Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - VECTOR GROUP LTD | vgr-2014613xex993sfd.htm |

| EX-99.1 - EXHIBIT 99.1 - VECTOR GROUP LTD | vgr-2014613xex991sfdnongaap.htm |

| 8-K - 8-K - VECTOR GROUP LTD | vgr-2014613x8ksfd.htm |

June 2014 Vector Group Ltd. Investor Presentation

Disclaimer This document and any related oral presentation does not constitute an offer or invitation to subscribe for, purchase or otherwise acquire any equity securities or debt securities instruments of Vector Group Ltd. (“Vector” or “the Company”) and nothing contained herein or its presentation shall form the basis of any contract or commitment whatsoever. The distribution of this document and any related oral presentation in certain jurisdictions may be restricted by law and persons into whose possession this document or any related oral presentation comes should inform themselves about, and observe, any such restriction. Any failure to comply with these restrictions may constitute a violation of the laws of any such other jurisdiction. The information contained herein does not constitute investment, legal, accounting, regulatory, taxation or other advice and the information does not take into account your investment objectives or legal, accounting, regulatory, taxation or financial situation or particular needs. You are solely responsible for forming your own opinions and conclusions on such matters and the market and for making your own independent assessment of the information. You are solely responsible for seeking independent professional advice in relation to the information and any action taken on the basis of the information. The following presentation may contain "forward-looking statements,” including any statements that may be contained in the presentation that reflect our expectations or beliefs with respect to future events and financial performance, such as the expectation that the tobacco transition payment program could yield substantial incremental free cash flow. These forward- looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those contained in any forward-looking statement made by or on behalf of the Company, including the risk that changes in our capital expenditures impact our expected free cash flow and the other risk factors described in our annual report on Form 10- K for the year ended December 31, 2013 and our quarterly report on Form 10-Q for the quarter ended March 31, 2014 as filed with the SEC. Results actually achieved may differ materially from expected results included in these forward-looking statements as a result of these or other factors. Due to such uncertainties and risks, potential investors are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date on which such statements are made. The Company disclaims any obligation to, and does not undertake to, update or revise and forward-looking statements in this presentation. 1 1

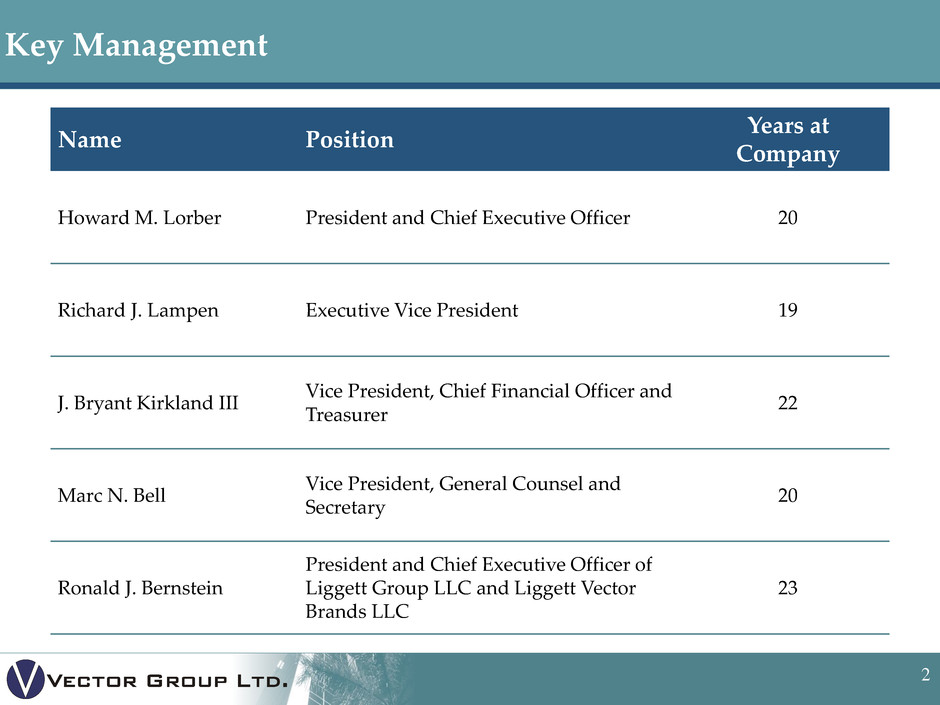

Management Team 2 2 Name Position Years at Company Howard M. Lorber President and Chief Executive Officer 20 Richard J. Lampen Executive Vice President 19 J. Bryant Kirkland III Vice President, Chief Financial Officer and Treasurer 22 Marc N. Bell Vice President, General Counsel and Secretary 20 Ronald J. Bernstein President and Chief Executive Officer of Liggett Group LLC and Liggett Vector Brands LLC 23 Key Management

Introduction 3 3 2013 was a transformational year for Vector ─ Increased ownership stake in Douglas Elliman Realty, LLC (“Douglas Elliman”), the fourth-largest residential real estate brokerage in the United States and the largest residential brokerage in the New York metropolitan area, from 50% to 70.59% for $60 million ─ Reached a settlement with approximately 4,900 Engle progeny plaintiffs, which represented the overwhelming majority of Liggett’s pending litigation ─ Introduced Eagle 20’s, a deep discount cigarette brand positioned for long-term growth, and Zoom e-cigarettes ─ Invested approximately $75.0 million in non-consolidated real estate investments through New Valley LLC (“New Valley”), Vector’s wholly-owned real estate subsidiary ─ Completed a $450.0 million Senior Secured Notes offering which refinanced existing Senior Secured Notes and extended maturities until 2021 ─ Paid cash dividend to stockholders for the 19th consecutive year and 5% stock dividend to stockholders for the 15th consecutive year Vector has continued to show strong results thus far in 2014 ─ Vector Pro-Forma Adjusted EBITDA of $245.0 million for the LTM period ended March 31, 2014(1) ─ Adjusted EBITDA for the Company’s tobacco segment (“Tobacco Adjusted EBITDA”) of $201.8 million for the LTM period ended March 31, 2014(2) ─ In March 2014, Vector completed a $258.75 million Convertible Senior Notes offering and, in April 2014, Vector executed a $150 million tack-on to its existing Senior Secured Notes Net proceeds of both offerings will be used for general corporate purposes including additional investments in real estate through Vector’s New Valley subsidiary (1) Pro-Forma Adjusted EBITDA is presented assuming Vector’s acquisition of its additional 20.59% interest in Douglas Elliman, and the related purchase accounting adjustments, occurred prior to January 1, 2013. Please refer to the Appendix for additional detail including a reconciliation to net income as calculated under U.S. GAAP. (2) All “Liggett” and “Tobacco” financial information in this presentation includes the operations of Liggett Group LLC, Vector Tobacco Inc., Liggett Vector Brands LLC and Zoom e-Cigs LLC unless otherwise noted. Tobacco Adjusted EBITDA is defined as Operating Income plus D&A excluding one-time restructuring, litigation charges and other one-time gains from litigation settlements.

Key Investment Highlights Historically strong financial performance ─ Vector Pro-Forma Adjusted EBITDA of $245.0 million and Tobacco Adjusted EBITDA of $201.8 million for the LTM period ended March 31, 2014(1) Key price advantage resulting from Master Settlement Agreement (“MSA”)(2) ─ Current price advantage of 62 cents per pack compared to the three largest U.S. tobacco companies and quality advantage compared to smaller firms(3) ─ MSA exemption worth approximately $162 million in 2013 2014 expiration of the Tobacco Transition Payment Program (TTPP) could yield substantial incremental free cash flow ─ Approximately $28.7 million based on Liggett’s 2013 TTPP payments Diversified New Valley assets ─ Pro-Forma Adjusted Revenues and Pro-Forma Adjusted EBITDA from Douglas Elliman Realty, LLC of $449.5 million and $52.4 million for the LTM period ended March 31, 2014(4) ─ Broad portfolio of consolidated and non-consolidated domestic and international real estate investments Substantial liquidity with cash, marketable securities and long-term investments of $601.9 million as of March 31, 2014(5) Proven management team with substantial equity ownership ─ Approximately 17.3% director and executive officer owned(6) 4 4 Key Investment Highl ght (1) Refer to the Appendix hereto for a reconciliation to net income as calculated under U.S. GAAP. (2) In 1998, various tobacco companies, including Liggett and the four largest U.S. cigarette manufacturers, Philip Morris, Brown & Williamson, R.J. Reynolds and Lorillard, entered into the Master Settlement Agreement (“MSA”) with 46 states, the District of Columbia, Puerto Rico and various other territories to settle their asserted and unasserted health care cost recovery and certain other claims caused by cigarette smoking (Brown & Williamson and R.J. Reynolds merged in 2004 to form Reynolds American). Pursuant to the MSA, Liggett has no payment obligations unless its market share exceeds a market share exemption of approximately 1.65% of total cigarettes sold in the United States, and Vector Tobacco has no payment obligations unless its market share exceeds a market share exemption of approximately 0.28% of total cigarettes sold in the United States. (3) Price advantage applies only to cigarettes sold below applicable market share exemption. (4) Pro-Forma Adjusted Revenues and Adjusted EBITDA are presented assuming Vector’s acquisition of its additional 20.59% interest in Douglas Elliman, and the related purchase accounting adjustments, occurred prior to January 1, 2013. (5) Excludes real estate investments. (6) Excludes 3,209,850 shares lent under the Share Lending Agreement between the Company and Jefferies LLC.

Tobacco Operations 5 5

Liggett Overview Fourth-largest U.S. tobacco company; founded in 1873 ─ Core Discount Brands –Pyramid, Grand Prix, Liggett Select, Eve and Eagle 20’s ─ Partner Brands – USA, Bronson and Tourney Consistent and strong cash flow ─ Tobacco Adjusted EBITDA of $201.8 million for the LTM period ended March 31, 2014 ─ Low capital requirements with capital expenditures of $12.4 million related to tobacco operations for the LTM period ended March 31, 2014 ─ 2014 expiration of the TTPP could yield substantial incremental free cash flow Approximately $28.7 million based on Liggett’s 2013 TTPP payments Current price advantage of 62 cents per pack compared to the three largest U.S. tobacco companies expected to maintain volume and drive profit in core brands ─ Pursuant to the MSA, Liggett has no payment obligations unless its market share exceeds a market share exemption of approximately 1.65% of total cigarettes sold in the United States, and Vector Tobacco has no payment obligations unless its market share exceeds a market share exemption of approximately 0.28% of total cigarettes sold in the United States ─ MSA exemption worth approximately $162 million in 2013 for Liggett and Vector Tobacco Recently entered the emerging electronic cigarette market with Zoom brand e-cigarettes 6 6 Liggett Overvie

$46 $79 $77 $121 $111 $127 $130 $144 $146 $158 $170 $165 $158 $174 $186 $199 $202 1.3% 1.2% 1.5% 2.2% 2.4% 2.5% 2.3% 2.2% 2.4% 2.5% 2.5% 2.7% 3.5% 3.8% 3.5% 3.3% 3.3% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% $0 $30 $60 $90 $120 $150 $180 $210 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 LTM 3/31/14 History and Recent Developments Signed the MSA, as a Subsequent Participating Manufacturer, which established ongoing price advantage versus the three largest U.S. tobacco companies 7 7 (1) Adjusted for restructuring, factory relocation and litigation charges, as well as one-time gains. Note: The Liggett and Vector Tobacco businesses have been combined into a single segment for all periods since 2007. T o b a cc o A dj u st e d E B IT D A (1 ) Liggett History 1998 1999 2000 Dom e stic M a rk e t S h a re 2002 2005 2009 Today ($ M il li o n s) Introduced the deep discount brand Liggett Select taking advantage of the Company’s price advantage versus the three largest U.S. tobacco companies Relocated to a state-of-the-art manufacturing facility in Mebane, North Carolina to enhance quality and efficiency Purchased the Medallion Company, Inc. with approximately 0.28% market share exemption. Acquired the USA brand as part of this transaction and subsequently entered into a partner brand agreement with Wawa Launched the deep discount brand Grand Prix, which quickly experienced widespread adoption In response to a large Federal Excise Tax increase, Liggett repositioned Pyramid as a low-price, box-only brand Liggett focuses on margin enhancement resulting in continued earnings growth with Tobacco Adjusted EBITDA reaching a high of $198.9 million for the fiscal year ended December 31, 2013 and $201.8 million for the LTM period ended March 31, 2014 2013 Introduced Eagle 20’s, a brand positioned in the deep discount segment for long-term growth, and Zoom e-Cigarettes

Litigation History and Regulatory Overview Litigation History Liggett has historically led the industry in acknowledging the addictive properties of nicotine while seeking a legislated settlement of litigation On October 23, 2013, Liggett reached a settlement with approximately 4,900 Engle progeny plaintiffs, which represented the overwhelming majority of Liggett’s pending litigation ─ Liggett has agreed to pay $110 million including $2.1 million in December 2013, $59.5 million in February 2014 and the balance paid in installments over the next 14 years ─ Approximately 400 Engle plaintiffs did not participate in the settlement ─ There are presently another seven cases under appeal, and the range of loss in these cases is up to $18.5 million Liggett continues to aggressively fight all remaining individual and third-party payor actions ─ Liggett has secured approximately $5.3 million in outstanding bonds related to adverse verdicts which were on appeal as of March 31, 2014 Since 1998, the MSA has restricted the advertising and marketing of tobacco products In 2009, Family Smoking Prevention and Tobacco Control Act granted the FDA power to regulate the manufacture, sale, marketing and packaging of tobacco products ─ FDA is prohibited from issuing regulations which ban cigarettes Current Federal Excise Tax of $1.01/pack (since April 1, 2009) Additional state and municipal excise taxes The TTPP, also known as the tobacco quota buyout, was established in 2004 and is scheduled to expire at the end of 2014 ─ In 2013, Liggett was required to pay approximately $28.7 million under the TTPP 8 8 Litigation and Regulatory Update Litigation Update Regulatory Update

Real Estate Operations 9

New Valley LLC Overview Consolidated Real Estate Investments (as of March 31, 2014) ─ Douglas Elliman Realty, LLC (70.59% owned by New Valley LLC): Largest residential brokerage company in the New York metropolitan area and ranked as the fourth-largest residential brokerage company in the U.S. in 2012 based on closed sales volume Also offers relocation services, title and settlement services, residential property management services and loan originations through various subsidiaries Pro-Forma Adjusted Revenues and Pro-Forma Adjusted EBITDA for Douglas Elliman Realty, LLC of $449.5 million and $52.4 million for the fiscal year ended March 31, 2014(1) ─ Additional consolidated real estate investments include: Escena, a master planned community in Palm Springs, which presently has 667 residential lots In October 2013, New Valley sold 200 lots for $22.7 million and reported a gain of $20.2 million Indian Creek, a residential real estate conversion project in Indian Creek Village, Florida, which was sold in March 2014 10 10 New Valley Consolidated Real Estate Investments New York City Long Island & Westchester County South Florida Agents 2,504 2,009 336 Offices 21 42 6 LTM 3/31/14 Real Estate Sales $10.5 Billion $4.7 Billion $0.8 Billion (1) Pro-Forma Adjusted Revenues and Adjusted EBITDA are presented assuming Vector’s acquisition of its additional 20.59% interest in Douglas Elliman, and the related purchase accounting adjustments, occurred prior to January 1, 2013.

New Valley LLC Overview (Cont’d) 11 11 New Valley Non-consolidated Real Estate Investments Condominiums and Mixed Use Developments (as of March 31, 2014) ─ Sesto Holdings S.r.l. – New Valley owns a 6% interest in entity that owns a 322-acre land plot in Milan, Italy ─ 1107 Broadway – New Valley has a 5% interest in the owner of 1107 Broadway, a luxury residential condominium in the Flatiron District/ NoMad neighborhood of Manhattan ─ The Whitman – New Valley has an approximate 12% interest in a joint venture which developed a luxury condominium in the Flatiron District / NoMad neighborhood of Manhattan. Construction has been completed and three of four units have been sold ─ The Marquand – New Valley owns an approximate 19% interest in 11 East 68th Street, also known as The Marquand located on 68th Street between Fifth Avenue and Madison Avenue in Manhattan ─ 11 Beach Street – New Valley owns an approximate 49.5% interest in a Manhattan luxury residential condominium conversion project located in the TriBeCa neighborhood ─ 701 Seventh Avenue – New Valley owns an approximate 7% interest in a joint venture that is developing a 340,000 square foot multi-use project in the Times Square submarket ─ 101 Murray Street – New Valley owns an approximate 25% interest (and a related note receivable) in a joint venture that is developing a mixed-used property that includes both commercial space and a 150-unit luxury residential condominum in TriBeCa ─ Leroy Street – New Valley owns an approximate 2.5% interest in a development site in the West Greenwich Village ─ 8701 Collins Avenue – New Valley owns a 15% interest in the Howard Johnson’s Dezerland Beach hotel in Miami Beach, which is being redeveloped into a modern hotel and residential condominium The Whitman – Flatiron / NoMad 701 Seventh Ave – Times Square 8701 Collins Ave – Miami Beach 11 Beach St - TriBeCa

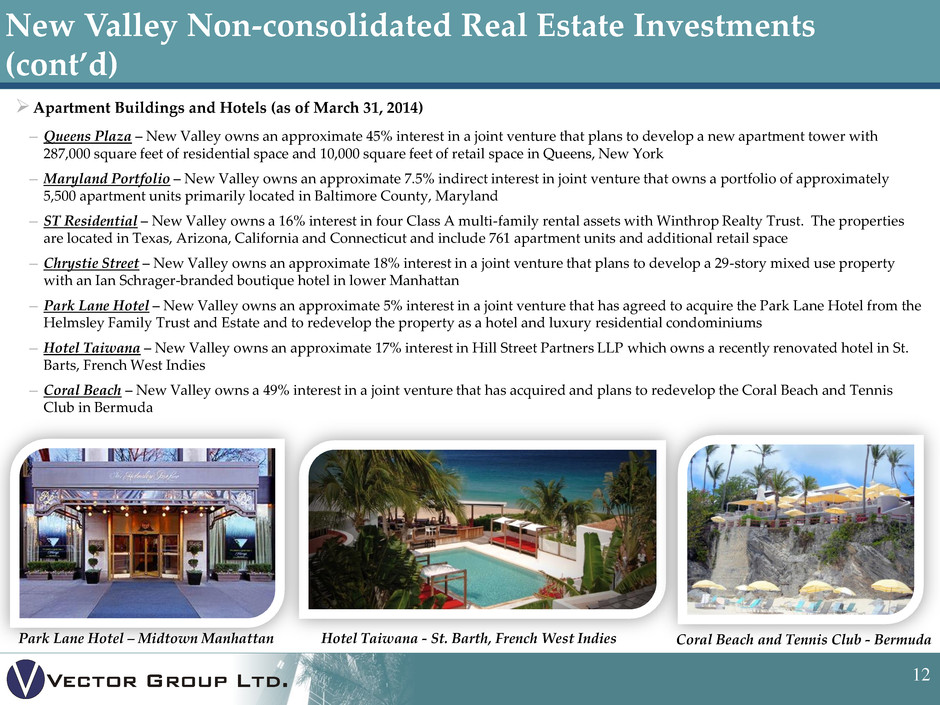

New Valley LLC Overview (Cont’d) 12 12 New Valley Non-consolidated Real Estate Investments (cont’d) Apartment Buildings and Hotels (as of March 31, 2014) ─ Queens Plaza – New Valley owns an approximate 45% interest in a joint venture that plans to develop a new apartment tower with 287,000 square feet of residential space and 10,000 square feet of retail space in Queens, New York ─ Maryland Portfolio – New Valley owns an approximate 7.5% indirect interest in joint venture that owns a portfolio of approximately 5,500 apartment units primarily located in Baltimore County, Maryland ─ ST Residential – New Valley owns a 16% interest in four Class A multi-family rental assets with Winthrop Realty Trust. The properties are located in Texas, Arizona, California and Connecticut and include 761 apartment units and additional retail space ─ Chrystie Street – New Valley owns an approximate 18% interest in a joint venture that plans to develop a 29-story mixed use property with an Ian Schrager-branded boutique hotel in lower Manhattan ─ Park Lane Hotel – New Valley owns an approximate 5% interest in a joint venture that has agreed to acquire the Park Lane Hotel from the Helmsley Family Trust and Estate and to redevelop the property as a hotel and luxury residential condominiums ─ Hotel Taiwana – New Valley owns an approximate 17% interest in Hill Street Partners LLP which owns a recently renovated hotel in St. Barts, French West Indies ─ Coral Beach – New Valley owns a 49% interest in a joint venture that has acquired and plans to redevelop the Coral Beach and Tennis Club in Bermuda Hotel Taiwana - St. Barth, French West Indies Coral Beach and Tennis Club - Bermuda Park Lane Hotel – Midtown Manhattan

Vector Group Ltd. Financial Summary 13

$351 $389 $483 $513 $1,133 $1,085 $1,014 $1,007 $6 $1,484 $1,474 $1,498 $1,526 PF 2011 PF 2012 PF 2013 LTM Real Estate Tobacco Corporate & Other $18 $17 $47 $54 $163 $176 $189 $189 ($16) ($15) ($16) ($17) $165 $179 $220 $226 PF 2011 PF 2012 PF 2013 LTM Real Estate Tobacco Corporate & Other $2 $4 $4 $4 $11 $9 $10 $12 $1 $2 $2 $3 $14 $15 $16 $18 PF 2011 PF 2012 PF 2013 LTM Real Estate Tobacco Corporate & Other $20 $21 $51 $57 $174 $186 $199 $202 ($15) ($13) ($14) ($14) $179 $193 $237 $245 12.1% 13.1% 15.7% 16.1% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% ($50) $0 $50 $100 $150 $200 $250 $300 $350 PF 2011 PF 2012 PF 2013 LTM Real Estate Tobacco Corporate & Other % Margin Summary Historical Financial Data 14 14 ($ Millions) Pro-Forma Historical Financial Data Pro-Forma Capital Expenditures Pro-Forma Adjusted Revenues (1) Pro-Forma Adjusted EBITDA(2) Pro-Forma Free Cash Flow(4) Note: Pro-Forma financials are presented assuming Vector’s acquisition of its additional 20.59% interest in Douglas Elliman, and the related purchase accounting adjustments, occurred at the beginning of each period presented. (1) Amounts include one-time purchase accounting adjustments to fair value for deferred revenues recorded in connection with the increase of the Company's ownership of Douglas Elliman on December 13, 2013. (2) Pro-Forma Adjusted EBITDA defined as Net Income before Interest, Taxes, Depreciation & Amortization, adjusted as described in the Appendix. Percentages reflect Pro-Forma Adjusted EBITDA as a percentage of Pro-Forma Adjusted Revenues. (3) 2013 and LTM results include the sale of 200 lots at Escena. (4) Pro-Forma Free Cash Flow defined as Pro-Forma Adjusted EBITDA less Pro-Forma Capital Expenditures as described in the Appendix. (3) (3) (3) (3) (3) (3) (3) (3)

Historical Stock Price Performance 15 15 0% 50% 100% 150% 200% 250% 300% 350% 400% Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Dec-13 VGR Dividend Adjusted Share Price S&P MidCap S&P 500 Index NYSE Arca Tobacco Index Dow Jones U.S. Real Estate Index 383.9% 153.1% 188.9% Vector Group Ltd. 1.00 1.13 1.44 1.13 1.36 1.94 2.28 2.20 2.80 3.84 S&P 500 1.00 1.12 1.16 0.71 0.88 0.99 0.99 1.12 1.46 1.53 S&P MidCap 1.00 1.07 1.15 0.72 0.97 1.21 1.17 1.36 1.79 1.89 NYSE Arca Tobacco 1.00 1.34 1.42 1.08 1.44 1.63 1.83 2.09 2.22 2.26 Dow Jones Real Estate 1.00 1.27 0.98 0.54 0.70 0.84 0.86 0.96 0.95 1.07 Historical Stock Price Performance 225.7% Note: The graph above compares the total annual return of Vector’s Common Stock, the S&P 500 Index, the S&P MidCap 400 Index, the NYSE Arca Tobacco Index, formerly known as the AMEX Tobacco Index, and the Dow Jones Real Estate Index for the period from December 31, 2005 through June 17, 2014. The graph assumes that all cash dividends and distributions were reinvested. Source: S&P Capital IQ. 106.6% Jun -14

Appendix 16

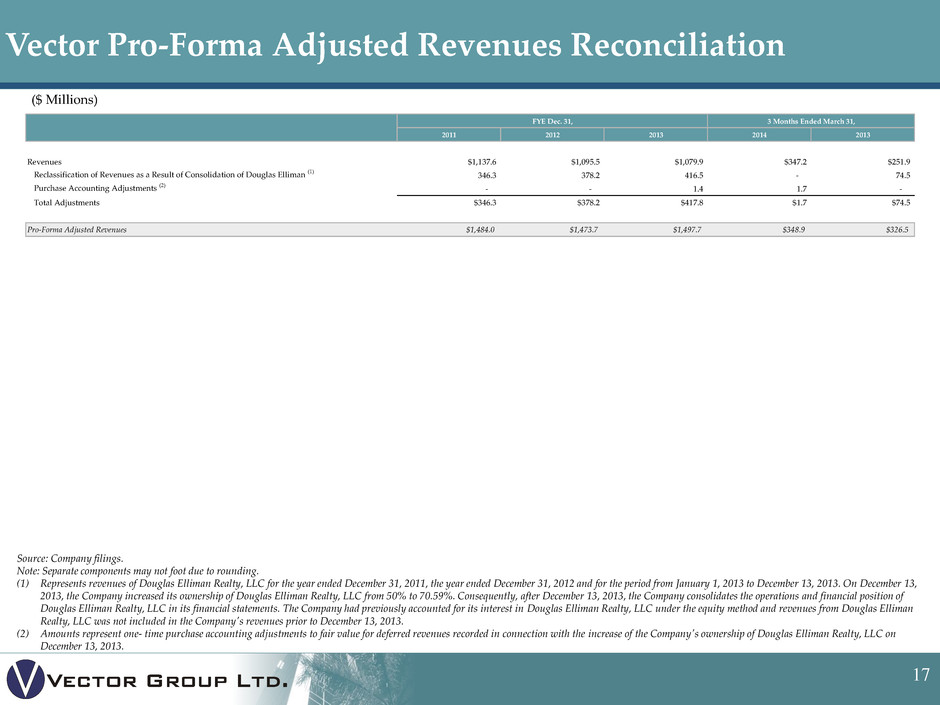

Summary Historical Financial Data 17 17 ($ Millions) Vector Pro-Forma Adjusted Revenues Reconciliation Source: Company filings. Note: Separate components may not foot due to rounding. (1) Represents revenues of Douglas Elliman Realty, LLC for the year ended December 31, 2011, the year ended December 31, 2012 and for the period from January 1, 2013 to December 13, 2013. On December 13, 2013, the Company increased its ownership of Douglas Elliman Realty, LLC from 50% to 70.59%. Consequently, after December 13, 2013, the Company consolidates the operations and financial position of Douglas Elliman Realty, LLC in its financial statements. The Company had previously accounted for its interest in Douglas Elliman Realty, LLC under the equity method and revenues from Douglas Elliman Realty, LLC was not included in the Company's revenues prior to December 13, 2013. (2) Amounts represent one- time purchase accounting adjustments to fair value for deferred revenues recorded in connection with the increase of the Company's ownership of Douglas Elliman Realty, LLC on December 13, 2013. FYE Dec. 31, 3 Months Ended March 31, 2011 2012 2013 2014 2013 Revenues $1,137.6 $1,095.5 $1,079.9 $347.2 $251.9 Reclassification of Revenues as a Result of Consolidation of Douglas Elliman (1) 346.3 378.2 416.5 - 74.5 Purchase Accounting Adjustments (2) - - 1.4 1.7 - Total Adjustments $346.3 $378.2 $417.8 $1.7 $74.5 Pro-Forma Adjusted Revenues $1,484.0 $1,473.7 $1,497.7 $348.9 $326.5

Summary Historical Financial Data 18 18 ($ Millions) Vector Adjusted EBITDA and Free Cash Flow Reconciliation Source: Company filings. Note: Free Cash Flow defined as Pro-Forma Adjusted EBITDA minus Pro-Forma Capital Expenditures Attributed to Vector Group Ltd. Separate components may not foot due to rounding. Note: Pro-Forma Adjusted EBITDA defined as Net Income before Interest, Taxes, Depreciation & Amortization. FYE Dec. 31, 3 Months Ended March 31, 2011 2012 2013 2014 2013 Net Income (loss) attributed to Vector Group Ltd. $75.0 $30.6 $38.9 $2.6 ($1.7) Interest Expense 100.7 110.1 132.1 35.5 33.4 Income Tax Expense (income) 48.1 23.1 24.8 2.9 (0.3) Net Income attributed to non-controlling interest - - - 0.9 - Depreciation and Amortization 10.6 10.6 12.6 7.1 2.6 EBITDA $234.5 $174.4 $208.5 $49.0 $34.0 Change in Fair Value of Derivatives Embedded Within Convertible Debt (8.0) 7.5 (18.9) 1.7 (3.0) Gain on Liquidation of Long-Term Investments (25.8) - - - - Equity Loss (Gain) on Long-Term Investments 0.9 1.3 (2.1) (0.9) 0.0 Loss (Gain) on Sale of Investment Securities Available for Sale (23.3) (1.6) (5.2) 0.1 (5.4) Equity Income From Non-Consolidated Real Estate Businesses (20.0) (29.8) (22.9) (1.6) (0.5) Gain on Townhomes (3.8) - - - - Loss on Extinguishment of Debt 1.2 - 21.5 - 21.5 Acceleration of Interest Expense Related to Debt Conversion - 15.0 12.4 3.7 - Stock-Based Compensation Expense 3.2 5.6 2.5 0.5 0.6 Litigation Settlement and Judgment Expense - - 88.1 1.5 - Impact of MSA Settlement - - (11.8) - (5.6) Gain on Acquisition of Douglas Elliman - - (60.8) - - Reclassification of EBITDA as a Result of the Consolidation of Douglas Elliman 31.0 31.6 46.6 - 0.9 Other, Net (1.7) (1.2) (7.6) (2.1) (0.8) Pro-Forma Adjusted EBITDA $188.1 $202.7 $250.3 $51.8 $41.6 Pro-Forma Adjusted EBITDA Attributed to Non-Controlling Interest (9.1) (9.3) (13.7) (2.2) (0.3) Pro-Forma Adjusted EBITDA Attributed to Vector Group Ltd. $179.0 $193.4 $236.6 $49.7 $41.3 Vector Group Ltd. Capital Expenditures 11.8 11.3 13.3 4.5 3.6 Douglas Elliman Capital Expenditures 2.5 4.6 4.3 1.9 0.7 Pro-Forma Capital Expenditures 14.3 15.9 17.6 6.5 4.3 Pro-Forma Capital Expenditures Attributed to Non-Controlling Interest (0.7) (1.4) (1.3) (0.4) (0.2) Pro-Forma Capital Expenditures Attributed to Vector Group Ltd. 13.6 14.6 16.3 6.1 4.1 Pro-Forma Free Cash Flow Attributed to Vector Group Ltd. $165.4 $178.8 $220.3 $43.6 $37.2