demand 38,063 36.2% MMDA, Savings & Int. Bearing Demand 43,546 41.4% NOW + Other Trans 6,656 6.3% CDs < $100k 7,279 6.9% CDs ≥ $100k 9,694 9.2% Total Deposits 105,238 100.0% Cost of Total Deposits 0.20% Type Balance ($000s) % of Total Deposits Noninterest-bearing Demand 354,455 29.0% MMDAs + Savings 438,147 35.9% NOW + Other Trans 129,799 10.6% CDs < $100k 84,179 6.9% CDs ≥ $100k 213,598 17.5% Total Deposits 1,220,178 100.0% Cost of Total Deposits 0.19% Noninterest bearing, 29.6% NOW + Other Trans, 10.3% MMDAs + Savings, 36.3% CDs < $100K, 6.9% CDs ≥ $100K, 16.8% Pro Forma Deposit Mix Noninterest bearing, 29.0% NOW + Other Trans, 10.6% MMDAs + Savings, 35.9% CDs < $100K, 6.9% CDs ≥ $100K, 17.5% Noninterest bearing, 36.2% NOW + Other Trans, 6.3% MMDAs + Savings, 41.4% CDs < $100K, 6.9% CDs ≥ $100K, 9.2% BSRR Combined* SCVE *Combined does not include any purchase accounting adjustments. Source : Regulatory data per SNL Financial as of 3 months ended 3/31/2014. 5

Type Balance ($000s) % of Total Loans Construction & Development 31,279 3.5% Commercial Real Estate 351,065 38.9% Multi-Family 17,789 2.0% 1-4 Family 173,963 19.3% Commercial & Industrial 99,243 11.0% Consumer 22,396 2.5% Farm + Other 206,217 22.9% Total Loans 901,952 100.0% Gross Loans/Deposits 68.1% Type Balance ($000s) % of Total Loans Construction & Development 98 0.2% Commercial Real Estate 38,522 61.2% Multi-Family 11,219 17.8% 1-4 Family 5,573 8.9% Commercial & Industrial 5,848 9.3% Consumer 80 0.1% Farm + Other 1,597 2.5% Total Loans 62,937 100.0% Gross Loans/Deposits 59.8% Yield on Loans & Leases 5.17% Type Balance ($000s) % of Total Loans Construction & Development 31,181 3.7% Commercial Real Estate 312,543 37.3% Multi-Family 6,570 0.8% 1-4 Family 168,390 20.1% Commercial & Industrial 93,395 11.1% Consumer 22,316 2.7% Farm + Other 204,620 24.4% Total Loans 839,015 100.0% Gross Loans/Deposits 68.8% Yield on Loans & Leases 5.27% Pro Forma Loan Mix Constr. & LD, 3.7% CRE, 37.3% Multifamily, 0.8% 1 - 4 Family, 20.1% C&I, 11.1% Consumer, 2.7% Farm + Other, 24.4% Constr. & LD, 0.2% CRE, 61.2% Multifamily, 17.8% 1 - 4 Family, 8.9% C&I, 9.3% Consumer, 0.1% Farm + Other, 2.5% Constr. & LD, 3.5% CRE, 38.9% Multifamily, 2.0% 1 - 4 Family, 19.3% C&I, 11.0% Consumer, 2.5% Farm + Other, 22.9% BSRR Combined* SCVE 6 *Combined does not include any purchase accounting adjustments. Source : Regulatory data per SNL Financial as of 3 months ended 3/31/2014.

SIERRA BANCORP KEEP CLIMBING