Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MYERS INDUSTRIES INC | d755873d8k.htm |

Myers

Industries, Inc. Scepter Acquisition Conference Call

July 9, 2014 |

2

Statements

in

this

presentation

concerning

the

Company’s

goals,

strategies,

and

expectations

for

business

and

financial

results

may

be

"forward-looking

statements"

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995

and

are

based

on

current indicators and expectations. Whenever you read a statement that is

not simply a statement of historical fact (such as when we describe what we

"believe," "expect," or "anticipate" will occur, and other similar statements), you must remember that our

expectations

may

not

be

correct,

even

though

we

believe

they

are

reasonable.

We

do

not

guarantee

that

the

transactions

and

events described will happen as described (or that they will happen at all).

You should review this presentation with the understanding that actual

future results may be materially different from what we expect. Many of the factors that will determine

these

results

are

beyond

our

ability

to

control

or

predict.

You

are

cautioned

not

to

put

undue

reliance

on

any

forward-looking

statement. We do not intend, and undertake no obligation, to update these

forward-looking statements. These statements involve a number of

risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the

applicable statements. Such risks include: (1) changes in the markets for the

Company’s business segment; (2) changes in trends and demands in

the markets in which the Company competes; (3) unanticipated downturn in business relationships with customers

or their purchase; (4) competitive pressures on sales and pricing; (5) raw material

availability, increases in raw material costs, or other

production

cost;

(6)

harsh

weather

condition;

(7)

future

economic

and

financial

conditions

in

the

United

States

and

around

the

world; (8) inability of the Company to meet future capital requirements; (9)

claims, litigation and regulatory actions against the Company; (10) changes

in laws and regulations affecting the Company; (11) the Company’s ability to execute the components of

its strategic plan; and other risks as detailed in the Company’s 10-K and

other reports filed with the Securities and Exchange Commission.

Myers Industries, Inc. encourages investors to learn more about these risk factors.

A detailed explanation of these factors is available

in

the

Company’s

publicly

filed

quarterly

and

annual

reports,

which

can

be

found

online

at

www.myersind.com

and

at

the

SEC.gov web site.

EBITDA, adjusted EBITDA, free cash flow and net debt are not defined terms under

U.S. generally accepted accounting principles (non-GAAP measures).

Non-GAAP measures should not be considered in isolation or as a substitute for net income, cash flow or

total debt figures prepared in accordance with GAAP and may not be comparable to

similarly titled measures calculated by other companies.

Forward Looking Statements; Non GAAP Measures

Exhibit 99.1 |

Myers

Industries Overview 3

•

NYSE: MYE

•

Founded in 1933

•

Headquartered in Akron, Ohio

•

3600 employees

•

International manufacturer of polymer products

•

Wholesale distributor for tire repair and retread products |

Scepter

Overview •

Founded in Ontario in 1949

•

Headquartered in Toronto, Ontario

•

350 employees

•

Industry leading manufacturer of polymer products

that serve four markets:

•

Consumer

•

Military

•

Marine

•

Industrial

4 |

Scepter

Acquisition Overview •

Acquisition completed July 2, 2014

•

Purchase price was $157M

•

Purchased Scepter Corporation (Canadian company) and

Scepter Manufacturing, LLC (U.S. company)

•

Third bolt-on acquisition in Material Handling in two

years

•

2013 annual sales approximately $100M

•

Represents an almost 30% increase to the Material Handling Segment

2013 sales

5 |

Scepter

Acquisition Rationale •

Immediately enhances Myers’

overall profitability, free

cash flow and return on invested capital

•

Complements Material Handling Segment in end markets,

products, and technologies

•

Aligns closely with core growth platforms

•

Storage and Safety Products

•

Specialty Molding

•

Provides Myers opportunity to move into adjacent

markets –

military and consumer

•

Expands geographic reach

6 |

Scepter

Transaction Economics •

Purchase price $157M

•

Trailing twelve months EBITDA $23.5M

•

EBITDA multiple of 6.7 times before synergies

•

Myers increased its senior secured revolving credit facility

to $300M to fund acquisition

•

Other terms of the facility remain unchanged

•

Proceeds from the divestiture of the Lawn & Garden Segment will be

used to pay down debt

7

•

Expected to be immediately accretive to adjusted earnings

per share

•

Annual synergies of more than $2.0M are anticipated |

Additional

Recent Announcements & Events •

Commencement of the sale of the Lawn & Garden

Segment

•

Two-phase restructuring complete

•

Engaged William Blair to assist with the sales process

•

Expect the sale to be completed in less than twelve months

•

Reported as discontinued operation in second quarter Form 10Q filing

•

Sale of WEK Industries, Inc. to Industrial Opportunity

Partners

•

Sale price of approximately $19.5M

•

Segment reporting realignment

•

Reduces our reporting segments from four to two

•

Starts with the second quarter Form 10Q filing

•

Two reportable segments

•

Material Handling

•

Distribution

8 |

Appendix

9 |

Scepter EBITDA

Reconciliation (Unaudited) 10

(1) Earnings before interest and taxes of Scepter Corporation and Scepter

Manufacturing, LLC (Scepter). ($ millions USD)

TTM 5/31/2014

EBIT

(1)

$ 18.2

Depreciation and Amortization

EBITDA

$ 23.5

5.3 |

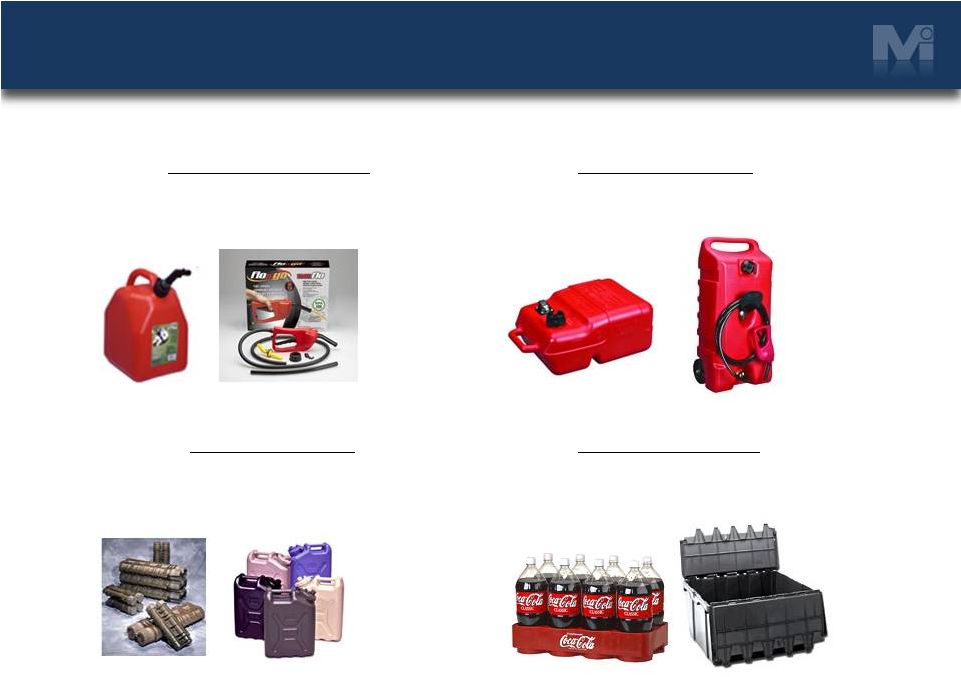

Scepter

Markets & Products 11

Consumer Segment

•

Automotive fuel containers

•

“Flo n’

go”

fluid transfer system

Marine Segment

•

Remote outboard engine fuel tanks

•

Fuel transfer systems

Military

Segment

•

Ammunition packaging

•

Fuel and water canisters

Industrial Segment

•

Food and beverage handling

•

Storage cotainers |

|