Attached files

| file | filename |

|---|---|

| EX-5 - OPINION AND CONSENT OF SYNERGEN LAW GROUP - NuZee, Inc. | exhibit51.htm |

| EX-16 - LETTER FROM ANTON & CHIA, LLP - NuZee, Inc. | exhibit162.htm |

| EX-10 - TRADEMARK LICENSE AGREEMENT WITH NATUREX RE: CEREBOOST - NuZee, Inc. | exhibit104.htm |

| EX-10 - TRADEMARK LICENSE AGREEMENT WITH NATUREX RE: SVETOL - NuZee, Inc. | exhibit103.htm |

| EX-16 - LETTER FROM MALONEBAILEY LLP - NuZee, Inc. | exhibit161.htm |

| EX-10 - SERVICE AGREEMENT WITH SAN DIEGO COFFEE - NuZee, Inc. | exhibit105.htm |

|

SECURITIES AND EXCHANGE COMMISSION | |||||||||||

|

Washington, D.C.20549 | |||||||||||

|

| |||||||||||

|

FORM S-1 | |||||||||||

|

| |||||||||||

|

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 | |||||||||||

|

| |||||||||||

|

|

| ||||||||||

|

|

NUZEE, INC. |

| |||||||||

|

|

(Exact name of registrant as specified in its charter) |

| |||||||||

|

|

|

| |||||||||

|

|

|

| |||||||||

|

|

NEVADA |

|

2080 |

|

000-55157 |

| |||||

|

|

(State or other jurisdiction of incorporation or organization) |

|

(Primary Standard Industrial Classification Code Number) |

|

(I.R.S. Employer Identification No.) |

| |||||

|

|

|

| |||||||||

|

|

|

| |||||||||

|

|

16955 Via Del Campo, Suite 260 San Diego, CA 92127 |

| |||||||||

|

|

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices) |

| |||||||||

|

|

|

| |||||||||

|

|

With Copies To: Karen A. Batcher, Esq. Synergen Law Group, APC 819 Anchorage Place, Suite 28 Chula Vista, CA 91914 Tel. 619.475.7882 Fax. 866.352.4342 |

| |||||||||

|

|

National Registered Agents Inc. of NV 1000 East Williams Street, Suite 204 Carson City, Nevada 89701 (800) 550-6724 |

| |||||||||

|

|

(Name, address, including zip code, and telephone number, including area code, of agent for service) |

| |||||||||

|

|

|

| |||||||||

|

|

|

| |||||||||

|

|

From time to time after this Registration Statement is declared effective. |

| |||||||||

|

|

(Approximate date of commencement of proposed sale to the public) |

| |||||||||

|

| |||||||||||

|

| |||||||||||

|

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: x | |||||||||||

|

| |||||||||||

|

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨ | |||||||||||

|

| |||||||||||

|

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨ | |||||||||||

|

| |||||||||||

|

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨ | |

|

| |

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b2 of the Exchange Act. | |

|

| |

|

Large accelerated filer ¨ |

Accelerated filer ¨ |

|

Non-accelerated filer ¨ (Do not check if a smaller reporting company) |

Smaller reporting company x |

Calculation of Registration Fee

|

Title of Each Class of Securities to be Registered |

Amount to be Registered |

Offering Price Per Share (1) |

Aggregate Offering Price |

Registration Fee |

|

Common Stock |

18,366,873 |

$0.50 |

$9,183,436.50 |

$1,182.83 |

(1) Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(a) under the Securities Act of 1933, as amended.

(2) Consists of shares of common stock held by 29 selling shareholders. Pursuant to Rule 416 of the Securities Act, this registration statement shall be deemed to cover additional securities (i) to be offered or issued in connection with any provision of any securities purported to be registered hereby to be offered pursuant to terms that provide for a change in the amount of securities being offered or issued to prevent dilution resulting from stock splits, stock dividends, or similar transactions and (ii) of the same class as the securities covered by this registration statement issued or issuable prior to completion of the distribution of the securities covered by this registration statement as a result of a split of, or a stock dividend paid with respect to, the registered securities.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON DATES AS THE COMMISSION, ACTING UNDER SAID SECTION 8(a), MAY DETERMINE.

2

Subject to Completion, Dated June 18, 2014

|

PROSPECTUS

18,366,873 Shares of Common Stock

NUZEE, INC.

We are registering a total of 18,366,873 shares of our common stock on behalf of the selling shareholders identified under the heading “Selling Shareholders” in this prospectus. The Selling Shareholders may sell their shares from time to time in the over-the-counter market or any exchange on which our company may be listed in the future at the prevailing market price or in negotiated transactions. Our shares are currently quoted on the e OTCQB tier of the marketplace maintained by OTC Markets Group, Inc. (“OTCQB”) under the symbol “NUZE”.

We are not selling any shares of our common stock in this offering and therefore will not receive any proceeds from the resale of our common stock pursuant to this offering.

INVESTING IN OUR COMMON STOCK INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD INVEST IN OUR COMMON STOCK ONLY IF YOU CAN AFFORD TO LOSE YOUR ENTIRE INVESTMENT. FOR A DISCUSSION OF SOME OF THE RISKS INVOLVED, SEE “RISK FACTORS” BEGINNING ON PAGE 6 OF THIS PROSPECTUS.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

THE DATE OF THIS PROSPECTUS IS JUNE 18, 2014.

3

TABLE OF CONTENTS

DETERMINATION OF OFFERING PRICE.. 13

INTERESTS OF NAMED EXPERTS AND COUNSEL.. 19

MARKET PRICE OF AND DIVIDENDS ON THE REGISTRANT’S. 26

COMMON EQUITY AND RELATED STOCKHOLDER MATTERS. 26

SUPPLEMENTARY FINANCIAL INFORMATION.. 44

MANAGEMENT’S DISCUSSION AND ANALYSIS OF. 44

FINANCIAL CONDITION AND RESULTS OF OPERATIONS. 44

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS. 47

ON ACCOUNTING AND FINANCIAL DISCLOSURE.. 47

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.. 48

DIRECTORS AND EXECUTIVE OFFICERS. 48

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT.. 54

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS. 55

DISCLOSURE OF COMMISSION POSITION OF. 56

INDEMNIFICATION FOR SECURITIES ACT LIABILITIES. 56

4

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. It does not contain all of the information that you should consider before investing in our common stock. You should read the entire prospectus carefully, including the section titled “Risk Factors” and our consolidated financial statements and the related notes. You should only rely on the information contained in this prospectus. We have not, and the selling shareholders have not, authorized any other person to provide you with different information. This prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any state where the offer or sale is not permitted. The information in this prospectus is accurate only as of the date on the front cover, but the information may have changed since that date.

Unless the context otherwise requires, when we use the words “the Company,” “we,” “us” or “our Company” in this prospectus, we are referring to Nuzee, Inc., a Nevada corporation.

OUR COMPANY

Nuzee Inc. is the operating company that manages a portfolio of branded consumer packaged goods. The Company was incorporated in July 2011 as Havana Furnishings, Inc. (“Havana”) under the laws of the State of Nevada. From the date of Incorporation through April 2013, the Company was a development stage company engaged in the business of selling public restaurant and bar furnishings and accessories from Asia to retailer customers at wholesale prices on the internet. In April 2013, the Company's sole officer decided that it was not economically feasible to continue with the Company’s business plan and began to seek other companies for potential merger.

On April 19, 2013, the Company completed a merger with Nuzee Co., Ltd. a California corporation “Nuzee-CA”) wherein Nuzee Co., Ltd. became a wholly owned subsidiary of Havana. Pursuant to the Share Exchange Agreement, each of the 33,733,333 outstanding shares of Nuzee-CA common stock was converted into one share of the Company’s common stock. In addition, upon the closing of the Merger, the Company amended its Articles of Incorporation to change its name from Havana Furnishings, Inc. to Nuzee, Inc. Nuzee-CA was established in 2011 as an importer and distributor of natural spring water and skincare products as well as energy drinks.

In December, 2013, we completed a merger with our wholly owned subsidiary, Nuzee Co., Ltd. wherein Nuzee Co., Ltd. merged with and into Nuzee, Inc. Nuzee, Inc. was the surviving company of the merger, and at the closing of the merger, Nuzee Co., Ltd. ceased to exist.

Our global corporate headquarters is located in San Diego, California. When we refer to our company and its business in this report, we are referring to the business and activities of our consolidated operations.

To date, we mainly distributed natural and organic products produced by 3rd parties. These legacy product lines which included New Zealand bottled spring water, natural and organic skincare from New Zealand as well as the TorqueTM energy drinks are being phased out and/or discontinued as the Company believes its best near and long term success is to focus resources on our own product line of functional beverages which will enable the Company to control, develop, manufacture and promote its brands from the United States.

During the 2013 fiscal year we began researching and investigating the viability of a new product platform for functional beverages. We plan to start producing our first family of functional beverages in early 2014. These products are considered healthy alternatives, with all natural ingredients and provide an added wellness benefit when compared to the traditional non-fortified version of the same beverage. As a result, Nuzee’s mission is to be a good-for-you company focused on building beverage brands that offer functional and nutritional benefits.

EMERGING GROWTH COMPANY

We are an Emerging Growth Company as defined in the Jumpstart Our Business Startups Act.

We shall continue to be deemed an emerging growth company until the earliest of:

5

(A) the last day of the fiscal year of the issuer during which it had total annual gross revenues of $1,000,000,000 (as such amount is indexed for inflation every 5 years by the Commission to reflect the change in the Consumer Price Index for All Urban Consumers published by the Bureau of Labor Statistics, setting the threshold to the nearest 1,000,000) or more;

(B) the last day of the fiscal year of the issuer following the fifth anniversary of the date of the first sale of common equity securities of the issuer pursuant to an effective registration statement under this title;

(C) the date on which such issuer has, during the previous 3-year period, issued more than $1,000,000,000 in non-convertible debt; or

(D) the date on which such issuer is deemed to be a ‘large accelerated filer’, as defined in section 240.12b-2 of title 17, Code of Federal Regulations, or any successor thereto.

As an emerging growth company we are exempt from Section 404(b) of Sarbanes Oxley. Section 404(a) requires Issuers to publish information in their annual reports concerning the scope and adequacy of the internal control structure and procedures for financial reporting. This statement shall also assess the effectiveness of such internal controls and procedures.

Section 404(b) requires that the registered accounting firm shall, in the same report, attest to and report on the assessment on the effectiveness of the internal control structure and procedures for financial reporting.

As an emerging growth company we are exempt from Section 14A and B of the Securities Exchange Act of 1934 which require the shareholder approval of executive compensation and golden parachutes.

We have irrevocably opted out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the Act.

For so long as we are an emerging growth company, we will be permitted to provide the scaled executive compensation disclosure applicable to smaller reporting companies even if we no longer qualify as a smaller reporting company. In addition, as an emerging growth company, we are exempt from PCAOB rules regarding mandatory firm rotation or the auditor reporting model.

GOING CONCERN

MaloneBailey, LLP, our independent auditor, has expressed substantial doubt about our ability to continue as a going concern given our recurring losses, large accumulated deficits, dependence on the shareholder to provide additional funding for operating expenses, and no recurring revenues. Potential investors should be aware that there are difficulties associated with being a new venture, and the high rate of failure associated with this fact.

THE OFFERING

The following is a brief summary of this offering:

|

Common stock outstanding prior to this offering (as of June 16, 2014) |

29,865,357 |

|

Common stock being offered for resale to the public through this offering |

18,366,873 |

|

Common stock outstanding after this offering |

29,865,357 |

|

Percentage of outstanding common stock to be registered |

63.35% |

6

RISK FACTORS

In addition to the other information set forth in this report, you should carefully consider the following factors, which could materially affect our business, financial condition or results of operations in future periods. The risks described below are not the only risks facing our company. Additional risks not currently known to us or that we currently deem to be immaterial also may materially adversely affect our business, financial condition or results of operations in future periods.

RISKS RELATED TO OUR COMPANY

If we cannot sustain profitable operations, we will need to raise additional capital to continue our operations, which may not be available on commercially reasonable terms, or at all, and which may dilute your investment.

We generated a net loss of $1,097,980 for the year ended September 30, 2013 and therefore we cannot guarantee that we will be successful in building a functional beverage business in future periods.

If we are unable to generate sufficient revenues to pay our expenses and our existing sources of cash and cash flows are otherwise insufficient to fund our activities, we will need to raise additional funds to continue our operations. We do not have any arrangements in place to provide additional funds. If needed, those funds may not be available on favorable terms, or at all. Furthermore, if we issue equity or debt securities to raise additional funds, our existing stockholders may experience dilution, and the new equity or debt securities may have rights, preferences and privileges senior to those of our existing stockholders. If we are unsuccessful in sustaining profitability and reducing our accumulated deficit, and we cannot obtain additional funds on commercially reasonable terms or at all, we may be required to curtail significantly or cease our operations.

Because we have a limited operating history, our ability to fully and successfully develop our business is unknown.

Nuzee Co, Ltd. was incorporated in California in 2011 prior to the merger with Havana Furnishings as a result we have only recently begun developing and producing our functional products, and do not have a significant operating history with which investors can evaluate our business. Our ability to successfully develop our products and to realize consistent, meaningful revenues and profit has not been established and cannot be assured. For us to achieve success, our products must receive broad market acceptance by consumers. Without this market acceptance, we will not be able to generate sufficient revenue to continue our business operation. If our products are not widely accepted by the market, our business may fail.

Our independent auditor has indicated substantial doubt about our ability to continue as a going concern.

MaloneBailey, LLP, our independent auditor, has expressed substantial doubt about our ability to continue as a going concern given our recurring losses, large accumulated deficits, dependence on the shareholder to provide additional funding for operating expenses, and no recurring revenues. Potential investors should be aware that there are difficulties associated with being a new venture, and the high rate of failure associated with this fact.

Our financial statements included with this prospectus have been prepared assuming that we will continue as a going concern. If we are not able to achieve revenues, then we may not be able to continue as a going concern and our financial condition and business prospects will be adversely affected.

Our ability to achieve and maintain profitability and positive cash flow is dependent upon our ability to generate revenues, manage development costs and expenses, and compete successfully with our direct and indirect competitors.

Based upon current plans, we expect to incur operating losses in future periods. This will happen because there are expenses associated with the development, production, marketing, and sales of our product. As a result, we may not generate significant revenues in the future. Failure to generate significant revenues in near future may cause us to suspend or cease activities.

We will need additional funds to produce, market, and distribute our product.

We will have to spend additional funds to produce, market and distribute our product. If we cannot raise sufficient capital, we may have to cease operations and you could lose your investment.

7

There is no guarantee that sufficient sale levels will be achieved.

There is no guarantee that the expenditure of money on distribution and marketing efforts will translate into sales or sufficient sales to cover our expenses and result in profits. Consequently, there is a risk that you may lose all of your investment.

Our development, marketing, and sales activities are limited by our size.

Because we are small and do not have significant capital reserves, we must limit our product development, marketing, and sales activities. As such we may not be able to scale our production and business development activities to the level required. If this becomes a reality, we may not ever generate revenues and you will lose your investment.

Changes in the nutritional beverage business environment and retail landscape could adversely impact our financial results.

The nutritional and functional beverage business environment is rapidly evolving as a result of, among other things, changes in consumer preferences, including changes based on health and nutrition considerations and obesity concerns; shifting consumer tastes and needs; changes in consumer lifestyles; and competitive product and pricing pressures. In addition, the nutritional beverage retail landscape is very dynamic and constantly evolving, not only in emerging and developing markets, where modern trade is growing at a faster pace than traditional trade outlets, but also in developed markets, where discounters and value stores, as well as the volume of transactions through e-commerce, are growing at a rapid pace. If we are unable to successfully adapt to the rapidly changing environment and retail landscape, our share of sales, volume growth and overall financial results could be negatively affected.

Intense competition and increasing competition in the commercial beverage market could hurt our business.

The commercial retail beverage industry, and in particular the functional beverage segment is still nascent and viewed as highly competitive. Market participants are of various sizes, with various market shares and geographical reach, some of whom have access to substantially more sources of capital.

We will compete generally with many liquid refreshments, including numerous specialty beverages, such as hot and cold coffee and teas.

We will compete indirectly with major international beverage companies including but not limited to: Green Mountain Coffee Roasters, the Coca-Cola Company; PepsiCo, Inc.; Nestlé; Kraft Foods Group, Inc.; and Starbucks. These companies have established market presence in the United States, and offer a variety of beverages that are substitutes to our product. We face potential direct competition from such companies, because they have the financial resources, and access to manufacturing and distribution channels to rapidly enter the health food and beverage market.

We will compete directly with other consumer products participants in the emerging functional beverage sector including BulletProof Coffee, Green Mountain Wellness Coffee, Organo Gold Herbal Coffee, Nuvia Trim Coffee, South Beach Java, Javita, and NatureGift Instant Coffee. These companies could bolster their position in the sector through additional expenditure and promotion.

As a result of both direct and indirect competition, our ability to successfully distribute, market and sell our product, and to gain sufficient market share in the United States and internationally to realize profits may be limited, greatly diminished, or totally diminished, which may lead to partial or total loss of your investments in our company.

8

Our growth and profitability depends on the performance of third-parties and our relationship with them.

A significant portion of our distribution network and its success depend on the performance of third parties. Any non-performance or deficient performance by such parties may undermine our operations, profitability, and result in total loss to your investment. To distribute our product, we will use a broker-distributor-retailer network whereby brokers represent our products to distributors and retailers who will in turn sell our product to consumers. The success of this network will depend on the performance of the brokers, distributors and retailers of this network. There is a risk that a broker, distributor, or retailer may refuse to or cease to market or carry our product. There is a risk that the mentioned entities may not adequately perform their functions within the network by, without limitation, failing to distribute to sufficient retailers or positioning our product in localities that may not be receptive to our product. Furthermore, such third-parties’ financial position or market share may deteriorate, which could adversely affect our distribution, marketing and sale activities. We also need to maintain good commercial relationships with third-party brokers, distributors and retails so that they will promote and carry our product. Any adverse consequences resulting from the performance of third-parties or our relationship with them could undermine our operations, profitability and may result in total loss of your investment.

We depend on third party manufacturers and ingredients providers to produce all of our products.

Our reliance on third party manufacturers and providers exposes us to a number of risks that are beyond our control, including:

· Unexpected increases in production costs;

· Unexpected scheduling delays;

· Unexpected shortage of ingredients;

· Loss of priority assignment of any and all supplies and materials;

· The failure from any of our partners to deliver components or finished goods.

Health benefits of the functional ingredients are not guaranteed.

Although we use ingredient backed by clinical studies that support our claims such health benefits to individuals are not guaranteed. Consequently, negative studies and publicity surrounding any of our ingredients may result in loss of market share or potential market share and hence loss of your investment.

Significant additional labeling or warning requirements or limitations on the availability of our product may inhibit sales of affected products.

Various jurisdictions may seek to adopt significant additional product labeling or warning requirements or limitations on the availability of our product relating to the content or perceived adverse health consequences of our product. If these types of requirements become applicable to our product under current or future environmental or health laws or regulations, they may inhibit sales of our product.

Unfavorable general economic conditions in the United States or elsewhere could negatively impact our financial performance.

Unfavorable general economic conditions, such as a recession or economic slowdown, in the United States could negatively affect the affordability of, and consumer demand for, our product in the United States. Under difficult economic conditions, consumers may seek to reduce discretionary spending by forgoing purchases of our products or by shifting away from our beverages to lower-priced products offered by other companies. Lower consumer demand for our product in the United States could reduce our profitability.

We will rely primarily on the United States and Keurig brewer households to generate adoption and use in our products.

The consumer acceptance for Keurig brewers could decline and negatively impact the market size and growth potential. We are attempting to develop other geographic markets and single-serve brewer platforms for our products, in Asia and other markets. We are looking for opportunities to generate additional significant customers to reduce our risk associated with customer concentration. We can make no assurance, however, that we will succeed in diversifying our customer base, developing other geographic markets or in becoming less reliant on a small number of significant customers.

9

If we do not compete effectively in the functional beverage market, our revenues and market share will decline.

The markets for Coffee Blenders are highly competitive. We face competition from larger and better capitalized competitors such as Green Mountain Coffee Roasters, Inc. and many nutraceutical beverage firms which have significantly greater penetration in key markets than we do. Economies of scale allow these competitors to offer product pricing and related incentives that we may be unable to match. We also face competition from a number of smaller competitors. These competitors may be able to:

- develop better and more variety of products

- develop less expensive products

- develop broader channels

- as well as the ability to respond more rapidly to changing market conditions

If we are not successful in enhancing our products, maintaining customer relationships and managing our cost structure so that we can provide competitive prices, we may experience reduced sales and our potential market share may decline.

Our competitive position could be seriously damaged and we may incur substantial expenses if we become party to lawsuits alleging that our products infringe the intellectual property rights of others.

The technology around K-CUP®, K-Cup Brewers and related Keurig know-how and processes may impact our ability and/or our partner’s ability to deliver finished goods.

If we are forced to take any of the foregoing legal actions to defend our products, we could face substantial costs and shipment delays and our business could be seriously harmed. Although we carry general liability insurance, our insurance may not cover potential claims of this type or be adequate to indemnify us for all liability that may be imposed.

In addition, it is possible that our distribution partners or manufacturing partners may seek indemnity from us in the event that our products are found or alleged to infringe upon the intellectual property rights of others. Any such claim for indemnity could result in substantial expenses to us that could harm our operating results.

Our international sales and operations subject us to various risks associated with, among other things, foreign laws, policies, economies, and exchange rate fluctuations.

All of our international sales and operations are subject to inherent risks, which could have a material adverse effect on our financial condition or results of operations. Each country has their own regulations regarding food safety and ingredient panel disclosures. Our ability to meet those requirements may prevent us from launching products or force us to reverse orders and business.

Adverse weather conditions could reduce the supply or demand for our products.

The sales of our products are influenced to some extent by weather conditions in the markets in which we operate. Also the supply of our raw ingredients could be impacted by adverse weather that increase cost or reduce availability.

Because the majority of our sales are denominated in United States dollars, changes in foreign currency exchange rates affect the market price for our products in countries in which they are sold. If the currency of a particular country weakens against the United States dollar, the cost of our products in that country may increase.

If we are unable to attract and retain key personnel necessary to operate our business, our ability to develop and market our products successfully could be harmed.

We have a small employee base and depend substantially on our current executive officers and key sales, and operational employees. The loss of key employees or the inability to attract or retain qualified personnel, could delay product development and harm our ability to sell our products. Our success depends on our ability to identify, attract and retain qualified management, sales, and marketing personnel.

10

A substantial portion of our sales are completed on a purchase order basis. Although these purchase orders are generally not cancelable, customers may decide to delay or cancel orders, which could negatively impact our revenues.

Orders covered by firm purchase orders are generally not cancelable; however, customers may decide to delay or cancel orders. In the event that we experience any delays or cancellations, we may have difficulty enforcing the provisions of the purchase order and our revenues could decline substantially. Any such decline could result in us incurring net losses, increasing our accumulated deficit and needing to raise additional capital to fund our operations.

Changes in, or failure to comply with, the laws and regulations applicable to our products or our business operations could increase our costs or reduce our net operating revenues.

The advertising, distribution, labeling, production, safety, sale, and transportation in the United States of our company’s product will be subject to: the Federal Food, Drug, and Cosmetic Act; the Federal Trade Commission Act; the Lanham Act; state consumer protection laws; competition laws; federal, state, and local workplace health and safety laws, such as the Occupational Safety and Health Act; various federal, state and local environmental protection laws; and various other federal, state, and local statutes and regulations. Legal requirements also apply in many jurisdictions in the United States requiring that deposits or certain eco taxes or fees be charged for the sale, marketing, and use of certain non-refillable beverage containers. The precise requirements imposed by these measures vary. Other types of statutes and regulations relating to beverage container deposits, recycling, eco taxes and/or product stewardship also apply in various jurisdictions in the United States. We anticipate that additional, similar legal requirements may be proposed or enacted in the future at the local, state and federal levels in the United States. Changes to such laws and regulations could increase our costs or reduce or net operating revenues.

RISK RELATED TO OUR STOCK

Because Nuzee ownership is concentrated with the Chairman controlling a large percentage of our common stock, he has the ability to influence matters affecting our stockholders.

As a result, he has the ability to influence matters affecting our stockholders, including the election of our directors, the acquisition or disposition of our assets, and the future issuance of our shares of common stock. Because he controls such shares, investors may find it difficult to replace our management if they disagree with the way our business is being operated. Because their interest could result in management making decisions that are in their best interest and not in the best interest of the general investor base, you may lose some or all of the value of your investment in our common stock.

Because we can issue additional shares of common stock, our stockholders may experience dilution in the future.

We are authorized to issue up to 100,000,000 shares of common stock and 100,000,000 shares of preferred stock, of which 37,957,790 shares of common stock and no share of preferred stock are issued and outstanding as of the date hereof. Our board of directors has the authority to cause us to issue additional shares of common stock, and to determine the rights, preferences and privileges of such shares, without consent of any of our stockholders. Consequently, the stockholders may experience more dilution in their ownership of our stock in the future.

Our common stock is quoted on the OTC Markets, which may be detrimental to investors.

Our common stock is currently quoted on the OTC Markets. Stocks quoted on the OTC Markets generally have limited trading volume and exhibit a wider spread between the bid and ask quotations as compared to stocks traded on national exchanges. Accordingly, you may not be able to sell your shares quickly or at the market price if trading in our stock is not active.

11

Trading on the OTC Markets and Bulletin Board exchanges may be volatile and sporadic, which could depress the market price of our common stock and make it difficult for our stockholders to resell their shares.

Our common stock is quoted on the OTC Markets and Bulletin Board. Trading in stock quoted on the OTC Markets is often thin and characterized by wide fluctuations in trading prices, due to many factors that may have little to do with our operations or business prospects. This volatility could depress the market price of our common stock for reasons unrelated to operating performance. Moreover, the OTC Markets is not a stock exchange, and trading of securities on the OTC Markets is often more sporadic than the trading of securities listed on a quotation system like NASDAQ a stock exchange like the NYSE. Accordingly, stockholders may have difficulty reselling any of the shares.

A decline in the price of our common stock could affect our ability to raise further working capital, it may adversely impact our ability to continue operations and we may go out of business.

A prolonged decline in the price of our common stock could result in a reduction in the liquidity of our common stock and a reduction in our ability to raise capital. Because we may attempt to acquire a significant portion of the funds we need in order to conduct our planned operations through the sale of equity securities, a decline in the price of our common stock could be detrimental to our liquidity and our operations because the decline may cause investors not to choose to invest in our stock. If we are unable to raise the funds we require for all our planned operations, we may be forced to reallocate funds from other planned uses and may suffer a significant negative effect on our business plan and operations, including our ability to develop new products and continue our current operations. As a result, our business may suffer, and not be successful and we may go out of business. We also might not be able to meet our financial obligations if we cannot raise enough funds through the sale of our common stock and we may be forced to go out of business.

Because we do not intend to pay any cash dividends on our shares of common stock in the near future, our stockholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common stock in the near future. The declaration, payment and amount of any future dividends will be made at the discretion of the board of directors, and will depend upon, among other things, the results of operations, cash flows and financial condition, operating and capital requirements, and other factors as the board of directors considers relevant. There is no assurance that future dividends will be paid, and if dividends are paid, there is no assurance with respect to the amount of any such dividend. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them.

Our stock is a penny stock. Trading of our stock may be restricted by the SEC’s penny stock regulations which may limit a stockholder’s ability to buy and sell our stock.

Our stock is a penny stock. The Securities and Exchange Commission (“SEC”) has adopted Rule 15g-9 which generally defines “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and “accredited investors”. The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock.

12

FINRA sales practice requirements may also limit a stockholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules promulgated by the SEC, the Financial Industry Regulatory Authority (“FINRA”) has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, the FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock.

USE OF PROCEEDS

We will not receive any proceeds from the sale of the common stock offered through this prospectus by the selling shareholders.

DETERMINATION OF OFFERING PRICE

The selling stockholders may offer their shares through public or private transactions, on or off OTCBB, at prevailing market prices, or at privately negotiated prices. Although our stock is currently listed on the OTCQB tier of the marketplace maintained by OTC Markets Group, Inc. under the symbol “NUZE,” no market for our shares has materialized. Therefore, we determined the price of our public offering based to the last sale price of our common stock to investors.

DILUTION

The common stock to be sold by the selling shareholders is common stock that is currently issued and outstanding. Accordingly, there will be no dilution to our existing shareholders.

SELLING SHAREHOLDERS

The selling shareholders named in this prospectus are offering all of the 18,366,873 shares of common stock offered through this prospectus. The following table provides, as of the date of this prospectus, information regarding the beneficial ownership of our common stock held by each of the selling shareholders, including:

1. The number of shares owned by each prior to this offering;

2. The total number of shares that are to be offered by each;

3. The total number of shares that will be owned by each upon completion of the offering;

4. The percentage owned by each upon completion of the offering; and

5. The identity of the beneficial holder of any entity that owns the shares.

13

|

Name of Selling Shareholder |

Shares Owned Prior to this Offering |

Shares Being Offered |

Shares Held Upon Completion of this Offering (1) |

Percent Owned Upon Completion of this Offering (2) |

|

Arata Matsushima (3) |

1,520,000 |

760,000 |

760,000 |

2.54 |

|

Atsuo Hirayama |

10,000 |

10,000 |

0 |

0 |

|

Aura A. Nieto De Almanza |

40,000 |

40,000 |

0 |

0 |

|

Ayako Ogawa |

4,167 |

4,167 |

0 |

0 |

|

Ayako Terai |

10,000 |

10,000 |

0 |

0 |

|

Azusa Nakahara |

20,833 |

20,833 |

0 |

0 |

|

Bolivar De Sedas |

40,000 |

40,000 |

0 |

0 |

|

Chika Ono |

10,000 |

10,000 |

0 |

0 |

|

Chikako Sumida |

10,000 |

10,000 |

0 |

0 |

|

Contribution Co., Ltd. (4) |

41,667 |

41,667 |

0 |

0 |

|

Craig Hagopian (5) |

1,216,000 |

608,000 |

608,000 |

2.04 |

|

Daisuke (Sachi) Takemura |

20,833 |

20,833 |

0 |

0 |

|

Eguchi Steel Co., Ltd. (6) |

200,000 |

200,000 |

0 |

0 |

|

Eiji Yamaguchi |

20,833 |

20,833 |

0 |

0 |

|

Eri Fushimi |

100,000 |

100,000 |

0 |

0 |

|

Eric Enrique Morales Del Sed |

60,000 |

60,000 |

0 |

0 |

|

Eugenio Martinez Valencia |

60,000 |

60,000 |

0 |

0 |

|

Fumiko Morikage |

10,000 |

10,000 |

0 |

0 |

|

Fusako Eguchi |

140,000 |

140,000 |

0 |

0 |

|

Geraldine M. Auila O. |

40,000 |

40,000 |

0 |

0 |

|

GTP-1(7) |

766,667 |

766,667 |

0 |

0 |

|

Hideyuki Kawaguchi |

62,500 |

62,500 |

0 |

0 |

|

Hiroyasu Kato |

20,000 |

20,000 |

0 |

0 |

|

Hiroyuki Sakaguchi |

20,000 |

20,000 |

0 |

0 |

|

Hitoshi Koda |

10,000 |

10,000 |

0 |

0 |

|

Hutex Corporation (8) |

20,000 |

20,000 |

0 |

0 |

|

Isamu Kurita |

20,000 |

20,000 |

0 |

0 |

|

Jackeline Sharpe |

60,000 |

60,000 |

0 |

0 |

|

Juan Gonzalez Reyes |

60,000 |

60,000 |

0 |

0 |

|

Jun Endo |

10,000 |

10,000 |

0 |

0 |

|

Junpei Ando |

20,000 |

20,000 |

0 |

0 |

|

Kan Yoo Park |

10,000 |

10,000 |

0 |

0 |

|

Karen De Sedas |

40,000 |

40,000 |

0 |

0 |

|

Karina Velasquez Banilla |

40,000 |

40,000 |

0 |

0 |

|

Karla Rodriquez De De Urriola |

60,000 |

60,000 |

0 |

0 |

|

Katsunori Ohtani |

62,500 |

62,500 |

0 |

0 |

14

|

Katsuyoshi Eguchi |

828,800 |

828,800 |

0 |

0 |

|

Kazuaki Hirayama |

20,000 |

20,000 |

0 |

0 |

|

Kazuki Nakao |

20,833 |

20,833 |

0 |

0 |

|

Kazumi Ikeda |

1,342,133 |

1,282,133 |

60,000 |

0.20 |

|

Kazunobu Izue |

10,000 |

10,000 |

0 |

0 |

|

Kazushige Okumura |

10,000 |

10,000 |

0 |

0 |

|

Keisuke Yagami |

10,000 |

10,000 |

0 |

0 |

|

Ken Saito |

20,000 |

20,000 |

0 |

0 |

|

Kenji Matsuba |

20,389 |

20,389 |

0 |

0 |

|

Kenta Ono |

10,000 |

10,000 |

0 |

0 |

|

Ko Ukai |

10,000 |

10,000 |

0 |

0 |

|

Koichi Murayama |

30,000 |

30,000 |

0 |

0 |

|

Koichi Nakamura |

333,333 |

333,333 |

0 |

0 |

|

Kotaro Shiozawa |

100,000 |

100,000 |

0 |

0 |

|

Kozo Yamakita |

333,333 |

333,333 |

0 |

0 |

|

Leonardo Cubilla |

60,000 |

60,000 |

0 |

0 |

|

Lilia Rosa Aguilar B. |

60,000 |

60,000 |

0 |

0 |

|

Lohas and Company, Ltd.(9) |

333,333 |

333,333 |

0 |

0 |

|

Luis E. Rodiguez |

60,000 |

60,000 |

0 |

0 |

|

Luis Enrique Hernandez |

40,000 |

40,000 |

0 |

0 |

|

Mahito Morikage |

10,000 |

10,000 |

0 |

0 |

|

Makoto Mori |

200,000 |

200,000 |

0 |

0 |

|

Manami Nagata |

10,000 |

10,000 |

0 |

0 |

|

Maria Del C. Nieto M. |

40,000 |

40,000 |

0 |

0 |

|

Masaaki Nagase |

85,417 |

85,417 |

0 |

0 |

|

Masaaki Naruse |

10,000 |

10,000 |

0 |

0 |

|

Masakazu Shigemori |

20,833 |

20,833 |

0 |

0 |

|

Masateru Higashida (10) |

14,233,633 |

7,116,817 |

7,116,816 |

23.83 |

|

Masato Hoshikawa |

10,000 |

10,000 |

0 |

0 |

|

Mayumi Sakai |

10,000 |

10,000 |

0 |

0 |

|

Miho Naruse |

10,418 |

10,418 |

0 |

0 |

|

Minaru Nishihira |

10,000 |

10,000 |

0 |

0 |

|

Mitsujiro Oike |

224,277 |

224,277 |

0 |

0 |

|

Mitzila Espinosa |

60,000 |

60,000 |

0 |

0 |

|

Myung Soon Kim |

100,000 |

100,000 |

0 |

0 |

|

Naho Eguchi |

20,000 |

20,000 |

0 |

0 |

|

Naoki Sugiura |

10,000 |

10,000 |

0 |

0 |

|

Nobuaki Suzuki |

20,000 |

20,000 |

0 |

0 |

|

Nobuyuki Hiroya |

333,333 |

273,333 |

60,000 |

0.20 |

|

Norihiko Sumida |

10,000 |

10,000 |

0 |

0 |

|

Noriko Sugimoto |

60,000 |

60,000 |

0 |

0 |

|

Noritoshi Terai |

10,000 |

10,000 |

0 |

0 |

|

Oscar Rodriguez |

60,000 |

60,000 |

0 |

0 |

|

Oscar Rodriguez |

60,000 |

60,000 |

0 |

0 |

15

|

Raimundo Barragan |

60,000 |

60,000 |

0 |

0 |

|

Ri Park |

68,657 |

68,657 |

0 |

0 |

|

Ryoji Masuda |

20,833 |

20,833 |

0 |

0 |

|

Saori Harayama |

10,000 |

10,000 |

0 |

0 |

|

Satoru Yukie (11) |

1,520,000 |

760,000 |

760,000 |

2.54 |

|

Seiko Okumura |

10,000 |

10,000 |

0 |

0 |

|

Scott Rieger |

20,000 |

20,000 |

0 |

0 |

|

Shinichi Harada |

10,000 |

10,000 |

0 |

0 |

|

Shun Nakamura |

10,000 |

10,000 |

0 |

0 |

|

Stefeno Cerutti |

60,000 |

60,000 |

0 |

0 |

|

Steven I. Bellach Revocable Living Trust (12) |

40,000 |

40,000 |

0 |

0 |

|

Takafumi Suzue |

10,000 |

10,000 |

0 |

0 |

|

Takao Kino |

10,000 |

10,000 |

0 |

0 |

|

Takayuki Naruse |

20,302 |

20,302 |

0 |

0 |

|

Tatsuya Takase |

10,000 |

10,000 |

0 |

0 |

|

Teodolinda Bethancourt |

40,000 |

40,000 |

0 |

0 |

|

Teppei Urayama |

10,000 |

10,000 |

0 |

0 |

|

Teruko Shirai |

10,000 |

10,000 |

0 |

0 |

|

Tomohiro Morimoto |

20,833 |

20,833 |

0 |

0 |

|

Tomoki Kato |

120,000 |

120,000 |

0 |

0 |

|

Tomotaka Suzuki |

31,250 |

31,250 |

0 |

0 |

|

Torus International Enterprises Limited (13) |

333,333 |

273,333 |

60,000 |

0.20 |

|

Toshihiro Tsukada |

104,165 |

104,165 |

0 |

0 |

|

Travis Gorney |

1,520,000 |

760,000 |

760,000 |

2.54 |

|

Tsutomu Sakurai |

20,000 |

20,000 |

0 |

0 |

|

Tsuyoshi Sugimoto |

10,000 |

10,000 |

0 |

0 |

|

Tsuyoshi(Takeshi) Shirai |

104,167 |

104,167 |

0 |

0 |

|

Tyseth S. Esquivel |

60,000 |

60,000 |

0 |

0 |

|

Yasuji Otsubo |

40,000 |

40,000 |

0 |

0 |

|

Yasuyuki Harayama |

10,000 |

10,000 |

0 |

0 |

|

Yoshiaki Egami |

41,667 |

41,667 |

0 |

0 |

|

Yoshiki Nakamura |

20,000 |

20,000 |

0 |

0 |

|

Yuichi Suzuki |

10,417 |

10,417 |

0 |

0 |

|

Yukino Niimi |

10,000 |

10,000 |

0 |

0 |

|

Yuko Takase |

10,000 |

10,000 |

0 |

0 |

|

Yusuke Fukatsu |

10,000 |

10,000 |

0 |

0 |

|

Yutaka Misasagawa |

10,000 |

10,000 |

0 |

0 |

|

TOTAL |

28,551,689 |

18,366,873 |

10,184,816 |

34.09 |

(1) Assumes that all of the shares offered hereby are sold and that shares owned before the offering but not offered hereby are not sold.

(2) Based on 29,865,357 shares of common stock outstanding on May 28, 2014.

(3) Arata Matsushima is a Director of the Company.

(4) The person with voting and investment control over the securities held by Contribution Co., Ltd. is Mr. Hikaru Taguchi.

(5) Craig Hagopian is the President, Chief Executive Officer Director of the Company.

(6) The person with voting and investment control over the securities held by Eguchi Steel Co., Ltd. is Katsuyoshi Eguchi.

(7) The person with voting and investment control over the securities held by GTP-1 is Naomichi Yamaguchi.

(8) The person with voting and investment control over the securities held by Hutex Corporation is Katsuyoshi Eguchi.

(9) The person with voting and investment control over the securities held by Lohas and& Company, Ltd. is Kenichi Miura.

16

(10) Masateru (“Masa”) Higashida is a Director of the Company.

(11) Satoru Yukie is the Chief Financial Officer, Treasurer, Secretary, Chief Operations Officer, and a Director of the Company.

(12) The person with voting and investment control over the securities held by Steven I. Bellach Revocable Living Trust is Steven I. Bellach.

(13) The person with voting and investment control over the securities held by Torus International Enterprises, Ltd. is Katsuyoshi Eguchi.

Other than those noted above, none of the selling shareholders:

a) has had a material relationship with us other than as a shareholder at any time within the past three years; or

b) has ever been one of our officers or directors.

PLAN OF DISTRIBUTION

The selling shareholders may sell some or all of their common stock in one or more transactions, including block transactions:

(1) On such public markets as the common stock may from time to time be trading;

(2) In privately negotiated transactions;

(3) Through the writing of options on the common stock;

(4) In short sales; or

(5) In any combination of these methods of distribution.

The sales price to the public is fixed at $0.50 per share until such time as the shares of our common stock are traded on the OTCQB. Although our common stock is currently listed on the OTCQB, public trading of our common stock may never materialize. If a market for our common stock does materialize on the OTCQB, then the sales price to the public will vary according to the selling decisions of each selling shareholder and the market for our stock at the time of resale. In these circumstances, the sales price to the public may be:

(1) The market price of our common stock prevailing at the time of sale;

(2) A price related to such prevailing market price of our common stock; or

(3) Such other price as the selling shareholders determine from time to time.

The shares may also be sold in compliance with Rule 144 of the Securities Act.

We can provide no assurance that all or any of the common stock offered will be sold by the selling shareholders named in this prospectus.

We are bearing all costs relating to the registration of the common stock. The selling shareholders, however, will pay any commissions or other fees payable to brokers or dealers in connection with any sale of the common stock.

The selling shareholders named in this prospectus must comply with the requirements of the Securities Act and the Exchange Act in the offer and sale of the common stock. The selling shareholders and any broker-dealers who execute sales for the selling shareholders may be deemed to be an "underwriter" within the meaning of the Securities Act in connection with such sales. In particular, during such times as the selling shareholders may be deemed to be engaged in a distribution of the common stock, and therefore be considered to be an underwriter, they must comply with applicable law and may, among other things:

(1) Not engage in any stabilization activities in connection with our common stock;

(2) Furnish each broker or dealer through which common stock may be offered, such copies of this prospectus, as amended from time to time, as may be required by such broker or dealer; and

(3) Not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities other than as permitted under the Exchange Act.

17

DESCRIPTION OF SECURITIES

COMMON STOCK

Our authorized capital stock consists of 100,000,000 shares of common stock, par value $0.00001 per share. The holders of our common stock:

· have equal ratable rights to dividends if and when a dividend is declared by our board of directors;

· are entitled to share ratably in all of our assets available for distribution to holders of common stock upon liquidation, dissolution or winding up of our affairs;

· do not have preemptive, subscription or conversion rights and there are no redemption or sinking fund provisions or rights; and

· are entitled to one non-cumulative vote per share on all matters on which stockholders may vote.

We refer you to our Articles of Incorporation, Bylaws and the applicable statutes of the State of Nevada for a more complete description of the rights and liabilities of holders of our securities.

NON-CUMULATIVE VOTING

Holders of shares of our common stock do not have cumulative voting rights, which means that the holders of more than 50% of the outstanding shares, voting for the election of directors, can elect all of the directors to be elected, if they so choose, and, in that event, the holders of the remaining shares will not be able to elect any of our directors.

CASH DIVIDENDS

As of the date of this prospectus, we have not paid any cash dividends to our stockholder. The declaration of any future cash dividend will be at the discretion of our board of directors and will depend upon our earnings, if any, our capital requirements and financial position, our general economic conditions, and other pertinent conditions. It is our present intention not to pay any cash dividends in the foreseeable future, but rather to reinvest earnings, if any, in our business operations.

PREFERRED STOCK

We are authorized to issue 100,000,000 shares of preferred stock with a par value of $0.00001 per share. The terms of the preferred shares are at the discretion of the board of directors. Currently no preferred shares are issued and outstanding.

SHARE PURCHASE WARRANTS

On August 1, 2013 the Company’s Board of Directors approved a resolution to grant 1,000,000 warrants to consultants. To date, no warrants have been granted.

OPTIONS

During October 2013 the Company granted 3,471,665 options to employee. The right to exercise these options shall vest and become 25% exercisable on the first anniversary of when granted, with the exception that 100% of options issued to one employee vested immediately. The remaining options shall vest and become exercisable ratably over the next 36 months, with the exception that options issued to 2 employees shall vest and become exercisable over 18 months and option issued to one employee shall vest and become exercisable as of the effective date of the Option Agreement. The exercise price is $0.48 per share and will expire ten years from the grant date, unless terminated earlier as provided by the Option Agreements.

18

The fair value of each option award was estimated on the date of grant using the Black-Scholes option valuation model using the assumptions noted as follows: expected volatility was based on historical trading in the company's stock. The expected term of options granted was determined using the simplified method under SAB 107 and represents one-half the exercise period. The risk-free rate is calculated using the U.S. Treasury yield curve, and is based on the expected term of the option. The Company has estimated there will be no forfeitures.

The Black-Scholes option pricing model was used with the following weighted average assumptions for options granted during the three months ended March 31, 2014:

Risk-free interest rate 1% - 2%

Expected option life 5 – 6 years

Expected volatility 300%

Expected dividend yield 0.0%

At March 31, 2014, 2,011,945 options are exercisable and the Company recognized $1,326,055 of stock options expenses during the three months ended March 31, 2014.

CONVERTIBLE SECURITIES

We have not issued and do not have outstanding any securities convertible into shares of our common stock or any rights convertible or exchangeable into shares of our common stock.

ANTI-TAKEOVER PROVISIONS

There are no Nevada anti-takeover provisions that may have the affect of delaying or preventing a change in control.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

You may read copies of any materials we file with the SEC at the SEC's Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet site that will contain copies of the reports we file electronically. The address for the Internet site is www.sec.gov.

STOCK TRANSFER AGENT

Our transfer agent is QuickSilver Stock Transfer, 6623 Las Vegas Blvd South #255, Las Vegas, Nevada 89119.

INTERESTS OF NAMED EXPERTS AND COUNSEL

The financial statements included in this prospectus and the registration statement have been audited by MaloneBailey LLP and by our former independent auditors, Anton & Chia LLP to the extent and for the periods set forth in their respective reports appearing elsewhere herein and in the registration statement, and are included in reliance upon such report given upon the authority of said firms as experts in auditing and accounting.

Karen A. Batcher, Esq of Synergen Law Group, APC our independent legal counsel, has provided an opinion on the validity of our common stock.

19

DESCRIPTION OF BUSINESS

OVERVIEW

Nuzee Inc. is the operating company that manages a portfolio of branded consumer packaged goods. The Company was incorporated in July 2011 as Havana Furnishings, Inc. (“Havana”) under the laws of the State of Nevada. From the date of Incorporation through April 2013, the Company was a development stage company engaged in the business of selling public restaurant and bar furnishings and accessories from Asia to retailer customers at wholesale prices on the internet. In April 2013, the Company's sole officer decided that it was not economically feasible to continue with the Company’s business plan and began to seek other companies for potential merger.

On April 19, 2013, the Company completed a merger with Nuzee Co., Ltd. a California corporation (“Nuzee-CA”) wherein Nuzee Co., Ltd. became a wholly owned subsidiary of Havana. Pursuant to the Share Exchange Agreement, each of the 33,733,333 outstanding shares of Nuzee-CA common stock was converted into one share of the Company’s common stock. In addition, upon the closing of the Merger, the Company amended its Articles of Incorporation to change its name from Havana Furnishings, Inc. to Nuzee, Inc. Nuzee-CA was established in 2011 as an importer and distributor of natural spring water and skincare products as well as energy drinks.

Our global corporate headquarters is located in San Diego, California. When we refer to our company and its business in this report, we are referring to the business and activities of our consolidated operations.

To date, we mainly distributed natural and organic products produced by 3rd parties. These legacy product lines which included New Zealand bottled spring water, natural and organic skincare from New Zealand as well as the TorqueTM energy drinks are being phased out and/or discontinued as the Company believes its best near and long term success is to focus resources on our own product line of functional beverages which will enable the Company to control, develop, manufacture and promote its brands from the United States.

During the 2013 fiscal year we began researching and investigating the viability of a new product platform for functional beverages. We plan to start producing our first family of functional beverages in early 2014. These products are considered healthy alternatives, with all natural ingredients and provide an added wellness benefit when compared to the traditional non-fortified version of the same beverage. As a result, Nuzee’s mission is to be a good-for-you company focused on building beverage brands that offer functional and nutritional benefits.

Our operational approach has and will remain to develop and manufacture our products under strict guidelines for good manufacturing and food safety practices before releasing our products to the market. We own our formulas and work with experts in beverage, nutrition and flavoring sciences to ensure our products not only taste delicious but are also good-for-you using quality and natural ingredients with proven clinical research to support the functional efficacy. We are using multiple manufacturing partners, known in the industry as co-packers, to scale our manufacturing capabilities.

We sell our products directly to consumers through our website portal (in final development) as well as through soon to be announced affiliate online stores and retailers.

MARKET OPPORTUNITY

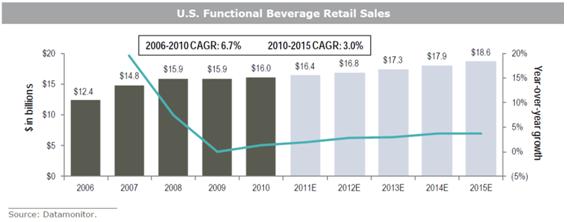

As an emerging company in the functional beverage sector we are participating in large growing market with historical sales of more than $16 billion with anticipated growth of 3% per year through 2015 according to research by Datamonitor. Nuzee’s products fall within the nutraceutical drink portion of the functional beverage market which accounts for approximately 6% or $1 billion in the United States annually.

20

PRINCIPAL PRODUCTS

After careful study and research the company determined its first functional beverage will be a line of single-serve gourmet coffees. Our decision was based on numerous factors including the market for coffee and its continued growth, the ability to serve a cup of coffee quickly and conveniently as well as the ability for precise dosage of our active ingredients in pre-portioned packs. Our knowhow is tied to our formula, process and use of natural flavoring to mask the undesired off-notes produced by the added functional ingredient(s) such that the original beverage is preserved and there are no deficiencies in the taste and aroma profile.

Coffee Blenders

|

Coffee BlendersTM |

Product Branding and Packaging |

|

www.coffeeblenders.com

Escape for Stress Reduction Lean for Weight Loss Focus for Cognitive Performance

|

|

21

The company will make Coffee BlendersTM available in the first quarter of 2014. We believe Coffee Blenders to be the first line of gourmet specialty grade coffee offered in convenient K-Cups® using only natural ingredients with clinically supported branded nutraceuticals.

Each Coffee Blenders K-cup® will include a total of 11 grams of coffee plus natural ingredients and come in retail packaging of 15 K-Cup packs per box.

The coffee packs are compatible with Keurig K-Cup brewers and systems. Keurig is owned by Green Mountain Coffee Rosters (NASDAQ: GMCR). A key consideration in launching Coffee Blenders in K-Cup formats was due to the patent protection surrounding the K-Cups expiring in late 2012. This enables 3rd party companies to produce K-Cup compatible packs for an existing installed base of brewers totaling more than 16 million units according to GMCR company filings and reports.

With the majority of Keurig machines installed in the United States the Company is researching the viability of stick packs for international markets where Keurig brewers are not as popular or available. Additionally, the Company plans to explore other single-serve brewer platforms as well as distribution partnership opportunities as coffee consumption varies around the globe.

We plan to initially launch three functional varieties called Lean (for weight loss), Focus (for cognitive performance) and Escape (for stress reduction). The current family of products all utilize GRAS (Generally Recognized As Safe) ingredients that are also supported by clinical studies using the exact strengthen and dosage recommended by our ingredient partner’s claims and research. Based on market feedback we anticipate introducing another set of functions in the second half of 2014. The Company is in the preliminary product development stages in determining the expansion of new functions and ingredients.

OUR STRATEGY

Our objective is to be a profitable, leading provider of functional beverages. Elements of our business strategy for 2014 include:

· Secure additional working capital to support growth and development of Nuzee sales and support operations

· Build product and brand awareness through marketing and communication programs

· Build an enthusiast and loyal base of consumers for Coffee Blenders

· Expand family of functional coffees to include new functions and flavors

· Expand distribution across retail, online and affiliate channels

· Contract with multiple manufacturing partners to scale production as required

· Build portfolio of formulas for functional beverages

· Explore new beverage platforms beyond coffee

CUSTOMERS

Our customers are divided into two groups: direct consumers and distribution partners.

Direct Consumers -- we believe that the existing K-cup single serve household will be our primary target audience. We plan to reach them through direct response techniques using search marketing and direct advertising to drive purchases on our e-commerce shopping site. Orders will be processed after payment has been received via credit card or other electronic remittance.

Distribution Partners -- we will target outlets and distributors that are engaged in selling beverages such as coffee or teas as well as those who focus on health and wellness products. All products will be sold on a purchase order basis using standard terms and conditions associated with wholesale procurement with minimum order quantities. We supply products to these customers on a purchase order basis.

22

SALES AND MARKETING

Sales revenues reported in fiscal year 2013 were related to legacy product lines which were being discontinued. Therefore, the some cases the products were sold at a significant discount in order to eliminate inventory as we ready our warehouse for the upcoming Coffee Blenders.

As an emerging product brand we believe that a significant amount of spend is required to generate sales in 2014. We plan to implement a four stage approach:

1. Build Awareness and Consideration

2. Generate Trial

3. Drive Initial Sales

4. Drive Repeat Sales

We anticipate the need to spend more than one million in target marketing, sampling and test advertising (stages #1 and #2) in 2014. We will use the learning from our advertising campaigns to determine the optimal cost of acquisition in order to scale the business appropriately. We also plan to implement a loyalty club program to encourage repeat orders. Once the Company has metrics on the successfully conversion rate (i.e. from initial sale to repeat order) management will then be in a position to determine our cash requirements to sustain and grow the business.

At this time, most of our products will be sold around the world under the “COFFEE BLENDERS” brand name. However, the Company will consider private label arrangements if the margin structure and distribution potential are economically viable.

MANUFACTURING

We plan to use third party contract manufacturers to provide finished products and goods. We have agreements in place with suppliers and partners for all components required to deliver a finished Coffee Blenders product. Currently, the Company has not made any long-term commitments to any suppliers or production partners that will burden or impair the Company’s ability to operate.

We currently purchase our nutraceuticals, Svetol (green coffee bean extract) and Cereboost (American Ginseng extract), from Naturex, Inc. (“Naturex”) Pursuant to license agreements with Naturex, in order to maintain our license, we are required to purchase an annual minimum amount of product. Copies of our license agreements with Naturex for Svetol and Cereboost are included with this Registration Statement as Exhibits 10.3 and 10.4 respectively.

We purchase coffee from San Diego Coffee, Tea & Spice, Inc. (“SDCTS”). Our Agreement with SDCTS commenced on March 7, 2014 and will remain in force for a period of two years. After the first two years, the agreement with SDCTS will automatically renew for subsequent one year terms. Either party can terminate the agreement upon 90 days written notice before the end of any term. San Diego Coffee, Tea & Spice, Inc. (“SDCTS”) A copy of our agreement with SDCTS is included with this Registration Statement as Exhibit 10.5.

All of the raw products (ground coffee and nutraceuticals) are sent to Core Supplement Technology, Inc. (“Core”) for mixing into our proprietary blends. We do not have a written agreement with Core. Rather, all services performed by Core are on a purchase order basis. After Core mixes our coffees, the final product is shipped to SDCTS, or our other packager Cafejo, for packaging into single-serving containers commonly known as “K cups” and boxed for retail sales.

RESEARCH AND DEVELOPMENT

We focus our research and development efforts on developing innovative functional beverages that not only taste delicious but also include a healthy wellness benefit.

23

Over the course of the last fiscal year Nuzee has maintained a modest R&D budget. With the advent of the functional beverage focus the Company plans to invest more to secure unique flavor and formula profiles but anticipates the out of pocket expense will not be significant as the Company has agreements with flavor and formula design partners to waive development fees in exchange for purchasing the flavorings and ingredients. The Company has contracted product from Blue California and Naturex (Paris Stock Exchange: NRX) both global natural specialty ingredient suppliers who are providing assistance in ingredient identification, testing, marketing support, and clinical studies to accelerate our development efforts.

In 2013, our product development initiatives included:

· $15,000 developing a raw ingredient selection, blending and flavoring for Coffee Blenders

For 2014, our research and development initiatives will be concentrated on the following projects:

· Continued development of our Coffee Blenders series with new functions and ingredients Research of instant coffee with micro-grounds for stick packs Development of functional beverages beyond coffee such as teas or hot chocolate

INTELLECTUAL PROPERTY

Nuzee has filed for trademark registrations in the United States on several marks it intends to use in the beverage industry and is in the process of submitting additional related trademark applications. The Company intends to continue growing its trademark portfolio in the United States with other related slogans and brands, as those products come closer to launch. The Company further intends to expand its brand protections outside of the United States, in line with its prospective international growth.