Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - RAYONIER INC | d745107d8k.htm |

| EX-99.2 - EX-99.2 - RAYONIER INC | d745107dex992.htm |

Table of Contents

Exhibit 99.1

June 18, 2014

Dear Rayonier Inc. Shareholder:

Earlier this year, we announced plans to separate our performance fibers business from our forest resources and real estate businesses. The separation will occur by means of a spin-off of a newly formed company named Rayonier Advanced Materials Inc. (“SpinCo”), which will contain the Performance Fibers segment of Rayonier Inc. (“Rayonier”). Rayonier, the existing publicly traded company, will continue to manage its forest resources and real estate businesses. As two distinct publicly traded companies, Rayonier and SpinCo will be better positioned to capitalize on significant growth opportunities and focus resources on their respective businesses and strategic priorities.

Both of these companies will be industry-leading in terms of both products and services. With 2.6 million acres of high-quality timber and real estate holdings in the United States and New Zealand, Rayonier will continue to be an international leader in the forest resources industry, with a strong capital structure and greater ability to focus its capital deployment strategy on growing its timberland base. SpinCo will continue to be the world’s largest producer of high-value specialty cellulose fibers, which are used in a variety of products, including cigarette filters, liquid crystal displays, thickeners for food products, pharmaceuticals, personal care products, cosmetics, impact-resistant plastics, and food casings.

The separation will provide current Rayonier shareholders with equity ownership in both Rayonier and SpinCo. We expect that the separation will be tax-free to Rayonier shareholders and have received a ruling from the Internal Revenue Service regarding the tax-free nature of the separation.

The separation will be effected by means of a pro rata distribution of 100% of the outstanding shares of SpinCo common stock to holders of Rayonier common shares. Each Rayonier shareholder will receive one share of SpinCo common stock for every three Rayonier common shares held as of the close of business on June 18, 2014, the record date for the distribution. No vote of Rayonier shareholders is required for distribution. You do not need to take any action to receive shares of SpinCo common stock to which you are entitled as a Rayonier shareholder, and you do not need to pay any consideration or surrender or exchange your Rayonier common shares.

I encourage you to read the attached information statement, which is being provided to all Rayonier shareholders who held shares on the record date for the distribution. The information statement describes the separation in detail and contains important business and financial information about SpinCo.

I believe the separation provides tremendous opportunities for our businesses and our shareholders, as we work to continue building long-term shareholder value. We appreciate your continuing support of Rayonier, and look forward to your future support of both companies.

Sincerely,

Paul G. Boynton

Chairman, President and Chief Executive Officer

Rayonier Inc.

Table of Contents

June 18, 2014

Dear Future Rayonier Advanced Materials Inc. Stockholder:

I am pleased to welcome you as a future stockholder of Rayonier Advanced Materials Inc. (“SpinCo”), whose common stock has been authorized for listing on the New York Stock Exchange under the symbol “RYAM,” subject to official notice of distribution. Although we are newly independent, we have long been the world leader in the production of high purity specialty cellulose fibers. With more than 85 years of experience, we have unparalleled knowledge and expertise in this business, which translates into superior quality, customer focus and service.

Our high-value cellulose specialties are derived from wood that has been processed into custom fibers using SpinCo’s proprietary knowledge to achieve customers’ exacting specifications. In 2013, we generated $1.0 billion in sales and $289 million in operating income. Our strong cash flow has allowed us to invest in additional capacity and successfully complete a $385 million project to expand capacity by approximately 190,000 metric tons in 2013.

As explained in the attached information statement, we intend to capitalize on our differentiated product offering, strengthen our leadership position in the manufacture of the highest value-added cellulose specialties and drive growth opportunities, as well as continue to focus on operational excellence and maximize cash flow. As a newly independent company, we believe that our leading positions, culture of innovation, technologically-advanced operations, long-term relationships and demonstrated financial resilience will enable us to meet these goals.

Our stockholder value proposition is simple: provide superior returns to SpinCo stockholders by maintaining our leadership position in cellulose specialties production, investing in the growth of our newly stand-alone company and generating strong cash flows.

We invite you to learn more about SpinCo and our strategic initiatives by reading the attached information statement. We thank you in advance for your support as a future stockholder of SpinCo.

Sincerely,

Paul G. Boynton

Chairman, President and Chief Executive Officer

Rayonier Advanced Materials Inc.

Table of Contents

INFORMATION STATEMENT

Rayonier Advanced Materials Inc.

This information statement is being furnished in connection with the distribution by Rayonier Inc. (“Rayonier”) to its shareholders of all of the outstanding shares of common stock of Rayonier Advanced Materials Inc. (“SpinCo”), a wholly owned subsidiary of Rayonier that will hold directly or indirectly the assets and liabilities associated with Rayonier’s performance fibers business. To implement the distribution, Rayonier will distribute all of the shares of SpinCo common stock on a pro rata basis to Rayonier shareholders in a manner that is intended to be tax-free in the United States.

For every three common shares of Rayonier held of record by you as of the close of business on June 18, 2014, the record date for the distribution, you will receive one share of SpinCo common stock. You will receive cash in lieu of any fractional shares of SpinCo common stock that you would have received after application of the above ratio. As discussed under “The Separation and Distribution—Trading Between the Record Date and Distribution Date,” if you sell your Rayonier common shares in the “regular-way” market after the record date and before the distribution, you also will be selling your right to receive shares of SpinCo common stock in connection with the separation. SpinCo expects the shares of SpinCo common stock to be distributed by Rayonier to you at 11:59 p.m., Eastern Time, on June 27, 2014. SpinCo refers to the date of the distribution of the SpinCo common stock as the “distribution date.”

No vote of Rayonier shareholders is required for the distribution. Therefore, you are not being asked for a proxy, and you are requested not to send Rayonier a proxy, in connection with the distribution. You do not need to pay any consideration, exchange or surrender your existing Rayonier common shares or take any other action to receive your shares of SpinCo common stock.

There is no current trading market for SpinCo common stock, although SpinCo expects that a limited market, commonly known as a “when-issued” trading market, will develop on or shortly before the record date for the distribution, and SpinCo expects “regular-way” trading of SpinCo common stock to begin on the first trading day following the completion of the distribution. SpinCo has been authorized to have its common stock listed on the New York Stock Exchange under the symbol “RYAM,” subject to official notice of distribution. Following the spin-off, Rayonier will continue to trade under the symbol “RYN.”

In reviewing this information statement, you should carefully consider the matters described under the caption “Risk Factors” beginning on page 19.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined if this information statement is truthful or complete. Any representation to the contrary is a criminal offense.

This information statement does not constitute an offer to sell or the solicitation of an offer to buy any securities.

The date of this information statement is June 18, 2014.

This information statement will be made publicly available on or about June 18, 2014, and notice of this information statement’s availability will be first sent to Rayonier shareholders on or about June 18, 2014.

Table of Contents

| Page | ||||

| 1 | ||||

| 7 | ||||

| 19 | ||||

| 34 | ||||

| 36 | ||||

| 42 | ||||

| 43 | ||||

| Selected Historical Combined Financial Data of Rayonier Advanced Materials Inc. |

44 | |||

| 45 | ||||

| 55 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operation |

66 | |||

| 81 | ||||

| 83 | ||||

| 90 | ||||

| 104 | ||||

| 124 | ||||

| 132 | ||||

| 135 | ||||

| Security Ownership of Certain Beneficial Owners and Management |

138 | |||

| Description of Rayonier Advanced Materials Inc.’s Capital Stock |

140 | |||

| 144 | ||||

| 145 | ||||

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE SEPARATION AND DISTRIBUTION

| What is SpinCo and why is Rayonier separating SpinCo’s business and distributing SpinCo stock? | SpinCo, which is currently a wholly owned subsidiary of Rayonier, was formed to own and operate Rayonier’s performance fibers business. The separation of SpinCo from Rayonier and the distribution of SpinCo common stock are intended to provide you with equity ownership in two separate, publicly traded companies that will be able to focus exclusively on each of their respective businesses. Rayonier and SpinCo expect that the separation will result in enhanced long-term performance of each business for the reasons discussed in the sections entitled “The Separation and Distribution—Reasons for the Separation.” | |

| Why am I receiving this document? | Rayonier is delivering this document to you because you are a holder of Rayonier common shares. If you are a holder of Rayonier common shares as of the close of business on June 18, 2014, the record date of the distribution, you will be entitled to receive one share of SpinCo common stock for every three Rayonier common shares that you held at the close of business on such date. This document will help you understand how the separation and distribution will affect your post-separation ownership in Rayonier and SpinCo, respectively. | |

| How will the separation of SpinCo from Rayonier work? | To accomplish the separation, Rayonier will distribute all of the outstanding shares of SpinCo common stock to Rayonier shareholders on a pro rata basis as a distribution intended to be tax-free for U.S. federal income tax purposes. | |

| Why is the separation of SpinCo structured as a distribution? | Rayonier believes that a tax-free distribution of shares in the United States of SpinCo stock to the Rayonier shareholders is an efficient way to separate its performance fibers business in a manner that will create long-term value for Rayonier, SpinCo and their respective shareholders. | |

| What is the record date for the distribution? | The record date for the distribution will be June 18, 2014. | |

| When will the distribution occur? | It is expected that all of the shares of SpinCo common stock will be distributed by Rayonier at 11:59 p.m., Eastern Time, on June 27, 2014 to holders of record of Rayonier common shares at the close of business on June 18, 2014, the record date for the distribution. | |

| What do shareholders need to do to participate in the distribution? | Shareholders of Rayonier as of the record date for the distribution will not be required to take any action to receive SpinCo common stock in the distribution, but you are urged to read this entire information statement carefully. No shareholder approval of the distribution is required. You are not being asked for a proxy. You do not need to pay any consideration, exchange or surrender your existing Rayonier common shares or take any other action to receive your shares of SpinCo common stock. Please do not send in your Rayonier stock certificates. The distribution will not affect the number of outstanding Rayonier common shares or any rights of Rayonier shareholders, although it will affect the market value of each outstanding Rayonier common share. | |

| How will shares of SpinCo common stock be issued? | You will receive shares of SpinCo common stock through the same channels that you currently use to hold or trade Rayonier common shares, whether through a brokerage account, 401(k) plan or other channel. Receipt of SpinCo shares will be documented for you in the same manner that you typically receive shareholder updates, such as monthly broker statements and 401(k) statements. | |

1

Table of Contents

| If you own Rayonier common shares as of the close of business on, June 18, 2014, the record date for the distribution, including shares owned in certificate form, Rayonier, with the assistance of Computershare Trust Company, N.A., the distribution agent, will electronically distribute shares of SpinCo common stock to you or to your brokerage firm on your behalf in book-entry form. Computershare will mail you a book-entry account statement that reflects your shares of SpinCo common stock, or your bank or brokerage firm will credit your account for the shares. If you own Rayonier common shares through the Rayonier dividend reinvestment plan, the SpinCo shares you receive will be distributed to a new SpinCo dividend reinvestment plan account that will be created for you. | ||

| If I was enrolled in the Rayonier dividend reinvestment plan, will I automatically be enrolled in the SpinCo dividend reinvestment plan? | Yes. If you elected to have your Rayonier cash dividends applied toward the purchase of additional Rayonier common shares, the SpinCo shares you receive in the distribution will be automatically enrolled in the SpinCo dividend reinvestment plan sponsored by Computershare (SpinCo’s transfer agent and registrar), unless you notify Computershare that you do not want to reinvest any SpinCo cash dividends in additional SpinCo shares. For contact information for Computershare, see “Description of Rayonier Advanced Materials Inc.’s Capital Stock—Transfer Agent and Registrar.” | |

| How many shares of SpinCo common stock will I receive in the distribution? | Rayonier will distribute to you one share of SpinCo common stock for every three common shares of Rayonier held by you as of close of business on the record date for the distribution. Based on approximately 126.5 million Rayonier common shares outstanding as of June 13, 2014, a total of approximately 42.2 million shares of SpinCo common stock will be distributed. For additional information on the distribution, see “The Separation and Distribution.” | |

| Will SpinCo issue fractional shares of its common stock in the distribution? | No. SpinCo will not issue fractional shares of its common stock in the distribution. Fractional shares that Rayonier shareholders would otherwise have been entitled to receive will be aggregated and sold in the public market by the distribution agent. The aggregate net cash proceeds of these sales will be distributed pro rata (based on the fractional share such holder would otherwise be entitled to receive) to those shareholders who would otherwise have been entitled to receive fractional shares. Recipients of cash in lieu of fractional shares will not be entitled to any interest on the amounts of payment made in lieu of fractional shares. | |

| What are the conditions to the distribution? | The distribution is subject to the satisfaction (or waiver by Rayonier in its sole discretion) of the following conditions: | |

| • the transfer of assets and liabilities from Rayonier to SpinCo shall be completed in accordance with the separation and distribution agreement; | ||

| • Rayonier shall have received a private letter ruling from the Internal Revenue Service (or the “IRS”) to the effect that, among other things, the contribution by Rayonier of assets and liabilities to SpinCo and the distribution, taken together, will qualify as a transaction that is tax-free for U.S. federal income tax purposes under Sections 355 and 368(a)(1)(D) of the Internal Revenue Code of 1986, as amended (or the “Code”), and certain transactions related to the transfer of assets and liabilities to SpinCo in connection with the separation will not result in the recognition of any gain or loss to Rayonier, SpinCo or their shareholders (which private letter ruling has been received by Rayonier), and such private letter ruling shall not have been revoked or modified in any material respect; | ||

2

Table of Contents

| • Rayonier shall have received an opinion from Rayonier’s outside tax counsel to the effect that with respect to certain requirements for tax-free treatment under Section 355 of the Code on which the IRS will not rule, such requirements will be satisfied; | ||

| • the U.S. Securities and Exchange Commission (or the “SEC”) shall have declared effective the registration statement of which this information statement forms a part, and this information statement shall have been mailed to the Rayonier shareholders; | ||

| • all actions or filings necessary or appropriate under applicable U.S. federal, U.S. state or other securities laws shall have been taken and, where applicable, have become effective or been accepted by the applicable governmental entity; | ||

| • the transaction agreements relating to the separation shall have been duly executed and delivered by the parties; | ||

| • no order, injunction, or decree issued by any court of competent jurisdiction or other legal restraint or prohibition preventing the consummation of the separation, distribution or any of the related transactions shall be in effect; | ||

| • the shares of SpinCo common stock to be distributed shall have been accepted for listing on the New York Stock Exchange, subject to official notice of distribution; | ||

| • Rayonier shall have received the proceeds from the cash transfers from SpinCo, as described in “Certain Relationships and Related Person Transactions—Separation Agreement—Cash Transfers,” and Rayonier shall be satisfied in its sole and absolute discretion that as of the effective time of the distribution, it shall have no further liability under any of the SpinCo financing arrangements described under “Description of Material Indebtedness”; and | ||

| • no other event or development shall exist or have occurred that, in the judgment of Rayonier’s board of directors, in its sole discretion, makes it inadvisable to effect the separation, distribution and other related transactions.

Rayonier and SpinCo cannot assure you that any or all of these conditions will be met and may also waive any of the conditions to the distribution. In addition, Rayonier can decline at any time to go forward with the separation. For a complete discussion of all of the conditions to the distribution, see “The Separation and Distribution—Conditions to the Distribution.” | ||

| What is the expected date of completion of the separation? | The completion and timing of the separation are dependent upon a number of conditions. It is expected that the shares of SpinCo common stock will be distributed by Rayonier at 11:59 p.m., Eastern Time, on June 27, 2014 to the holders of record of Rayonier common shares at the close of business on June 18, 2014, the record date for the distribution. However, no assurance can be provided as to the timing of the separation or that all conditions to the distribution will be met. | |

3

Table of Contents

| Can Rayonier decide to cancel the distribution of SpinCo common stock even if all the conditions have been met? | Yes. The distribution is subject to the satisfaction or waiver of certain conditions. See the section entitled “The Separation and Distribution—Conditions to the Distribution.” Until the distribution has occurred, Rayonier has the right to terminate the distribution, even if all of the conditions are satisfied. | |

| What if I want to sell my Rayonier common shares or my SpinCo common stock? | You should consult with your financial advisors, such as your stockbroker, bank or tax advisor. | |

| What is “regular-way” and “ex-distribution” trading of Rayonier common shares? | Beginning on or shortly before the record date for the distribution and continuing up to and through the distribution date, it is expected that there will be two markets in Rayonier common shares: a “regular-way” market and an “ex-distribution” market. Rayonier common shares that trade in the “regular-way” market will trade with an entitlement to shares of SpinCo common stock distributed pursuant to the distribution. Shares that trade in the “ex-distribution” market will trade without an entitlement to shares of SpinCo common stock distributed pursuant to the distribution. If you decide to sell any Rayonier common shares before the distribution date, you should make sure your stockbroker, bank or other nominee understands whether you want to sell your Rayonier common shares with or without your entitlement to SpinCo common stock pursuant to the distribution. | |

| Where will I be able to trade shares of SpinCo common stock? | SpinCo has been authorized to have its common stock listed on the New York Stock Exchange under the symbol “RYAM,” subject to official notice of distribution. SpinCo anticipates that trading in shares of its common stock will begin on a “when-issued” basis on or shortly before June 18, 2014, the record date for the distribution, and will continue up to and through the distribution date and that “regular-way” trading in SpinCo common stock will begin on the first trading day following the completion of the separation. If trading begins on a “when-issued” basis, you may purchase or sell SpinCo common stock up to and through the distribution date, but your transaction will not settle until after the distribution date. SpinCo cannot predict the trading prices for its common stock before, on or after the distribution date. | |

| What will happen to the listing of Rayonier common shares? | Rayonier common shares will continue to trade on the New York Stock Exchange after the distribution under the symbol “RYN.” | |

| Will the number of Rayonier common shares that I own change as a result of the distribution? | No. The number of Rayonier common shares that you own will not change as a result of the distribution. | |

| Will the distribution affect the market price of my Rayonier common shares? | Yes. As a result of the distribution, Rayonier expects the trading price of Rayonier common shares immediately following the distribution to be lower than the “regular-way” trading price of such shares immediately prior to the distribution because the trading price will no longer reflect the value of the performance fibers business. There can be no assurance that the aggregate market value of the Rayonier common shares and the SpinCo common stock following the separation will be higher or lower than the market value of Rayonier common shares if the separation did not occur. This means, for example, that the combined trading prices of three Rayonier common shares and one share of SpinCo common stock after the distribution may be equal to, greater than or less than the trading price of three Rayonier common shares before the distribution. | |

4

Table of Contents

| What are the material U.S. federal income tax consequences of the contribution and the distribution? | Rayonier has received a private letter ruling from the IRS to the effect that, among other things, the contribution of assets and liabilities from Rayonier to SpinCo and the distribution, taken together, will qualify as a transaction that is tax-free for U.S. federal income tax purposes under Sections 355 and 368(a)(1)(D) of the Code. It is a condition to the completion of the distribution that such ruling shall not have been revoked or modified in any material respect. In addition, it is a condition to the completion of the distribution that Rayonier receive an opinion from outside tax counsel to the effect that, with respect to certain requirements for tax-free treatment under Section 355 of the Code on which the IRS will not rule, such requirements will be satisfied. Under the private letter ruling from the IRS, the contribution of assets and liabilities from Rayonier to SpinCo and the distribution, taken together, will qualify as a reorganization for U.S. federal income tax purposes under Section 355 and Section 368(a)(1)(D) of the Code, and accordingly, no gain or loss will be recognized by Rayonier in connection with the contribution and distribution and, except with respect to cash received in lieu of a fractional share of SpinCo common stock, no gain or loss will be recognized by you, and no amount will be included in your income, upon the receipt of shares of SpinCo common stock in the distribution for U.S. federal income tax purposes. You will, however, recognize gain or loss for U.S. federal income tax purposes with respect to cash received in lieu of a fractional share of SpinCo common stock. For more information regarding the private letter ruling and the potential U.S. federal income tax consequences to SpinCo and to you of the contribution and the distribution, see the section entitled “Material U.S. Federal Income Tax Consequences.” | |

| How will I determine my tax basis in the SpinCo shares I receive in the distribution? | For U.S. federal income tax purposes, your aggregate basis in the common shares that you hold in Rayonier and the new SpinCo common stock received in the distribution (including any fractional share interest in SpinCo common stock for which cash is received) will equal the aggregate basis in the Rayonier common shares held by you immediately before the distribution, allocated between your Rayonier common shares and the SpinCo common stock (including any fractional share interest in SpinCo common stock for which cash is received) you receive in the distribution in proportion to the relative fair market value of each on the distribution date. You should consult your tax advisor about the particular consequences of the distribution to you, including the application of the tax basis allocation rules and the application of state, local and non-U.S. tax laws. | |

| What will SpinCo’s relationship be with Rayonier following the separation? | SpinCo will enter into a separation and distribution agreement with Rayonier to effect the separation and provide a framework for SpinCo’s relationship with Rayonier after the separation and will enter into certain other agreements, such as a transition services agreement, a tax matters agreement, an employee matters agreement and an intellectual property agreement. These agreements will provide for the separation between SpinCo and Rayonier of the assets, employees, liabilities and obligations (including its investments, property and employee benefits and tax-related assets and liabilities) of Rayonier and its subsidiaries attributable to periods prior to, at and after SpinCo’s separation from Rayonier and will govern the relationship between SpinCo and Rayonier subsequent to the completion of the separation. For additional information regarding the separation and distribution agreement and other transaction agreements, see the sections entitled “Risk Factors—Risks Related to the Separation” and “Certain Relationships and Related Person Transactions.” | |

5

Table of Contents

| Who will manage SpinCo after the separation? | SpinCo will benefit from a management team with an extensive background in the performance fibers business. Led by Paul G. Boynton, who will be SpinCo’s Chairman, President and Chief Executive Officer after the separation, SpinCo’s management team will possess deep knowledge of, and extensive experience in, its industry. For more information regarding SpinCo’s management, see “Management.” | |

| Are there risks associated with owning SpinCo common stock? | Yes. Ownership of SpinCo common stock is subject to both general and specific risks relating to SpinCo’s business, the industry in which it operates, its ongoing contractual relationships with Rayonier and its status as a separate, publicly traded company. Ownership of SpinCo common stock is also subject to risks relating to the separation. These risks are described in the “Risk Factors” section of this information statement beginning on page 19. You are encouraged to read that section carefully. | |

| Does SpinCo plan to pay dividends? | SpinCo currently expects that it will initially pay a regular cash dividend. However, the declaration and payment of any dividends in the future by SpinCo will be subject to the sole discretion of its board of directors and will depend upon many factors. See “Dividend Policy.” | |

| Will SpinCo incur any indebtedness prior to or at the time of the distribution? | Yes. SpinCo anticipates having approximately $950 million of indebtedness upon completion of the separation. On the distribution date, SpinCo anticipates that the debt will consist of $325 million of term loans under the term loan facilities of Rayonier A.M. Products Inc., which will be a wholly owned subsidiary of SpinCo after the separation, borrowings of $75 million under SpinCo’s revolving credit facility and $550 million of corporate bonds issued by Rayonier A.M. Products Inc. See “Description of Material Indebtedness” and “Risk Factors—Risks Related to SpinCo’s Business.” Promptly following the distribution, it is anticipated that the $75 million of revolving borrowings by SpinCo will be repaid with the proceeds of a delayed draw term loan expected to be made available to Rayonier A.M. Products Inc. under the term loan facilities described above. | |

| Who will be the distribution agent, transfer agent and registrar for the SpinCo common stock? | The distribution agent, transfer agent and registrar for the SpinCo common stock will be Computershare Trust Company, N.A. For questions relating to the transfer or mechanics of the stock distribution, you should contact Computershare toll free at (866) 246-0322 or non-toll free at (201) 680-6578. | |

| Where can I find more information about Rayonier and SpinCo? | Before the distribution, if you have any questions relating to Rayonier’s business performance, you should contact:

Rayonier Inc. 1301 Riverplace Boulevard Suite 2300 Jacksonville, Florida 32207 Attention: Investor Relations

After the distribution, SpinCo stockholders who have any questions relating to SpinCo’s business performance should contact SpinCo at:

Rayonier Advanced Materials Inc. 1301 Riverplace Boulevard Suite 2300 Jacksonville, Florida 32207 Attention: Investor Relations

The SpinCo investor Web site (rayonieram.com) will be operational as of June 27, 2014. | |

6

Table of Contents

Except as otherwise indicated or unless the context otherwise requires, the information included in this information statement about Rayonier Advanced Materials Inc. assumes the completion of all of the transactions referred to in this information statement in connection with the separation and distribution. Unless the context otherwise requires, references in this information statement to “SpinCo” refer to Rayonier Advanced Materials Inc., a Delaware corporation, and its combined subsidiaries. References to SpinCo’s historical business and operations refer to the business and operations of Rayonier’s performance fibers business that will be transferred to SpinCo in connection with the separation and distribution. References in this information statement to “Rayonier” refer to Rayonier Inc., a North Carolina corporation, and its consolidated subsidiaries, unless the context otherwise requires.

Rayonier Advanced Materials Inc.

Rayonier Advanced Materials Inc. (“SpinCo”) is the leading global producer of high-purity cellulose, a natural polymer, used as a raw material to manufacture a broad range of consumer-oriented products such as cigarette filters, liquid crystal displays, impact-resistant plastics, thickeners for food products, pharmaceuticals, cosmetics, high-tenacity rayon yarn for tires and industrial hoses, food casings, paints and lacquers. Purified cellulose is an organic material primarily derived from either wood or cotton and sold as cellulose specialties or commodity viscose, depending on its purity level. Cellulose specialties typically contain over 95% cellulose, while commodity viscose typically contains less than 95% cellulose. Cellulose specialties generally command a price premium, earn higher margins and benefit from greater demand stability through the economic cycle relative to commodity viscose.

SpinCo’s cellulose specialties require high levels of purity, process knowledge and are custom engineered and manufactured to customers’ exacting specifications. SpinCo’s customers (primarily specialty chemical companies) place a high premium on products that have great impact in terms of form, function and composition as they modify SpinCo’s fibers through various chemical reactions, which require high purity and uniformity for efficient production. As a result, cellulose specialties require a stringent qualification process as any inconsistencies in purity and/or uniformity can result in very negative and costly consequences to SpinCo’s customers.

With approximately 675,000 metric tons of cellulose specialties capacity and nearly double the sales of its next largest competitor, SpinCo is the global leader in the production of cellulose specialties. SpinCo’s key competitive advantage is the “SpinCo Recipe” — its unique ability to utilize its manufacturing facilities to engineer cellulose specialties fibers to customers’ exacting specifications. SpinCo is the only cellulose specialties producer with manufacturing facilities that provide flexibility to use both hardwood and softwood, kraft and sulfite cooking processes, and a variety of proprietary chemical treatments. Additionally, SpinCo has a tremendous asset of process knowledge: the understanding of wood fiber properties and their modification under a sequence of chemical processes, accumulated and developed over 85 years of practical application to achieve unique properties for a variety of customer needs. When this process knowledge is combined with its manufacturing flexibility and knowledge of customers’ applications and specifications, it allows SpinCo to have the most extensive capability set to modify cellulose fibers in the industry.

SpinCo’s strategy has resulted in an increase in gross margin from $201 million in 2009 to $333 million in 2013. Net income has decreased from $305 million in 2009 to $220 million in 2013, as 2009 included $205 million, net of expenses, related to the Alternative Fuel Mixture Credit. Adjusted earnings before interest, taxes, depreciation and amortization (or “Adjusted EBITDA”) increased from $226 million in 2009 to $363 million in 2013, representing a compound annual growth rate (or “CAGR”) of 13%. For a reconciliation of Adjusted EBITDA to net income, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Performance Indicators.”

7

Table of Contents

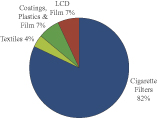

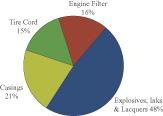

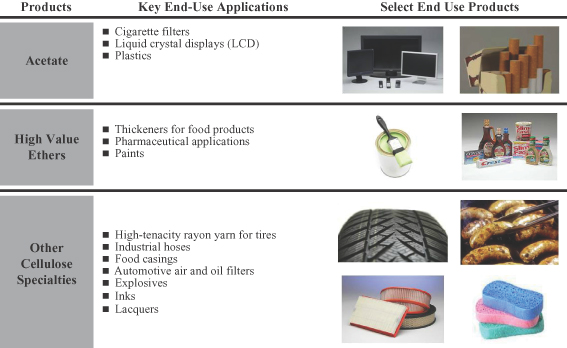

SpinCo categorizes its cellulose specialties into three product lines: acetate, high-value ethers and other cellulose specialties which account for 81%, 6% and 13% of its total cellulose specialties volume, respectively. SpinCo’s products are used primarily in the manufacture of a broad range of end-use products, as shown in the table below.

8

Table of Contents

SpinCo estimates that cellulose specialties demand was approximately 1.6 million metric tons in 2012. SpinCo believes that its 2013 sales volume of approximately 486,000 metric tons makes it the industry leader, reflecting sales in three product lines where SpinCo’s management estimates that it was one of the top three producers by volume. The charts below summarize the global end use breakdown by product line of the cellulose specialties business:

Global Cellulose Specialties End Use Breakdown (1)(2)

| Acetate | High Value Ethers (3) | Other Cellulose Specialties

| ||||||

| End Use Breakdown

|

End Use Breakdown

|

End Use Breakdown

| ||||||

|

|

|

| ||||||

| Estimated Product Demand n ~ 710,000 metric tons n 1—2% growth per year |

Estimated Product Demand n ~ 503,000 metric tons n 4—6% growth per year |

Estimated Product Demand n ~ 355,000 metric tons n 2—3% growth per year | ||||||

|

Estimated SpinCo Position n Number 1 |

Estimated SpinCo Position n Top 4 |

Estimated SpinCo Position n Top 2 | ||||||

Source: Hawkins Wright, PCI Fibres, Markets and Markets, and company estimates

(1) Data from 2012. (latest available)

(2) Product line size includes approximately 130,000 to 160,000 metric tons of cotton linter.

(3) Product line size includes approximately 100,000 metric tons MCC.

SpinCo’s production facilities, located in Jesup, Georgia, and Fernandina Beach, Florida, have a combined annual production capacity of approximately 675,000 metric tons. The Jesup mill can produce approximately 520,000 metric tons of cellulose specialties, or approximately 77% of SpinCo’s total capacity. The Fernandina Beach mill can produce approximately 155,000 metric tons of cellulose specialties, or approximately 23% of SpinCo’s total capacity. Combined, these facilities manufacture more than 25 different grades of purified cellulose.

Historically, about one-third of SpinCo’s production was absorbent materials, a commodity product mainly used in disposable baby diapers, feminine hygiene products, incontinence pads, convalescent bed pads, industrial towels and wipes, and non-woven fabrics. In May 2011, SpinCo decided to convert its absorbent material production line located in the Jesup mill to cellulose specialties based on increased demand from its customers for high-value cellulose specialties and SpinCo’s desire to exit commodity-like product lines. Management believes this conversion, referred to as the cellulose specialties expansion project, positions SpinCo as the only fully dedicated supplier of cellulose specialties.

The cellulose specialties expansion project cost $385 million and converted approximately 260,000 metric tons of absorbent materials capacity into approximately 190,000 metric tons of cellulose specialties capacity. The

9

Table of Contents

project was completed in June 2013, after significant modifications to the production line and increased capacity of ancillary systems.

In July 2013, SpinCo restarted the converted production line and began the qualification process for the line’s production with its customers. SpinCo expects to produce cellulose specialties, commodity viscose and other products, modulating volumes in each product group to meet demand. As cellulose specialties demand grows over the next several years, SpinCo expects to increase its sales of cellulose specialties and complete its transition to a dedicated cellulose specialties supplier.

Strategies

Key elements of SpinCo’s business strategy are as follows:

Strengthen SpinCo’s cellulose specialties leadership position. With approximately 675,000 metric tons of cellulose specialties capacity and nearly double the sales of the next largest competitor, SpinCo is the global leader in the production of cellulose specialties, a high-value sector. SpinCo believes the global demand is growing approximately 45,000 to 50,000 metric tons a year as customers’ product needs continue to expand. SpinCo’s cellulose specialties expansion project’s approximately 190,000 metric tons of cellulose specialties capacity is in the process of qualification with new and existing customers. As demand continues to grow for cellulose specialties, SpinCo will be positioned to drive increases in margins and cash flows.

Differentiate through technically superior products and research and development. The quality and consistency of SpinCo’s cellulose specialties and its premier research and development capabilities create a significant competitive advantage, resulting in a premium price (a price greater than competitors) for SpinCo’s products and driving strong profitability. SpinCo manufactures products that are tailored to the precise and demanding chemical and physical requirements of its customers, achieving industry leading high purity levels and product functionality for specific grades. Its ability to manufacture technically superior products is the result of its proprietary production processes, intellectual property, technical expertise, diverse manufacturing processes and knowledge of cellulosic chemistry.

SpinCo’s premier research and development facility allows it to replicate its customers’ manufacturing processes which differentiates SpinCo from its competitors. Combined with SpinCo’s deep understanding of its customers’ processes and historical success in applied research and development, SpinCo is uniquely qualified to continue partnering with its customers to develop new products to meet evolving consumer needs and to trouble shoot customer production issues. For the periods ending December 31, 2013, 2012 and 2011, SpinCo recorded research and development expenses of approximately $3.3 million, $2.8 million and $2.8 million respectively.

Drive growth and diversification. Expanding sales to other cellulose specialty applications will provide attractive opportunities for increasing revenue and improving profitability. With 80% of its current sales volume in the acetate product line, SpinCo intends to expand its sales in the faster growing ethers and other cellulose specialty product lines. SpinCo’s additional approximately 190,000 metric tons of cellulose specialties capacity combined with its process knowledge and expertise in cellulose specialties manufacturing will allow it to pursue growth and diversification without additional investment. SpinCo also intends to evaluate adjacent specialty chemical market opportunities for further growth and diversification.

Focus on operational excellence. Operating mills reliably and at a competitive cost while producing consistently high-quality and high-value cellulose is critical to SpinCo’s existing customers and enhances its ability to attract new customers. SpinCo strives to continuously improve its cost position, throughput and reliability of its manufacturing facilities through targeted expenditures and capital investments. For instance, SpinCo has identified a number of high return projects that it expects will achieve internal rates of return greater than 20 percent and are executable in the next three years. Additionally, SpinCo continues to develop maintenance systems and procedures that will improve the throughput, purity and uniformity of SpinCo’s products by increasing the reliability of its manufacturing processes. SpinCo’s continued focus on operational excellence will continue to enable it to drive profitability and strengthen customer relationships.

10

Table of Contents

Maximize cash flow. SpinCo has historically maintained a strong margin profile as part of Rayonier. As a stand-alone business, the SpinCo team will be able to implement a focused strategy to more efficiently allocate resources and further maximize cash flow. Additionally, SpinCo believes that its production capacity is sufficient to meet its current growth initiatives without significant additional spending. Over the last five years, Rayonier invested approximately $397 million in growth capital expenditures for capacity expansions and productivity enhancements. Given the significant investment to date, SpinCo anticipates that further investment in growth capital will be spent only upon the expectation of significant returns. SpinCo’s strong balance sheet, financial flexibility and significant cash flows are key, differentiating attributes from its competitors in its industry.

Strengths

SpinCo believes the following strengths support its business strategies:

Leading position in high-value cellulose specialties. With nearly double the sales of the next largest competitor, SpinCo is the largest global producer of high-value cellulose specialties and is ideally positioned to capture anticipated growth in its markets. SpinCo’s leadership position in custom-engineered high-value cellulose specialties reflects its technical expertise, outstanding product purity and consistency, strong partnership with its global customers and continued investment in capacity. SpinCo’s processes and products are technologically difficult to replicate for other cellulose specialty producers and SpinCo believes they are not possible without significant investment in equipment and intellectual property. As a result, none of the competitors currently are able to match the consistency and purity of SpinCo’s products and the breadth of its product offering. More broadly, in the past 10 years, SpinCo believes there was only one new entrant into the specialty cellulose industry.

SpinCo decided to leverage its process and product expertise by investing $385 million in its recently-completed cellulose specialties expansion project. The project converted SpinCo’s approximate 260,000 metric tons of absorbent materials production capacity to approximately 190,000 metric tons of additional cellulose specialties capacity, positioning SpinCo to capture the anticipated growth in demand in developed and emerging markets and to expand its sales to other cellulose specialty uses, such as ethers, which offer attractive growth rates and profit margins.

Broad product offering and customization enabled by the proprietary “SpinCo recipe.” SpinCo’s manufacturing processes have been developed over 85 years. SpinCo’s production facilities utilize kraft and sulfite manufacturing processes, hardwood and softwood fibers, proprietary bleaching sequences and specialized cold caustic processes to engineer and manufacture highly customized cellulose specialties. This operational flexibility, combined with its state-of-the-art research and development facility, industry-leading technical capabilities, access to desirable hardwood and softwood species and proprietary process knowledge, allows SpinCo to engineer a wide breadth of customized fibers each specifically configured for its customers’ unique needs, and to achieve the specific properties required for a broad range of end uses. New product development is another area where SpinCo is the preferred partner for its customers that collaborate with SpinCo to develop and qualify the proprietary formulations for customized fibers.

Long-term relationships with financially strong, global customers. SpinCo benefits from long-standing relationships with blue-chip, industry-leading companies in each of its key product lines, as well as from low customer turnover (SpinCo’s average customer relationship among SpinCo’s top 10 customers is 38 years). SpinCo has customers in more than 35 countries across five continents and delivers its products to more than 79 ports around the world and, as a result, has developed strategic competence in handling global logistics and distribution. SpinCo’s five largest customers, who account for approximately 70% of sales, are all either well known global diversified specialty chemical companies or state owned enterprises. SpinCo has long-term volume contracts with most of the world’s cellulose specialties-based product manufacturers, representing a significant majority of SpinCo’s cellulose specialties production. SpinCo’s relationships with its largest cellulose specialties

11

Table of Contents

customers span 24 to 82 years, facilitating a deep understanding of its customers’ products and manufacturing processes that have led to strong partnerships on new product development. See Note 4— Segment and Geographical Information of SpinCo’s Combined Financial Statements for information on SpinCo’s major customers.

Resilience through economic cycles. SpinCo’s technically-demanding products are used in many consumer end-use products such as cigarette filters, sausage casings, food additives, personal care products and pharmaceuticals, which benefit from stable demand throughout the economic cycle. As a result, SpinCo’s financial performance tends to be relatively less impacted during cyclical downturns because of the resilient demand for its end-use products. As an example, during the 2008—2009 economic downturn, SpinCo’s sales increased by 5%, SpinCo’s net income increased 12%, excluding the 2009 inclusion of $205 million, net of expenses, related to the Alternative Fuel Mixture Credit, and SpinCo’s Adjusted EBITDA grew 18%. SpinCo believes that its end-use markets will continue to grow in various economic environments given their stable nature. For a reconciliation of Adjusted EBITDA to net income, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Performance Indicators.”

Attractive margins and strong free cash flow generation. SpinCo’s gross margin increased from $201 million in 2009 to $333 million in 2013. Net income decreased from $305 million in 2009 to $220 million in 2013, as 2009 included $205 million, net of expenses, related to the Alternative Fuel Mixture Credit. Cash flow from operations was $258 million, $305 million, $258 million, $408 million and $128 million for the years ended December 31, 2013, 2012, 2011, 2010 and 2009, respectively. From the beginning of fiscal 2009 through fiscal 2013, SpinCo has generated strong Adjusted Free Cash Flow totaling $633 million. SpinCo produced Adjusted EBITDA of $363 million, $402 million, $339 million, $258 million and $226 million for the years ended December 31, 2013, 2012, 2011, 2010 and 2009, respectively. During this five-year period, net income margins averaged 19%, excluding $205 million, net of expenses, related to the Alternative Fuel Mixture Credit in 2009. Adjusted EBITDA margins averaged 32%. SpinCo attributes its strong financial performance to its technical product consistency and purity, significant capital investment in its production and research and development facilities, and its deep understanding of customers’ manufacturing processes and product requirements and anticipates that its business will continue to generate attractive returns to its shareholders. For a reconciliation of Adjusted Free Cash Flow to cash flow from operations and Adjusted EBITDA to net income, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Performance Indicators.”

Industry

Cellulose Specialties

SpinCo believes the global demand in 2012 for cellulose specialties was about 1.6 million metric tons, including 130,000 to 160,000 metric tons of cellulose specialties derived from cotton linters. SpinCo expects global demand to grow approximately 3% to 4% per year for the next 5 years. SpinCo is the global leader in the manufacture of cellulose specialties, and categorizes its sales of cellulose specialties into the following key product lines:

| • | Acetate. SpinCo is the leading global manufacturer of cellulose specialties for acetate products. SpinCo estimates that the global demand in 2012 for cellulose specialties for acetate products was approximately 710,000 metric tons and expects this demand to grow 1% to 2% per year over the next 5 years. |

| • | High Value Ethers. SpinCo is a leading global manufacturer of cellulose specialties for ethers products. SpinCo estimates that the global demand in 2012 for cellulose specialties for ethers products was approximately 503,000 metric tons and expects this demand to grow 4% to 6% per year over the next 5 years. |

12

Table of Contents

| • | Other Cellulose Specialties. SpinCo is a leading global manufacturer of other cellulose specialties. SpinCo estimates that the global demand in 2012 for other cellulose specialties is approximately 355,000 metric tons and expects this demand to grow 2% to 3% per year over the next 5 years. |

In 2013, additional cellulose specialties capacity was added, including approximately 190,000 metric tons added by SpinCo following the completion of its cellulose specialties expansion project and approximately 45,000 metric tons added by SpinCo’s competitors. SpinCo believes global capacity totaled approximately 1.8 million metric tons (including the new capacity) at the end of 2013.

Commodity Viscose

Commodity viscose is primarily sold to producers of viscose staple fibers. Viscose staple is used in woven applications such as textiles for clothing and other fabrics, and in non-woven applications such as baby wipes, cosmetic and personal wipes, industrial wipes and mattress ticking. In recent years, shifts in fashion styles and higher than historical cotton prices have increased demand for viscose staple fibers. Weak global cotton harvests during 2011 provided a further boost to demand for viscose staple as a cotton substitute. Additionally, variability in cotton linter supply, due to competing uses of cotton seeds in agriculture, and increasing concerns about the environmental impact of producing viscose staple from cotton have resulted in viscose staple producers shifting volume to commodity viscose derived from wood. SpinCo believes global demand for commodity viscose in 2012 was approximately 4.4 million metric tons (including approximately 800,000 metric tons derived from cotton) and expects this demand to grow approximately 9% to 10% per year for the next 5 years.

Significant new commodity viscose capacity has been added in the last three years to meet this demand. SpinCo believes global capacity totaled 5.7 million metric tons at the end of 2013, and an additional 1.0 million metric tons of capacity has been announced and is expected to be completed in the next two years.

In February 2013, China’s Ministry of Commerce (MOFCOM) initiated an anti-dumping investigation of imports of dissolving wood, cotton and bamboo pulp into China from the U.S., Canada and Brazil during 2012. In November 2013, MOFCOM issued a preliminary determination that SpinCo’s lower purity Fibernier grade product used in commodity viscose applications would be subject to a 21.7% interim duty effective November 7, 2013. In April 2014, MOFCOM issued a final determination reducing duty from 21.7% to 17.2% effective April 6, 2014. SpinCo expects MOFCOM’s final determination to remain in place for five years. SpinCo does not expect that MOFCOM’s duty will materially affect its business results. For more information regarding the investigation, see “Risk Factors—Risks Related to SpinCo’s Business” and “Business—Legal and Regulatory Proceedings.”

Although SpinCo’s business is focused on the production of cellulose specialties, it expects to sell approximately 135,000 metric tons of commodity viscose to commodity markets in 2014. As demand for cellulose specialties increases over the next several years, SpinCo expects to shift production from commodity viscose markets to cellulose specialties until it has essentially exited commodity viscose.

Summary of Risk Factors

An investment in SpinCo’s common stock is subject to a number of risks, including risks relating to SpinCo’s business, risks related to the separation and risks related to SpinCo’s common stock. Set forth below are some, but not all, of these risks. Please read the information in the section captioned “Risk Factors” for a more thorough description of these and other risks.

Risks Related to SpinCo’s Business

| • | The industry in which SpinCo operates is highly competitive. Actions by SpinCo’s competitors and excess production capacity, as well as decreased prices resulting from excess production capacity, could adversely affect SpinCo’s business, financial condition and results of operations. |

13

Table of Contents

| • | SpinCo is dependent on relatively few large customers for a majority of its sales, and the loss of all or a substantial portion of its sales to any of these customers could adversely affect its financial results. |

| • | Changes in energy or raw material prices could affect SpinCo’s results of operations and financial condition. |

| • | SpinCo is subject to risks associated with doing business outside of the United States. |

| • | SpinCo’s business is subject to extensive environmental laws and regulations that may restrict or adversely affect SpinCo’s ability to conduct its business. |

| • | A material disruption at one of SpinCo’s manufacturing facilities could prevent SpinCo from meeting customer demand, reduce SpinCo’s sales or negatively affect SpinCo’s results of operation and financial condition. |

| • | Failure to develop new ideas and protect SpinCo’s intellectual property could negatively affect its future performance and growth. |

| • | Future tobacco legislation, campaigns to discourage smoking, increases in tobacco taxes, increased costs of tobacco products and increased use of non-filtered substitutes could adversely affect SpinCo’s business, financial condition and results of operations. |

Risks Related to the Separation

| • | SpinCo has no history operating as an independent company, and its historical and pro forma financial information is not necessarily representative of the results that it would have achieved as a separate, publicly traded company and may not be a reliable indicator of its future results. |

| • | SpinCo may not achieve some or all of the expected benefits of the separation, and the separation may adversely affect SpinCo’s business. |

| • | After SpinCo’s separation from Rayonier, SpinCo will have debt obligations that could restrict SpinCo’s ability to pay dividends and have a negative impact on SpinCo’s financing options and liquidity position. |

Risks Related to SpinCo’s Common Stock

| • | SpinCo cannot be certain that an active trading market for its common stock will develop or be sustained after the separation, and following the separation, SpinCo’s stock price may fluctuate significantly. |

| • | A significant number of shares of SpinCo common stock may be traded following the separation, which may cause SpinCo’s stock price to decline. |

| • | Certain provisions in SpinCo’s amended and restated certificate of incorporation and bylaws, and of Delaware law, may prevent or delay an acquisition of SpinCo, which could decrease the trading price of SpinCo’s common stock. |

| • | SpinCo’s amended and restated certificate of incorporation will contain an exclusive forum provision that may discourage lawsuits against SpinCo and SpinCo’s directors and officers. Alternatively, if a court were to find the exclusive forum provision inapplicable or unenforceable, SpinCo may incur additional litigation costs, which could adversely affect SpinCo’s business, financial condition or results of operations. |

14

Table of Contents

The Separation and Distribution

On January 27, 2014, Rayonier announced that it intends to separate its performance fibers business from its forest resources and real estate businesses. The separation will occur by means of pro rata distribution to the Rayonier shareholders of 100% of the shares of common stock of SpinCo, which was formed to hold Rayonier’s performance fibers business.

On May 27, 2014, the Rayonier board of directors approved the distribution of all of SpinCo’s issued and outstanding shares of common stock on the basis of one share of SpinCo common stock for every three Rayonier common shares held as of the close of business on June 18, 2014, the record date for the distribution.

SpinCo’s Post-Separation Relationship with Rayonier

SpinCo will enter into a separation and distribution agreement with Rayonier, which is referred to in this information statement as the “separation agreement” or the “separation and distribution agreement.” In connection with the separation, SpinCo will also enter into various other agreements to effect the separation and provide a framework for its relationship with Rayonier after the separation, such as a transition services agreement, a tax matters agreement, an employee matters agreement and an intellectual property agreement. These agreements will provide for the allocation between SpinCo and Rayonier of Rayonier’s assets, employees, liabilities and obligations (including its investments, property and employee benefits and tax-related assets and liabilities) attributable to periods prior to, at and after SpinCo’s separation from Rayonier and will govern certain relationships between SpinCo and Rayonier after the separation. For additional information regarding the separation agreement and other transaction agreements, see the sections entitled “Risk Factors—Risks Related to the Separation” and “Certain Relationships and Related Person Transactions.”

Reasons for the Separation

The Rayonier board of directors believes that separating the performance fibers business from the remaining businesses of Rayonier is in the best interests of Rayonier and its shareholders for a number of reasons, including that:

| • | The separation will allow investors to separately value Rayonier and SpinCo based on their unique investment identities, including the merits, performance and future prospects of their respective businesses. The separation will also provide investors with two distinct and targeted investment opportunities. |

| • | The separation will allow each business to more effectively pursue its own distinct operating priorities and strategies, and will enable the management of both companies to pursue unique opportunities for long-term growth and profitability, free from potential REIT structural constraints that could limit the future growth potential of the performance fibers business. |

| • | The separation will permit each company to concentrate its financial resources solely on its own operations, providing greater flexibility to invest capital in its business in a time and manner appropriate for its distinct strategy and business needs. This will facilitate a more efficient allocation of capital. |

| • | The separation will create separate independent equity structures that will afford each company direct access to capital markets and facilitate the ability to capitalize on its unique growth opportunities and effect future acquisitions utilizing its common stock. |

| • | The separation will facilitate incentive compensation arrangements for employees more directly tied to the performance of each relevant company’s business, and enhance employee hiring and retention by, among other things, improving the alignment of management and employee incentives with performance and growth objectives. |

15

Table of Contents

The Rayonier board of directors also considered a number of potentially negative factors in evaluating the separation, including, among others, risks relating to the creation of a new public company, possible increased costs and one-time separation costs, but concluded that the potential benefits of the separation outweighed these factors. For more information, see the sections entitled “The Separation and Distribution—Reasons for the Separation” and “Risk Factors” included elsewhere in this information statement.

Corporate Information

SpinCo was incorporated in Delaware for the purpose of holding Rayonier’s performance fibers business in connection with the separation and distribution described herein. Prior to the contribution of this business to SpinCo, which will occur immediately prior to the distribution, SpinCo will have no operations. The address of SpinCo’s principal executive offices is 1301 Riverplace Boulevard, Suite 2300, Jacksonville, Florida 32207. SpinCo’s telephone number after the distribution will be (904) 357-4600. SpinCo maintains an Internet site at www.rayonieram.com. SpinCo’s website and the information contained therein or connected thereto shall not be deemed to be incorporated herein, and you should not rely on any such information in making an investment decision.

SpinCo owns or has rights to use the trademarks, service marks and trade names that it uses in conjunction with the operation of its business. SpinCo will have the right to use “Rayonier” as part of SpinCo’s name pursuant to the intellectual property agreement. See “Certain Relationships and Related Person Transactions—Intellectual Property Agreement.”

Reason for Furnishing this Information Statement

This information statement is being furnished solely to provide information to shareholders of Rayonier who will receive shares of SpinCo common stock in the distribution. It is not and is not to be construed as an inducement or encouragement to buy or sell any of SpinCo’s securities. The information contained in this information statement is believed by SpinCo to be accurate as of the date set forth on its cover. Changes may occur after that date and neither Rayonier nor SpinCo will update the information except in the normal course of their respective disclosure obligations and practices.

16

Table of Contents

Summary Historical and Unaudited Pro Forma Condensed Combined Financial Data

The following summary financial data reflects the combined operations of SpinCo. SpinCo derived the summary combined income statement data for the three months ended March 31, 2014 and 2013 and the summary combined balance sheet data as of March 31, 2014 from its unaudited interim combined financial statements, which are included elsewhere in this information statement. SpinCo derived the summary combined income statement data for the years ended December 31, 2013, 2012 and 2011, and summary combined balance sheet data as of December 31, 2013 and 2012, as set forth below, from its audited combined financial statements, which are included in the “Index to Financial Statements and Schedule” section of this information statement. SpinCo derived the summary combined balance sheet data as of March 31, 2013 and December 31, 2011 from SpinCo’s underlying financial records, which were derived from the financial records of Rayonier and are not included in this information statement. The historical results do not necessarily indicate the results expected for any future period. To ensure a full understanding of this summary financial data, you should read the summary combined financial data presented below in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the combined financial statements and accompanying notes included elsewhere in this information statement.

The summary unaudited pro forma condensed combined financial data for the three months ended March 31, 2014 and the year ended December 31, 2013 has been prepared to reflect the separation, including the incurrence of indebtedness of approximately $950 million. The $950 million of indebtedness is expected to consist of $325 million of borrowings by Rayonier A.M. Products Inc., which will be a wholly owned subsidiary of SpinCo following the separation, under new term loan and revolving credit facilities, $550 million of corporate bonds issued by Rayonier A.M. Products Inc. and $75 million of borrowings by SpinCo under its revolving credit facility. The net proceeds of the borrowings are expected to fund cash transfers of approximately $950 million, less certain fees and expenses, to Rayonier, and Rayonier TRS Holdings Inc., a wholly owned subsidiary of Rayonier, as described in “Certain Relationships and Related Person Transactions—Separation Agreement—Cash Transfers.” In addition, SpinCo anticipates that it and its wholly-owned subsidiary Rayonier A.M. Products Inc. will have $250 million of borrowing capacity under a new revolving credit facility for working capital and general corporate purposes. Prior to the distribution, it is anticipated that SpinCo will borrow $75 million under such revolving credit facility and transfer the proceeds of such borrowing, together with SpinCo common stock and the assumption of certain liabilities, in exchange for the contribution by Rayonier of Rayonier A.M. Products Inc.’s common stock and certain other assets to SpinCo. Such borrowing under the revolving credit facility is anticipated to be repaid with the proceeds of a delayed draw term loan expected to be made available to Rayonier A.M. Products Inc. under the new term loan facilities promptly after the distribution. The unaudited pro forma condensed combined income statement data presented for the three months ended March 31, 2014 and the year ended December 31, 2013 assumes the spin-off occurred on January 1, 2013. The unaudited pro forma condensed combined balance sheet data assumes the separation occurred on March 31, 2014. The assumptions used and pro forma adjustments derived from such assumptions are based on currently available information and SpinCo believes such assumptions are reasonable under the circumstances.

The unaudited pro forma condensed combined financial statements are not necessarily indicative of SpinCo’s results of operations or financial condition had the distribution and its anticipated post-separation capital structure been completed on the dates assumed. Also, they may not reflect the results of operations or financial condition that would have resulted had SpinCo been operating as an independent, publicly traded company during such periods. In addition, they are not necessarily indicative of its future results of operations or financial condition.

You should read this summary financial data together with “Unaudited Pro Forma Condensed Combined Financial Statements,” “Capitalization,” “Selected Historical Combined Financial Data of Rayonier Advanced Materials Inc.,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the combined financial statements and accompanying notes included in this information statement.

17

Table of Contents

| As of and for the Three Months Ended March 31, |

As of and for the Years Ended December 31, | |||||||||||||||||||||||||||

| Pro forma |

|

|

Pro forma |

|

|

|

||||||||||||||||||||||

| (dollar amounts in millions) | 2014 | 2014 | 2013 | 2013 | 2013 | 2012 | 2011 | |||||||||||||||||||||

| Statement of Income Data: |

|

|||||||||||||||||||||||||||

| Sales |

$ | 243 | $ | 243 | $ | 285 | $ | 1,047 | $ | 1,047 | $ | 1,095 | $ | 1,021 | ||||||||||||||

| Gross margin |

54 | 54 | 97 | 333 | 333 | 379 | 323 | |||||||||||||||||||||

| Operating income |

43 | 43 | 87 | 286 | 289 | 342 | 283 | |||||||||||||||||||||

| Net income |

25 | 31 | 80 | 174 | 220 | 242 | 214 | |||||||||||||||||||||

| Balance Sheet Data: |

||||||||||||||||||||||||||||

| Total assets |

$ | 1,121 | $ | 1,122 | $ | 1,053 | n/a | $ | 1,120 | $ | 921 | $ | 665 | |||||||||||||||

| Property, plant and equipment, net |

849 | 848 | 745 | n/a | 846 | 681 | 433 | |||||||||||||||||||||

| Statement of Cash Flows Data: | ||||||||||||||||||||||||||||

| Cash provided by operating activities |

n/a | $ | 55 | $ | 30 | n/a | $ | 258 | $ | 305 | $ | 258 | ||||||||||||||||

| Cash used for investing activities |

n/a | (21 | ) | (55 | ) | n/a | (251 | ) | (305 | ) | (131 | ) | ||||||||||||||||

| Cash used for financing activities |

n/a | (34 | ) | 25 | n/a | (7 | ) | — | (127 | ) | ||||||||||||||||||

| Capital expenditures |

n/a | (22 | ) | (21 | ) | n/a | (96 | ) | (105 | ) | (97 | ) | ||||||||||||||||

| Jesup mill cellulose specialties expansion project |

n/a | — | (37 | ) | n/a | (141 | ) | (201 | ) | (43 | ) | |||||||||||||||||

| Other Data: |

||||||||||||||||||||||||||||

| EBITDA (a) |

n/a | $ | 64 | $ | 102 | n/a | $ | 363 | $ | 402 | $ | 339 | ||||||||||||||||

| Sales volumes (thousands of metric tons) |

||||||||||||||||||||||||||||

| Cellulose specialties |

n/a | 113 | 132 | n/a | 486 | 503 | 504 | |||||||||||||||||||||

| Absorbent materials |

n/a | 16 | 56 | n/a | 106 | 214 | 227 | |||||||||||||||||||||

| Commodity viscose |

n/a | 34 | — | n/a | 51 | — | — | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total |

163 | 188 | 643 | 717 | 731 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

(a) For a reconciliation of EBITDA to net income and cash flow from operations, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Performance Indicators.”

18

Table of Contents

You should carefully consider the following risks and other information in this information statement in evaluating SpinCo and SpinCo’s common stock. Any of the following risks could materially and adversely affect SpinCo’s business, financial condition or results of operations. The risk factors generally have been separated into three groups: risks related to SpinCo’s business, risks related to the separation and risks related to SpinCo’s common stock.

Risks Related to SpinCo’s Business

The industry in which SpinCo operates is highly competitive.

SpinCo faces competition from domestic and foreign producers of high purity cellulose specialties and producers of products that can substitute for them in certain applications, such as cotton linters. Moreover, the entry of new competitors and the expansion of existing competitors could create excess capacity, which might cause SpinCo to lose sales or result in price reductions. For example, over the past 24 months some manufacturers of commodity viscose have publicly announced plans to convert facilities to manufacture, or claimed to have already commenced production of, high purity cellulose specialties that may compete with SpinCo’s products. In addition to SpinCo’s recently completed cellulose specialties expansion project, which added approximately 190,000 metric tons of cellulose specialties capacity, a few competitors have announced expansions of their capacity. Buckeye Technologies recently completed a project to increase its cellulose specialties capacity by 40,000 metric tons at its Perry, Florida operation. Tembec, Inc. announced plans to increase capacity by 5,000 metric tons.

As a result of the increased cellulose specialties capacity described above, SpinCo expects 2014 cellulose specialties prices to decrease 7 percent to 8 percent. Although SpinCo plans to gradually increase cellulose specialties production in line with demand, additional increases in cellulose specialties capacity could continue to adversely affect product pricing, which could result in a potential decline in SpinCo’s revenues and margins, thereby adversely affecting SpinCo’s financial condition and results of operations.

SpinCo is dependent on a relatively few large customers for a majority of its sales. The loss of all or a substantial portion of its sales to any of these large customers could have a material adverse effect on SpinCo.

SpinCo is subject to risks related to customer concentration because of the relative importance of its largest customers, many of whom have been doing business with Rayonier for decades, and the ability of those customers to influence pricing and other contract terms. SpinCo depends on major acetate tow manufacturers for a substantial portion of its sales. SpinCo’s five largest customers, which account for approximately 70% of its sales, are all either well known global diversified specialty chemical companies or state owned enterprises. Although SpinCo strives to broaden and diversify its customer base, a significant portion of its revenue is derived from a relatively small number of large-volume customers, and the loss of all or a substantial portion of sales to any of these customers, or significant unfavorable changes to pricing or terms contained in SpinCo’s contracts with them, could adversely affect SpinCo’s business, financial condition or results of operations. SpinCo is also subject to credit risk associated with this customer concentration. If one or more of SpinCo’s largest customers were to become bankrupt, insolvent or otherwise were unable to pay for its products, SpinCo may incur significant write-offs of accounts that may have a material adverse effect on its business, financial condition and results of operations. See Note 4—Segment and Geographical Information of SpinCo’s Combined Financial Statements for information on SpinCo’s major customers.

SpinCo’s business is exposed to risks associated with the cyclicality of the business of certain of its customers, which may adversely affect its business and results of operations.

Some of the industries in which SpinCo’s end-use customers participate, such as the construction, automotive and textile industries, are cyclical in nature, thus posing a risk to SpinCo which is beyond its control. The

19

Table of Contents

industries in which these customers participate are highly competitive, to a large extent driven by end-use applications, and may experience overcapacity or reductions in demand, all of which may affect demand for and pricing of SpinCo’s products. The consequences of this could include the reduction, delay or cancellation of customer orders, and bankruptcy of customers, suppliers or other creditors. Although the occurrence of these events has not had a material impact on SpinCo’s historical financial condition, the occurrence of these events may adversely affect SpinCo’s business, financial condition and results of operation in the future.

SpinCo is subject to risks associated with doing business outside of the United States.