Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FUEL TECH, INC. | d761435d8k.htm |

Exhibit 99.1

FUEL TECH Technologies to enable clean efficient energy Delivering global environmental Solutions today for tomorrow’s generations 2014 let ter to StockholderS

Fuel Tech, Inc. (NASDAQ: FTEK) fuel tech, Inc. is a fully integrated company utilizing a suite of advanced technologies to provide boiler and combustion optimization, efficiency improvement, and air pollution reduction and control solutions to utility and industrial customers worldwide. the company’s core activities center on its nitrogen oxide (Nox) reduction systems and processes and its unique application of chemicals to improve combustion unit performance. fuel tech’s products and services rely heavily on the company’s exceptional computational fluid dynamics modeling skills, which are enhanced by internally developed, high-end visualization software. Additional information can be found at www.ftek.com. Management team (left to right) robert e. Puissant, david s. collins, douglas G. Bailey, Vincent J. Arnone, Albert G. Grigonis

dear StockholderS fellow douglas G. Bailey Chairman, President and Chief Executive Officer “Our results for 2013 reflected a high degree of geographic diversity for our regulatory-driven Air Pollution Control (APC) business, buoyed by modest revenue growth and predictable gross margin at our ROI-driven FUEL CHEM® segment. Consolidated revenues in 2013 rose for the fourth consecutive year, our annual profits increased substantially from 2012, and we made significant progress in achieving global geographic diversity within our APC portfolio. As proud as I am of all we accomplished in 2013, I am more excited about what lies ahead.” ViSion MiSSion A cleaner, more energy-efficient, We provide our customers innovative solutions to produce sustainable environment to benefit the clean, efficient energy by applying advanced technologies world’s present and future generations. through engineering excellence and our knowledge of complex combustion processes. We create long-term value for our employees and our stockholders, and for the communities in which we do business, through our continued pursuit of innovation and growth. 1

Fuel Tech, inc. consolidated revenues rose to a record $109.3 million net income increased to $5.1 million, or $0.23 per diluted share At December 31, 2013, total cash and equivalents were $27.7 million, or $1.23 per diluted share I wish to begin with a comment on this communication. Air PollUtion control: An increASinGlY The timing and format of this mid-year Letter to Stockholders GloBAl MArket enables me to discuss certain 2014 developments in the Our APC business is witnessing dramatic change as it relates context of the business environment of both the current and to an evolving mix of energy use, global cross-border previous year. concerns for air quality, and renewed regulatory effort. On Our results for 2013 were indicative of our business model the domestic regulatory front, on April 29, 2014 the United and the current market environment. Specifically, a high States Supreme Court (Supreme Court) upheld the EPA’s Cross degree of geographic diversity for our regulatory-driven State Air Pollution Rule (CSAPR), which mandates that so-called Air Pollution Control (APC) business, buoyed by modest “upwind states” reduce emissions from coal-fired power revenue growth and predictable gross margin for our ROI- plants of sulfur dioxide (SO2) and nitrogen oxides (NOx). driven FUEL CHEM® segment, enabled us to achieve a very By way of background, following the introduction of CSAPR successful year. on July 6, 2011 we experienced a surge in domestic orders Consolidated revenues rose for the fourth consecutive year for our SNCR technology as utility and industrial clients rushed to a record $109.3 million, with contributions coming from to comply with the lower emissions standards set to take both our domestic and international operations. In the U.S., effect on January 1, 2012. SNCR is an ideal low-capital the APC utility market continued to be driven by a number cost solution as this technology reduces NOx emissions by of consent decrees under which customers agreed to 25–50% with minimal installation downtime and low energy reduce NO emissions as part of settlement agreements or consumption. However, CSAPR was short-lived and eventually x individual state requirements. This included growth in certain vacated by the U.S. Court of Appeals for the District of industrial markets, where new plants and plant expansions Columbia Circuit (D.C. Circuit) on August 21, 2012. Since required new or modified air permits, prompting the need for that time, our domestic APC business has operated under our Selective Catalytic Reduction (SCR) and Selective Non- other existing regulations and state consent decrees. Although Catalytic Reduction (SNCR) technologies in order to achieve U.S. bookings continued, the pace of new domestic awards compliance. While the domestic market continued to face slowed and backlog declined as utilities delayed their broad regulatory uncertainty, we made significant progress purchases while awaiting regulatory clarity. The Supreme in achieving global geographic diversity within our APC Court’s action regarding CSAPR was a significant step portfolio. As a result, 2013 international revenues rose for a toward achieving that clarity. third consecutive year and comprised 42% of total revenues, The D.C. Circuit had held that CSAPR had exceeded EPA’s the highest percentage in our history. We also ended the authority under the Clean Air Act (CAA) in at least two year with a strong balance sheet that included total cash respects. The first is that EPA issued CSAPR as a Federal and equivalents of $27.7 million, or $1.23 per diluted share, Implementation Plan as opposed to setting reduction and no long-term debt. obligations and allowing states an opportunity to develop As proud as I am of all we accomplished in 2013, I am State Implementation Plans to reduce emissions within state more excited about what lies ahead. We are now well borders. The second is that the rule required upwind states into 2014 and it has already been an eventful year for to reduce emissions by more than the CAA’s “significant our Company. 2

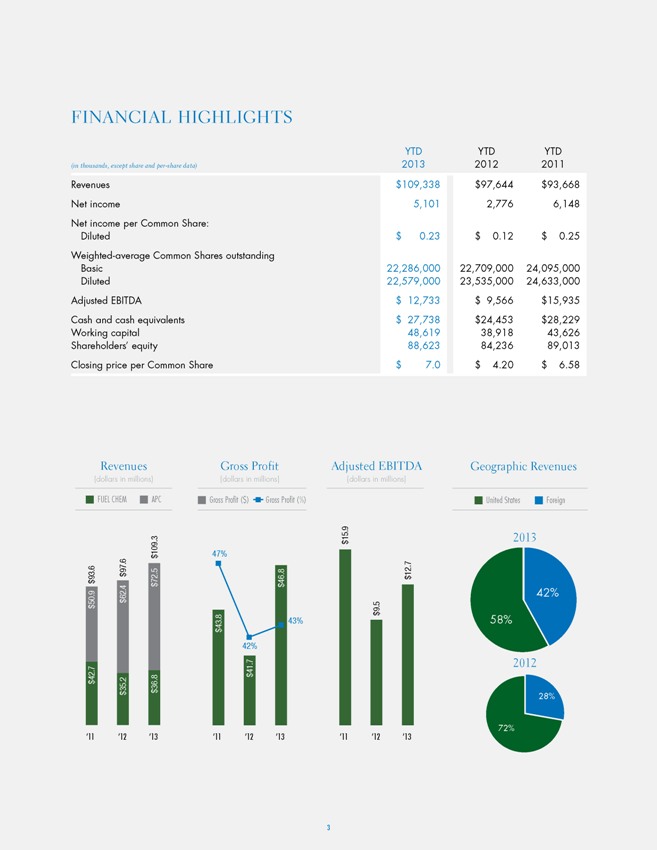

FinAnciAl hiGhliGhtS YTD YTD YTD (in thousands, except share and per-share data) 2013 2012 2011 Revenues $109,338 $97,644 $93,668 Net income 5,101 2,776 6,148 Net income per Common Share: Diluted $ 0.23 $ 0.12 $ 0.25 Weighted-average Common Shares outstanding Basic 22,286,000 22,709,000 24,095,000 Diluted 22,579,000 23,535,000 24,633,000 Adjusted EBITDA $ 12,733 $ 9,566 $15,935 Cash and cash equivalents $ 27,738 $24,453 $28,229 Working capital 48,619 38,918 43,626 Shareholders’ equity 88,623 84,236 89,013 Closing price per Common Share $ 7.0 $ 4.20 $ 6.58 Revenues Gross Profit Adjusted EBITDA Geographic Revenues (dollars in millions) (dollars in millions) (dollars in millions) FUEL CHEM APC Gross Profit ($) Gross Profit (%) United States Foreign . 9 3 . $ 15 2013 $ 109 47% . 6 . 7 . 6 97 . 5 8 93 $ . $ 12 $ $ 72 46 4 $ 9 . . 62 42% 50 $ . 5 $ $ 9 . 8 43% 58% $ 43 42% . 7 2012 . 7 41 42 8 $ 2 . . $ 36 35 $ $ 28% ’11 ’12 ’13 ’11 ’12 ’13 ’11 ’12 ’13 72% 3

We are well-positioned to address growing global market opportunities. Our APC business is witnessing dramatic change as it relates to an evolving mix of energy use, global cross-border concerns for air quality, and renewed regulatory effort. On April 29, 2014 the United States Supreme Court upheld the EPA’s Cross State Air Pollution Rule (CSAPR), which could prove to be a significant factor in driving domestic growth of our APC business. On April 30, 2014, we announced the acquisition of two related private companies that broaden our APC product portfolio and grant us immediate access into the fast-growing particulate control market. APc revenues were a record $72.5 million, up 16% from $62.4 million in 2012 international revenues rose to $46.1 million, the highest in our history china/Pacific Rim revenues increased 27% from 2012 4

Fuel Tech, inc. We continUe to inVeSt in neWlY enGineered SolUtionS thAt AddreSS the onGoinG coMPliAnce And oPerAtinG needS oF oUr cUStoMerS. contribution” threshold as established by EPA and more than These acquisitions broaden Fuel Tech’s APC product necessary to achieve attainment. portfolio and grant us immediate access into the fast-growing particulate control market, a substantial opportunity as coal-In reversing the D.C. Circuit’s decision, the Supreme Court fired power plants throughout the U.S. and abroad are concluded that EPA’s approach was lawful. The Supreme creating strategies to meet upcoming regulations. In the U.S., Court ruling clarified the scope and breadth of EPA’s regulatory this includes EPA’s Mercury and Air Toxics Standards Rule authority in the implementation of interstate transport rules and CSAPR for utility boilers, along with the Boiler Maximum and the case now has been remanded to the D.C. Circuit Achievable Control Technology Rule for industrial boilers. to address other issues left open by the Supreme Court. Fuel Tech and PECO and FGC share a similar customer The revival of CSAPR could prove to be a significant factor base, which provides substantial cross-selling opportunities in driving domestic growth of our APC business, although and a natural channel for potential follow-on business from compliance dates remain uncertain. What we now know is those clients requiring multi-pollutant emissions control solutions. that our decision to maintain Fuel Tech’s internal resources The solutions offered by PECO and FGC will also assist us during the judicial process has proven to be a sound one. in strengthening our already established presence in China, We will continue to monitor the implementation of this where our 2013 revenues increased for the third consecutive regulation and align, as necessary, our sales and marketing year. Air pollution control, especially for particulate matter, infrastructure to support our efforts to secure a significant has become a critical issue of growing public and political share of associated contract awards. concern in China. Over the past year, we devoted a considerable amount of In our view, China continues to present a significant growth time and resources to identifying strategic ways to evolve our opportunity for Fuel Tech. China plans to spend $277 billion business. On April 30, 2014—coincidentally, just one day over the next five years preventing and controlling air after the CSAPR ruling—we announced the acquisition of pollution. As previously reported, we have adopted a two related private companies: Cleveland Roll Forming decidedly more aggressive posture towards broadening Environmental Division, Inc. (d/b/a PECO) and FGC our nearly seven-year presence in China, where we have Corporation (FGC). Collectively, PECO and FGC provide become a recognized leader by providing APC solutions to particulate control and electrostatic precipitator performance some of that nation’s largest power generation and industrial improvement solutions to coal-fired power plants and other companies. Fuel Tech has now installed more than 160 solid fuel energy facilities. With combined 2013 revenues systems that contribute to emission reductions in China, of $10 million, we acquired these companies for a total of representing 20% of our total installation base, and our $8.25 million in cash. Operating profitably, PECO and FGC China/Pacific Rim revenues rose 27% in 2013. Importantly, are expected to be immediately accretive to our earnings. we are not perceived as just another “foreign company.” 5

Fuel Tech, inc. oUr FUel cheM BUSineSS SeGMent PerForMed AdMirABlY in 2013. While FUel cheM iS PriMArilY A doMeStic MArket todAY, We exPect it to GAin An exPAnded internAtionAl PreSence. Pollution levels in China are hitting record highs, resulting in and FGC, provides us with a distinct advantage in this as many as 500,000 premature deaths each year, according important market. to an article in The Lancet medical journal. Thick clouds Fuel Tech was a pioneer in developing emissions reduction of smog are reducing by as much as 50% the amount of technologies in the U.S., enabling our nation to meet sunlight reaching China’s crops, impeding photosynthesis stringent reduction targets that have vastly improved the and putting at risk that nation’s agricultural output. Chinese quality of life for Americans. We also believe that we are news media, including official state outlets, are reporting uniquely positioned to assist China in addressing its current more aggressively on the causes and effects of pollution. challenges to balance rapid industrialization with the health Awareness is rising both inside this country, most notably and quality of life for its citizens. We remain cautiously among its burgeoning middle class, as well as beyond its optimistic that a combination of public sentiment and political borders reflecting a growing realization that China is commitment can drive historic change with respect to that exporting its pollution to neighboring countries in Asia and nation’s air pollution control initiatives. Our goal is to expand even the west coast of the U.S. our position there as an indigenous air pollution control leader. It is likely that coal will remain the predominant fuel source To that end, we will continue to localize our capabilities and in China for the foreseeable future. It is projected that supply chain, while building strong commercial relationships. approximately one-half of China’s power generation capacity Our international expansion initiatives are not confined to Asia. to be built between 2012 and 2020 will be coal-fired. From In Latin America, we continued with the turnkey installation a regional perspective, coal is projected to generate nearly of Over-Fire Air systems and Low NOx Burners for six coal-half of Southeast Asia’s electricity by 2035, up from less fired units for a major utility in Chile. This project—the largest than a third at present. If the source of China’s fuel is not in our history—will be substantially executed by mid-2014, going to change, then how that fuel is burned must change. with one remaining unit to be complete by mid-2015 to China has recognized that and is accelerating its commitment accommodate a customer-requested change in outage to reducing hazardous emissions, which should translate to schedule. Customer feedback has been very positive, and higher bookings and revenues for our business. we remain encouraged that our elevated profile will result We are also experiencing a broadening level of interest in in the awarding of additional projects of this size, scope our suite of emissions control solutions. Prior to 2013 our and complexity. China/Pacific Rim business was concentrated in our ULTRA™ process, a U.S. patented approach that converts safe urea FUel cheM: conSiStent reSUltS FroM An reagent to ammonia for use on new SCR systems and in roi-driVen BUSineSS Model retrofit applications for existing systems. This past year, Our FUEL CHEM business performed admirably in 2013, we experienced an increase in China orders for our SCR, despite the persistent challenges of low natural gas prices, SNCR and Flue Gas Conditioning technologies. We believe decreased energy demand and slower economic growth. that the diverse nature of our NOx solutions portfolio, now combined with the particulate matter expertise of PECO 6

chinA: at the forefront of our business development efforts China plans to spend $277 billion over the next five years preventing and controlling air pollution. We have adopted a decidedly more aggressive posture towards broadening our nearly seven-year presence in China, where we have become a recognized leader by providing APC solutions to some of that nation’s largest power generation and industrial companies. Fuel Tech has now installed more than 160 systems that contribute to emission reductions in China, representing 20% of our total installation base. Our China/ Pacific Rim revenues rose 27% in 2013. 7

Fuel Tech, inc. We Are More oPtiMiStic thAn eVer thAt FUel tech iS PoSitioned to exPAnd itS PreSence AS A leAder in the GloBAl enerGY And enVironMentAl SolUtionS MArketPlAce. We reMAin FocUSed on ProVidinG cAPitAl-eFFicient, coSt-eFFectiVe SolUtionS thAt AlloW oUr cUStoMerS to oPerAte in A cleAner, More eFFicient MAnner And, in doinG So, enhAncinG the lonG-terM VAlUe oF FUel tech For oUr StockholderS. FUEL CHEM programs improve the efficiency, reliability and measure ammonia emissions from SNCR and SCR applications. environmental status of utility and industrial facilities with an We are focused on unfolding opportunities in the control of emphasis on controlling slagging, fouling, corrosion, opacity, multiple pollutants, such as acid gases, mercury, and oxides acid plume, loss on ignition and SO3-related issues, including of sulfur and nitrogen. In addition, we believe that new ammonium bisulfate and particulate matter formation. process technologies can enable cleaner and economically more efficient use of traditional fossil fuels. Boilers that employ FUEL CHEM technology can realize significant benefits arising from higher efficiencies achieved We are also actively exploring in-licensing opportunities or during the fuel combustion process, including an increase in acquisition of technologies that both complement and expand megawatt (MW) generation per unit of fuel input (or constant our core capabilities, guided by the overarching desire to MW with lower fuel consumption), and reductions in power trend our business mix to a greater level of recurring revenues. requirements, unburned impurities and lower furnace exit gas temperature. FUEL CHEM also offers numerous opportunities in cloSinG for operating cost reductions, including labor cost savings, We are more optimistic than ever that Fuel Tech is positioned and avoided equipment replacement expense. to expand its presence as a leader in the global energy and FUEL CHEM customers appreciate how our technology environmental solutions marketplace. The growth we achieved allows them to compete with low natural gas prices through and the challenges we faced in 2013 have steeled our fuel flexibility. Our set of proprietary solutions allows plants resolve to increase our global presence, introduce more new to burn more economical coal, such as those mined from products, and continue to drive the evolution of our business the Powder River and Illinois Basins, without compromising model to provide for recurring revenue streams. We remain stringent air quality standards. focused on providing capital-efficient, cost-effective solutions that allow our customers to operate in a cleaner, more While FUEL CHEM is primarily a domestic market today, efficient manner and, in doing so, enhancing the long-term we expect it to gain an expanded international presence. value of Fuel Tech for our Stockholders. In Mexico, we continue to demonstrate good technical progress, in the form of visible plume reduction, for the As always, I wish to thank Fuel Tech’s team of professionals comprehensive control of SO around the world. Their dedication, resourcefulness and 3 at customer units. We believe support are, in full measure, responsible for our past and that this developing market holds promise for Fuel Tech to future success. establish a long-term leadership position in that country. innoVAtion We continue to invest in newly engineered solutions that Sincerely, address the ongoing compliance and operating needs of our customers. This past year we debuted our XCAM™ Douglas G. Bailey Extractive Continuous Ammonia Monitoring system, which is Chairman, President and Chief Executive Officer an engineered process designed to quickly and accurately 8

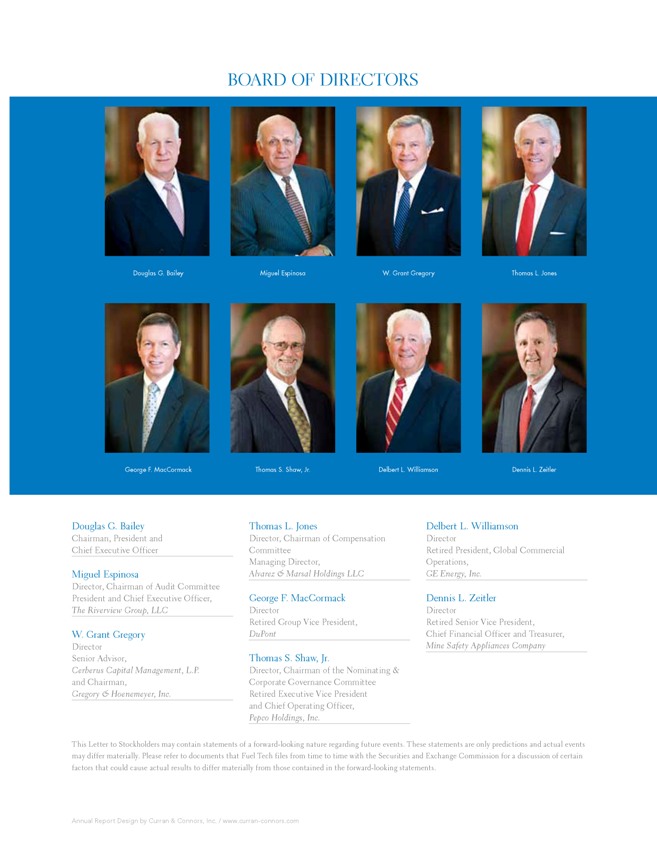

BoArd oF directorS Douglas G. Bailey Miguel Espinosa W. Grant Gregory Thomas L. Jones George F. MacCormack Thomas S. Shaw, Jr. Delbert L. Williamson Dennis L. Zeitler douglas G. Bailey thomas l. Jones delbert l. Williamson chairman, President and director, chairman of compensation director chief executive officer committee retired President, Global commercial Managing director, operations, Miguel espinosa Alvarez & Marsal Holdings LLC GE Energy, Inc. director, chairman of Audit committee President and chief executive officer, George F. Maccormack dennis l. Zeitler The Riverview Group, LLC director director retired Group Vice President, retired Senior Vice President, W. Grant Gregory DuPont chief Financial officer and treasurer, director Mine Safety Appliances Company Senior Advisor, thomas S. Shaw, Jr. Cerberus Capital Management, L.P. director, chairman of the Nominating & and chairman, corporate Governance committee Gregory & Hoenemeyer, Inc. retired executive Vice President and chief operating officer, Pepco Holdings, Inc. this letter to Stockholders may contain statements of a forward-looking nature regarding future events. these statements are only predictions and actual events may differ materially. Please refer to documents that Fuel tech files from time to time with the Securities and exchange commission for a discussion of certain factors that could cause actual results to differ materially from those contained in the forward-looking statements. Annual Report Design by Curran & Connors, Inc. / www.curran-connors.com

www.ftek.com