Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - TCP International Holdings Ltd. | d693313dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on June 24, 2014.

Registration No. 333-196129

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 3

to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

TCP INTERNATIONAL HOLDINGS LTD.

(Exact name of registrant as specified in its charter)

| Switzerland | 3641 | Not Applicable | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Alte Steinhauserstrasse 1

6330 Cham, Switzerland

(330) 995-6111

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Ellis Yan

325 Campus Drive

Aurora, Ohio 44202

(330) 995-6111

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Phyllis G. Korff Joshua A. Kaufman Skadden, Arps, Slate, Meagher & Flom LLP Four Times Square New York, NY 10036-6522 Tel: (212) 735-3000 Fax: (212) 735-2000 |

Joseph A. Hall New York, NY 10017 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer (Do not check if a smaller reporting company) | x | Smaller reporting company | ¨ | |||

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement with respect to these securities filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, and we are not soliciting an offer to buy these securities, in any state where the offer or sale of such securities is not permitted.

Subject to Completion

Preliminary Prospectus, dated June 24, 2014

PROSPECTUS

7,142,858 Common Shares

This is TCP International Holdings Ltd.’s initial public offering. We are offering 7,142,858 of our common shares.

We expect the public offering price to be between $13.00 and $15.00 per share. Currently, no public market exists for our common shares. We have been approved to list our common shares on the New York Stock Exchange, or NYSE, under the symbol “TCPI” subject to notice of official issuance.

We are an emerging growth company as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, have elected to comply with certain reduced public company reporting requirements for future filings.

Investing in our common shares involves risk. See “Risk Factors” beginning on page 12 of this prospectus.

| Per Share | Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions |

$ | $ | ||||||

| Proceeds, before expenses, to TCP International Holdings Ltd.(1) |

$ | $ | ||||||

| (1) | See “Underwriting.” |

We have granted the underwriters an option to purchase up to 1,071,428 shares from us, to cover over-allotments, at the initial public offering price less underwriting discounts and commissions.

The underwriters expect to deliver the shares on or about , 2014.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Deutsche Bank Securities | Piper Jaffray | |

| Canaccord Genuity | Cowen and Company |

The date of this prospectus is , 2014

Table of Contents

Table of Contents

| PAGE | ||||

| 1 | ||||

| 7 | ||||

| 9 | ||||

| 12 | ||||

| 37 | ||||

| 39 | ||||

| 40 | ||||

| 41 | ||||

| 42 | ||||

| 43 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

46 | |||

| 71 | ||||

| 98 | ||||

| 108 | ||||

| 110 | ||||

| 111 | ||||

| 120 | ||||

| 126 | ||||

| 128 | ||||

| 136 | ||||

| 137 | ||||

| 143 | ||||

| 144 | ||||

| 144 | ||||

| F-1 | ||||

| A-1 | ||||

We have not, and the underwriters and their affiliates have not, authorized anyone to provide you with any information or to make any representation not contained in this prospectus. We do not, and the underwriters and their affiliates do not, take any responsibility for, and can provide no assurances as to, the reliability of any information that others may provide you. We are not, and the underwriters and their affiliates are not, making an offer to sell, or seeking offers to buy, these securities in any jurisdiction where the offer or sale thereof is not permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common shares. Our business, financial condition, operating results and prospects may have changed since that date.

TRADEMARKS

We have proprietary rights in the trademarks Connected by TCP™, Connected™, Elite Series by TCP™, Elite Designer Series by TCP™, Spring Lamp™, SpringLight™, TCP®, TruDim®, TruStart®, Brilliant choice™, Powerlume®, Pulse Plus® and Sky Bay® in the United States. We reserve all rights to our trademarks, regardless of the manner in which we refer to them in this prospectus. All other trademarks, trade names and service marks appearing in this prospectus are the property of their respective owners.

MARKET AND INDUSTRY DATA

This prospectus includes statistical data, market data and other industry data and forecasts, which we obtained or derived from market research, publicly available information and independent industry publications and reports that we believe to be reliable sources, including an industry study conducted by McKinsey & Company, or McKinsey, that is publicly available. These industry publications generally state that they obtain their information from sources that they believe to be reliable, but they do not guarantee the accuracy and completeness of the information. Although we believe that these sources are reliable, we have not independently verified the information contained in such publications. Data in the McKinsey study is set forth in Euros and converted into U.S. dollars for the purposes of this prospectus on the basis of $1.3910 per €1.00, which is the average exchange rate for 2011 (the reference year for McKinsey’s publication). On March 31, 2014, the exchange rate used for conversion of Euros into U.S. dollars was $1.3768 per €1.00.

i

Table of Contents

This summary highlights information contained elsewhere in this prospectus. It does not contain all of the information that you should consider before deciding to invest in our common shares. You should read this entire prospectus carefully, including the risks of investing in our common shares described under “Risk Factors” and the more detailed information in “Management’s Discussion and Analysis of Financial Conditions and Results of Operations” and our consolidated financial statements and related notes prepared in accordance with accounting principles generally accepted in the United States, or “U.S. GAAP,” appearing elsewhere in this prospectus. In this prospectus, unless the context otherwise requires, the term “TCP” refers to TCP International Holdings Ltd., and the terms the “Company,” “we,” “us,” and “our” refer to TCP International Holdings Ltd. together with its subsidiaries. The term “CHF” refers to Swiss francs, the terms “dollar” and “$” refer to U.S. dollars, the terms “pound sterling” and “£” refer to British pound sterling and the terms “yuan” and “¥” refer to Chinese yuan. All share and per share data relating to our common shares in this prospectus have been adjusted to reflect a 1:10 reverse stock split to be given effect prior to the effectiveness of the registration statement of which this prospectus is a part.

Overview

We are a leading global provider of energy efficient LED and CFL lighting technologies. We design, develop, manufacture and deliver high quality energy efficient lamps, fixtures and internet-based lighting control solutions. Our internally developed driver, optical system, thermal management and power management technologies deliver a high standard of efficiency and light quality. Our broad portfolio of advanced LED and CFL lamps and fixtures enables us to address a wide range of applications required by our retail and commercial and industrial, or C&I, customers. We have established the largest number of Energy Star® compliant lighting products for LEDs and CFLs combined. The lighting market is characterized by rapid product innovation and, as a result, we have maintained integrated product design and manufacturing capabilities to allow us to quickly respond to the rapidly evolving demands of our customers. Our products are currently offered through thousands of retail outlets and C&I distributors. Since our inception in 1993, we have sold more than one billion energy efficient lighting products. We believe that the market for LED lighting solutions is at an inflection point, and that we are well positioned to capitalize on this rapidly growing opportunity, as reflected in our 2011 to 2013 LED sales compound annual growth rate, or CAGR, of 208.0%.

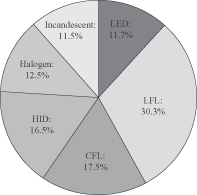

The general lighting market is in a state of transition from inefficient lighting technologies, primarily incandescent lamps, to efficient lighting technologies, primarily LEDs and CFLs. This transition is driven by improving light quality, appealing economics, government regulations, public awareness, and emerging connectivity and control capabilities. According to McKinsey, the global LED and CFL markets are expected to grow from $22.1 billion in 2011 to $87.4 billion in 2020 in aggregate, representing a CAGR of 16.5%.

We have a strong global customer base in North and South America, Asia and Europe, with our products primarily sold through the retail and C&I channels. Our key customers in the retail channel include The Home Depot, to which we are one of the largest energy efficient lamp suppliers in the United States, Walmart, from whom we received a Supplier Award of Excellence in 2013, and Carrefour. Our key customers in the C&I channel include HD Supply, Regency, Rexel, CED and Grainger. In recent years, we established a sales force to better serve our C&I customers and end users. We are also increasing our product sales through e-commerce retailers, including Amazon.com and HomeDepot.com.

We operate product development facilities in Aurora, Ohio and Shanghai, China focused on introducing new technologies, increasing functionality, enhancing quality, improving manufacturing processes and reducing costs that enable us to provide a wide range of advanced lighting products tailored to our customers’ needs. We have received numerous awards for our products, including being named an ENERGY STAR® Partner of the Year in 2013 and 2014. We also received the Envisioneering Innovation and Design Award at the Consumer Electronics Show in 2014 for our Connected by TCP™ internet-based lighting control solution. For our LED

1

Table of Contents

lamps, we develop our own design specifications and source components from world-class suppliers, such as Nichia, NXP Semiconductors, Texas Instruments and Seoul Semiconductor, which enables us to remain technologically agnostic with the flexibility to adopt advancements in LED technology and leverage the LED chip manufacturers’ R&D. Unlike many of our competitors, we utilize a vertically integrated, efficient and automated process to manufacture our CFL products at four facilities in China. This allows us to maintain control over product quality, react quickly to our customers’ specifications, achieve faster product introductions and maximize our margins.

Our net sales have increased from $263.8 million in 2011 to $428.9 million in 2013, representing a 27.5% CAGR. From 2011 to 2013, our LED sales increased from $11.3 million, or 4.3% of net sales, to $107.1 million, or 25.0% of net sales, representing a 208.0% CAGR. The remaining portion of our net sales largely represents CFL sales, which increased from $215.6 million, or 81.7% of net sales, in 2011 to $289.3 million, or 67.5% of net sales, in 2013, representing a 15.8% CAGR. Our net income (loss) attributable to TCP was $3.3 million in 2011, $(6.2) million in 2012 and $8.2 million in 2013. Our net sales increased from $90.3 million for the three months ended March 31, 2013 to $101.1 million for the three months ended March 31, 2014, and net income attributable to TCP increased from $0.9 million for the three months ended March 31, 2013 to $3.9 million for the three months ended March 31, 2014. CFL sales and LED sales represented 70.4% and 20.7% of net sales for the three months ended March 31, 2013, respectively, compared to 58.8% and 35.9% of net sales for the three months ended March 31, 2014, respectively.

Industry Background

We compete in the global general lighting market, which consists of lamps and fixtures used for general illumination purposes in residential and C&I applications. Based on a report by McKinsey, the global general lighting market was $75.8 billion in 2011 and is expected to grow to $114.8 billion by 2020. The global lighting market is expected to undergo significant transition in the coming years driven by the rapid adoption of energy efficient lighting products as a result of improved light quality and performance, lower total cost of ownership, greater focus on energy efficiency, increased regulatory requirements banning inefficient lamps, as well as macroeconomic trends, such as population growth and increasing urbanization. These changes are expected to accelerate the adoption of energy efficient, or non-incandescent, lighting technologies, primarily LEDs. According to McKinsey, the global LED market was $8.9 billion in 2011 and is forecasted to grow to $81.2 billion by 2020, representing a 27.9% CAGR. In the interim, we expect other energy efficient lighting technologies, such as CFLs, to aid in the transition from inefficient lighting technologies prior to the widespread adoption of LEDs. In addition, we expect that the increasing integration of control systems will also drive adoption of intelligent lighting systems that utilize advanced products, including LED and CFL lamps and fixtures, and provide for capabilities including remote monitoring and control, advanced sensing and device-level communication.

Our Competitive Strengths

Well-Positioned to Capitalize on Rapidly Growing LED Opportunity. We believe that LED lighting solutions are at an inflection point, having become the fastest growing sector of the general lighting market due to light quality, appealing economics, government regulation, public awareness, and emerging connectivity and control capabilities. Our LED product portfolio is aligned to capitalize on this growth within the retail and C&I channels. In addition, we have developed strong relationships with key customers, including Walmart. We also have secured new LED customers outside of the United States and Canada, including Homebase and Carrefour in EMEA, IRIS Ohyama, Inc. (“IRIS”) and Emart in Asia and Sodimac in Latin America. As a result of these factors, from 2011 to 2013, our LED sales grew at a 208.0% CAGR. LED products are an increasing portion of our revenues, accounting for 4.3% of net sales in 2011, 25.0% of net sales in 2013 and 35.9% of net sales for the three months ended March 31, 2014.

2

Table of Contents

Broad Portfolio of Efficient Lighting Products. Our high quality lighting solutions including lamps, indoor and outdoor fixtures and connected lighting products focus solely on the energy efficient lighting market. We have more than 750 LED SKUs and 2,500 CFL SKUs, which in 2013 together accounted for 92.4% of our net sales, as well as complementary lighting solutions that address specific customer needs. Countries around the world are increasingly adopting standards to reduce the use of inefficient lighting technologies. Our portfolio helps our end users meet these standards and reduce energy usage and costs without sacrificing light quality. Our products have received numerous awards, including ENERGY STAR® Partner of the Year awards in 2013 and 2014.

Strong Distribution Network Through Retail and C&I Channels. Our products are sold through thousands of retail outlets and C&I distributors. We have established strong relationships with key retail customers, including The Home Depot, Walmart and Carrefour. In the C&I channel, we have established deep customer relationships and a reputation for high quality products with leading distributors, including HD Supply, Regency, Rexel, CED and Grainger. In recent years, we established a sales force to better serve our C&I customers and end users such as Chipotle and Hilton.

Proprietary Technology Leads to High Quality Lighting. Our focus on product development enables us to provide a wide range of advanced lighting products to our customers in a timely fashion. We operate product development facilities in Aurora, Ohio and Shanghai, China, where we focus on new technologies, increasing functionality, enhancing quality, improving manufacturing processes and reducing costs. We believe that our rigorous product development and testing processes led to our receipt of ENERGY STAR® Partner of the Year awards in 2013 and 2014, among other awards. We have developed driver technologies for our CFL products, including our patented TruDim® and TruStart® technologies. We have leveraged these existing technologies for our LED drivers, which has helped us achieve a high standard of efficiency.

Flexible Manufacturing Capabilities. For our LED lamps, we develop our own design specifications and source components from world-class suppliers, such as Nichia, NXP Semiconductors, Texas Instruments and Seoul Semiconductor, which enables us to remain technologically agnostic with the flexibility to react to advancements in LED technology and leverage our suppliers’ R&D. We intend to develop a more automated and advanced manufacturing process for our LED products, in part through the use of the net proceeds of this offering. Unlike many of our competitors, we utilize a vertically integrated, efficient and automated process to manufacture our CFL products at four facilities in China. This allows us to maintain control over product quality, react quickly to our customers’ specifications, achieve faster product introductions and maximize our margins.

Smart Lighting Platform for the Connected World. In the fall of 2013, we launched our internet-based lighting control system called Connected by TCP™, which consists of wireless LED lamps connected to an internet-enabled gateway that can be controlled by a simple, user-friendly interface. This solution provides a user with the ability to control and customize lighting in a home or office from anywhere in the world through an Android or iOS mobile device. We believe lighting control systems will accelerate adoption of LED lighting products by providing dynamic control and functional capabilities to lighting that go beyond the simple turning off and on of light. Furthermore, the Connected by TCP™ gateway has the ability to add other smart devices in a home or office setting, including connectable sensors, smoke detectors, security systems and smart thermostats. Our Connected by TCP™ smart lighting solution received the Envisioneering Innovation and Design Award at the Consumer Electronics Show in 2014.

Experienced Management Team with Deep Lighting Expertise. We have a strong and experienced management team, led by our CEO, Ellis Yan. Ellis Yan founded and developed our company and has been instrumental in growing the business into a leading provider of energy efficient lighting solutions. Our core management team consists of nine individuals who have an average of 12 years of experience in the lighting

3

Table of Contents

industry. Members of our senior management have joined us from major lighting companies, such as General Electric and Philips, and from leading lighting retailers, including The Home Depot. We believe that we have a strong team in place to continue to build our global lighting business.

Our Growth Strategies

Our goal is to be the global market leader in energy efficient lighting solutions. Our growth strategies include:

Increase Our Sales of LED Products. Our LED portfolio consists of more than 750 SKUs that address a wide range of general lighting applications. In addition, we have a strong product roadmap to develop new LED products, including fixtures, high voltage lamps and smart lighting products, that we intend to introduce to the market in the near-term. In recent years, we have established a C&I sales force to address catalog and electrical, specialty lighting and utility distributors as well as directly marketing to large hospitality and retail store end users, including Chipotle and Hilton. We believe that these efforts will enable us to benefit from the expanding global market for LED lighting technology. We intend to use the net proceeds from this offering in part to acquire and develop advanced, automated manufacturing equipment to expand our LED manufacturing capacity, which will allow us to decrease our time-to-market and maintain our product technology and quality leadership.

Develop the TCP Brand. Our goal is for our customers and end-users to further associate the TCP brand with high quality lighting solutions that offer industry leading technology. We have built strong brand awareness and customer recognition within the C&I channel. For the retail channel, we currently sell our products primarily under private label, whereby our retail customers then re-sell these products to consumers under their own brand names. Recently, we have begun introducing TCP-branded and co-branded products into our retail channel to increase TCP brand awareness with consumers. To further promote TCP brand awareness, we intend to use a targeted media campaign to leverage directed internet advertising and social media, as well as strategically placed in-store interactive video and displays. We believe that our smart lighting platform for the connected home and office will also increase brand recognition among consumers.

Expand Our Energy Efficient Lighting and Smart Technology Portfolio. We have added numerous LED and connected lamps and fixtures, such as our next generation Elite Series of PAR, BR and A lamps, to our portfolio over the past two years. These solutions offer industry-leading technological advancements, such as a smooth heat sink base. We will continue to use our strong product development capabilities to introduce new categories, increase functionality and efficiency, enhance product design and aesthetics and lower product costs. In 2013, we also introduced our smart lighting solution Connected by TCP™. We continue to advance our home and office connectivity solutions and will introduce a number of new connected products that incorporate technologies that utilize Bluetooth and Zigbee protocols.

Continue Global Expansion. We believe there is a tremendous opportunity to increase our sales outside of the United States and Canada. Our sales outside of this region have increased from 10.2% in 2011 to 17.6% in 2013. We intend to leverage our strong, established customer relationships in the United States and Canada to expand our sales in these markets. We continue to add new retail and C&I customers, including IRIS in Asia, Carrefour in Europe and Sodimac in Latin America. We continue to open sales offices abroad, most recently in Japan and Germany, to complement our existing offices in China, the United Kingdom, France and Brazil.

4

Table of Contents

Risk Factors

There are a number of risks related to our business, our intellectual property, this offering and our common shares, our corporate structure, doing business in China and taxation, as more fully described in the section entitled “Risk Factors” immediately following this prospectus summary. Some of the principal risks include the following:

| • | Our industry is highly competitive. If we are not able to compete effectively, including against larger lighting manufacturers with greater resources, our business, financial condition and results of operations will be adversely affected. |

| • | The loss of our relationship with The Home Depot or Walmart, or a significant decline in either of their purchases, could have a material adverse effect on our business, our ability to distribute our products, and our financial condition and results of operations. |

| • | Lighting products are subject to rapid technological changes. If we fail to accurately anticipate and adapt to these changes, the products we sell could become obsolete, and our business, financial condition and results of operations would be adversely affected. |

| • | If we are unable to increase production capacity for our products in a cost effective and timely manner or manage our operations and supply chain, we may incur delays in shipment and our sales and reputation in the marketplace could be harmed. |

| • | The suspension of, repeal of or amendments to current requirements to phase-out energy inefficient lamp technologies by governments or the provision of government sponsored subsidies in our target geographies could impair our sales of energy efficient lamps in our markets. |

| • | If we are unable to obtain and adequately protect our intellectual property rights, our competitive position could be harmed. |

| • | Assertions by third parties of intellectual property infringement could result in significant costs and cause our operating results to suffer. |

| • | There may be circumstances in which the interests of our major shareholders could be in conflict with your interests as a shareholder. |

These and other risks are more fully described in the section entitled “Risk Factors” in this prospectus. If any of these risks actually occurs, they could adversely affect our business, financial condition and results of operations.

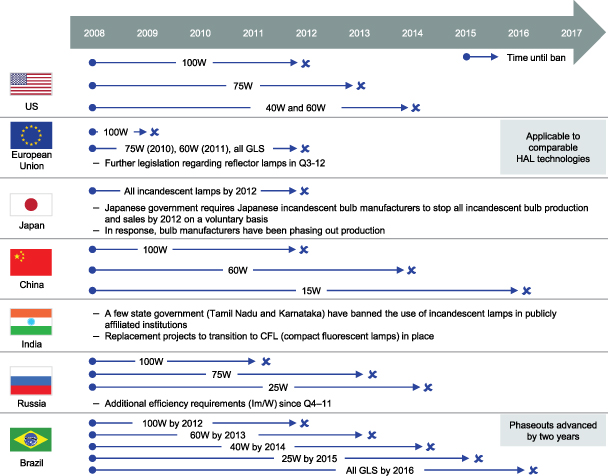

Corporate Information

Our principal executive offices are located at Alte Steinhauserstrasse 1, 6330 Cham, Switzerland, where our phone number is (330) 995-6111. Our website address is www.tcpi.com. The information on, or accessible through, our website does not constitute part of this prospectus.

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in annual gross revenues during our last fiscal year, we qualify as an “emerging growth company” pursuant to the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. These provisions include exemption from the auditor attestation requirement in the assessment of the emerging growth company’s internal control over financial reporting. The JOBS Act also provides that an emerging growth company need not comply with any new or

5

Table of Contents

revised financial accounting standard until such date that a non-reporting company is required to comply with such new or revised accounting standard. However, we have not elected to avail ourselves of this exemption and, therefore, we will comply with new or revised financial accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies.

We will remain an emerging growth company until the earliest of (a) the last day of our fiscal year during which we have total annual gross revenues of at least $1.0 billion; (b) the last day of our fiscal year following the fifth anniversary of the completion of this offering; (c) the date on which we have, during the previous three year period, issued more than $1.0 billion in non-convertible debt; or (d) the date on which we are deemed to be a “large accelerated filer” under the Securities Exchange Act of 1934, as amended, or the Exchange Act. When we are no longer deemed to be an emerging growth company, we will not be entitled to the exemptions provided in the JOBS Act discussed above.

6

Table of Contents

| Common shares offered: |

7,142,858 common shares |

| Option to purchase additional shares: |

We have granted the underwriters a 30-day option to purchase up to an additional 1,071,428 common shares from us, to cover over-allotments, at the initial public offering price less underwriting discounts and commissions on the same terms as set forth in this prospectus. |

| Common shares to be outstanding immediately after the offering: |

27,696,288 common shares (or 28,767,716 common shares if the underwriters exercise in full their option to purchase additional shares). |

| Use of proceeds: |

We intend to use the net proceeds from this offering to acquire and develop advanced, automated manufacturing equipment to expand our LED manufacturing capacity, for the repayment of indebtedness outstanding and for general corporate purposes. See “Use of Proceeds.” |

| Dividend policy: |

We currently do not intend to pay cash dividends after the completion of this offering, subject to the discretion of our board of directors. We currently intend to reinvest any future earnings in developing and expanding our business. See “Dividend Policy.” |

| Lock-up agreements: |

We have agreed with the underwriters, subject to certain exceptions, not to sell or dispose of any common shares or any securities convertible into or exchangeable for any common shares during the period commencing on the date of this prospectus until 180 days after the date of this prospectus. All of our directors, executive officers and all of our shareholders have agreed to similar lockup restrictions for a period of 180 days. See “Underwriting.” |

| Directed share program: |

At our request, the underwriters have reserved for sale, at the initial public offering price, up to five percent of the common shares offered by this prospectus for sale to some of our directors, officers and certain other persons. If these persons purchase reserved shares, this will reduce the number of shares available for sale to the public. Any reserved shares that are not so purchased will be offered by the underwriters to the public on the same terms as the other shares offered by this prospectus. |

| NYSE symbol: |

“TCPI” |

| Risk factors: |

Investing in our common shares involves a high degree of risk and purchasers of our common shares may lose part or all of their investment. See “Risk Factors” and the other information included elsewhere in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common shares. |

7

Table of Contents

Unless otherwise indicated, the information in this prospectus:

| • | assumes a 1:10 reverse stock split to be given effect prior to the effectiveness of the registration statement of which this prospectus is a part; |

| • | assumes no exercise of the underwriters’ option to purchase up to 1,071,428 common shares from us at the initial public offering price less underwriting discounts and commissions; |

| • | assumes an initial public offering price of $14.00 per share, the midpoint range set forth on the cover of this prospectus; |

| • | does not give effect to the issuance of any shares under our proposed 2014 Omnibus Incentive Plan, including the 1,683,600 common shares to be issued upon vesting of the restricted share units granted to our employees, directors, and other eligible service providers prior to the completion of this offering, and the issuance of up to a maximum of 816,400 of our common shares following the offering, as described in “Management–2014 Omnibus Incentive Plan”; and |

| • | does not give effect to Solomon Yan’s intention to transfer 2,034,789 common shares to a trust for the benefit of his immediate family members prior to the completion of this offering. |

8

Table of Contents

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL DATA

The following summary consolidated statement of operations data for the years ended December 31, 2011, 2012 and 2013 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. The summary consolidated statement of operations data for the three months ended March 31, 2013 and 2014 and the summary consolidated balance sheet data as of March 31, 2014 have been derived from our unaudited condensed consolidated financial statements included elsewhere in this prospectus. In our opinion, these unaudited condensed consolidated financial statements have been prepared on a basis consistent with our audited consolidated financial statements and contain all normal and recurring adjustments necessary for a fair presentation of such consolidated financial data. Our historical results are not necessarily indicative of results to be expected in any future periods. You should read this information together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus.

| Year Ended December 31, | Three Months Ended March 31, |

|||||||||||||||||||

| 2011 | 2012 | 2013 | 2013 | 2014 | ||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||

| Net sales |

$ | 263,846 | $ | 359,355 | $ | 428,925 | $ | 90,294 | $ | 101,117 | ||||||||||

| Cost of goods sold |

208,098 | 275,109 | 336,819 | 69,459 | 76,330 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

55,748 | 84,246 | 92,106 | 20,835 | 24,787 | |||||||||||||||

| Selling, general and administrative expenses |

39,590 | 60,128 | 64,252 | 14,570 | 16,963 | |||||||||||||||

| Litigation settlements1 |

— | 27,550 | 3,032 | — | 100 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating income (loss) |

16,158 | (3,432 | ) | 24,822 | 6,265 | 7,724 | ||||||||||||||

| Interest expense, net |

3,949 | 5,260 | 6,059 | 1,295 | 2,280 | |||||||||||||||

| Foreign exchange losses (gains), net |

4,752 | 249 | 5,929 | 2,406 | (674 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) from continuing operations before income taxes |

7,457 | (8,941 | ) | 12,834 | 2,564 | 6,118 | ||||||||||||||

| Income tax expense (benefit) from continuing operations |

3,796 | (2,738 | ) | 4,662 | 1,623 | 2,197 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) from continuing operations |

3,661 | (6,203 | ) | 8,172 | 941 | 3,921 | ||||||||||||||

| Net loss from discontinued operations2 |

(249 | ) | — | — | — | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

3,412 | (6,203 | ) | 8,172 | 941 | 3,921 | ||||||||||||||

| Net income attributable to noncontrolling interests |

149 | — | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) attributable to TCP |

$ | 3,263 | $ | (6,203 | ) | $ | 8,172 | $ | 941 | 3,921 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) per share attributable to TCP, basic and diluted3 |

$ | 0.16 | $ | (0.30 | ) | $ | 0.40 | $ | 0.05 | $ | 0.19 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted average number of shares outstanding, basic and diluted3 |

20,553 | 20,553 | 20,553 | 20,553 | 20,553 | |||||||||||||||

| Dividends per share3 |

$ | 0.05 | $ | 0.87 | $ | — | $ | — | $ | — | ||||||||||

| Other Financial Data: |

||||||||||||||||||||

| Adjusted EBITDA (unaudited)4 |

$ | 24,152 | $ | 35,714 | $ | 35,996 | $ | 8,217 | $ | 10,014 | ||||||||||

9

Table of Contents

| As of March 31, 2014 | ||||||||

| Actual | As Adjusted5 | |||||||

| (in thousands) | ||||||||

| Balance Sheet Data: |

||||||||

| Cash and cash equivalents6 |

$ | 23,021 | $ | 112,825 | ||||

| Working capital7 |

(56,419 | ) | 33,385 | |||||

| Property, plant and equipment, net |

72,955 | 72,955 | ||||||

| Total assets |

334,659 | 424,463 | ||||||

| Total debt |

146,790 | 146,790 | ||||||

| Total liabilities |

327,214 | 327,214 | ||||||

| Total shareholders’ equity |

7,445 | 97,249 | ||||||

| 1 | Represents the settlement of various litigation matters, as detailed in Note 14 to our consolidated financial statements and Note 7 to our unaudited condensed consolidated financial statements included elsewhere in this prospectus. See also “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources” and “Business—Legal Proceedings.” |

| 2 | In August 2011, we sold the stock of one of our Chinese subsidiaries to an entity owned and controlled by our majority shareholders. We have no continuing activity with this entity and, accordingly, it has been reflected as discontinued operations in the accompanying consolidated financial statements. |

| 3 | All share and per share data relating to our common shares in this prospectus have been adjusted to reflect a 1:10 reverse stock split to be given effect prior to the effectiveness of the registration statement of which this prospectus is a part. |

| 4 | We present the non-GAAP financial measure “Adjusted EBITDA” as a supplemental measure of our performance. This non-GAAP financial measure is not a measure of financial performance or liquidity calculated in accordance with U.S. GAAP, and should be viewed as a supplement to, not a substitute for, our results of operations and balance sheet information presented on the basis of U.S. GAAP. |

We define EBITDA as net income (loss) attributable to TCP before interest expense, income taxes, depreciation and amortization, and Adjusted EBITDA as EBITDA before net foreign currency losses (gains), litigation settlements and costs related to our withdrawn initial public offering. Adjusted EBITDA is not necessarily comparable to similarly titled measures reported by other companies. Adjusted EBITDA may exclude certain financial information that some may consider important in evaluating our financial performance. Adjusted EBITDA may not be indicative of historical operating results, and we do not intend for it to be predictive of future results of operations. We believe the use of Adjusted EBITDA as a metric assists our board, management and investors in comparing our operating performance on a consistent basis because it removes the impact of our capital structure (such as interest expense), asset base (such as depreciation and amortization) and tax structure, as well as certain items that affect inter-period comparability.

10

Table of Contents

The following table presents a reconciliation of EBITDA and Adjusted EBITDA to net income (loss) attributable to TCP, which is the most directly comparable U.S. GAAP measure, for the periods presented.

| Year Ended December 31, | Three Months Ended March 31, | |||||||||||||||||||

| 2011 | 2012 | 2013 | 2013 | 2014 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Net income (loss) attributable to TCP |

$ | 3,263 | $ | (6,203 | ) | $ | 8,172 | $ | 941 | $ | 3,921 | |||||||||

| Adjustments: |

||||||||||||||||||||

| Interest expense, net |

3,949 | 5,260 | 6,059 | 1,295 | 2,280 | |||||||||||||||

| Income tax expense (benefit) |

3,796 | (2,738 | ) | 4,662 | 1,623 | 2,197 | ||||||||||||||

| Depreciation and amortization |

6,739 | 7,154 | 8,142 | 1,952 | 2,190 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDA |

17,747 | 3,473 | 27,035 | 5,811 | 10,588 | |||||||||||||||

| Adjustments: |

||||||||||||||||||||

| Foreign exchange losses (gains), net |

4,752 | 249 | 5,929 | 2,406 | (674 | ) | ||||||||||||||

| Litigation settlements |

— | 27,550 | 3,032 | — | 100 | |||||||||||||||

| Cost related to withdrawn initial public offeringa |

1,653 | 4,442 | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA (unaudited) |

$ | 24,152 | $ | 35,714 | $ | 35,996 | $ | 8,217 | $ | 10,014 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| a | Represents legal, accounting and professional fees incurred in connection with our proposed initial public offering in 2012, which was withdrawn. |

| 5 | The “as adjusted” data gives effect to the issuance of 7,142,858 common shares in this offering at an assumed offering price of $14.00 per common share, which is the midpoint of the range set forth on the cover of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

| 6 | Excludes restricted cash of $5,421. |

| 7 | Total current assets minus total current liabilities. |

11

Table of Contents

Investing in our common shares involves a high degree of risk. You should carefully consider the following risk factors, as well as the financial and other information in this prospectus, before deciding to invest in our common shares. If any of the following risks actually occurs, our business, financial condition and results of operations could be materially adversely affected. In such case, the trading price of our common shares could decline and you may lose all or part of your investment in our common shares.

Risks Related to Our Business

Our industry is highly competitive. If we are not able to compete effectively, including against larger lighting manufacturers with greater resources, our business, financial condition and results of operations will be adversely affected.

Our industry is highly competitive. We face competition from vendors of traditional lighting technologies and from vendors of newer innovative products. The lighting industry is characterized by rapid technological change, short product lifecycles, frequent new product introductions and a competitive pricing environment. These characteristics increase the need for continual innovation and, as new technologies evolve, provide entry points for new competitors as well as opportunities for rapid share shifts. Our products compete with a number of existing products and our success depends on our ability to effectively compete in this global market. Many of our competitors, such as Philips, General Electric, OSRAM, Cree, and Acuity Brands are large, well-capitalized companies with significantly more resources than ours and they are able to spend more aggressively on product development, marketing, sales and other product initiatives.

Our ability to compete effectively in our markets depends upon our ability to distinguish our company and our products from our competitors and their products based on various factors, including, among others:

| • | breadth and quality of product offering; |

| • | product pricing and cost competitiveness; |

| • | access to distribution channels globally; |

| • | customer orientation and strong customer relationships; and |

| • | the success and timing of new product development. |

To the extent we are unable to distinguish our products, our larger competitors and any other more innovative competitors may be able to capture our customers and reduce our opportunities for success, which will adversely affect our business, financial condition and results of operations.

The loss of our relationship with The Home Depot or Walmart, or a significant decline in either of their purchases, could have a material adverse effect on our business, our ability to distribute our products, and our financial condition and results of operations.

Net sales to The Home Depot accounted for 34.8%, 28.8% and 31.4% of our net sales in 2011, 2012 and 2013, respectively, and net sales to Walmart accounted for 10.3% and 13.0% of our net sales in 2012 and 2013, respectively. Net sales to The Home Depot and Walmart accounted for 18.3% and 26.4%, respectively, of our net sales for the three months ended March 31, 2014. We do not have a long-term contract with, or any volume commitments from, The Home Depot or Walmart. Our sales have been and may continue to be materially affected by fluctuations in the buying patterns of The Home Depot and Walmart, and such fluctuations may result from general economic conditions, higher than anticipated inventory positions or other factors. A loss of The Home Depot or Walmart as a customer, or a significant decline in either of their purchases from us, could have a material adverse effect on our business, financial condition and results of operations and our ability to distribute our products.

12

Table of Contents

Each such company may make decisions regarding its business undertakings with us that may be contrary to our interests, or may terminate its relationship with us altogether, which it may do at any time. In addition, if either company changes its business strategy, we may fail to maintain our relationship with such company. Furthermore, should either company face changes that decrease its customer base due to the economy or for any other reason, our sales could be materially and adversely affected.

Lighting products are subject to rapid technological changes. If we fail to accurately anticipate and adapt to these changes, the products we sell will become obsolete, and our business, financial condition and results of operations will be adversely affected.

Lighting products are subject to rapid technological changes and short product life cycles that often lead to price erosion and cause product obsolescence. Companies within the lighting industry are continuously developing new products with heightened performance and functionality, which puts pricing pressure on existing products and constantly threatens to make them, or causes them to be, obsolete. These trends are especially relevant for our LED lamp products, which have experienced, and are expected to continue to experience, very rapid technological improvement and cost declines compared to other current lamp technologies. Our typical product’s life cycle is relatively short, generating lower average selling prices as the cycle matures. If we fail to accurately anticipate the introduction of new technologies, we may possess significant amounts of obsolete inventory that can only be sold at substantially lower prices and profit margins than we anticipated, which in turn may cause the stated value of our inventory to decline. In addition, if we fail to accurately anticipate the introduction of new technologies or are unable to develop the planned new technologies, we may be unable to compete effectively due to our failure to offer products most demanded by the marketplace. If any of these failures occurs, our business, financial condition and results of operations will be adversely affected.

If we are unable to increase production capacity for our products in a cost effective and timely manner or manage our operations and supply chain, we may incur delays in shipment and our sales and reputation in the marketplace could be harmed.

An important part of our business plan is the expansion of production capacity for our products. In order to fulfill anticipated demand for our products, we invest in capacity in advance of actual customer orders, typically based on preliminary, non-binding indications of future demand. As customer demand for our products changes, we must be able to adjust our production capacity, and manage our operations and supply chain, to meet demand while keeping costs down. Uncertainty is inherent within our facility and capacity expansion, and unforeseen circumstances could offset the anticipated benefits, disrupt our ability to provide products to our customers and impact product quality. Our ability to provide products to our customers in a cost effective and timely manner depends on a number of factors, including the following:

| • | our ability to effectively increase the automation of the manufacturing processes for our LED and CFL product lines; |

| • | our ability to transition production among manufacturing facilities; |

| • | our ability to properly and quickly anticipate customer preferences among lighting products; |

| • | our ability to repurpose equipment from the production of one product to another; |

| • | the availability of critical components and raw materials used in the manufacture of our products; |

| • | the reliability of our inventory management systems and supply chain visibility tools; |

| • | our ability to effectively establish and use adequate management information systems, financial controls and quality control procedures; and |

| • | equipment failures, power outages, environmental risks or variations in the manufacturing process. |

13

Table of Contents

If we are unable to increase production capacity for our products in a cost effective and timely manner while maintaining adequate quality, we may incur delays in shipment or be unable to meet increased demand for our products, which could harm our sales and operating margins and damage our reputation and our relationships with current and prospective customers. In addition, even if we are able to increase production capacity in a cost-effective and timely manner while maintaining adequate quality, if we are not able to effectively manage our inventory, supply chain and our operations, there may be delays in the delivery of our products that could also result in the loss of customers. From time to time, in part due to the growth of our business, we have experienced some delays in delivering products demanded by certain of our customers. Finally, if demand does not increase at the rate forecast, we may not be able to reduce manufacturing expenses or overhead costs at the same rate as demand decreases, which could also result in lower margins and adversely affect our business, financial condition and results of operations.

The reduction or elimination of investments in, or incentives to adopt, LED, CFL and other energy efficient lighting or the elimination of, or changes in, policies, incentives or rebates in certain states or countries that encourage the use of LEDs, CFLs and other energy efficient lighting solutions over some traditional lighting technologies could cause the growing demand for our products to slow, which could materially and adversely affect our business, financial condition and results of operations.

Today, the upfront cost to consumers of LEDs, CFLs and other forms of lighting solutions exceeds the upfront cost for some traditional lighting technologies that provide similar lumen output in many applications. Some governments around the world, including the United States, China, the European Union, and Canada, have used policy initiatives and other regulations, including financial incentives and rebates to consumers from which we benefit, to accelerate the development and adoption of LEDs, CFLs and other forms of lighting solutions and other non-traditional lighting technologies that are seen as more environmentally friendly compared to some traditional lighting technologies. Reductions in (including as a result of any budgetary constraints), or the elimination of, government investment and favorable energy policies could result in decreased demand for our products and decrease our sales, profits and margins. Further, if our products fail to qualify for any financial incentives or rebates or if restrictions by regulation of competitive products are removed, demand for our products may decrease, and our sales and profits may decrease.

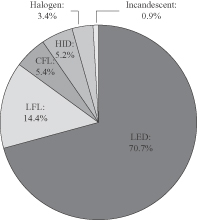

The suspension of, repeal of or amendments to current requirements to phase-out energy inefficient lamp technologies by governments or the provision of government sponsored subsidies in our target geographies could impair our sales of energy efficient lamps in international markets.

Effective legislation in many countries that mandates energy efficiency standards for lamps represents an important driver to the growth in adoption of the energy efficient lamp technologies that we offer. The suspension of, repeal of or amendments to current laws or regulations banning inefficient lamp technologies in the United States and Canada, EMEA, Asia or Latin America could materially and adversely affect our business, financial condition and results of operations.

Any increase in the cost or disruption in the availability of the raw materials or key components utilized in our lighting products may adversely affect our business, financial condition and results of operations.

The lighting industry is subject to significant fluctuations in the cost and availability of raw materials and components. We rely on a number of third-party suppliers to provide certain raw materials and to manufacture certain of the components of our products and expect to continue to rely on such suppliers.

Our results of operations are directly affected by the cost of our raw materials, which could be affected by, among other things, general shortages in the marketplace and high price volatility. Our principal raw materials and components are phosphor, LED chips, plastic and aluminum. As a result of the significant portion of our cost of goods sold represented by these raw materials, our gross profit and margins could be adversely affected by changes in the cost of these raw materials if we are unable to pass the increases on to our customers. In recent

14

Table of Contents

years, the price of phosphor has experienced extreme volatility due to changes in the global supply of rare earth elements, the main raw material inputs for phosphor, particularly in China. More than 95% of the world’s current supply of rare earth elements comes from China, which has enacted a policy to reduce its exports because of its rising domestic demand and new environmental restrictions. Given the volatility in the cost of phosphorous elements, there can be no assurance that prices will not increase in the future, potentially at significant rates. Such increases may adversely affect our business, financial condition and results of operations.

We depend on a limited number of suppliers for these and other raw materials. We do not have guaranteed supply arrangements with our suppliers and few alternative sources exist. Substitution of alternate raw materials could significantly change the performance of the lighting products that we manufacture. If the availability of any of these raw materials is limited, we may be unable to produce some of our products in the quantities demanded by our customers, which could have an adverse effect on plant utilization and our sales of products requiring such raw materials.

We depend on certain key suppliers for components that we require for our lighting products, and the loss of any of these suppliers could have an adverse effect on our business, financial condition and results of operations.

We depend on certain key suppliers for certain key components that we require for our lighting products, including the LEDs for our LED-based lighting products. We do not have long-term contracts with these suppliers or any volume commitments from them. Our third-party suppliers may encounter problems obtaining materials required during their manufacturing processes due to a variety of reasons, any of which could delay or impede their ability to meet our demand for components. Our reliance on third-party suppliers also subjects us to additional risks that could harm our business, including, among others:

| • | we may not be able to obtain an adequate supply of our components in a timely manner or on commercially reasonable terms; |

| • | our suppliers may be accused of infringing the intellectual property of third parties which, if upheld, could alter or inhibit their ability to fulfill our orders and meet our requirements; and |

| • | our suppliers may encounter financial or other hardships unrelated to our demand, which could inhibit their ability to fulfill our orders and meet our requirements. |

Finding a suitable alternate supply of required raw materials and components that meet our strict specifications and obtaining them in needed quantities may be a time-consuming process, and we may not be able to find an adequate alternative source of supply at an acceptable cost. Any significant interruption in the supply of these raw materials or components could have a material adverse effect on our business, financial condition and results of operations.

We occasionally experience component quality problems with suppliers, and our current suppliers may not deliver satisfactory components in the future.

We occasionally experience component quality problems with suppliers. We may experience quality problems with suppliers in the future, which could decrease our gross margin and profitability, lengthen our sales cycles, adversely affect our customer relations and future sales prospects and subject our business to negative publicity. Our suppliers, especially new suppliers, may make manufacturing errors that may not be detected by our quality assurance testing, which could negatively affect the efficacy or safety of our products or cause shipment delays due to such errors. Additionally, we sometimes satisfy warranty claims even if they are not covered by our general warranty policy as a customer accommodation. If we were to experience quality problems with certain components purchased from our key suppliers, these adverse consequences could be magnified, and our business, financial condition and results of operations could be materially adversely affected.

15

Table of Contents

Our success is largely dependent upon the skills, experience and efforts of our senior management and the loss of their services could have a material adverse effect on our business, financial condition and results of operations.

Our continued success depends upon the continued availability, contributions, skills, experience and efforts of our senior management. We are particularly dependent on the services of Ellis Yan, our Chief Executive Officer. Ellis Yan has major responsibilities with respect to sales, product development and overall corporate administration. We do not have a formal succession plan in place for Ellis Yan. Our employment agreement with Ellis Yan does not guarantee his services for a specified period of time. All of the employment agreements with our senior management team may be terminated by the employee at any time. While all such agreements include non-competition and confidentiality covenants, there can be no assurance that such provisions will be enforceable or adequately protect us. The loss of the services of any of these persons might impede our operations or the achievement of our strategic and financial objectives, and we may not be able to attract and retain individuals with the same or similar levels of experience or expertise. Additionally, while we have key man insurance on the life of Ellis Yan, such insurance may not adequately compensate us for the loss of Ellis Yan. The loss or interruption of the service of members of our senior management, particularly Ellis Yan, or our inability to attract or retain other qualified personnel could have a material adverse effect on our business, financial condition and results of operations.

If we are unable to execute our business strategy to expand the marketing, distribution and sale of our products, and if we are unable to effectively manage the associated risks, our ability to expand our business abroad could be impaired.

We commenced sales activities in China in 2004, EMEA in 2010 and Latin America in 2011, and we expect to continue to expand our sales outside of the United States and Canada as part of our core business strategy. The marketing, distribution and sale of our products in these markets may expose us to a number of risks, including:

| • | fluctuations in currency exchange rates; |

| • | increased costs associated with maintaining the ability to understand the local markets and follow their trends; |

| • | failure to develop products that work under the various voltage standards that can differ from region to region; |

| • | failure to maintain effective marketing and distributing presence in various countries; |

| • | failure to provide adequate customer service and support in these markets; |

| • | failure to develop appropriate risk management and internal control structures tailored to overseas operations; |

| • | difficulty and cost relating to compliance with the different commercial and legal requirements of the markets in which we offer or plan to offer our products; |

| • | failure to obtain or maintain certifications for our products in these markets; |

| • | inability to obtain, maintain or enforce intellectual property rights; |

| • | unanticipated changes in prevailing economic conditions and regulatory requirements; |

| • | difficulty in employing and retaining sales personnel who are knowledgeable about, and can function effectively in, export markets; and |

| • | trade barriers such as export requirements, tariffs and taxes. |

16

Table of Contents

Our multi-national sales, manufacturing and operations subjects us to risks associated with operating in global markets.

We are a global business. For 2011, 2012 and 2013, 10.2%, 11.6% and 17.6%, respectively, of our net sales were outside of the United States and Canada. We are incorporated in Switzerland. Most of our manufacturing facilities are located in China. We also maintain offices in the United States, United Kingdom, Canada, Brazil, France, Germany and Japan. Global business operations are subject to inherent risks, including, among others:

| • | unexpected changes in regulatory requirements, tariffs and other trade barriers or restrictions; |

| • | longer accounts receivable payment cycles and the difficulty of enforcing contracts and collecting receivables through certain non-U.S. legal systems; |

| • | difficulties in managing and staffing operations; |

| • | potentially adverse tax consequences; |

| • | the burdens of compliance with the laws and regulations of a number of jurisdictions; |

| • | import and export license requirements and restrictions of China, the United States and each other country in which we operate; |

| • | exposure to different legal standards and reduced protection for intellectual property rights in some countries; |

| • | currency fluctuations and restrictions; |

| • | political, social and economic instability, including war and the threat of war, acts of terrorism, pandemics, boycotts, curtailment of trade or other business restrictions; |

| • | periodic economic downturns in the markets in which we operate; |

| • | customs clearance and transportation delays; and |

| • | sales variability as a result of translating our non-U.S. sales into U.S. dollars. |

Any of these factors may adversely affect our future sales outside the United States and, consequently, our business, financial condition and results of operations.

Fluctuations in currency exchange rates may significantly impact our results of operations and may significantly affect the comparability of our results between financial periods.

Our operations are conducted by subsidiaries in many countries. The results of operations and the financial position of these subsidiaries are reported in the relevant foreign currencies and then translated into U.S. dollars at the applicable exchange rates for inclusion in our consolidated financial statements. The main currencies to which we are exposed are the Euro, British pound sterling, Chinese yuan, Brazilian real and Swiss franc. The exchange rates between these currencies and the U.S. dollar in recent years have fluctuated significantly and may continue to do so in the future. A depreciation of these currencies against the U.S. dollar will decrease the U.S. dollar equivalent of the amounts derived from these operations reported in our consolidated financial statements and an appreciation of these currencies will result in a corresponding increase in such amounts. To the extent that we are required to pay for goods or services in foreign currencies, the appreciation of such currencies against the U.S. dollar will tend to negatively impact our results of operations. The steady appreciation of the Chinese currency versus the U.S. dollar over the past four years has increased the relative cost of our manufacturing to the extent we have used U.S. dollars or other currencies generated from our sales outside of China to purchase goods and services in China. In addition, currency fluctuations may affect the comparability of our results of operations between financial periods.

We do not hedge our currency exposure and, therefore, we incur currency transaction risk whenever we enter into either a purchase or sale transaction using a currency other than the local currency of the transacting

17

Table of Contents

entity. Given the volatility of exchange rates, there can be no assurance that we will be able to effectively manage our currency transaction risks or that any volatility in currency exchange rates will not have a material adverse effect on our business, financial condition or results of operations.

We may be exposed to fines, penalties or other sanctions if we do not comply with laws and regulations designed to combat government corruption in countries in which we sell our products, and any determination that we violated such laws and regulations could have a material adverse effect on our business, financial condition and results of operations.

We operate in some countries that have experienced significant levels of governmental corruption. Our employees, agents and contractors may take actions in violation of our policies and applicable laws and regulations that generally prohibit the making of improper payments to foreign government officials for the purpose of obtaining or keeping business, including the U.S. Foreign Corrupt Practices Act of 1977, as amended, or the FCPA. Such violations, if they occur, could have an adverse effect on our business, financial condition and results of operations and reputation. Any failure by us to ensure that our employees and agents comply with the FCPA and other applicable laws and regulations in non-U.S. jurisdictions could result in substantial civil and criminal penalties or restrictions on our ability to conduct business in certain non-U.S. jurisdictions, and our business, financial condition and results of operations could be materially and adversely affected.

We generally do not enter into long-term contracts with our customers, which could result in a disconnect between our production and sales.

We generally do not enter into long-term contracts with our customers. Rather, we sell our products to customers through purchase orders based on their current needs, which could result in a disconnect between our production and sales. As a result, we could experience periods during which our production exceeds the orders for our products, resulting in higher levels of inventory and of working capital employed in our business than would otherwise be required. We will also have to pay our fixed costs during such periods. We may not be able to timely find new customers, or increase orders from existing customers, in order to absorb our excess production and supplement our sales during these periods and we may not be able to recover our fixed costs as a result. Periods of no or limited purchase orders for our products could have a material adverse effect on our business, financial condition and results of operations.

Certification and compliance are important to adoption of our lighting products, and failure to obtain such certification or compliance may have an adverse effect on our business, financial condition and results of operations.

We are required to comply with certain legal requirements governing the materials used in our products and we submit to voluntary registration for the certification of some of our products. Certifications and compliance standards that we follow include UL, an independent organization that provides a UL mark on products that have passed testing and safety certification, and the efficiency requirements of ENERGY STAR®. The United States Environmental Protection Agency has announced that it intends to make its ENERGY STAR® rating standards more rigorous in the second half of 2014. If our products do not meet the new standards, our sales of any non-compliant products could decrease, which could have a material impact on our business. Any other amendments to existing requirements, or new requirements with which we cannot comply, may materially harm our sales. In addition, we cannot be certain that we will be able to obtain any such certifications for our new products or that, if certification standards are amended, we will be able to maintain certifications for our existing products. The failure to obtain such certifications or compliance may adversely affect our business, financial condition and results of operations.

18

Table of Contents

We are subject to the SEC’s new rules regarding the use and disclosure of “conflict minerals,” which we expect will increase our operating and compliance costs. Our products may contain conflict minerals, which could harm our reputation and cause sales of our products to decline.

The SEC adopted its final rule implementing Section 1502 of the Dodd-Frank Wall Street Reform and Consumer Protection Act concerning conflict minerals in August 2012. This rule requires us to: (1) determine whether conflict minerals (tin, tantalum, tungsten, gold or similar derivatives) are used in our products and, if so, determine if the minerals originated from the Democratic Republic of Congo (“DRC”) or its immediately adjoining countries; and (2) if so, to conduct due diligence regarding the source and chain of custody of these conflict minerals to determine whether the conflict minerals financed or benefitted armed groups. The rule will require us to submit forms and reports to the SEC by 2016 and annually thereafter that disclose our determinations and due diligence measures. We are currently conducting conflict minerals due diligence and are working toward the required deadline. Presently, we have not determined how many or if any of our supply chain partners use conflict minerals or how much expense our due diligence exercise will add to our operational cost. If we do not properly assess supply chain partners and appropriately control costs and budget for conflict minerals compliance, our results of operations and profitability in the future could suffer. In addition, if our products contain conflict minerals, sales of our products could suffer due to adverse public reaction, resulting in a decline in revenue and profitability.

Our products may contain defects or otherwise not perform as expected, which could reduce sales, result in costs associated with warranty or product liability claims or recall of those items, all of which could materially adversely affect our business, financial condition and results of operations.

The manufacturing of our products involves complex processes and defects have been, and could be, found in our existing or future products. These defects may cause us to incur significant warranty, support and replacement costs, and costs associated with recall may divert the attention of our engineering personnel from our product development efforts and harm our relationships with customers and our reputation in the marketplace. We generally provide limited warranties ranging from one to nine years on our products, and such warranties may require us to repair, replace or reimburse the end user for the purchase price of the product. Moreover, even if our products meet standard specifications, end users may attempt to use our products in applications they were not designed for or in products that were not designed or manufactured properly, resulting in product failures and creating customer dissatisfaction. Since the majority of our products use electricity, and our CFL lamps contain a small amount of mercury, it is possible that our products could result in injury or increased health risks, including the health risks associated with exposure to ultraviolet light generated by mercury vapors, whether by product malfunctions, defects, improper installation or other causes. Particularly because our products often incorporate new technologies or designs, we cannot predict whether or not product liability claims will be brought against us. We may not have adequate resources in the event of a successful claim against us or a recall of a product. A successful product liability claim against us or a significant recall of a product that is not covered by insurance or is in excess of our available insurance limits could require us to make significant payments of damages and could materially adversely affect our results of operations and financial condition. These problems could result in, among other things, a delay in the recognition or loss of sales, loss of market share or failure to achieve market acceptance. A significant product recall or product liability litigation could also result in adverse publicity, damage to our reputation and a loss of confidence in our products and adversely affect our business, financial condition and results of operations.

If we are unable to manage our anticipated sales growth effectively, our business, financial condition and results of operations could be adversely affected.

We intend to undertake a number of strategies in an effort to grow our sales. If we are successful, our sales growth may place significant strain on our limited resources, including our research and development, sales and marketing, operational and administrative resources. To properly manage any future sales growth, we must continue to improve our management, operational, administrative, accounting and financial reporting systems and expand, train and manage our employee base, which may involve significant expenditures and increased

19

Table of Contents

operating costs. We may not be able to effectively manage the expansion of our operations or recruit and adequately train additional qualified personnel. If we are unable to manage our anticipated sales growth effectively, the quality of our customer care may suffer, we may experience customer dissatisfaction, reduced future sales or increased warranty claims, and our expenses could substantially and disproportionately increase. Any of these circumstances could adversely affect our business, financial condition and results of operations.

We may engage in future acquisitions that could disrupt our business, divert management attention, increase our expenses or otherwise adversely affect our business, financial condition and results of operations.