Attached files

| file | filename |

|---|---|

| EX-31 - EXHIBIT 31.1 - Oceanus Acquisition Corp. | oceanus10q3exh31.htm |

| EX-32 - EXHIBIT 32.1 - Oceanus Acquisition Corp. | oceanus10q3exh32.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

| [X] | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934. |

FOR THE QUARTERLY PERIOD ENDED SEPTEMBER 30, 2013

OR

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

COMMISSION FILE NUMBER: 000-54682

Oceanus Acquisition Corp.

(Exact name of registrant as specified in its charter)

| Delaware | 45-5737221 | |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

|

Attn: German Rivero-Zerpa, Director c/o Brilla Financial Holdings, LLC 1441 Brickell Avenue, Suite 1220 Miami, FL |

33131 | |

| (Address of principal executive offices) | (Zip Code) | |

(786) 375-5600

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. [X ]Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). [X ]Yes [ ] No

-1-

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | [ ] | Accelerated filer | [ ] | |||

| Non-accelerated filer | [ ] (Do not check if a smaller reporting company) | Smaller reporting company | [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

[X ]Yes [ ] No

State the number of shares outstanding of each of the issuer’s classes of common equity, as of September 30, 2013: 31,390,000 shares of common stock.

-2-

TABLE OF CONTENTS

Oceanus ACQUISITION Corp.

(A DEVELOPMENT STAGE COMPANY)

INDEX

PART I-FINANCIAL INFORMATION

| ITEM | 1 - FINANCIAL STATEMENTS | 4 | ||

| Interim Balance Sheets at September 30, 2013 and December 31, 2012 (unaudited) | 4 | |||

| Interim Statements of Operations for the Three Months ended September 30, 2013, and for the period from January 31, 2012 (Date of Inception) through September 30, 2013 (unaudited) | 5 | |||

| Interim Statements of Cash Flows for the Three Months ended September 30, 2013, and for the Period from January 31, 2012 (Date of Inception) through September 30, 2013 (unaudited) | 6 | |||

| Interim Statements of Stockholders’ Deficit for the Three Months ended September 30, 2013, and for the Period from January 31, 2012 (Date of Inception) through September 30, 2013 (unaudited) | 7 | |||

| Notes to Unaudited Financial Statements | 8-10 | |||

| ITEM | 2 - MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITIONS AND RESULTS OF OPERATIONS | 11 | ||

| ITEM | 3 - QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 11 | ||

| ITEM | 4 - CONTROLS AND PROCEDURES. | 12 | ||

| PART II-OTHER INFORMATION | ||||

| ITEM | 1- LEGAL PROCEEDING | 12 | ||

| ITEM | 1A - RISK FACTORS | |||

| ITEM | 2 - UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS | 12 | ||

| ITEM | 3 - DEFAULTS UPON SENIOR SECURITIES | 12 | ||

| ITEM | 4 - REMOVED AND RESERVED | 12 | ||

| ITEM | 5 - OTHER INFORMATION | 12 | ||

| ITEM | 6 - EXHIBITS | 13 | ||

| SIGNATURES | 14 | |||

-3

PART I-FINANCIAL INFORMATION

| ITEM 1 | FINANCIAL STATEMENTS |

The following unaudited interim financial statements of Oceanus Acquisition Corp. (sometimes referred to as "we", "us" or "our Company") are included in this quarterly report on Form 10-Q:

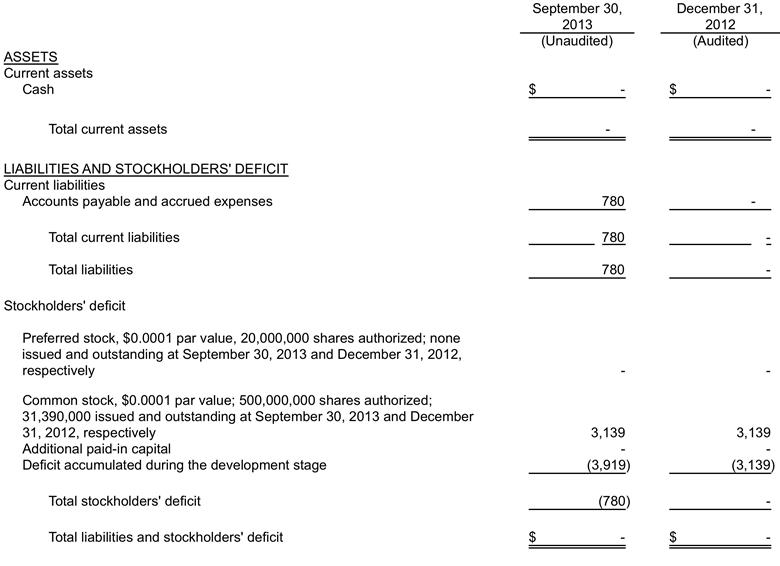

OCEANUS ACQUISITION CORP.

(A Development Stage Company)

INTERIM BALANCE SHEETS

See Accompanying Notes to Unaudited Financial Statements

-4-

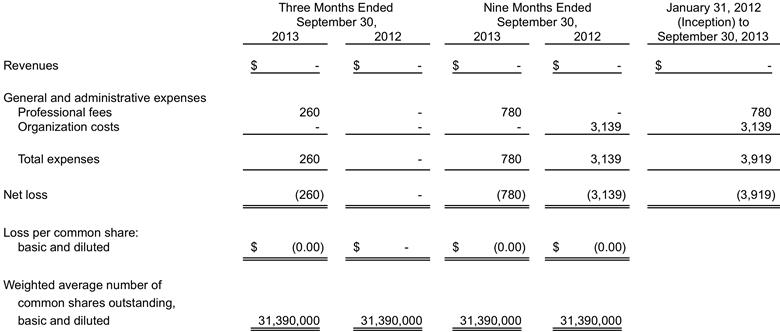

OCEANUS ACQUISITION CORP.

(A Development Stage Company)

INTERIM STATEMENTS OF OPERATIONS

(Unaudited)

See Accompanying Notes to Unaudited Financial Statements

-5-

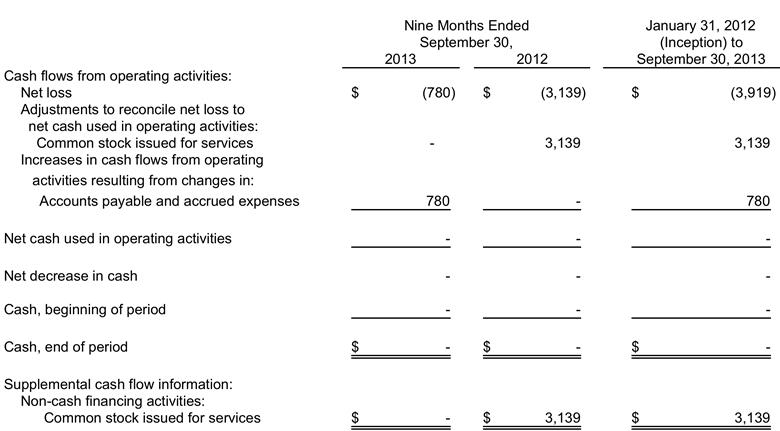

OCEANUS ACQUISITION CORP.

(A Development Stage Company)

INTERIM STATEMENTS OF CASH FLOWS

(Unaudited)

See Accompanying Notes to Unaudited Financial Statements

-6-

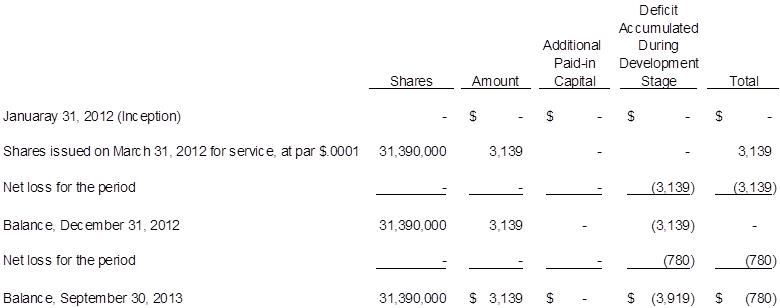

OCEANUS ACQUISITION CORP.

(A Development Stage Company)

INTERIM STATEMENT OF CHANGES IN STOCKHOLDERS’ DEFICIT

(Unaudited)

See Accompanying Notes to Unaudited Financial Statements

-7-

OCEANUS ACQUISITION CORP.

(A Development Stage Company)

NOTES TO INTERIM FINANCIAL STATEMENTS

SEPTEMBER 30, 2013

(Unaudited)

NOTE 1 – BASIS OF PRESENTATION, ORGANIZATION OF THE COMPANY AND GOING CONCERN

Basis of Presentation

The accompanying unaudited interim financial statements as of September 30, 2013 and for the three months ended September 30, 2013 and 2012 and for the period from January 31, 2012 (inception) to September 30, 2013 have been prepared by the Company pursuant to the rules and regulations of the Securities and Exchange Commission, (“SEC”), including Form 10-Q and Regulation S-K. The information furnished herein reflects all adjustments (consisting of normal recurring accruals and adjustments), which are, in the opinion of management, necessary to fairly present the operating results for the respective periods. Certain information and footnote disclosures normally present in annual financial statements prepared in accordance with accounting principles generally accepted in the United States of America have been omitted pursuant to such rules and regulations. The Company believes that the disclosures provided are adequate to make the information presented not misleading. These unaudited interim financial statements should be read in conjunction with the audited financial statements and explanatory notes for the year ended December 31, 2012 and for the period January 31, 2012, (inception), to December 31, 2012 as disclosed in the Company's 10-K for that period as filed with the SEC.

The results of the period ended September 30, 2013 are not necessarily indicative of the results to be expected for the year ending December 31, 2013, the Company’s fiscal year end.

The Company has not earned any revenue since its inception. Accordingly, the Company’s activities have been accounted for as those of a “Development Stage Company” as set forth in the FASB Codification Topic 915. Among the disclosures required by the FASB Codification Topic 915 are that the Company’s financial statements be identified as those of a development stage company, and that the statements of operations, stockholders’ equity and cash flows disclose activity since the date of the Company’s inception.

Organization of the Company

Oceanus Acquisition Corp. (the “Company”), a development stage company, was incorporated under the laws of the State of Delaware on January 31, 2012 and has been inactive since inception. The Company intends to serve as a vehicle to effect an asset acquisition, merger, exchange of capital stock or other business combination with a domestic or foreign business.

Going Concern

The accompanying unaudited financial statements have been prepared in conformity with generally accepted accounting principles in the United States of America, which contemplate continuation of the Company as a going concern. The Company, however, has minimal assets and working capital and lacks a sufficient source of revenues, which raises substantial doubt about the Company’s ability to continue as a going concern. The Company’s ability to continue as a going concern and to realize its assets and to discharge its liabilities is dependent upon the Company’s management to securing a business combination. Management intends to fund working capital requirements for the foreseeable future and believes that the current business plan if successfully implemented may provide the opportunity for the Company to continue as a going concern. The accompanying statements do not include any adjustments that might result should the Company be unable to continue as a going concern.

-8-

OCEANUS ACQUISITION CORP.

(A Development Stage Company)

NOTES TO INTERIM FINANCIAL STATEMENTS

SEPTEMBER 30, 2013

(Unaudited)

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Estimates

The preparation of financial statements in conformity with generally accepted accounting principles in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities, at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Loss Per Share

The Company uses Topic 260, “Earnings Per Share”, for calculating the basic and diluted loss per share. The Company computes basic loss per share by dividing net loss and net loss attributable to common stockholders by the weighted average number of common shares outstanding. Diluted loss per share is computed similar to basic loss per share except that the denominator is increased to include the number of additional common shares that would have been outstanding if the potential shares had been issued and if the additional shares were dilutive. Common stock equivalents are excluded from the computation of net loss per share if their effect is anti-dilutive. The Company does not have any common stock equivalents.

Fair Value Measurements

Generally accepted accounting principles ("GAAP") define fair value, provide guidance for measuring fair value and require certain disclosures. GAAP utilizes a fair value hierarchy which is categorized into three levels based on the inputs to the valuation techniques used to measure fair value. These principles discuss valuation techniques, such as the market approach (comparable market prices), the income approach (present value of future income or cash flows) and the cost approach (cost to replace the service capacity of an asset or replacement cost). These principles provide for a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value into three broad levels. The following is a brief description of those three levels:

Level 1: Observable inputs such as quoted prices (unadjusted) in active markets for identical assets or

Liabilities.

Level 2: Inputs other than quoted prices that are observable for the asset or liability, either directly or

indirectly. These include quoted prices for similar assets or liabilities in active markets and

quoted prices for identical or similar assets or liabilities in markets that are not active.

Level 3: Unobservable inputs that reflect the Company's assumptions.

The Company’s financial instruments consist of cash, accounts payable and accrued expenses and loan payable – President. The carrying value approximates fair value due to the short maturity of these instruments.

-9-

OCEANUS ACQUISITION CORP.

(A Development Stage Company)

NOTES TO INTERIM FINANCIAL STATEMENTS

SEPTEMBER 30, 2013

(Unaudited)

NOTE 3 - RELATED PARTY BALANCES AND TRANSACTIONS

Equity Transaction

Upon formation, the Board of Directors issued 31,390,000 shares of common stock to the founding shareholder in exchange for incorporation fees of $89, annual resident agent fees in the State of Delaware for $50, and developing the Company’s business concept and plan valued at $3,000 to a total sum of $3,139.

On March 18, 2013, William Tay, the funding shareholder sold 31,390,000 shares of Common Stock to Brilla Financial Holdings, LLC for $40,000 in cash. Mr. Tay sold these shares of Common Stock under the exemption from registration provided by Section 4(2) of the Securities Act. The Company did not receive any of the proceeds from this sale.

NOTE 4 – INCOME TAXES

As of December 31, 2012, there are loss carryforwards for Federal income tax purposes of approximately $3,139, available to offset future taxable income. The carryforwards begin to expire in 2028. The Company does not expect to incur a Federal income tax liability in the foreseeable future. As of December 31, 2012, the Company had a deferred tax asset amounting to approximately $1,070. Realization of deferred tax assets is dependent on future earnings, if any, the timing and amount of which is uncertain. Accordingly, the deferred tax asset has been fully offset by a valuation allowance of the same amount.

Certain provisions of the tax law may limit net operating loss carryforwards available for use in any given year in the event of a significant change in ownership.

Federal and state income tax returns are subject to examination by tax authorities.

NOTE 5 – STOCKHOLDER’S EQUITY

On January 31, 2012, the Board of Directors issued 31,390,000 shares of common stock to the founding shareholder in exchange for incorporation fees of $89, annual resident agent fees in the State of Delaware for $50, and developing the Company’s business concept and plan valued at $3,000 to a total sum of $3,139.

On March 18, 2013, William Tay, the former sole officer and director of the Company sold 31,390,000 shares of Common Stock to Brilla Financial Holdings, LLC for $40,000 in cash. Mr. Tay sold these shares of Common Stock under the exemption from registration provided by Section 4(2) of the Securities Act. The Company did not receive any of the proceeds from this sale.

The stockholders’ equity section of the Company contains the following classes of capital stock as of September 30, 2013:

• Common stock, $ 0.0001 par value: 500,000,000 shares authorized; 31,390,000 shares issued and outstanding.

• Preferred stock, $ 0.0001 par value: 20,000,000 shares authorized; but not issued and outstanding.

-7-

NOTE 6 – SUBSEQUENT EVENTS

None.

Subsequent events have been evaluated through May 12, 2014, the date the financial statements were issued.

-10-

|

ITEM 2 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

PLAN OF OPERATION

The Company will attempt to locate and negotiate with a business entity for the combination of that target company with the Company. The combination will normally take the form of a merger, stock-for-stock exchange or stock-for-assets exchange (the “business combination”). In most instances, the target company will wish to structure the business combination to be within the definition of a tax-free reorganization under Section 351 or Section 368 of the Internal Revenue Code of 1986, as amended. No assurances can be given that the Company will be successful in locating or negotiating with any target business.

The Company has not restricted its search for any specific kind of businesses, and it may acquire a business which is in its preliminary or development stage, which is already in operation, or in essentially any stage of its business life. It is impossible to predict the status of any business in which the Company may become engaged, in that such business may need to seek additional capital, may desire to have its shares publicly traded, or may seek other perceived advantages which the Company may offer.

In implementing a structure for a particular business acquisition, the Company may become a party to a merger, consolidation, reorganization, joint venture, or licensing agreement with another corporation or entity.

It is anticipated that any securities issued in any such business combination would be issued in reliance upon exemption from registration under applicable federal and state securities laws. In some circumstances, however, as a negotiated element of its transaction, the Company may agree to register all or a part of such securities immediately after the transaction is consummated or at specified times hereafter. If such registration occurs, it will be undertaken by the surviving entity after the Company has entered into an agreement for a business combination or has consummated a business combination. The issuance of additional securities and their potential sale into any trading market which may develop in the Company’s securities may depress the market value of the Company’s securities in the future if such a market develops, of which there is no assurance.

The Company will participate in a business combination only after the negotiation and execution of appropriate agreements. Negotiations with a target company will likely focus on the percentage of the Company, which the target company shareholders would acquire in exchange for their shareholdings. Although the terms of such agreements cannot be predicted, generally such agreements will require certain representations and warranties of the parties thereto, will specify certain events of default, will detail the terms of closing and the conditions which must be satisfied by the parties prior to and after such closing and will include miscellaneous other terms. Any merger or acquisition effected by the Company can be expected to have a significant dilutive effect on the percentage of shares held by the Company’s shareholders at such time.

OFF-BALANCE SHEET ARRANGEMENTS

The Company does not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on the Company’s financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

| ITEM 3 |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

As a “smaller reporting company” as defined by Item 10 of Regulation S-K, the Company is not required to provide the information required by this Item.

-11-

| ITEM 4 | CONTROLS AND PROCEDURES |

Evaluation of Disclosure Controls and Procedures

Our Principal Executive Officer and Principal Financial Officer evaluated the effectiveness of our disclosure controls and procedures as of September 30, 2013. Based on that evaluation, our Principal Executive Officer and Principal Financial Officer concluded that our disclosure controls and procedures as of the end of the period covered by this report were effective such that the information required to be disclosed by us in reports filed under the Securities Exchange Act of 1934 is (i) recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms and (ii) accumulated and communicated to the Principal Executive Officer and Principal Financial Officer, as appropriate, to allow timely decisions regarding disclosure.

Changes in Internal Controls

There have been no significant changes to the Company’s internal controls over financial reporting that occurred during our last fiscal quarter ended September 30, 2013, that materially affected, or were reasonably likely to materially affect, our internal controls over financial reporting.

PART II-OTHER INFORMATION

| ITEM 1 |

LEGAL PROCEEDINGS

|

There are no legal proceedings against the Company and the Company is unaware of such proceedings contemplated against it.

| ITEM 1A | RISK FACTORS |

As a “smaller reporting company” as defined by Item 10 of Regulation S-K, the Company is not required to provide the information required by this Item.

| ITEM 2 | UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS |

The Company did not sell any unregistered equity securities during the three months ended September 30, 2013.

| ITEM 3 | DEFAULTS UPON SENIOR SECURITIES |

The Company currently does not have senior securities.

| ITEM 4 | MINE SAFETY DISCLOSURES |

Not applicable.

| ITEM 5 | OTHER INFORMATION |

None.

-12-

| ITEM 6 | EXHIBITS |

| (a) |

Exhibits required by Item 601 of Regulation S-K.

|

|

Exhibit No. |

Description | |

| 3.1 | Certificate of Incorporation, as filed with the Delaware Secretary of State on January 31, 2012. (1) | |

| 3.2 | By-laws. (1) | |

| 31.1 | Certification of the Company’s Principal Executive and Principal Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002, with respect to the registrant’s report on Form 10-Q for the quarter ended September 30, 2013. (2) | |

| 32.1 | Certification of the Company’s Principal Executive and Principal Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. (2) | |

____________________

| (1) | Filed as an exhibit to the Company's Registration Statement on Form 10, as filed with the SEC on September 25, 2012, and incorporated herein by this reference. |

| (2) | Filed herewith. |

-13-

SIGNATURES

In accordance with the requirements of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, there unto duly authorized.

Oceanus Acquisition Corp.

(Registrant)

By: /s/ German Rivero-Zerpa

German Rivero-Zerpa, President, Secretary and

Principal Financial Officer

Dated: May 27, 2014

-14-