Attached files

| file | filename |

|---|---|

| 8-K - 8-K - VALIDUS HOLDINGS LTD | a20140623-validusandwester.htm |

Validus Agreed Acquisition of Western World June 23, 2014

Cautionary Note Regarding Forward-Looking Statements This presentation may include forward-looking statements, both with respect to Validus and Western World and their industries, that reflect their current views with respect to future events and financial performance. Statements that include the words “expect,” “intend,” “plan,” “believe,” “project,” “anticipate,” “will,” “may,” “would” and similar statements of a future or forward-looking nature identify forward-looking statements. All forward-looking statements address matters that involve risks and uncertainties, many of which are beyond Validus’ and Western World’s control. Accordingly, there are or will be important factors that could cause actual results to differ materially from those indicated in such statements and, therefore, you should not place undue reliance on any such statements. Validus and Western World believe that these factors include, but are not limited to, the following: 1) uncertainty as to the timing of completion of the transactions described herein, 2) the ability of Validus to obtain the regulatory approvals required to consummate the transactions, 3) rating agency actions; 4) failure to realize the anticipated benefits of the proposed transaction; 5) competition in the insurance and reinsurance markets; 6) cyclicality of demand and pricing in the insurance and reinsurance markets; 7) retention of key personnel; 8) customers' reactions to the transaction and to products that may be offered by Validus or Western World in the future; 9) potential loss of business from one or more major insurance or reinsurance producers, as well as Validus and Western World management’s response to any of the aforementioned factors. The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included herein and elsewhere, including the risk factors included in Validus’ most recent reports on Form 10-K and Form 10-Q and other documents of Validus on file with or furnished to the U.S. Securities and Exchange Commission (“SEC”). Any forward-looking statements made in this presentation are qualified by these cautionary statements, and there can be no assurance that the actual results or developments anticipated by Validus will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, Validus or Western World or their respective businesses or operations. Each forward-looking statement speaks only as of the date of the particular statement and, except as may be required by applicable law, Validus undertakes no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future events or otherwise. 2

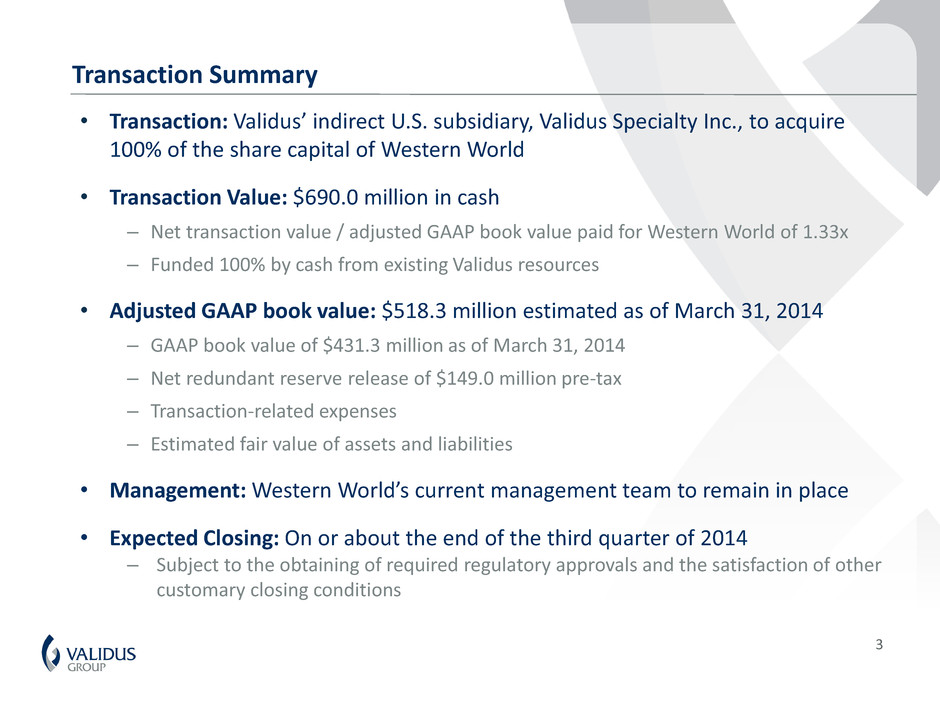

• Transaction: Validus’ indirect U.S. subsidiary, Validus Specialty Inc., to acquire 100% of the share capital of Western World • Transaction Value: $690.0 million in cash – Net transaction value / adjusted GAAP book value paid for Western World of 1.33x – Funded 100% by cash from existing Validus resources • Adjusted GAAP book value: $518.3 million estimated as of March 31, 2014 – GAAP book value of $431.3 million as of March 31, 2014 – Net redundant reserve release of $149.0 million pre-tax – Transaction-related expenses – Estimated fair value of assets and liabilities • Management: Western World’s current management team to remain in place • Expected Closing: On or about the end of the third quarter of 2014 – Subject to the obtaining of required regulatory approvals and the satisfaction of other customary closing conditions Transaction Summary 3

• Strategic – A strategic move to enhance Validus’ access to the specialty U.S. commercial insurance market – the world’s largest short tail market • Leverage – Ability to leverage and enhance Validus’ existing market position and operational strengths in short tail classes of business • Growth – Western World has identified short tail classes of business as being essential for their continued development and relevance to agents and customers • Fit – Good cultural and management fit between Validus and Western World • Diversification – Improves Validus’ cycle management abilities – reinsurance and insurance Transaction Rationale 4

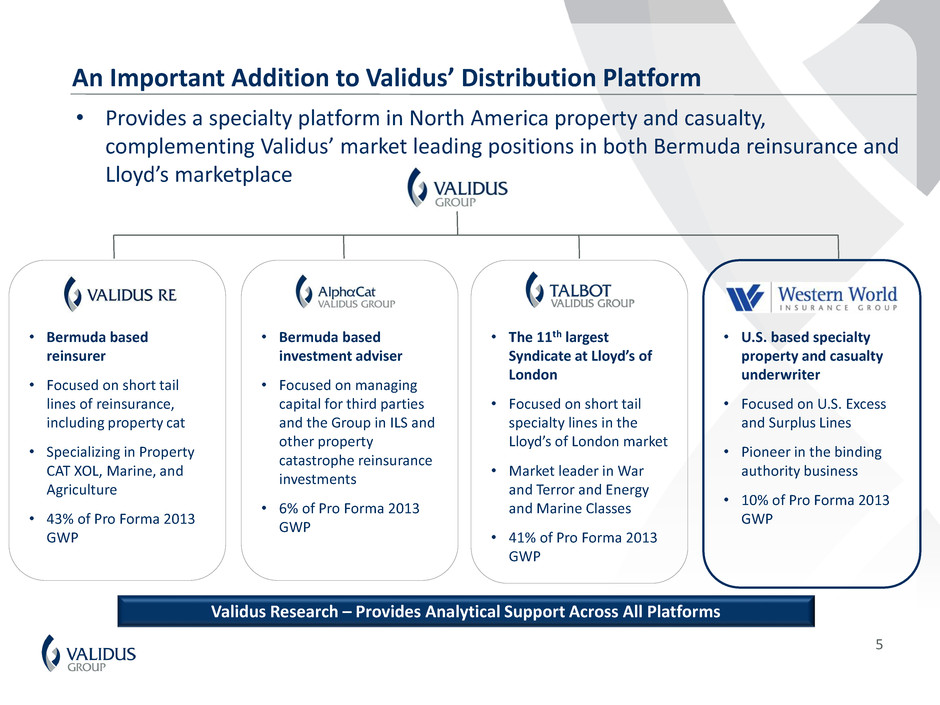

An Important Addition to Validus’ Distribution Platform • Provides a specialty platform in North America property and casualty, complementing Validus’ market leading positions in both Bermuda reinsurance and Lloyd’s marketplace • U.S. based specialty property and casualty underwriter • Focused on U.S. Excess and Surplus Lines • Pioneer in the binding authority business • 10% of Pro Forma 2013 GWP • Bermuda based investment adviser • Focused on managing capital for third parties and the Group in ILS and other property catastrophe reinsurance investments • 6% of Pro Forma 2013 GWP • The 11th largest Syndicate at Lloyd’s of London • Focused on short tail specialty lines in the Lloyd’s of London market • Market leader in War and Terror and Energy and Marine Classes • 41% of Pro Forma 2013 GWP • Bermuda based reinsurer • Focused on short tail lines of reinsurance, including property cat • Specializing in Property CAT XOL, Marine, and Agriculture • 43% of Pro Forma 2013 GWP Validus Research – Provides Analytical Support Across All Platforms 5

What Western World Brings to Validus • Excellent Track Record and Market Reputation in the Specialty U.S. Insurance Market – 50 consecutive years of increased shareholders’ equity – Pioneer and leader in the small and medium enterprise (“SME”) excess and surplus (“E&S”) lines specialty U.S. insurance market • Platform and Distribution – Established position in multiple distribution channels – Superior technology capabilities (“Western World Integrated Platform” or “WWIP”) – Admitted and non-admitted licenses • Experienced Management Team with Complementary Competencies – Deep understanding of target markets and proven ability to navigate market cycles – Established and proven underwriting and claims functions • Business Compatibility and Meaningful Opportunity to Expand the Current Platform – Clean balance sheet with full operational capabilities in the U.S. insurance market – Excellent positioning to introduce Validus/Talbot short tail products – speed to market 6

Broadens and Diversifies Validus’ Product Offerings 56% Reinsurance / 44% Insurance 1) $2.7 billion in consolidated pro forma gross premium written is net of $80 million of intersegment eliminations and includes $280 million of Western World gross premium written. Validus Pro Forma 2013 Gross Premium Written of $2.7 Billion Western World 10% Validus Re 43% Talbot 41% AlphaCat 6% U.S. E&S 10% Property Cat XOL 28% Specialty 25% Marine 22% Other Property 15% 7

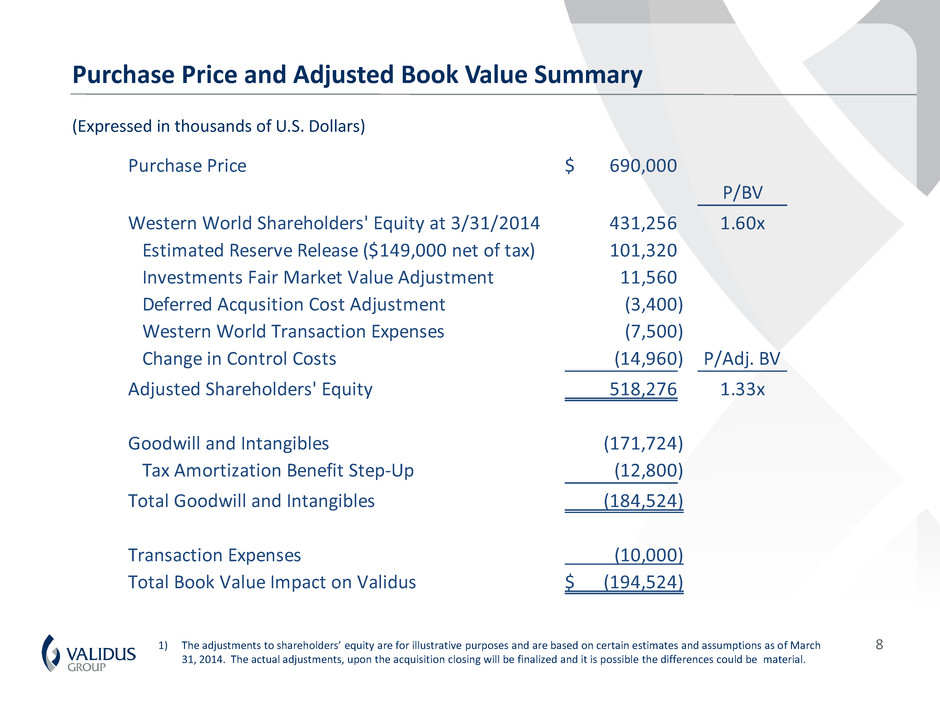

Purchase Price and Adjusted Book Value Summary 8 (Expressed in thousands of U.S. Dollars) Purchase Price 690,000$ P/BV Western World Shareholders' Equity at 3/31/2014 431,256 1.60x Estimated Reserve Release ($149,000 net of tax) 101,320 Investments Fair Market Value Adjustment 11,560 Deferred Acqusition Cost Adjustment (3,400) Western World Transaction Expenses (7,500) Change in Control Costs (14,960) P/Adj. BV Adjusted Shareholders' Equity 518,276 1.33x Goodwill and Intangibles (171,724) Tax Amortization Benefit Step-Up (12,800) Total Goodwill and Intangibles (184,524) Transaction Expenses (10,000) Total Book Value Impact on Validus (194,524)$ 1) The adjustments to shareholders’ equity are for illustrative purposes and are based on certain estimates and assumptions as of March 31, 2014. The actual adjustments, upon the acquisition closing will be finalized and it is possible the differences could be material.

9 Expected Pro Forma Book Value Impact & Capitalization 1) Capitalization and debt ratios exclude noncontrolling interest. (1) Transaction Impact ($690m) Metric Pre- Transaction Post- Transaction $ Increase/ (Decrease) % Increase/ (Decrease) Diluted Book Value per Share March 31, 2014 37.58$ 37.48$ (0.10)$ -0.3% Diluted Tangible Book Value per Share March 31, 2014 36.33$ 34.39$ (1.94)$ -5.3% Capitalization Senior debt/capitalization 5.6% 5.6% 0.0% Hybrid securities/capitalization 12.2% 12.2% 0.0% Total leverage/capitalization 17.8% 17.8% 0.0%

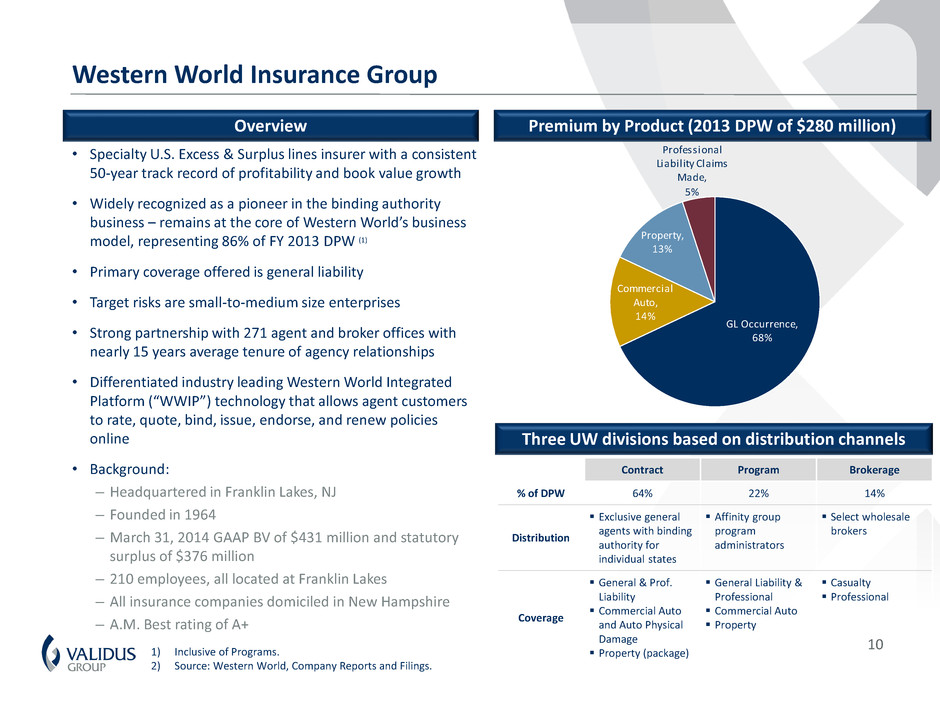

Western World Insurance Group • Specialty U.S. Excess & Surplus lines insurer with a consistent 50-year track record of profitability and book value growth • Widely recognized as a pioneer in the binding authority business – remains at the core of Western World’s business model, representing 86% of FY 2013 DPW (1) • Primary coverage offered is general liability • Target risks are small-to-medium size enterprises • Strong partnership with 271 agent and broker offices with nearly 15 years average tenure of agency relationships • Differentiated industry leading Western World Integrated Platform (“WWIP”) technology that allows agent customers to rate, quote, bind, issue, endorse, and renew policies online • Background: – Headquartered in Franklin Lakes, NJ – Founded in 1964 – March 31, 2014 GAAP BV of $431 million and statutory surplus of $376 million – 210 employees, all located at Franklin Lakes – All insurance companies domiciled in New Hampshire – A.M. Best rating of A+ Contract Program Brokerage % of DPW 64% 22% 14% Distribution Exclusive general agents with binding authority for individual states Affinity group program administrators Select wholesale brokers Coverage General & Prof. Liability Commercial Auto and Auto Physical Damage Property (package) General Liability & Professional Commercial Auto Property Casualty Professional Premium by Product (2013 DPW of $280 million) Overview Three UW divisions based on distribution channels 1) Inclusive of Programs. 2) Source: Western World, Company Reports and Filings. Professional Liability Claims Made, 5% GL Occurrence, 68% Commercial Auto, 14% Property, 13% 10

Western World - Corporate Structure Western World Insurance Group, Inc. (“WWIG”) Western World Insurance Company (“WWIC”) Stratford Insurance Company Tudor Insurance Company • Domiciled in NH and licensed in 49 jurisdictions. Stratford writes primarily commercial auto business on an admitted basis, where the coverage cannot be written on a non- admitted basis due to regulatory requirements • Domiciled in NH as a DSLI, Tudor writes business on a surplus lines basis nationwide • 94% owned by a family-controlled non-U.S. holding company • As Western World’s flagship underwriting entity, WWIC, domiciled in NH, writes business on a surplus lines basis in all other states except NY Pooling Arrangement • WWIC, Stratford, and Tudor participate in an intercompany reinsurance pooling arrangement • WWIC assumes a share of 80% under the pooling arrangement; the remaining 20% is allocated equally between Stratford and Tudor • All premiums, losses and loss adjustment expenses, and underwriting and investment expenses distributed among the three companies in proportion to their participation percentage in the pool 1) Source: Western World, Company Reports and Filings. 11

1964 1972 1979 1981 1989 1991 1992 1996 2000 2004 2006 2008 2010 2013 1972 Derek Hughes appointed as President 1981 Stratford formed 1991 Upgraded to A+ A.M.Best FSR 1996 Launched property coverage 2004 Achieved peak annual premiums of $325mm during the mid-2000s 2008 Initial market research for next phase of growth 2013 WWIP introduced for commercial auto 1964 Company was formed with $900K 1979 Tudor formed 1989 Launched Professional Liability Business and Commercial Auto 1992 Andrew Frazier appointed as President 2000 Program Division launched 2006 Achieved $1bn in invested assets 2010 Tom Mulligan appointed President: WWIP introduced; Brokerage team joins Western World - History Five Decades of Industry Leadership and Franchise Development 1) Source: Western World, Company Reports and Filings. 12

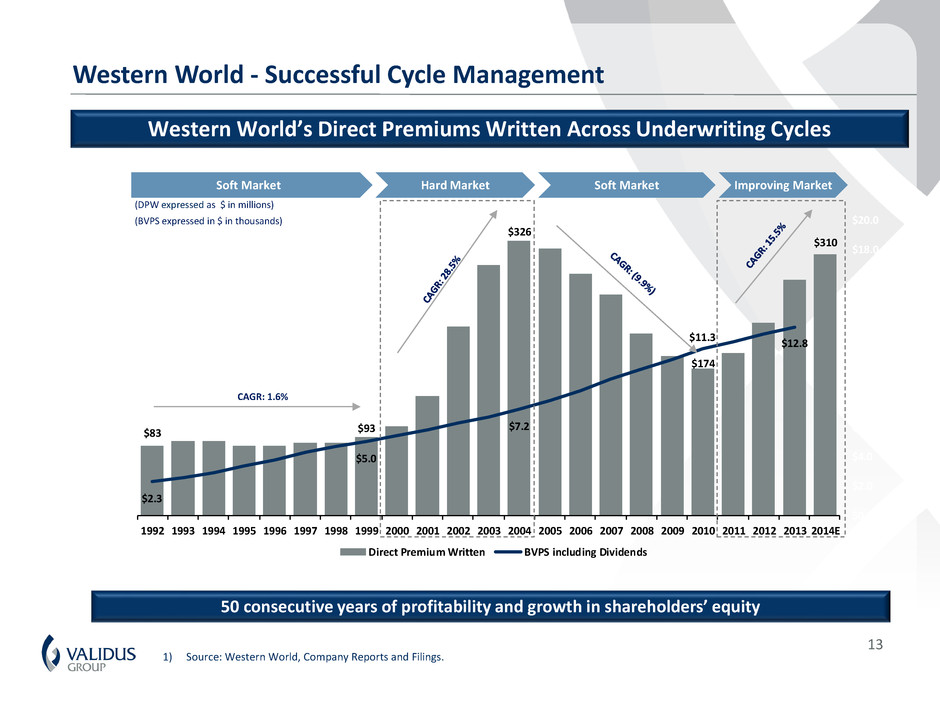

$83 $93 $326 $174 $310 $2.3 $5.0 $7.2 $11.3 $12.8 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 $18.0 $20.0 $0 $50 $100 $150 $200 $250 $300 $350 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014E Direct Premium Written BVPS including Dividends Western World’s Direct Premiums Written Across Underwriting Cycles (DPW expressed as $ in millions) (BVPS expressed in $ in thousands) Soft Market Hard Market Soft Market Improving Market CAGR: 1.6% Western World - Successful Cycle Management 50 consecutive years of profitability and growth in shareholders’ equity 1) Source: Western World, Company Reports and Filings. 13

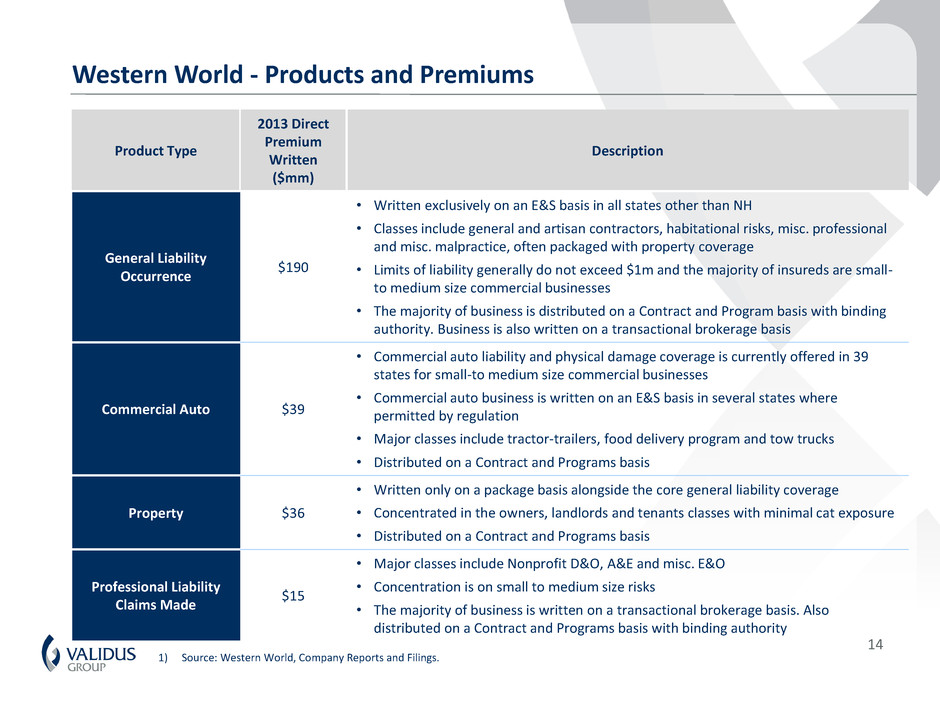

Western World - Products and Premiums Product Type 2013 Direct Premium Written ($mm) Description General Liability Occurrence $190 • Written exclusively on an E&S basis in all states other than NH • Classes include general and artisan contractors, habitational risks, misc. professional and misc. malpractice, often packaged with property coverage • Limits of liability generally do not exceed $1m and the majority of insureds are small- to medium size commercial businesses • The majority of business is distributed on a Contract and Program basis with binding authority. Business is also written on a transactional brokerage basis Commercial Auto $39 • Commercial auto liability and physical damage coverage is currently offered in 39 states for small-to medium size commercial businesses • Commercial auto business is written on an E&S basis in several states where permitted by regulation • Major classes include tractor-trailers, food delivery program and tow trucks • Distributed on a Contract and Programs basis Property $36 • Written only on a package basis alongside the core general liability coverage • Concentrated in the owners, landlords and tenants classes with minimal cat exposure • Distributed on a Contract and Programs basis Professional Liability Claims Made $15 • Major classes include Nonprofit D&O, A&E and misc. E&O • Concentration is on small to medium size risks • The majority of business is written on a transactional brokerage basis. Also distributed on a Contract and Programs basis with binding authority 1) Source: Western World, Company Reports and Filings. 14

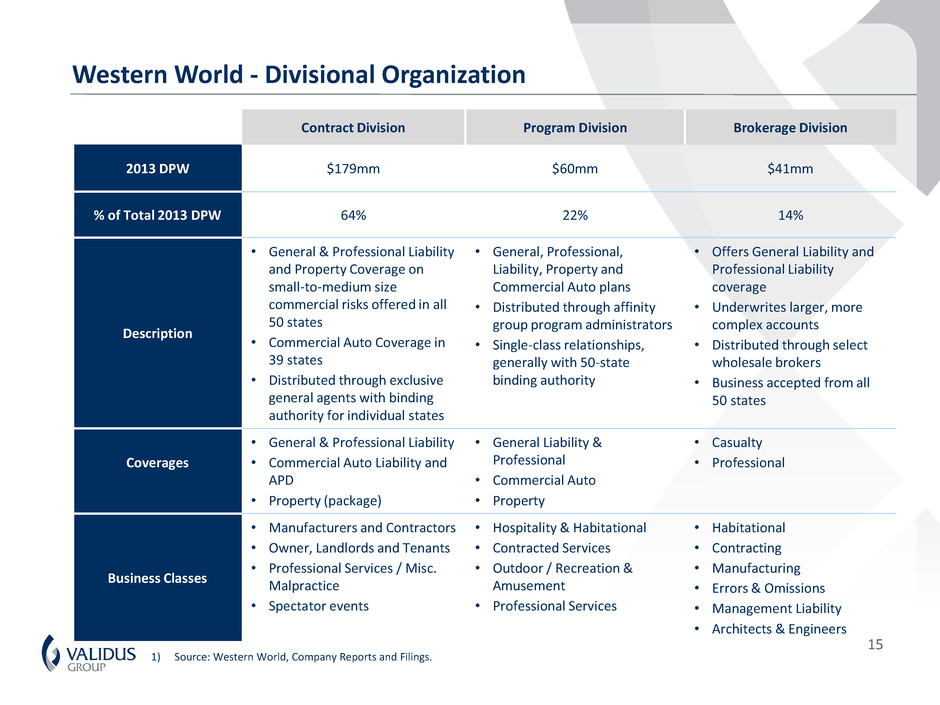

Contract Division Program Division Brokerage Division 2013 DPW $179mm $60mm $41mm % of Total 2013 DPW 64% 22% 14% Description • General & Professional Liability and Property Coverage on small-to-medium size commercial risks offered in all 50 states • Commercial Auto Coverage in 39 states • Distributed through exclusive general agents with binding authority for individual states • General, Professional, Liability, Property and Commercial Auto plans • Distributed through affinity group program administrators • Single-class relationships, generally with 50-state binding authority • Offers General Liability and Professional Liability coverage • Underwrites larger, more complex accounts • Distributed through select wholesale brokers • Business accepted from all 50 states Coverages • General & Professional Liability • Commercial Auto Liability and APD • Property (package) • General Liability & Professional • Commercial Auto • Property • Casualty • Professional Business Classes • Manufacturers and Contractors • Owner, Landlords and Tenants • Professional Services / Misc. Malpractice • Spectator events • Hospitality & Habitational • Contracted Services • Outdoor / Recreation & Amusement • Professional Services • Habitational • Contracting • Manufacturing • Errors & Omissions • Management Liability • Architects & Engineers Western World - Divisional Organization 1) Source: Western World, Company Reports and Filings. 15

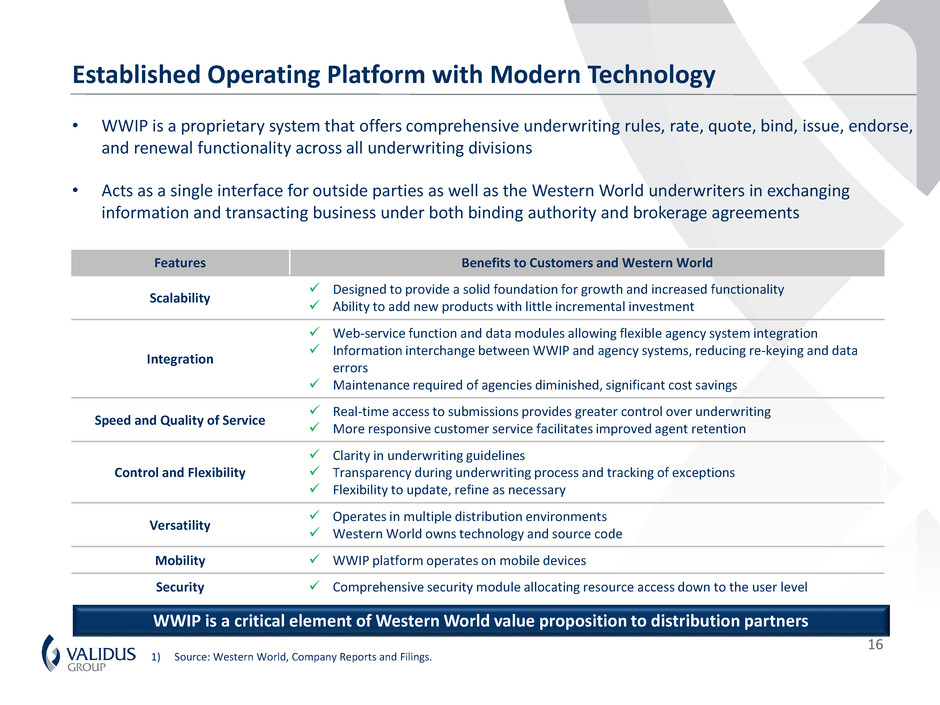

Established Operating Platform with Modern Technology • WWIP is a proprietary system that offers comprehensive underwriting rules, rate, quote, bind, issue, endorse, and renewal functionality across all underwriting divisions • Acts as a single interface for outside parties as well as the Western World underwriters in exchanging information and transacting business under both binding authority and brokerage agreements Features Benefits to Customers and Western World Scalability Designed to provide a solid foundation for growth and increased functionality Ability to add new products with little incremental investment Integration Web-service function and data modules allowing flexible agency system integration Information interchange between WWIP and agency systems, reducing re-keying and data errors Maintenance required of agencies diminished, significant cost savings Speed and Quality of Service Real-time access to submissions provides greater control over underwriting More responsive customer service facilitates improved agent retention Control and Flexibility Clarity in underwriting guidelines Transparency during underwriting process and tracking of exceptions Flexibility to update, refine as necessary Versatility Operates in multiple distribution environments Western World owns technology and source code Mobility WWIP platform operates on mobile devices Security Comprehensive security module allocating resource access down to the user level WWIP is a critical element of Western World value proposition to distribution partners 1) Source: Western World, Company Reports and Filings. 16

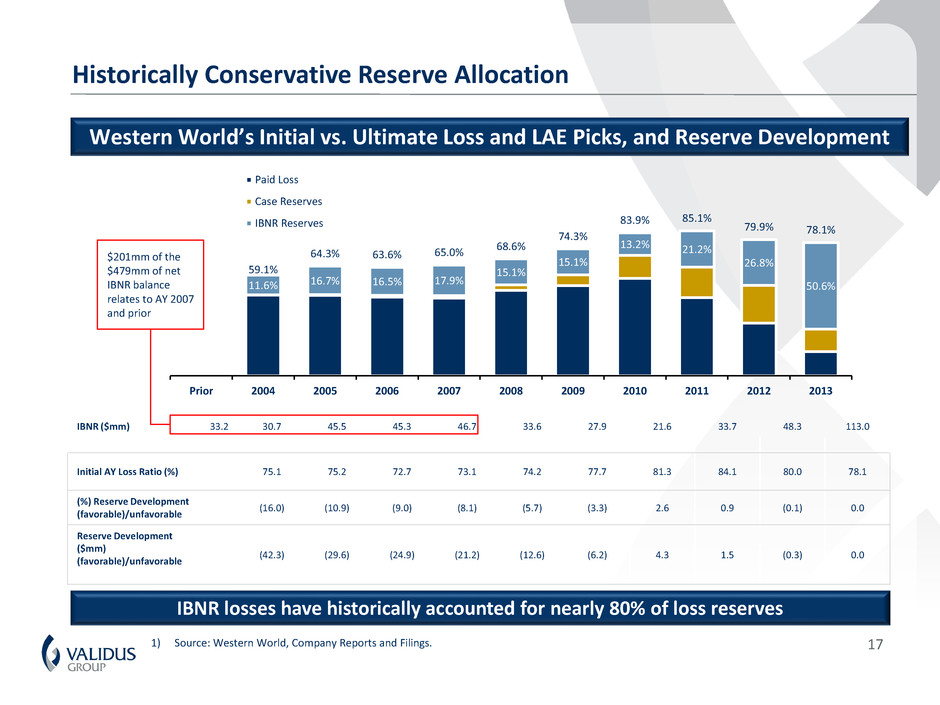

Historically Conservative Reserve Allocation IBNR ($mm) 33.2 30.7 45.5 45.3 46.7 33.6 27.9 21.6 33.7 48.3 113.0 Initial AY Loss Ratio (%) 75.1 75.2 72.7 73.1 74.2 77.7 81.3 84.1 80.0 78.1 (%) Reserve Development (favorable)/unfavorable (16.0) (10.9) (9.0) (8.1) (5.7) (3.3) 2.6 0.9 (0.1) 0.0 Reserve Development ($mm) (favorable)/unfavorable (42.3) (29.6) (24.9) (21.2) (12.6) (6.2) 4.3 1.5 (0.3) 0.0 $201mm of the $479mm of net IBNR balance relates to AY 2007 and prior Western World’s Initial vs. Ultimate Loss and LAE Picks, and Reserve Development IBNR losses have historically accounted for nearly 80% of loss reserves 11.6% 16.7% 16.5% 17.9% 15.1% 15.1% 13.2% 21.2% 26.8% 50.6% 59.1% 64.3% 63.6% 65.0% 68.6% 74.3% 83.9% 85.1% 79.9% 78.1% Prior 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Paid Loss Case Reserves IBNR Reserves 1) Source: Western World, Company Reports and Filings. 17

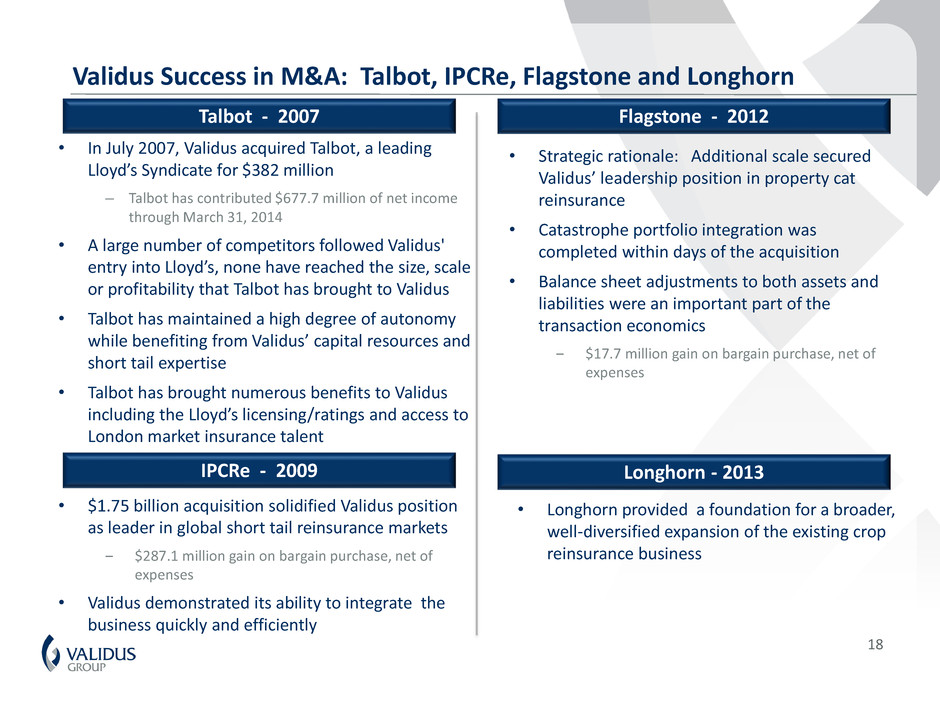

Talbot - 2007 IPCRe - 2009 • In July 2007, Validus acquired Talbot, a leading Lloyd’s Syndicate for $382 million – Talbot has contributed $677.7 million of net income through March 31, 2014 • A large number of competitors followed Validus' entry into Lloyd’s, none have reached the size, scale or profitability that Talbot has brought to Validus • Talbot has maintained a high degree of autonomy while benefiting from Validus’ capital resources and short tail expertise • Talbot has brought numerous benefits to Validus including the Lloyd’s licensing/ratings and access to London market insurance talent • $1.75 billion acquisition solidified Validus position as leader in global short tail reinsurance markets ‒ $287.1 million gain on bargain purchase, net of expenses • Validus demonstrated its ability to integrate the business quickly and efficiently Flagstone - 2012 • Strategic rationale: Additional scale secured Validus’ leadership position in property cat reinsurance • Catastrophe portfolio integration was completed within days of the acquisition • Balance sheet adjustments to both assets and liabilities were an important part of the transaction economics ‒ $17.7 million gain on bargain purchase, net of expenses Validus Success in M&A: Talbot, IPCRe, Flagstone and Longhorn 18 Longhorn - 2013 • Longhorn provided a foundation for a broader, well-diversified expansion of the existing crop reinsurance business

• Culture – High level of existing alignment • Financial Reporting – Western World currently reports on a quarterly basis and prepares U.S. GAAP financials • Enterprise Risk Management – Validus ERM framework to be implemented at Western World • Loss Reserving – Detailed, class by class analysis has already taken place as part of due diligence • Expense Synergies – Validus not assuming any expense synergies in current and projected economics Key Integration Steps 19

• A leading Bermuda based reinsurer focused on short tail classes • Market leading analytical and underwriting expertise • Profitable every year • Managing third party reinsurance capital since 2008 • Unique strategy supporting the Validus Re customer value proposition • Profitable every year • The 11th largest Syndicate at Lloyd’s of London • Leadership in short tail specialty classes • Profitable every year • A pioneer in the unique binding authority business model • Attractive distribution capabilities to be supported by Validus’ increased risk appetite • Profitable every year The Validus Model – Strongly Profitable Growing Global Business Building a Global Business….Delivering Sustainable Earnings 20

• A strategic move to enhance Validus’ access to the specialty U.S. commercial insurance market – the world’s largest short tail market • Ability to leverage and enhance Validus’ existing market position and operational strengths in short tail classes of business • Western World has identified short tail classes of business as essential for their continued development and relevance to agents and customers • Good cultural and management fit between Validus and Western World • Improves Validus’ cycle management abilities – reinsurance and insurance Summary 21

APPENDIX Validus Agreed Acquisition of Western World

In presenting the Company’s results herein, management has included and discussed certain schedules containing diluted book value per common share that are not calculated under standards or rules that comprise U.S. GAAP. Such measures are referred to as non-GAAP. Non- GAAP measures may be defined or calculated differently by other companies. We believe that these measures are important to investors and other interested parties. These measures should not be viewed as a substitute for those determined in accordance with U.S. GAAP. Diluted book value per share is calculated based on total shareholders’ equity plus the assumed proceeds from the exercise of outstanding stock options and warrants, divided by the sum of unvested restricted shares, stock options, warrants and share equivalents outstanding (assuming their exercise). Diluted tangible book value per share is calculated based on diluted book value per share excluding goodwill and intangible assets per share. Investors should not rely on the information set forth in this presentation when considering an investment in the Company. The information contained in this presentation has not been audited nor has it been subject to independent verification. The estimates set forth herein speak only as of the date of this presentation and the Company undertakes no obligation to update or revise such information to reflect the occurrence of future events. The events presented reflect a specific set of prescribed calculations and do not necessarily reflect all events that may impact the Company. 23 Notes on Non-GAAP Measures

Street Address: 29 Richmond Road Pembroke, Bermuda Mailing Address: Suite 1790 48 Par-la-Ville Road Hamilton, Bermuda HM 11 Telephone: +1-441-278-9000 Email: investor.relations@validusholdings.com For more information on our company, products and management team please visit our website at: www.validusholdings.com