Attached files

| file | filename |

|---|---|

| EX-1.1 - EX-1.1 - Envision Healthcare Holdings, Inc. | a2220686zex-1_1.htm |

| EX-5.1 - EX-5.1 - Envision Healthcare Holdings, Inc. | a2220686zex-5_1.htm |

| EX-23.1 - EX-23.1 - Envision Healthcare Holdings, Inc. | a2220603zex-23_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

As filed with the Securities and Exchange Commission on July 8, 2014

Registration No. 333-197027

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Envision Healthcare Holdings, Inc.

(Exact Name of Registrant as Specified in its Charter)

| Delaware (State or other jurisdiction of incorporation) |

4100 (Primary Standard Industrial Classification Code Number) |

45-0832318 (I.R.S. Employer Identification No.) |

6200 S. Syracuse Way

Suite 200

Greenwood Village, CO 80111

(303) 495-1200

(Address, including Zip Code, and Telephone Number, including Area Code, of Registrant's Principal Executive Offices)

Craig A. Wilson, Esq.

Senior Vice President and General Counsel

6200 S. Syracuse Way

Suite 200

Greenwood Village, CO 80111

(303) 495-1200

(Name, Address, including Zip Code, and Telephone Number, including Area Code, of Agent for Service)

With copies to:

| Peter J. Loughran, Esq. Debevoise & Plimpton LLP 919 Third Avenue New York, New York 10022 (212) 909-6000 |

Jonathan A. Schaffzin, Esq. Stuart G. Downing, Esq. Cahill Gordon & Reindel LLP Eighty Pine Street New York, New York 10005 (212) 701-3000 |

Approximate date of commencement of proposed sale of the securities to the public:

As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer", "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Aggregate Offering Price Per Share(1)(2) |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee(3) |

||||

|---|---|---|---|---|---|---|---|---|

Common stock, $0.01 par value per share |

31,625,000 | $36.42 | $1,151,782,500 | $148,350 | ||||

|

||||||||

- (1)

- Includes

shares/offering price of shares that may be sold upon exercise of the underwriters' option to purchase additional shares.

- (2)

- This

amount represents the proposed maximum aggregate offering price of the securities registered hereunder. These figures are estimated solely for the

purpose of calculating the amount of the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended. The price shown is the average of the high and low sale prices

for the registrant's common stock on June 20, 2014 as reported on the New York Stock Exchange.

- (3)

- Previously paid.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay the effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state of jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JULY 8, 2014

27,500,000 Shares

Envision Healthcare Holdings, Inc.

Common Stock

All of the 27,500,000 shares of common stock of Envision Healthcare Holdings, Inc. are being sold by the selling stockholders identified in this prospectus. Envision Healthcare Holdings, Inc. will not receive any of the proceeds from the sale of the shares being sold by the selling stockholders.

The common stock of Envision Healthcare Holdings, Inc. is listed on the New York Stock Exchange under the symbol "EVHC". The last reported sale price of the common stock on July 7, 2014 was $35.97 per share.

See "Risk Factors" on page 17 to read about factors you should consider before buying shares of the common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

|

|||||||

| |

Per Share |

Total |

|||||

|---|---|---|---|---|---|---|---|

Public offering price |

$ | $ | |||||

Underwriting discount |

$ | $ | |||||

Proceeds, before expenses, to the selling stockholders |

$ | $ | |||||

|

|||||||

To the extent that the underwriters sell more than 27,500,000 shares of common stock, the underwriters have the option to purchase up to an additional 4,125,000 shares of common stock from the selling stockholders at the offering price less the underwriting discount. Envision Healthcare Holdings, Inc. will not receive any of the proceeds from the shares of common stock sold by the selling stockholders pursuant to any exercise of the underwriters' option to purchase additional shares.

The underwriters expect to deliver the shares against payment in New York, New York on , 2014.

| Goldman, Sachs & Co. | Barclays | BofA Merrill Lynch | Citigroup |

| Credit Suisse | Deutsche Bank Securities | Morgan Stanley | RBC Capital Markets | UBS Investment Bank |

Jefferies

Avondale Partners |

Cantor Fitzgerald & Co. |

Oppenheimer & Co. |

Piper Jaffray |

William Blair |

Prospectus dated , 2014.

Neither we nor the selling stockholders have authorized anyone to provide any information or to make any representations other than those contained or incorporated by reference into this prospectus or in any free writing prospectuses we have prepared. We and the selling stockholders take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained or incorporated by reference in this prospectus is accurate only as of the date such information is presented.

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS AND INFORMATION

This prospectus and the information incorporated by reference into this prospectus contain statements about future events and expectations that constitute forward-looking statements. Forward-looking statements may include, but are not limited to, statements relating to our projected second quarter 2014 Adjusted EBITDA and net income ranges described under "Prospectus Summary—Recent Developments" elsewhere in this prospectus. Forward-looking statements are based on our beliefs, assumptions and expectations of our future financial and operating performance and growth plans, taking into account the information currently available to us. These statements are not statements of historical fact. Forward-looking statements involve risks and uncertainties that may cause our actual results to differ materially from the expectations of future results we express or imply in any forward-looking statements and you should not place undue reliance on such statements. Factors that could contribute to these differences include, but are not limited to, the following:

- •

- Decreases in our revenue and profit margin under our fee-for-service contracts due to changes in volume, payor mix and

third party reimbursement rates, including from political discord in the federal budgeting process;

- •

- The loss of existing contracts;

- •

- Failure to accurately assess costs under new contracts;

- •

- Difficulties in our ability to recruit and retain qualified physicians and other healthcare professionals, and enforce our

non-compete agreements with our physicians;

- •

- Failure to implement some or all of our business strategies, including our efforts to grow our Evolution

Health, LLC ("Evolution Health") business and cross-sell our services;

- •

- Lawsuits for which we are not fully reserved;

- •

- The adequacy of our insurance coverage and insurance reserves;

- •

- Our ability to successfully integrate strategic acquisitions;

- •

- The high level of competition in the markets we serve;

- •

- The cost of capital expenditures to maintain and upgrade our vehicle fleet and medical equipment;

- •

- The loss of one or more members of our senior management team;

- •

- Our ability to maintain or implement complex information systems;

- •

- Disruptions in disaster recovery systems or management continuity planning;

- •

- Our ability to adequately protect our intellectual property and other proprietary rights or to defend against intellectual

property infringement claims;

- •

- Challenges by tax authorities on our treatment of certain physicians as independent contractors;

- •

- The impact of labor union representation;

- •

- The impact of fluctuations in results due to our national contract with the Federal Emergency Management Agency ("FEMA");

- •

- Potential penalties or changes to our operations, including our ability to collect accounts receivable, if we fail to comply with extensive and complex government regulation of our industry;

ii

- •

- The impact of changes in the healthcare industry, including changes due to healthcare reform;

- •

- Our ability to timely enroll our providers in the Medicare program;

- •

- Our ability to restructure our operations to comply with future changes in government regulation;

- •

- The outcome of government investigations of certain of our business practices;

- •

- Our ability to comply with the terms of our settlement agreements with the government;

- •

- Our ability to generate cash flow to service our substantial debt obligations;

- •

- The significant influence of investment funds sponsored by, or affiliated with, Clayton, Dubilier &

Rice, LLC (the "CD&R Affiliates") over us; and

- •

- The factors discussed in "Risk Factors".

Words such as "anticipates", "believes", "continues", "estimates", "expects", "goal", "objectives", "intends", "may", "opportunity", "plans", "potential", "near-term", "long-term", "projections", "assumptions", "projects", "guidance", "forecasts", "outlook", "target", "trends", "should", "could", "would", "will" and similar expressions are intended to identify such forward-looking statements. We qualify any forward-looking statements entirely by these cautionary factors.

Other risks, uncertainties and factors, including those discussed under "Risk Factors", could cause our actual results to differ materially from those projected in any forward-looking statements we make. Readers should read carefully the factors described in "Risk Factors" and the documents incorporated by reference to better understand the risks and uncertainties inherent in our business and underlying any forward-looking statements.

We assume no obligation to update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data.

iii

The following summary highlights information contained elsewhere in this prospectus or the documents incorporated by reference into this prospectus and does not contain all of the information that you should consider before investing in our common stock. You should read this entire prospectus and the documents incorporated by reference into this prospectus before making an investment decision. Unless the context otherwise requires, in this prospectus: (i) references to the "Company" mean Envision Healthcare Holdings, Inc., the issuer of the common stock offered hereby, (ii) references to "we", "us" and "our" mean the Company and its consolidated subsidiaries, (iii) references to "EVHC" mean Envision Healthcare Corporation, an indirect wholly owned subsidiary of the Company, (iv) references to "AMR" mean American Medical Response, Inc., an indirect wholly owned subsidiary of the Company, and (v) references to "EmCare" mean EmCare Holdings Inc., an indirect wholly owned subsidiary of the Company. References to "underwriters" refer to the firms listed on the cover page of this prospectus.

We are a leading provider of physician-led, outsourced medical services in the United States with more than 20,000 affiliated clinicians. We offer a broad range of clinically-based and coordinated care solutions across the patient continuum, by which we mean the patient treatment cycle, from medical transportation to hospital encounters to comprehensive care alternatives in various settings. We believe that our capabilities offer a powerful value proposition to healthcare facilities, communities and payors by helping to improve the quality of care and lower overall healthcare costs. We market our services on a stand-alone, multi-service and integrated basis, primarily under our EmCare and AMR brands. EmCare, with nearly 8,000 affiliated physicians and other clinicians, is a leading provider of integrated facility-based physician services, including emergency, anesthesiology, hospitalist/inpatient care, radiology, teleradiology and surgery. EmCare also offers physician-led care management solutions outside the hospital. AMR, with more than 12,000 paramedics and emergency medical technicians, is a leading provider and manager of community-based medical transportation services, including emergency ("911"), non-emergency, managed transportation, fixed-wing air ambulance and disaster response.

Since May 2011, our management has implemented a number of value-enhancing initiatives to expand our service offerings, increase our market presence and position us for future growth. Some of these initiatives include:

- •

- Optimizing our contract portfolio and prioritizing markets at EmCare and AMR;

- •

- Developing further EmCare's integrated service offerings, resulting in a meaningful acceleration of new contract growth;

- •

- Re-aligning AMR's business model and strategy by improving productivity, clinical outcomes and the use of technology,

leading to operating margin improvements and revenue growth opportunities; and

- •

- Leveraging the core competencies of EmCare and AMR to extend our clinical capabilities into various settings outside the hospital.

In 2012, we expanded EmCare's physician-led services outside the hospital through the formation of Evolution Health. Evolution Health provides comprehensive care management solutions through a suite of physician-led services, including transitional care teams, direct patient care and care coordination by clinicians outside the acute-care setting, as well as telemonitoring and telemedicine. Evolution Health serves patients who require comprehensive care across various settings, many of whom suffer from advanced illnesses and chronic diseases. Our Evolution Health solutions leverage many of the competencies of EmCare and AMR, including clinical resource

management, patient flow coordination, evidence-based clinical protocols, community-based clinical and medical transportation services, patient monitoring and clinician recruitment.

For the year ended December 31, 2013, we generated net revenue of $3.7 billion, of which EmCare represented 63% and AMR represented 37%, and Adjusted EBITDA of $445.7 million, of which EmCare represented 66% and AMR represented 34%. Approximately 89% of our net revenue for the year ended December 31, 2013 was generated under exclusive contracts. As of December 31, 2013, EmCare had contracts covering 706 clinical departments, and AMR had 169 "911" contracts and 3,677 non-emergency transport arrangements. During 2013, we had a total of 14.9 million weighted patient encounters and weighted transports across approximately 2,100 communities nationwide. In calculating weighted patient encounters at EmCare across our four main categories of patient encounters — emergency department ("ED") visits, hospitalist encounters, radiology reads and anesthesiology cases — each radiology read and anesthesiology case is not counted as a full patient encounter as we apply a discount factor to reflect differences in reimbursement rates for and associated costs of providing such services. In calculating "weighted transports" at AMR for our two main transport categories — ambulance transports and wheelchair transports — we likewise apply a discount factor to wheelchair transports. See "— Summary Consolidated Financial Data" for a discussion of Adjusted EBITDA and a reconciliation to net income.

We believe that we are well-positioned to benefit from trends currently affecting the healthcare services markets in which we compete, including:

Continued Healthcare Services Outsourcing. Due to the growing complexity of the healthcare delivery system, healthcare facilities and communities are increasingly turning to leading outsourced medical services providers that offer comprehensive solutions. Healthcare facilities continue to outsource as a result of increasing cost pressures, difficulty in recruiting physicians and the need to improve operational efficiency. Communities increasingly outsource medical transportation services due to cost pressures, service issues and the challenge of meeting peak emergency demands in a cost-effective manner while delivering optimal clinical outcomes. We believe that large, national providers of outsourced medical services will continue to benefit from these outsourcing trends and gain market share by demonstrating the ability to improve productivity, lower costs and enhance quality of care.

Focus on Cost Containment. As rising healthcare costs have further strained federal, state and local budgets, healthcare facilities, communities and payors have come under significant pressure to reduce costs and improve the quality of care. Opportunities to reduce healthcare costs include improving patient flow coordination, decreasing the length of hospital stays, reducing readmission rates, identifying more cost-efficient clinical settings and providing more efficient community-based and facility-based medical transportation services. In addition, there is increasing focus on the subset of patients that account for a disproportionate share of national healthcare costs. We believe that efficient management of care across the patient continuum, particularly for patients with complex and chronic conditions, represents a significant opportunity to reduce overall healthcare costs and improve quality and outcomes.

Shift Towards Coordinated Care and Measured Clinical Outcomes. In the current healthcare environment, we believe the hospital-centric delivery system requires improved care coordination and communication among healthcare providers. We believe that improved collaboration and access to information across the patient continuum will facilitate the ability of healthcare providers to analyze patient data and identify more effective treatment protocols that ultimately improve outcomes and reduce costs. As the number of patients with complex and chronic conditions

2

increases, innovative services that promote coordinated, cost-effective and high-quality care across different settings will be essential. In addition, we believe the ability to integrate evidence-based clinical protocols into patient-specific care is becoming increasingly important for patients, healthcare providers, healthcare facilities, communities and payors.

Opportunities Created by Healthcare Legislation. We anticipate that recent healthcare legislation will create opportunities for outsourced medical services providers. The Patient Protection and Affordable Care Act ("PPACA") is designed to provide healthcare coverage to previously uninsured individuals through the expansion of state Medicaid programs and the creation of federal and state healthcare exchanges. ED and ambulance providers typically encounter a significant proportion of patients who have no or limited healthcare insurance; for example, our self-payors (primarily uninsured patients) represented 17.7% of our total patient volume in 2013. Due to expected coverage expansion, we anticipate increased overall utilization of, and reimbursement for, outsourced medical services. We believe the impact of the PPACA and evolving value-based payment models will add further stress to conventional healthcare delivery systems and increase the need to coordinate and collaborate across the patient continuum. We expect that increased accountability for clinical quality and patient coordination will be a catalyst for healthcare facilities, communities and payors to align with leading providers of outsourced medical services.

Utilization of Technology. Technology has emerged as a vital tool for healthcare providers to optimize the delivery of care. We believe that technology investments as a means to monitor clinical outcomes, improve clinician productivity, contain costs and comply with regulatory reporting and government reimbursement requirements will be an important differentiator among outsourced providers. We believe that large, outsourced medical services providers that continue to dedicate resources and invest capital toward technology-enabled capabilities will be best-positioned to provide high-quality and cost-effective care.

We believe the following competitive strengths position us to capitalize on the favorable healthcare services industry trends:

Leading Player in Large and Highly Fragmented Markets. In 2013, we had a total of 14.9 million weighted patient encounters and weighted transports across approximately 2,100 communities. We are one of the largest outsourced providers in our markets, though we estimate that none of our services currently has greater than a 9% share of its respective total market. Due to our scale and scope, we are able to offer our customers integrated services and national contracting capabilities, while demonstrating differentiated clinical outcomes across our businesses. We have developed strong brand recognition and competitive advantages in clinician recruitment as a result of our market position, clinical best practices and clinician leadership development programs. We believe that our scale and scope, when combined with our capabilities and comprehensive service offerings across the patient continuum, enable us to enter strategic business partnerships with multi-state hospital systems and communities, differentiating us from local and regional competitors. Given our market positions and the highly fragmented markets in which we provide our services, we believe there continue to be significant opportunities to grow market share by obtaining new contracts and through targeted acquisitions.

Strong and Consistent Revenue Growth from Diversified Sources. We have a history of delivering strong revenue growth through a combination of new contracts, same-contract revenue growth and acquisitions. We believe that our significant new contract revenue growth has been driven by our differentiated service offerings and ability to deliver efficient, high-quality care. Further, new contract growth has been accelerating since 2011 as a result of our integrated service offerings and the success of each of EmCare and AMR in cross-selling services to their respective

3

customers. Our new contract pipeline remains robust across each of our businesses. In 2013, 61% of EmCare new contracts were signed with facilities not previously utilizing its services. We believe that same-contract revenue growth is supported by consistent underlying market volume trends and stable pricing due to the emergency nature of many of our services. Market volumes have been driven primarily by the non-discretionary nature of our services, aging demographics and primary care physician shortages that drive additional patients to emergency rooms. Furthermore, we expect that the PPACA will increase patient volumes and provide reimbursement opportunities with respect to previously uninsured patients. To supplement our same-contract and new contract organic growth, we have a proven track record of executing strategic acquisitions to expand our service lines and market presence.

Differentiated Service Model Well-Positioned for Growth. We provide a broad set of clinically-based solutions designed to enable healthcare providers, hospital systems, communities and payors to realize economic and clinical benefits. EmCare is differentiated by providing integrated physician and clinician resource management across multiple service lines, utilizing comprehensive evidence-based clinical protocols and employing a data-driven process to more effectively recruit and retain physicians. AMR is differentiated by its clinical expertise, logistics management, dispatch and communication center expertise and disaster response on a local and national level. Evolution Health, which draws upon the competencies of EmCare and AMR, partners with payors, hospitals and hospitalist physicians to provide physician-led coordinated care teams in multiple settings. The quality and cost-effectiveness of care delivered by these care teams is enhanced by our medical command center for remote telemedicine, our community-based paramedics for in-home patient monitoring and our transportation services for transferring patients between medical settings. Through the coordination of care among our service lines, we believe that we can deliver a differentiated offering of comprehensive care solutions across the patient continuum.

Ability to Attract and Retain High-Quality Physicians and Other Clinicians. Through our differentiated recruiting databases and processes, we are able to identify and target high-quality clinicians, many with a local market connection, to optimally match the needs of our facility-based and community-based customers. We offer physicians and other clinicians substantial flexibility in terms of geographic location, scheduling work hours, benefits packages and opportunities for career development. We also offer clinicians the ability to provide care across the patient continuum, including in pre-hospital, hospital and post-hospital environments. We believe that our national presence and operating infrastructure enable us to provide attractive opportunities for our clinicians to enhance their skills through extensive clinical and leadership development programs. At EmCare, we have established what we believe is a highly effective medical director leadership development program. At AMR, we believe we have developed the largest paramedic and emergency medical technician training program in the country. We believe that our differentiated recruiting, training and development programs strengthen our customer and provider relationships, enhance our strong contract and clinician retention rates, and allow us to efficiently recruit clinicians to support our robust new contract pipeline across each of our businesses.

Significant Recurring Revenue with Strong and Stable Cash Flow. We believe that our business model and the contractual nature of our businesses drive a meaningful amount of recurring revenue. We believe that our ability to consistently deliver high levels of customer service to improve our customers' key metrics is illustrated by our long-term customer relationships. The ten largest customers at EmCare and AMR have an average tenure of 12.5 and 32 years, respectively. During 2013, approximately 89% of our net revenue was generated under exclusive contracts that historically have yielded high retention rates. We believe that our recurring revenue, when combined with our attractive operating margins and relatively low capital expenditure and working capital requirements, has resulted in strong and predictable cash flows. We believe that our

4

geographic, customer, facility and service line diversification further supports the stability of our business model and cash flows.

Efficient Cost Structure and Disciplined Approach to Sustainable Growth. We have a strong track record of achieving profitable growth, increasing operating margins and identifying cost reduction opportunities. From 2008 to 2013, our revenue grew at a compound annual growth rate ("CAGR") of 9.1%. Over the same time period, our Adjusted EBITDA CAGR was 12.5%, with Adjusted EBITDA margins increasing 171 basis points, which we believe was driven primarily by our disciplined approach to obtaining new business as well as continued efficiency and productivity improvements. We have improved our AMR operations by investing in enhanced deployment technology and processes, re-aligning our support costs and exiting certain underperforming contracts, resulting in improved operating margins. At EmCare, we have implemented initiatives to improve physician productivity, including more efficient scheduling around peak and off-peak hours, use of mid-level providers and re-aligning physician compensation programs, each of which resulted in improved hospital metrics. We believe there are significant additional opportunities to improve productivity and reduce operating costs.

Scalable Technologies and Systems. As the healthcare industry evolves towards value-based care, we believe that our technology investments and underlying technology infrastructure will facilitate improved productivity and patient outcomes. Our recent proprietary technology investments include: (i) real-time patient reporting systems at EmCare to enhance tracking of key patient metrics and improve information flow to our hospital customers, (ii) electronic patient care record at AMR to enhance clinical data collection and improve billing system automation and (iii) innovative medical command center at Evolution Health, which provides for clinical intervention with patients through remote access to physicians and other clinicians and telemedicine solutions. We believe that our existing technology infrastructure and continued technology investments will enhance our value proposition and further differentiate us from our competitors.

Strong and Experienced Management Team with Demonstrated Track Record of Performance. We have a strong and innovative senior management team who established a track record of success while working together at our company for more than a decade. We are led by William Sanger, our Chief Executive Officer, who has 38 years of industry experience. Randel Owen, our Executive Vice President, Chief Operating Officer and Chief Financial Officer, has 31 years of industry experience. Todd Zimmerman, EmCare's Chief Executive Officer and one of our Executive Vice Presidents, has 23 years of industry experience. Edward Van Horne, the President of AMR, has 24 years of industry experience. Our management team has recently implemented a number of value-enhancing initiatives which have resulted in strong organic revenue growth and improved operating margins.

We intend to enhance our leading market positions by implementing the following key elements of our business strategy:

Capitalize on Organic Growth Opportunities. Our scale and scope, leading market positions and long operating history combined with our value-enhancing initiatives since 2011, provide us with competitive advantages to continue to grow our business. We intend to gain market share from local, regional and national competitors as well as through continued outsourcing of clinical services by healthcare facilities, communities and payors. We believe that EmCare is well-positioned to continue to generate significant organic growth due to its integrated service offerings, differentiated, data-driven processes to recruit and retain physicians, scalable technology and sophisticated risk management programs. At AMR, we believe market share gains will be driven by our strong clinical expertise, differentiated clinical results, high-quality service, strong brand

5

recognition and advanced information technology capabilities. We anticipate driving significant organic growth in Evolution Health by adding new contracts to meet the demand for physician-led care management solutions outside the hospital.

Grow Complementary and Integrated Service Lines. Our continued focus on cross-selling and offering integrated services across the patient continuum has helped hospital systems, communities and payors to realize economic benefits and clinical value for patients. At EmCare, we continue to expand and integrate our ED, anesthesiology, hospitalist, post-hospital, radiology, teleradiology and surgery services. Our ability to cross-sell EmCare services is enhanced by our national and regional contracts that provide preferred access to certain healthcare facilities throughout the United States. These factors, among others, have increased the percentage of healthcare facilities utilizing multiple EmCare service lines from 11% in 2009 to 22% in 2013. At AMR, we have expanded service lines, such as our managed transportation operations, fixed-wing air transportation services and community paramedic programs, with both new and existing customers. We expect Evolution Health to be a catalyst for cross-selling our services across all of our businesses and not just within a particular segment or service line. We have developed joint venture/shared governance arrangements with hospitals, health systems and payors that have contributed to our recent growth. We believe these arrangements will be important to our ability to gain market share in the future.

Supplement Organic Growth with Selective Acquisitions. The markets in which we compete are highly fragmented, with only a few national providers. We believe we have a successful track record of completing and integrating selective acquisitions in both our EmCare and AMR segments that have enhanced our presence in existing markets, facilitated our entry into new geographies and expanded the scope of our services. For the five-year period from 2007 through 2011, we successfully completed and integrated 24 acquisitions that were funded primarily through operating cash flows. In 2012 and 2013, we acquired five companies in each year for total consideration of more than $190 million and $34 million, respectively. We combined two of these acquired entities in 2012 to create our Evolution Health business. In the first quarter of 2014, we acquired two medical transportation service providers for total consideration of approximately $36.2 million in cash. On June 17, 2014, we acquired Phoenix Physicians, LLC, a provider of clinical services to healthcare facilities, for an aggregate purchase price of $170 million in cash, subject to certain post-closing adjustments. We believe there are substantial opportunities for additional acquisitions across our businesses and are exploring possible acquisition targets with purchase prices ranging from approximately $50 million to approximately $150 million. We will continue to follow a disciplined strategy in exploring future acquisitions by analyzing the strategic rationale, financial impact and organic growth profile of each potential opportunity.

Enhance Operational Efficiencies and Productivity. We believe there continue to be significant opportunities to build upon our success in improving our productivity and profitability. At AMR, we expect to benefit from additional investments in technology aimed at improving deployment of our resources. We also believe there are opportunities in areas such as optimization of field operations and fleet management. At EmCare, we continue to focus on initiatives to improve productivity. These include more efficient scheduling, continued use of mid-level providers, enhancing our leadership development programs and improving and re-aligning compensation programs. We believe that our significant investments in scalable technology systems will facilitate additional cost reductions and efficiencies.

Expand our Evolution Health Business. We believe that our strong market positions in integrated facility-based physician services and community-based medical transportation services uniquely position us to provide physician-led care management solutions outside the hospital. We offer an attractive value proposition through our business model which helps payors reduce their cost of care, promote the most appropriate care in the most appropriate setting, identify member

6

health risks, enable self-care and independence at home, and reduce hospital lengths of stay and readmissions. For hospitals, we believe our business model can improve patient flow coordination, decrease lengths of stay and reduce readmission rates. We are implementing our strategy by first utilizing analytics to identify eligible patients and then employing multiple techniques and physician-led services to manage the quality and cost of patient care, including transitional care teams, direct patient care and care coordination by clinicians outside the acute-care setting, telemonitoring and telemedicine.

Projected Second Quarter 2014 Adjusted EBITDA

We project that second quarter 2014 Adjusted EBITDA will be $129 million to $133 million. For our definition of Adjusted EBITDA and a description of its limitations, see Note 1 in "—Summary Consolidated Financial Data". A reconciliation of our projected second quarter 2014 Adjusted EBITDA range to our projected second quarter 2014 net income range is provided in the table below. Since this non-GAAP financial measure is not a measure determined in accordance with U.S. generally accepted accounting principles ("GAAP") and is susceptible to varying calculations, Adjusted EBITDA, as presented, may not be comparable to other similarly titled measures of other companies.

| |

Quarter ended June 30, 2014 |

|||

|---|---|---|---|---|

| |

(unaudited; dollars in millions) |

|||

Projected net income |

$7 - $9 | |||

Income tax expense |

5 - 6 | |||

Loss on early debt extinguishment |

50 | |||

Depreciation and amortization expense |

36 | |||

Interest and other expense, realized gain on investments, equity in earnings of unconsolidated subsidiary, equity based compensation expense and other |

31 - 32 | |||

| | | | | |

Projected Adjusted EBITDA |

$129 - $133 | |||

The projected second quarter 2014 Adjusted EBITDA range is preliminary, unaudited and subject to completion, reflects management's current views (including, among other things, its views on the operating results for April and May and the current outlook for June) and may change as a result of management's review of results and other factors, including a wide variety of significant business, economic and competitive risks and uncertainties. See "Risk Factors" for additional information. Such preliminary range is subject to the closing of the second quarter of 2014 and finalization of quarter-end financial and accounting procedures (which have yet to be performed) and should not be viewed as a substitute for full quarterly financial statements prepared in accordance with GAAP. We do not expect to disclose publicly whether or not our expectations have changed or to update our expectations, other than through the release of actual results in the ordinary course of business. Actual results may be materially different. Accordingly, you should not place undue reliance on our projected data. Our projected data is a forward-looking statement and should be read together with the financial information included and incorporated by reference into this prospectus. See "Special Note Regarding Forward-Looking Statements and Information".

The projected Adjusted EBITDA range was not prepared with a view toward complying with the Public Company Accounting Oversight Board guidelines with respect to prospective financial information. Neither our independent registered public accounting firm nor any other independent registered public accounting firm has audited, reviewed or compiled, examined or performed any procedures with respect to the projected Adjusted EBITDA range, nor have they expressed any opinion or any other form of assurance thereon.

7

EVHC's 2022 Notes

On June 18, 2014, EVHC issued $750 million in principal amount of its 5.125% Notes due 2022 (as further described in "Description of Certain Indebtedness—2022 Notes", the "2022 Notes"). EVHC used a portion of the net proceeds from the offering to redeem all of its outstanding 8.125% Senior Notes due 2019 totaling $617.5 million in aggregate principal amount and to pay related fees and expenses. We expect that the lower interest expense that we will realize from the redemption of the 2019 Notes will positively impact our earnings per share for full-year 2014.

Ownership and Corporate Information

In May 2011, pursuant to the Agreement and Plan of Merger among EVHC, Envision Healthcare Intermediate Corporation ("Intermediate Corporation"), and CDRT Merger Sub, Inc. ("Sub"), Sub merged with and into EVHC, with EVHC as the surviving corporation and an indirect wholly owned subsidiary of the Company (the "Merger"). As a result of the Merger, our historical consolidated financial statements and financial data are presented in two periods: the period prior to the Merger ("Predecessor") and the period succeeding the Merger ("Successor"). Financial information for the Predecessor period is for EVHC.

The CD&R Affiliates and certain executive officers, directors and employees of the Company will be the selling stockholders in this offering. The CD&R Affiliates currently hold approximately 54.2% of our common stock, and, following the completion of this offering, will own less than 50% of our outstanding common stock. See "Principal and Selling Stockholders".

Clayton, Dubilier & Rice, LLC (along with its associated investment funds, or any successor to its investment management business, "CD&R") was founded in 1978. CD&R is a private equity firm composed of a combination of financial and operating executives pursuing an investment strategy predicated on building stronger, more profitable businesses. Since inception, CD&R has managed the investment of approximately $19 billion in 59 U.S. and European businesses with an aggregate transaction value of approximately $90 billion. CD&R has a disciplined and clearly defined investment strategy with a special focus on multi-location services and distribution businesses.

We are a Delaware corporation incorporated in February 2011 in connection with the Merger. In June 2013, we changed our name from CDRT Holding Corporation to Envision Healthcare Holdings, Inc., and our indirect wholly owned subsidiary, Emergency Medical Services Corporation, changed its name to Envision Healthcare Corporation. Our principal executive offices are located at 6200 S. Syracuse Way, Suite 200, Greenwood Village, CO 80111, and our telephone number at that address is (303) 495-1200.

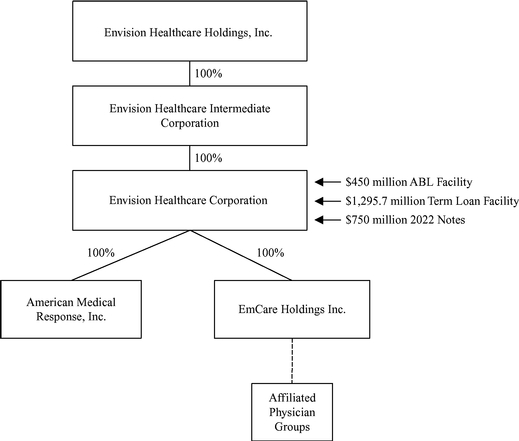

We conduct our business primarily through two operating subsidiaries, EmCare and AMR. Due to the corporate practice of medicine restrictions in certain states, we maintain long-term management contracts with affiliated physician groups which employ or contract with physicians to provide physician services. These entities are not subsidiaries of the Company but are consolidated for financial reporting purposes. See "Business — EmCare — Contracts — Affiliated Physician Group Contracts" included in our 2013 Form 10-K, which is incorporated by reference into this prospectus. Our indirect wholly owned subsidiary, EVHC, is the borrower under EVHC's senior secured term loan facility (as further described in "Description of Certain Indebtedness — Term Loan Facility", the "Term Loan Facility") and senior secured asset-based revolving credit facility (as further described in "Description of Certain Indebtedness — ABL Facility", the "ABL Facility" and, together with the Term Loan Facility, the "Senior Secured Credit Facilities") of up to $450 million and the obligor on $750.0 million aggregate principal amount of the 2022 Notes. As of March 31, 2014, there was $1,295.7 million outstanding under the Term Loan Facility and no amounts outstanding under the ABL Facility. On June 18, 2014, EVHC issued $750 million in aggregate

8

principal amount of the 2022 Notes (the "2022 Notes Offering"). A portion of the net proceeds from the 2022 Notes Offering was used to redeem all of EVHC's outstanding 8.125% Senior Notes due 2019 (the "2019 Notes") totaling $617.5 million in aggregate principal amount of which $9.8 million was held by our captive insurance subsidiary.

The following chart illustrates our organizational structure. Certain immaterial subsidiaries of EVHC have been omitted from this chart for convenience.

The market and industry data contained in this prospectus and the documents incorporated by reference into this prospectus, including trends in our markets and our position within such markets, are based on a variety of sources, including our good faith estimates, which are derived from our review of internal surveys, information obtained from customers and publicly available information, as well as from independent industry publications, government publications, reports by market research firms and other published independent sources. Although we believe these sources are reliable, none of we, the selling stockholders or the underwriters have independently verified the information. None of the independent industry publications used in this prospectus and the documents incorporated by reference into this prospectus were prepared on our or our affiliates' behalf. No source cited in this prospectus and the documents incorporated by reference into this prospectus consented to the inclusion of any data from any such publication, nor have we sought its consent. Estimates of market size and relative positions in a market are difficult to develop and inherently uncertain. Accordingly, investors should not place undue weight on the industry and market share data presented in this prospectus and the documents incorporated by reference into this prospectus.

9

This prospectus and the documents incorporated by reference into this prospectus use certain brand names, trademarks and service marks of the Company, including EmCare® and American Medical Response®. We do not intend our use or display of other trade names, trademarks or service marks to imply relationships with, or endorsement of us by, any other company or its goods or services.

Investing in our common stock involves a high degree of risk. You should carefully consider all of the information in this prospectus and the documents incorporated by reference into this prospectus prior to investing in our common stock, including the risks related to our business and the healthcare industry that are described under "Risk Factors" elsewhere in this prospectus. Among these important risks are, without limitation, the following:

- •

- we are subject to decreases in our revenue and profit margin under our fee-for-service contracts due to changes in volume,

payor mix and third party reimbursement rates, including from political discord in the federal budgeting process;

- •

- our revenue would be adversely affected if we lose existing contracts;

- •

- we may not accurately assess the costs we will incur under new contracts;

- •

- we may not be able to successfully recruit and retain physicians and other healthcare professionals;

- •

- our non-compete agreements and other restrictive covenants involving physicians may not be enforceable;

- •

- we may fail to implement some or all of our business strategies, including our efforts to grow our Evolution Health

business and cross-sell our services;

- •

- we may make acquisitions which could divert the attention of management and which may not be integrated successfully into

our existing business;

- •

- the high level of competition in the markets we serve could adversely affect our contract and revenue base;

- •

- our business depends on numerous complex information systems that we may fail to maintain or implement;

- •

- we conduct business in a heavily regulated industry and if we fail to comply with these laws and regulations, we could

incur penalties or be required to make significant changes to our operations;

- •

- the recent healthcare reform legislation and other changes in the healthcare industry and in healthcare spending may

adversely affect our revenue;

- •

- changes in the rates or methods of third party reimbursements, including due to political discord in the budgeting process

outside our control, may adversely affect our revenue and operations;

- •

- our substantial indebtedness may adversely affect our financial health;

- •

- the CD&R Affiliates will retain significant influence over us and may not always exercise their influence in a way that

benefits our public stockholders; and

- •

- other factors set forth under "Risk Factors" in this prospectus.

10

Common stock offered by the selling stockholders |

27,500,000 | |

Common stock outstanding after the offering |

182,557,484 shares |

|

Option to purchase additional shares of common stock |

The underwriters have a 30-day option to purchase an additional 4,125,000 shares of common stock from the CD&R Affiliates at the public offering price less underwriters' discounts and commissions. |

|

Use of proceeds |

We will not receive any proceeds from the sale of our common stock by the selling stockholders. The selling stockholders will receive all of the net proceeds and bear all commissions and discounts, if any, from the sale of our common stock pursuant to this prospectus. See "Use of Proceeds" and "Principal and Selling Stockholders". |

|

Dividend policy |

We do not expect to pay dividends on our common stock for the foreseeable future. See "Dividend Policy". |

|

Stock exchange symbol |

"EVHC" |

As of June 30, 2014, we had 181,205,468 shares of common stock outstanding. Unless otherwise indicated, all information in this prospectus:

- •

- assumes no exercise by the underwriters of their option to purchase 4,125,000 additional shares from the CD&R Affiliates;

- •

- excludes 14,874,084 shares of common stock issuable upon exercise of options outstanding as of June 30, 2014 at a

weighted average exercise price of $3.92 per share, except for 1,352,016 shares of common stock that we assume will be issued upon exercise of outstanding options prior to the completion of this

offering by the Company's executive officers, directors and employees selling shares in this offering;

- •

- excludes 123,723 shares of our common stock subject to restricted stock units outstanding as of June 30, 2014; and

- •

- excludes 16,539,986 shares of common stock reserved for future issuances under the Envision Healthcare Holdings, Inc. 2013 Omnibus Incentive Plan (the "Omnibus Incentive Plan").

11

Summary Consolidated Financial Data

The following table sets forth our summary historical financial data derived from our consolidated financial statements for each of the periods indicated. The summary historical consolidated financial data as of December 31, 2013, 2012 and 2011 and for the Successor years ended December 31, 2013 and 2012 and the Successor period from May 25 through December 31, 2011 and the Predecessor period from January 1 through May 24, 2011 set forth below are derived from our audited consolidated financial statements and related notes included in our Annual Report on Form 10-K for the year ended December 31, 2013 (our "2013 Form 10-K"), which is incorporated by reference into this prospectus. The summary historical consolidated financial data for the three months ended March 31, 2014 and 2013 and our consolidated balance sheet data as of March 31, 2014 are derived from our unaudited condensed consolidated financial statements and related notes included in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2014 (our "Q1 2014 Form 10-Q"), which is incorporated by reference into this prospectus. The historical consolidated financial data for the Predecessor period are for EVHC.

This "Summary Consolidated Financial Data" should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and related notes included in our 2013 Form 10-K and Q1 2014 Form 10-Q. Our historical financial data may not be indicative of our future performance.

12

| |

Successor | |

Predecessor | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Three Months ended March 31, |

Year ended December 31, |

Period from May 25 through December 31, 2011 |

|

Period from January 1 through May 24, 2011 |

||||||||||||||||

| |

2014

|

2013

|

2013

|

2012

|

|||||||||||||||||

| |

(unaudited) |

|

|

|

|

|

|||||||||||||||

| |

(dollars in thousands, except share and per share data) |

||||||||||||||||||||

Statement of Operations Data: |

|||||||||||||||||||||

Revenue, net of contractual discounts |

$ | 1,858,494 | $ | 1,605,248 | $ | 6,771,522 | $ | 5,834,632 | $ | 3,146,039 | $ | 2,053,311 | |||||||||

Provision for uncompensated care |

(844,283 | ) | (716,924 | ) | (3,043,210 | ) | (2,534,511 | ) | (1,260,228 | ) | (831,521 | ) | |||||||||

| | | | | | | | | | | | | | | | | | | | | | |

Net revenue |

1,014,211 | 888,324 | 3,728,312 | 3,300,121 | 1,885,811 | 1,221,790 | |||||||||||||||

Compensation and benefits |

743,661 | 641,789 | 2,667,439 | 2,307,628 | 1,311,060 | 874,633 | |||||||||||||||

Operating expenses |

114,635 | 100,450 | 424,865 | 421,424 | 259,639 | 156,740 | |||||||||||||||

Insurance expense |

30,981 | 25,833 | 106,293 | 97,950 | 65,030 | 47,229 | |||||||||||||||

Selling, general and administrative expenses |

19,375 | 21,998 | 106,659 | 78,540 | 44,355 | 29,241 | |||||||||||||||

Depreciation and amortization expense |

36,432 | 34,755 | 140,632 | 123,751 | 71,312 | 28,467 | |||||||||||||||

Restructuring charges |

809 | 637 | 5,669 | 14,086 | 6,483 | — | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | |

Income from operations |

68,318 | 62,862 | 276,755 | 256,742 | 127,932 | 85,480 | |||||||||||||||

Interest income from restricted assets |

86 | 366 | 792 | 625 | 1,950 | 1,124 | |||||||||||||||

Interest expense |

(30,049 | ) | (51,752 | ) | (186,701 | ) | (182,607 | ) | (104,701 | ) | (7,886 | ) | |||||||||

Realized gain (loss) on investments |

606 | 13 | 471 | 394 | 41 | (9 | ) | ||||||||||||||

Other (expense) income, net |

(808 | ) | (12,721 | ) | (12,760 | ) | 1,422 | (3,151 | ) | (28,873 | ) | ||||||||||

Loss on early debt extinguishment |

— | (122 | ) | (68,379 | ) | (8,307 | ) | — | (10,069 | ) | |||||||||||

| | | | | | | | | | | | | | | | | | | | | | |

Income (Loss) before income taxes and equity in earnings of unconsolidated subsidiary |

38,153 | (1,354 | ) | 10,178 | 68,269 | 22,071 | 39,767 | ||||||||||||||

Income tax (expense) benefit |

(16,675 | ) | (2,568 | ) | 994 | (27,463 | ) | (9,328 | ) | (19,242 | ) | ||||||||||

| | | | | | | | | | | | | | | | | | | | | | |

Income (Loss) before equity in earnings of unconsolidated subsidiary |

21,478 | (3,922 | ) | 11,172 | 40,806 | 12,743 | 20,525 | ||||||||||||||

Equity in earnings of unconsolidated subsidiary |

47 | 75 | 323 | 379 | 276 | 143 | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) |

21,525 | (3,847 | ) | 11,495 | 41,185 | 13,019 | 20,668 | ||||||||||||||

Less: Net loss (income) attributable to non-controlling interest |

3,300 | — | (5,500 | ) | — | — | — | ||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) attributable to Envision Healthcare Holdings, Inc. |

$ | 24,825 | $ | (3,847 | ) | $ | 5,995 | $ | 41,185 | $ | 13,019 | $ | 20,668 | ||||||||

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

|

|||||||||||||||||||||

13

| |

Successor | |

Predecessor | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Three Months ended March 31, |

Year ended December 31, |

Period from May 25 through December 31, 2011 |

|

Period from January 1 through May 24, 2011 |

||||||||||||||||

| |

2014

|

2013

|

2013

|

2012

|

|||||||||||||||||

| |

(unaudited) |

|

|

|

|

|

|||||||||||||||

| |

(dollars in thousands, except share and per share data) |

||||||||||||||||||||

Comprehensive Income: |

|||||||||||||||||||||

Net income (loss) |

$ | 21,525 | $ | (3,847 | ) | $ | 11,495 | $ | 41,185 | $ | 13,019 | $ | 20,668 | ||||||||

Other comprehensive income (loss), net of tax: |

|||||||||||||||||||||

Unrealized holding (losses) gains during the period |

(337 | ) | (436 | ) | (892 | ) | 1,632 | (41 | ) | 182 | |||||||||||

Unrealized gains (losses) on derivative financial instruments |

51 | (298 | ) | 266 | 857 | (2,661 | ) | 25 | |||||||||||||

| | | | | | | | | | | | | | | | | | | | | | |

Comprehensive income (loss) |

21,239 | (4,581 | ) | 10,869 | 43,674 | 10,317 | 20,875 | ||||||||||||||

Less: Comprehensive loss (income) attributable to non-controlling interest |

3,300 | — | (5,500 | ) | — | — | — | ||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | |

Comprehensive income (loss) attributable to Envision Healthcare Holdings, Inc. |

$ | 24,539 | $ | (4,581 | ) | $ | 5,369 | $ | 43,674 | $ | 10,317 | $ | 20,875 | ||||||||

Weighted average shares outstanding (in millions): |

|||||||||||||||||||||

Basic |

180.8 | 130.7 | 150.2 | 130.2 | 129.5 | 411.8 | |||||||||||||||

Diluted |

189.4 | 130.7 | 157.0 | 132.9 | 130.8 | 417.1 | |||||||||||||||

Earnings per share: |

|||||||||||||||||||||

Basic |

$ | 0.14 | $ | (0.03 | ) | $ | 0.04 | $ | 0.32 | $ | 0.10 | $ | 0.05 | ||||||||

Diluted |

$ | 0.13 | $ | (0.03 | ) | $ | 0.04 | $ | 0.31 | $ | 0.10 | $ | 0.05 | ||||||||

Other Financial Data: |

|||||||||||||||||||||

Adjusted EBITDA(1) |

$ | 110,007 | $ | 100,932 | $ | 445,705 | $ | 404,452 | $ | 214,789 | $ | 130,582 | |||||||||

Balance Sheet Data (at end of period): |

|||||||||||||||||||||

Cash and cash equivalent |

$ | 190,996 | $ | 204,712 | $ | 57,832 | $ | 134,023 | |||||||||||||

Working capital(2) |

631,254 | 630,954 | 274,565 | 385,323 | |||||||||||||||||

Property, plant and equipment net |

190,935 | 194,715 | 191,864 | 191,946 | |||||||||||||||||

Total assets |

4,314,530 | 4,300,017 | 4,036,833 | 4,013,108 | |||||||||||||||||

Total debt(3) |

1,908,234 | 1,911,916 | 2,677,913 | 2,380,387 | |||||||||||||||||

Net debt(3) |

1,717,238 | 1,707,204 | 2,620,081 | 2,246,364 | |||||||||||||||||

Total equity |

1,631,999 | 1,609,753 | 544,687 | 913,490 | |||||||||||||||||

Cash Flow Data(4) |

|||||||||||||||||||||

Cash flows provided by (used in): |

|||||||||||||||||||||

Operating activities |

$ | 30,220 | $ | 6,642 | $ | 54,115 | $ | 216,435 | $ | 114,821 | $ | 67,975 | |||||||||

Investing activities |

(39,973 | ) | (4,770 | ) | (98,597 | ) | (154,043 | ) | (2,965,976 | ) | (89,459 | ) | |||||||||

Financing activities |

(3,963 | ) | 20,428 | 191,362 | (138,583 | ) | 2,698,630 | 20,671 | |||||||||||||

Purchases of property plant and equipment |

10,714 | 10,493 | 65,879 | 60,215 | 46,351 | 18,496 | |||||||||||||||

- (1)

- Adjusted

EBITDA is defined as net income (loss) before equity in earnings of unconsolidated subsidiary, income tax (benefit) expense, loss on debt

extinguishment, other income (expense), net, realized gains (losses) on investments, interest expense, equity-based compensation expense, related party management fees, restructuring charges, and

depreciation and amortization expense. Adjusted EBITDA measures are commonly used by management and investors as performance measures and liquidity indicators. Adjusted EBITDA is not considered a

measure of financial performance under GAAP, and the items excluded from Adjusted EBITDA are significant components in understanding and assessing our financial performance. Adjusted EBITDA should not

be considered in isolation or as an alternative to such GAAP measures as net income (loss), cash flows provided by or used in operating, investing or financing activities or other financial statement

data presented in our consolidated financial statements as an indicator of financial performance or liquidity. Some of these limitations

are:

- •

- Adjusted EBITDA does not reflect changes in, or cash requirements for, working capital needs;

14

- •

- Adjusted EBITDA does not reflect interest expense, or the requirements necessary to

service interest or principal payments on debt;

- •

- Adjusted EBITDA does not reflect income tax expenses or the cash requirements to

pay taxes;

- •

- Adjusted EBITDA does not reflect historical cash capital expenditures or future

requirements for capital expenditures or contractual commitments; and

- •

- Although depreciation and amortization charges are non-cash charges, the assets

being depreciated and amortized will often have to be replaced in the future, and Adjusted EBITDA does not reflect any cash requirements for such replacements.

Because Adjusted EBITDA is not a measure determined in accordance with GAAP and is susceptible to varying calculations, Adjusted EBITDA, as presented, may not be comparable to other similarly titled measures of other companies.

The following table sets forth a reconciliation of Adjusted EBITDA to net income (loss) for the periods presented:

| |

Successor | |

Predecessor | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Three Months ended March 31, |

Year ended December 31, |

Period from May 25 through December 31, 2011 |

|

Period from January 1 through May 24, 2011 |

||||||||||||||||

| |

2014

|

2013

|

2013

|

2012

|

|||||||||||||||||

| |

(unaudited) |

|

|

|

|

|

|||||||||||||||

| |

(dollars in thousands, except share and per share data) |

||||||||||||||||||||

Net income (loss) |

$ | 21,525 | $ | (3,847 | ) | $ | 11,495 | $ | 41,185 | $ | 13,019 | $ | 20,668 | ||||||||

Net loss (income) attributable to non-controlling interest |

3,300 | — | (5,500 | ) | — | — | — | ||||||||||||||

Equity in earnings of unconsolidated subsidiary(a) |

(47 | ) | (75 | ) | (323 | ) | (379 | ) | (276 | ) | (143 | ) | |||||||||

Income tax expense (benefit) |

16,675 | 2,568 | (994 | ) | 27,463 | 9,328 | 19,242 | ||||||||||||||

Loss on early debt extinguishment(b) |

— | 122 | 68,379 | 8,307 | — | 10,069 | |||||||||||||||

Other expense (income), net |

808 | 12,721 | 12,760 | (1,422 | ) | 3,151 | 28,873 | ||||||||||||||

Realized (gains) losses on investments(c) |

(606 | ) | (13 | ) | (471 | ) | (394 | ) | (41 | ) | 9 | ||||||||||

Interest expense |

30,049 | 51,752 | 186,701 | 182,607 | 104,701 | 7,886 | |||||||||||||||

Related party management fees(d) |

— | 1,250 | 23,109 | 5,000 | 3,014 | 399 | |||||||||||||||

Equity-based compensation expense(e) |

1,062 | 1,062 | 4,248 | 4,248 | 4,098 | 15,112 | |||||||||||||||

Restructuring charges(f) |

809 | 637 | 5,669 | 14,086 | 6,483 | — | |||||||||||||||

Depreciation and amortization expense |

36,432 | 34,755 | 140,632 | 123,751 | 71,312 | 28,467 | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA |

$ | 110,007 | $ | 100,932 | $ | 445,705 | $ | 404,452 | $ | 214,789 | $ | 130,582 | |||||||||

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

- (a)

- Represents

the equity in earnings recognized in the 2011, 2012, 2013 and 2014 periods relating to the minority interest held by AMR in a joint venture in

Trinidad. AMR recognizes equity in earnings of the unconsolidated subsidiary in the income statement but not as a component of Adjusted EBITDA.

- (b)

- Represents

the write-off of debt issuance costs associated with unscheduled debt repayments in 2011 and 2012, the redemption in full of our 9.250%/10.000%

Senior PIK Toggle Notes due 2017 in August 2013 and the redemption of $332.5 million in principal amount of EVHC's 2019 Notes in December 2013, of which $5.2 million was held by our

captive insurance subsidiary.

- (c)

- Represents

realized gains or losses on investments held at EMCA Insurance Company, Ltd. ("EMCA") associated with insurance related assets. These

gains or losses are recorded only upon a sale or maturity of such investments.

- (d)

- Represents the management fee paid to CD&R for the Successor period and management fees paid to Onex Partners LP and Onex Corporation for the Predecessor period.

15

- (e)

- Represents

the non-cash equity based compensation expense related to equity based awards under the Predecessor and Successor equity incentive plans.

- (f)

- Represents restructuring charges incurred in connection with the continuing efforts to re-align operations and billing functions of AMR and EmCare and reduce administrative costs at EVHC.

- (2)

- Working

capital is defined as current assets less current liabilities.

- (3)

- Total

debt is defined as long-term debt and capital lease obligations, including current maturities, and excludes adjustments resulting from original issue

discounts, which are accounted for as a reduction to outstanding debt. Net debt is defined as Total debt less cash and cash equivalents. Total debt and Net debt amounts are reduced by

$9.8 million principal amount of EVHC's 2019 Notes held by EVHC's captive insurance subsidiary, EMCA, as of December 31, 2013.

- (4)

- In April 2013, we paid $52.1 million in a settlement of a former stockholder's appraisal action arising from the Merger. Of the total amount we paid, $13.7 million was included in cash flows from operating activities and $38.4 million was included in cash flows from financing activities for the year ended December 31, 2013. See Note 17 to our audited consolidated financial statements included in our 2013 Form 10-K.

16

Investing in our common stock involves a high degree of risk. Before you make your investment decision, you should carefully consider the risks described below and the other information contained in this prospectus and the documents incorporated by reference into this prospectus, including our consolidated financial statements and related notes. If any of the following risks actually occurs, our business, financial position, results of operations or cash flows could be materially adversely affected.

You should carefully consider the factors described below, in addition to the other information set forth in this prospectus and the documents incorporated by reference into this prospectus, when evaluating us and our business. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may also materially and adversely affect our business operations. Any of the following risks could materially adversely affect our business, financial condition or results of operations.

Risks Related to Our Business

We are subject to decreases in our revenue and profit margin under our fee-for-service contracts, where we bear the risk of changes in volume, payor mix and third party reimbursement rates.

In our fee-for-service arrangements, which generated approximately 84% of our net revenue for the year ended December 31, 2013, we, or our affiliated physicians, collect the fees for transports and physician services provided. Under these arrangements, we assume financial risks related to changes in the mix of insured and uninsured patients and patients covered by government-sponsored healthcare programs, third party reimbursement rates, and transports and patient volume. In some cases, our revenue decreases if our volume or reimbursement decreases, but our expenses may not decrease proportionately. See "— Risks Related to Healthcare Regulation — Changes in the rates or methods of third party reimbursements, including due to political discord in the budgeting process outside our control, may adversely affect our revenue and operations".

We collect a smaller portion of our fees for services rendered to uninsured patients than for services rendered to insured patients. Our credit risk related to services provided to uninsured individuals is exacerbated because the law requires communities to provide "911" emergency response services and hospital EDs to treat all patients presenting to the ED seeking care for an emergency medical condition regardless of their ability to pay. We also believe uninsured patients are more likely to seek care at hospital EDs because they frequently do not have a primary care physician with whom to consult.

Our revenue would be adversely affected if we lose existing contracts.

A significant portion of our growth historically has resulted from increases in the number of patient encounters and fees for services we provide under existing contracts, the addition of new contracts and the increase in the number of emergency and non-emergency transports. Substantially all of our net revenue in the year ended December 31, 2013 was generated under contracts, including exclusive contracts that accounted for approximately 89% of our 2013 net revenue. Our contracts with hospitals generally have terms of three years and the term of our contracts with communities to provide "911" services generally ranges from three to five years. Most of our contracts are terminable by either of the parties upon notice of as little as 30 days. Any of our contracts may not be renewed or, if renewed, may contain terms that are not as favorable to us as our current contracts. We cannot assure you that we will be successful in retaining our existing contracts or that any loss of contracts would not have a material adverse effect on our business, financial condition and results of operations. Furthermore, certain of our contracts will

17

expire during each fiscal period, and we may be required to seek renewal of these contracts through a formal bidding process that often requires written responses to a request for proposal. We cannot assure you that we will be successful in retaining such contracts or that we will retain them on terms that are as favorable as present terms.

We may not accurately assess the costs we will incur under new contracts.

Our new contracts increasingly involve a competitive bidding process. When we obtain new contracts, we must accurately assess the costs we will incur in providing services in order to realize adequate profit margins and otherwise meet our financial and strategic objectives. Increasing pressures from healthcare payors to restrict or reduce reimbursement rates at a time when the costs of providing medical services continue to increase make assessing the costs associated with the pricing of new contracts, as well as maintenance of existing contracts, more difficult. Starting new contracts in a number of our service lines may also negatively impact cash flow as we absorb various expenses before we are able to bill and collect revenue associated with the new contracts. In addition, integrating new contracts, particularly those in new geographic locations, could prove more costly, and could require more management time, than we anticipate. Our failure to accurately predict costs or to negotiate an adequate profit margin could have a material adverse effect on our business, financial condition and results of operations.

We may not be able to successfully recruit and retain physicians and other healthcare professionals with the qualifications and attributes desired by us and our customers.

Our ability to recruit and retain affiliated physicians and other healthcare professionals significantly affects our performance under our contracts. Our customer hospitals have increasingly demanded a greater degree of specialized skills, training and experience in the healthcare professionals providing services under their contracts with us. This decreases the number of healthcare professionals who may be permitted to staff our contracts. Moreover, because of the scope of the geographic and demographic diversity of the hospitals and other facilities with which we contract, we must recruit healthcare professionals, and particularly physicians, to staff a broad spectrum of contracts. We have had difficulty in the past recruiting physicians to staff contracts in some regions of the country and at some less economically advantaged hospitals. Moreover, we compete with other entities to recruit and retain qualified physicians and other healthcare professionals to deliver clinical services. Our future success in retaining and winning new hospital contracts depends in part on our ability to recruit and retain physicians and other healthcare professionals to maintain and expand our operations.

Our non-compete agreements and other restrictive covenants involving physicians may not be enforceable.

We have contracts with physicians and professional corporations in many states. Some of these contracts, as well as our contracts with hospitals, include provisions preventing these physicians and professional corporations from competing with us both during and after the term of our relationship with them. The law governing non-compete agreements and other forms of restrictive covenants varies from state to state. Some states are reluctant to strictly enforce non-compete agreements and restrictive covenants applicable to physicians. There can be no assurance that our non-compete agreements related to affiliated physicians and professional corporations will not be successfully challenged as unenforceable in certain states. In such event, we would be unable to prevent former affiliated physicians and professional corporations from competing with us, potentially resulting in the loss of some of our hospital contracts.

18

If we fail to implement our business strategy, our financial performance and our growth could be materially and adversely affected.