Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - SWISS HELVETIA FUND, INC. | swisshelv-8k_062514.htm |

Schroder Swiss Equities for

The Swiss Helvetia Fund, Inc.

The Swiss Helvetia Fund, Inc.

Chris Moran

Head of US Sub-Advisory, New York

June 27, 2014

Stefan Frischknecht, CFA

Head of Swiss Equities, Zurich

Mark Hemenetz

Chief Operating Officer, New York

Focus

Why Schroders?

A worldwide team - dedicated to asset management

n Asset management is our sole business

Experience and independence

n Over 200 years of financial services experience

n Founding Schroder family still controls 47.5% of

voting equity

voting equity

Resources

n Well established teams in all key

investment regions

investment regions

n Over 390 portfolio managers and

analysts worldwide

analysts worldwide

n Over 3,500 personnel in 27 countries

Financial strength

n $446.8 billion in AUM globally

n Approximately $1.1 billion* surplus capital available for

building the business

building the business

Source: Schroders

Statistics are as of March 31, 2014

*As of December 31, 2013

Bermuda

Cayman Islands

Mexico City

New York

Philadelphia

Amsterdam

Chester

Chester

Copenhagen

Edinburgh

Edinburgh

Frankfurt

Geneva

Gibraltar

Guernsey

Jersey

London

Luxembourg

Madrid

Milan

Oxford

Oxford

Paris

Rome

Stockholm

Zurich

Beijing

Hong

Kong

Kong

Jakarta

Seoul

Shanghai

Singapore

Sydney

Taipei

Tokyo

Buenos

Aires

Aires

Santiago

São Paulo

Dubai

Mumbai

Mumbai

Schroders offices

(Investment offices in orange)

1

Besides our London headquarters, the Swiss and US presence is significant

n In the US: investment management presence has been established since 1923

n A registered Investment Advisor with the SEC

n SIMNA manages > $54 billion in North America, > $22 billion across 19 sub-advisory portfolios

and over $3 billion across 15 mutual funds

and over $3 billion across 15 mutual funds

n Resources and infrastructure dedicated to managing, servicing, and marketing1940 Act funds

n Swiss Based Investment Team with a track record since 1999

n AUM in Swiss equities of $1.3 billion, Zurich office with client assets of nearly $23 billion

n Team receives compliance and fund administration support from Schroders subsidiaries in

London, Zurich and New York

London, Zurich and New York

About Schroders

2

Schroders Investment Management North America and Switzerland

Source: Schroders

Long - standing locally based Swiss investment team

3

We believe we are unmatched in local market in terms of stability and experience

Source: Schroders as of May 31, 2014. Caspar Benz has been with Schroders since June 1, 2008; the date his former company of employment was taken over by Schroders

|

Name

|

Function

|

Years with

current employer |

Years experience

in Swiss equities |

|

Stefan Frischknecht

|

Fund Manager, Team Head

|

15

|

18

|

|

Daniel Lenz

|

Fund Manager

|

14

|

16

|

|

Philipp Bruderer

|

Swiss Analyst

|

10

|

12

|

|

Yves Berthelon

|

Swiss Analyst

|

4

|

4

|

|

Caspar Benz*

|

European Fund Manager

|

34

|

34

|

Investment Philosophy

4

Focus is on historically proven and widely recognized factors of outperformance

Value

n Classical value style analysis based on valuation multiples (P/B, P/CF, P/E, div yield)

n Proprietary Valuation Model based on DCF

Quality

n Quality of Balance Sheet

n Quality of Management

n Quality of Product / Service

n Shareholder Value Creation

Small & Mid Cap bias

n Small & mid cap factor has been empirically proven to lead to outperformance vs. large caps

n More likely to find mispriced stocks through bottom up analysis in small & mid than in large caps

We seek to exploit inefficiency of markets by focusing on:

Source: Schroders

5

Source: Bloomberg, March 31, 2014. Swiss performance index is broken down into small, mid and large cap sub -indicies according to the official market cap breakdown of the

Swiss Exchange (SIX). All returns in CHF. Past performance is no guarantee of future results. The value of an investment can go down as well as up and is not guaranteed.

Swiss Exchange (SIX). All returns in CHF. Past performance is no guarantee of future results. The value of an investment can go down as well as up and is not guaranteed.

Investment Philosophy

Long-term outperformance of small caps and mid caps in Switzerland

Investment Process

6

1. Quantitative screen and other

sources for cheap stocks

sources for cheap stocks

2. Decision within team if and who

will put more work into research

will put more work into research

3. Recommendation or rejection of

idea due to extensive research &

valuation model

idea due to extensive research &

valuation model

4. Monitoring fundamentally and

through proprietary risk control

through proprietary risk control

5. Sell when price target is reached

or when things have changed

dramatically

or when things have changed

dramatically

Swiss stock universe:

~200 listed companies

~200 listed companies

Source: Schroders

Investment Process

Stock example: Helvetia Insurance

7

Helvetia Insurance

Valuation

Fair value: CHF 500 (upside 17%)

Multiples: est. P/E (2014) 10.0, P/B 0.9, Div. 4.1%

Quality (Summary)

Competitive Analysis +/- Strong position with SME clients, but not top 3 overall

Shareholder Value Creation + 12.3% p.a. book value per share increase over 10y

Management Quality + Solid and stable top management team

Balance Sheet Quality + Solid balance sheet, low debt; 9% goodwill / equity

1.

In depth

research

research

3.

4.

5.

Source: Schroders, Bloomberg, May 31, 2014. Data in CHF. The example illustrates the value and quality aspects we seek when selecting stocks. The stock shown above is not

a holding of the Swiss Helvetia Fund, Inc. and not intended to be read as a performance claim. Not a recommendation to buy or sell stocks mentioned.

a holding of the Swiss Helvetia Fund, Inc. and not intended to be read as a performance claim. Not a recommendation to buy or sell stocks mentioned.

Investment Process

8

Recommendation /Rejection: Example Value / Quality Matrix

Source: Schroders , Diagram illustrates the value and quality aspects as a stock selection tool. Company scoring is as of March 2014 and is subject to change. Not a

recommendation to buy or sell stocks mentioned.

recommendation to buy or sell stocks mentioned.

1.

2.

Recommend/

Reject

Reject

4.

5.

Upside

Lindt

Burckhardt

Sika

APG

SGS

Helvetia

Lem

Geberit

Huber Suhner

Inficon

EMS

Galenica

Actelion

Novartis

Leonteq

Kühne

Straumann

Bucher

Panalpina

Rieter

Zurich

Givaudan

Emmi

Oerlikon

Publigroup

Swiss Re

Bachem

Temenos

Swiss Life

Fischer

Swisscom

Aryzta

Barry

Adecco

uBlox

Ascom

UBS

Phoenix

Kaba

Gurit

Comet

Clariant

Holcim

Huegli

Baloise

SHL Telemedicine

Komax

Lonza

Valora

Flughafen

Meyer Burger

Airesis

Burkhalter

Bossard

Interroll

Weatherford

LLB

Nestlé

Richemont

Swatch

VZ

Partners Group

Schindler

Roche

Daetwyler

Tecan

Sonova

BCV

Bell

Zehnder

Schweiter

Implenia

Swissquote

St. Galler KB

Siegfried

Sulzer

Logitech

Syngenta

Baer

Nobel Biocare

ABB

Orior

Transocean

EFG Int

Micronas

Coltene

AMS

Dufry

Swisslog

Goldbach

CS

GAM

Gategroup

Schaffner

Kuoni

Belimo

Forbo

DKSH

Metall Zug

AFG

Looser

BKW

Cembra

Higher quality/

Lower quality

Lower quality

Median

upside

upside

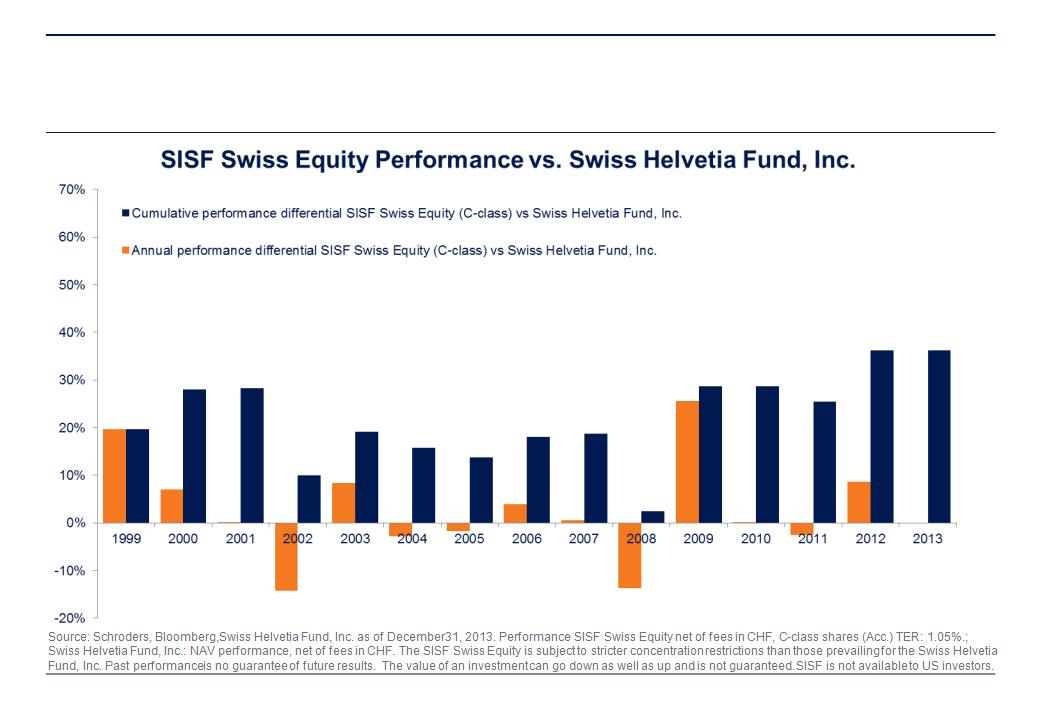

Fund Performance

9

SISF Swiss Equity

Performance 12.31.1998 - 12.31.2013:

Swiss Equity (C-Class): 104%

The Swiss Helvetia Fund, Inc.: 50%

Cumulative performance difference: 54%

Cumulative performance differential: 36%

( = (1+ Perf 104%) divided by (1 + 50%)= 1.36)

Swiss Equity (C-Class): 104%

The Swiss Helvetia Fund, Inc.: 50%

Cumulative performance difference: 54%

Cumulative performance differential: 36%

( = (1+ Perf 104%) divided by (1 + 50%)= 1.36)

A long tradition in Swiss Equities:

n Schroders presence in Switzerland since 1960

A global group structure with the necessary resources for the Swiss Helvetia Fund, Inc.:

n SEC registered* entities to service the Fund, shareholders, and board of directors

n Experience managing and marketing registered products

n Zurich investment team eager to support marketing the ‘case for Swiss equities’

A Schroders investment team with a 15 year investment track record:

n The track record of our fund since 1999 reflects the strength of the Swiss Equity team

n An investment team with one of the longest collaborations in the industry

Schroders sole focus is on providing asset management services:

n No conflict of interest as an independent asset manager; no commercial or investment banking

n Our fund management staff is incentivized on performance

n Fund managers can invest into the funds they manage

Summary

10

Why is Schroders the ideal partner for The Swiss Helvetia Fund, Inc.?

*The New York Schroders Investment Management North America, Inc. legal entity and the London based Schroders Investment Management North America, Ltd legal entity are

registered with the SEC.

registered with the SEC.

This presentation intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not

intended as an offer or solicitation for the purchase of sale of any financial instrument. The material is not intended to provide, and should not be

relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder

Investment Management North America Inc. does not warrant its completeness or accuracy.

intended as an offer or solicitation for the purchase of sale of any financial instrument. The material is not intended to provide, and should not be

relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder

Investment Management North America Inc. does not warrant its completeness or accuracy.

The returns presented represent past performance and are not necessarily representative of future returns which may vary. The value of

investments can fall as well as rise as a result of market or currency movements.

investments can fall as well as rise as a result of market or currency movements.

All investments, domestic and foreign, involve risks including the risk of possible loss of principal. The market value of a fund’s portfolio may

decline as a result of a number of factors, including adverse economic and market conditions, prospects of stocks in the portfolio, changing

interest rates, and real or perceived adverse competitive industry conditions. Investing overseas involves special risks including among others,

risks related to political or economic instability, foreign currency (such as exchange, valuation, and fluctuation) risk, market entry or exit

restrictions, illiquidity and taxation. Emerging markets pose greater risks than investments in developed markets.

decline as a result of a number of factors, including adverse economic and market conditions, prospects of stocks in the portfolio, changing

interest rates, and real or perceived adverse competitive industry conditions. Investing overseas involves special risks including among others,

risks related to political or economic instability, foreign currency (such as exchange, valuation, and fluctuation) risk, market entry or exit

restrictions, illiquidity and taxation. Emerging markets pose greater risks than investments in developed markets.

The views and forecasts contained herein are those of the Schroders Swiss Equities team and are subject to change. The information and

opinions contained in this document have been obtained from sources we consider to be reliable. No responsibility can be accepted for errors of

facts obtained from third parties. Reliance should not be placed on the views and information in the document when taking individual investment

and/or strategic decisions.

opinions contained in this document have been obtained from sources we consider to be reliable. No responsibility can be accepted for errors of

facts obtained from third parties. Reliance should not be placed on the views and information in the document when taking individual investment

and/or strategic decisions.

Schroder Investment Management North America Inc.

875 Third Avenue, New York, NY 10022-6225

(212) 641-3800

www.schroders.com\us

Important Information

11