Attached files

| file | filename |

|---|---|

| EX-99.1 - EX 99.1 - EARNINGS RELEASE - Celanese Corp | q220148-kex991.htm |

| EX-99.4 - EX 99.4 - PREPARED REMARKS - Celanese Corp | q220148-kex994.htm |

| EX-99.2 - EX 99.2 - NON-GAAP MEASURES - Celanese Corp | q220148-kex992.htm |

| 8-K - 8-K - Celanese Corp | q220148-kdoc.htm |

Celanese Q2 2014 Earnings Thursday, July 17, 2014 Conference Call / Webcast Friday, July 18, 2014 10:00 a.m. EDT © Celanese Mark Rohr, Chairman and Chief Executive Officer Chris Jensen, Senior Vice President, Finance Exhibit 99.3

© Celanese Celanese Corporation 2 This presentation may contain “forward-looking statements,” which include information concerning the company's plans, objectives, goals, strategies, future revenues or performance, capital expenditures, financing needs and other information that is not historical information. All forward-looking statements are based upon current expectations and beliefs and various assumptions. There can be no assurance that the company will realize these expectations or that these beliefs will prove correct. There are a number of risks and uncertainties that could cause actual results to differ materially from the results expressed or implied in the forward-looking statements contained in this release. These risks and uncertainties include, among other things: changes in general economic, business, political and regulatory conditions in the countries or regions in which we operate; the length and depth of product and industry business cycles, particularly in the automotive, electrical, textiles, electronics and construction industries; changes in the price and availability of raw materials, particularly changes in the demand for, supply of, and market prices of ethylene, methanol, natural gas, wood pulp and fuel oil and the prices for electricity and other energy sources; the ability to pass increases in raw material prices on to customers or otherwise improve margins through price increases; the ability to maintain plant utilization rates and to implement planned capacity additions and expansions; the ability to reduce or maintain their current levels of production costs and to improve productivity by implementing technological improvements to existing plants; increased price competition and the introduction of competing products by other companies; market acceptance of our technology; the ability to obtain governmental approvals and to construct facilities on terms and schedules acceptable to the company; changes in the degree of intellectual property and other legal protection afforded to our products or technologies, or the theft of such intellectual property; compliance and other costs and potential disruption or interruption of production or operations due to accidents, interruptions in sources of raw materials, cyber security incidents, terrorism or political unrest or other unforeseen events or delays in construction or operation of facilities, including as a result of geopolitical conditions, the occurrence of acts of war or terrorist incidents or as a result of weather or natural disasters; potential liability for remedial actions and increased costs under existing or future environmental regulations, including those relating to climate change; potential liability resulting from pending or future litigation, or from changes in the laws, regulations or policies of governments or other governmental activities in the countries in which we operate; changes in currency exchange rates and interest rates; our level of indebtedness, which could diminish our ability to raise additional capital to fund operations or limit our ability to react to changes in the economy or the chemicals industry; and various other factors discussed from time to time in the company's filings with the Securities and Exchange Commission. Any forward-looking statement speaks only as of the date on which it is made, and the company undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date on which it is made or to reflect the occurrence of anticipated or unanticipated events or circumstances. Results Unaudited The results in this presentation, together with the adjustments made to present the results on a comparable basis, have not been audited and are based on internal financial data furnished to management. Quarterly results should not be taken as an indication of the results of operations to be reported for any subsequent period or for the full fiscal year. Non-GAAP Financial Measures and Change in Accounting Policy This presentation, and statements made in connection with this presentation, contain references to non-GAAP financial measures. For more information on the non-GAAP financial measures used by the company and referenced in this presentation, including definitions and reconciliations with comparable GAAP financial measures, as well as prior period information, please refer to the Non-GAAP Financial Measure and Supplemental Information document available under Investor Relations/Financial Information/Non-GAAP Financial Measures and Supplemental Information on our website, www.celanese.com. The website materials also describe a change in accounting policy regarding pension and other postretirement benefits effective January 1, 2013. Forward-Looking Statements

© Celanese Celanese Corporation 3 Mark Rohr Chairman and Chief Executive Officer

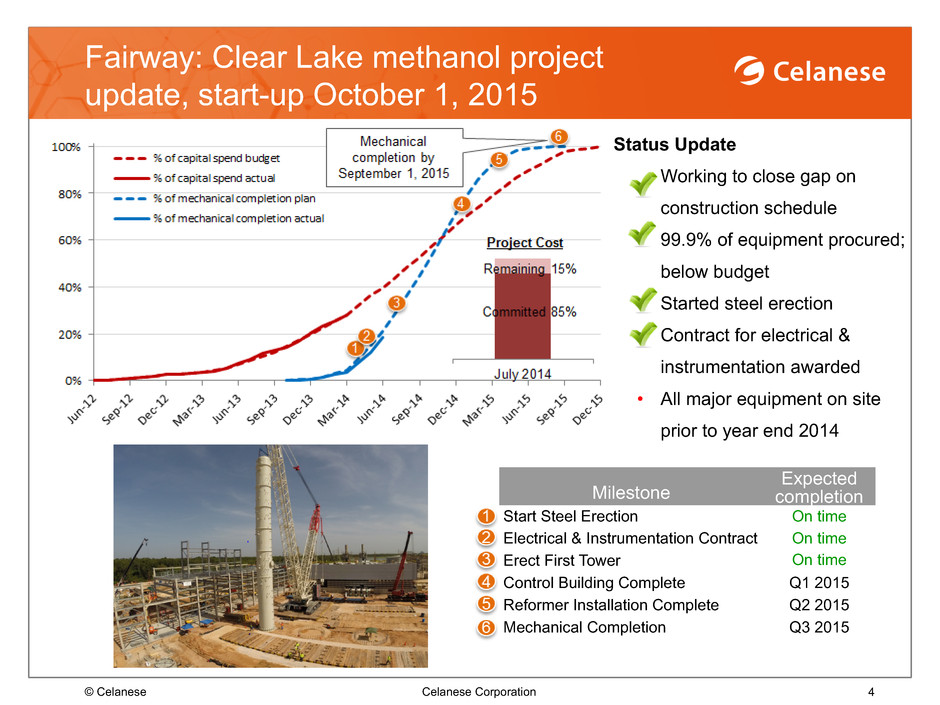

© Celanese Celanese Corporation 4 Fairway: Clear Lake methanol project update, start-up October 1, 2015 Status Update Working to close gap on construction schedule • 99.9% of equipment procured; below budget • Started steel erection • Contract for electrical & instrumentation awarded • All major equipment on site prior to year end 2014 Milestone Expected completion Start Steel Erection On time Electrical & Instrumentation Contract On time Erect First Tower On time Control Building Complete Q1 2015 Reformer Installation Complete Q2 2015 Mechanical Completion Q3 2015

© Celanese Celanese Corporation 5 Recent Highlights *For additional details please refer to Investor Relations/Financial news on our website, www.celanese.com. • Opened Commercial Technology Center in Seoul, Republic of Korea • Expanding compounding capabilities in Nanjing, China and Florence, Kentucky • Expanding Suzano, Brazil facility to include long- fiber reinforced thermoplastics • Exploring construction of a VAE emulsions production unit in Southeast Asia Commercial Technology Center in Seoul, Republic of Korea

© Celanese Celanese Corporation 6 Innovation Success Electronics (Zenite® and Vectra LCP®) Non wovens (VAE Emulsion) *For additional details please refer to Investor Relations/Recent Business and Product Related Releases on our website, www.celanese.com. • Next generation of engineered materials • Enables new compact camera module design • Improved optics with 20% higher mega-pixel density • Reduces production waste >70% • Re-launched a lower VOC version of VAE emulsion • Strong demand for improved environmental characteristics during production of non-wovens • Reduces carbon footprint versus prior product generations

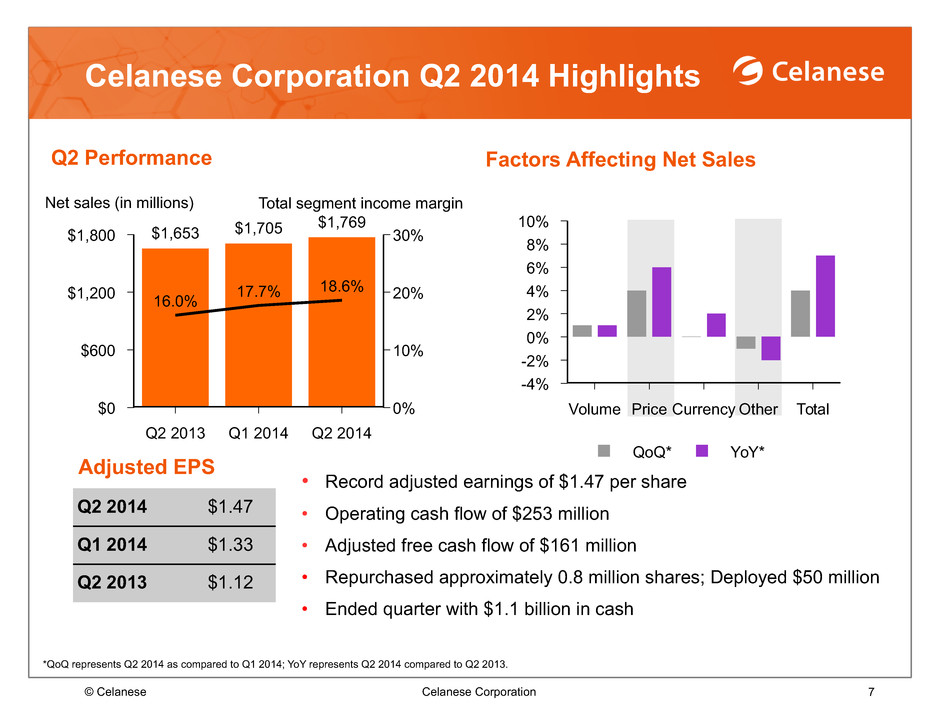

© Celanese Celanese Corporation 7 QoQ* YoY* 10% 8% 6% 4% 2% 0% -2% -4% Volume Price Currency Other Total $1,800 $1,200 $600 $0 30% 20% 10% 0% Q2 2013 Q1 2014 Q2 2014 16.0% 17.7% 18.6% $1,653 $1,705 $1,769 Celanese Corporation Q2 2014 Highlights Q2 Performance Factors Affecting Net Sales • Record adjusted earnings of $1.47 per share • Operating cash flow of $253 million • Adjusted free cash flow of $161 million • Repurchased approximately 0.8 million shares; Deployed $50 million • Ended quarter with $1.1 billion in cash *QoQ represents Q2 2014 as compared to Q1 2014; YoY represents Q2 2014 compared to Q2 2013. Adjusted EPS Q2 2014 $1.47 Q1 2014 $1.33 Q2 2013 $1.12 Net sales (in millions) Total segment income margin

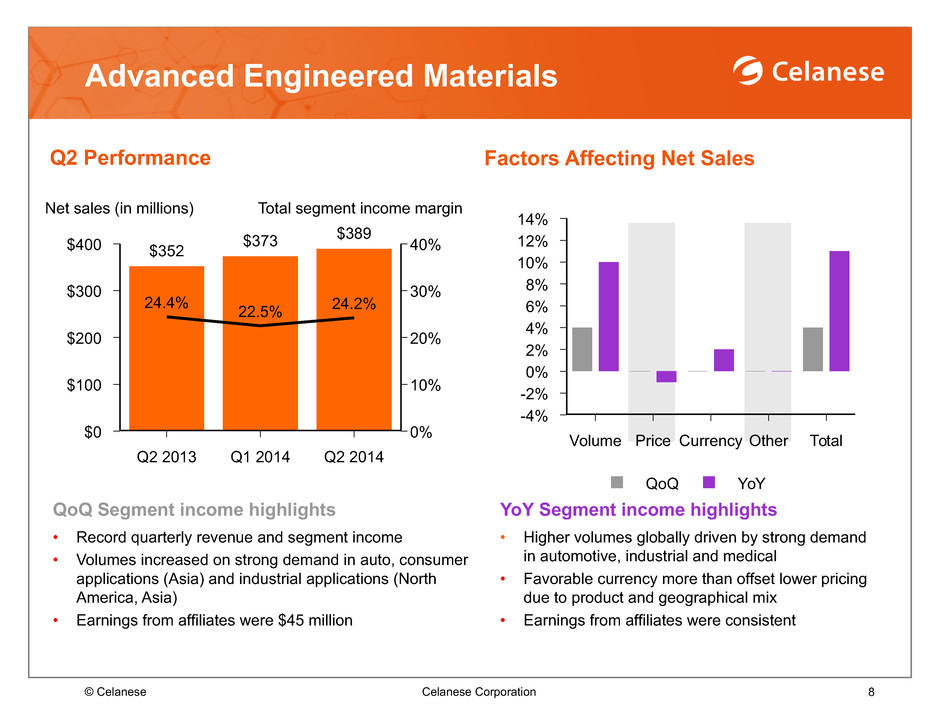

© Celanese Celanese Corporation 8 YoY Segment income highlights • Higher volumes globally driven by strong demand in automotive, industrial and medical • Favorable currency more than offset lower pricing due to product and geographical mix • Earnings from affiliates were consistent QoQ Segment income highlights • Record quarterly revenue and segment income • Volumes increased on strong demand in auto, consumer applications (Asia) and industrial applications (North America, Asia) • Earnings from affiliates were $45 million Net sales (in millions) Advanced Engineered Materials Q2 Performance Factors Affecting Net Sales $400 $300 $200 $100 $0 40% 30% 20% 10% 0% Q2 2013 Q1 2014 Q2 2014 24.4% 22.5% 24.2% $352 $373 $389 Total segment income margin QoQ YoY 14% 12% 10% 8% 6% 4% 2% 0% -2% -4% Volume Price Currency Other Total

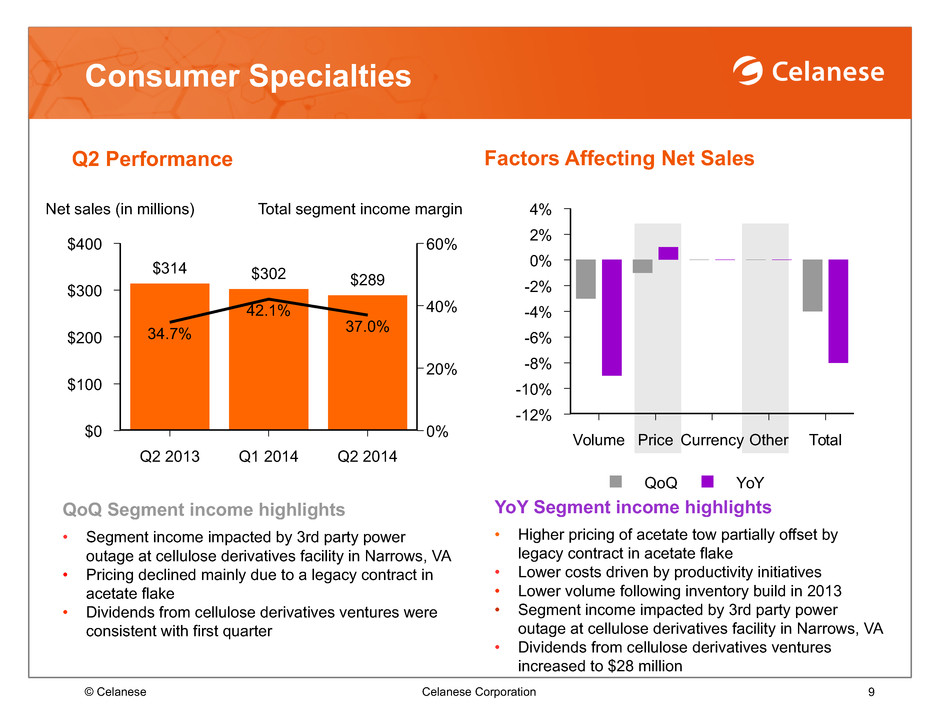

© Celanese Celanese Corporation 9 Consumer Specialties Q2 Performance Factors Affecting Net Sales YoY Segment income highlights • Higher pricing of acetate tow partially offset by legacy contract in acetate flake • Lower costs driven by productivity initiatives • Lower volume following inventory build in 2013 • Segment income impacted by 3rd party power outage at cellulose derivatives facility in Narrows, VA • Dividends from cellulose derivatives ventures increased to $28 million QoQ Segment income highlights • Segment income impacted by 3rd party power outage at cellulose derivatives facility in Narrows, VA • Pricing declined mainly due to a legacy contract in acetate flake • Dividends from cellulose derivatives ventures were consistent with first quarter Net sales (in millions) Total segment income margin $400 $300 $200 $100 $0 60% 40% 20% 0% Q2 2013 Q1 2014 Q2 2014 34.7% 42.1% 37.0% $314 $302 $289 QoQ YoY 4% 2% 0% -2% -4% -6% -8% -10% -12% Volume Price Currency Other Total

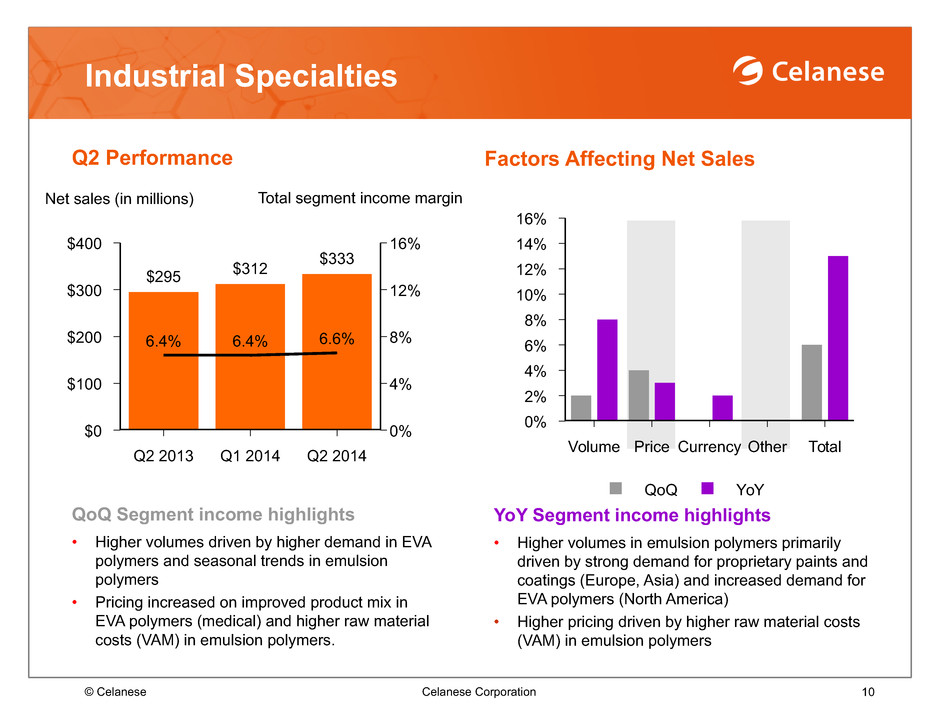

© Celanese Celanese Corporation 10 Industrial Specialties Q2 Performance Factors Affecting Net Sales YoY Segment income highlights • Higher volumes in emulsion polymers primarily driven by strong demand for proprietary paints and coatings (Europe, Asia) and increased demand for EVA polymers (North America) • Higher pricing driven by higher raw material costs (VAM) in emulsion polymers QoQ Segment income highlights • Higher volumes driven by higher demand in EVA polymers and seasonal trends in emulsion polymers • Pricing increased on improved product mix in EVA polymers (medical) and higher raw material costs (VAM) in emulsion polymers. Net sales (in millions) Total segment income margin $400 $300 $200 $100 $0 16% 12% 8% 4% 0% Q2 2013 Q1 2014 Q2 2014 6.4% 6.4% 6.6% $295 $312 $333 QoQ YoY 16% 14% 12% 10% 8% 6% 4% 2% 0% Volume Price Currency Other Total

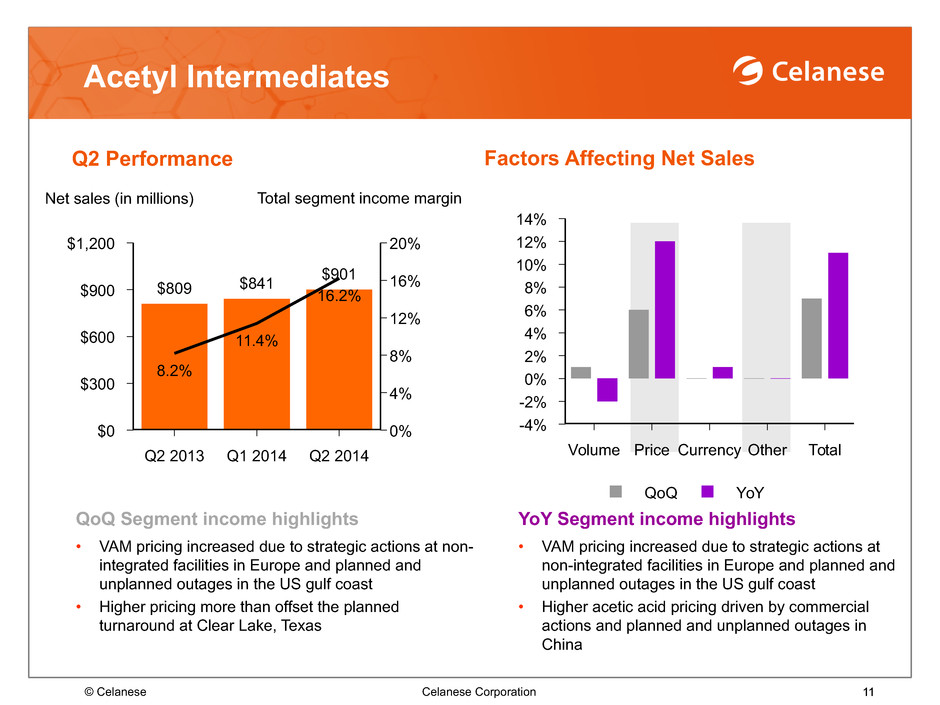

© Celanese Celanese Corporation 11 QoQ YoY 14% 12% 10% 8% 6% 4% 2% 0% -2% -4% Volume Price Currency Other Total Acetyl Intermediates Q2 Performance Factors Affecting Net Sales YoY Segment income highlights • VAM pricing increased due to strategic actions at non-integrated facilities in Europe and planned and unplanned outages in the US gulf coast • Higher acetic acid pricing driven by commercial actions and planned and unplanned outages in China QoQ Segment income highlights • VAM pricing increased due to strategic actions at non- integrated facilities in Europe and planned and unplanned outages in the US gulf coast • Higher pricing more than offset the planned turnaround at Clear Lake, Texas Net sales (in millions) Total segment income margin $1,200 $900 $600 $300 $0 20% 16% 12% 8% 4% 0% Q2 2013 Q1 2014 Q2 2014 8.2% 11.4% 16.2%$809 $841 $901

© Celanese Celanese Corporation 12 Chris Jensen Senior Vice President, Finance

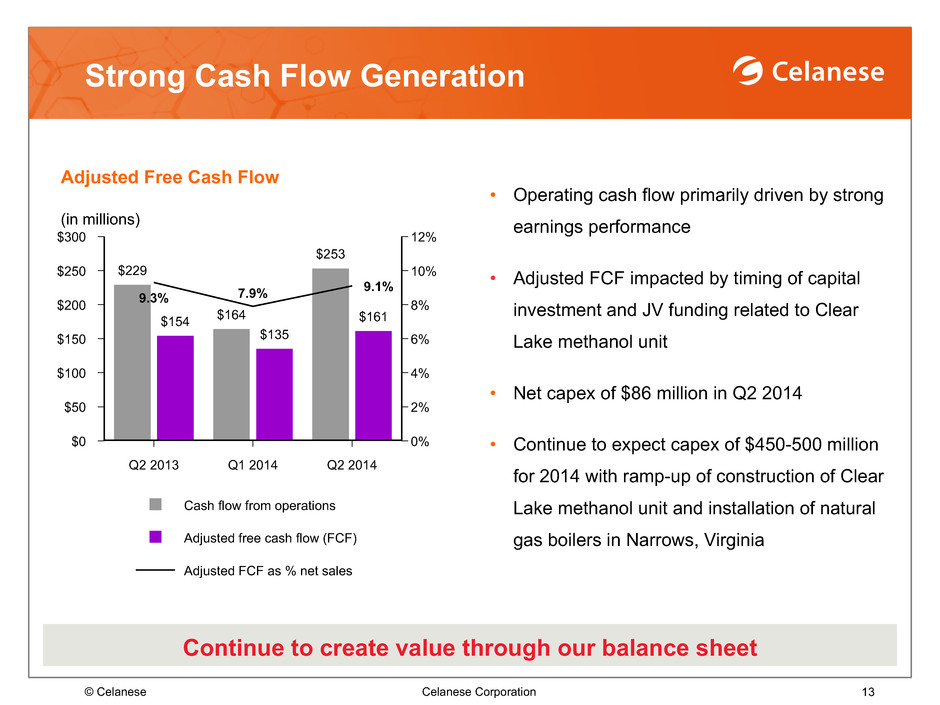

© Celanese Celanese Corporation 13 Strong Cash Flow Generation • Operating cash flow primarily driven by strong earnings performance • Adjusted FCF impacted by timing of capital investment and JV funding related to Clear Lake methanol unit • Net capex of $86 million in Q2 2014 • Continue to expect capex of $450-500 million for 2014 with ramp-up of construction of Clear Lake methanol unit and installation of natural gas boilers in Narrows, Virginia Continue to create value through our balance sheet Cash flow from operations Adjusted free cash flow (FCF) Adjusted FCF as % net sales $300 $250 $200 $150 $100 $50 $0 12% 10% 8% 6% 4% 2% 0% Q2 2013 Q1 2014 Q2 2014 $229 $164 $253 $154 $135 $161 9.3% 7.9% 9.1% Adjusted Free Cash Flow (in millions)

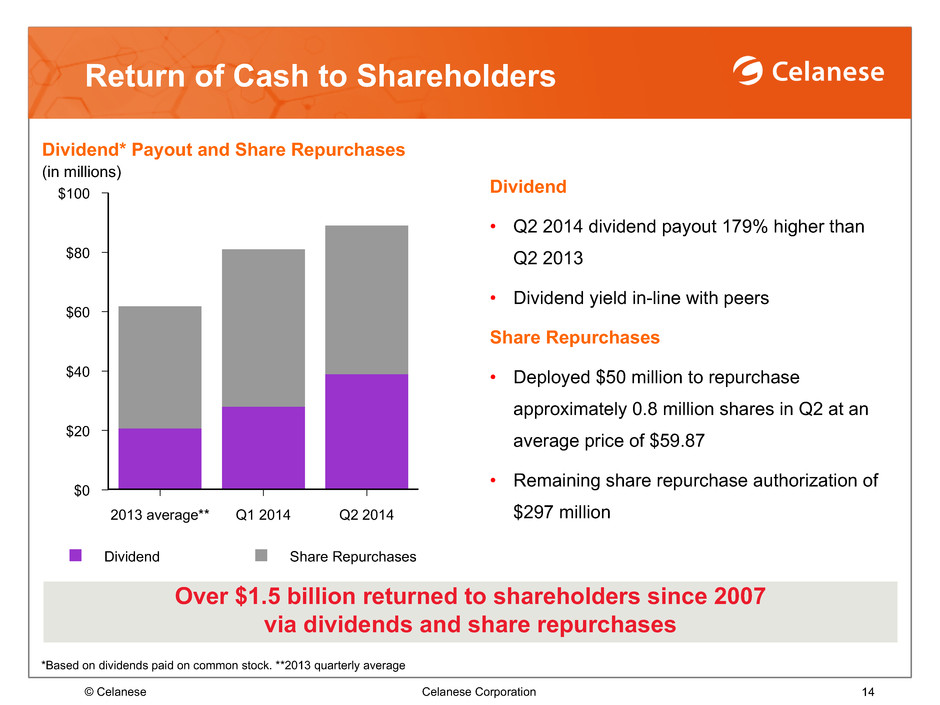

© Celanese Celanese Corporation 14 Dividend Share Repurchases $100 $80 $60 $40 $20 $0 2013 average** Q1 2014 Q2 2014 Return of Cash to Shareholders Dividend • Q2 2014 dividend payout 179% higher than Q2 2013 • Dividend yield in-line with peers Share Repurchases • Deployed $50 million to repurchase approximately 0.8 million shares in Q2 at an average price of $59.87 • Remaining share repurchase authorization of $297 million Dividend* Payout and Share Repurchases Over $1.5 billion returned to shareholders since 2007 via dividends and share repurchases *Based on dividends paid on common stock. **2013 quarterly average (in millions)