Attached files

| file | filename |

|---|---|

| EX-1.1 - EX-1.1 - Karyopharm Therapeutics Inc. | a2220615zex-1_1.htm |

| EX-5.1 - EX-5.1 - Karyopharm Therapeutics Inc. | a2220615zex-5_1.htm |

| EX-23.1 - EX-23.1 - Karyopharm Therapeutics Inc. | a2220615zex-23_1.htm |

As filed with the Securities and Exchange Commission on June 25, 2014

Registration No. 333-196892

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1 to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

KARYOPHARM THERAPEUTICS INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

2834 (Primary Standard Industrial Classification Code Number) |

26-3931704 (I.R.S. Employer Identification No.) |

2 Mercer Road

Natick, MA 01760

(508) 975-4820

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices)

Michael G. Kauffman, M.D., Ph.D.

Chief Executive Officer

Karyopharm Therapeutics Inc.

2 Mercer Road

Natick, MA 01760

(508) 975-4820

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

| Copies to: | ||||

Steven D. Singer, Esq. Joshua D. Fox, Esq. Wilmer Cutler Pickering Hale and Dorr LLP 60 State Street Boston, MA 02109 Telephone: (617) 526-6000 |

Christopher B. Primiano, Esq. Vice President, General Counsel Karyopharm Therapeutics Inc. 2 Mercer Road Natick, MA 01760 Telephone: (508) 975-4820 |

Patrick O'Brien, Esq. Ropes & Gray LLP Prudential Tower 800 Boylston Street Boston, MA 02199 Telephone: (617) 951-7000 |

||

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

||||||||

| Class of Securities to be Registered |

Number of Shares to be Registered(1) |

Proposed Maximum Offering Price Per Share(2) |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee(3) |

||||

|---|---|---|---|---|---|---|---|---|

Common Stock, par value $0.0001 per share |

2,530,000 | $43.20 | $109,296,000 | $14,077.32 | ||||

|

||||||||

- (1)

- Includes shares that the underwriters have the option to purchase.

- (2)

- Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended, and based on the average of the high and low sales price of the registrant's common stock as reported on the NASDAQ Global Select Market on June 18, 2014.

- (3)

- $14,812 previously paid on June 19, 2014.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We and the selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated June 25, 2014

PROSPECTUS

2,200,000 Shares

Common Stock

We are offering 2,000,000 shares of our common stock and the selling stockholders are offering 200,000 shares of our common stock. We will not receive any proceeds from the sale of shares by the selling stockholders.

Our common stock is listed on The NASDAQ Global Select Market under the symbol "KPTI." The last reported sale price of our common stock on The NASDAQ Global Select Market on June 24, 2014 was $41.37 per share.

We are an "emerging growth company" under federal securities laws and are subject to reduced public company disclosure standards. See "Prospectus Summary—Implications of Being an Emerging Growth Company."

Investing in the common stock involves risks that are described in the "Risk Factors" section beginning on page 15 of this prospectus.

| |

Per Share

|

Total

|

||

|---|---|---|---|---|

Public offering price |

$ | $ | ||

Underwriting discount(1) |

$ | $ | ||

Proceeds, before expenses, to us |

$ | $ | ||

Proceeds, before expenses, to selling stockholders |

$ | $ |

- (1)

- We refer you to "Underwriting" on page 36 for additional information regarding total underwriting compensation.

The underwriters may also exercise their option to purchase up to an additional 330,000 shares from us at the public offering price, less the underwriting discount, for 30 days after the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The shares will be ready for delivery on or about , 2014.

| BofA Merrill Lynch | Leerink Partners |

JMP Securities |

Wedbush PacGrow Life Sciences |

Oppenheimer & Co. |

The date of this prospectus is , 2014.

TABLE OF CONTENTS

You should rely only on the information contained in or incorporated by reference in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. We have not, the selling stockholders have not, and the underwriters have not, authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We and the selling stockholders are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information contained or incorporated by reference in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock.

For investors outside the United States: We have not, the selling stockholders have not, and the underwriters have not, done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside the United States.

This summary highlights information contained elsewhere in this prospectus or incorporated by reference into this prospectus from our Annual Report on Form 10-K for the year ended December 31, 2013, our Quarterly Report on Form 10-Q for the quarter ended March 31, 2014 and our other filings with the Securities and Exchange Commission listed in the section of this prospectus entitled "Incorporation of Documents by Reference" and is qualified in its entirety by the more detailed information and consolidated financial statements included or incorporated by reference elsewhere in this prospectus. This summary does not contain all of the information that may be important to you. You should read and carefully consider the following summary together with the entire prospectus and the documents included herein by reference, including our consolidated financial statements and the notes thereto incorporated herein by reference and the matters discussed under "Risk Factors," "Selected Consolidated Financial Data" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in each case appearing elsewhere in this prospectus or in our Annual Report on Form 10-K for the year ended December 31, 2013 and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2014 incorporated by reference herein before deciding to invest in our common stock. Some of the statements in this prospectus constitute forward-looking statements that involve risks and uncertainties. See "Cautionary Note Regarding Forward-Looking Statements." Our actual results could differ materially from those anticipated in such forward-looking statements as a result of certain factors, including those discussed in "Risk Factors" and other sections of this prospectus and the documents incorporated herein by reference.

Except as otherwise indicated herein or as the context otherwise requires, references in this prospectus to "Karyopharm" "the Company," "we," "us" and "our" refer to Karyopharm Therapeutics Inc. and, where appropriate, its consolidated subsidiaries.

Overview

We are a clinical-stage pharmaceutical company founded in December 2008 by Dr. Sharon Shacham. We are focused on the discovery and development of novel first-in-class drugs directed against nuclear transport targets for the treatment of cancer and other major diseases. Our scientific expertise is focused on the understanding of the regulation of intracellular transport between the nucleus and the cytoplasm. We have discovered and are developing wholly-owned, novel, small molecule, Selective Inhibitors of Nuclear Export, or SINE, compounds that inhibit the nuclear export protein XPO1. We have worldwide rights to these SINE compounds. Our lead drug candidate, Selinexor (KPT-330), is an XPO1 inhibitor being evaluated in multiple open-label Phase 1 and Phase 2 clinical trials in patients with heavily pretreated relapsed and/or refractory hematological and solid tumor malignancies. To date, we have administered Selinexor to over 330 patients across Phase 1 and Phase 2 clinical trials in hematologic and solid tumor indications. Evidence of anti-cancer activity has been observed in some patients and Selinexor has been sufficiently well-tolerated to allow many of these patients to remain on therapy for prolonged periods, including several who have remained on study for over 12 months. During 2014, we plan to initiate registration-directed clinical trials in three different hematological malignancy indications. We plan to initiate up to two additional registration-directed trials in hematological or solid tumor indications in late 2014 or early 2015. These registration-directed trials are designed to serve as the basis for an application seeking regulatory approval for Selinexor in such indications. To our knowledge, no other XPO1 inhibitors are in clinical development at the present time.

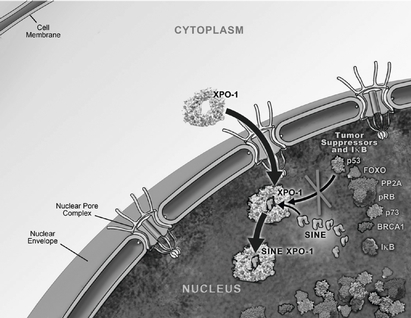

One of the ways in which the cell regulates the function of a particular protein is by controlling the protein's location within the cell, as a specific function may only occur within a particular location in the cell. In healthy cells, nuclear transport, both into and out of the nucleus, is a normal and regular occurrence that is tightly regulated and requires specific carrier proteins to occur. XPO1 mediates the export of approximately 220 different mammalian cargo proteins, including the vast majority of tumor

1

suppressor proteins. Moreover, XPO1 appears to be the only nuclear exporter for most of these tumor suppressor proteins. Cancer cells have increased levels of XPO1, causing the increased export of these tumor suppressor proteins from the nucleus. Since the tumor suppressor proteins need to be located in the nucleus to promote programmed cell death, or apoptosis, XPO1 overexpression in cancer cells counteracts the natural apoptotic process that protects the body from cancer. Due to XPO1 inhibition by our SINE compounds, the export of tumor suppressor proteins is prevented, thereby leading to their accumulation in the nucleus. This subsequently reinitiates and amplifies their natural apoptotic function in cancer cells with minimal effects on normal cells. The figure below depicts the process by which our SINE compounds inhibit the XPO1 nuclear export of tumor suppressor proteins.

Transient XPO1 Inhibition by SINE Compounds

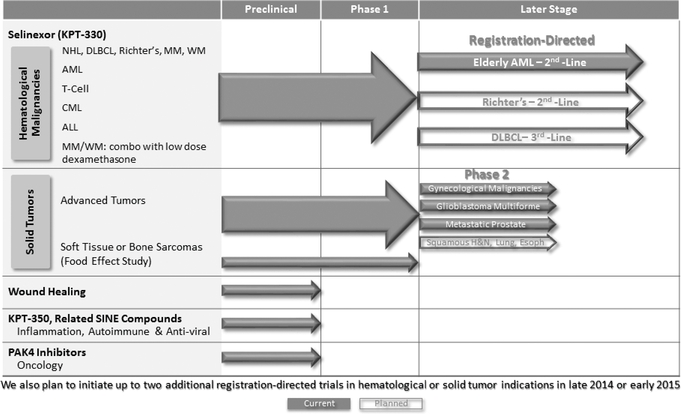

We are currently conducting multiple open-label clinical trials of Selinexor, including three Phase 1 clinical trials, the first in patients with various advanced hematological malignancies, the second in patients with various advanced or metastatic solid tumor malignancies and the third, a food effect study, in patients who have metastatic, locally advanced or locally recurrent soft tissue or bone sarcomas. In these trials, we have observed evidence of anti-cancer activity of Selinexor across a spectrum of patients with advanced cancers who had received multiple previous treatments and, despite these treatments, had disease that was progressing at the time of enrollment in our clinical trials. Our hematological malignancy trial consists of six arms, in which Selinexor is administered as a monotherapy in Arms 1-5 and in combination in Arm 6. Arm 1 includes patients with certain chronic B-cell malignancies, including non-Hodgkin's lymphoma, or NHL, chronic lymphocytic leukemia, or CLL, multiple myeloma, or MM and Waldenström's Macroglobulinemia, or WM; Arm 2 includes patients with acute myeloid leukemia, or AML; Arm 3 includes patients with T-cell lymphomas; Arm 4 includes patients with chronic myeloid leukemia, or CML; Arm 5 includes patients with acute lymphocytic leukemia, or ALL; and Arm 6 includes patients on combination therapy who have MM and are taking low-dose dexamethasone (20mg) in combination with each biweekly dose of Selinexor.

Of the patients evaluated in our hematological malignancy trial as of May 13, 2014, we have observed complete responses or remissions, partial responses or remissions, minimal responses or stable disease in a number of these patients, all as determined in accordance with commonly accepted evaluation criteria for the specific indication. Partial or minimal responses or stable disease have been observed in 70% of patients with relapsed and/or refractory chronic B-cell malignancies. In patients

2

with relapsed and/or refractory acute myeloid leukemia, or AML, as of May 13, 2014, we have observed complete remissions, partial remissions, morphologic leukemia-free state or stable disease in 49% of patients, some for longer than three months. Among eight patients with multiple myeloma treated with Selinexor in combination with low-dose dexamethasone (20mg twice weekly), complete, partial or minor responses were observed in 75% of patients as of June 5, 2014. Of the patients in the solid tumor malignancy trial evaluated as of May 13, 2014, we have observed partial responses or stable disease in 49%, all as determined in accordance with Response Evaluation Criteria In Solid Tumors, or RECIST.

We have initiated Phase 2 studies of Selinexor in several indications, including prostate cancer, gynecologic malignancies (ovarian, cervical and uterine cancers) and glioblastoma and we expect initial data during 2015. In addition, we expect to initiate a Phase 2 clinical trial in squamous head, neck or lung cancers during 2014. We have also initiated a Phase 1/2 study of Selinexor in combination with decitabine (Dacogen) in patients with AML and additional combination studies are expected to begin in 2014 and 2015.

We have initiated one registration-directed clinical trial and, assuming positive results from our ongoing clinical trials and pending regulatory feedback, we plan to initiate registration-directed clinical trials of Selinexor in two additional hematological malignancy indications during 2014. We refer to these trials as registration-directed because they are designed to serve as the basis for an application seeking regulatory approval of Selinexor. On June 24, 2014, we announced the initiation of a registration-directed clinical trial for Selinexor in older patients with relapsed refractory AML. We expect to initiate registration-directed clinical trials in Richter's Syndrome (also called Richter's Transformation) during the middle of 2014 and in diffuse large B-cell lymphoma, or DLBCL, in the second half of 2014. Moreover, we plan to initiate up to two additional registration-directed trials in hematological or solid tumor indications, potentially including multiple myeloma, in late 2014 or early 2015. We plan to seek regulatory approvals of Selinexor in North America and Europe in each such indication with respect to which we receive positive results and positive regulatory feedback. We may seek such approvals in other geographies as well.

We believe that the XPO1-inhibiting SINE compounds that we have discovered and developed to date, including Selinexor, have the potential to provide a novel targeted therapy that enables tumor suppressor proteins to remain in the nucleus and promote apoptosis of cancer cells. Moreover, our SINE compounds spare normal cells, which, unlike cancer cells, do not have significant damage to their genetic material, and we believe this selectivity for cancer cells minimizes side effects. We believe that the oral administration of Selinexor and the lack of cumulative or major organ toxicities observed to date in patients treated with Selinexor in clinical trials create the potential for its broad use across many cancer types, including both hematological and solid tumor malignancies. We believe that no currently approved cancer treatments or current clinical-stage cancer drug candidates are selectively targeting the restoration and increase in the levels of multiple tumor suppressor proteins in the nucleus.

Another SINE compound, Verdinexor (KPT-335), which is closely related to Selinexor, is being developed for the treatment of pet dogs with lymphomas. The approval of drugs to treat animals is based on a New Animal Drug Application, or NADA, reviewed by the FDA's Center for Veterinary Medicine. Three of the four technical sections of the NADA for Verdinexor have been approved by the FDA, including Effectiveness, Safety and Environmental Impact. We anticipate obtaining a marketing collaborator to complete the final major technical section of the NADA, the Chemicals/Manufacturing/Controls section, which covers the commercial-scale manufacturing, or CMC. of Verdinexor. We believe that the approval of the effectiveness and safety sections of the NADA for Verdinexor for the treatment of dogs with lymphoma helps confirm the activity and tolerability of our novel SINE compounds for the treatment of cancers.

We are focused on building a leading oncology business. Karyopharm was founded by Sharon Shacham, Ph.D., M.B.A., our President and Chief Scientific Officer. We are led by Dr. Shacham and

3

Dr. Michael Kauffman, our Chief Executive Officer. Dr. Kauffman played a leadership role in the development and approval of Velcade® at Millennium Pharmaceuticals, and of Kyprolis® while serving as Chief Medical Officer at Proteolix and then Onyx Pharmaceuticals. Dr. Shacham has played a leadership role in the discovery and development of many novel drug candidates, which have been or are being tested in human clinical trials, prior to her founding of Karyopharm and while at Karyopharm.

In addition to cancer, we believe that our SINE compounds have the potential to provide therapeutic benefit in a number of additional indications, including autoimmune and inflammatory diseases, wound healing, HIV and influenza. We have discovered and are developing a pipeline of SINE compounds that have shown evidence of activity in preclinical models of inflammation, wound healing and viral infection. We may seek to enter into development, marketing and commercialization collaboration arrangements for our SINE compounds other than Selinexor in non-oncology indications globally.

The table below summarizes the current stages of development of our key human drug candidates and indications that we expect to initially focus on for each candidate. We expect to initiate the planned clinical trials of Selinexor described below assuming positive results from our ongoing clinical trials and pending regulatory feedback. We also expect a number of investigator-sponsored trials, or ISTs, to be initiated for Selinexor in a variety of cancer indications over the next year. These ISTs could consist of single agent or combination studies with other agents in both hematological and solid tumor malignancies.

Recent Developments

We recently presented updated data from our ongoing Phase 1 clinical trials of Selinexor in patients with various advanced hematological malignancies and in patients with various advanced or metastatic solid tumor malignancies. All patients entering these trials have progressive disease upon enrollment that is relapsed after and/or refractory to all available classes of anti-cancer agents, typically

4

after multiple approved therapies and often after one or more experimental therapies. Anti-cancer activity has been observed with tumor reductions and durable disease control across many hematologic and solid tumor malignancies. Several patients have remained on single-agent oral Selinexor for over one year. Adverse events observed in our most recent patient data are generally mild, responsive to standard supportive care and consistent with those previously reported in patients in our Phase 1 clinical trials.

Response data presented herein are interim unaudited data based on reports by physicians at the clinical trial sites. Responses in the hematological trial are measured using commonly accepted evaluation criteria for the specific indication. Responses in the sold tumor trial are measured using RECIST. Responses include:

- •

- sCR – stringent complete response;

- •

- CR – complete response;

- •

- CR(i/p) – complete response without hematological recovery;

- •

- PR – partial response;

- •

- MLFS – morphological leukemia free state;

- •

- MR – minor response;

- •

- SD – stable disease;

- •

- PD – progressive disease;

- •

- WC – withdrew consent; or

- •

- NE – non-evaluable, meaning the patient's response could not be evaluated due to a number of potential factors, including when a patient withdraws consent or fails to comply with the therapeutic protocol for the trial.

Disease control rate, or DCR, refers to the percentage of responses that are SD or better (MR or better in the case of MM) and overall response rate, or ORR, refers to the percentage of responses that are PR or better.

Advanced Hematological Malignancies

We recently reported data from patients with non-Hodgkin's lymphoma, including diffuse large B-cell lymphoma and Richter's syndrome/transformation (Richter's), acute myeloid leukemia and multiple myeloma as part of our ongoing Phase 1 clinical trial of Selinexor in patients with various advanced hematological malignancies. The primary objectives of the Phase 1 trial are to determine the safety, tolerability and recommended Phase 2 dose of orally administered Selinexor. Patients were dosed 3 - 80mg/m2 of Selinexor orally over a four-week cycle, with lower doses initially given ten times per cycle and higher doses given twice weekly. Responses were evaluated every one to two cycles.

Non-Hodgkin's Lymphoma

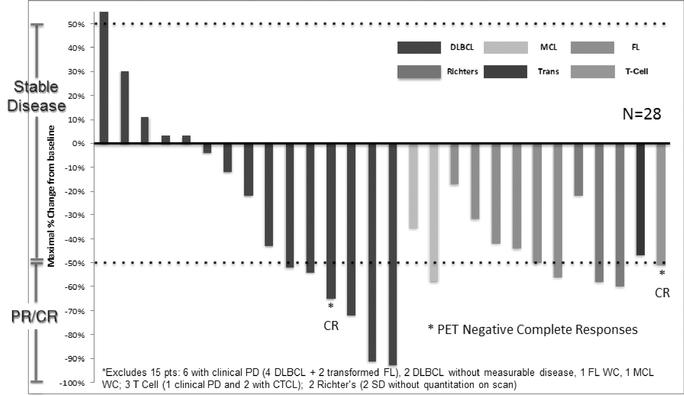

Fifty-one heavily pretreated patients with relapsed and/or refractory NHL, including DLBCL and Richter's, and mean prior treatment regimens of 4.1 were enrolled in this arm of the Phase 1 clinical trial as of May 13, 2014. Of this group, 43 patients were evaluable, five patients had tumors deemed non-evaluable and three patients had tumors pending evaluation. Among the 43 evaluable patients, the DCR was 74% across all doses of Selinexor and the ORR was 28%. Responses were observed across all subtypes of NHL, independent of genetic abnormalities, with durable cancer control observed across several patients who remained on study for longer than nine months. Responses in 43 evaluable patients are shown below.

5

Best Responses in NHL Patients as of May 13, 2014

Cancer

|

N | DCR (%) | ORR(%) | CR (%) | PR (%) | SD (%) | PD (%) | WC (%) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

DLBCL |

21 | 15 (70%) | 6 (29%) | 1 (5%) | 5 (25%) | 9 (40%) | 5 (25%) | 1 (5%) | ||||||||

Follicular |

7 | 6 (86%) | 1 (14%) | — | 1 (14%) | 5 (71%) | — | 1 (14%) | ||||||||

Mantle Cell |

3 | 2 (67%) | 1 (33%) | — | 1 (33%) | 1 (33%) | — | 1 (33%) | ||||||||

Transformed |

3 | 1 (33%) | 1 (33%) | — | 1 (33%) | — | 2 (67%) | — | ||||||||

T-Cell |

4 | 3 (75%) | 1 (25%) | 1 (25%) | — | 2 (50%) | — | 1 (25%) | ||||||||

Richter's Syndrome |

5 | 5 (100%) | 2 (40%) | — | 2 (40%) | 3 (60%) | — | — | ||||||||

| | | | | | | | | | | | | | | | | |

Total |

43 | 32 (74%) | 12 (28%) | 2 (5%) | 10 (23%) | 20 (47%) | 7 (16%) | 4 (9%) | ||||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

The following chart indicates the maximum percentage shrinkage of tumors across various subtypes of NHL relative to baseline scans for the patients depicted.

Among the 21 patients with heavily pretreated DLBCL, ORR and DCR were nearly identical across all subtypes of DLBCL. There are two major subtypes of DLBCL, namely Germinal Center B-Cell, or GCB and Activated B-Cell, or ABC, also called non-GCB. Many targeted therapies such as ibrutinib or lenalidomide show activity primarily against the ABC subtype. However, as detailed in the table below and consistent with the broadly applicable mechanism of action of Selinexor, Selinexor shows activity across both major subtypes.

Best Responses in Diffuse Large B-Cell Patients as of May 13, 2014

Type

|

N | DCR (%) | ORR (%) | CR (%) | PR (%) | SD (%) | PD (%) | WC (%) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

GCB |

11 | 8 (72%) | 3 (27%) | 1 (9%) | 2 (18%) | 5 (45%) | 2 (18%) | 1 (9%) | ||||||||

non-GCB |

4 | 3 (75%) | 1 (25%) | — | 1 (25%) | 2 (50%) | 1 (25%) | — | ||||||||

Unknown |

6 | 4 (67%) | 2 (33%) | — | 2 (33%) | 2 (33%) | 2 (33%) | — |

6

In addition, a minority of DLBCL patients have "double-hit" disease because these tumors over-express the two oncogenes MYC and BCL2 (or BCL6). Double-hit DLBCL is particularly difficult to treat due in part to its resistance to multi-agent immunochemotherapy and many targeted agents. Of four patients with double-hit DLBCL, there was one CR, two patients with SD (with 43% and 45% lymph node reductions, respectively), and one PD. We believe, together, these data and the consistent data across DLBCL subtypes indicate that Selinexor has the potential to treat a broad range of subtypes of DLBCL, largely independent of the cell of origin or oncogenic drivers.

Among all NHL patients, Grade 3/4 adverse events occurring in more than three patients included thrombocytopenia (20%), neutropenia (16%) and hyponatremia (6%). The most common Grade 1/2 adverse events were nausea (51%), anorexia (41%) and fatigue (36%). There have been no dose limiting toxicities among NHL patients as of May 13, 2014. The maximum tolerated dose was not reached, but based on biological activity and data from additional studies, the intended Phase 2 or Phase 3 trial dose of oral Selinexor for NHL is 60mg/m2 twice weekly.

Acute Myeloid Leukemia

Sixty-five heavily pretreated patients with progressive, relapsed and/or refractory AML, most with three or more prior treatment regimens, were enrolled in this arm of the Phase 1 clinical trial as of May 13, 2014. These patients were dosed 16.8 - 70mg/m2 in a four-week cycle, with lower doses initially given ten times per cycle and higher doses given twice weekly. Of these 65 patients, two patients had tumors pending evaluation, and among the 63 other patients, the complete response rate with or without full hematologic recovery was 11%, the ORR was 16% and the DCR was 49%; 16 (25%) of the 63 patients with AML were non-evaluable but were included in the AML response rate calculation. Responses were observed across multiple genetic subtypes of AML. Higher doses of Selinexor were associated with greater reductions in bone marrow blast counts, which were also observed across different AML subtypes. Responses in 63 patients are shown below. Two patients had tumors pending evaluation.

Best Responses in AML Patients as of May 13, 2014

N

|

DCR (%) | ORR (%) | CR (%) | CR(i/p) (%) | PR (%) | MLFS (%) | SD (%) | PD (%) | NE (%) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

63 |

31 (49%) | 10 (16%) | 5 (8%) | 2 (3%) | 1 (2%) | 2 (3%) | 21 (33%) | 16 (25%) | 16 (25%) |

Grade 3/4 adverse events occurring in more than three patients included fatigue (18%), thrombocytopenia (15%), neutropenia (11%), and nausea (8%). The most common Grade 1/2 adverse events were diarrhea (82%), anorexia (78%), nausea (74%), and fatigue (65%). There have been no dose limiting toxicities in AML patients as of May 13, 2014 and the maximum tolerated dose is ³70mg/m2 twice weekly. The intended Phase 2 or Phase 3 trial dose of oral Selinexor for AML is 55mg/m2 twice weekly.

Multiple Myeloma

As part of our Phase 1 clinical trial of Selinexor in patients with advanced hematological malignancies, patients with multiple myeloma were treated with either single-agent Selinexor or Selinexor in combination with "low-dose" (20mg) dexamethasone, all dosed twice weekly. Forty-four patients with multiple myeloma whose disease was relapsed and/or refractory to all available classes of approved therapies, with a mean of 5.7 prior therapies, and progressing on study entry have been enrolled in this trial as of June 5, 2014. Of these 44 patients, 34 received single-agent Selinexor therapy and eight patients were treated with Selinexor in combination with dexamethasone. Among the 34 patients receiving single-agent Selinexor therapy, including six patients who were non-evaluable, best responses include one PR (3%), five MRs (15%), 16 SDs (47%) and six PDs (18%). It should also be noted that some patients treated with single agent Selinexor receive very low doses of dexamethasone

7

(£12mg with each dose of selinexor) or another steroid as part of supportive care. These very low doses of steroids are not known to have any anti-myeloma activity, particularly in the patients enrolled in this study, whose disease is refractory to steroids and multiple other agents.

Eight patients were treated with 45mg/m2 of oral Selinexor and 20mg of dexamethasone, each dosed twice weekly. Two additional patients have been treated with combination therapy but had not yet completed the first treatment cycle as of June 5, 2014. This dose of dexamethasone is the standard low dose dexamethasone (40mg weekly or 20mg twice weekly) used with other anti-myeloma drugs including lenalidomide or pomalidomide. The patients enrolled in this study had received a median of 5.5 prior lines of therapy. All had received prior therapy with a proteasome inhibitor, such as Kyprolis or Velcade, and an immunomodulatory agent, such as pomalidomide, steroids (typically two or more times) while seven of the eight patients also received stem cell transplantations. As of June 5, 2014, the best responses among the eight patients were one stringent complete response (sCR) (12.5%), three PRs (37.5%), two MRs (25%), one PD (12.5%) and one NE (12.5%). The clinical benefit response rate (sCR+PR+MR) was 75% and the ORR was 50%. Five of the six responding patients remain on study as of June 5, 2014. Approximately 12 additional patients with multiple myeloma may be dosed with Selinexor in combination with dexamethasone in this ongoing Phase 1 study. Responses in these eight patients are described below.

Patients with Relapsed/Refractory MM Treated with Twice Weekly

Oral Selinexor 45mg/m2 + Dexamethasone 20mg

| MM Type | Number of Prior therapies |

Maximal Change |

Response | Study Days |

|||||

|---|---|---|---|---|---|---|---|---|---|

| IgG-k | 7 | -73% | PR | 122+ | |||||

| FLC-l | 5 | * | NE | 15 | |||||

| FLC-k | 3 | -53% | PR | 45 | |||||

| FLC-k | 5 | -98% | sCR | 107+ | |||||

| IgG-k | 7 | -81% | PR | 81+ | |||||

| IgG-k | 4 | * | PD | 38 | |||||

| IgA-k | 6 | -48% | MR | 51+ | |||||

| IgG-k | 7 | -32% | MR | 46+ |

- *

- Patients did not undergo post-cycle 1 scan.

Adverse events in patients receiving single-agent Selinexor were generally low-grade, consistent with events observed in patients with other hematological malignancies and responsive to standard supportive care. Compared with Selinexor given alone, fewer adverse events in patients receiving Selinexor in combination with dexamethasone were reported, particularly levels of nausea, consistent with dexamethasone's reduction in Selinexor's main side effects of nausea, anorexia, and fatigue.

In addition to patients with multiple myeloma achieving durable responses and disease control on Selinexor single-agent therapy, Selinexor with low dose dexamethasone showed activity with rapid M-protein reductions and good tolerability, even in patients with disease refractory to pomalidomide and/or carfilzomib. We believe that Selinexor may have synergistic potential with other therapies.

Advanced or Metastatic Solid Tumor Malignancies

We recently reported data from our ongoing Phase 1 clinical trial of Selinexor in patients with advanced or metastatic solid tumor malignancies. All patients entered the study with advanced or

8

metastatic solid tumor cancers relapsed or refractory after multiple previous treatments and objectively progressing on study entry. The primary objectives of the Phase 1 dose escalation trial are to determine the safety, tolerability and recommended Phase 2 dose of orally administered Selinexor. These patients were dosed 3 - 85mg/m2 of oral Selinexor over a four-week cycle, with lower doses initially given ten times per cycle and higher doses given twice weekly. Response evaluation was done every two cycles in accordance with RECIST.

As of May 13, 2014, 129 patients were enrolled in this Phase 1 clinical trial. Enrolled patients had received a mean of 3.7 prior therapies. Of these patients, 106 were evaluable and 23 patients were non-evaluable or pending evaluation as of May 13, 2014. Of these evaluable patients, the DCR was 49%. PRs were observed in four patients, one each with colorectal cancer (KRAS mutant), melanoma (BRAFwt), ovarian adenocarcinoma and cervical cancer. SD was noted in 47 patients, with 17 patients (16%) experiencing SD for six months or longer. Eight of nine evaluable patients with hormone and chemotherapy refractory prostate cancer achieved stable disease and have remained on study for between 70 and 317 days. Among 14 evaluable patients with head and neck cancer, nine achieved stable disease with eight on study for 75 to over 401 days. Responses in 106 evaluable patients are shown below.

Best Responses in Solid Tumor Patients as of May 13, 2014

Cancer Type

|

N | DCR (%) |

PR (%) | SD (%) | PD (%) | |||||

|---|---|---|---|---|---|---|---|---|---|---|

Colorectal |

39 | 14 (36%) | 1 (3%) | 13 (33%) | 25 (64%) | |||||

Head & Neck |

14 | 9 (64%) | — | 9 (64%) | 5 (36%) | |||||

Prostate |

8 | 7 (88%) | — | 7 (88%) | 1 (12%) | |||||

Cervical |

5 | 4 (80%) | 1 (20%) | 3 (60%) | 1 (20%) | |||||

Ovarian |

5 | 3 (60%) | 1 (20%) | 2 (40%) | 2 (40%) | |||||

GBM |

5 | — | — | — | 5 (100%) | |||||

Melanoma |

3 | 2 (67%) | 1 (33%) | 1 (33%) | 1 (33%) | |||||

Sarcoma |

8 | 7 (88%) | — | 7 (88%) | 1 (12%) | |||||

Other |

19 | 6 (32%) | — | 6 (32%) | 13 (68%) | |||||

| | | | | | | | | | | |

Total |

106 | 52 (49%) | 4 (4%) | 48 (45%) | 54 (51%) | |||||

| | | | | | | | | | | |

| | | | | | | | | | | |

Side effects were generally low grade and typically gastrointestinal in nature, or fatigue. These common side effects decreased over time, in part due to prophylactic use of standard supportive care. Two DLTs were observed in solid tumor patients receiving 85 mg/m2 dosed twice weekly. Grade 3/4 adverse events occurring in six or more patients in the first cycle included fatigue hyponatremia (8%), fatigue (7%), and thrombocytopenia (7%). The most common Grade 1/2 adverse events in the first cycle were nausea (62%), fatigue (52%), anorexia (48%) and vomiting (35%). One was Grade 3 asymptomatic hyponatremia and the other was acute cerebellar syndrome that reversed over several weeks with markedly improving ataxia and dysarthria. No additional central nervous system toxicities were observed in any other patients receiving Selinexor to date. Major organ dysfunction or clinically significant cumulative toxicities have not been observed. The intended Phase 2 or Phase 3 trial dose of oral Selinexor in solid tumors is 65mg/m2 twice weekly.

Registration-Directed Trial Design

On June 24, 2014, we announced the initiation of our Phase 2 study of Selinexor in patients 60 years of age or older with relapsed or refractory acute myeloid leukemia (AML) who are ineligible for intensive chemotherapy and/or transplantation. We have titled this trial the Selinexor in Older Patients with Relapsed/Refractory AML, or SOPRA, study. We also expect to initiate registration-

9

directed clinical trials for Selinexor in Richter's Syndrome during the middle of 2014 and in DLBCL in the second half of 2014.

In SOPRA, 150 patients with AML which has relapsed after, or was refractory to, first line therapy will be randomized in a 2:1 fashion to Selinexor provided orally twice per week at a dose of 55mg/m2 versus one of four physician choices. Physician choices include best supportive care, or BSC, alone, or BSC plus either azacytidine (Vidaza), decitabine (Dacogen), or low dose cytosine arabinoside (LD-AraC). Overall survival is the primary endpoint. SOPRA was designed based on data from the ongoing Phase 1 study of Selinexor in patients with advanced hematologic malignancies, including AML. SOPRA is expected to take approximately two years to complete.

Our registration-directed trial in Richter's Syndrome is designed as a single-arm trial in patients with CLL who experienced a transformation to Richter's Syndrome and subsequently relapsed after chemotherapy. The primary endpoint of this trial is ORR and the trial is expected to enroll approximately 50 patients who will be treated with Selinexor given at a dose of 60mg/m2, administered orally two times per week.

Our registration-directed trial in DLBCL is designed as a single-arm trial in patients that are relapsed and/or refractory to two lines of chemotherapy. The primary endpoint of this trial is ORR and the trial is expected to enroll approximately 150 patients who will be treated with Selinexor given at a dose of 60mg/m2 in combination with low dose dexamethasone (12mg), each administered orally two times per week.

Our Strategy

As a clinical-stage pharmaceutical company focused on the discovery and development of orally available, novel first-in-class drugs directed against nuclear transport targets for the treatment of cancer and other major diseases, the critical components of our business strategy are to:

- •

- Develop and seek regulatory approval of Selinexor, our novel lead drug candidate, in North America and Europe.

- •

- Maximize the commercial value of Selinexor.

- •

- Maintain our competitive advantage and scientific expertise in the field of nuclear transport.

- •

- Develop novel drug candidates by leveraging our proprietary drug discovery and optimization platform and our understanding

of nuclear transport.

- •

- Collaborate with key opinion leaders to conduct investigator-sponsored trials of Selinexor.

- •

- Maximize the value of our other SINE compounds in non-oncology indications and veterinary oncology through collaborations.

Risks Associated with Our Business

Our business is subject to a number of risks of which you should be aware before making an investment decision. These risks are discussed more fully in the "Risk Factors" section of this prospectus immediately following this prospectus summary and in our Annual Report on Form 10-K for the year ended December 31, 2013 and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2014 incorporated by reference herein. These risks include the following:

- •

- We depend heavily on the success of Selinexor, our lead drug candidate, which is currently in Phase 1 and Phase 2 clinical trials, and we cannot be certain that we will receive regulatory approval for Selinexor or will successfully commercialize Selinexor even if we receive such regulatory approval.

10

- •

- Our approach to the discovery and development of drug candidates that target Exportin 1, or XPO1, is unproven, and

we do not know whether we will be able to develop any drugs of commercial value.

- •

- If clinical trials of our drug candidates fail to demonstrate safety and efficacy to the satisfaction of regulatory

authorities or do not otherwise produce positive results, we may incur additional costs or experience delays in completing, or ultimately be unable to complete, the development and commercialization

of our drug candidates; to date, both adverse and serious adverse events have been experienced by patients in our clinical trials of Selinexor, including several which have been determined to relate

to Selinexor.

- •

- We cannot be certain that, even if successful, our registration-directed trials will be sufficient to allow us to file

for, or receive approval for, Selinexor.

- •

- We have incurred significant losses since inception. We expect to incur losses for the foreseeable future and may never

achieve or maintain profitability. As of March 31, 2014, we had an accumulated deficit of $76.3 million.

- •

- Our short operating history may make it difficult for you to evaluate the success of our business to date and to assess

our future viability.

- •

- We will need substantial additional funding. If we are unable to raise capital when needed, we would be forced to delay,

reduce or eliminate our research and drug development programs or commercialization efforts.

- •

- We expect to depend on third parties for the development, marketing and/or commercialization of our drug candidates. If

those collaborations are not successful, we may not be able to capitalize on the market potential of these drug candidates.

- •

- We have applied for, but not yet received, patent protection for our key drug candidates and if we are unable to obtain and maintain patent protection for our drug candidates and other discoveries, or if the scope of the patent protection obtained is not sufficiently broad, our competitors could develop and commercialize drugs and other discoveries similar or identical to ours, and our ability to successfully commercialize our drug candidates and other discoveries may be adversely affected.

Our Corporate Information

We were incorporated under the laws of the State of Delaware in December 2008. Our executive offices are located at 2 Mercer Road, Natick, MA 01760, and our telephone number is (508) 975-4820. Our website address is www.karyopharm.com. The information contained in, or accessible through, our website does not constitute part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference. The trademarks, trade names and service marks appearing in this prospectus are the property of their respective owners.

Implications of Being an Emerging Growth Company

As a company with less than $1 billion in revenue during our last fiscal year, we qualify as an "emerging growth company" as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally to public companies. These provisions include:

- •

- reduced disclosure about our executive compensation arrangements;

- •

- exemption from holding the non-binding advisory votes on executive compensation, including golden parachute arrangements; and

11

- •

- exemption from the auditor attestation requirement in the assessment of our internal controls over financial reporting.

Generally, we may take advantage of these exemptions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company if we have more than $1 billion in annual revenue, we have more than $700 million in market value of our stock held by non-affiliates or we issue more than $1 billion of non-convertible debt over a three-year period. We may choose to take advantage of some, but not all, of the available exemptions. We have taken advantage of certain reduced reporting burdens in this prospectus. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

In addition, the JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. This allows an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably elected not to avail ourselves of this exemption from new or revised accounting standards and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

12

Common stock offered by us |

2,000,000 shares | |

Common stock offered by the selling stockholders |

200,000 shares |

|

Common stock to be outstanding after this offering |

31,762,499 shares |

|

Option to purchase additional shares |

The underwriters have an option for a period of 30 days to purchase up to 330,000 additional shares of our common stock. |

|

Use of proceeds |

We intend to use the net proceeds from this offering as follows: approximately $65.0 million to fund the continued clinical development of our lead drug candidate, Selinexor (KPT-330), including by initiating and conducting planned registration-directed clinical trials of Selinexor in three hematological malignancy indications, up to two additional registration-directed clinical trials of Selinexor in hematological or solid tumor indications, Phase 2 clinical trials of Selinexor in solid tumor indications and additional clinical trials of Selinexor in additional cancer indications as a single agent as well as in combination with other therapies; approximately $4.0 million to continue the preclinical development of our drug candidates for anti-inflammatory, viral and wound-healing indications; approximately $8.0 million for discovery, research, preclinical development and clinical trials of additional drug candidates; and the balance for working capital and other general corporate purposes. |

|

|

We will not receive any of the proceeds from any sale of shares by the selling stockholders. |

|

|

See "Use of Proceeds" for more information. |

|

NASDAQ Global Select Market symbol |

"KPTI" |

The number of shares of our common stock to be outstanding after this offering is based on 29,762,499 shares of our common stock issued and outstanding as of March 31, 2014, including 143,620 shares of unvested restricted stock subject to repurchase by us, and excludes:

- •

- 2,505,749 shares of our common stock issuable upon exercise of stock options outstanding as of March 31, 2014 at a

weighted-average exercise price of $9.21 per share; and

- •

- 1,722,111 and 242,424 additional shares of our common stock available for future issuance, as of March 31, 2014, under our 2013 stock incentive plan and our 2013 employee stock purchase plan, respectively.

Unless otherwise indicated, this prospectus reflects and assumes the following:

- •

- no exercise of the outstanding options described above;

- •

- no exercise by the underwriters of their option to purchase up to 330,000 additional shares of our common stock;

and

- •

- no purchases of shares of our common stock by our existing stockholders in this offering.

13

SUMMARY CONSOLIDATED FINANCIAL DATA

The following table presents our summary consolidated financial data. We have derived the following summary of our statement of operations data for the years ended December 31, 2013, 2012 and 2011 from our audited consolidated financial statements incorporated by reference in this prospectus from our Annual Report on Form 10-K for the year ended December 31, 2013. We have derived the following summary of our statement of operations data for the three months ended March 31, 2014 and 2013 from our unaudited consolidated financial statements incorporated by reference in this prospectus from our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2014. We have derived the summary of our balance sheet data as of March 31, 2014 from our unaudited consolidated financial statements incorporated by reference herein. Our historical results are not necessarily indicative of the results that may be expected in the future. The summary of our consolidated financial data set forth below should be read together with our consolidated financial statements and the related notes to those statements, as well as "Management's Discussion and Analysis of Financial Condition and Results of Operations," all included elsewhere or incorporated by reference in this prospectus. For more details on how you can obtain the documents incorporated by reference in this prospectus, see "Where You Can Find More Information" and "Incorporation of Documents by Reference" appearing elsewhere in this prospectus.

| |

|

|

|

Three Months Ended, March 31, |

Period from December 22, 2008 (Inception) to March 31, 2014 |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Year Ended December 31, | ||||||||||||||||||

| |

2013 | 2012 | 2011 | 2014 | 2013 | ||||||||||||||

| |

(in thousands, except share and per share data) |

||||||||||||||||||

Consolidated Statement of Operations Data: |

|||||||||||||||||||

Contract and grant revenue |

$ | 387 | $ | 634 | $ | 152 | $ | 171 | $ | 233 | $ | 1,437 | |||||||

| | | | | | | | | | | | | | | | | | | | |

Operating expenses: |

|||||||||||||||||||

Research and development |

28,452 | 14,095 | 8,623 | 10,979 | 4,965 | 63,814 | |||||||||||||

General and administrative |

5,885 | 2,429 | 1,840 | 2,904 | 879 | 13,721 | |||||||||||||

| | | | | | | | | | | | | | | | | | | | |

Total operating expenses |

34,337 | 16,524 | 10,463 | 13,883 | 5,844 | 77,535 | |||||||||||||

| | | | | | | | | | | | | | | | | | | | |

Loss from operations |

(33,950 | ) | (15,890 | ) | (10,311 | ) | (13,712 | ) | (5,611 | ) | (76,098 | ) | |||||||

Interest income (expense), net |

3 | 2 | — | 18 | — | (165 | ) | ||||||||||||

| | | | | | | | | | | | | | | | | | | | |

Net loss |

$ | (33,947 | ) | $ | (15,888 | ) | $ | (10,311 | ) | $ | (13,694 | ) | $ | (5,611 | ) | $ | (76,263 | ) | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Net loss per share applicable to common stockholders—basic and diluted |

$ | (5.59 | ) | $ | (8.95 | ) | $ | (10.27 | ) | $ | (0.46 | ) | $ | (2.52 | ) | $ | (24.70 | ) | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Weighted-average number of common shares used in net loss per share applicable to common stockholders—basic and diluted |

6,067,679 | 1,775,323 | 1,004,144 | 29,606,683 | 2,225,596 | 3,087,622 | |||||||||||||

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| |

As of March 31, 2014 | ||||||

|---|---|---|---|---|---|---|---|

| |

Actual | As Adjusted(1) |

|||||

| |

(in thousands) |

||||||

Consolidated Balance Sheet Data: |

|||||||

Cash and cash equivalents |

$ | 144,893 | 221,919 | ||||

Working capital |

142,551 | 219,577 | |||||

Total assets |

149,285 | 226,311 | |||||

Total stockholders' equity |

144,100 | 221,126 | |||||

- (1)

- The as adjusted balance sheet data give effect to our issuance and sale of 2,000,000 shares of common stock in this offering at an assumed public offering price of $41.37 per share, which is the last reported sale price of our common stock on The NASDAQ Global Select Market on June 24, 2014, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us.

14

Investing in our common stock involves a high degree of risk. Before investing in our common stock, you should consider carefully the risks described below, together with the other information contained in this prospectus and incorporated by reference in this prospectus, including the risk factors incorporated by reference from our Annual Report on Form 10-K for the year ended December 31, 2013, our Quarterly Report on Form 10-Q for the quarter ended March 31, 2014 and other filings we make with the SEC. We believe the risks described below and incorporated by reference herein are the risks that are material to us as of the date of this prospectus. If any of the following risks or the risks incorporated by reference herein occur, our business, financial condition, results of operations and future growth prospects could be materially and adversely affected. In these circumstances, the market price of our common stock could decline, and you may lose all or part of your investment.

Risks Related To This Offering

Our executive officers, directors and principal stockholders maintain the ability to control all matters submitted to stockholders for approval.

As of June 1, 2014, our executive officers, directors and a small number of stockholders own more than a majority of our outstanding common stock. As a result, if these stockholders were to choose to act together, they would be able to control all matters submitted to our stockholders for approval, as well as our management and affairs. For example, these persons, if they choose to act together, would control the election of directors and approval of any merger, consolidation or sale of all or substantially all of our assets. This concentration of voting power could delay or prevent an acquisition of our company on terms that other stockholders may desire.

If you purchase shares of common stock in this offering, you will suffer immediate dilution of your investment.

The price of our common stock in this offering will be substantially higher than the net tangible book value per share of our common stock. Therefore, if you purchase shares of our common stock in this offering, you will pay a price per share that substantially exceeds our net tangible book value per share after this offering. To the extent shares are issued under outstanding options, you will incur further dilution. Based on an assumed public offering price of $41.37 per share, which is the last reported sale price of our common stock on The NASDAQ Global Select Market on June 24, 2014, you will experience immediate dilution of $34.41 per share, representing the difference between our as adjusted net tangible book value per share after giving effect to this offering and the assumed public offering price per share.

An active trading market for our common stock may not be sustained following this offering.

Although our common stock is listed on The NASDAQ Global Select Market, an active trading market for our shares may not be sustained following this offering. If an active market for our common stock does not continue, it may be difficult for you to sell shares you purchase in this offering without depressing the market price for the shares, or at all. An inactive trading market for our common stock may also impair our ability to raise capital to continue to fund our operations by selling shares and may impair our ability to acquire other companies or technologies by using our shares as consideration.

We have broad discretion in the use of our cash and cash equivalents, including the net proceeds we receive in this offering, and may not use them effectively.

Our management has broad discretion to use our cash and cash equivalents, including the net proceeds we receive in this offering, to fund our operations and could spend these funds in ways that do not improve our results of operations or enhance the value of our common stock. The failure by

15

our management to apply these funds effectively could result in financial losses that could have a material adverse effect on our business, cause the price of our common stock to decline and delay the development of our drug candidates. Pending their use to fund our operations, we may invest our cash and cash equivalents, including the net proceeds from this offering, in a manner that does not produce income or that loses value.

Because we do not anticipate paying any cash dividends on our capital stock in the foreseeable future, capital appreciation, if any, of our common stock will be the sole source of gain for our stockholders.

We have never declared or paid cash dividends on our capital stock. We currently intend to retain all of our future earnings, if any, to finance the growth and development of our business. In addition, the terms of any future debt agreements may preclude us from paying dividends. As a result, capital appreciation, if any, of our common stock will be the sole source of gain for our stockholders for the foreseeable future.

A significant portion of our total outstanding shares are restricted from immediate resale but may be sold into the market in the near future, which could cause the market price of our common stock to drop significantly, even if our business is doing well.

Sales of a substantial number of shares of our common stock in the public market could occur at any time. These sales, or the perception in the market that the holders of a large number of shares intend to sell shares, could reduce the market price of our common stock. After this offering, we will have outstanding 31,762,499 shares of common stock based on 29,762,499 shares outstanding as of March 31, 2014. This assumes no exercise by the underwriters of their option to purchase additional shares and includes the shares that we and the selling stockholders are selling in this offering, which may be resold in the public market immediately without restriction, unless purchased by our affiliates. Of the remaining shares, a majority are currently restricted as a result of securities laws, including under Rule 144 or under lock-up agreements but will be able to be sold after the offering as described in the "Shares Eligible for Future Sale" section of this prospectus. Moreover, following this offering, based on information we have available to us, we believe holders of an aggregate of 17,819,662 shares of our common stock will have rights, subject to some conditions, to require us to file registration statements covering their shares or to include their shares in registration statements that we may file for ourselves or other stockholders. We have also registered shares of common stock that we have issued upon the exercise of outstanding stock options, and that we may in the future issue, under our equity compensation plans. These can be freely sold in the public market upon issuance, subject to volume limitations applicable to affiliates and the lock-up agreements described in the "Underwriting" section of this prospectus.

16

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference into it contain forward-looking statements that involve substantial risks and uncertainties. These statements include all matters that are not related to present facts or current conditions or that are not historical facts, including statements regarding our strategy, future operations, future financial position, future revenue, projected costs, prospects, plans, objectives of management and expected market growth. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward- looking statements.

The words "anticipate," "believe," "estimate," "expect," "intend," "may," "plan," "predict," "project," "would" and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements include, among other things, statements about:

- •

- the timing, progress and results of current and future preclinical studies and clinical trials, and our research and

development programs;

- •

- our plans to develop and commercialize our drug candidates;

- •

- the timing or likelihood of regulatory filings and approvals;

- •

- the implementation of our business model and strategic plans for our business, drug candidates and technology;

- •

- our commercialization, marketing and manufacturing capabilities and strategy;

- •

- the rate and degree of market acceptance and clinical utility of our drugs;

- •

- our competitive position;

- •

- our intellectual property position;

- •

- developments and projections relating to our competitors and our industry;

- •

- our ability to establish collaborations or obtain additional funding;

- •

- our expectations regarding the time during which we will be an emerging growth company under the JOBS Act;

- •

- our expectations related to the use of proceeds from this offering; and

- •

- our estimates regarding expenses, future revenue, capital requirements and needs for additional financing.

We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. We have included important factors in the cautionary statements included in this prospectus, particularly in the "Risk Factors" section and the other documents incorporated by reference herein, that could cause actual results or events to differ materially from the forward-looking statements that we make. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments that we may make.

You should read this prospectus, the documents that we incorporate by reference or otherwise reference herein and the documents that we have filed as exhibits to the registration statement of which this prospectus is a part completely and with the understanding that our actual future results may be materially different from what we expect. The forward-looking statements contained in this prospectus and in the documents incorporated herein by reference are made as of the date of this prospectus and we do not assume any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

17

We estimate that the net proceeds to us from this offering will be approximately $77.0 million, based on an assumed public offering price of $41.37 per share, which is the last reported sale price of our common stock on The NASDAQ Global Select Market on June 24, 2014, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. If the underwriters exercise their option to purchase additional shares of our common stock in full, we estimate that our net proceeds will be approximately $89.9 million after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

We will not receive any of the proceeds from any sale of shares in this offering by the selling stockholders.

As of March 31, 2014, we had cash and cash equivalents of $144.9 million. We currently intend to use the net proceeds from this offering as follows:

- •

- approximately $65.0 million to fund the continued clinical development of our lead drug candidate, Selinexor

(KPT-330), including: approximately $52.0 million for initiating and conducting planned registration-directed clinical trials of Selinexor in three hematological malignancy indications and up

to two additional registration-directed clinical trials of Selinexor in hematological or solid tumor indications; approximately $13.0 million for initiating and conducting clinical trials of

Selinexor in additional clinical trials of Selinexor in additional cancer indications as a single agent as well as in combination with other therapies;

- •

- approximately $4.0 million to continue our preclinical development of our drug candidates for anti-inflammatory,

viral and wound-healing indications;

- •

- approximately $8.0 million for discovery, research, preclinical development and clinical trials of additional drug

candidates; and

- •

- the balance for working capital and other general corporate purposes.

This expected use of net proceeds from this offering represents our intentions based upon our current plans and business conditions, which could change in the future as our plans and business conditions evolve. The amounts and timing of our actual expenditures may vary significantly depending on numerous factors, including the progress of our development, feedback from regulatory authorities, the status of and results from clinical trials, as well as any collaborations that we may enter into with third parties for our drug candidates, and any unforeseen cash needs. As a result, our management will retain broad discretion over the allocation of the net proceeds from this offering.

Pending use of the proceeds as described above, we intend to invest the proceeds in a variety of capital preservation investments, including short-term, interest-bearing, investment-grade instruments and U.S. government securities.

18

Our common stock began trading on The NASDAQ Global Select Market under the symbol "KPTI" on November 6, 2013. Prior to that time, there was no public market for our common stock. The following table sets forth the high and low sale prices per share of our common stock, as reported on The NASDAQ Global Select Market, for the periods indicated.

| |

High | Low | |||||

|---|---|---|---|---|---|---|---|

Year Ended December 31, 2013 |

|||||||

Fourth quarter (from November 6, 2013) |

$ | 25.69 | $ | 15.50 | |||

Year Ending December 31, 2014 |

|||||||

First quarter |

$ | 47.87 | $ | 21.13 | |||

Second quarter (through June 24, 2014) |

$ | 47.98 | $ | 23.86 | |||

On June 24, 2014, the last reported sale price of our common stock on The NASDAQ Global Select Market was $41.37 per share. As of the date of this prospectus, we had approximately 25 holders of record of our common stock. The actual number of stockholders is greater than this number of record holders and includes stockholders who are beneficial owners but whose shares are held in street name by brokers and other nominees. This number of holders of record also does not include stockholders whose shares may be held in trust by other entities.

We have not declared or paid any cash dividends on our capital stock since our inception. We intend to retain future earnings, if any, to finance the operation and expansion of our business and do not anticipate paying any cash dividends in the foreseeable future.

We obtained the industry, market and competitive position data in this prospectus from our own internal estimates and research as well as from industry and general publications and research, surveys and studies conducted by third parties. Industry and general publications and research, surveys and studies conducted by third parties generally state that they have been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information.

19

The following table sets forth our cash and cash equivalents and capitalization as of March 31, 2014, as follows:

- •

- on an actual basis; and

- •

- on an as adjusted basis to give effect to our issuance and sale of 2,000,000 shares of common stock in this offering at an assumed public offering price of $41.37 per share, which was the last reported sale price of our common stock on The NASDAQ Global Select Market on June 24, 2014, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us.

You should read this information in conjunction with our consolidated financial statements and the related notes and the "Management's Discussion and Analysis of Financial Condition and Results of Operations" section, the "Selected Financial Data" section and other financial information in our Annual Report on Form 10-K for the year ended December 31, 2013 and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2014, which are incorporated by reference in this prospectus.

| |

As of March 31, 2014 | ||||||

|---|---|---|---|---|---|---|---|

| |

Actual | As Adjusted | |||||

| |

(in thousands, except share and per share data) |

||||||

Cash and cash equivalents |

$ | 144,893 | $ | 221,919 | |||

| | | | | | | | |

Undesignated preferred stock, $0.0001 par value: 5,000,000 shares authorized and no shares issued or outstanding |

— | — | |||||

Common stock, par value $0.0001 per share; 100,000,000 shares authorized, 29,618,879 shares issued and outstanding, actual; and 31,618,879 shares issued and outstanding, as adjusted |

3 | 3 | |||||

Additional paid-in capital |

220,360 | 297,386 | |||||

Deficit accumulated during the development stage |

(76,263 | ) | (76,263 | ) | |||

| | | | | | | | |

Total stockholders' equity |

144,100 | 221,126 | |||||

| | | | | | | | |

Total capitalization |

$ | 144,100 | $ | 221,126 | |||

| | | | | | | | |

| | | | | | | | |

The table above does not include:

- •

- 143,620 shares of unvested restricted stock subject to repurchase by us;

- •

- 2,505,749 shares of our common stock issuable upon exercise of stock options outstanding as of March 31, 2014 at a

weighted-average exercise price of $9.21 per share;

- •

- 1,722,111 and 242,424 additional shares of our common stock available for future issuance, as of March 31, 2014,

under our 2013 stock incentive plan and our 2013 employee stock purchase plan, respectively; and

- •

- 330,000 shares of our common stock available for purchase by the underwriters pursuant to their option.

20

PRINCIPAL AND SELLING STOCKHOLDERS

The following table sets forth information with respect to the beneficial ownership of our common stock, as of May 31, 2014, by:

- •

- each person, or group of affiliated persons, known by us to beneficially own more than 5% of our common stock;

- •

- each of our directors;

- •

- each of our named executive officers;

- •

- all of our executive officers and directors as a group; and

- •

- each of the selling stockholders.

The column entitled "Shares Beneficially Owned Prior to Offering—Percentage" is based on a total of 29,786,403 shares of our common stock outstanding as of May 31, 2014. The column entitled "Shares Beneficially Owned After Offering—Percentage" is based on shares of our common stock to be outstanding after this offering, including 2,000,000 shares of our common stock that we are selling in this offering, and 200,000 shares of our common stock that the selling stockholders are selling in this offering, each at an assumed public offering price of $41.37 per share, which was the last reported sale price of our common stock on The NASDAQ Global Select Market on June 24, 2014, but not including any additional shares issuable upon exercise of outstanding options or the underwriters' option to purchase additional shares.

The number of shares beneficially owned by each stockholder is determined under rules issued by the Securities and Exchange Commission and includes voting or investment power with respect to securities. Under these rules, beneficial ownership includes any shares as to which the individual or entity has sole or shared voting power or investment power. In computing the number of shares beneficially owned by an individual or entity and the percentage ownership of that person, shares of common stock subject to options or other rights held by such person that are currently exercisable or will become exercisable within 60 days of May 31, 2014, are considered outstanding, although such shares subject to options or other rights are not considered outstanding for purposes of computing the percentage ownership of any other person. Unless otherwise indicated, the address of all listed stockholders is c/o Karyopharm Therapeutics Inc., 2 Mercer Road, Natick, Massachusetts 01760. Each of the stockholders listed has sole voting and investment power with respect to the shares beneficially owned by the stockholder unless noted otherwise, subject to community property laws where applicable.

21

The table below does not reflect any shares of our common stock that our directors, executive officers, 5% stockholders or their affiliated entities may purchase in this offering.

| |

Shares Beneficially Owned Prior to Offering |

|

Shares Beneficially Owned After Offering |

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Number of Shares Offered | |||||||||||||||

Name of Beneficial Owner

|

Number | Percentage | Number | Percentage | ||||||||||||

5% Stockholders |

||||||||||||||||

Chione Ltd.(1) |

10,258,079 | 34.44% | — | 10,258,079 | 32.30 | % | ||||||||||

Entities Affiliated with Franklin Resources, Inc.(2) |

3,542,004 | 11.89% | — | 3,542,004 | 11.15 | % | ||||||||||

Plio Limited(3) |

3,193,473 | 10.72% | — | 3,193,473 | 10.05 | % | ||||||||||

Entities Affiliated with Foresite Capital(4) |

2,378,615 | 7.99% | — | 2,378,615 | 7.49 | % | ||||||||||

Entities Affiliated with FMR LLC(5) |

2,346,000 | 7.88% | — | 2,346,000 | 7.39 | % | ||||||||||

Entities Affiliated with Delphi Ventures(6) |

2,217,552 | 7.44% | — | 2,217,552 | 6.98 | % | ||||||||||

Named Executive Officers and Directors |

||||||||||||||||

Michael G. Kauffman, M.D., Ph.D.(7) |

1,836,821 | 6.17% | 100,000 | (15) | 1,636,821 | 5.15 | % | |||||||||

Sharon Shacham, Ph.D., M.B.A.(8) |

1,836,821 | 6.17% | 100,000 | (16) | 1,636,821 | 5.15 | % | |||||||||

Paul Brannelly |

66,136 | * | — | 66,136 | * | |||||||||||

Deepa R. Pakianathan, Ph.D.(9) |

2,217,552 | 7.44% | — | 2,217,552 | 6.98 | % | ||||||||||

Mansoor Raza Mirza, M.D.(10) |

69,478 | * | — | 69,478 | * | |||||||||||

Alan T. Barber(11) |

10,952 | * | — | 10,952 | * | |||||||||||

Barry E. Greene(12) |

5,301 | * | — | 5,301 | * | |||||||||||

Kenneth E. Weg(13) |

2,683 | * | — | 2,683 | * | |||||||||||

Garen Bohlin |

0 | * | — | 0 | * | |||||||||||

All executive officers and directors as a group (9 persons)(14) |

4,208,923 | 14.13% | 200,000 | 4,008,923 | 12.62 | % | ||||||||||

All selling stockholders |