Attached files

| file | filename |

|---|---|

| 8-K - 8-K - JPMORGAN CHASE & CO | jpmc2q14form8k.htm |

July 15, 2014 F I N A N C I A L R E S U L T S 2Q14

F I N A N C I A L R E S U L T S 2Q14 Financial highlights 1 See note 1 on slide 20 2 See note 2 on slide 20 3 See note 4 on slide 20 4 Basel III Advanced Fully Phased-In refers to the capital rules the Firm will be subject to as of January 1, 2019 5 Estimated; reflects the U.S. Final Leverage Ratio NPR issued on April 8, 2014 6 The repurchase amount is presented on a trade-date basis 7 See note 9 on slide 20 8 Assumes a tax rate of 38% for items that are tax deductible 2Q14 net income of $6.0B and EPS of $1.46 Revenue of $25.3B1, adjusted expense of $14.8B2 and ROTCE of 14%3 Fortress balance sheet Basel III Advanced Fully Phased-In Common Equity Tier 1 (“CET1”) of $161B4; ratio of 9.8%4 Firm Supplementary Leverage Ratio (“SLR”) of 5.4%5 ~$3B of capital returned to shareholders in 2Q14 Repurchased $1.5B of common equity6 – $5.0B capacity remaining for 3Q14-1Q15 Increased common dividend to $0.40 per share Core loans up 4% QoQ and 8% YoY7 2Q14 results included as a significant item $500mm (after-tax) firmwide legal expense Also included were a number of other less significant items – some positive, some negative Adjusted for all of these items our core performance was $6B+/- $mm, excluding EPS1 Pretax Net income8 EPS8 Firmwide − Legal expense ($669) ($500) ($0.13) 1

F I N A N C I A L R E S U L T S $ O/(U) 2Q14 1Q14 2Q13 Revenue (FTE)1 $25,349 $1,486 ($609) Credit costs 692 (158) 645 Expense 15,431 795 (435) Reported net income/(loss) $5,985 $711 ($511) Net income/(loss) applicable to common stockholders 5,573 675 (528) Reported EPS 1.46 0.18 (0.14) ROE2 11% 10% 13% ROTCE2,3 14 13 17 Memo: Adjusted expense 4 $14,762 $164 ($426) Memo: Adjusted expense/revenue 4 58% 2Q14 Financial results1 1 See note 1 on slide 20 2 Actual numbers for all periods, not over/(under) 3 See note 4 on slide 20 4 See note 2 on slide 20 $mm, excluding EPS 2Q14 ROE by LOB CCB 19% CIB 13 CB 19 AM 25 Expect adjusted expense to be $58B4+/- for FY14 2

F I N A N C I A L R E S U L T S 2Q14 1Q14 2Q13 Basel III Advanced Fully Phased-In2 CET1 $161 $156 $148 CET1 ratio 9.8% 9.6% 9.3% Risk-weighted assets $1,640 $1,637 $1,587 Firm SLR3 5.4% 5.1% NA Bank SLR3 5.6 5.3 NA HQLA4 $576 $538 $454 Total assets (EOP) $2,520 $2,477 $2,439 Tangible book value per share $43.17 $41.73 $39.97 $B, except where noted Fortress balance sheet and returns1 Available resources5 represent ~20% of Basel III RWA Compliant with Firm LCR6 Firmwide total credit reserves of $16.0B; loan loss coverage ratio of 1.69% Note: Estimated for 2Q14 1 See notes on non-GAAP financial measures on slide 20 2 Basel III Advanced Fully Phased-In refers to the capital rules the Firm will be subject to as of January 1, 2019 3 Estimated; reflects the U.S. Final Leverage Ratio NPR issued on April 8, 2014 4 High Quality Liquid Assets (“HQLA”) is the estimated amount of assets that qualify for inclusion in the Basel III Liquidity Coverage Ratio (“LCR”) 5 Available resources include Basel III CET1, preferred and trust preferred securities, as well as holding company unsecured long-term debt with remaining maturities greater than 1 year 6 In the case of U.S. LCR, based on current understanding of the proposed rules 3 2Q14 Basel III Advanced Transitional of 9.8%

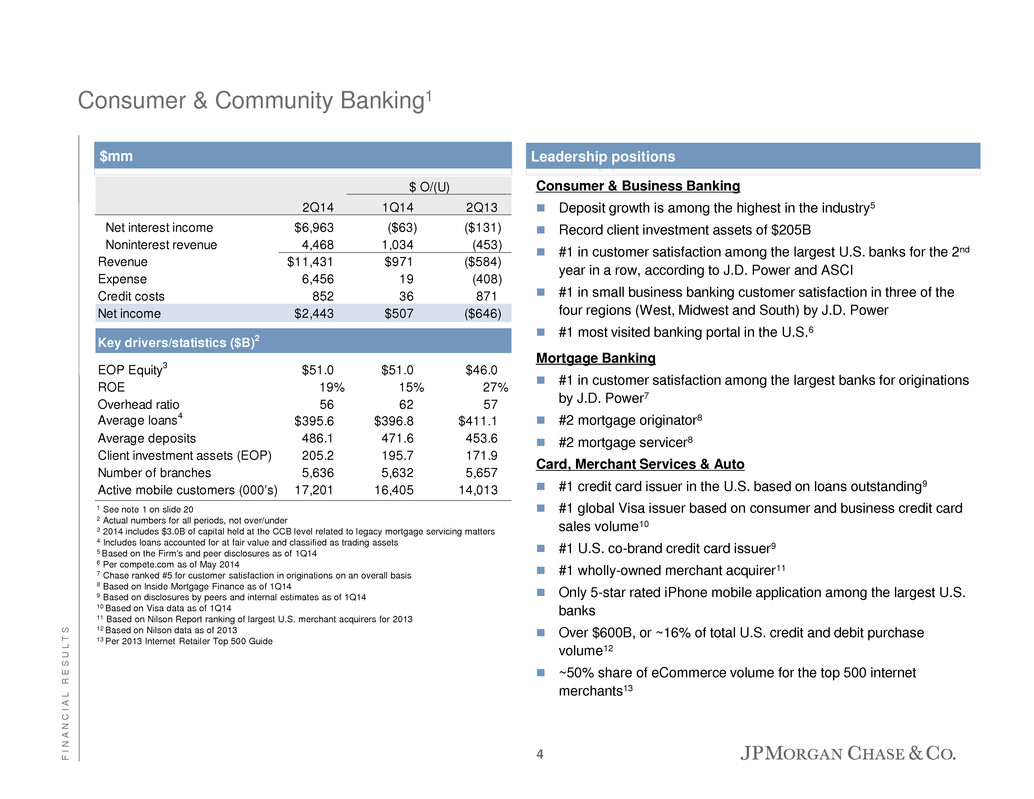

F I N A N C I A L R E S U L T S Consumer & Community Banking1 Consumer & Business Banking Deposit growth is among the highest in the industry5 Record client investment assets of $205B #1 in customer satisfaction among the largest U.S. banks for the 2nd year in a row, according to J.D. Power and ASCI #1 in small business banking customer satisfaction in three of the four regions (West, Midwest and South) by J.D. Power #1 most visited banking portal in the U.S.6 Mortgage Banking #1 in customer satisfaction among the largest banks for originations by J.D. Power7 #2 mortgage originator8 #2 mortgage servicer8 Card, Merchant Services & Auto #1 credit card issuer in the U.S. based on loans outstanding9 #1 global Visa issuer based on consumer and business credit card sales volume10 #1 U.S. co-brand credit card issuer9 #1 wholly-owned merchant acquirer11 Only 5-star rated iPhone mobile application among the largest U.S. banks Over $600B, or ~16% of total U.S. credit and debit purchase volume12 ~50% share of eCommerce volume for the top 500 internet merchants13 Leadership positions 1 See note 1 on slide 20 2 Actual numbers for all periods, not over/under 3 2014 includes $3.0B of capital held at the CCB level related to legacy mortgage servicing matters 4 Includes loans accounted for at fair value and classified as trading assets 5 Based on the Firm's and peer disclosures as of 1Q14 6 Per compete.com as of May 2014 7 Chase ranked #5 for customer satisfaction in originations on an overall basis 8 Based on Inside Mortgage Finance as of 1Q14 9 Based on disclosures by peers and internal estimates as of 1Q14 10 Based on Visa data as of 1Q14 11 Based on Nilson Report ranking of largest U.S. merchant acquirers for 2013 12 Based on Nilson data as of 2013 13 Per 2013 Internet Retailer Top 500 Guide $mm $ O/(U) 2Q14 1Q14 2Q13 Net interest income $6,963 ($63) ($131) Noninterest revenue 4,468 1,034 (453) Revenue $11,431 $971 ($584) Expense 6,456 19 (408) Credit costs 852 36 871 Net income $2,443 $507 ($646) Key drivers/statistics ($B)2 EOP Equity3 $51.0 $51.0 $46.0 ROE 19% 15% 27% Overhead ratio 56 62 57 Average loans4 $395.6 $396.8 $411.1 Average depo its 486.1 471.6 453.6 Client investment asse s (EOP) 205.2 195.7 171.9 Number of branches 5,636 5,632 5,657 Active mobile customers (000's) 17,201 16,405 14,013 4

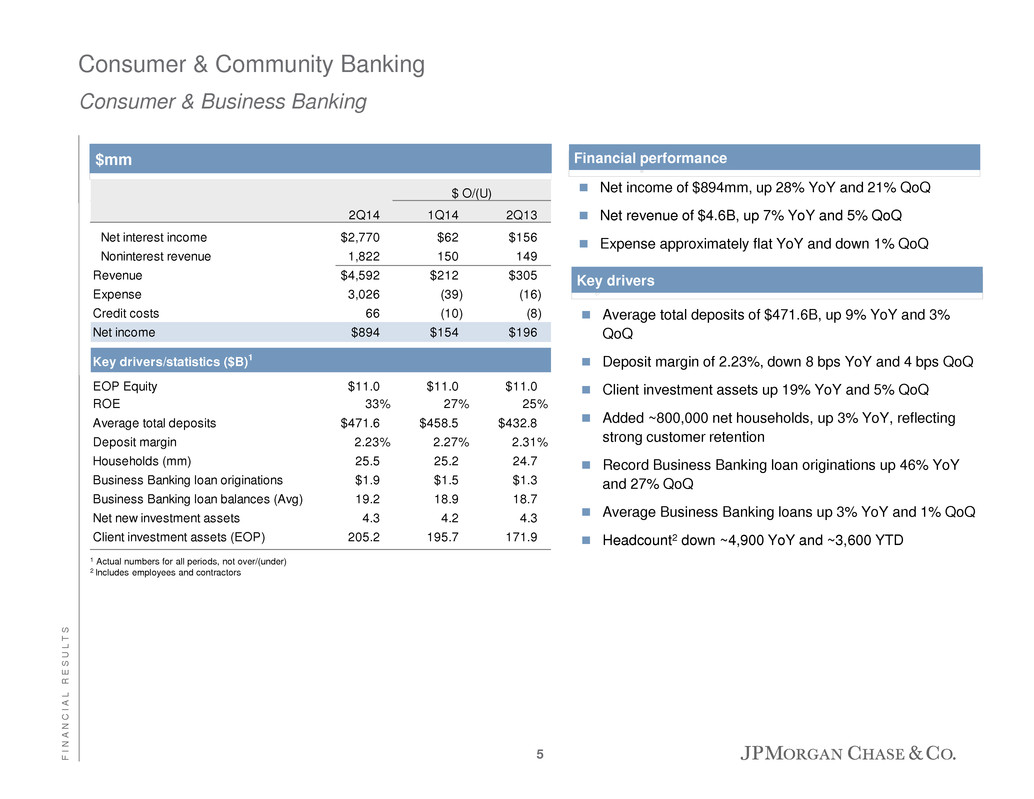

F I N A N C I A L R E S U L T S Consumer & Community Banking Consumer & Business Banking 1 Actual numbers for all periods, not over/(under) 2 Includes employees and contractors Net income of $894mm, up 28% YoY and 21% QoQ Net revenue of $4.6B, up 7% YoY and 5% QoQ Expense approximately flat YoY and down 1% QoQ Average total deposits of $471.6B, up 9% YoY and 3% QoQ Deposit margin of 2.23%, down 8 bps YoY and 4 bps QoQ Client investment assets up 19% YoY and 5% QoQ Added ~800,000 net households, up 3% YoY, reflecting strong customer retention Record Business Banking loan originations up 46% YoY and 27% QoQ Average Business Banking loans up 3% YoY and 1% QoQ Headcount2 down ~4,900 YoY and ~3,600 YTD Financial performance Key drivers $mm $ O/(U) 2Q14 1Q14 2Q13 Net interest income $2,770 $62 $156 Noninterest revenue 1,822 150 149 Revenue $4,592 $212 $305 Expense 3,026 (39) (16) Credit costs 66 (10) (8) Net income $894 $154 $196 Key drivers/statistics ($B)1 EOP Equity $11.0 $11.0 $11.0 ROE 33% 27% 25% Average total deposits $471.6 $458.5 $432.8 Deposit margin 2.23% 2.27% 2.31% Households (mm) 25.5 25.2 24.7 Business Ba king loan originations $1.9 $1.5 $1.3 Business Banking loan balances (Avg) 19.2 18.9 18.7 Net new invest ent assets 4.3 4.2 4.3 Client investment assets (EOP) 205.2 195.7 171.9 5

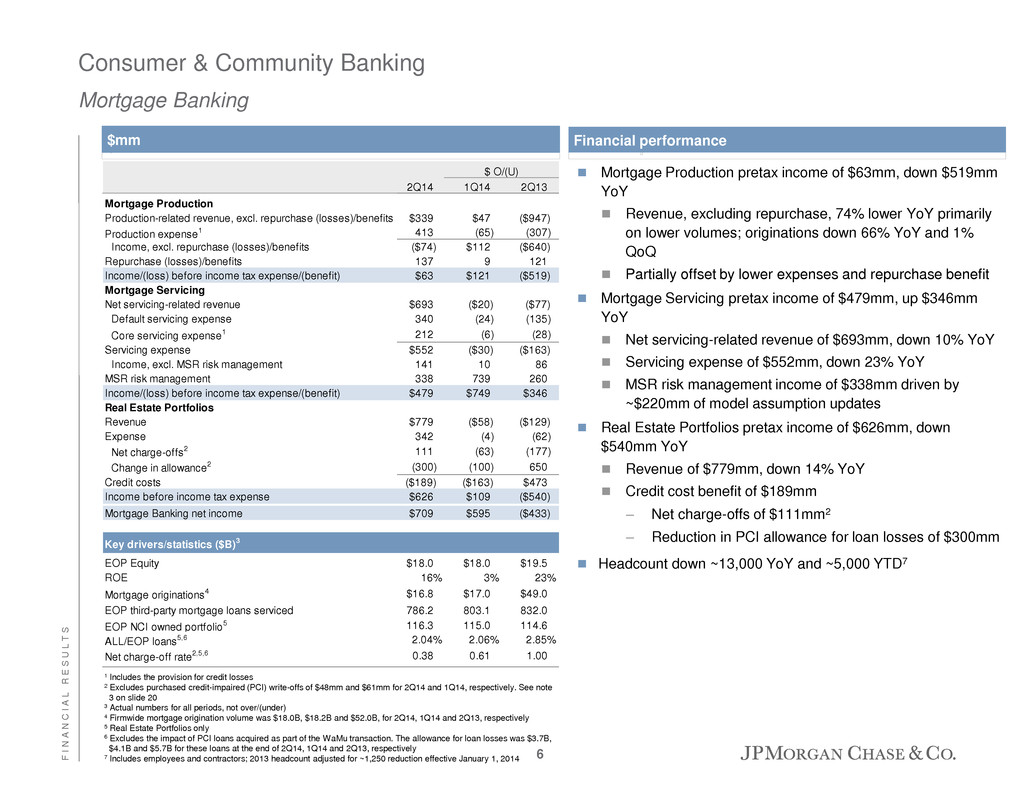

F I N A N C I A L R E S U L T S Consumer & Community Banking Mortgage Banking 1 Includes the provision for credit losses 2 Excludes purchased credit-impaired (PCI) write-offs of $48mm and $61mm for 2Q14 and 1Q14, respectively. See note 3 on slide 20 3 Actual numbers for all periods, not over/(under) 4 Firmwide mortgage origination volume was $18.0B, $18.2B and $52.0B, for 2Q14, 1Q14 and 2Q13, respectively 5 Real Estate Portfolios only 6 Excludes the impact of PCI loans acquired as part of the WaMu transaction. The allowance for loan losses was $3.7B, $4.1B and $5.7B for these loans at the end of 2Q14, 1Q14 and 2Q13, respectively 7 Includes employees and contractors; 2013 headcount adjusted for ~1,250 reduction effective January 1, 2014 Financial performance $mm Mortgage Production pretax income of $63mm, down $519mm YoY Revenue, excluding repurchase, 74% lower YoY primarily on lower volumes; originations down 66% YoY and 1% QoQ Partially offset by lower expenses and repurchase benefit Mortgage Servicing pretax income of $479mm, up $346mm YoY Net servicing-related revenue of $693mm, down 10% YoY Servicing expense of $552mm, down 23% YoY MSR risk management income of $338mm driven by ~$220mm of model assumption updates Real Estate Portfolios pretax income of $626mm, down $540mm YoY Revenue of $779mm, down 14% YoY Credit cost benefit of $189mm – Net charge-offs of $111mm2 – Reduction in PCI allowance for loan losses of $300mm Headcount down ~13,000 YoY and ~5,000 YTD7 $ O/(U) 2Q14 1Q14 2Q13 Mortgage Production Production-related revenue, excl. repurchase (losses)/benefits $339 $47 ($947) Production expense1 413 (65) (307) Income, excl. repurchase (losses)/benefits ($74) $112 ($640) Repurchase (losses)/benefits 137 9 121 Income/(loss) before income tax expense/(benefit) $63 $121 ($519) Mortgage Servicing Net servicing-related revenue $693 ($20) ($77) Default servicing expense 340 (24) (135) Core servicing expense1 212 (6) (28) Servicing expense $552 ($30) ($163) Income, excl. MSR risk management 141 10 86 MSR risk management 338 739 260 Income/(loss) before income tax expense/(benefit) $479 $749 $346 Real Estate Portfolios Revenue $779 ($58) ($129) Expense 342 (4) (62) Net charge-offs2 111 (63) (177) Change in allowance2 (300) (100) 650 Credit costs ($189) ($163) $473 Income before income tax expense $626 $109 ($540) Mortgage Banking net income $709 $595 ($433) Key drivers/statistics ($B)3 EOP Equity $18.0 $18.0 $19.5 ROE 16% 3% 23% Mortgage originations4 $16.8 $17.0 $49.0 EOP third-party mortgage loans serviced 786.2 803.1 832.0 EOP NCI owned portfolio5 116.3 115.0 114.6 ALL/EOP loans5,6 2.04% 2.06% 2.85% Net charge-off rate2,5,6 0.38 0.61 1.00 6

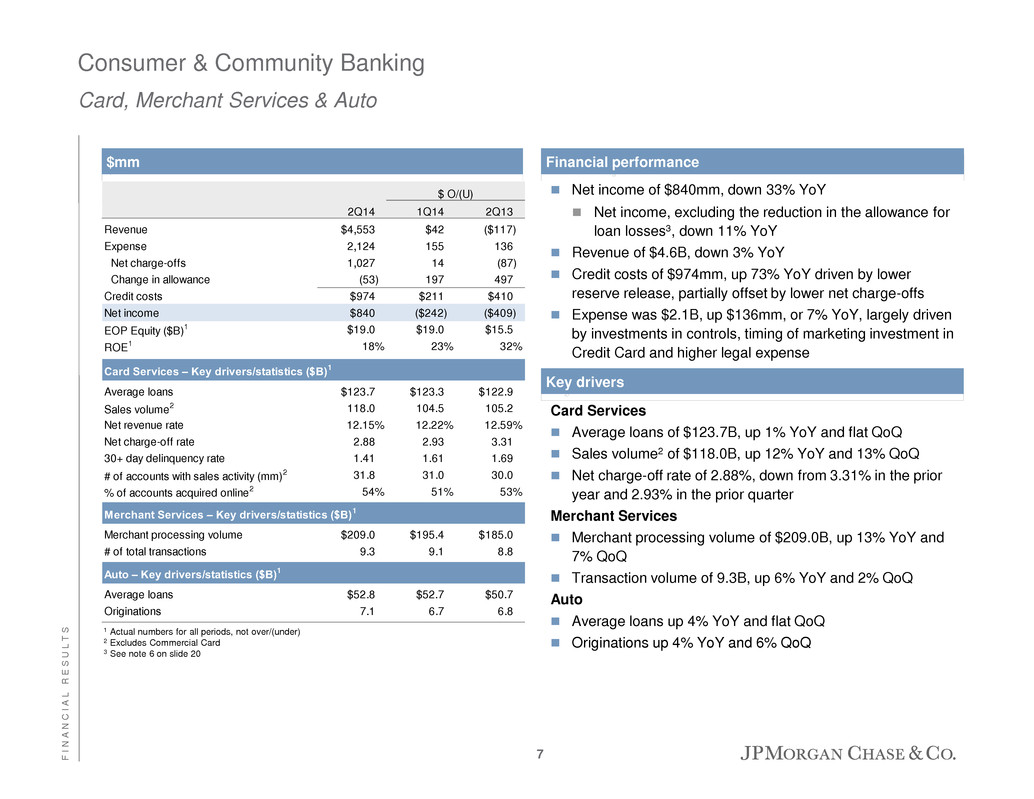

F I N A N C I A L R E S U L T S Net income of $840mm, down 33% YoY Net income, excluding the reduction in the allowance for loan losses3, down 11% YoY Revenue of $4.6B, down 3% YoY Credit costs of $974mm, up 73% YoY driven by lower reserve release, partially offset by lower net charge-offs Expense was $2.1B, up $136mm, or 7% YoY, largely driven by investments in controls, timing of marketing investment in Credit Card and higher legal expense 1 Actual numbers for all periods, not over/(under) 2 Excludes Commercial Card 3 See note 6 on slide 20 Card Services Average loans of $123.7B, up 1% YoY and flat QoQ Sales volume2 of $118.0B, up 12% YoY and 13% QoQ Net charge-off rate of 2.88%, down from 3.31% in the prior year and 2.93% in the prior quarter Merchant Services Merchant processing volume of $209.0B, up 13% YoY and 7% QoQ Transaction volume of 9.3B, up 6% YoY and 2% QoQ Auto Average loans up 4% YoY and flat QoQ Originations up 4% YoY and 6% QoQ Consumer & Community Banking Card, Merchant Services & Auto $mm Financial performance Key drivers 2Q14 1Q14 2Q13 Revenue $4,553 $42 ($117) Expense 2,124 155 136 Net charge-offs 1,027 14 (87) Change in allowance (53) 197 497 Credit costs $974 $211 $410 Net income $840 ($242) ($409) EOP Equity ($B)1 $19.0 $19.0 $15.5 ROE1 18% 23% 32% Card Services – Key drivers/statistics ($B)1 Average loans $123.7 $123.3 $122.9 Sales volume2 118.0 104.5 105.2 Net revenue rate 12.15% 12.22% 12.59% Net charge-off rate 2.88 2.93 3.31 30+ day delinquency rate 1.41 1.61 1.69 # of accounts with sales activity (mm)2 31.8 31.0 30.0 % of accounts acquired online2 54% 51% 53% Merchant Services – Key drivers/statistics ($B)1 Merchant processing volume $209.0 $195.4 $185.0 # of total transactions 9.3 9.1 8.8 Auto – Key rivers/statistics ($B)1 Average loans $52.8 $52.7 $50.7 Originations 7.1 6.7 6.8 $ O/(U) 7

F I N A N C I A L R E S U L T S Corporate & Investment Bank1 1 Represents results on a managed basis 2 Lending revenue includes net interest income, fees, gains or losses on loan sale activity, gains or losses on securities received as part of a loan restructuring and the risk management results related to the credit portfolio (excluding trade finance) 3 Consists primarily of credit valuation adjustments (“CVA”) managed by the credit portfolio group, and FVA (effective fourth quarter 2013) and DVA on OTC derivatives and structured notes. Results are presented net of associated hedging activities and net of CVA and FVA amounts allocated to Fixed Income Markets and Equity Markets 4 Actual numbers for all periods, not over/under 5 Calculated based on average equity; period-end equity and average equity are the same. Return on equity excluding DVA, a non-GAAP financial measure, was 19% for 2Q13 6 Overhead ratio excluding DVA, a non-GAAP financial measure, was 60% for 2Q13 7 Compensation expense as a percentage of total net revenue excluding DVA, a non-GAAP financial measure, was 31% for 2Q13 8 ALL/EOP loans as reported was 1.11%, 1.23% and 1.21% for 2Q14, 1Q14 and 2Q13, respectively 9 Pro forma results exclude DVA in 2Q13; 2014 reported results include FVA/DVA, net of hedges $mm Financial performance Net income of $2.0B on revenue of $9.0B ROE of 13%, as reported, compared to 19%, ex DVA, in 2Q13 Banking revenue IB fees of $1.8B, up 3% YoY, driven by higher advisory and equity underwriting fees, partially offset by lower debt underwriting fees – Ranked #1 in Global IB fees for YTD14 Treasury Services revenue of $1.0B, down 4% YoY, primarily driven by lower trade finance revenue, as well as the impact of business simplification initiatives Lending revenue of $297mm, down 20% YoY, primarily on lower NII Markets & Investor Services revenue Markets revenue of $4.6B, down 14% YoY, primarily driven by: – Fixed Income Markets of $3.5B, down 15% YoY, on historically low levels of volatility and lower client activity across products – Equity Markets of $1.2B, down 10% YoY, primarily due to lower derivatives revenue Securities Services revenue of $1.1B, up 5% YoY, primarily driven by higher NII on increased deposits Credit Adjustments & Other gain of $125mm driven by net FVA/DVA Expense of $6.1B, up 6% YoY, driven by higher noncompensation expense 2Q14 includes ~$300mm of legal expense and ~$300mm of costs related to business simplification Pro forma results ($mm)9 $ O/(U) 2Q14 1Q14 2Q13 Corporate & Investment Bank revenue $8,991 $385 ($885) Investment banking fees 1,773 329 56 Treasury Services 1,012 3 (39) Lending2 297 13 (76) Total Banking $3,082 $345 ($59) Fixed Income Markets 3,482 (278) (596) Equity Markets 1,165 (130) (131) Securities Services 1,137 126 50 Credit Adjustments & Other3 125 322 (149) Total Markets & Investor Services $5,909 $40 ($826) Expense 6,058 454 316 Credit costs (84) (133) (78) Net income $1,963 ($16) ($875) Key drivers/statistics ($B)4 EOP equity $61.0 $61.0 $56.5 ROE5 13% 13% 20% Overhead ratio6 67 65 58 Comp/revenue7 31 33 30 EOP loans $108.8 $104.7 $110.8 Average client deposits 403.3 412.6 369.1 Assets under custody ($T) 21.7 21.1 18.9 ALL/EOP loans ex-conduits and trade8 1.80% 2.18% 2.35% Net charge-off/(recovery) rate (0.02) 0.00 (0.31) Average VaR ($ m) $43 $42 $40 $ O/(U) 2Q14 1Q14 2Q13 Corporate & Investment Bank revenue $8,991 $385 ($530) Total Banking 3,082 345 (59) Total Markets & Investor Services 5,909 40 (471) Net income $1,963 ($16) ($655) ROE4 13% 13% 19% Overhead ratio4 67 65 60 Comp/revenue4 31 33 31 8

F I N A N C I A L R E S U L T S Commercial Banking1 Net income of $658mm, up 6% YoY and 14% QoQ Revenue of $1.7B, down 2% YoY and up 3% QoQ Expense of $675mm, up 4% YoY, largely reflecting higher investment in controls Credit cost benefit of $67mm Net recovery rate of 7 bps; 6th consecutive quarter of net recoveries or single-digit net charge-off rate Excluding recoveries, charge-off rate of 1 bp EOP loan balances up 9% YoY and 2% QoQ C&I4 loans up 3% QoQ CRE5 loans up 2% QoQ Average client deposits of $200B, up 2% YoY and down 1% QoQ 1 See notes 1 and 10 on slide 20 2 Actual numbers for all periods, not over/(under) 3 Loans held-for-sale and loans at fair value were excluded when calculating the loan loss coverage ratio and net charge-off/(recovery) rate 4 CB’s Commercial & Industrial (C&I) grouping includes certain client segments (Middle Market, which includes Government, Nonprofit & Healthcare Clients; and Corporate Client Banking (CCB)) and will not align with regulatory definitions 5 CB's Commercial Real Estate (CRE) grouping is internally defined to include certain client segments (Real Estate Banking, Commercial Term Lending and Community Development Banking) and will not align with regulatory definitions $mm Financial performance 2Q14 1Q14 2Q13 Revenue $1,701 $50 ($27) Middle Market Banking 709 11 (68) Corporate Client Banking 477 31 33 Commercial Term Lending 307 (1) (8) Real Estate Banking 129 13 16 Other 79 (4) – Expense 675 (11) 23 Credit costs (67) (72) (111) Net income $658 $80 $37 Key drivers/statistics ($B)2 EOP equity $14.0 $14.0 $13.5 ROE 19% 17% 18% Overhead ratio 40 42 38 Average loans $140.8 $137.7 $131.6 EOP loans 142.3 138.9 130.9 Average client deposits 200.0 202.9 195.2 Allowance for loan losses 2.6 2.7 2.7 Nonaccrual loans 0.4 0.5 0.5 Net charge-off/(recovery) rate3 (0.07)% (0.04)% 0.03% ALL/loans3 1.87 1.95 2.06 $ O/(U) 9

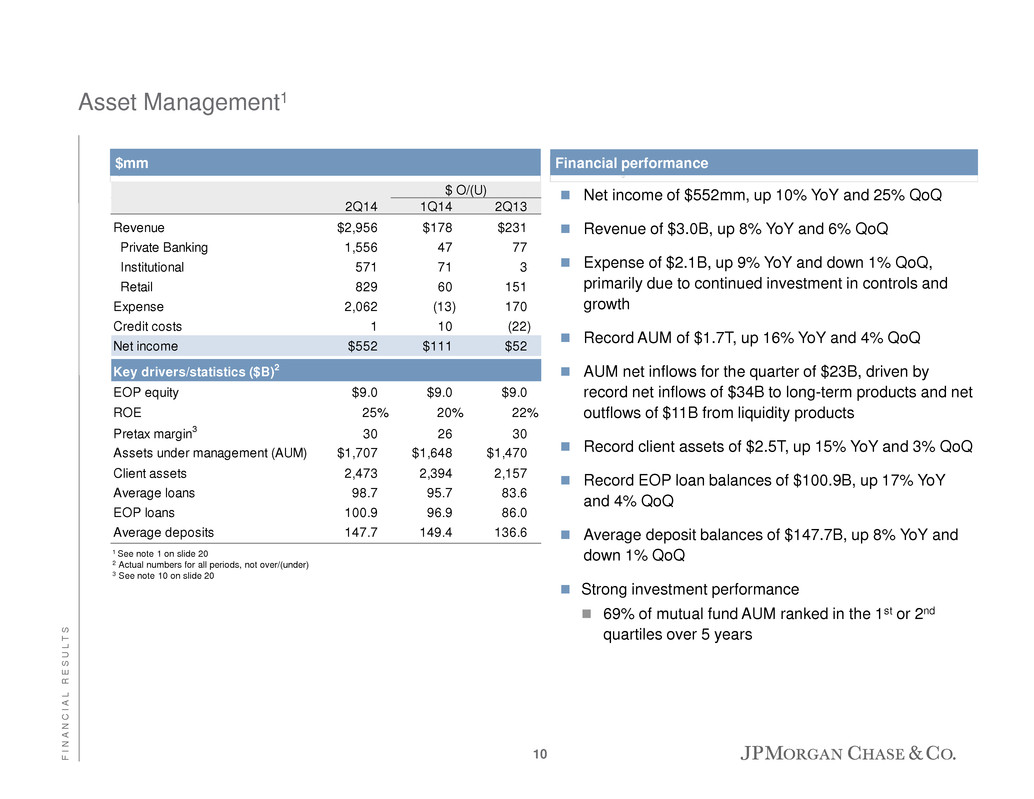

F I N A N C I A L R E S U L T S Asset Management1 1 See note 1 on slide 20 2 Actual numbers for all periods, not over/(under) 3 See note 10 on slide 20 Net income of $552mm, up 10% YoY and 25% QoQ Revenue of $3.0B, up 8% YoY and 6% QoQ Expense of $2.1B, up 9% YoY and down 1% QoQ, primarily due to continued investment in controls and growth Record AUM of $1.7T, up 16% YoY and 4% QoQ AUM net inflows for the quarter of $23B, driven by record net inflows of $34B to long-term products and net outflows of $11B from liquidity products Record client assets of $2.5T, up 15% YoY and 3% QoQ Record EOP loan balances of $100.9B, up 17% YoY and 4% QoQ Average deposit balances of $147.7B, up 8% YoY and down 1% QoQ Strong investment performance 69% of mutual fund AUM ranked in the 1st or 2nd quartiles over 5 years $mm Financial performance 2Q14 1Q14 2Q13 Revenue $2,956 $178 $231 Private Banking 1,556 47 77 Institutional 571 71 3 Retail 829 60 151 Expense 2,062 (13) 170 Credit costs 1 10 (22) Net income $552 $111 $52 Key drivers/statistics ($B)2 EOP equity $9.0 $9.0 $9.0 ROE 25% 20% 22% Pretax margin3 30 26 30 Assets under management (AUM) $1,707 $1,648 $1,470 Client assets 2,473 2,394 2,157 Average loans 98.7 95.7 83.6 EOP loans 100.9 96.9 86.0 Average deposits 147.7 149.4 136.6 $ O/(U) 10

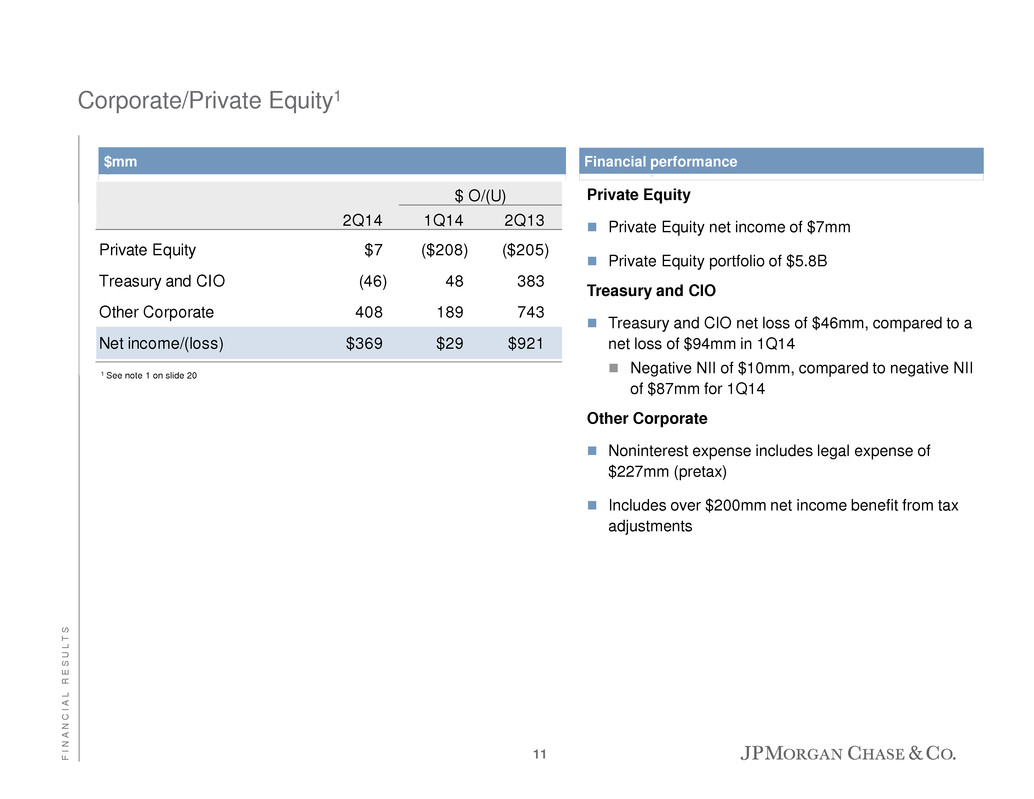

F I N A N C I A L R E S U L T S Private Equity Private Equity net income of $7mm Private Equity portfolio of $5.8B Treasury and CIO Treasury and CIO net loss of $46mm, compared to a net loss of $94mm in 1Q14 Negative NII of $10mm, compared to negative NII of $87mm for 1Q14 Other Corporate Noninterest expense includes legal expense of $227mm (pretax) Includes over $200mm net income benefit from tax adjustments 1 See note 1 on slide 20 $mm Corporate/Private Equity1 Financial performance 2Q14 1Q14 2Q13 Private Equity $7 ($208) ($205) Treasury and CIO (46) 48 383 Other Corpo ate 408 189 743 Net income/(l ss) $369 $29 $921 $ O/(U) 11

F I N A N C I A L R E S U L T S Outlook 12 Selected outlook items ($mm, unless otherwise noted) 1 See note 2 on slide 20 2 This line item is net of changes in the MSR asset fair value due to collection/realization of expected cash flows; plus net interest income 2Q14 FY2013 LOB Line item Actual Actual Current management outlook Firmwide adjusted expense ($B)1 $14.8 $59.0 Expect $58B+/- adjusted expense for FY14; final firmwide expense will be affected by performance-related compensation for FY14 CCB, excl. MB, expense $5,150 $20,240 Expect CCB, excluding MB, expense to increase by approximately 1% for FY14 vs. FY13, in-line with previous guidance CB expense $675 $2,610 Expect expense of a little less than $700mm for 3Q14 AM expense $2,062 $8,016 Expect AM expense to increase modestly in 3Q14 vs. 2Q14 Production-related pretax income, excl. repurchase ($74) $494 Expect small negative Production pretax income in 3Q14 – market dependent Servicing-related net revenue2 $693 $2,869 Expect Servicing revenue to be $600mm +/- in 3Q14 Reduction in NCI Real Estate Portfolios allowance for loan losses $0 ($2,300) Expect a $500mm to $1B reduction over the next couple of years, as the credit quality of the portfolio continues to improve Card revenue rate 12.15% 12.49% Expect net revenue rate to be at the lower end of the 12.0-12.5% guidance – with fluctuations by quarter due to seasonality Reduction in Card allowance for loan losses $0 ($1,706) Do not expect any significant reductions in the Card allowance for loan losses – based on the current credit environment Fixed Income & Equities revenue (Markets revenue) $4,647 $20,226 Expect current environment to persist into 3Q14 with normal seasonal trends Securities Services revenue $1,137 $4,082 Expect Securities Services revenue to decrease by approximately $100mm in 3Q14 vs. 2Q14 – due to seasonality Treasury Services revenue $1,012 $4,135 Expect TS revenue to be flat vs. 2Q14, at approximately $1B in 3Q14 – primarily due to the impact of business simplification and lower trade finance balances and spreads Pretax margin 30% 29% ROE 25% 23% CC B CI B AM Expect FY14 pretax margin and ROE to be lower than 2Q14 – as the business continues to invest in both infrastructure and controls – as well as select front office hiring – but on track to deliver TTC targets for FY15 Fi rm wi de

Agenda Page F I N A N C I A L R E S U L T S 13 Appendix 13

A P P E N D I X Firm and core NIM down 1 bp and 2 bps, respectively, QoQ primarily due to: Lower loan yields Partially offset by lower long-term debt yields Core net interest margin1 1 See note 7 on slide 20 2 The core and market-based NII presented for FY2010, FY2011 and FY2012 represent their quarterly averages (e.g., total for the year divided by 4); the yield for all periods represent the annualized yield 3.67% 3.29% 2.97% 2.83% 2.60% 2.60% 2.64% 2.66% 2.64% 1.51% 1.41% 1.16% 1.14% 1.05% 0.89% 0.86% 0.84% 0.82% 3.06% 2.74% 2.48% 2.37% 2.20% 2.18% 2.20% 2.20% 2.19% FY2010 FY2011 FY2012 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 Core NII Market-based NII Core NIM Market-based NIM JPM NIM Net interest income trend Comments 2 Average balances Deposits with banks $80B $157B $266B $321B $329B $319B $48B 2 $118B 2 $335B Firm and core NII up QoQ, driven by: Higher securities portfolio balances Lower long-term debt expense Higher loan balances Partially offset by lower loan yields 14

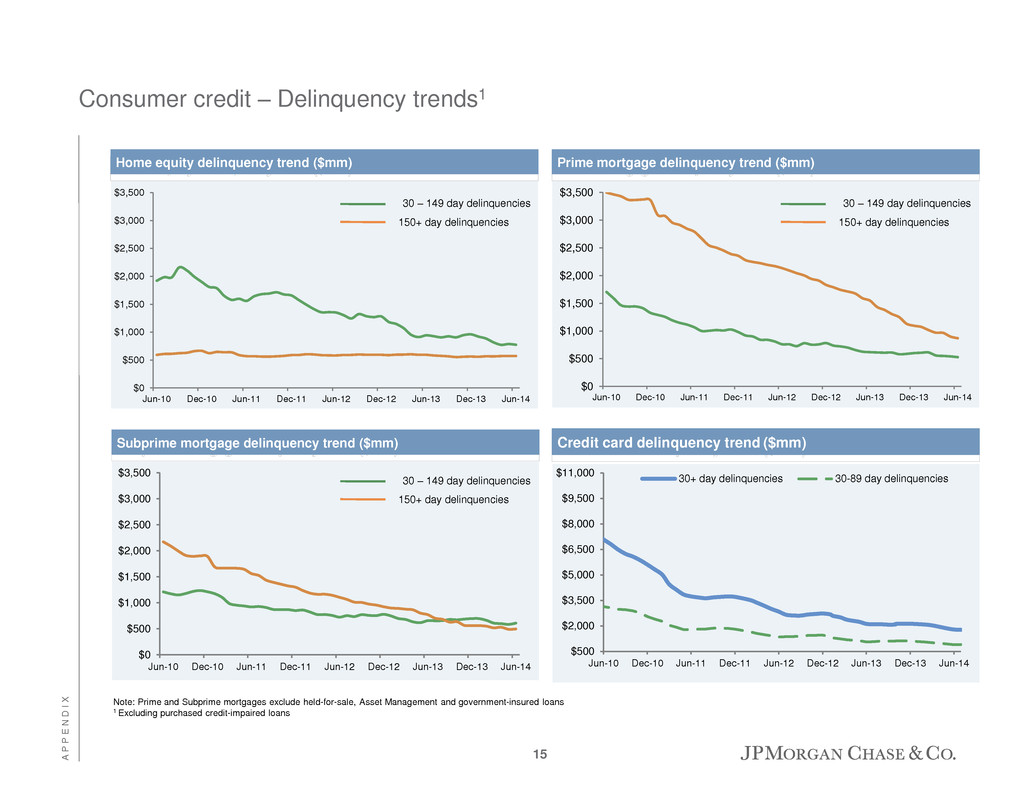

A P P E N D I X Consumer credit – Delinquency trends1 Note: Prime and Subprime mortgages exclude held-for-sale, Asset Management and government-insured loans 1 Excluding purchased credit-impaired loans Credit card delinquency trend ($mm) Prime mortgage delinquency trend ($mm) Home equity delinquency trend ($mm) Subprime mortgage delinquency trend ($mm) $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 Jun-10 Dec-10 Jun-11 Dec-11 Jun-12 Dec-12 Jun-13 Dec-13 Jun-14 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 Jun-10 Dec-10 Jun-11 Dec-11 Jun-12 Dec-12 Jun-13 Dec-13 Jun-14 30 – 149 day delinquencies 150+ day delinquencies 30 – 149 day delinquencies 150+ day delinquencies $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 Jun-10 Dec-10 Jun-11 Dec-11 Jun-12 Dec-12 Jun-13 Dec-13 Jun-14 30 – 149 day delinquencies 150+ day delinquencies $500 $2,000 $3,500 $5,000 $6,500 $8,000 $9,500 $11,000 Jun-10 Dec-10 Jun-11 Dec-11 Jun-12 Dec-12 Jun-13 Dec-13 Jun-14 30+ day delinquencies 30-89 day delinquencies 15

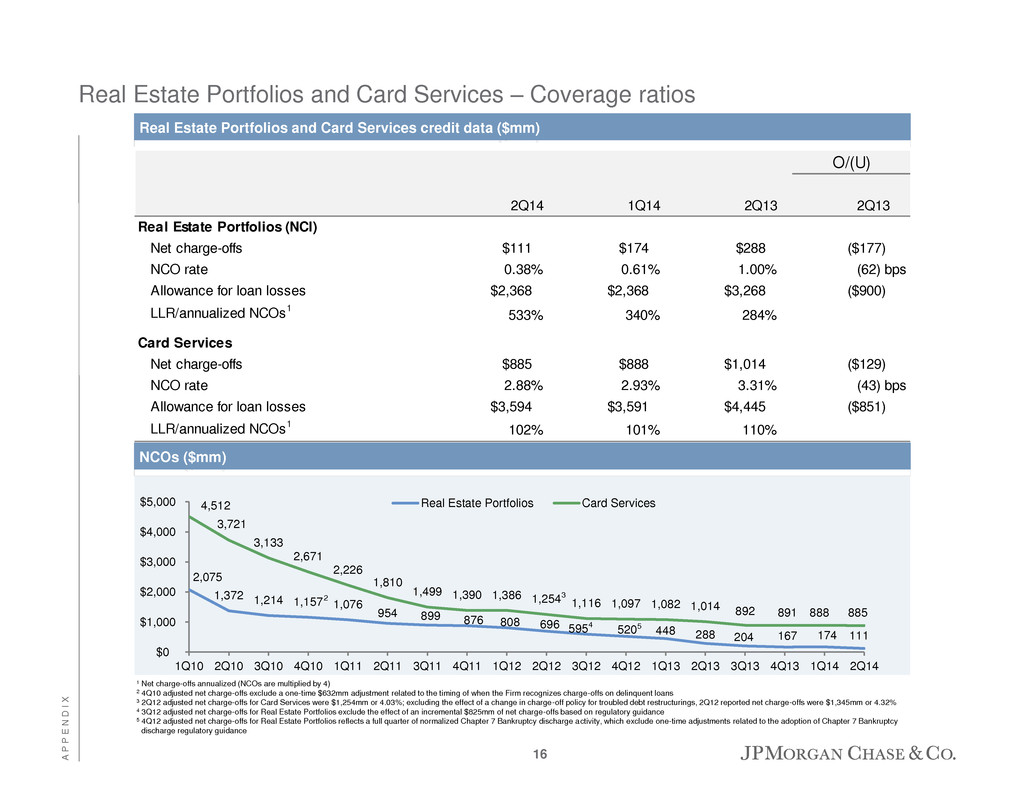

A P P E N D I X 2,075 1,372 1,214 1,157 1,076 954 899 876 808 696 595 520 448 288 204 167 174 111 4,512 3,721 3,133 2,671 2,226 1,810 1,499 1,390 1,386 1,254 1,116 1,097 1,082 1,014 892 891 888 885 $0 $1,000 $2,000 $3,000 $4,000 $5,000 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 Real Estate Portfolios Card Services Real Estate Portfolios and Card Services – Coverage ratios Real Estate Portfolios and Card Services credit data ($mm) 1 Net charge-offs annualized (NCOs are multiplied by 4) 2 4Q10 adjusted net charge-offs exclude a one-time $632mm adjustment related to the timing of when the Firm recognizes charge-offs on delinquent loans 3 2Q12 adjusted net charge-offs for Card Services were $1,254mm or 4.03%; excluding the effect of a change in charge-off policy for troubled debt restructurings, 2Q12 reported net charge-offs were $1,345mm or 4.32% 4 3Q12 adjusted net charge-offs for Real Estate Portfolios exclude the effect of an incremental $825mm of net charge-offs based on regulatory guidance 5 4Q12 adjusted net charge-offs for Real Estate Portfolios reflects a full quarter of normalized Chapter 7 Bankruptcy discharge activity, which exclude one-time adjustments related to the adoption of Chapter 7 Bankruptcy discharge regulatory guidance NCOs ($mm) 2 3 4 5 O/(U) 2Q14 1Q14 2Q13 2Q13 Real Estate Portfolios (NCI) Net charge-offs $111 $174 $288 ($177) NCO rate 0.38% 0.61% 1.00% (62) bps Allowance for loan losses $2,368 $2,368 $3,268 ($900) LLR/annualized NCOs1 533% 340% 284% Card Services Net charge-offs $885 $888 $1,014 ($129) NCO rate 2.88% 2.93% 3.31% (43) bps Allowance for loan losses $3,594 $3,591 $4,445 ($851) LLR/annualized NCOs1 102% 101% 110% 16

A P P E N D I X 9,874 11,124 10,609 10,296 9,578 9,027 8,317 8,123 7,634 23,791 22,824 21,936 20,780 19,384 17,571 16,264 15,847 15,326 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 0% 100% 200% 300% 400% 500% Firmwide – Coverage ratios $15.3B of loan loss reserves at June 30, 2014, down $4.1B from $19.4B in the prior year, reflecting improved portfolio credit quality Loan loss coverage ratio of 1.69%1 1 See note 2 on slide 20 2 NPLs at 2Q14, 1Q14, 4Q13, 3Q13, 2Q13, 1Q13, 4Q12 and 3Q12 include $1.9B $2.0B $2.0B, $1.9B, $1.9B, $1.9B, $1.8B and $1.7B, respectively, in accordance with regulatory guidance requiring loans discharged under Chapter 7 bankruptcy and not reaffirmed by the borrower, regardless of their delinquency status to be reported as nonaccrual loans. In addition the Firm’s policy is generally to exempt credit card loans from being placed on nonaccrual status as permitted by regulatory guidance $mm JPM credit summary Loan loss reserve Nonperforming retained loans Loan loss reserve/Total loans1 2 2 2 2 2 2 2 Loan loss reserve/NPLs1 2 2Q14 1Q14 2Q13 Consumer, ex. credit c rd LLR/Total loans 1.68% 1.71% 2.16% LLR/NPLs2 58 55 58 Credit Card LLR/Total loans 2.86% 2.96% 3.58% Wholesale LLR/Total loans 1.24% 1.32% 1.38% LLR/NPLs 549 546 424 Firmwide LLR/Total loans 1.69% 1.75% 2.06% LLR /NPLs (ex. credit card)2 105 100 96 LLR /NPLs2 152 145 143 Comments 17

A P P E N D I X Corporate & Investment Bank – Key metrics & leadership positions Comments Corporate & Investment Bank 50% of revenue is international for LTM 2Q14 International deposits increased 27% from FY2011 driven by growth across regions Banking Maintained #1 ranking in Global IB fees #1 in combined Fedwire and CHIPS volume5 LTM 2Q14 total international electronic funds transfer volume up 21% from FY13 Markets & Investor Services #1 in Total Markets revenue share of top 10 investment banks6 International AUC up 39% from FY2011; represents 46% of total AUC at 2Q14 JPM ranked #1 for FY2013/12/11 for both All-America Fixed Income Research and Equity Research Note: LTM rankings included as available. All-America Institutional Investor research rankings are as of October of their respective year 1 Last twelve months 2 International client deposits and other third party liabilities 3 Includes TS product revenue reported in other LOBs related to customers who are also customers of those LOBs 4 International electronic funds transfer represents volume over the period and includes non-U.S. dollar Automated Clearing House ("ACH") and clearing volume 5 2Q14 volume; per Federal Reserve, 2002-2013 6 1Q14 rank of JPM Markets revenue of 10 leading competitors based on reported information, excluding DVA Corporate & Investment Bank Banking Markets & Investor Services ($B) LTM1 FY2013 FY2012 FY2011 International revenue $15.9 $16.5 $16.3 $17.1 International deposits (Avg)2 228.8 213.5 189.6 180.1 International loans (EOP) 63.6 59.9 67.7 67.0 Gross CIB revenue from CB 4.3 4.1 4.0 3.7 l bal IB fees (Dealogic) #1 # #1 #1 TS firmwide reve ue3 $6.9 $6.9 $6.9 $6.4 Combined Fedwire/CHIPS volume #1 #1 #1 #1 International electronic funds transfer volume (mm)4 394.7 325.5 304.8 250.5 International AUC ($T, EOP) $9.9 $9.2 $8.3 $7.1 All-America Institutional I vestor research rankings NA #1 #1 #1 18

A P P E N D I X Source: Dealogic 1 Reflects ranking of fees and market share 2 Long-term debt rankings include investment-grade, high-yield, supranational, sovereigns, agencies, covered bonds, asset-backed securities (“ABS”) and mortgage-backed securities (“MBS”); and exclude money market, short-term debt and U.S. municipal securities 3 Global Equity and equity-related ranking includes rights offerings and Chinese A-Shares 4 Announced M&A and M&A reflects the removal of any withdrawn transactions. U.S. announced M&A volumes represent any U.S. involvement ranking. US M&A wallet represents wallet from client parents based in the U.S. 5 Global Investment Banking fees rankings exclude money market, short-term debt and shelf deals 6 Rankings reflect transaction volume rank and market share. Global announced M&A is based on transaction value at announcement; because of joint M&A assignments, M&A market share of all participants will add up to more than 100%. All other transaction volume-based rankings are based on proceeds, with full credit to each book manager/equal if joint IB League Tables League table results – volumes League table results – wallet share 1H14 FY2013 Rank Share Rank Share Based on volumes 6 : Global Debt, Equity & Equity-related 1 6.8% 1 7.3% US Debt, Equity & Equity-related 1 11.8% 1 11.9% Global Long-term Debt2 1 6.7% 1 7.2% US Long-term Debt 1 11.3% 1 11.7% Global Equity & Equity-related3 2 7.3% 2 8.2% US Equity & Equity-related 4 10.4% 2 12.1% Global M&A Announced4 4 21.5% 2 23.1% US M&A Announced 4 29.6% 2 35.3% Global Loan Syndications 1 10.4% 1 9.9% US Loan Syndications 1 18.6% 1 17.6% 1H14 FY2013 Rank Share Rank Share Based on fees 1 : Global Debt, Equity & Equity-related 1 7.4% 1 8.3% US Debt, Equity & Equity-related 1 10.6% 1 11.4% Global Long-term Debt2 1 8.0% 1 8.2% US Long-term Debt 1 11.7% 1 11.6% Global Equity & Equity-related3 3 6.9% 2 8.4% US Equity & Equity-related 4 9.3% 1 11.4% Global M&A4 2 8.8% 2 7.7% US M&A 2 10.8% 2 8.8% Global Loan Syndications 1 9.6% 1 9.9% US Loan Syndications 1 12.9% 1 13.9% Global IB fees1,5 1 8.2% 1 8.5% 19

A P P E N D I X Notes on non-GAAP financial measures 1. In addition to analyzing the Firm’s results on a reported basis, management reviews the Firm’s results and the results of the lines of business on a “managed” basis, which is a non-GAAP financial measure. The Firm’s definition of managed basis starts with the reported U.S. GAAP results and includes certain reclassifications to present total net revenue for the Firm (and each of the business segments) on a fully taxable-equivalent (“FTE”) basis. Accordingly, revenue from investments that receive tax credits and tax exempt securities is presented in the managed results on a basis comparable to taxable securities and investments. This non-GAAP financial measure allows management to assess the comparability of revenue arising from both taxable and tax-exempt sources. The corresponding income tax impact related to tax-exempt items is recorded within income tax expense. These adjustments have no impact on net income as reported by the Firm as a whole or by the lines of business. 2. Adjusted expense, a non-GAAP financial measure, excludes firmwide legal expense and expense related to foreclosure-related matters (“FRM”). Management believes this information helps investors understand the effect of these items on reported results and provides an alternate presentation of the Firm’s performance. 3. The ratio of the allowance for loan losses to end-of-period loans excludes the following: loans accounted for at fair value and loans held-for-sale; purchased credit-impaired (“PCI”) loans; and the allowance for loan losses related to PCI loans. Additionally, Real Estate Portfolios net charge-offs and net charge-off rates exclude the impact of PCI loans. 4. Tangible common equity (“TCE”), return on tangible common equity (“ROTCE”) and tangible book value per share (“TBVPS”), are each non-GAAP financial measures. TCE represents the Firm’s common stockholders’ equity (i.e., total stockholders’ equity less preferred stock) less goodwill and identifiable intangible assets (other than MSRs), net of related deferred tax liabilities. ROTCE measures the Firm’s earnings as a percentage of TCE. TBVPS represents the Firm’s tangible common equity divided by period-end common shares. TCE, ROTCE, and TBVPS are meaningful to the Firm, as well as analysts and investors in assessing the Firm’s use of equity and are used in facilitating comparisons of the Firm with competitors. 5. Common Equity Tier 1 (“CET1”) capital, risk-weighted assets (“RWA”) and the CET1 ratio under the Basel III Advanced Fully Phased-In rules, and the U.S. proposed supplementary leverage ratio (“SLR”) are each non-GAAP financial measures. These measures are used by management, bank regulators, investors and analysts to assess and monitor the Firm’s capital position. For additional information on these measures, see Regulatory capital on pages 161-165 of JPMorgan Chase & Co.’s Annual Report on Form 10-K for the year ended December 31, 2013, and on pages 63-68 of the Firm’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2014. 6. Within Consumer & Community Banking, Card, Merchant Services and Auto presents its change in net income excluding the change in the allowance for loan losses (assuming a tax rate of 38%). This non-GAAP financial measure is used by management to facilitate a more meaningful comparison with prior periods. 7. In addition to reviewing JPMorgan Chase's net interest income on a managed basis, management also reviews core net interest income to assess the performance of its core lending, investing (including asset-liability management) and deposit-raising activities (which excludes the impact of Corporate & Investment Bank's ("CIB") market-based activities). The core net interest income data presented are non-GAAP financial measures due to the exclusion of CIB’s market-based net interest income and the related assets. Management believes this exclusion provides investors and analysts a more meaningful measure by which to analyze the non-market-related business trends of the Firm and provides a comparable measure to other financial institutions that are primarily focused on core lending, investing and deposit-raising activities. 8. The CIB provides certain non-GAAP financial measures, as such measures are used by management to assess the underlying performance of the business and for comparability with peers: The ratio of the allowance for loan losses to end-of-period loans is calculated excluding the impact of consolidated Firm-administered multi-seller conduits and trade finance loans, to provide a more meaningful assessment of CIB’s allowance coverage ratio. Prior to January 1, 2014, the CIB provided several non-GAAP financial measures excluding the impact of FVA (effective fourth quarter 2013) and DVA on: net revenue, net income, and compensation, overhead and return on equity ratios. Beginning in the first quarter 2014, the Firm does not exclude FVA and DVA from its assessment of business performance; however, the Firm continues to present these non-GAAP measures for the periods prior to January 1, 2014, as they reflected how management assessed the underlying business performance of the CIB in those prior periods. Additional notes on financial measures 9. Core loans include loans considered central to the Firm’s ongoing businesses; core loans exclude runoff portfolios, discontinued portfolios and portfolios the Firm has an intent to exit. 10. Pretax margin represents income before income tax expense divided by total net revenue, which is, in management’s view, a comprehensive measure of pretax performance derived by measuring earnings after all costs are taken into consideration; it is, therefore, another basis that management uses to evaluate the performance of AM against the performance of its peers. Notes 20

A P P E N D I X Forward-looking statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the current beliefs and expectations of JPMorgan Chase & Co.’s management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements. Factors that could cause JPMorgan Chase & Co.’s actual results to differ materially from those described in the forward-looking statements can be found in JPMorgan Chase & Co.’s Annual Report on Form 10-K for the year ended December 31, 2013, and Quarterly Report on Form 10-Q for the quarter ended March 31, 2014, which have been filed with the Securities and Exchange Commission and are available on JPMorgan Chase & Co.’s website (http://investor.shareholder.com/jpmorganchase), and on the Securities and Exchange Commission’s website (www.sec.gov). JPMorgan Chase & Co. does not undertake to update the forward-looking statements to reflect the impact of circumstances or events that may arise after the date of the forward- looking statements. 21