Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Sorrento Tech, Inc. | d623882dex231.htm |

| EX-1.1 - EX-1.1 - Sorrento Tech, Inc. | d623882dex11.htm |

| EX-10.26 - EX-10.26 - Sorrento Tech, Inc. | d623882dex1026.htm |

| EX-3.5 - EX-3.5 - Sorrento Tech, Inc. | d623882dex35.htm |

| EX-10.27 - EX-10.27 - Sorrento Tech, Inc. | d623882dex1027.htm |

| EX-5.1 - EX-5.1 - Sorrento Tech, Inc. | d623882dex51.htm |

| EX-10.4 - EX-10.4 - Sorrento Tech, Inc. | d623882dex104.htm |

| EX-3.2 - EX-3.2 - Sorrento Tech, Inc. | d623882dex32.htm |

| EX-10.20 - EX-10.20 - Sorrento Tech, Inc. | d623882dex1020.htm |

| EX-3.3 - EX-3.3 - Sorrento Tech, Inc. | d623882dex33.htm |

| EX-10.24 - EX-10.24 - Sorrento Tech, Inc. | d623882dex1024.htm |

| EX-4.7 - EX-4.7 - Sorrento Tech, Inc. | d623882dex47.htm |

| EX-4.1 - EX-4.1 - Sorrento Tech, Inc. | d623882dex41.htm |

| EX-10.22 - EX-10.22 - Sorrento Tech, Inc. | d623882dex1022.htm |

Table of Contents

As filed with the Securities and Exchange Commission on July 7, 2014

Registration No. 333-196135

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ROKA BIOSCIENCE, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 3826 | 27-0881542 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

20 Independence Boulevard

Warren, New Jersey 07059

(908) 605-4700

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Steven T. Sobieski

Senior Vice President and Chief Financial Officer

Roka Bioscience, Inc.

20 Independence Boulevard

Warren, New Jersey 07059

(908) 605-4700

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Steven M. Skolnick Meredith Prithviraj Lowenstein Sandler LLP 1251 Avenue of the Americas New York, NY 10020 (212) 262-6700 |

Mitchell S. Bloom Michael H. Bison Goodwin Procter LLP 53 State Street Exchange Place Boston, MA 02109 (617) 570-1000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

The registrant is an “emerging growth company” as defined in Section 2(a) of the Securities Act. This registration statement complies with the requirements that apply to an issuer that is an emerging growth company.

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of each class of securities to be registered |

Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee(2) | ||

| Common Stock, par value $0.001 per share |

$86,250,000 | $11,109 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933. Includes the offering price of shares that the underwriters have the option to purchase to cover over-allotments, if any. |

| (2) | Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price of the securities registered hereunder to be sold by the registrant. The registrant previously paid $9,660 in connection with the original filing on May 21, 2014 and has paid $1,449 in connection with the filing of this amendment. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated July 7, 2014

PROSPECTUS

5,000,000 Shares

Common Stock

This is Roka Bioscience, Inc.’s initial public offering. We are selling 5,000,000 shares of our common stock.

We expect the public offering price to be between $14.00 and $16.00 per share. Currently, no public market exists for the shares. After pricing of the offering, we expect that the shares will trade on the NASDAQ Global Market under the symbol “ROKA.”

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 and will be subject to reduced public company reporting requirements. See “Prospectus Summary—Implications of Being an Emerging Growth Company”

Investing in our common stock involves risks that are described in the “Risk Factors” section beginning on page 14 of this prospectus.

| Per Share |

Total |

|||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount(1) |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| (1) | We refer you to “Underwriting” beginning on page 145 of this prospectus for additional information regarding total underwriter compensation. |

The underwriters may also exercise their option to purchase up to an additional 750,000 shares from us at the public offering price, less the underwriting discount, for 30 days after the date of this prospectus.

The shares will be ready for delivery on or about , 2014.

Certain of our existing stockholders, including stockholders affiliated with certain of our directors, have indicated an interest in purchasing up to an aggregate of approximately $15.0 million in shares of our common stock in this offering at the initial public offering price. However, because indications of interest are not binding agreements or commitments to purchase, the underwriters could determine to sell more, less or no shares to any of these potential investors and any of these potential investors could determine to purchase more, less or no shares in this offering.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| BofA Merrill Lynch | Leerink Partners |

| Cowen and Company | Wedbush PacGrow Life Sciences |

The date of this prospectus is , 2014.

Table of Contents

You should rely only on the information contained in this prospectus and any related free writing prospectus that we may provide to you in connection with this offering. We have not, and the underwriters have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: neither we nor any of the underwriters has done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this offering in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus and any such free writing prospectus outside of the United States.

-i-

Table of Contents

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should read the entire prospectus carefully, including the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes included elsewhere in this prospectus. Unless the context suggests otherwise, references in this prospectus to “Roka,” the “Company,” “we,” “us” and “our” refer to Roka Bioscience, Inc. References in this prospectus to “Gen-Probe” refer to Gen-Probe Incorporated, which is a wholly-owned subsidiary of Hologic, Inc.

Company Overview

We are a molecular diagnostics company initially focused on providing advanced testing solutions for the detection of foodborne pathogens, which is projected to be the fastest growing segment of the $2 billion food safety testing market. The proprietary molecular technology used in our assays enables us to offer accurate and rapid testing solutions while our fully automated instrument helps our customers reduce labor costs and minimize operator error. We recently launched our proprietary Atlas Detection Assays and Atlas instrument in the North American food safety testing market and have worldwide rights to develop and commercialize our advanced molecular testing solutions for a wide range of other industrial applications.

We believe our Atlas solution addresses the significant performance gaps that traditional pathogen detection methods have with respect to accuracy, time to results and automation. Our Atlas Detection Assays incorporate our advanced molecular technologies and are performed on our “sample-in-result-out” Atlas instrument that automates all aspects of molecular diagnostic testing on a single, integrated platform, which is designed to provide our customers with accurate and rapid test results with reduced labor costs and improved laboratory efficiencies. Although we are in the early stages of commercialization and rely on a limited number of customers, our initial customers include key opinion leaders in food safety testing, such as leading contract testing labs, well-known food processors and government agencies. Through June 30, 2014, we have installed 36 Atlas instruments pursuant to commercial agreements.

We expect the food safety testing market to grow due to enactment of new government regulations to improve food safety, quality improvement initiatives by food processors and consumer demand for safe food. We believe we are uniquely positioned to gain share in the food safety testing market given our key strengths:

| • | innovative molecular-based assays, designed to deliver accurate and rapid test results; |

| • | fully automated instrument, designed to reduce labor costs and operator error; |

| • | dedicated sales force, customer service organization and customer applications laboratory; |

| • | highly scalable business model with significant operating leverage potential; |

| • | significant technical expertise and extensive understanding of food safety customers; and |

| • | experienced management team with a proven track record of performance. |

We believe we have the potential to transform microbiological testing in the industrial application markets by delivering enhanced molecular-based testing solutions with respect to assay accuracy, time to results and automation. We have worldwide rights, except for certain rights retained by Gen-Probe, to Gen-Probe’s

-1-

Table of Contents

broad intellectual property portfolio including assay technologies and instrument platforms for microbiological testing in industrial application markets including food safety, pharmaceutical process, personal care products, water and environmental, veterinary, biothreat and infection control in healthcare facilities including testing for Hospital Acquired Infections, or HAI. We purchase our Atlas instruments from Gen-Probe as well as certain proprietary disposable components and certain proprietary reagents and universal reagents that we use to manufacture our Atlas Detection Assays, which assays also contain our proprietary compositions and methods.

Company Strategy

Our objective is to transform testing for microbiological and chemical contaminants in industrial application markets, including food safety, by developing and commercializing diagnostic products that provide accurate, rapid and cost-effective test results on fully automated platforms. To achieve this objective, our strategy is to:

Expand commercialization of our Atlas Detection Assays for foodborne pathogens in North America.

We intend to leverage our dedicated sales force, dedicated customer service organization and flexible instrument placement strategies to drive adoption of our Atlas instrument and Atlas Detection Assays. To accelerate market adoption, we conduct comparative methods and workflow efficiency studies that seek to demonstrate the high accuracy, rapid time to results and cost-effectiveness of our Atlas solution.

Drive innovation in foodborne pathogen testing beyond our current menu of assays.

We currently offer molecular tests for Salmonella, Listeria, E. coli O157:H7, Shiga toxin-producing E. coli and Listeria monocytogenes, which we estimate address 98% of global pathogen test volume. We are actively working on next generation versions of these tests. We also plan to reach a broader customer base by launching non-amplified versions of our molecular tests in 2015 as well as by developing a fully automated molecular diagnostic instrument designed for lower throughput customers.

Develop a portfolio of innovative food safety tests beyond foodborne pathogen tests.

Our customers have food safety testing needs beyond pathogen detection, including the detection of chemical contaminants, such as allergens, antibiotic residues and mycotoxins, and non-pathogenic indicator organisms. We believe we can leverage our development expertise, commercial infrastructure, customer relationships and knowledge of the regulatory environment applicable to our customers to enter these adjacent and complementary segments of the food safety testing market.

Selectively launch our innovative food safety testing products in global markets.

We intend to selectively globalize our business with a market specific, hybrid model of direct sales and/or strategic partnerships with established food safety companies. We believe our customers will require us to provide global solutions for pathogen testing due in part to The Food Safety Modernization Act, or FSMA, which requires verification of foreign supplier preventive controls to ensure the safety of the $110 billion worth of food imported into the United States annually.

Develop innovative diagnostic products for industrial application markets beyond food safety.

We believe the inherent strengths of the proprietary technology used in our products with respect to the delivery of accurate, rapid and cost-effective microbiological test results on a fully automated instrument will be relevant for a wide range of industrial application markets. We intend to selectively seek opportunities to develop solutions for markets such as personal care products, water and environmental, veterinary, pharmaceutical process, biothreat and infection control in healthcare facilities, including testing for HAI. We have not yet evaluated the regulatory pathway, if any, necessary for the development of these solutions.

-2-

Table of Contents

Market Opportunity

Foodborne illness is a substantial and growing public health problem. The imperative to ensure a safe food supply is becoming more challenging due to the growing industrialization and globalization of food production. We estimate the value of the 2013 global food safety testing market to be approximately $2 billion. Our market estimate is comprised of three distinct testing segments for foodborne contaminants:

| • | Pathogen Testing—the detection of disease-causing microorganisms, primarily bacteria, or pathogens, such as Salmonella, Listeria, E. coli O157:H7, Shiga toxin-producing E. coli and Listeria monocytogenes, which we estimate to be approximately $730 million; |

| • | Chemical Contaminants Testing—the detection of chemical contaminants such as allergens, mycotoxins and drug residues, which we estimate to be approximately $570 million; and |

| • | Indicator Organism Testing—the detection of organisms that are not inherently pathogenic, such as coliforms, yeast and molds, which we estimate to be approximately $700 million. |

We are initially focused on the pathogen testing segment of the food safety testing market. The most commonly tested foodborne pathogens are Salmonella, Listeria, E. coli O157:H7, Shiga toxin-producing E. coli and Listeria monocytogenes, which we estimate collectively represent 98% of the pathogen testing performed by food processors and third-party contract testing laboratories. We estimate the pathogen testing market to be 167 million tests in 2013 and we expect it to increase at an approximate 6% compound annual growth rate through 2017 due to the enactment of new government regulations to improve food safety, quality improvement initiatives by food processors and consumer demand for safe food.

Pathogen testing includes traditional culture-based methods as well as newer immunochemical and molecular-based methods. We believe that the pathogen testing segment of the market will continue to migrate away from culture and immunochemical methods towards molecular-based methods, especially in North America, as food processors seek to improve assay accuracy and obtain faster time to results. We expect the use of higher value molecular test methods to increase at approximately twice the growth rate of the overall test market, at an approximately 10% compound annual growth rate from 2013 to 2017.

In addition to pathogen testing, we are exploring opportunities to develop or acquire technologies and products to address the chemical contaminant testing market. In the future, we also intend to develop or acquire technologies and products to address the indicator organism testing market.

Limitations of Competing Pathogen Testing Methods

Complexities and challenges of pathogen testing

The presence of a single pathogenic bacterial cell may be sufficient to cause foodborne illness in a person consuming or handling contaminated food. Current pathogen testing standards require the detection of a single pathogenic bacterial cell in a food sample ranging in size from 25 to 375 grams, a challenge similar to finding a needle in a haystack.

The microbiological analysis of food is a difficult task due to the complexity and wide variety of food sample types, the heterogeneous distribution of low levels of pathogens, the need to detect and discriminate closely related species and the technical limitations of current pathogen testing methods.

The complexity and labor-intensity of current pathogen testing methods also contributes to the challenge of obtaining accurate test results. The high number of technical process steps and manual touches per sample in

-3-

Table of Contents

current pathogen test methods significantly increases the likelihood of operator error. In addition, in light of the increased sensitivity of molecular pathogen testing methods relative to other testing methods, failure to adopt and sufficiently train personnel on appropriate laboratory practices and processes increases the likelihood of operator error and inaccurate test results.

Performance gaps of current pathogen testing

We believe current pathogen test methods have significant performance gaps in areas of critical importance to food processors, third-party contract testing laboratories and the government agencies that regulate food safety. We believe customers are seeking improvements in pathogen testing in the following areas:

| • | Accuracy—new methods that enable the delivery of more accurate test results, regardless of sample type, in order to reduce significant lost revenue, brand erosion and operational costs associated with false positive and false negative test results. |

| • | Time to Results—new methods that enable the delivery of faster test results in order to reduce the delay in operational response to pathogen control, to potentially reduce working capital needs due to longer product release times and support a longer shelf life for perishable products. |

| • | Automation—new methods that enable higher test volume throughput with reduced labor costs, reduced training requirements, improved accuracy through reduction of operator error and complete electronic data traceability and audit trail. |

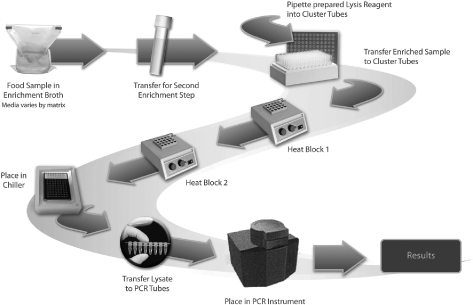

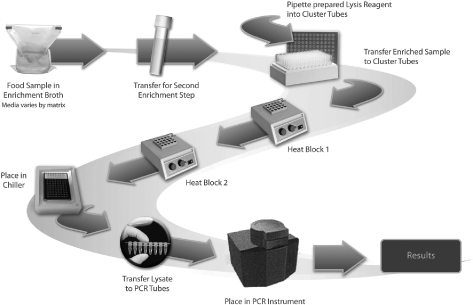

While customers seeking improvement in pathogen testing methods have moved towards adopting molecular PCR-based methods, the workflow for PCR-based methods is complex and labor-intensive. Current pathogen test methods involve up to approximately 40 process steps and up to approximately 30 manual touches per sample for a typical PCR-based method. The workflow for a commonly used molecular PCR-based pathogen detection method for Salmonella and Listeria is illustrated below.

Molecular PCR-based Testing Workflow

-4-

Table of Contents

Our Solution

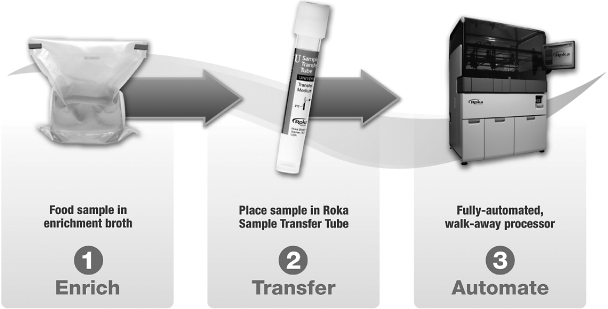

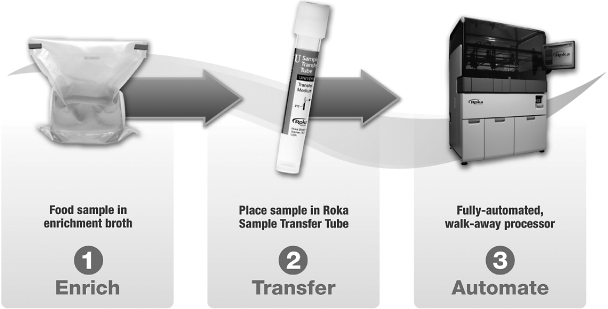

Our Atlas solution delivers accurate, rapid and cost-effective molecular diagnostic test results for foodborne pathogens in three steps: enrich, transfer and automate.

| • | Enrich—a single, shortened sample enrichment step with commercially available media. |

| • | Transfer—a single transfer step with no manual preparation of the sample required. |

| • | Automate—load sample on the Atlas instrument with complete electronic data traceability and audit trail. |

Roka Workflow

We believe our Atlas solution addresses the significant performance gaps facing today’s food testing market by delivering improved accuracy, faster time to results and full automation compared to competitive pathogen test methods. Our Atlas Detection Assays for foodborne pathogen testing are performed on the “sample-in-result-out” Atlas instrument that automates all aspects of molecular diagnostic testing on a single, integrated platform.

Commercialization Strategy

We intend to drive adoption of our Atlas solution for foodborne pathogen testing by executing on our commercialization strategy. To achieve this objective, we plan to:

| • | target high-volume throughput laboratories that are typically performing 75 to 150 molecular tests per instrument per day; |

-5-

Table of Contents

| • | demonstrate the technical advantages of our Atlas solution by conducting comparative method and verification studies; |

| • | demonstrate the economic benefits of automation derived from the Atlas instrument by conducting total value analysis studies in collaboration with our customers; |

| • | partner with customers in the sales and implementation process to minimize the learning curve associated with adopting a new molecular testing method; |

| • | minimize barriers to adoption of our Atlas solution with a flexible instrument placement strategy; and |

| • | collaborate with food safety thought leaders and regulatory authorities to support the evaluation and adoption of our Atlas Detection Assays. |

Future Growth Opportunities

We are committed to developing diagnostic products that provide accurate, rapid and cost-effective test results on fully automated instrument platforms for use in the food safety testing market and a range of other industrial application markets.

Within the food safety testing market, we are pursuing the initiatives described below:

| • | development of an innovative, non-amplified version of our molecular-based testing products for detection of Salmonella and Listeria, which we believe will allow our customers the flexibility to consolidate different test methods at multiple price points on a single platform; |

| • | development of a low-volume throughput version of our Atlas instrument that we refer to as the mini Atlas instrument to address the needs of lower-volume throughput testing laboratories; and |

| • | exploration of opportunities to develop or acquire technologies and products to address adjacent and complementary segments of the food safety testing market. |

Additionally, we seek future opportunities where our technologies could provide an improved solution for microbiological testing in industrial application markets including pharmaceutical process, personal care products, water and environmental, veterinary, biothreat and infection control in healthcare facilities. We have worldwide rights, except for certain rights retained by Gen-Probe, to Gen-Probe’s broad intellectual property portfolio including assay technologies and instrument platforms.

Recent Developments

In June 2014, we entered into an amendment to our license agreement with Gen-Probe which grants us a two-year option to reduce the royalty rate we pay to Gen-Probe in exchange for an option payment of $2.5 million in cash. The option is exercisable at our discretion if we raise less than $55.0 million in net proceeds from this offering and is automatically exercised if we raise at least $55.0 million in net proceeds from this offering. We expect that the option would be exercised simultaneously with the closing of this offering. Upon exercise of such option, we will make the following payments to Gen-Probe: (i) within ten days of the closing of this offering, we would issue 865,063 shares of our common stock to Gen-Probe, (ii) within ten days of the closing of this offering, we would make a cash payment of $8.0 million using a portion of the net proceeds from this offering, (iii) on January 1, 2018, we would make a cash payment of $5.0 million and (iv) on January 1, 2020, we would make a cash payment of $5.0 million. In addition, if we achieve certain revenue milestones, we

-6-

Table of Contents

would pay additional milestone fees of up to $6.0 million and the royalty rate would be further reduced. We may elect to accelerate the royalty rate reduction by paying the additional milestone fees in advance of achieving the applicable revenue milestone. Upon making the payments described under clauses (i) and (ii), the royalty we pay to Gen-Probe for sales of our Atlas Detection Assays, which percentage is currently 12%, will be reduced to 8% and if all payments are made, including the milestone payments, such royalty will be reduced to 4%.

Our Risks

An investment in our common stock involves a high degree of risk. You should carefully consider the risks summarized below. These risks are discussed more fully in the “Risk Factors” section of this prospectus immediately following this prospectus summary. These risks include, but are not limited to, the following:

| • | we may not be able to generate sufficient revenue from the commercialization of our Atlas Detection Assays and Atlas instruments to achieve or sustain profitability; |

| • | our sales cycle is lengthy and variable, which makes it difficult for us to forecast revenue and other operating results; |

| • | we have limited experience in marketing and selling our products, and if we are unable to adequately address our customers’ needs, it could negatively impact sales and market acceptance of our product and we may never generate sufficient revenue to achieve or sustain profitability; |

| • | if we cannot compete successfully with our competitors, we may be unable to increase or sustain our revenue or achieve or sustain profitability; |

| • | if our products do not perform as expected, whether as a result of operator error or otherwise, it would impair our operating results and reputation; |

| • | we depend on certain technologies that are licensed to us. We do not control these technologies and any loss of our rights to them could prevent us from selling our products; |

| • | claims that our molecular assays and instruments infringe the patent rights of third parties, including a patent that expires next year which has some claims that are relevant to nucleic acid hybridization and detection, could result in costly litigation or, in the event of an unfavorable outcome, could result in damages and have an adverse impact on our ability to commercialize our current or future products, grow and maintain profitability and could have a material adverse impact on our business; |

| • | we are an early, commercial-stage company and have a limited operating history, which may make it difficult to evaluate our current business and predict our future performance; |

| • | we have a history of net losses and we expect to incur net losses in the future and we may never achieve or sustain profitability; and |

| • | our independent registered public accounting firm’s report for the fiscal year ended December 31, 2013 includes an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern. |

-7-

Table of Contents

Implications of Being an Emerging Growth Company

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and, for as long as we continue to be an “emerging growth company,” we are permitted to, and intend to, rely on exemptions from certain disclosure requirements. In particular, we have provided only two years of audited financial statements and we have not included all of the executive compensation related information that would be required in this prospectus if we were not an emerging growth company. In addition, the JOBS Act provides that an “emerging growth company” can take advantage of an extended transition period for complying with new or revised accounting standards, delaying the adoption of these accounting standards until they would apply to private companies. However, we are electing not to take advantage of such extended transition period, and as a result we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that our decision to not take advantage of the extended transition period for complying with new or revised accounting standards is irrevocable. We could be an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, amended, or the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period.

Corporate Information

We were incorporated in Delaware under the name Roka Bioscience, Inc. in September 2009. Our principal executive offices are located at 20 Independence Boulevard, Warren, New Jersey 07059, and our telephone number is (908) 605-4700. Our website address is www.rokabio.com. Our website and the information contained on, or that can be accessed through, our website will not be deemed to be incorporated by reference in, and are not considered part of, this prospectus. You should not rely on our website or any such information in making your decision whether to purchase our common stock.

We own various U.S. federal trademark registrations and applications, and unregistered trademarks and servicemarks, including Roka Bioscience®, our corporate logo, Atlas®, the Atlas logo, and mini AtlasTM. All other trademarks or trade names referred to in this prospectus are the property of their respective owners. Solely for convenience, the trademarks and trade names in this prospectus are referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend the use or display of other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

-8-

Table of Contents

THE OFFERING

| Common stock offered by us |

5,000,000 Shares |

| Common stock to be outstanding after this offering |

17,631,596 Shares |

| Underwriters’ option to purchase additional shares from us |

750,000 Shares |

| Use of proceeds |

We estimate that we will receive net proceeds from this offering of approximately $67.4 million, or approximately $77.8 million if the underwriters exercise their overallotment option in full, based upon an assumed initial public offering price of $15.00 per share (the midpoint of the estimated price range set forth on the cover page of this prospectus) and after deducting the underwriting discounts and commissions and estimating offering expenses payable by us. We intend to use the net proceeds from this offering to fund the commercialization of our products and our research and development activities and to pay $8.0 million to Gen-Probe pursuant to the amendment to our license agreement with Gen-Probe, as well as for working capital and other general corporate purposes. See the section entitled “Use of Proceeds” for a more complete description of the intended use of proceeds from this offering. |

| Dividend policy |

We have never declared or paid any cash dividends on our common stock, and currently do not plan to declare cash dividends on shares of our common stock in the foreseeable future. We expect that we will retain all of our available funds and future earnings, if any, for use in the operation and expansion of our business. Our loan agreements prohibit us from paying cash dividends on our common stock and the terms of any future loan agreement we enter into or any debt securities we may issue are likely to contain similar restrictions on the payment of dividends. |

| Risk factors |

See the section entitled “Risk Factors” and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in shares of our common stock. |

| Proposed NASDAQ Global Market symbol |

ROKA |

Certain of our existing stockholders, including stockholders affiliated with certain of our directors, have indicated an interest in purchasing up to an aggregate of approximately $15.0 million in shares of our common stock in this offering at the initial public offering price. However, because indications of interest are not binding agreements or commitments to purchase, the underwriters could determine to sell more, less or no shares to any of these potential investors and any of these potential investors could determine to purchase more, less or no shares in this offering. Any shares purchased by our existing stockholders will be subject to lock-up restrictions described in “Shares Eligible for Future Sale.”

-9-

Table of Contents

The number of shares of our common stock to be outstanding after this offering is based on 12,631,596 shares of common stock outstanding as of June 30, 2014 and excludes:

| • | 554,484 shares of our common stock issuable upon the exercise of outstanding stock options issued under our equity incentive plan as of June 30, 2014, at a weighted average exercise price of $3.11 per share; |

| • | 270,813 shares of our common stock issuable upon the exercise of warrants outstanding as of June 30, 2014, at a weighted average exercise price of $11.56 per share, which warrants prior to the completion of this offering are exercisable to purchase preferred stock and will be exercisable for common stock following this offering; |

| • | 256,078 additional shares of our common stock reserved for future issuance under our 2009 Equity Incentive Plan, or the 2009 Plan as of June 30, 2014; and |

| • | 1,086,956 shares reserved for future issuance under our 2014 Equity Incentive Plan, or the 2014 Plan, as of June 30, 2014. |

Unless otherwise indicated, all information in this prospectus reflects or assumes the following:

| • | the filing and effectiveness of our amended and restated certificate of incorporation and the adoption of our amended and restated bylaws, which will occur upon completion of this offering; |

| • | a 1-for-11.04 reverse split of our common stock effected on July 3, 2014; |

| • | the conversion of all of our outstanding shares of preferred stock into an aggregate of 10,494,557 shares of common stock upon the completion of this offering; |

| • | the elimination of our Series A common stock and Series B common stock and the creation of one series of common stock, which will occur upon completion of this offering; |

| • | the conversion of warrants exercisable for 2,989,804 shares of preferred stock into warrants exercisable for an aggregate of 270,813 shares of common stock; |

| • | no issuance or exercise of stock options or warrants on or after June 30, 2014; |

| • | the issuance of 865,063 shares of our common stock to Gen-Probe within ten days following the closing of this offering pursuant to the automatic exercise of the royalty reduction option contained in the amendment to our license agreement with Gen-Probe; and |

| • | no exercise by the underwriters of their option to purchase up to an additional 750,000 shares of common stock in this offering. |

-10-

Table of Contents

SUMMARY FINANCIAL DATA

The following tables summarize our financial data. We derived the following summary of our statement of operations data for the years ended December 31, 2013 and 2012 from our audited financial statements and related notes included elsewhere in this prospectus. Our financial statements are prepared and presented in accordance with generally accepted accounting principles in the United States. The summary financial data as of March 31, 2014 and for the three months ended March 31, 2014 and 2013 have been derived from our unaudited financial statements included elsewhere in this prospectus. These unaudited financial statements have been prepared on a basis consistent with our audited financial statements and, in our opinion, contain all adjustments, consisting only of normal and recurring adjustments, necessary for a fair presentation of such financial data. Our historical results are not necessarily indicative of our future results, and our operating results for the three-month period ended March 31, 2014 are not necessarily indicative of the results that may be expected for the fiscal year ending December 31, 2014 or any other interim periods or any future year or period. You should read this information together with the sections entitled “Capitalization,” “Selected Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes included elsewhere in this prospectus.

| Three Months Ended |

Year Ended |

|||||||||||||||

| March 31, 2014 |

March 31, |

December 31, 2013 |

December 31, 2012 |

|||||||||||||

| (unaudited) |

||||||||||||||||

| (in thousands, except share and per share data) | ||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||

| Revenue |

$ | 828 | $ | 266 | $ | 2,182 | $ | 105 | ||||||||

| Operating expenses: |

||||||||||||||||

| Cost of revenue |

1,265 | 1,873 | 6,600 | 3,186 | ||||||||||||

| Research and development |

1,842 | 1,752 | 7,568 | 9,584 | ||||||||||||

| Selling, general and administrative |

5,048 | 4,258 | 17,483 | 16,052 | ||||||||||||

| Amortization of intangible assets |

42 | 42 | 168 | 168 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

8,197 | 7,925 | 31,819 | 28,990 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating loss |

(7,369 | ) | (7,659 | ) | (29,637 | ) | (28,885 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Change in fair value of financial instruments |

(603 | ) | 18 | (2,595 | ) | 4,996 | ||||||||||

| Interest income (expense), net |

(389 | ) | (74 | ) | (438 | ) | (140 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss before income taxes |

(8,361 | ) | (7,715 | ) | (32,670 | ) | (24,029 | ) | ||||||||

| Income tax provision (benefit) |

6 | — | (3,092 | ) | (783 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss and comprehensive loss |

$ | (8,367 | ) | $ | (7,715 | ) | $ | (29,578 | ) | $ | (23,246 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss per common share: |

||||||||||||||||

| Basic and diluted |

$ | (13.68 | ) | $ | (18.33 | ) | $ | (56.81 | ) | $ | (70.54 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average common shares outstanding, basic and diluted |

611,419 | 420,992 | 519,995 | 329,561 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Unaudited pro forma net loss per common share, basic and diluted(1) |

$ | (0.75 | ) | $ | (3.26 | ) | ||||||||||

|

|

|

|

|

|||||||||||||

| Unaudited pro forma weighted average common shares used in computing unaudited pro forma net loss per common share, basic and diluted(1) |

11,105,877 | 9,069,000 | ||||||||||||||

|

|

|

|

|

|||||||||||||

-11-

Table of Contents

| As of March 31, 2014 |

||||||||||||

| Actual |

Pro Forma(1) |

Pro Forma as |

||||||||||

| (unaudited) | ||||||||||||

| (in thousands) | ||||||||||||

| Balance Sheet Data: |

||||||||||||

| Cash and cash equivalents |

$ | 32,699 | $ | 32,699 | $ | 89,549 | ||||||

| Working capital |

27,173 | 27,173 | 84,023 | |||||||||

| Total assets |

56,280 | 56,280 | 143,593 | |||||||||

| Notes payable |

9,725 | 9,725 | 16,712 | |||||||||

| Convertible preferred stock warrant liability |

1,183 | — | — | |||||||||

| Total convertible preferred stock |

127,700 | — | — | |||||||||

| Accumulated deficit |

(109,141 | ) | (109,141 | ) | (109,141 | ) | ||||||

| Total stockholders’ (deficit) equity |

$ | (89,450 | ) | $ | 39,433 | $ | 119,759 | |||||

| (1) | Pro forma to give effect to (i) the conversion upon completion of this offering of all of our outstanding shares of preferred stock into an aggregate of 10,494,557 shares of common stock, (ii) the conversion of our outstanding warrants to purchase shares of our preferred stock into warrants to purchase an aggregate of 270,813 shares of our common stock upon completion of this offering, (iii) the elimination of our Series A common stock and Series B common stock and the creation of one series of common stock to be effected upon completion of this offering and (iv) the filing and effectiveness of our amended and restated certificate of incorporation, which will occur upon completion of this offering. |

| (2) | Pro forma as adjusted to reflect the pro forma adjustments described in (1) above, and to further reflect (i) the sale of 5,000,000 shares of our common stock offered in this offering, assuming an initial public offering price of $15.00 per share (the midpoint of the estimated price range set forth on the cover page of this prospectus,) after deducting underwriting discounts and commissions and estimated offering expenses payable by us and (ii) the payment of the consideration to Gen-Probe pursuant to the amendment to our license agreement with Gen-Probe in connection with the royalty reduction option which will be exercised upon completion of this offering and which is comprised of (a) the payment of $2.5 million in cash by July 10, 2014, (b) the issuance of 865,063 shares of common stock to Gen-Probe within 10 days of the closing of this offering, (c) the payment of $8.0 million in cash within 10 days of the closing of this offering and (d) $5.0 million in cash payable to Gen-Probe on each of January 1, 2018 and January 1, 2020 discounted back to its present value of $7.0 million using the imputed interest method and an estimated average interest rate of 8.25% in exchange for a royalty reduction. Total consideration will be recorded as a $31.4 million addition to our intangible technology asset and will be amortized over the estimated remaining life of the technology asset. |

| (3) | A $1.00 increase (decrease) in the assumed initial public offering price of $15.00 per share (the midpoint of the estimated price range set forth on the cover page of this prospectus) would increase (decrease) the amount of cash and cash equivalents, additional paid-in capital, total stockholders’ equity (deficit) and total capitalization on a pro forma as adjusted basis by approximately $4.7 million, assuming the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. Similarly, each increase (decrease) of one million shares offered by us would increase (decrease) cash and cash equivalents, total stockholders’ equity (deficit) and total capitalization on a pro forma as adjusted basis by approximately $14.0 million, assuming the assumed initial public offering price of $15.00 per share (the midpoint of the estimated price range set forth on the cover page of this prospectus) remains the same, and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. A one million share increase in the number of shares offered by us together with a concomitant $1.00 increase in the assumed initial public offering price of $15.00 per share (the midpoint of the estimated price range set forth on the cover page of this prospectus) would increase each of cash and cash equivalents and total stockholders’ (deficit) equity by approximately $19.5 million after deducting underwriting discounts and |

-12-

Table of Contents

| commissions and any estimated offering expenses payable by us. Conversely, a one million share decrease in the number of shares offered by us together with a concomitant $1.00 decrease in the assumed initial public offering price of $15.00 per share (the midpoint of the estimated price range set forth on the cover page of this prospectus) would decrease each of cash and cash equivalents and total stockholders’ (deficit) equity by approximately $17.7 million after deducting underwriting discounts and commissions and any estimated offering expenses payable by us. The pro forma as adjusted information discussed above is illustrative only and will be adjusted based on the actual public offering price and other terms of this offering determined at pricing. |

-13-

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the following risk factors, as well as the other information in this prospectus, including our financial statements and the related notes thereto, before deciding whether to invest in shares of our common stock. These risk factors contain, in addition to historical information, forward looking statements that involve risks and uncertainties. Our actual results could differ significantly from the results discussed in the forward looking statements. The order in which the following risks are presented is not intended to reflect the magnitude of the risks described. The occurrence of any of the following adverse developments described in the following risk factors could materially and adversely harm our business, financial condition, results of operations or prospects. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Relating to the Commercialization of Our Products

We may not be able to generate sufficient revenue from the commercialization of our Atlas Detection Assays and Atlas instrument to achieve or sustain profitability.

Currently, we rely solely on the commercialization of our Atlas Detection Assays and Atlas instrument to generate revenue. We believe that our commercialization success is dependent upon our ability to significantly increase the number of customers that are using our products. We achieved our first commercial sales in late 2012 and experienced limited revenue and customer adoption during 2013. In addition, demand for our Atlas products may not increase as quickly as planned and we may be unable to increase our revenue levels as expected. We are currently not profitable. Even if we succeed in increasing adoption of our Atlas solution by the food safety testing market, maintaining and creating relationships with our existing and new customers and developing and commercializing additional molecular testing products, we may not be able to generate sufficient revenue to achieve or sustain profitability.

We are in the early stages of commercialization and our Atlas Detection Assays and Atlas instrument may never achieve significant commercial market acceptance.

Our success depends on our ability to develop and market products that are recognized in the food safety testing market as accurate, rapid and cost-effective. Most of our potential customers currently use molecular or immunochemical testing methods and may be reluctant to change those methods to a new technology. Market acceptance will depend on many factors, including our ability to convince potential customers that our Atlas solution is an attractive alternative to existing molecular and immunochemical testing systems. We will need to demonstrate that our products provide accurate, time saving and cost-effective alternatives to existing testing methods. Compared to most competing technologies, our molecular technology is relatively new, and most potential customers have limited knowledge of, or experience with, our products. Prior to adopting our solution, potential customers are required to devote significant time and effort to testing and validating our Atlas Detection Assays and Atlas instrument. In addition, during the implementation phase, customers may be required to devote significant time and effort to training their personnel on appropriate laboratory practices to ensure accurate results due to the highly sensitive nature of our assays, such as our Listeria assay. Although customers have successfully implemented our Listeria assay without experiencing false positives, particularly when sufficient resources have been allocated to training personnel and good laboratory practices and our recommended processes have been appropriately implemented, customers or prospects who may not have properly modified their processes as recommended by us, or may not follow good laboratory practices required of the workflow prior to using our Atlas solution, have experienced false positives during implementation. Any failure of our Atlas solution to meet customer benchmarks or expectations could result in customers choosing to retain their existing testing methods or to adopt systems other than ours.

Many factors influence the perception of a system including its use by leaders in the industry, such as major food processors, third-party food safety testing laboratories and thought leaders. If we are unable to

-14-

Table of Contents

continue to induce major food processors, third-party food safety testing laboratories and thought leaders in the food safety testing market to adopt our Atlas solution, acceptance and adoption of our products could be slowed. In addition, if our products fail to gain significant acceptance in the marketplace and we are unable to expand our customer base, we may never generate sufficient revenue to achieve or sustain profitability.

Our sales cycle is lengthy and variable, which makes it difficult for us to forecast revenue and other operating results.

The sales cycle for our Atlas solution is lengthy, which makes it difficult for us to accurately forecast revenues in a given period, and may cause revenue and operating results to vary significantly from period to period. Potential customers for our products typically need to commit significant time and resources to evaluate the technology used in our products and their decision to purchase our products may be further limited by budgetary constraints and numerous layers of internal review and approval, which are beyond our control. We spend substantial time and effort assisting potential customers in evaluating our Atlas solution, including providing demonstrations and validation on the food types that they test. Even after initial approval by appropriate decision makers, the negotiation and documentation processes for the actual adoption of our Atlas solution can be lengthy. As a result of these factors, based on our experience to date, our sales cycle, the time from initial contact with a prospective customer to routine commercial utilization of our Atlas Detection Assays, has varied and can often be 12 months or longer, which has made it difficult for us to accurately project revenues and other operating results. In addition, the revenue generated from sales of our Atlas Detection Assays may fluctuate from time to time due to changes in the testing volumes of our customers. As a result, our financial results may fluctuate on a quarterly basis which may adversely affect the price of our common stock.

We have limited experience in marketing and selling our products, and if we are unable to adequately address our customers’ needs, it could negatively impact sales and market acceptance of our product and we may never generate sufficient revenue to achieve or sustain profitability.

We sell our Atlas solution through our own direct sales force. We have limited experience in marketing and selling these products, which had their formal commercial launch in late 2012. In addition, our assays and instrument are a new technology to the food safety testing market. Our future sales will depend in large part on our ability to increase our marketing efforts and adequately address our customers’ needs. The food safety testing industry is a large and diverse market. As a result, we believe it is necessary to maintain a sales force that includes sales representatives with specific technical backgrounds that can support our customers’ needs. We will also need to attract and develop sales and marketing personnel with industry expertise. Competition for such employees is intense. We may not be able to attract and retain sufficient personnel to maintain an effective sales and marketing force. If we are unable to adequately address our customers’ needs, it could negatively impact sales and market acceptance of our products and we may never generate sufficient revenue to achieve or sustain profitability.

We may be unable to manage our future growth effectively, which could make it difficult to execute our business strategy.

We commenced our formal commercial launch in late 2012 and anticipate growth in our business operations. Since our inception in 2009, we have increased our number of employees to 121 as of June 30, 2014 and we expect to increase our number of employees further as our business grows. This future growth could create strain on our organizational, administrative and operational infrastructure, including laboratory operations, quality control, customer service and sales and marketing. Our ability to manage our growth properly will require us to continue to improve our operational, financial, and management controls, as well as our reporting systems and procedures. If our current infrastructure is unable to handle our growth, we may need to expand our infrastructure and staff and implement new reporting systems. The time and resources required to implement such expansion and systems could adversely affect our operations. Our expected future growth will impose significant added responsibilities on members of management, including the need to identify, recruit, maintain, and integrate

-15-

Table of Contents

additional employees. Our future financial performance and our ability to commercialize our products and to compete effectively will depend, in part, on our ability to manage this potential future growth effectively, without compromising quality.

If we cannot compete successfully with our competitors, we may be unable to increase or sustain our revenue or achieve or sustain profitability.

The food safety testing industry is highly competitive and we face competition from companies that offer molecular, immunochemical and culture testing products. In order to achieve market acceptance for our products, we may be required to demonstrate that our products provide accurate, cost-effective and time saving alternatives to traditional testing platforms and products made by our competitors.

Key competitors offering molecular pathogen testing solutions include E.I. du Pont de Nemours and Company, Bio-Rad Laboratories, Inc., BioControl Systems, Inc., Life Technologies Corporation and 3M Food Safety. Key competitors offering immunochemical testing solutions include bioMérieux, S.A. and Neogen Corporation. Key competitors offering culture testing solutions include 3M, bioMérieux and Neogen. These companies compete with us primarily on the basis of technology, quality, reputation, accuracy, time to results, ease of use, price, reliability, the timing of new product introductions and product line offerings, including the ability to offer a broader range of testing methods than we can offer. Our existing competitors or new market entrants may be in a better position than we are to respond quickly to new or emerging technologies, may be able to undertake more extensive marketing campaigns, may adopt more aggressive pricing strategies and may be more successful in attracting potential customers. Many of our existing competitors or new market entrants have, or may have, significantly greater financial, marketing, sales, manufacturing, distribution and technological resources than we do. Additionally, these companies may have substantially greater expertise in conducting research and development, greater ability to obtain necessary intellectual property and greater brand recognition than we do, any of which may adversely affect our ability to obtain new customers or retain existing customers.

The loss or significant reduction in business with key customers could have a material adverse effect on our revenue, results of operations and business.

We have a limited number of customers and have derived a significant portion of our revenue from a subset of these customers. For the three months ended March 31, 2014, our top four customers, PrimusLabs, Silliker, Inc, Marshfield Food Safety, LLC and MVTL Laboratories, Inc. accounted for an aggregate of 82% of our total revenue. Each of these customers accounted for more than 10% of our total revenue for the period. For the year ended December 31, 2013, each of Marshfield Food Safety, LLC and MVTL Laboratories, Inc. accounted for more than 10% of our total revenue, together representing an aggregate of 61% of our total revenue. We do not have any long term contracts and our customer contracts are terminable at will by either party. The complete loss of, or significant reduction in business from these key customers or any significant future customers could have a material adverse effect on our revenue, results of operations and business.

Risks Relating to Our Business and Strategy

If our products do not perform as expected, whether as a result of operator error or otherwise, it would impair our operating results and reputation.

Our success depends on the food safety market’s confidence that we can provide reliable, high-quality molecular food safety testing products. There is no guarantee our customers or potential customers will achieve the accuracy that we have demonstrated in our performance studies, particularly as the number of customers using our assays increases and as the number of different assays in our test menu expands. We believe that our customers are likely to be particularly sensitive to product defects and operator errors, including if our assays fail to accurately detect pathogens in food samples or if the failure to detect pathogens leads to a product recall. In addition, our reputation and the reputation of our products can be adversely affected if our assays fail to perform as expected,

-16-

Table of Contents

which performance could be negatively impacted by failure to adopt or modify laboratory practices and processes to support the adoption of our solution, errors made by operators of the Atlas instrument, or if such operators improperly prepare their testing samples or fail to properly enrich them. For example, while we have many customers who have adopted our assays without incident, when customers have failed to properly train personnel, modify processes, or follow good laboratory practices, customers have experienced false positives using our highly sensitive Listeria assay. Based on data provided to us by such customers and observations by our personnel of their implementation of our Atlas solution in their laboratory operations, operators have contaminated samples with Listeria, which generally exists in the laboratory environment, when transferring samples from the enrichment bag to the sample transfer tube, ultimately leading to a false positive result. We have worked, and continue to work, with these customers to allocate appropriate resources to training and implementation of limited process changes and good laboratory practices to resolve these issues. However, if our customers or potential customers fail to implement appropriate laboratory practices or process steps as suggested by us, they may continue to see unsatisfactory test results using our Atlas solution. As a result, the failure or perceived failure of our products to perform as expected, which could have a material adverse effect on our revenue, results of operations and business.

If we are sued for product liability, we could face substantial liabilities that exceed our resources.

The marketing, sale and use of our products could lead to the filing of product liability claims against us were someone to allege that our products failed to identify, or inaccurately or incompletely identified, information regarding the specific pathogens being testing using our products. For instance, in the event a customer using our products is required to recall its food products, such customer may make a claim against us. We may also be subject to liability for errors in, a misunderstanding of, or inappropriate reliance upon, the information we provide in the ordinary course of our business activities. A product liability claim could result in substantial damages to us and be costly and time-consuming for us to defend.

We maintain product liability insurance, but this insurance may not fully protect us from the financial impact of defending against product liability claims. Any product or liability claim brought against us, with or without merit, could increase our insurance rates or prevent us from securing insurance coverage in the future. Additionally, any product liability lawsuit could damage our reputation, or cause current customers and potential customers to seek other products, any of which could have a material adverse effect on our revenue, results of operations and business.

If our facility in San Diego, California becomes damaged or inoperable or we are required to vacate this facility, our ability to continue manufacturing our assays will be disrupted, which could have a material adverse effect on our business.

We manufacture our Atlas Detection Assays and conduct our research and development activities in our facility in San Diego, California. In addition, our San Diego facility is the center for quality assurance and distribution operations and instrument service and customer technical support. Our facility and the equipment we use to manufacture our assays would be costly, and would require substantial lead-time, to repair or replace. San Diego is situated near active earthquake fault lines. The facility may be harmed or rendered inoperable by natural or man-made disasters, including earthquakes, power outages, communications failure or terrorism, which may render it difficult or impossible for us to produce our assays or continue our research and development activities for some period of time. This inability to manufacture our assays for even a short period of time may result in the loss of customers or harm to our reputation, and we may be unable to regain those customers or repair our reputation in the future. We carry insurance for damage to our property and the disruption of our business, but this insurance may not cover all of the risks associated with damage or disruption to our business, may not provide coverage in amounts sufficient to cover our potential losses, and may not continue to be available to us on acceptable terms, if at all.

-17-

Table of Contents

Failure to manufacture our assays in accordance with product specifications could result in increased costs, lost revenue, customer dissatisfaction or voluntary product recalls, any of which could have a material adverse effect on our revenue, results of operations and business.

Properly manufacturing our Atlas Detection Assays requires precise technological execution and strict compliance with our guidelines. We may experience problems in the manufacturing process for a number of reasons, such as equipment malfunction, failure to follow specific protocols or human error. If problems arise during the production of a particular product lot, that product lot may need to be discarded or destroyed. This could among other things, result in increased costs, lost revenue, customer dissatisfaction and injury to our reputation. If problems are not discovered before the product lot is released to the market, we may incur recall and product liability costs. Any failure to manufacture our products in accordance with product specifications could have a material adverse effect on our revenue, results of operations and business.

If we are unable to manufacture our assays in sufficient quantities, on a timely basis, and at acceptable costs, our ability to sell our products will be harmed.

Our Atlas Detection Assays must be manufactured in sufficient quantities and on a timely basis, while maintaining product quality and acceptable manufacturing costs and complying with our requirements. In determining the required quantities of assays and the manufacturing schedule, we must make significant judgments and estimates based on historical experience, inventory levels, current market trends and other related factors. There could be significant differences between our estimates and the actual amounts of products we and our customers require, which could have a material adverse effect on our revenue, results of operations and business.

Additional work will be required for scaling-up manufacturing of each new assay prior to commercialization, and we may not successfully complete this work. Manufacturing and quality control problems may arise in the future as we attempt to scale up our manufacturing of a new assay, and we may not achieve scale-up in a timely manner, at a commercially reasonable cost or at all. New assays that detect or quantify more than one target pathogen may contain significantly more complex reagents, which will increase the cost of our manufacturing processes and quality control testing. We may not be able to manufacture these products at a cost or in quantities that would make these products commercially viable. If we are unable to develop or contract for manufacturing capabilities on acceptable terms for our products under development, we may not be able to expand our product offerings.

If we are unable to support demand for our Atlas Detection Assays, Atlas instrument or our future products, including ensuring that we have adequate capacity to meet increased demand, it could have a material adverse effect on our revenue, results of operations and business.

As our business grows, we will need to continue to increase our workflow capacity for sales, customer service and support, billing and general process improvements, expand our internal quality assurance program and expand our manufacturing capability. We will need additional personnel to support an expansion of our business. We will also need to purchase additional equipment, some of which can take several months or more to procure, setup, and validate, and increase our software and computing capacity to meet increased demand. There is no assurance that any of these increases in scale, expansion of personnel, equipment, software and computing capacities, or process enhancements will be successfully implemented. Failure to manage this growth could result in an inability to supply our products as needed, higher product costs, declining product quality, deteriorating customer service, and slower responses to competitive challenges. A failure in any one of these areas could make it difficult for us to meet market expectations for our products, which could have a material adverse effect on our revenue, results of operations and business.

-18-

Table of Contents

Our future success may depend in part upon our ability to enhance existing products and to develop, introduce and commercialize new products. New product development involves a lengthy and complex process and we may be unable to commercialize new or improved assays or any other products we may develop on a timely basis, or at all.

The market for our products is characterized by changing technology, evolving industry standards and new product introductions, which could make our competitors’ products more attractive and our existing products obsolete. Our future success will depend in part upon our ability to enhance our existing products and to develop new innovative products that meet our customer’s needs and expectations. Our failure to successfully develop new products on a timely basis could have a material adverse effect on our revenue, results of operations and business.

The development of new or enhanced assays is a complex and uncertain process requiring the accurate anticipation of technological, market and industry trends, as well as precise technological execution. In addition, the successful development of new products may depend on the development of new technologies. We may be required to undertake time-consuming and costly development activities. We may experience difficulties that could delay or prevent the successful development, commercialization and marketing of these new products. Before we can commercialize any new products, we will need to expend significant funds in order to conduct substantial research and development, including validation studies.

Our product development process involves a high degree of risk, and product development efforts may fail for many reasons, including a failure to demonstrate the performance of the product or an inability to obtain any required certification or regulatory approval, if any.

As we develop products, we will have to make significant investments in product development, as well as sales and marketing resources. In addition, competitors may develop and commercialize competing products faster than we are able to do so, which could have a material adverse effect on our revenue, results of operations and business.

If we cannot provide quality technical support, we could lose customers, which could have a material adverse effect on our revenue, results of operations and business.

The placement of our products at new customer sites, the introduction of the technology used in our products and ongoing customer support can be complex. Accordingly, we need highly trained technical support personnel. As of March 31, 2014, we had a nine-person technical support organization, which supports the installation and maintenance of the Atlas instrument and provides technical proficiency training for operators of the Atlas instrument. Attracting and retaining technical support personnel is very competitive in our industry. Customers are particularly sensitive to any interruptions or downtime with respect to our Atlas instruments and therefore we need to retain sufficient technical support staff to service and maintain the Atlas instruments that we place. In addition, extensive training is required to learn and understand our Atlas Detection Assays and Atlas instrument. In order to manage our growth and effectively support potential new customers and the expanding needs of our current customers, we may need to expand our technical support staff. If we are unable to attract, train or retain the number of highly qualified technical services personnel that our business may need or if we are unable to provide our customers with the technical support that they need, we may be unable to retain our customers, which could have a material adverse effect on our revenue, results of operations and business.

The loss of any member of our senior management team or our inability to attract and retain highly skilled personnel could have a material adverse effect on our business.

Our success depends on the skills, experience and performance of key members of our senior management team, including Paul Thomas, our President and Chief Executive Officer. The individual and collective efforts of our senior management team will be important as we continue to expand our commercial

-19-

Table of Contents

activities and develop additional products. The loss or incapacity of existing members of our senior management team could adversely affect our operations if we experience difficulties in hiring qualified successors. Our executive officers have employment agreements; however, the existence of an employment agreement does not guarantee the retention of the executive officer for any period of time. We do not maintain “key person” insurance on any of our employees.

Our research and development programs and laboratory operations depend on our ability to attract and retain highly skilled scientists and technicians. We may not be able to attract or retain qualified scientists and technicians in the future due to the competition for such qualified personnel. We also face competition from universities and public and private research institutions in recruiting and retaining highly qualified scientific personnel. All of our employees are at-will, which means that either we or the employee may terminate their employment at any time. We may have difficulties locating, recruiting or retaining qualified sales people. Recruiting and retention difficulties can limit our ability to support our research and development and sales programs. The loss of any member of our senior management team or our inability to attract and retain highly skilled scientists, technicians and sales personnel could have a material adverse effect on our business.

We may acquire other businesses or form joint ventures or make investments in other companies or technologies that could negatively affect our operating results, dilute our stockholders’ ownership, increase our debt or cause us to incur significant expense.