Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WESTLAKE CHEMICAL CORP | d758564d8k.htm |

Exhibit 10.1

EXECUTION VERSION

THIRD AMENDED AND RESTATED CREDIT AGREEMENT

Dated as of July 17, 2014

among

THE FINANCIAL INSTITUTIONS NAMED HEREIN

as the Lenders

and

BANK OF AMERICA, N.A.

as the Agent

DEUTSCHE BANK AG SECURITIES INC.,

JPMORGAN CHASE BANK, N.A.,

and

WELLS FARGO CAPITAL FINANCE, LLC

as Co-Syndication Agents

BANK OF AMERICA, N.A.

as the Sole Lead Arranger and Book Runner

and

WESTLAKE CHEMICAL CORPORATION

and each other Person listed on Schedule 1 hereto,

as the Borrowers

$400,000,000

TABLE OF CONTENTS

| Section |

Page | |||||

| ARTICLE 1. LOANS AND LETTERS OF CREDIT |

1 | |||||

| 1.1 |

Total Facility. |

1 | ||||

| 1.2 |

Revolving Loans. |

2 | ||||

| 1.3 |

Letters of Credit. |

5 | ||||

| 1.4 |

Bank Products. |

10 | ||||

| ARTICLE 2. INTEREST AND FEES |

10 | |||||

| 2.1 |

Interest. |

10 | ||||

| 2.2 |

Continuation and Conversion Elections. |

11 | ||||

| 2.3 |

Maximum Interest Rate. |

12 | ||||

| 2.4 |

Closing Fee. |

12 | ||||

| 2.5 |

Unused Line Fee. |

12 | ||||

| 2.6 |

Letter of Credit Fee. |

13 | ||||

| ARTICLE 3. PAYMENTS AND PREPAYMENTS |

13 | |||||

| 3.1 |

Revolving Loans. |

13 | ||||

| 3.2 |

Full or Partial Termination of Facility. |

13 | ||||

| 3.3 |

Prepayments of the Loans. |

13 | ||||

| 3.4 |

LIBOR Rate Loan Prepayments. |

14 | ||||

| 3.5 |

Payments by the Borrowers. |

14 | ||||

| 3.6 |

Payments as Revolving Loans. |

15 | ||||

| 3.7 |

Apportionment, Application and Reversal of Payments. |

15 | ||||

| 3.8 |

Indemnity for Returned Payments. |

15 | ||||

| 3.9 |

Agent’s and Lenders’ Books and Records; Monthly Statements. |

16 | ||||

| ARTICLE 4. TAXES, YIELD PROTECTION AND ILLEGALITY |

16 | |||||

| 4.1 |

Taxes. |

16 | ||||

| 4.2 |

Lender Tax Information. |

18 | ||||

| 4.3 |

Illegality. |

20 | ||||

| 4.4 |

Increased Costs; Capital Adequacy. |

20 | ||||

| 4.5 |

Funding Losses. |

21 | ||||

| 4.6 |

Inability to Determine Rates. |

21 | ||||

| 4.7 |

Certificates of the Agent. |

21 | ||||

| 4.8 |

Delay in Requests. |

22 | ||||

| 4.9 |

Mitigation. |

22 | ||||

| 4.10 |

Replacement of Lenders. |

22 | ||||

| 4.11 |

Survival. |

22 | ||||

| ARTICLE 5. BOOKS AND RECORDS; FINANCIAL INFORMATION; NOTICES |

22 | |||||

| 5.1 |

Books and Records. |

22 | ||||

| 5.2 |

Financial Information. |

23 | ||||

| 5.3 |

Notices to the Agent. |

26 | ||||

| ARTICLE 6. GENERAL WARRANTIES AND REPRESENTATIONS |

28 | |||||

| 6.1 |

Authorization, Validity, and Enforceability of this Agreement and the Loan Documents. |

28 | ||||

| 6.2 |

Validity and Priority of Security Interest. |

28 | ||||

i

| 6.3 |

Organization and Qualification. |

29 | ||||

| 6.4 |

Corporate Name; Prior Transactions. |

29 | ||||

| 6.5 |

Subsidiaries and Affiliates. |

29 | ||||

| 6.6 |

Financial Statements and Projections. |

29 | ||||

| 6.7 |

Solvency. |

29 | ||||

| 6.8 |

Real Estate; Leases. |

30 | ||||

| 6.9 |

Proprietary Rights. |

30 | ||||

| 6.10 |

Trade Names. |

30 | ||||

| 6.11 |

Litigation. |

30 | ||||

| 6.12 |

Labor Disputes. |

30 | ||||

| 6.13 |

Environmental Laws. |

31 | ||||

| 6.14 |

No Violation of Law. |

32 | ||||

| 6.15 |

No Default. |

32 | ||||

| 6.16 |

ERISA Compliance. |

32 | ||||

| 6.17 |

Taxes. |

32 | ||||

| 6.18 |

Regulated Entities. |

33 | ||||

| 6.19 |

Use of Proceeds; Margin Regulations. |

33 | ||||

| 6.20 |

Copyrights, Patents, Trademarks and Licenses, etc. |

33 | ||||

| 6.21 |

No Material Adverse Change. |

33 | ||||

| 6.22 |

Full Disclosure. |

33 | ||||

| 6.23 |

Locations of Collateral. |

34 | ||||

| 6.24 |

Deposit Accounts. |

34 | ||||

| 6.25 |

Governmental Authorization. |

34 | ||||

| 6.26 |

No Restrictions. |

34 | ||||

| 6.27 |

OFAC. |

34 | ||||

| 6.28 |

Anti-Corruption Laws. |

34 | ||||

| ARTICLE 7. AFFIRMATIVE AND NEGATIVE COVENANTS |

35 | |||||

| 7.1 |

Taxes and Other Obligations. |

35 | ||||

| 7.2 |

Legal Existence and Good Standing. |

35 | ||||

| 7.3 |

Compliance with Law and Agreements; Maintenance of Licenses; Amendments to Charter Documents. |

35 | ||||

| 7.4 |

Maintenance of Property; Inspection of Property. |

35 | ||||

| 7.5 |

Insurance. |

36 | ||||

| 7.6 |

Insurance and Condemnation Proceeds. |

37 | ||||

| 7.7 |

Environmental Laws. |

37 | ||||

| 7.8 |

Compliance with ERISA. |

37 | ||||

| 7.9 |

Mergers; Consolidations; or Sales. |

38 | ||||

| 7.10 |

Distributions; Capital Change; Restricted Investments. |

40 | ||||

| 7.11 |

Transactions Affecting Collateral or Obligations. |

42 | ||||

| 7.12 |

Guaranties. |

42 | ||||

| 7.13 |

Debt. |

42 | ||||

| 7.14 |

Payment / Prepayment of Debt. |

43 | ||||

| 7.15 |

Transactions with Affiliates. |

44 | ||||

| 7.16 |

Business Conducted. |

46 | ||||

| 7.17 |

Liens. |

46 | ||||

| 7.18 |

Sale and Leaseback Transactions. |

46 | ||||

| 7.19 |

New Subsidiaries. |

46 | ||||

| 7.20 |

Fiscal Year. |

46 | ||||

| 7.21 |

Fixed Charge Coverage Ratio. |

46 | ||||

| 7.22 |

Use of Proceeds. |

46 | ||||

ii

| 7.23 |

Collateral. |

47 | ||||

| 7.24 |

[Reserved]. |

48 | ||||

| 7.25 |

Permitted Acquisitions. |

48 | ||||

| 7.26 |

Excluded Deposit Accounts. |

49 | ||||

| 7.27 |

Further Assurances. |

50 | ||||

| 7.28 |

Designation of Restricted and Unrestricted Subsidiaries; Restricted Investments in Unrestricted Subsidiaries. |

50 | ||||

| 7.29 |

Anti-Corruption Laws. |

52 | ||||

| ARTICLE 8. CONDITIONS OF LENDING |

52 | |||||

| 8.1 |

Conditions Precedent to Making of Loans on the Closing Date. |

52 | ||||

| 8.2 |

Conditions Precedent to Each Loan. |

54 | ||||

| ARTICLE 9. DEFAULT; REMEDIES |

54 | |||||

| 9.1 |

Events of Default. |

54 | ||||

| 9.2 |

Remedies. |

57 | ||||

| ARTICLE 10. TERM AND TERMINATION |

58 | |||||

| 10.1 |

Term and Termination. |

58 | ||||

| ARTICLE 11. AMENDMENTS; WAIVERS; PARTICIPATIONS; ASSIGNMENTS; SUCCESSORS |

59 | |||||

| 11.1 |

Amendments and Waivers. |

59 | ||||

| 11.2 |

Assignments; Participations. |

60 | ||||

| ARTICLE 12. THE AGENT |

63 | |||||

| 12.1 |

Appointment and Authorization. |

63 | ||||

| 12.2 |

Delegation of Duties. |

63 | ||||

| 12.3 |

Liability of Agent. |

63 | ||||

| 12.4 |

Reliance by Agent. |

64 | ||||

| 12.5 |

Notice of Default. |

64 | ||||

| 12.6 |

Credit Decision. |

64 | ||||

| 12.7 |

Indemnification. |

65 | ||||

| 12.8 |

Agent in Individual Capacity. |

65 | ||||

| 12.9 |

Successor Agent. |

65 | ||||

| 12.10 |

Collateral Matters. |

65 | ||||

| 12.11 |

Restrictions on Actions by Lenders; Sharing of Payments. |

67 | ||||

| 12.12 |

Agency for Perfection. |

68 | ||||

| 12.13 |

Payments by Agent to Lenders. |

68 | ||||

| 12.14 |

Settlement. |

68 | ||||

| 12.15 |

Concerning the Collateral and the Related Loan Documents. |

71 | ||||

| 12.16 |

Field Audit and Examination Reports; Disclaimer by Lenders. |

71 | ||||

| 12.17 |

Relation Among Lenders. |

72 | ||||

| 12.18 |

Co-Agents. |

72 | ||||

| 12.19 |

Bank Product Providers. |

72 | ||||

| ARTICLE 13. MISCELLANEOUS |

72 | |||||

| 13.1 |

No Waivers; Cumulative Remedies. |

72 | ||||

| 13.2 |

Severability. |

73 | ||||

| 13.3 |

Governing Law; Choice of Forum; Service of Process. |

73 | ||||

| 13.4 |

WAIVER OF JURY TRIAL. |

74 | ||||

iii

| 13.5 |

Survival of Representations and Warranties. |

74 | ||||

| 13.6 |

Other Security and Guaranties. |

74 | ||||

| 13.7 |

Fees and Expenses. |

75 | ||||

| 13.8 |

Notices. |

75 | ||||

| 13.9 |

Waiver of Notices. |

77 | ||||

| 13.10 |

Binding Effect. |

77 | ||||

| 13.11 |

Indemnity of the Agent, the Arranger, the Letter of Credit Issuers and the Lenders by the Borrowers. |

77 | ||||

| 13.12 |

Limitation of Liability. |

78 | ||||

| 13.13 |

No Advisory or Fiduciary Responsibility. |

78 | ||||

| 13.14 |

Final Agreement. |

78 | ||||

| 13.15 |

Counterparts. |

79 | ||||

| 13.16 |

Captions. |

79 | ||||

| 13.17 |

Right of Setoff. |

79 | ||||

| 13.18 |

Confidentiality. |

79 | ||||

| 13.19 |

Conflicts with Other Loan Documents. |

80 | ||||

| 13.20 |

Westlake as Agent. |

80 | ||||

| 13.21 |

Patriot Act Notice. |

81 | ||||

| 13.22 |

Restatement of Existing Credit Agreement. |

81 | ||||

| 13.23 |

Confirmations. |

81 | ||||

| 13.24 |

Electronic Execution. |

82 | ||||

| 13.25 |

Consent to MLP Transaction. |

82 |

ANNEXES, EXHIBITS AND SCHEDULES

| ANNEX A | – | DEFINITIONS | ||

| EXHIBIT A | – | FORM OF NOTE | ||

| EXHIBIT B | – | FORM OF BORROWING BASE CERTIFICATE | ||

| EXHIBIT C | – | FORM OF OBLIGATION GUARANTY | ||

| EXHIBIT D | – | FORM OF NOTICE OF BORROWING | ||

| EXHIBIT E | – | FORM OF NOTICE OF CONTINUATION/CONVERSION | ||

| EXHIBIT F | – | FORM OF ASSIGNMENT AND ACCEPTANCE AGREEMENT | ||

| EXHIBIT G | – | FORM OF COMPLIANCE CERTIFICATE | ||

| SCHEDULE 1 | – | BORROWERS | ||

| SCHEDULE 1.2 | – | LENDERS’ COMMITMENTS | ||

| SCHEDULE 6.4 | – | PRIOR CORPORATE NAMES | ||

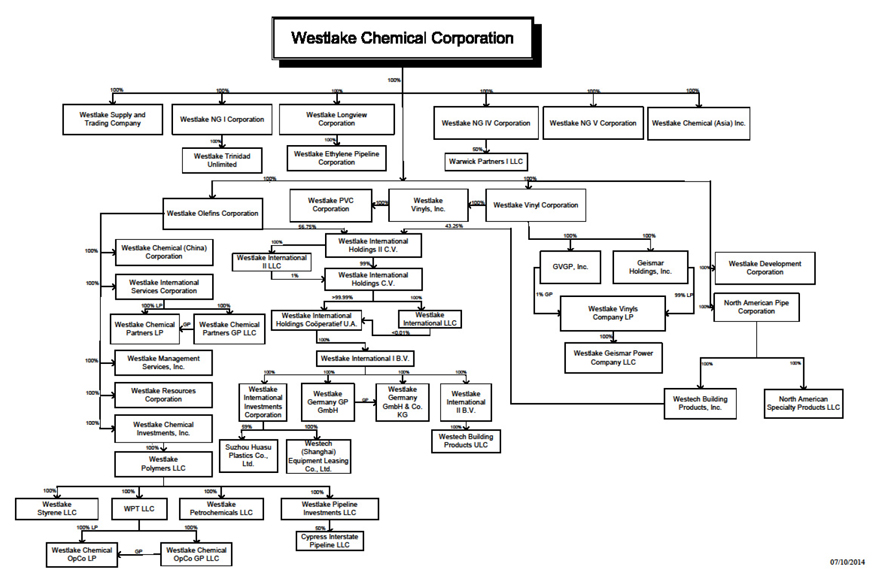

| SCHEDULE 6.5 | – | SUBSIDIARIES AND AFFILIATES | ||

| SCHEDULE 6.9 | – | PROPRIETARY RIGHTS | ||

| SCHEDULE 6.10 | – | TRADE NAMES | ||

| SCHEDULE 6.11 | – | LITIGATION | ||

| SCHEDULE 6.12 | – | LABOR DISPUTES | ||

| SCHEDULE 6.13 | – | ENVIRONMENTAL LAW | ||

| SCHEDULE 6.16 | – | ERISA COMPLIANCE | ||

| SCHEDULE 6.23 | – | LOCATIONS OF COLLATERAL | ||

| SCHEDULE 6.24 | – | DEPOSIT ACCOUNTS | ||

| SCHEDULE 7.10 | – | EXISTING INVESTMENTS | ||

| SCHEDULE 7.13 | – | DEBT AND EXISTING LETTERS OF CREDIT | ||

| SCHEDULE 7.17 | – | EXISTING LIENS | ||

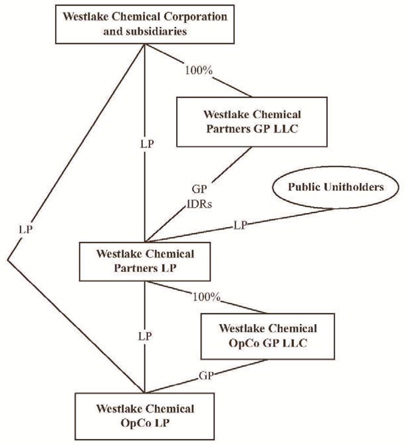

| SCHEDULE 13.25 | FORMATION TRANSACTIONS AND PARTNERSHIP STRUCTURE; PROSPECTUS SUMMARY | |||

iv

Exhibit 10.1

THIRD AMENDED AND RESTATED CREDIT AGREEMENT

This Third Amended and Restated Credit Agreement, dated as of July 17, 2014 (this “Agreement”) among the financial institutions from time to time parties hereto (such financial institutions, together with their respective successors and assigns, are referred to hereinafter each individually as a “Lender” and collectively as the “Lenders”), Bank of America, N.A. with an office at 901 Main Street, Dallas, Texas, 75202, as agent for the Lenders (in its capacity as agent, the “Agent”), and Westlake Chemical Corporation, a Delaware corporation (“Westlake”) and certain of its domestic subsidiaries listed on Schedule 1 hereto, each with offices at 2801 Post Oak Boulevard, Houston, Texas 77056 (each a “Borrower” and collectively, all Borrowers, including Westlake, the “Borrowers”).

W I T N E S S E T H:

WHEREAS, Westlake and certain of its domestic subsidiaries as borrowers, the Agent, and lenders party thereto entered into that certain Credit Agreement dated as of July 31, 2003 (as amended from time to time prior to September 8, 2008, the “2003 Credit Agreement”);

WHEREAS, the 2003 Credit Agreement was amended and restated in its entirety by that certain Amended and Restated Credit Agreement dated as of September 8, 2008 (as amended from time to time prior to September 16, 2011, the “2008 Credit Agreement”);

WHEREAS, the 2008 Credit Agreement was further amended and restated in its entirety by that certain Second Amended and Restated Credit Agreement dated as of September 16, 2011 (as amended from time to time prior to the date hereof, the “Existing Credit Agreement”);

WHEREAS, Westlake and other Borrowers have requested that the Lenders amend certain provisions of the Existing Credit Agreement, and the parties have agreed to amend and restate the Existing Credit Agreement, in each case, upon the terms and conditions set forth in this Agreement; and

WHEREAS, capitalized terms used in this Agreement and not otherwise defined herein shall have the meanings ascribed thereto in Annex A, which is attached hereto and incorporated herein; the rules of construction contained therein shall govern the interpretation of this Agreement, and all Annexes, Exhibits, and Schedules attached hereto are incorporated herein by reference.

NOW, THEREFORE, in consideration of the mutual conditions and agreements set forth in this Agreement, and for good and valuable consideration, the receipt of which is hereby acknowledged, the Lenders, the Agent, and the Borrowers hereby agree as follows.

ARTICLE 1.

LOANS AND LETTERS OF CREDIT

1.1 Total Facility. Subject to all of the terms and conditions of this Agreement, the Lenders agree to make available a total credit facility of up to $400,000,000 (as such amount may be increased or reduced from time to time pursuant to the terms of this Agreement, the “Total Facility”) to the Borrowers from time to time during the term of this Agreement. The Total Facility shall be composed of a revolving line of credit consisting of Revolving Loans and Letters of Credit described herein.

1.2 Revolving Loans.

(a) Revolving Loans and Notes.

(i) Amounts. Subject to the satisfaction of the conditions precedent set forth in Article 8, each Lender severally, but not jointly, agrees, upon any Borrower’s request from time to time on any Business Day during the period from the Closing Date to the Termination Date, to make revolving loans (the “Revolving Loans”) to the Borrowers in amounts not to exceed such Lender’s Pro Rata Share of Availability, except for Non-Ratable Loans and Agent Advances. The Lenders, however, in their unanimous discretion, may elect to make Revolving Loans or issue or arrange to have issued Letters of Credit in excess of the Borrowing Base but not in excess of the Maximum Revolver Amount on one or more occasions, but if they do so, neither the Agent nor the Lenders shall be deemed thereby to have changed the limits of the Borrowing Base or to be obligated to exceed such limits on any other occasion. If any Borrowing would exceed Availability, the Lenders may refuse to make or may otherwise restrict the making of Revolving Loans as the Lenders determine until such excess has been eliminated, subject to the Agent’s authority, in its sole discretion, to make Agent Advances pursuant to the terms of Section 1.2(i).

(ii) The Borrowers shall execute and deliver to each Lender requesting a note, a note, an amended and restated note, or a second amended and restated note, as applicable, to evidence the Revolving Loan of that Lender. Each note shall be in the principal amount of the requesting Lender’s Pro Rata Share of the Maximum Revolver Amount, dated the date hereof and substantially in the form of Exhibit A (each a “Note” and, collectively, the “Notes”). Each Note shall represent the obligation of the Borrowers to pay the amount of the requesting Lender’s Pro Rata Share of the Maximum Revolver Amount, or, if less, such Lender’s Pro Rata Share of the aggregate unpaid principal amount of all Revolving Loans to the Borrowers together with interest thereon as prescribed in Section 2.1. The entire unpaid balance of the Revolving Loans and all other Obligations (other than Bank Products that the applicable Lender chooses not to terminate and indemnity obligations that survive the termination of this Agreement and are not due and payable at such termination) shall be immediately due and payable in full in immediately available funds on the Termination Date.

(b) Procedure for Borrowing.

(i) Each Borrowing shall be made upon any Borrower’s irrevocable written notice delivered to the Agent in the form of a notice of borrowing in substantially the form of Exhibit D (“Notice of Borrowing”) and signed by Westlake, on its behalf and as agent for the other Borrowers, which Notice of Borrowing shall be received by the Agent prior to (i) 12:00 noon (Houston, Texas time) three (3) Business Days prior to the requested Funding Date, in the case of LIBOR Rate Loans and (ii) 12:30 p.m. (Houston, Texas time) on the requested Funding Date, in the case of Base Rate Loans, specifying:

(A) the amount of the Borrowing, which in the case of a LIBOR Rate Loan must equal or exceed $5,000,000 (and integral increments of $1,000,000 in excess of such amount);

(B) the requested Funding Date, which must be a Business Day;

(C) whether the Revolving Loans requested are to be Base Rate Loans or LIBOR Rate Loans (and if not specified, it shall be deemed a request for a Base Rate Loan);

2

(D) the duration of the Interest Period for LIBOR Rate Loans (and if not specified, it shall be deemed a request for an Interest Period of one month); and

(E) the Borrower or Borrowers which are to receive all or any portion of such Borrowing and the amount of such Borrowing to be advanced to such Borrower or Borrowers.

(ii) In lieu of delivering a Notice of Borrowing, the Borrowers may give the Agent telephonic notice of such request for advances to the Designated Account on or before the deadline set forth above. The Agent at all times shall be entitled to rely on such telephonic notice in making such Revolving Loans, regardless of whether any written confirmation is received.

(iii) In lieu of delivering a Notice of Borrowing, the Borrowers may also request Borrowings in accordance with any ancillary agreements entered into by the Agent and the Borrowers from time to time relating to borrowing procedures.

(iv) The Borrowers shall have no right to request a LIBOR Rate Loan while a Default or Event of Default has occurred and is continuing.

(c) Reliance upon Authority. Prior to the Closing Date, the Borrowers shall deliver to the Agent, a notice setting forth the account of the Borrowers (“Designated Account”) to which the Agent is authorized to transfer the proceeds of the Revolving Loans requested hereunder. The Borrowers may designate a replacement account from time to time by written notice. All such Designated Accounts must be reasonably satisfactory to the Agent. The Agent is entitled to rely conclusively on any person’s request for Revolving Loans on behalf of the Borrowers, so long as the proceeds thereof are to be transferred to the Designated Account. The Agent has no duty to verify the identity of any individual representing himself or herself as a person authorized by the Borrowers to make such requests on its behalf.

(d) No Liability. The Agent shall not incur any liability to the Borrowers as a result of acting upon any notice referred to in Sections 1.2(b) and (c), which the Agent believes in good faith to have been given by an officer or other person duly authorized by any Borrower to request Revolving Loans on its behalf. The crediting of Revolving Loans to the Designated Account conclusively establishes the obligation of the Borrowers to repay such Revolving Loans as provided herein.

(e) Notice Irrevocable. Any Notice of Borrowing (or telephonic notice in lieu thereof) made pursuant to Section 1.2(b) shall be irrevocable. The Borrowers shall be bound to borrow the funds requested therein in accordance therewith.

(f) Agent’s Election. Promptly after receipt of a Notice of Borrowing (or telephonic notice in lieu thereof), the Agent shall elect to have the terms of Section 1.2(g) or the terms of Section 1.2(h) apply to such requested Borrowing. If the Bank declines in its sole discretion to make a Non-Ratable Loan pursuant to Section 1.2(h), the terms of Section 1.2(g) shall apply to the requested Borrowing.

(g) Making of Revolving Loans. If the Agent elects to have the terms of this Section 1.2(g) apply to a requested Borrowing, then promptly after receipt of a Notice of Borrowing or telephonic notice in lieu thereof, the Agent shall notify the Lenders by telecopy,

3

telephone or e-mail of the requested Borrowing. Each Lender shall transfer its Pro Rata Share of the requested Borrowing available to the Agent in immediately available funds, to the account from time to time designated by the Agent, not later than 2:30 p.m. (Houston, Texas time) on the applicable Funding Date. After the Agent’s receipt of all proceeds of such Revolving Loans, the Agent shall make the proceeds of such Revolving Loans available to the Borrowers on the applicable Funding Date by transferring same day funds to the Designated Account; provided, however, that the amount of Revolving Loans so made on any date shall not exceed the Availability on such date.

(h) Making of Non-Ratable Loans.

(i) If any Borrower requests a Base Rate Loan and the Agent elects, with the consent of the Bank, to have the terms of this Section 1.2(h) apply to a requested Borrowing, the Bank shall make a Revolving Loan in the amount of that Borrowing available to the Borrowers on the applicable Funding Date by transferring same day funds to the Designated Account. Each Revolving Loan made solely by the Bank pursuant to this Section 1.2(h) is herein referred to as a “Non-Ratable Loan,” and such Revolving Loans are collectively referred to as the “Non-Ratable Loans.” Each Non-Ratable Loan shall be subject to all the terms and conditions applicable to other Revolving Loans except that all payments thereon shall be payable to the Bank solely for its own account. The aggregate amount of Non-Ratable Loans outstanding at any time shall not exceed $40,000,000. The Agent shall not request the Bank to make any Non-Ratable Loan if (1) the Agent has received written notice from any Lender that one or more of the applicable conditions precedent set forth in Article 8 will not be satisfied on the requested Funding Date for the applicable Borrowing, or (2) the requested Borrowing would exceed Availability on that Funding Date.

(ii) The Non-Ratable Loans shall be secured by the Agent’s Liens in and to the Collateral and shall constitute Base Rate Loans and Obligations hereunder.

(i) Agent Advances.

(i) Subject to the limitations set forth below, the Agent is authorized by the Borrowers and the Lenders, from time to time in the Agent’s sole discretion, (A) after the occurrence of a Default or an Event of Default, or (B) at any time that any of the other conditions precedent set forth in Article 8 have not been satisfied, to make Base Rate Loans to the Borrowers on behalf of the Lenders in an aggregate amount outstanding at any time not to exceed 5% of the Borrowing Base but not in excess of the Maximum Revolver Amount which the Agent, in its reasonable business judgment, deems necessary or desirable (1) to preserve or protect the Collateral, or any portion thereof, (2) to enhance the likelihood of, or maximize the amount of, repayment of the Revolving Loans and other Obligations, or (3) to pay any other amount chargeable to the Borrowers pursuant to the terms of this Agreement, including costs, fees, and expenses as described in Section 13.7 (any of such advances are herein referred to as “Agent Advances”); provided, that the Required Lenders may at any time revoke the Agent’s authorization to make Agent Advances. Any such revocation must be in writing and shall become effective prospectively upon the Agent’s receipt thereof.

(ii) The Agent Advances shall be secured by the Agent’s Liens in and to the Collateral and shall constitute Base Rate Loans and Obligations hereunder.

4

(j) Increase in Commitments. The Borrowers may request an increase in the Commitments from time to time upon notice to the Agent, as long as (a) the requested increase is in a minimum amount of $25,000,000 and is offered on the same terms as existing Commitments, except for a closing fee specified by the Borrowers, (b) increases under this Section do not exceed $200,000,000 in the aggregate and no more than four (4) increases are made, (c) no reduction in Commitments pursuant to Section 3.2 has occurred prior to the requested increase, (d) the Agent shall have received certified copies of the resolutions of Westlake approving such increase in the Commitments, (e) the increased Commitments shall be on the same terms and conditions as the existing Commitments, (f) the Borrowers shall deliver any legal opinions or other documents reasonably requested by the Agent, and (g) the Borrowers shall pay, on demand, all fees and reasonable costs and expenses (including Attorney Costs) paid or incurred by the Agent and the Arranger in connection with the increase in the Commitments. The Agent shall promptly notify Lenders of the requested increase and, within ten (10) Business Days thereafter, each Lender shall notify the Agent if and to what extent such Lender commits to increase its Commitment; provided that no Lender shall have any obligation to increase its Commitment. Any Lender not responding within such period shall be deemed to have declined an increase. If Lenders fail to commit to the full requested increase, Eligible Assignees may issue additional Commitments and become Lenders hereunder. The Agent may allocate, in its discretion, the increased Commitments among committing Lenders and, if necessary, Eligible Assignees. Provided the conditions set forth in Section 8.2 are satisfied, total Commitments shall be increased by the requested amount (or such lesser amount committed by Lenders and Eligible Assignees) on a date agreed upon by the Agent and the Borrowers, but no later than forty-five (45) days following the Borrowers’ increase request. The Agent, the Borrowers, and new and existing Lenders shall execute and deliver such documents and agreements as the Agent deems appropriate to evidence the increase in and allocations of the Commitments. On the effective date of an increase, all outstanding Revolving Loans, Letter of Credit Obligations and other exposures shall be reallocated among Lenders, and settled by the Agent if necessary, in accordance with Lenders’ adjusted shares of such Commitments.

1.3 Letters of Credit.

(a) Agreement to Issue. Subject to the terms and conditions of this Agreement, each Letter of Credit Issuer, as requested by any Borrower, agrees to issue, and to amend or renew Letters of Credit previously issued by it in accordance with this Section 1.3, for the account of any Borrower one or more commercial/documentary and standby letters of credit (each a “Letter of Credit” and collectively, the “Letters of Credit”) and the Agent agrees to provide credit support or other enhancement to a letter of credit issuer acceptable to the Agent, which issues a letter of credit for the account of any Borrower (any such credit support or enhancement being herein referred to as a “Credit Support”) from time to time during the term of this Agreement. All Existing Letters of Credit shall be deemed to have been issued pursuant hereto, and from and after the Closing Date shall be subject to and governed by the terms and conditions hereof.

(b) Amounts; Outside Expiration Date. A Letter of Credit Issuer shall not have any obligation to issue any Letter of Credit and the Agent shall not have any obligation to provide Credit Support at any time if: (i) the maximum face amount of the requested Letter of Credit is greater than the Unused Letter of Credit Subfacility at such time; (ii) the maximum undrawn amount of the requested Letter of Credit and all commissions, fees, and charges due from the Borrowers in connection with the opening thereof would exceed Availability at such time; or (iii) such Letter of Credit has an expiration date less than thirty (30) days prior to the Stated Termination Date or more than twelve (12) months from the date of issuance for standby letters of credit and 180 days from the date of issuance for documentary letters of credit; provided that

5

any Letter of Credit issued in connection with the IRBs may have an expiration date of not later than the Termination Date. With respect to any Letter of Credit which contains any “evergreen” or automatic renewal provision, each Lender shall be deemed to have consented to any such extension or renewal unless any such Lender shall have provided to the Agent, written notice that it declines to consent to any such extension or renewal at least thirty (30) days prior to the date on which the applicable Letter of Credit Issuer is entitled to decline to extend or renew the Letter of Credit. If all of the requirements of this Section 1.3 are met and no Default or Event of Default has occurred and is continuing, no Lender shall decline to consent to any such extension or renewal.

(c) Other Conditions. In addition to conditions precedent contained in Article 8, the obligation of a Letter of Credit Issuer to issue any Letter of Credit and the obligation of the Agent to provide Credit Support is subject to the following conditions precedent having been satisfied in a manner reasonably satisfactory to the Agent:

(i) The Borrowers shall have delivered to the applicable Letter of Credit Issuer, at such times and in such manner as such Letter of Credit Issuer may prescribe, an application in form and substance satisfactory to such Letter of Credit Issuer and reasonably satisfactory to the Agent for the issuance of the Letter of Credit and such other documents as may be required pursuant to the terms thereof, and the form, terms and purpose of the proposed Letter of Credit shall be reasonably satisfactory to the Agent and such Letter of Credit Issuer; and

(ii) If a Defaulting Lender exists, no Letter of Credit Issuer shall have any obligation to issue any Letter of Credit and the Agent shall not have any obligation to provide any Credit Support, until such Lender or the Borrowers have entered into arrangements satisfactory to the Agent and the applicable Letter of Credit Issuer to eliminate any Fronting Exposure associated with the Defaulting Lender; and

(iii) As of the date of issuance, no order of any court, arbitrator or Governmental Authority shall purport by its terms to enjoin or restrain money center banks generally from issuing letters of credit of the type and in the amount of the proposed Letter of Credit, and no law, rule or regulation applicable to money center banks generally and no request or directive (whether or not having the force of law) from any Governmental Authority with jurisdiction over money center banks generally shall prohibit, or request that the proposed Letter of Credit Issuer refrain from, the issuance of letters of credit generally or the issuance of such Letters of Credit.

(d) Issuance of Letters of Credit.

(i) Request for Issuance. The Borrowers must notify the Agent of a requested Letter of Credit at least three (3) Business Days prior to the proposed issuance date. Such notice shall be irrevocable and must specify the proposed Letter of Credit Issuer, the original face amount of the Letter of Credit requested, the Business Day of issuance of such requested Letter of Credit, whether such Letter of Credit is standby, commercial, or documentary, whether such Letter of Credit may be drawn in a single or in partial draws, the Business Day on which the requested Letter of Credit is to expire, the purpose for which such Letter of Credit is to be issued, and the beneficiary of the requested Letter of Credit. The Borrowers shall attach to such notice the proposed form of the Letter of Credit.

6

(ii) Responsibilities of the Agent; Issuance. As of the Business Day immediately preceding the requested issuance date of the Letter of Credit, the Agent shall determine the amount of the applicable Unused Letter of Credit Subfacility and Availability. If (A) the face amount of the requested Letter of Credit is less than the Unused Letter of Credit Subfacility and (B) the amount of such requested Letter of Credit and all commissions, fees, and charges due from the Borrowers in connection with the opening thereof would not exceed Availability, the Agent shall notify the applicable Letter of Credit Issuer and such Letter of Credit Issuer shall issue the requested Letter of Credit on the requested issuance date so long as the other conditions hereof are met. No Letter of Credit Issuer shall issue any Letter of Credit without receiving prior notice or confirmation from the Agent that the foregoing clauses (A) and (B) are met.

(iii) No Extensions or Amendment. No Letter of Credit Issuer shall be obligated to extend or amend any Letter of Credit issued pursuant hereto unless the requirements of this Section 1.3 are met as though a new Letter of Credit were being requested and issued.

(e) Assumption of Risk; Rights of Letter of Credit Issuers.

(i) Assumption of Risk by the Borrowers. The Borrowers assume all risks of the acts, omissions or misuses of any Letter of Credit by the beneficiary. In connection with issuance of any Letter of Credit, none of the Agent, any Letter of Credit Issuer or any Lender shall be responsible for the existence, character, quality, quantity, condition, packing, value or delivery of any goods purported to be represented by any Letter of Credit Documents; any differences or variation in the character, quality, quantity, condition, packing, value or delivery of any goods from that expressed in any documents; the form, validity, sufficiency, accuracy, genuineness or legal effect of any documents or of any endorsements thereon; the time, place, manner or order in which shipment of goods is made; partial or incomplete shipment of, or failure to ship, any goods referred to in a Letter of Credit or any Letter of Credit Documents; any deviation from instructions, delay, default or fraud by any shipper or other Person in connection with any goods, shipment or delivery; any breach of contract between a shipper or vendor and a Borrower; errors, omissions, interruptions or delays in transmission or delivery of any messages, by mail, cable, telegraph, telex, telecopy, e-mail, telephone or otherwise; errors in interpretation of technical terms; the misapplication by a beneficiary of any Letter of Credit or the proceeds thereof; or any consequences arising from causes beyond the control of any Letter of Credit Issuer, the Agent or any Lender, including any act or omission of a Governmental Authority. The rights and remedies of the Letter of Credit Issuers under the Loan Documents shall be cumulative. The Letter of Credit Issuers shall be fully subrogated to the rights and remedies of each beneficiary whose claims against the Borrowers are discharged with proceeds of any Letter of Credit. Nothing set forth herein shall prevent the Borrowers, following reimbursement in respect of any Letter of Credit, from asserting claims against a Letter of Credit Issuer for any honor of any Letter of Credit constituting gross negligence or willful misconduct.

(ii) Rights of Letter of Credit Issuers. In connection with its administration of and enforcement of rights or remedies under any Letters of Credit or Letter of Credit Documents, a Letter of Credit Issuer shall be entitled to act, and shall be fully protected in acting, upon any certification, documentation or communication in whatever form believed by such Letter of Credit Issuer, in good faith, to be genuine and correct and to have been signed, sent or made by a proper Person. A Letter of Credit Issuer may consult

7

with and employ legal counsel, accountants and other experts to advise it concerning its obligations, rights and remedies, and shall be entitled to act upon, and shall be fully protected in any action taken in good faith reliance upon, any advice given by such experts. A Letter of Credit Issuer may employ agents and attorneys-in-fact in connection with any matter relating to Letters of Credit or Letter of Credit Documents, and shall not be liable for the negligence or misconduct of agents and attorneys-in-fact selected with reasonable care.

(iii) Account Party. The Borrowers hereby authorize and direct any Letter of Credit Issuer to name any Borrower as the “Account Party” therein and to deliver to the Agent all instruments, documents, and other writings and property received by such Letter of Credit Issuer pursuant to the Letter of Credit, and to accept and rely upon the Agent’s instructions and agreements with respect to all matters arising in connection with the Letter of Credit or the application therefor.

(f) Reimbursement; Participations.

(i) If any Letter of Credit Issuer honors any request for payment under a Letter of Credit, the Borrowers shall pay to such Letter of Credit Issuer, on the same day (“Reimbursement Date”), the amount paid by such Letter of Credit Issuer under such Letter of Credit, together with interest at the interest rate for Base Rate Loans from the Reimbursement Date until payment by the Borrowers. The obligation of the Borrowers to reimburse a Letter of Credit Issuer for any payment made under a Letter of Credit shall be absolute, unconditional, irrevocable, and joint and several, and shall be paid without regard to any lack of validity or enforceability of any Letter of Credit or the existence of any claim, setoff, defense or other right that the Borrowers may have at any time against the beneficiary. Whether or not the Borrowers submit a Notice of Borrowing, the Borrowers shall be deemed to have requested a Borrowing of Base Rate Loans in an amount necessary to pay all amounts due a Letter of Credit Issuer on any Reimbursement Date and each Lender agrees to fund its Pro Rata Share of such Borrowing whether or not the Commitments have terminated, an overadvance exists or is created thereby, or the conditions in Article 8 are satisfied.

(ii) Upon issuance of a Letter of Credit, each Lender shall be deemed to have irrevocably and unconditionally purchased from the applicable Letter of Credit Issuer, without recourse or warranty, an undivided Pro Rata Share interest and participation in all Letter of Credit Obligations relating to such Letter of Credit. If a Letter of Credit Issuer makes any payment under a Letter of Credit and the Borrowers do not reimburse such payment on the Reimbursement Date, the Agent shall promptly notify the Lenders and each Lender shall promptly (within one Business Day) and unconditionally pay to the Agent, for the benefit of such Letter of Credit Issuer, the Lender’s Pro Rata Share of such payment. Upon request by a Lender, a Letter of Credit Issuer shall furnish copies of any Letters of Credit and Letter of Credit Documents in its possession at such time.

(iii) The obligation of each Lender to make payments to the Agent for the account of a Letter of Credit Issuer in connection with such Letter of Credit Issuer’s payment under a Letter of Credit shall be absolute, unconditional and irrevocable, not subject to any counterclaim, setoff, qualification or exception whatsoever, and shall be made in accordance with this Agreement under all circumstances, irrespective of any lack of validity or unenforceability of any Loan Documents; any draft, certificate or other document presented under a Letter of Credit having been determined to be forged,

8

fraudulent, invalid or insufficient in any respect or any statement therein being untrue or inaccurate in any respect; or the existence of any setoff or defense that any Loan Party may have with respect to any Obligations. The Letter of Credit Issuers do not assume any responsibility for any failure or delay in performance or any breach by any Borrower or other Person of any obligations under any Letter of Credit Documents. The Letter of Credit Issuers do not make to Lenders any express or implied warranty, representation or guaranty with respect to the Collateral, the Letter of Credit Documents or any Account Party. The Letter of Credit Issuers shall not be responsible to any Lender for any recitals, statements, information, representations or warranties contained in, or for the execution, validity, genuineness, effectiveness or enforceability of any Letter of Credit Documents; the validity, genuineness, enforceability, collectibility, value or sufficiency of any Collateral or the perfection of any Lien therein; or the assets, liabilities, financial condition, results of operations, business, creditworthiness or legal status of any Account Party.

(iv) No Letter of Credit Indemnitee shall be liable to any Lender or other Person for any action taken or omitted to be taken in connection with any Letter of Credit Documents except as a result of its actual gross negligence or willful misconduct. A Letter of Credit Issuer shall not have any liability to any Lender if such Letter of Credit Issuer refrains from any action under a Letter of Credit or Letter of Credit Documents until it receives written instructions from Required Lenders.

(g) Supporting Letter of Credit; Cash Collateral. (i) If, notwithstanding the provisions of Section 1.3(b) and Section 10.1, any Letter of Credit or Credit Support is outstanding upon the termination of this Agreement, then upon such termination the Borrowers shall deposit with the Agent, for the ratable benefit of the Agent and the Lenders, with respect to each Letter of Credit or Credit Support then outstanding, a standby letter of credit (a “Supporting Letter of Credit”) in form and substance satisfactory to the Agent, issued by an issuer satisfactory to the Agent in an amount equal to the greatest amount for which such Letter of Credit or such Credit Support may be drawn plus any fees and expenses associated with such Letter of Credit or such Credit Support, under which Supporting Letter of Credit the Agent is entitled to draw amounts necessary to reimburse the Agent and the Lenders for payments to be made by the Agent and the Lenders under such Letter of Credit or Credit Support and any fees and expenses associated with such Letter of Credit or Credit Support. Such Supporting Letter of Credit shall be held by the Agent, for the ratable benefit of the Agent and the Lenders, as security for, and to provide for the payment of, the aggregate undrawn amount of such Letters of Credit or such Credit Support remaining outstanding. In the event Supporting Letters of Credit are not delivered, then the Loan Parties shall provide cash collateral for all remaining Letters of Credit in an amount equal to 110% of the aggregate face amount of such Letters of Credit. (ii) If a Defaulting Lender exists, the Borrowers shall, on demand by any Letter of Credit Issuer or the Agent from time to time, cash collateralize the Pro Rata Share of any Defaulting Lender of the Letter of Credit Obligations.

(h) Auto-Reinstatement Letters of Credit. The Lenders acknowledge that the Letter of Credit issued by the Bank in connection with the IRBs (as amended, renewed, replaced, and extended from time to time, the “IRB L/C”) permits the automatic reinstatement of all or a portion of the stated amount thereof after any drawing thereunder. Unless otherwise directed by the Bank, no Borrower shall be required to make a specific request to the Bank to permit such reinstatement. The Lenders shall be deemed to have authorized (but may not require) the Bank to reinstate all or a portion of the stated amount thereof in accordance with the provisions of the IRB L/C.

9

(i) Additional Letter of Credit Issuers. The Borrowers and all Additional Letter of Credit Issuers shall comply with all terms and conditions relating to Letters of Credit set forth in this Agreement, including without limitation, Section 1.3(d)(i) above. Each Additional Letter of Credit Issuer shall promptly provide to the Agent a copy of all original Letters of Credit issued by such Additional Letter of Credit Issuer, and all renewals, extensions, amendments, modifications, cancellations, or draws thereof. Each Additional Letter of Credit Issuer shall only issue a Letter of Credit in accordance with this Section 1.3.

(j) Resignation of Letter of Credit Issuer. Any Letter of Credit Issuer may resign at any time upon notice to the Agent and the Borrowers. On the effective date of such resignation, such Letter of Credit Issuer shall have no further obligation to issue, amend, renew, extend or otherwise modify any Letter of Credit, but shall continue to have all rights and obligations of a Letter of Credit Issuer hereunder, including under Sections 1.3 and 13.11, relating to any Letter of Credit issued prior to such date. The Agent shall promptly appoint a replacement Letter of Credit Issuer, which, as long as no Default or Event of Default exists, shall be reasonably acceptable to Borrowers.

1.4 Bank Products. The Loan Parties and their Affiliates (including Westlake Veba Trust) may request and the Agent or Lenders may, in their sole and absolute discretion, arrange for the Loan Parties and their Affiliates (including Westlake Veba Trust) to obtain from the Bank or the Bank’s Affiliates or the Lenders or the Lenders’ Affiliates, Bank Products, although the Loan Parties and their Affiliates (including Westlake Veba Trust) are not required to do so. If Bank Products are provided by an Affiliate of the Bank, any Lender or an Affiliate of a Lender, the Loan Parties agree to indemnify and hold the Agent, the Bank, the Lenders, and their respective Affiliates harmless from any and all costs and obligations now or hereafter incurred by the Agent, the Bank, or any of the Lenders and their respective Affiliates which arise from any indemnity given by the Agent, its Affiliates, or the Lenders or their respective Affiliates related to such Bank Products; provided, however, nothing contained herein is intended to limit any Loan Party’s rights, with respect to the Bank, any Lender or their respective Affiliates, as the case may be, which relate to the Bank Products or the provision of the Bank Products pursuant thereto. The agreement contained in this Section shall survive termination of this Agreement. Each Loan Party acknowledges and agrees that the obtaining of Bank Products from the Bank, any Lender or their respective Affiliates (a) is in the sole and absolute discretion of the Bank, any Lender, or their respective Affiliates, and (b) is subject to all rules and regulations of the Bank, any Lender, or their respective Affiliates.

ARTICLE 2.

INTEREST AND FEES

2.1 Interest.

(a) Interest Rates. All outstanding Revolving Loans shall bear interest on the unpaid principal amount thereof (including, to the extent permitted by law, on interest thereon not paid when due) from the date made until paid in full in cash at a rate determined by reference to the Base Rate or the LIBOR Rate plus the Applicable Margin, but not to exceed the Maximum Rate. If at any time Revolving Loans are outstanding with respect to which the Borrowers have not delivered to the Agent a notice specifying the basis for determining the interest rate applicable thereto in accordance herewith, those Revolving Loans shall bear interest at a rate determined by reference to the Base Rate (unless the Default Rate has been effected by the Agent and the Required Lenders pursuant to Section 2.1(b)) until notice to the contrary has been given to the Agent in accordance with this Agreement and such notice has become effective. Except as otherwise provided herein, the outstanding Revolving Loans shall bear interest as follows:

(i) For all Base Rate Loans at a fluctuating per annum rate equal to the Base Rate plus the Applicable Margin; and

10

(ii) For all LIBOR Rate Loans at a per annum rate equal to the LIBOR Rate plus the Applicable Margin.

Each change in the Base Rate shall be reflected in the interest rate applicable to Base Rate Loans as of the effective date of such change. All interest charges for LIBOR Rate Loans shall be computed on the basis of a year of 360 days and actual days elapsed (which results in more interest being paid than if computed on the basis of a 365-day year). All interest charges for Base Rate Loans shall be computed on the basis of a year of 365 or 366 days, as the case may be, and for actual days elapsed. The Borrowers shall pay to the Agent, for the ratable benefit of Lenders, interest accrued on all Base Rate Loans in arrears on the first day of each month hereafter and on the Termination Date. The Borrowers shall pay to the Agent, for the ratable benefit of Lenders, interest on all LIBOR Rate Loans in arrears on each LIBOR Interest Payment Date. The Agent does not warrant or accept responsibility for, nor shall it have any liability with respect to, administration, submission or any other matter related to any rate described in the definition of LIBOR Rate.

(b) Default Rate. If any Event of Default occurs and is continuing and the Agent or the Required Lenders in their discretion so elect, then, while any such Event of Default is continuing, (i) the principal amount of all Revolving Loans shall bear interest at the Default Rate applicable thereto; (ii) the Letter of Credit Fee shall bear interest at the Default Rate applicable thereto; and (iii) any other amount (other than principal of any Revolving Loan and the Letter of Credit Fee) payable by the Borrowers under any Loan Document shall bear interest at the Default Rate applicable to Base Rate Loans.

2.2 Continuation and Conversion Elections.

(a) The Borrowers may:

(i) elect, as of any Business Day, in the case of Base Rate Loans, to convert any Base Rate Loans (or any part thereof in an amount not less than $5,000,000, or that is in an integral multiple of $1,000,000 in excess thereof) into LIBOR Rate Loans; or

(ii) elect, as of the last day of the applicable Interest Period, to continue any LIBOR Rate Loans having Interest Periods expiring on such day (or any part thereof in an amount not less than $1,000,000, or that is in an integral multiple of $1,000,000 in excess thereof);

provided, that if at any time the aggregate amount of LIBOR Rate Loans in respect of any Borrowing is reduced, by payment, prepayment, or conversion of part thereof to be less than $1,000,000, such LIBOR Rate Loans shall automatically convert into Base Rate Loans; provided further that if the notice shall fail to specify the duration of the Interest Period, such Interest Period shall be one (1) month.

(b) Westlake, on its behalf and as agent for the other Borrowers, shall deliver a notice of continuation/conversion (“Notice of Continuation/Conversion”) to the Agent not later than 12:00 noon (Houston, Texas time) at least three (3) Business Days in advance of the Continuation/Conversion Date, if the Revolving Loans are to be converted into or continued as LIBOR Rate Loans and specifying:

(i) the proposed Continuation/Conversion Date;

11

(ii) the aggregate amount of Loans to be converted or continued;

(iii) the type of Loans resulting from the proposed conversion or continuation; and

(iv) the duration of the requested Interest Period, provided, however, the Borrowers may not select an Interest Period that ends after the Stated Termination Date.

(c) If upon the expiration of any Interest Period applicable to LIBOR Rate Loans, the Borrowers have failed to select timely a new Interest Period to be applicable to LIBOR Rate Loans, the Borrowers shall be deemed to have elected to convert such LIBOR Rate Loans into Base Rate Loans effective as of the expiration date of such Interest Period.

(d) The Agent will promptly notify each Lender of its receipt of a Notice of Continuation/Conversion. All conversions and continuations shall be made ratably according to the respective outstanding principal amounts of the Revolving Loans with respect to which the notice was given held by each Lender.

(e) There may not be more than twelve (12) different LIBOR Rate Loans in effect hereunder at any time.

2.3 Maximum Interest Rate. In no event shall any interest rate provided for hereunder (including any fees or other fees or other compensation which are deemed or determined to be interest) exceed the maximum rate legally chargeable by any Lender under applicable law for such Lender with respect to loans of the type provided for hereunder (the “Maximum Rate”). If, for any period, any interest, absent such limitation, would have exceeded the Maximum Rate, then the interest rate for that period shall be the Maximum Rate, and, if in future periods, that interest rate would otherwise be less than the Maximum Rate, then that interest rate shall remain at the Maximum Rate until such time as the amount of interest paid hereunder equals the amount of interest which would have been paid if the same had not been limited by the Maximum Rate. In the event that, upon payment in full of the Obligations, the total amount of interest paid or accrued under the terms of this Agreement is less than the total amount of interest which would, but for this Section 2.3, have been paid or accrued if the interest rate otherwise set forth in this Agreement had at all times been in effect, then the Borrowers shall, to the extent permitted by applicable law, pay the Agent, for the account of the Lenders, an amount equal to the excess of (a) the lesser of (i) the amount of interest which would have been charged if the Maximum Rate had, at all times, been in effect or (ii) the amount of interest which would have accrued had the interest rate otherwise set forth in this Agreement, at all times, been in effect over (b) the amount of interest actually paid or accrued under this Agreement. If a court of competent jurisdiction determines that the Agent and/or any Lender has received interest and other charges hereunder in excess of the Maximum Rate, such excess shall be deemed received on account of, and shall automatically be applied to reduce, the Obligations other than interest, in the inverse order of maturity, and if there are no Obligations outstanding, the Agent and/or such Lender shall refund to the Borrowers such excess.

2.4 Closing Fee. Borrowers shall pay the Agent for its account the fees described in the Fee Letter (the “Closing Fee”).

2.5 Unused Line Fee. On the first day of each month hereafter and on the Termination Date, the Borrowers agree to pay to the Agent, for the account of the Lenders, in accordance with their respective Pro Rata Shares, an unused line fee (the “Unused Line Fee”) equal to the Applicable Margin for Unused Line Fee times the amount by which the Maximum Revolver Amount exceeded the sum of the average daily outstanding principal amount of Revolving Loans and the average daily undrawn face

12

amount of outstanding Letters of Credit, during the immediately preceding month or shorter period if calculated for the first month hereafter or on the Termination Date. The Unused Line Fee shall be computed on the basis of a 360-day year for the actual number of days elapsed. All principal payments received by the Agent shall be deemed to be credited to the Borrowers’ Loan Account immediately upon receipt for purposes of calculating the Unused Line Fee pursuant to this Section 2.5.

2.6 Letter of Credit Fee. The Borrowers agree to pay (a) to the Agent, for the account of the Lenders, in accordance with their respective Pro Rata Shares, for each Letter of Credit, a per annum fee (the “Letter of Credit Fee”) equal to the Applicable Margin for LIBOR Rate Loans multiplied by the stated amount of each Letter of Credit, (b) on the date of issuance of any Letter of Credit, to the Agent for the benefit of the applicable Letter of Credit Issuer, a fronting fee of one-eighth of one percent (0.125%) per annum of the undrawn face amount of each Letter of Credit, and (c) on the date of issuance of any Letter of Credit, to the applicable Letter of Credit Issuer, all out-of-pocket costs, fees and expenses incurred by such Letter of Credit Issuer in connection with the application for, processing of, issuance of, or amendment to any Letter of Credit. The Letter of Credit Fee shall be payable monthly in arrears on the first day of each month following any month in which a Letter of Credit is outstanding and on the Termination Date. The Letter of Credit Fee shall be computed on the basis of a 360-day year for the actual number of days elapsed.

ARTICLE 3.

PAYMENTS AND PREPAYMENTS

3.1 Revolving Loans. The Borrowers shall repay the outstanding principal balance of the Revolving Loans, plus all accrued but unpaid interest thereon, on the Termination Date. The Borrowers may prepay Revolving Loans at any time, and reborrow subject to the terms of this Agreement. In addition, and without limiting the generality of the foregoing, upon demand, the Borrowers shall pay to the Agent, for account of the Lenders, the amount, without duplication, by which the Aggregate Revolver Outstandings exceeds the lesser of the Borrowing Base or the Maximum Revolver Amount.

3.2 Full or Partial Termination of Facility.

(a) Termination of Facility. The Borrowers may terminate this Agreement upon at least ten (10) Business Days’ notice (or such shorter period as agreed to by the Agent in its sole discretion) to the Agent, upon Full Payment of all Obligations (other than Bank Products that the applicable Lender chooses not to terminate and indemnity obligations that survive the termination of this Agreement and are not due and payable at such termination). On the effective date of termination of this Agreement, any Lender may terminate its and its Affiliates’ Bank Products.

(b) Partial Reduction of Facility. The Borrowers may permanently reduce the Maximum Revolver Amount in increments of $25,000,000 but in no event shall the Maximum Revolver Amount be less than $300,000,000 (the amount of such reduction, the “Partial Termination Amount”) upon at least ten (10) days’ notice to the Agent, upon the payment in full of any Revolving Loans, together with accrued interest thereon, to the extent such Revolving Loans exceed the Maximum Revolver Amount (after giving effect to such reduction). Once reduced in accordance with this Section 3.2(b), the Maximum Revolver Amount may not be increased.

3.3 Prepayments of the Loans.

(a) To the extent set forth in this Section 3.3(a), immediately upon receipt by any Loan Party of proceeds from the sale of any Collateral (other than sales of Inventory in the

13

ordinary course of business), the Borrowers shall prepay the Revolving Loans in an amount equal to 100% of all such proceeds, net of (i) commissions and other reasonable and customary transaction costs, fees, and expenses properly attributable to such transaction and payable by such Loan Party in connection therewith (in each case, paid to non-Affiliates), (ii) transfer taxes, and (iii) appropriate amounts required to be reserved (in accordance with GAAP) for post-closing adjustments by any Loan Party in connection with such transaction, against any liabilities retained by any Loan Party after such transaction, which liabilities are associated with the asset or assets sold (“Net Sale Proceeds”). No payment from the Net Sale Proceeds shall be required hereunder to the extent Availability exceeds the amount of Revolving Loans outstanding on such date of determination. In addition, 100% of the Net Sale Proceeds shall be deducted from the calculation of the Borrowing Base, but such reduction shall not be deemed to be a permanent reduction of the Maximum Revolver Amount.

(b) Prepayments from the proceeds of all dispositions of Collateral in accordance with Section 3.3(a) shall be applied as follows: first, to accrued interest with respect to the Revolving Loans, second, to pay the principal of the Revolving Loans, and third to cash collateralize outstanding Letters of Credit.

3.4 LIBOR Rate Loan Prepayments. In connection with any prepayment, if any LIBOR Rate Loans are prepaid prior to the expiration date of the Interest Period applicable thereto, the Borrowers shall pay to the Lenders the amounts described in Section 4.5.

3.5 Payments by the Borrowers.

(a) All payments to be made by the Borrowers shall be made without set off, recoupment or counterclaim. Except as otherwise expressly provided herein, all payments by the Borrowers shall be made to the Agent for the account of the Lenders, at the account designated by the Agent and shall be made in Dollars and in immediately available funds, no later than 12:00 noon (Houston, Texas time) on the date specified herein. Any payment received by the Agent after such time shall be deemed (for purposes of calculating interest only) to have been received on the following Business Day and any applicable interest shall continue to accrue.

(b) Subject to the provisions set forth in the definition of “Interest Period,” whenever any payment is due on a day other than a Business Day, such payment shall be due on the following Business Day, and such extension of time shall in such case be included in the computation of interest or fees, as the case may be.

(c) Each Loan Party that is a Qualified ECP when its guaranty of or grant of a Lien as security for a Swap Obligation becomes effective hereby jointly and severally, absolutely, unconditionally and irrevocably undertakes to provide funds or other support to each Specified Obligor with respect to such Swap Obligation as may be needed by such Specified Obligor from time to time to honor all of its obligations under the Loan Documents in respect of such Swap Obligation (but, in each case, only up to the maximum amount of such liability that can be hereby incurred without rendering such Qualified ECP's obligations and undertakings under this Section 3.5(c) voidable under any applicable fraudulent transfer or conveyance act). The obligations and undertakings of each Qualified ECP under this Section 3.5(c) shall remain in full force and effect until Full Payment of all Obligations. Each Loan Party intends this Section 3.5(c) to constitute, and this Section 3.5(c) shall be deemed to constitute, a guarantee of the obligations of, and a “keepwell, support or other agreement” for the benefit of, each Loan Party for all purposes of the Commodity Exchange Act.

14

3.6 Payments as Revolving Loans. At the election of the Agent, all payments of principal, interest, reimbursement obligations in connection with Letters of Credit and Credit Support, fees, premiums, reimbursable expenses and other sums payable hereunder, may be paid from the proceeds of Revolving Loans made hereunder. The Borrowers hereby irrevocably authorize the Agent to charge the Loan Account for the purpose of paying all amounts from time to time due hereunder (without regard to any grace periods hereunder, including, without limitation, Loans that constitute Agent Advances) and agrees that all such amounts charged shall constitute Revolving Loans (including Non-Ratable Loans and Agent Advances).

3.7 Apportionment, Application and Reversal of Payments. Principal and interest payments shall be apportioned ratably among the Lenders (according to the unpaid principal balance of the Revolving Loans to which such payments relate held by each Lender) and payments of the fees shall, as applicable, be apportioned ratably among the Lenders, except for fees payable solely to the Agent and the Letter of Credit Issuers and except as provided in Section 11.1(b) or 12.14(e). All payments shall be remitted to the Agent and all such payments not relating to principal or interest of specific Loans, or not constituting payment of specific fees, and all proceeds of Accounts or other Collateral received by the Agent following the occurrence and during the continuation of any Event of Default shall be applied, ratably, subject to the provisions of this Agreement, first, to pay any fees, indemnities, or expense reimbursements then due to the Agent from the Borrowers (other than any fees, indemnities, or expense reimbursements arising under any Bank Product); second, to pay any fees or expense reimbursements then due to the Lenders from the Borrowers (other than any fees or expense arising from any Bank Product); third, to pay interest due in respect of all Loans, including Non-Ratable Loans and Agent Advances; fourth, to pay or prepay principal of the Non-Ratable Loans and Agent Advances; fifth, to pay or prepay principal of the Revolving Loans (other than Non-Ratable Loans and Agent Advances), unpaid reimbursement obligations in respect of Letters of Credit, and Pari Passu Bank Product Obligations; sixth, to pay an amount to the Agent equal to all outstanding Letter of Credit Obligations to be held as cash collateral for such Obligations; and seventh, to the payment of any other Obligations including any amounts relating to Bank Products due to the Agent, any Lender, or their respective Affiliates by the Borrowers that are not Pari Passu Bank Product Obligations. Notwithstanding anything to the contrary contained in this Agreement, unless so directed by the Borrowers, or unless an Event of Default has occurred and is continuing, neither the Agent nor any Lender shall apply any payments which it receives to any LIBOR Rate Loan, except (a) on the expiration date of the Interest Period applicable to any such LIBOR Rate Loan, or (b) in the event, and only to the extent, that there are no outstanding Base Rate Loans and, in any event, the Borrowers shall pay LIBOR breakage losses in accordance with Section 4.5. To the extent not inconsistent with the express terms of this Agreement, the Agent and the Lenders shall have the continuing and exclusive right to apply and reverse and reapply any and all such proceeds and payments to any portion of the Obligations.

3.8 Indemnity for Returned Payments. If after receipt of any payment which is applied to the payment of all or any part of the Obligations, the Agent, any Lender, the Bank or any Affiliate of the Bank is for any reason compelled to surrender such payment or proceeds to any Person because such payment or application of proceeds is invalidated, declared fraudulent, set aside, determined to be void or voidable as a preference, impermissible setoff, or a diversion of trust funds, or for any other reason, then the Obligations or part thereof intended to be satisfied shall be revived and continued and this Agreement shall continue in full force as if such payment or proceeds had not been received by the Agent or such Lender and the Borrowers shall be liable to pay to the Agent and the Lenders, and hereby do indemnify the Agent and the Lenders and hold the Agent and the Lenders harmless for the amount of such payment or proceeds surrendered. The provisions of this Section 3.8 shall be and remain effective notwithstanding any contrary action which may have been taken by the Agent or any Lender in reliance upon such payment or application of proceeds, and any such contrary action so taken shall be without prejudice to the Agent’s and the Lenders’ rights under this Agreement and shall be deemed to have been conditioned upon such payment or application of proceeds having become final and irrevocable. The provisions of this Section 3.8 shall survive the termination of this Agreement.

15

3.9 Agent’s and Lenders’ Books and Records; Monthly Statements. The Agent shall record the principal amount of the Revolving Loans owing to each Lender, the undrawn face amount of all outstanding Letters of Credit and the aggregate amount of unpaid reimbursement obligations outstanding with respect to the Letters of Credit from time to time on its books. In addition, each Lender may note the date and amount of each payment or prepayment of principal of such Lender’s Loans in its books and records. Failure by the Agent or any Lender to make such notation shall not affect the obligations of the Borrowers with respect to the Revolving Loans or the Letters of Credit. Each Borrower agrees that the Agent’s and each Lender’s books and records showing the Obligations and the transactions pursuant to this Agreement and the other Loan Documents shall be admissible in any action or proceeding arising therefrom, and shall constitute rebuttably presumptive proof thereof, absent manifest error, irrespective of whether any Obligation is also evidenced by a promissory note or other instrument. The Agent will provide to the Borrowers a monthly statement of Revolving Loans, payments, and other transactions pursuant to this Agreement. Such statement shall be deemed correct, accurate, and binding on the Borrowers and an account stated (except for reversals and reapplications of payments made as provided in Section 3.7 and corrections of errors discovered by the Agent), unless the Borrowers notify the Agent in writing to the contrary within thirty (30) days after such statement is received. In the event a timely written notice of objections is given by the Borrowers, only the items to which exception is expressly made will be considered to be disputed by the Borrowers.

ARTICLE 4.

TAXES, YIELD PROTECTION AND ILLEGALITY

4.1 Taxes.

(a) Payments Free of Taxes; Obligation to Withhold; Tax Payment.

(i) All payments of the Obligations by the Loan Parties shall be made without deduction or withholding for any Taxes, except as required by Requirement of Law. If Requirement of Law (as determined by an applicable Withholding Agent in its discretion) requires the deduction or withholding of any Tax from any such payment by the Agent or a Loan Party, then the Agent or such Loan Party shall be entitled to make such deduction or withholding based on information and documentation provided pursuant to Section 4.2.

(ii) If the Agent or any Loan Party is required by the Code to withhold or deduct any Taxes from any payment, then (i) the Agent shall timely pay the full amount to be withheld or deducted to the IRS, and (ii) to the extent the withholding or deduction is made on account of Indemnified Taxes, the sum payable by the applicable Loan Party shall be increased as necessary so that the Recipient receives an amount equal to the sum it would have received had no such withholding or deduction been made.

(iii) If the Agent or any Loan Party is required by any Requirement of Law other than the Code to withhold or deduct Taxes from any payment, then (i) the Agent or such Loan Party, to the extent required by Requirement of Law, shall timely pay the full amount to be withheld or deducted to the relevant Governmental Authority, and (ii) to the extent the withholding or deduction is made on account of Indemnified Taxes, the sum payable by the applicable Loan Party shall be increased as necessary so that the Recipient receives an amount equal to the sum it would have received had no such withholding or deduction been made.

16

(b) Payment of Other Taxes. Without limiting the foregoing, Borrowers shall timely pay to the relevant Governmental Authority in accordance with Requirement of Law, or at the Agent's option, timely reimburse the Agent for payment of, any Other Taxes.

(c) Tax Indemnification.

(i) Each Borrower shall indemnify and hold harmless, on a joint and several basis, each Recipient against any Indemnified Taxes (including Indemnified Taxes imposed or asserted on or attributable to amounts payable under this Section) payable or paid by such Recipient or required to be withheld or deducted from a payment to such Recipient, and any penalties, interest and reasonable expenses arising therefrom or with respect thereto, whether or not such Indemnified Taxes were correctly or legally imposed or asserted by the relevant Governmental Authority. Each Borrower shall make payment within 10 days after demand for any amount or liability payable under this Section. A certificate as to the amount of such payment or liability delivered to Borrowers by a Lender or Letter of Credit Issuer (with a copy to the Agent), or by the Agent on its own behalf or on behalf of any Recipient, shall be conclusive absent manifest error.

(ii) Each Lender and Letter of Credit Issuer shall indemnify and hold harmless, on a several basis, the Agent against any Indemnified Taxes attributable to such Lender or Letter of Credit Issuer (but only to the extent Borrowers have not already paid or reimbursed the Agent therefor and without limiting Borrowers’ obligation to do so), that are payable or paid by the Agent in connection with any Obligations, and any reasonable expenses arising therefrom or with respect thereto, whether or not such Indemnified Taxes were correctly or legally imposed or asserted by the relevant Governmental Authority. Each Lender and Letter of Credit Issuer shall make payment within 10 days after demand for any amount or liability payable under this Section. A certificate as to the amount of such payment or liability delivered to any Lender or Letter of Credit Issuer by the Agent shall be conclusive absent manifest error.

(d) Evidence of Payments. If the Agent or a Loan Party pays any Taxes pursuant to this Section, then upon request, the Agent shall deliver to Westlake or Westlake shall deliver to the Agent, respectively, a copy of a receipt issued by the appropriate Governmental Authority evidencing the payment, a copy of any return required by Requirement of Law to report the payment, or other evidence of payment reasonably satisfactory to the Agent or Westlake, as applicable.

(e) Treatment of Certain Refunds. Unless required by Requirement of Law, at no time shall the Agent have any obligation to file for or otherwise pursue on behalf of a Lender or Letter of Credit Issuer, nor have any obligation to pay to any Lender or Letter of Credit Issuer, any refund of Taxes withheld or deducted from funds paid for the account of a Lender or Letter of Credit Issuer. If a Recipient determines in its reasonable discretion that it has received a refund of any Taxes as to which it has been indemnified by Borrowers or with respect to which a Borrower has paid additional amounts pursuant to this Section, it shall pay Borrowers an amount equal to such refund (but only to the extent of indemnity payments made, or additional amounts paid, by Borrowers with respect to the Taxes giving rise to such refund), net of all out-of-pocket expenses (including Taxes) incurred by such Recipient, and without interest (other than any interest paid by the relevant Governmental Authority with respect to such refund), provided that Borrowers agree, upon request by the Recipient, to repay the amount paid over to Borrowers (plus any penalties, interest or other charges imposed by the relevant Governmental Authority)

17

to the Recipient if the Recipient is required to repay such refund to the Governmental Authority. Notwithstanding anything herein to the contrary, no Recipient shall be required to pay any amount to Borrowers if such payment would place the Recipient in a less favorable net after-Tax position than it would have been in if the Tax subject to indemnification and giving rise to such refund had not been deducted, withheld or otherwise imposed and the indemnification payments or additional amounts with respect to such Tax had never been paid. In no event shall the Agent or any Recipient be required to make its tax returns (or any other information relating to its taxes that it deems confidential) available to any Loan Party or other Person.

(f) Survival. Each party’s obligations under Sections 4.1 and 4.2 shall survive the resignation or replacement of the Agent or any assignment of rights by or replacement of a Lender or Letter of Credit Issuer, the termination of the Commitments, and the repayment, satisfaction, discharge or Full Payment of any Obligations.

4.2 Lender Tax Information.

(a) Status of Lenders. Any Lender that is entitled to an exemption from or reduction of withholding Tax with respect to payments of Obligations shall deliver to Westlake and the Agent properly completed and executed documentation reasonably requested by Westlake or the Agent as will permit such payments to be made without or at a reduced rate of withholding. In addition, any Lender, if reasonably requested by Westlake or the Agent, shall promptly deliver such other documentation prescribed by Requirement of Law or reasonably requested by Westlake or the Agent to enable them to determine whether such Lender is subject to backup withholding or information reporting requirements. Notwithstanding the foregoing, such documentation (other than documentation described in Sections 4.2(b)(i), (ii) and (iv)) shall not be required if a Lender reasonably believes delivery of the documentation would subject it to any material unreimbursed cost or expense or would materially prejudice its legal or commercial position.

(b) Documentation. Without limiting the foregoing, if any Borrower is a U.S. Person,

(i) Any Lender that is a U.S. Person shall deliver to Westlake and the Agent on or prior to the date on which such Lender becomes a Lender hereunder (and from time to time thereafter upon reasonable request of Westlake or the Agent), executed originals of IRS Form W-9, certifying that such Lender is exempt from U.S. federal backup withholding Tax;