Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LABORATORY CORP OF AMERICA HOLDINGS | form8-kq22014pptjuly18.htm |

1 8-K Filed July 18, 2014

2 Introduction This slide presentation contains forward-looking statements which are subject to change based on various important factors, including without limitation, competitive actions in the marketplace and adverse actions of governmental and other third-party payors. Actual results could differ materially from those suggested by these forward-looking statements. Further information on potential factors that could affect the Company’s financial results is included in the Company’s Form 10-K for the year ended December 31, 2013, and subsequent SEC filings. The Company has no obligation to provide any updates to these forward-looking statements even if its expectations change.

3 Second Quarter Results (In millions, except per share data) (1) See Reconciliation of non-GAAP Financial Measures on slides 7 and 8 2014 2013 +/(-) Revenue 1,516.4$ 1,468.2$ 3.3% Adjusted Operating Income (1) 253.4$ 275.9$ -8.2% Adjusted Operating Income Margin (1) 16.7% 18.8% (210) bp Adjusted EPS (1) 1.84$ 1.80$ 2.2% Operating Cash Flow 207.4$ 137.6$ 50.7% Less: Capital Expenditures (48.1)$ (48.8)$ -1.4% Free Cash Flow 159.3$ 88.8$ 79.4% Three Months Ended Jun 30,

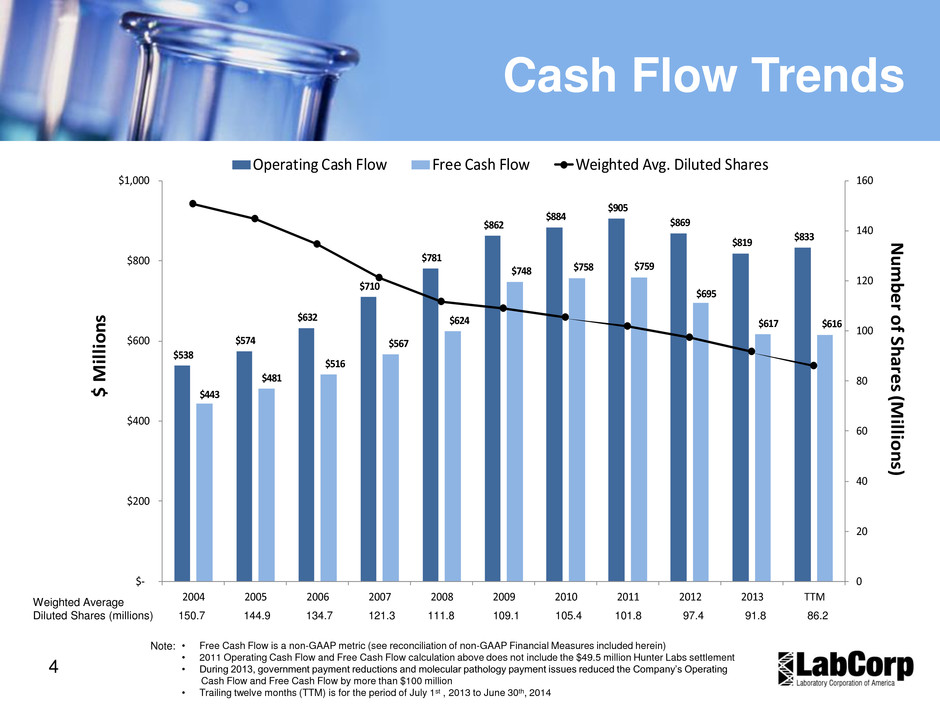

4 Cash Flow Trends • Free Cash Flow is a non-GAAP metric (see reconciliation of non-GAAP Financial Measures included herein) • 2011 Operating Cash Flow and Free Cash Flow calculation above does not include the $49.5 million Hunter Labs settlement • During 2013, government payment reductions and molecular pathology payment issues reduced the Company’s Operating Cash Flow and Free Cash Flow by more than $100 million • Trailing twelve months (TTM) is for the period of July 1st , 2013 to June 30th, 2014 $538 $574 $632 $710 $781 $862 $884 $905 $869 $819 $833 $443 $481 $516 $567 $624 $748 $758 $759 $695 $617 $616 0 20 40 60 80 100 120 140 160 $- $200 $400 $600 $800 $1,000 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 TTM Number of Shares (M illions) $ M illi on s Operating Cash Flow Free Cash Flow Weighted Avg. Diluted Shares Weighted Average Diluted Shares (millions) 150.7 144.9 134.7 121.3 111.8 109.1 105.4 101.8 97.4 91.8 86.2 Note:

5 Financial Guidance - 2014 Excluding the impact of restructuring and special items and share repurchase activity after June 30, 2014, guidance for 2014 is: • Revenue growth: Approximately 2.0% • Adjusted EPS: $6.50 - $6.75 • Operating cash flow: $780 Million - $820 Million • Capital expenditures: $185 Million - $205 Million • Free cash flow: $575 Million - $635 Million

6 Supplemental Financial Information Q1 14 Q2 14 YTD Depreciation 38.3$ 39.6$ 77.9$ Amortization 21.0$ 22.0$ 43.0$ Capital expenditures 56.5$ 48.1$ 104.6$ Cash flows from operations 142.3$ 207.4$ 349.7$ Bad debt as a percentage of sales 4.6% 4.8% 4.7% Effective interest rate on debt: Zero coupon-subordinated notes 2.00% 2.00% 2.00% 3 1/8% Senior Notes 3.27% 3.27% 3.27% 4 5/8% Senior Notes 4.74% 4.74% 4.74% 5 5/8% Senior Notes 5.75% 5.75% 5.75% 2 1/5% Senior Notes 2.24% 2.24% 2.24% 3 3/4% Senior Notes 3.76% 3.76% 3.76% 4% Senior Notes 4.16% 4.16% 4.16% 2 1/2% Senior Notes 2.52% 2.52% 2.52% Revolving credit facility (weighted average) 1.13% 1.13% 1.13% Days sales outstanding 52 49 49 Laboratory Corporation of America Other Financial Information June 30, 2014 ($ in millions)

7 Reconciliation of non-GAAP Financial Measures Adjusted Operating Income 2014 2013 Operating income 246.7$ 269.3$ Restructuring and other special charges (1) (2) 2.0 6.6 Consulting fees and CFO transition expenses (1) 4.7 - Adjusted operating income 253.4$ 275.9$ Adjusted EPS Diluted earnings per common share 1.64$ 1.62$ Impact of restructuring and special items (1) (2) 0.05 0.04 Amortization expense (3) 0.15 0.14 Adjusted EPS 1.84$ 1.80$ Reconciliation of non-GAAP Financial Measures (In millions, except per share data) Three Months Ended June 30, Note: Please see footnotes for this reconciliation on slide 9

8 Reconciliation of non-GAAP Financial Measures Adjusted Operating Income 2014 2013 Operating income 450.0$ 531.3$ Restructuring and other special charges (1) (2) 9.6 14.1 Consulting fees and CFO transition expenses (1) 4.7 - Adjusted operating income 464.3$ 545.4$ Adjusted EPS Diluted earnings per common share 2.94$ 3.18$ Impact of restructuring and special items (1) (2) 0.10 0.09 Amortization expense (3) 0.31 0.26 Adjusted EPS 3.35$ 3.53$ Reconciliation of non-GAAP Financial Measures (In millions, except per share data) Six Months Ended June 30, Note: Please see footnotes for this reconciliation on slide 9

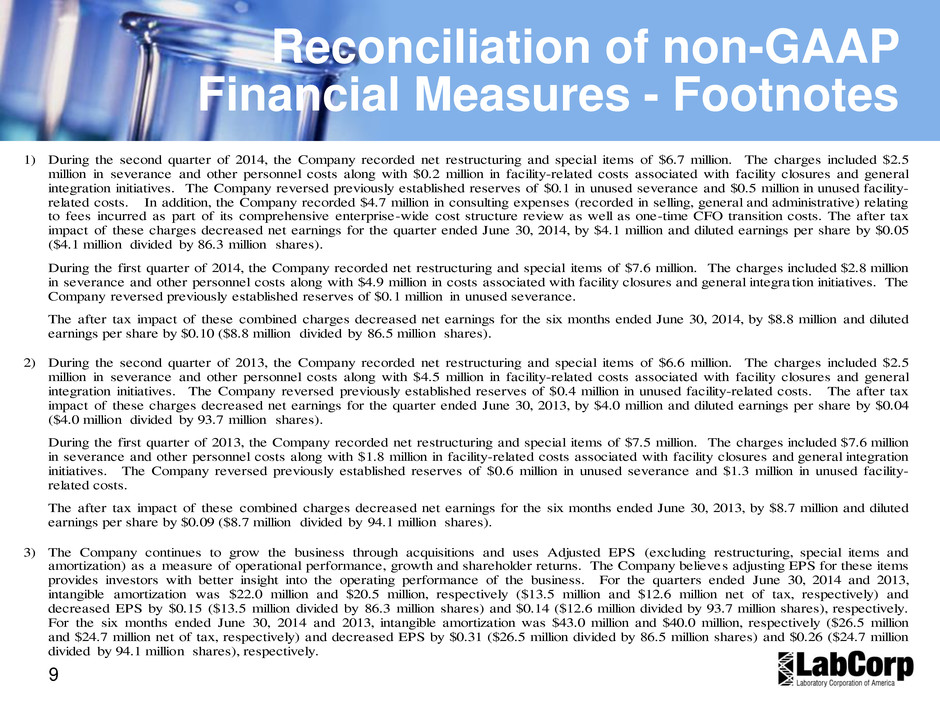

9 Reconciliation of non-GAAP Financial Measures - Footnotes 1) During the second quarter of 2014, the Company recorded net restructuring and special items of $6.7 million. The charges included $2.5 million in severance and other personnel costs along with $0.2 million in facility-related costs associated with facility closures and general integration initiatives. The Company reversed previously established reserves of $0.1 in unused severance and $0.5 million in unused facility- related costs. In addition, the Company recorded $4.7 million in consulting expenses (recorded in selling, general and administrative) relating to fees incurred as part of its comprehensive enterprise-wide cost structure review as well as one-time CFO transition costs. The after tax impact of these charges decreased net earnings for the quarter ended June 30, 2014, by $4.1 million and diluted earnings per share by $0.05 ($4.1 million divided by 86.3 million shares). During the first quarter of 2014, the Company recorded net restructuring and special items of $7.6 million. The charges included $2.8 million in severance and other personnel costs along with $4.9 million in costs associated with facility closures and general integra tion initiatives. The Company reversed previously established reserves of $0.1 million in unused severance. The after tax impact of these combined charges decreased net earnings for the six months ended June 30, 2014, by $8.8 million and diluted earnings per share by $0.10 ($8.8 million divided by 86.5 million shares). 2) During the second quarter of 2013, the Company recorded net restructuring and special items of $6.6 million. The charges included $2.5 million in severance and other personnel costs along with $4.5 million in facility-related costs associated with facility closures and general integration initiatives. The Company reversed previously established reserves of $0.4 million in unused facility-related costs. The after tax impact of these charges decreased net earnings for the quarter ended June 30, 2013, by $4.0 million and diluted earnings per share by $0.04 ($4.0 million divided by 93.7 million shares). During the first quarter of 2013, the Company recorded net restructuring and special items of $7.5 million. The charges included $7.6 million in severance and other personnel costs along with $1.8 million in facility-related costs associated with facility closures and general integration initiatives. The Company reversed previously established reserves of $0.6 million in unused severance and $1.3 million in unused facility- related costs. The after tax impact of these combined charges decreased net earnings for the six months ended June 30, 2013, by $8.7 million and diluted earnings per share by $0.09 ($8.7 million divided by 94.1 million shares). 3) The Company continues to grow the business through acquisitions and uses Adjusted EPS (excluding restructuring, special items and amortization) as a measure of operational performance, growth and shareholder returns. The Company believes adjusting EPS for these items provid s investors with better insight into the operating performance of the business. For the quarters ended June 30, 2014 and 2013, intangible amortization was $22.0 million and $20.5 million, respectively ($13.5 million and $12.6 million net of tax, respectively) and decreased EPS by $0.15 ($13.5 million divided by 86.3 million shares) and $0.14 ($12.6 million divided by 93.7 million shares), respectively. For the six months ended June 30, 2014 and 2013, intangible amortization was $43.0 million and $40.0 million, respectively ($26.5 million and $24.7 million net of tax, respectively) and decreased EPS by $0.31 ($26.5 million divided by 86.5 million shares) and $0.26 ($24.7 million divided by 94.1 million shares), respectively.

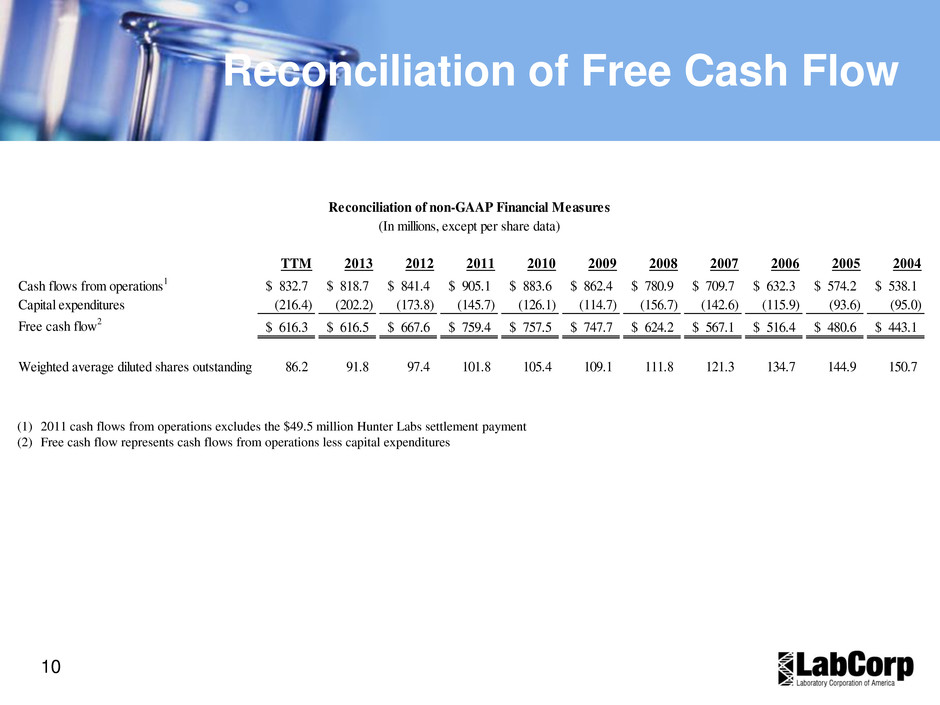

10 Reconciliation of Free Cash Flow (1) 2011 cash flows from operations excludes the $49.5 million Hunter Labs settlement payment (2) Free cash flow represents cash flows from operations less capital expenditures TTM 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 Cash flows from operations1 832.7$ 818.7$ 841.4$ 905.1$ 883.6$ 862.4$ 780.9$ 709.7$ 632.3$ 574.2$ 538.1$ Capital expenditures (216.4) (202.2) (173.8) (145.7) (126.1) (114.7) (156.7) (142.6) (115.9) (93.6) (95.0) Free cash flow2 616.3$ 616.5$ 667.6$ 759.4$ 757.5$ 747.7$ 624.2$ 567.1$ 516.4$ 480.6$ 443.1$ Weighted average diluted shares outstanding 86.2 91.8 97.4 101.8 105.4 109.1 111.8 121.3 134.7 144.9 150.7 Reconciliation of non-GAAP Financial Measures (In millions, except per share data)

11