Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - VEREIT, Inc. | v381947_8k.htm |

Exhibit 99.1

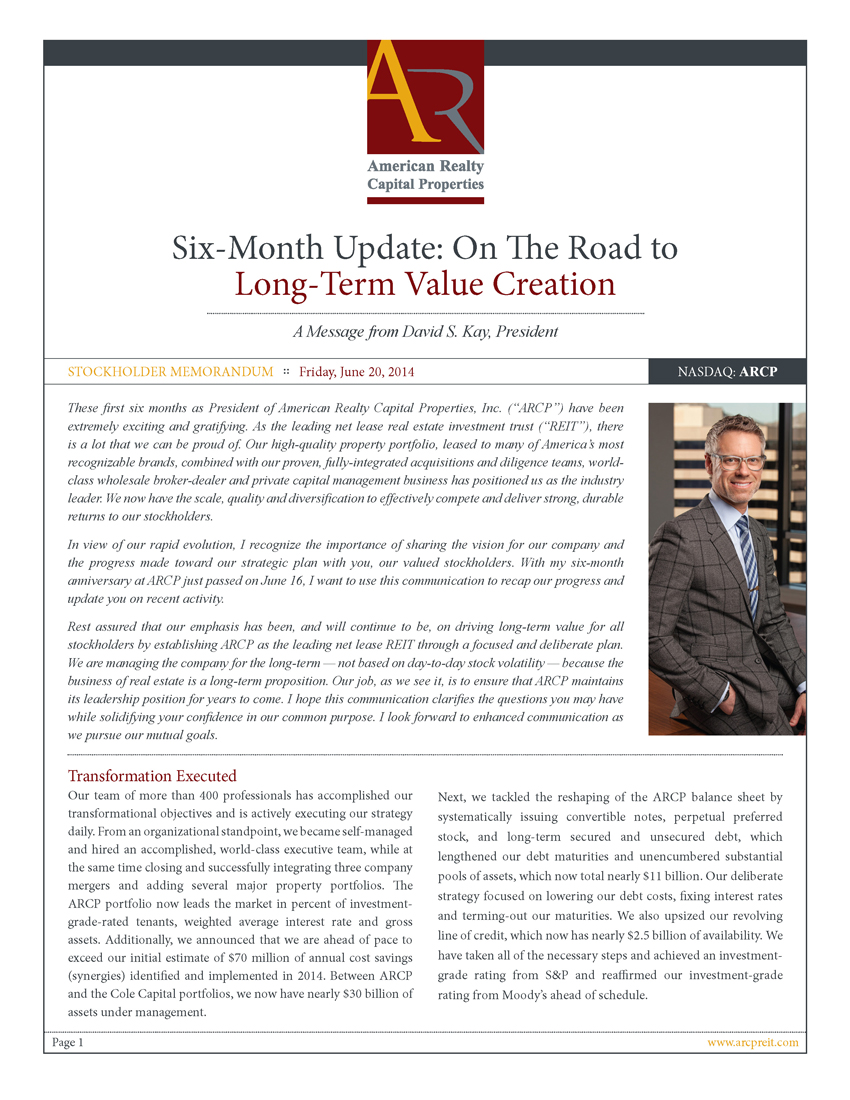

Six-Month Update: On The Road to Long-Term Value Creation A Message from David S. Kay, President STOCKHOLDER MEMORANDUM :: Friday, June 20, 2014 NASDAQ: ARCP These first six months as President of American Realty Capital Properties, Inc. (“ARCP”) have been extremely exciting and gratifying. As the leading net lease real estate investment trust (“REIT”), there is a lot that we can be proud of. Our high-quality property portfolio, leased to many of America’s most recognizable brands, combined with our proven, fully-integrated acquisitions and diligence teams, world-class wholesale broker-dealer and private capital management business has positioned us as the industry leader. We now have the scale, quality and diversification to effectively compete and deliver strong, durable returns to our stockholders. In view of our rapid evolution, I recognize the importance of sharing the vision for our company and the progress made toward our strategic plan with you, our valued stockholders. With my six-month anniversary at ARCP just passed on June 16, I want to use this communication to recap our progress and update you on recent activity. Rest assured that our emphasis has been, and will continue to be, on driving long-term value for all stockholders by establishing ARCP as the leading net lease REIT through a focused and deliberate plan. We are managing the company for the long-term — not based on day-to-day stock volatility — because the business of real estate is a long-term proposition. Our job, as we see it, is to ensure that ARCP maintains its leadership position for years to come. I hope this communication clarifies the questions you may have while solidifying your confidence in our common purpose. I look forward to enhanced communication as we pursue our mutual goals. Transformation Executed Our team of more than 400 professionals has accomplished our transformational objectives and is actively executing our strategy daily. From an organizational standpoint, we became self-managed and hired an accomplished, world-class executive team, while at the same time closing and successfully integrating three company mergers and adding several major property portfolios. The ARCP portfolio now leads the market in percent of investment-grade-rated tenants, weighted average interest rate and gross assets. Additionally, we announced that we are ahead of pace to exceed our initial estimate of $70 million of annual cost savings (synergies) identified and implemented in 2014. Between ARCP and the Cole Capital portfolios, we now have nearly $30 billion of assets under management. Next, we tackled the reshaping of the ARCP balance sheet by systematically issuing convertible notes, perpetual preferred stock, and long-term secured and unsecured debt, which lengthened our debt maturities and unencumbered substantial pools of assets, which now total nearly $11 billion. Our deliberate strategy focused on lowering our debt costs, fixing interest rates and terming-out our maturities. We also upsized our revolving line of credit, which now has nearly $2.5 billion of availability. We have taken all of the necessary steps and achieved an investment-grade rating from S&P and reaffirmed our investment-grade rating from Moody’s ahead of schedule. Page 1q www.arcpreit.com

ARCP STOCKHOLDER MEMORANDUM Tractor Supply Focus on Pure-Play Net Lease Last month, we announced the sale of ARCP’s multi-tenant shopping center portfolio to Blackstone Real Estate Partners VII (“Blackstone”), completing the culling of our multi-tenant assets and allowing us to create a pure-play net lease REIT. When considering options for the multi-tenant portfolio, as with any major transaction, we carefully reviewed all possibilities, including a spin-off, joint venture or sale of the portfolio outright, with the goal of maximizing value for our stockholders. Eliminating multi-tenant properties from the portfolio improves our occupancy rate, decreases capital expenditures and reduces complexity. Ultimately, we were able to identify this attractive transaction with Blackstone, allowing us to deliver value to our stockholders and further clarify our core net lease investment strategy. Additionally, this will result in the elimination of $600 million of secured debt and will provide $1.4 billion of capital for net lease acquisitions. Red Lobster Announcement On May 16, we announced our entry into a $1.5 billion sale-leaseback transaction. We conducted due diligence on more than 700 Red Lobster locations and carefully selected approximately 500 stores that met our stringent acquisition criteria. The deal is intelligently structured, selecting only the best performing locations with strong real estate fundamentals. Our highly experienced team was able to obtain market-leading economics with exceptional cash and GAAP cap rates and significant income growth through built-in annual rent escalations. The acquisition was structured with multiple homogenous lease pools, very long-term cross-defaulted master leases with financial covenants and restrictions on leverage and assignability — protecting us while also providing us with flexibility. Selling the multi-tenant portfolio for 6.63% and acquiring the Red Lobster portfolio at 7.9% allows us to redeploy capital on an accretive basis. Merrill Lynch Campus Focused Execution Outlined below are key achievements that further demonstrate the focused execution of our plan. Created the most diverse net lease portfolio in the industry with industry-leading statistics including assets under management; lease duration; geographic and tenant diversification; investment-grade tenant base; fixed charge coverage ratio; average cost of debt; and portfolio occupancy Created a flexible balance sheet with nearly $11 billion in unencumbered assets Received investment-grade credit ratings from Moody’s and S&P with the potential for upgrades in the future based on our recent successful de-levering Fully integrated the Cole and CapLease acquisitions teams with ours and completed our self-management process Entered into an agreement to sell our multi-tenant portfolio to Blackstone, which will focus our strategy on single-tenant net lease properties and solidify ARCP as the leading net lease REIT Took successful steps toward de-levering to a 6.0x net debt to EBITDA ratio following the closing of our pending Blackstone and Red Lobster transactions Demonstrated our size and scale advantages with respect to superior deal sourcing through the planned acquisition of a $1.5 billion portfolio of concentrated Red Lobster properties, without materially affecting the overall diversity and credit strength of our portfolio Combined granular acquisitions with large sale-leaseback transactions to exploit the dynamic size and scope of our acquisitions platform, which has allowed us to generate acquisitions with cap rates that lead our peers, averaging approximately 8% yields Provided considerable education to the market on Cole Capital, including capital raising and deployment estimates Page 2 www.arcpreit.com

ARCP STOCKHOLDER MEMORANDUM Kay Red Lobster Is a Compelling Investment By partnering strategically, underwriting thoroughly and structuring intelligently, ARCP has made an investment that is extremely beneficial to our stockholders. Consider the following: Ideal Sponsor Golden Gate Capital, with $12 billion of assets under management, has a long and successful history of buying and improving the operations of restaurants and retail businesses, deep financial resources to fund restructured operations where needed, as well as a long, successful history with our company. Irreplaceable Real Estate We are acquiring strong locations in strategic markets with consistent and continued maintenance and upkeep. They are being purchased at 82% of replacement cost at a cap rate comparing favorably to other transactions, as well as comparable data in the recent Green Street Advisors report. Additionally, an average of $500,000 was spent renovating each location during the past four years. Growth Potential Through thorough underwriting, ARCP is confident in the real estate and coverage metrics of the investment. The real estate is positioned to appreciate in value while rents will escalate contractually. Effective Management Team The experienced management team demonstrated a proven track record of operational excellence when they previously managed the Red Lobster portfolio. They have put in place a detailed operational plan to grow the brand and create upside and long-term value. Risk Mitigation Through conservative performance underwriting (based on actual and not pro forma results) and strategic structuring of the purchase agreement, risk is further reduced, demonstrated by the 2.2x rent coverage. Self-Originated Acquisitions By successfully executing on our acquisition strategy, we have built ARCP into the leading net lease REIT with one of the strongest and most diverse portfolios in the industry, and we are now well-positioned to focus on organic growth through core acquisitions. During the conference call for our first quarter results on May 8, 2014, we announced that our acquisition performance would far exceed the market’s expectations. In fact, acquisitions totaled $3.5 billion for the first six months of the year. Our aggregate average cash cap rate of 7.9% and GAAP cap rate of 9.0% lead the net lease industry, as does our increased 12.3-year portfolio weighted average remaining lease term. We outlined our ongoing plan to leverage our Walgreens Experience & Patience During my tenure at Capital Automotive REIT (“Capital Automotive”), we generated significant value for stockholders by executing on a clear and consistent strategy, a situation that is analogous to our commitment to the current strategic plan at ARCP. In February of 1998, after I co-founded Capital Automotive and was serving as Chief Financial Officer, the company’s IPO priced at $15 per share and, after several busy quarters, we fell short of analyst expectations and our stock price dropped. With a falling REIT market and technology stocks in vogue, the financial community questioned our strategy and portfolio, and the stock price fell below $9 per share. Despite the noise and questions, the Capital Automotive management team and our Board persevered and never strayed from our strategy, which we strongly believed would drive long-term value. We continued to execute large and small transactions and issued equity at prices we deemed could add value to the company. We eventually sold the company in September 2005 at $38.75 per share. This example is evidence of the success that can be achieved by staying committed to a strategic plan and executing it cleanly. I have every reason to believe there is the potential to realize the same value at ARCP. Our portfolio and our team are strong and we have built a solid foundation. As we move forward, we remain focused on our current strategy, which we believe will position the company for long-term success. To date, we have executed our plan and we will not be deterred by short-term movements in share price. We will continue to take actions to drive long-term value for all of our stockholders. ARCP Setting high expectations and meeting them are the hallmark of success. David S. Kay Page 3 www.arcpreit.com

ARCP STOCKHOLDER MEMORANDUM Center Wendy’s acquisitions team from a size and expertise standpoint, enabling us to buy self-originated assets on a granular basis – something our peers haven’t been able to do at the same pace or scale. Building our acquisitions team, coupled with the size and strength of our balance sheet, has afforded us the additional competitive advantage of being able to efficiently underwrite and purchase large-scale sale-leaseback opportunities that smaller companies cannot transact. Based on year-to-date acquisition activity and our capabilities, we increased our expectations for the year to $4.5 billion of property purchases based on granular, self-originated acquisitions. (See page 6) Equity Issuance As I’m sure you can appreciate, navigating the current volatile economic environment has presented its challenges. As good stewards of your capital, our responsibility is to protect and to create safety, coverage and durability for our earnings and dividends. Our management team outlined a proactive strategy to reduce leverage this year by issuing equity, combined with executing accretive transactions in order to bolster earnings. Based on economic forecasts, our leverage and our growth projections, as well as careful deliberation with management and the Board, we decided to raise equity to bring leverage down now and fortify our balance sheet for the long haul. The long-only dedicated REIT investors were supportive, buying aggressively which resulted in the upsizing of the offering by an additional 20 million shares and net proceeds of approximately $1.59 billion. We dramatically transformed our stockholder base focusing on investors looking for solid, long-term returns. Feedback from dedicated REIT and long-only investors who participated in the offering remains positive regarding our strategy to delever the company. My Next Steps As Nick outlines in the next section, I will be taking a more active role in the day-to-day management of ARCP, as well as personally leading the vital investor communications function. My responsibility will be to implement and augment a proactive investor communications program, providing investors with a single point of contact for credible and consistent information. I will build out a world-class team by adding senior-level financial reporting, accounting and treasury professionals. One of our first actions will be hiring a Director of Financial Reporting and Treasury, dedicated to enhancing financial oversight, reporting controls and treasury functions. As part of my duties, I will continue to provide you with timely and important updates. In the meantime, I encourage you to visit www.arcpreit.com for additional information or contact our Investor Relations team at investorrelations@arcpreit.com with your questions. We have accomplished a lot in my first six months as President, but we have yet to see share price growth. We are resolute in the long-term plan outlined above, and we remain confident that the focused implementation of our strategy will drive returns. Market feedback continues to motivate us, creating positive energy to better this great company and show the market what a solid foundation we have poured. As President, I assure you that we will stay the course for success. Knowing what the ARCP team can accomplish, I am very excited about managing the company for long-term success. We are creating an organization built for durability in all market conditions. I appreciate your investment in our company and look forward to many shared successes. Sincerely, David S. Kay Page 4 www.arcpreit.com

ARCP STOCKHOLDER MEMORANDUM Our Commitment for 2014 From the Desk of the Chairman & CEO The transformation of ARCP has been dramatic, and we are very pleased with what we have built. With the ARCP balance sheet and the Cole Capital portfolios, we manage nearly $30 billion of assets and have established the company as a global leader for pure-play net lease. With all that we’ve already accomplished in the six months since David Kay joined ARCP, we now turn our focus to using the established foundation to maximize the long-term value for our stockholders. I have two important announcements before outlining our commitment to you for the remainder of 2014. First and foremost, as planned, I will transition my CEO role, responsibility and title to David on October 1, 2014. This transition will allow me to focus on long-term and strategic initiatives, while David will drive day-to-day operations and investor communications for the company. The Board and I are extremely pleased with David’s leadership and accomplishments, and this transition will allow us to effectively grow the company as a team. Second, in our continuing effort to enhance corporate governance, William M. Kahane and Edward M. Weil, Jr., are resigning from the ARCP Board of Directors. On behalf of the ARCP Board, we appreciate their dedication and service. Going forward, Bill and Mike will dedicate their time to their roles at RCS Capital. With these changes, we will have five independent directors, along with me, serving as your Board. Having addressed leadership and governance, we now turn our attention to operations. The following five key commitments will guide our actions for the remainder of the year, building on the foundation we’ve already established. Deliberate execution of our core acquisition strategy with no additional merger activity in 2014. We are now able to create value by doing what we do best: source, underwrite and close granular, self-originated net lease acquisitions. Rather than focus on corporate mergers, we will concentrate on the deliberate execution of our organic acquisition strategy. This approach includes individual transactions, small portfolios and build-to-suits, allowing us to achieve or exceed our $4.5 billion acquisition target for the year, while enhancing our industry leading portfolio metrics. Actively manage our portfolio for core growth with no additional equity raise in 2014. With leverage at target levels and available capacity, there is no need to raise additional equity. As explained above, primary growth and portfolio enhancement will be accomplished by adhering to our granular acquisition plan. Additional opportunities can be realized from the active management of our existing assets. By culling through the portfolio and identifying properties above market value, non-core assets, shorter lease terms and less desirable tenants, we will have the opportunity to pursue dispositions, harvest and re-deploy capital, extend leases and augment the overall quality of our portfolio. Further lengthen debt maturities. We will continue to systematically and deliberately eliminate secured, short-term debt acquired via mergers in favor of longer-term, unsecured debt. These harvesting efforts will allow us to enhance our credit ratings, stability, liquidity and balance sheet metrics. Our unencumbered assets now total nearly $11 billion, and we are focused on increasing that pool while decreasing our secured real estate. We believe these actions are fundamental to building the quality balance sheet for long-term sustainability, improved credit agency ratings and a lower cost of capital. Proactive investor communication and transparency. Because it is so important, David will dedicate a substantial portion of his time as CEO to investor communications. In this role, I expect David to develop his team – including appointing a Director of Financial Reporting and Treasury; enhance clarity and transparency; proactively and effectively communicate our balance sheet initiatives; and demonstrate the value of the Cole Capital brand. We will be sponsoring an ARCP Investor Day (to be held promptly after the second quarter earnings calls) providing all investors the opportunity to meet and interact with management, with an emphasis on the significant potential growth embedded in Cole Capital, our private capital management business. Full details will be announced in the next 30 days. Provide the framework to value, measure and model the business. With our focus on deliberate execution, we will be able to provide a more clear, concise and transparent financial framework, allowing investors and analysts to better value, measure and model our business. We will develop and provide an earnings and growth sensitivity matrix that includes Cole Capital, which has been a cornerstone in the rapidly expanding alternative investment space. The off-balance sheet activity generated by Cole Capital’s sponsored non-listed REITs allows us to grow EBITDA while maintaining, and potentially decreasing, our new low leverage levels. This additional financial clarity and transparency is at the core of fortifying investor confidence. By adhering to these five basic commitments for the balance of the year, investors can all focus on our company’s performance. It is now time for ARCP to prove its worth by actions and the quality of the portfolio. Together we will create long-term value. Regards, Nicholas S. Schorsch Page 5 www.arcpreit.com

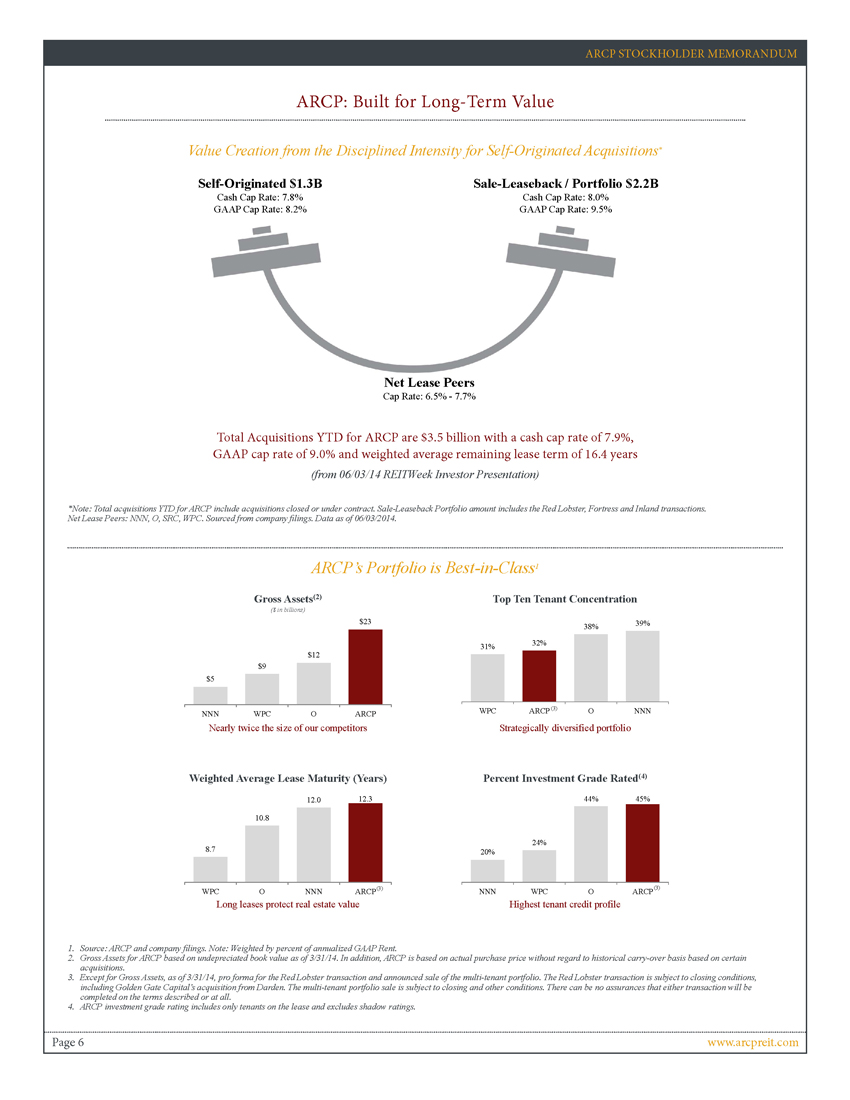

ARCP STOCKHOLDER MEMORANDUM ARCP: Built for Long-Term Value Value Creation from the Disciplined Intensity for Self-Originated Acquisitions* Self-Originated $1.3BCash Cap Rate: 7.8%GAAP Cap Rate: 8.2% Sale-Leaseback / Portfolio $2.2BCash Cap Rate: 8.0%GAAP Cap Rate: 9.5% Net Lease PeersCap Rate: 6.5% -7.7% total Acquisitions YTD for ARCP are $3.5 billion with a cash cap rate of 7.9%, GAAP cap rate of 9.0% and weighted average lease term of 16.4 years (from 06/03/14 reitweek investor presentation) *Note: Total acquisitions YTD for ARCP include acquisitions closed or under contract. Sale-Leaseback Portfolio amount includes the Red Lobster, Fortress and Inland transactions. Net Lease Peers: NNN, O, SRC, WPC. Sourced from company filings. Data as of 06/03/2014. ARCP’s Portfolio is Best-in-Class1 Gross Assets(2)Weighted Average Lease Maturity (Years)Top Ten Tenant ConcentrationPercent Investment Grade Rated(4)($ in billions) ARCP’s Portfolio is Best-in-Class1Nearly twice the size of our competitorsStrategically diversified portfolioLong leases protect real estate valueHighest tenant credit profile 1. Source: ARCP and company filings. Note: Weighted by percent of annualized GAAP Rent. 2. Gross Assets for ARCP based on undepreciated book value as of 3/31/14. In addition, ARCP is based on actual purchase price without regard to historical carry-over basis based on certain acquisitions. 3. Except for Gross Assets, as of 3/31/14, pro forma for the Red Lobster transaction and announced sale of the multi-tenant portfolio. The Red Lobster transaction is subject to closing conditions, including Golden Gate Capital’s acquisition from Darden. The multi-tenant portfolio sale is subject to closing and other conditions. There can be no assurances that either transaction will be completed on the terms described or at all. 4. ARCP investment grade rating includes only tenants on the lease and excludes shadow ratings. Page 6 www.arcpreit.com

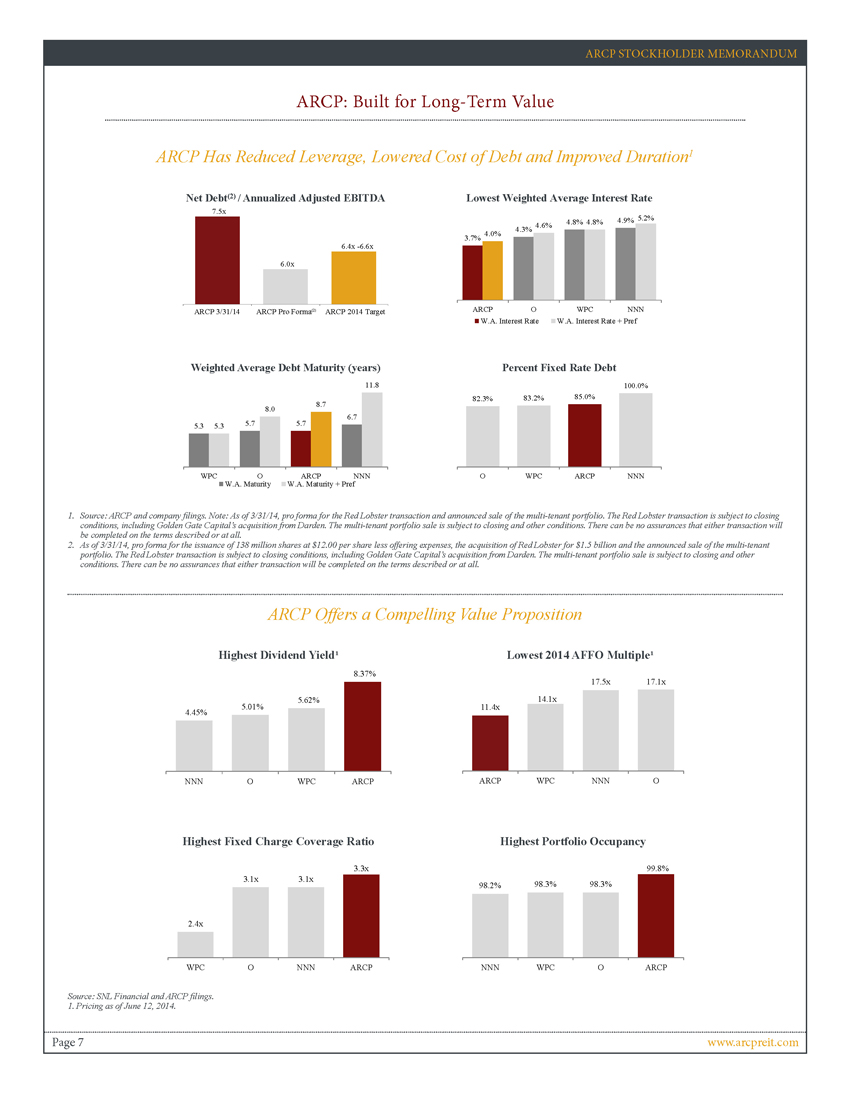

ARCP STOCKHOLDER MEMORANDUM ARCP: Built for Long-Term Value ARCP Has Reduced Leverage, Lowered Cost of Debt and Improved Duration1 Net Debt(2)/ Annualized Adjusted EBITDA Lowest Weighted Average Interest RatePercent Weighted Average Debt Maturity (years) RatePercent Fixed Rate Debt 1. Source: ARCP and company filings. Note: As of 3/31/14, pro forma for the Red Lobster transaction and announced sale of the multi-tenant portfolio. The Red Lobster transaction is subject to closing conditions, including Golden Gate Capital’s acquisition from Darden. The multi-tenant portfolio sale is subject to closing and other conditions. There can be no assurances that either transaction will be completed on the terms described or at all. 2. As of 3/31/14, pro forma for the issuance of 138 million shares at $12.00 per share less offering expenses, the acquisition of Red Lobster for $1.5 billion and the announced sale of the multi-tenant portfolio. The Red Lobster transaction is subject to closing conditions, including Golden Gate Capital’s acquisition from Darden. The multi-tenant portfolio sale is subject to closing and other conditions. There can be no assurances that either transaction will be completed on the terms described or at all. ARCP Offers a Compelling Value Proposition Highest Dividend Yield1 Highest Fixed Charge Coverage Ratio 11.4x14.1x17.5x17.1xARCPWPCNNNOLowest 2014 AFFO Multiple1 Highest Portfolio Occupancy4.45%5.01% Source: SNL Financial and ARCP filings. 1. Pricing as of June 12, 2014. Page 7 www.arcpreit.com