Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

|

[X]

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED MARCH 31, 2014

|

Commission File Number: 000-52752

SILVER STREAM MINING CORP.

(Exact name of registrant as specified in its charter)

Nevada

(State or other jurisdiction of incorporation or organization)

9550 South Eastern Avenue, Suite 253

Las Vegas, NV 89123

(Address of principal executive offices, including zip code.)

(702) 818-1775

(Registrant's telephone number, including area code)

|

Securities registered pursuant to Section 12(b) of the Act:

|

Securities registered pursuant to section 12(g) of the Act:

|

|

NONE

|

COMMON STOCK

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES [ ] NO [X]

Indicate by check mark if the registrant is required to file reports pursuant to Section 13 or Section 15(d) of the Act: YES [X] NO [ ]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES [X] NO [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES [ ] NO [X]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer

|

[ ]

|

Accelerated Filer

|

[ ]

|

|

Non-accelerated Filer (Do not check if a smaller reporting company)

|

[ ]

|

Smaller Reporting Company

|

[X]

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES [ ] NO [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of July 15, 2014: $3,100,000.00.

As of July 15, 2014, 46,727,250 shares of the registrant's common stock were outstanding.

|

|

Page

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business.

|

3

|

|

|

Risk Factors.

|

19

|

|

|

Unresolved Staff Comments.

|

19

|

|

|

Properties.

|

20

|

|

|

Legal Proceedings.

|

20

|

|

|

Mine Safety Disclosures.

|

20

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Market for Our Common Equity, Related Stockholder Matters and Issuer Purchases of

Equity Securities.

|

20

|

|

|

Selected Financial Data.

|

22

|

|

|

Management's Discussion and Analysis of Financial Condition and Results of Operation.

|

22

|

|

|

Quantitative and Qualitative Disclosures About Market Risk.

|

24

|

|

|

Financial Statements and Supplementary Data.

|

24

|

|

|

Changes in and Disagreements With Accountants on Accounting and Financial

Disclosure.

|

38

|

|

|

Controls and Procedures.

|

38

|

|

|

Other Information.

|

39

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Directors, Executive Officers and Corporate Governance.

|

40

|

|

|

Executive Compensation.

|

43

|

|

|

Security Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters.

|

46

|

|

|

Certain Relationships and Related Transactions, and Director Independence.

|

47

|

|

|

Principal Accountant Fees and Services.

|

47

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibits and Financial Statement Schedules.

|

48

|

|

|

|

|

|

|

50

|

||

|

|

|

|

|

51

|

||

Page 2 of 52

Forward Looking Statement

This report contains forward-looking statements, which reflect, among other things, management's expectations regarding the Company's future growth, results of operations, performance and business prospects and opportunities. The use of any of the words "anticipate", "continue", "estimate", "expect", "may", "will", "project", "should", "believe" and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. The Company believes that the expectations reflected in these forward-looking statements are based on reasonable assumptions but no assurance can be given that these expectations will prove to be correct and the forward-looking statements included in this report should not be unduly relied upon. These statements speak only as of the date of this report and save and except as required under applicable securities legislation the Company assumes no obligation to update or revise them to reflect new events or circumstances.

General

Silver Stream Mining Corp. ("we", "our", "us", "Silver Stream," or "the Company"), formerly known as W.S. Industries, Inc. was incorporated in the State of Nevada on April 5, 2004, for the purpose of providing consulting services to businesses, and engaging in any other lawful activity. The Company's principal address is 9550 South Eastern Avenue, Suite 253, Las Vegas, NV 89123.

The Merger

On April 22, 2013, we (as W.S. Industries) entered into an Agreement and Plan of Merger (the "Merger Agreement") by and among W.S. Industries, W.S. Merger Corp., a Nevada company and a wholly owned subsidiary of W.S. Industries ("Merger Sub"), Rio Plata Exploration Corporation, a company organized pursuant to the laws of the Province of British Columbia, Canada (the "Rio Plata"), and certain holders (the "WS Debt Holders") of debt of W.S. Industries (the "WS Debt"), pursuant to which, at the effective time of the merger on May 14, 2013, the WS Debt Holders sold their WS Debt to certain purchasers, who converted such debt into an aggregate of 5,000,000 shares of W.S. Industries, and Merger Sub was merged with and into Rio Plata (the "Merger"). Merger Sub remained as the surviving entity in the Merger and succeeded to all of the assets, liabilities and operations of Rio Plata, and Rio Plata effectively became a wholly owned operating subsidiary of W.S. Industries. Shareholders of Rio Plata exchanged their shares of Rio Plata for an aggregate of 28,000,000 shares of W.S. Industries under the Merger, including holders of short-term debt of Rio Plata that converted their debt into shares of Rio Plata prior to the effective time of the Merger.

The Merger constituted a change in control of W.S. Industries and, accordingly, was accounted for as a "reverse merger" with the Corporation treated as the acquiring entity and operating company for accounting purposes. Merger Sub was subsequently merged with and into W.S. Industries in August 2013, with W.S. Industries as the surviving entity which succeeded to all of the assets, liabilities and operations of Rio Plata, effectively making Rio Plata the public entity. At that time, the name of W.S. Industries was changed to Silver Stream Mining Corp.

Our Business

We are a junior natural resource company engaged in the business of the acquisition and exploration of mineral resource properties. Our primary interest currently is in a property located in the State of Sinaloa, Mexico known as the "Metates Property". We have also recently purchased an option to acquire an interest in a property located in Beardmore, Ontario, Canada known as the "Solomon Pillars Gold Property"; entered into an agreement with Redstone Resources Corporation regarding the Zonia Copper Project in Yavapai County, Arizona; and entered into an agreement with Placer Mining Corporation regarding the Bunker Hill Mine, near Kellogg, Idaho. We have conducted limited exploration work on our properties. See "Risk Factors" below.

Page 3 of 52

Metates Property

Our primary property is the Metates Property located approximately 110 kilometers NW of the city of Mazatlan, Municipality of Mazatlan, in the State of Sinaloa, Mexico. The Metates Property is in the exploration stage and is currently without a known body of commercial minerals. Additional exploration activity is required on the Metates Property to determine if there are any commercial amounts of minerals extractable from the property.

The Metates Property consists of a group of exploration concessions with a total area of 15,789 hectares (ha). These concessions were acquired in three groups. The initial block was composed of seven concessions with a total area of 942 ha, which we secured through our wholly owned subsidiary Real de Plata in 2010 from the property owner by way of an option under an exploration contract. In 2010, we acquired an additional group of 6 concessions with a total area of 5056.5 ha from the property owner by way of an assignment of the applications made for the concessions (subsequently approved and obtained) in consideration for a royalty. In 2012, we applied for and acquired the adjacent La Gloria concession of 9791 ha.

Our wholly owned subsidiary, Real de Plata, entered into an exploration contract in August 2010 with the Metates Property owner pursuant to which we were granted (i) the option to purchase a 100% interest in the initial seven mineral exploration concessions (and related assets) and (ii) the right to explore the property.

Under the terms of the exploration contract, the initial seven mineral exploration concessions (and related assets) were to be transferred to us over a 49 month period through a series of staged payments totaling US$6,100,000. On May 9, 2013, we and the property owner entered into a letter of intent pursuant to which we could acquire a full interest in the property concessions upon the payment of US$450,000 on July 15, 2013 and a further US$2,000,000 on January 15, 2014, which would supersede amounts due under the original contract; otherwise, the payment terms under the original agreement would apply. However, due to the current downturn in the mining industry, we have not made any payments under the letter of intent and are currently in the process of renegotiating the payments under the exploration contract.

Depending on the results of the renegotiation, our focus with respect to exploration of the Metates Property will be on the initial seven mineral exploration concessions, or exploring the potential of our concessions outside of the initial seven mineral exploration concessions.

We will require significant financing to pursue our exploration plans. While we are currently in discussions with third parties regarding financing for our company, there can be no assurance that we will obtain any additional financing, on terms acceptable to us or at all. In the event we are unable to obtain the required financing, we may be required to curtail our plans or may not be able to pursue our plans altogether until we obtain additional funds and our business may fail. See "Risk Factors".

Metates Property Description and Location

Location

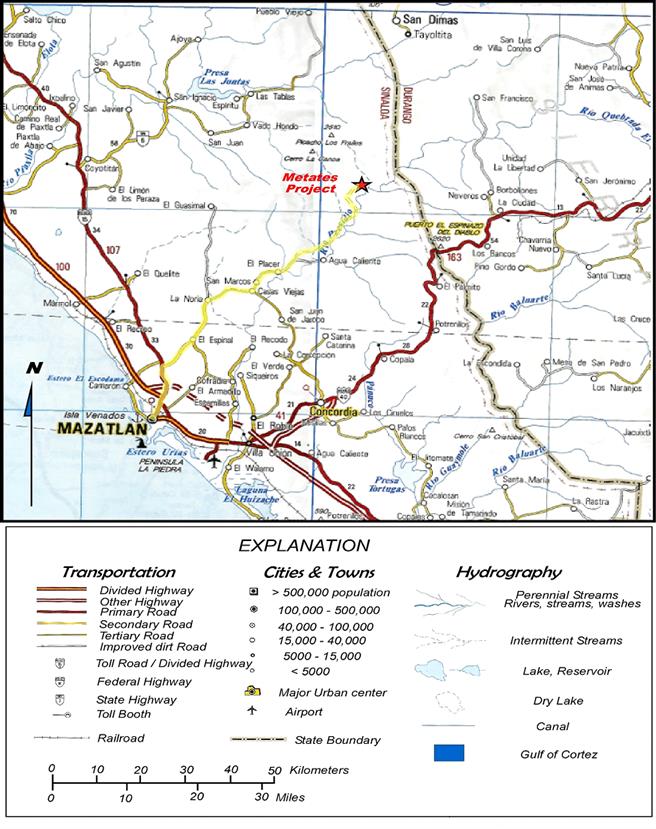

The Metates property is located approximately 110 kilometers northeast of the city of Mazatlan, State of Sinaloa, Mexico. The figure below shows the location of the property relative to other projects and cities in Mexico. The center of the property is at a latitude/longitude of 23 44'1.7" North and 106 00'43.9" West. Driving time to the property from Mazatlan is approximately 5 hours. The initial portion of the road is a paved highway which extends as far as the town of La Noria. From there, the road gradually declines in quality from a fairly well maintained dirt road to a very poorly maintained dirt road as the property is approached.

Page 4 of 52

Index Map showing location of Rio Plata's Metates project in Mexico (2010)

The Metates Property is in the exploration stage and is currently without a known body of commercial minerals. Additional exploration activity is required on the Metates Property to determine if there are any commercial amounts of minerals extractable from the property.

Property Concessions

The exploration and exploitation of minerals and substances in Mexico is subject to the Mexican Mining Law and may only be carried out in Mexico by Mexican citizens, or Mexican companies incorporated under Mexican laws, by means of obtaining mining concessions. However, foreign investment participation in Mexican mining companies is currently allowed up to 100%. Mining concessions are granted by the Mexican federal government through the Ministry of Economy for a period of fifty (50) years from the date of their recording in the Public Registry of Mining and are renewable if they are in compliance with the Mexican Mining Law. We own our interests at the Metates property through our wholly owned Mexican subsidiary, Real de Plata, and pursuant to the agreements outlined below.

The Metates Property consists of a group of exploration concessions with a total area of 15,789 ha. These concessions were acquired in three groups. The initial block was composed of seven concessions with a total area of 942 ha, which we secured through our wholly owned subsidiary Real de Plata in 2010 from the property owner by way of an option. In 2010, we acquired an additional group of 6 concessions with a total area of 5056.5 ha from the property owner by way of an assignment of applications for the claims made by the property owner. In 2012, we applied for and acquired the adjacent La Gloria concession of 9791 ha. Concession data is listed in the table below.

Metates Concession Data

|

Group

|

Concession Name

|

Title Number

|

Area (ha)

|

Valid until

|

|

|

|

|

|

|

|

Hernandez

|

La Nueva Luz

|

185315

|

40.0000

|

Dec-13-2039

|

|

|

Ampl. La Nueva Luz

|

222628

|

71.2714

|

Jul-29-2054

|

|

|

Ampl. La Nueva Luz 2

|

225906

|

96.0000

|

Nov-03-2055

|

|

|

La Luz

|

231253

|

62.7286

|

Feb-06-2058

|

|

|

Las Habitas

|

231354

|

200.0000

|

Feb-06-2058

|

|

|

Arroyo Verde

|

231355

|

400.0000

|

Feb-06-2058

|

|

|

Habitas 1

|

231357

|

200.0000

|

Feb-06-2058

|

Page 5 of 52

|

Rio Plata 2010

|

Los Panales

|

232018

|

90.0000

|

Jun-02-2058

|

|

|

Metates

|

232100

|

20.0000

|

Jun-19-2058

|

|

|

Metates 2

|

232127

|

4000.4470

|

Jun-19-2058

|

|

|

Amp. Arroyo Verde

|

232137

|

300.0000

|

Jun-23-2058

|

|

|

El Magistral

|

232138

|

400.0000

|

Jun-23-2058

|

|

|

El Cerro Prieto 2

|

232139

|

246.0000

|

Jun-23-2058

|

|

|

|

|

|

|

|

Rio Plata 2012

|

La Gloria

|

E-95/14473

|

9791.0000

|

April-08-2052

|

To keep our mineral concessions in good standing with the Government of Mexico, we must pay yearly property taxes. These taxes are based on a tariff per hectare and per the number of years (maturity) of each concession. The taxes are paid twice a year by us. We paid $21,298 in 2010, $9,321 in 2011, $15,553 in 2012 and $20,672 in 2013 in taxes for the concessions. We believe we are in compliance with all of our tax payments to the government as at March 31, 2014.

Metates Exploration Contract

Our wholly owned subsidiary, Real de Plata, has entered into an Exploration Contract and Unilateral Promise of Sale dated August 26, 2010 (the "Exploration Contract") with Manuel de Jesus Hernandez Tovar (the "Optionor") pursuant to which we were granted (i) the option (the "Option") to purchase a 100% interest in seven mineral exploration concessions which comprise part of the Metates Property (the "Concessions"), as well as certain lands the Optionor controls as part of a local communal's (Ejido) land holdings, certain mineral processing assets (the "Assets") located on the Metates Property which we do not consider to be material to our future operations, and all available data, and (ii) the right to explore the property. The Concessions are more particularly described above.

Pursuant to the terms of the Exploration Contract, Real de Plata has the Option to purchase the Concessions for the price of US$6,100,000 (the "Purchase Price") payable over a period of 49 months, of which US$750,000 has been paid to date. On May 9, 2013, the Company and Optionor entered into a letter of intent pursuant to which we can acquire a full interest in the Concessions upon the payment of US$450,000 on July 15, 2013 and a further payment of US$2,000,000 on January 15, 2014, which would supersede amounts due under the original contract, otherwise the payment terms under the original agreement would apply. However, due to the current downturn in the mining industry, we have not made any payments under the letter of intent and are currently in the process of renegotiating the payments under the Exploration Contract.

Depending on the results of the renegotiation, our focus with respect to exploration of the Metates Property will be on the initial seven mineral exploration concessions, or exploring the potential of our concessions outside of the initial seven mineral exploration concessions. We will require significant financing to pursue our exploration plans. While we are currently in discussions with third parties regarding financing for our company, there can be no assurance that we will obtain any additional financing, on terms acceptable to us or at all. In the event we are unable to obtain the required financing, we may be required to curtail our plans or may not be able to pursue our plans altogether until we obtain additional funds and our business may fail. See "Risk Factors".

Payment of the Purchase Price or any portion thereof is optional. Real de Plata is entitled to terminate the Exploration Contract at any time, but in such event, any payments on account of the Purchase Price made prior to the date of termination are non-refundable.

In addition to the payment of the Purchase Price, the Optionor is also entitled to receive a net smelter royalty of 0.33% on the minerals extracted and recovered from the Concessions.

The Exploration Contract also includes an area of interest provision which, on election by Real de Plata, requires that the Optionor transfer to Real de Plata any mining concessions or applications for mining concessions acquired by the Optionor within an area of five (5) kilometers from the external perimeter of each of the Concessions. In such event, Real de Plata is required to pay to the Optionor the sum of US$100 for each mining concession or application for mining concession acquired by the Optionor. In addition, prior to the exercise of the Option, the Exploration Contract provides Real de Plata the right to access the Metates Property and the surface lands, and to explore for and exploit any minerals located on the Metates Property.

Page 6 of 52

Pursuant to the Exploration Contract, Real de Plata has agreed to: (i) conduct all exploration and, if applicable, exploitation operations in a careful and miner-like manner and in compliance with all laws and regulations applicable to the Metates Property; (ii) prepare and submit all required reports on exploration work and, if applicable, exploitation work, and pay all applicable duties, taxes and other charges required to maintain the Concessions in good standing with applicable governmental authorities; (iii) use its best efforts to prevent access to the Concessions by third parties, other than authorized employees and contractors; and (iv) assume all responsibility for the activities undertaken by it and its employees and contractors on the Concessions.

The Exploration Contract will terminate: (i) at any time during the term of the Exploration Contract by Real de Plata giving 15 days notice to the Optionor; or (ii) upon election of a party if the other party is in breach of any of its obligations under the Exploration Contract and the default has not been cured by the defaulting party within 30 days of notice of default.

Assignment of Applications for Concessions

The Optionor and Real de Plata also entered into an Assignment of Mining Rights Contract dated August 27, 2010 (the "Assignment") pursuant to which the Optionor assigned to the Corporation its interests in applications for six new mineral exploration concessions at the Metates Property (subsequently approved and received). In consideration for the assignment, Real de Plata granted the Optionor a 0.33% net smelter royalty on the minerals extracted and recovered from these mining concessions.

Further to the Exploration Contract, the Optionor and Real de Plata also entered into an Asset Operation Contract dated August 27, 2010 (the "Asset Operation Contract") pursuant to which the Optionor has the right to use an older 50 ton per day processing mill to process any materials that have already been mined prior to the date of the agreement. There are about 500 tons of materials mined previous to the date of the Asset Operation Contract that are stockpiled on the property. Previously mined materials may have been extracted from the Metates property or nearby mines at any time over the previous 130 years and are piled at various places near the old mine workings. These materials are both oxidized mineralization as well as unoxidized mineralization discarded by earlier miners. Once these materials have been processed, the Asset Operation Contract shall be deemed to have terminated, and Real de Plata shall have full control over the use and operation of the mill during the term of the Exploration Contract.

Real de Plata has the right to explore the Metates Property under the Exploration Contract, and we do not consider the mill to be material to our future operations. The benefit to the Company of the mill is in data collection from the samples processed at the mill.

During the term of the Asset Operation Contract, in the event any minerals processed through the mill by the Optionor are sold, Real de Plata is entitled to receive from the Optionor a 20% participation in the net returns, before taxes, realized from the sale of such minerals by the Optionor (separate and apart from any smelter returns to Real de Plata under the Exploration Contract). The Optionor is solely responsible for all activities undertaken by him and his employees and contractors in connection with the use of the mill, including all expenses incurred by any of them, and has agreed to indemnify and hold Real de Plata harmless against all losses and damages that may be suffered by Real de Plata as a result of the Optionor's operation of the mill.

Since entering into the Asset Operation Contract, the Optionee has not in any material respect employed the mill to process minerals and, accordingly, Real de Plata has received no payments from the Optionor on account of its 20% participation interest in net returns from mineral processing activities. Management does not anticipate that any such payments will be made to it in the near future.

Environmental Factors

Surface disturbance and potential environmental issues are controlled by the Mexican government agency SEMARNAT. The current situation appears to be properly permitted. The construction of new access roads and drill sites will require additional permitting.

Page 7 of 52

It is possible, but unlikely, that some unforeseen environmental problem, endangered species or important archaeological feature will be discovered. This could potentially delay the exploration program. Such obstacles can nearly always be overcome through cooperation with the regulatory agency, for example by making a detour of a proposed road to avoid an archeological site.

Accessibility, Climate, Local Resources, Infrastructure, and Physiography

The Metates project area is 107 kilometers northeast of Mazatlan in the Mexican state of Sinaloa, near the Durango border, at an elevation of approximately 1180 meters above sea level. The quality, width and capacity of the access roads decrease as the property is approached. Currently the last 21 kilometers of road beyond the small town of Tecomate is gravel, is 3 meters wide, and has a 10 ton capacity. There are many stream crossings along this part of the road and most of these use fords rather than bridges. During the July-August rainy season, some of the crossings will be impassible for short terms. On the property itself, the roads can be used year-round as there are no significant stream crossings. Normal 4-wheel drive vehicles can use all the roads most of the year, but trucks moving heavier loads will find access more difficult. For larger exploration programs or supplying a mine of any significant size, these roads will require substantial improvement. The Mexican government says it intends to improve the roads, but progress will be slow.

Situated on the southwest-facing slope of the Sierra Madre Occidental, the property has a climate strongly depending on the up-slope weather conditions and the general southwest to northeast trending winds. Slopes are generally quite steep with sparse outcrops in strongly weathered soils. Much of the year the amount of moisture is moderate, but sufficient to support a dense scrubby forest of deciduous trees and shrubs. Areas of evergreen timber large enough to support logging are also present nearby in higher elevations, but not on the property itself. The weather sharply defines the difference between the summer rainy season and the rest of the year. From October to June rainfall averages about 25mm per month, but in July to September rainfall averages 190 mm per month. Temperatures from October to June average a high of 26 degrees C and a low of 16 degrees C. In July to September temperatures average a high of 33 degrees C and a low of 25 degrees C. Weather conditions severe enough to halt mining operations would be rare, probably confined to stream flooding during occasional heavy summer rains.

The area within 25 kilometers of the mine portal is sparsely populated, largely by subsistence farmers and herders. A few of the nearby people have some experience working small mines such as that at Metates. Larger scale logistical support and mining personnel would have to come from the Mazatlan area. Mazatlan is a seaport and has good railroad and airline service.

The current property is sufficiently large to contain space for mining and processing operations. The immediate area of the current mill has very limited room for the fabrication of a larger scale mine. The small current mill tailings pond is nearly full. Other areas could be expanded, but this would require substantial earthworks due to the generally steep topography.

The figure below shows the access route to the property from the city of Mazatlan (in yellow).

Page 8 of 52

Metates property access map. A map of a portion of the Mexican State of Sinaloa showing road access to the Metates property from Mazatlan, Sinaloa, Mexico. February 10, 2014.

Page 9 of 52

Water for processing of the minerals is a major concern. In Mexico the government controls the surface water rights. The current water supply is a pipeline carrying water from springs several kilometers away. For a larger operation a much larger water supply would be needed.

It will be necessary to generate electrical power on site, as it is 20 kilometers by road to the nearest power line. Current environmental liabilities are limited to the very small tailings pond located at the small mill that was working over the past several years.

Much of the surface area of the Metates concessions is part of a local communal land-holding group called an Ejido. Agreements must also be made with this group for surface access. The Optionor is a member of this group and should have sufficient influence to smooth the process. However, it will be very important to maintain a good working relationship with the local Ejido.

There are two significant factors or risks that may affect access, title or the right or ability to perform work on the property. The first of these is the hazardous situation caused by the conflicts among the two drug cartels active in the area and the military. The second is a result of the remote location and the poor road access, especially in the rainy season.

Metates History

District History

There are very few records of the mining history of the local area. Most of what is known was derived from the history of nearby areas, local oral histories and amateur archaeology. It is known that the Spanish were in Sinaloa as early as 1530 and were mining in Alamos (Sonora) shortly thereafter. In the Tayoltita district, approximately 40 km to the northeast of Metates, the Spanish were operating mines by the mid 1700's (Conrad and Peterson, 1992). This period ended in 1810 due to the Mexican War of independence and only smaller scale operations continued until the 1880's. At that time, American and British companies became very active in this part of Mexico and mines were opened (or re-opened) in many districts and operated until about 1910. Most foreign mining companies left Mexico during the Revolution beginning in 1910, and mining became a small scale local enterprise again in many places, often until the 1940's.

Discussions with village elders in the Metates area confirmed that, in a general sense, the same scenario happened locally. There were small scale mining operations in the area "for a long time" before the 1880's, but there are no written records, only vague oral histories. The local mines operated until the Revolution. The time of the Mexican Revolution and afterward was "a very bad time" and only local very small scale mining was done.

The villagers were able to show the Company's personnel the sites of mills from the 1880's (a plate on an old steam engine had 1880's dates and other artifacts from that era were noted) and a few workings that appeared to be older than that time, including the Polonia shaft, now filled with water. This supports the idea that at least some smaller scale mining operations took place before 1880, and that larger scale and more organized mining was done until the Revolution in 1910. The workings on the four levels of the Metates mine were mined during that time period. There was very little mining activity between 1910 and 1945.

There was said to be a small amount of minerals extracted during the late 1940's when a small airstrip (now overgrown) was built, but there are no records available. In the early 1980's a former owner gained control of the Metates property and operated it sporadically until 2010. His group roughly mapped and sampled the workings and mined pillars, some low grade minerals and the better grade mine dumps. Some of his mapping was made available to the Company. He also built and operated the 50 tons per day processing plant which is currently on the property. Extraction records are not available.

The Optionor acquired the property from the former owner in 2010. His group has made sporadic processing runs in the processing plant using lower grade material that had already been mined, such as stockpiles and waste dumps. An agreement with the Corporation allows him to continue this small scale processing if he desires, until this material is exhausted or the contract expires.

There are no resource estimates that comply with the standards of the SEC, historical or current, and no available records of extraction from the property.

Page 10 of 52

Surface Disturbances

Previous mining activities on the Metates property have left a number of adits and shafts on the property. Many of these workings have small waste piles associated with them. As well, there is a sparse network of roads that connects some adits of the Metates mine.

The largest disturbance on the property is a deeply eroded tailings pile that exists just downslope from the old mill on the property. It is unknown when the bulk of these tailings were produced, but a small amount was produced by recent processing that was done at the existing mill. The tailings lie in a steep canyon and are deeply eroded. It is unlikely that any of these tailings were produced during the main period of mining on the property, 1880 – 1910.

The only other notable disturbance on the property is in the camp area, where approximately one-half (1/2) of a hectare has been disturbed to build dormitory, office and cantina facilities. This area appears to have been used for many years.

The only disturbance that appears to present an environmental liability is the old tailings pile. To date, no governmental agency has identified it as such, but this could happen if advancement of the property proceeds.

Currently, the company has no plans for remediation of the site. Any such plans that would be made in the future would be dependent of the recommendations of SEMARNAT, the Mexican government agency charged with environmental protection.

As no groundwater investigations have been done on the property, it is unknown as to whether or not past activities there have impacted groundwater quality.

Metates Geologic Setting and Mineralization

Regional Geology

The Metates property is located in the west central part of the Sierra Madre Occidental, which is a very large northwest trending slightly domed volcanic plateau composed predominantly of Tertiary volcanic rocks. Areas of extensional faulting occur on both the east and west, which Sedlock, et. al. (1993), called the eastern and western Mexican Basin and Range provinces. The Sierra Madre Occidental is composed primarily of two sequences of Tertiary volcanic rocks overlying a basement consisting largely of a variety of Mesozoic intrusive and Paleozoic sedimentary rocks (Salas, 1991). The basement rocks are locally exposed in deeply incised canyons.

The Tertiary volcanics are grouped into two thick sequences. The Lower Volcanic Group (LVG) is composed of over 2000 meters of predominantly andesitic volcanic rocks; inter-layered ash flows, widespread mudflows (lahars) and related hypabyssal intrusions, and is latest Cretaceous to early Tertiary in age. Nearly all of the productive base and precious metals veins found to date in the Sierra Madre Occidental are hosted within the LVG, including those of the Metates Project.

The Upper Volcanic Group (UVG) is over a kilometer thick, nearly flat-lying and unconformably overlies the Lower Volcanic sequence. The UVG is composed largely of rhyolite to rhyodacite ash-flow tuffs, flows and domes, with minor andesite and basalt, which were deposited by a series of caldera eruptions during the Eocene and Oligocene.

Only a minor percentage of productive veins have been found in the lower portions of the UVG. Some altered rhyolitic intrusive bodies, often associated with mineralization, may be related to early phases of the upper sequence. Later Miocene basaltic andesites and basalts locally overly the upper sequence (Salas, 1991). Intrusive activity in the western portion of the Sierra Madre Occidental has been dated continuously from 102 to 43 million years.

It has been recognized that precious and base metal veins formed in the Sierra Madre Occidental volcanic province in three distinct periods, in response to differing styles of tectonic deformation. For example, veins of the early Tertiary trend east-west and are localized in openings produced by horizontal offsets. Veins formed during the mid-Tertiary (35 to 25 million years ago), occur in weak fractures and are small and erratic. Veins formed during the Miocene occur in normal faults, low-angle gravity structures, and regional strike-slip faults. During the early Tertiary, this deformation resulted from east-west compression, whereas later on, in the Miocene, it was a result of extension. Many of the Miocene veins are of regional extent and have been spectacular producers (Dreier, J., 1984). However, this is not to suggest that the Miocene structures are preferred exploration targets. Deposits formed in earlier Tertiary structures, such as at Tayoltita, which is about 40 m northeast of Metates, have been impressive producers.

Page 11 of 52

Project Geology

The geology in the Metates area is relatively simple in general. The rock units are primarily a series of andesitic flows and laharic tuffs of the LVG. There is a distinctive thinly bedded tuff in the main mine area and a small area of basaltic rocks 500 meters to the southwest. There is also a small area of intrusive diorite in the south near the town of Nacimiento. The principal veins trend north-south and there are a few cross-cutting veins with a northwest-southeast trend. Exposures are generally poor due to the thick scrub brush and weathering. There has been only a limited amount of geologic mapping, due to the steep terrain and this undergrowth.

The veins that have been located on the Metates property are nearly all hosted in andesitic volcanic rocks of the LVG and appear to occupy northerly trending, normal fault structures and lesser northwest-southeast trending structures. The Metates vein itself strikes approximately 5 to 20 degrees east of north, dips steeply to the east and extends at least 650 meters along strike. Movement on the vein structure appears to have been largely vertical with at least some right lateral movement which caused the curved shapes and vein splits seen in levels 2 and 3. Past extraction appears to have been largely from Levels 2, 3 and 4.

The nearby Cheto vein strikes about N40W and is projected to intersect the Metates vein a short distance east of the Level 1 mine portal. In this right lateral system of movement, it would also have experienced right lateral and vertical movement. The only known workings on the Cheto vein are old trenches, pits and very shallow exploration shafts.

Other old workings re-discovered by the Company in the area are the Parota shaft and Crucero workings (probably dating from the1880-1910 mining period) located 0.5 km southwest of the Metates mill site, near the old Metates town site. Both have collapsed workings and water-filled shafts. The Polonio shaft is potentially the pre-1880's shaft noted in the History section of this report and is located an additional 600 meters southwest of the Parota shaft. Both are filled with water and inaccessible. To the north approximately 1.8 to 2 kilometers are the old (possibly 1880-1910 era) workings named Rosa Amarilla, Tancudos and Las Palomas. These inaccessible old workings exploit quartz veins with the same strike as the Metates Vein and may be established among the same structure, or possibly a parallel one. They are located near the old Manzanillo townsite, now abandoned.

Metates Mineralization

Only the Metates vein mineralization has been studied in any detail. In general it is in a fault zone which hosts an epithermal quartz vein and siliceous hydrothermal breccia system. The quartz often displays cockade or comb structures indicating its lower temperature environment of deposition. Locally noted is quartz replacement of bladed calcite crystals, which is indicative of being within the boiling zone of the system when it was precipitated, which is also where the precious metals are deposited in such systems.

Gold and silver may occur as electrum at Metates. The veins exposed in the workings are thoroughly oxidized with only the un-oxidized material remaining un-mined. Minor amounts of chalcopyrite, pyrite, galena and sphalerite were noted in a petrographic examination of samples. However, the small amount of sulfides seen in those samples are likely due to the strong oxidation of the sampled materials. Samples of sulfide portions of the vein, collected in the lower, mixed oxide-sulfide part of the vein exposed in the lower workings at Metates, show 20 – 25% sulfide content; consisting primarily of galena and sphalerite, with accessory chalcopyrite and acanthite. Samples also showed evidence of multiple stages of brecciation and re-cementation, both of which are common in such systems.

It is important to note that during the periods in which most of the past mining occurred, the miners were only able to process oxidized minerals. The patio process was used, in which minerals were crushed in a stamp mill to a sand size, mixed with salt, copper sulfate and then ground in an arrastre, several of which have been found in the Metates area. The salt and copper sulfate released the silver and gold from the minerals and mercury was subsequently added to the minerals to recover the precious metals by amalgamation. The amalgam was then retorted to recover the precious metals.

It is currently unknown how much oxidized minerals are left within the workings, but sulfide or non-oxidized minerals were left in the ground by necessity. In silver-gold systems such as this one, weathering and oxidation released some of the precious metals into solution, and they were re-deposited near the top of the sulfide zone, just below the water table. This material could be substantially higher grade than the oxidized material. It may be present over a vertical range of 100 meters or more (or possibly less). The potential for such a supergene enriched zone is untested at Metates.

Page 12 of 52

Deposit Types

General Deposit Model (after Geological Survey of Japan, 2011)

The principal deposit type likely to be present at Metates is an epithermal vein deposit. Such deposits are very common in similar settings, as close by as the Tayoltita area less than 40 kilometers to the northeast, and throughout the Sierra Madre Occidental range of Mexico. These systems form largely in volcano-plutonic arcs associated with subduction zones, with ages similar to those of the volcanism. The deposits generally form at shallow depths, less than 1 kilometer, and are hosted mainly by volcanic rocks. The fluids responsible for the formation of such epithermal deposits originate in hydrothermal systems related to volcanic activity. Boiling of liquid in this environment leads to precipitation of gold and silver in veins, accompanied by a variety of typical features such as adularia and bladed calcite cementing colloform and brecciated quartz. There are multiple generations of quartz deposition within individual veins and adjacent stockwork zones.

Typical observable characteristics of epithermal vein type gold-silver deposits are:

|

1.

|

Open space vein textures dominant, stockwork minerals common, disseminated and replacement minerals minor.

|

|

2.

|

Vein textures - cavity fillings, colloform banding, druses, multi-stage breccias.

|

|

3.

|

Minerals include electrum, gold, pyrite, sphalerite, galena, chalcopyrite, cinnabar

|

|

4.

|

Gangue minerals include: quartz, chalcedony, calcite, adularia, carbonates, illite.

|

|

5.

|

Metals include: gold, silver, zinc, lead, copper, antimony, arsenic, mercury.

|

Metates Exploration

Prior Mapping, Sampling and Drilling

There is virtually no available information about work done on the Metates property from the time before the former owner started working there in the early 1980's. Some of his mapping of the mine workings and limited sampling data were made available to the Corporation. However details of sample collection or quality control procedures are unknown. So sample collection and assay data are informative, but not useful in any resource estimation. The current property holder has been processing mine dumps and stockpiles, so any assay data that he could provide would not be relevant to increasing the knowledge of the distribution of mineralization in the Metates underground workings. The former owner was able to guide the Corporation personnel to several other old workings in the vicinity of the Metates mine.

There was no recorded drilling at Metates before the Corporation acquired the property.

Silver Stream Exploration, 2007-2013

Through our Mexican subsidiary Real de Plata, SA de CV, we became interested in the property late in 2007 and commissioned a review of the project geology and mine workings and a detailed review of the existing processing plant. Both reports were completed in January 2008.

The preliminary field work by Real de Plata was summarized in a Technical Report by Richard Munroe dated November 10, 2008. As part of this due diligence effort, the accessible portions of the workings were cleaned, ladders were replaced and winzes and minerals passes were covered to allow safe access. Levels 2, 3 and 4 were quickly mapped with a Brunton compass and tape. A few samples were collected in the workings to confirm analyses reported. However, sampling procedures and quality control procedures were not documented. Interviews were done with local elders regarding other old workings. Several of those were visited, and their locations were marked by GPS coordinates. Several initial rock chip samples were collected from these old pits, trenches, adits and mine dumps to initially characterize the mineralization. Again, there is little documentation. Petrographic work was done on a few samples as well.

Real de Plata completed negotiations with the former concession holder in 2008. The Optionor gained control of the property early in 2010, and the agreements were re-written in his name. According to a report by Richard Munroe dated November 27, 2010, very little additional work had been done between 2008 and November 2010 by Real de Plata. After the new agreements with the Optionor were signed in November 2010, Real de Plata was free to do additional work.

Page 13 of 52

The most recent work done by the Company started in March 2012, with the objective of demonstrating the potential for minerals discovery and continuing the initial exploration at other prospects. This work included:

|

1.

|

Survey of the Metates mine levels and accessible stopes with a total station.

|

|

2.

|

Collection of 191 chip-channel samples from the Metates Vein and its hanging wall and foot wall rocks (see comments on procedures and documentation below).

|

|

3.

|

Survey and sampling of adit portals in the Manzanillo area 2 km to the north.

|

|

4.

|

Incomplete but widespread surface reconnaissance sampling of exposures of veins, alteration and other old mine workings.

|

|

5.

|

Construction of a modern, 4-room dormitory and a small office near the No. 1 adit of the Metates mine.

|

Metates Mine Sampling

The channel sampling in the Metates Mine workings was reviewed by the Company's consultant Douglas Wood in June 2013. He observed that many sample "channels" were really only chip-channel samples that were only a few inches wide and very shallow, barely scraping the rock surface – certainly not 25 cm wide and several cm deep, as reported in the 2013 Technical Report. The samples were taken with little regard to vein-wallrock contacts, thus greatly diluting what may have been called vein samples. In his 2013 report Munroe stated that the previously exploited high grade zone was 80 to 100 meters in length and extended from Level 1 to Level 5, a vertical distance of 150 meters, and mined widths of this zone ranged from 1 to 3 meters. Mr. Wood observed that in actuality the mined-out higher grade stopes were much smaller than that, consisting of rod-like minerals shoots raking very steeply within the vein. It is correct that the mine workings extend over an interval of 80 to 100 meters along strike. However, in reality, there were several much smaller stopes distributed over this distance with substantial pillars of waste or low grade mineralization separating them.

In addition to the main vein, there were a few areas where a second vein was exploited, especially in Level 2. This "second vein" appeared to be a local split off the main vein. There is no information available below Level 1. Drilling of the down-dip extension of the vein appears warranted based on this assay information, but much additional information is needed before a drilling program can be designed.

El Oro - El Orito Area

The El Oro mine portal is located 750 meters east of the Metates portal. The interior of the adit has not been surveyed, and no systematic sampling has been done. There are at least two adits in the area, 30 meters apart vertically, a very old vertical shaft and several trenches. Interviews with local people suggest that there are several other workings in the area.

Nacimiento Area

This area is 2.5 km south of the Metates mine and has a strong iron oxide signature. The source of the iron oxide appears to be a diorite body with disseminated pyrite in the diorite and the surrounding andesitic rocks. Limited rock chip sampling suggests that the two higher pyrite content zones which were sampled have weak but anomalous gold and silver values. The exploration target here is apparently a larger, lower grade body of mineralization, quite different from the Metates Mine, but it is poorly known and of lower priority.

Manzanillo Area

Manzanillo is an abandoned town site with at least three old adits called the Rosa Amarilla, Tancudos and Las Palomas. These appear to be established along veins in the same structure as Metates, or parallel ones. Limited sampling revealed very low silver and gold grades. However, the presence of substantial workings there suggests that the area should be systematically sampled before its potential can be ranked.

Cheto Vein

The Cheto vein is located west of the Metates vein and is projected to intersect it near the Level 1 portal. On the surface it is a 1.2 to 1.5 meter wide quartz veinlet stockwork with a N45W strike and a dip of 60 to 70 degrees to the northeast. Evaluation of the potential of the Cheto Vein area awaits the results of systematic sampling and a structural analysis of the relationships between the Metates and Cheto veins.

Page 14 of 52

Other Areas of Old Workings

The San Juan Mine is 1.5 km northeast of Metates adjacent to a river. It was probably operated in the 1880-1910 period. It has several adits and an old mill and tailings site on the river bank. Only a few preliminary samples were collected there on a brief visit. However, the high values returned from initial sampling, as well as the extensive mine workings there, suggest that the area should be systematically mapped and sampled before any evaluation of the potential of that area is made.

A short distance to the west of the old Metates town site is the Old Metates mine (late 1800's or possibly earlier). There is a vertical water-filled shaft that was found to be at least 40 meters deep by lowering a weighted rope. The size of the associated waste dump suggests that there may be at least 200 meters of workings. Along strike to the south are several old trenches. There is no data available from these old workings.

There are several other small workings known to be scattered about the property. According to the local people there are many more that the Company has not yet visited. At this point the Metates mine remains the principal exploration target.

Metates Drilling

The Company has not conducted any drilling on the property. There also has been no known drilling done by previous operators of the property.

Metates Sample Preparation, Analysis and Security

Historical Sampling Procedures

Nothing is known of sampling procedures or analysis of any sampling done prior to 2008.

Silver Stream Sampling Procedures

A review of the Company's sampling program indicated that much of the underground sampling at Metates was poorly planned and poorly carried out. Areas sampled as chip channels were narrow, shallow and often inappropriately placed across lithologic or vein contacts. Samples collected in that manner cannot be considered representative of the mineralization present, and certainly cannot be used in any resource calculations.

There is no available quality control data from the sampling programs carried out by the Company in the Metates project area. Although Munroe says in his 2013 Technical Report that quality control measures were taken, no data to support that claim has yet been presented.

Silver Stream Sample Preparation, Analysis and Security (Munroe, 2013)

Samples were carried to the Metates camp where they were placed in large sacks containing 10 to 20 samples per sack. These were sealed and marked with the sample numbers, the project area, the date and the company information. These were taken by Richard Munroe to Mazatlan for shipment to a certified sample preparation facility in Guadalajara operated by International Plasma Labs Incorporated (IPL), headquartered in Richmond, BC, Canada. Some samples were sent to the SGS lab in Durango for processing.

The pulps from Guadalajara were sent by courier to the IPL lab in Richmond, BC for analysis. IPL is an ISO 9001:2000 certified company claiming to have "extensive experience in mineral assay work". The SGS lab in Vancouver, Canada was used in a similar manner for samples sent to Durango. Munroe reports that "check samples" were sent lab to lab to act as referee samples due to the occasional high grade nugget effect in some of the samples. Apparently, the check samples were additional samples taken from selected sample sites and intended as duplicate samples. Re-assay of such samples would serve no "referee" purpose and at most, could only be used as a general measure of the variability of gold grade within small areas.

Samples taken from the Metates mine workings were assayed for only gold and silver by fire assay with an atomic absorption finish. Gold values were reported in ppb and g/t; silver values were in ppm and gm/t. Regional reconnaissance samples were assayed for gold and silver by fire assay with an atomic absorption finish. Gold values were reported in ppb and gm/t; silver values were in ppm and gm/t. An additional suite of 30 elements were assayed by ICP-ES methods for the regional reconnaissance samples only, and the results were reported in ppm and percent.

Page 15 of 52

Other than the laboratories' internal quality control protocols, there is no available documentation of quality control procedures used with these samples, no variability statistics, and no comparison of data between labs. Thus the quality of the assay data is very uncertain.

Munroe (2013) simply states that several blank (or very low metal content) samples were inserted in the sample stream at the Metates site to act as control samples. In the lab, each assay submission lot was subjected to three random re-assays as well as containing blank and standard samples as part of the laboratory's internal quality control system.

Metates Mineral Processing and Metallurgical Testing

The small mill on the property which was built in the early 1980's has the capacity to process approximately 50 tons of material per day. The mill design was reviewed in great detail, with several photographs included, in a January 2008 report for Real de Plata which concluded that the design was not very efficient, but that it was functional at a low processing level and fairly well maintained, in part because it had been processing low grade material. The mill did not process the minerals efficiently, and recoveries were perhaps 60%.

From the perspective of moving the property forward, this older cobbled-together mill is really only suitable for bulk testing or minimal processing by the Optionor. If the Metates mine were ever to be feasible for extraction, a new mill with a more modern design, appropriate to the higher grade minerals and larger scale mining rates anticipated, would be necessary.

It will be necessary to have completed detailed bench-scale metallurgical testing of representative minerals grade material by a reputable laboratory before such a mill is designed. At the current stage of exploration at Metates, it has not been demonstrated that any quantity of potential minerals-grade material has been discovered at Metates and it will be necessary to define an appreciable amount of such material before any metallurgical tests are contemplated.

Metates Mineral Resource Estimates

There are no historic or current resource estimates for the Metates project.

Metates Adjacent Properties

There are no active exploration or producing properties close enough to the Metates project to be considered adjacent. The silver and gold producing Tayoltita-San Dimas district is 40 kilometers to the northeast. While the Tayoltita area is similar geologically, this does not necessarily indicate that mineralization at Metates is comparable to that at Tayoltita, particularly at this early stage of exploration.

Metates Recommendations

It has been recommended that re-mapping and re-sampling of the underground workings at Metates will be necessary before sufficiently accurate measurements of the mineralized structures can be made to allow accurate sections of the mineral deposit to be drawn. A geologist with strong experience in epithermal vein systems should compile all available data and, if necessary, re-map in detail all of the levels that are accessible and see that any inaccessible workings are opened and mapped. At the very least, all available mapping should be carefully checked. The existing surveying of the workings should also be checked.

The underground sampling appears to have poorly carried out and has not respected the margins of veins and mineralized areas, thus failing to discriminate between samples of vein material and samples of barren wall rock. This needs to be reviewed and probably re-sampled. This work combined with mapping is expected to define well the structure, style and geometry of veining and the location and orientation of the higher grade zones (now largely mined away). This work program will provide sufficient data to construct a series of geologic and assay cross sections and a three dimensional model. These sections and the model could then guide the planning of a drilling program to test the suspected down-dip extensions of the mined-out higher grade zones.

Prior to the consideration of drilling the Metates Vein, the known old workings elsewhere in the area should be systematically mapped and sampled in a reconnaissance fashion. Those prospects that show promising results should be rehabilitated sufficiently to make them safe to enter and then systematically mapped and sampled in detail similar to the program at the Metates mine. Currently the Metates mine appears to be the best exploration target, but there is not sufficient

Page 16 of 52

knowledge of the several other old workings on the property to be sure that it really is the best drilling target. Before contemplating a drilling program on the property, the various prospects present there should be investigated well enough to allow them each to be ranked on their potential to yield a substantial discovery before one or more of them is selected for drilling. There are almost certainly additional old workings on the Metates property of which the Company is unaware.

Recommendations to make further expenditures on the exploration of the Metates property will be contingent not only on the results of the preliminary exploration work recommended herein, but also on evaluation of a number of other factors which would bear substantially on the feasibility of further project advancement.

Metates Project Budget – Fiscal Year 2015

A proposed program and conservative budget for the next fiscal year ending March 31, 2015 is as follows:

|

Metates Mine detailed mapping and sampling:

|

|

|

|||

|

|

Contract Geologist – 6 weeks, including expenses

|

$

|

25,000

|

||

|

|

|

Conduct Metates underground mapping

|

|

|

|

|

|

|

Manage sampling team

|

|

|

|

|

|

|

Map other workings

|

|

|

|

|

|

|

Plot geology and assays on sections and plans

|

|

|

|

|

|

Engineer/Surveyor – one month, including expenses

|

$

|

15,000

|

||

|

|

|

Check or re-survey workings

|

|

|

|

|

|

|

Manage re-opening of old workings

|

|

|

|

|

|

|

Survey other old workings

|

|

|

|

|

|

Samplers – one month

|

$

|

10,000

|

||

|

|

|

Two teams of two people

|

|

|

|

|

|

|

Sample Metates Mine and any other workings

|

|

|

|

|

|

Reconnaissance person (e.g. Mr. Fitch) – 3 weeks

|

$

|

8,000

|

||

|

|

|

Search for additional old workings

|

|

|

|

|

|

|

Two local helpers

|

|

|

|

|

|

Camp Cook and helper – one month

|

$

|

5,000

|

||

|

|

|

Keep camp clean and feed the people

|

|

|

|

|

|

|

Includes food, water, fuel, supplies

|

|

|

|

|

|

Administration and contingencies

|

$

|

12,000

|

||

|

|

Vehicle rentals

|

$

|

5,000

|

||

|

|

|

|

|

|

|

|

|

|

|

|

$

|

80,000

|

We anticipate we will require approximately $300,000 to carry out our exploration plans and for working capital over the next 12 months and will require significant financing to pursue our exploration plans. While we are currently in discussions with third parties regarding financing for our company, there can be no assurance that we will obtain any additional financing, on terms acceptable to us or at all. In the event we are unable to obtain the required financing, we may be required to curtail our plans or not pursue our plans altogether, and our business may fail.

Solomon Pillars Gold Property

Effective November 5, 2013, we entered into an option agreement ("Option Agreement") with Sage Gold Inc. ("Sage"), a Canadian public company listed on the TSX Venture Exchange. Under the Option Agreement, we can initially earn a 55% undivided interest, and ultimately an 80% undivided interest, in the Solomon Pillars Gold Property ("Solomon Property") owned by Sage and located in the Townships of Walters and Leduc in Beardmore, Ontario, Canada. The Solomon Property is comprised of 418.1 hectares with 22 leased and 4 staked claims. The Solomon Property is located within the Southern Metasedimentary Sub-belt of the Beardmore-Geraldton Greenstone Belt, which has hosted 11 past producing gold mines over the years.

The Solomon Property is in the exploration stage and is currently without a known body of commercial minerals. Additional exploration activity is required on the Solomon Property to determine if there are any commercial amounts of minerals extractable from the property.

Page 17 of 52

Under the terms of the Option Agreement, we have been granted the option to earn a 55% interest in the Solomon Property by fulfilling the following:

|

·

|

An initial payment of CDN$25,000 payable to Sage upon signing the Option Agreement, which has been paid

|

|

·

|

CDN$50,000 of exploration expenditures to be incurred on the Solomon Property and a payment of CDN$30,000 (cash or shares at the Company's option) to Sage on or before the first anniversary of the effective date of the Option Agreement

|

|

·

|

An additional CDN$100,000 of exploration expenditures to be incurred on the Solomon Property and a payment of CDN$40,000 (cash or shares at the Company's option) payable to Sage, on or before the second anniversary of the effective date of the Option Agreement

|

|

·

|

An additional CDN$150,000 of exploration expenditures to be incurred on the Solomon Property on or before the third anniversary of the effective date of the Option Agreement.

|

The Corporation has the exclusive right to a one-time option to increase the undivided interest from 55% to 80% by making a payment of CDN$250,000 to Sage within 90 days of completing the initial earn-in and exercising of the option.

Once the initial interest is earned the Corporation in the Solomon Property, each party will fund continuing exploration on a pro-rata basis according to their equity in the project. The Corporation will be the project operator.

The Solomon Property is divided into two sets of claims, each with a different royalty structure. The "Solomon Pillars" on the eastern section of the property has a net smelter royalty of 1%. The "King Solomon Pillars" on the western section of the property has a 3% net smelter royalty on precious metals with a 1% buyback provision for CDN$1,500,000.

The Property is subject to a CDN$25,000 annual advance royalty payment preceding the commencement of commercial production, if any.

The Option Agreement may be terminated in the event any of the payments set forth above are not made within the stated periods, or upon written notice by the Corporation to Sage.

As we have yet to meet the requirements to earn our initial interest in the Solomon Property, this property is not currently material to our operations. However, we plan to make the required payments and incur the required expenditures to earn a material interest in this property going forward, which will require financing. While we are currently in discussions with third parties regarding financing for our company, there can be no assurance that we will obtain any additional financing, on terms acceptable to us or at all. In the event we are unable to obtain the required financing, we may be required to curtail our plans or not pursue our plans altogether, and our business may fail.

ADDITIONAL CONTRACTS

Zonia Copper Project

On May 9, 2014, the Company entered into a definitive agreement with Redstone Resources Corporation, a Nevada corporation, ("Redstone") to acquire 100% of the total outstanding shares of common stock of Redstone. Redstone currently owns the Zonia Copper Project located in Yavapai County, Arizona.

Under the terms of the agreement, the Company will be making a $500,000 First Tranche investment into Redstone over six monthly installments of $83,333 and acquiring 2,500,000 shares of Redstone's common stock at a price of $0.20 per share for a 4.94% equity position.

Upon completion of the First Tranche investment, the Company will make a $1,500,000 Second Tranche investment to acquire an additional 7,500,000 shares of Redstone's common stock at a price of $0.20 for a 19.76% total equity position in Redstone.

Upon completion of the Second Tranche investment, the Company will have twelve months to complete a Third Tranche investment of $4,500,000 to acquire an additional 22,500,000 shares of Redstone's common stock at a price of $0.20 per share for a 44.45% total equity position in Redstone.

Convertible warrants will also be received from Redstone which will allow the Company to acquire additional shares of common stock that will result, if exercised, in the Company's ownership interest in Redstone to increase to 62.3%.

Page 18 of 52

The Company will have the ability to increase the total percentage ownership in Redstone to 75% for consideration of $3,373,851. The Company can increase its ownership of Redstone to 100% by purchasing the remaining outstanding shares of common stock of Redstone for consideration of $6,426,149 or 7% of the net present value as determined by the Feasibility Study on the Zonia property.

In the event that the Company does not convert the warrants into common stock, Redstone will have the right and option to purchase in one or more transactions up to 100% of the securities acquired by the Company in the Second and Third Tranche purchase transactions at a cost equal to the Company's total investment in the shares that Redstone elects to repurchase.

We have yet to complete the First Tranche investment to earn our initial interest in the Zonia Copper Project, and this project will require financing. While we are currently in discussions with third parties regarding financing for our company, there can be no assurance that we will obtain any additional financing, on terms acceptable to us or at all. In the event we are unable to obtain the required financing, we may be required to curtail our plans or not pursue our plans altogether, and our business may fail.

Bunker Hill Project

On May 16, 2014, the Company entered into an agreement with Placer Mining Corporation, a Nevada corporation ("Placer"), which owns certain mining property known as the Bunker Hill Mine, near Kellogg, Idaho ("Bunker" or the "Property"), in which the Company will have the exclusive right to evaluate and perform due diligence on the Property until August 15, 2014 (the "Review Period"). Upon completion of the Review Period, the parties expect to negotiate and enter into option and exclusivity agreements (the "Option Agreements") whereby the Company can acquire the interests of Placer shareholders upon satisfaction of certain terms and conditions to be negotiated.

During the Review Period, Placer agrees it will not, directly or indirectly, solicit, initiate, assist, facilitate, promote or encourage proposals or offers from, entertain or enter into discussions or negotiations with, or provide information relating to the Property, including, but not limited to any and all due diligence materials, to any persons, entity or group in connection with the sale of the Property or any interest therein, or any amalgamation, merger, consolidation, arrangement, or sale of all or substantially all of the assets of Placer.

In consideration for the Review Period, the Company will pay Placer the sum of $60,000 USD (Sixty Thousand Dollars) per month, on a payment schedule of $15,000 USD (Fifteen Thousand Dollars) per week on Friday, commencing Friday, May 16, 2014, with payments concluding Friday, August 1, 2014. However, the Review Period will extend until Friday, August 15, 2014. We will have a seven (7) day grace period in the event a payment to Placer is delayed for any reason. If a payment is delayed beyond the seven (7) day grace period, the Agreement will automatically terminate, and neither Placer nor the Company will have any obligation to one another from that date forward.

In the event Placer terminates this Agreement in order to accept another offer, or for any reason whatsoever, then Placer will pay Silver Stream a breakup fee in the amount of $5,000,000 USD (Five Million Dollars USD) within fifteen (15) days of notifying Silver Stream in writing of such termination.

We have yet to complete the Review Period, and this project will require financing. While we are currently in discussions with third parties regarding financing for our company, there can be no assurance that we will obtain any additional financing, on terms acceptable to us or at all. In the event we are unable to obtain the required financing, we may be required to curtail our plans or not pursue our plans altogether, and our business may fail.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

None.

Page 19 of 52

None.

We are not presently a party to any litigation.

None

| ITEM 5. | MARKET FOR OUR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

Our stock is listed for trading on the Bulletin Board operated the Financial Industry Regulatory Authority (FINRA) on OTCBB under the symbol "AGSM."

|

Fiscal Year – 2014

|

High Bid

|

Low Bid

|

|

|

|

Fourth Quarter: 01/01/14 to 03/31/14

|

$0.99

|

$0.1453

|

|

|

Third Quarter: 10/01/13 to 12/31/13

|

$0.1453

|

$0.10

|

|

|

Second Quarter: 07/01/13 to 09/30/13

|

$0.50

|

$0.10

|

|

|

First Quarter: 04/01/13 to 06/30/13

|

$0.50

|

$0.50

|

|

|

|

|

|

|

Fiscal Year – 2013

|

High Bid

|

Low Bid

|

|

|

|

Fourth Quarter: 01/01/13 to 03/31/13

|

$0.50

|

$0.50

|

|

|

Third Quarter: 10/01/12 to 12/31/12

|

$0.50

|

$0.50

|

|

|

Second Quarter: 07/01/12 to 09/30/12

|

$0.50

|

$0.50

|

|

|

First Quarter: 04/01/12 to 06/30/12

|

$0.50

|

$0.50

|

Holders

There are approximately 350 holders of record for our common stock. There are a total of 46,727,250 shares of common stock outstanding.

Stock Options and Warrants

There are currently 6,005,748 outstanding options and 4,135,625 warrants to purchase, or securities convertible into, our common stock.

|

Options Outstanding

|

Exercise Price

|

Expiration Date

|

|

1,925,000

|

$0.10

|

01/31/2019

|

|

1,900,000

|

$0.25

|

02/05/2019

|

|

1,805,748

|

$0.01

|

04/21/2019

|

|

200,000

|

$0.25

|

06/01/2019

|

|

5,830,748

|

|

|

|

Warrants Outstanding

|

Exercise Price

|

Expiration Date

|

|

2,983,750

|

$0.25

|

03/26/2016

|

|

1,151,875

|

$0.25

|

04/05/2016

|

|

4,135,625

|

|

|

Page 20 of 52

Dividends

We have not declared any cash dividends, nor do we intend to do so. We are not subject to any legal restrictions respecting the payment of dividends, except that they may not be paid to render us insolvent. Dividend policy will be based on our cash resources and needs, and it is anticipated that all available cash will be needed for our operations in the foreseeable future.

Section 15(g) of the Securities Exchange Act of 1934

Our shares are covered by section 15(g) of the Securities Exchange Act of 1934, as amended that imposes additional sales practice requirements on broker/dealers who sell such securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouses). For transactions covered by the Rule, the broker/dealer must make a special suitability determination for the purchase and have received the purchaser's written agreement to the transaction prior to the sale. Consequently, the Rule may affect the ability of broker/dealers to sell our securities and also may affect your ability to sell your shares in the secondary market.