Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Franklin Financial Network Inc. | d748676d8k.htm |

Exhibit 99.1 |

Except for the

historical information contained herein, this presentation contains forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as

amended.

The Company intends that all such statements be subject

to the "safe harbor" provisions of those Acts.

Because forward-

looking statements involve risks and uncertainties, actual results

may differ materially from those expressed or implied.

Investors are

cautioned not to place undue reliance on these forward-looking

statements and are advised to carefully review the discussion of

forward-looking statements and risk factors in documents the

Company

files

with

the

Securities

and

Exchange

Commission.

The

Company undertakes no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise. |

FRANKLIN SYNERGY

BANK PROGRESS REPORT |

Progress Report

Topics Brief History

The Success of Franklin Synergy Bank

The Changing Banking Environment

The Future of FFN/FSB: Expansion and

Success Factors |

BRIEF HISTORY OF

FFN/FSB |

Brief

History 2007

June –

Company formed; $26.3 million capital raised locally

November –

FSB charter approved, Cool Springs opened |

|

Brief

History 2007

June –

Company formed; $26.3 million capital raised locally

November –

FSB charter approved, Cool Springs opened

2008

May –

Banc Compliance Group purchased

November –

Franklin branch, Brentwood mortgage office opened

2009

January -

$2.8 million local offering completed

March –

First profitable quarter in FSB history

2010

February -

$6.5 million local offering completed

May –

Relocated Franklin branch to Columbia Avenue |

|

Brief

History 2007

June –

Company formed; $26.3 million capital raised locally

November –

FSB charter approved, Cool Springs opened

2008

May –

Banc Compliance Group purchased

November –

Franklin branch, Brentwood Mortgage office opened

2009

January -

$2.8 million local offering completed

March –

First profitable quarter in FSB history

2010

February -

$ 6.5 million local offering completed

May –

Relocated Franklin branch to Columbia Avenue

2011

January –

Opened Brentwood office |

Opening

Brentwood – January 2011 |

Brief

History 2011

September –

Established Franklin Synergy Investment

Management

September –

Received $10 million Small Business Lending Fund

Capital

2012

June –

Opened Westhaven Branch

November –

Celebrated 5 year anniversary

2013

February –

Opened Spring Hill Office

July –

Groundbreaking for Columbia Ave HQ

Phase II |

July 2013

- April 2014

Columbia Ave HQ

Phase II |

Brief

History 2013

October –

Opened Berry Farms Branch

November –

Groundbreaking for new Aspen Grove Office

November –

Announced Merger with MidSouth Bank

2014

March –

Opened Spring Hill Branch

June –

Columbia Ave HQ Phase II |

Berry Farms

Grand Opening – Oct 2013

Spring Hill Grand Opening

–

March 2014 |

THE SUCCESS OF

FRANKLIN SYNERGY BANK |

The FSB Success

Story First Step: Defining Success |

Mission

Statement Our Mission is to build a legacy company by:

We will profitably market technology

advantaged

financial products and services to relationship-

oriented local businesses, professionals,

consumers, and community banks.

Creating

Cultivating strong customer relationships

Fostering an extraordinary team of directors, officers, and

employees

shareholder value |

The FSB Success

Story Enhancing Shareholder Value Dynamics

Corporate Performance

Market Acceptance |

Success

- Competing Objectives

Soundness

Growth

Profitability

Corporate Citizenship |

Soundness

– Adequate Capital

“Well Capitalized”

by Regulatory

Standards

Received $10 million in SBLF in 2011:

only strongest, healthiest US banks

could participate

Raised $15 million in 2013 through a

Private Placement

FFN Will Raise Capital in Future to

Provide Base for Further Growth and

Profitability |

Soundness

– Asset Quality

FSB Performance: among

the leading banks in

maintaining low levels of

problem assets

22.4%

22.4%

13.0%

13.0%

8.4%

8.4%

8.8%

8.8%

4.0%

4.0%

12.6%

20.7%

18.9%

23.1%

17.5% |

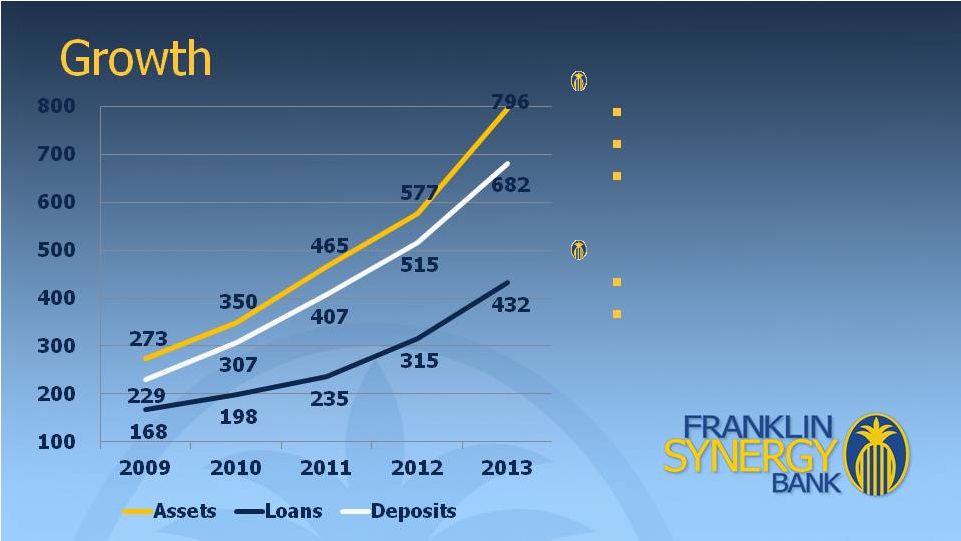

Growth

At March 31, 2014:

Assets

-

$866

(+42.2%)

Loans

-

$463

(+42.8%)

Deposits

–

$740

(+37.8%)

June 2013 Market Share

Williamson County –

3rd

Franklin –

1st |

Profitability

FSB Was Not Fully Taxable

until 2012

FSB Has Been Profitable for

21 Consecutive Quarters

FSB Has Achieved Critical

Mass as a Foundation for

Future Profits

$0.5

$1.3

$2.7

$4.2

$5.0 |

Corporate

Citizenship Follow Regulatory Guidelines for Banking

Practices –

successful programs

Community Reinvestment Act

Consumer Compliance Programs

Provide Leadership for Civic, Professional, and

Charitable Organizations within the Community |

THE CHANGING

BANKING ENVIRONMENT |

The Community

Banking Challenges Threats to Earning Power of Banks

Margin Compression

Leverage Compression

Growing Operating Overhead from Regulatory Initiatives

The Future of Community Banking

Significant Consolidation

Focus on Growth to Offset Diseconomies of Scale |

LOOKING INTO THE

FUTURE: EXPANSION |

The FSB

Acquisition of MidSouth Bank Merger Date: July 1, 2014

Combined Banks’

Anticipated Numbers

Assets: $1.2 billion

Loans: $670 million

Locations: 11

Merger Dynamics: local community bank in state’s

two fastest growing counties |

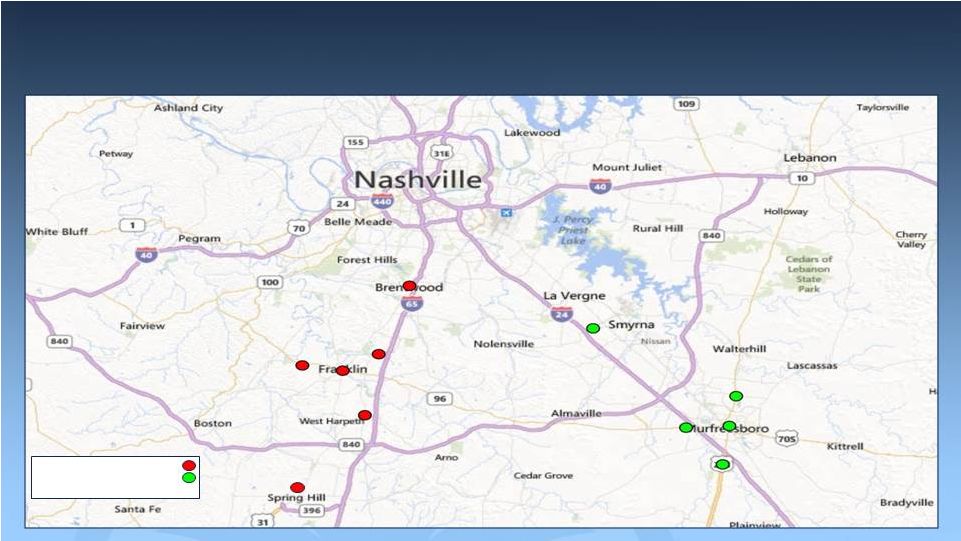

Branch Locations for Merged Bank

Franklin Synergy

MidSouth |

Looking to the

Future… Organic Growth in Williamson and Rutherford

Counties

IPO (Initial Public Offering)

Public Trading of FFN Stock through NASDAQ |

LOOKING INTO THE

FUTURE: FSB SUCCESS FACTORS |

Why Has FSB

Been So Successful? Location –

Williamson County and Middle

Tennessee

Proficient, Experienced, Proven Banking

Team

The FSB Culture

The FSB Culture |

Key Components

of FSB Culture We are profit driven; the key measurement of

success is increased shareholder value

We never compromise personal or corporate

integrity

We are customer and market focused

We are family |

Facilities

Expansion Plans Expansion of Downtown Campus

–

early 2015

Relocation of Cool Springs Branch –

2014

Relocation of Brentwood Branch –

2014

|

FSB Direction:

Focus on Basics Conservative

Loan

Underwriting:

asset

quality

is

paramount

to

success

Continued Emphasis on Growth

Objective: 25% annually

Method: organic growth, primarily (after acquisition)

Continued Real Estate Focus, but Enhanced Small Business

Initiative

Local Bank, Focused on Williamson and Rutherford Counties |

Questions? |