Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Jubilant Flame International, Ltd | Financial_Report.xls |

| EX-32.2 - CERTIFICATION - Jubilant Flame International, Ltd | jfil_ex322.htm |

| EX-31.2 - CERTIFICATION - Jubilant Flame International, Ltd | jfil_ex312.htm |

| EX-32.1 - CERTIFICATION - Jubilant Flame International, Ltd | jfil_ex321.htm |

| EX-31.1 - CERTIFICATION - Jubilant Flame International, Ltd | jfil_ex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

| x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended February 28, 2014

OR

| o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission file number 333-173456

JIU FENG INVESTMENT HONG KONG LTD

(Exact name of Registrant as specified in its charter)

Nevada

(State of other jurisdiction of incorporation or organization)

2293 Hong Qiao Rd, Shanghai China, 200336

(Address of principal executive offices, including zip code)

+86 21 64748888

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO o

Indicate by check mark whether registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | o | Accelerated filer | o |

| Non-accelerated filer | o | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the 1,920,000 shares of common stock held by non-affiliates as of the last business day of the Company’s second fiscal quarter was $3,417,600.

As of June 19, 2014, there are 8,500,000 shares of common stock outstanding.

TABLE OF CONTENTS

|

Page Number

|

|||||

| Special Note Regarding Forward-Looking Statements | 3 | ||||

| PART I | |||||

| Item 1. |

Business

|

3 | |||

| Item 1A. |

Risk Factors

|

10 | |||

| Item 1B. |

Unresolved Staff Comments

|

10 | |||

| Item 2. |

Properties

|

10 | |||

| Item 3. |

Legal Proceedings

|

10 | |||

| Item 4. |

Mine Safety Disclosures

|

10 | |||

| PART II | |||||

| Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

11 | |||

| Item 6. |

Selected Financial Data

|

12 | |||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

12 | |||

| Item 7A. |

Quantitative and Qualitative Disclosures about Market Risk

|

14 | |||

| Item 8. |

Financial Statements and Supplementary Data

|

15 | |||

| Item 9. |

Changes In and Disagreements With Accountants on Accounting and Financial Disclosure

|

16 | |||

| PART III | |||||

| Item 10. |

Directors, Executive Officers and Corporate Governance

|

17 | |||

| Item 11. |

Executive Compensation

|

18 | |||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

19 | |||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence

|

19 | |||

| Item 14. |

Principal Accounting Fees and Services

|

20 | |||

| Item 15. |

Exhibits, Financial Statement Schedules

|

21 | |||

2

JUI FENG INVESTMENT HONG KONG, INC.

FORWARD LOOKING STATEMENTS

This Annual Report contains forward-looking statements. Forward-looking statements are projections of events, revenues, income, future economic performance or management’s plans and objectives for our future operations. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” and the risks set out below, any of which may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. These risks include, by way of example and not in limitation:

|

·

|

the uncertainty of profitability based upon our history of losses;

|

|

·

|

risks related to failure to obtain adequate financing on a timely basis and on acceptable terms to continue as going concern;

|

|

·

|

risks related to our international operations and currency exchange fluctuations; and

|

|

·

|

other risks and uncertainties related to our business plan and business strategy.

|

This list is not an exhaustive list of the factors that may affect any of our forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on our forward-looking statements. Forward looking statements are made based on management’s beliefs, estimates and opinions on the date the statements are made and we undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles. All references to “common stock” refer to the common shares in our capital stock.

As used in this annual report, the terms “we”, “us”, “our”, the “Company”, the ‘Registrant”, and “Jiu Feng” mean Jiu Feng Investment Hong Kong, Inc. and its subsidiary, unless otherwise indicated.

ITEM 1. BUSINESS

Jiu Feng Investment Hong Kong, Inc., (the “Company” also the “Registrant”) was formed on September 29, 2009 under the name Liberty Vision, Inc. On December 16, 2012, the Registrant changed its name to: Jiu Feng Investment Hong Kong, Inc. On January 27, 2013, Jiu Feng Investment Hong Kong Ltd. (the “Company”), issued a press release announcing the change of their ticker symbol from “LBYV” to “JFIL”. On July 24, 2013, the Company changed its business sector to the medical sector. On September 30, 2013, the Company entered into a world-wide five year licensing agreement (the “Agreement”) with BioMark Technologies (Asia) Limited ("BioMark") whereby the Company is licensed to sell, market, and/or distribute certain products pertaining to the health care industry (the “Licensed Products”); and to conduct research and development of BioMark’s cancer detection scanning technology.

Description of Business

The Company develops and markets medical products under license from BioMark. The products currently marketed include Bone-Induction Artificial Bone (BIAB) products and Vacuum Sealing Drainage (VSD) products. The Company is also licensed to conduct research and development of BioMark’s cancer detection scanning technology. In the event that the research and development of BioMark’s cancer detection scanning technology provides marketable technology, the Company shall have the right of first refusal to a license to market, sell and distribute such cancer detection scanning technology.

3

Licensed Products:

The primary Licensed Products include the following BIAB and VSD products:

|

Name

|

Description

|

|

VSD 1

|

Negative pressure drainage special bolster

|

|

VSD 2

|

Negative pressure drainage special bolster

|

|

VSD 3

|

Medical Operation Film

|

|

VSD 4

|

Medical Operation Film

|

|

VSD 5

|

Negative pressure drainage device

|

|

VSD 6

|

Negative pressure drainage device

|

|

Bone induction Artificial bone A1

|

Bone induction to tissue regeneration membrane

|

|

Artificial bone A1

|

Artificial bone to tissue regeneration membrane

|

|

Bone induction Artificial bone A2

|

Bone induction to albumin layer

|

|

Artificial bone A2

|

Artificial bone to collagen layer

|

|

Bone induction Artificial bone A3

|

Bone induction to regeneration microporous membrane

|

|

Artificial bone A3

|

Artificial bone to regeneration microporous membrane

|

|

Bone induction Artificial bone A4

|

Bone induction to microporous albumin layer

|

|

Artificial bone A4

|

Artificial bone to microporous albumin layer

|

|

Xishu Qing

|

Gynecological antibacterial care dressing

|

|

Microcyn Skin and Wound Hydrogel

|

Gel dressing

|

|

Incision protection sleeve

|

Incision protection sleeve

|

|

Kangfu Shengyuan

|

Collagen antimicrobial dressing

|

I. Bone-Induction Artificial Bone

BIAB has completed over 200 animal tests, 5000 clinical trail tests, and was approved by the State Food and Drug Administration of China (“SFDA”) in 2006. The BIAB won the second prize of 2007 China National Natural Science. VSD also has been approved by SFDA in 2006.

BIAB is a bionic porous repairing bone material which is made of calcium phosphate through a special process. Its composition and structure is similar with the natural mineral of human bone, which stands for its predominant biocompatibility, biological activity and biological safety. It helps to absorb human self’s BMP growth factor; it also regulates gene function to induct bone regeneration, shorter the convalescence, and meet the target of repairing bone defect permanently. The advanced artificial bone is used: (i) in repairing traumatic bone defects; (ii) in repairing bone defect after complete removal of bone tissue as required in the treatment of certain diseases including bone tumor, bone tuberculosis, chronic osteomyelitis, osteofibrous dysplasia, delayed union, nonunion, and false joint fracture; (iii) for treatment of bone loss or bone defects caused by congenital malformation; (iv) as a filling material for spinal fusion, joint fusion, and orthopedic bone grafting; and (v) as a filling material for bone grafting fusion and decompressive laminectomy.

Product Characteristics:

The BIAB provides three-dimensional support structure and the physical and chemical composition which is similar to the body's natural bone mineral. They reassembled in human body’s environment. It can help lead the fibrous tissue and bone marrow stromal stem cells to grow into the porous of the material, thus obtains the essential multipotent mesenchymal cells for bone formation and provide the growth support of cells.

The human body fluid contains BMP and other growth factors, but the content is too low, and is not enough to cause induction phenomena happen. The specific composition and structure of BIAB provides the growth factor with binding sites. The material implanted could selectively enrich and adsorb the bone growth factors in the blood and fluid of human body. The implantation of growth factor in the microenvironment will induce mesenchymal cells to the osteoblasts differentiation and new bone growth threshold. Under the synergistic effect of bone induction of signaling molecules and biological environment, BIAB can promote bone gene up-regulation, enhance down-stream gene function, and regulate cell movement in the direction of bone differentiation.

As the cells and nutrients transfer through the porous structure, the BMP growth factors cause the formation and maturation of new bone within the Bone-induction artificial bone. The implanted materials are thus gradually replaced with new bone, and the new bone finishes growth and ossification.

4

This innovative material provides several benefits:

|

1.

|

Optimizes bone conduction performance

|

|

2.

|

Precise osteo-induction

|

|

3.

|

Rapid bone formation

|

|

4.

|

Suitable biodegradation absorption and ossification

|

Comparison with other products

|

Category

|

Advantage and Disadvantage

|

|

Autogenous bone graft material

|

· Bone conduction and bone induction property

· None immunological rejection

· May damage healthy tissue, cause secondary vulnus to patients

· Source of bone is limited; operation lasts longer, higher risk of intra-operative bleeding and infection

· May cause injury and pain around the bone

|

|

Allogenic bone transplantation material and Xenogeneic bone transplantation material

|

· Only bone conduction property, no bone induction property

· Limit Source

· Potential of immunological rejection and spreading underlying diseases

· May cause over reaction with large numbers of applications

|

|

Traditional artificial synthetic material

|

· Good biocompatibility and bone conduction property

· No bone induction; absorptivity does not match the speed of bone growth

· Only for filing material, not for bone tissue regeneration

|

|

External growth factor and bone matrix removal protein

|

· Bone induction

· External source

· No mechanical strength, need support material in practices

· Potential risk of immunological rejection and spreading underlying diseases

· High requirements for storage and transportation

· Not fully mature technology

|

|

BioMark’s Bone-induction artificial bone

|

· Both bone conduction and safe bone induction properties

· Replicates normal process of osteogenesis and bone formation

· Sufficient and safe sources

· Avoids immunological rejection and spreading underlying diseases, is an ideal material for bone repairing

|

Comparison with similar products

|

Biological safety

|

Absorption

|

Bone induction

|

|

|

HA 、 Silicate

|

+

|

-

|

-

|

|

ß-TCP 、 Caso4

|

+

|

Too fast

|

-

|

|

Allogeneic bone

|

-

|

+

|

-

|

|

Allogeneic bone + BMP/DBM

|

?

|

+

|

+

|

|

BioMark’s Bone-induction artificial bone

|

+

|

Moderate

|

+

|

II. Vacuum Sealing Drainage

VSD was approved by the SFDA in 2006. It is made of polyvinyl alcohol aqueous gelatin foam: a three-dimensional porous structure, which is non ciliated, and exhibits strong water absorption characteristics. It is hydrophilic and has excellent thermal insulation capabilities as compared with other vacuum sealing drainage specialty foams. VSD has good histocompatibility and will not adhere to a wound. VSD aids skin creation around a wound bed with minimal vulnus. The dressing material acts as a drug carrier with strong bactericidal characteristics, and the gelatin protein promotes the growth of granulation, accelerating wound healing. It can be used in the surgery of burns, orthopedics, trauma repair, plastic, and general surgery.

5

Product Characteristics:

Advantages:

|

1.

|

Good treatment effect. VSD allows an individualized complete treatment plan, which fully ensures the effect of clinical treatment. VSD basically eliminates adverse events such as clinical wound blowing and drainage tube blocking, leading to excellent treatment reliability;

|

|

2.

|

Easy to operate. Using VSD is as simple as changing a fresh dressing for the wound; the material does not adhere with the wound, which avoids secondary vulnus;

|

|

3.

|

Large range of indications; innovation of operation, especially for large size wound treatments.

|

Comparison with previous technology

|

Category

|

Using Method

|

Requirements for the surrounding skin

|

Product properties

|

Clinical effect

|

Adverse events happening %

|

Indication

|

|

Old technology

|

· Need certain conditions, experience and technology.

· Difficult to seal the wound;

· operation time long;

· huge nursing work

|

High

|

Single function;

cannot clean the wound

|

Common

|

Drainage tube blocking >70%

Wound blowing 100%

Material becomes dry and hard >90%

|

Suitable for in- patients

|

|

BioMark’s

VSD

technology

|

· No certain conditions, experience and technology required.

· Easy to seal the wound;

· operation time low;

· small nursing work

|

No special requirements.

|

Functions of wound cleaning and vacuuming

|

Good

|

All very seldom

|

Suitable for out-patient and in-patient

|

Comparison with other products

|

Category

|

Working principals

|

Using method

|

Products properties

|

Clinical Effect

|

Adverse events

happening %

|

|

BioMark’s

VSD

Products

|

Cleaning the wound through the inlay drainage tube which transmits the vacuum

|

Easy

|

Functions of wound cleaning and vacuuming

|

Good

|

Very seldom

|

|

Other VSD/ VAC with suckers

|

· Drainage tube is connected with the foam material through the suckers.

· Transmitting Vacuum effect is poor;

· Draining effect is poor.

· Potential problem for drainage tube blocking.

|

· Need open the sealing membrane to clean the suckers.

· Hard to use the suckers since the different sizes of wound.

|

Single function

|

Poor

|

Very high, Drainage tube blocking happens up to 70% after a 3-days usage

|

III. Cancer Detection Scanning Technology

The Company is also licensed to conduct research and development of BioMark’s cancer detection scanning technology. The technology uses biomarkers for the early detection of cancers. In the event that the research and development of BioMark’s cancer detection scanning technology provides marketable technology, the Company shall have the right of first refusal to a license to market, sell and distribute such cancer detection scanning technology.

6

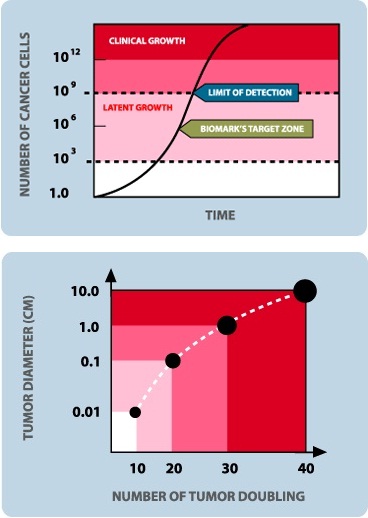

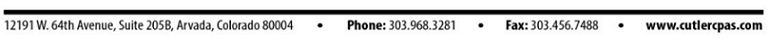

BioMark’s cancer detection scanning technology provides innovative techniques and assay analysis to increases early detection of tumors in the latent growth phase.

Poor prognosis associated with late diagnosis = large tumor size

The graph above indicates the current limit of clinical detection for most tumors. A good 70% of the natural history of the tumor has already existed by time it is detected.

Facts About Cancer

|

·

|

The leading cause of premature mortality

|

|

·

|

1 in 3 individuals will develop cancer

|

|

·

|

70% of those will die as a result of the disease

|

|

·

|

7.6 million deaths a year or 20,000 per day

|

|

·

|

Poor prognosis due to poor therapy and, poor detection

|

7

Cancer Prevalence

|

CANCER SITE

|

NEW CASES

|

|

Lung and Bronchus

|

1.6 million

|

|

Colon and Rectum

|

1.12 million

|

|

Stomach

|

1.1 million

|

|

Esophagus

|

0.56 million

|

|

Liver

|

0.7 million

|

|

Breast

|

1.3 million

|

|

Prostrate

|

0.8 million

|

|

Cervix

|

0.6 million

|

Demographics

|

·

|

750,000 cases of breast, lung and prostate cancer diagnosed annually in the U.S. alone.

|

|

·

|

Those who are most aware of the dangers of specific cancers are also those most able and likely to pay for early screening, detection and treatment.

|

|

·

|

High awareness of these diseases among health care professionals and among the general population.

|

|

·

|

Cancer has become one of the most significant causes of morbidity and mortality in the world, and recently overtook heart disease as the leading cause of death for Americans.

|

|

·

|

Close to 20 million people in Europe and the U.S. live with cancer today and approximately 2.6 million new cases are diagnosed each year.

|

|

·

|

The number of new cases diagnosed each year is increasing mainly as a result of demographics, because most types of solid cancer are typically diseases of the elderly.

|

|

·

|

More than 6 million people around the world die of cancer every year, and one of two men and one of three women will develop cancer in their lifetimes. The overall annual costs associated with malignancies currently amount to $107 billion (Source: Biomarkers in Oncology, June 29, 2004).

|

Characteristics of an Ideal Cancer Biomarker

|

·

|

Can be detected in the early stages of disease

|

|

·

|

Accurately detected

|

|

·

|

Highly specific

|

|

·

|

Detected with high sensitivity

|

|

·

|

Low cost

|

|

·

|

Reliable

|

|

·

|

Non-invasive method

|

Applications of Biomarkers

|

·

|

Early disease identification

|

|

·

|

Identification of potential drug targets

|

|

·

|

Predicting the response of patients to treatments

|

|

·

|

Personalized medicine

|

Industry Trends

|

·

|

Rapid rise in specific cancers - breast, lung, and prostate cancer cases in U.S. have doubled over past 20 years

|

|

·

|

Currently, diagnostic findings influence 60–70% of healthcare decision-making (source: Lewin Grp)

|

|

·

|

More health services delivered out of hospital — need for technology that is portable and compact

|

|

·

|

Increased popularity of wellness centers throughout the world — interest and demand for preventative medicine

|

8

Market for Diagnostic Equipment

|

·

|

Worldwide market for diagnostics was estimated to be $28.6 billion in 2005. U.S. accounted for $11.2 billion.

|

|

·

|

Diagnostic testing in hospitals accounts for 60% of revenue from diagnostics; reference labs account for 32%

|

|

·

|

Low compliance with diagnostic-based quality measures was linked to up to 34,000 avoidable deaths and $900 million in avoidable healthcare costs in the U.S., according to the National Committee for Quality Assurance

|

Intellectual Property

BioMark holds the following patents and patent applications relating to products licensed by the Company:

|

Patent Name

|

Type

|

Number

|

Status

|

|

BONE INDUCTION ARTIFICIAL BONE

|

Patent for utility models (China)

|

ZL201220149510.1

|

Issued

|

|

BONE INDUCTION ARTIFICIAL BONE

|

Patent for utility models (China)

|

ZL201220180329.7

|

Issued

|

|

BONE INDUCTION ARTIFICIAL BONE

|

Patent for utility models (China)

|

ZL201220180328.2

|

Issued

|

|

BONE INDUCTION ARTIFICIAL BONE

|

Patent for utility models (China)

|

ZL201220149212.2

|

Issued

|

|

TESTING METHOD FOR THE LOW CONCENTRATION ACETYLIZED ADMANTADINE.

|

Patent (China)

|

ZL200910050662.9

|

Issued

|

|

ONE METHOD FOR TESTING THE ACTIVITY OF SPERMIDINE / SPERMINE N1- ACETYL TRANSFERASE.

|

Patent Application (China)

|

ZL201110145069.X

|

Pending

|

|

THE FORMULA, USING METHOD AND APPLICATION FOR A FILM COATING WHICH CONTAINS CALCIUM CARBONATE.

|

Patent Application (China)

|

ZL201110168565.7

|

Pending

|

|

ONE TYPE OF PATCH FOR PREVENTING SKETCH MARKS.

|

Patent Application (China)

|

ZL201410039948.8

|

Pending

|

|

MONOCLONAL ANTIBODY FOR ACETYLAMANTADINE

|

Canadian Patent Application

|

2,835,506

|

Pending

|

|

Chinese Patent Application

|

201280024582.6

|

Pending

|

|

|

European Patent Application

|

12782078.5

|

Pending

|

|

|

U.S. Patent Application

|

14/116,743

|

Pending

|

|

|

METHOD FOR ASSAYING THE ACTIVITY OF SPERMIDINE/SPERMINE N1-ACETYLTRANSFERASE

|

PCT Patent Application (Canada)

|

PCT/CA2012/050828

|

Pending

|

|

DETECTION AND QUANTIFICATION OF ACETYLAMANTADINE IN URINE SAMPLES

|

PCT Patent Application (Canada)

|

PCT/CA2014/050273

|

Pending

|

|

IMMUNOLOGICAL ASSAY TO DETECT AND QUANTIFY ACETYLAMANTADINE IN A PATIENT

|

U.S. Provisional Patent Application **

|

61/871,642

|

Pending

|

|

SPERMIDINE/SPERMINE N1-ACETYLTRANSFERASE SUBSTRATES AS ANTI-CANCER DRUG COMPOUNDS

|

PCT Patent Application (Canada)

|

PCT/CA2013/050873

|

Pending

|

|

SPERMIDINE/SPERMINE N1-ACETYLTRANSFERASE ANTIBODIES AS ANTI-CANCER DRUG COMPOUNDS

|

PCT Patent Application (Canada)

|

PCT/CA2014/050059

|

Pending

|

** U.S. Provisional patent applications are not examined for patentability and become abandoned not later than 12 months after their filing date. Within the 12 month period that the provisional patent applications are effective, corresponding utility patent applications must be filed in order to preserve the early filing date established by the provisional application.

9

Employees

Our officers and directors are responsible for planning, developing and operational duties, and will continue to do so throughout the early stages of our growth. We expect to hire approximately 5 full time employees during the next twelve months.

Reports to Securities Holders

We provide an annual report that includes audited financial information to our shareholders. We will make our financial information equally available to any interested parties or investors through compliance with the disclosure rules for a small business issuer under the Securities Exchange Act of 1934. We are subject to disclosure filing requirements including filing Form 10K annually and Form 10Q quarterly. In addition, we will file Form 8K and other proxy and information statements from time to time as required. We do not intend to voluntarily file the above reports in the event that our obligation to file such reports is suspended under the Exchange Act. The public may read and copy any materials that we file with the Securities and Exchange Commission, ("SEC"), at the SEC's Public Reference Room at 100 F Street NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

ITEM 1A. RISK FACTORS

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

There are no unresolved comments from the SEC.

ITEM 2. PROPERTIES

The Company does not hold ownership or leasehold interest in any property.

ITEM 3. LEGAL PROCEEDINGS

Currently, the Company is not involved in any pending litigation or legal proceeding.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

10

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Market Information

Our common stock is currently quoted on the OTC Bulletin Board under the symbol “JFIL”.

|

Fiscal Quarter

|

High Bid

|

Low Bid

|

||||||

|

2014

|

||||||||

|

Fourth Quarter 12-01-13 to 2-28-14

|

$ | 3.00 | $ | 1.70 | ||||

|

Third Quarter 09-01-13 to 11-30-13

|

$ | 1.60 | $ | 1.55 | ||||

|

Second Quarter 06-01-13 to 8-31-13

|

$ | 1.78 | $ | 1.40 | ||||

|

First Quarter 03-01-13 to 05-31-13

|

$ | 1.50 | $ | 1.20 | ||||

|

Fiscal Quarter

|

High Bid

|

Low Bid

|

||||||

|

2013

|

||||||||

|

Fourth Quarter 12-01-12 to 2-28-13

|

$ | n/a | $ | n/a | ||||

|

Third Quarter 09-01-12 to 11-30-12

|

$ | n/a | $ | n/a | ||||

|

Second Quarter 06-01-12 to 8-31-12

|

$ | n/a | $ | n/a | ||||

|

First Quarter 03-01-12 to 05-31-12

|

$ | n/a | $ | n/a | ||||

Holders.

As of February 28, 2014, there were 77 total record holders of 8,500,000 shares of the Company's common stock.

Dividends.

The Company has not paid any cash dividends to date and does not anticipate or contemplate paying dividends in the foreseeable future. It is the present intention of management to utilize all available funds for the development of the Company's business.

Securities Authorized for Issuance Under Equity Compensation Plans

None.

Recent sales of unregistered securities.

There were no sales of unregistered securities during the years ended February 28, 2014 and 2013.

Issuer Purchases of Equity Securities

We did not repurchase any of our equity securities during the years ended February 28, 2014 and 2013.

11

ITEM 6. SELECTED FINANCIAL DATA

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with our audited financial statements and notes thereto included herein. In connection with, and because we desire to take advantage of, the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, we caution readers regarding certain forward looking statements in the following discussion and elsewhere in this report and in any other statement made by, or on our behalf, whether or not in future filings with the Securities and Exchange Commission. Forward-looking statements are statements not based on historical information and which relate to future operations, strategies, financial results or other developments. Forward looking statements are necessarily based upon estimates and assumptions that are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control and many of which, with respect to future business decisions, are subject to change. These uncertainties and contingencies can affect actual results and could cause actual results to differ materially from those expressed in any forward looking statements made by, or our behalf. We disclaim any obligation to update forward-looking statements.

Results of Operations

Revenue

During the years ended February 28, 2014 and February 28, 2013, the Company recognized no revenue.

Operating Expenses

The major components of our operating expenses for the year ended February 28, 2014 are outlined in the table below:

|

Year Ended

February 28,

2014

|

||||

|

Officers compensation

|

$ | 195,000 | ||

|

Consulting

|

112,404 | |||

|

Other

|

6,328 | |||

|

Professional Fees

|

22,517 | |||

|

Total operating expenses

|

$ | 336,249 | ||

The increase in our operating costs for the year ended February 28, 2014 to $336,249 from the $93,939 we incurred in the year ended February 28, 2013, was due to the increase in our corporate activities, specifically officers compensation, expenses related to implementation of our business plan and increase in consulting fees associated with our reporting obligations under the Securities Exchange Act.

On April 17, 2013, the Company entered into Employment Agreements with its president, Ms. Yan Li, and its secretary and treasurer, Mr. Robert Ireland. Ms. Yan’s agreement is retroactively effective as of December 4, 2012, for a term of 36 months (measured from December 4, 2012). Pursuant to the agreement, Ms. Li shall receive an annual salary of $78,000, and shall act as the company’s CEO.Mr. Ireland’s agreement is retroactively effective as of December 4, 2012, for a term of 36 months (measured from December 4, 2012). Pursuant to the agreement, Mr. Ireland shall receive an annual salary of $78,000, and shall act as the company’s Secretary and Treasurer. As at February 28, 2014 a total of $195,000 had been accrued as compensation payable to Ms. Li and Mr. Ireland.

During the year ended February 28, 2014, consulting expenses included 1,500,000 shares of our common stock, valued at $75,000, issued to three of our advisors.

Other expenses represent bank charges, filing fees, office and travel expenses.

During the year ended February 28, 2014, we incurred $22,517 in professional fees. These fees consisted of accounting audit, legal, and transfer agent fees.

12

Loss from Continuing Operations

During the years ended February 28, 2014 and February 28, 2013, the Company realized losses from continuing operations totaling $336,249 and $93,988, respectively, due to the factors discussed above.

Discontinued Operations

On December 5, 2012 the Company disposed of its subsidiary corporation to a shareholder for a nominal sum, as well as other management operations at which time it discontinued its web development and marketing business. The loss on discontinued operations in fiscal year 2013 was $115,903, including a gain on disposal of $2,430.

Net Loss

During the years ended February 28, 2014 and February 28, 2013, the Company realized a net loss of $336,249 and $209,891, respectively due to the factors discussed above.

Liquidity and Capital Resources

|

Year Ended

February 28,

2014

|

Year Ended

February 28,

2013

|

|||||||

|

Current Assets

|

$ | 4,986 | $ | 5,000 | ||||

|

Current Liabilities

|

$ | 290,068 | $ | 23,833 | ||||

|

Working Capital Deficit

|

$ | (285,082 | ) | $ | (18,833 | ) | ||

As at February 28, 2014 the Company had current assets, comprising of cash, of $4,986 and current liabilities of $290,068 resulting in a working capital deficit of $285,082. The Company currently has no profitable trading activities and has an accumulated deficit of $662,068 as at February 28, 2014.

In the audited financial statements for the fiscal years ended February 28, 2014 and 2013, the Reports of the Independent Registered Public Accounting Firms include an explanatory paragraph that describes substantial doubt about our ability to continue as a going concern.

This raises substantial doubt about the Company’s ability to continue as a going concern.

The Company may raise additional capital through the sale of its equity securities, offering of debt securities, or through borrowings from financial institutions or related parties. By doing so, the Company hopes to generate sufficient capital to execute its business plan. Management believes that actions presently being taken to obtain additional funding provide the opportunity for the Company to continue as a going concern. There is no guarantee the Company will be successful in achieving these objectives.

The financial statements have been prepared on a going concern basis which assumes the Company will be able to realize its assets and discharge its liabilities in the normal course of business for the foreseeable future.

Cash Flows

The table below, for the periods indicated, provides selected cash flow information:

|

Year Ended

February 28,

2014

|

Year Ended

February 28,

2013

|

|||||||

|

Cash provided by (used in) operating activities

|

$ | (66,249 | ) | $ | (99,026 | ) | ||

|

Cash provided by (used in) investing activities

|

$ | - | $ | - | ||||

|

Cash provided by financing activities

|

$ | 66,235 | $ | 54,945 | ||||

|

Net increase (decrease) in cash

|

$ | (14 | ) | $ | (44,081 | ) | ||

13

Operating Activities

During the year ended February 28, 2014 we used $66,249 in operating activities compared to $99,026 during the year ended February 28, 2013.

During the year ended February 28, 2014 we incurred a net loss of $336,249 which was partially reduced for cash flow purposes by $75,000 in non-cash expenses related to the issuance of shares of common stock for services and by an increase of $195,000 in accrued officer compensation.

During the year ended February 28, 2013 we incurred a net loss of $209,891 which was partially reduced for cash flow purposes by $75,500 in non-cash expenses related to the issuance of shares of common stock for services and $35,428 arising from our discontinued operations.

Investing Activities

We did not generate or use any cash from investing activities during the years ended February 28, 2014 and February 29, 2013.

Cash Flows from Financing Activities

During the twelve months ended February 28, 2014 we generated $66,235 from financing activities compared to $54,945 during the twelve months ended February 28, 2013.

During the twelve months ended February 28, 2014 we received $71, 235 by way of loan from a related party and paid $5,000 in deferred financing costs.

During the twelve months ended February 28, 2013 we received $22,372 by way of loan from a related party and $32,573 by way of capital contribution from an officer of the Company.

We have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to stockholders.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

14

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

JIU FENG INVESTMENTS HONG KONG LTD.

Index to Audited Financial Statements

For the Twelve Months Ended February 28, 2014 and 2013

|

Contents

|

Page (s)

|

|||

|

Report of Independent Registered Public Accounting Firm

|

F-1 | |||

|

Report of Independent Registered Public Accounting Firm

|

F-2 | |||

|

Balance Sheets as of February 28, 2014 and February 28, 2013

|

F-3 | |||

|

Statements of Operations for the Years Ended February 28, 2014 and February 28, 2013

|

F-4 | |||

|

Statement of Changes Stockholders’ Equity (Deficit) for the Years Ended February 28, 2014 and February 28, 2013

|

F-5 | |||

|

Statements of Cash Flows for the Years Ended February 28, 2014 and February 28, 2013

|

F-6 | |||

|

Notes to the Audited Financial Statements

|

F-7 | |||

15

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Board of Directors

Jiu Feng Investment Hong Kong Ltd.

(formerly Liberty Vision, Inc.)

2293 Hong Qiao Road

Shanghai, China, 200336

We have audited the accompanying balance sheet of Jiu Feng Investment Hong Kong Ltd. as of February 28, 2014 and the related statement of operations, changes in stockholders' deficit and cash flows for the year then ended. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audit. The financial statements as of February 28, 2013 and for the year then ended were audited by another auditor who expressed an unqualified opinion on May 1, 2013.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Jiu Feng Investment Hong Kong Ltd. as of February 28, 2014, and the results of its operations and its cash flows for the year then ended in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 3 to the financial statements the Company has suffered losses from operations and currently does not have sufficient available funding to fully implement its business plan. These factors raise substantial doubt about its ability to continue as a going concern. Management's plans in regard to these matters are also described in Note 3. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

|

Arvada, Colorado

|

|

|

June 19, 2014

|

Cutler & Co., LLC

|

F-1

Certified Public Accountant

2851 South Parker Road, Suite 720

Aurora, Colorado 80014

Telephone (303)306-1967

Fax (303)306-1944

Board of Directors

Jiu Feng Investment Hong Kong Ltd.

(formerly Liberty Vision, Inc.)

Shanghai, China

I have audited the accompanying balance sheet of Jiu Feng Investment Hong Kong Ltd. as of February 28, 2013 and the related statements of operations, stockholders' equity and cash flows for the year then ended. These financial statements are the responsibility of the Company's management. My responsibility is to express an opinion on these financial statements based on my audit.

I conducted my audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that I plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. I believe that my audit provides a reasonable basis for my opinion.

In my opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Jiu Feng Investment Hong Kong Ltd. as of February 28, 2013 and the results of its operations and its cash flows for the year then ended in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 3 to the financial statements the Company has suffered a loss from operations and has negative working capital and a stockholders’ deficit that raise substantial doubt about its ability to continue as a going concern. Management's plans in regard to these matters are also described in Note 3. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

|

Aurora, Colorado

|

Ronald R. Chadwick, P.C.

|

|

May 1, 2013

|

RONALD R. CHADWICK, P.C.

|

F-2

|

Jiu Feng Investment Hong Kong Ltd

|

|

(Formerly Liberty Vison, Inc.)

|

|

Balance Sheets

|

|

February 28,

|

February 28,

|

|||||||

|

2014

|

2013

|

|||||||

|

ASSETS

|

||||||||

|

Current assets

|

||||||||

|

Cash

|

$ | 4,986 | $ | 5,000 | ||||

|

Total current assets

|

4,986 | 5,000 | ||||||

|

Other assets

|

||||||||

|

Deferred financings costs

|

30,000 | - | ||||||

|

Total Assets

|

$ | 34,986 | $ | 5,000 | ||||

|

LIABILITIES & STOCKHOLDERS' DEFICIT

|

||||||||

|

Current liabilities

|

||||||||

|

Accounts payable and accrued liabilities

|

$ | 1,461 | $ | 1,461 | ||||

|

Accrued officer compensation

|

195,000 | - | ||||||

|

Loan payable - related party

|

93,607 | 22,372 | ||||||

|

Total current liabilties

|

290,068 | 23,833 | ||||||

|

Total Liabilities

|

290,068 | 23,833 | ||||||

|

Stockholders' Deficit

|

||||||||

| Common stock, $0.001 par value per share | 8,500 | 6,500 | ||||||

|

75,000,000 shares authorized;

|

||||||||

| 8,500,000 and 6,600,000 shares issued and | ||||||||

| outstanding at February 28, 2014 and 2013 | ||||||||

|

respectively

|

||||||||

|

Additional paid in capital

|

398,486 | 300,486 | ||||||

|

Retained deficit

|

(662,068 | ) | (325,819 | ) | ||||

|

Total Stockholders' Deficit

|

(255,082 | ) | (18,833 | ) | ||||

| Total Liabilities and Stockholders' Deficit | $ | 34,986 | $ | 5,000 | ||||

The accompanying notes are an integral part of the consolidated financial statements.

F-3

|

Jiu Feng Investment Hong Kong Ltd

|

|

(Formerly Liberty Vision, Inc.)

|

|

Statements of Operations

|

|

Year Ended

|

Year Ended

|

|||||||

|

February 28,

|

February 28,

|

|||||||

|

2014

|

2013

|

|||||||

|

Revenues - net

|

$ | - | $ | - | ||||

|

Cost of revenues

|

- | - | ||||||

|

Gross profit

|

- | - | ||||||

|

Operating Expenses:

|

||||||||

|

General and administrative

|

336,249 | 93,939 | ||||||

|

Total operating expenses

|

336,249 | 93,939 | ||||||

|

Income (loss) from operations

|

(336,249 | ) | (93,939 | ) | ||||

|

Other income (expense):

|

||||||||

|

Foreign currency translation

|

- | (49 | ) | |||||

|

Other income (expense) net

|

- | (49 | ) | |||||

|

Income (loss) from continuing operations

|

||||||||

|

before provision for income taxes

|

(336,249 | ) | (93,988 | ) | ||||

|

Provision for income tax:

|

- | - | ||||||

|

Income (loss) from continuing operations

|

(336,249 | ) | (93,988 | ) | ||||

|

Discontinued operations:

|

||||||||

|

Income (loss) from discontinued operations

|

- | (115,903 | ) | |||||

|

Net income (loss)

|

$ | (336,249 | ) | $ | (209,891 | ) | ||

|

Net income (loss) per share

|

||||||||

|

(Basic and fully diluted)

|

||||||||

|

Continuing operations

|

$ | (0.04 | ) | $ | (0.02 | ) | ||

|

Discontinued operations

|

$ | - | $ | (0.02 | ) | |||

|

Total operations

|

$ | (0.04 | ) | $ | (0.04 | ) | ||

|

Weighted average number of common shares outstanding

|

||||||||

|

(Basic and fully diluted)

|

7,538,356 | 5,365,833 | ||||||

The accompanying notes are an integral part of the consolidated financial statements.

F-4

|

Jiu Feng Investment Hong Kong Ltd

|

||||||||||

|

(Formerly Liberty Vision, Inc.)

|

||||||||||

|

Statements of Changes in Stockholders' Equity (Deficit)

|

|

Common Stock

|

Stockholders'

|

|||||||||||||||||||

|

Amount

|

Paid in

|

Retained

|

Equity

|

|||||||||||||||||

|

Shares

|

($0.001 Par)

|

Capital

|

(Deficit)

|

(Deficit)

|

||||||||||||||||

|

Balances at February 29, 2012

|

4,990,000 | $ | 4,990 | $ | 112,210 | $ | (115,928 | ) | $ | 1,272 | ||||||||||

|

Debt relief - related party

|

- | - | 81,713 | - | 81,713 | |||||||||||||||

|

Capital contributions - related party

|

- | - | 32,573 | - | 32,573 | |||||||||||||||

|

Compensatory stock issuances @ $0.05 per share

|

1,510,000 | 1,510 | 73,990 | - | 75,500 | |||||||||||||||

|

Net loss for the year

|

- | - | - | (209,891 | ) | (209,891 | ) | |||||||||||||

|

Balances at February 28, 2013

|

6,500,000 | 6,500 | 300,486 | (325,819 | ) | (18,833 | ) | |||||||||||||

|

Compensatory stock issuances @ $0.05 per share

|

2,000,000 | 2,000 | 98,000 | - | 100,000 | |||||||||||||||

|

Net loss for the year

|

- | - | - | (336,249 | ) | (336,249 | ) | |||||||||||||

|

Balances at February 28, 2014

|

8,500,000 | $ | 8,500 | $ | 398,486 | $ | (662,068 | ) | $ | (255,082 | ) | |||||||||

The accompanying notes are an integral part of the consolidated financial statements.

F-5

|

Jiu Feng Investment Hong Kong Ltd

|

|

(Fromerly Liberty Vision, Inc.)

|

|

Statements of Cash Flows

|

|

Year Ended

|

Year Ended

|

|||||||

|

February 28,

|

February 28,

|

|||||||

|

2014

|

2013

|

|||||||

|

Cash Flows From Operating Activities:

|

||||||||

|

Net income (loss)

|

$ | (336,249 | ) | $ | (209,891 | ) | ||

|

Adjustments to reconcile net (loss) to net cash (used in) operating activities

|

||||||||

|

Shares of common stock issued for services

|

75,000 | 75,500 | ||||||

|

Changes in Operating Assets and Liabilities-

|

||||||||

|

Accounts payable and accrued liabilities

|

- | 1,461 | ||||||

|

Accrued officers' compensation

|

195,000 | - | ||||||

|

Income taxes payable

|

- | (1,524 | ) | |||||

|

Discontinued operations

|

- | 35,428 | ||||||

|

Net cash provided by (used for)

|

||||||||

|

operating activities

|

(66,249 | ) | (99,026 | ) | ||||

|

Cash Flows From Investing Activities:

|

||||||||

| - | - | |||||||

|

Net cash provided by (used for)

|

||||||||

|

investing activities

|

- | - | ||||||

|

Cash Flows From Financing Activities:

|

||||||||

|

Loan payable - related party

|

71,235 | 22,372 | ||||||

|

Capital contribution from related parties

|

- | 32,573 | ||||||

|

Deferred financing costs

|

(5,000 | ) | - | |||||

|

Net cash provided by (used for)

|

||||||||

|

financing activities

|

66,235 | 54,945 | ||||||

|

Net Increase (Decrease) In Cash

|

(14 | ) | (44,081 | ) | ||||

|

Cash At The Beginning Of The Period

|

5,000 | 49,081 | ||||||

|

Cash At The End Of The Period

|

$ | 4,986 | $ | 5,000 | ||||

|

Schedule of Non-Cash Investing and Financing Activities

|

||||||||

|

500,000 shares of common stock issued as deferred financimg costs

|

$ | 25,000 | $ | - | ||||

|

Supplemental Disclosure

|

||||||||

|

Cash paid for interest

|

$ | - | $ | - | ||||

|

Cash paid for income taxes

|

$ | - | $ | 1,549 | ||||

The accompanying notes are an integral part of the consolidated financial statements.

F-6

JIU FENG INVESTMENT HONG KONG LTD.

(FORMERLY LIBERTY VISION, INC.)

NOTES TO AUDITED FINANCIAL STATEMENTS

FOR THE TWELVE MONTHS ENDED FEBRUARY 28, 2014 AND 2013

NOTE 1 – ORGANIZATION AND OPERATIONS

Jiu Feng Investment Hong Kong, Inc., (the “Company”) was formed on September 29, 2009 under the name Liberty Vision, Inc. The Company provided web development and marketing services for clients. On December 5, 2012 the Company disposed of its subsidiary corporation to a shareholder for a nominal sum, as well as other management operations. On December 16, 2012, the Company changed its name to Jiu Feng Investment Hong Kong, Inc. On July 24, 2013, the Company changed its business sector to the medical sector. On September 30, 2013, the Company entered into a world-wide five year licensing agreement with BioMark Technologies (Asia) Limited ("BioMark") whereby the Company is licensed to sell, market, and, or, distribute certain products pertaining to the health care industry; and to conduct research and development of BioMark’s cancer detection scanning technology

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of presentation

The Company’s financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S.GAAP”).

Use of estimates and assumptions

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reported period. Management bases its estimates on historical experience and on various assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources.

The Company’s significant estimates include the valuation allowance of deferred tax assets; the fair value of financial instruments and the assumption that the company will continue as a going concern. Those significant accounting estimates or assumptions bear the risk of change due to the fact that there are uncertainties attached to those estimates or assumptions, and certain estimates or assumptions are difficult to measure or value.

Management regularly reviews its estimates utilizing currently available information, changes in facts and circumstances, historical experience and reasonable assumptions. After such reviews, and if deemed appropriate, those estimates are adjusted accordingly. Actual results could differ from those estimates.

F-7

Fiscal year end

The Company elected February 28 as its fiscal year end date.

Cash and cash equivalents

The Company considers all highly liquid investments with a maturity of three months or less to be cash and cash equivalents.

Deferred Financing Costs

Costs with respect to issue of common stock, warrants, stock options or debt instruments by the Company are initially deferred and ultimately offset against the proceeds from such equity transactions or amortized as debt discount over the term of any debt funding if successful or expensed if the proposed equity or debt transaction is unsuccessful.

During the twelve months ended February 28, 2014, the Company paid cash in the amount of $5,000 and issued 500,000 shares of common stock valued at $25,000 as compensation for the preparation of a form S-1 to be filed during the year ended February 28, 2015.

Fair value of financial instruments

The Company follows paragraph 825-10-50-10 of the FASB Accounting Standards Codification for disclosures about fair value of its financial instruments and has adopted paragraph 820-10-35-37 of the FASB Accounting Standards Codification (“Paragraph 820-10-35-37”) to measure the fair value of its financial instruments. Paragraph 820-10-35-37 of the FASB Accounting Standards Codification establishes a framework for measuring fair value in generally accepted accounting principles (GAAP), and expands disclosures about fair value measurements. To increase consistency and comparability in fair value measurements and related disclosures, paragraph 820-1-35-37 of the FASB Accounting Standards Codification establishes a fair value hierarchy which prioritizes the inputs to valuation techniques used to measure fair value into three (3) broad levels. The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. The three (3) levels of fair value hierarchy defined by paragraph 820-10-35-37 of the FASB Accounting Standards Codification are described below:

|

Level 1

|

Quoted market prices available in active markets for identical assets or liabilities as of the reporting date.

|

|

Level 2

|

Pricing inputs other than quoted prices in active markets included in Level 1, which are either directly or indirectly observable as of the reporting date.

|

|

Level 3

|

Pricing inputs that are generally observable inputs and not corroborated by market data.

|

The carrying amounts of the Company’s financial assets and liabilities, such as cash, deferred financing costs, accounts payable and accrued expenses and loan payable – related party approximate their fair values because of the short maturity of these instruments.

F-8

Carrying Value, Recoverability and Impairment of Long-Lived Assets

The Company has adopted paragraph 360-10-35-17 of the FASB Accounting Standards Codification for its long-lived assets. The Company’s long-lived assets, which include office equipment, are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable.

The Company assesses the recoverability of its long-lived assets by comparing the projected undiscounted net cash flows associated with the related long-lived asset or group of long-lived assets over their remaining estimated useful lives against their respective carrying amounts. Impairment, if any, is based on the excess of the carrying amount over the fair value of those assets. Fair value is generally determined using the asset’s expected future discounted cash flows or market value, if readily determinable. If long-lived assets are determined to be recoverable, but the newly determined remaining estimated useful lives are shorter than originally estimated, the net book values of the long-lived assets are depreciated over the newly determined remaining estimated useful lives.

The Company considers the following to be some examples of important indicators that may trigger an impairment review: (i) significant under-performance or losses of assets relative to expected historical or projected future operating results; (ii) significant changes in the manner or use of assets or in the Company’s overall business strategy; (iii) significant negative industry or economic trends; (iv) increased competitive pressures; (v) a significant decline in the Company’s stock price for a sustained period of time; and (vi) regulatory changes. The Company evaluates acquired assets for potential impairment indicators at least annually and more frequently upon the occurrence of such events.

The impairment charges, if any, are included in operating expense in the accompanying statements of income and comprehensive income (loss).

Commitments and contingencies

The Company follows subtopic 450-20 of the FASB Accounting Standards Codification to report accounting for contingencies. Liabilities for loss contingencies arising from claims, assessments, litigation, fines and penalties and other sources are recorded when it is probable that a liability has been incurred and the amount of the assessment can be reasonably estimated.

Revenue Recognition

The Company applies paragraph 605-10-S99-1 of the FASB Accounting Standards Codification for revenue recognition. The Company recognizes revenue when it is realized or realizable and earned. The Company considers revenue realized or realizable and earned when all of the following criteria are met: (i) persuasive evidence of an arrangement exists, (ii) the product has been shipped or the services have been rendered to the customer; (iii) the sales price is fixed or determinable, and (iv) collectability is reasonably assured.

F-9

Foreign currency transactions

The Company applies the guidelines as set out in Section 830-20-35 of the FASB Accounting Standards Codification (“Section 830-20-35”) for foreign currency transactions. Pursuant to Section 830-20-35 of the FASB Accounting Standards Codification, foreign currency transactions are transactions denominated in currencies other than the US Dollar, the Company’s reporting currency. Foreign currency transactions may produce receivables or payables that are fixed in terms of the amount of foreign currency that will be received or paid. A change in exchange rates between the reporting currency and the currency in which a transaction is denominated increases or decreases the expected amount of reporting currency cash flows is a foreign currency transaction gain or loss that generally shall be included in determining net income for the period in which the exchange rate changes. Likewise, a transaction gain or loss (measured from the transaction date or the most recent intervening balance sheet date, whichever is later) realized upon settlement of a foreign currency transaction generally shall be included in determining net income for the period in which the transaction is settled. The exceptions to this requirement for inclusion in net income of transaction gains and losses pertain to certain intercompany transactions and to transactions that are designated as, and effective as, economic hedges of net investments and foreign currency commitments. Pursuant to Section 830-20-25 of the FASB Accounting Standards Codification, the following shall apply to all foreign currency transactions of an enterprise and its investees: (a) at the date the transaction is recognized, each asset, liability, revenue, expense, gain or loss arising from the transaction shall be measured and recorded in the functional currency of the recording entity by use of the exchange are in effect at that date as defined in Section 830-10-20 of the FASB Accounting Standards Codification; and (b) at each balance sheet date, recorded balances that are denominated in currencies other than the functional currency or reporting currency of the recording entity shall be adjusted to reflect the current exchange rate.

All of the Company’s operations are carried out in U.S. Dollars. The Company uses the U.S. Dollar as its reporting currency as well as its functional currency.

Income taxes

The Company accounts for income taxes pursuant to ASC 740. Under ASC 740 deferred taxes are provided on a liability method whereby deferred tax assets are recognized for deductible temporary differences and operating loss carryforwards and deferred tax liabilities are recognized for taxable temporary differences. Temporary differences are the differences between the reported amounts of assets and liabilities and their tax bases. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax asset will not be realized. Deferred tax assets and liabilities are adjusted for the effects of changes in tax laws and rates on the date of enactment.

Net income (loss) per common share

Net income (loss) per common share is computed pursuant to section 2660-10-45 of the FASB Accounting Standards Codification. Basic net income (loss) per common share is computed by dividing net income (loss) by the weighted average number of shares of common stock outstanding during the period. Diluted net income (loss) per common share is computed by dividing net income (loss) by the weighted average number of shares of common stock and potentially outstanding shares of common stock during the period. There were no potentially dilutive debt or equity instruments issued or outstanding during the years ended February 28, 2014 and 2013.

F-10

Advertising Costs

The Company’s policy regarding advertising is to expense advertising when incurred. The Company incurred advertising expense of $0 during the years ended February 28, 2014 and 2013.

Reclassifications

Certain amounts previously presented for prior years have been reclassified. The reclassification had no effect on net loss, total assets or total stockholders’ deficit.

Recent accounting pronouncements

The Company has reviewed all the recent accounting pronouncements issued to date of the issuance of these financial statements, and does not believe any of these pronouncements will have a material impact on the Company’s financial statements.

NOTE 3 – GOING CONCERN

The financial statements have been prepared on a going concern basis which assumes the Company will be able to realize its assets and discharge its liabilities in the normal course of business for the foreseeable future. As at February 28, 2014 the Company had current assets, comprising of cash, of $4,986 and current liabilities of $290,068 resulting in a working capital deficit of $285,082. The Company currently has no profitable trading activities and has an accumulated deficit of $662,068 as at February 28, 2014. This raises substantial doubt about the Company’s ability to continue as a going concern.

The Company may raise additional capital through the sale of its equity securities, through an offering of debt securities, or through borrowings from financial institutions or related parties. By doing so, the Company hopes to generate sufficient capital to execute its new business plan in the medical sector on an ongoing basis. Management believes that actions presently being taken to obtain additional funding provide the opportunity for the Company to continue as a going concern. There is no guarantee the Company will be successful in achieving these objectives.

NOTE 4 – ACCRUED OFFICER COMPENSATION

On April 17, 2013, the Company entered into Employment Agreements with its president, Ms. Yan Li, and its secretary and treasurer, Mr. Robert Ireland. Ms. Yan’s agreement is retroactively effective as of December 4, 2012, for a term of 36 months (measured from December 4, 2012). Pursuant to the agreement, Ms. Li shall receive an annual salary of $78,000, and shall act as the company’s CEO.

F-11

Mr. Ireland’s agreement is retroactively effective as of December 4, 2012, for a term of 36 months (measured from December 4, 2012). Pursuant to the agreement, Mr. Ireland shall receive an annual salary of $78,000, and shall act as the company’s Secretary and Treasurer.

As at February 28, 2014 a total of $195,000 had been accrued as compensation payable to Ms. Li and Mr. Ireland.

NOTE 5 – RELATED PARTY TRANSACTIONS

In support of the Company’s efforts and cash requirements, it may rely on advances from related parties until such time that the Company can support its operations or attains adequate financing through sales of its equity or traditional debt financing. There is no formal written commitment for continued support by shareholders. Amounts represent advances or amounts paid in satisfaction of liabilities. The advances are considered temporary in nature and have not been formalized by a promissory note.

As of February 28, 2014, the Company had a $93,607 loan outstanding with a shareholder of the Company. The loan is non-interest bearing, due upon demand and unsecured.

NOTE 6 – COMMON STOCK

The Company has 75,000,000 shares of common stock authorized with a par value of $ 0.001 per share.

On August 15, 2013 the Company issued 2,000,000 shares of its common stock to unrelated parties for services rendered. The share issuance was valued at $0.05 per common share. At close of business on August 15, 2013 the stock was quoted at a price of $1.46 per share, but as there was, and is, no active trading market, management does not believe that this is a true indication of the fair value of these shares. The value assigned is based on the price at which the Company had most recently sold shares of its common stock for cash. 1,500,000 of the shares issued in the year related to consulting services and the $75,000 cost associated with them expensed in the statement of operations. 500,000 of the shares and the issued in the year related to preparation of a from S1 and the $25,000 cost associated with them has been capitalized as deferred financing costs.

Total shares outstanding as of February 28, 2014 were 8,500,000.

NOTE 7– INCOME TAX

Deferred tax assets and liabilities are adjusted for the effects of changes in tax laws and rates on the date of enactment. Deferred income taxes arise from the temporary differences between financial statement and income tax recognition of net operating losses. These loss carryovers are limited under the Internal Revenue Code should a significant change in ownership occur.

At February 28, 2014, after the disposal of its subsidiary Company in fiscal 2013, the Company had net operating loss carryforwards of approximately $430,000 which expire in 2034. The deferred tax asset of $146,000 created by the net operating loss has been offset by a 100% valuation allowance. The change in valuation allowance in 2014 was approximately $114,000.

F-12

NOTE 8 – DISCONTINUED OPERATIONS

On December 5, 2012 the Company disposed of its subsidiary corporation to a shareholder for a nominal sum, as well as other management operations. The loss on discontinued operations in fiscal year 2013 was $115,903, including a gain on disposal of $2,430.

NOTE 9 – SUBSEQUENT EVENTS

In accordance with ASC 855-10, “Subsequent Events”, the Company has analyzed its operations subsequent to February 28, 2014 to the date these financial statements were filed with the Securities and Exchange Commission and has determined that it does not have any material subsequent events to disclose in these financial statements.

F-13

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

On January 13, 2014, Ronald R. Chadwick, P.C. (“Chadwick”) resigned as the Registrant’s registered independent public accountant.

On January 13, 2014, the Registrant engaged Cutler & Co., LLC as its new registered independent public accountant.

We had no disagreements with either Chadwick or Cutler & Co., LLC with respect to accounting or financial disclosure.

ITEM 9A. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls

We evaluated the effectiveness of our disclosure controls and procedures as of the end of the 2014 fiscal year. This evaluation was conducted with the participation of our chief executive officer and our principal accounting officer.

Disclosure controls are controls and other procedures that are designed to ensure that information that we are required to be disclosed in the reports we file pursuant to the Securities Exchange Act of 1934 is recorded, processed, summarized and reported.

Limitations on the Effective of Controls