Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K DATED JUNE 23, 2014 - MERITOR, INC. | meritor8k062314.htm |

| EX-99.1 - PRESS RELEASE DATED JUNE 23, 2014 - MERITOR, INC. | meritor8k062314ex991.htm |

Exhibit 99.2

1 MERITOR Eaton Litigation Settlement June 23, 2014

2 Forward-Looking Statements This presentation contains statements relating to future results of the company (including certain projections and business trends) that are “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements are typically identified by words or phrases such as “believe,” “expect,” “anticipate,” “estimate,” “should,” “are likely to be,” “will” and similar expressions. SEC filings may differ materially from those projected as a result of certain risks and uncertainties, including but not limited to reduced production for certain military programs and our ability to secure new military programs as our primary military programs wind down by design through 2015; reliance on major original equipment manufacturer (“OEM”) customers and possible negative outcomes from contract negotiations with our major customers, including failure to negotiate acceptable terms in contract renewal negotiations and our ability to obtain new customers; the outcome of actual and potential product liability, warranty and recall claims; our ability to successfully manage rapidly changing volumes in the commercial truck markets and work with our customers to adjust their demands in view of rapid changes in production levels; global economic and market cycles and conditions; availability and sharply rising costs of raw materials, including steel, and our ability to manage or recover such costs; our ability to manage possible adverse effects on our European operations, or financing arrangements related thereto, in the event one or more countries exit the European monetary union; risks inherent in operating abroad (including foreign currency exchange rates, implications of foreign regulations relating to pensions and potential disruption of production and supply due to terrorist attacks or acts of aggression); rising costs of pension and other postretirement benefits; the ability to achieve the expected benefits of restructuring actions; the demand for commercial and specialty vehicles for which we supply products; whether our liquidity will be affected by declining vehicle productions in the future; OEM program delays; demand for and market acceptance of new and existing products; successful development of new products; labor relations of our company, our suppliers and customers, including potential disruptions in supply of parts to our facilities or demand for our products due to work stoppages; the financial condition of our suppliers and customers, including potential bankruptcies; possible adverse effects of any future suspension of normal trade credit terms by our suppliers; potential difficulties competing with companies that have avoided their existing contracts in bankruptcy and reorganization proceedings; potential impairment of long-lived assets, including goodwill; potential adjustment of the value of deferred tax assets; competitive product and pricing pressures; the amount of our debt; our ability to continue to comply with covenants in our financing agreements; our ability to access capital markets; credit ratings of our debt; the outcome of existing and any future legal proceedings, including any litigation with respect to environmental or asbestos-related matters; and possible changes in accounting rules; as well as other substantial costs, risks and uncertainties, including but not limited to those detailed herein and from time to time in other filings of the company with the SEC. These forward-looking statements are made only as of the date hereof, and the company undertakes no obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise, except as otherwise required by law. All earnings per share amounts are on a diluted basis. The company's fiscal year ends on the Sunday nearest Sept. 30, and its fiscal quarters generally end on the Sundays nearest Dec. 31, March 31 and June 30. All year and quarter references relate to the company's fiscal year and fiscal quarters, unless otherwise stated.

3

Eaton Litigation Settlement

ZF Meritor LLC, a joint venture between a Meritor, Inc. subsidiary and ZF Friedrichshafen AG (ZF), and Meritor Transmission Corporation have reached a settlement agreement with Eaton Corporation for $500 million(1) Proceeds to Meritor of $209 million • Settlement dismisses all pending antitrust litigation between ZF Meritor LLC, Meritor Transmission Corporation and Eaton 1) Subject to ZF Friedrichshafen AG corporate approval, which is expected to occur in early July.

4

Settlement is Positive for Meritor

After careful consideration, in-depth analyses, advice from expert advisors and robust negotiation, we believe this settlement is the best risk-adjusted outcome for the company and its shareholders Settlement provides certainty by eliminating risks of: Jury trial Lengthy and costly appeals process Time value of money One of the largest, private antitrust settlement awards collected by a plaintiff over the past ten years Settlement Provides Immediate and Certain Value to Meritor

5 Use of Proceeds Addresses Funded Status Risk $209 million of proceeds to be used to pre-fund mandatory pension contributions in the U.S. and U.K. pension plans Eliminates funding requirements in the U.S. qualified pension plan and the U.K. pension plan for the next three years(1) Accelerates the path to achieving our M2016 $400 million net debt reduction target(2) (3) Accretive to earnings and cash flow Mitigates impact of ~$124 million mortality table change expected for pension and retiree medical plans(1) 1) Based on management’s current planning assumptions and other factors. Actual results may differ materially from projections as a result of risks and uncertainties. Please see slide “Forward Looking Statements.” 2) Debt plus retirement benefit liabilities, less cash and cash equivalents, expected to decrease by $400 million (compared to fiscal 2012 ending balance) to less than $1.5 billion by the end of FY16. 3) See Appendix – “Non-GAAP Financial Information.”

Pension Funded Status Has Been a Risk Factor Meritor – FY12 S&P 1500 aggregate (88% funded ratio, 15% materiality) Meritor FY12 (74% funded ratio, 203% materiality) Meritor FY13 (80% funded ratio, 167% materiality) FY 2012 FY 2013 PBO $2,066 $1,708 Assets $1,537 $1,367 Funded status ($529) ($341) Funded status (%) 74% 80% Meritor Pension Plans are Significantly Large and Underfunded Relative to S&P 1500 Meritor – FY13 S&P 1500 – 2012 S&P 1500 – 2013 Source: CapitalIQ, FactSet includes U.S. as well as non-U.S. pension plans. Market capitalization data as of 12/31/2013. Meritor pension PBO, assets, and funded status as of fiscal year ends 9/30/2012 and 9/30/2013.

7

M2016 – Net Debt Scorecard M2016 align. achieve. advance. FY13 Ending Balance FY14 Pro Forma FY16 Sustainable Strength1 1) Achieve 10% Adjusted EBITDA margin2, 5 2) Reduce net debt, including retirement benefit liabilities, by $400 million to <$1.5 billion3, 5 3) Incremental booked revenue of $500 million per year (at run-rate)4 1. Based on management’s current planning assumptions and other factors. Actual results may differ materially from projections as a result of risks and uncertainties. Please see slide “Forward Looking Statements.” 2. Expected achievement of at least 10 percent Adjusted EBITDA margin for the full FY16 based on expected revenue of $4.5 billion. 3. Debt plus retirement benefit liabilities, less cash and cash equivalents, expected to decrease by $400 million (compared to fiscal 2012 ending balance) to less than $1.5 billion by the end of FY16. 4. Expected incremental business secured between the beginning of FY13 and the end of FY16 from new products, new customers, or significant increases in customer penetration. Although the $500 million in new business is expected to be secured prior to the end of FY16, roughly half of this business is not expected to materialize into revenue until after FY16. This measure of incremental revenue is ‘gross’, before consideration of any business existing at the beginning of FY13 that may subsequently be lost and which could offset the benefit of this expected new business. 5. See Appendix – “Non-GAAP Financial Information.” ($1,699M) ($124M) $209M $0 - $25M ($1,614M)- ($1,589M) Mortality Table Changes Eaton Proceeds FY14 Free Cash Flow Guidance M2016 Target <($1,500M) (1) (1) (5)

8

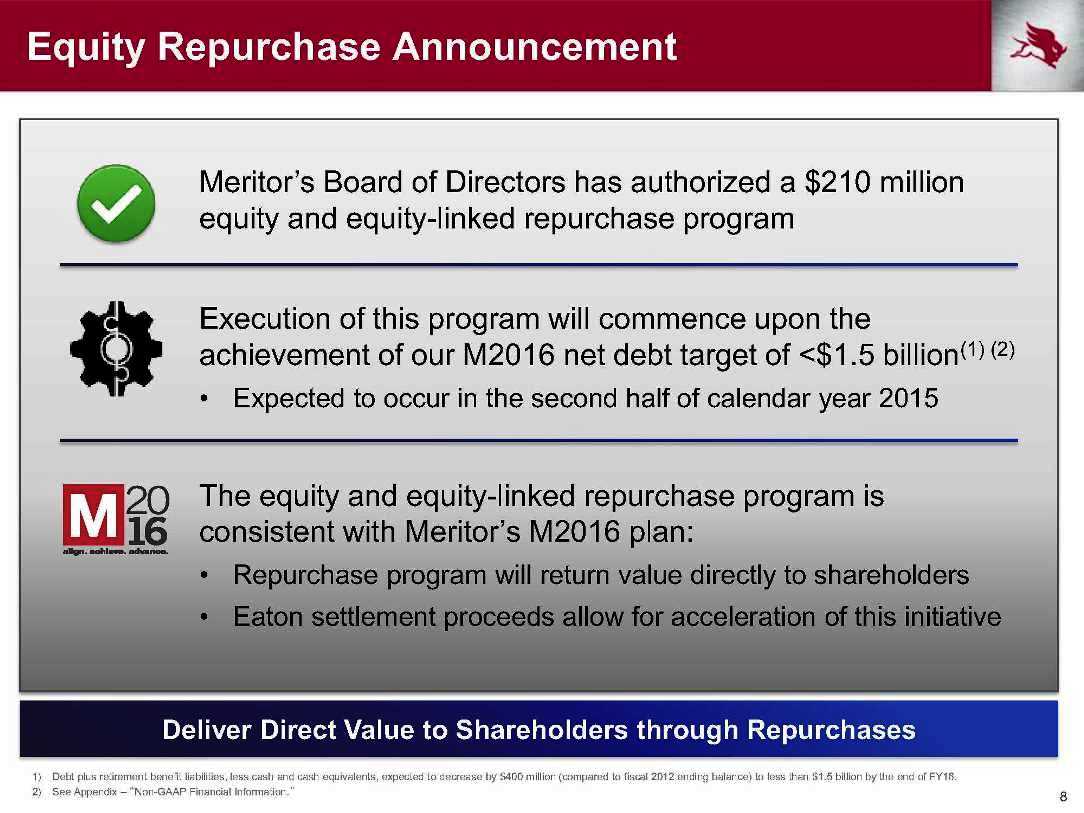

Equity Repurchase Announcement Deliver Direct Value to Shareholders through Repurchases 1) Debt plus retirement benefit liabilities, less cash and cash equivalents, expected to decrease by $400 million (compared to fiscal 2012 ending balance) to less than $1.5 billion by the end of FY16. 2) See Appendix – “Non-GAAP Financial Information.” Meritor’s Board of Directors has authorized a $210 million equity and equity-linked repurchase program Execution of this program will commence upon the achievement of our M2016 net debt target of <$1.5 billion(1) (2) • Expected to occur in the second half of calendar year 2015 The equity and equity-linked repurchase program is consistent with Meritor’s M2016 plan: • Repurchase program will return value directly to shareholders • Eaton settlement proceeds allow for acceleration of this initiative

9

Summary • Eaton litigation settlement provides immediate and certain value to Meritor and its shareholders • Proceeds to be used to strengthen the balance sheet and de-risk pension plans • Accelerates our efforts to achieve the M2016 goal of reducing net debt to <$1.5 billion (1) (2) • Enables acceleration of plans to deliver direct value to shareholders through an equity and equity-linked repurchase initiative • Repurchase authorization reaffirms the Board of Director’s confidence in Meritor’s strategy and long-term growth potential 1) Debt plus retirement benefit liabilities, less cash and cash equivalents, expected to decrease by $400 million (compared to fiscal 2012 ending balance) to less than $1.5 billion by the end of FY16. 2) See Appendix – “Non-GAAP Financial Information.”

10 10

11 Appendix

12

Non-GAAP Financial Information In addition to the results reported in accordance with accounting principles generally accepted in the United States (“GAAP”) included throughout this presentation, the company has provided information regarding Adjusted EBITDA margin, free cash flow and net debt which are non-GAAP financial measures. Adjusted EBITDA margin is defined as Adjusted EBITDA divided by consolidated sales. Adjusted EBITDA is defined as income (loss) from continuing operations before interest, income taxes, depreciation and amortization, non-controlling interests in consolidated joint ventures, loss on sale of receivables, restructuring expenses, asset impairment charges and other special items as determined by management. Free cash flow is defined as cash flow provided by (used for) operating activities less capital expenditures. Net debt including retirement liabilities is defined as total debt plus pension assets, pension liability, retiree medical liability and other retirement benefits less cash and cash equivalents. Management believes that the non-GAAP financial measures used in this presentation are useful to both management and investors in their analysis of the company's financial position and results of operations. In particular, management believes that Adjusted EBITDA and Adjusted EBITDA margin are meaningful measures of performance as they are commonly utilized by management and the investment community to analyze operating performance in our industry. Further, management uses Adjusted EBITDA for planning and forecasting in future periods. Management believes that free cash flow is useful in analyzing our ability to service and repay debt. Net debt including retirement liabilities is a specific financial measure which is part of our three-year plan, M2016, to reduce debt and other balance sheet liabilities. Adjusted EBITDA should not be considered a substitute for the reported results prepared in accordance with GAAP and should not be considered as an alternative to net income as an indicator of our operating performance or to cash flows as a measure of liquidity. Free cash flow should not be considered a substitute for cash provided by (used for) operating activities, or other cash flow statement data prepared in accordance with GAAP, or as a measure of financial position or liquidity. In addition, this non-GAAP cash flow measure does not reflect cash used to service debt or cash received from the divestitures of businesses or sales of other assets and thus does not reflect funds available for investment or other discretionary uses. These non-GAAP financial measures, as determined and presented by the company, may not be comparable to related or similarly titled measures reported by other companies.

13 13