Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AGILYSYS INC | form8-kxinvestorpresentati.htm |

TECHNOLOGY | INNOVATION | SOLUTIONS Investor Presentation June 2014

TECHNOLOGY | INNOVATION | SOLUTIONS Forward-looking Statements & Non-GAAP Financial Information 2 Forward-Looking Language This presentation and all publicly available documents, including the documents incorporated herein and therein by reference, contain, and our officers and representatives may from time to time make, "forward-looking statements" within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: "anticipate," "intend," "plan," "goal," "seek," "believe," "project," "estimate," "expect," "strategy," "future," "likely," "may," "should," "will" and similar references to future periods, including statements on the slides in this presentation titled “Total Addressable Market,” “Business Outlook,” and “Investment Highlights.” Forward-looking statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. These statements are based on management’s current expectations, intentions or beliefs and are subject to a number of factors, assumptions and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Factors that could cause or contribute to such differences or that might otherwise impact the business include the risk factors set forth in Item 1A of the company’s Annual Report for the fiscal year ended March 31, 2014. Copies are available from the SEC or the Agilysys website. We undertake no obligation to update any such factor or to publicly announce the results of any revisions to any forward-looking statements contained herein whether as a result of new information, future events or otherwise. Use of Non-GAAP Financial Information To supplement the unaudited condensed consolidated financial statements presented in accordance with U.S. GAAP in this presentation, certain non-GAAP financial measures as defined by the SEC rules are used. These non-GAAP financial measures include adjusted operating income (loss) from continuing operations, adjusted net income (loss), adjusted net income (loss) per share from continuing operations and adjusted cash flow from continuing operations. Management believes that such information can enhance investors' understanding of the company's ongoing operations. See the table on slide 22 for reconciliations of adjusted operating income (loss) from continuing operations and adjusted net income (loss) from continuing operations to the comparable GAAP measures.

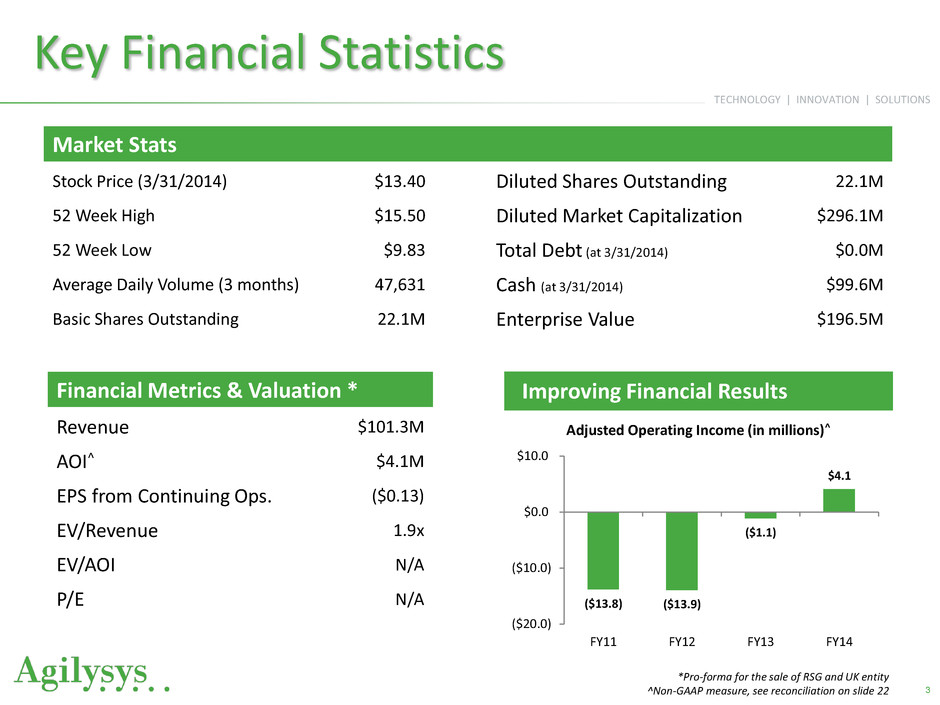

TECHNOLOGY | INNOVATION | SOLUTIONS Key Financial Statistics 3 •Improving Financial Results Market Stats Stock Price (3/31/2014) $13.40 Diluted Shares Outstanding 22.1M 52 Week High $15.50 Diluted Market Capitalization $296.1M 52 Week Low $9.83 Total Debt (at 3/31/2014) $0.0M Average Daily Volume (3 months) 47,631 Cash (at 3/31/2014) $99.6M Basic Shares Outstanding 22.1M Enterprise Value $196.5M Financial Metrics & Valuation * Revenue $101.3M AOI^ $4.1M EPS from Continuing Ops. ($0.13) EV/Revenue 1.9x EV/AOI N/A P/E N/A ($13.8) ($13.9) ($1.1) $4.1 ($20.0) ($10.0) $0.0 $10.0 FY11 FY12 FY13 FY14 Adjusted Operating Income (in millions)^ *Pro-forma for the sale of RSG and UK entity ^Non-GAAP measure, see reconciliation on slide 22

TECHNOLOGY | INNOVATION | SOLUTIONS Our community Our team Purpose 4 Lasting Connections Our customers & their guests Connecting Our customers with their guests Our customers with our team Our team with their communities Our investors

TECHNOLOGY | INNOVATION | SOLUTIONS Competitive Advantages for Our Customers Objectives to Increase Shareholder Value Strategic Objectives 5 Strategic Expansion Technology Differentiated Markets Highest Value Solutions Value Accretive Growth Greater Recruitment Increased Wallet Share Improved Experience

TECHNOLOGY | INNOVATION | SOLUTIONS Strategy Execution 6 Develop Our People Improve Capabilities Increase Awareness Improve Operations Reduce Working Capital Value Creating CapEx Reduce Expense Grow Revenue Improve Capital Use Increase Profits Capital Efficient Profitable Growth

TECHNOLOGY | INNOVATION | SOLUTIONS What We Do 7 Inventory & Procurement Property Management Document Management Point-of-Sale Activities Management Workforce Management

TECHNOLOGY | INNOVATION | SOLUTIONS Key Product Differentiators 8 Universal Competitive Strengths Stability Scalability The best hospitality knowledge coupled with the best technology talent Customer engagement Offline capabilities

TECHNOLOGY | INNOVATION | SOLUTIONS Point-of-Sale Property Management Document Management Inventory & Procurement Workforce Management • Audit log and electronic journal • POS generic authorization • Campus and gift card support • Combination packages and prix fixe menus • Fully integrated suite • Groups management • Master folio logic and web pickup tools • Built-in activities scheduler • Comp accounting • Remote on demand data access • Streamlined document retrieval • Electronic document routing • Individual permission levels • Online Web ordering • Wireless handheld devices for ordering, inventory and receiving • Automated strategic sourcing • Full function accounting backbone • Patented time clock functionality • Mobile scheduling • Effective forecasting – import from any external source (site or enterprise) • Total labor management – HR on/off boarding – operations management Our products allow customers to: Recruit more guests Maximize their share of their guests’ wallet Connect with their guests and prospective guests pre- and post-stay but, more importantly, while onsite Key In-Market Products 9

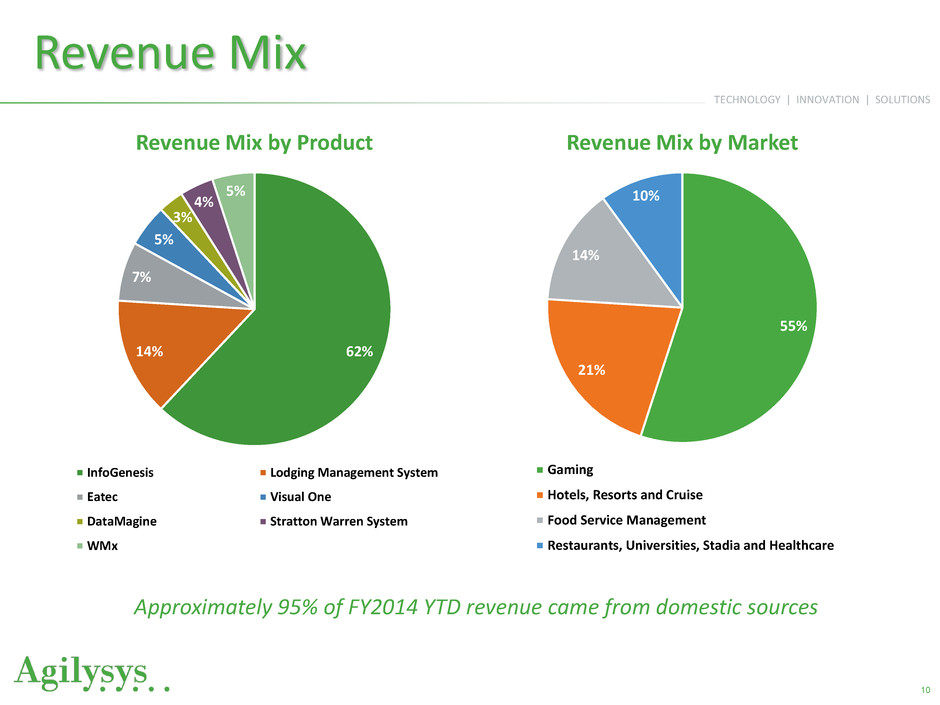

TECHNOLOGY | INNOVATION | SOLUTIONS Revenue Mix 10 62% 14% 7% 5% 3% 4% 5% Revenue Mix by Product InfoGenesis Lodging Management System Eatec Visual One DataMagine Stratton Warren System WMx 55% 21% 14% 10% Revenue Mix by Market Gaming Hotels, Resorts and Cruise Food Service Management Restaurants, Universities, Stadia and Healthcare Approximately 95% of FY2014 YTD revenue came from domestic sources

TECHNOLOGY | INNOVATION | SOLUTIONS Total Addressable Market 11 $12B+ Market Opportunity $4B Addressed Market AGYS Projected product roadmap opens to total addressable market Expected 5-7% annual growth for industry (commissioned IHL and STR study)

TECHNOLOGY | INNOVATION | SOLUTIONS Significant Room for Growth 12 $4B in annual spending on existing software services and recurring software maintenance for current product portfolio Casinos Stadiums/Arenas Pinnacle Entertainment Casino Del Sol Sands Casino & Resort Boyd Gaming The Cosmopolitan of Las Vegas Ho-Chunk Gaming Valley View Casino & Hotel Oxford Casino Caesars Palace Maryland Live! Casino Barclays Center Chester Racecourse Giant Center Etihad Stadium Madison Square Garden Aviva Stadium Hotels/Resorts Cruise Lines The Broadmoor Colorado Springs The Landmark London The Breakers Palm Beach Pinehurst The SeaPines Resort Vail Resorts Black Rock Oceanfront Resort Royal Lahaina Resort Royal Caribbean International Norwegian Cruise Lines Foodservice Higher Education Benchmarc Restaurants by Marc Murphy Sugar Factory BRguest Hospitality Savor Yale University Vanderbilt University California State University at Fullerton – Auxiliary Services Corporation

TECHNOLOGY | INNOVATION | SOLUTIONS M&A Strategy • Focus is on software enabled solutions for hospitality markets • Keys to success for M&A • Talent – management capacity and industry-leading talent • Technology – extend our solutions and expand our offerings • Markets – greater share from current and expand to new markets • Recent example of M&A success • TimeManagement (WMx) • Preferred workforce management solution • Integrates seamlessly with existing Agilysys solution (Eatec) • Strong initial sales into current customer base • Eliminates the need for a separate time clock following integration with Agilysys point-of-sale solutions 13

TECHNOLOGY | INNOVATION | SOLUTIONS Historical Financial Results 14 All numbers in thousands, except per share data * All historical numbers are unaudited and reflect the sale of RSG and UK entity ^ Non-GAAP measure, see reconciliation on slide 22 $88,085 $82,051 $94,008 $101,261 $0 $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 FY11* FY12* FY13* FY14 Revenue ($0.56) ($0.67) ($0.06) $0.19 ($1.00) ($0.80) ($0.60) ($0.40) ($0.20) $0.00 $0.20 $0.40 FY11 FY12 FY13 FY14 Adjusted EPS^ ($13,750) ($13,878) ($1,106) $4,064 ($20,000) ($15,000) ($10,000) ($5,000) $0 $5,000 $10,000 FY11 FY12 FY13 FY14 AOI^ ($23,558) ($37,493) ($6,214) ($2,895) ($50,000) ($40,000) ($30,000) ($20,000) ($10,000) $0 FY11* FY12* FY13* FY14 Loss from Continuing Operations

TECHNOLOGY | INNOVATION | SOLUTIONS Our Current Product Mix 15 36% 49% 15% FY11* Product Revenue Support, Maintenance & Subscription Revenue Professional Services Revenue 34% 53% 13% FY14 Product Revenue Support, Maintenance & Subscription Revenue Professional Services Revenue * All historical numbers are unaudited and reflect the sale of RSG and UK entity

TECHNOLOGY | INNOVATION | SOLUTIONS Growing Recurring Revenue 16 $43.1 $45.4 $49.1 $53.2 $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 $45.0 $50.0 $55.0 $60.0 FY11 FY12 FY13 FY14 (in m ill io n s) Recurring Revenue • Recurring revenues comprised over 53% of the Company’s revenue in fiscal 2014 • Seeking to leverage growing market share and installed product base to offer an increased level of recurring services • Expanding SaaS-based product offerings to create an ongoing customer relationship and foster enhanced recurring revenues

TECHNOLOGY | INNOVATION | SOLUTIONS Strong Balance Sheet 17 Consolidated Balance Sheet (unaudited) in thousands March 31, 2014 March 31, 2013 Cash and cash equivalents $99,566 $82,444 Other current assets 30,288 63,852 Long-term assets 61,041 51,202 Total assets $190,895 $197,498 Current liabilities $48,143 $74,174 Other liabilities 9,879 9,468 Total liabilities $58,022 $83,642 Shareholders’ equity 132,873 113,856 Total liabilities and shareholders’ equity $190,895 $197,498 Cash and liquid investments of almost $100 million Fully valued federal net operating losses of approximately $160M

TECHNOLOGY | INNOVATION | SOLUTIONS Business Outlook – FY 15 • Revenue growth above the market rate of growth • Improve operating expense efficiency and effectiveness • Generate break even to slightly positive adjusted operating income • Invest the balance sheet in products and markets • Organic product innovation and next-generation solutions • Strategic M&A • Solutions that accelerate the product roadmap • Enter new markets or target new customers 18

TECHNOLOGY | INNOVATION | SOLUTIONS Hospitality industry investments Across in-market products Next generation platforms Enhancing partner ecosystem SaaS New innovation Product Investment Strategy 19

TECHNOLOGY | INNOVATION | SOLUTIONS FY14 and FY15 Releases • Visual One 8.51 • LMS 7.2 • InfoGenesis 4.4 • Insight™ Mobile Manager for LMS • InfoGenesis™ Mobile • Elevate • Analytics 2.0 20

TECHNOLOGY | INNOVATION | SOLUTIONS Investment Highlights 21 Focused Business with Significant Room for Growth • $4B in annual industry spend for current product portfolio • Gain share, expand product capabilities through focused investments, acquisitions • Support growth with world-class customer service and high client engagement Growing Recurring Revenue Business • Ability to leverage large installed base • Growing SaaS-based product offerings • Over 53% of revenue in FY2014; 95%+ renewal rate Large Untapped International Opportunities • Europe and Asia infrastructure in place • Expanding reseller community • International revenues currently make up approximately 5% of revenue Strong Industry Demand and Upsell Opportunities • Strong relationships with industry leading brands • 3,100+ customers • Two thirds of current customers have only one of our software titles Products that Drive Performance • Customer and market driven technology delivery • Guest centric business intelligence & reporting • New innovation Strong Financial Model with Upside • Recurring revenue growth and margin expansion • Fully valued federal net operating losses of approximately $160M • Balance sheet (almost $100M in cash, no debt) to support growth

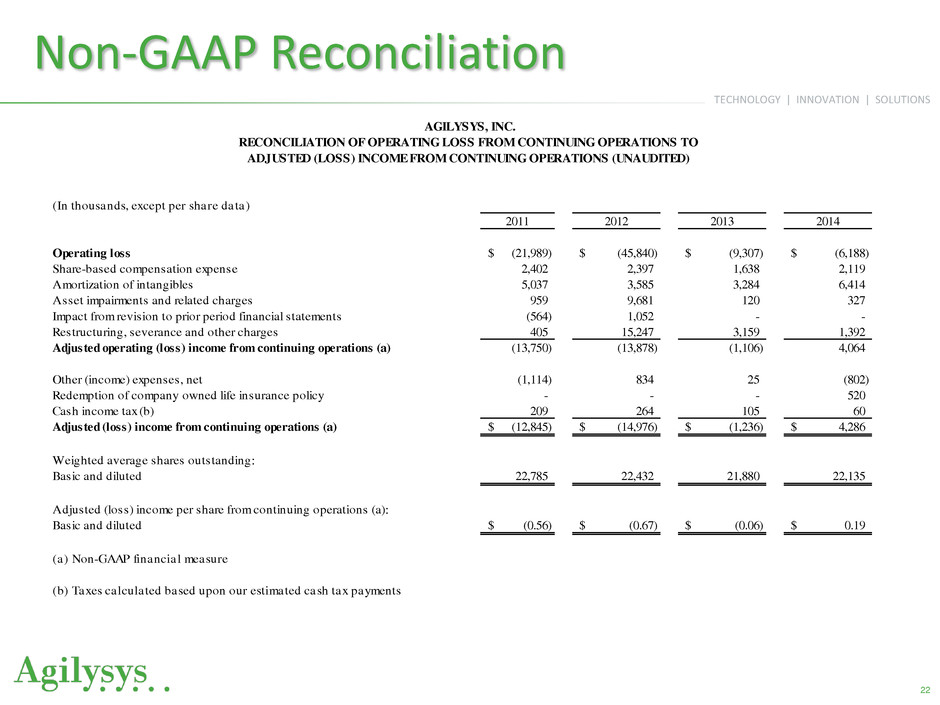

TECHNOLOGY | INNOVATION | SOLUTIONS Non-GAAP Reconciliation 22 2011 2012 2013 2014 Operating loss (21,989)$ (45,840)$ (9,307)$ (6,188)$ Share-based compensation expense 2,402 2,397 1,638 2,119 Amortization of intangibles 5,037 3,585 3,284 6,414 Asset impairments and related charges 959 9,681 120 327 Impact from revision to prior period financial statements (564) 1,052 - - Restructuring, severance and other charges 405 15,247 3,159 1,392 Adjusted operating (loss) income from continuing operations (a) (13,750) (13,878) (1,106) 4,064 Other (income) expenses, net (1,114) 834 25 (802) Redemption of company owned life insurance policy - - - 520 Cash income tax (b) 209 264 105 60 Adjusted (loss) income from continuing operations (a) (12,845)$ (14,976)$ (1,236)$ 4,286$ Weighted average shares outstanding: Basic and diluted 22,785 22,432 21,880 22,135 Adjusted (loss) income per share from continuing operations (a): Basic and diluted (0.56)$ (0.67)$ (0.06)$ 0.19$ (a) Non-GAAP financial measure (b) Taxes calculated based upon our estimated cash tax payments AGILYSYS, INC. (In thousands, except per share data) RECONCILIATION OF OPERATING LOSS FROM CONTINUING OPERATIONS TO ADJUSTED (LOSS) INCOME FROM CONTINUING OPERATIONS (UNAUDITED)