Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Real Goods Solar, Inc. | d752883d8k.htm |

| EX-4.1 - EX-4.1 - Real Goods Solar, Inc. | d752883dex41.htm |

| EX-10.2 - EX-10.2 - Real Goods Solar, Inc. | d752883dex102.htm |

| EX-10.1 - EX-10.1 - Real Goods Solar, Inc. | d752883dex101.htm |

| EX-99.1 - EX-99.1 - Real Goods Solar, Inc. | d752883dex991.htm |

| Exhibit 99.2

|

Exhibit EX99_2

SERVING SOLAR SINCE 1978

Corporate Presentation

June 2014

NASDAQ: RGSE

|

|

SERVING SOLAR SINCE 1978 NASDAQ: RGSE

Important Cautions Regarding Forward Looking Statements

This communication includes forward-looking statements relating to matters that are not historical facts.

Forward-looking statements may be identified by the use of words such as “expect,” “intend,” “believe,” “will,” “should” or comparable terminology or by discussions of strategy. While RGS Energy believes its assumptions and expectations underlying forward-looking statements are reasonable, there can be no assurance that actual results will not be materially different. Risks and uncertainties that could cause materially different results include, among others, completion and integration of acquisitions, realizing synergies and other benefits from acquisitions, the possibility of negative impact from weather conditions, introduction of new products and services, supplier delivery disruption, the possibility of negative economic conditions and other risks and uncertainties included in RGS Energy’s filings with the Securities and Exchange Commission. RGS Energy assumes no duty to update any forward-looking statements.

© 2014 RGS Energy. All Rights Reserved.

2

|

|

SERVING SOLAR SINCE 1978 NASDAQ: RGSE

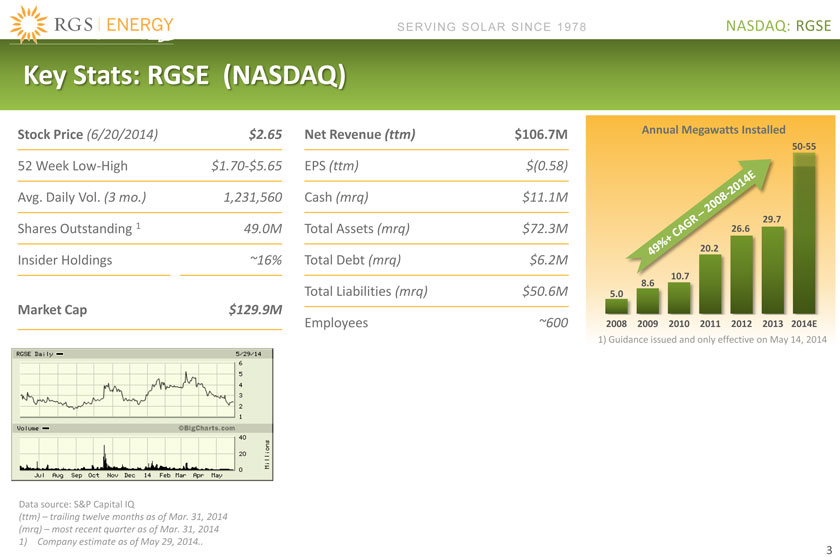

Key Stats: RGSE (NASDAQ)

Stock Price (6/20/2014) $2.65 Net Revenue (ttm) $106.7M Annual Megawatts Installed

50-55

52 Week Low-High $1.70-$5.65 EPS (ttm) $(0.58)

Avg. Daily Vol. (3 mo.) 1,231,560 Cash (mrq) $11.1M

Shares Outstanding 1 49.0M Total Assets (mrq) $72.3M

Insider Holdings ~16% Total Debt (mrq) $6.2M

8.6 49%+ CAGR-2008-2014E

Total Liabilities (mrq) $50.6M 5.0

Market Cap $129.9M

Employees ~600 2008 2009 2010 2011 2012 2013 2014E

1) Guidance issued and only effective on May 14, 2014

Data source: S&P Capital IQ

(ttm) – trailing twelve months as of Mar. 31, 2014 (mrq) – most recent quarter as of Mar. 31, 2014

1) Company estimate as of May 29, 2014.

3

|

|

SERVING SOLAR SINCE 1978 NASDAQ: RGSE

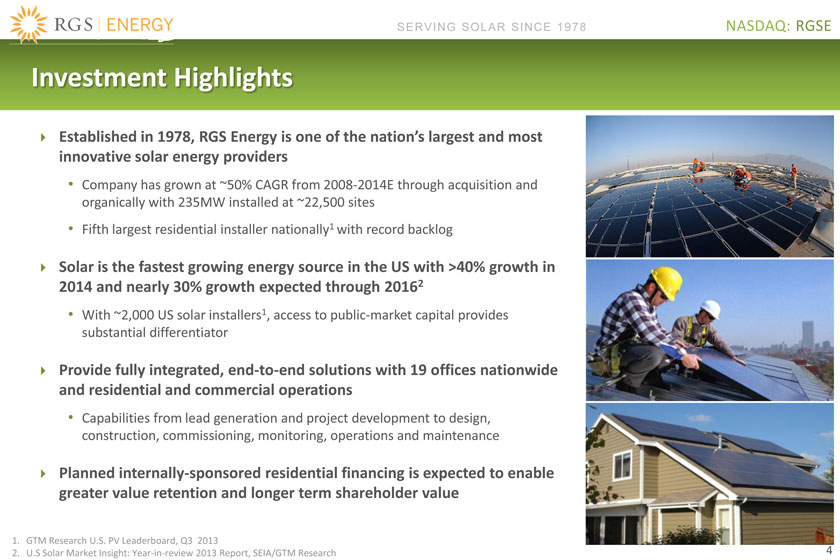

Investment Highlights

Established in 1978, RGS Energy is one of the nation’s largest and most innovative solar energy providers

Company has grown at ~50% CAGR from 2008-2014E through acquisition and organically with 235MW installed at ~22,500 sites

Fifth largest residential installer nationally1 with record backlog

Solar is the fastest growing energy source in the US with >40% growth in 2014 and nearly 30% growth expected through 20162

With ~2,000 US solar installers1, access to public-market capital provides substantial differentiator

Provide fully integrated, end-to-end solutions with 19 offices nationwide and residential and commercial operations

Capabilities from lead generation and project development to design, construction, commissioning, monitoring, operations and maintenance

Planned internally-sponsored residential financing is expected to enable greater value retention and longer term shareholder value

1. GTM Research U.S. PV Leaderboard, Q3 2013

2. U.S Solar Market Insight: Year-in-review 2013 Report, SEIA/GTM Research

4

|

|

SERVING SOLAR SINCE 1978 NASDAQ: RGSE

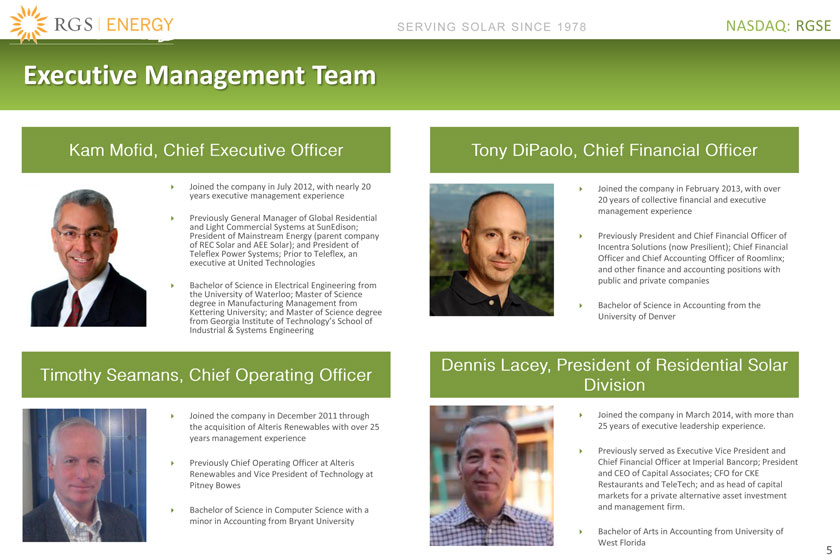

Executive Management Team

Kam Mofid, Chief Executive Officer

Tony DiPaolo, Chief Financial Officer

Timothy Seamans, Chief Operating Officer

Dennis Lacey, President of Residential Solar Division

Joined the company in July 2012, with nearly 20 Joined the company in February 2013, with over years executive management experience 20 years of collective financial and executive Previously General Manager of Global management experience Residential and Light Commercial Systems at SunEdison; President of Mainstream Energy (parent company Previously President and Chief Financial Officer of of REC Solar and AEE Solar); and President of Incentra Solutions (now Presilient); Chief Financial Teleflex Power Systems; Prior to Teleflex, an Officer and Chief Accounting Officer of Roomlinx; executive at United Technologies and other finance and accounting positions with public and private companies Bachelor of Science in Electrical Engineering from the University of Waterloo; Master of Science degree in Manufacturing Management from Bachelor of Science in Accounting from the Kettering University; and Master of Science degree University of Denver from Georgia Institute of Technology’s School of

Industrial & Systems Engineering

Joined the company in December 2011 through Joined the company in March 2014, with more than the acquisition of Alteris Renewables with over 25 25 years of executive leadership experience. years management experience Previously served as Executive Vice President and Previously Chief Operating Officer at Alteris Chief Financial Officer at Imperial Bancorp; President Renewables and Vice President of Technology at and CEO of Capital Associates; CFO for CKE

Pitney Bowes Restaurants and TeleTech; and as head of capital markets for a private alternative asset investment and management firm.

Bachelor of Science in Computer Science with a minor in Accounting from Bryant University

Bachelor of Arts in Accounting from University of West Florida

5

|

|

SERVING SOLAR SINCE 1978 NASDAQ: RGSE

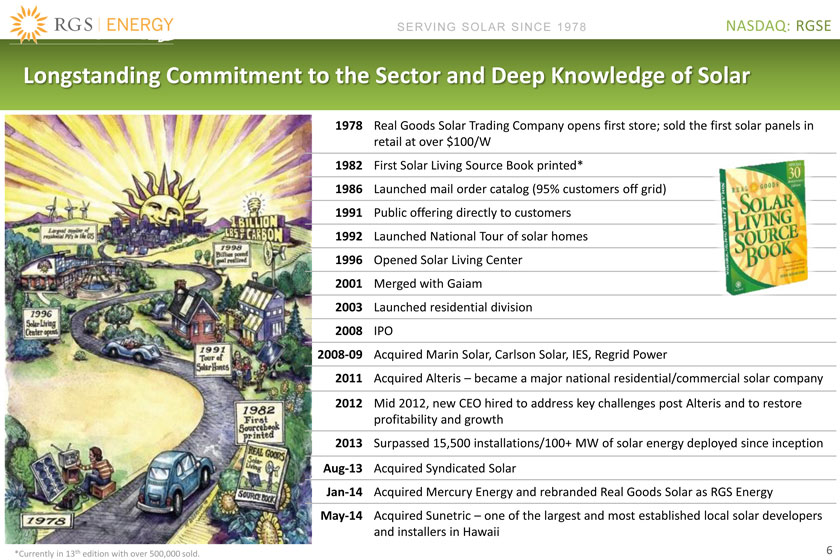

Longstanding Commitment to the Sector and Deep Knowledge of Solar

1978 Real Goods Solar Trading Company opens first store; sold the first solar panels in retail at over $100/W

1982 First Solar Living Source Book printed*

1986 Launched mail order catalog (95% customers off grid) 1991 Public offering directly to customers 1992 Launched National Tour of solar homes 1996 Opened Solar Living Center 2001 Merged with Gaiam 2003 Launched residential division

2008 IPO

2008-09 Acquired Marin Solar, Carlson Solar, IES, Regrid Power

2011 Acquired Alteris – became a major national residential/commercial solar company

2012 Mid 2012, new CEO hired to address key challenges post Alteris and to restore profitability and growth

2013 Surpassed 15,500 installations/100+ MW of solar energy deployed since inception Aug-13 Acquired Syndicated Solar Jan-14 Acquired Mercury Energy and rebranded Real Goods Solar as RGS Energy

May-14 Acquired Sunetric – one of the largest and most established local solar developers and installers in Hawaii

*Currently in 13th edition with over 500,000 sold.

6

|

|

SERVING SOLAR SINCE 1978 NASDAQ: RGSE

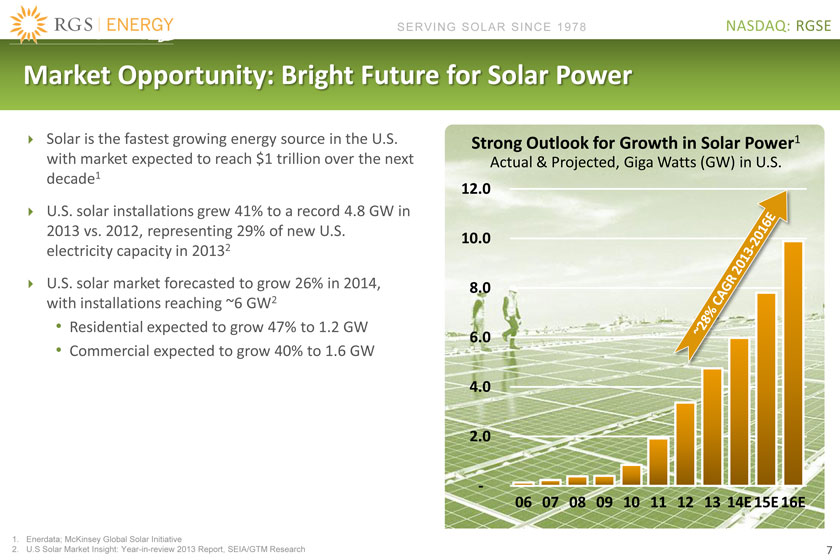

Market Opportunity: Bright Future for Solar Power

Solar is the fastest growing energy source in the U.S. Strong Outlook for Growth in Solar Power1 with market expected to reach $1 trillion over the next Actual & Projected, Giga Watts (GW) in U.S. decade1

12.0

U.S. solar installations grew 41% to a record 4.8 GW in 2013 vs. 2012, representing 29% of new U.S.

2 10.0 electricity capacity in 2013

U.S. solar market forecasted to grow 26% in 2014, 8.0 with installations reaching ~6 GW2

Residential expected to grow 47% to 1.2 GW

6.0

~28% CAGR 2013-2016E

Commercial expected to grow 40% to 1.6 GW

4.0

2.0

—

06 07 08 09 10 11 12 13 14E 15E 16E

1. Enerdata; McKinsey Global Solar Initiative

2. U.S Solar Market Insight: Year-in-review 2013 Report, SEIA/GTM Research

7

|

|

SERVING SOLAR SINCE 1978 NASDAQ: RGSE

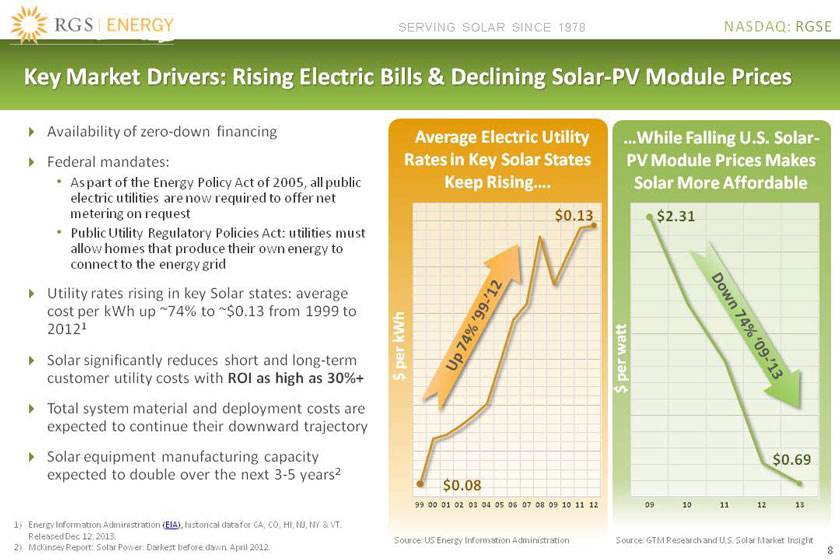

Key Market Drivers: Rising Electric Bills & Declining Solar-PV Module Prices

Availability of zero?down financing Federal mandates:

As part of the Energy Policy Act of 2005, all public electric utilities are now required to offer net metering on request $0.13

$2.31

Public Utility Regulatory Policies Act: utilities must allow homes that produce their own energy to connect to the energy grid

? Utility rates rising in key Solar states: average QTA cost per kWh up ~74% to ~$0.13 from 1999 to 20121

? Solar significantly reduces short and long?term customer utility costs with ROI as high as 30%+

? Total system material and deployment costs are expected to continue their downward trajectory

? Solar equipment manufacturing capacity $0.69 expected to double over the next 3?5 years 2

$0.08

99 00 01 02 03 04 05 06 07 08 09 10 11 12 09 10 11 12 13

1) Energy Information Administration (EIA), historical data for CA, CO, HI, NJ, NY & VT. Released Dec. 12, 2013.

2) McKinsey Report: Solar Power: Darkest before dawn. April 2012. Source: US Energy Information Administration Source: GTM Research and U.S. Solar Market Insight

8

|

|

SERVING SOLAR SINCE 1978 NASDAQ: RGSE

Cost of Electricity High in Key U.S. Solar States

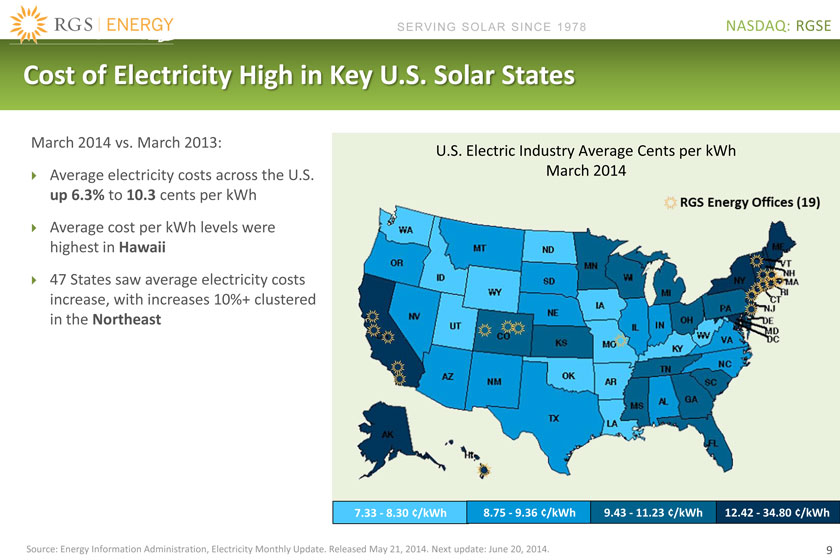

March 2014 vs. March 2013:

U.S. Electric Industry Average Cents per kWh Average electricity costs across the U.S. March 2014 up 6.3% to 10.3 cents per kWh

Average cost per kWh levels were highest in Hawaii

47 States saw average electricity costs increase, with increases 10%+ clustered in the Northeast

7.33—8.30 ¢/kWh 8.75—9.36 ¢/kWh 9.43—11.23 ¢/kWh 12.42—34.80 ¢/kWh

Source: Energy Information Administration, Electricity Monthly Update. Released May 21, 2014. Next update: June 20, 2014.

9

|

|

SERVING SOLAR SINCE 1978 NASDAQ: RGSE

Turnkey Solutions Across Multiple Market Segments

RGS Energy

~50% of sales Commercial ~50% of sales

Residential Utility

Solar for Governments Solar for Schools

Solar for Businesses

22,500+ Installations Nationwide, Representing 235+ Megawatts

10

|

|

SERVING SOLAR SINCE 1978 NASDAQ: RGSE

Selective Acquisitions Can be a Strong Source of Value Creation

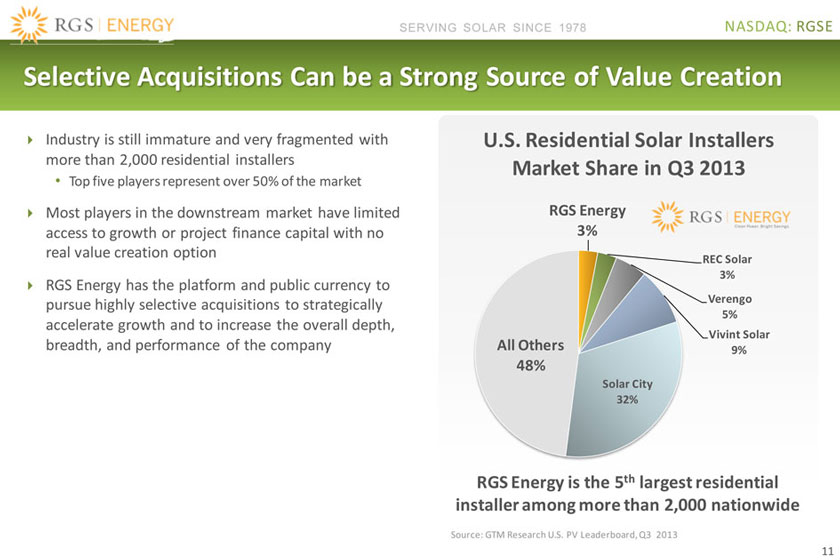

Industry is still immature and very fragmented with more than 2,000 residential installers

Top five players represent over 50% of the market

Most players in the downstream market have limited

access to growth or project finance capital with no real value creation option RGS Energy has the platform and public currency to pursue highly selective acquisitions to strategically accelerate growth and to increase the overall depth, breadth, and performance of the company

U.S. Residential Solar Installers Market Share in Q3 2013

RGS Energy 3%

REC Solar 3%

Verengo 5% Vivint Solar

All Others 9% 48%

Solar City 32%

RGS Energy is the 5th largest residential installer among more than 2,000 nationwide

Source: GTM Research U.S. PV Leaderboard, Q3 2013

11

|

|

SERVING SOLAR SINCE 1978 NASDAQ: RGSE

National Footprint and Capabilities via a Disciplined Acquisition Strategy

Acquired August 2013

Strengthened residential division

Expanded footprint to Missouri and enhanced presence in Colorado and California

Created much improved front-end capabilities, with strong sales talent and know-how

Acquired January 2014

Expanded northeast commercial & residential customer base and capabilities

~2,000 installations (50MW+)

Revenue: $250M+ since inception

Added ~$10M in cash without adding debt

Acquired May 2014

Provided entry into one of the nation’s largest and most lucrative solar markets, Hawaii

Since its formation in 2004, 3,500+ installations (65MW+)

Strong backlog of commercial, residential and government projects, with revenue topping $38M in 2013

12

|

|

SERVING SOLAR SINCE 1978 NASDAQ: RGSE

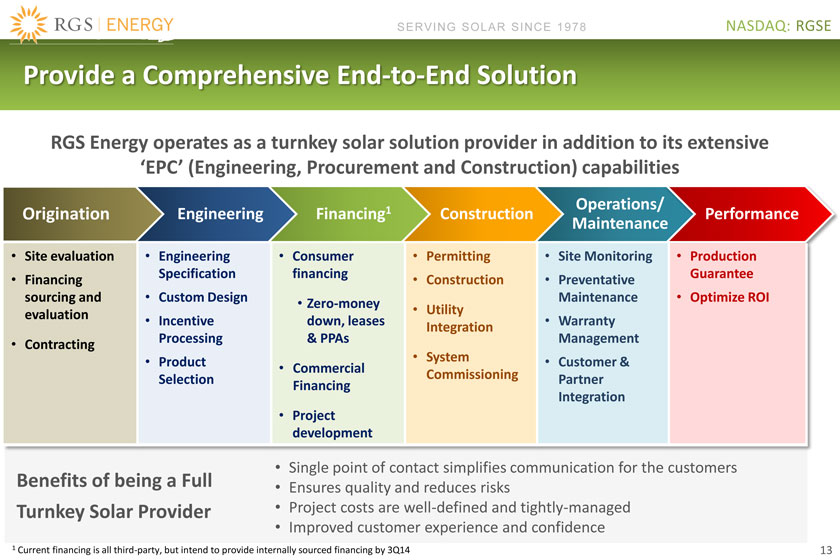

Provide a Comprehensive End-to-End Solution

RGS Energy operates as a turnkey solar solution provider in addition to its extensive

‘EPC’ (Engineering, Procurement and Construction) capabilities

1 Operations

Origination Engineering Financing Construction Performance Maintenanc

Site evaluation Engineering Consumer Permitting Site Monitoring Production Specification financing Guarantee

Financing Construction Preventative sourcing and Custom Design Maintenance Optimize ROI

Zero-money evaluation Utility

Incentive down, leases Warranty

Processing & PPAs Integration Management

Contracting

Product Commercial System Customer &

Selection Commissioning Partner Financing Integration

Project development

Single point of contact simplifies communication for the customers Benefits of being a Full Ensures quality and reduces risks Turnkey Solar Provider Project costs are well-defined and tightly-managed

Improved customer experience and confidence

1 Current financing is all third-party, but intend to provide internally sourced financing by 3Q14

13

|

|

SERVING SOLAR SINCE 1978 NASDAQ: RGSE

Commercial Business Unit – Impeccable Credentials

Internal professional project development, sales, project management and deployment staff of 100+ personnel on both coasts including HI

Excellent in-house electrical and mechanical engineering capabilities Capable of handling complex and demanding requirements NABCEP and Diamond Certified installation professionals OSHA certified technicians Award-winning engineering designs Strong relationship with major commercial financiers and developers

|

|

SERVING SOLAR SINCE 1978 NASDAQ: RGSE

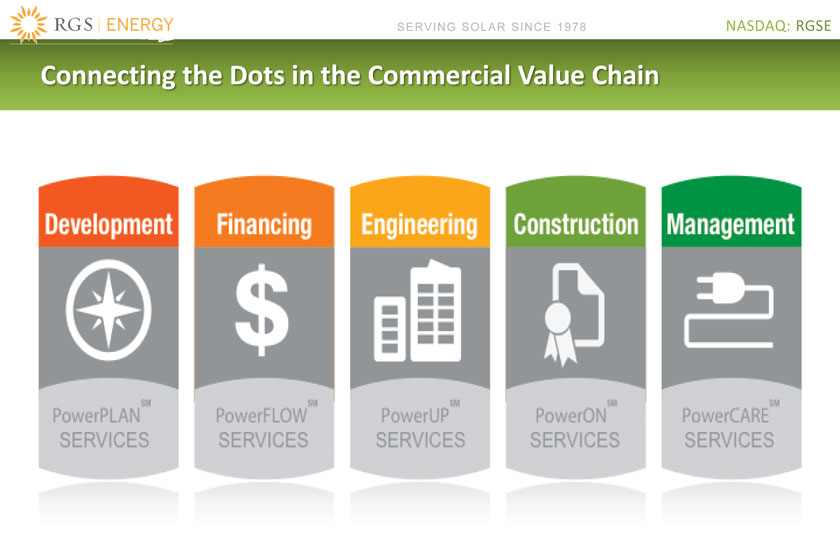

Connecting the Dots in the Commercial Value Chain

|

|

SERVING SOLAR SINCE 1978

Marquee Customers

NASDAQ: RGSE

We have successfully provided solar solutions to many key commercial customers across the country such as…

16

|

|

NASDAQ: RGSE

SERVING SOLAR SINCE 1978

Deep Capabilities in Residential with Broad Market Reach

?A top ranking national player with highly experienced team members in key US solar markets with local operations in CA, HI, MA, NY, CO, CT, VT, NH

?Full turnkey end-to-end offer from sales, to engineering, procurement, construction, customer service, financing (currently through third parties), and post-sales support

?A flexible residential construction model built upon a strong internal construction team and augmented by external integrators as needed to maximize capacity utilization

|

|

NASDAQ: RGSE

SERVING SOLAR SINCE 1978

Improving Sales and Operational Productivity and Creating Scale

?A clear roadmap that is being executed to improve sales productivity and reduce cost of acquisition

Much improved sales training and sales management

Regionally focused and optimized marketing and lead generation activities

Investment in “e-sales” which in a short period of time has already contributed to significant uptick in sales

Excellent results with community solarize programs allowing for rapid and efficient customer acquisition within specific geographical areas; these programs have resulted in record monthly sales performance in the North East

?Implementation of an operational roadmap that is resulting in improved lead-times and is expected to support a clear path towards improved margins

?Addition of a very seasoned executive talent to lead the residential business to accelerate performance improvements and to deploy an internal financing solution

Hired Dennis Lacey in March 2014 to help transform the residential business model; Lacey has 25 years of executive management experience and was the CEO of Capital Associates, a publicly traded leasing company, and started the leasing division for Imperial Bancorp, a $6 billion publicly traded commercial bank. He was also CFO of one of the largest customer service/call centers in the country.

|

|

NASDAQ: RGSE

SERVING SOLAR SINCE 1978

In-House Financing:

Commercial

?Formed RGS Energy Asset Management as a joint venture with Altus Power America Management to develop, finance & manage up to $150M of commercial solar projects

?Joint development agreements in key solar states –enables RGS to participate in management fees (through carried interest) and long-term ownership of commercial systems

Residential

?Mosaic Home Solar Loan, crowd sourced loan product to homeowners

?Expect to begin sales of systems for RGS’s own portfolio in third quarter 2014

Significant Investment & Development in Financing Capabilities

19

|

|

NASDAQ: RGSE

SERVING SOLAR SINCE 1978

?Residential solar provides two opportunities for profit: Dealer (installer) profit and financing profit

?Today, RGSE realizes profit from system installation only—third party finance partners provide financing

?RGSE has both the substantial sales engine and critical back office competence to establish an in-house residential leasing platform

?In 4Q13, RGS began to invest in the infrastructure (technology and people) to support its own in-house leasing fund in order to unlock long-term value of sales and installation platform

?Hired new and redeployed key talent into the leasing development and launch activities

Executive leadership

Financial analytics and back-office processing

Marketing launch material and support

Extensive sales training development

Value Creation—In-House Residential Financing Capabilities

20

|

|

NASDAQ: RGSE

SERVING SOLAR SINCE 1978

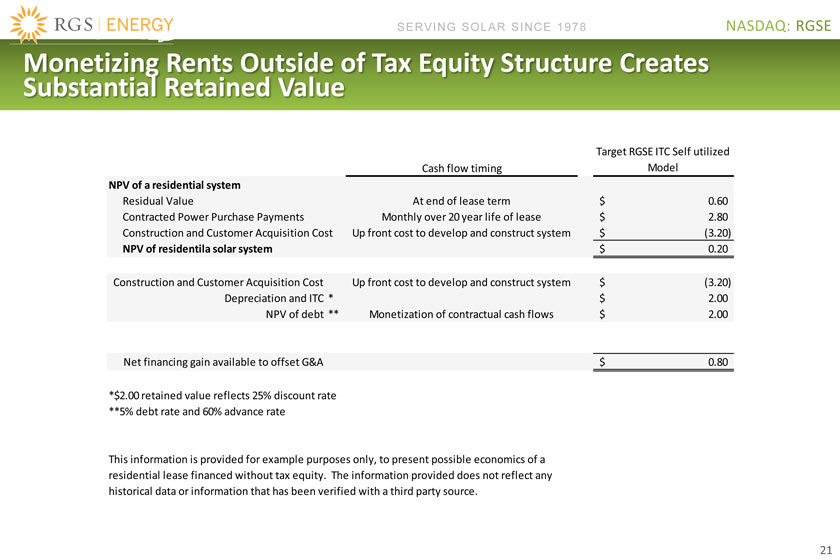

Monetizing Rents Outside of Tax Equity Structure Creates Substantial Retained Value

Target RGSE ITC Self utilized Cash flow timing Model

NPV of a residential system

Residual Value At end of lease term $ 0.60 Contracted Power Purchase Payments Monthly over 20 year life of lease $ 2.80 Construction and Customer Acquisition Cost Up front cost to develop and construct system $ (3.20)

NPV of residentila solar system $ 0.20

Construction and Customer Acquisition Cost Up front cost to develop and construct system $ (3.20) Depreciation and ITC * $ 2.00 NPV of debt ** Monetization of contractual cash flows $ 2.00

Net financing gain available to offset G&A $ 0.80

*$2.00 retained value reflects 25% discount rate **5% debt rate and 60% advance rate

This information is provided for example purposes only, to present possible economics of a residential lease financed without tax equity. The information provided does not reflect any historical data or information that has been verified with a third party source.

21

|

|

NASDAQ: RGSE

SERVING SOLAR SINCE 1978

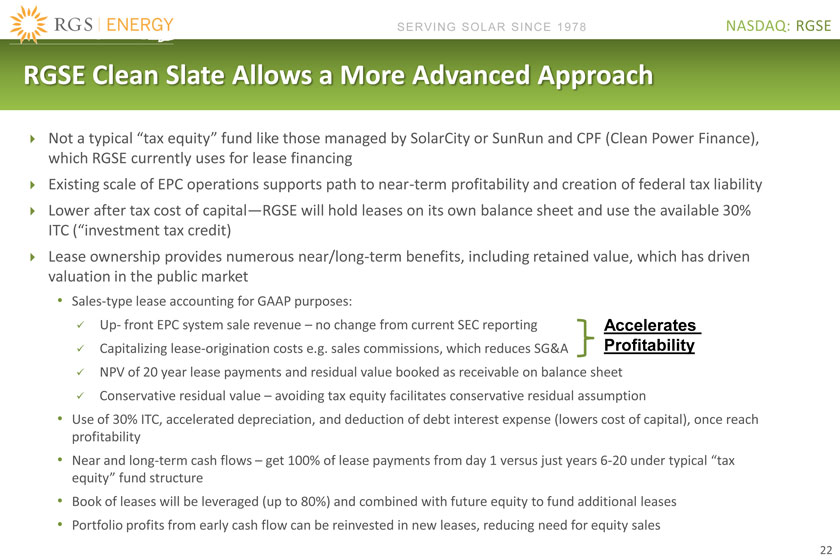

?Not a typical “tax equity” fund like those managed by SolarCity or SunRun and CPF (Clean Power Finance), which RGSE currently uses for lease financing

?Existing scale of EPC operations supports path to near-term profitability and creation of federal tax liability

?Lower after tax cost of capital—RGSE will hold leases on its own balance sheet and use the available 30% ITC (“investment tax credit)

?Lease ownership provides numerous near/long-term benefits, including retained value, which has driven valuation in the public market

Sales-type lease accounting for GAAP purposes:

?Up- front EPC system sale revenue – no change from current SEC reporting

?Capitalizing lease-origination costs e.g. sales commissions, which reduces SG&A

?NPV of 20 year lease payments and residual value booked as receivable on balance sheet

?Conservative residual value – avoiding tax equity facilitates conservative residual assumption

Use of 30% ITC, accelerated depreciation, and deduction of debt interest expense (lowers cost of capital), once reach profitability

Near and long-term cash flows – get 100% of lease payments from day 1 versus just years 6-20 under typical “tax equity” fund structure

Book of leases will be leveraged (up to 80%) and combined with future equity to fund additional leases

Portfolio profits from early cash flow can be reinvested in new leases, reducing need for equity sales

RGSE Clean Slate Allows a More Advanced Approach

22

|

|

NASDAQ: RGSE

SERVING SOLAR SINCE 1978

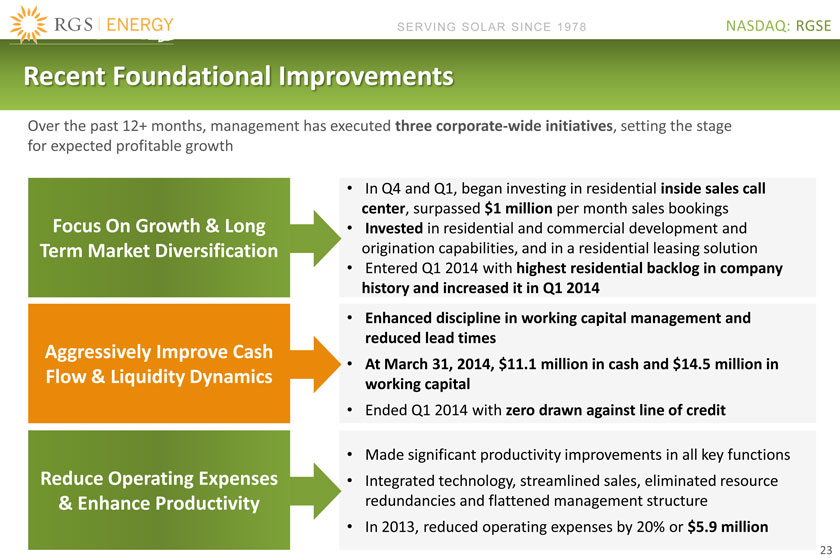

In Q4 and Q1, began investing in residential inside sales call center, surpassed $1 million per month sales bookings

Invested in residential and commercial development and origination capabilities, and in a residential leasing solution

Entered Q1 2014 with highest residential backlog in company history and increased it in Q1 2014

Recent Foundational Improvements

Over the past 12+ months, management has executed three corporate-wide initiatives, setting the stage for expected profitable growth

Enhanced discipline in working capital management and reduced lead times

At March 31, 2014, $11.1 million in cash and $14.5 million in working capital

Ended Q1 2014 with zero drawn against line of credit

Made significant productivity improvements in all key functions

Integrated technology, streamlined sales, eliminated resource redundancies and flattened management structure

In 2013, reduced operating expenses by 20% or $5.9 million

Focus On Growth & Long Term Market Diversification

Aggressively Improve Cash Flow & Liquidity Dynamics

Reduce Operating Expenses & Enhance Productivity

23

|

|

NASDAQ: RGSE

SERVING SOLAR SINCE 1978

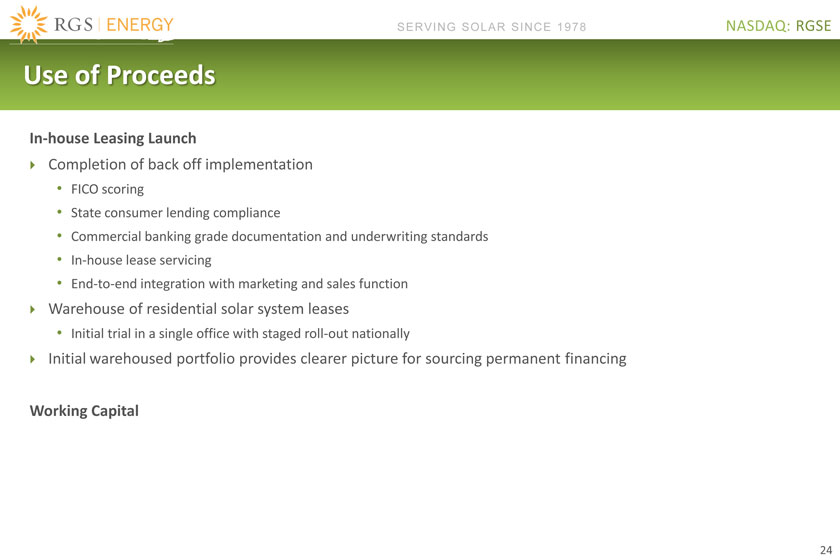

Use of Proceeds

In-house Leasing Launch

?Completion of back off implementation

FICO scoring

State consumer lending compliance

Commercial banking grade documentation and underwriting standards

In-house lease servicing

End-to-end integration with marketing and sales function

?Warehouse of residential solar system leases

Initial trial in a single office with staged roll-out nationally

?Initial warehoused portfolio provides clearer picture for sourcing permanent financing

Working Capital

24

|

|

NASDAQ: RGSE

SERVING SOLAR SINCE 1978

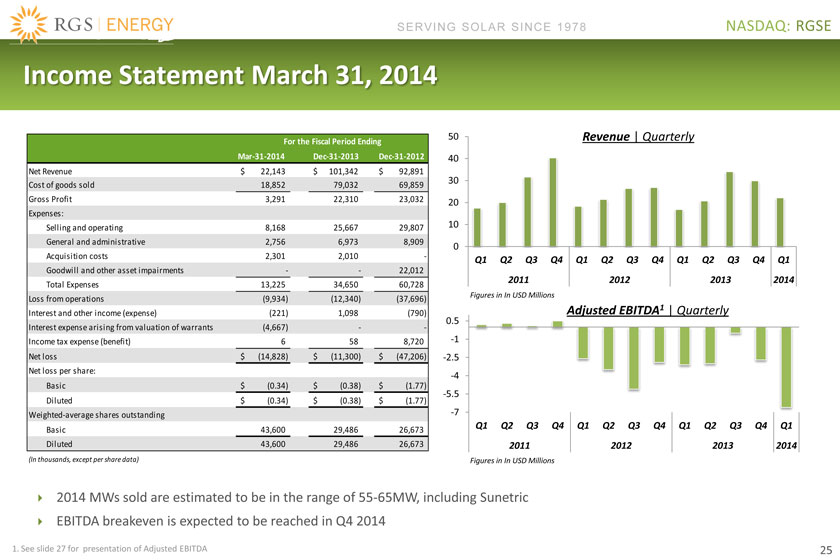

Income Statement March 31, 2014

For the Fiscal Period Ending

Mar-31-2014 Dec-31-2013 Dec-31-2012

Net Revenue $ 22,143 $ 101,342 $ 92,891 Cost of goods sold 18,852 79,032 69,859 Gross Profit 3,291 22,310 23,032 Expenses: Selling and operating 8,168 25,667 29,807 General and administrative 2,756 6,973 8,909 Acquisition costs 2,301 2,010 -Goodwill and other asset impairments — 22,012 Total Expenses 13,225 34,650 60,728 Loss from operations (9,934) (12,340) (37,696) Interest and other income (expense) (221) 1,098 (790) Interest expense arising from valuation of warrants (4,667) —Income tax expense (benefit) 6 58 8,720 Net loss $ (14,828) $ (11,300) $ (47,206) Net loss per share: Basic $ (0.34) $ (0.38) $ (1.77) Diluted $ (0.34) $ (0.38) $ (1.77) Weighted-average shares outstanding Basic 43,600 29,486 26,673 Diluted 43,600 29,486 26,673

(In thousands, except per share data)

50 Revenue | Quarterly

40 30 20 10 0

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1

2011 2012 2013 2014

Figures in In USD Millions

Adjusted EBITDA1 | Quarterly

0.5 -1 -2.5 -4 -5.5 -7

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1

2011 2012 2013 2014

Figures in In USD Millions

2014 MWs sold are estimated to be in the range of 55-65MW, including Sunetric EBITDA breakeven is expected to be reached in Q4 2014

1. See slide 27 for presentation of Adjusted EBITDA

25

|

|

NASDAQ: RGSE

SERVING SOLAR SINCE 1978

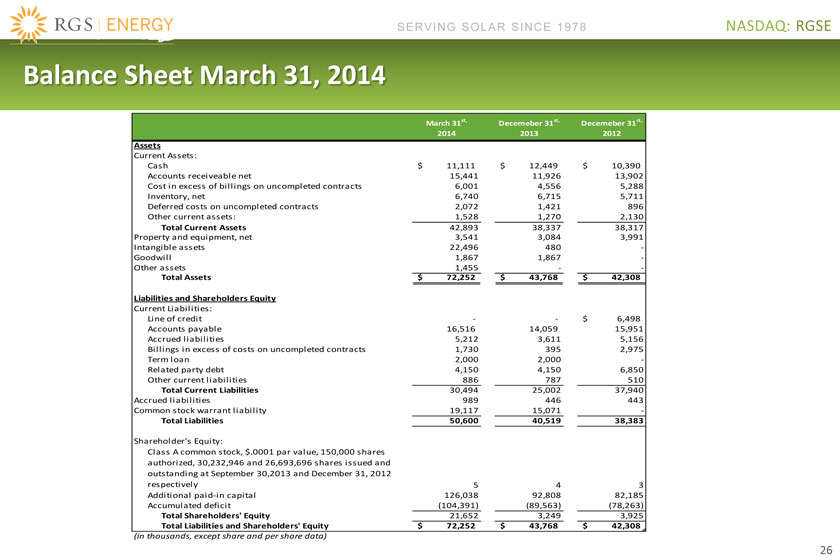

Balance Sheet March 31, 2014

March 31st, Decemeber 31st, Decemeber 31st, 2014 2013 2012

Assets

Current Assets:

Cash $ 11,111 $ 12,449 $ 10,390 Accounts receiveable net 15,441 11,926 13,902 Cost in excess of billings on uncompleted contracts 6,001 4,556 5,288 Inventory, net 6,740 6,715 5,711 Deferred costs on uncompleted contracts 2,072 1,421 896 Other current assets: 1,528 1,270 2,130

Total Current Assets 42,893 38,337 38,317 Property and equipment, net 3,541 3,084 3,991 Intangible assets 22,496 480 -Goodwill 1,867 1,867 -Other assets 1,455 —

Total Assets $ 72,252 $ 43,768 $ 42,308

Liabilities and Shareholders Equity

Current Liabilities:

Line of credit — $ 6,498 Accounts payable 16,516 14,059 15,951 Accrued liabilities 5,212 3,611 5,156 Billings in excess of costs on uncompleted contracts 1,730 395 2,975 Term loan 2,000 2,000 -Related party debt 4,150 4,150 6,850 Other current liabilities 886 787 510

Total Current Liabilities 30,494 25,002 37,940 Accrued liabilities 989 446 443 Common stock warrant liability 19,117 15,071 -

Total Liabilities 50,600 40,519 38,383

Shareholder’s Equity:

Class A common stock, $.0001 par value, 150,000 shares authorized, 30,232,946 and 26,693,696 shares issued and outstanding at September 30,2013 and December 31, 2012 respectively 5 4 3 Additional paid-in capital 126,038 92,808 82,185 Accumulated deficit (104,391) (89,563) (78,263)

Total Shareholders’ Equity 21,652 3,249 3,925 Total Liabilities and Shareholders’ Equity $ 72,252 $ 43,768 $ 42,308

(in thousands, except share and per share data)

26

|

|

NASDAQ: RGSE

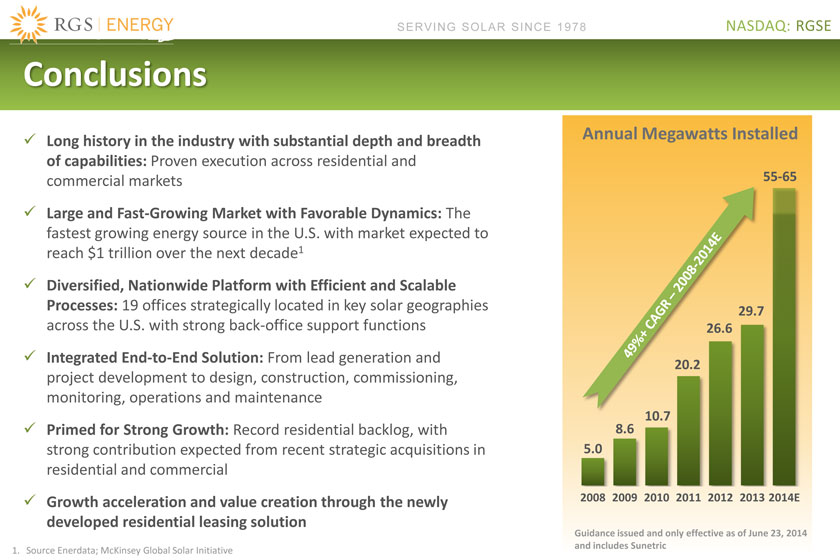

Conclusions

SERVING SOLAR SINCE 1978

?Long history in the industry with substantial depth and breadth of capabilities: Proven execution across residential and commercial markets

?Large and Fast-Growing Market with Favorable Dynamics: The fastest growing energy source in the U.S. with market expected to reach $1 trillion over the next decade1

?Diversified, Nationwide Platform with Efficient and Scalable Processes: 19 offices strategically located in key solar geographies across the U.S. with strong back-office support functions

?Integrated End-to-End Solution: From lead generation and project development to design, construction, commissioning, monitoring, operations and maintenance

?Primed for Strong Growth: Record residential backlog, with strong contribution expected from recent strategic acquisitions in residential and commercial

?Growth acceleration and value creation through the newly developed residential leasing solution

1.Source Enerdata; McKinsey Global Solar Initiative

49%+ CAGR-2008-2014E

5.0

8.6

10.7

20.2

26.6

29.7

55-65

2008

2009

2010

2011

2012

2013

2014E

Annual Megawatts Installed

Guidance issued and only effective as of June 23, 2014 and includes Sunetric

|

|

SERVING SOLAR SINCE 1978

NASDAQ: RGSE

Appendix

28

|

|

NASDAQ: RGSE

SERVING SOLAR SINCE 1978

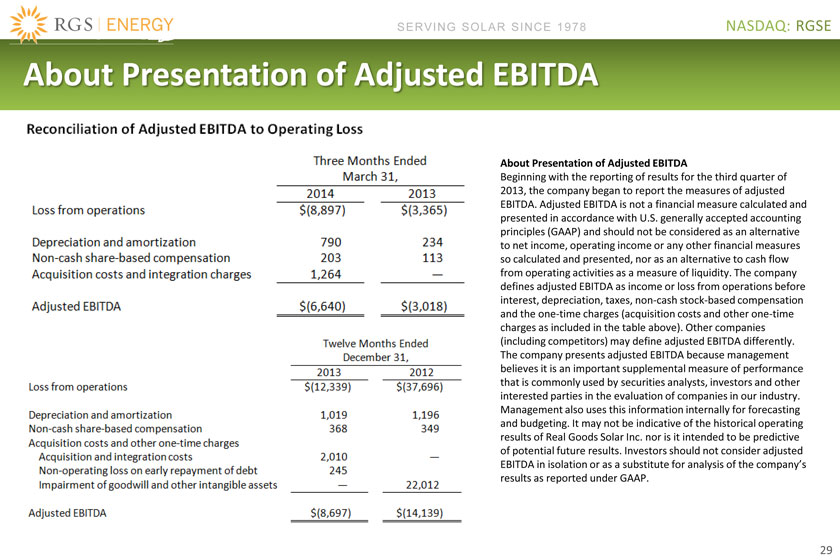

About Presentation of Adjusted EBITDA

About Presentation of Adjusted EBITDA Beginning with the reporting of results for the third quarter of 2013, the company began to report the measures of adjusted EBITDA. Adjusted EBITDA is not a financial measure calculated and presented in accordance with U.S. generally accepted accounting principles (GAAP) and should not be considered as an alternative to net income, operating income or any other financial measures so calculated and presented, nor as an alternative to cash flow from operating activities as a measure of liquidity. The company defines adjusted EBITDA as income or loss from operations before interest, depreciation, taxes, non-cash stock-based compensation and the one-time charges (acquisition costs and other one-time charges as included in the table above). Other companies (including competitors) may define adjusted EBITDA differently. The company presents adjusted EBITDA because management believes it is an important supplemental measure of performance that is commonly used by securities analysts, investors and other interested parties in the evaluation of companies in our industry. Management also uses this information internally for forecasting and budgeting. It may not be indicative of the historical operating results of Real Goods Solar Inc. nor is it intended to be predictive of potential future results. Investors should not consider adjusted EBITDA in isolation or as a substitute for analysis of the company’s results as reported under GAAP.

29

|

|

NASDAQ: RGSE

SERVING SOLAR SINCE 1978

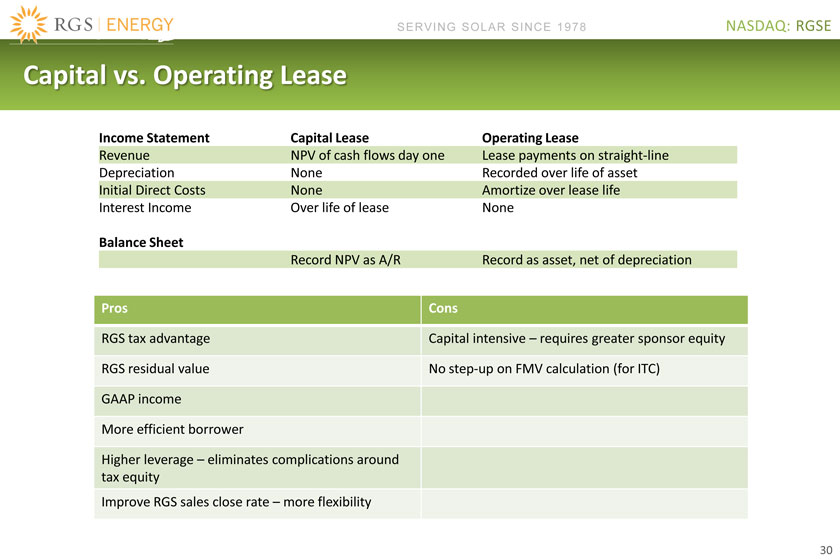

Capital vs. Operating Lease

Income Statement

Capital Lease

Operating Lease

Revenue

NPV of cash flows day one

Lease payments on straight-line

Depreciation

None

Recorded over life of asset

Initial Direct Costs

None

Amortize over lease life

Interest Income

Over life of lease

None

Balance Sheet

Record NPV as A/R

Record as asset, net of depreciation

Pros

Cons

RGS tax advantage

Capital intensive – requires greater sponsor equity

RGS residual value

No step-up on FMV calculation (for ITC)

GAAP income

More efficient borrower

Higher leverage – eliminates complications around tax equity

Improve RGS sales close rate – more flexibility

30