Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - WINHA INTERNATIONAL GROUP LTD | v383868_ex32-1.htm |

| EX-31.1 - EXHIBIT 31.1 - WINHA INTERNATIONAL GROUP LTD | v383868_ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For The Fiscal Year Ended March 31, 2014

¨ TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File No. 333-191063

WINHA International Group Limited

(Exact name of registrant as specified in its charter)

| Nevada | ||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| Yihe Center | ||

| 5 Xinzhong Avenue, Suite 918 | ||

| Shiqi District, Zhongshan | ||

| People’s Republic of China 528400 | 528400 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: +86 (760) 8896-3655

Securities registered pursuant to Section 12(b) of the Exchange Act: None.

Securities registered pursuant to Section 12(g) of the Exchange Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |

|

Non-accelerated filer (Do not check if a smaller reporting company) |

¨ | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the registrant’s voting common stock held by non-affiliates computed by reference to the closing price as of the last business day of the quarterly period ended September 30, 2013 was none.

As of July 9, 2014, the registrant had 49,989,500 shares of common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

None.

TABLE OF CONTENTS

| i |

Forward-Looking Statements

Certain statements in this Annual Report on Form 10-K constitute “forward-looking statements” that are based on current expectations, estimates, forecasts and assumptions and are subject to risks and uncertainties. Words such as “anticipate,” “assume,” “believe,” “estimate,” “expect,” “goal,” “intend,” “plan,” “project,” “seek,” “target,” and variations of such words and similar expressions are intended to identify such forward-looking statements. All forward-looking statements speak only as of the date on which they are made. Such forward-looking statements are subject to certain risks, uncertainties and assumptions relating to certain factors that could cause actual results to differ materially from those anticipated in such statements.

We cannot predict all of the risks and uncertainties. Accordingly, such information should not be regarded as representations that the results or conditions described in such statements or that our objectives and plans will be achieved and we do not assume any responsibility for the accuracy or completeness of any of these forward-looking statements. These forward-looking statements are found at various places throughout this Annual Report on Form 10-K and include information concerning possible or assumed future results of our operations, including statements about potential acquisition or merger targets; business strategies; future cash flows; financing plans; plans and objectives of management; any other statements regarding future acquisitions, future cash needs, future operations, business plans and future financial results, and any other statements that are not historical facts.

These forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors. Many of those factors are outside of our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of the Annual Report on Form 10-K. All subsequent written and oral forward-looking statements concerning other matters addressed in this Annual Report on Form 10-K and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Annual Report on Form 10-K.

Except to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, a change in events, conditions, circumstances or assumptions underlying such statements, or otherwise.

| ii |

In this Annual Report on Form 10-K, the terms “WINHA,” “Company,” “we,” “us,” and “our,” refer to WINHA International Group Limited, and its wholly-owned subsidiary C&V International Holdings Company Limited (“C&V International”), C&V International’s wholly-owned subsidiary WINHA International Investment Holdings Company Limited (“WINHA International”), WINHA International’s wholly-owned subsidiary Shenzhen WINHA Information Technology Company, Ltd. (“Shenzhen WINHA”), Shenzhen WINHA’s variable interest entity Zhongshan WINHA Electronic Commerce Company Limited (“Zhongshan WINHA”), and Zhongshan WINHA’s subsidiary Zhongshan WINHA Supermarket Limited (“Zhongshan Supermarket”).

Overview

WINHA retails local specialty products from different regions across China through its self-operated physical store, website, mobile store, set-top boxes for television sets, and also carries on wholesale of the products to a regional distributor. Our innovative business model utilizes a multi-channel shopping platform to sell locally-produced food, beverages, and arts and crafts that are well-known across China. Through our shopping platform, we provide customers with access to a large variety of local products that can traditionally only be found in local stores or markets in specific regions.

Our vision is to promote different local cultures and traditions that exist throughout China, while bolstering local economies and raising people’s awareness of each region’s cultural heritage.

Our Corporate History and Structure

WINHA International was incorporated in Nevada on April 15, 2013. We operate our business in China through Zhongshan WINHA, a variable interest entity of us. We expect that virtually all of our revenue, once generated, derives from Zhongshan WINHA. On August 1, 2013, we obtained the controlling interest of Zhongshan WINHA via Shenzhen WINHA through a series of contractual arrangements executed on August 1, 2013, including:

| ¨ | exclusive business cooperation agreement, through which Zhongshan WINHA appoints Shenzhen WINHA as its exclusive services provider to provide Zhongshan WINHA with comprehensive services and the service fee shall be determined by the parties through negotiation. In addition, Zhongshan WINHA grants Shenzhen WINHA an irrevocable and exclusive option to purchase from Zhongshan WINHA at Shenzhen WINHA’s sole discretion, any or all of the assets and business of Zhongshan WINHA at the lowest purchase price permitted by PRC law. Unless terminated due to the failure to renew the operation term of Shenzhen WINHA or Zhongshan WINHA as such application to renew the operation term is not approved by competent government authorities or terminated in writing by Shenzhen WINHA, this agreement shall remain effective; |

| ¨ | exclusive option agreements executed by Shenzhen WINHA, Zhongshan WINHA and each shareholder of Zhongshan WINHA, according to which Shenzhen WINHA has an irrevocable and exclusive right to purchase the equity interests in Zhongshan WINHA at Shenzhen WINHA’s sole and absolute discretion to the extent permitted by Chinese laws. The purchase price of all of the equity interest of Zhongshan WINHA held by each of its shareholders is equal to the loan borrowed by each shareholder of Zhongshan WINHA from Shenzhen WINHA. These agreements shall remain effective until all equity interests held by each shareholder of Zhongshan WINHA in Zhongshan WINHA have been transferred or assigned to Shenzhen WINHA and/or any other person designated by Shenzhen WINHA in accordance with these agreements; |

| ¨ | loan agreements, pursuant to which Shenzhen WINHA extends a loan to each shareholder of Zhongshan WINHA respectively and the loan shall be repaid by the shareholders by transferring all equity interest in Zhongshan WINHA to Shenzhen WINHA, and any proceeds herefrom shall be used to repay the loan to Shenzhen WINHA. These agreements shall expire upon the date of full performance by each party of their respective obligations under these agreements unless Shenzhen WINHA exercises its right to terminate these agreements due to any material breach of these agreements by any shareholder of Zhongshan WINHA; |

| 1 |

| ¨ | equity interest pledge agreements, pursuant to which each shareholder of Zhongshan WINHA pledges all of his/her equity interest in Zhongshan WINHA and all of the equity interest hereafter acquired by him/her in favor of Shenzhen WINHA to secure Zhongshan WINHA and its shareholders’ obligations under these contractual arrangements and, if Zhongshan WINHA or any of its shareholders breach any of their contractual obligations under these arrangements, Shenzhen WINHA will be entitled to exercise the pledge. These agreements shall remain effective until all Parties have performed their respective obligations under these agreements or Shenzhen WINHA exercises its right to terminate these agreements due to any material breach of these agreements by Zhongshan WINHA or any of its shareholders. We have filed all application documents and completed the registration procedure with competent local authority on October 23, 2013. The additional capital contribution of RMB 1,000,000, or approximately $164,204 made to Zhongshan WINHA by the stockholders of Zhongshan WINHA, was registered with Zhongshan Bureau Administration for Industry and Commerce on November 5, 2013. Also, on December 27, 2013 we completed the amendment to the registration of equity interest pledge on due to such additional capital contribution; |

| ¨ | powers of attorney executed by each shareholder of Zhongshan WINHA who appoints Shenzhen WINHA to be its attorney-in-fact, and to vote on its behalf on all the matters concerning Zhongshan WINHA that may require shareholders’ approval. These powers of attorney shall be irrevocable and continuously effective and valid upon execution during the period that the undersigned remain shareholders of Zhongshan WINHA; and |

| ¨ | spousal consent letters executed by spouses of certain shareholders of Zhongshan WINHA, acknowledging that a certain percentage of the equity interest in Zhongshan WINHA held by those spouses will be disposed of pursuant to the exclusive option agreement and the equity interest pledge agreement. |

As a holding company, our ability to pay dividends depends upon dividends paid to us by our wholly owned subsidiaries, Shenzhen WINHA and Shenzhen WINHA through these arrangements became the primary beneficiary of and consolidated with its variable interest entity, Zhongshan WINHA. According to the exclusive business cooperation agreement, Shenzhen WINHA shall provide Zhongshan WINHA with comprehensive services as its exclusive services provider and Shenzhen WINHA is entitled to receive service fee from Zhongshan WINHA each month, which shall be determined by the parties through negotiation after considering complexity, difficulty, contents, value of the services and other considerations. In that way, we could be able to receive economic benefits generated from Zhongshan WINHA. Although we may not receive all of Zhongshan WINHA’s revenues upon the exclusive business cooperation agreement, we are considered the primary beneficiary of and have the controlling interest of Zhongshan WINHA through the contractual arrangements.

However, if Zhongshan WINHA and its shareholders fail to perform their obligations under the contractual arrangements, or if we suffer significant delay or other obstacles in the process of enforcing these contractual arrangements, or if legal remedies under the PRC law that we rely on are not available or effective, our business and operations could be severely disrupted, which could materially and adversely affect our results of operations, revenue generated in the PRC and damage our reputation, which could materially and adversely affect our results of operations and our ability to generate revenue in the PRC and damage our reputation. Further, if the Company is deemed to have lost control of Zhongshan WINHA, we may not able to continue to consolidate Zhongshan WINHA’s financials. As a result, we may be unable to pay any dividend to our shareholders and the price of our common stock may drop drastically which could cause our shareholder to experience severe loss in their investment in our Company. See a more detailed discussion of the relevant risks under the heading “RISK FACTORS” beginning on page 8.

Furthermore, current PRC regulations permit our PRC subsidiary to pay dividends to us only out of their accumulated profits, if any, determined in accordance with Chinese accounting standards and regulations. In addition, our subsidiary in China is required to set aside at least 10% of its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of its registered capital. These reserves are not distributable as cash dividends. Furthermore, if our subsidiary in China incurs debt on its own behalf in the future, the instruments governing the debt may restrict its ability to pay dividends or make other payments to us. As a result, there may be limitations on the ability of our PRC subsidiary to pay dividends or make other investments or acquisitions that could be beneficial to our business or otherwise fund and conduct our business.

| 2 |

On August 1, 2013, Chung Yan Winnie Lam, our President and sole director as well as the sole shareholder of PILOT International, entered into a Share Transfer Agreement with Zening Lai, the director of PILOT International, pursuant to which Ms. Lam agreed to grant to Ms. Lai an Option to purchase 100% of the outstanding ordinary shares of PILOT International currently held by Ms. Lam in three installments, provided that WINHA achieves certain performance thresholds in each given time period. On August 1, 2013, Ms. Lam entered into a Power of Attorney with Ms. Lai to grant Ms. Lai as her agent, attorney and proxy to exercise any and all shareholder rights with the same powers in respect of all the shares of PILOT International on any and all matters on behalf of Ms. Lam.

Pursuant to the Share Transfer Agreement and Power of Attorney, as well as the contractual control of Zhongshan WINHA by the Company (the “Restructuring”), Ms Lai, who also had controlling interest of Zhongshan WINHA with ownership of 70.2% of its shares, was deemed to have retained financial controlling interests in the combined entity, and the combined entity remained under common control. As a result, the Restructuring was accounted for as a combination of entities under common control.

On December 5, 2013, Zhongshan WINHA as the 90% equity holder and a non-affiliate party as the 10% equity holder, formed Zhongshan Supermarket in Guangdong, China. Zhongshan Supermarket was formed to operate the storefront in Guangdong Province.

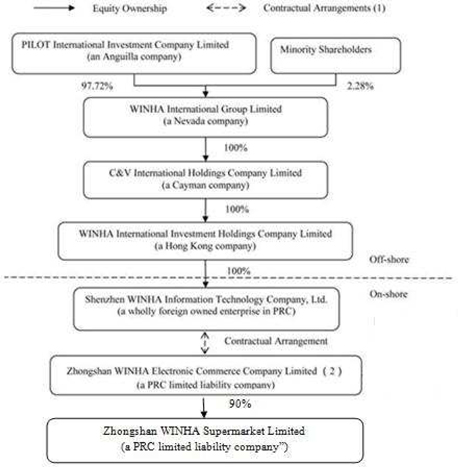

Corporate Structure

The following chart demonstrates our current corporate structure.

| (1) | Zhongshan WINHA was acquired by the Company through contractual arrangements on August 1, 2013. Such arrangements include an exclusive business cooperation agreement, exclusive option agreements, loan agreements, share pledge agreements, powers of attorney and spousal consents. |

| 3 |

| (2) | The shareholders of Zhongshan WINHA are Zening Lai (70.2%), WanfangZhong (4.9%), QifangZhong (4.9%), Fang Tian (4.5%), Hong Cui (4.8%), Zhifei Huang (4.6%), Wenliang Zhou (3.5%) and Yun Teng (2.6%). |

Our Business Model

We market and sell the local specialty goods to customers through four retail channels: self-operated physical store, online store, mobile store, set-top box store and one wholesale channel: a regional distributor. Our revenue comes from the sales of local specialty goods made through these channels.

Self-operated Physical Store. Self-operated Physical Store. We established a self-operated storefront in December 2013 in Zhongshan city in China. In addition, we established three self-operated storefront in the second quarter of 2014. Our self-operated storefront retails local specialty goods to customers.

Online Store. Consumers may access our products at our website www.winha.com. Our goal is to build our website into a one-stop shop for local specialty products of all kinds. We are working to recruit employees in areas such as graphic design, photography, and business administration.

Mobile Store. We unveiled the mobile store at the end of August 2013. Our mobile store is searchable on WeChat, a social network platform that is developed by Tencent and has gained its popularity among China-based smart phone users. We worked with a third-party developer in creating consents for the mobile store, and obtained a public account with WeChat that so that our mobile store can be searched and “friended” by the public at large. Our mobile store has two segments, introductory pages of local cultures throughout China and a virtual store that provides exclusive deals, such as free samples and special discounted items.

Below is a series of graphical information showing a virtual shopping experience through our mobile store.

|

Search for WINHA

Our users can find WINHA’s WeChat page through WeChat’s search engine with the keyword “WINHA.” |

| 4 |

|

Subscribe

Our users can then subscribe to WINHA’s WeChat page, which contains a brief description of WINHA’s products and services. |

|

Subscribe

Our users may choose to receive updates or unsubscribe from WINHA’s WeChat Page |

| 5 |

|

Browse for Products

Our mobile home page allows users to browse products, and learn about the historical background of our many featured products and the local regions they come from across China. |

|

Complete Purchase

Our users can select desired products, add them to a cart, and enter payment information to complete purchases. |

Mobile Store Push Notifications

We periodically send our Registered Members push notifications regarding featured products and sales items, with a direct link for them to easily review and purchase. Our push notifications also provide our Registered Members with information about different local Chinese cultures and a variety of specialty goods, as well as direct links to items on sales and featured items.

| 6 |

Set-Top Box Store. Customers can browse our products on a television set (TV) screen if they choose to install a pre-programmed set-top box on their TVs. A set-top box turns a TV into a display device, and customers with a set-top box pre-programmed with our product information can view and select products and complete purchase on a TV screen, among other functions of set-top boxes such as accessing internet web pages, streaming videos and movies, and playing games. We have worked with a third-party developer and completed programming our store of local specialty products into set-top boxes. We plan to make our set-top boxes available for purchase at our self-operated stores.

Wholesale . We utilize a regional distributor in Hunan province to promote our products to local retail stores. We are in the trial stage of the wholesale channel and yet to decide if we plan to engage additional regional distributors.

Consignment sales. We also sell merchandizes under consignment arrangements at our self-operated storefronts. We pay the consignors only after the consigned goods are sold, and we are allowed to return the unsold consigned goods to the consignors with no charge. We only sell two types of consigned goods at this stage.

VIP Club Program

At our existing and any future self-operated physical retail store(s) in Guangdong Province, we offer prepaid cards to customers for purchase. The prepaid cards are only available for purchase at our self-operated physical store(s) in Guangdong Province, not any of our online, mobile, and set-top box stores. Customers can use the prepaid cards to purchase local specialty products at all of our self-operated physical retail store(s), online, mobile or set-top box stores. In connection with prepaid card sales, we offer club memberships (VIP Club Memberships”) to qualified VIP customers (the “VIP Club Members). To receive one VIP Club Membership, a customer is required to purchase at once prepaid cards in an amount of RMB 30,000 (approximately US $4,958) and, recruit 30 registered members (the “Registered Members”) to our self-operated physical store(s). Registered Members receive special promotions and discounts as do VIP Club Members, but unlike VIP Club Members, they do not have to meet the thresholds of prepaid card purchase or member recruiting and are not entitled to profit sharing discussed below. We plan to grant up to 2,500 VIP Club Memberships at the self-operated physical retail store(s) in total. Each individual customer can receive up to three VIP Club Memberships. In return for joining the VIP club, the VIP Club Members receive in cash each quarter, a total of 40% of the quarterly net income of all of our self-operated physical retail store(s) in Guangdong Province on an aggregated basis, if these self-operated physical retail store(s), on an aggregated basis, record net income (under the U.S. GAAP standard) for that quarter. The cash award is distributed within 15 calendar days after each quarter end among the VIP Club Members pro rata according to the number of their membership(s). If any adjustment is made to the net income amount of the self-operated physical retail store(s) after the review or audit by our auditor, we reflect the difference in the next immediate distribution. In addition, when a VIP Club Member refers a new member to the VIP club, the referrer is awarded in the form of prepaid cards, 10% of the amount that the referee spends on his or her first-time purchase.

This VIP Club Membership program is designed to improve the cash flow of our self-operated physical retail store(s) at the development stage and enhance their operating performance in the long run by utilizing the VIP club members as a marketing force. Both “net income” and “referral” awards are treated as promotional expenses to promoting self-operated physical retail store(s).

Because the Company is in a development stage, it has incurred considerable expenses with very limited revenue. As a result, the Company has historically reported a net loss and is currently operating on a going concern basis. The Company’s expenses at this stage are principally professional fees, relating to organizing the Company and its subsidiaries. Our self-operated physical retail store(s), which are controlled and managed by Zhongshan Supermarket, is not expected to incur substantial expenses of professional fees as the Company does, and rather, they are only expected to incur costs of sales, operating and other expenses in line with revenues generation. Therefore, we expect that when the self-operated physical retail stores(s) record net income there will most likely be positive cash flow to fund the distribution to our VIP Club Members. If the self-operated physical retail stores(s) encounter insufficient cash and cash equivalents to fund the distribution of cash awards, the shareholders of Zhongshan Supermarket will fund the distribution pro rata in accordance with their shareholdings. However, they are not under any contractual obligations to do so. If any distribution due is not promptly funded, we may face legal actions taken by the VIP Club Members and the operation of our self-operated physical retail store(s) may be severely disrupted.

| 7 |

About Franchise Model

Our management originally incorporated physical franchise stores as one of the Company’s distribution channels. From April 2013 to December 2013, we had six franchise stores and were once in discussions to open 12 more. We collected a website construction and maintenance from each contracted franchise stores and provided advice to the franchisees with respect to store decoration and layout, marketing materials, and employee training and management. We did not take commissions from the sales made at our franchise stores. In November 2013, we ceased our efforts to further develop any franchise stores because we do not meet all of the prerequisites for a commercial franchisor under the PRC laws, which include ownership of at least two self-operated storefronts that have been in operation for at least one year within China. To become compliant with the PRC laws and regulation of commercial franchise, we established one self-operated storefront in December 2013 and established three additional self-operated storefront in the second quarter of 2014. We estimate that we could satisfy the requirements under PRC laws and regulations related to commercial franchising within the first quarter of 2015. Meanwhile, the management has decided to unwind the six existing franchise stores and keep the Company’s physical distribution channel free of franchise stores until we are fully in compliance with the PRC laws and regulation of commercial franchise. Therefore, in December 2013 we terminated all the existing franchise agreements and refunded the collected website construction and maintenance fees. After removing the franchise stores, we exclusively rely on direct suppliers to source our products. We believe that our current supply relationship with over 50 direct suppliers across 15 provinces will provide us a healthy and stable supply networks. We also believe that the self-operated store will help to promote our virtual stores to customers and brand our Company.

Though the Company initially began to open up self-operated storefronts to satisfy the regulatory requirements under the PRC laws and regulations for engaging in commercial franchise operation, management has been exploring the advantages of self-operated stores and intend to integrate self-operated stores into the Company’s multi-channel distribution platform. Once the Company becomes a qualified commercial franchisor under the PRC laws, management plans to review the plan for opening up franchise stores.

Products

We offer a broad array of specialty products, including locally-produced food and beverages as well as locally-sourced arts and crafts for sale through our self-operated store, website, mobile store, set-up box store and wholesale distributor.

Supply and Distribution

We rely on direct suppliers across the country to supply products to us. We have established supply relationship with over 50 direct suppliers across 15 provinces. We intend to expand the supply chain by around 300 direct suppliers in the next twelve months.

We plan to develop a logistics system that integrates delivery and inventory control systems. Under this system, a sales order will be automatically filled and delivered from a most cost-effective location, whether it is our self-operated store or the Company’s headquarter. We use express mail service to deliver all orders within seven business days.

Quality Control

We control our product quality by requiring pre-approval for any item to be sold in a store, online and through our mobile application and set-top boxes. In order for products to be marketed and sold by us, we ask suppliers to ship samples of product to our company headquarter for quality and safety inspection. In addition, for each order through our website, mobile store and set-top box store, our customer service staff follows up with the customer to obtain feedback regarding the quality of our products and services. We remove any item receiving three or more complaints within a month and we only re-list such item if it passes our further inspection.

| 8 |

Our Industry

China has developed rapidly in the last two decades and its GDP has been growing at a steady rate for the last ten years. In 2012, China’s total GDP reached approximately USD$8 trillion, making it the second largest economy in the world. This attractive economic outlook is also evident in the tourism industry. In 2012, total revenue from the tourism industry alone is estimated at USD 419 billion (RMB 2,570 billion), representing a 14% increase from the previous year.

With nearly 5,000 years of history and 56 ethnic groups, China is known for its large population, abundant resources and diverse locally-produced specialty goods. As China covers almost 9.6 million square kilometers of land, the variation of climate and environment nourished many distinct local folk cultures and traditions that produced myriad local specialty goods.

Since the turn of the century, as the living standard in China has drastically improved, the demand for diversified consumer products has been on the rise every year. Specialty goods, which reflect local cultures, history, and tradition, have become increasingly popular gifts for families and friends. However, due to factors such as limited business investment, incomplete infrastructure in certain rural areas, low brand awareness, lack of sales channels and ineffective marketing, the local specialty product business is still at its early stage. In addition, with the goal to promote local cultures, China’s State Council has been actively working to stimulate domestic demand for local specialty goods.

Competitive Advantages

We are a development stage company. A number of our competitors, including Taobao, Gongtianxia.com and Techan.com, are established and have greater resources than we do. We believe all e-commerce segments in China compete on the basis of price, product quality, brand identification and customer service. Our competitive strategy is to implement our innovative business model of selling local specialty goods retail on a shopping platform that utilizes both physical stores and virtual stores and integrate traditional physical stores into the supply chain of the virtual stores.

Development Cost of Our Website

We incurred website development cost for our online store of approximately $30,773 from inception to March 31, 2014.

Government Regulation

Foreign Exchange Regulation Relating to Foreign Invested Enterprises

Under current Chinese regulations, RMB are freely convertible for trade and service-related transactions denominated in foreign currency, including the distribution of dividends, interest payments, trade and service-related foreign exchange transactions, but not for direct investment, loans, repatriation of investments or investments in securities outside China without the prior approval of the SAFE or its local branches. In May 2013, SAFE promulgated SAFE Circular 21 which provides for and simplifies the operational steps and regulations on foreign exchange matters related to direct investment by foreign investors, including foreign exchange registration, account opening and use, receipt and payment of funds, and settlement and sales of foreign exchange.

Foreign-invested enterprises in China may execute foreign exchange transactions without the SAFE approval for trade and service-related transactions denominated in foreign currency by providing commercial documents evidencing these transactions. Foreign exchange transactions related to direct investment, loans and investment in securities outside China are still subject to limitations and require approval from the SAFE.

| 9 |

Furthermore, on August 29, 2008, the SAFE issued the Circular on the Relevant Operating Issues Concerning the Improvement of the Administration of the Payment and Settlement of Foreign Currency Capital of Foreign-Invested Enterprises, or Circular 142. Pursuant to Circular 142, RMB capital derived from the settlement of a foreign-invested enterprise’s foreign currency capital must be used within the business scope approved by the applicable government authority and cannot be used for domestic equity investment, unless specifically provided for otherwise. Documents certifying the purposes of the settlement of foreign currency capital into RMB, including a business contract, must also be submitted for the settlement of such foreign currency. In addition, foreign-invested enterprises may not change how they use such capital without the SAFE’s approval and may not in any case use such capital to repay RMB loans if they have not used the proceeds of such loans. Violation of Circular 142 can result in severe penalties, including heavy fines as set forth in the Foreign Exchange Administration Rules. The SAFE promulgated a circular on November 9, 2010, or Circular 59, which tightens the regulation over settlement of net proceeds from overseas offerings like this offering and requires that the settlement of net proceeds must be consistent with the description in the prospectus for the offering. Furthermore, the SAFE promulgated the Circular on Further Clarification and Regulation of the Issues Concerning the Administration of Certain Capital Account Foreign Exchange Businesses, or Circular 45, on November 9, 2011, which expressly restricts a foreign-invested enterprise from using RMB converted from its registered capital to provide entrusted loans or repay loans between non-financial enterprises. Circular 142, Circular 59 and Circular 45may significantly limit our ability to transfer the net proceeds from this offering to our PRC subsidiary and convert the net proceeds into RMB, which may adversely affect our liquidity and our ability to fund and expand our business in the PRC.

Regulations on Dividend Distributions

The principal regulations governing dividend distributions of wholly foreign owned companies include: the Companies Law (2005), the Wholly Foreign Owned Enterprise Law (2000), and the Wholly Foreign Owned Enterprise Law Implementing Rules (2001).

Under these regulations, wholly foreign owned companies in China may pay dividends only out of their accumulated profits, if any, as determined in accordance with PRC accounting standards and regulations. In addition, wholly foreign owned companies are required to set aside at least 10% of their respective accumulated profits each year, if any, to fund certain reserve funds, until the aggregate amount of these funds reaches 50% of the company’s registered capital. Wholly foreign owned companies may, at their discretion, allocate a portion of their after-tax profits based on PRC accounting standards to staff benefits and bonus funds. These reserve funds and staff benefits and bonus funds are not distributable as cash dividends.

Regulations Relating to Internet Information Services and Content of Internet Information

According to the Administrative Measures on Internet Information Services, or the Internet Measures issued in September 2000 by the State Council to regulate the provision of information services to online users through the internet, our business conducted through our winha.com website involves operating commercial internet information services, which requires us to obtain a value-added telecommunications business license, or an ICP license. If an internet information service provider fails to obtain an ICP license, the relevant local telecommunications administration authority may levy fines, confiscate its income or even block its website.

According to the Administrative Provisions on Foreign-Invested Telecommunications Enterprises promulgated by the State Council in December, 2001 and revised in September, 2008, foreign investors cannot hold more than 50% equity interest in a value-added telecommunications services provider. The Circular on Strengthening the Administration of Foreign Investment in and Operation of Value-added Telecommunications Business promulgated by the Ministry of Industry and Information Technology of the People's Republic of China in 2006, or the MIIT Circular, requires foreign investors to set up foreign invested enterprises and obtain an ICP license to conduct any value-added telecommunications business in China. Under the MIIT Circular, a domestic company that holds an ICP license is prohibited from leasing, transferring or selling the license to foreign investors in any form, and from providing any assistance, including providing resources, sites or facilities, to foreign investors that conduct value-added telecommunications business illegally in China. We hold our ICP license through Zhongshan WINHA due to the above restrictions. Zhongshan WINHA currently holds an ICP license issued by Guangdong Province Communications Administration, a local branch of the Ministry of Information Industry. Our ICP license will expire in July 2018 and we will renew such license prior to its expiration date. The additional capital contribution of RMB 1,000,000, or approximately $164,204 made to Zhongshan WINHA by the stockholders of Zhongshan WINHA, was registered with Zhongshan Bureau Administration for Industry and Commerce on November 5, 2013. Also, on December 27, 2013 we completed the amendment to the registration of equity interest pledge on due to such additional capital contribution. Our ICP license is required to be amended as to such change on the registered capital of Zhongshan WINHA according to the Internet Measures. Such amendment procedure was completed in the end January 2014.

| 10 |

In May 2010, the State Administration for Industry and Commerce issued the Interim Measures for the Trading of Commodities and Services through the Internet effective in July 2010, which requires internet service providers that operate internet trading platforms to register and verify online shop owners’ identities along with their business credentials, establish mechanisms to ensure safe online transactions, protect online shoppers’ rights, and prevent the sale of counterfeit goods. We are subject to this rule as a result of our operation of the www.winha.com.

Regulations Relating to Privacy Protection

As an internet information provider, we are subject to regulations relating to protection of privacy. Under the Internet Measures, internet information providers are prohibited from producing, copying, publishing or distributing information that is humiliating or defamatory to others or that infringes the lawful rights and interests of others. Internet information providers that violate the prohibition may face criminal charges or administrative sanctions by PRC security authorities. In addition, relevant authorities may suspend their services, revoke their licenses or temporarily suspend or close down their websites. We believe that we are currently in compliance with these regulations in all material aspects.

Regulations on Advertising Business

The State Administration for Industry and Commerce, or SAIC, is the government agency responsible for regulating advertising activities in China. Regulations governing advertising business mainly include: Advertisement Law of the People’s Republic of China promulgated by the Standing Committee of the National People’s Congress on October 27, 1994 and went into effect on February 1, 1995; Administrative Regulations for Advertising promulgated by the State Council on October 26, 1987 and went into effect on December 1, 1987; and Implementation Rules for the Administrative Regulations for Advertising promulgated by the State Council on January 9, 1988 and amended on December 3, 1998, December 1, 2000 and November 30, 2004 respectively.

Regulations on Commercial Franchising

Franchise operations are subject to the supervision and administration of MOFCOM, and its regional counterparts. Such activities are mainly regulated by the Regulations for Administration of Commercial Franchising promulgated by the State Council on February 6, 2007, effective as of May 1, 2007. Under the above applicable regulation, commercial franchising refers to the business activities where an enterprise that possesses the registered trademarks, enterprise logos, patents, proprietary technology or any other business resources allows such business resources to be used by another business operator through contract and the franchisee follows the uniform business model to conducts business operation and pays franchising fees according to the contract. The above applicable regulation provides that a franchisor must have certain prerequisites including a mature business model, the capability to provide long-term business guidance and training services to franchisees and ownership of at least two self-operated storefronts that have been in operation for at least one year within China. Franchisors engaged in franchising activities without satisfying the above requirements may be subject to penalties such as forfeit of illegal income, imposition of fines ranging from RMB 100,000 to RMB 500,000, and may be bulletined by the MOFCOM or its local counterparts. Franchisors are generally required to register franchise contracts with the MOFCOM or its local counterparts, and our failure to carry out record-filing with MOFCOM or its counterparts may result in penalties such as fines ranging from RMB 10,000 to RMB 100,000. Such noncompliance may also be bulletined.

| 11 |

Due to our six franchise stores existed until December 2013, we were likely recognized as a commercial franchisor for authorizing other business entities to use our trademark and adopting a uniform business model. We did not own two self-operated storefronts that have been in operation for one year or longer and have not carried out record-filing with MOFCOM or its counterparts when we had the franchise stores. Therefore, we may be subject to penalties such as forfeit of illegal income, imposition of fines from RMB 10,000 to RMB 500,000 and may be bulletined by MOFCOM or its local counterparts. However, we are arranging to establish two or more self-operated storefronts and will attempt to carry out record-filing with MOFCOM or its local counterparts after our self-operated storefronts operate for one year. We are looking for appropriate premises for our self-operated stores currently and have established one self-operated storefront in December 2013. We will probably establish another one in the first quarter of 2014. We estimate that we could satisfy the requirements under PRC laws and regulations related to commercial franchising within the first quarter of 2015.

Regulations on Product Liability and Consumers Protection

Product liability claims may arise if the products sold have any harmful effect on the consumers. The injured party may claim for damages or compensation. The Product Quality Law of the PRC, which was enacted in 1993 and amended in 2000, strengthens the quality control of products and protects consumers’ rights and interests. Under this law, manufacturers and distributors who produce or sell defective products may be subject to confiscation of earnings from such sales, revocation of business licenses and imposition of fines, and in severe circumstances, may be subject to criminal liability.

The Law of the PRC on the Protection of the Rights and Interests of Consumers was promulgated on October 31, 1993 and became effective on January 1, 1994 to protect consumers’ rights when they purchase or use goods or services. All business operators must comply with this law when they manufacture or sell goods and/or provide services to customers.

The Tort Law of the PRC effective on July 1, 2010 requires that when the product defect endangers people’s life or property, the injured party may hold the producer or the seller liable in tort and require that it remove obstacles, eliminate danger, or take other action. The Tort Law also requires that when a product is found to be defective after it is put into circulation, the producer and the seller shall give timely warnings, recall the defective product, or take other remedial measures.

Regulations on Trademarks

The PRC Trademark Law, adopted in 1982 and revised in 1993 and 2001, provides protection to the holders of registered trademarks. The State Trademark Bureau, under the authority of the State Administration for Industry and Commerce (“SAIC”) handles trademark registrations and grants rights of a term of 10 years in connection with registered trademarks. License agreements with respect to registered trademark must be filed with the State Trademark Bureau.

Environmental Matters

Our business currently does not implicate any environmental regulation in China.

Intellectual Property

Trademark

We are currently applying for trademark protection for our company’s logo “Wanqiwang” and we anticipate that we will be able to obtain the trademark within the next 12 months.

Domain Names

We have applied to add the domain name www.winha.com to the Internet Content Provider License that we currently hold and we have received the updated ICP License covering the foregoing domain name.

Employees

We currently have 45 full-time employees.

| 12 |

Investing in our common stock involves a high degree of risk. The risks below are those that we believe are the material risks that we currently face, but are not the only risks facing us and our business. If any of the events contemplated by the following discussion should occur, our business, financial condition and operating results could be adversely affected, and you could lose all or part of your investment.

Risks Related to Our Financial Position and Capital Requirements

WE HAVE A HISTORY OF LOSSES, AND WE ANTICIPATE THAT WE WILL INCUR CONTINUED LOSSES.

We reported a net loss of $1,002,870 and used cash in operations of $524,683 during the period from April 15, 2013 (inception) to March 31, 2014. As of March 31, 2014, the Company had an accumulated deficit of $1,002,870.

We have not begun to generate revenue until the quarter ended December 31, 2013. In the course of our development activities, we have devoted substantially all of our resources to development of prior franchisees, our online store, mobile store, set-top box store and self-operated stores. We expect to continue to incur expenses of (i) administration and start-up costs, (ii) website, mobile application and set-top boxes development and maintenance, (iii) marketing and advertising, (iv) legal and accounting fees at various stages of operation, and (v) hiring employees. In addition, unanticipated problems, expenses and delays are frequently encountered in developing and commercializing new businesses. As a result, we anticipate that we will incur continued losses. These losses, among other things, have had and will continue to have an adverse effect on our stockholders’ deficit.

We expect to finance operations primarily through capital contributions from a principal stockholder, as well as cash flow from revenue. In the event that we require additional funding to finance the growth of the Company’s current and expected future operations as well as to achieve our strategic objectives, our principal stockholder has indicated the intent to provide additional equity financing. However, this principal stockholder is not under any contractual obligation to provide such financing. If we are unable to obtain the necessary capital or financing to fund our cash needs, our operation will adversely affected.

THE REPORT OF OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM EXPRESSES SUBSTANTIAL DOUBT ABOUT OUR ABILITY TO CONTINUE AS A GOING CONCERN.

Our auditor has indicated in their report on our financial statements for the period from April 15, 2013 (inception) through March 31, 2014 that conditions exist that raise substantial doubt about our ability to continue as a going concern due to our recurring losses from operations, deficit in equity, and the need to raise additional capital to fund operations.

Our ability to continue as a going concern will depend on our ability to meet obligations as they become due and obtain additional equity or alternative financing required to fund operations until sufficient sources of recurring revenue and profit can be generated. The stockholders of Zhongshan WINHA made additional capital contribution to Zhongshan WINHA of RMB 3,000,000, or approximately $482,594 subsequently in June and July 2014. Our management estimates that our Company can continue as a going concern for twelve months without further obtaining additional working capital. There can be no assurance that we will be successful in our plans of generating recurring revenues and profit. We have financed our operations through capital contribution by our principal stockholder, and the stockholders of Zhongshan WINHA indicated that they will make further capital contribution to Shenzhen WINHA if needed. However, we cannot guarantee our principal stockholder will continue to do so. We are uncertain if we can attract equity or alternative financing on acceptable terms, or if at all. In addition, a “going concern” opinion could impair our ability to finance our operations through the sale of debt or equity securities. If we are unable to achieve these goals, our business would be jeopardized and we may not be able to continue. If we ceased operations, it is likely that all of our investors would lose their investment.

| 13 |

Risks Related to Our General Business Operation

WE HAVE LIMITED OPERATING HISTORY AND MAY FACE MANY RISKS AND DIFFICULTIES.

We have a limited operating history for investors to evaluate the potential of our business. Although we have developed an initial customer base, we may face many of the risks and difficulties inherent in gaining market share as a company with a limited history. These risks and difficulties include but are not limited to:

| ¨ | our ability to effectively implement our business plan and growth strategy; |

| ¨ | uncertain market acceptance of our business model; |

| ¨ | our ability to modify our business model and growth strategy to respond to unexpected market reactions; |

| ¨ | our ability to further develop our customer base and build customer loyalty; |

| ¨ | our ability to establish and maintain brand recognition; |

| ¨ | our ability to improve and upgrade our products and services; |

| ¨ | our ability to manage the growth of our business; and |

| ¨ | our ability to raise capital when expanding our business. |

Our future will depend, in part, on our ability to continually bring our products and services to the marketplace, which requires careful planning to provide products and services that meet customer standards without incurring unnecessary cost and expense.

OUR BUSINESS MODEL IS NOVEL AND IS THEREFORE UNPROVEN.

To the best of our management’s knowledge, WINHA is currently the first and only company that specializes in retailing locally-produced specialty goods via a website, a mobile store, set-top boxes for television sets and physical self-operated stores in China. There is no history upon which to base any assumption as to the likelihood that the Company will prove successful. In order to generate significant operating revenue or ever achieve profitable operations, we will have to establish additional self-operated stores and further develop, maintain and market our online, mobile and set-top box platform. We cannot provide any assurance that our self-operated store, website, mobile store and set-top boxes for television sets will attract purchasers. Hence, our business model has not been proven by an established record to be potentially profitable and sustainable.

WE MAY ENCOUNTER SUBSTANTIAL COMPETITION IN OUR BUSINESS AND OUR FAILURE TO COMPETE EFFECTIVELY MAY ADVERSELY AFFECT OUR ABILITY TO GENERATE REVENUE.

We are a development stage company. A number of our competitors, including Taobao, Gongtianxia.com and Techan.com, are established and have greater resources than we do. Our competitive strategy is to implement our innovative business model of selling local specialty goods retail on a shopping platform that utilizes both physical stores and virtual stores and integrate traditional physical stores into the supply chain of the virtual stores. However, we believe that new competitors will enter the market and adopt our business model to introduce new websites, mobile applications and services and set-top boxes with competitive characteristics. We expect that we will be required to continue to invest in improving our services to compete effectively in our markets. Our competitors could develop a more efficient business model or undertake more aggressive and costly marketing campaigns than ours, which may adversely affect our marketing strategies and could have a material adverse effect on our business, results of operations and financial condition.

FROM TIME TO TIME, WE NEED TO IDENTIFY NEW SUPPLIERS OF LOCAL SPECIALTY PRODUCTS. IF WE CANNOT OBTAIN SUFFICIENT SUPPLY THAT MEET OUR STANDARDS AT A REASONABLE COST OR AT ALL, OUR SALES COULD BE INTERRUPTED, OUR FINANCIAL PERFORMANCE COULD SUFFER.

| 14 |

Though each local region generally has abundant sources of specialty products, we cannot assure that the specialty products will continue to be available or in the sense of quality and prices, accessible to us. Numerous factors, most of which are beyond our control, can influence the prices of the supply for local specialty products. These factors include, to name a few, general economic conditions, manufacturer capacity utilization, vendor backlogs and transportation delays, and other uncertainties.

If we experience insufficiency of the supply of local specialty products, our sales could be interrupted if we do not have inventory to meet the demand, which will directly lead to a decrease in our revenue and profit.

BECAUSE OUR MANAGEMENT IS INEXPERIENCED IN OPERATING WINHA’S BUSINESS, OUR BUSINESS PLAN MAY FAIL.

Our management does not have any specific training in running an e-commerce company. With no direct technical training or experience in this area, management may not be fully aware of many of the specific requirements related to working within this industry. As a result, our management may lack certain skills that are advantageous in managing our company. Consequently, our operations, earnings, and ultimate financial success could suffer irreparable harm due to management’s lack of experience in this industry.

THE LOSS OF THE SERVICES OF OUR EXECUTIVE OFFICER AND SENIOR MANAGEMENT WOULD DISRUPT OUR OPERATIONS AND INTERFERE WITH OUR ABILITY TO COMPETE.

We depend upon the continued contributions of our executive officer and senior management. Our management personnel handle all of the responsibilities in the area of corporate administration, business development and research. We do not carry key person life insurance on any of their lives and the loss of services of any of these individuals could disrupt our operations and interfere with our ability to compete with others.

ANY INTELLECTUAL PROPERTY RIGHTS WE DEVELOP MAY BE VALUABLE AND ANY INABILITY TO PROTECT THEM COULD REDUCE THE VALUE OF OUR PRODUCTS, SERVICES AND BRAND.

Any trademarks, trade secrets, copyrights and other intellectual property rights that we develop will be important assets to us. We are currently seeking trademark protection for our website logo. There can be no assurance that the protections provided by these intellectual property rights will be adequate to prevent our competitors from misappropriating our technology or that our competitors will not independently develop technologies that are substantially equivalent or superior to our technology. There are events that are outside our control that could pose a threat to our intellectual property rights. Additionally, protecting our intellectual property rights is costly and time consuming. Any increase in the unauthorized use of our intellectual property could make it more expensive to do business and harm our operating results.

WE MAY BE SUBJECT TO INTELLECTUAL PROPERTY RIGHTS CLAIMS IN THE FUTURE, WHICH MAY BE COSTLY TO DEFEND, COULD REQUIRE THE PAYMENT OF DAMAGES AND COULD LIMIT OUR ABILITY TO USE CERTAIN TECHNOLOGIES IN THE FUTURE.

Companies in the internet, technology and software industries own large numbers of patents, copyrights, trademarks and trade secrets and frequently enter into litigation based on allegations of infringement or other violations of intellectual property rights. As we face increasing competition, the possibility of intellectual property rights claims increases. Our technologies may not be able to withstand any third-party claims or rights against their use. Any intellectual property claims, with or without merit, could be time consuming, expensive to litigate or settle and could divert management resources and attention. An adverse determination also could prevent us from offering our products and services to others and may require that we procure substitute products or services for these members.

With respect to any intellectual property rights claim, we may have to pay damages or stop using technology found to be in violation of a third party’s rights. We may have to seek a license for the technology, which may not be available on reasonable terms and may significantly increase our operating expenses. The technology also may not be available for license to us at all. As a result, we may also be required to develop alternative non-infringing technology, which could require significant effort and expense. If we cannot license or develop technology for the infringing aspects of our business, we may be forced to limit our product and service offerings and may be unable to compete effectively. Any of these results could harm our brand and operating results.

| 15 |

CHANGES IN REGIONAL ECONOMIC CONDITIONS MAY INFLUENCE THE RETAIL INDUSTRY, CONSUMER PREFERENCES AND SPENDING PATTERNS.

Our revenues may be negatively influenced by changes in regional or local economic variables and consumer confidence. External factors that affect economic variables and consumer confidence and over which we exercise no influence include unemployment rates, levels of personal disposable income and regional or local economic conditions. Changes in economic conditions could adversely affect consumer spending patterns, travel and tourism in certain of our market areas. Most of our stores are located in popular tourist destinations and, historically, travel and consumer behavior in such markets is more severely affected by weak economic conditions.

THE DISRUPTIONS IN THE NATIONAL AND GLOBAL ECONOMIES MAY ADVERSELY IMPACT OUR REVENUES, RESULTS OF OPERATIONS, BUSINESS AND FINANCIAL CONDITION.

Disruptions in the Chinese national and global economies may result in high unemployment rates and declines in consumer confidence and spending. If such conditions occur, they may result in significant declines in consumer spending, which could directly affect purchase volume at our stores. There can be no assurance that government responses to the disruptions will be able to restore consumer confidence. Disruptions in the national and global economies therefore may adversely impact our revenues, results of operations, business and financial condition.

Risks Related to Our Franchisees

ACCORDING TO PRC LAWS AND REGULATIONS REGARDING COMMERCIAL FRANCHISING, OUR BUSINESS MODEL MAY BE RECOGNIZED AS COMMERCIAL FRANCHISING. HOWEVER, WE HAVE NOT MET LEGAL REQUIREMENTS TO CONDUCT COMMERCIAL FRANCHISING ACTIVITIES. THEREFORE, WE MAY BE SUBJECT TO PENALTIES AND ADMINISTRATIVE ACTIONS.

Under related PRC laws and regulations, commercial franchising refers to the business activities where an enterprise that possesses the registered trademarks, enterprise logos, patents, proprietary technology or any other business resources, the franchisor, allows such business resources to be used by another business operator, the franchisee, through a contract and the franchisee follows the uniform business model to conduct business operation and pays franchising fees according to the contract to conduct commercial franchising activities. A franchisor must have certain prerequisites including a mature business model, the capability to provide long-term business guidance and training services to franchisees and ownership of at least two self-operated storefronts that have been in operation for at least one year within China. Franchisors engaged in franchising activities without satisfying the above requirements may be subject to penalties such as forfeit of illegal income, imposition of fines ranging from RMB 100,000 to RMB 500,000, and may be bulletined by MOFCOM or its local counterparts. In addition, franchisors shall carry out record-filing with MOFCOM or its counterparts within 15 days upon executing the first franchise contract, and our failure to comply with such requirement may result in fines ranging from RMB 10,000 to RMB 100,000. Due to our six franchise stores existed until December 2013, we were likely recognized as a commercial franchisor for authorizing other business entities to use our trademark and adopting a uniform business model. We did not own two self-operated storefronts that have been in operation for one year or longer and have not carried out record-filing with MOFCOM or its counterparts when we had franchise stores. Therefore, we may be subject to penalties such as forfeit of illegal income, imposition of fines from RMB 10,000 to RMB 500,000 and may be bulletined by MOFCOM or its local counterparts. We have unwound our franchise stores in December 2013. In addition, we are taking steps to comply with the requirements for self-operated storefronts and will attempt to carry out record-filing with MOFCOM or its local counterparts after our self-operated storefronts operate for one year. We estimate that we may become compliant with PRC laws and regulations related to commercial franchising within the first quarter of 2015. Until we become compliant with the relevant PRC laws and regulations, we do not plan to develop any franchise stores.

| 16 |

Risks Related To Our Online Retail Platform

WE MAY NOT BE ABLE TO MARKET OUR WEBSITE, MOBILE STORE AND SET-TOP BOX STORE SUCCESSFULLY.

Once we establish a stable and comprehensive supply of specialty products across the country, we plan to seek outside capital and launch a marketing campaign to fully promote and advertise our brand. The e-commerce industry is extremely competitive. Though very few, if any, specialize in local specialty goods, there are currently many general online shopping websites both in China and worldwide that sell local products. An effective marketing plan will need to be executed in order to establish a loyal client base, and to get our website and mobile application known in the marketplace. If we fail to develop such an effective marketing plan, and if we are unable to market our website, mobile application and set-top boxes successfully to consumers, we may not be able to sustain business operations.

THE CHANGING INDUSTRY REQUIRES EXPANSION AND CONSTANT UPDATING OF OUR WEBSITE, MOBILE STORE, SET-TOP BOXES AND SOFTWARE.

The e-commerce industry is characterized by rapid technological change that could render our website, mobile store, set-top box store and backend application obsolete. The development of our website, mobile store and set-top box store entails significant technical and business risks. We can give no assurance that we will successfully use new technologies effectively or adapt our website, application or set-top boxes to customer requirements or needs. If our management is unable, for technical, legal, financial, or other reasons, to adapt in a timely manner in response to changing market conditions or customer requirements, we may never become profitable which may result in the loss of all or part of your investment.

OUR TECHNICAL SYSTEMS ARE VULNERABLE TO INTERRUPTION AND DAMAGE THAT MAY BE COSTLY AND TIME-CONSUMING TO RESOLVE AND MAY HARM OUR BUSINESS AND REPUTATION.

A disaster could interrupt our services for an indeterminate length of time and severely damage our business, prospects, financial condition and results of operations. Our systems and operations will be vulnerable to damage or interruption from fire, floods, network failure, hardware failure, software failure, power loss, telecommunication failures, break-ins, terrorism, war or sabotage, computer viruses, denial of service attacks, penetration of our network by unauthorized computer users and “hackers” and other similar events, and other unanticipated problems.

We may not have developed or implemented adequate protections or safeguards to overcome any of these events. We may also not have anticipated or addressed many of the potential events that could threaten or undermine our technology network. Any of these occurrences could cause material interruptions or delays in our business, result in the loss of data or render us unable to provide services to our consumers. In addition, if anyone can circumvent our security measures, he or she could destroy or misappropriate valuable information or disrupt our operations. We do not have insurance to compensate us for all the losses that may occur as a result of a catastrophic system failure or other loss.

If we fail to address these issues in a timely manner, we may lose the confidence of our customers, and our revenue may decline and our business could suffer.

WE RELY ON OUTSIDE FIRMS TO HOST OUR SERVERS, AND A FAILURE OF SERVICE BY THESE PROVIDERS COULD ADVERSELY AFFECT OUR BUSINESS AND REPUTATION.

We rely upon third-party providers to host our main server. In the event that our providers experience any interruption in operations or cease operations for any reason or if we are unable to agree on satisfactory terms for continued hosting relationships, we would be forced to enter into a relationship with other service providers or assume hosting responsibilities ourselves. If we are forced to switch hosting facilities, we may not be successful in finding an alternative service provider on acceptable terms or in hosting the computer server ourselves. We may also be limited in our remedies against these providers in the event of a failure of service.

WE MAY NOT BE ABLE TO FIND SUITABLE SOFTWARE DEVELOPERS AT AN ACCEPTABLE COST.

| 17 |

We contract software developers to further develop and upgrade our website and mobile store and associated backend interface. Due to the current demand for skilled technological developers, we run the risk of not being able to find or retain suitable personnel at an acceptable price. We would also need to ensure that the candidates are adequately qualified to develop a website or mobile application that is user friendly, free of errors and seamless in design. Without these developers, we may not be able to further develop and upgrade the software, which is the most important aspect of our business development.

OUR BUSINESS DEPENDS, IN PART, ON THE GROWTH AND MAINTENANCE OF THE INTERNET AND TELECOMMUNICATIONS INFRASTRUCTURE.

The success of our business depends in part on the continued growth and maintenance of the internet and telecommunication infrastructure. This includes maintaining a reliable network backbone with the necessary speed, data capacity and security for providing reliable internet services. Internet infrastructure may be unable to support the demands placed on it if the number of internet users continue to increase or if existing or future internet users access the internet more often or increase their bandwidth requirements. We have no control over the providers of access services to the internet. Interruptions, delays or capacity problems with any points of access between the internet and our website could adversely affect our ability to provide services to users of our websites. The temporary or permanent loss of all or a portion of our services on the internet, the internet infrastructure generally, or our users’ ability to access the internet, could have a material adverse effect on our business, results of operations, financial condition and the trading price of our common stock.

Risks Related To Product Liabilities

FOOD SAFETY EVENTS INVOLVING US OR OUR SUPPLY CHAIN COULD CREATE NEGATIVE PUBLICITY AND ADVERSELY AFFECT SALES AND OPERATING RESULTS.

Because some of our items are perishable food products, food safety is a top priority, and we dedicate resources to ensure that our customers enjoy safe and quality food products. However, food safety events, including instances of food-borne illness have often occurred in the Chinese food industry in the past, and could occur in the future. As a result, our stores could experience a significant increase in supply costs if there are food safety events whether or not such events involve our stores or those of competitors.

In addition, food safety events, whether or not accurate or involving us, could result in negative publicity for WINHA or for the industry or market segments in which we operate. Increased use of social media could create and/or amplify the effects of negative publicity. This negative publicity, as well as any other negative publicity concerning types of food products we serve, may reduce demand for our products and could result in a decrease in guest traffic to our online, mobile store and physical stores as consumers shift their preferences to our competitors or to other products or food types. A decrease in traffic to our stores, website and/or mobile store as a result of these health concerns or negative publicity could result in a decline in sales.

WE MAY BE SUBJECT TO PRODUCT LIABILITY CLAIMS IF PEOPLE OR PROPERTIES ARE HARMED BY THE PRODUCTS SOLD THROUGH OUR STORE, WEBSITE OR MOBILE STORE.

Products sold through our stores, website and mobile store are manufactured by third parties. Some of those products may be defectively designed or manufactured. As a result, sales of such products through our stores, website or mobile store could expose us to product liability claims relating to personal injury or property damage and may require product recalls or other actions. Third parties subject to such injury or damage may bring claims or legal proceedings against us as the e-commerce platform to offer the products. We do not currently maintain any third-party liability insurance or product liability insurance in relation to products sold through our store, website or mobile store. As a result, any material product liability claim or litigation could have a material and adverse effect on our business, financial condition and results of operations. Even unsuccessful claims could result in the expenditure of funds and managerial efforts in defending them and could have a negative impact on our reputation.

| 18 |

Risks Related to Doing Business in China

ALL OF OUR ASSETS AND OUR DIRECTOR AND OFFICER ARE OUTSIDE THE UNITED STATES, WITH THE RESULT THAT IT MAY BE DIFFICULT OR IMPOSSIBLE FOR INVESTORS TO ENFORCE WITHIN THE UNITED STATES ANY JUDGMENTS OBTAINED AGAINST US OR OUR DIRECTOR OR OFFICER.

All of our assets are located in China and we do not currently maintain a permanent place of business within the United States. Consequently, it may be difficult for United States investors to affect service of process within the United States upon our assets or our officer and director, or to realize in the United States upon judgments of United States courts predicated upon civil liabilities under U.S. Federal Securities Laws. A judgment of a U.S. court predicated solely upon such civil liabilities may not be enforceable in China by a Chinese court if the U.S. court in which the judgment was obtained did not have jurisdiction, as determined by the Chinese court, in the matter. There is substantial doubt whether an original action could be brought successfully in China against any of our assets or our sole director and officer predicated solely upon such civil liabilities. You may not be able to recover damages as compensation for a decline in your investment.

ADVERSE CHANGES IN POLITICAL AND ECONOMIC POLICIES OF THE PRC GOVERNMENT COULD HAVE A MATERIAL ADVERSE EFFECT ON THE OVERALL ECONOMIC GROWTH OF CHINA, WHICH COULD REDUCE THE DEMAND FOR OUR PRODUCTS AND MATERIALLY AND ADVERSELY AFFECT OUR COMPETITIVE POSITION.

Substantially all of our business operations are conducted in China. Accordingly, our business, results of operations, financial condition and prospects are subject to economic, political and legal developments in China. Although the Chinese economy is no longer a planned economy, the PRC government continues to exercise significant control over China’s economic growth through direct allocation of resources, monetary and tax policies, and a host of other government policies such as those that encourage or restrict investment in certain industries by foreign investors, control the exchange between RMB and foreign currencies, and regulate the growth of the general or specific market. These government involvements have been instrumental in China’s significant growth in the past 30 years. In response to the recent global and Chinese economic downturn, the PRC government has adopted policy measures aimed at stimulating economic growth in China. If the PRC government’s current or future policies fail to help the Chinese economy achieve further growth or if any aspect of the PRC government’s policies limits the growth of our industry or otherwise negatively affects our business, our growth rate or strategy, our results of operations could be adversely affected as a result.

UNCERTAINTIES WITH RESPECT TO THE PRC LEGAL SYSTEM COULD ADVERSELY AFFECT US.

We conduct all of our business through our subsidiary in China. Our operations in China are generally subject to laws and regulations applicable to foreign investments in China and, in particular, laws and regulations applicable to wholly foreign-owned enterprises. The PRC legal system is based on statutes. Prior court decisions may be cited for reference but have limited precedential value.

Since 1979, PRC legislation and regulations have significantly enhanced the protections afforded to various forms of foreign investments in China. However, China has not developed a fully integrated legal system and recently enacted laws and regulations may not sufficiently cover all aspects of economic activities in China. In particular, because these laws and regulations are relatively new, and because of the limited volume of published decisions and their nonbinding nature, the interpretation and enforcement of these laws and regulations involve uncertainties. In addition, the PRC legal system is based in part on government policies and internal rules (some of which are not published on a timely basis or at all) that may have a retroactive effect. As a result, we may not be aware of our violation of these policies and rules until sometime after the violation. In addition, any litigation in China may be protracted and result in substantial costs and diversion of resources and management’s attention.

| 19 |

NEW LABOR LAWS IN THE PRC MAY ADVERSELY AFFECT OUR RESULTS OF OPERATIONS.

On June 29, 2007, the PRC government promulgated a new labor law, namely, the Labor Contract Law of the PRC, or the New Labor Contract Law, which became effective on January 1, 2008, as amended on December 28, 2012. The New Labor Contract Law imposes greater liabilities on employers and significantly affects the cost of an employer’s decision to reduce its workforce. Further, it requires certain terminations to be based upon seniority and not merit. In the event we decide to significantly change or decrease our workforce, the New Labor Contract Law could adversely affect our ability to enact such changes in a manner that is most advantageous to our business or in a timely and cost-effective manner, thus materially and adversely affecting our financial condition and results of operations.

UNDER THE ENTERPRISE INCOME TAX LAW, WE MAY BE CLASSIFIED AS A “RESIDENT ENTERPRISE” OF CHINA. SUCH CLASSIFICATION WILL LIKELY RESULT IN UNFAVORABLE TAX CONSEQUENCES TO US AND OUR NON-PRC STOCKHOLDERS.