Attached files

| file | filename |

|---|---|

| EX-1.1 - EX-1.1 - Intersect ENT, Inc. | d681748dex11.htm |

| EX-23.1 - EX-23.1 - Intersect ENT, Inc. | d681748dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on July 18, 2014

Registration No. 333-196974

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 3

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Intersect ENT, Inc.

(Exact name of Registrant as specified in its charter)

| Delaware | 3841 | 20-0280837 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

1555 Adams Drive

Menlo Park, California 94025

(650) 641-2100

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Lisa D. Earnhardt

President and Chief Executive Officer

Intersect ENT, Inc.

1555 Adams Drive

Menlo Park, California 94025

(650) 641-2100

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Matthew B. Hemington Brett D. White Seth J. Gottlieb Cooley LLP 3175 Hanover Street Palo Alto, California 94304 Telephone: (650) 843-5000 Facsimile: (650) 849-7400 |

B. Shayne Kennedy Thomas E. Mitchell Latham & Watkins LLP 650 Town Center Drive, 20th Floor Costa Mesa, California 92626 Telephone: (714) 540-1235 Facsimile: (714) 755-8290 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer x | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated July 18, 2014

Prospectus

5,000,000 Shares

Common Stock

This is the initial public offering of common stock of Intersect ENT, Inc. We are offering 5,000,000 shares of our common stock. We anticipate the initial public offering price will be between $11.00 and $13.00 per share.

Prior to this offering, there has been no public market for our common stock. We have applied for our common stock to be listed on The Nasdaq Global Market under the symbol “XENT.”

We are an “emerging growth company” as that term is defined under the federal securities laws of the United States and, as such, may elect to comply with certain reduced public company reporting requirements for this and future filings.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds, before expenses, to Intersect ENT, Inc. |

$ | $ | ||||||

| (1) | See “Underwriting” for additional disclosure regarding the compensation payable to the underwriters. |

We have granted to the underwriters an option to purchase up to 750,000 additional shares of common stock at the initial public offering price, less the underwriting discounts and commissions, for 30 days after the date of this prospectus.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 12 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock to investors on or about , 2014.

| J.P. Morgan | Piper Jaffray | |

| Leerink Partners | Wedbush PacGrow Life Sciences | |

The date of this prospectus is , 2014.

Table of Contents

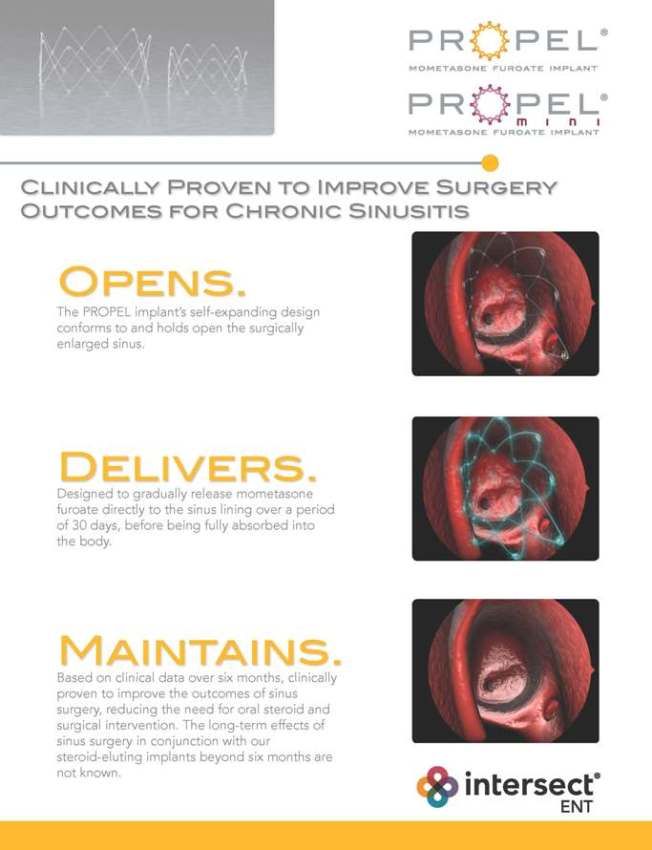

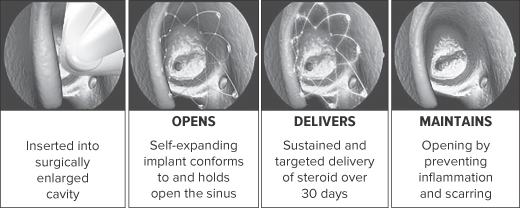

CLINICALLY PROVEN TO IMPROVE SURGERY OUTCOMES FOR CHRONIC SINUSITIS OPENS. The PROPEL implant’s self-expanding design conforms to and holds open the surgically enlarged sinus. DELIVERS. Designed to gradually release mometasone furoate directly to the sinus lining over a period of 30 days, before being fully absorbed into the body. MAINTAINS. Based on clinical data over six months, clinically proven to improve the outcomes of sinus surgery, reducing the need for oral steroid and surgical intervention. The long-term effects of sinus surgery in conjunction with our steroid-eluting implants beyond six months are not known.

Table of Contents

Neither we nor the underwriters have authorized anyone to provide you with information that is different from that contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the underwriters are offering to sell shares of common stock and are seeking offers to buy shares of common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date on the front of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

Until , 2014 (25 days after the commencement of this offering), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

TRADEMARKS

Intersect ENT, Inc. and our logo are our trademarks and are used in this prospectus. This prospectus also includes trademarks, tradenames and service marks that are the property of other organizations. Solely for convenience, our trademarks and tradenames referred to in this prospectus appear without the ™ symbol, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights, or the right of the applicable licensor to these trademarks and tradenames.

INVESTORS OUTSIDE THE UNITED STATES

Neither we nor any of the underwriters have taken any action that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons who have come into possession of this prospectus in a jurisdiction outside the United States are required to inform themselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

i

Table of Contents

This summary highlights information contained elsewhere in this prospectus. This summary is not complete and may not contain all the information you should consider before investing in our common stock. You should read this entire prospectus carefully, especially the risks of investing in our common stock discussed under the heading “Risk Factors,” and our financial statements and related notes included elsewhere in this prospectus before making an investment decision. Except as otherwise indicated herein or as the context otherwise requires, references in this prospectus to “Intersect ENT,” “the company,” “we,” “us” and “our” refer to Intersect ENT, Inc.

Overview

We are a commercial stage drug-device company committed to improving the quality of life for patients with ear, nose and throat conditions. We have developed a drug-eluting bioabsorbable implant technology that enables targeted and sustained release of therapeutic agents. This targeted drug delivery technology is designed to allow ear, nose and throat, or ENT, physicians to improve patient care. Our initial products, PROPEL and PROPEL mini, are the first and only drug-eluting implants approved by the U.S. Food and Drug Administration, or FDA, for use in patients with chronic sinusitis. Inserted by a physician during ethmoid sinus surgery, the self-expanding implants are designed to conform to and hold open the surgically enlarged sinus, while gradually releasing an anti-inflammatory steroid over a period of 30 days, before being fully absorbed into the body. Use of our PROPEL implants is clinically proven to improve surgical outcomes by maintaining the open pathways created in surgery and reducing the need for oral steroids and additional surgical procedures. In addition, we are using our drug-eluting bioabsorbable implant technology to develop new, less-invasive and more cost-effective treatment options for the management of chronic sinusitis in the physician office setting to provide benefits for patients, physicians and payors. Any new products we develop, or changes that we make in the therapeutic agent used in PROPEL or PROPEL mini, will require FDA approval prior to commercialization in the United States.

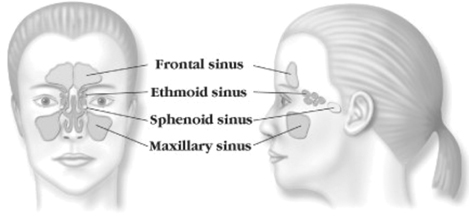

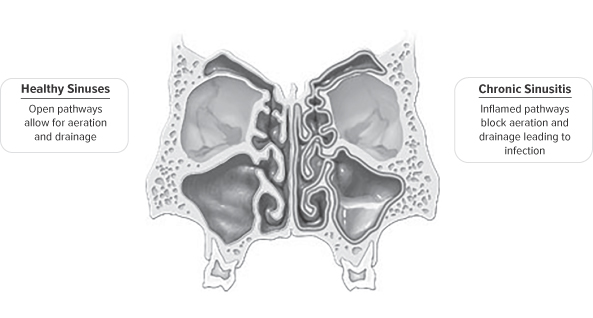

Chronic sinusitis is one of the most prevalent chronic diseases in the United States and significantly impacts the quality of life of patients. According to the Centers for Disease Control and Prevention, or CDC, approximately 12% of the U.S. adult population, or 29 million people, are affected by chronic sinusitis, making it more prevalent than heart disease and asthma. Chronic sinusitis is an inflammatory condition in which the sinus lining becomes swollen and inflamed, leading to significant patient morbidity, including difficulty breathing, chronic headaches, recurrent infections, bodily pain, and loss of sense of smell and taste. These persistent symptoms can severely impact a patient’s day-to-day well-being, resulting in frequent doctor visits and lost work productivity and can lead to chronic fatigue and depression. Chronic sinusitis is managed by a combination of medical management and surgical intervention. The first line of therapy is medical management involving antibiotics, anti-inflammatory steroids and decongestants. Patients whose symptoms persist, despite medical management, are recommended to undergo functional endoscopic sinus surgery, or FESS. FESS is performed in the operating room to open the blocked sinus pathways by removing inflamed tissue and bone using surgical tools. Approximately 540,000 patients underwent sinus surgery for chronic sinusitis in 2013 in the United States. Although sinus surgery can be effective, a majority of patients experience recurrent symptoms which commonly necessitate additional treatment with medications and surgery.

Our two commercial products, PROPEL and PROPEL mini, are designed to improve the outcomes of sinus surgery by reducing postoperative inflammation and scarring from the underlying condition as well as the surgery. PROPEL and PROPEL mini were clinically proven in a meta-analysis of prospective, multicenter, randomized, controlled, double-blind clinical studies to improve surgical outcomes, including a 35% reduction in the need for postoperative oral steroid and surgical intervention.

In August 2011 we received Premarket Approval, or PMA, from the FDA for our first product, PROPEL, indicated for use in patients 18 years or older following ethmoid sinus surgery to maintain patency. Our second product, PROPEL mini, received PMA approval from the FDA in November 2012. PROPEL mini is designed for patients requiring less extensive surgery and those who have smaller anatomy, thus expanding the treatable patient population. In the first half of 2013, we began scaling our U.S. direct commercial presence. As of March 31, 2014, over 1,000 physicians in the United States have been trained and have incorporated our steroid-

1

Table of Contents

eluting implants into their practice. Based on the number of units shipped as of March 31, 2014, we estimate that physicians have treated over 25,000 patients with PROPEL and PROPEL mini. For the year ended December 31, 2013, we generated revenue of $17.9 million and had a net loss of $18.4 million. For the three months ended March 31, 2014, we generated revenue of $7.5 million and had a net loss of $4.4 million. As of March 31, 2014, we had an accumulated deficit of $82.7 million.

The Market

According to the CDC, approximately 12% of the U.S. adult population, or 29 million people, are affected by chronic sinusitis, making it more prevalent than heart disease and asthma. The CDC estimated that in 2005 the condition resulted in 12.6 million physician office and 1.2 million hospital out-patient department visits per year in the United States. Industry sources estimate that chronic sinusitis resulted in $8.6 billion in direct healthcare costs in 2007 in the United States.

Our target market consists of more than 3.5 million people with chronic sinusitis in the United States who are managed by ENT physicians and who we believe could benefit from products that incorporate our drug-eluting bioabsorbable implant technology. These patients are treated by approximately 7,500 ENT physicians who perform sinus surgery. Approximately 540,000 patients underwent sinus surgery for chronic sinusitis in 2013 in the United States. This includes patients who are under the age of 18 and surgeries on the frontal sinuses, both of which represent potential expanded future indications for PROPEL and PROPEL mini and would require FDA approval. Based on the number of sinus surgeries (including surgeries performed by the approximately 40% of surgeons that do not use packing materials in their surgeries), and assuming two devices per surgery and an average selling price of $695 per device, we estimate the annual total addressable market for PROPEL and PROPEL mini in the United States to be approximately $830 million. We further estimate the annual total addressable market for our products in clinical development in the United States that are specifically designed to address patients in the physician office setting to be approximately $4.0 billion. This estimate is based on our estimate that of the more than 3.5 million chronic sinusitis patients in the United States who are managed by ENT physicians, (i) approximately 34% have undergone prior FESS procedures and we assume that 64% of these patients would undergo approximately 1.5 procedures per year to treat recurring symptoms using two devices at an average selling price of $495 per device, and (ii) the remaining approximately 66% of all chronic sinusitis patients managed by ENT physicians would use a different device we have in clinical development assuming that these patients would undergo approximately one procedure per year using two devices at an average selling price of $595 per device.

While our current commercial focus is the U.S. market, we plan to initiate efforts that will allow for future expansion into international geographies. To that end, in July 2014, we received CE mark approval for PROPEL and PROPEL mini which enables market access in Europe. We estimate the annual total addressable market for PROPEL and PROPEL mini in these regions to be greater than $1.0 billion. This estimate is based on an estimated approximately 865,000 FESS procedures annually in the 16 countries in which we did research (including surgeries performed by the approximately 40% of surgeons that do not use packing materials in their surgeries), assuming that 85% involve ethmoid sinuses and 25% frontal sinuses and assuming using two devices at an average selling price of $695 per device. Therefore, we estimate the global annual total addressable market for our products and products in clinical development for chronic sinusitis patients to exceed $6.0 billion.

Current Treatments for Chronic Sinusitis and Their Limitations

The treatment of chronic sinusitis often entails a combination of medical management and surgical intervention to treat the underlying inflammation of the sinus lining, while addressing the secondary symptoms caused by obstruction of the natural drainage pathways.

Medical Management

The first line of therapy for chronic sinusitis is medical management, which typically includes prescribed antibiotics, anti-inflammatory steroids and decongestants. Steroids are prescribed in two forms, oral steroid pills and nasal steroid sprays, both of which have serious limitations. Oral steroid therapy is effective at reaching the sinus lining, but it does so by means of systemic exposure and therefore carries the risk of serious side effects,

2

Table of Contents

including glaucoma, bone loss, weight gain, psychosis and difficulty in controlling blood glucose levels in patients with diabetes. Nasal steroid sprays, commonly indicated for rhinitis, or inflammation of the nasal passage, are routinely prescribed for chronic sinusitis patients. While nasal steroid sprays avoid systemic exposure, an estimated 70% of the drug is swallowed and the remainder is directed to the nasal passages, instead of the sinuses, which limits efficacy. In a published study, the fraction of drug deposited in the sinuses from a nasal steroid spray was measured to be less than 2%. Poor patient compliance further limits the effectiveness of nasal steroid sprays. Although medical management can reduce symptoms, an estimated 20% or more of chronic sinusitis patients who receive medical therapy are unresponsive.

Sinus Surgery

In cases where patients are symptomatic despite medical management, a physician may recommend FESS. In the FESS procedure, the physician enlarges the inflamed and obstructed sinus pathways by removing inflamed tissue and bone in order to facilitate normal sinus drainage and aeration. While FESS is the standard of care for treating chronic sinusitis, it has several limitations:

| • | Limited effectiveness. Inflammation and scarring in the postoperative period are common and can compromise the surgical result by negatively impacting the ability of the sinuses to heal. This increases the need for continued medical management and additional surgical procedures. Within the first year after surgery, approximately 64% of patients experience recurrent symptoms. |

| • | Limited ability to address postoperative inflammation. While oral steroids prescribed postoperatively can be effective at addressing inflammation and scarring, the required doses are significant and can result in serious systemic side effects. We believe, as a result, only 20% of physicians prescribe them routinely after surgery. The absence of anti-inflammatory steroid therapy leaves the surgical wound susceptible to postoperative complications. |

| • | Pain and discomfort during postoperative period. During surgery, an ENT physician typically places sinus packing materials into the ethmoid sinuses to physically separate tissues in an attempt to prevent scarring and adhesions. The sinus packing materials are removed in the physician’s office postoperatively by pulling or suctioning them from the newly opened cavity, a painful and time-consuming process, often necessitating pain medication. Moreover, the use of sinus packing materials obstructs the newly opened sinuses, leading to patient symptoms of congestion and discomfort. Despite the use of packing materials, scarring and adhesions are common, necessitating painful removal of additional tissue during postoperative treatments. |

| • | Potential for revision surgery. Within the first year after FESS, approximately 10% of patients will return to the operating room to undergo a revision procedure, while additional patients will return for a revision procedure after one year. We believe the risk of potential revision surgery is a significant deterrent to some patients that would otherwise undergo FESS for chronic sinusitis. |

We believe that because of the limitations of medical management and lack of disease resolution after FESS, many chronic sinusitis patients remain undertreated. We estimate that only a third of patients recommended for sinus surgery proceed with the potentially beneficial procedure, which we believe is due to its limitations and high risk for additional medical management and surgical revision. While balloon sinuplasty has been introduced to open the frontal, maxillary and sphenoid sinuses, or dependent sinuses, in a less invasive manner, it cannot treat disease in the most commonly involved sinuses, the ethmoids, and does not address the underlying inflammation associated with chronic sinusitis. We believe that an opportunity exists to reach these undertreated patients by providing a more effective option to address their inflammatory disease, while improving the overall outcomes of FESS.

Our Solution

We have designed a drug-eluting implant that consists of bioabsorbable polymers that control drug release and provide structural support to adjacent tissues during the healing process, while the implant is gradually and fully absorbed into the body.

3

Table of Contents

Our PROPEL implants are designed to improve the outcomes of sinus surgery by holding open the sinus passageways, reducing postoperative inflammation and scarring. They are inserted by a physician under endoscopic visualization during sinus surgery in the ethmoids. Once inserted, the self-expanding implants conform to and hold open the surgically enlarged sinus, while gradually releasing an anti-inflammatory steroid, mometasone furoate, directly to the sinus lining over a period of 30 days. Mometasone furoate, which is available generically and has been approved by the FDA for use in PROPEL and PROPEL mini, is the active ingredient in NASONEX, a nasal spray used to treat allergic rhinitis and other indications. The implants fully absorb into the body after a period of four to six weeks or are removed at the discretion of a physician during a routine office visit. Once absorbed or removed, the implant no longer provides structural support. We believe the principal benefits of our steroid-eluting implants are:

| • | Improved surgical outcomes. Our PROPEL implants have been clinically proven to improve FESS results by reducing postoperative inflammation and scarring. In a meta-analysis of prospective, multicenter, randomized, controlled, double-blind clinical studies, our PROPEL implants provided a 46% relative reduction in inflammation and a 70% relative reduction in scarring compared to the control implant. The control implant was identical to the PROPEL implant in composition, size, structure and mode of insertion but lacked the mometasone furoate coating. |

| • | Targeted steroid therapy to address postoperative inflammation. Our PROPEL implants are the first and only drug-eluting bioabsorbable sinus implants. They deliver postoperatively an anti-inflammatory steroid directly to the sinus lining in a controlled fashion over a period of 30 days, which helps in the wound healing process. In a meta-analysis of prospective, multicenter, randomized, controlled, double-blind clinical studies, our PROPEL implants reduced the need for oral steroids by 40% compared to the control implant. |

| • | Reduced pain and discomfort during postoperative period. Our PROPEL implants improve postoperative care. Once inserted, the self-expanding implants are designed to conform to and hold open the surgically enlarged ethmoid sinuses until fully absorbed into the body, which improves wound healing without obstructing the sinuses and causing congestion. Our steroid-eluting implants are designed to obviate the need for sinus packing materials, which can be a significant source of postoperative pain and discomfort. Our PROPEL implants significantly reduce scarring and adhesions, which reduces the potential for pain in postoperative treatments. |

| • | Reduced surgical revisions. In clinical studies, our PROPEL implants demonstrated a significant reduction in need for postoperative surgical intervention. In a meta-analysis of prospective, multicenter, randomized, controlled, double-blind clinical studies, our PROPEL implants provided a 35% relative reduction in the need for postoperative oral steroid and surgical intervention compared to the control implant. We believe that patients who have been deterred by the high revision rates associated with FESS may now consider surgical intervention to treat their chronic sinusitis condition. |

We believe these benefits will help expand the size of the FESS market as referring physicians increase their prescription of surgical intervention for chronic sinusitis and more patients elect to undergo sinus surgery to resolve their condition. However, although we believe PROPEL and PROPEL mini have significant advantages over sinus packing materials and other treatment options, we do not have clinical results directly comparing the effectiveness of our PROPEL implants versus sinus packing materials. Additionally, PROPEL and PROPEL mini are expensive relative to packing materials and may not be reimbursed by third-party payors, which has led some ENT physicians to not use these products, or to use them sparingly. ENT physicians may be slow to adopt our PROPEL implants until further clinical evidence or physician experience exists. Until we are able to obtain widespread coverage of our products by third-party payors, our products may be viewed by some ENT physicians, hospitals or other healthcare providers as too expensive to employ in every FESS procedure.

4

Table of Contents

Our Strategy

Our goal is to be a leading drug-device company committed to advancing clinically proven therapeutic solutions that improve the quality of life for patients with ENT conditions. The key elements of our strategy include:

| • | Expand our sales and marketing organizations to support growth. We plan to continue to invest in the expansion of our sales and marketing organizations to provide ENT physicians in the United States with access to our steroid-eluting implants. |

| • | Promote awareness amongst ENT physicians, referring physicians and patients. We believe that many patients with chronic sinusitis are currently undertreated, and we intend to educate ENT physicians, allergists, primary care physicians or other referring medical professionals and patients to raise awareness of the disease and available treatment alternatives, including the advantages of using our steroid-eluting implants. |

| • | Advance our platform of innovative products for additional chronic sinusitis patients. We are developing additional products using our drug-eluting bioabsorbable implant technology that are specifically designed to treat and manage chronic sinusitis in the physician office setting during a routine visit. We are also working to expand indications for our PROPEL implants to allow for the treatment of the dependent sinuses. |

| • | Facilitate access to our products via third-party reimbursement. We believe that establishment of reimbursement codes specific to the use of drug-eluting implants for chronic sinusitis is an important factor in expanding access to our products, especially in the physician office setting. Therefore, our strategy includes efforts to engage physician societies and encourage third-party payors to establish coverage, coding and payment that will facilitate access to our drug-eluting implants as we expand our commercialization efforts in the United States. |

| • | Introduce our steroid-eluting implants in markets outside the United States. We plan to leverage our FDA PMA approved products and clinical data to access markets outside the United States, starting first with the development of clinical, regulatory and reimbursement strategies for countries in Europe and the Asia-Pacific region. |

Risks Related to Our Business

Our ability to successfully operate our business is subject to numerous risks, including those that are generally associated with operating in the medical device industry. Any of the factors set forth under the heading “Risk Factors” may limit our ability to successfully execute our business strategy. You should carefully consider all of the information set forth in this prospectus and, in particular, you should evaluate the specific factors set forth under the heading “Risk Factors” in deciding whether to invest in our common stock. Some of the principal risks relating to our business and our ability to execute our business strategy include:

| • | We have incurred significant operating losses since inception and may not be able to achieve profitability. |

| • | All of our revenue is generated from a limited number of products and we are completely dependent on the success of our PROPEL and PROPEL mini steroid-eluting implants, which have a limited commercial history. If these products fail to gain widespread market acceptance, our business will suffer. |

| • | The establishment of adequate coverage and reimbursement is important for sales of our products. Coverage and reimbursement policies for procedures using our steroid-eluting implants could affect the adoption of our products, particularly our product candidates for the physician office setting, and our future revenue. |

| • | Pricing pressure from our hospital and ambulatory surgery center customers due to limited coverage and reimbursement for our products may impact our ability to sell our products at prices necessary to support our current business strategies. |

| • | We may never obtain regulatory approval for future products or products outside the United States. |

| • | If we are unable to protect our intellectual property, or operate our business without infringing on the intellectual property rights of third parties, our business will be negatively affected. |

5

Table of Contents

Corporate Information

We were incorporated in Delaware in October 2003 as Sinexus, Inc. We changed our name to Intersect ENT, Inc. in November 2009. Our offices are located at 1555 Adams Drive, Menlo Park, California 94025. Our telephone number is (650) 641-2100. Our corporate website is at www.intersectent.com. The information contained on or that can be accessed through our website is not incorporated by reference into this prospectus, and you should not consider information on our website to be part of this prospectus or in deciding to purchase our common stock.

Preliminary Unaudited Second Quarter 2014 Financial Expectations

Set forth below are certain preliminary revenue, cost, expense and net loss expectations for the three and six months ended June 30, 2014. These preliminary results represent our estimates only based on currently available information and do not present all necessary information for an understanding of our financial condition as of June 30, 2014 or our results of operations for the three and six months ended June 30, 2014. As we complete our quarter-end financial close process and finalize our second quarter 2014 unaudited financial statements, we will be required to make significant judgments in a number of areas, including inventory, stock-based compensation and the liability for preferred stock warrants. This financial information has been prepared by and is the responsibility of our management. Our independent registered public accounting firm has not audited, reviewed or performed any procedures with respect to this preliminary financial data or the accounting treatment thereof and does not express an opinion or any other form of assurance with respect thereto. We expect to complete our unaudited financial statements for the quarter ended June 30, 2014 subsequent to the completion of this offering. It is possible that we or our independent registered public accounting firm may identify items that require us to make adjustments to the financial information set forth below and those changes could be material. Accordingly, undue reliance should not be placed on these preliminary estimates. These preliminary estimates are not necessarily indicative of any future period and should be read together with “Risk Factors,” “Special Note Regarding Forward-Looking Statements,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Selected Financial Data” and our financial statements and related notes included elsewhere in this prospectus.

We estimate that our total revenue for the three months ended June 30, 2014 was between approximately $8.4 million and $8.6 million as compared to $3.9 million for the three months ended June 30, 2013. We estimate that our total revenue for the six months ended June 30, 2014 was between approximately $15.9 million and $16.1 million as compared to $6.7 million for the six months ended June 30, 2013. The estimated increase in total revenue is primarily attributable to the growth of our revenue as we expanded our commercial sales force by increasing the number of our territory managers.

We estimate that our cost of sales was between approximately $2.3 million and $2.6 million for the three months ended June 30, 2014 as compared to cost of sales of $2.2 million for the three months ended June 30, 2013. We estimate that our cost of sales was between approximately $4.7 million and $5.0 million for the six months ended June 30, 2014 as compared to cost of sales of $4.2 million for the six months ended June 30, 2013. This estimated increase is primarily due to the increase in units sold.

We estimate that our operating expenses for the three months ended June 30, 2014 was between approximately $10.7 million and $11.2 million as compared to $6.5 million for the three months ended June 30, 2013. We estimate that our operating expenses for the six months ended June 30, 2014 was between approximately $19.9 million and $20.4 million as compared to $12.1 million for the six months ended June 30, 2013. This increase is primarily due to headcount increases associated with the commercial expansion of our sales force and related growth of our business and increased marketing and promotional expenses.

We estimate that our operating loss for the three months ended June 30, 2014 was between approximately $4.4 million and $5.4 million and between $8.5 million and $9.5 million for the six months ended June 30, 2014. We also estimate that our net loss for the three months ended June 30, 2014 was between approximately $4.4 million and $5.4 million and between $8.8 million and $9.8 million for the six months ended June 30, 2014. Consequently, we expect that our accumulated deficit increased to between approximately $87.1 million and $88.1 million as of June 30, 2014.

6

Table of Contents

Implications of Being an Emerging Growth Company

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies. These include, but are not limited to, (1) reduced obligations with respect to the disclosure of selected financial data in registration statements filed with the Securities and Exchange Commission, or the SEC, including the registration statement on Form S-1 of which this prospectus is a part, (2) reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, (3) an exception from compliance with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, and (4) exemptions from the requirements of holding a non-binding advisory vote on executive compensation and the requirement to obtain shareholder approval of any golden parachute payments not previously approved.

We may take advantage of these exemptions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company if we have more than $1.0 billion in annual revenue, we have more than $700 million in market value of our stock held by non-affiliates or we issue more than $1.0 billion of non-convertible debt over a three-year period. We may choose to take advantage of some, but not all, of the available exemptions. We have taken advantage of certain reduced reporting burdens in this prospectus. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

In addition, Section 107 of the JOBS Act provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, or Securities Act, for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We intend to take advantage of such extended transition period, and as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for private companies. Section 107 of the JOBS Act provides that we can elect to opt out of the extended transition period at any time, which election is irrevocable.

7

Table of Contents

The Offering

| Issuer |

Intersect ENT, Inc. |

| Common stock offered by us |

5,000,000 shares (or 5,750,000 shares if the underwriters exercise in full their option to purchase additional shares) |

| Common stock to be outstanding immediately after this offering |

22,501,808 shares (or 23,251,808 shares if the underwriters exercise in full their option to purchase additional shares) |

| Underwriters’ option to purchase additional shares |

750,000 shares |

| Use of proceeds |

We intend to use substantially all of the net proceeds from this offering for sales, marketing, research and development activities, clinical and regulatory initiatives, working capital and general corporate purposes. See “Use of Proceeds” on page 43 for a more complete description of the intended use of proceeds from this offering. |

| Risk factors |

See “Risk Factors” beginning on page 12 and other information included in this prospectus for a discussion of factors that you should consider carefully before deciding to invest in our common stock. |

| Proposed Nasdaq Global Market Symbol |

“XENT” |

The number of shares of common stock to be outstanding after this offering is based on 17,501,808 shares of common stock outstanding as of March 31, 2014, and excludes the following:

| • | 1,964,978 shares of common stock issuable upon the exercise of outstanding options as of March 31, 2014, having a weighted average exercise price of $1.34 per share; |

| • | 47,554 shares of common stock issuable upon the exercise and subsequent conversion of warrants to purchase our Series A convertible preferred stock at an exercise price of $3.68 per share; |

| • | Up to 20,313 shares of common stock issuable upon the exercise and subsequent conversion of a warrant to purchase our Series D convertible preferred stock at an exercise price of $6.89 per share, which, as of March 31, 2014, was exercisable for 5,803 shares; |

| • | 4,750,000 shares of common stock reserved for future issuance under our 2014 Equity Incentive Plan, as well as any automatic increases in the number of shares of common stock reserved for future issuance under this plan, which will become effective upon the execution of the underwriting agreement related to this offering; and |

| • | 496,092 shares of common stock reserved for future issuance under our 2014 Employee Stock Purchase Plan, as well as any automatic increases in the number of shares of common stock reserved for future issuance under this plan, which will become effective upon the execution of the underwriting agreement related to this offering. |

Unless otherwise indicated, all information in this prospectus assumes:

| • | the automatic conversion of 15,703,875 shares of our convertible preferred stock outstanding as of March 31, 2014, into an aggregate of 15,703,875 shares of our common stock immediately prior to the closing of this offering; |

| • | the automatic conversion of all convertible preferred stock warrants outstanding as of March 31, 2014, into warrants to purchase up to an aggregate 67,867 shares of our common stock immediately prior to the closing of this offering; |

8

Table of Contents

| • | the filing of our amended and restated certificate of incorporation and the effectiveness of our amended and restated bylaws immediately prior to the closing of this offering; |

| • | no exercise of the underwriters’ option to purchase additional shares; and |

| • | a 1-for-4 reverse stock split of our common stock and preferred stock effected on July 11, 2014. |

9

Table of Contents

Summary Financial Data

The following tables set forth a summary of our historical financial data as of, and for the period ended on, the dates indicated. The statements of operations data for the years ended December 31, 2012 and 2013, are derived from our audited financial statements included elsewhere in this prospectus. The statements of operations data for the three months ended March 31, 2013 and 2014, and the balance sheet data as of March 31, 2014, are derived from our unaudited interim financial statements included elsewhere in this prospectus. We have prepared the unaudited interim financial statements on the same basis as the audited financial statements and have included, in our opinion, all adjustments, consisting only of normal recurring adjustments that we consider necessary for a fair presentation of the financial information set forth in those statements. You should read this data together with our audited financial statements and related notes appearing elsewhere in this prospectus and the information under the captions “Selected Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our historical results are not necessarily indicative of our future results and are not necessarily indicative of results to be expected for the full year ending December 31, 2014, or any other period.

| Year

Ended December 31, |

Three Months Ended March 31, |

|||||||||||||||

| 2012 | 2013 | 2013 | 2014 | |||||||||||||

| (in thousands, except per share data) |

(unaudited) | |||||||||||||||

| Statements of Operations Data: |

||||||||||||||||

| Revenue |

$ | 5,863 | $ | 17,931 | $ | 2,744 | $ | 7,497 | ||||||||

| Cost of sales |

3,837 | 8,150 | 1,949 | 2,360 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross profit |

2,026 | 9,781 | 795 | 5,137 | ||||||||||||

| Operating expenses: |

||||||||||||||||

| Selling, general and administrative |

9,251 | 18,229 | 3,350 | 6,658 | ||||||||||||

| Research and development |

9,260 | 9,518 | 2,256 | 2,577 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

18,511 | 27,747 | 5,606 | 9,235 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss from operations |

(16,485 | ) | (17,966 | ) | (4,811 | ) | (4,098 | ) | ||||||||

| Other income (expense), net |

120 | (403 | ) | 58 | (311 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss |

$ | (16,365 | ) | $ | (18,369 | ) | $ | (4,753 | ) | $ | (4,409 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss per share, basic and diluted |

$ | (16.38 | ) | $ | (12.57 | ) | $ | (4.57 | ) | $ | (2.49 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average common shares used to compute net loss per share, basic and diluted |

999 | 1,461 | 1,039 | 1,773 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Pro forma net loss per share, basic and diluted (unaudited)(1) |

$ | (1.17 | ) | $ | (0.25 | ) | ||||||||||

|

|

|

|

|

|||||||||||||

| Weighted average common shares used to compute pro forma net loss per share, basic and diluted (unaudited)(1) |

15,655 | 17,474 | ||||||||||||||

|

|

|

|

|

|||||||||||||

10

Table of Contents

| As of March 31, 2014 | ||||||||||||

| (in thousands) |

Actual | Pro Forma(1) | Pro

Forma As Adjusted(2)(3) |

|||||||||

| (unaudited) | ||||||||||||

| Balance Sheet Data: |

||||||||||||

| Cash and cash equivalents |

$ | 7,478 | $ | 7,478 | $ | 60,278 | ||||||

| Working capital |

8,643 | 9,137 | 61,937 | |||||||||

| Total assets |

16,767 | 16,767 | 69,567 | |||||||||

| Preferred stock warrant liability |

494 | — | — | |||||||||

| Total debt |

1,280 | 1,280 | 1,280 | |||||||||

| Total liabilities |

6,783 | 6,289 | 6,289 | |||||||||

| Convertible preferred stock |

90,789 | — | — | |||||||||

| Accumulated deficit |

(82,668 | ) | (82,668 | ) | (82,668 | ) | ||||||

| Total stockholders’ (deficit) equity |

(80,805 | ) | 10,478 | 63,278 | ||||||||

| (1) | Reflects the automatic conversion of all outstanding shares of our convertible preferred stock into an aggregate of 15,703,875 shares of common stock immediately prior to the closing of this offering and the conversion of warrants to purchase up to 67,867 shares of convertible preferred stock into warrants to purchase up to 67,867 shares of common stock immediately prior to the closing of this offering. |

| (2) | Reflects the pro forma adjustments described in footnote (1) above and the sale by us of 5,000,000 shares of common stock in this offering at an assumed initial public offering price of $12.00 per share, the midpoint of the price range set forth on the cover page of this prospectus, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. |

| (3) | A $1.00 increase (decrease) in the assumed initial public offering price of $12.00 per share, the midpoint of the price range set forth on the cover page of this prospectus, would increase (decrease) each of pro forma as adjusted cash and cash equivalents, working capital, total assets and total stockholders’ equity by $4.7 million, assuming the number of shares we are offering, as set forth on the cover page of this prospectus, remains the same, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We may also increase or decrease the number of shares we are offering. An increase (decrease) of 1,000,000 in the number of shares we are offering would increase (decrease) each of pro forma as adjusted cash and cash equivalents, working capital, total assets and total stockholders’ equity by approximately $11.2 million, assuming the assumed initial public offering price per share remains the same. The pro forma as adjusted information is illustrative only, and we will adjust this information based on the actual initial public offering price, number of shares offered and other terms of this offering determined at pricing. |

11

Table of Contents

An investment in our common stock involves a high degree of risk. You should carefully consider the following risk factors together with all of the other information contained in this prospectus, including our financial statements and the related notes, before deciding whether to invest in shares of our common stock. Each of these risks could harm our business, operating results, financial condition or growth prospects. As a result, the trading price of our common stock could decline and you may lose all or part of your investment.

Risks Related to Our Business

We have incurred significant operating losses since inception and may not be able to achieve profitability.

We have incurred net losses since our inception in 2003. For the years ended December 31, 2012 and 2013, and for the three months ended March 31, 2014, we had net losses of $16.4 million, $18.4 million and $4.4 million, respectively. As of March 31, 2014, we had an accumulated deficit of $82.7 million. To date, we have financed our operations primarily through private placements of our equity securities, certain debt-related financing arrangements and from sales of our approved products. We have devoted substantially all of our resources to research and development of our products, sales and marketing activities and clinical and regulatory initiatives to obtain approvals for our products. Our ability to generate sufficient revenue from our existing products or from any of our product candidates in development, and to transition to profitability and generate consistent positive cash flows is uncertain. Following this offering, we expect that our operating expenses will continue to increase as we continue to build our commercial infrastructure, develop, enhance and commercialize new products and incur additional operational and reporting costs associated with being a public company. As a result, we expect to continue to incur operating losses for the foreseeable future and may never achieve profitability.

All of our revenue is generated from our PROPEL and PROPEL mini steroid-eluting implants and we are completely dependent on the success of these products, which have a limited commercial history. If these products fail to gain widespread market acceptance, our business will suffer.

We started selling PROPEL in August 2011 and PROPEL mini in November 2012. We expect that sales of these products will account for substantially all of our revenue for the foreseeable future and therefore our ability to become profitable will depend upon the commercial success of these products. Because of their recent commercial introduction, PROPEL and PROPEL mini have limited product and brand recognition. We market these products primarily to ear, nose and throat, or ENT, physicians and believe they may be slow or fail to adopt our products for a variety of reasons, including, among others:

| • | lack of experience with our products; |

| • | lack of availability of adequate coverage and reimbursement for hospitals, ambulatory surgery centers and physicians; |

| • | lack of evidence supporting cost benefits or cost effectiveness of our products over existing alternatives; |

| • | lack of clinical data supporting patient benefits beyond six months; |

| • | perception that our products are unproven, investigational or experimental; |

| • | liability risks generally associated with the use of new products and procedures; and |

| • | training required to use new products. |

If we are unable to effectively demonstrate to ENT physicians the benefits of our products when used during sinus surgery and our products fail to achieve market acceptance, our future revenue will be adversely impacted. In addition, we believe recommendations and support of our products by influential ENT physicians are essential for market acceptance and adoption. If we do not receive support from these influential ENT physicians, ENT physicians in general may not use our products and our future revenue will be harmed.

Because of the numerous risks and uncertainties associated with our commercialization efforts, we are unable to predict the extent to which we will continue to generate revenue from our products or the timing for

12

Table of Contents

when or the extent to which we will become profitable. Even if we do achieve profitability, we may not be able to sustain or increase profitability on an ongoing basis.

Pricing pressure from our hospital and ambulatory surgery center customers due to limited coverage and reimbursement for our products may impact our ability to sell our products at prices necessary to support our current business strategies.

Hospital and other healthcare provider customers, including ambulatory surgery center customers, that purchase our products typically bill various third-party payors to cover all or a portion of the costs and fees associated with the sinus surgery procedures in which our products are used and bill patients for any deductibles or co-payments. Because there is often no separate reimbursement for supplies used in surgical procedures, the additional cost associated with the use of our steroid-eluting implants can impact the profit margin of the hospital or surgery center where the sinus surgery is performed. Some of our target customers may be unwilling to adopt our steroid-eluting implants in light of the additional associated cost. Further, any decline in the amount payors are willing to reimburse our customers for sinus surgery procedures could make it difficult for existing customers to continue using, or adopt, our steroid-eluting implants and could create additional pricing pressure for us. If we are forced to lower the price we charge for our products, our gross margins will decrease, which will adversely affect our ability to invest in and grow our business.

We are actively seeking new billing codes for our products and the procedure associated with their use, including codes that are established by the Centers for Medicare & Medicaid Services, or CMS, and the American Medical Association, or AMA. Our ability to obtain new billing codes will depend, in part, on support from the ENT community and physician acceptance of our technology. Although obtaining billing codes may result in payment amounts that better reflect the costs and resources of our products and related procedure, there is a possibility that they may not do so.

We cannot assure you that we will be successful in garnering the necessary support for new codes from the ENT community or from third-party payors, who are responsible for determining which billing codes are to be used for procedures performed on their insured population. Even if we are able to establish reimbursement codes for our products, we will continue to be subject to significant pricing pressure, which could harm our business, results of operations, financial condition and prospects.

Our future growth depends on physician awareness and adoption of our steroid-eluting implants.

We focus our sales, marketing and education efforts primarily on ENT physicians. We train physicians on the patient population that would benefit from our steroid-eluting implants. This patient population is based on those included in our clinical studies and includes, for example, patients with or without polyps as well as patients undergoing either primary or revision surgery. Some physicians may choose to utilize our products on a subset of their patients such as patients with severe polyp disease that they deem at higher risk for postoperative complications. If we are not able to effectively demonstrate to those physicians that our products are beneficial in a broad range of patients on which they operate, their adoption of our products will be limited.

We train our physician customers on the proper techniques in using our devices to achieve the intended outcome. The successful use of our steroid-eluting implants depends in large part on the physician’s adherence to the techniques that they are provided in training by our sales representatives. In the event that physicians do not adhere to these techniques or if they perceive that our products are too cumbersome for them to use, we may have difficulty facilitating adoption. Additionally, physicians may develop their own techniques for use of our products during insertion and during the period in which the drug is delivered and is bioabsorbed. For example, we are aware some physicians are removing our steroid-eluting implants before all of the drug has eluted into the surrounding tissue. While physicians were allowed to remove the implant at any time at their discretion in our clinical studies, early removal could lead to suboptimal outcomes. In addition, if physicians utilize our products in a manner that is inconsistent with how they were studied clinically, their outcomes may not be consistent with the outcomes achieved in our clinical studies, which may impact their perception of patient benefit and limit their adoption of our products.

In addition, the initial point of contact for many patients suffering from chronic sinusitis may be primary care physicians or other referring medical professionals who commonly treat patients experiencing sinus-related

13

Table of Contents

symptoms or complications. We believe that we must educate these primary care physicians and other referring medical professionals about our steroid-eluting implants in order to grow the market beyond the over 3.5 million patients with chronic sinusitis who are currently managed by ENT physicians. If we fail to do so, these primary care physicians and other referring medical professionals may not refer patients to an ENT physician who will perform sinus surgery and use our steroid-eluting implants. As a result, those patients may go untreated, attempt to manage their sinusitis through medical management alone or seek alternative surgical procedures. If we are not successful in educating primary care physicians and other referring medical professionals about our steroid-eluting implants, our ability to increase our revenue may be impaired.

We have limited experience marketing and selling our steroid-eluting implants, and if we are unable to expand, manage and maintain our direct sales and marketing organizations we may not be able to generate anticipated revenue.

We started selling our first approved product, PROPEL, on a limited basis in August 2011. We subsequently started selling PROPEL mini in November 2012, and in the first half of 2013 we began to expand and scale our direct sales and marketing organizations in the United States. As a result, we have limited experience marketing and selling our steroid-eluting implants. As of March 31, 2014, our direct sales organization, including marketing, customer service and reimbursement, consisted of 62 employees, having increased from 21 employees as of December 31, 2012. Our operating results are directly dependent upon the sales and marketing efforts of our employees. If our direct sales representatives fail to adequately promote, market and sell our products, our sales may suffer.

In order to generate our anticipated sales, we will need to expand the size and geographic scope of our direct sales organization. As a result, our future success will depend largely on our ability to continue to hire, train, retain and motivate skilled regional sales managers and direct sales representatives with significant technical knowledge of ENT. Because of the competition for their services, we cannot assure you we will be able to hire and retain additional direct sales representatives on favorable or commercially reasonable terms, if at all. Failure to hire or retain qualified sales representatives would prevent us from expanding our business and generating sales. Additionally, new hires require training and take time before they achieve full productivity. If we fail to train new hires adequately, new hires may not become as productive as may be necessary to maintain or increase our sales.

If we are unable to expand our sales and marketing capabilities, we may not be able to effectively commercialize our products, which would adversely affect our business, results of operations and financial condition.

Our clinical studies were designed to demonstrate the safety and efficacy of our steroid-eluting implants based on FDA requirements and may not be seen as compelling to physicians. Any subsequent clinical studies that are conducted and published may not be positive or consistent with our existing data, which would affect the rate of adoption of our products.

Our success depends on the medical community’s acceptance of our steroid-eluting implants as tools that are useful to ENT physicians treating patients with chronic sinusitis. We have sponsored three multi-center, prospective studies of over 200 patients to track outcomes of treatment with our steroid-eluting implants, which clinical data has resulted in the highest level of evidence generated for any product used in sinus surgery. The principal safety and efficacy information of our steroid-eluting implants is derived from the ADVANCE II study, a prospective, multicenter, randomized controlled, double-blind, pivotal study that was completed in September 2010. We also sponsored the ADVANCE study, a prospective, multicenter, single-cohort, open-label trial completed in December 2009 and the PROPEL Pilot Study, a prospective, multicenter, randomized, controlled, double-blind feasibility study completed in April 2009. While the results of these three studies collectively indicate a favorable safety and efficacy profile, the study designs and results may not be viewed as compelling to our physician customers. If physicians do not find our data compelling, they may choose not to use our products or limit their use. Our PROPEL Pilot study and ADVANCE II study incorporated an intra-patient control design comparing PROPEL to a non-drug-eluting control version of the implant in order to maintain blinding. Primary efficacy endpoints for these two studies were measured at 30 days after placement as we believe that proper healing in the immediate postoperative period is indicative of long-term outcomes. Additionally, it was important to allow for medical intervention after day 30 given one sinus side of each patient had the control device. Clinical

14

Table of Contents

efficacy demonstrated at this short-term endpoint does not guarantee long-term clinical benefits. Our ADVANCE study measured patient symptom improvements out to six months. The long-term effects of sinus surgery in conjunction with our steroid-eluting implants beyond six months are not known. Certain ENT physicians, hospitals and surgery centers may prefer to see longer term efficacy data than we have produced. We cannot assure you that any data that we or others generate will be consistent with that observed in these studies nor that results will be maintained beyond the time points studied. We also cannot assure you that any data that may be collected will be compelling to the medical community because the data may not be scientifically meaningful and may not demonstrate that sinus surgery using our steroid-eluting implants is an attractive procedure when compared against data from alternative treatments.

Each ENT physician’s individual experience with our steroid-eluting implants will vary, and we believe that physicians will compare actual long-term outcomes in their own practices using our steroid-eluting implants against sinus surgery used in conjunction with traditional sinus packing techniques. A long-term, adequately-controlled clinical study comparing sinus surgery performed in conjunction with our steroid-eluting implants against sinus surgery performed in conjunction with the variety of traditional sinus packing techniques incorporated by physicians would be expensive and time-consuming and we have not conducted, and are not currently planning to conduct, such a study. If the experience of physicians indicates that the use of our steroid-eluting implants in FESS is not as safe or efficacious as other treatment options or does not provide a lasting solution to patients with chronic sinusitis, adoption of our products may suffer and our business would be harmed.

We utilize third-party, single source suppliers for many of the components and materials used in our steroid-eluting implants, and the loss of any of these suppliers could harm our business.

The active pharmaceutical ingredient, or API, and a number of our critical components used in our steroid-eluting implants are supplied to us from single source suppliers. We rely on single source suppliers for some of our polymer materials, some extrusions and molded components, some off-the-shelf components and for finished goods testing. Our ability to supply our products commercially and to develop our product candidates depends, in part, on our ability to obtain these components in accordance with regulatory requirements and in sufficient quantities for commercialization and clinical testing. We have entered into manufacturing, supply or quality agreements with a number of our single source suppliers pursuant to which they supply the components we need. We are not certain that our single source suppliers will be able to meet our demand for their products, either because of the nature of our agreements with those suppliers, our limited experience with those suppliers or our relative importance as a customer to those suppliers. It may be difficult for us to assess their ability to timely meet our demand in the future based on past performance. While our suppliers have generally met our demand for their products on a timely basis in the past, they may subordinate our needs in the future to their other customers.

Establishing additional or replacement suppliers for the API or any of the components or processes used in our products, if required, may not be accomplished quickly. If we are able to find a replacement supplier, the replacement supplier would need to be qualified and may require additional regulatory authority approval, which could result in further delay. For example, the U.S. Food and Drug Administration, or FDA, could require additional supplemental data if we rely upon a new supplier for the API used in PROPEL and PROPEL mini. While we seek to maintain adequate inventory of the single source components and materials used in our products, any interruption or delay in the supply of components or materials, or our inability to obtain components or materials from alternate sources at acceptable prices in a timely manner, could impair our ability to meet the demand of our customers and cause them to cancel orders.

If our third-party suppliers fail to deliver the required commercial quantities of materials, on a timely basis and at commercially reasonable prices, and we are unable to find one or more replacement suppliers capable of production at a substantially equivalent cost in substantially equivalent volumes and quality, and on a timely basis, the continued commercialization of our products and the development of our product candidates would be impeded, delayed, limited or prevented, which could harm our business, results of operations, financial condition and prospects.

It is difficult to forecast future performance, which may cause our financial results to fluctuate unpredictably.

Our limited operating history and commercial experience make it difficult for us to predict future performance. As we gain additional commercial experience, a number of factors over which we have limited

15

Table of Contents

control may contribute to fluctuations in our financial results, such as seasonal variations in revenue. In the first quarter, our results can be impacted by adverse weather and by resetting of annual patient healthcare insurance plan deductibles, both of which may cause patients to delay elective procedures such as FESS. In the second quarter, demand may be impacted by the seasonal nature of allergies and the resultant onset of sinus-related symptoms. In the third quarter, the number of FESS procedures nationwide is historically lower than other quarters throughout the year, which we believe is attributable to the summer vacations of ENT physicians and their patients. In the fourth quarter, demand may be impacted by the onset of the cold and flu season and related symptoms, as well as the desire of patients to spend their remaining balances in flexible-spending accounts or because they have met their annual deductibles under their health insurance plans. Other factors that may impact our quarterly results include:

| • | ENT physician adoption of our steroid-eluting implants; |

| • | unanticipated pricing pressure; |

| • | the hiring, retention and continued productivity of our sales representatives; |

| • | our ability to expand the geographic reach of our sales and marketing efforts; |

| • | our ability to obtain regulatory clearance or approval for our products in development or for our current products outside the United States; |

| • | results of clinical research and trials on our existing products and products in development; |

| • | delays in receipt of anticipated purchase orders; |

| • | timing of new product offerings, acquisitions, licenses or other significant events by us or our competitors; |

| • | delays in, or failure of, component and raw material deliveries by our suppliers; and |

| • | positive or negative coverage in the media or clinical publications of our steroid-eluting implants or products of our competitors or our industry. |

In the event our actual revenue and operating results do not meet our forecasts for a particular period, the market price of our common stock may decline substantially.

Our long-term growth depends on our ability to develop and commercialize additional ENT products.

It is important to our business that we continue to build a more complete product offering within the ENT market. We are using our drug-eluting bioabsorbable technology to develop new products for use in the physician office setting. Developing additional products is expensive and time-consuming and could divert management’s attention away from our current sinus surgery products and harm our business. Even if we are successful in developing additional products, including those currently in development for use in the physician office setting, the success of any new product offering or enhancement to an existing product will depend on several factors, including our ability to:

| • | properly identify and anticipate ENT physician and patient needs; |

| • | develop and introduce new products or product enhancements in a timely manner; |

| • | avoid infringing upon the intellectual property rights of third parties; |

| • | demonstrate, if required, the safety and efficacy of new products with data from preclinical studies and clinical trials; |

| • | obtain the necessary regulatory clearances or approvals for new products or product enhancements; |

| • | be fully FDA-compliant with marketing of new devices or modified products; |

| • | provide adequate training to potential users of our products; |

| • | receive adequate coverage and reimbursement for procedures performed with our products; and |

| • | develop an effective and FDA-compliant, dedicated sales and marketing team. |

16

Table of Contents

If we are unsuccessful in developing and commercializing additional products in other areas of ENT, our ability to increase our revenue may be impaired.

If clinical studies of our future products do not produce results necessary to support regulatory clearance or approval in the United States or, with respect to our current or future products, elsewhere, we will be unable to commercialize these products.

We will likely need to conduct additional clinical studies in the future to support new product approvals, or for the approval of the use of our products in some foreign countries. Clinical testing takes many years, is expensive and carries uncertain outcomes. The initiation and completion of any of these studies may be prevented, delayed, or halted for numerous reasons, including, but not limited to, the following:

| • | the FDA, institutional review boards or other regulatory authorities do not approve a clinical study protocol, force us to modify a previously approved protocol, or place a clinical study on hold; |

| • | patients do not enroll in, or enroll at a lower rate than we expect, or do not complete a clinical study; |

| • | patients or investigators do not comply with study protocols; |

| • | patients do not return for post-treatment follow-up at the expected rate; |

| • | patients experience unexpected adverse event or side effects for a variety of reasons that may or may not be related to our products; |

| • | sites participating in an ongoing clinical study withdraw, requiring us to engage new sites; |

| • | difficulties or delays associated with establishing additional clinical sites; |

| • | third-party clinical investigators decline to participate in our clinical studies, do not perform the clinical studies on the anticipated schedule, or are inconsistent with the investigator agreement, clinical study protocol, good clinical practices or other agency requirements; |

| • | third-party organizations do not perform data collection and analysis in a timely or accurate manner; |

| • | regulatory inspections of our clinical studies or manufacturing facilities require us to undertake corrective action or suspend or terminate our clinical studies; |

| • | changes in federal, state, or foreign governmental statutes, regulations or policies; |

| • | interim results are inconclusive or unfavorable as to immediate and long-term safety or efficacy; |

| • | the study design is inadequate to demonstrate safety and efficacy; or |

| • | the study does not meet the statistical endpoints. |

Clinical failure can occur at any stage of the testing. Our clinical studies may produce negative or inconclusive results, and we may decide, or regulators may require us, to conduct additional clinical and non-clinical testing in addition to those we have planned. Our failure to adequately demonstrate the safety and efficacy of any of our devices would prevent receipt of regulatory clearance or approval and, ultimately, the commercialization of that device or indication for use. Even if our future products are approved in the United States, commercialization of our products in foreign countries would require approval by regulatory authorities in those countries. Approval procedures vary among jurisdictions and can involve requirements and administrative review periods different from, and greater than, those in the United States, including additional preclinical studies or clinical trials. Any of these occurrences may harm our business, results of operations, financial condition and prospects.

Consolidation in the healthcare industry could lead to demands for price concessions, which may impact our ability to sell our products at prices necessary to support our current business strategies.

Healthcare costs have risen significantly over the past decade, which has driven numerous cost reform initiatives by legislators, regulators and third-party payors. A typical FESS procedure is paid at a Medicare rate of approximately $10,000. Private insurer payment rates average 139 percent of Medicare rates nationally. Cost reform has elicited a consolidation trend in the healthcare industry to aggregate purchasing power, which may

17

Table of Contents

create more requests for pricing concessions in the future. Additionally, group purchasing organizations, independent delivery networks and large single accounts may continue to use their market power to consolidate purchasing decisions for hospitals and ambulatory surgery centers. We expect that market demand, government regulation, third-party coverage and reimbursement policies and societal pressures will continue to change the healthcare industry worldwide, resulting in further business consolidations and alliances among our customers, which may exert further downward pressure on the prices of our products and may adversely impact our business, results of operations, financial condition and prospects.

We compete or may compete in the future against other companies, some of which have longer operating histories, more established products and greater resources, which may prevent us from achieving significant market penetration or improved operating results.