Attached files

| file | filename |

|---|---|

| EX-10 - EXHIBIT 10.17 - Principal Solar, Inc. | ex10-17.htm |

| EX-23 - EXHIBIT 23.1 - Principal Solar, Inc. | ex23-1.htm |

| EX-23 - EXHIBIT 23.3 - Principal Solar, Inc. | ex23-3.htm |

| EX-10 - EXHIBIT 10.18 - Principal Solar, Inc. | ex10-18.htm |

| EX-99 - EXHIBIT 99.2 - Principal Solar, Inc. | ex99-2.htm |

As filed with the Securities and Exchange Commission on July 17, 2014

Registration No. 333-193058

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1/A

Amendment No. 2

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

PRINCIPAL SOLAR, INC.

(Exact name of registrant as specified in its charter)

|

Delaware (State or other jurisdiction of Incorporation) |

4911 (Primary Standard Industrial Classification Code) |

27-3096175 (I.R.S. Employer Identification No.) |

2700 Fairmount

Dallas, Texas 75201

(855) 774-7799

(Address and Telephone Number of Registrant’s Principal

Executive Offices and Principal Place of Business)

Michael Gorton

Chief Executive Officer

2700 Fairmount

Dallas, Texas 75201

(855) 774-7799

(Name, Address and Telephone Number of Agent for Service)

Copies of communications to:

Copies to:

|

Grant Seabolt, Esq. |

|

David M. Loev |

||

|

5307 E. Mockingbird Lane |

|

John S. Gillies |

||

|

5th Floor |

|

The Loev Law Firm, PC |

||

|

Dallas, Texas 75206 |

|

6300 West Loop South, Suite 280 |

||

|

Phone: (214) 871-5079 |

|

Bellaire, Texas 77401 |

||

|

Fax: (214) 347-0578 |

|

Phone: (713) 524-4110 |

||

|

|

|

Fax: (713) 524-4122 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act

|

Large Accelerated filer ☐ |

Accelerated Filer ☐ |

|

Non-Accelerated filer ☐ |

Smaller reporting company ☒ |

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered |

|

Amount to be Registered (1) |

|

|

Proposed Maximum Per Share Offering Price (2) |

|

|

Proposed Maximum Aggregate Offering Price |

|

|

Amount of Registration Fee (3) |

| ||||||||

|

Common stock, $0.001 par value per share (3) |

|

|

3,229,870 |

|

|

$ |

1.15 |

|

|

$ |

3,714,351 |

|

|

$ |

478.41 |

(4) | ||||

|

Total |

|

|

3,229,870 |

|

|

$ |

1.15 |

|

|

$ |

3,714,351 |

|

|

$ |

478.41 |

(4) | ||||

|

(1) |

In accordance with Rule 416(a), the registrant is also registering hereunder an indeterminate number of shares that may be issued and resold resulting from stock splits, stock dividends or similar transactions. |

|

(2) |

Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(c) under the Securities Act of 1933, as amended, based on the last reported sale price for the common stock as reported on the OTC Pink® market on April 30, 2014. |

|

(3) |

This Registration Statement covers the resale (the “Resale”) of an aggregate of 3,229,870 shares of our common stock owned by 104 selling stockholders identified below. The Company will not receive any proceeds from the Resale. |

|

(4) |

Previously paid in connection with the Form S-1 Registration Statement filed with the Securities and Exchange Commission on December 23, 2013. |

The Registrant hereby amends its Registration Statement, on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this Prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This Prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION DATED JULY 17, 2014

PROSPECTUS

Principal Solar, Inc.

RESALE OF

3,229,870 SHARES OF COMMON STOCK

Initial Public Offering

The selling stockholders listed beginning on page 85 may offer and sell up to 3,229,870 shares of the common stock of Principal Solar, Inc. (the “Company”, “we” and “us”) under this Prospectus for their own account.

Our common stock is currently quoted on the OTC Pink® market maintained by OTC Markets Group, Inc. under the symbol “PSWW”; however, our securities are currently highly illiquid, and subject to large swings in trading price, and are only traded on a sporadic and limited basis. As a result, you should not expect to be able to resell your common stock regardless of how we perform and, if you are able to sell your common stock, you may receive less than your purchase price. As a result of these factors, an investment in our common stock is not suitable for investors who require short or medium term liquidity.

The Selling Stockholders will sell at a fixed price of $1.50 per share until our common stock is quoted on the Over-the-Counter Bulletin Board, OTCQB or traded on a national securities exchange and thereafter at prevailing market prices, or privately negotiated prices. We intend to arrange for a registered broker-dealer to apply to have our common stock listed on a national securities exchange or to quote our common stock on the OTCQB market maintained by OTC Markets Group, Inc., depending upon our qualifications at the time, in the future. There is no assurance, however, that our common stock will ever be listed on a national securities exchange or quoted on the OTCQB. As a reporting company subsequent to the effectiveness of the registration statement of which this Prospectus is a part, we will file annual, quarterly and current reports and other information about us with the SEC, as required.

A current Prospectus must be in effect at the time of the sale of the shares of common stock discussed above. The selling stockholders will be responsible for any commissions or discounts due to brokers or dealers. We will pay all of the other offering expenses.

Each selling stockholder or dealer selling the common stock is required to deliver a current Prospectus upon the sale. In addition, for the purposes of the Securities Act of 1933, as amended, selling stockholders may be deemed underwriters.

Our common stock will be considered a “penny stock”, and subject to the requirements of Rule 15g-9, promulgated under the Securities Exchange Act of 1934, as amended. “Penny stock” is generally defined as any equity security not traded on an exchange or quoted on NASDAQ that has a market price of less than $5.00 per share. Under such rule, broker-dealers who recommend low-priced securities to persons other than established customers and accredited investors must satisfy special sales practice requirements, including a requirement that they make an individualized written suitability determination for the purchaser and receive the purchaser's consent prior to the transaction. The Securities Enforcement Remedies and Penny Stock Reform Act of 1990, also requires additional disclosure in connection with any trades involving a stock defined as a penny stock.

The required penny stock disclosures include the required delivery, prior to any transaction, of a disclosure schedule explaining the penny stock market and the risks associated with it. Such requirements could severely limit the market liquidity of the securities and the ability of purchasers to sell their securities in the secondary market. In addition, various state securities laws impose restrictions on transferring "penny stocks" and as a result, investors in the common stock may have their ability to sell their shares of the common stock impaired.

The information in this Prospectus is not complete and may be changed. We may not sell these securities until the Registration Statement filed with the Securities and Exchange Commission is effective. This Prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

We are an “emerging growth company” under the federal securities laws and will be subject to reduced public company reporting requirements. An investment in our common stock may be considered speculative and involves a high degree of risk, including the risk of a substantial loss of your investment. See “Risk Factors” beginning on page 11 to read about the risks you should consider before buying shares of our common stock. An investment in our common stock is not suitable for all investors. We intend to continue to issue common stock after this offering and, as a result, your ownership in us is subject to dilution.

This Prospectus contains important information that a prospective investor should know before investing in our common stock. Please read this Prospectus before investing and keep it for future reference. As a reporting company subsequent to the effectiveness of the registration statement of which this Prospectus is a part, we file annual, quarterly and current reports and other information about us with the SEC, as required. This information will be available free of charge by contacting us at 2700 Fairmount, Dallas, Texas 75201 or by telephone at (855) 774-7799. The SEC also maintains a website at www.sec.gov that contains such information.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We may amend or supplement this Prospectus from time to time by filing amendments or supplements as required and will provide investors with all such subsequent material information. You should read the entire Prospectus and any amendments or supplements we provide carefully.

TABLE OF CONTENTS

|

|

PAGE |

|

|

|

|

Forward-Looking Statements |

1 |

|

Prospectus Summary |

2 |

|

Risk Factors |

11 |

|

Use of Proceeds |

30 |

|

Dividend Policy |

30 |

|

Description of Business |

31 |

|

Description of Property |

56 |

|

Legal Proceedings |

57 |

|

Directors, Executive Officers, Promoters and Control Persons |

58 |

|

Executive and Director Compensation |

63 |

|

Security Ownership of Certain Beneficial Owners and Management |

66 |

|

Indemnification of Directors and Officers |

68 |

|

Management's Discussion and Analysis of Financial Condition and Results of Operations |

69 |

|

Certain Relationships and Related Transactions |

77 |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

80 |

|

Descriptions of Capital Stock |

80 |

|

Shares Available for Future Sale |

83 |

|

Plan of Distribution and Selling Stockholders |

85 |

|

Market for Common Equity and Related Stockholder Matters |

92 |

|

Additional Information |

93 |

|

Legal Matters |

93 |

|

Experts |

93 |

|

Financial Statements |

F-1 |

You should rely only on the information contained in this Prospectus. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. No offers are being made hereby in any jurisdiction where the offer or sale is not permitted. You should assume that the information in this Prospectus is accurate only as of the date on the cover. Our business, financial condition, results of operations and prospects may have changed since that date.

Unless otherwise indicated, information contained in this Prospectus concerning our industry, including our market opportunity, is based on information from independent industry analysts, third-party sources and management. Management estimates are derived from publicly-available information released by independent industry analysts and third party sources, as well as data from our internal research, and are based on assumptions made by us using data and our knowledge of such industry and market, which we believe to be reasonable. In addition, while we believe the market opportunity information included in this Prospectus is generally reliable and is based on reasonable assumptions, such data involves risks and uncertainties and is subject to change based on various factors, including those discussed under the heading “Risk Factors.”

For investors outside the United States: we have not taken any action to permit a public offering of the shares of our common stock or the possession or distribution of this Prospectus in any jurisdiction where action for that purpose is required, other than the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this Prospectus.

FORWARD-LOOKING STATEMENTS

All statements contained in this Prospectus, other than statements of historical facts, that address future activities, events or developments, are forward-looking statements, including, but not limited to, statements containing the words "anticipates", "believes", "expects", "intends", "forecasts", "plans", "future", "strategy" or words of similar meaning. Forward-looking statements are subject to risks and uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from the results, performance or achievements expressed or implied by the forward-looking statements. These statements are based on certain assumptions and analyses made by us in light of our experience and our assessment of historical trends, current conditions and expected future developments as well as other factors we believe are appropriate under the circumstances. Whether actual results will conform to the expectations and predictions of management, however, is subject to a number of risks and uncertainties that may cause actual results to differ materially.

You should read the matters described in “Risk Factors” beginning on page 11, and the other cautionary statements made in this Prospectus as being applicable to all related forward-looking statements wherever they appear in this Prospectus. We cannot assure you that the forward-looking statements in this Prospectus will prove to be accurate and therefore prospective investors are encouraged not to place undue reliance on forward-looking statements. You should read this Prospectus completely.

Consequently, all of the forward-looking statements made in this Prospectus are qualified by these cautionary statements, and there can be no assurance that the actual results anticipated by management will be realized or, even if substantially realized, that they will have the expected consequences to or effects on our business operations.

With respect to any forward-looking statement that includes a statement of its underlying assumptions or basis, we caution that, while we believe such assumptions or basis to be reasonable and have formed them in good faith, assumed facts or basis almost always vary from actual results, and the differences between assumed facts or basis and actual results can be material depending on the circumstances. When, in any forward-looking statement, we or our management express an expectation or belief as to future results, that expectation or belief is expressed in good faith and is believed to have a reasonable basis, but there can be no assurance that the stated expectation or belief will result or be achieved or accomplished. All subsequent written and oral forward-looking statements attributable to us, or anyone acting on our behalf, are expressly qualified in their entirety by the cautionary statements. Except as required by applicable law, including the securities laws of the United States and/or if the existing disclosure fundamentally or materially changes, we do not undertake any obligation to publicly release any revisions to any forward-looking statements to reflect events or circumstances after the date of this Prospectus or to reflect unanticipated events that may occur.

PROSPECTUS SUMMARY

The following summary highlights material information found in more detail elsewhere in the Prospectus. It does not contain all of the information you should consider. You should carefully read all information in the Prospectus, including the financial statements and their explanatory notes, under the Financial Statements and the risks of investing in our common stock as discussed under "Risk Factors" prior to making an investment decision. In this Prospectus, the terms "we," "us," "our," "Company," “PSWW”, “PSI”, and “Principal Solar” refer to Principal Solar, Inc., a Delaware corporation and its subsidiaries.

Organization

Principal Solar, Inc. is the successor company to Kupper Parker Communications, Inc. (“KPCG”), having been created in March 2011 through a reverse merger undertaken pursuant to an Exchange Agreement dated as of March 15, 2011 between Principal Solar, Inc. (a Texas corporation, “Principal Solar Texas”) and KPCG. Upon completion of the transactions contemplated by the Exchange Agreement as described in more detail below, KPCG’s name was changed to “Principal Solar, Inc.” (see also “Description of Business” – “Organizational History”, below for a more detailed description of the Company’s organizational history).

Principal Solar Texas was incorporated in Texas in July 2010 (“Principal Solar Texas”). Effective as of March 7, 2011, the Company, Principal Solar Texas, the shareholders of Principal Solar Texas who included certain of our officers and directors (as described in greater detail below under “Certain Relationships and Related Transactions”), and Pegasus Funds LLC (the then holder of certain shares or our preferred stock) entered into an Exchange Agreement. Pursuant to the Exchange Agreement, the shareholders of Principal Solar Texas exchanged all 10,595,389 shares of that company’s outstanding common stock for 10,595,389 newly issued shares of the Company, constituting approximately 82% of the Company’s post-exchange outstanding shares and Pegasus Funds LLC exchanged its preferred stock for 2,138,617 shares of the Company’s common stock (the “Preferred Stock Exchange”). Immediately subsequent to the consummation of the transactions contemplated by the Exchange Agreement, including, but not limited to a 1:40 reverse stock split (the “Reverse Split”, effective with FINRA on May 25, 2011), the stockholders of the Company prior to the Exchange Agreement held 157,322 shares of our common stock, representing approximately 1.25% of our outstanding common stock. Subsequent to the closing of the Exchange in April 2011, we merged Principal Solar Texas into the Company with the Company surviving the merger. Unless otherwise stated or the context would require otherwise, all share amounts disclosed throughout this Prospectus retroactively take into account the Reverse Split.

The Exchange is described in greater detail below under “Description of Business” – “Organizational History” – “Exchange Agreement”.

Business

The Company is in a fast growing segment of the global energy industry and, as of June 30, 2014, had approximately $66,000 of cash on hand, and has generated only approximately $820,000 of total revenues since the Company’s change in business focus in connection with the Exchange Agreement, and there remain questions about the Company’s ability to continue as a going concern.

Based on the knowledge, expertise and operational experience of our technical and management team, as well as our focus on photovoltaic (PV) generation facilities, we believe we have a team in place that can grow our operations and to potentially become one of the most significant players in the renewable energy sector.

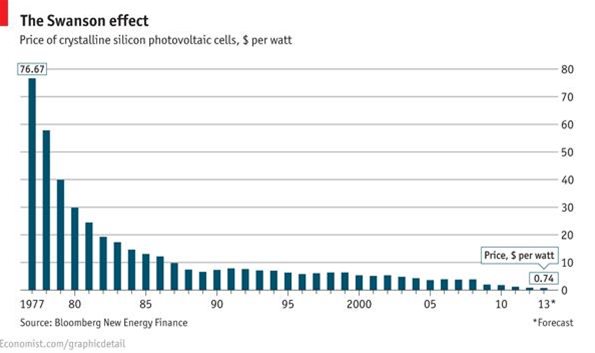

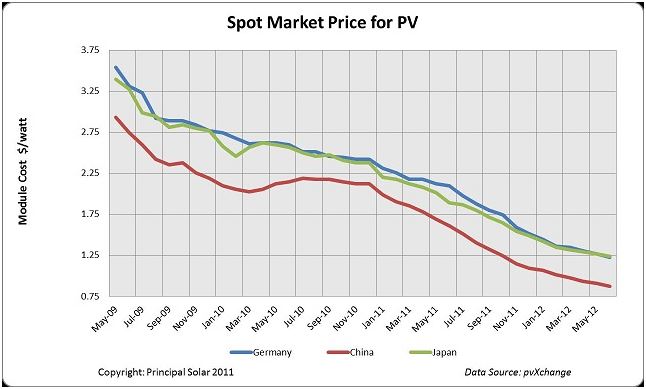

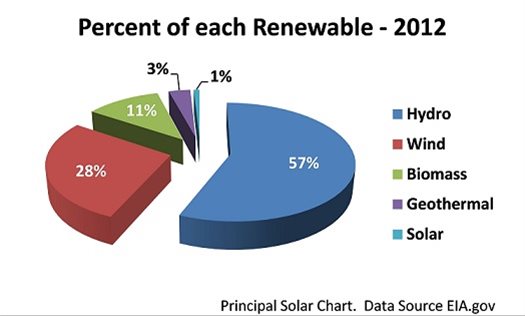

Our Primary objective is to build a significant, innovative and valuable solar company. We are currently employing our business expertise, our Board of Directors, advisory team and employee expertise with the goal of accelerating growth in an industry that we believe is ripe for consolidation today based upon our management’s observation that the solar industry has many unrelated participants (i.e., that it is "fragmented"), our observation of the industry's rapid expansion and growing acceptance of solar generation, and the observable declining costs for solar panels and inverters. These observations have caused us to believe the solar industry is on the brink of building very large scale projects in the next two to three years due to the number of projects currently proposed. Each of these observations is described in greater detail below under "Industry". Over the next three to five years, we have a goal to establish ourselves as one of the world’s leading solar power companies using a 4-pronged approach. Already underway, the Company plans to:

|

1. |

Aggregate the large community of fragmented solar entities in an accelerating acquisition strategy with the goal of creating a large balance sheet of solar electricity generation. | |

|

2. |

Establish thought leadership by networking with, in the view of our management, some of the best-known and highly regarded individuals in the sector, who author white papers, define standards and host webinars at www.PrincipalSolarInstitute.org. | |

|

3. |

Develop new commercial utility-scale solar projects leveraging our existing partnerships and relationships and those of our Board members and advisors, many of whom have spent decades in management roles within the traditional utility or energy industries, to make introductions to solar project developers, financiers, and utility industry executives with whom we hope to negotiate power purchase agreements, interconnection agreements, and other agreements. | |

|

4. |

Build an entity capable of creating innovative large-scale solar projects by hiring capable and experienced engineers and engaging developers experienced in the design and construction of large-scale solar projects, both domestically and abroad; by hiring capable executives in accounting, legal, real estate, etc., necessary to manage such an endeavor; and by obtaining financing from commercial banks, non-bank lenders (assuming such financing is available), and one or more public or private offerings of our equity securities in combination sufficient to fund the project. We expect such financing needs could fall within the range of $1.5 to $2.0 billion, which funding may not be available on favorable terms, if at all . |

To date, we have completed the acquisition of four entities (including three solar power production companies). We have begun to create what we call the “world’s first distributed solar utility” - although there are many individual solar projects in operation throughout the world, we don’t believe that anyone has previously attempted to bring together multiple, disparate, geographically diverse solar projects under common ownership thereby building a complete utility-scale solar power generation company. Our business plan begins with a rollup strategy. We are in the process of acquiring cash flow positive solar assets from around the country with the goal of consolidating those assets into a distributed generation business. We utilize a partnership strategy that leverages creative deal making expertise and our team of energy industry personnel with significant experience in the industry.

Our strategy is to couple fifty years of electric utility expertise with business expertise, entrepreneurial innovation, financial know-how and solar engineering to create a new era in electricity generation. Over the next three to five years, we hope to become the recognized leader in solar energy delivery by consolidating a significant share of the fragmented solar market to gain significant momentum and, when grid parity (i.e., solar power being as expensive if not cheaper than traditionally generated energy) has arrived, building large scale projects with an ultimate goal of generating gigawatts (GW) of cost effective, clean electricity with the goal of stabilizing electrical prices and preserving natural resources.

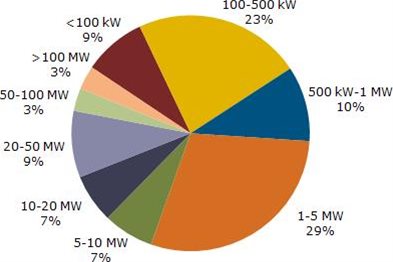

Acquisitions

As of the date of this Prospectus, the Company has completed the acquisition of three solar power production facilities amounting to just under 3,200 kilowatts (KW). Moving forward, management plans to negotiate with entities that manage and own projects in the 1 MW range up to 20 MW. As the assets under Company management increase, the Company hopes that its resources and market momentum, as well as its access to additional capital once public, will enable the acquisition of larger entities.

White Papers, Standards and Thought Leadership

Over the past two years, via the acquisition and expansion of the Principal Solar Institute (www.PrincipalSolarInstitute.org)(the Company’s industry website), the Company has become one of the most prolific authors in the solar industry. The Company has produced multiple white papers and dozens of articles on solar and solar-related topics. The Institute also regularly hosts industry experts to conduct valuable and relevant webinars. The long-term goal is to publish an authoritative library of papers and webinars, which will represent a single source and resource for understanding the solar industry. In the fall of 2012, the Company launched the Principal Solar Ratings System, an industry-first ratings system that allows easy, unbiased, comprehensive analysis and comparison of photovoltaic modules and solar power generation systems. The Institute built the Ratings system by bringing together a standards committee consisting in the view of our management, of some of the best-known and highly regarded individuals in the sector.

Construction of Commercial Distributed Generation (DG) Facilities.

Contemporaneous with the on-going acquisition phase of the Company’s growth plan, the Company hopes to selectively and opportunistically build, own and operate solar photovoltaic production facilities based on management’s contacts as well as via the relationships and pipeline of partners.

The Company plans to target large commercial enterprises whose facilities can accommodate at least 1 MW of solar on their property and/or offer significant promotional impact for the Company through the target’s well-known brand in its community.

Gigawatt Scale Projects.

Solar energy does not become a serious contender in the industry until power plants can be built which compete with traditional power generation. In order to compete, electricity produced must be priced so that larger plants makes sense, and, just as important, there must be demonstrable evidence from an engineering perspective, that larger plants which can withstand the forces of mother nature for extended periods. Construction on a gigawatt scale must be an engineering project with the ultimate goal of saving critical natural resources and more importantly, dollars. The Company will promote solar energy’s inherent, long-term strategic advantage to generate electricity in a more reliable and redundant distributed mode with the goal of fundamentally mitigating electricity disruptions (brown outs, black outs) that often plague a highly centralized mode of generation (such as we have today in the US). The Company anticipates that each GW scale project will cost approximately $1.70 to $1.80 per watt to construct or approximately $1.70 to $1.80 billion per GW.

The Company has built its management team and Board around the belief that grid parity will happen within the next few years. Pursuant to a report published by GBI Research report, “Solar Photovoltaics Power Market to 2020” (October 2012), grid parity in the United States (on average) will occur between 2014 and 2017. We believe that the desert southwest will become a major resource for the supply of affordable energy to the United States. Company engineering and management has already begun working with its Board of Directors, advisors and legal team to design its very large scale projects. The desert southwest has the highest number of days with sunshine in the U.S. It is important to note that a 10 megawatt facility (for example) would cost roughly the same amount in New York as it would in the desert southwest, but the facility in the desert would be exposed to more sunshine and would thus generate more electricity and more revenue.

How a Solar Energy System Works:

|

1. |

Solar photovoltaic (“PV”) panels are installed (sometimes mounted on a commercial building’s roof and sometimes at a standalone location chosen to be a power generation plant), where the panels collect energy from the sun in the form of direct current (DC) electricity. |

|

2. |

The direct current electricity is then converted by an inverter into alternating current (AC) electricity and sold back to the local or regional power utility. |

|

3. |

The AC electricity can be fed directly into the commercial building itself, for use by the tenant and/or owner of the building, similar to its use by the local electricity provider or in the case of a power generation plan, fed directly into the power grid. Since the solar energy system works in tandem with the electricity provider, the commercial user will continue to get electricity from the provider when the user needs more than the solar energy system can provide (e.g. during overcast weather and at night, when the PV panel cannot collect energy from the sun). |

Summary Business Plan

As described above (and in greater detail below under “Description of Business”), our business plan is to acquire, build, own and operate profitable, large scale solar generation facilities while also creating a website which is a focal point for solar vendors and buyers. Implementation of the final development and construction phase of our business plan depends on the cost of solar continuing to drop to the point where PV is cost competitive with traditional power generation and the 20 year economic model favors solar.

We need to raise approximately $5,000,000 of additional funding to satisfy our cash requirements for the next 24 months (as described in greater detail below under “Management's Discussion and Analysis of Financial Condition and Results of Operations” – “Plan of Operations”. Because we do not develop new products, no new cash will be required for product development. As previously described, the Company has a four-pronged strategy which it plans to undertake over the next five years. Accomplishing this four-pronged approach will require significant capital. From time-to-time, the Company enters into discussions with various parties regarding non-binding letters of intent; however, each non-binding letter of intent remains subject to significant uncertainties including, among other things, completion of due diligence and arranging both debt and equity financing with third-parties and we have not entered into any definitive agreements in connection with any such letters of intent and we can provide no assurances that the transactions contemplated thereby will be completed, nor are any such transactions currently “probable’. We hope to acquire these assets with a combination of debt from banking institutions and equity from investors.

Moving forward, after the registration of which this Prospectus is a part is declared effective by the Securities and Exchange Commission, we plan to seek out debt and/or equity financing to pay costs and expenses associated with our filing requirements with the Securities and Exchange Commission and to affect our plan of operations, however, we do not currently have any specific plans to raise such additional financing at this time. The sale of additional securities, if undertaken by the Company and if accomplished, may result in dilution to our stockholders. We cannot assure you, however, that future financing will be available in amounts or on terms acceptable to us, or at all.

Penny Stock Rules

Our common stock will be considered a “penny stock”, and subject to the requirements of Rule 15g-9, promulgated under the Securities Exchange Act of 1934, as amended. “Penny stock” is generally defined as any equity security not traded on an exchange or quoted on NASDAQ that has a market price of less than $5.00 per share. Under such rule, broker-dealers who recommend low-priced securities to persons other than established customers and accredited investors must satisfy special sales practice requirements, including a requirement that they make an individualized written suitability determination for the purchaser and receive the purchaser's consent prior to the transaction. The Securities Enforcement Remedies and Penny Stock Reform Act of 1990, also requires additional disclosure in connection with any trades involving a stock defined as a penny stock.

The required penny stock disclosures include the required delivery, prior to any transaction, of a disclosure schedule explaining the penny stock market and the risks associated with it. Such requirements could severely limit the market liquidity of the securities and the ability of purchasers to sell their securities in the secondary market. In addition, various state securities laws impose restrictions on transferring "penny stocks" and as a result, investors in the common stock may have their ability to sell their shares of the common stock impaired.

Emerging Growth Company

We are and we will remain an "emerging growth company" as defined under The Jumpstart Our Business Startups Act (the “JOBS Act”), until the earliest to occur of (i) the last day of the fiscal year during which our total annual revenues equal or exceed $1 billion (subject to adjustment for inflation), (ii) the last day of the fiscal year following the fifth anniversary of our initial public offering, (iii) the date on which we have, during the previous three-year period, issued more than $1 billion in non-convertible debt securities, or (iv) the date on which we are deemed a "large accelerated filer" (with at least $700 million in public float) under the Securities and Exchange Act of 1934, as amended (the “Exchange Act”).

As an "emerging growth company", we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally to public companies. These provisions include:

|

• |

only two years of audited financial statements in addition to any required unaudited interim financial statements with correspondingly reduced “Management’s Discussion and Analysis of Financial Conditions and Results of Operations” disclosure; |

|

• |

reduced disclosure about our executive compensation arrangements; |

|

• |

no requirement that we hold non-binding advisory votes on executive compensation or golden parachute arrangements; and |

|

• |

exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting. |

We have taken advantage of some of these reduced burdens, and thus the information we provide stockholders may be different from what you might receive from other public companies in which you hold shares.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. However, we are choosing to “opt out” of such extended transition period, and as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

Notwithstanding the above, we are also currently a “smaller reporting company”, meaning that we are not an investment company, an asset-backed issuer, or a majority-owned subsidiary of a parent company that is not a smaller reporting company and have a public float of less than $75 million and annual revenues of less than $50 million during the most recently completed fiscal year. In the event that we are still considered a “smaller reporting company”, at such time are we cease being an “emerging growth company”, the disclosure we will be required to provide in our SEC filings will increase, but will still be less than it would be if we were not considered either an “emerging growth company” or a “smaller reporting company”. Specifically, similar to “emerging growth companies”, “smaller reporting companies” are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; are not required to conduct say-on-pay and frequency votes until annual meetings occurring on or after January 21, 2013; and have certain other decreased disclosure obligations in their SEC filings, including, among other things, only being required to provide two years of audited financial statements in annual reports.

Risks Relating to Our Business and Our Industry

Our business is subject to numerous risks and uncertainties, including those highlighted in the section titled “Risk Factors” immediately following this Prospectus Summary. Some of these risks include risks associated with:

|

• |

Our need for additional funding; | |

|

• |

The inability to obtain additional funding; | |

|

• |

Our ability to grow and compete; | |

|

• |

Our ability to continue as a going concern; | |

|

• |

The fact that we are a former “shell company”; | |

|

• |

Risks associated with the JOBS Act; | |

|

• |

Our lack of operating history; | |

|

• |

Risks associated with future acquisitions; | |

|

• |

Our dependence on key executives; | |

|

• |

Severance pay provided under employment agreements; | |

|

• |

The voting control of our officers and directors; | |

|

• |

Our ability to manage our growth; | |

|

• |

Required indemnification of officers and directors; | |

|

• |

Failure to respond to change in our industry; | |

|

• |

Delays, cost overruns and difficulties in connection with our facilities; | |

|

• |

General risks associated with the solar energy industry; | |

|

• |

Dependence on third-party suppliers; | |

|

• |

Reductions or eliminations of government subsidiaries; | |

|

• |

Changes in government regulations affecting our operations; | |

|

• |

The high cost of financing; | |

|

• |

Competition in our industry; | |

|

• |

Costs associated with environmental obligations and liabilities; | |

|

• |

Our ability to obtain and maintain long-term contracts; | |

|

• |

The illiquid, sporadic and volatile market for our common stock; | |

|

• |

Penny stock rules and regulations; | |

|

• |

Dilution to stockholders in connection with our issuance of additional shares; | |

|

• |

Risks associated with secondary trading of our stock; | |

|

• |

Costs associated with being a fully-reporting company; and | |

|

• |

Our ability to issue blank check preferred stock. |

Glossary

Incorporated by reference as Exhibit 99.1 to the Registration Statement of which this Prospectus is a part, is a glossary of certain terms, abbreviations and definitions used throughout this Prospectus.

Summary of the Offering

|

Common Stock Offered: |

|

3,229,870 shares |

|

|

|

|

|

Common Stock Outstanding Before the Offering: |

|

19,747,227 shares |

|

|

|

|

|

Common Stock Outstanding After the Offering: |

|

19,747,227 shares All of the common stock to be sold under this Prospectus will be sold by existing stockholders and represents already outstanding shares of our common stock. There will be no increase in our issued and outstanding shares as a result of this offering. |

|

|

|

|

|

Use Of Proceeds: |

|

We will not receive any proceeds from the shares offered by the selling stockholders in this offering. |

|

|

|

|

|

Need for Additional Financing: |

|

The Company anticipates the need for approximately $5,000,000 of additional funding over the next 24 months (as described in greater detail below under “Management's Discussion and Analysis of Financial Condition And Results of Operations”, below), which includes $800,000 and funds required to pay its expenses associated with being a fully reporting company over the next 24 months. We anticipate raising this funding through the sale of debt or equity securities (subsequent to the effectiveness of our Registration Statement) and/or through traditional bank funding. If we are unable to raise the additional funding, the value of our securities, if any, would likely become worthless and we may be forced to abandon our business plan. |

|

|

|

|

|

Risk Factors: |

|

See “Risk Factors” and the other information in this Prospectus for a discussion of the factors you should consider before deciding to invest in shares of our common stock. |

|

|

|

|

|

Trading Symbol: |

|

Our common stock is quoted on the OTC Pink® market under the symbol "PSWW." |

|

|

|

|

|

Limited Market: |

|

The market for our common stock is highly volatile, sporadic and illiquid as discussed in more detail below, under the heading "Risk Factors." We can provide no assurance that there will be a market for our securities in the future. If in the future market does exist for our securities, it is likely to be highly illiquid and sporadic. |

|

|

|

|

|

Address: |

|

2700 Fairmount, Dallas, Texas 75201 |

|

|

|

|

|

Telephone Number: |

|

(855) 774-7799 |

|

|

|

|

|

Principal Websites: |

|

www.PrincipalSolar.com and www.PrincipalSolarInstitute.org. The information on, or that may be accessed through, our websites is not incorporated by reference into this Prospectus and should not be considered a part hereof. |

General Information About This Prospectus

Unless otherwise noted, throughout this Prospectus the number of shares of our common stock to be outstanding following this offering is based on 19,747,227 shares of our common stock outstanding as of June 30, 2014. It does not include:

|

• |

1,611,333 shares of our common stock issuable upon exercise of outstanding stock options at a weighted average exercise price of $1.30 per share; |

|

• |

warrants to purchase 2,350,368 shares of our common stock at an exercise price of $1.00 per share; or |

|

• |

1,253,026 shares of common stock reserved for future issuance under a pool of options approved by the Board of Directors. |

Financial Summary

Because this is only a financial summary, it does not contain all the financial information that may be important to you. Therefore, you should carefully read all the information in this Prospectus, including the financial statements and their explanatory notes before making an investment decision.

Summary of Financial Data

The following summary financial information includes balance sheet and statement of operations data derived from our audited financial statements and data from our unaudited quarterly statements contained herein. The information contained in this table should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and are derived from the financial statements and accompanying notes included in this Prospectus.

SUMMARY FINANCIAL DATA

The following tables set forth, for the periods and dates indicated, our summary financial data. The summary financial data has been derived from our audited historical consolidated financial statements and accompanying notes for the years ended December 31, 2013 and 2012 as included below. The results included here are not necessarily indicative of future performance.

|

Three Months Ended March 31 |

||||||||

| 2014 | 2013 | |||||||

|

Revenues |

$ | 217,290 | $ | 7,875 | ||||

|

Cost of revenues |

135,103 | 13,658 | ||||||

|

Gross profit (loss) |

82,187 | (5,783 | ) | |||||

|

Operating expenses: |

||||||||

|

Selling, general and administrative expenses |

435,990 | 510,744 | ||||||

|

Loss from operations |

(353,803 | ) | (516,527 | ) | ||||

|

Other expense |

116,113 | 21,606 | ||||||

|

Loss before income tax |

(469,916 | ) | (538,113 | ) | ||||

|

Provision for income taxes |

300 | 450 | ||||||

|

Less: Income attributable to non-controlling interest in subsidiary |

10,671 | - | ||||||

|

Net loss attributable to common stockholders |

$ | (480,887 | ) | $ | (538,583 | ) | ||

|

Net loss per common share |

$ | (0.02 | ) | $ | (0.04 | ) | ||

|

Shares used in computed earnings per share |

19,164,699 | 14,946,135 | ||||||

| As of | ||||||||

| March 31, 2014 | December 31, 2013 | |||||||

|

Cash and equivalents |

$ | 120,795 | $ | 122,533 | ||||

|

Solar arrays, net |

6,901,821 | 6,984,936 | ||||||

|

Total assets |

7,390,476 | 7,433,979 | ||||||

|

Total debt (1) |

5,790,253 | 5,831,560 | ||||||

|

Total liabilities |

7,738,782 | 7,604,806 | ||||||

|

Total stockholders’ deficit |

$ | (348,306 | ) | $ | (170,827 | ) | ||

(1) Includes liabilities arising from reverse merger; current portion of acquisition note payable, net; note payable for insurance premiums; acquisition note payable, net; and convertible notes payable, related parties.

RISK FACTORS

The securities offered herein are highly speculative and should only be purchased by persons who can afford to lose their entire investment in us. You should carefully consider the following risk factors and other information in this Prospectus before deciding to become a holder of our common stock. If any of the following risks actually occur, our business and financial results could be negatively affected to a significant extent.

General Risks

We will require additional financing to continue our business operations and continue our business plan.

The Company anticipates the need for approximately $5,000,000 of additional funding over the next 24 months (as described in greater detail below under “Management's Discussion and Analysis of Financial Condition And Results of Operations”), which includes $800,000 required for the Company to pay its expenses associated with being a fully reporting company over the next 24 months. We anticipate raising this funding through the sale of debt or equity securities (subsequent to the effectiveness of our Registration Statement) and/or through traditional bank funding. If we are unable to raise the additional funding, the value of our securities, if any, would likely become worthless and we may be forced to abandon our business plan.

We may have difficulty obtaining future funding sources, and we may have to accept terms that would adversely affect stockholders.

We will need to raise funds from additional financing. We have no commitments for any financing and any financing commitments may result in dilution to our existing stockholders. We may have difficulty obtaining additional funding, and we may have to accept terms that would adversely affect our stockholders. For example, the terms of any future financings may impose restrictions on our right to declare dividends or on the manner in which we conduct our business. Additionally, we may raise funding by issuing convertible notes, which if converted into shares of our common stock would dilute our then stockholders’ interests. Lending institutions or private investors may impose restrictions on a future decision by us to make capital expenditures, acquisitions or significant asset sales. If we are unable to raise additional funds, we may be forced to curtail or even abandon our business plan.

Our ability to grow and compete in the future will be adversely affected if adequate capital is not available.

The ability of our business to grow and compete depends on the availability of adequate capital, which in turn depends in large part on our cash flow from operations and the availability of equity and debt financing. Our cash flow from operations may not be sufficient or we may not be able to obtain equity or debt financing on acceptable terms or at all to implement our growth strategy. As a result, adequate capital may not be available to finance our current growth plans, take advantage of business opportunities or respond to competitive pressures, any of which could harm our business.

Our auditor has expressed uncertainty about our ability to continue as a going concern.

The Company has negative cash flows from operating activities, negative working capital and an accumulated deficit of approximately $7.6 million as of March 31, 2014 and approximately $7.1 million as of December 31, 2013. Because of the above, we have been issued an opinion by our auditors that substantial concern exists as to whether we can continue as a going concern. As such, it may be more difficult to attract investors.

Stockholders who hold unregistered “restricted securities” will be subject to resale restrictions pursuant to rule 144, due to the fact that we are deemed to be a former “shell company.”

Pursuant to Rule 144 of the Securities Act of 1933, as amended (“Rule 144”), a “shell company” is defined as a company that has no or nominal operations; and, either no or nominal assets; assets consisting solely of cash and cash equivalents; or assets consisting of any amount of cash and cash equivalents and nominal other assets. While we do not believe that we are currently a “shell company”, we were previously a “shell company” and as such are deemed to be a former “shell company” pursuant to Rule 144, and as such, sales of our securities pursuant to Rule 144 may not be able to be made until we are subject to Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended, and have filed all of our required periodic reports for at least the previous one year period prior to any sale pursuant to Rule 144; and a period of at least twelve months has elapsed from the date “Form 10 information” has been filed with the Commission reflecting the Company’s status as a non-“shell company.” Because we are deemed to be a former “shell company”, none of our non-registered “restricted securities” will be eligible to be sold pursuant to Rule 144, until at least a year after the date that our Registration Statement is filed with the Commission, any non-registered securities we sell in the future or issue to consultants or employees, in consideration for services rendered or for any other purpose will have no liquidity until and unless such securities are registered with the Commission and/or until a year after we have complied with the requirements of Rule 144. As a result, it may be harder for us to fund our operations and pay our consultants with our securities instead of cash. Furthermore, it will be harder for us to raise funding through the sale of debt or equity securities unless we agree to register such securities with the Commission, which could cause us to expend additional resources in the future. Our status as a former “shell company” could prevent us from raising additional funds, engaging consultants, and using our securities to pay for any acquisitions (although none are currently planned), which could cause the value of our securities, if any, to decline in value or become worthless.

The recently enacted JOBS Act will allow us to postpone the date by which we must comply with certain laws and regulations and to reduce the amount of information provided in reports filed with the SEC. We cannot be certain if the reduced disclosure requirements applicable to “emerging growth companies” will make our common stock less attractive to investors.

We are and we will remain an "emerging growth company" until the earliest to occur of (i) the last day of the fiscal year during which our total annual revenues equal or exceed $1 billion (subject to adjustment for inflation), (ii) the last day of the fiscal year following the fifth anniversary of our initial public offering, (iii) the date on which we have, during the previous three-year period, issued more than $1 billion in non-convertible debt securities, or (iv) the date on which we are deemed a "large accelerated filer" (with at least $700 million in public float) under the Securities and Exchange Act of 1934, as amended (the “Exchange Act”). For so long as we remain an "emerging growth company" as defined in the JOBS Act, we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not "emerging growth companies" as described in further detail in the risk factors below. We cannot predict if investors will find our common stock less attractive because we will rely on some or all of these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile. If we avail ourselves of certain exemptions from various reporting requirements, as is currently our plan, our reduced disclosure may make it more difficult for investors and securities analysts to evaluate us and may result in less investor confidence.

The recently enacted JOBS Act will also allow the Company to postpone the date by which it must comply with certain laws and regulations intended to protect investors and to reduce the amount of information provided in reports filed with the SEC.

As an "emerging growth company", we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally to public companies. These provisions include:

|

• |

only two years of audited financial statements in addition to any required unaudited interim financial statements with correspondingly reduced “Management’s Discussion and Analysis of Financial Conditions and Results of Operations” disclosure; |

|

• |

reduced disclosure about our executive compensation arrangements; |

|

• |

no requirement that we hold non-binding advisory votes on executive compensation or golden parachute arrangements; and |

|

• |

exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting. |

We have taken advantage of some of these reduced burdens, and thus the information we provide stockholders may be different from what you might receive from other public companies in which you hold shares.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. However, we are choosing to “opt out” of such extended transition period, and as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

Notwithstanding the above, we are also currently a “smaller reporting company”, meaning that we are not an investment company, an asset-backed issuer, or a majority-owned subsidiary of a parent company that is not a smaller reporting company and have a public float of less than $75 million and annual revenues of less than $50 million during the most recently completed fiscal year. In the event that we are still considered a “smaller reporting company”, at such time are we cease being an “emerging growth company”, the disclosure we will be required to provide in our SEC filings will increase, but will still be less than it would be if we were not considered either an “emerging growth company” or a “smaller reporting company”. Specifically, similar to “emerging growth companies”, “smaller reporting companies” are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; are not required to conduct say-on-pay and frequency votes until annual meetings occurring on or after January 21, 2013; and have certain other decreased disclosure obligations in their SEC filings, including, among other things, only being required to provide two years of audited financial statements in annual reports. Decreased disclosures in our SEC filings due to our status as an “emerging growth company” or “smaller reporting company” may make it harder for investors to analyze the Company’s results of operations and financial prospects.

We lack a significant operating history focusing on our current business strategy which you can use to evaluate us, making share ownership in our company risky.

Our Company lacks a long standing operating history focusing on our current business strategy which investors can use to evaluate our Company’s previous results. Therefore, ownership in our Company is risky because we have no significant business history and it is hard to predict what the outcome of our business operations will be in the future.

If we make any acquisitions in the future, they may disrupt or have a negative impact on our business.

If we make acquisitions in the future, funding permitting, of which there can be no assurance, we could have difficulty integrating the acquired companies' personnel and operations with our own. We do not anticipate that any acquisitions or mergers we may enter into in the future would result in a change of control of the Company. In addition, the key personnel of the acquired business may not be willing to work for us. We cannot predict the effect expansion may have on our core business. Regardless of whether we are successful in making an acquisition, the negotiations could disrupt our ongoing business, distract our management and employees and increase our expenses. In addition to the risks described above, acquisitions are accompanied by a number of inherent risks, including, without limitation, the following:

|

▪ |

the difficulty of integrating acquired companies, concepts and operations; |

|

▪ |

the potential disruption of the ongoing businesses and distraction of our management and the management of acquired companies; |

|

▪ |

difficulties in maintaining uniform standards, controls, procedures and policies; |

|

▪ |

the potential impairment of relationships with employees and customers as a result of any integration of new management personnel; |

|

▪ |

the potential inability to manage an increased number of locations and employees; |

|

▪ |

our ability to successfully manage the companies and/or concepts acquired; |

|

▪ |

the failure to realize efficiencies, synergies and cost savings; or |

|

▪ |

the effect of any government regulations which relate to the business acquired. |

Additionally, any properties or facilities that we acquire may be subject to unknown liabilities, such as undisclosed environmental contamination, for which we would have no recourse, or only limited recourse, to the former owners of such properties. As a result, if a liability were asserted against us based upon ownership of an acquired property, we might be required to pay significant sums to settle it, which could adversely affect our financial results and cash flow.

Our business could be severely impaired if and to the extent that we are unable to succeed in addressing any of these risks or other problems encountered in connection with an acquisition, many of which cannot be presently identified. These risks and problems could disrupt our ongoing business, distract our management and employees, increase our expenses and adversely affect our results of operations.

We depend on our executive officers and if we were to lose any of such individuals, we will be forced to expend significant resources to locate replacements, and the loss of such individuals could have a material adverse effect on our operations.

Our performance is substantially dependent upon the performance of Michael Gorton, our Chairman and Chief Executive Officer, David N. Pilotte, our Chief Financial Officer, Kenneth G. Allen our Chief Operations Officer, R. Michael Martin, our Executive Vice President of Business Development, and Dan Bedell, our Executive Vice President of Corporate Development (the “Executives”). We rely on the Executives’ and especially Mr. Gorton’s discretion in the direction of our business and guidance regarding the agreements we enter into. The loss of the services of any of the Executives, but in particular, Mr. Gorton will have a material adverse effect on our business, results of operations, and financial condition. In addition, the absence of any one of the Executives, but especially Mr. Gorton, will force us to seek a replacement who may have less experience or who may not understand our business as well, or we may not be able to find a suitable replacement. Without the expertise of any of the Executives, or an immediate and qualified successor, we may be forced to curtail or scale back our operations thereby decreasing the value of our securities. The Company has employment agreements with, our Chief Executive Officer and Chairman, Mr. Gorton; our Executive Vice President Business Development, Mr. Martin; and our Chief Financial Officer, Mr. Pilotte, each as described below under “Executive and Director Compensation” – “Employment Agreements”). The agreements with Mr. Gorton and Mr. Martin provide that either can resign at any time, and our agreement with Mr. Pilotte provides that he can resign upon 60 days written notice. The Company does not maintain “key man” life insurance on any Executives.

In the event Mr. Gorton’s or Mr. Martin’s employment agreements are terminated by the Company without cause or Mr. Gorton or Mr. Martin resign for any reason or die, we owe them (or their heirs or estates as applicable) significant amounts of severance pay.

As described below under “Executive and Director Compensation” – “Employment Agreements”, effective January 1, 2012, the Company entered into an Employment Agreement with Michael Gorton to serve as the Company’s Chief Executive Officer and effective January 1, 2011, the Company entered into an Employment Agreement with R. Michael Martin to serve as the Company’s Executive Vice President Business Development (collectively Mr. Gorton and Mr. Martin, the “Key Executives”). The agreements remain in effect until the Board of Directors terminates the employment of the Key Executives with the Company or the Key Executives resign with 30 days’ notice. Pursuant to the agreements, the Company agreed to pay Mr. Gorton $22,000 per month ($264,000 per year, as adjusted from time-to-time) during the term of the agreement and an additional $2,000 per month for the first 18 months of the agreement to repay accrued compensation due to Mr. Gorton and Mr. Martin $16,000 per month ($192,000 per year, as adjusted from time-to-time) during the term of the agreement and reimburse him for up to $170 of monthly cell phone expenses and up to $1,000 in health insurance premiums. The Company can terminate either agreement at any time with or without cause, provided that if the Company terminates an agreement without cause, it is required to pay the Key Executive, all salary due as of the date of such termination, plus either one year of severance pay (Mr. Gorton) or six months of severance pay (Mr. Martin) (at his then applicable salary) and all unvested options held by the Key Executive, if any, vest immediately. Termination for cause under the agreements include the Key Executive’s willful misconduct or habitual neglect in the performance of his duties, conviction for any felony involving fraud, dishonesty or moral turpitude, a material breach of the agreement which remains uncured for 10 days after written notice of such breach by the Company, the material violation of the Company’s policies, or the material dishonesty, moral turpitude, fraud or misrepresentation with respect to the Key Executive’s duties under the applicable agreement. In the event an Key Executive resigns from the Company for any reason, or upon the Key Executive’s death, the Company is required to pay the Key Executive (or as applicable his heirs or estate), all salary due as of the date of such termination, plus one year of severance pay (Mr. Gorton) or six months of severance pay (Mr. Martin) (at his then applicable salary) and all unvested options held by the Key Executive, if any, vest immediately. In the event of the termination of a Key Executive’s employment agreement for cause or disability, the Company is only required to pay him any salary and other benefits earned as of the date of termination. The requirement to pay the Key Executives’ severance pay required under this Employment Agreements could prevent a change of control, even if in the best interests of the Company, provide incentives for the Company not to terminate Mr. Gorton and/or Mr. Martin, and could, if we are forced to pay such severance pay, have an adverse effect on our liquidity and cash flows.

Our executive officers and directors, and our largest stockholder possess significant voting control over the Company.

Our executive officers and directors own in aggregate 5,327,937 shares of common stock (not including shares issuable upon exercise of outstanding options) or approximately 28% of our outstanding common stock as of the date of this Prospectus.

Additionally, our largest stockholder, Steuben Investment Company II, L.P. (“Steuben”), beneficially owns 4,210,027 shares of our common stock (of which 1,300,935 shares are being registered herein) and warrants to purchase 2,181,818 shares of our common stock with an exercise price of $1.00 per share, which expire on June 13, 2023. As such, taking into account the exercise of the warrants, Steuben beneficially owns 29.5% of our voting stock prior to the offering of shares described in this Prospectus and notwithstanding the fact that Steuben is a Selling Stockholder in the offering.

Accordingly, such executive officers and directors, and separately, Steuben, possess significant influence over the matters submitted to the stockholders for approval. These matters include the election of directors, mergers, consolidations, the sale of all or substantially all of our assets, and also the power to prevent or cause a change in control. This level of control by the executive officers and directors, and separately, Steuben, gives them substantial ability to determine our future as a business. These changes may not be in the best interests of the Company’s stockholders and/or may eventually make the value of any investment in us worthless. Any investor who purchases shares in the Company will be a minority stockholder and as such will have little say in the direction of the Company and the election of directors. As a potential investor in the Company, you should keep in mind that even if you own shares of the Company's common stock and wish to vote them at annual or special stockholder meetings, your shares will likely have little effect on the outcome of corporate decisions.

A significant portion of our revenues comes from only one solar installation.

In fiscal 2013, 96% of our consolidated power generation revenue arose from our Powerhouse One solar installation under a fixed-price Power Purchase Agreement (PPA) having a remaining term through 2031. The buyer and counterparty of the PPA is Fayetteville Public Utility of Lincoln County Tennessee. A similar percentage of the accounts receivable also stems from this single relationship. As a result, if the installation were unable to generate power for any reason, our revenues would be significantly adversely effected. Additionally, once such PPA expires, if we are unable to enter into similar PPA’s or otherwise generate revenues from other sources our results of operations will be materially adversely affected and the value of our common stock may decline in value.

Our growth will place significant strains on our resources.

Our growth is expected to place a significant strain on our managerial, operational and financial resources. Further, in connection with our planned growth, we will be required to manage multiple relationships with various suppliers, partners and third parties. These requirements will be exacerbated in the event of our further growth or increases in the number of our contracts. Our systems, procedures or controls may not be adequate to support our operations or able to achieve the rapid execution necessary to successfully offer our services and implement our business plan in the event of future growth. Our future operating results will also depend on our ability to add additional personnel commensurate with the growth of our business. If we are unable to manage growth effectively, our business, results of operations and financial condition will be adversely affected.

We believe that certain prior corporate actions undertaken by us pursuant to the purported authority and approval of our preferred stock holders, including our March 2011 reverse stock split, were completed without effective stockholder approval and in violation of state statutes.

In March 2011, the Company paid approximately $89,007 to Pegasus Funds LLC (“Pegasus”) and issued two shares of Series A Super Voting Preferred Stock (the “Series A Preferred Stock”) for finding a public shell company and for structuring the Principal Solar Exchange Agreement and as compensation for monies paid by Pegasus in connection with the renewal of the Company’s charter. Among other powers provided to the Series A Preferred Stock by the Board of Directors was that each share of Series A Preferred Stock provided the holder thereof the right to vote a number of voting shares equal to the total number of shares of authorized common stock of the Company on any and all stockholder matters (effectively providing such Series A Preferred Stock stockholders majority voting control over the Company). Subsequently in March 2011, we, with the approval of our Board of Directors and the Series A Preferred Stock stockholders (purporting to vote a majority of our outstanding voting shares) affected a 1 for 40 reverse split of our outstanding shares such that, each share of common stock then outstanding, par value $0.01 of the Company was exchanged for one-fortieth (0.025) of a share of common stock, which reverse stock split became effective with FINRA on May 25, 2011.

In connection with the due diligence associated with the preparation and filing of the registration statement of which this Prospectus is a part, it came to attention of our current management (who were appointed subsequent to the purported approval of the reverse stock split by the Series A Preferred Stock stockholders as described above), that no preferred stock designation setting the preferences and rights (including the voting rights) of the Series A Preferred Stock was ever filed with the Secretary of State of New York (where the Company was then domiciled) and as such Pegasus, as the holder of the Series A Preferred Stock, did not obtain any valid voting rights associated with such Series A Preferred Stock or have any rights in connection therewith. Consequently, the purported approval by Pegasus of the reverse split in March 2011 was not valid and such corporate action was in effect taken without valid stockholder approval in contravention of New York law.

Notwithstanding the above, the documentation relating to the reverse split was filed with and accepted by the Secretary of State of New York and approved by FINRA. Additionally, in October 2012 the Company re-domiciled to Delaware and adopted a new Certificate of Incorporation in connection with re-domiciling and as such, we believe that the reverse stock split was effectively retroactively approved by stockholders of the Company in connection with such re-domiciling (due to the approval by the Company’s stockholders of a new Certificate of Incorporation retroactively reflecting such reverse stock split). We could face liability and claims and could be forced to pay damages, take remedial actions, or further ratify the reverse stock split in the future, which costs and expenses could have a material adverse effect on our results of operations and liquidity. Furthermore, the fact that certain of our corporate actions were not affected properly, the perception in the marketplace that such corporate actions were not affected properly, or uncertainties associated therewith, could raise questions about our corporate governance and controls and procedures and result in the trading value of our common stock, if any, being lower than companies without similar issues.

Our Certificate of Incorporation and Bylaws limit the liability of, and provide indemnification for, our officers and directors.