Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Quartet Merger Corp. | v384219_8k.htm |

157 27 26 110 162 210 4 112 173 177 175 174 191 214 235 217 217 217 Merger of Quartet Merger Corp. (QTET) & Pangaea Logistics Solutions Ltd. Supplemental Information July 2014

157 27 26 110 162 210 4 112 173 177 175 174 191 214 235 217 217 217 The attached presentation was filed with the Securities and Exchange Commission on July [ 18 ], 2014 as part of the Current Report on Form 8 - K filed by Quartet Merger Corp . (“Quartet”) . Quartet is holding presentations for certain of its stockholders, as well as other persons who might be interested in purchasing Quartet’s securities, regarding its merger with Pangaea Logistics Solutions Ltd . (“Pangaea” or the “Company”) . The attached presentation will be distributed to attendees of these presentations . Jefferies LLC is the lead advisor in connection with the merger and will receive a fee in connection therewith . In addition, EarlyBirdCapital , Inc . (“EBC”) acted as managing underwriter of Quartet’s initial public offering (“IPO”) and as Quartet’s investment banker and will receive a fee upon consummation of the merger . Quartet and its directors and executives officers, and Jefferies LLC and EBC may be deemed to be participants in the solicitation of proxies for the special meeting of Quartet’s stockholders to be held to approve the merger . STOCKHOLDERS OF QUARTET AND OTHER INTERESTED PERSONS ARE ADVISED TO READ QUARTET’S PRELIMINARY JOINT PROXY STATEMENT/REGISTRATION STATEMENT, AND WHEN AVAILABLE, DEFINTIVE JOINT PROXY STATEMENT/REGISTRATION STATEMENT (“PROXY STATEMENT”) WHICH WILL CONTAIN IMPORTANT INFORMATION , INCLUDING INFORMATION ON THE SECURITY HOLDINGS OF QUARTET’S OFFICERS AND DIRECTORS AND THE INTERESTS OF SUCH PERSONS AND OF JEFFERIES LLC AND EBC IN THE SUCCESSFUL CONSUMMATION OF THE MERGER . Such persons may also read Quartet’s F inal Prospectus, dated October 29 , 2013 , and Quartet’s Annual Report on Form 10 - K for the fiscal year ended December 31 , 2013 for additional information . The definitive Proxy Statement will be mailed to stockholders as of a record date to be established for voting on the merger . Stockholders will also be able to obtain a copy of the preliminary Proxy Statement and definitive Proxy Statement, once available, without charge, by directing a request to : Quartet Merger Corp . , 777 Third Avenue, 37 th Floor, New York, New York 10017 . The preliminary Proxy Statement and definitive Proxy Statement, once available, and Final Prospectus and Form 10 - K can also be obtained, without charge, at the Securities and Exchange Commission’s internet site (http : //www . sec . gov) . Important Disclosures

157 27 26 110 162 210 4 112 173 177 175 174 191 214 235 217 217 217 Safe Harbor This presentation includes certain forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 , including statements regarding future financial performance, future growth and future acquisitions . These statements are based on Pangaea’s and Quartet’s managements’ current expectations or beliefs and are subject to uncertainty and changes in circumstances . Actual results may vary materially from those expressed or implied by the statements herein due to changes in economic, business, competitive and/or regulatory factors, and other risks and uncertainties affecting the operation of Pangaea’s business . These risks, uncertainties and contingencies include : business conditions ; weather and natural disasters ; changing interpretations of GAAP ; outcomes of government reviews ; inquiries and investigations and related litigation ; continued compliance with government regulations ; legislation or regulatory environments ; requirements or changes adversely affecting the business in which Pangaea is engaged ; fluctuations in customer demand ; management of rapid growth ; intensity of competition from other providers of logistics and shipping services ; general economic conditions ; geopolitical events and regulatory changes ; the possibility that the merger does not close, including due to the failure to receive required security holder approvals or the failure of other closing conditions ; and other factors set forth in Quartet’s filings with the Securities and Exchange Commission . The information set forth herein should be read in light of such risks . Further, investors should keep in mind that certain of Pangaea’s financial results are unaudited and do not conform to SEC Regulation S - X and as a result such information may fluctuate materially depending on many factors . Accordingly, Pangaea’s financial results in any particular period may not be indicative of future results . Neither Quartet nor Pangaea is under any obligation to, and expressly disclaims any obligation to, update or alter its forward - looking statements, whether as a result of new information, future events, changes in assumptions or otherwise .

157 27 26 110 162 210 4 112 173 177 175 174 191 214 235 217 217 217 1 See Appendix VIII of the Investor Presentation attached as an exhibit to the Form 8 - K for Quartet Merger Corp. filed on July 3, 2014 for important disclosures relating to Pangaea’s Historic Adjusted EBITDA. 0 5,000 10,000 15,000 20,000 25,000 30,000 35,000 2009 2010 2011 2012 2013 ($ in thousands) Historic Adjusted EBITDA Consistent Historic Adjusted EBITDA growth … * Compound annual growth rate

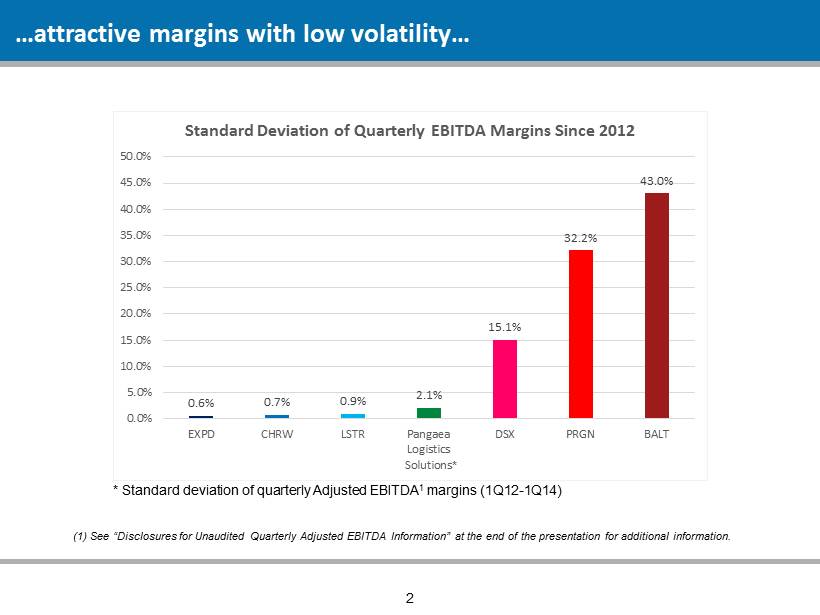

157 27 26 110 162 210 4 112 173 177 175 174 191 214 235 217 217 217 2 (1) See “Disclosures for Unaudited Quarterly Adjusted EBITDA Information” at the end of the presentation for additional infor mat ion. …attractive margins with low volatility… * Standard deviation of quarterly Adjusted EBITDA 1 margins (1Q12 - 1Q14) * 0.6% 0.7% 0.9% 2.1% 15.1% 32.2% 43.0% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% 45.0% 50.0% EXPD CHRW LSTR Pangaea Logistics Solutions DSX PRGN BALT Standard Deviation of Quarterly EBITDA Margins Since 2012

157 27 26 110 162 210 4 112 173 177 175 174 191 214 235 217 217 217 3 …supported by long - term contracts providing visibility… As of March 31, 2014: more than 20 long - term “Contracts of Affreightment “ Covering transportation of more than 45 million tons of cargo Representing nearly $500 million in contracted amounts CoA backlog: over 2,500 days on average per year through 2017 Contracts typically cover “backhaul” routes Defray the cost of vessel - positioning Margin - enhancing in virtually any rate environment Majority of backhaul for repeat, longstanding customers

157 27 26 110 162 210 4 112 173 177 175 174 191 214 235 217 217 217 4 …are features typical of a logistics company, not a ship - owning company * Mean Indexed Adjusted EBITDA margins -50.0% 0.0% 50.0% 100.0% 150.0% 200.0% 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 Mean Indexed EBITDA Margins 2 EXPD CHRW LSTR Pangaea Logistics Solutions DSX PRGN BALT * (2) See “Disclosures for Unaudited Quarterly Adjusted EBITDA Information” at the end of the presentation for additional infor mat ion.

157 27 26 110 162 210 4 112 173 177 175 174 191 214 235 217 217 217 Upon the request of potential investors, Quartet is providing the quarterly Adjusted EBITDA from 2012 through the first quarter of 2014 . The information contained in the Quarterly Adjusted EBITDA Information set out in this presentation has not been audited or reviewed by an independent registered public accounting firm . Third party data is believed to be correct but has not been independently verified . (1) Adjusted EBITDA represents operating earnings before interest expense, income taxes, depreciation and amortization and other non - operating income and/or expense, if any . Adjusted EBITDA is included in response to the request of certain investors . Adjusted EBITDA is not an item recognized by the generally accepted accounting principles in the United States of America, or U . S . GAAP, and should not be considered as an alternative to net income, operating income, or any other indicator of a company’s operating performance required by U . S . GAAP . Pangaea’s definition of Adjusted EBITDA used here may not be comparable to the definition of EBITDA used by other companies . A reconciliation of income from operations to Adjusted EBITDA is as follows : ( 2 ) Source : Company data and Bloomberg Disclosures for Unaudited Quarterly Adjusted EBITDA Information 5 For the three months ended Mar 31, 2012 Jun 30, 2012 Sept 30, 2012 Dec 31, 2012 Mar 31, 2013 Jun 30, 2013 Sept 30, 2013 Dec 31, 2013 Mar 31, 2014 ($ in thousands) Income from operations 2,989 7,828 4,991 3,835 6,545 5,032 4,813 4,994 10,060 Depreciation & amortization 1,455 1,813 2,107 1,805 2,373 1,733 2,955 2,553 2,552 Adjusted EBITDA 4,445 9,641 7,099 5,640 8,918 6,765 7,768 7,547 12,612