Attached files

| file | filename |

|---|---|

| EX-99.2 - PRESS RELEASE - VICTORY OILFIELD TECH, INC. | vyey_992.htm |

| 8-K - FORM 8-K - VICTORY OILFIELD TECH, INC. | vyey_8k.htm |

EXHIBIT 99.1

(OTCQX: VYEY)

Investor Presentation

GHS 100 Energy Conference, Chicago - June 2014

2

Forward-Looking and Cautionary Statements

This presentation contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934.

All statements, other than statements of historical facts, included in this press release that address activities, events or

developments that the Company expects, believes or anticipates will or may occur in the future are forward-looking statements.

These statements are based on certain assumptions made by the Company based on management’s experience, perception of

historical trends and technical analyses, current conditions, anticipated future developments and other factors believed to be

appropriate and reasonable by management. When used in this press release, the words “will,” “potential,” “believe,” “estimated,”

“intend,” “expect,” “may,” “should,” “anticipate,” “could,” “plan,” “project,” or their negatives, other similar expressions or the

statements that include those words, are intended to identify forward-looking statements, although not all forward-looking

statements contain such identifying words.

All statements, other than statements of historical facts, included in this press release that address activities, events or

developments that the Company expects, believes or anticipates will or may occur in the future are forward-looking statements.

These statements are based on certain assumptions made by the Company based on management’s experience, perception of

historical trends and technical analyses, current conditions, anticipated future developments and other factors believed to be

appropriate and reasonable by management. When used in this press release, the words “will,” “potential,” “believe,” “estimated,”

“intend,” “expect,” “may,” “should,” “anticipate,” “could,” “plan,” “project,” or their negatives, other similar expressions or the

statements that include those words, are intended to identify forward-looking statements, although not all forward-looking

statements contain such identifying words.

Among these forward-looking statements are statements regarding EURs, estimated BOE, estimated future gross undiscounted

cash flow and estimated drilling and completion costs. Such forward-looking statements are subject to a number of assumptions,

risks and uncertainties, many of which are beyond the control of the Company, which may cause actual results to differ materially

from those implied or expressed by the forward-looking statements, including but not limited to, changes to drilling plans and

schedules by the operators of prospects, overruns in costs of operations, hazards, delays, and any other difficulties related to

drilling for and producing oil or gas, the price of oil, NGLs, and gas, results of marketing and sales of produced oil and gas, estimates

made in evaluating reserves, competition, general economic conditions and the ability to manage and continue growth, and other

factors described in the Company Annual Report on Form 10-K for the fiscal year ended December 31, 2012 and any updates to

those risk factors set forth in the Company’s Quarterly Reports on Form 10-Q. Further information on such assumptions, risks and

uncertainties is available in the Company’s other filings with the Securities and Exchange Commission (“SEC”) that are available on

the SEC’s website at www.sec.gov, and on the Company’s website at www.vyey.com.

cash flow and estimated drilling and completion costs. Such forward-looking statements are subject to a number of assumptions,

risks and uncertainties, many of which are beyond the control of the Company, which may cause actual results to differ materially

from those implied or expressed by the forward-looking statements, including but not limited to, changes to drilling plans and

schedules by the operators of prospects, overruns in costs of operations, hazards, delays, and any other difficulties related to

drilling for and producing oil or gas, the price of oil, NGLs, and gas, results of marketing and sales of produced oil and gas, estimates

made in evaluating reserves, competition, general economic conditions and the ability to manage and continue growth, and other

factors described in the Company Annual Report on Form 10-K for the fiscal year ended December 31, 2012 and any updates to

those risk factors set forth in the Company’s Quarterly Reports on Form 10-Q. Further information on such assumptions, risks and

uncertainties is available in the Company’s other filings with the Securities and Exchange Commission (“SEC”) that are available on

the SEC’s website at www.sec.gov, and on the Company’s website at www.vyey.com.

Any forward-looking statement speaks only as of the date on which such statement is made and the Company undertakes no

obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise,

except as required by applicable law.

obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise,

except as required by applicable law.

3

Company Profile

|

STOCK TICKER (OTCQX) 1

|

VYEY

|

|

Share Price

|

$0.35

|

|

Market Cap

|

$9.6 M

|

|

Shares Authorized

|

47.5 M

|

|

Shares Outstanding

|

27.5 M

|

|

Shares Held By Insiders

|

6.5 M

|

|

Float 2

|

21.0 M

|

|

Proved Reserves (PV-10)

|

$2.4 M

|

|

Proved Reserves (PV-0)

|

$4.2 M

|

|

Current Liquidity 4

|

>$25 M

|

|

2013 E&P Capex

|

~$2.0 M

|

|

2014 Estimated E&P Capex

|

$30.0 M

|

(1) As of 06/06/2014

(2) Includes 14.1 M shares held in certificate

(3) Proved reserves based on SEC case as of 1/1/2014

(4) Includes $25 million credit facility and cash on hand

(5) Based on 2013 10-K filed on March 28th, 2014

|

Mineral & Drilling Investments

|

81%

|

|

Proved Reserves (PV-10)

|

88%

|

|

Oil as a percentage of production

|

130%

|

|

Revenue from hydrocarbon sales

|

116%

|

Victory Energy Corporation

•High growth oil and gas E&P focused on

creating shareholder value through the

acquisition and development of assets in

the World Class Permian Basin

creating shareholder value through the

acquisition and development of assets in

the World Class Permian Basin

•The company currently holds interests in

high profile plays such as the Cline,

Wolfcamp, Mississippian and Fusselman

high profile plays such as the Cline,

Wolfcamp, Mississippian and Fusselman

•Victory is growing cash-flows through

sustainable low-risk vertical well

development

sustainable low-risk vertical well

development

•Established as Victory Energy in 2006 and

headquartered in Austin, Texas, with

additional technical resources located in

Midland, Texas

headquartered in Austin, Texas, with

additional technical resources located in

Midland, Texas

2012 - 2013 Year-over-Year Growth Rates 5

Operations Summary 3

4

Investor Highlights

• Permian Basin (Texas), Resource Focus

• Early stage rapid-growth company

• Oil and liquid rich gas focus, growing

reserves and cash flow

reserves and cash flow

• Experienced management team and

world-class operators

world-class operators

• Asset value upside (PUD) in the portfolio

• $35M in Capex access through Texas

Capital Bank credit facility and Aurora

Energy Partners

Capital Bank credit facility and Aurora

Energy Partners

5

Business Model

• Low-risk vertical well development on existing and acquired properties.

• Focus on well-known basins with break-even points below $55 per barrel of oil. 1

• Locate multi-well drilling opportunities that provide three or more years of drilling inventory.

• Focus acquisitions on lower risk development opportunities that offer significant seismic and

analogous well data support.

analogous well data support.

• Targets predictable resource plays with favorable operating environments, consistent reservoir

quality across multiple horizons, long-lived reserve characteristics and high drilling success rates.

quality across multiple horizons, long-lived reserve characteristics and high drilling success rates.

• Permian vertical wells typically deliver greater than $2 M of proved reserve value for every $1 M of

Capex spent to drill and complete a well. (“Capex multiple”). 2

Capex spent to drill and complete a well. (“Capex multiple”). 2

• Return of investment capital occurs in 12-24 months.

• Leverages both internal capabilities and key industry relationships to acquire non-operated, high-

grade working interest positions in predictable, low-to-moderate risk oil and gas prospects.

grade working interest positions in predictable, low-to-moderate risk oil and gas prospects.

• Target 5%-25% working interest in Permian Basin, liquids rich oil and gas prospects

• The operator must have an established track record and a team of management, geologists,

engineers and service providers who have worked together on similar plays.

engineers and service providers who have worked together on similar plays.

• The operator must have a significant portion of the risked working interest.

• Build-out of internal operating capacity to begin early 2015

• Through Texas Capital Bank credit facility and access to equity capital through Aurora Energy Partners,

the Company has access to $35M in investment capital.

the Company has access to $35M in investment capital.

(1) 2013 Standard & Poor’s Report

(2) Based on independent third party reserve reports and 2013 and Q1 2014 sales

6

Established Capital Sources for Sustained

Growth

Growth

• Financial relationship established in October 2011

• Members include sophisticated investors & boutique private equity

• $10 M private placement now underway (Navitus Partners)

• Issue of VYEY warrants with each investment provides additional

capital at a later date

capital at a later date

• Investors are represented on the Victory board of directors

AURORA ENERGY

PARTNERS

PARTNERS

(50/50 owned by Victory and Navitus)

• Midland banking relationship established in February 2014

• Agreement provides for $25 M credit facility for operations and

acquisitions

acquisitions

• Allows Victory to acquire capital as needed and when deployable

• Additional relationships will be developed as needed, which could

include a future VYEY institutional private equity round

include a future VYEY institutional private equity round

• Institutional round provides basis for moving to a larger exchange

BANKING AND OTHER

RELATIONSHIPS

RELATIONSHIPS

7

2014 Strategic Financial Deliverables

• Disciplined use of acquisition capital as needed and when deployable

• Short-term capital deployment focused on growing cash-flow

• Secondary capital deployment focused on upside development

• Leverage and balance private capital, equity and debt to provide

additional development funds into 2015

additional development funds into 2015

• Deploy $30 M of capital towards E&P development and acquisitions

• Create more than $60 M in proved reserves

• Target longer-life, quality prospects with improved PUD opportunity

• Expand strategic relationships, geographical reach and quality operators

• Focus on Permian Basin wells with 75% or better liquid profile

INCREASE

RESERVES

RESERVES

• Reduce F&D costs; shift investment mix to include higher working

interest projects with upside potential; focus more on oil and liquids rich gas

interest projects with upside potential; focus more on oil and liquids rich gas

• Continue to drive down G&A expenses as a percent of revenue

• Achieve higher annual production rates

• Maintain optimal balance of oil vs. liquids rich gas production

IMPROVE

RETURNS

RETURNS

MANAGE

BALANCE

BALANCE

SHEET

8

2013 Success Validates Capex Model

First Permian Acquisition

in March 2012. Spud January 2013.

(1) Proved reserves based on SEC case as of 1/1/2014

2011-2013 2012 vs 2013

Growth Rates CAGR Annual

Growth Rates CAGR Annual

}Net Proved Reserves 42% 81%

}Proved Reserves (PV-10) 50% 39%

}Mineral & Drilling Investment 87% 88%

$25,000

$589,395

$1,212,899

$2,278,032

9

2013 Permian Oil Focus is Accelerating Results

2011-2013 2012 vs 2013

Growth Rates CAGR Annual

Growth Rates CAGR Annual

}Oil as a percentage of production N/A 130%

}Revenue from hydrocarbon sales 55% 125%

10

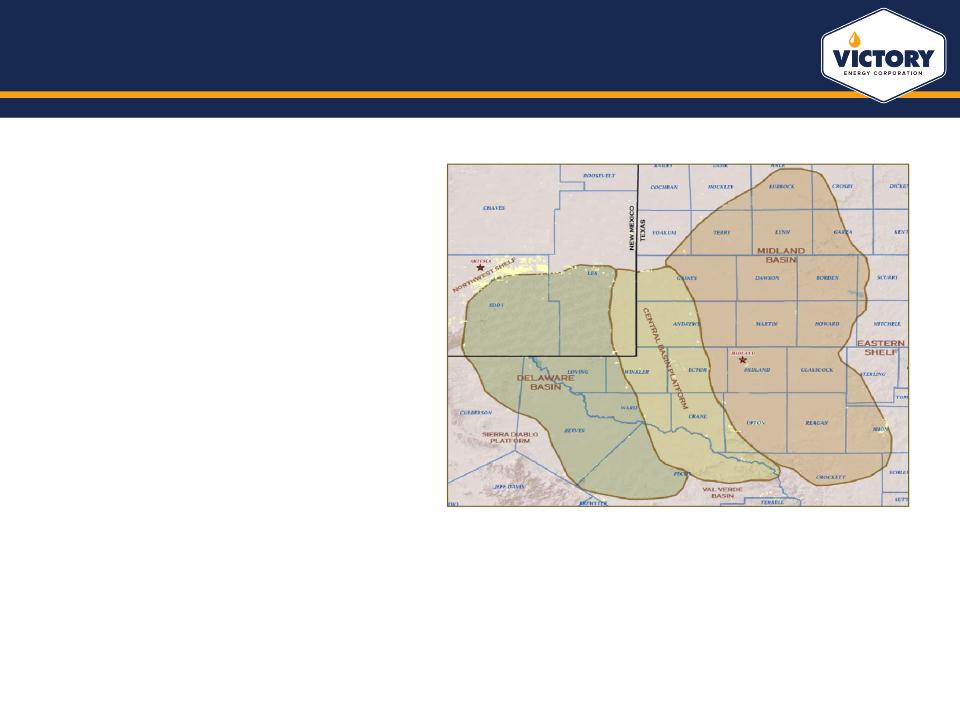

Why Focus on the Permian Basin?

• The play is the largest oil field in the U.S. (Baker-Hughes

rig count & recoverable resources).

rig count & recoverable resources).

• Predictable vertical well economics deliver break-even

points at less than $55 per bbl (Midland Basin). 1

Standard & Poor’s 2013 Report

points at less than $55 per bbl (Midland Basin). 1

Standard & Poor’s 2013 Report

• Increased use of enhanced-recovery practices has

produced a substantial impact on U.S. oil production,

making up 71% of all oil production in Texas and 17% of

total U.S. production at the end of 2013.

produced a substantial impact on U.S. oil production,

making up 71% of all oil production in Texas and 17% of

total U.S. production at the end of 2013.

• The estimated ultimate recovery (EUR) for a Permian

Basin vertical well is between 100,000 and 150,000

BOE, with horizontal wells yielding averages from

350,000 BOE to more than 600,000.

Basin vertical well is between 100,000 and 150,000

BOE, with horizontal wells yielding averages from

350,000 BOE to more than 600,000.

• According to industry consultants, production in the

Permian Basin is estimated to grow 60% between now

and 2016, reaching a total of 1.8 million barrels per day.

Permian Basin is estimated to grow 60% between now

and 2016, reaching a total of 1.8 million barrels per day.

1 Standard & Poor’s 2013 Report

11

Predictable Economics Deliver Predictable Outcomes

Our current focus is on vertical wells with $49 - $55 WTI Oil Price Break Even

Estimated Internal Rates of Return By Play *

* Returns are based on Standard & Poor’s West Texas Intermediate price

assumptions of US$85 per barrel for 2013, US$80 for 2014, and US$75

thereafter.

assumptions of US$85 per barrel for 2013, US$80 for 2014, and US$75

thereafter.

S&P’s Estimated Break-Even WTI Oil Price By Play

US$/Barrel

12

As Learning Curve Improves, Horizontal Activity Increases

Source: Baker Hughes Rig Count November 2013

13

Horizontal Decision Metrics (Best Cost Curve Drives Choice)

• Deploy capital in the sweet spot

• Completion techniques for optimal EUR and lower

drilling costs provide more predictable returns

drilling costs provide more predictable returns

• Lower cost acreage positions remain available

• Geoscience and other technical data provide

solid guidance for analogous well log analysis

and soil testing.

solid guidance for analogous well log analysis

and soil testing.

Production and Ultimate Recovery Rates Improve

High

Low

Low

High

Early

Development

14

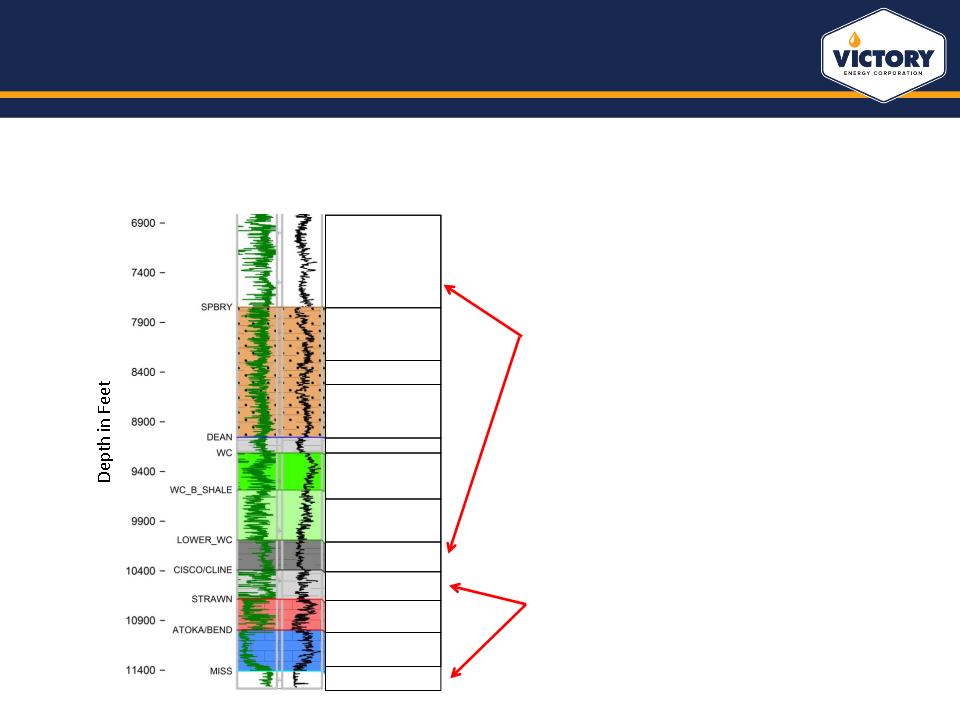

Opportunity for Secondary Development

The Permian is also attractive because it has multiple pay zones - some of which are

extremely amenable to horizontal drilling (Develop vertical now, horizontal later)

extremely amenable to horizontal drilling (Develop vertical now, horizontal later)

•Most Permian companies have been exploiting

“Wolfcamp” or “Clear Fork” plays using

inexpensive vertical wells with multiple frac

zones

“Wolfcamp” or “Clear Fork” plays using

inexpensive vertical wells with multiple frac

zones

•In some cases, these same zones are amenable

to much more effective horizontal techniques

(recent completions in the

Wolfcamp/Spraberry have yielded IP of 500-

3600 Boepd)

to much more effective horizontal techniques

(recent completions in the

Wolfcamp/Spraberry have yielded IP of 500-

3600 Boepd)

•Further upside still can come from successfully

exploiting “behind the pipe” pay-zones such as

the Mississippian or Cline using new

technologies

exploiting “behind the pipe” pay-zones such as

the Mississippian or Cline using new

technologies

Clear Fork

Upper Spraberry

Lower Spraberry

Jo Mill

Dean

Woldcamp A

Wolfcamp B

Wolfcamp C

Cline

Strawn

Atoka

Mississippian

15

Acquisition and Development Plan

1. Drill and complete available

development well locations on

current high-value

properties

development well locations on

current high-value

properties

2. Acquire producing property(s) in

the Midland and Central basins

with

the Midland and Central basins

with

• Over 12 months of

production history

production history

• $125,000 to $200,000 of monthly

cash-flow

cash-flow

• Additional upside from proved

undeveloped (PUD) drilling

locations

undeveloped (PUD) drilling

locations

3. Acquire additional properties with PDP valuations representing 75% or more of prospect

value

value

4. Sell properties with limited development upside and re-deploy capital to other properties

with production and three or more years of development

with production and three or more years of development

16

Lightnin’ Property

Disposition Details

• Acquired March 2012 (640 gross acres) for $480,256

• First well spud January 2013

• Cumulative Capex of $2,075,074

• Gross cumulative cash flows of $461,918

• Sold June 2014 for $4,021,400

63% internal rate of return (IRR)

Adding Value Through Disciplined Development

17

Disciplined Deployment of Capital

|

|

|

|

|

|

|

|

|

|

|

Lightnin' Sale

|

Fairway Purchase

|

Delta

|

Multiple

|

|

|

|

Permian Basin County

|

Glasscock (Tier 1)

|

Glasscock (Tier 1)

|

N/A

|

N/A

|

|

|

|

Purchase (Sale) Price

|

$ 4,080,000

|

$ 5,985,059

|

$ 1,905,059

|

1.5

|

|

|

|

Developed Acres

|

320

|

1,280

|

960

|

4.0

|

|

|

|

Undeveloped Acres

|

320

|

3,280

|

2,960

|

10.3

|

|

|

|

BOE/PD

|

32 (1)

|

64.43 (2)

|

32

|

2.0

|

|

|

|

PDP Wells

|

4

|

9

|

5

|

2.3

|

|

|

|

PUD Wells

|

2

|

8

|

6

|

4.0

|

|

|

|

Pro-Forma Sale (Purchase)

Price per Flowing BOE |

$ 127,500

|

$ 92,894

|

$ (33,983)

|

0.7

|

|

|

|

% Oil

|

72.9%

|

73.0%

|

0.1%

|

1.0

|

|

|

|

|

|

|

|

|

|

(1) Reflects Q1 and Q2 2014 production

(2) Based on third party reserve reports and internal forecasts

18

Pending Fairway Acquisition (Proved and Producing)

• Target Energy is selling a 10% WI (7.5% NRI) of its proven and producing Permian Basin asset

• The proven property is located within the “Core” Wolfberry and Fusselman acreage window of

Glasscock County Texas and has significant development upside

Glasscock County Texas and has significant development upside

• Purchase price of $5.9 million

• Current in-place development

– 4,560 gross non-contiguous acres in the central Midland Basin of the Permian

– 480 acres are held by production (HBP) with 5 vertical Wolfberry and 4 vertical Fusselman

producers

producers

– Current production to the net 10% working interest is 64 BOE/PD

• The operator has identified 40 additional drilling locations on the remaining development acreage in

the Wolfberry and Fusselman with attractive IRRs - >50%

the Wolfberry and Fusselman with attractive IRRs - >50%

– First 8 well locations will be drilled and completed in 2014 with individual AFE’s of $1.8 - $2.1M

– An additional 22 wells will be drilled and completed in 2015 and 2016, leaving an estimated 10

additional wells for future development

additional wells for future development

– $6.2M additional development capital is required over next 3 years (net the 10% working interest)

• Anticipated closing June 30th, 2014

19

Fairway Economic Plan & Assessment

• The company plans to acquire Fairway and improve the property’s current cash-flow and market

valuation via a three year or shorter development plan

valuation via a three year or shorter development plan

• Utilizing an independent third-party reserve report and a development model established by the current

operator, the company anticipates a significant financial return

operator, the company anticipates a significant financial return

• Total three year acquisition and development Capex of $12.1 million

• $5.9 million purchase price

• $6.2 million three year drilling and development plan

• Cash-flow and sale at end of three year period offers better than 60% IRR

• Total 3 year EBITDA of $8.3 million with $3.1 million occurring in year three

• Based on current comparable flowing barrel sales in this area ($115k - $152K), the company

anticipates a late 2016 or early 2017 sale of the asset

anticipates a late 2016 or early 2017 sale of the asset

• EOY 2016 daily flow rate estimate of 143 BOE to our NRI

– At $115,000 per flowing barrel the sale price is $16,4 million

– At $152,000 per flowing barrel, the sale price is $21.7 million

• That’s $24.7 to $30 million cash on cash return for the $12.1 million of investment

20

Fairway is in the Heart of the “Tier 1” Zone

Source: Pioneer 2013, 3Q Report

21

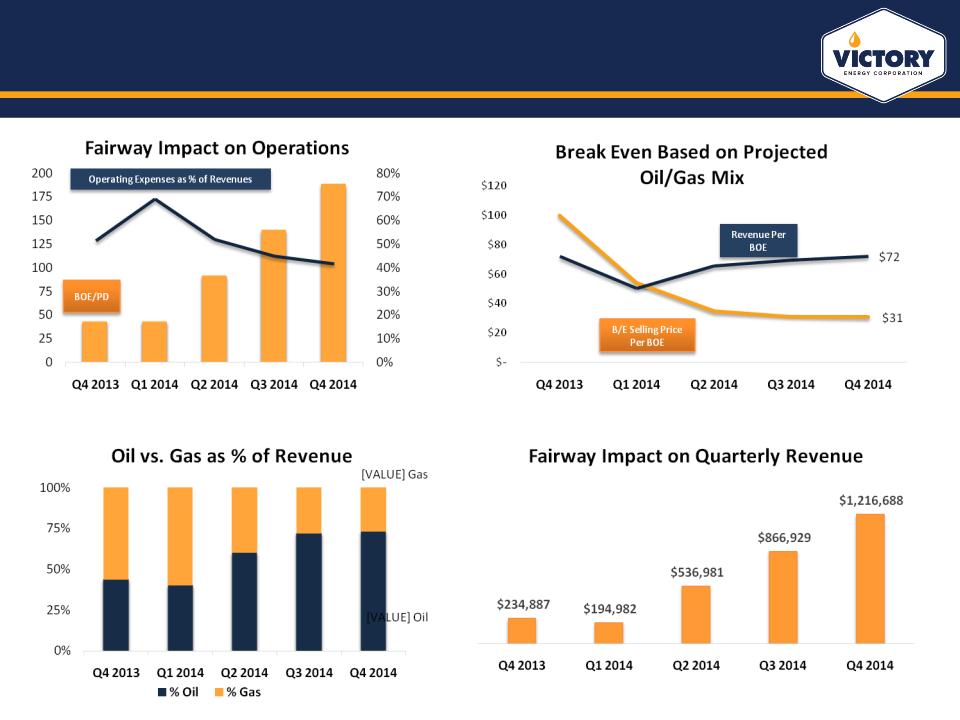

Fairway Impact on the Company

Production and economics based on May 2014 third-party reserve report

22

Bootleg Canyon (Proved and Producing)

Vertical Well Economic Summary

• Well cost to the 100% $1.55M

• Working Interest 5%

• Net Revenue Interest 3.75%

• Well Costs to working interest $78,000

• Return on capital multiple 7.79

Description

• Acquired April 2011 (over 5,000 acres)

• Located in Pecos County, TX

• Conventional drilling play (vertical)

• Three wells completed with seven remaining

o 2 oil wells with EUR of 187,240 BO

o 1 gas well flowing to sales with daily flow at 475 mcf

188,000 BOE

188,000 BOE

• 3D seismic supported

• Formation focus - Ellenberger (oil) & Connell (gas)

• Operator is V.F. Petroleum (Midland, TX)

Reserves and Production Model to 3.75% NRI

• Production estimated to occur through 2027

• Gross EUR (BO) per well 187,240 BO

• Net EUR (BO) per well 6,909 BO

• Gross EUR, ten wells 1,872,400 BO

• Net EUR, ten wells 69,090 BO

• Percent Oil 75%

• Percent Gas 25%

23

Adams Baggett Gas Field (Proved and Producing)

Per Well Economics

• Well cost to the 100% $600K

• Working Interest in 7 wells 100%

o Net Revenue Interest 75%

• Working Interest in 2 wells 50%

o Net Revenue Interest 38%

• High Btu premium price to market of 28%

Description

• Acquired 2008 (180 acres)

• Located in Crockett County, TX

• High Btu natural gas production

• Nine vertical gas wells completed and on production

with zero remaining locations available

with zero remaining locations available

• Formation focus - Canyon Sandstone (4,300-4,900’)

• Operator is Cambrian Management (Midland, TX)

Reserves and Production Model to 75% NRI

• Gross EUR for the field 937.48 MMcf

• Net EUR for the field 599.80 MMcf

• Estimated Net future cash

flow from proved reserves of $1.7M

flow from proved reserves of $1.7M

24

Experienced E&P Management

• Served as Victory’s COO from Jan. 2011 - Jan. 2012.

• 21 years of professional experience, seven in E&P.

• Previously held titles of Interim CEO, VP of Operations and VP

Investor Relations with another publicly traded E&P company.

Investor Relations with another publicly traded E&P company.

• Member of the first 20 employees at Dell Inc.

• Business Management and Business Marketing Southwest Texas

State University (now Texas State University). The University of

Texas Graduate School of Business Executive Education program,

The Aspen Institute and the Center for Creative Leadership.

State University (now Texas State University). The University of

Texas Graduate School of Business Executive Education program,

The Aspen Institute and the Center for Creative Leadership.

• Energy Finance Executive with 36 years of proven leadership in

financial and operational reporting, internal controls and SOX

compliance, tax, legal and information systems.

financial and operational reporting, internal controls and SOX

compliance, tax, legal and information systems.

• 20 years with Louisiana Land & Exploration Co

• 7 years experience with ConocoPhillips as a Director in upstream

accounting services

accounting services

• 4 years as Controller for Pioneer Natural Resoruces

• CAO with MagnumHunter and River Gas Corp.

• Over 35 years of oil and gas industry law centered on the upstream,

midstream and downstream activities of major and independent oil

companies.

midstream and downstream activities of major and independent oil

companies.

• His expertise encompasses all aspects of oil and gas operations.

• Recognized as one of the top oil and gas attorneys in the United

States.

States.

• Member of the Bar, State of Texas: a Life Fellow, Texas Bar

Association and Founding Fellow, Austin Bar Association.

Association and Founding Fellow, Austin Bar Association.

• Over 40 years of oil and gas experience in prospect evaluation,

acquisition, exploration, drilling, development and divestitures.

This includes 25 years of Management and Executive level

experience.

acquisition, exploration, drilling, development and divestitures.

This includes 25 years of Management and Executive level

experience.

• Mr. Hair is the founder and managing member of privately held

C&F Minerals LLC. He has run this privately owned company since

1985.

C&F Minerals LLC. He has run this privately owned company since

1985.

• Held the position of Division Land Manager for Samedan Oil

Corporation (NYSE - Noble Affiliates).

Corporation (NYSE - Noble Affiliates).

• Held the position of Exec. VP for Costilla Energy Inc. (NYSE)

• BBA in Accounting at The University of Houston, member of the

Permian Basin Landman’s Association, the Permian Basin Oil and

Gas Association and serves on the Board of Director’s for Habitat

for Humanity Permian Basin.

Permian Basin Landman’s Association, the Permian Basin Oil and

Gas Association and serves on the Board of Director’s for Habitat

for Humanity Permian Basin.

• The company also utilizes a team of third-party professionals on an

as-needed basis. This team includes geologists for property

evaluation, assessment and reservoir engineering resources for the

analysis of current and new properties. Each independent operator

utilized by the company also has their own array of targeted experts.

as-needed basis. This team includes geologists for property

evaluation, assessment and reservoir engineering resources for the

analysis of current and new properties. Each independent operator

utilized by the company also has their own array of targeted experts.

25

Investment Summary

• Proven management team with over 150 years of combined oil and gas experience

• Predictable IRRs offered by the largest resource play in the U.S. (Permian Basin)

• Access to proved producing properties and development project deal flow

• Strong balance sheet - excellent capital liquidity

o Low cost capital source via $25 M bank credit facility

o $10 M private placement through the Aurora partnership is underway

o Improving cash-flow and proved reserves from near-term acquisitions

• Ground-floor entry into fast growing publicly traded company

o 2013 revenue from hydrocarbon sales up 125% vs. EOY 2012

o 2013 proved reserves (PV-10) value up 39%+ vs. EOY 2012

o 2013 oil as a percent of production up 130% vs. EOY 2012

o Recent addition of new capital will accelerate future growth

• The opportunity pipeline and new technology deployment has combined to deliver lower F&D

costs; higher volumes, longer life assets, incremental revenue and higher EBITDA

costs; higher volumes, longer life assets, incremental revenue and higher EBITDA

26

Contacts

Investor Relations

Derek Gradwell

Senior Vice President, Natural Resources - MZ North America

Main: 212-301-7130

Direct: 512-270-6990

Email: dgradwell@mzgroup.us

www.mzgroup.us

Victory Energy Corporation

Kenneth Hill, CEO

Email: Kenny@vyey.com

Phone: (512) 347-7300

www.vyey.com